Monthly Market Update – June 2018

HOW WE ARE POSITIONED FOR THE END OF Q2 2018

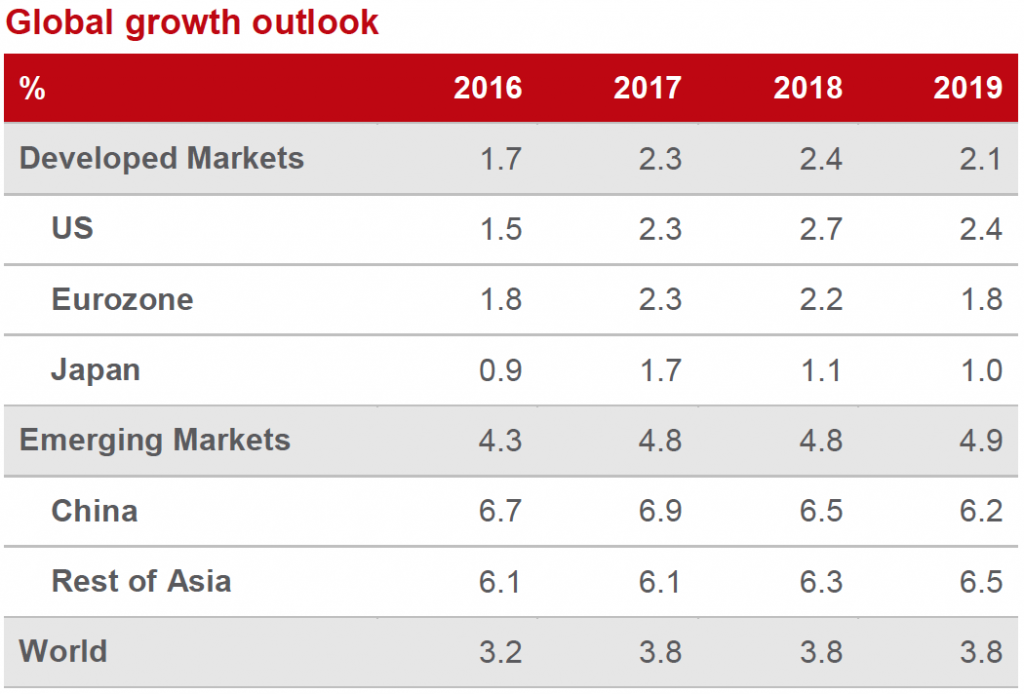

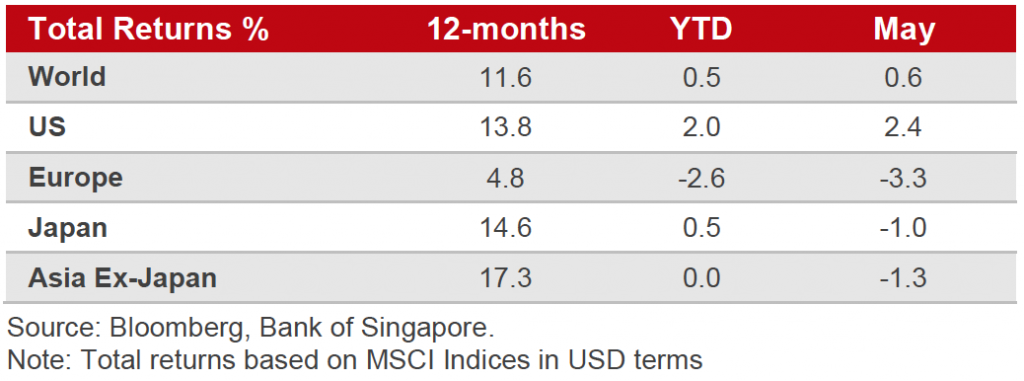

Global equities had a choppy and volatile month as initial strong gains gave way to profit taking in May.

US equities, fuelled by a positive 1Q earnings season, outperformed the rest of the world; while European equities, dragged down by higher political risk in Italy, considerably underperformed.

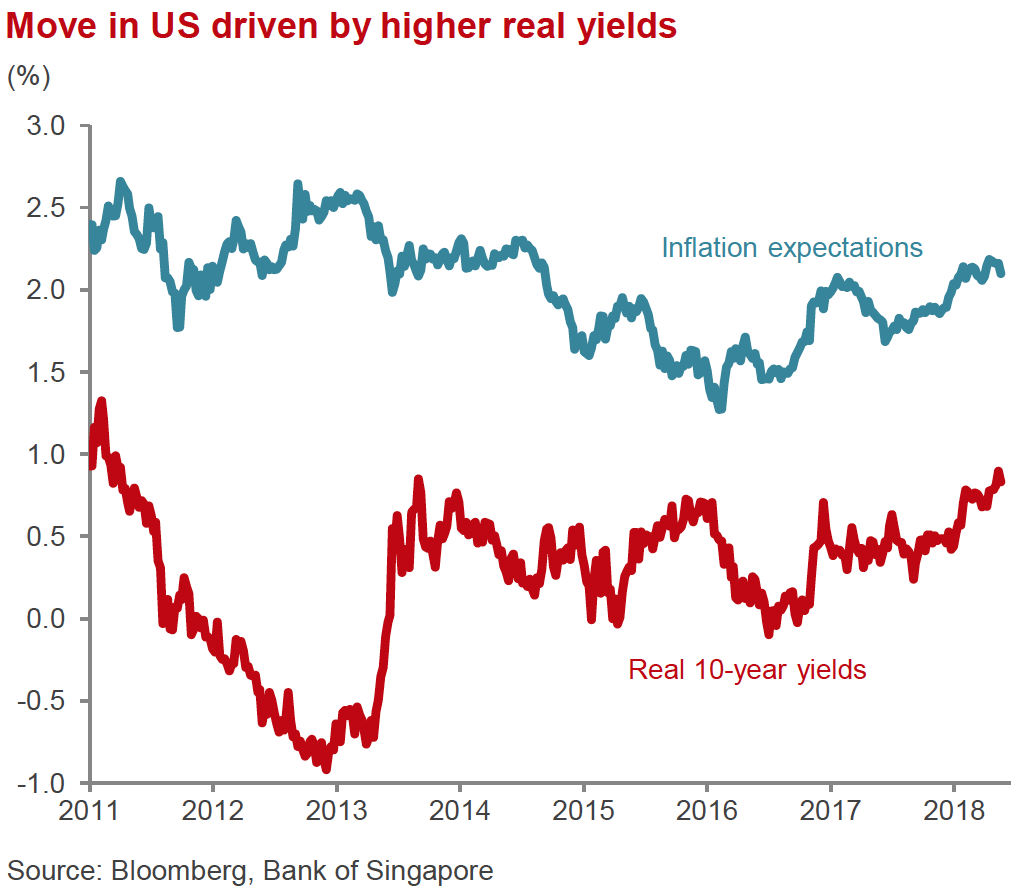

While the current environment demonstrates strong earnings and solid economic growth and should be supportive for the broader global equity markets. We anticipate that the recent rise in volatility will likely stay elevated for the time being while the current as Trade War Risk and Inflation risk returns, along with the US 10-year Yield hovering around the 3% mark.

