Dec 21, 2017 | Careers

Who Are We

The Odyssey Capital Group is an international alternative asset manager that provides differentiated and bespoke investment solutions across multiple asset classes, including the capital markets, real estate and hedge funds. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest with its clients. The Odyssey team has over 400 years of combined experience across Asia Pacific, Europe and North America.

Our entrepreneurial culture allows us to generate attractive investment returns by following a prudent and long term approach. We aim to only employ the highest quality people as partners in our business, while pursuing the highest standards, and aligning our interests with those of our investment partners.

The Odyssey team have decades of financial and operational experience, broad regional an industry expertise, insight into global macro and geopolitical trends, and a powerful network of global relationships. When clients partner with the Odyssey group of companies, they benefit from the breadth and expertise of the entire firm working in unison to achieve a defined outcome.

Ideal Candidate

Odyssey Capital Group Ltd is an international alternative asset manager, based in Hong Kong. As part of our expansion program we are seeking to recruit a Private Equity Investment Analyst. The primary responsibilities are:

- Screen and analyse investment opportunities across different industry sectors, including real estate.

- Perform industry, competitor and company analysis.

- Perform due diligence on potential acquisitions.

- Develop financial models for new and existing investments, conduct extensive financial analysis.

- Prepare presentations and investment committee memorandums for new and add-on investments.

- Manage and monitor existing portfolio investments, interact constantly with management of investees.

- Prepare periodic reviews of existing portfolio companies, including valuations and quarterly reports to investors.

- Have the ability to think laterally and ability to form strong opinions.

- Provide support for accounting, compliance and marketing efforts.

Additional Requirements

- Proven trackrecord as an private equity investment analyst, with minimum 3-5 years relevant experience.

- Knowledge of financial modelling, statistics and project management.

- Hands-on experience in financial due diligence and advanced spreadsheet modelling skills.

- Proven written and spoken English and Chinese/Mandarin proficiency.

- Excellent academic background, with a CFA/CPA being an advantage.

- Degree or experience in Accounting or HK Law is an advantage.

- Experience in Asia consumer markets and beverages is an advantage.

Contact

Roger Leader

roger.leader@odysseycapital-group.com

Note: Successful applicants will be contacted, if you don’t hear from us then you can assume you have not been successful.

Dec 21, 2017 | Careers

Who Are We

The Odyssey Capital Group is an international alternative asset manager that provides differentiated and bespoke investment solutions across multiple asset classes, including the capital markets, real estate and hedge funds. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest with its clients. The Odyssey team has over 400 years of combined experience across Asia Pacific, Europe and North America.

Our entrepreneurial culture allows us to generate attractive investment returns by following a prudent and long term approach. We aim to only employ the highest quality people as partners in our business, while pursuing the highest standards, and aligning our interests with those of our investment partners.

The Odyssey team have decades of financial and operational experience, broad regional an industry expertise, insight into global macro and geopolitical trends, and a powerful network of global relationships. When clients partner with the Odyssey group of companies, they benefit from the breadth and expertise of the entire firm working in unison to achieve a defined outcome.

As part of the Odyssey Group’s continued expansion, we are in the process of setting up a Cryptocurrency Hedge Fund as well as separately managed account (SMA) service. The platform will provide our clients with access to Blockchain assets and a convenient and secure wallet storage solution. As a result we are actively seeking to recruit a Hedge Fund Manager to head up our Cryptocurrency fund and portfolio management strategy.

Ideal Candidate

The candidate’s primary responsibility will be managing the trading and execution of the Cryptocurrency fund and separately managed portfolios. The candidate will therefore be expected to have an in depth knowledge and proven track record of trading cryptocurrencies, and in addition a background in data science and Bitcoin Python programming. It is anticipated the candidate will have over 5+ years’ experience in traditional financial assets either at a bulge bracket investment bank or hedge fund. It would be beneficial if the candidate has experience in derivatives, volatility trading, algorithmic trading, plus a combination of listed and unlisted securities trading experience.

