Market Update: December 2018

Global equity markets recovered slightly from the October sell-off, with the MSCI All Country World Index ending November +1.30%. However, while investors stuck with equities, global trade and geopolitical events led them to remain defensive. This month saw a continued rotation into defensive sectors like Health Care and Real Estate on the S&P 500, and the Telecommunications, Utilities and F&B sectors on Stoxx 600. The US mid-term election results at the start of the month saw the Democrats take the House while the Republicans retained control of the Senate. This was in line with expectations and helped provide an early boost to the US equity markets.

“Too late to buy equities, too early to buy fixed income (FI)” was a perceptive quote out last week. We think 2019 will be another tricky year after this year given the large number of uncertainties out there and a lack of predictable outcomes. In our view, no one (including the Fed), really knows what might happen to inflation next year with widely polarised views on how many Fed hikes there will be as there are a wide range of inflation expectations.

Markets were also focused on the meeting between Trump and Xi at the G20 summit. The meeting ended with a 90-day truce and set up a framework for future trade talks. We see this truce as a win for both parties in the short-term, given the avoidance of a trade escalation. However, in the longer term, this truce is simply a ‘pause’ in a very complicated dispute and does very little in reducing the substantial differences between China and the US. We remain cautious on whether any of the existing structural issues can be resolved by the end of the 90-day truce. One reason for this is the hostility present within the US administration against China.

Global trade, extending beyond the more well-publicized Sino-US squabble still remains largely uncertain. Sizeable geo-political concerns also remain, with unclear outcomes from Brexit; the Italian budget; Russia’s encroachment on Ukraine; and the powder keg that is the Middle East with its important links to oil prices. In FI, there are opposing views over developments in credit quality and on the favoured spot for duration whilst FX, unlike last year end’s strong consensus behind further USD weakness, appears to have little in the way of conviction.

Depending on the outcomes of these important, but uncertain, outcomes, there could be the need for speedy and material portfolio construction changes. As we’ve seen this year, 2019 could well be another year where making capital gains in equities might prove to be difficult, whilst owning FI might fail to preserve capital. The significant de-rating of equities, despite solid earnings growth bar Asia ex-Japan, provides us with reason to remain more weighted here than in FI, which we still see as a dangerous asset class outside short duration holdings where the risk is not rewarded by the yields. Given the difficulties going forward for traditional asset classes with weaker returns than normal and likely higher volatility, we continue to recommend diversifying into non-traditional asset classes as alternatives and private assets, and the use of significant tactical cash holdings from time to time.

Equities

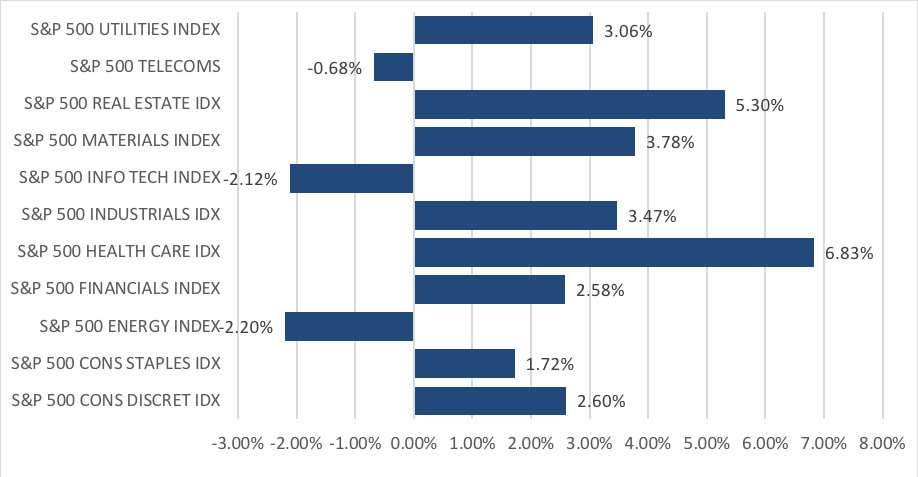

Fig 1: S&P 500 Sector Performance in November Source: Bloomberg

Fig 1: S&P 500 Sector Performance in November Source: Bloomberg

- The S&P 500 gained 1.79%, with Healthcare (+6.83%) and Real Estate (+5.30%) as the biggest gainers in the index which saw gains across most sectors, with the exception of Energy (-2.20%), Info Tech (-2.12%) and Telecommunications (-0.68%). Likewise, the Dow Jones gained 1.68%, while the tech-heavy Nasdaq also managed to gain 0.34% to end the month on a higher close. [Fig 1]

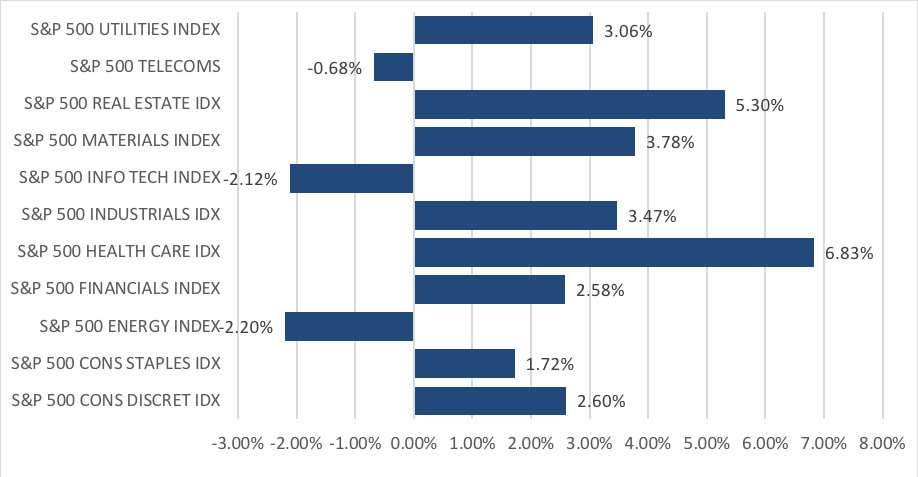

Figure 2: S&P 500 Sector Performance in October

Figure 2: S&P 500 Sector Performance in October

- As we highlighted last month, the divergence between growth and value extended through November, with the SVX Index (Value) closing +2.63% higher and the SGX Index (Growth) trailing behind at +1.53%. [Fig 2]

- Fundamentally, composite lead indicators in the US continue to reflect a strong economy, with nothing to suggest below-trend growth over the next few quarters. The ISM Manufacturing survey came in well above expectations, as production and new orders rebounded from a month ago while export activity held steady and respondents remained confident around business strength.

- GS sees single-digit absolute returns on the S&P 500 for FY19, with the view that US Equities are likely to provide a lower risk-adjusted return compared to its long-term average. In terms of allocation within the US, we are inclined to agree with the GS view to increase exposure to defensive assets within US, as with sectors such as Communication Services and Utilities, and continue to be much more selective when it comes to growth stocks, particularly within IT.

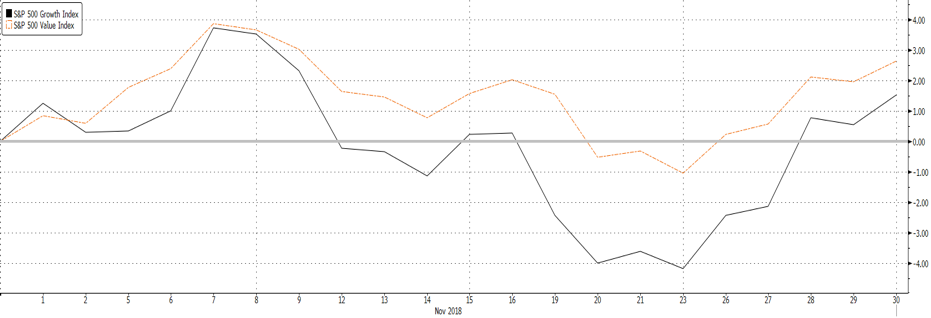

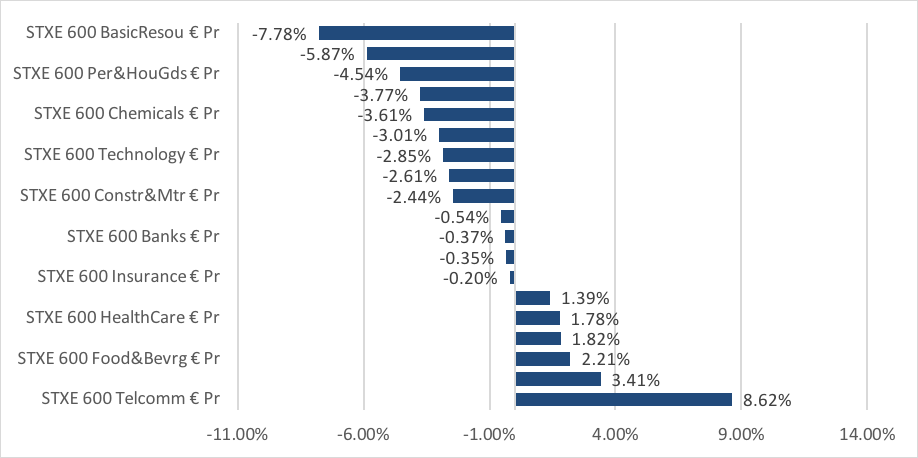

Fig 3: S&P 500 Sector Performance in November Source: Bloomberg

Fig 3: S&P 500 Sector Performance in November Source: Bloomberg

- The Stoxx 600 fell 1.14% in November, but we saw a marked difference in performance across sectors as Telecommunications (+8.62%) and Utilities (+3.41%) outperformed, while Basic Resources (-7.78%) and Oil & Gas (-5.87%) saw steep declines. Given our expectation of elevated political risks next year, we choose to remain underweight Europe in our portfolio allocations. In our view, the risk-reward still remains somewhat lacking in these markets, and until valuations decline lower or we are able to gain some clarity on these issues, we would avoid being too heavily allocated into this region. [Fig 3]

- Asian markets were largely focused around the outcome of the Trump-Xi meeting on the 30th, where the announcement of the 90-day ceasefire sent most Asian markets higher early into December, with the exception of China A-shares which closed -0.57% lower on the month.

- In our view, the agreement between Trump and Xi was more symbolic rather than substantial, and that the Chinese came to the table from a position of weaker bargaining power to provide Xi some relief to focus on the domestic economy.

- The next date to look out for is December 20th, which is scheduled to be the Central Economic Working Conference, where the Politburo’s policymakers are likely to discuss growth and inflation targets for CY19, and any adjustment to policies which they will choose to undertake.

- Ultimately, the question now will be whether China can bring enough to the table to satisfy the U.S.’ concerns around industrial policy & IPR. Our economist foresees a long-drawn negotiation that lies ahead, and what we can expect from that is further market volatility as risks continue to rise around tariffs or threats around them.

- More broadly for Asia ex-Japan, we could very well be looking at the start of a bottoming process which has had seen some uplift from the recent ceasefire in the Sino-US trade conflict. At valuations that float around 11.5x FY19 P/E for MSCI Asia ex-Japan (AxJ), valuations remain at unjustified trough-like levels, which is a prime reason why we have moved from c. 50% to 5% cash in out Asia ex-Japan portfolio, and re-allocated back into what we view as a market with attractive risk-to-reward.

Fixed-Income

- UST yields traded higher earlier in the month after the mid-term elections and on technical factors, with the 2Y yield rising to a high of 2.97% and the 10Y at a high of 3.24%, just above a key resistance level of 3.2% [Fig 4]. However, markets perceived Powell’s speech late in the month to be dovish, causing the UST 10Y yield to fall significantly and end the month at 2.99%, while the 2Y yield finished just 20bps lower at 2.79%. The yield curve continued to flatten into early December.

