Jun 28, 2019 | Press Releases, Uncategorized

From AsianPrivateBanker.com:

Odyssey Asset Management, the wealth management subsidiary of alternative asset manager Odyssey Group, has hired a former Indosuez WM banker to build out its NRI division, Asian Private Banker can reveal.

Mullikkottu Veetil Ramadasan has joined Odyssey Asset Management as senior director and head of the NRI division and has been tasked with hiring a team of India private bankers to build out the firm’s NRI client base.

Ramadasan will be based out of Hong Kong and will cover the Hong Kong, Singapore, and Dubai markets, among others.

A spokesperson for the IAM confirmed the hire.

Ramadasan has over 35 years of industry experience and, in addition to Indosuez WM, previously worked with the likes of EFG Bank, J Safra Sarasin, and UBS.

In April, the Odyssey Group launched CapConnectAsia, an Asia-focused third-party fund distribution platform for the region’s family offices and institutional investors. Shortly after the launch, it hired former Standard Chartered private banker Peter Stertzenbach as director of private clients.

“In the coming years, more Southeast Asian countries will reach a level of economic development that will leave their citizens with enough discretionary income to start indulging their travel fantasies. As more Southeast Asians take to the sky, they will go a long way toward helping Japan reach its goal of boosting the number of foreign tourists to 60 million by 2030.”

Read the full article on Asian Private Banker here.

Click here to download the full article.

Odyssey Asset Management Limited

Odyssey Asset Management Ltd, a sister company to the Odyssey Capital Group, is a Hong Kong SFC 1, 4 & 9 licensed company. The Japanese CRE team is headed up by Christopher A. Aiello, and also includes Alex Walker, Daniel Vovil and Sam Luck.

Odyssey Capital Group Ltd is Asia’s leading international Alternative Asset Manager that provides differentiated and bespoke investment solutions across multiple asset classes, including asset management, real estate, private equity and hedge funds. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest in with its clients.

The Odyssey team comprises over 30 experienced executives, asset managers, lawyers, private bankers, trust & tax planning specialists and experienced investors with over 400 years of combined financial and operational experience across the Asia Pacific, Europe and North America.

For more information about the Odyssey Japan Boutique Hospitality Fund, phone or email Daniel Vovil via the contact details listed below.

Daniel Vovil, Co-Founder and President, Odyssey Capital Group

daniel.vovil@odysseycapital-group.com | (852) 9725-5477

Jun 17, 2019 | Press Releases, Uncategorized

[Thai tourists find their nirvana at a Buddhist temple in Takayama, Gifu Prefecture, central Japan.]

From Asia.Nikkei.com:

“Thai tourists to Japan topped 1 million in 2018, while their Vietnamese and Filipino counterparts also came over in large numbers. What is even better for Japan’s economy is that many of these travelers ended up in stores, where they were not shy about spending.”

“In the coming years, more Southeast Asian countries will reach a level of economic development that will leave their citizens with enough discretionary income to start indulging their travel fantasies. As more Southeast Asians take to the sky, they will go a long way toward helping Japan reach its goal of boosting the number of foreign tourists to 60 million by 2030.”

Read the full article on Nikkei Asian Review here.

Click here to download the full article.

Odyssey Asset Management Limited

Odyssey Asset Management Ltd, a sister company to the Odyssey Capital Group, is a Hong Kong SFC 1, 4 & 9 licensed company. The Japanese CRE team is headed up by Christopher A. Aiello, and also includes Alex Walker, Daniel Vovil and Sam Luck.

Odyssey Capital Group Ltd is Asia’s leading international Alternative Asset Manager that provides differentiated and bespoke investment solutions across multiple asset classes, including asset management, real estate, private equity and hedge funds. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest in with its clients.

The Odyssey team comprises over 30 experienced executives, asset managers, lawyers, private bankers, trust & tax planning specialists and experienced investors with over 400 years of combined financial and operational experience across the Asia Pacific, Europe and North America.

For more information about the Odyssey Japan Boutique Hospitality Fund, phone or email Daniel Vovil via the contact details listed below.

