Monthly Market Update – July 2018

HOW WE ARE POSITIONED FOR 3Q18

It was a choppy and volatile month as US President Trump announced a 25% levy on $50 billion of imports from China, who likewise responded with similar measures. Stakes were raised toward month-end as the US threatened additional import tariffs of close too $200 billion.

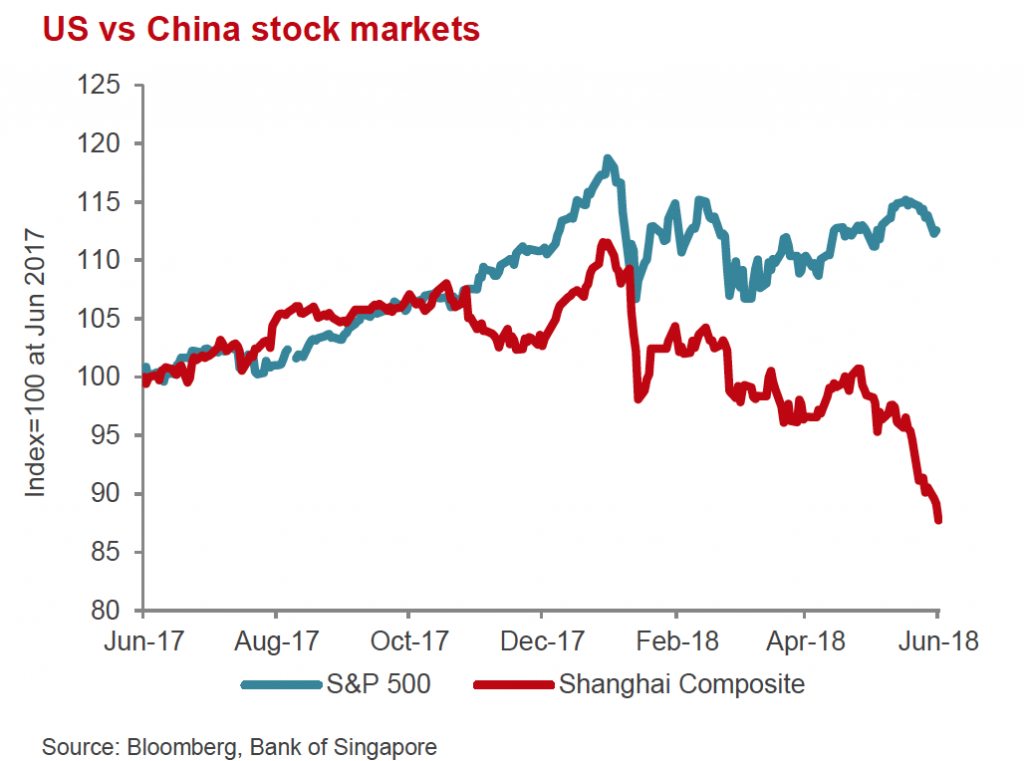

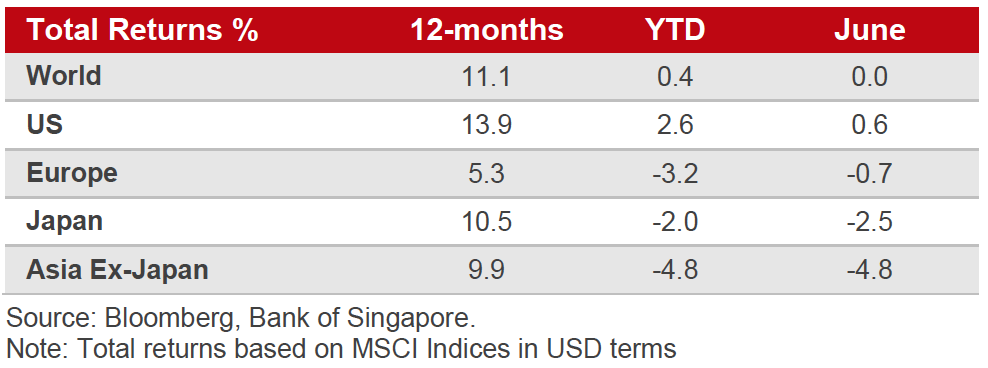

Non-US equities were the hardest hit, notably Asia ex-Japan, which saw its benchmark index off 5.2% from last month. China’s A-shares were particularly hit hard, down c. 8% for the month, and 20% off its January peak. It was a rough month in general for AxJ/EM equities despite a strong finish on a quarter-end window dressing. It was also a poor month for Europe as the Stoxx 600, and in particular Italy’s MIB, also fell after the Italian election result that took Euro lower to test a key support at 1.15. On the other hand, US equities saw large inflows as they are seen to be relative winners from developments in trade while ‘growth’ equities have outperformed – within US equities – by 20%.

