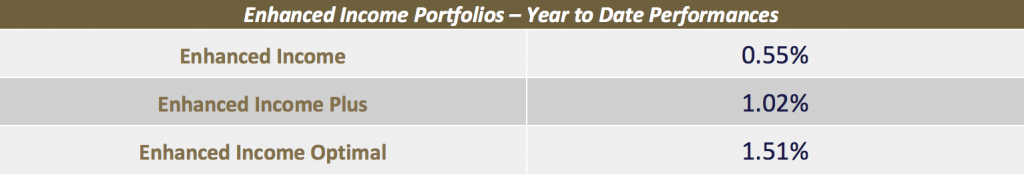

Increase your investment portfolios income from 0.5% to 1.5% per month

Positive Returns – Even in Bear Markets!

Odyssey is always looking for ways to generate additional returns for our clients. As part of this goal, some 5 years ago we developed the Enhanced Income Overlay, which allows us to generate additional passive income from 0.25% to 1.5% per month for our clients, irrespective of market conditions, while taking on minimal risk. Since then, our clients have enjoyed consistent returns with additional income being generated from the Enhanced Income Overlay.

To help further support the Enhanced Income Overlay solution, Odyssey bolstered the Asset Management team by hiring seasoned market veteran, Max Martirani who has 15 year track record of delivering positive performance, even during the global financial crisis. Max’s CV is impressive, he has worked for some of the most well known banks and hedge funds. It is his experience that has allowed us further develop the Enhanced Income Overlay to generate positive performance for our clients’ portfolios in both bull and bear markets.

The overlay can be added to:

- An existing investment portfolio.

- A new portfolio.

- As a standalone trading vehicle.

The Enhanced Income Overlay aims to generate between 0.5% and 1.5% in income per month, this is generated by selling listed option contracts. This return is in excess of any gains and income generated or received from the underlying portfolio’s assets. We employ rigorous risk management tools and are focused on placing only defined risk option strategies to ensure that we conservatively manage the portfolios risk exposure at all times.

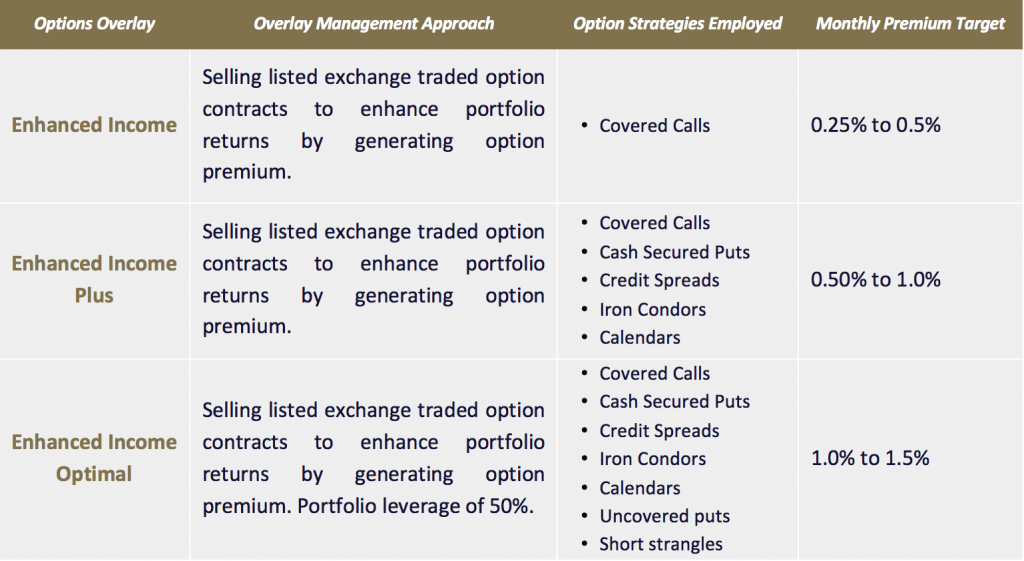

Available Overlay Choices

The following is a summary of the different overlay’s that we offer:

Past Performance

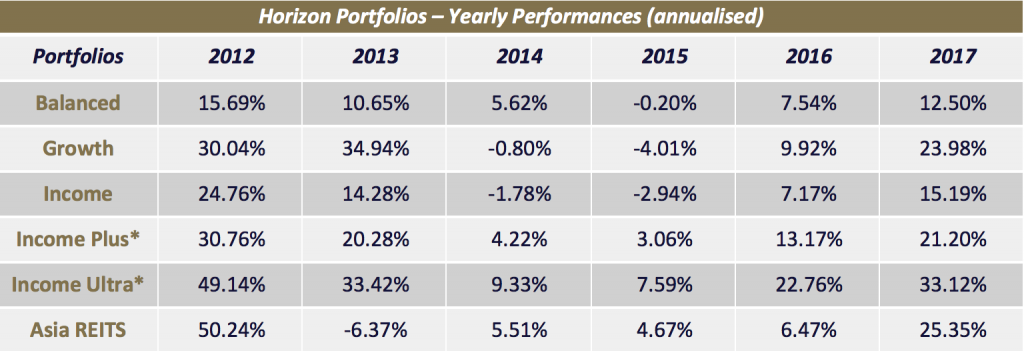

The following is the performance for our Enhanced Income Overlay and our inhouse Horizon Discretionary Portfolios:

*These portfolios employ the Enhanced Income Plus options overlay.

*These portfolios employ the Enhanced Income Plus options overlay.

Our portfolios have a consistent track record and have even been back tested and stress tested and have shown to produce satisfactory returns.

The option overlay will increase the portfolios returns during a bull market, but the option overlay provides real alpha to the portfolios returns as these will be enhanced during sideways and bear markets as the income generated from the option overlay provides additional yield for the portfolio.

Portfolio Manager

Max Martirani is the Managing Director of Odyssey Asset Management, with responsibility for overseeing the groups hedge fund strategies and managing the segregated portfolios.

Mr. Martirani has over 20 years of experience finance industry and working with large institutions such as Citigroup, HVB, Mizuho Corporate Bank, Banca Commerciale Italiana and Barclays.

Prior to joining Odyssey Asset Management, Mr. Martirani has been a Senior Portfolio Manager at Symmetry Investments where he manages a macro portfolio investing in global liquid assets focused on Asia and developed markets since 2014. He was a Senior Portfolio Manager at Graham Capital in London from 2012 to 2014, managing a macro portfolio investing in FX and equity derivatives.

Mr. Martirani holds a Business Administration (Hons) degree from the European Business School, London.

Odyssey Overview

Odyssey Capital Group Ltd is an international alternative asset manager that provides differentiated and bespoke investment solutions across multiple asset classes, including asset management, real estate, private equity and hedge funds. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest with its clients.

Our entrepreneurial culture allows us to generate attractive investment returns by following a prudent and long term approach. We aim to only employ the highest quality people as partners in our business, while pursuing the highest standards, and aligning out interests with those of our investment partners.

The Odyssey team have over 400 years of combined financial and operational experience across Asia Pacific, Europe and North America. This allows the Odyssey team to provide a broad regional industry expertise, insight into global macro and geopolitical trends, and a powerful network of global relationships. When clients partner with the Odyssey Group of companies, they benefit from the breadth and depth of expertise with the entire firm working in unison to achieve a targeted outcome.

Summary

In summary, our proprietary Enhanced Income Overlays provide our clients an additional source of passive income for investment portfolios. We are the only firm in Asia that offers this service and are proud to continue to provide our clients this unique service for their portfolios.

If you would like to generate additional, consistent and passive income for your investment portfolio, please contact us to find out more.