Fig 4: Flattening yield curve Source: Bloomberg

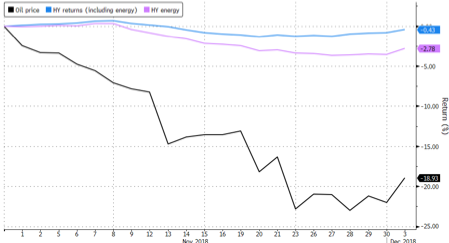

- HY debt continued to lose the most amid concerns of slowing growth globally and in the US. The HY energy sector fell 3.58%, its worst since losing 8.41% in February ‘16 while CCCs led the decline in the general HY sector (Figs 5 & 6).

Fig 5: HY energy sector’s worst month since ’16 Source: Bloomberg

Fig 5: HY energy sector’s worst month since ’16 Source: Bloomberg

Fig 6: CCC debt leads decline Source: Bloomberg

Fig 6: CCC debt leads decline Source: Bloomberg

- The Fed will likely raise rates by another 25bps to 2.25%-2.50% when they meet later this month. Fed fund futures are pricing in a 78.4% probability of that at time of writing. The futures are also pricing in a 75.3% probability that rates will remain at 2.25%-2.50% after January ‘19’s meeting but is more uncertain about a rate increase in March ’19.

- Given the current environment, we recommend staying defensive by allocating to government bonds. We also prefer to remain at the front-end of the curve, given that the current yield spreads do not provide a sufficient yield pick-up to justify the duration risk in longer duration bonds.

- We remain positive on HY debt, albeit less so than in previous months. HY bonds have fallen recently and this pullback came earlier than expected. Yet, there is no sign of a collapse in earnings or an approaching recession. This supports the case that HY debt still remains an attractive asset class, though there is a need to be more selective on the companies we allocate to.

FX

- The USD had a volatile month with mid-term elections, tariff developments, dovish Fedspeak and what markets took to be mixed data releases. December opened with a 90-day ceasefire between Trump and Xi, amidst slowing momentum from October’s stream of strong data.Going into ’19, we expect more sensitivity from the greenback around data releases, given the Fed will also be largely data-dependent.

- The EUR saw a monthly high of 1.145 against the dollar, and a low of 1.12 before ending the month at 1.13, just 3bps from where it started. The EUR remains weighed down by political uncertainty, not least Brexit’s key vote on December 16, and a yet unresolved budget from Italy. It remains to be seen how these headwinds will weigh on the EUR, but we remain more concerned around the GBP which is currently sitting near a critical support at 1.27.

- CNY continued to decline throughout November, but found some artificial support from the 6.97 to 6.95 region before recovering to 6.83 just after the Trump-Xi meeting. Although CNY led most AXJ currencies lower, INR emerged victorious against its peers, ending November higher by +5.90%, supported by cheap oil prices to alleviate its twin deficits.

- Uncertainty around China’s growth given the challenges it will face might cause further doubt on the strength of the CNY. There also remains much uncertainty around EM FX as the spotlight is now on the fragile partnership that is beginning to foster between US and China.

Commodities

- As we draw closer to December’s Vienna meeting, investors have been notably wary with the release of inventory data and news around Russia, Saudi Arabia and potential changes on the supply-side. Despite the sanctions against Iran (albeit with waivers issued to eight nations), November saw Brent plunge from 72.70 (on Nov 1st, Brent fell below its 200DMA for the first time since Aug ’17) to eventually form a short-term support at 59.

- December 2nd’s positive news gave a 5% boost to oil; a trade war ceasefire brought a short lived risk-on appetite to markets; Alberta’s oilfields cut their production by 350,000bbls/day, and the OPEC President hinted a likely production cut during the month.

- Looking ahead, directionality on oil prices could be largely driven by the outcome of the Vienna meeting on 6th Dec.

- In terms of support for Brent crude, we look to three factors in determining our stance 1) Demand is still growing, albeit at a far more muted pace than we had originally expected 2) Supply can and will be cut if necessary, and the OPEC alliance with Russia will be able to do this & 3) The market clearly underprices a risk premium that, in our view, is clearly more evident in the Middle East

- For the factors listed above, we continue to remain bullish on oil prices, with the view that over the next few months, Brent Crude should normalise closer to or above US$70/bbl as opposed to c. US$61 where it sits now.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at.