Daniel Vovil, Co-Founder and President, Odyssey Capital Group

daniel.vovil@odysseycapital-group.com | (852) 9725-5477

Jun 17, 2019 | 未分类

[Thai tourists find their nirvana at a Buddhist temple in Takayama, Gifu Prefecture, central Japan]

From Asia.Nikkei.com:

“Thai tourists to Japan topped 1 million in 2018, while their Vietnamese and Filipino counterparts also came over in large numbers. What is even better for Japan’s economy is that many of these travelers ended up in stores, where they were not shy about spending.”

“In the coming years, more Southeast Asian countries will reach a level of economic development that will leave their citizens with enough discretionary income to start indulging their travel fantasies. As more Southeast Asians take to the sky, they will go a long way toward helping Japan reach its goal of boosting the number of foreign tourists to 60 million by 2030.”

Read the full article on Nikkei Asian Review here.

Odyssey Asset Management Limited

Odyssey Asset Management Ltd, a sister company to the Odyssey Capital Group, is a Hong Kong SFC 1, 4 & 9 licensed company. The Japanese CRE team is headed up by Christopher A. Aiello, and also includes Alex Walker, Daniel Vovil and Sam Luck.

Odyssey Capital Group Ltd is Asia’s leading international Alternative Asset Manager that provides differentiated and bespoke investment solutions across multiple asset classes, including asset management, real estate, private equity and hedge funds. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest in with its clients.

The Odyssey team comprises over 30 experienced executives, asset managers, lawyers, private bankers, trust & tax planning specialists and experienced investors with over 400 years of combined financial and operational experience across the Asia Pacific, Europe and North America.

For more information about the Odyssey Japan Boutique Hospitality Fund, phone or email Daniel Vovil via the contact details listed below.

Daniel Vovil, Co-Founder and President, Odyssey Capital Group

daniel.vovil@odysseycapital-group.com | (852) 9725-5477

Jun 13, 2019 | Articles, Global Markets Update

Equities were hit hard last month after sentiment soured after a rapid about-turn on a US-China trade deal that was expected to be signed. The US blamed it on a U-turn by the Chinese leadership that worried the deal, as it stood, might be seen as ‘humiliating’. Unsurprisingly, Asia Pacific (APAC) markets were hard hit with Hong Kong off almost 10%, MSCI Asia ex-Japan (AXJ) -9% and Nikkei 225 -7.5%. The exception was India after the BJP’s surprising landslide victory, which saw Sensex rise 1.75% for the month on the hope this will enable further reform progress. India was not alone in producing a positive election result as Australia, Europe, Indonesia, Philippines, South Africa and Thailand all exceeded expectations and helped equities and currencies. US markets were not spared with trade impacted Nasdaq off -7.9%, notably the semiconductor space, and S&P 500 off -6.6%. A further negative for US technology/social media are concerns around antitrust actions by the regulators that included Facebook, Google, Amazon and Apple.

Risk-off assets rallied with the US Treasury (UST) 10Y yield dropping quickly through the support at 2.30% towards a stronger support at 2.00% and the lowest since September ’17, whilst 10Y German bunds, in part around worries over Italy’s fiscal rectitude, rallied such that the yield fell into unchartered territory below the previous low at -20bps. US high yield (HY) fixed income (FI) belatedly saw spreads widen out by 70bps, led by weakness in CCCs that fell -2.2%. However, AXJ HY FI was resilient, gaining 8bps over May, helped by positive election results and a belief the key sub-sector, China’s real estate developers’ HY FI, would be defensive should a trade war continue as it is a sector that will gain from domestic reflation.

Gold, after being puzzlingly quiet, rallied, along with JPY, later in May with the former breaking through key resistances at $1,300 and $1,320. Apart from the ‘safe haven’ JPY rally, the USD gained 2.5% against CNY that fell from 6.74 to end at 6.90 but tested key support at 6.96 during the month on worsening trade news. Continued Brexit chaos helped sink GBP by over 3% towards YTD lows at 1.26. Oil was the worst performing asset class of all, with Brent oil plunging over 11% to break strong support at $70/brl then $68/brl to head to testing the next support at $60/brl, off a combination of rising US crude inventories, with US producing a record 12.5mn/bpd last month, forecasts of weaker global demand and concern that Russia might seek to increase its production amount at the next OPEC meeting this month.