Other qualities that will be required for the role:

- The ability to analyse and manage digital asset portfolio positions.

- Actively follow cryptocurrency markets, and generate profitable trading strategies.

- Design, implement and monitor automated trading strategies.

- Investigate and improve existing trade execution and general strategy performance.

- Develop investment strategies to profit from wide arbitrage spreads.

- Manage client and consultant requests.

- Maintaining and enhancing existing quantitative systems and procedures.

- Exploring opportunities to incorporate ‘big data’ sources into existing processes.

- Excellent academic qualifications in Computing, Finance or Mathematics.

- Strong written communication.

- Competent in using office applications, Bloomberg and other software and trading applications.

Contact

Roger Leader

roger.leader@odysseycapital-group.com

Note: Successful applicants will be contacted, if you don’t hear from us then you can assume you have not been successful.

Dec 8, 2017 | Articles, Global Markets Update

HOW WE ARE POSITIONED FOR THE END OF Q4 17

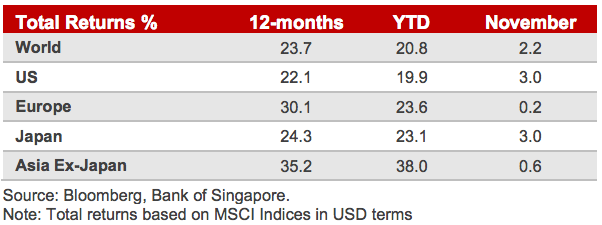

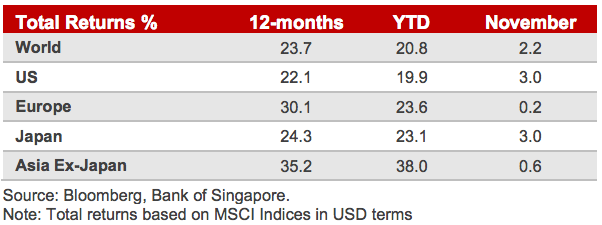

We anticipate that markets will be trading, reasonably supported into year-end. US stock indexes have reached new highs after an impressive run-up, and then have sold off the last days of November. They overcame uncertainties surrounding the Tax Cut and headlines about Trump. In addition, the HK and Asian markets have been trading higher; meanwhile, European and UK stocks have overall been slightly underperforming. This is mainly contributed to a stronger Euro and uncertainty regarding Brexit and the Political risk following the fiasco in the German coalition.

- Bond prices globally have traded weaker as the market has been preparing for interest rate rises and the end of Quantitative Easing.

