Capital Pulse

Welcome to the inaugural issue of Odyssey’s Capital Pulse, Odyssey Corporate Advisory’s quarterly publication that focuses on major capital and financial markets events that occurred during the quarter and its potential implications for you and your business.

Odyssey Corporate Advisory is an independent boutique consultant providing business advisory, investment consultancy, project management and coordination services for companies that intends to access the Hong Kong capital markets.

It has been a busy quarter for the Hong Kong capital markets despite most major economies in the world implementing national border closures and movement restrictions due to COVID-19.

In this inaugural issue we have highlighted interesting regulatory developments from a primary market perspective and our financial market expectations from a secondary market perspective.

SEARCHING FOR THE LIGHT AT THE END OF THE TUNNEL

For six months ended 31 March 2020, there were 212 applications for listing on the Hong Kong Stock Exchange compared to 255 applications in 2019 and 243 in 2018 based on their first posting date. However, since January 2020, application for listing activity has slowed markedly with only 57 new applications for the first quarter, which is almost a 50% decline in new applications compared to the same quarter in 2018 and 2019. There were 33 approval-in-principle outstanding with 28 approval-in-principle granted during the quarter. 69 applications lapsed but 38 applicants renewed their listing applications representing a 55% renewal rate. Four applications were withdrawn and 139 applications remain in the pipeline.

During the quarter, 40 new companies listed on the stock exchange and two companies were transferred from the Hong Kong GEM Board to the main board under the grandfathering arrangements. This compares to 38 companies in 2019 and 36 companies in 2018 for the same quarter. However, funds raised were significantly lower averaging HK$349 million per IPO which was approximately 40% lower than 2019 and 50% lower than 2018.

Given that measures to contain Covid-19 only started during the quarter, it appears that the slowdown in fund raising activity was well underway since mid-late 2019 given the time required for the raising equity capital, if not for Alibaba’s secondary listing on and Budweiser APAC IPO. Unfortunately, the slowdown is expected to continue given lower market valuations even though it has been reported in the media of an expected mega-IPO by the end of this year. Unlike traders where day-to-day market fluctuations matters, equity capital raising require significantly amount more time making current market conditions less relevant for companies planning such an undertaking.

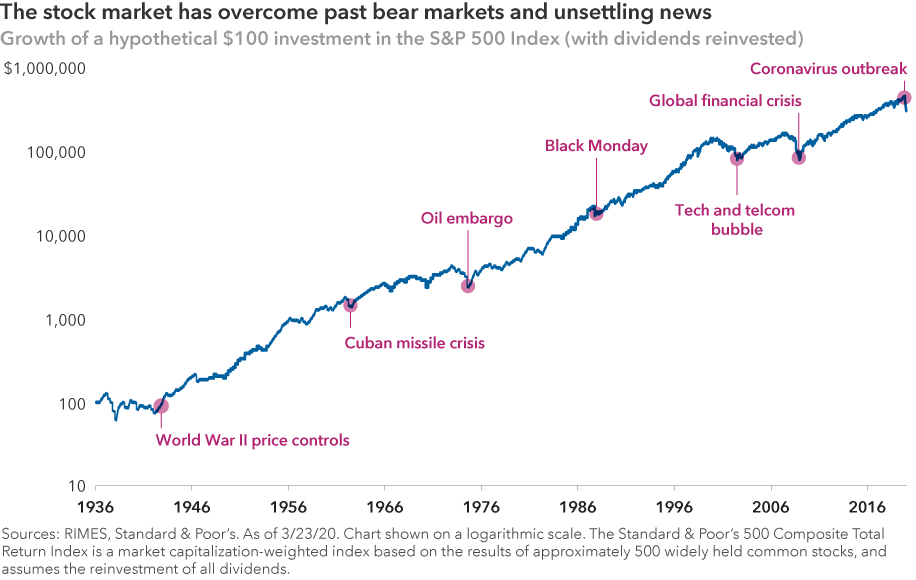

THE MORE THINGS CHANGE, THE MORE THEY STAY THE SAME

Every market crisis may have a different root cause, but the market reaction to each crisis may not be so dissimilar. Even in the post GFC a low interest rate environment, we still witness the classic decade long cycle between major financial crisis. Although we have experienced average weekly swings in the Hang Seng Index (“HSI”) of over 800 points per week since the beginning of the year, it would come as no surprise that there will be more volatile markets in the foreseeable future.