Equities

-

All three major US indices fell significantly in May, breaking their respective 200DMA support lines although there was some respite in a Fed ‘put’, after FOMC comments were released in early June which saw equity markets make a broader rebound with Powell’s comments helping to alleviate some selling pressure. Energy (-11.70% MoM) stocks were the biggest losers this month, led lower as oil prices fell on the back of concerns over the impact of US tariffs on global growth.

Figure 1: Relative performance of US indices Source: Bloomberg

-

IT (-8.91% MoM) shares also saw a big fall, alongside the Nasdaq (-7.93% MoM) as growth stocks came off and investors fled into safe haven assets. Notably, a big contributor to weakness came from Semiconductor stocks, as the Philadelphia Semiconductor Index (-16.70% MoM) came off sharply from all-time highs after weaker guidance from Q1 earnings reports raised fears that an anticipated 2H19 recovery in the industry could be delayed. This weakness extended over the past week, following antitrust concerns over the reach of Facebook and Amazon which fell -7.50% and -6.11% overnight last week as the news broke (Figure 1)

-

On the geopolitical front, headlines continued to be dominated by trade, first with the ramping up of tariffs on China, then subsequently an announcement on tariffs for all Mexican exports effective June 10th. Thankfully both US and Mexico reached a deal, with Trump removing the tariff threat ‘indefinitely’. He also delayed implementation of tariffs on numerous Chinese exports to 15th June from 1st June to allow exporters to bring their goods into US before the tariff rates are increased.

-

Trade and US politics will drive short term directionality in the S&P 500. We think it is in a range of c.2,400-2,950 with upper bound capped by valuations and a slowing economy whilst lower bound by likely policy action by the Fed and Trump’s administration as neither has the intestinal fortitude to allow capital markets to suffer a ‘bear’ market. We see more negative, than positive, developments in the short term with the G20-Summit a possible flashpoint for further US tariff action towards China. We doubt an early resolution of the trade deal until closer to YE19 or Q1CY20.

-

Whilst the Fed has talked more ‘dovishly’ of late we think the hurdle to cut rates is much higher than the FI markets predict and this opens up a ‘disconnect’ for risk assets whilst, should the Fed actually cut rates this year then this might worry equities as to what there is to fear driving the Fed’s action. Either option could lead to significant sector rotation.

-

Sector action might be trickier as whilst this might have seen ‘growth’ sectors outperforms as IT the very real threat of antitrust action against some of the IT heavyweights, as Facebook, Amazon, Google and Apple, which has a rare degree of bipartisan support in Congress could complicate the past ‘norms’ plus ‘value’ is looking cheap relative to ‘growth’.

-

We doubt Trump will be impeached but the threat of this remains that could add to his erratic decision making and use of trade, where the President has a lot of power under the Constitution, as a way to deflect attention from his domestic woes. As we head into the election year, there is a genuine risk, should Trump fall behind in the polls, of really bizarre behaviour and this is disturbing given Trump has extremists like John Bolton and Peter Navarro as senior advisers. On the flip-side, Trump arguably uses the level of the S&P 500 as a key barometer of his Presidency and this may, should S&P 500 fall sharply, see him shift towards more market-friendly ‘tweets’ including ameliorating his hardline trade approach.

-

European equities also came off, with the Stoxx 600 (-5.79% MoM) led lower by Autos (-13.74% MoM) and Bank (-11.58% MoM) stocks. Unsurprisingly, defensive sectors like F&B (-0.07% MoM) and Real Estate (-1.36% MoM) outperformed, alongside German shares in the DAX (-3.48% MoM) index which were also noticeably resilient. Stoxx Q1 EPS, so far, have achieved its best result in two years.

-

However, the outlook for earnings for the rest of FY19 looks to be far more challenging as data suggests economic momentum is eroding on both the continent and the UK despite positive metrics from rising wages and falling unemployment. For now, consensus is for +4% FY19E EPS growth but with Bunds yield below -20bps and slowing loan demand EU banks’ earnings look to be at risk plus there remains another EUR 400-500bn required in fresh equity capital.

