Monthly Market Update – Apr 2018

HOW WE ARE POSITIONED FOR THE BEGINNING OF Q2 2018

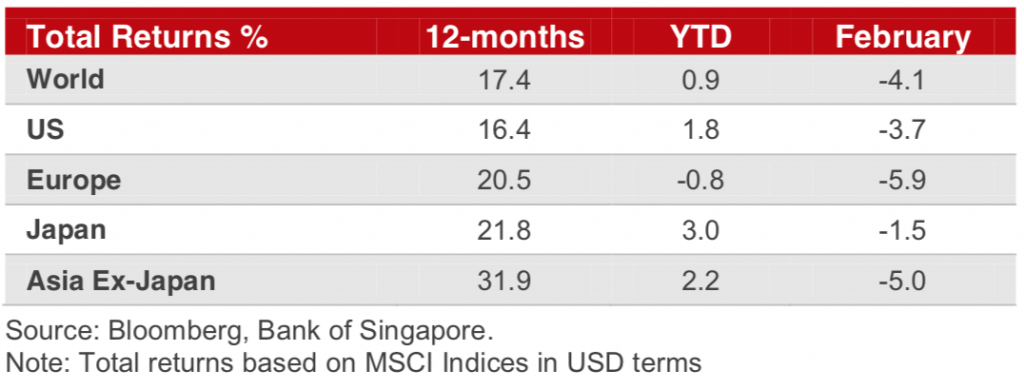

After the wild gyrations and heavy plunges in February, we experienced more downside in March. Since then, there has been a number of disturbing news releases which we expect will see the heightened market volatility to continue in the short term

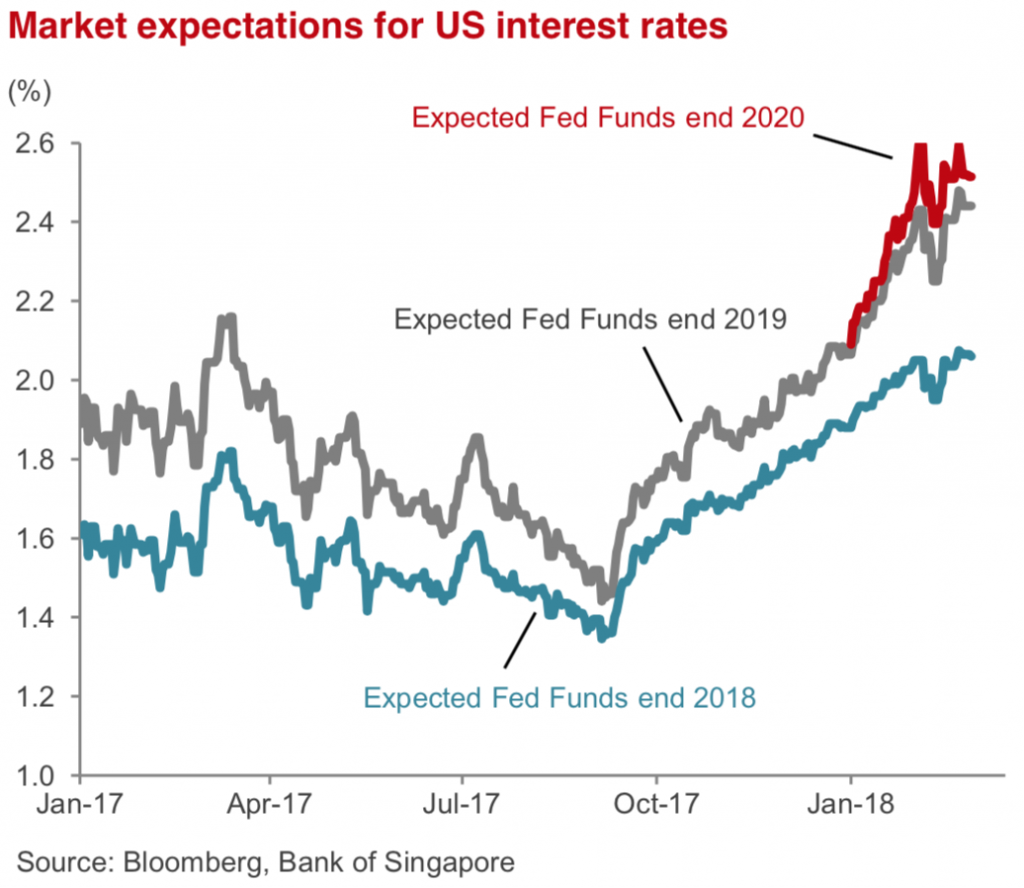

Following on from this recent market volatility, the markets experienced a sudden spike in bond yields, followed by considerable repricing of fixed income securities. This was driven by the market anticipating that the US FED will increase the speed of which it will raise US interest rates for 2018.

