Confidential. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation

Odyssey Japan Boutique Hospitality Investment Strategy

Why Invest in the Japanese Hospitality Real Estate strategy?

Market Data and Structural Demand Drivers

The right place at the right time

The Japanese hospitality market has compelling value drivers

Strong demand from Japanese domestic travellers

Approx. 400 Million per year since 2010

Domestic travellers = 80% of all hotel stays

Hospitality consistently out performs office & residential

Boutique hospitality offer higher returns

Strong growth in occupancy rates & forecast to remain robust

Occupancy rates rising since 2012

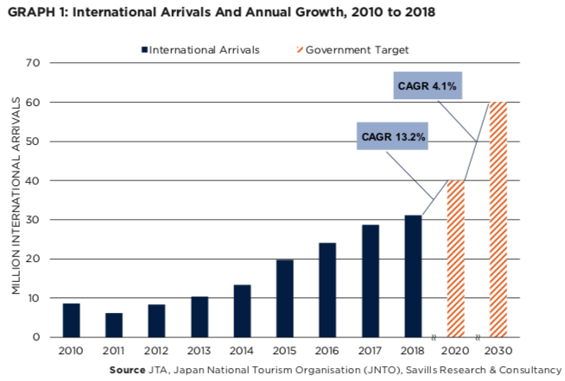

Exponential growth in foreign travellers to Japan

A record 30 Million visits in 2018

Government target of 40MM inbound visits by 2020

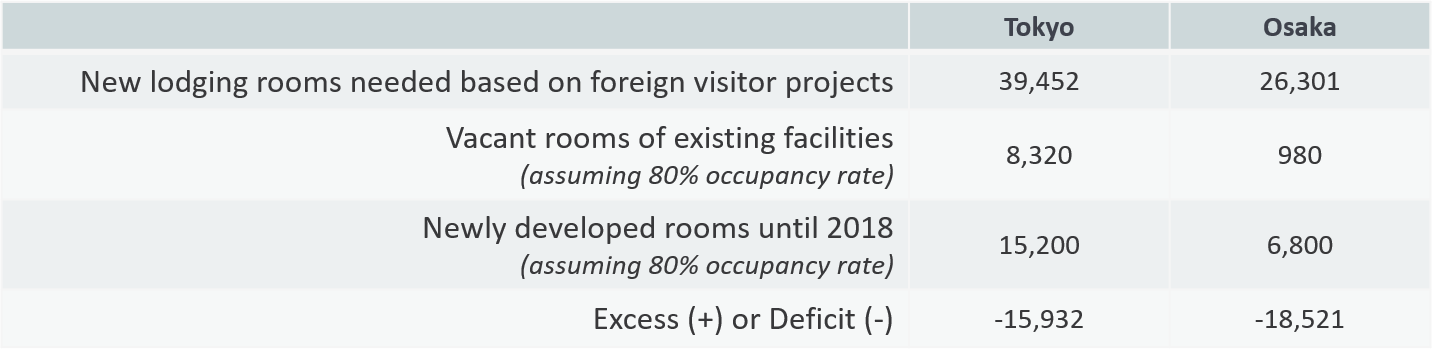

Structural shortage of hotel rooms across Japan

Hospitality sector underinvested after the GFC (2009)

Forecasted room shortage for 2020 Olympics

Tourism boom

Major growth engine for hospitality assets

Since Prime Minister Abe came into office in December 2012, inbound tourist arrivals have risen almost fourfold (4x), from a 2012 monthly average of 697,000 to 2.7 million in January 2019 and a record 31.19 million foreign visitors to Japan in 2018

Structural demand drivers of Tourism Growth:

- YEN depreciation.

- Easing of VISA restrictions for Mainland Chinese, and ASEAN based tourists.

- Deregulation of Japanese air industry (more flights, lower landing fees, more slots for LCC carriers).

- Government policy to support tourism sector growth.

Excellent Fundamentals

Strong demand & under supply of available rooms

Most of the new supply coming on-line is in the limited service, business hotel category and will not have significant impact on our niche focus on boutique luxury assets.

The Japanese hospitality market is very binary with the two primary offerings being small and cheap business hotels or a small number of 5-star hotels which are expensive for families and multi-night stays.

And despite new supply, a room shortage is expected for the 2020 Olympics.

The Japan Strategy Investment Team

THE JAPAN INVESTMENT TEAM

Odyssey has assembled a seasoned team of professionals in Hong Kong and Japan

Experience

The Odyssey Japan Boutique Hospitality Fund team has over 100 years of combined execution experience with alternative assets, funds management and hospitality real estate.

Track-Record

Our local asset managers also have compelling track records. Consistently producing +15% IRR, +8% Net Operating Income (NOI) Yields and 2x money returns.