-

The region’s key focus this month centred around the EU Parliament elections, which saw Pro-EU parties largely staying in power. This helped alleviate concerns over a growing populist influence, although the results did seem to spur a shift in a number of constituent nations. There’s also a growing risk the battle over the appointments of senior positions in the 3 key EU institutions, as the head of the European Commission and Draghi’s replacement at the ECB, will be contentious and may result in a weaker Franco-German relationship.

-

In addition, Austria’s Kurz was removed by a vote of no confidence, while Greece’s Tsipras announced a general election after Syzira disappointment in EU elections. To top things off, the European Commission sent a letter to Italy’s finance ministry, warning that it may take disciplinary action if Italy fails to justify its budget plans and sufficiently explain its deteriorating public debt and budget deficit.

-

The worry is Italy’s shift towards growing support for The League, providing it with the desire to fight the EU over its higher than allowed fiscal deficit. The likelihood of the EU moving forward on further integration reforms necessary to address structural frailties in its undercapitalised banking system and fiscal system looks to be remote.

-

Brexit developments were not particularly supportive either, with Corbyn calling off cross-party negotiations mid-month after six weeks of talks, calling May’s offer a ‘repackaged version of the same old dear’. May also stepped down as Prime Minister on 7th June but will remain at her position for as long as needed.

-

It is unlikely we get a new party leader in place until September with the EU deadline looming on 31st October. The odds of both a ‘no’ deal or no Brexit have risen, as have those of a second referendum, but what the outcome will be is impossible to forecast with any accuracy. What is increasingly true is the two camps are increasingly polarised and May’s legacy, having frittered away the chance to get a compromise deal agreed when the sides still could have accepted one, is to have opened the door to Nigel Farage’s brand of boorish inflexibility making the FTSE 100 and GBP binary bets and likely a bitterly disappointed 50% of the population whatever the outcome.

-

Whilst FTSE 100 might be a risky binary bet in the shorter term, should Brexit result in a major decline in GBP and domestic-demand related equities that might be a ‘bargain basement’ time to buy given institutions, notably FIIs, have been net sellers since the referendum and FTSE has world class companies as Shell, Diageo, BP, Llyods Bank to name a few.

