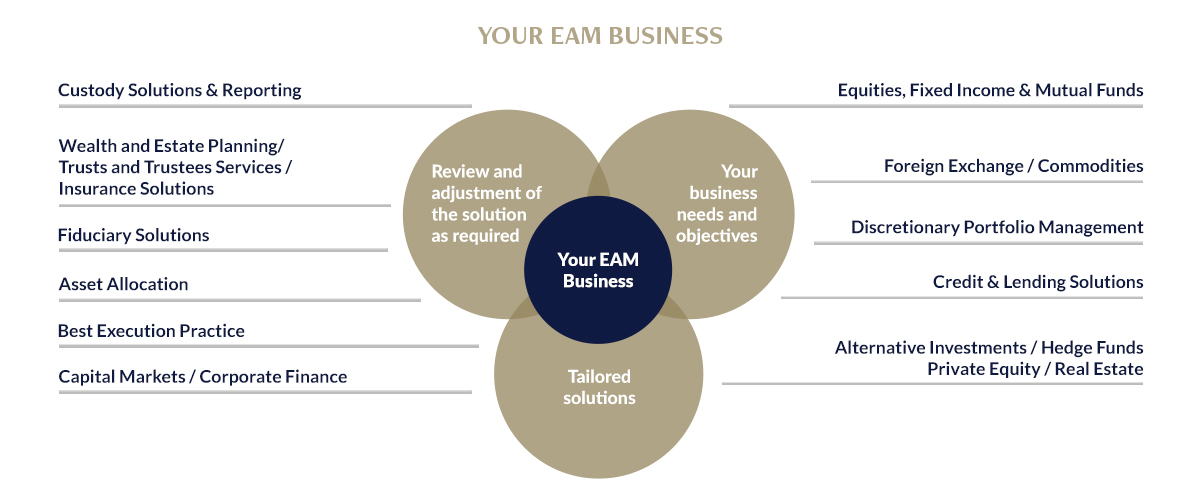

platform that allows them to offer a range of market leading solutions in order to address all of their client’s needs.

Our EAM platform allows experienced Private Bankers with established client bases to transform from being employees to being business owners, in turn securing their financial future.

Odyssey takes care of the day to day administrative tasks to allow you to focus on servicing your clients and addressing all their investment, wealth, tax and planning needs.

At Odyssey clients come first, hence we are constantly seeking ways we can create value for you and your clients.

YOUR BENEFITS

FLEXIBILITY

We will let you run your business the way you wish, with minimal interference. We have a “Loose – Tight” Framework, meaning you able to operate loosely within tight risk management and regulatory controlled environment.

BETTER ECONOMICS

Our revenue sharing model is more generous that other IAM platforms, linking your success to our success. In addition, we don’t charge you or your clients any desk, administration, licensing or professional indemnity fees.

TAILORED FEES

You have the flexibility to offer your clients bespoke fee structures that allow you to retain and attract new clients.

EQUITY PARTICIPATION

We consider the team at Odyssey as partners of the business, which we express through participation in the Employee Share Option Scheme.

FULL SUPPORT

We provide full administration, compliance and operations support to allow you to concentrate on serving your clients efficiently and effectively.