The trade conflict will be priced-in at some point but, unfortunately, this may remain a moving target ahead of the US mid-term elections and, in the short term, may get worse. There remains a fundamental gap between US – that views existing trade as ‘fundamentally unfair’ – and the rest of the world, hence its tariff impositions. This explains why, should there be any resultant retaliatory action by China, EU and Canada, would further US tariffs be triggered. EU and China want to negotiate first before the US imposes tariffs thus the two sides are unable to compromise.

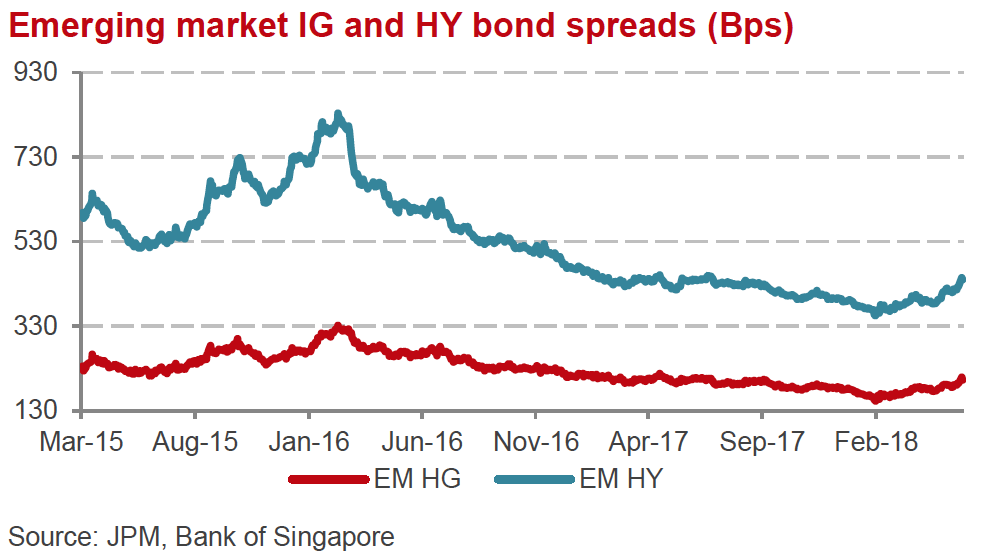

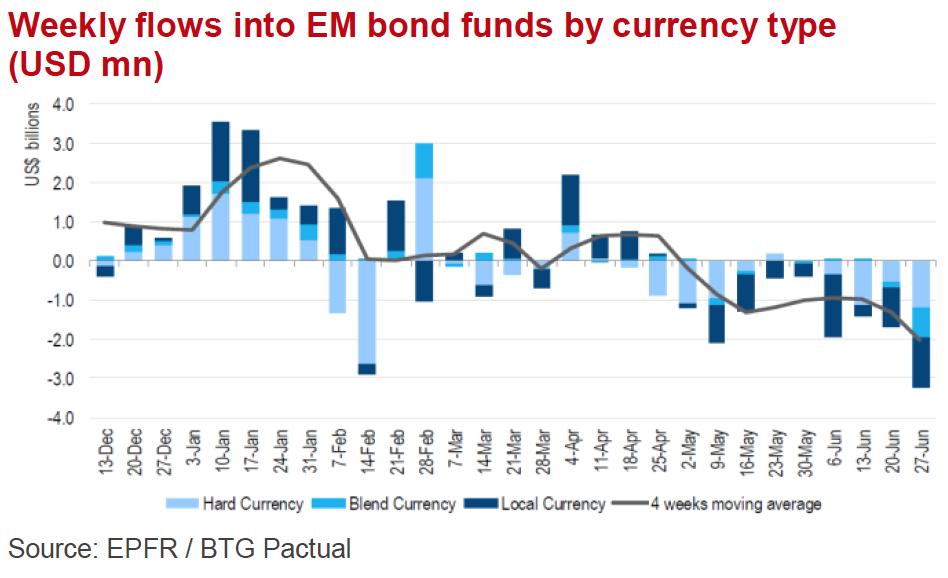

- Fixed-income (FI) markets were mixed as a continued selloff in credit was led by investment-grade (IG) credit, and further weakness in emerging market (EM) FI more generally – not least in local currency debt (LCD).