Industry Leaders

The Japanese Commercial Real Estate (CRE) market can be difficult to access and manoeuvre – we have solid, long-lasting partnerships with the top 1% of Japanese CRE professionals.

Expertise

Our ecosystem of partners are all specialists in the real estate hospitality space – everyone from our lawyers to our lenders are experts in Japanese CRE.

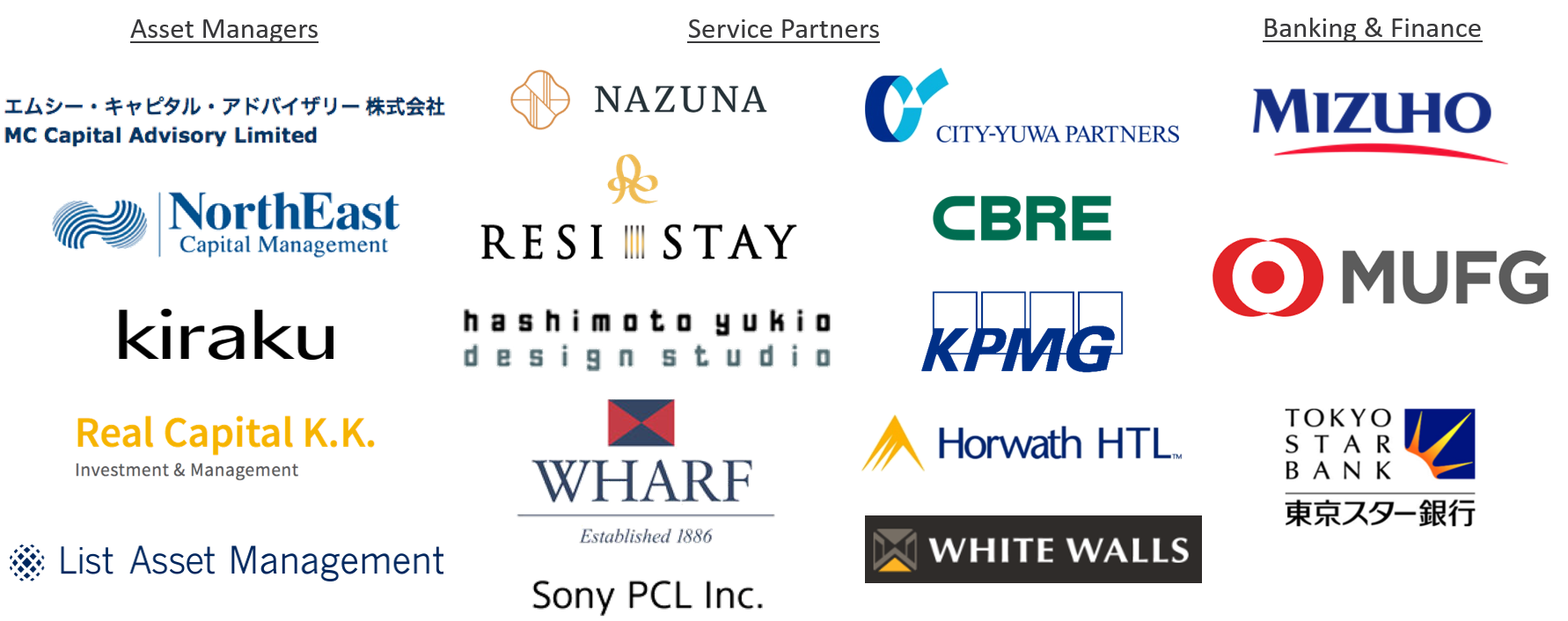

STRATEGIC PARTNERS

Proven execution capability in Japanese real estate & hospitality asset management. All our strategic partners work with us on a mandated basis and exclusive to specific projects.

