Jan 22, 2024 | Articles, Global Markets Update

Odyssey Asset Management Limited (the “Company”) acknowledges that climate change is emerging as a major driving factor affecting long term resilience in the industry and the global economy. Thereby, this creates an urgent need to accelerate the transition towards a net-zero economy. While climate change poses a systemic and unprecedented risk to the global economy, the impacts on specific markets, regions, communities, and investments are complex, dynamic, and uncertain.

As an SFC licensed corporation, we take our fiduciary responsibility to consider and disclose all material factors that may impact the risk-adjusted returns of our investments, including climate-related financial risks and opportunities.

As an investor in the global economy, the scale and multi-faceted nature of climate change presents a systemic risk to our portfolio. Climate change impacts investors like us in two main ways:

- Physical impacts (e.g. wildfires, extreme weather, sea-level rise, drought) can affect our fixed assets (e.g. real estate) and disrupt portfolio companies’ supply chains and operations. Climate change’s acute and chronic physical impacts can affect people’s health, food security, migration, water supply, and other ecosystem services in ways that could bring heightened volatility to financial markets and harm economic growth.

- Transition risks, or shifts in policies, technologies, industries, and customers, due to changed climate norms or movement toward a lower-carbon economy can affect the financial success of existing business models and industries. Our portfolio companies’ long-term success depends on the degree to which they can successfully navigate the transition.

Given our investment portfolio, frequency of trading and investment scope, we take climate-related risks into account in our investment and risk management process. In light of this, we are taking the necessary action to account for such risks, as explained below.

Corporate Governance

The governance structure of the Company consists of a.) supervising and overseeing of climate-related risk at the Board of Directors level and b.) planning, coordinating and promoting climate-related risk management at the management level.

To integrate climate-related risk considerations into our existing governance structures, different roles and responsibilities have been assigned to ensure proper monitoring is in place:

Supervisory level

The Board of Directors is generally responsible for supervising the climate-related risk management process and relevant company development strategies. Its main responsibilities include:

(i) Monitoring the status and progress of Company’s management efforts to incorporate climate related risks into the Company’s investment and risk management processes;

(ii) Setting and maintaining the high ethical standards and reputation of the Company; and

(iii) Reviewing the Company’s objectives in climate-related risk management and regularly checking the progress of achieving the objectives through regular reports.

Management level

The management team of the Company is responsible for developing, coordinating and promoting climate-related risk management. Its main responsibilities include:

(i) Maintaining, reviewing and updating the climate-related risk management policy of the Company;

(ii) Establishing the process for the management and Board of Directors to be regularly informed about the status and progress of efforts to manage climate-related risks;

(iii) Formulating relevant processes for incorporating climate-related risks into the Company’s investment and risk management; and

(iv) Identifying and evaluating climate-related risks in the Company’s investment activities through climate-related data from external sources.

Investment and Risk management process of Climate-related Risk

The Company is responsible for identifying the relevance and materiality of climate-related risk for each fund or investment strategy. The Company will regularly review the relevance and materiality of climate-related risks and assess once a year or when any major changes such as changes in the fund’s investment strategy or investment horizon occurred. Disclosure will be updated and provided to the investors if necessary.

In light of the above, having considered our investment strategy, categories of investment, investment horizon, investment universe, etc., the Company currently of the view that for passive investment strategies, climate-related risks are not relevant to their investment and risk management processes. The Company will properly record the basis of the judgements of irrelevance for these funds or investment strategies.

For funds which are deemed to be relevant of climate-related risk, the Company will take into accounts climate-related risks when making investment analysis and risk management. The Company will take appropriate measures to identify, assesses, manage and monitor the investments which is relevant and material to the climate-related risks.

The material assessment includes but not limited to SASB standards and Greenhouse gas emission related climate data where available. Once identified, the Company will conduct qualitative evaluations for those investments which is relevant and material to the climate-related risks. The Company will analyse those investments to make sure they have proper future climate-related improvements process, targets and controls in place where possible.

The Company will regularly monitor those climate-related risk metrics and report to the senior management and board of directors to demonstrate proper corporate governance, investment and risk management process is in place.

Therefore, the Company has incorporated such climate-related risks in the investment philosophy and investment strategies, along with climate-related data into the research and analysis process.In light of the above, Board members are informed annually on climate-related risks and opportunities and how these may influence decisions in relation to risk management, strategy setting, implementation and monitoring. This will include a climate assessment for all funds.

Through our engagement and advocacy efforts we are working to minimize the absolute risk from climate change to our portfolio. The Company also hopes to understand the financial risks to the Company’s funds and investment portfolios and prepare for the long-term changes that will accompany climate change through the Company’s research and integration efforts.

The Company will continue to take reasonable steps to assess the impact of the aforesaid risks on the performance of the Company’s underlying investments to ensure compliance with the Hong Kong SFC’s related requirements on management and disclosure of climate-related risks by fund managers. Our Board will also continue to thoroughly oversee the progress against goals for addressing climate-related issues.

Should you have any queries, please do not hesitate to contact us at info@odyssey-grp.com or +852 2111-0668.

Odyssey Asset Management Limited

Disclaimer: This disclosure statement is intended to provide information to stakeholders and by its nature may involve risk and uncertainty. This document may contain forward-looking statements. Any statements that may express forecasts, expectations and projections are not guarantees of future performance given the current uncertainties on this front.

Dec 29, 2022 | Articles, Global Markets Update

Odyssey Asset Management Limited (the “Company”) acknowledges that climate change is emerging as a major driving factor affecting long term resilience in the industry and the global economy. Thereby, this creates an urgent need to accelerate the transition towards a net-zero economy. While climate change poses a systemic and unprecedented risk to the global economy, the impacts on specific markets, regions, communities, and investments are complex, dynamic, and uncertain.

As an SFC licensed corporation, we take our fiduciary responsibility to consider and disclose all material factors that may impact the risk-adjusted returns of our investments, including climate-related financial risks and opportunities.

As an investor in the global economy, the scale and multi-faceted nature of climate change presents a systemic risk to our portfolio. Climate change impacts investors like us in two main ways:

- Physical impacts (e.g. wildfires, extreme weather, sea-level rise, drought) can affect our fixed assets (e.g. real estate) and disrupt portfolio companies’ supply chains and operations. Climate change’s acute and chronic physical impacts can affect people’s health, food security, migration, water supply, and other ecosystem services in ways that could bring heightened volatility to financial markets and harm economic growth.

- Transition risks, or shifts in policies, technologies, industries, and customers, due to changed climate norms or movement toward a lower-carbon economy can affect the financial success of existing business models and industries. Our portfolio companies’ long-term success depends on the degree to which they can successfully navigate the transition.

Given our investment portfolio, frequency of trading and investment scope, we take climate-related risks into account in our investment and risk management process. In light of this, we are taking the necessary action to account for such risks, as explained below.

Corporate Governance

The governance structure of the Company consists of a.) supervising and overseeing of climate-related risk at the Board of Directors level and b.) planning, coordinating and promoting climate-related risk management at the management level.

To integrate climate-related risk considerations into our existing governance structures, different roles and responsibilities have been assigned to ensure proper monitoring is in place:

Supervisory level

The Board of Directors is generally responsible for supervising the climate-related risk management process and relevant company development strategies. Its main responsibilities include:

(i) Monitoring the status and progress of Company’s management efforts to incorporate climate related risks into the Company’s investment and risk management processes;

(ii) Setting and maintaining the high ethical standards and reputation of the Company; and

(iii) Reviewing the Company’s objectives in climate-related risk management and regularly checking the progress of achieving the objectives through regular reports.

Management level

The management team of the Company is responsible for developing, coordinating and promoting climate-related risk management. Its main responsibilities include:

(i) Maintaining, reviewing and updating the climate-related risk management policy of the Company;

(ii) Establishing the process for the management and Board of Directors to be regularly informed about the status and progress of efforts to manage climate-related risks;

(iii) Formulating relevant processes for incorporating climate-related risks into the Company’s investment and risk management; and

(iv) Identifying and evaluating climate-related risks in the Company’s investment activities through climate-related data from external sources.

Investment and Risk management process of Climate-related Risk

The Company is responsible for identifying the relevance and materiality of climate-related risk for each fund or investment strategy. The Company will regularly review the relevance and materiality of climate-related risks and assess once a year or when any major changes such as changes in the fund’s investment strategy or investment horizon occurred. Disclosure will be updated and provided to the investors if necessary.

In light of the above, having considered our investment strategy, categories of investment, investment horizon, investment universe, etc., the Company currently of the view that for passive investment strategies, climate-related risks are not relevant to their investment and risk management processes. The Company will properly record the basis of the judgements of irrelevance for these funds or investment strategies.

For funds which are deemed to be relevant of climate-related risk, the Company will take into accounts climate-related risks when making investment analysis and risk management. The Company will take appropriate measures to identify, assesses, manage and monitor the investments which is relevant and material to the climate-related risks.

The material assessment includes but not limited to SASB standards and Greenhouse gas emission related climate data where available. Once identified, the Company will conduct qualitative evaluations for those investments which is relevant and material to the climate-related risks. The Company will analyse those investments to make sure they have proper future climate-related improvements process, targets and controls in place where possible.

The Company will regularly monitor those climate-related risk metrics and report to the senior management and board of directors to demonstrate proper corporate governance, investment and risk management process is in place.

Therefore, the Company has incorporated such climate-related risks in the investment philosophy and investment strategies, along with climate-related data into the research and analysis process.In light of the above, Board members are informed annually on climate-related risks and opportunities and how these may influence decisions in relation to risk management, strategy setting, implementation and monitoring. This will include a climate assessment for all funds.

Through our engagement and advocacy efforts we are working to minimize the absolute risk from climate change to our portfolio. The Company also hopes to understand the financial risks to the Company’s funds and investment portfolios and prepare for the long-term changes that will accompany climate change through the Company’s research and integration efforts.

The Company will continue to take reasonable steps to assess the impact of the aforesaid risks on the performance of the Company’s underlying investments to ensure compliance with the Hong Kong SFC’s related requirements on management and disclosure of climate-related risks by fund managers. Our Board will also continue to thoroughly oversee the progress against goals for addressing climate-related issues.

Should you have any queries, please do not hesitate to contact us at info@odyssey-grp.com or +852 2111-0668.

Odyssey Asset Management Limited

Disclaimer: This disclosure statement is intended to provide information to stakeholders and by its nature may involve risk and uncertainty. This document may contain forward-looking statements. Any statements that may express forecasts, expectations and projections are not guarantees of future performance given the current uncertainties on this front.

Nov 11, 2021 | Articles, Global Markets Update

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Original article (In Japanese): https://news.yahoo.co.jp/articles/4b9f951cb378e5a3e2d950a341a4512225e3f5ca

Below is our translation of the original article:

The Japanese government has decided to restart the “Go To Travel,” campaign, a travel stimulus measure, after January of next year.

Tourists and others who have been affected by the corona virus outbreak are demanding an early resumption of the campaign. However, the government is first looking to determine whether the drugs that can help fight off the corona virus infection can be used commercially by the end of this year.

When the campaign is resumed, they will take vaccination and negative test results into account.

“Go To Travel” is a government-sponsored campaign that subsidizes individual travel costs. It started in July 2020, but was suspended in December 2020 due to the spread of the corona virus. Yesterday, Prime Minister Fumio Kishida said that he would like to use vaccines and tests in order to create a safer and more secure system.

The government is aiming for the commercialization of oral drugs by the end of the year. Next January, the third dose of vaccinations for the elderly will begin. A government official mentioned that there are a lot of important parts in regards to controlling the corona virus infection.

It has been pointed out that last year, the campaign was heavily focused on weekend travel, and staying at major hotels. This time, they plan to modify the campaign, with increased emphasis on weekday travel, and increasing the benefits for staying at small and medium-sized hotels and inns.

If you would like to receive further details on Odyssey or some of the most attractive private markets investment opportunities Asia has to offer, please get in touch with us.

Nov 10, 2021 | Articles, Global Markets Update

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Japan looks to let foreigners visit the country for short business trips, study abroad and technical training in an easing of its strict coronavirus-related entry rules, Nikkei has learned.

Read here.

If you would like to receive further details on Odyssey or some of the most attractive private markets investment opportunities Asia has to offer, please get in touch with us.

Nov 10, 2021 | Articles, Global Markets Update

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Market Highlights

After a difficult September, October epitomised a V-shaped recovery in equity markets with the MSCI World TR Index surging 5.7%.

Performances were led by the US with the S&P 500 up 6.9%. US Growth stocks surged 9.1% while Value grew at only half this rate at 4.6%. MSCI Europe climbed 4.5% while Asia Pacific only managed a flat result.

