Apr 23, 2019 | Press Releases

[Japanese and International tourists enjoy the Cherry blossoms in Kyoto]

From asia.nikkei.com:

“….In 2018, foreign visitor arrivals jumped 8.7% to 31.19 million from a year earlier. And as Japan sprints toward two major sporting events — the Rugby World Cup from September to November and the Tokyo Summer Olympics next year — the numbers are expected to keep rising. Goals set by Prime Minister Shinzo Abe in 2016 peg foreign tourist arrivals at 40 million in 2020, and 60 million in 2030.

Abe is also working to stimulate domestic tourism, announcing that this year’s annual Golden Week holiday will run from April 27 to May 6. The usual weeklong vacation has been extended to 10 days to celebrate the coronation on May 1 of Crown Prince Naruhito as emperor. Data from JTB, Japan’s leading travel agency, shows the number of residents who are planning to travel domestically during the period is up 1.1% on the year; those with plans to travel abroad are higher by 6.9%.

The surge in foreign visitors to Japan reflects a gradual easing of travel visa requirements since 2013 for countries including Thailand, the Philippines and China; growth in the number of budget airlines in Asia; and a depreciation in the yen, all of which have made Japan one of the most popular destinations in the region….”

See the entire article here.

Odyssey Asset Management Limited

Odyssey Asset Management Ltd, a sister company to the Odyssey Capital Group, is a Hong Kong SFC 1, 4 & 9 licensed company. The Japanese CRE team is headed up by Christopher A. Aiello, and also includes Alex Walker, Daniel Vovil and Sam Luck.

Odyssey Capital Group Ltd is Asia’s leading international Alternative Asset Manager that provides differentiated and bespoke investment solutions across multiple asset classes, including asset management, real estate, private equity and hedge funds. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest in with its clients.

The Odyssey team comprises over 30 experienced executives, asset managers, lawyers, private bankers, trust & tax planning specialists and experienced investors with over 400 years of combined financial and operational experience across the Asia Pacific, Europe and North America.

For more information about the Odyssey Japan Boutique Hospitality Fund, phone or email Daniel Vovil via the contact details listed below.

Daniel Vovil, Co-Founder and President, Odyssey Capital Group

daniel.vovil@odysseycapital-group.com | (852) 9725-5477

Mar 27, 2019 | Press Releases

[Tourists in the overcrowded tourist destination Sensoji, Tokyo]

From Scmp.com:

“A boom in the tourism sector has seen significant growth in both the macroeconomy and Japan’s hospitality sector,” said Christopher Aiello, manager of Hong Kong-based Odyssey Capital Group’s Odyssey Japan Boutique Hospitality Fund. “And since Prime Minister Shinzo Abe’s appointment in 2012, tourist arrivals have risen fourfold. The demand for accommodation has never been higher.”

Odyssey Capital is renovating traditional town and guest houses, and is repurposing them as luxury boutique hotels.

See the entire article here.

Odyssey Asset Management Limited

Odyssey Asset Management Ltd, a sister company to the Odyssey Capital Group, is a Hong Kong SFC 1, 4 & 9 licensed company. The Japanese CRE team is headed up by Christopher A. Aiello, and also includes Alex Walker, Daniel Vovil and Sam Luck.

Odyssey Capital Group Ltd is Asia’s leading international Alternative Asset Manager that provides differentiated and bespoke investment solutions across multiple asset classes, including asset management, real estate, private equity and hedge funds. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest in with its clients.

The Odyssey team comprises over 30 experienced executives, asset managers, lawyers, private bankers, trust & tax planning specialists and experienced investors with over 400 years of combined financial and operational experience across the Asia Pacific, Europe and North America.

For more information about the Odyssey Japan Boutique Hospitality Fund, phone or email Daniel Vovil via the contact details listed below.

Daniel Vovil, Co-Founder and President, Odyssey Capital Group

daniel.vovil@odysseycapital-group.com | (852) 9725-5477

Mar 6, 2019 | Press Releases

[Bank of Japan Governor Haruhiko Kuroda, left, meets with Japan’s Prime Minister Shinzo Abe]

Abe to leave monetary policy up to BOJ chief Kuroda

From JapanToday.com:

Japanese Prime Minister Shinzo Abe said on Monday that he trusted Bank of Japan Governor Haruhiko Kuroda’s ability to guide monetary policy and that he would leave specific steps up to him…..