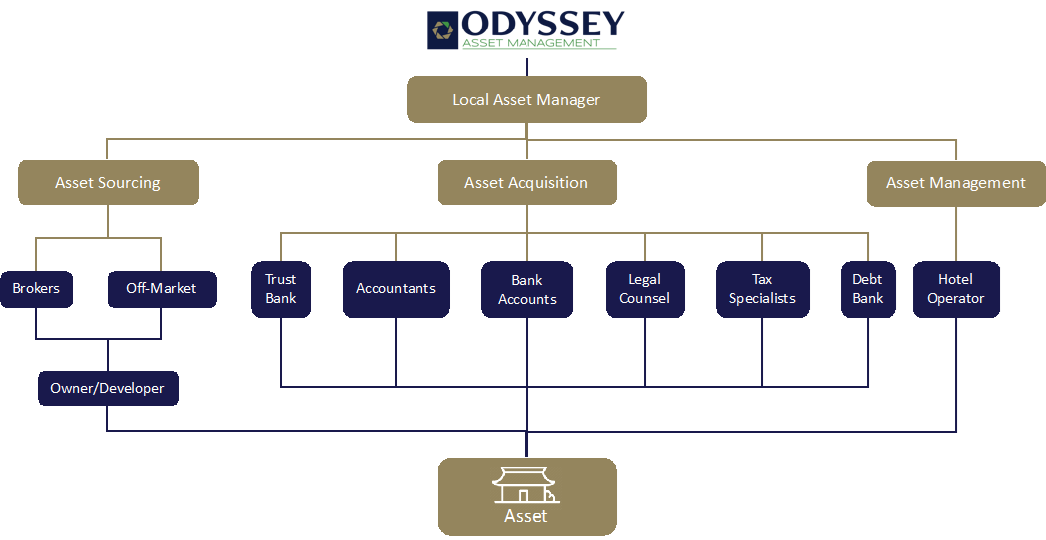

FUND ECOSYSTEM

Odyssey has built an institutional grade structure with clearly defined responsibilities for execution

Advisory Board

Deep experience in Japanese finance, real estate & hospitality

Fund team

Deep experience in Japanese finance, real estate & hospitality

Current and Future Acquisitions

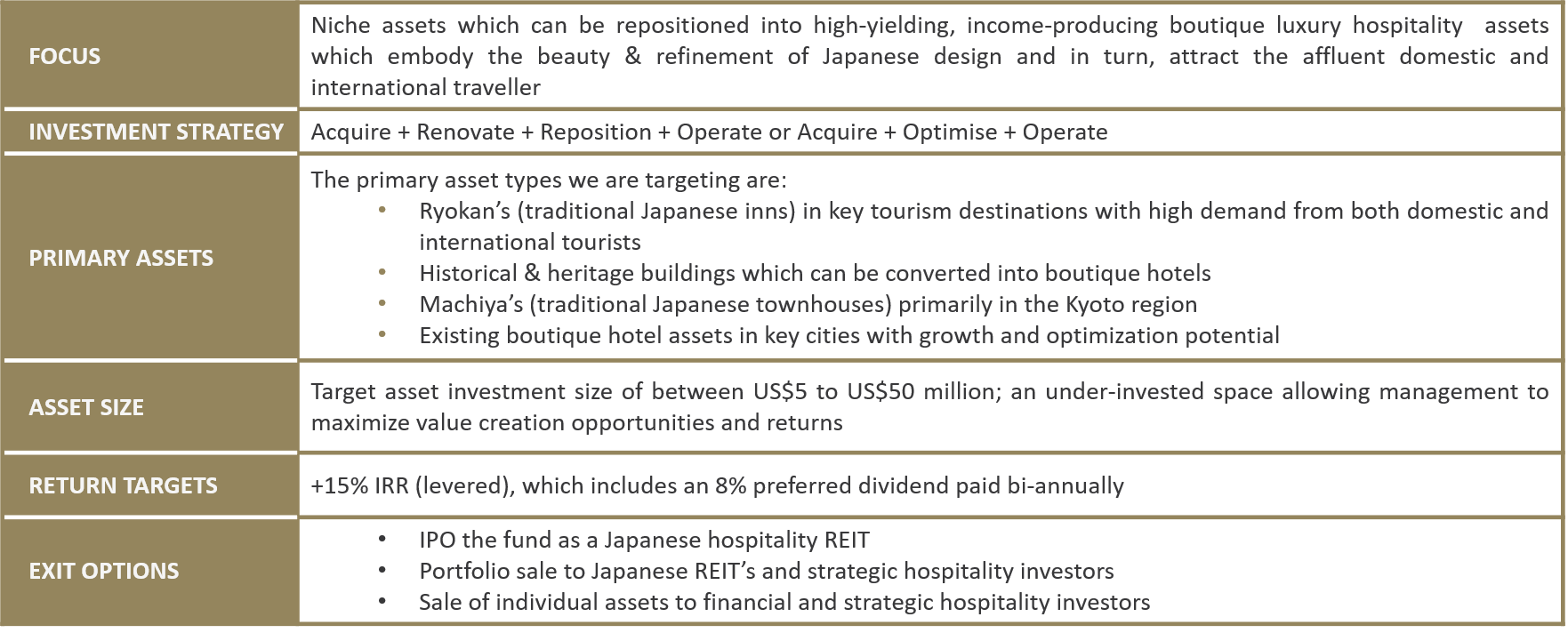

Investment strategy

How to invest

HOW TO INVEST IN THE JAPAN BOUTIQUE HOSPITALITY STRATEGY

2 ways to invest in the strategy

Contact

If you would like further information, please click here

Confidential. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation