Feb 21, 2019 | Press Releases

Odyssey Asset Management Limited, is pleased to announce that it has successfully completed the first-close of the Odyssey Japan Boutique Hospitality Fund.

The Odyssey Japan Boutique Hospitality Fund is a unique, private equity-real estate fund focused on the acquisition of Japanese boutique hospitality assets throughout Japan. After almost a year of research, planning and structuring, the Fund team identified that the most attractive investment opportunity could be found in mid-sized Hospitality real estate assets, valued between US$5 to US$50 million. This price range demonstrated the best value to secure under-valued, off-market hospitality properties with the most value-add potential.

Ryokan in Niigata

Ryokan in Niigata

Odyssey launched the Fund in June of 2018 and achieved the first close at the end of January 2019. The Fund has received a high degree of interest from High Net Worth Individuals and Family Offices, as well as large financial institutions across the Asia Pacific region.

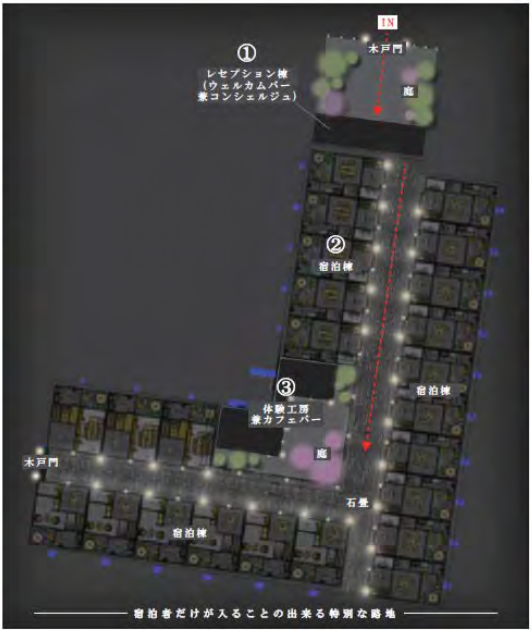

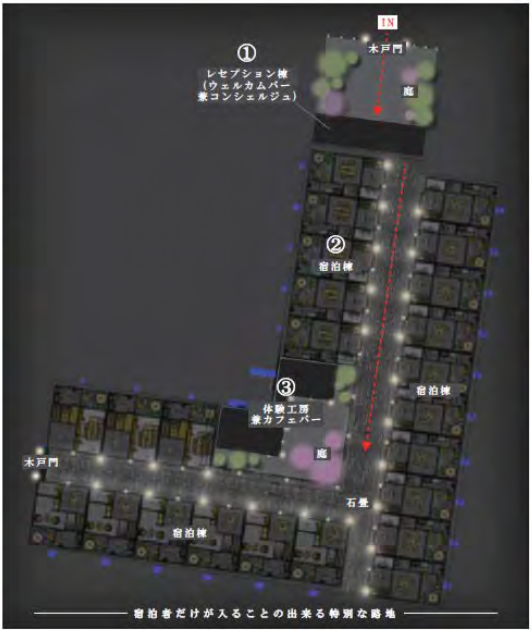

The purpose of the first close was to complete the call capital from committed investors to acquire one of the Fund’s flagship projects – Project Falcon. Project Falcon was the acquisition of a 24 machiya property portfolio situated on one contiguous lot in the heart of Kyoto. Odyssey will refurbish and transform the properties into a single urban luxury machiya resort.

Project Falcon was acquired and settled late January, the purchase price was approximately US$20 million dollars. Now that the acquisition is complete, the Odyssey team is moving ahead with the 15-month redevelopment and construction phase. The acquisition of Project Falcon makes the Odyssey Japan Boutique Hospitality Fund one of the largest owners of machiyas in Kyoto – a one-of-a-kind project in the cultural capital of Japan that is also a famous, booming tourism destination.

Mockup of Project Falcon

Mockup of Project Falcon

With Project Falcon, the Odyssey Japan Real Estate investment team has now purchased three hospitality assets in Japan since first launching the Fund in June of 2018.