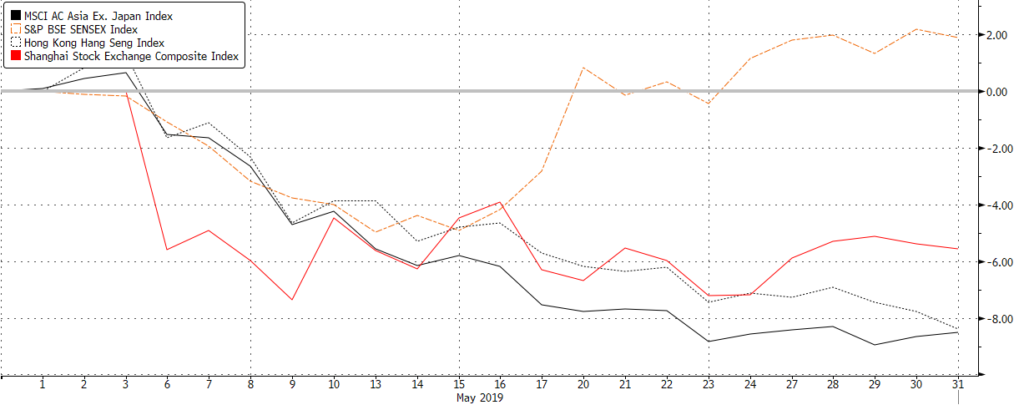

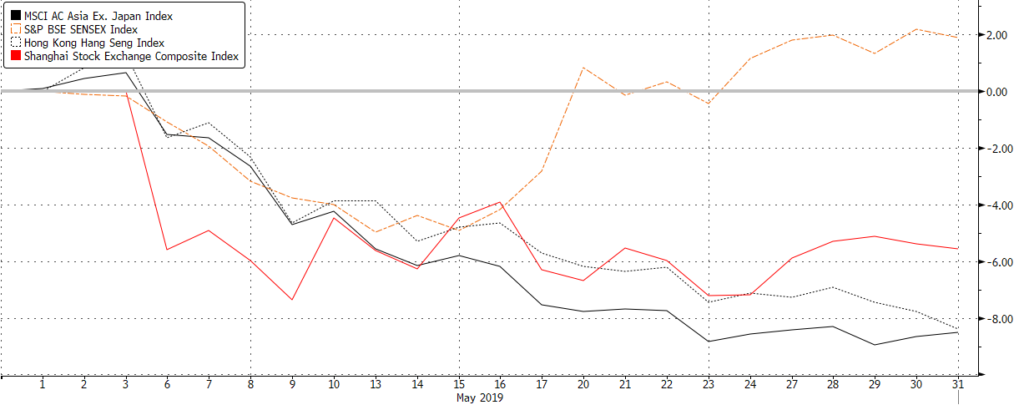

Figure 2: Sensex outperforms in the Asian region while Chinese equities weigh Source: Bloomberg

-

Shares in Asia were likewise depressed, with the broader MSCI Asia ex-Japan logging a -8.94% decline, unsurprisingly led lower by the HSI (-9.42% MoM) although the Shanghai A-shares Index (-5.83% MoM) was comparably resilient despite the re-escalation of trade tensions which undoubtedly weighed on China-focused stocks (Figure 2). MSCI ASEAN (-4.76% MoM also fell, albeit from a lower base compared to the 1Q19 rally we saw in Chinese stocks.

-

Sensex (1.75% MoM), however, outperformed the region, instead pushing into all-time high territory following a number of developments which helped buoy stocks against the selloff in global equities. One key overhang was eliminated this month, with Modi’s BJP winning a surprise landslide victory. The result was the first time in over 50Y a single, incumbent party has retained a majority in the Lower House since Indira Ghandi did in the early ‘70s and, given much of the success was due to Modi himself, reaffirmed his position as India’s reformer in chief. Arguably the more important development might be if, as seems likely, the BJP gains control of the Upper House by late ’20 that might see it then undertake the vital reforms needed of labour markets and in land acquisitions.

-

Later in the month, we also saw Trump terminate India’s designation as ‘beneficiary developing country’, disallowing duty-free allowances on some 2,000 products that were being exported to the US.

-

TOPIX weakened on trade related fears and poorer than expected Q1CY19 results but regained some ground after last month saw a record amount of share backs underpinning hopes Japanese companies are accelerating corporate governance and capital structures improvements that will continue to boost the underlying core ROE from a global low of 6% when Abe took over to 12% by FY22/23. Trump has tweeted the trade negotiations with Japan are going well that makes sense whilst US is preoccupied by China and the importance of Japan as a strategic ally in APAC.

-

The recent elections in Indonesia, Philippines and Thailand were equity positive as the outcomes left incumbents in power with strengthened positions to undertake important economic reforms. Likewise, in South Africa Cyril Ramaphosa lifted the ANC vote share relative to ’16 local elections with the hope he has a stronger mandate to accelerate the critical reforms required and to clean up the corruption within the ANC left over from Zuma’s failed Presidency. Not all was rosy around political action in EM as in Brazil Bolsonaro’s bizarre behaviour, and those of his sons, is reducing the prospect of getting meaningful fiscal reforms through the notoriously irresponsible Congress whilst an election in the state of Cordoba, in Argentina, saw the Peronist party regain power from Macri’s coalition fanning fears a populist might win the October Presidential election. Lastly, Erdogan succeed in overturning the Istanbul city election result with a rerun 23/6 so delaying the possible start of much needed economic reforms at a time Turkey is on the edge of a full-blown currency crisis.

-

A-shares outperformed HK last month helped by its higher inclusion in MSCI EM 28/5 and likely buying support from Chinese government backed funds. Our base case is the greater the trade related damage to the economy the more intense the fiscal and monetary policy reflation into the domestic economy and why we remain constructive on Chinese equities, including Banks, Insurance, Autos and Property that offer value but also in consumer related plays as Alibaba and Tencent. This might be why, despite weaker than expected official and Caixin PMI numbers for May, equities rallied on hopes this might see more stimulus and, sure enough, some positive pro-auto sector demand measures came out the next day!