Source: Bank of Singapore – Monthly Investment Guide, June 2018

Source: Bank of Singapore – Monthly Investment Guide, June 2018

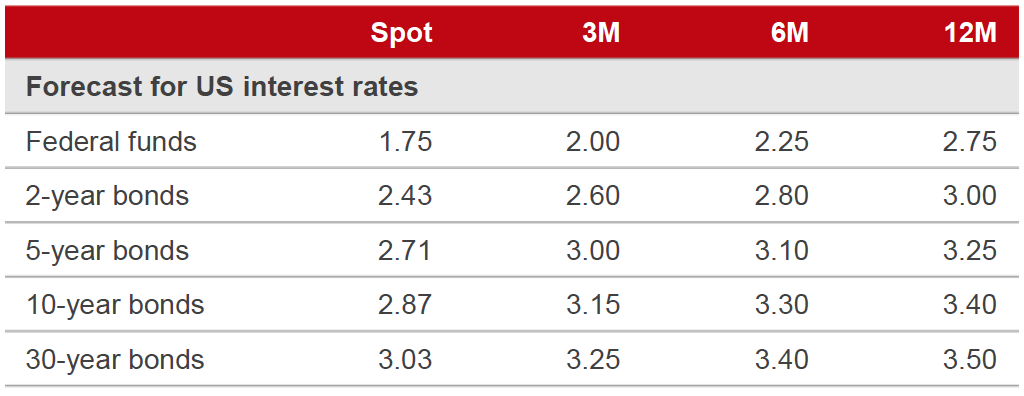

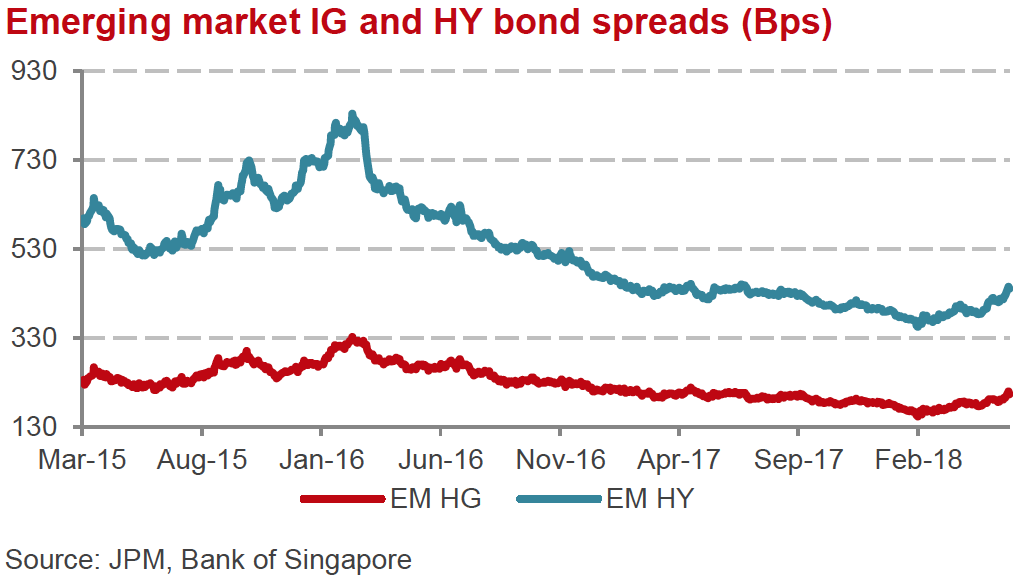

- We continue to expect the Bond Markets to underperform, as the Central Banks, led by the Fed, will continue to raise rates and remove their accommodative monetary policies.

- Commodity markets are mostly bullish , with Oil still trading close at 3 years high, while Gold is currently trading in a range.

- The US Dollar has made a strong come back in the past couple of months, but we still believe it is in a downtrend in the long run.

- The general consensus was initially for the Fed to hike up to 3 times this year, however, now we see a real risk of 4 potential hikes, as wage growth and inflation are picking up – essentially a 0.25% hike every quarter.

Source: Bank of Singapore – Monthly Investment Guide, June 2018

Source: Bank of Singapore – Monthly Investment Guide, June 2018

MARKETS OVERVIEW

Equities – Cautiously Constructive

- Overall, equities across the world had a flat May, with gains only in the US, as opposed to losses in most of the other markets.

- Our forecast for Year End Word stock markets is still a positive return, albeit in the single digits.

- We would like to move to neutral on European stocks after the very weak May performance, as we see few risks arising from the new Government in Italy. Even though valuations are cheaper we believe the Euro will appreciate, versus the Us Dollar, in the long run.

- Japan had a negative month in May and we remain neutral there too.