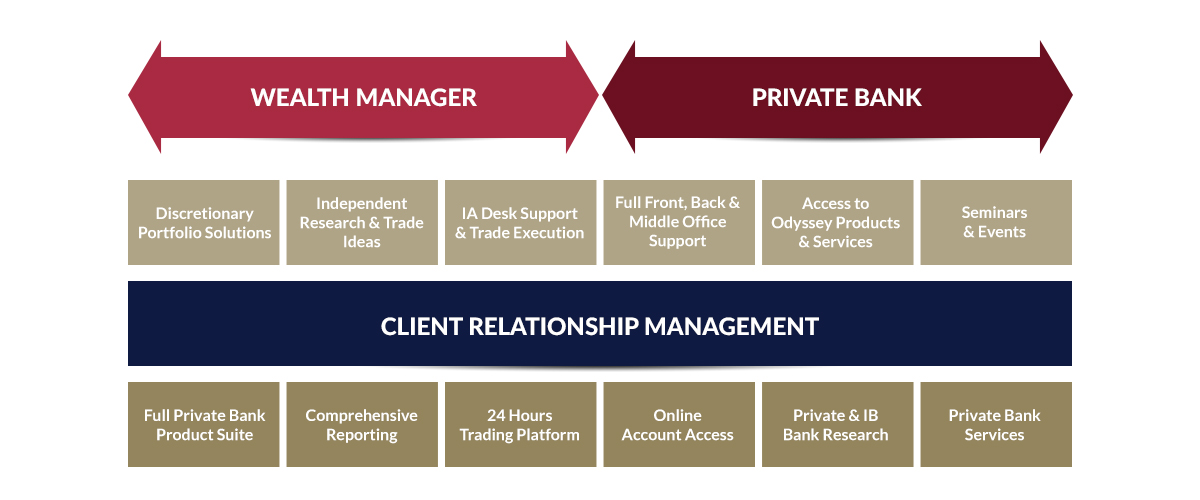

INVESTMENT ADVISORY

You have full access to the Investment Advisory team in order to provide you with investment ideas, bespoke portfolios and joint client meetings where required.

DEAL FLOW

Given our pedigree as one of Asia’s leading alternative asset managers, we provide access to our exclusive deal flow in across the different Odyssey divisions, including access

to property and alternative investments.

TACTICAL IDEAS

The Investment Advisory desk sources ideas from over 40 banks and brokers to disseminate only the best active buy and sell ideas across all major asset classes.

UNRESTRICTED VIEW

You are free to advise and manage your client’s assets without being bound by the “house view” of a bank.

PROVIDERS

We partner with some of the largest custodial platforms and product providers in the industry to enable you to offer your clients only the “best of breed” selection of custody,

products and services.

INDEPENDENT

By being independent, you can truly represent your client’s interests without any pressure to “push” any products.

SCALE

By tapping into our long term relationships with product and service providers, you benefit from substantial economies of scale.

CULTURE

We have two rules, we must operate at the highest professionalism at all times, and we must have fun.

COLLABORATION

You benefit from working with seasoned executives across the different business units to leverage off the synergies this brings and offer more to your clients.

CLIENT BENEFITS

COMPETITIVE PRICING

We have negotiated attractive terms with over 7 different custody providers whom we have a well-established relationship with. This allows your clients to benefit from pricing structures they wouldn’t otherwise be able to achieve themselves.

BROADER ACCESS

This allows your client to benefit from an unrestricted range of products, services and investment opportunities, as well as the other business divisions at Odyssey.

RESEARCH

Clients benefit from receiving regular market updates as generated by our Research Desk and to our 18+ third party research providers.

BUY IDEAS

Clients has access to our handpicked buy ideas.

DISCRETIONARY PORTFOLIOS

You are able to offer your clients access institutional quality discretionary mandates which are managed by seasoned professionals.

INVESTMENT ADVISORY

For those clients who require a tailored portfolio, our Investment Advisory team can provide you sophisticated portfolio presentations and ongoing portfolio support and management.

BALANCE SHEET

This allows clients to see their all of their assets at a glance, which in turn allows you to provide your clients holistic advice on their total balance sheet

SERVICE

We are committed to providing market leading service and administration turnaround.

HOLISTIC

You can address all of your clients’ needs by accessing a large range of market leading products, services and in-house professionals to address all of your clients planning needs.

VIP CLIENT EVENTS & INVITATIONS

We provide regular events and product show cases to further help support you in servicing your clients.

PRODUCTS

Our Private Client Advisers are able to offer the following products to their clients:

- Discretionary Portfolio Service

- Bespoke Portfolio Mandates

- IPO Allocations & New Bond Issues

- Property Opportunities

- Co-Investment Opportunities

- Differentiated Investment Funds

- Mortgages

- Insurance Solutions

- Institutional Solutions

SERVICES

Our Private Client Advisers are able to offer the following services to their clients:

- Lending Solutions

- Monthly & ad-hoc Research

- Stock Lending

- Regular VIP Client Seminars & Events

- Trust, Estate and Tax Planning

- Bank Network of Specialist Advisors and services

PLATFORM FEATURES

- Open Architecture, Access & Pricing

- Full Product Suite including Credit Facilities

- 24 hours Trading Platform

- Online Access

- Investment Advisory Desk

- Research Desk

- Multi Issuer Platform

- Full front, Middle and Back Office Support

YOUR REVENUE OPPORTUNITIES

ASSET MANAGEMENT

- Portfolio Management Fees

- Performance Fees

- Brokerage & Retrocessions

CORPORATE SERVICES

- Trusts

- Company Services

- Tax Planning

FUND PARTNER PLATFORM

- Seeder Fees

- Capital Introduction Fees

HUMAN CAPITAL

- Recruitment

- Out Placement

REAL ESTATE

- Syndicated Property

- Mezzanine Finance