Market Update: July 2019

June was a robust month for risk assets with equities rallying on a more ‘dovish’ Fed that shifted from talking about more accommodation to Powell effectively telling markets the Fed will cut rates July – the question now being 25bps or 50bps, and whether it is ‘one and done’ or if there will be several cuts. US markets once again are at all-time highs and for the third time in under a year. US was the best performing region, with the S&P 500, DJIA and Nasdaq gaining 6.89%, 7.19% and 7.42% respectively over the month. This is relative to Stoxx’s 4.28% and Nikkei’s 3.28%. Asia ex-Japan (AXJ) also saw a strong month with MSCI AXJ recovering from May to gain 6.06%. The US-China trade truce, from G20 Summit, added cream to the outcome. Fixed income (FI) rallied strongly on the 100bps shift in Fed funds rate expectations but the underlying narrative here, of a much weaker GDP outlook, is hard to reconcile with the rally in equities and tight high yield (HY) FI spreads. Moody’s highlighted it raised its default rate forecast for the first time in some years that has negative implications for HY FI in 6-9 months. Asian FI spreads remained ‘tight’ too, with Asian USD HY index spread ending the month at 4.55%, and the Asian USD investment grade (IG) index spread ending the month at 1.35%.

We remain cautious towards risk assets with much of the good news – a Fed rate cut and a US-China trade truce – now being discounted by markets. We also believe the next few months may well be tougher conditions for equities and HY FI. US growth – not least nominal GDP growth – is set to slow sharply in H2CY19 although we doubt a recession will unfold (the chances of recession are much higher in both the European Union and UK in our opinion). We also see reasons for more downside risks in equities as earnings forecasts look too optimistic relative to the likely outcome. The topline and margins will likely face a squeeze, and this makes the current forecasts of S&P 500 earnings per share (EPS) growing +10% in the remaining six months of the year improbable. We share a similar conservative view as Morgan Stanley (MS) which forecasts S&P 500 could fall 10% this quarter as investors start to discount weaker fundamentals.

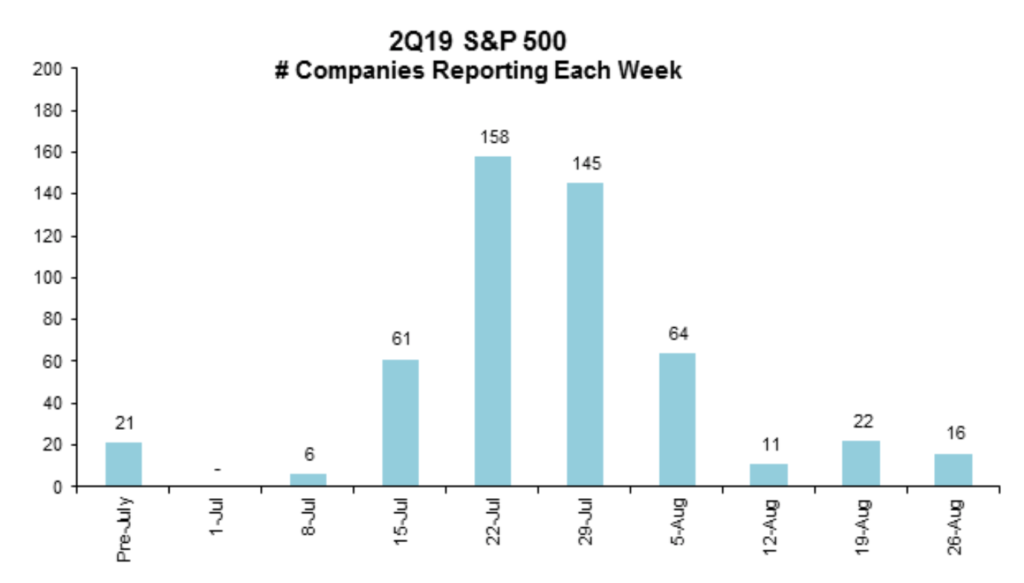

There is a debate as to whether the Fed will cut several times by YE19 as FI markets hope, or just do one ‘insurance’ cut – should the Fed start a new rate cut cycle, this will imply underlying macro conditions are weaker than equities are discounting. Our base case remains that the US economy is resilient, and the Fed will cut once, later this month, then pause but with S&P 500 expensive ahead of what may be two years of earnings contractions. Q2 results loom as the key driver for equities starting off in the week of 15th July, with about 50% of the S&P 500 reporting by week of 22nd July (Figure 1). The bar is a conservative one, given a dismal reading of MS’ Negative-to-positive guidance ratio of 3.48x. There is, obviously, a disconnect between the reason why both equities and FI rallied strongly last month. We see downside risks for both asset classes but, should FI be right and a recession is imminent then equities and HY FI would suffer sharp reversals.

Figure 1: No. of S&P 500 companies reporting each week Source: Morgan Stanley

On US and China’s trade truce during the G20 Summit, MS notes: “Developments over the weekend do not do enough to remove the uncertainty created by trade tensions, and they remain an overhang on corporate confidence. Risks remain skewed to the downside – if trade tensions escalate, (i.e., the US imposes 25% tariffs on the remaining US$300 billion of imports from China and they remain in effect for 4-6 months), we could wind up in a global recession in about three quarters.”

The recent history is that trade truces do not hold for long and underlying fundamental differences re-emerge. China will not accept US enforcement and monitoring, removal of industrial subsidies and constraints on its Made in China 2025 objective while US wants China to undertake structural changes. We do expect a deal later – by late Q4 or Q1CY20 – given US election realities and for economic factors in both countries but it is quite possible it gets worse again before it gets better.

Equities

- US equities continued to climb the wall of worry this month but saw a late rally after last weekend’s Trump-Xi meeting which bore a largely positive outcome. The three major indices had a similar performance, gaining 7% to see the S&P 500 have its best June since ’55 and the best 1H since ’97.

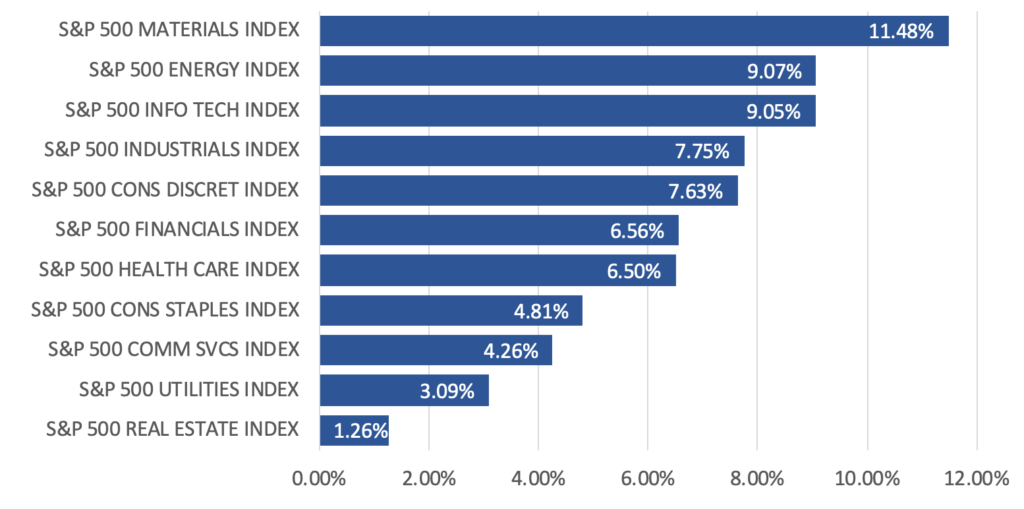

Figure 2: S&P 500 sector performance Source: Bloomberg

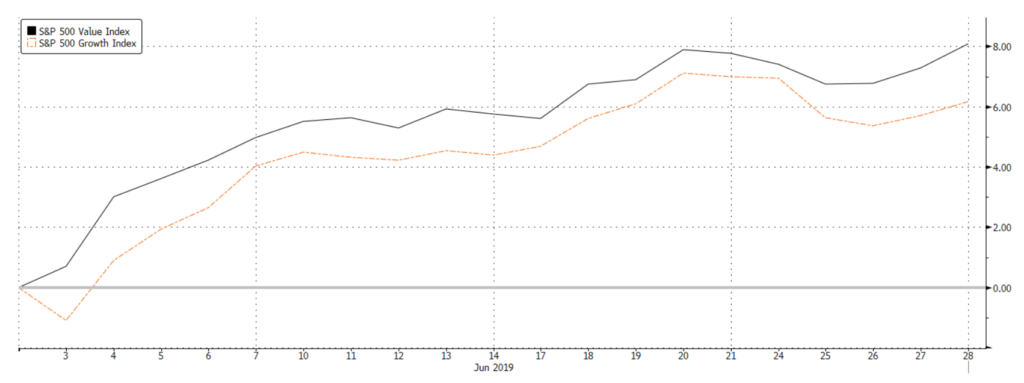

- In the S&P 500, Materials (+11.48% MoM) led gains, alongside Energy (+9.07% MoM) and Info Tech (+9.05% MoM) shares which also outperformed. Risk-on sentiment saw a rotation out of defensives like Real Estate (+1.26% MoM), Utilities (+3.09% MoM), Communication Services (+4.26% MoM) and Consumer Staples (+4.81% MoM) (Figure 2). Value stocks also outperformed growth significantly this month (Figure 3).