Fixed Income

-

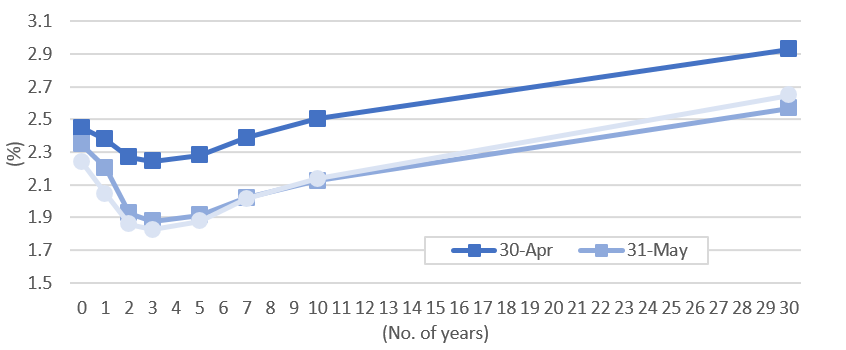

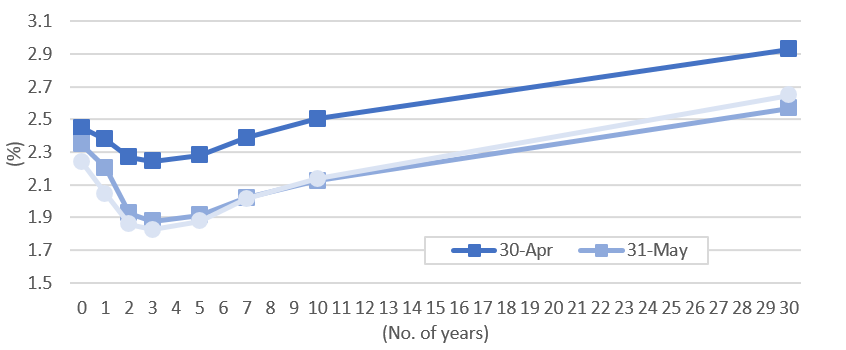

Sovereign yields tanked in May amid worsening trade environments between US and two of its biggest trade partners – Mexico and China. The UST yield curve saw a parallel shift downwards, while the 3M/10Y spread turned negative again in the last week of May and remained below zero through the first week of June (Figure 3). The 2Y and 10Y ended the month at 1.9221% and 2.1246%, falling 34.40bps and 37.72bps MoM. These are the largest MoM falls seen in 4.5yrs and 10.5yrs respectively.

Figure 3: US Treasury yield curve Source: Bloomberg

-

Powell’s statement on Tuesday (4th June) implied that the Fed is now opened to cutting rates if necessary. Recent comments from Bullard and other voting members of the Fed seem to echo Powell’s statement, raising expectations that rates will be cut this year.

-

Inflation data have not been supportive too, with the US core PCE YoY remaining persistently below the Fed’s 2% target. The same has been apparent in Europe, with the core CPI YoY fluctuating around 1% in recent months. The May Eurozone core CPI fell sharply to 0.8% from 1.3%, leading German 10Y bunds yield to fall 21.5bps and further below zero to -0.202% – a new all-time low.

-

Performance among credits were mixed – the risk-off mood in May saw a rotation to safer bonds. While spreads widened across all sectors, the rally in USTs was able to offset the slightly smaller spread widening of investment grade (IG) bonds. As measured by the Bloomberg Barclays indices, global and US IG bonds returned 0.68% and 1.43%, significantly outperforming their high yield (HY) counterparts (Global HY: -1.04%; US HY: -1.19%). In fact, May was US HY’s first MoM loss and its worst month since the rout in December last year. As expected, the CCC performed the worst with total returns of -2.73% and spreads widening 112bps.

-

Asian USD debt and EM hard currency debt also managed to close the month higher while EM local currency debt was flat. Of notable concern was S&P’s decision to upgrade Indonesia’s sovereign credit rating by one notch to BBB after the re-election of Jokowi, citing prudent fiscal policy and strong growth prospects relative to its peers with similar income levels.

-

We think USTs have been overbought and agree with houses like UBS and GS that the market’s reaction is likely overdone. To add on, the US economy is not all that bad, with recent economic data coming in mixed.