Previously in August (2018) we acquired the first ryokan for the Japan Boutique Hospitality Fund, Shousenkaku Kagetsu. The fund team see the most value in the ryokan sector of the Japanese hospitality market as this represents the most undervalued asset class in the Japanese Boutique Hospitality sector. This sector is currently highly fragmented and there is currently an opportunity to apply Odyssey’s value-add investment approach to handpicked ryokans.

Kagetsu Ryokan

Kagetsu Ryokan

The Odyssey Japan Real Estate investment team also purchased a boutique hotel in Kyoto, Hotel Owan Hanami on behalf of one of its Korean institutional clients, Shinhan Investments in October of 2018.

Hotel Owan Hanami

Hotel Owan Hanami

For 2019, the fund team expects to accelerate the pace and quantity of acquisitions for the Fund and for the institutional mandates they have secured to date.

In Q1 2019, it is anticipated that there will be three new acquisitions, including a boutique hotel in Shibuya (one of Tokyo’s most popular suburbs) and a number of ryokans on the Izu Peninsula.

The Fund is also accelerating work on Project Moji, which is the conversion of a beautiful historical building, constructed in 1938, into a 90-room luxury boutique hotel in Kitakyuushu.

Port Moji

Port Moji

Odyssey anticipates that the next close for the Japan Boutique Hospitality Fund will take place around May of 2019. This will add to the total aggregated commitments across our entire Japan investment strategy of over US$ 200 million to date, with more to come.

For more information on our fund, Kagetsu Ryokan, Hotel Owan Hanami, Project Falcon, Project Moji and other recent activities in Japan, please refer to our other Blog posts.

Or please contact Daniel Vovil, Co-Founder and President:

daniel.vovil@odysseycapital-group.com|(852) 9725-5477

For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation.

Odyssey Asset Management Limited

Odyssey Asset Management Ltd, a sister company to the Odyssey Capital Group, is a Hong Kong SFC 1, 4 & 9 licensed company. The Japanese CRE team is headed up by Christopher A. Aiello, and also includes Alex Walker, Daniel Vovil and Sam Luck.

Odyssey Capital Group Ltd is Asia’s leading international Alternative Asset Manager that provides differentiated and bespoke investment solutions across multiple asset classes, including asset management, real estate, private equity and hedge funds. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest in with its clients.

The Odyssey team comprises over 30 experienced executives, asset managers, lawyers, private bankers, trust & tax planning specialists and experienced investors with over 400 years of combined financial and operational experience across the Asia Pacific, Europe and North America.

For more information about the Odyssey Japan Boutique Hospitality Fund, phone or email Daniel Vovil via the contact details listed below.

Daniel Vovil, Co-Founder and President, Odyssey Capital Group

daniel.vovil@odysseycapital-group.com | (852) 9725-5477

Feb 19, 2019 | Press Releases

[Translated from Japanese, as published in the Nikkei Shimbun]

2019/1/23 21:00 | Nikkei Shimbun

Fund managers are actively acquiring Ryokans (Japanese-style hotels) in provincial cities. Odyssey Capital Group Limited, from Hong Kong, launched an investment fund which focuses on Ryokans in Japan. Also Bain Capital is expanding operations nationwide through its subsidiary, Oedo Onsen Monogatari group. Investment firms are increasing their presence as local banks in Japan lose their ability to financially support local unprofitable businesses. As a result, International firms are seeing opportunities in catering to the needs of international tourists in Japan, making the acquisition of local businesses an increasingly competitive venture.

In December 2018, in a meeting with staff in one of the rooms of the long-established hotel, Shosenkaku Kagetsu in Yuzawa in Niigata prefecture, Masami Koga, the general manager said “we have less group reservations. It is also challenging to increase average sales per guest”. One of his staff suggests “we should start sending out direct marketing emails again”, “how about suggesting Japanese sake which goes well with the food on the menu?” suggests another.

In December 2018, in a meeting with staff in one of the rooms of the long-established hotel, Shosenkaku Kagetsu in Yuzawa in Niigata prefecture, Masami Koga, the general manager said “we have less group reservations. It is also challenging to increase average sales per guest”. One of his staff suggests “we should start sending out direct marketing emails again”, “how about suggesting Japanese sake which goes well with the food on the menu?” suggests another.

[Picture: Kagetsu monthly management meeting, Yuzawa, Niigata. Dec, 2018]

In February 2018, Kagetsu’s management rights were transferred from the founder to an investment firm in Minato, Tokyo called Northeast Capital Management (NECM). Masami Koga is also from NECM.

In November that year, Odyssey Capital Group Limited, an asset management company for high-net-worth individuals in Asia, launched their “Ryokan fund”, worth several billion Yen and got involved in the management of Kagetsu as their first project. The company said Japanese ryokans have been attracting a lot of attention globally among wealthy individuals.

Kagetsu was founded in 1955. It was a small ryokan with 28 rooms and was popular with skiers during Japan’s bubble economy. Sales declined as downhill skiing lost its popularity. When Kagetsu started having trouble paying back its loan, its main local bank suggested enlisting the help of investment firms to revive the business which, in turn, would also help the bank in recovering the non-performing loan. Hideki Shibao, CEO of NECM, says “most of the requests for business restructuring come from the local banks”.

Japan’s SME Finance Facilitation Act requiring banks to extend loan payment terms for SMEs, ended in 2013. Because of their huge impact on local economies, supporting ryokans has always been a challenge for local banks but it has become increasingly difficult for them to help in the recovery process.

Investment firms expect the increase in tourism to be the key for recovery. Kagetsu, with the help of Odyssey, was able to increase the percentage of international tourists to a high of 40% by making services available in English. Some family groups from Asia visit the hotel every winter.

Kagetsu is planning a large-scale renovation of rooms and other facilities, like air-conditioning, after the long holidays in May. Talking about her impression of the investment firm’s support, Tomoko Fujii, manager of Kagetsu, said, “Odyssey’s attitude towards us is different, as the firm paid a considerable amount of money to acquire the business”.

One of the leading players in reconstruction of Ryokans is Bain Capital. Through their acquisition of Oedo Onsen Monogatari group in 2015, they have expanded their investment to their current 40 facilities across the country. They target large-scale facilities with more than 100 rooms and conduct renovations for half a year. They also take advantage of economies of scale by ordering food and ingredients in bulk and centralizing marketing operations for all their facilities. Doing this, they were able to cut down the price to an affordable 10,000 yen or less per night and achieve 80 to 90% occupancy rate on average.

Keystone Partners, an independent asset manager in Minato, Tokyo, invests in ryokans and hotels through existing investment funds worth 30 billion Yen. In 2018, the company became a major shareholder of Wealth Management, a hotel development company, and started engaging in reconstruction of ryokans. Local banks have also invested in these funds. Tomoaki Tsutsumi, CEO of Keystone Partners, adds, “besides including the funds to their portfolio, the local banks are also aiming to engage in the recovery of ryokans they provided loans to”.

Other Japanese financial institutions also see opportunities in ryokans in rural cities. In 2018, MUFJ Bank, together with 60 other companies such as Sekisui House and Japan Airlines, launched a fund focused on promoting tourism and remodeling ryokan and old Japanese-style houses. Development Bank of Japan, in collaboration with local banks, have launched several funds to support SMEs across the country. “Competition among financial institutions is becoming intense” says Shibao.

| Major companies and funds involved in reconstruction of ryokan business |

| Odyssey Capital Group Limited |

“Recruit Holdings” – Offers reconstruction projects. |

| Bain Capital |

Oedo Onsen Monogatari – Operates 40 facilities across the country. |

| Keystone Partners |

Provides financial support for reviving ryokans and hotels. |

| Orix |

Acquired long-established ryokans including Suginoi Hotel (Beppu, Oita). |

| Development Bank of Japan |

Launched corporate reconstruction funds with local banks and Hoshino resort. |

| MUFJ Bank |

Launched fund to promote tourism with 60 other companies including Sekisui House. |

Odyssey Asset Management Limited

Odyssey Asset Management Ltd, a sister company to the Odyssey Capital Group, is a Hong Kong SFC 1, 4 & 9 licensed company. The Japanese CRE team is headed up by Christopher A. Aiello, and also includes Alex Walker, Daniel Vovil and Sam Luck.

Odyssey Capital Group Ltd is Asia’s leading independent Alternative Asset Manager that provides differentiated and bespoke investment solutions across multiple asset classes, including asset management, real estate, private equity and hedge funds. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest in with its clients.

The Odyssey team comprises over 30 experienced executives, asset managers, lawyers, private bankers, trust & tax planning specialists and experienced investors with over 400 years of combined financial and operational experience across the Asia Pacific, Europe and North America.

For more information about the Odyssey Japan Boutique Hospitality Fund, phone or email Daniel Vovil via the contact details listed below.

Daniel Vovil, Co-Founder and President, Odyssey Capital Group

daniel.vovil@odysseycapital-group.com | (852) 9725-5477

Jan 7, 2019 | Press Releases

The Japan Boutique Hospitality Fund got off to a successful and promising start in 2018 and the fourth quarter was a busy period in terms of acquisitions and preparing the deal pipeline for accelerated activity in 2019.

At the end of October (2018) we acquired a boutique hotel in Kyoto called Hotel Owan on behalf of our institutional Client, Shinhan Financial Group. The property has been renamed as Hotel Owan Hanami (https://resistay.jp/en/room/owan-amaterrace/) and is a popular choice for Asian and Western Families visiting Kyoto due to the offering of large rooms, a superb design concept combining Japanese and contemporary design motifs, and ease of access to major tourism destinations in Kyoto.

Hotel Owan

Hotel Owan

One of our investment assumptions for the Hotel Owan acquisition was that the ADR’s (Average Daily Room Rate) were undervalued and that we could raise the rates. We have already started to increase the ADR’s in our first two months of ownership and this is increasing the Net Operating Income of the asset.

Hotel Owan

Hotel Owan

Hotel Owan

Hotel Owan

Previously in August (2018) we acquired the first ryokan for the Japan Boutique Hospitality Fund, Shousenkaku Kagetsu (https://www.shousenkaku-kagetsu.com/en/). We are particularly keen on the ryokan sector of the Japanese hospitality market as we feel it is undervalued, fragmented and there is tremendous opportunity to apply a value-add investment approach to well selected ryokans.

Shousenkaku Kagetsu

Shousenkaku Kagetsu

In the case of Kagetsu, the historical occupancy levels were 53% on average. By enhancing the marketing strategy and taking a more proactive marketing approach, in just three months of ownership, we have already moved the needle on the occupancies from 53% to 68% in pre-ski season months. Now that we are in the ski season in Japan, we anticipate to be running at near 100% capacity through April 2019. We will be making physical enhancements to the property in May by renovating 10 of the 28 rooms in Kagetsu ryokan, further enhancing the value of the property.

Shousenkaku Kagetsu

Shousenkaku Kagetsu

Shousenkaku Kagetsu

Shousenkaku Kagetsu

Our investment team’s ability to identify undervalued hospitality assets where we can actively improve the property and operations is already bearing fruit in these first two acquisitions.

In addition to acquiring these two properties and beginning the value-creation process, the Japan CRE investment team has been busy building the pipeline of investable assets for 2019, with on-site due diligence visits throughout Japan, where we have identified attractive boutique hospitality assets at attractive prices.

As we kick off the New Year of 2019, we now have a pipeline of 52 potential assets that are under various stages of due diligence.

Pipeline asset locations: Tokyo, Kyoto, Osaka, Izu, Niigata, Kitakyushu & Kobe

Pipeline asset locations: Tokyo, Kyoto, Osaka, Izu, Niigata, Kitakyushu & Kobe

The first quarter of 2019 is going to be a busy time as we start to ramp up the acquisition process for the Japan Boutique Hospitality Fund and our institutional mandates. At a minimum we anticipate acquiring and closing on 3-4 assets by March 2019.

While we can not disclose all of these assets at this point in time, one of the acquisitions we are most excited about is Project Falcon which is our acquisition of 24 machiyas in Kyoto which will be transformed into an Urban Luxury Machiya Resort. We have been working on this project for 8 months and we are scheduled to close and become the majority equity owner of the project at the end of January 2019.

Mockup of Project Falcon

Mockup of Project Falcon

We will also be acquiring a larger boutique hotel in Tokyo for an institutional partner, and a number of ryokans for the Japan Boutique Hospitality Fund.