Following the stock market sell off, the bond yields stabilised and then actually retraced lower. Uncertainty from the US administration taking an hawkish stance on trade and menacing a real Trade War with China and other trading partners brought about additional market gyrations.

While the current environment should be supportive for stocks, the current news flow is causing real concern to short term investors and the current volatility is shaking some people out of the market. At Odyssey, we do thorough due diligence on any securities we hold in our portfolios, hence we are comfortable in riding out short term volatility. We have also taken advantage of the short term spike in volatility by selling option premium via our Enhanced Income Overlay portfolio solution.

- We still expect the Bond Markets to underperform, especially longer dated Government bonds, as the Central Banks led by the US FED will continue to raise rates and remove their accommodative monetary policies.

- Commodity markets are expected to remain at a mixed to stabilised levels, with Oil taking a breather after the massive run up in the past few months, we remain long term bullish oil. Gold is still trading in a range.

- The US Dollar is still in a downtrend for the long run, as expected rate hikes have been discounted, and the markets are now focusing on other developed economies to start their rates rises.

- The consensus for the FED to hike up to 3 times this year, but we see a real risk of 4 potential hikes, as the US growth and inflation are picking up.

- We are overweight European stocks, specifically because valuations are cheaper and it is our view that the EURO will keep appreciating versus the US Dollar.

- While Brexit and the Italian political impasse are likely to be negative factors, we think Europe from here will outperform the US market over the medium term.

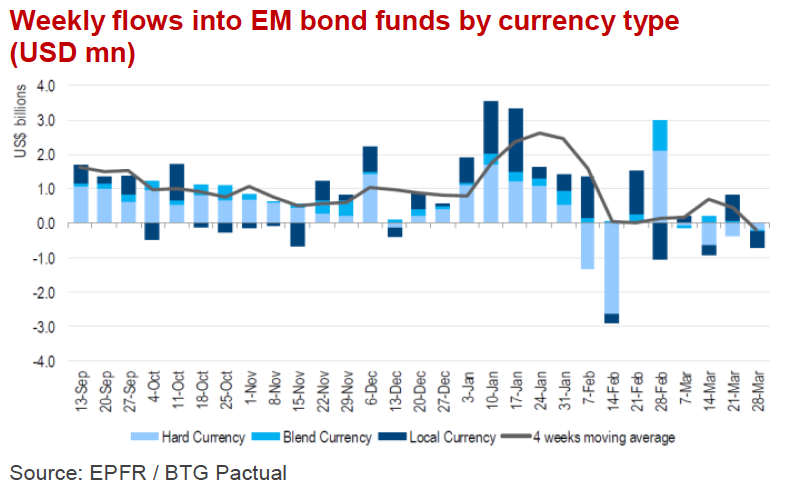

- We are in constructive on Emerging markets and China, as we see the economies growing at fast pace and in turn delivering stronger EPS growth. This said, we are becoming concerned with the US led Trade War, as well as likely contagion from the Russian Crisis.

Equities – Cautious

- Equities across the world had massive gyrations in the month of February, with more losses, combined with more volatility for the month of March.

- Our forecast for Year End Word stock markets is still a positive return, albeit in the single digits.

Bonds – Bearish

- A rising interest rate means most bond markets are vulnerable. Treasury Yields had moved up a massive 50 bps around the end of Q4 17 and Q1 18, hovering around the important 3% level. We believe the US 10yr will reach 3.25% by year end and we expect the yield curve to steepen as long dated bonds will sell off, while short dated will stay stable.

- If investors need to be positioned in fixed income, we prefer either inflation protected bonds (e.g. TIPS) or high quality corporate bonds with short durations trading at or near face value.

Commodities – Constructive

- Oil prices have rallied in the past 6 months on the back of limited supplies.

- Oil demand continues to grow at a steady pace, while the US rig counts has been increasing but at a lower speed than expected, while OPEC has been very successful at keeping the current level of production unchanged. While we think short term, we could see a correction in the price of Oil, we remain bullish for the long term. We are also watching the developments in Saudi Arabia closely.

- Gold has also recovered the recent losses taking the lead from a very heavy sell off in the US Dollar at the end of 2017 and the beginning of 2018.

- We see Gold remaining in a range of 1250/1350.