Figure 3: Value vs. Growth Source: Bloomberg

- June did see a string of weak data releases from the US, which was arguably supportive of equity markets as the case for rate cuts grew even stronger. Although June’s Fed meeting saw rates unchanged, this sentiment was echoed by Powell who took on a much more dovish stance, signalling possible rate cuts and indicating that the Fed would ‘act as appropriate to sustain the expansion’, without any mention of the earlier-emphasized ‘patient’ approach.

- To the extent that US equities have rallied to fresh all-time highs, we think that much of the recent good news (trade ‘truce’ back in play, a ‘dovish’ Fed likely to cut rates, decent Q1 results) has already been priced-in. It is hard to see catalysts that would help sustain a rally in US equities from here. In fact, a higher probability of further GDP downgrades will inadvertently exacerbate EPS estimates to the extent that this may impact markets quite significantly. As such, keeping a close eye on Q2 results will be key, and if we see a quarter of earnings contraction alongside GDP downgrades, that will be very negative for US markets.

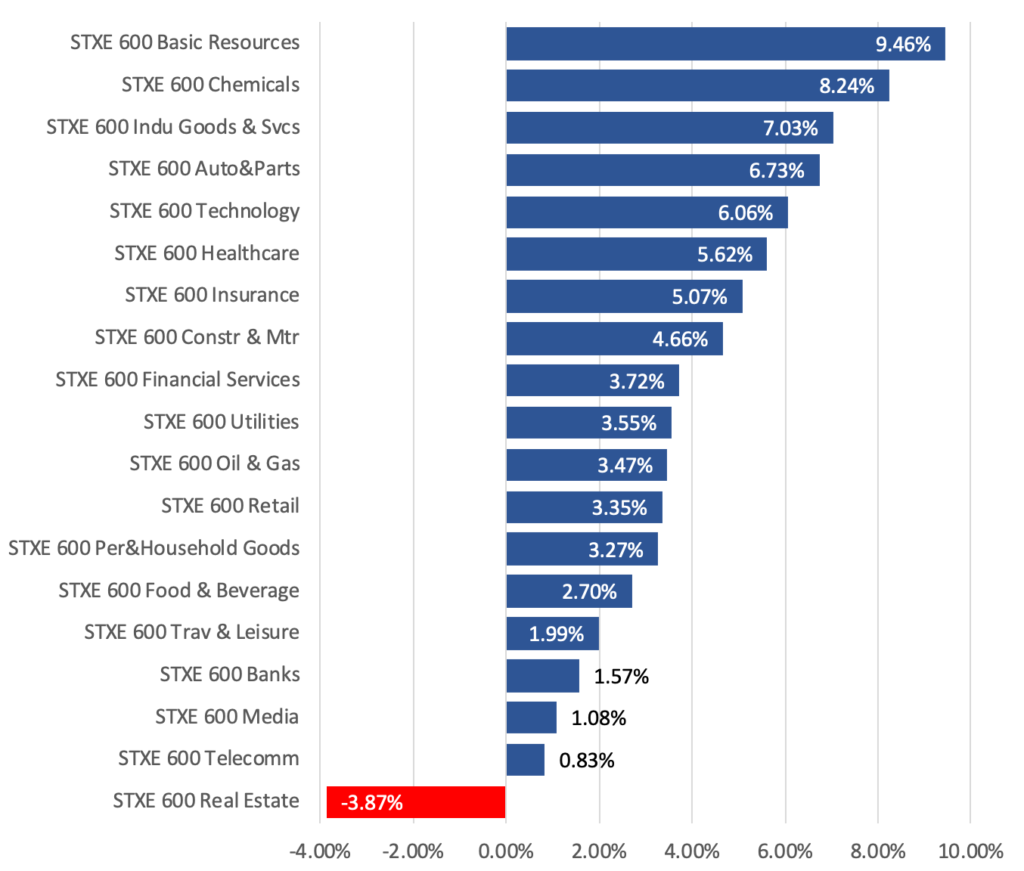

- The Stoxx 600 (+4.28% MoM) gained likewise, seeing broad-based gains across all sectors with the exception of Real Estate (-3.87% MoM). Basic Resources (+9.46% MoM) and Chemicals (+8.24% MoM) outperformed significantly, while Banks (+1.57% MoM) and defensives lagged (Figure 4).