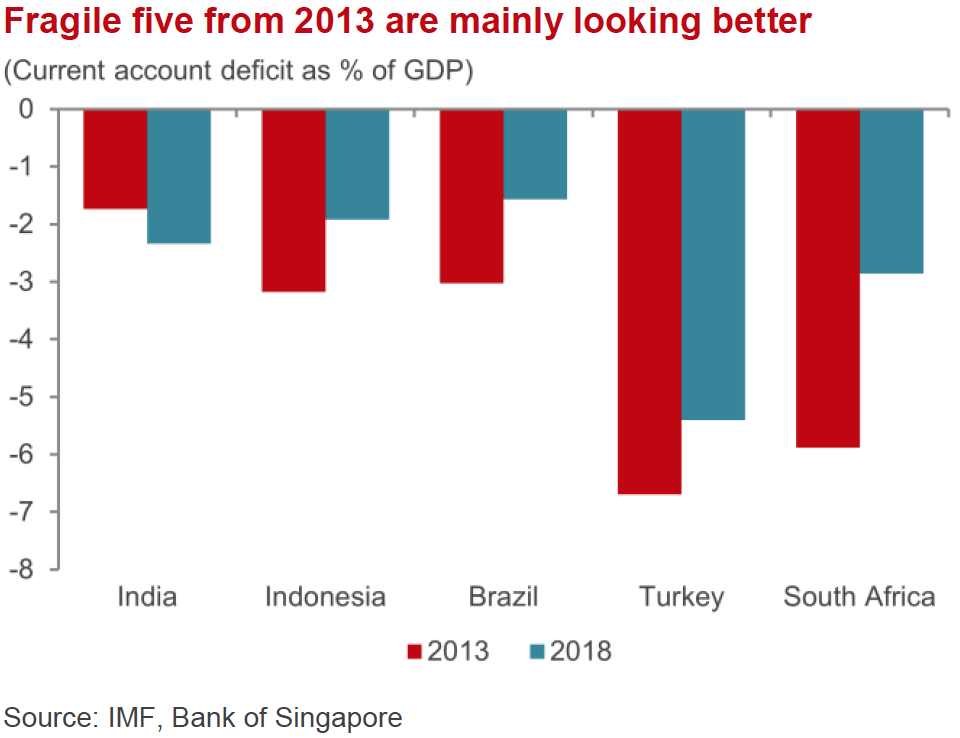

- Asia ex-Japan underperformed in May as the market grew concerned about the Malaysian elections. Malaysia, Singapore and Korea were the worst performers, while China and Hong Kong were the top performers. Emerging Markets as an Asset Class has been struggling with notable examples like Argentina and Turkey.

Bonds – Bearish

- A rising interest rate environment means most bond markets are vulnerable. Treasury Yields had moved up a massive 50 bps around the end of Q4 17 and Q1 18, hovering now around the critical 3% level. We believe US 10yr will reach 3.25% by year-end.

- While yields came off a considerable 30bps in May during the selloff of Italian bonds, we still see the US moving higher as the Fed will probably deliver a rate hike in Mid-June.

- If investors need to be positioned in fixed income, we prefer either inflation protected bonds (e.g. TIPS) or high quality corporate bonds with short durations – trading at or near face value.