….Kuroda also reiterated that the BOJ will “patiently” maintain its massive stimulus program to ensure inflation accelerates toward its 2 percent target.

“The economy is sustaining momentum for achieving the BOJ’s price target,” he said.

See the entire article here.

Odyssey Asset Management Limited

Odyssey Asset Management Ltd, a sister company to the Odyssey Capital Group, is a Hong Kong SFC 1, 4 & 9 licensed company. The Japanese CRE team is headed up by Christopher A. Aiello, and also includes Alex Walker, Daniel Vovil and Sam Luck.

Odyssey Capital Group Ltd is Asia’s leading international Alternative Asset Manager that provides differentiated and bespoke investment solutions across multiple asset classes, including asset management, real estate, private equity and hedge funds. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest in with its clients.

The Odyssey team comprises over 30 experienced executives, asset managers, lawyers, private bankers, trust & tax planning specialists and experienced investors with over 400 years of combined financial and operational experience across the Asia Pacific, Europe and North America.

For more information about the Odyssey Japan Boutique Hospitality Fund, phone or email Daniel Vovil via the contact details listed below.

Daniel Vovil, Co-Founder and President, Odyssey Capital Group

daniel.vovil@odysseycapital-group.com | (852) 9725-5477

Feb 21, 2019 | Press Releases

Record tourism flows in January during Japan’s coldest and quietest month of the year.

From JapanToday.com:

The estimated number of foreign visitors to Japan in January increased 7.5 percent from a year earlier to 2,689,400, an all-time high for the month, supported by the relaxation of visa rules for Chinese tourists, official data showed Wednesday….

….On the trend of visitors traveling around the time of the Lunar New Year holiday season celebrated by some Asian countries in February, Tabata said, “It is relatively good and I think the figure rose about 20 percent from last year.”

See the entire article here.

Odyssey Asset Management Limited

Odyssey Asset Management Ltd, a sister company to the Odyssey Capital Group, is a Hong Kong SFC 1, 4 & 9 licensed company. The Japanese CRE team is headed up by Christopher A. Aiello, and also includes Alex Walker, Daniel Vovil and Sam Luck.

Odyssey Capital Group Ltd is Asia’s leading international Alternative Asset Manager that provides differentiated and bespoke investment solutions across multiple asset classes, including asset management, real estate, private equity and hedge funds. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest in with its clients.

The Odyssey team comprises over 30 experienced executives, asset managers, lawyers, private bankers, trust & tax planning specialists and experienced investors with over 400 years of combined financial and operational experience across the Asia Pacific, Europe and North America.

For more information about the Odyssey Japan Boutique Hospitality Fund, phone or email Daniel Vovil via the contact details listed below.

Daniel Vovil, Co-Founder and President, Odyssey Capital Group

daniel.vovil@odysseycapital-group.com | (852) 9725-5477

Feb 21, 2019 | Press Releases

Odyssey Asset Management Limited, is pleased to announce that it has successfully completed the first-close of the Odyssey Japan Boutique Hospitality Fund.

The Odyssey Japan Boutique Hospitality Fund is a unique, private equity-real estate fund focused on the acquisition of Japanese boutique hospitality assets throughout Japan. After almost a year of research, planning and structuring, the Fund team identified that the most attractive investment opportunity could be found in mid-sized Hospitality real estate assets, valued between US$5 to US$50 million. This price range demonstrated the best value to secure under-valued, off-market hospitality properties with the most value-add potential.

Ryokan in Niigata

Ryokan in Niigata

Odyssey launched the Fund in June of 2018 and achieved the first close at the end of January 2019. The Fund has received a high degree of interest from High Net Worth Individuals and Family Offices, as well as large financial institutions across the Asia Pacific region.