Figure 4: Stoxx 600 Sector Performance Source: Bloomberg

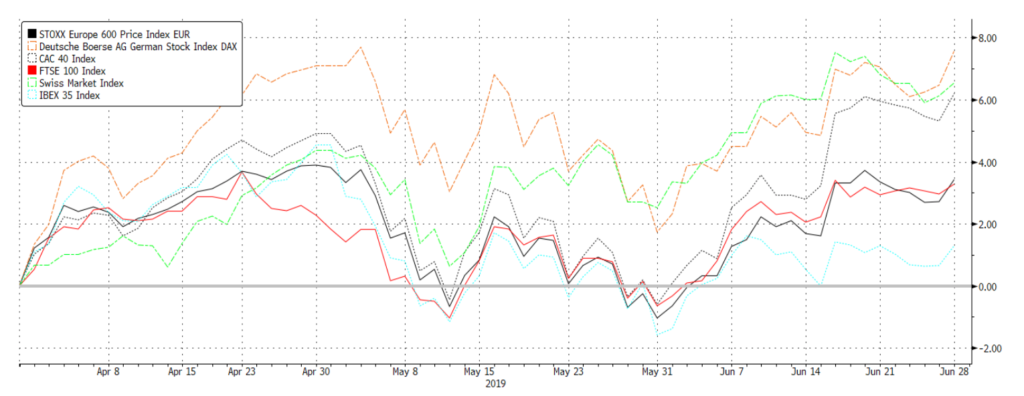

- This quarter, the index managed a slight 1.52% QoQ gain though performance varied significantly. The German DAX (+7.57% QoQ), Swiss Market Index (+4.44% QoQ) and France’s CAC 40 (+3.52% QoQ) lead the broader market, while Spain’s IBEX (-0.45% QoQ) underperformed significantly (Figure 5).

Figure 5: Regional indices performance Source: Bloomberg

- Economic data in this region has been weak so far this year, and has not shown any signs of significant improvement in the near-term. This will like weigh on the economic growth in Europe, which will in turn affect the corporate profit cycle in the region. In addition, the region is facing further headwinds in the form of potential trade tariffs from the US. US’s auto tariff threat still hangs in the background, along with the US Trade Representative’s recent proposal to impose tariffs on $4bn worth of European goods, increasing risks of further growth downgrades as supply chains are disrupted.

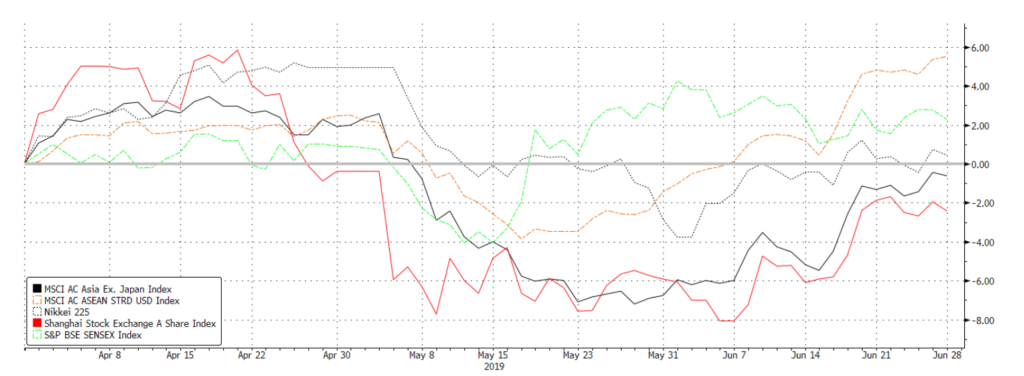

- Asian equities were broadly higher this month, not least helped by the positive rhetoric leading up to and the eventual ‘truce’ that between Trump and Xi during their meeting. This quarter, the MSCI ASEAN (+3.93% QoQ) outperformed, alongside the Sensex (+1.87% QoQ) which came off slightly from its all-time highs logged earlier in the month. China A-shares (-3.62% QoQ) also gave up some its gains from the Q1 rally, though recovering significantly from April and May’s steep decline (Figure 6).