Currencies – Consensus bearish on USD

- While the passage of the Tax Cut and the rising bond yields should be positive for the US Dollar, the greenback is likely to be vulnerable in case of a real Trade War.

- Our view is the anticipated rate hikes by the Fed for 2018 are priced in, the market is focused on other Central Banks to follow and change their accommodative stance.

- While we believe that the Dollar can strengthen in the short term, we expect the downtrend to carry on in the medium term.

Alternatives – Bullish

- We are positive on selective property markets, with a preference for commercial over residential. Our favoured countries for exposure include Australia, Japan, UK, South East Asia, USA, and Vietnam. Please ask for more information on some of the projects we are currently working on.

- We also have a positive outlook on Private Equity as we see better growth opportunities, whilst lower valuations are seen across the industry compared to most stock markets.

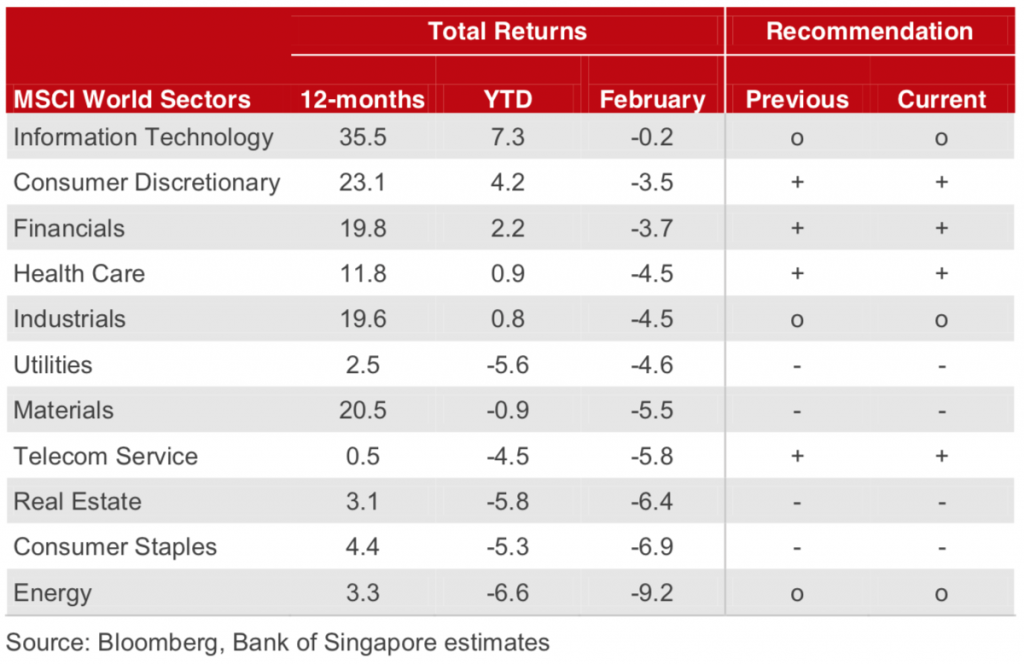

BULLISH SECTORS

- Utilities, Real Estate and Energy were the best performer sectors in March, as investors became more defensive and risk adverse, while defensive sectors like Financials, Consumer Discretionary and Technology were the underperformers.

- Technology stocks are still a crowded sector and bore the brunt of the sharp selloff, with intensifying government scrutiny in the US and Europe and growing trade tensions. Nevertheless, Technology is still the best performing sector YTD. We remain buyers of selected Tech names on dips, but very cautious.

- We are still positive on Financials after the heavy sell off in March., and we see a renewed push up in interest rates in the US and in the rest of the world, that will benefit the banks. We expect an eventual easing of capital restrictions, which could make it easier to increase dividends and buybacks.

- We remain positive on Consumer Discretionary especially in Europe and in Asia, that will benefit from the strong growth of the economy and from sustained improvements in labour markets and consumer confidence.

- We like Energy stocks as a defensive play and a possible hedge in case of more geopolitical turmoil.

HOW WE MANAGE RISK – PORTFOLIO PROTECTION, HEDGING & TAKING PROFITS

As opposed to just going to cash, we prefer alternative strategies such as hedging via options and option writing strategies to smooth out portfolio volatility.

We also actively monitor profits using trailing stop losses with the view of protecting and locking in gains.

PORTFOLIO MANAGEMENT SERVICES

Please let us know if you would like to hear more about our Discretionary Portfolios and how we consistently generate an additional 0.5% to 1.5% per month using our Options Overlay.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at.