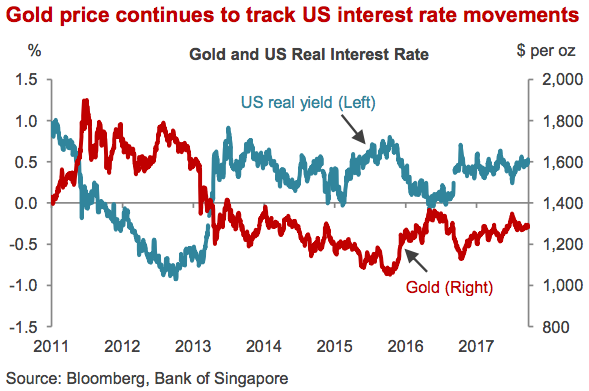

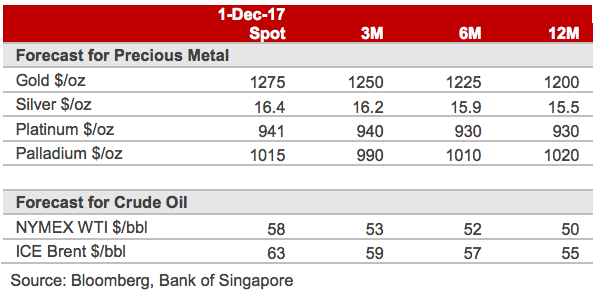

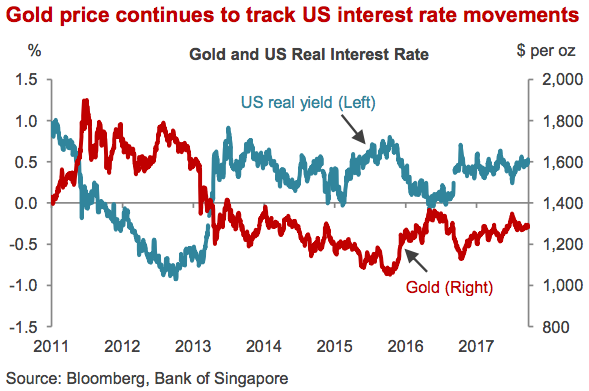

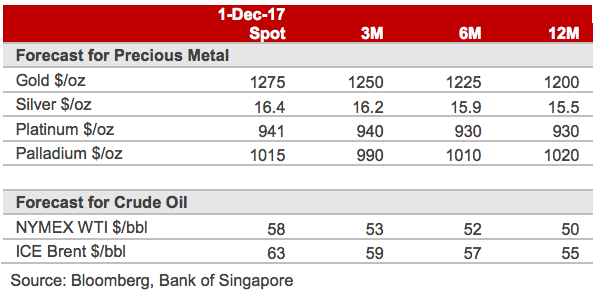

- Commodity markets are expected to remain at a mixed to stabilised level, with Oil trading well above the 50 level and reaching 60. Gold’s massive bull run has been partially reversed with prices dipping below the 1300 support level, helped by the strengthening of the US Dollar and diminishing fears about North Korea.

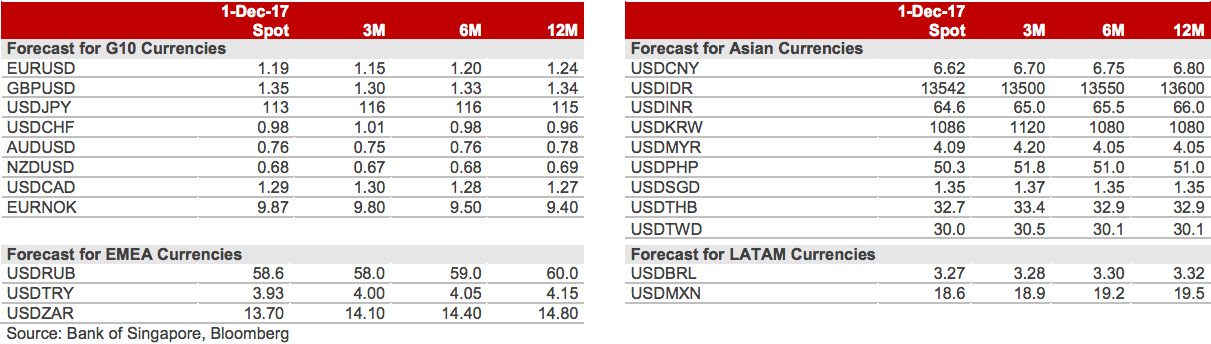

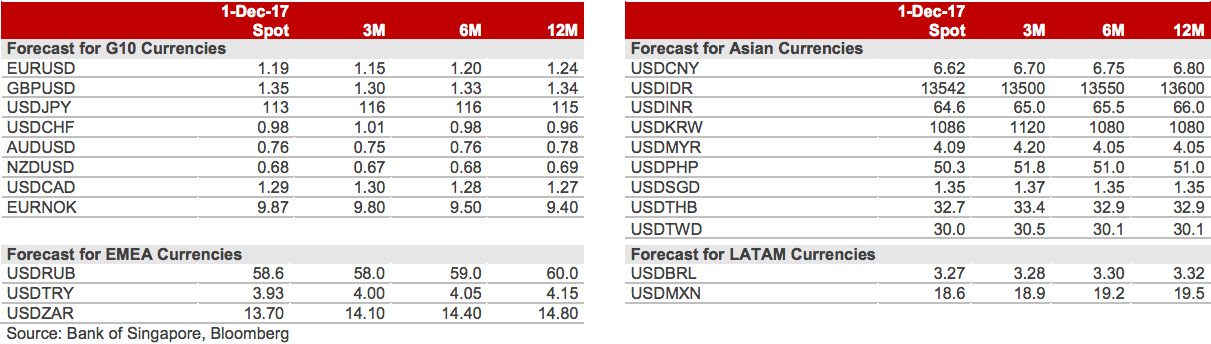

- The US Dollar is likely still to be weak in the medium term, as expected rate hikes have been discounted, and the markets are now focusing on other countries to raise interest rates.