Figure 6: Asian indices performance Source: Bloomberg

- The US-China deal has been undoubtedly positive for Asian equities, fuelling in particular a recovery in Chinese markets over the past week or so. Understandably, this is likely to carry on if trade tensions between the US and China simmer and of course, if the former does not start putting pressure on the rest of APAC to re-negotiate terms. In the longer-term, however, we would caution once more that the substantive, structural issues still remain and there is a reasonable chance that relations between China and the US could deteriorate again, just as it fell apart during the last round of negotiations which many (including us) had thought would have resulted in a far more substantial agreement by this time of the year.

Fixed Income

- Rates were in focus last month as central banks globally expressed dovishness. In addition to dovish statements from the Fed and ECB, BOJ held rates but pledged to continue its bond purchases while widening the purchase range for 1Y to 3Y JGBs to between JPY 250bn and JPY 500bn for July; central banks in Asia mostly held rates constant (except India, which cut its rates by 25bps) but expressed dovishness in response to the Fed’s decision.

- The UST yield curve shifted lower throughout the month on expectations of a July rate cut, coupled with moderately weak economic data. Shorter duration yields, which are typically more sensitive to policy changes, saw greater falls, causing the curve to steepen. the 10Y UST yield broke below a significant support of 2% intraday for the first time since November ’16. The 10Y yield found support at that level and has been fluctuating around the 2% mark for the rest of the month.

Figure 7: Spread compression pushed overall yields lower Source: Bloomberg

- Credits moved higher in June too, with all sectors ending the month higher. Yields across all sectors fell, mostly from spread tightening (Figure 7). Investors were less cautious in June, as HY debt broadly outperformed IG, with the safer BB debt outperforming the riskier CCC bonds. The Bloomberg Barclays US HY index yield fell below 6% for the first time since April ’18 and saw the biggest MoM fall since January.

- However, the best performing sector in June was EM local currency sovereign debt as investors looked for yield in today’s yield-scarce environment. While the index spread tightened only a mere 4.26bps, a weaker USD in June and the dovish sentiment from central banks in the EM regions helped boost returns in this sector.

- We expect the Fed to cut rates by 25bps later this month as a form of an insurance cut, then pause. Markets are pricing in a 100% probability of a cut this month and it is highly unlikely the Fed will not go ahead, barring some extraordinarily positive June macro data. Whilst there are polarizing views over whether this is the start of a new Fed rate-cut cycle, we do not feel the macro data is sufficiently weak to lead the Fed towards that direction despite some warning of imminent recession as early as H2CY19.

- Lagarde’s nomination could potentially be supportive for European sovereign debt, given how she is seen to be more accommodative and will likely continue the monetary stimulus that Draghi has started. This could place more downward pressure on Bund yields.

FX

- A weak month for the dollar and volatility remains low. Key events, such as the lack of negativity during G20, a trickle of negative and inflated data led markets to experience bouts of volatility but with an emphasis on the lack of directionality.

- The Fed’s comments after June’s FOMC meeting led markets to price in a Fed cut in July. This leads us to shift our base case to a data driven dollar with traders and investors wondering if July will be a ‘one and done’ cut. The DXY fell below its 200DMA of 96.715, a major support level since ‘18, since peaking at a resistance level of 98.30 before recovering to 98.80. We see this recovery as a short bout of strength caused by the lack of negativity from the G20 meeting.