The main driver has been the strength of the US Q3 earnings season. With approximately 52% of S&P 500 companies reported, 78% reported EPS beats of 11% with 71% also surprising on the upside in revenue. Similar numbers are being recorded by Europe, while Japan’s season has been less positive. While US index performances have been stellar, it is worth noting that a large portion of the rise has been due to just a handful of stocks. For instance, Microsoft and Tesla, at a combined weight of just 7.5% was responsible for 26% (1.8% out of 6.9%) of the S&P 500 performance. The stocks were up 18% and 44% respectively. The duo also accounted for 19% of the MSCI World TR Index performance. It is a month where active equity managers would be hard pressed to keep up with US indices unless they also had large positions in MSFT and TSLA. Nvidia, which is the 8th largest allocation in the S&P 500 at 1.9% has also been on a tear that has continued into November.

Commodities finished the month on a subdued note after some metals spiked mid-month on fears of a severe supply squeeze. Nevertheless, the SPGS Commodity Index was still up 5.5% with WTI Oil up 11%. The Global Credit Index was flat for the month.

Speculation Déjà vu

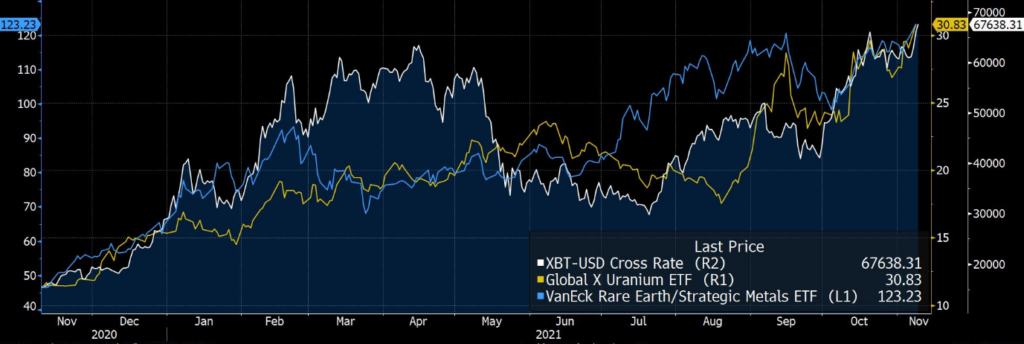

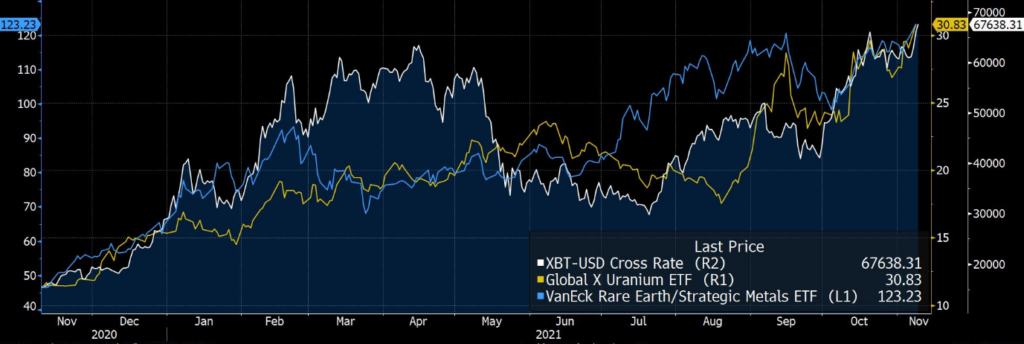

The rapid movement of Tesla and Nvidia brings us to another feature of the markets that has become increasingly prevalent, that of speculation. Last October we saw the start of a speculative bubble that extended until Q1/Q2 2021 when crypto-currencies, alternative energy stocks, “ARK” stocks, and other speculative exposures came back to earth. However, many speculators and day-traders must have fared well since they are at it again, ramping up assets where the speculative demand far-outstrips the physical real-world demand. This time it is again being led by crypto-currencies, but uranium exposures have also surged with the Global X Uranium ETF (URA) up 76% since mid-August, as well as rare-earth metal stocks. This is the result of a world flush with liquidity, consumer savings enormously bolstered by COVID, and large cap stocks already up 20+% YTD. The additional liquidity leaks into speculative assets, and due to being less liquid, prices are driven up quickly.

The market cap of Tesla is once again greater than the combined market cap of the 10 largest car companies in the world despite expecting to have circa 1% market share this year. It will be interesting to see how the EV market changes over the next 3 years as Toyota, BMW, Audi, Mercedes, Honda, Ford and GM accelerate their production of EVs.

