Monthly Market Update – Nov 2017

HOW WE ARE POSITIONED FOR Q4 17

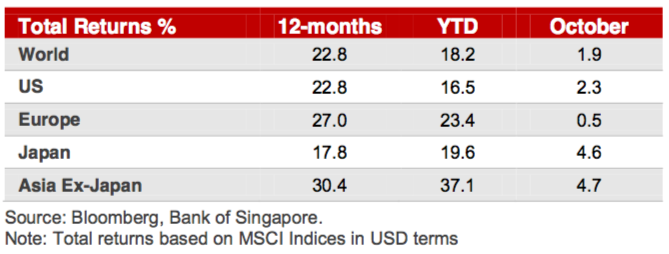

We anticipate that markets will be trading, well supported into year-end. US stock indexes have reached new highs after an impressive run-up. They overcame uncertainties surrounding the US politics and headlines about North Korea. In addition, the HK and Asian markets have been trading higher; meanwhile, European and UK stocks have overall been slightly underperforming. This is mainly contributed to a stronger Euro and uncertainty regarding Brexit and the Political risk in Spain.

- Bond prices globally have still traded weakly as the market has been preparing for interest rate rises and the end of Quantitative Easing.

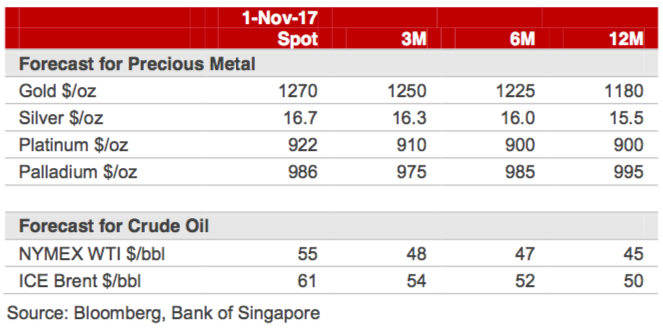

- Commodity markets are expected to remain at a mixed to stabilised level, with Oil trading well above the 50 level and reaching 55. Gold’s massive bull run has been partially reversed with prices dipping below the 1300 support level, helped by the strengthening of the US Dollar and diminishing fears about North Korea.

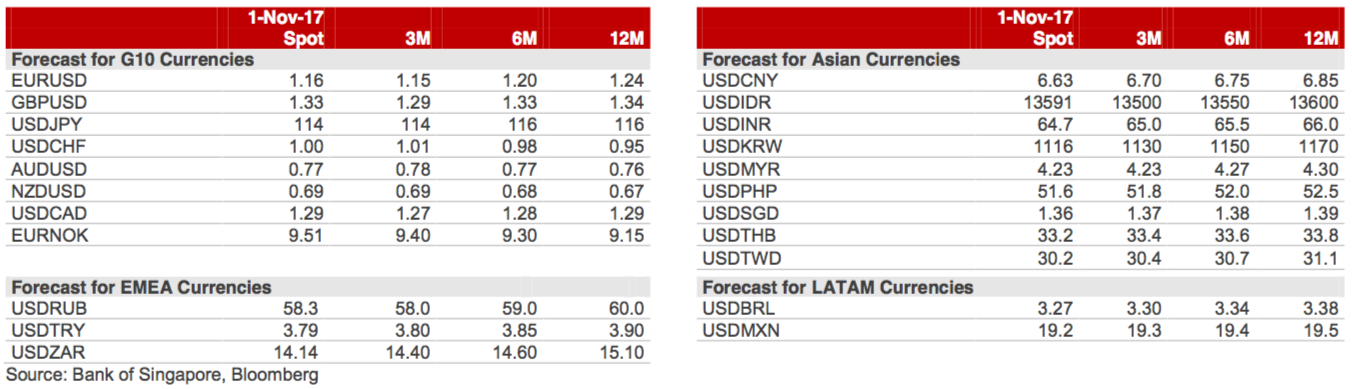

- The US Dollar is likely still to be weak in the medium term, as expected rate hikes have been discounted, and the markets are now focusing on other countries to raise interest rates.

- Overall, we remain medium-term relatively constructive on stocks; however, we are wary at the current levels and we would buy into a correction. We see some uncertainty surrounding future Central Bank moves and geopolitical risk. For this reason, we advise buying high dividend stocks and to generally carry and rotate from overvalued sectors to more undervalued.

- Market complacency is still at its extreme, but we do not think it is sustainable. Therefore, we suggest buying protection via hedging strategies to protect against market volatility while it trades at multi-year lows. Strategies prefer purchasing puts, selling call spreads, buying bear ETFs or allocating more to cash for this month are advised.

- It is interesting to note that since the last Fed Meeting in October, the USD has strengthened and the US yields have spiked.