Figure 1: Hang Seng Index (Weekly)

Apart from the GFC when the HSI fell almost 20,000 points over 16 months, the last significant correction was in 2015-2016 during the China stock market crisis when the HSI fell 10,000 points over 9 months. However the long-term picture indicates that we are now experiencing the somewhat overdue major correction in this decade long market cycle.

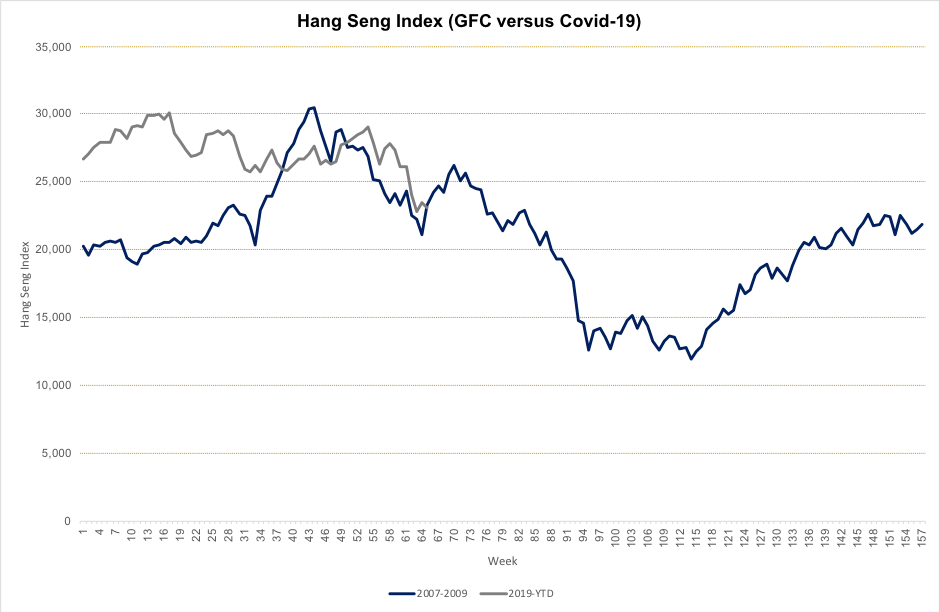

Figure 2: Covid-19 versus SARS market experience

Figure 3: Covid-19 versus GFC market experience

Whilst not suggesting that history is expected to repeat itself, there are a couple of points that history could serve as a guide. Apart from much greater volatility, the market tends to require a longer period to digest the magnitude and economic consequences of each crisis. There is one major difference between SARS and Covid-19, namely SARS predominately affected the Greater China region whereas Covid-19 has global footprint, and the associated economic problems are expected to be more pronounced and perhaps prolonged. Therefore it appears the GFC market experience might be a better proxy than SARs.