- Overall, we remain medium-term relatively constructive on stocks; however, we are wary at the current levels. We see some uncertainty surrounding future Central Bank moves and political risk. For this reason, we advise buying high dividend stocks and to generally carry and rotate from overvalued sectors to more undervalued.

- Market complacency is still at its extreme, but we do not think it is sustainable. Therefore, we suggest buying protection via hedging strategies to protect against market volatility while it trades at multi-year lows. Strategies prefer purchasing puts, selling call spreads, buying bear ETFs or allocating more to cash for this month are advised.

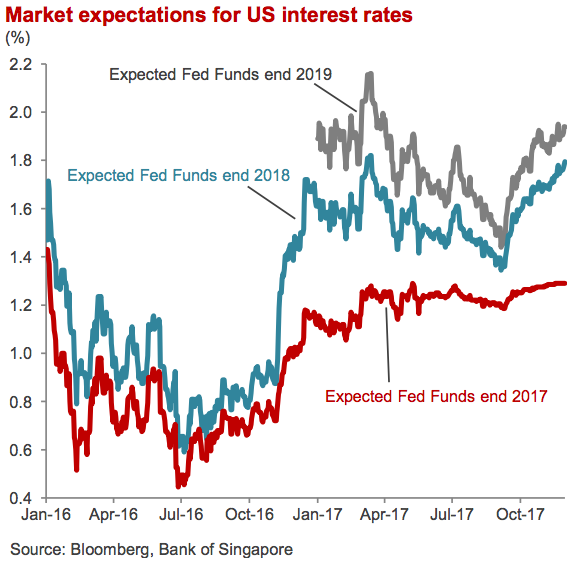

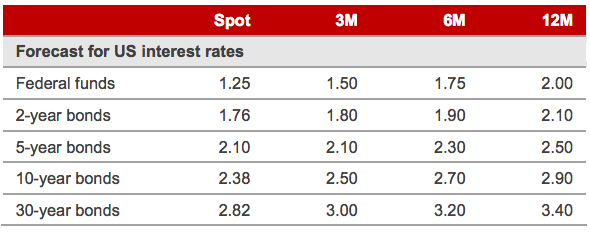

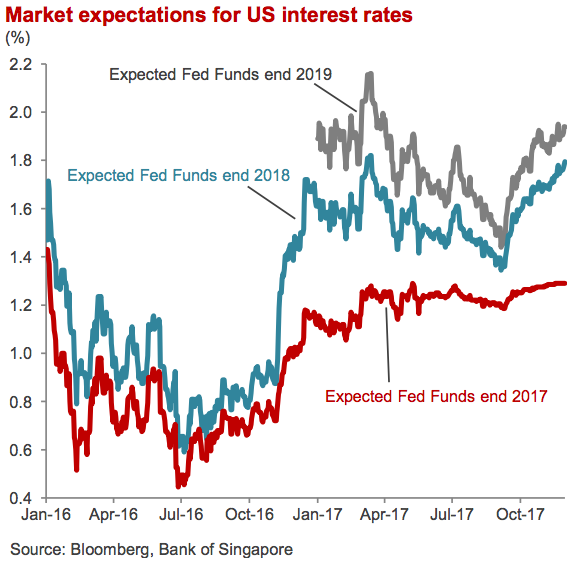

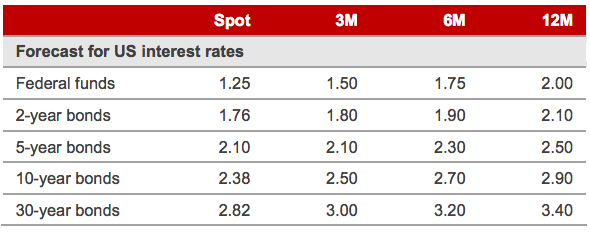

- We could see some volatility over the next Fed meeting on 13th December and possibly some uncertainties over the debt ceiling more headlines on Trump.