Commodities – Constructive

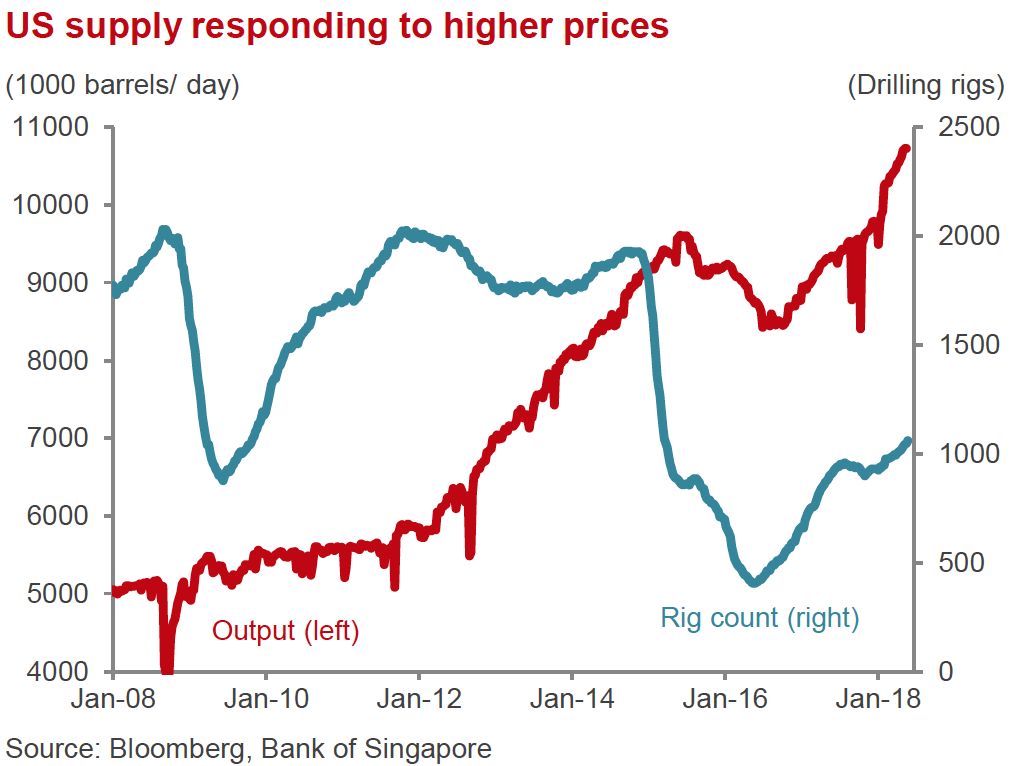

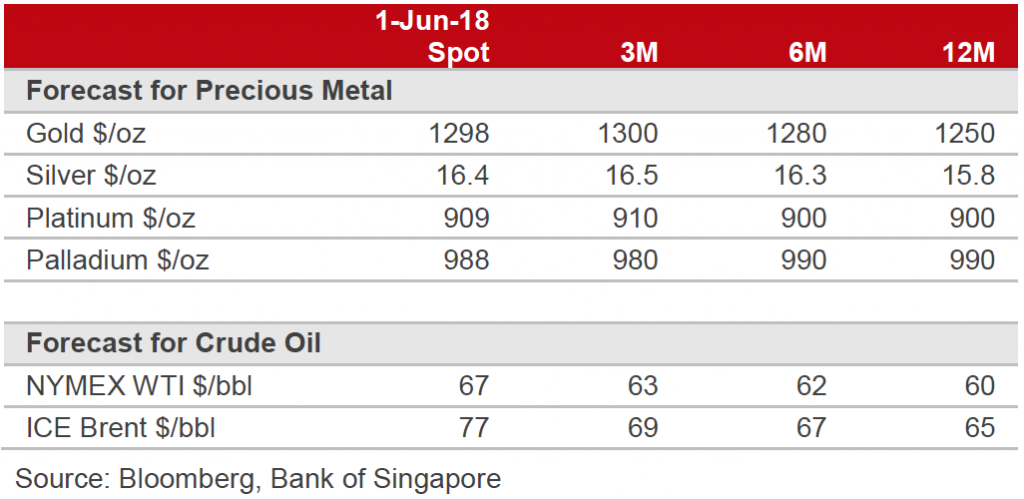

- Oil prices have rallied in the past 6 months as limits on supplies have been supporting prices.

- Oil demand continues to grow at a steady pace, while the US rig counts have been increasing, albeit at a lower speed than expected. So far, Opec has been very successful maintaining the current production rate. While we think short-term we could see a correction in the Oil price, we remain bullish for the long-term, as we are also wary of developments in Saudi Arabia and Iran.

- Gold has sold-off from the recent highs after a bounce in the US Dollar and with the stock market stabilising.

- We think Gold is still in the range of 1250/1350.

Currencies – Consensus is bearish on the US Dollar

- While the recent Emerging Markets uncertainty and the flight to quality in recent weeks have been positive for the US Dollar, the greenback could be vulnerable in the event of a real Trade War.

- As rate hikes by the Fed are mostly expected, the market is focused on other Central Banks to follow and change their accommodative stance.

- While we believe that the US Dollar can be strengthened in the short term, we expect the downtrend to carry on in the medium term.

Alternatives – Bullish

- We are generally positive on the property markets, with a preference for commercial over residential. Our favoured countries for exposure include Japan, Australia and Vietnam. Please ask if you require more information on some of the projects we are currently working on.

- We also have a positive outlook on Private Equity as we see better growth opportunities, whilst lower valuations are being seen across the industry compared to most other stock markets.