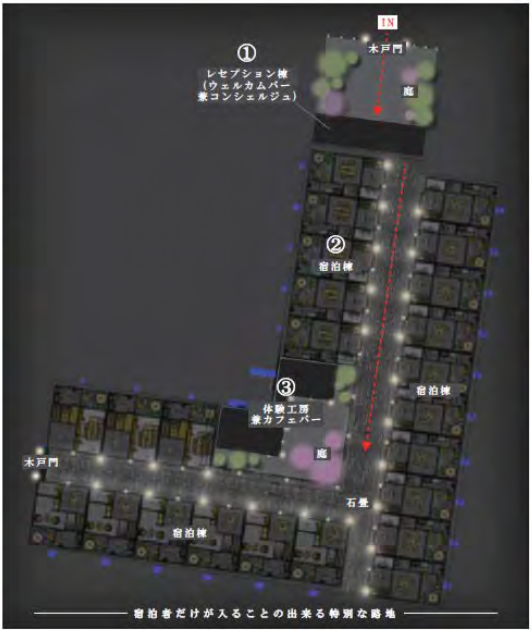

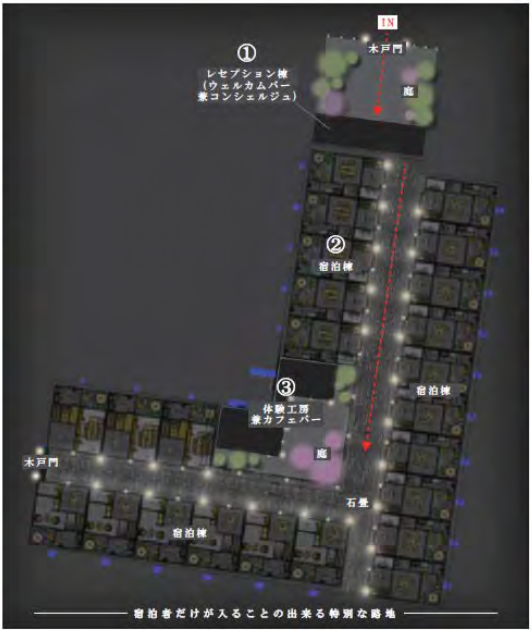

The purpose of the first close was to complete the call capital from committed investors to acquire one of the Fund’s flagship projects – Project Falcon. Project Falcon was the acquisition of a 24 machiya property portfolio situated on one contiguous lot in the heart of Kyoto. Odyssey will refurbish and transform the properties into a single urban luxury machiya resort.

Project Falcon was acquired and settled late January, the purchase price was approximately US$20 million dollars. Now that the acquisition is complete, the Odyssey team is moving ahead with the 15-month redevelopment and construction phase. The acquisition of Project Falcon makes the Odyssey Japan Boutique Hospitality Fund one of the largest owners of machiyas in Kyoto – a one-of-a-kind project in the cultural capital of Japan that is also a famous, booming tourism destination.

Mockup of Project Falcon

Mockup of Project Falcon

With Project Falcon, the Odyssey Japan Real Estate investment team has now purchased three hospitality assets in Japan since first launching the Fund in June of 2018.

Previously in August (2018) we acquired the first ryokan for the Japan Boutique Hospitality Fund, Shousenkaku Kagetsu. The fund team see the most value in the ryokan sector of the Japanese hospitality market as this represents the most undervalued asset class in the Japanese Boutique Hospitality sector. This sector is currently highly fragmented and there is currently an opportunity to apply Odyssey’s value-add investment approach to handpicked ryokans.

Kagetsu Ryokan

Kagetsu Ryokan

The Odyssey Japan Real Estate investment team also purchased a boutique hotel in Kyoto, Hotel Owan Hanami on behalf of one of its Korean institutional clients, Shinhan Investments in October of 2018.

Hotel Owan Hanami

Hotel Owan Hanami

For 2019, the fund team expects to accelerate the pace and quantity of acquisitions for the Fund and for the institutional mandates they have secured to date.

In Q1 2019, it is anticipated that there will be three new acquisitions, including a boutique hotel in Shibuya (one of Tokyo’s most popular suburbs) and a number of ryokans on the Izu Peninsula.

The Fund is also accelerating work on Project Moji, which is the conversion of a beautiful historical building, constructed in 1938, into a 90-room luxury boutique hotel in Kitakyuushu.

Port Moji

Port Moji

Odyssey anticipates that the next close for the Japan Boutique Hospitality Fund will take place around May of 2019. This will add to the total aggregated commitments across our entire Japan investment strategy of over US$ 200 million to date, with more to come.

For more information on our fund, Kagetsu Ryokan, Hotel Owan Hanami, Project Falcon, Project Moji and other recent activities in Japan, please refer to our other Blog posts.