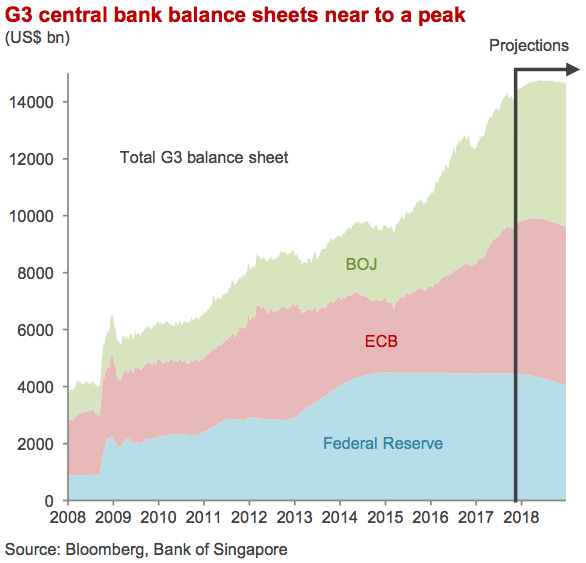

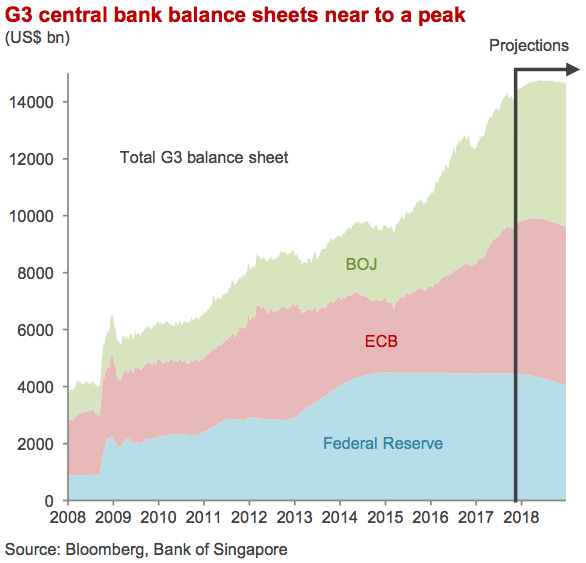

- However, we believe that the rate outlook seems pretty much discounted, and that we can expect to see the start of offloading the Fed Balance Sheets. This would be more crucial for the market.

- Another hike is forecasted for December, with the market giving an 80% chance of a hike as the Fed seems comfortable with the current pace of economic growth. However, the weakening of the USD this year has loosened financial conditions by increasing the levels of exports.

- While we are wary of Brexit and the stronger Euro, we believe that the existence of cheap valuations and a generally underweight position in European assets make certain European equities attractive.

- A stronger Euro, while a small drag on some European exporters, will be overall beneficial as it will contribute to a positive outlook for Europe.