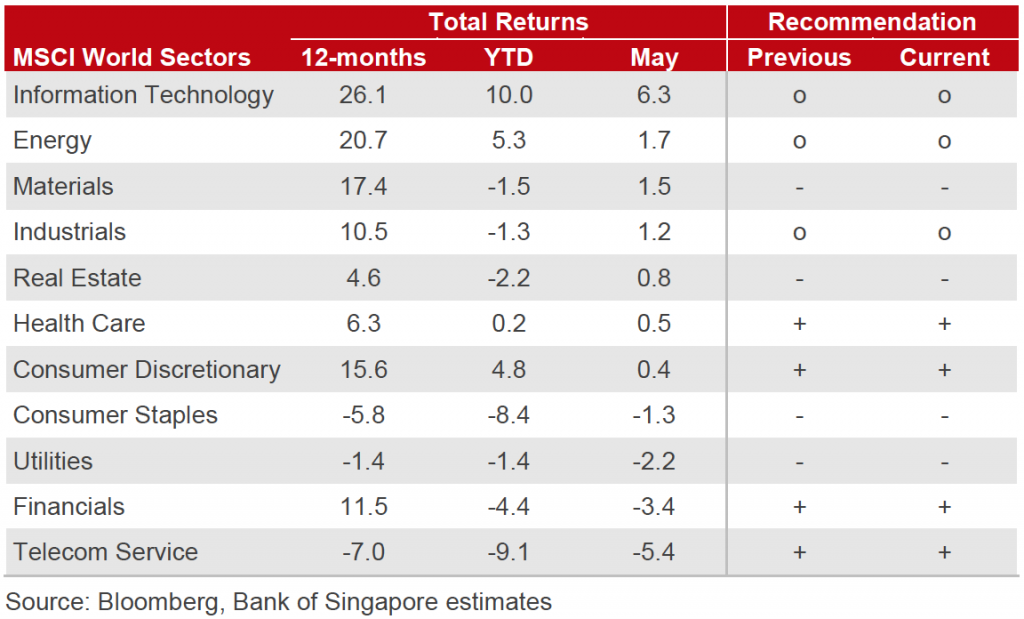

BULLISH SECTORS

- The Technology sector was the best performer in May, while the Telecom, Financial and Utilities sectors were the worst performers.

- Technology stocks outperformed and were supported by strong earnings and sales momentum. We remain neutral and opportunistic buyers of attractive companies in this sector, but are being very selective given the sectoo is currbelty the most expensive with a forward P/E of 19.3x.

- We are still positive on the Financial sector after its underperformance in May, as we think the concern over banks suffering a flat yield curve is overblown. We think a renewed increase in interest rates in the US and in the rest of the world will benefit the banks. We expect an eventual easing of capital restrictions, which could make it easier to increase dividends and buybacks. We prefer US banks over European ones, at this stage.

- We remain positive on Consumer Discretionary sector especially in Europe and in Asia as it will benefit from the strong economic growth and from sustained improvements in labour markets and consumer confidence.

- We like Energy stocks as a defensive play and a possible hedge in case of more geopolitical turmoil in the long run but we are aware that the market could be toppish in the short-term.

HOW WE MANAGE RISK – PORTFOLIO PROTECTION, HEDGING & TAKING PROFITS

As opposed to just going to cash, we prefer alternative strategies such as hedging via options and option writing strategies to smooth out portfolio volatility.

We also actively monitor profits using trailing stop losses with the view of protecting and locking in gains.

PORTFOLIO MANAGEMENT SERVICES

Please let us know if you would like to hear more about our Discretionary Portfolios and how we consistently generate an additional 0.5% to 1.5% per month using our Options Overlay.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at.

![[Press Release] Fund to convert Japan’s historic architecture into luxury boutique hotels](https://odyssey-grp.com/wp-content/uploads/2018/06/ryokan_5_resized.jpg)

Relaxing outdoor Hot Spring Onsen bath at Hotel project (Source: Daniel Vovil, Odyssey Capital Group)

Relaxing outdoor Hot Spring Onsen bath at Hotel project (Source: Daniel Vovil, Odyssey Capital Group)