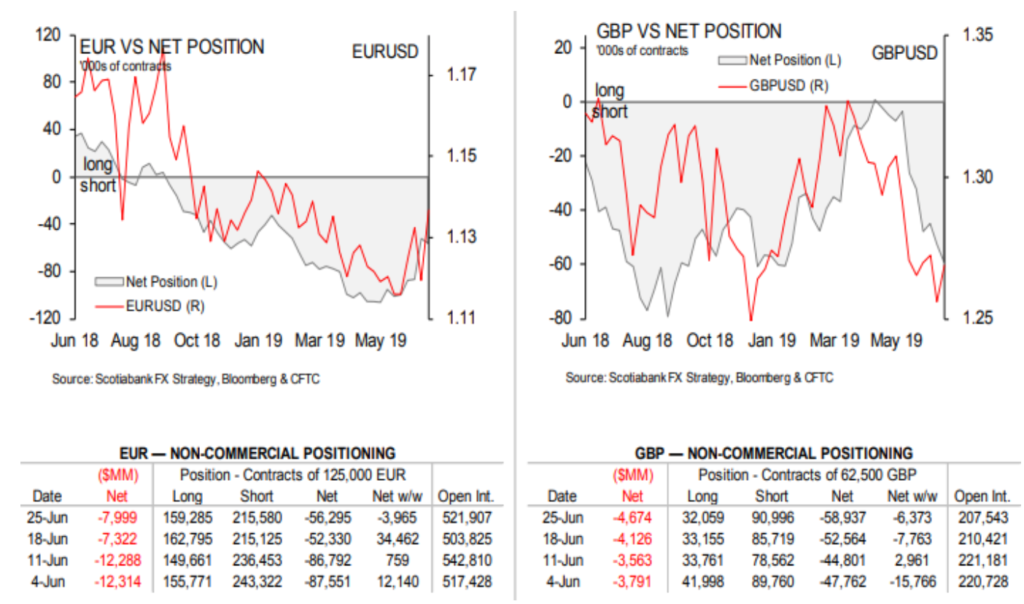

Figure 8: EUR and GBP non-commercial positioning Source: Scotiabank, Bloomberg, CFTC

- CFTC reports showed shorts decreasing rapidly in the EUR (Figure 8). The currency finished stronger in June against the USD, with traders adopting a positive view towards the ECB, relative to the Fed. ECB’s election of Lagarde also came as a healthy surprise to the market.

- Haven currencies also saw a dramatic reversal in shorts, with JPY being net long at the end of June among both retail and institutional traders. JPY gained significantly throughout June. We attribute the bulk of JPY’s strength to dollar weakness and haven attributes. However, the significant data that Japan reported, such as its Tankan survey as well as overall industrial production painted a much more negative outlook for future data. CHF also followed suit, drastically decreasing in shorts.

- Our views for Q3 will be based off yield directionality, CFTC sentiments, as well as economic data. These factors might point to a weaker dollar, but we think the USD will be supported by relative weakness in its major counterparts like EUR and GBP.

- Markets might move JPY higher if there are any potential trade tensions in the near-term, given its status as a haven currency, given that the net longs we have seen in CFTC reports. However, we remain sceptical of the fundamentals behind that shift as a worsening trade war will adversely affect Japan’s economy, notwithstanding the risks of auto tariffs still hanging in the background.

Commodities

- Oil picked up from May’s drop of US$73.60/bbl to US$62.30/bbl, boosted by two significant events: (1) Heightened tension between the US and Iran, and (2) OPEC+’s extension of its 1.2mbpd production cut to March ’20. Till mid-June, Brent ranged from US$65.00/bbl and found support at US$60.80/bbl as the International Energy Agency released its monthly report for June. Key takeaways from the report are (1) Global demand will slow by 0.1mbpd from May’s report; (2) ‘20 estimates non-OPEC production to be up 2.26mbpd; (3) OPEC crude production down 0.23mbpd, due to Iran production. CFTC reports showed WoW positions becoming net positive from the week of 18th June and onwards (Figure 9).

Figure 9: WTI non-commercial positioning Source: Scotiabank, Bloomberg, CFTC

Figure 9: WTI non-commercial positioning Source: Scotiabank, Bloomberg, CFTC

- We currently see a trading range for oil between US$60.80/bbl – US$68.00/bbl. We base this view on both negative and positive factors cancelling themselves out. OPEC+’s production cuts and Trump’s pressure to drive Iranian production to zero (and potential for tensions to escalate), are stopping oil from breaking below a short-term support of US$60.80/bbl. On the other hand, a slowdown in global demand for oil, as noted by the IEA (due to trade wars) and record production in US shale have been massive headwinds for oil. This stopped oil from advancing past US$67.75/bbl during June.

- Gold surged 9% from US$1306/Oz to a 5-year high of US$1439/Oz before retracing slightly and ending the month US$1409/Oz. The surge reflects perceived dollar weakness from the upcoming Fed cuts in July. On technicals, gold broke above a 5-year long resistance at US$1350/Oz, before continuing higher to US$1439/Oz. It is worth mentioning that as June came to an end, Gold failed to break above US$1439/Oz twice, confirming a resistance level.

- In our view, the outlook for gold will largely depend on dollar directionality. But in the shorter-term, we see buying opportunities should Gold retreat to $1380/Oz, in particular as investors start taking profit on the rally