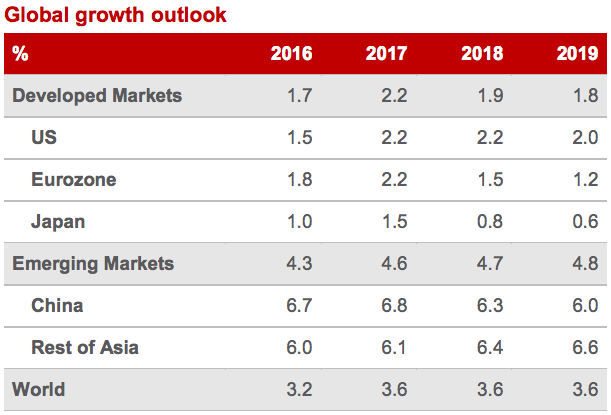

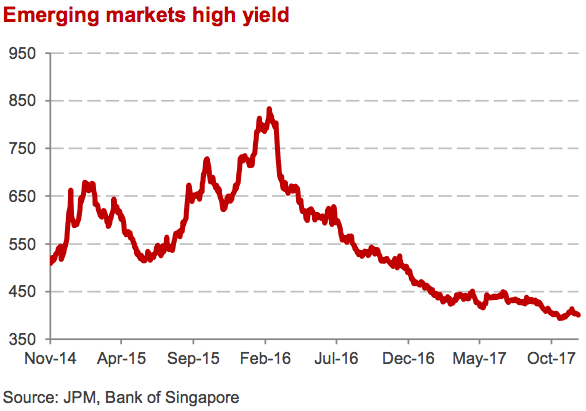

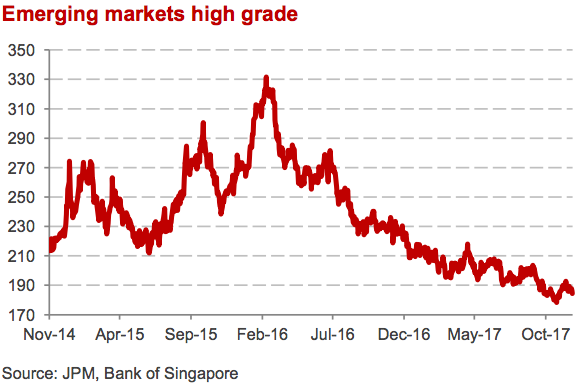

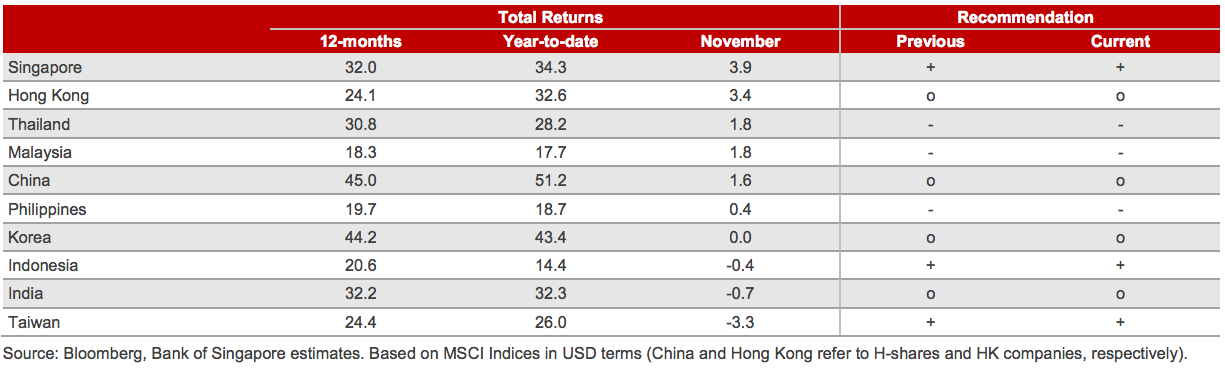

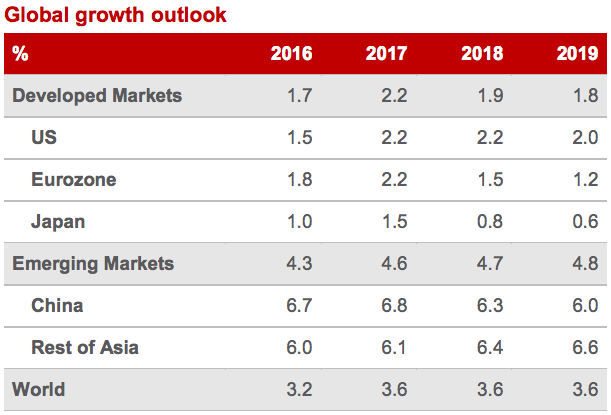

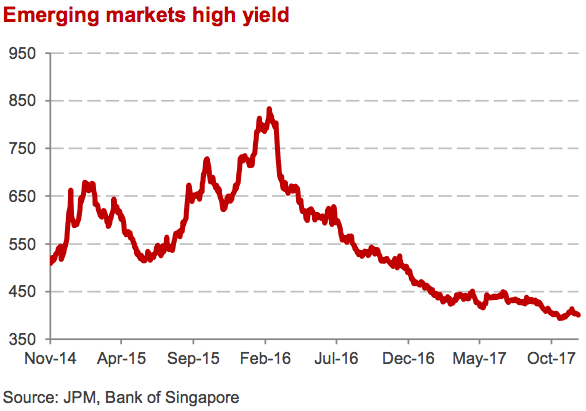

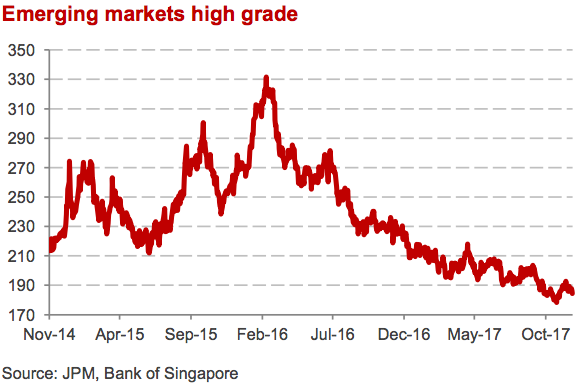

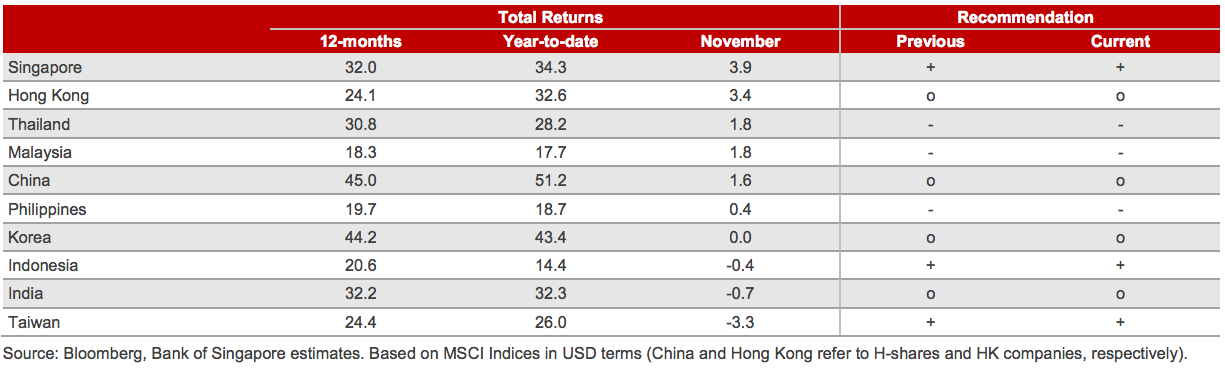

- We are constructive on Emerging Markets, as markets look solid and seem immune to the US interest rate hikes.

- We are still interested in South East Asian economies, as reforms have helped boost investments and growth. India, Indonesia, Vietnam and Philippines are our recommended markets to analyse.

MARKETS OVERVIEW

Equities – Expecting Sideways Moves

- Equities across the board have made new highs on the year. However, we are still concerned about a possible pullback due to valuation multiples looking stretched and the potential of stubborn political impasse from the US and uncertainties about the Central banks tapering. We think that a potentially positive tax cut could be seen as an excuse to take profit by some investors and we would prefer to fade a further rally rather than chase the move higher. For the long-term, we are selectively choosing overweight equities, against bonds: these offer the best return prospects against other asset classes over a 12-month horizon.