Ryokan Pipeline Asset

Ryokan Pipeline Asset

We will be announcing our first capital call and first soft closing on 10 January 2019 in order to facilitate the closing and acquisition of Project Falcon at the end of January.

We appreciate all those investors who have already made a commitment to the Fund and to those who will be joining us at the 10 January capital call.

We want to take this opportunity to wish all our Clients and Partners a wonderful 2019 filled with abundant success and good health.

Sincerely,

Christopher A. Aiello

Managing Director – Japan Real Estate

Odyssey Asset Management Limited

Odyssey Asset Management Ltd, a sister company to the Odyssey Capital Group, is a Hong Kong SFC 1, 4 & 9 licensed company. The Japanese CRE team is headed up by Christopher A. Aiello, and also includes Alex Walker, Daniel Vovil and Sam Luck.

Odyssey Capital Group Ltd is Asia’s leading independent Alternative Asset Manager that provides differentiated and bespoke investment solutions across multiple asset classes, including asset management, real estate, private equity and hedge funds. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest in with its clients.

The Odyssey team comprises over 30 experienced executives, asset managers, lawyers, private bankers, trust & tax planning specialists and experienced investors with over 400 years of combined financial and operational experience across the Asia Pacific, Europe and North America.

For more information about the Odyssey Japan Boutique Hospitality Fund, phone or email Daniel Vovil via the contact details listed below.

Daniel Vovil, Co-Founder and President, Odyssey Capital Group

daniel.vovil@odysseycapital-group.com | (852) 9725-5477

Oct 31, 2018 | Press Releases

Odyssey Capital Group Ltd is pleased to announce that the Odyssey Japan Private Equity Real Estate division has been selected by Shinhan Investment Corp (a division of Shinhan Financial Group) to be their Japan Hospitality Advisor and Fund Manager for an institutional mandate.

The joint venture will allow Shinhan’s clients to benefit from Odyssey’s Japan Hospitality investment strategy, which includes seeking investments in boutique hotels, Ryokan’s (Traditional Japanese Inns) and Machiya’s (Traditional Japanese Townhouses) in the Kansai region and other areas of Japan. The investment model is to acquire, re-position and operate. By deploying a value-add strategy, Odyssey aims to increase the value of the assets acquired both at the asset level and the operational level. Odyssey’s goal is to increase the value of the underlying assets through a combination of property enhancements and improving the operational efficiencies of the underlying assets.

On the back of its strong and stable corporate governance and financial structure, Shinhan Investment Corp is fast emerging as a leader in Korea’s securities industry and provides securities trading, wealth management, and investment banking services, mergers and acquisitions, investment trusts, and corporate financing services. Shinhan Investment serves clients worldwide and is a subsidiary of Shinhan Financial Group, the second largest Bank in South Korea. Shinhan is, historically, the first bank in Korea, established in 1897 and now boasting more than 10,000 employees with more than US$260 billion in total assets.

Coinciding with the partnership between Odyssey and Shinhan is the initial acquisition of an attractive boutique hotel in Kyoto, Hotel Owan (https://resistay.jp/en/room/owan-amaterrace/) with the closing completed on the Friday 26th of October.

Kyoto is the historical capital of Japan and, as a result, many of Japan’s greatest entertainers, artists, chefs, designers and architects have resided and honed their craft in and around the city.

Odyssey’s boutique hotel asset embodies Japanese traditional culture and combines traditional, historical, Kyoto-based design and art motifs with modern and funky, boutique construction. Hotel Owan has 19 rooms which spread across 4 floors and comprise 8 wholly unique styles to cater to all types of affluent taste, whether they be for a room that includes tatami floor space, or one fitted with spacious, family-sized, double bunk beds or sleek and minimalist rooms for couples. With traditional Kyoto crafts, such as Nishijin fabric, and delicately featured interiors, you can feel an authentic beautiful Kyoto experience during your stay.

The appeal for local and foreign guests is well established as Hotel Owan has operated at an occupancy rate above 80% since it’s opening in 2017 and frequently experiences periods of 100% occupancy with consistent, ubiquitous, rave reviews on its quality of construction and design, it’s feel and styling and its central location and service.

