Market Update: February 2021

February Market View

Wall Street meets Social Media

The evolution of social media has turned into a revolution for the financial markets. Ten years ago, the mostly forgotten Arab Spring showed how nascent social media could galvanise the populace to cause social and political change. More recently we’ve seen social media propel the #MeToo movement, Donald Trump tweeting over 26,000 times as the POTUS and often using it to announce official news, Russia being accused of using social media to affect the 2016 US elections, as well as being used in the recent protest on Capital Hill. Now the financial markets are experiencing how effective social media can be in moving asset prices.

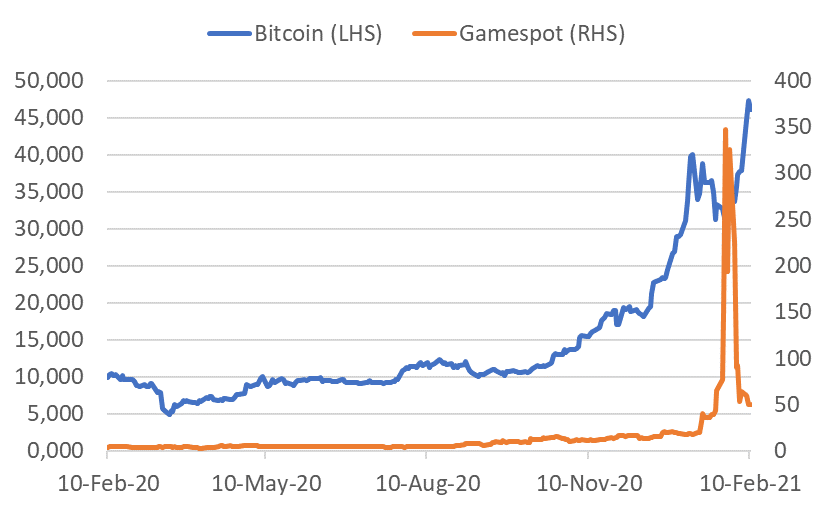

Chart: Bitcoin and Gamespot price

Source: Bloomberg

Dramatic price moves have occurred in Gamestop, AMC, and now Bitcoin through actions on social media. What does the increase in the use of social media platforms bode for investing? The use of social media for investment research has been prevalent for close to a decade. The rise of the “retail” or DIY investor can be seen by the massive growth fund flow to ETFs at the expense of the active manager. In recent months, the move has also transferred to individual stocks and stock options and this has been cited as a major reason behind the rally since November.

Chart: Net Call Option buys with less than 10 contracts on individual equities

Source: J.P. Morgan

The strength of the retail buying may be a major factor in market direction, at least in the short term. However, for most of us, monitoring retail flows may not be convenient or timely. What may be of use is the knowledge that this recent input to flows could lead to (and has led to) movements in stocks and ETFs to levels that defy valuation. On the flip side, when a popular stock disappoints, it could lead to buying opportunities as buyers hollow out. While most studies have focused on the impact of social media on small cap stocks, it would not surprise if retail also had an appreciable impact on popular big-cap stocks. Perhaps it was a factor Apple’s surge in August last year and subsequent fall in September. In short, we have seen and can continue to expect excessive movements that could lead to both buying and selling opportunities as stocks rise and fall in popularity.

Who will Blink?

Bears keep pointing to sky-high equity valuations, a very hot IPO market, record volumes, and the parabolic performance of certain thematic baskets where the majority of companies are unprofitable. Bulls see a recovering economy, particularly in the US, unprecedented stimulus, zero interest rates for the foreseeable future, the fastest vaccine rollout in history, and negligible inflation. As a short-term fillip, with over half the S&P500 companies having reported, 80% have beaten the consensus EPS estimate, and by a whopping 19%, with a 4% topline surprise. The story is similar in Europe and Japan, albeit to a lesser degree.

For the moment, the bulls are winning and as we saw in the 1990’s, a frothy market can last for longer than many bears can hold out. Nevertheless, we make no prediction on short-term direction, but suggest clients to analyse stocks at face value. For instance, on the claim there is a lack of inexpensive stocks, we propose three big cap examples – UnitedHealth, Qualcomm and FedEx. All have forward PERs in the teens and are expected to report robust operational numbers this year with or without COVID. Facebook is also worth mentioning with a forward PER that is below the S&P500 average. This is the first time that has occurred since Facebook listed in 2012. These are not poorly performing stocks – they have all outperformed the S&P500 over the last 12 months. However, you could say they are currently a little out of favour. This segues back to our earlier suggestion that the retail trade can well help to provide opportunities to buy quality stocks that are unpopular.

Chart: Performance of Select Inexpensive stocks

Source: Bloomberg, Odyssey

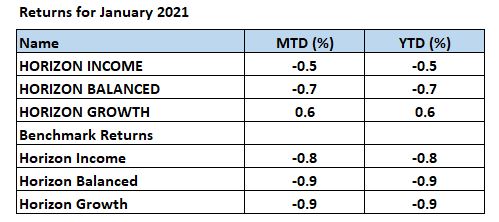

Horizon Performance

If you like to receive more information on our portfolios solutions, please contact us here: info@odysseycapital-group.com