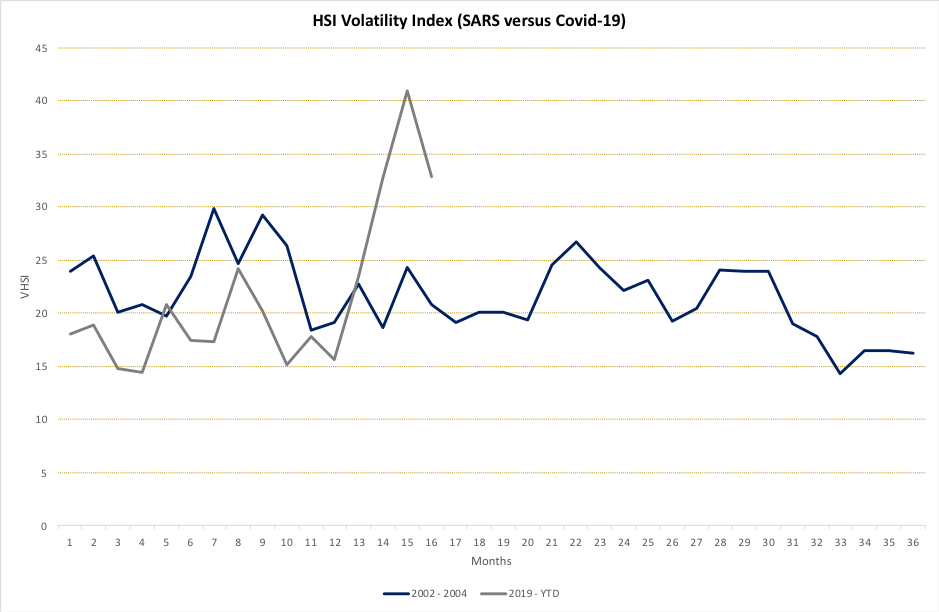

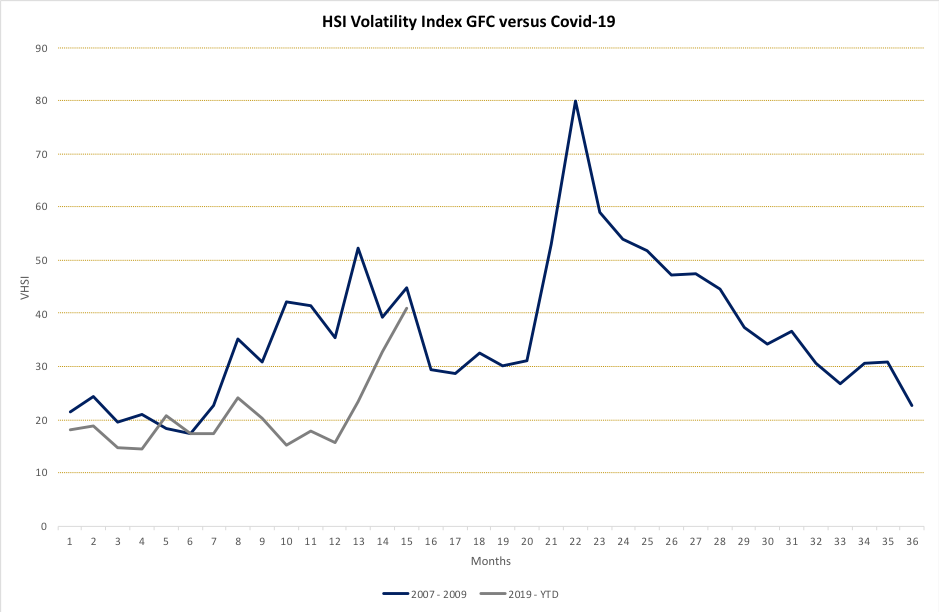

Volatility, volatility and more volatility

Figure 4: Covid-19 versus SARS volatility experience

Figure 5: Covid-19 versus GFC volatility experience

The behaviour of the HSI Volatility Index further demonstrates the parallels between the current market environment and the GFC rather than SARS where less volatility in the equity markets. If the GFC experience is any guide, we are nowhere close to the end of the tunnel. Investors should be wary of V-shape, W-shape or U-shape economic predictions given the extreme uncertainty.

The key takeaway is companies need to manage their capital positions carefully during the next few quarters as cost of equity will remain expensive and there may be little appetite for capital issuance in general. Those companies who would like deploy excess cash to take advantage investment opportunities in current market conditions should be aware that something that looks cheap can become (a lot) cheaper. Such investors need to stay vigilant in filtering out the noise in the market in their investment decisions.

NOTABLE REGULATORY INITIATIVES DURING THE QUARTER

Consultation on Corporate Weighted Voting Rights

The stock exchange published its consultation paper on corporate weighted voting rights on 31st January 2020. This is a follow-up to the weighted voting rights rules implemented on 24 April 2018 that applies to individual shareholders and the stock exchange’s decision to defer this consultation on 25 July 2018. Put simply the rationale for the corporate weighted voting rights are namely:

- Companies that are considered innovative by regulators have an ownership and business operating environment which is crucial for the success of the business that necessitates super-voting shares or weighted voting rights;

- It will affect the valuation of such company by stock analysts; and

- The competition allows it, if the stock exchange does not follow suit, it will lose business.

However, what about minority shareholder protection under the listing rules? The proposed protection measures include limiting the life of corporate weighted voting rights to ten years and the corporate weighted voting rights beneficiary must actively drive the business of the listing applicant. Also, size matters as the market capitalisation of the beneficiary entity of the weighted voting rights must be at least HK$200 billion (approximately US$25 billion) and the market capitalisation of the listing applicant must not account for more than 30% of the market capitalisation of such entity.