Odyssey’s Japan Real Estate investment team, led by Christopher A. Aiello, was able to acquire the asset at a below market price and felt that current market demand will allow for increasing Average Daily Room Rates (ADR’s) by 20% to 25% over the next 12 months. Odyssey also plans to add concierge service upgrades and also employ a focused and upgraded digital marketing and direct bookings strategy.

The Managing Director of Odyssey Japan CRE, Christopher Aiello said, “We are excited to have completed the acquisition of this wonderful boutique hotel today. We have been able to secure this asset over other bidders due to the long term vision we have for the Japanese Boutique Hospitality industry, the strength of the Odyssey team and our seasoned relationships in Japan. We were able to secure a very attractive debt package for this acquisition from Mitsublishi UFG, one of the leading banks in Japan with an LTV ratio of 65%, non-recourse debt, and with an annual cost of 1.6% pa.”

Odyssey has long-term working relationships with the top leading individuals and firms in the Japanese commercial real estate and hospitality market and these partnerships include our panel banks, trust institutions, local asset managers, legal counsel, tax specialists and accountancy professionals.

The Odyssey CRE team commenced operations in early 2017 in Japan, and its well established and deep local presence, networks and insights allowed for the identification of the best and most appropriate real estate opportunities for the Odyssey Japan Hospitality strategy. Since this time, the Manager has reviewed more than 50 assets and has built up a robust pipeline.

The Odyssey Japan Real Estate investment team looks forward to providing our valued clients with more unique and exciting opportunities in what, we believe, will be one of the most successful Japanese hospitality investment projects to date. Please contact Odyssey, should you be interested in investing in Japanese real estate.

Odyssey Asset Management Limited

Odyssey Asset Management Ltd, a sister company to the Odyssey Capital Group, is a Hong Kong SFC 1, 4 & 9 licensed company. The Japanese CRE team is headed up by Christopher A. Aiello, and also includes Alex Walker, Daniel Vovil and Sam Luck.

Odyssey Capital Group Ltd is Asia’s leading independent Alternative Asset Manager that provides differentiated and bespoke investment solutions across multiple asset classes, including asset management, real estate, private equity and hedge funds. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest in with its clients.

The Odyssey team comprises over 30 experienced executives, asset managers, lawyers, private bankers, trust & tax planning specialists and experienced investors with over 400 years of combined financial and operational experience across the Asia Pacific, Europe and North America.

If you would like to learn more about Owan Hotel or if you would like to learn about our upcoming property purchases, please get in touch with us at: japan@odysseycapital-group.com

For more information about the Odyssey Japan Boutique Hospitality Fund, phone or email Daniel Vovil via the contact details listed below.

Daniel Vovil, Co-Founder and President, Odyssey Capital Group

daniel.vovil@odysseycapital-group.com | (852) 9725-5477

Sep 25, 2018 | Press Releases

Dear Clients & Friends,

We are very pleased to announce that, as part of our Japanese Boutique Hotel strategy, we have made our first acquisition, a uniquely charmingRyokan (traditional Japanese inn) called “Kagetsu” in Echigo Yuzawa, Niigata Prefecture – see the website here: https://www.shousenkaku-kagetsu.com

(Kagetsu Ryokan Room with outside Bath)

(Kagetsu Ryokan Room with outside Bath)

(Kagetsu Ryokan In-house Onsen)

(Kagetsu Ryokan In-house Onsen)

Kagetsu is surrounded by three exceptional ski resorts and bordered by Takizawa Park and a quaint river that flows from the nearby Fudotaki Falls. Kagetsu has been owned and operated by the same family for more than 30 years.

During the winter season, our guests have access to 3 different ski resorts where they are able to enjoy the renowned Japanese slopes or beautiful hot-springs.

(Fudotaki Falls in Echigo Yuzawa)

(Fudotaki Falls in Echigo Yuzawa)

(Local Echigo Yuzawa Hot Springs)

(Local Echigo Yuzawa Hot Springs)

But it’s also the Spring, Summer and Fall that attract tourists from all over, as these seasons are filled with hiking and mountain biking, golfing, fishing, delicious farm to table local cuisine, sake tasting at famous sake breweries. The area is well known for young couples to make pledges and prayers at the famous Fudotaki Falls.