- We discussed last month that it would be viable to take profits on overvalued sectors like Technology and rotate into more undervalued sectors like Healthcare and Energy, and we will still believe this is the better investment option.

Bonds – Bearish

- A rising interest rate means most bond markets are vulnerable. After the big climb last year, the US bond yields have stalled in a range, and then have come off. European yields have been trending higher in the last few months as the ECB has announced that the end of QE could be approaching. Most sovereign bonds are still looking expensive and vulnerable to any hawkish changes from the Central Bank policies, especially in Europe, UK and Japan.

- If investors need to be positioned in fixed income, we prefer either inflation protected bonds (e.g. TIPS) or high quality corporate bonds with short durations trading at or near face value.

- Our previous view was to use bonds as an alternative for cash balances which were earning next to nothing. However, in this environment the risk of capital loss on bonds outweigh the potential rewards for trying to get a better than zero percent coupon.

Commodities – Expected Sideways Markets

- Oil prices have rallied in the past couple of months driven by limits on supplies, ultimately supporting the price rise.

- Oil demand continues to grow at a steady pace, while the US rig count has been trending lower, therefore, we believe a range of 50/60 seems reasonable with short-term risk to the upside. From a medium-term perspective, we remain bullish.

- Gold has come off after the big rally of the past few months, as geopolitical risks have faded and the US Dollar has strengthened from the lows. At the current level of 1275, we are neutral to bullish on Gold for the short term, but we are less positive for the long term.

Currencies – Consensus bearish on USD

- While the passage of the Tax Cut could be positive for the US Dollar, the main driver for the dollar’s strength will come from a US interest rate rise, and if the Fed is more hawkish than expected, we could see a renewed interest in buying USD. We are bullish on the Euro as investors are still too underweight. Economic data has been solid, pushing the ECB to talk about increasing rates earlier than expected, as Draghi mentioned in the last meeting. We remain bearish on the Sterling and the Yen, and neutral on Canadian Dollar, Australian Dollar and New Zealand Dollar.

Alternatives – Bullish

- We are generally positive on the property markets, with a preference for commercial over residential. Our favoured countries for exposure include Australia, UK, South East Asia, USA, and Vietnam. Please ask for more information on some of the projects we are currently working on.

- We also have a positive outlook on Private Equity as we see better growth opportunities, whilst lower valuations are seen across the industry compared to most stock markets.

BULLISH SECTORS

- Telecom, Consumers and Real Estate outperformed. The Technology and Material sectors was the biggest underperformers, with Financial and Health Care also performing well.

- Technology stocks have had the best performance Year to Date. Given that it is the most expensive sector, we still have the view that it is the right time to reduce some long positions and take some profits as the Tax Cut package will not benefit too much the sector.

- The Healthcare sector continues to benefit from improving pipeline productivity and an increasing number of new drugs approved by FDA.

- We think buy dips in the Energy sector after the strong performance of the past few months.

- We are still positive on Financials after a rally this year; valuations are still not expensive, and we see a renewed push up in interest rates in the US and in the rest of the world.

- Improving business and consumer confidence should continue to support credit demand.

- Stronger economic growth will reduce non-performing loans.

- Capital ratios have improved, and a steeper yield curve should be positive.

HOW WE MANAGE RISK – PORTFOLIO PROTECTION, HEDGING & TAKING PROFITS

As opposed to just going to cash, we prefer alternative strategies such as hedging via options and option writing strategies to smooth out portfolio volatility. We also actively monitor profits using trailing stop losses with the view of protecting and locking in gains.

PORTFOLIO MANAGEMENT SERVICES

Please let us know if you would like to hear more about our Discretionary Portfolios or how we can create tailored portfolio based on your investing needs.

PORTFOLIO OPTIONS OVERLAY SERVICE

If you are interested in receiving an additional 0.5% to 1.5% per month in income on your portfolio, please enquire about our Portfolio Options Overlay service.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at. Please contact us at contact@odysseycapital-group.com or on +852 2111-0668.