-

We also do not think US HY debt will continue the trend it saw in May. We see fundamentals of the sector as still being supportive and think it is worth holding on to. However, we see no reason to add to it as its 8+% gain YTD limits the upside and its correlation to equities provides downside risks.

-

Asian credit should continue to see strength in the short-term. Election positives from the results in the region should help support economic growth in the region and should be credit positive, especially for countries like Indonesia and India. In addition, a huge part of Asian credit, especially in the HY space, is made up of debt from Chinese RE developers, which are seen to be less affected by trade concerns. The sector might even benefit should the Chinese government decide to reflate the economy.

FX

-

Volatility in the G7 pairs rose further in May amid the new trade developments. Concerns around global growth grew further and markets have priced in up to two Federal rate cuts by the end of ‘19.

-

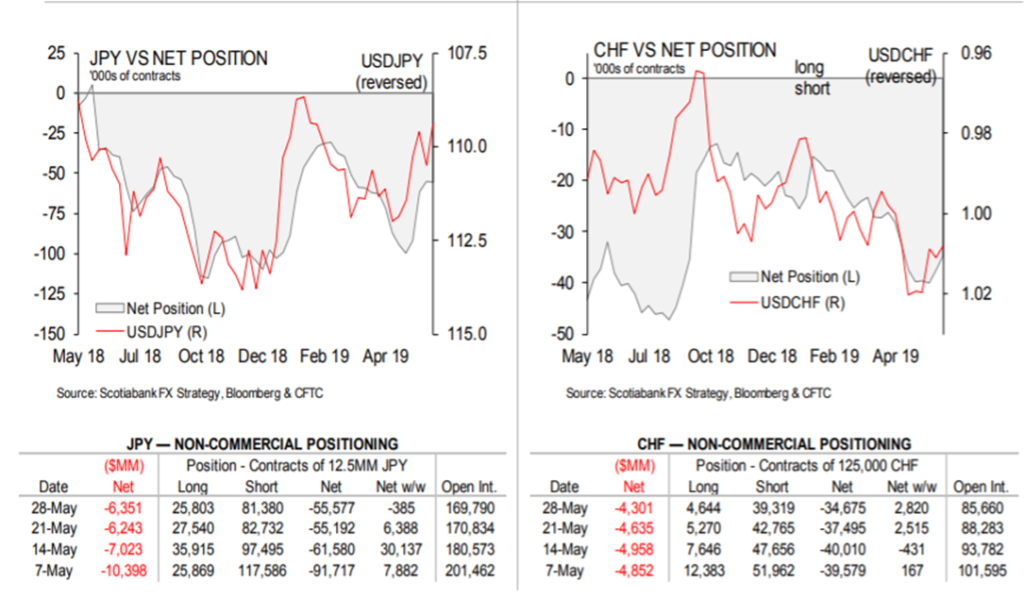

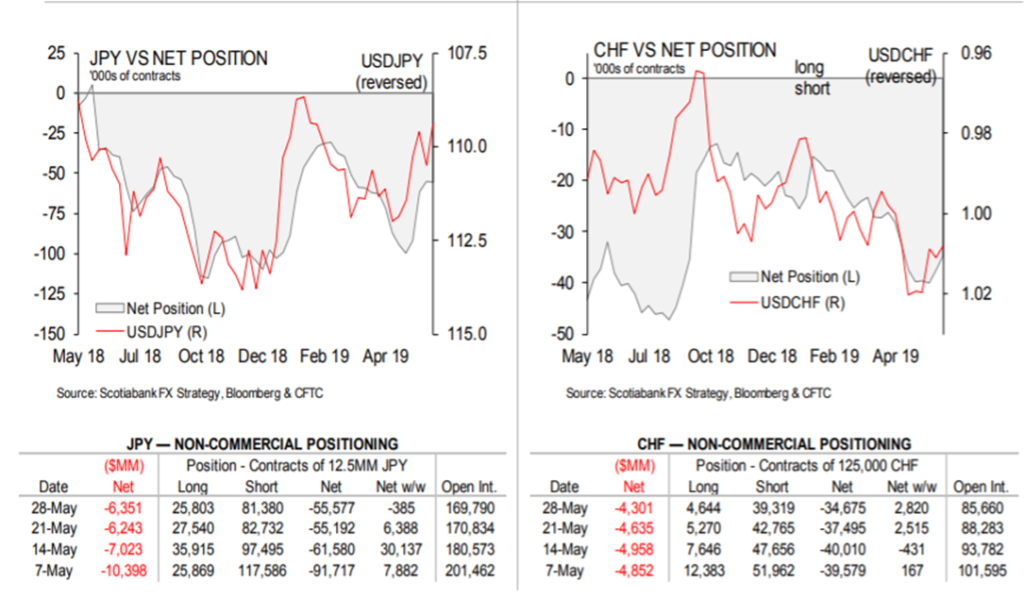

USD weakened and conventional havens, such as JPY and CHF, gained significantly. Weaker US data over the month further weighed on the dollar. CFTC reports show both CHF and JPY shorts unwinding with JPY shorts reporting -117k to -81k and CHF shorts from -52k to -40k (Figure 4).

Figure 4: Non-commercial positioning of haven currencies Source: Scotiabank FX Strategy, Bloomberg, CFTC

-

AUD dipped from 0.7090 to 0.6109 in May. Weighed down by what was seen as an unlikely win by the conservative party, we now believe the 0.70 support will become a resistance between Q3 and Q4. We also think it is not pricing in the current weakness in the economy – economic momentum is slowing while the country experiencing a collapse in its housing market and risks from the US-China trade war.

-

Sterling continued its descent and experienced a very depressing month of trading as Brexit continues to steer the pound. Theresa May’s resignation and what remains of the political leadership have all but confirmed the uncertainty in the pound.

-

The Thai Baht stood out in terms of strength and finished +1.78% stronger against the dollar, supported by local bond purchases as well as relatively small equity outflows.

-