(Yuzawa River)

(Yuzawa River)

(Yuzawa Chuo Park)

(Yuzawa Chuo Park)

After completing thorough due diligence, the key parameters for the purchase of Kagetsu included: the abundant tourist experiences that guests can enjoy during all four seasons in the surrounding area and community, securing a below market acquisition price which will contribute to the a targeted IRR of 20.3%, an attractive cash-on-cash yield of 12% based on the application of our value-enhancement strategies along with favourable debt financing at 1.8% p.a., all combine as key factors behind the acquisition of this unique property as the first of many for Odyssey’s Japan Boutique Accommodation strategy.

(Kagetsu Ryokan Entrance)

(Kagetsu Ryokan Entrance)

(Kagetsu Ryokan Deluxe Room)

(Kagetsu Ryokan Deluxe Room)

Clients of Odyssey are eligible for a 20% discount on room stays so please contact your Private Client Adviser if you are planning to be in Japan and would like to experience the charm of Kagetsu.

If you would like to learn more about Kagetsu or if you would like to learn about our upcoming property purchases, please get in touch with us at: japan@odysseycapital-group.com

(Kagetsu Ryokan Banquet Hall)

(Kagetsu Ryokan Banquet Hall)

For more information about the Odyssey Japan Boutique Hospitality Fund, phone or email Daniel Vovil via the contact details listed below.

Daniel Vovil, Co-Founder and President, Odyssey Capital Group

daniel.vovil@odysseycapital-group.com | (852) 9725-5477

Ryokan in Niigata

Ryokan in Niigata Mockup of Project Falcon

Mockup of Project Falcon Kagetsu Ryokan

Kagetsu Ryokan Hotel Owan Hanami

Hotel Owan Hanami Port Moji

Port Moji

In December 2018, in a meeting with staff in one of the rooms of the long-established hotel, Shosenkaku Kagetsu in Yuzawa in Niigata prefecture, Masami Koga, the general manager said “we have less group reservations. It is also challenging to increase average sales per guest”. One of his staff suggests “we should start sending out direct marketing emails again”, “how about suggesting Japanese sake which goes well with the food on the menu?” suggests another.

In December 2018, in a meeting with staff in one of the rooms of the long-established hotel, Shosenkaku Kagetsu in Yuzawa in Niigata prefecture, Masami Koga, the general manager said “we have less group reservations. It is also challenging to increase average sales per guest”. One of his staff suggests “we should start sending out direct marketing emails again”, “how about suggesting Japanese sake which goes well with the food on the menu?” suggests another.

Hotel Owan

Hotel Owan Hotel Owan

Hotel Owan Shousenkaku Kagetsu

Shousenkaku Kagetsu Shousenkaku Kagetsu

Shousenkaku Kagetsu Pipeline asset locations: Tokyo, Kyoto, Osaka, Izu, Niigata, Kitakyushu & Kobe

Pipeline asset locations: Tokyo, Kyoto, Osaka, Izu, Niigata, Kitakyushu & Kobe Mockup of Project Falcon

Mockup of Project Falcon Ryokan Pipeline Asset

Ryokan Pipeline Asset

(Kagetsu Ryokan Room with outside Bath)

(Kagetsu Ryokan Room with outside Bath) (Kagetsu Ryokan In-house Onsen)

(Kagetsu Ryokan In-house Onsen) (Fudotaki Falls in Echigo Yuzawa)

(Fudotaki Falls in Echigo Yuzawa)  (Local Echigo Yuzawa Hot Springs)

(Local Echigo Yuzawa Hot Springs) (Yuzawa River)

(Yuzawa River)  (Yuzawa Chuo Park)

(Yuzawa Chuo Park) (Kagetsu Ryokan Entrance)

(Kagetsu Ryokan Entrance) (Kagetsu Ryokan Deluxe Room)

(Kagetsu Ryokan Deluxe Room) (Kagetsu Ryokan Banquet Hall)

(Kagetsu Ryokan Banquet Hall)