Market Update: November 2020

November Market View

In God we Trust

It appeared there was 2 main factors driving the market on US election day. The first was simply the relief that the event was finally taking place after a nervous S&P 500 had fallen 8% in the prior 3 weeks. The second was a little more perplexing. As the polls see-sawed from favouring one candidate to the other, the market kept going up. The one constant was that it was a close race, i.e. neither party was going to control both houses. This can be interpreted as neither candidate being particularly appealing to the market, and the likely difficulty in carrying out ideological policy was regarded as a positive.

The market is expecting that the highest priority of the government post-election is to get the stimulus bill passed. Jerome Powell has recently reiterated that the country requires “direct fiscal support”. Assuming the departing President actually departs, and the bill is passed, the remaining gorilla in the room is COVID.

Hallelujah

Pfizer and BionTech announced on November 10 that in phase 3 trials their vaccine was more than 90% effective in preventing COVID-19 in participants without evidence of prior infection. Submission for emergency FDA approval is planned soon after the safety milestone is achieved, which is expected in the third week of November. The partnership projects producing up to 50 million vaccine doses in 2020 and up to 1.3 bn doses in 2021.

At a time when the second wave continues to spread rapidly across the US and Europe, this is indeed welcomed news. Other Western firms also in phase 3 trials that have yet to report are Moderna, Johnson & Johnson, and AstraZeneca & University of Oxford. All these firms have received funding from the US government to develop and distribute a COVID vaccine.

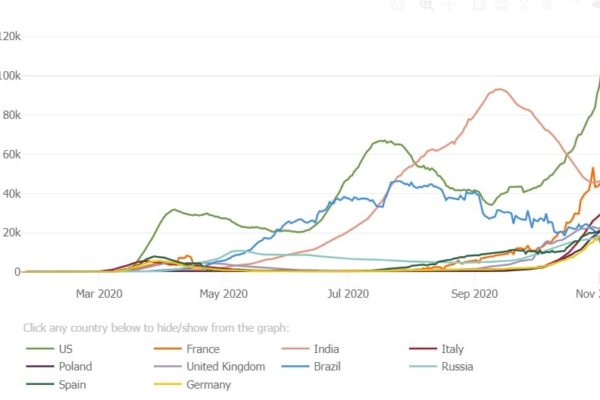

Chart 2: New COVID cases in the US and Select Countries

Source: Johns Hopkins University

Return of the Prodigal Son

The two most shunned sectors in the last 7 months have been the US Banks and Energy. While the oil price is a complicated issue, the banks have historically been a favoured sector to benefit from recessionary conditions. However, due to unique aspects of the COVID induced recession and the resultant low and flat interest rate yield curve, the Banks have had little succour from investors … until now.

Source: Bloomberg

Prior to the Pfizer & BionTech success, the US Banks sector were down 34% YTD. On the announcement the sector gained 13%. Other downtrodden sectors such as those in the travel industry companies surged, with Cruise Ships rising 27-28% and the Global JETS (airlines) ETF jumped 18%.

At the same time, stocks that had benefitted most from COVID, such as many in the Tech sector fell heavily as investors sold momentum and bought value. Given the 66% difference in performance between the InfoTech and Bank sectors YTD prior to the announcement, this was understandable. The Banks sector still needs to rise 75% to catch up to the InfoTech YTD performance, and we expect this performance gap has more room to narrow. Indeed, the more diversified portfolio we have been calling for over the last two months seems even more applicable.

Short Market Comment

October was a month of two halves, with equity markets surging up in the first half, only to give up those gains up and more as the election and surging COVID cases cast a pall over the markets. The MSCI World Index fell -2.5%. US Tech stocks continued to their losses after a difficult September, while US banks started to outperform, in a trend that has accelerated into November. WTI Oil also fell 11% while credit markets and Gold were relatively resilient.

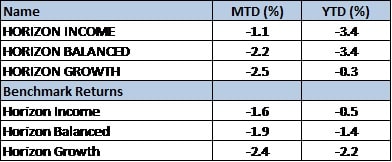

Horizon Portfolio Performance

If you like to receive more information on our portfolios solutions, please contact us here: info@odysseycapital-group.com