Market Update: October 2020

COVID 4 : Governments 2

September was a difficult month for equity markets as MSCI ACWI (developed and EM) dropped -3.4%. Tech stocks were particularly hard hit as the NASDAQ fell -12% from peak to trough before recovery a little to be down -5.2% for the month. Further, against the trend was the 2.1% rise in the USD Index and Gold fell -4.2%. Commodities also gave up ground with WTI oil falling -5.6% the London Metals Index fell -1.6%. One of the few places to hide was investment-grade credit which was flat for the month.

At the end of the month, just as Tech stocks appeared to be finding their feet, President Trump succumbed to the Virus, creating yet another cause for uncertainty. Along with the second COVID wave in Europe, cases in the US mid-west rising, major global economies starting to lose recovery steam, and the difficulty in passing the stimulus package in the US Congress, equity markets could remain unsettled in the short term.

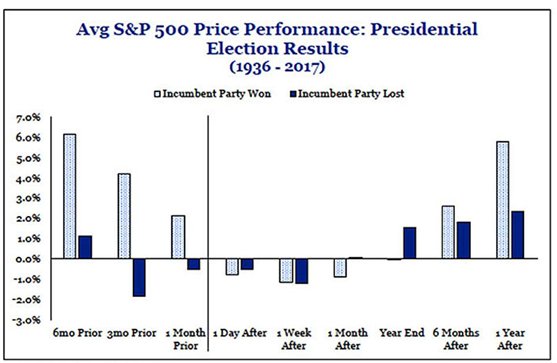

Despite the likelihood that the health of the president and the upcoming US elections may hold many investors’ attention, we remain relatively sanguine for the medium term. A Biden victory appears already partially baked into prices and is generally perceived less favourably for markets than a Trump victory, but it may be pertinent that during Obama’s 8 year reign the S&P 500 Index surged 160%, an annualized return of 12.7% p.a. Not even “Reaganomics” could outperform those numbers. Yes, there is the threat of a tax-cut roll-back, but that is not a given and could be politically unpalatable in the medium term as the nation struggles to recover from the Virus. Apart from some stated policy differences concerning a few sectors, both candidates are keen to support rapid economic recovery and that could be the overriding factor for markets. In fact, the sector differences have already begun to play out some months back in Defence and Health Care with some sub-sectors at 10-year low valuations relative to the Index.

Source: Strategas Research Partners

Second Half Comeback?

Composite PMI numbers for the large economies still appears relatively resilient. But the improvement in numbers coincided with lower new COVID cases and loosening restrictions in many parts of the world. Recently, lockdown rules have been tightened in some countries such as France, Spain and the UK. More are planned if conditions to do improve with New York also planning stricter rules as cases start to climb again. Large scale vaccine treatment is expected to be ready by mid-2021, but that’s 8 months away. With the coming change of seasons, the risk of a growing infection rate and further tightening of lockdown rules cannot be discarded.

Source: Bloomberg, Odyssey

To offset these economic impediments and the potential for social unrest, governments may need to do more. This means further boosts to fiscal stimulus. The US is deliberating over a massive stimulus package. Despite the urgency, the consensus view is that it will not pass Congress before the US election. That means the market must be supported on the belief that the package will pass both houses expeditiously after the election. Any news that suggests the package may be further delayed is unlikely to meet with a positive market response. On the other hand, if taken at face value: the President’s health continues to improve, the elections proceed without abnormal scandal, and the stimulus package can be passed since the elected government should have a mandate, we can realistically look constructively at the equity market. Real-life and the markets usually do not behave so smoothly, but if we can eventually reach the same results, the market result should also be similar.

As for other regions, Europe also has significant firepower. Of the EUR1.35tn package approved, there remained EUR850bn unused as of 10 September. In China, local governments must sell CNY3.75tn worth of so-called special bonds by the end of October, with CNY2.27tn issued by the end of July. That’s already more than in the whole of 2019, and the government is hoping this will jump-start private spending and investment.

Ultimately, the use of a fiscal stimulus is not a solution. It’s a stop-gap measure to attempt to contain the damage to the economy until the impact of the virus is mitigated in some fashion, either through social policy (where the efficacy has been mixed) or through a medical solution.

Conclusion

On a 3-6 month view, we are mildly constructive on the equity market. In the short term, the market is understandably fragile and any adverse news could add to existing headwinds. However, the major governments are not without firepower, and while there are delays to enactment and efficacy of stimulus measures, on balance, global economies should receive enough support to be maintained until a more permanent solution is found. In a sense, the criticism of these stimulus measures is familiar with what China has faced regularly over the last 20 years – that the dependence on liquidity-driven growth and repair of the economy during difficult periods would result in an economic implosion. During that time China’s economy has grown 12 times, from a USD1.2tn economy to a USD14.4tn economy.

Last month we suggested clients maintain a diversified portfolio, within their equity portfolio as well including asset classes that have low correlation to equity. Given the current economic, political and market headwinds, we reiterate this advice.

Short Market Comment

September was a difficult month for equity markets as MSCI ACWI (developed and EM) dropped -3.4%. Tech stocks were particularly hard hit as the NASDAQ fell -12% from peak to trough before recovery a little to be down -5.2% for the month. Further, against the trend was the 2.1% rise in the USD Index and Gold fell -4.2%. Commodities also gave up ground with WTI oil falling -5.6% the London Metals Index fell -1.6%. One of the few places to hide was investment-grade credit which was flat for the month.

If you like to receive more information on our portfolios solutions, please contact us here: info@odysseycapital-group.com