Odyssey Asset Management Limited, is pleased to announce that it has successfully completed the first-close of the Odyssey Japan Boutique Hospitality Fund.

The Odyssey Japan Boutique Hospitality Fund is a unique, private equity-real estate fund focused on the acquisition of Japanese boutique hospitality assets throughout Japan. After almost a year of research, planning and structuring, the Fund team identified that the most attractive investment opportunity could be found in mid-sized Hospitality real estate assets, valued between US$5 to US$50 million. This price range demonstrated the best value to secure under-valued, off-market hospitality properties with the most value-add potential.

Ryokan in Niigata

Ryokan in Niigata

Odyssey launched the Fund in June of 2018 and achieved the first close at the end of January 2019. The Fund has received a high degree of interest from High Net Worth Individuals and Family Offices, as well as large financial institutions across the Asia Pacific region.

The purpose of the first close was to complete the call capital from committed investors to acquire one of the Fund’s flagship projects – Project Falcon. Project Falcon was the acquisition of a 24 machiya property portfolio situated on one contiguous lot in the heart of Kyoto. Odyssey will refurbish and transform the properties into a single urban luxury machiya resort.

Project Falcon was acquired and settled late January, the purchase price was approximately US$20 million dollars. Now that the acquisition is complete, the Odyssey team is moving ahead with the 15-month redevelopment and construction phase. The acquisition of Project Falcon makes the Odyssey Japan Boutique Hospitality Fund one of the largest owners of machiyas in Kyoto – a one-of-a-kind project in the cultural capital of Japan that is also a famous, booming tourism destination.

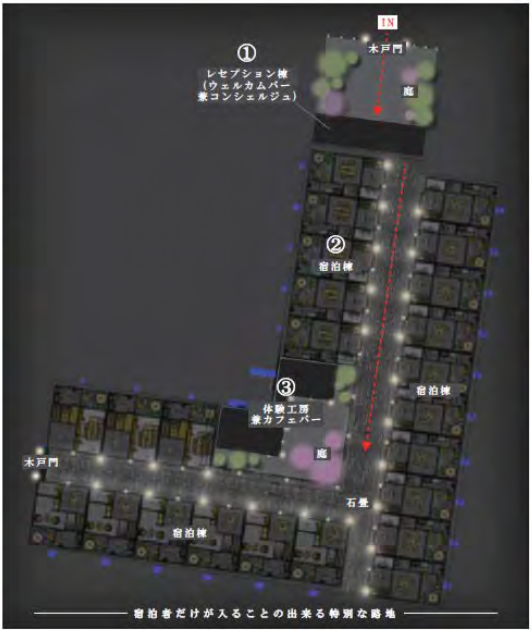

Mockup of Project Falcon

Mockup of Project Falcon

With Project Falcon, the Odyssey Japan Real Estate investment team has now purchased three hospitality assets in Japan since first launching the Fund in June of 2018.

Previously in August (2018) we acquired the first ryokan for the Japan Boutique Hospitality Fund, Shousenkaku Kagetsu. The fund team see the most value in the ryokan sector of the Japanese hospitality market as this represents the most undervalued asset class in the Japanese Boutique Hospitality sector. This sector is currently highly fragmented and there is currently an opportunity to apply Odyssey’s value-add investment approach to handpicked ryokans.

Kagetsu Ryokan

Kagetsu Ryokan

The Odyssey Japan Real Estate investment team also purchased a boutique hotel in Kyoto, Hotel Owan Hanami on behalf of one of its Korean institutional clients, Shinhan Investments in October of 2018.

Hotel Owan Hanami

Hotel Owan Hanami

For 2019, the fund team expects to accelerate the pace and quantity of acquisitions for the Fund and for the institutional mandates they have secured to date.

In Q1 2019, it is anticipated that there will be three new acquisitions, including a boutique hotel in Shibuya (one of Tokyo’s most popular suburbs) and a number of ryokans on the Izu Peninsula.

The Fund is also accelerating work on Project Moji, which is the conversion of a beautiful historical building, constructed in 1938, into a 90-room luxury boutique hotel in Kitakyuushu.

Port Moji

Port Moji

Odyssey anticipates that the next close for the Japan Boutique Hospitality Fund will take place around May of 2019. This will add to the total aggregated commitments across our entire Japan investment strategy of over US$ 200 million to date, with more to come.

For more information on our fund, Kagetsu Ryokan, Hotel Owan Hanami, Project Falcon, Project Moji and other recent activities in Japan, please refer to our other Blog posts.

Or please contact Daniel Vovil, Co-Founder and President:

daniel.vovil@odysseycapital-group.com|(852) 9725-5477

For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation.

Odyssey Asset Management Limited

Odyssey Asset Management Ltd, a sister company to the Odyssey Capital Group, is a Hong Kong SFC 1, 4 & 9 licensed company. The Japanese CRE team is headed up by Christopher A. Aiello, and also includes Alex Walker, Daniel Vovil and Sam Luck.

Odyssey Capital Group Ltd is Asia’s leading international Alternative Asset Manager that provides differentiated and bespoke investment solutions across multiple asset classes, including asset management, real estate, private equity and hedge funds. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest in with its clients.

The Odyssey team comprises over 30 experienced executives, asset managers, lawyers, private bankers, trust & tax planning specialists and experienced investors with over 400 years of combined financial and operational experience across the Asia Pacific, Europe and North America.

For more information about the Odyssey Japan Boutique Hospitality Fund, phone or email Daniel Vovil via the contact details listed below.

Daniel Vovil, Co-Founder and President, Odyssey Capital Group

daniel.vovil@odysseycapital-group.com | (852) 9725-5477