The consultation paper tries to present a balance view for allowing corporate weighted voting rights and similar points were previously presented in the 2018 consultation paper. Whilst a full response to the current consultation paper is outside the scope of this Quarterly update, it is interesting to observe the corporate governance measures for corporate weighted voting rights are similar to those implemented for individual weighted voting rights even though minority shareholder protection under corporate weighted voting rights maybe more complex. Further as the stock exchange plays catch-up with its competitors, it seems that this is a missed opportunity to cater the listing rules for other industries that may have similar operating environment but are not currently considered “innovative”. Nevertheless, the creation of such rules are beneficial for innovative companies choosing to list in Hong Kong and may benefit investors by extending the range of investee companies. One small point to note, if you would like to provide feedback on this consultation paper, the deadline is 1st May 2020. Perhaps an extension of the deadline might be helpful given the current environment.

Guidance and training on Environmental, Social and Governance

The term Environmental Social Governance (“ESG”) was made popular from a 2005 in a joint study by financial institutions and supported by the Swiss government on the back of an invitation of the then UN General Secretary Kofi Annan to develop guidelines and recommendations on integrating environmental, social and corporate governance issues in the financial services. It draws up qualitative factors that investors should consider to judge the sustainability of a business such as:

| ESG | Typical Qualitative Factors |

| Environmental | Resource exploitation Pollution Climate change |

| Social | Workplace exploitation Diversity policies and practices Community engagement |

| Governance | Business ethics Corruption Remuneration policy and practices |

Table 1: ESG Factors

In summary, the emphasis is on the listed company to explain its ESG policy and approach to the investing public rather than to focus on specific areas. It leaves a free-hand to the company to explain the material ESG risks of the business in the ESG report following a policy of “comply or explain”, i.e. if an ESG risk is not relevant or material to the company then it can explain why such disclosure is unnecessary. This is a positive step towards establishing a minimum standard of reporting to investors, especially since ESG funds a more recent trend in asset management products and incorporation into investment processes in the Asia Pacific region as opposed to the US and European counterparts. The Global Reporting Initiative or GRI standards is a reference for a deeper discussion of ESG issues.

OTHER HOUSEKEEPING MATTERS

Guidance provided to companies due to Covid-19

The regulators issued a Joint guidance on results announcement in light of the travel restrictions relating to Covid-19 on 4th February 2020 and 16th March 2020, and an FAQ on this topic on 28th February 2020. Listed companies are requested to consult with the Exchange on their ability to meeting their financial results announcement obligations in light of the Covid-19 and are required to publish material financial information to maintain their trading status. Listed companies may defer the publication of its annual reports due on 31st March 2020 and 30th April 2020 initially for up to 60 days from the date of the 16th March 2020 joint guidance statement if the company has published, on or before 31st March 2020 financial information specified therein.

Streamlining of Guidance Letters and FAQs relating to listing matters

The listing department has updated their guidance to the market pertaining to issues relating to controlling shareholders, mineral applicant companies and distributorship business. Thus far, there has been three new guidance letters, 20 updates to guidance material to the market and 54 withdrawal of the same as part of this streamlining initiative.

The update to controlling shareholder guidance letter is a minor housekeeping item to incorporate the principle that the ownership continuity and control requirement applies to the single largest shareholder when an applicant does not have a controlling shareholder, which was previously published in FAQ Series 1 No.16 that has been withdrawn.

Similarly, the update to the minerals companies guidance letter draws principles from eight guidance materials that have been withdrawn pertaining to disclosures in the prospectus and competent persons report such as conditions for exclusion of assets in such report but supplemented by alternative disclosure in the prospectus.

There have been further clarifications provided in the updated guidance letter to applicants that are distributorship businesses on issues of which parties are considered distributors and sub-distributors, and risk disclosure requirements on cannibalisation and control over sub-distributors on the business model.

Odyssey Corporate Advisory is a boutique corporate advisor providing independent and impartial investment and capital markets consultancy services catered for your circumstances and preferences. Corporate Advisory is a division of Odyssey Asset Management Ltd, a Type 1, 4 and 9 SFC licensed company and subsidiary of the Odyssey Group. If you have any enquiries, please contact:

Kuan Yu Oh

Managing Director, Co-Head of Corporate Advisory

Mobile: +852 6971-7989

Email: kuanyu.oh@odysseycapital-group.com

Notice

This publication is for informational purposes only and does not address the circumstances of any particular individual or entity. It does not constitute financial advice and should not be used as such. You should seek a duly licensed professional for investment advice. For more information about please see our Disclaimer.