Or please contact Daniel Vovil, Co-Founder and President:

daniel.vovil@odysseycapital-group.com|(852) 9725-5477

For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation.

Odyssey Asset Management Limited

Odyssey Asset Management Ltd, a sister company to the Odyssey Capital Group, is a Hong Kong SFC 1, 4 & 9 licensed company. The Japanese CRE team is headed up by Christopher A. Aiello, and also includes Alex Walker, Daniel Vovil and Sam Luck.

Odyssey Capital Group Ltd is Asia’s leading international Alternative Asset Manager that provides differentiated and bespoke investment solutions across multiple asset classes, including asset management, real estate, private equity and hedge funds. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest in with its clients.

The Odyssey team comprises over 30 experienced executives, asset managers, lawyers, private bankers, trust & tax planning specialists and experienced investors with over 400 years of combined financial and operational experience across the Asia Pacific, Europe and North America.

For more information about the Odyssey Japan Boutique Hospitality Fund, phone or email Daniel Vovil via the contact details listed below.

Daniel Vovil, Co-Founder and President, Odyssey Capital Group

daniel.vovil@odysseycapital-group.com | (852) 9725-5477

Feb 19, 2019 | Press Releases

[Translated from Japanese, as published in the Nikkei Shimbun]

2019/1/23 21:00 | Nikkei Shimbun

Fund managers are actively acquiring Ryokans (Japanese-style hotels) in provincial cities. Odyssey Capital Group Limited, from Hong Kong, launched an investment fund which focuses on Ryokans in Japan. Also Bain Capital is expanding operations nationwide through its subsidiary, Oedo Onsen Monogatari group. Investment firms are increasing their presence as local banks in Japan lose their ability to financially support local unprofitable businesses. As a result, International firms are seeing opportunities in catering to the needs of international tourists in Japan, making the acquisition of local businesses an increasingly competitive venture.

In December 2018, in a meeting with staff in one of the rooms of the long-established hotel, Shosenkaku Kagetsu in Yuzawa in Niigata prefecture, Masami Koga, the general manager said “we have less group reservations. It is also challenging to increase average sales per guest”. One of his staff suggests “we should start sending out direct marketing emails again”, “how about suggesting Japanese sake which goes well with the food on the menu?” suggests another.

In December 2018, in a meeting with staff in one of the rooms of the long-established hotel, Shosenkaku Kagetsu in Yuzawa in Niigata prefecture, Masami Koga, the general manager said “we have less group reservations. It is also challenging to increase average sales per guest”. One of his staff suggests “we should start sending out direct marketing emails again”, “how about suggesting Japanese sake which goes well with the food on the menu?” suggests another.

[Picture: Kagetsu monthly management meeting, Yuzawa, Niigata. Dec, 2018]

In February 2018, Kagetsu’s management rights were transferred from the founder to an investment firm in Minato, Tokyo called Northeast Capital Management (NECM). Masami Koga is also from NECM.

In November that year, Odyssey Capital Group Limited, an asset management company for high-net-worth individuals in Asia, launched their “Ryokan fund”, worth several billion Yen and got involved in the management of Kagetsu as their first project. The company said Japanese ryokans have been attracting a lot of attention globally among wealthy individuals.

Kagetsu was founded in 1955. It was a small ryokan with 28 rooms and was popular with skiers during Japan’s bubble economy. Sales declined as downhill skiing lost its popularity. When Kagetsu started having trouble paying back its loan, its main local bank suggested enlisting the help of investment firms to revive the business which, in turn, would also help the bank in recovering the non-performing loan. Hideki Shibao, CEO of NECM, says “most of the requests for business restructuring come from the local banks”.

Japan’s SME Finance Facilitation Act requiring banks to extend loan payment terms for SMEs, ended in 2013. Because of their huge impact on local economies, supporting ryokans has always been a challenge for local banks but it has become increasingly difficult for them to help in the recovery process.

Investment firms expect the increase in tourism to be the key for recovery. Kagetsu, with the help of Odyssey, was able to increase the percentage of international tourists to a high of 40% by making services available in English. Some family groups from Asia visit the hotel every winter.