Even in China we have seen results of excess liquidity and pent-up savings with the speculative Chi-Next Index up +18% YTD compared to the large-cap broad CSI300 Index down -3%.

Investment Strategy

V-Shaped market movements are difficult to navigate but we remain positive for the markets for the remainder of the year. The liquidity driving speculative investments is likely to remain supportive of most risk assets.

While we are generally cautious following a strong month, the reason for the equity market strength – a strong earnings season – compels a pro-equity stance. Earlier in the year, a strong Q2 reporting season, together with a benign rates environment were the factors that have propelled the equity market since May. This was largely despite the Delta variant and slowing economic growth concerns.

Certainly, supply chain integrity has been an issue, but global COVID infection rates have been declining, and importantly they have been declining in areas that have caused supply chain bottlenecks. Temporary shortage of fossil fuels is likely to remain for some time but already many commodity prices are moderating after spiking in mid-October.

We maintain our focus on the US equity with Europe being the next preferred market. While Japan could perform with a recovering global economy, China appears focused on dampening some of the excesses of the past and may continue to represent a difficult investment environment.

While we continue to support quality in our portfolio, the announcement by Pfizer of an anti-viral drug that appears to have high efficacy against COVID-19, suggest it may be prudent to have some cyclical stocks as well as exposures that have underperformed due to lock-down restrictions such as travel-related stocks. Since many of these stocks can be more volatile than blue-chips, you may consider ETFs such as AWAY US that has technology-based stocks in the global travel and tourism industry, as well as JETS US which, as the name suggests, is an ETF of global airline-related stocks.

Outlook

Our positive outlook on the markets to year-end means that we would increase our investments in market leaders such as GOOGL, Microsoft and Apple. For those with the risk appetite, we would also add some additional risk to the above-mentioned ETFs as well as small cap exposure, either through single stocks, or via a Russell 2000 tracker ETF such as IWM US. This said, we note that the S&P500 is at the highest PER valuation for the year in regard to next 2022 earnings at 21x, and speculative assets are frothy to say the least. We suggest investors remain prudent in their allocations and be watchful for changes in market sentiment.

We have recently launched the Odyssey Optimum Return Fund. This is an investable global multi-strategy fund that is designed for clients that would like to invest in the global equity and credit in a risk-controlled manner. The goal is to provide attractive returns in bull markets and to preserve capital in bear markets. The latest factsheet can be found here.

If you like to receive more information on our portfolio solutions, please contact us here: info@odyssey-grp.com.

Nov 5, 2021 | Articles, Global Markets Update

As the CEO and Co-Founder of the Odyssey Group, the Odyssey team and I strive on a daily basis to give our very best, but there are those who have to fight every day with 100% maximum effort, those kids battling with cancer.

I am raising money for a fantastic charity in Singapore that supports children with cancer. On Sat 13 Nov 2021, I will be running the ForestForce 50k Virtual ultra-trail running race in Singapore to raise money for “Love, Nils“, a Singapore Charity that helps kids with cancer. Please support me by donating to this wonderful cause.

Your donation will help to change the life stories of the children who are battling the toughest fight, cancer.

At LOVE, NILS, they provide emotional, social and community support to cancer patients and caregivers. The team guide the families through the healthcare system, provide professional therapies, community support and more. As a registered charity, their goal is to be there for the families before, during and after treatment, every step of the way.

Vision: To be a beacon of hope and resilience for pediatric cancer patients and their caregivers in Singapore.

Mission: To encourage and empower them through healthcare guidance, emotional, social and community support.

With the above in mind, I would like to encourage everyone to take a short moment out of their day to contribute to a great charity who are helping the children and their families in need. Everyone has different financial circumstances, hence, please give what is affordable for you. All proceeds go to the charity directly.

You can view and contribute to the charity run here:

https://www.simplygiving.com/sponsor-alex-s-run-to-raise-funds-for-kids-wi

Please also share the link via your social media to help spread the word and support this great charity.

Please donate now and show the team at LOVE, NILS and the families they are helping, that you care.

Details

Charity website: https://www.lovenils.org/

Race website: https://www.forestforce50.sg

Alex’s Racing bib nu#: 327

Alex’s Strava Profile: https://www.strava.com/athletes/46249161