We remain of the view that the dollar is the least bad currency amongst all developing markets FX. The US economy remains robust and we expect a likely rebound in UST yields, and a widening of real yield differentials, to support the DXY. Despite DXY’s fall below its 97.50 support, we think it is too early to call the end of USD strength, notwithstanding various FOMC members’ best attempts to talk it down.

-

AXJ FX finished relatively flat against the wandering dollar bar the Chinese Yuan, which weakened -2.53% against the dollar amidst the re-escalation of the trade war. We continue to believe that the CNY will remain below 7 as its line in the sand as we believe China continues to be well-equipped to defend this level. CNY remains below a key resistance at 6.96.

Commodities

- We believe oil reacted more towards the build-up of US stock and the unwinding of gross long positions. Brent’s failure to break past $75 caused it to return to its $70 support. Concerns around global growth slowing also saw traders lower their net long positions, causing oil to end the month at $63. On technicals, we see $55 as the next potential support level for Brent oil. Should this level fail, we have a horizontal support at $45 that has held since ‘16

-

We do not believe the weak oil price will persist given the tensions in the Middle East, OPEC’s clear commitment to production quotas – especially, Saudi Arabia – even if Russia seeks a release in the June meeting, supply side reductions regarding troubles in Libya, Venezuela, Algeria etc. and US sanctions on Iran. The extraordinary ability of US shale oil to increase production to a record 12.5mn bpd will cap the upside but, to a degree, limit the downside as producers are very quick to respond to price movement. At the year-end, environmental requirements will force ships to burn lower sulphur bunker oil that will increase demand for middle distillates by 2-3mn/bpd that is meaningful.

-

Gold had a quiet start in May before ending $50 higher, in part due to its haven status as equities sold off amidst the trade war escalation, as well as a weaker dollar. Gold may well advance to test a multi-month high above $1,340/Oz and conditions are in place for this to go higher should we be closer to the USD peak at a time UST yields offer limited compensation and less capital upside. Speculative selling much of this year has removed a source of selling and might become a source of demand alongside steady EM central bank buying. As we enter a riskier global outlook gold’s insurance attributes and as a portfolio diversifier will boost its appeal.

Jun 2, 2019 | Uncategorized

Odyssey Japan Boutique Hospitality Strategy 2019 1H