Kagetsu is planning a large-scale renovation of rooms and other facilities, like air-conditioning, after the long holidays in May. Talking about her impression of the investment firm’s support, Tomoko Fujii, manager of Kagetsu, said, “Odyssey’s attitude towards us is different, as the firm paid a considerable amount of money to acquire the business”.

One of the leading players in reconstruction of Ryokans is Bain Capital. Through their acquisition of Oedo Onsen Monogatari group in 2015, they have expanded their investment to their current 40 facilities across the country. They target large-scale facilities with more than 100 rooms and conduct renovations for half a year. They also take advantage of economies of scale by ordering food and ingredients in bulk and centralizing marketing operations for all their facilities. Doing this, they were able to cut down the price to an affordable 10,000 yen or less per night and achieve 80 to 90% occupancy rate on average.

Keystone Partners, an independent asset manager in Minato, Tokyo, invests in ryokans and hotels through existing investment funds worth 30 billion Yen. In 2018, the company became a major shareholder of Wealth Management, a hotel development company, and started engaging in reconstruction of ryokans. Local banks have also invested in these funds. Tomoaki Tsutsumi, CEO of Keystone Partners, adds, “besides including the funds to their portfolio, the local banks are also aiming to engage in the recovery of ryokans they provided loans to”.

Other Japanese financial institutions also see opportunities in ryokans in rural cities. In 2018, MUFJ Bank, together with 60 other companies such as Sekisui House and Japan Airlines, launched a fund focused on promoting tourism and remodeling ryokan and old Japanese-style houses. Development Bank of Japan, in collaboration with local banks, have launched several funds to support SMEs across the country. “Competition among financial institutions is becoming intense” says Shibao.

| Major companies and funds involved in reconstruction of ryokan business |

| Odyssey Capital Group Limited |

“Recruit Holdings” – Offers reconstruction projects. |

| Bain Capital |

Oedo Onsen Monogatari – Operates 40 facilities across the country. |

| Keystone Partners |

Provides financial support for reviving ryokans and hotels. |

| Orix |

Acquired long-established ryokans including Suginoi Hotel (Beppu, Oita). |

| Development Bank of Japan |

Launched corporate reconstruction funds with local banks and Hoshino resort. |

| MUFJ Bank |

Launched fund to promote tourism with 60 other companies including Sekisui House. |

Odyssey Asset Management Limited

Odyssey Asset Management Ltd, a sister company to the Odyssey Capital Group, is a Hong Kong SFC 1, 4 & 9 licensed company. The Japanese CRE team is headed up by Christopher A. Aiello, and also includes Alex Walker, Daniel Vovil and Sam Luck.

Odyssey Capital Group Ltd is Asia’s leading independent Alternative Asset Manager that provides differentiated and bespoke investment solutions across multiple asset classes, including asset management, real estate, private equity and hedge funds. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest in with its clients.

The Odyssey team comprises over 30 experienced executives, asset managers, lawyers, private bankers, trust & tax planning specialists and experienced investors with over 400 years of combined financial and operational experience across the Asia Pacific, Europe and North America.

For more information about the Odyssey Japan Boutique Hospitality Fund, phone or email Daniel Vovil via the contact details listed below.

Daniel Vovil, Co-Founder and President, Odyssey Capital Group

daniel.vovil@odysseycapital-group.com | (852) 9725-5477

Ryokan in Niigata

Ryokan in Niigata Mockup of Project Falcon

Mockup of Project Falcon Kagetsu Ryokan

Kagetsu Ryokan Hotel Owan Hanami

Hotel Owan Hanami Port Moji

Port Moji

In December 2018, in a meeting with staff in one of the rooms of the long-established hotel, Shosenkaku Kagetsu in Yuzawa in Niigata prefecture, Masami Koga, the general manager said “we have less group reservations. It is also challenging to increase average sales per guest”. One of his staff suggests “we should start sending out direct marketing emails again”, “how about suggesting Japanese sake which goes well with the food on the menu?” suggests another.

In December 2018, in a meeting with staff in one of the rooms of the long-established hotel, Shosenkaku Kagetsu in Yuzawa in Niigata prefecture, Masami Koga, the general manager said “we have less group reservations. It is also challenging to increase average sales per guest”. One of his staff suggests “we should start sending out direct marketing emails again”, “how about suggesting Japanese sake which goes well with the food on the menu?” suggests another.