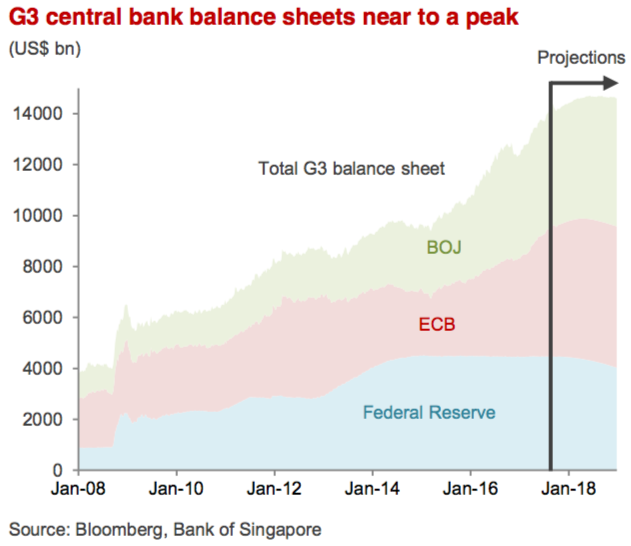

- However, we believe that the rate outlook seems pretty much discounted, and that we can expect to see the start of offloading the Fed Balance Sheets. This would be more crucial for the market.

- Another hike is forecasted for December, with the market giving an 80% chance of a hike as the Fed seems comfortable with the current pace of economic growth. However, the weakening of the USD this year has loosened financial conditions by increasing the levels of exports.

- While we are wary of Brexit and the stronger Euro, we believe that the existence of cheap valuations and a generally underweight position in European assets make certain European equities attractive.

- A stronger Euro, while a small drag on some European exporters, will be overall beneficial as it will contribute to a positive outlook for Europe.

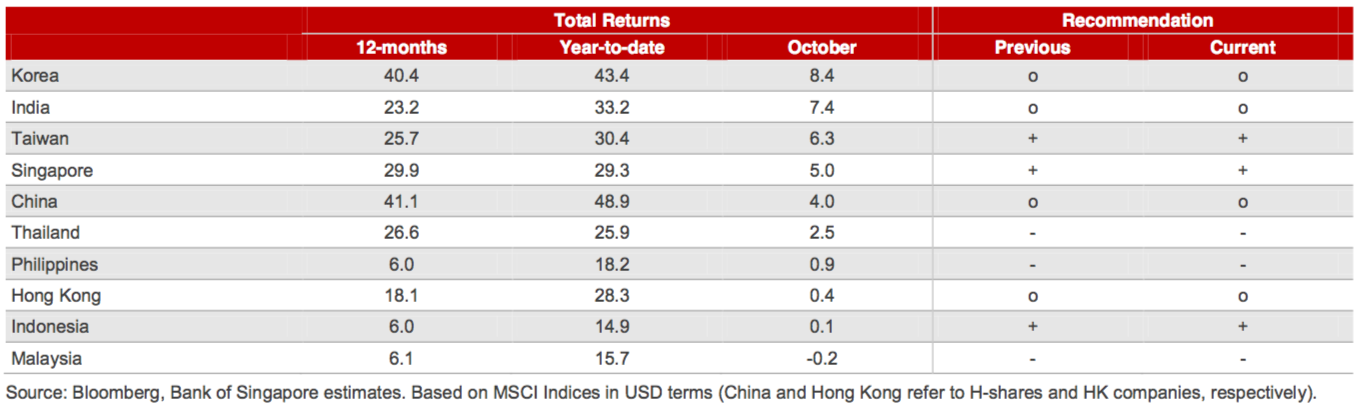

- We are constructive on Emerging Markets, as markets look solid and seem immune to the US interest rate hikes.

- We are still interested in South East Asian economies, as reforms have helped boost investments and growth. India, Indonesia, Vietnam and Philippines are our recommended markets to analyse.

MARKETS OVERVIEW Equities – Expecting Sideways Moves

MARKETS OVERVIEW Equities – Expecting Sideways Moves

- Equities across the board have made new highs on the year. However, we are still concerned about a possible pullback due to valuation multiples looking stretched and the potential of stubborn political impasse from the US. In addition, there some further geopolitical worries about North Korea and uncertainties about the Central banks tapering. For the long-term, we are selectively choosing overweight equities, against bonds: these offer the best return prospects against other asset classes over a 12-month horizon.

- We discussed last month that it would be viable to take profits on overvalued sectors like Technology and rotate into more undervalued sectors like Healthcare and Energy, and we will still believe this is the better investment option.

Bonds – Bearish

Bonds – Bearish

- A rising interest rate means most bond markets are vulnerable. After the big climb last year, the US bond yields have stalled in a range, and then have come off. European yields have been trending higher in the last few months as the ECB has announced that the end of QE could be approaching. Most sovereign bonds are still looking expensive and vulnerable to any hawkish changes from the Central Bank policies, especially in Europe, UK and Japan.

- If investors need to be positioned in fixed income, we prefer either inflation protected bonds (e.g. TIPS) or high quality corporate bonds with short durations trading at or near face value.

- Our previous view was to use bonds as an alternative for cash balances which were earning next to nothing. However, in this environment the risk of capital loss on bonds outweigh the potential rewards for trying to get a better than zero percent coupon.

Commodities – Expected Sideways Markets

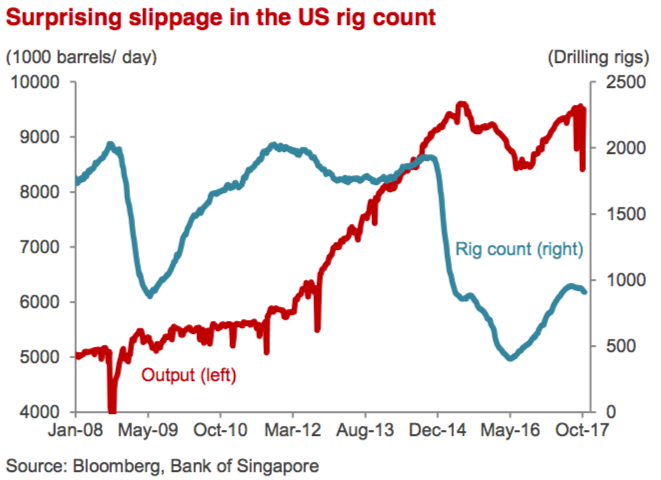

- Oil prices have rallied in the past month with limit on supplies have been supporting prices.

- Oil demand continues to grow at a steady pace, while the US rig count has been trending lower, therefore, we believe a range of 50/60 seems reasonable with short-term risk to the upside. From a medium-term perspective, we remain bullish.

- Gold has come off after the big rally of the past few months, as geopolitical risks have faded and the US Dollar has strengthened from the lows. At the current level of 1275, we are neutral to bullish on Gold for the short term, but we are less positive for the long term.

Currencies – Consensus bearish on USD

Currencies – Consensus bearish on USD

- Until there is more clarity on Trump’s policies, the US dollar will continue to loweragainst most currencies. While interest rate hikes will benefit the USD, the Administration’s fiscal policies could put a ceiling on the value of the greenback. The main driver of the US dollar’s strength will come from a US interest rate rise, and if the Fed is more hawkish than expected, we could see a renewed interest in buying USD. We are bullish on the Euro as investors are still too underweight. Economic data has been solid, pushing the ECB to talk about increasing rates earlier than expected, as Draghi mentioned in the last meeting. We remain bearish on the Sterling and the Yen, and neutral on Canadian Dollar, Australian Dollar and New Zealand Dollar.

Alternatives – Bullish

Alternatives – Bullish

- We are generally positive on the property markets, with a preference for commercial over residential. Our favoured countries for exposure include Australia, UK, South East Asia, USA, and Vietnam. Please ask for more information on some of the projects we are currently working on.

- We also have a positive outlook on Private Equity as we see better growth opportunities, whilst lower valuations are seen across the industry compared to most stock markets.

BULLISH SECTORS

- Technology, Materials and Industrials outperformed. The Telecom and Health Care sectors was the biggest loser, with Financial and Industrial also performing well.

- Technology stocks have had the best performance Year to Date. Given that it is the most expensive sector, we still have the view that it is the right time to reduce some long positions and take some profits particularly because we believe exposure to China could be negative.

- The Healthcare sector continues to benefit from improving pipeline productivity and an increasing number of new drugs approved by FDA.

- We think it is time to take some profit on the Energy sector after the strong performance in September and October.

- Lastly, we are still positive on Financials although a 4% rally in September and 1.5% in October: valuations are still not expensive, and we see a renewed push up in interest rates in the US and in the rest of the world.

- Improving business and consumer confidence should continue to support credit demand.

- Stronger economic growth will reduce non-performing loans.

- Capital ratios have improved, and a steeper yield curve should be positive.

HOW WE MANAGE RISK – PORTFOLIO PROTECTION, HEDGING & TAKING PROFITS

As opposed to just going to cash, we prefer alternative strategies such as hedging via options and option writing strategies to smooth out portfolio volatility. We also actively monitor profits using trailing stop losses with the view of protecting and locking in gains.

PORTFOLIO MANAGEMENT SERVICES

Please let us know if you would like to hear more about our Discretionary Portfolios and how we consistently generate an additional 0.5% to 1.5% per month using our Options Overlay.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at. Please contact us at contact@odysseycapital-group.com or on +852 2111-0668.