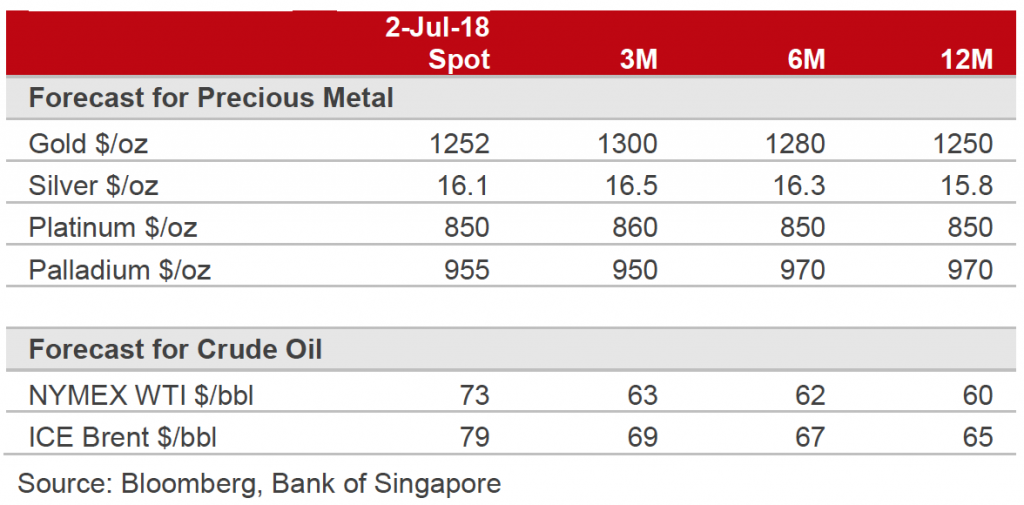

- Commodities remained well-supported, with Oil still seeing favourable supply-demand dynamics, amidst potential disruptions in the Middle East. Gold remains range-bound in the $1,240 – $1,360 region.

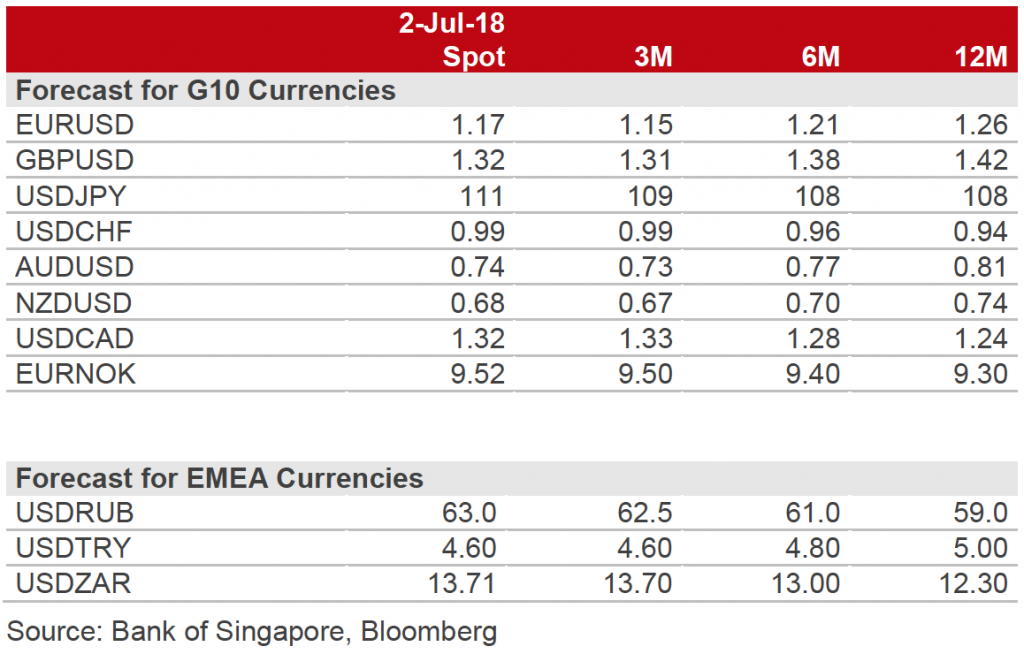

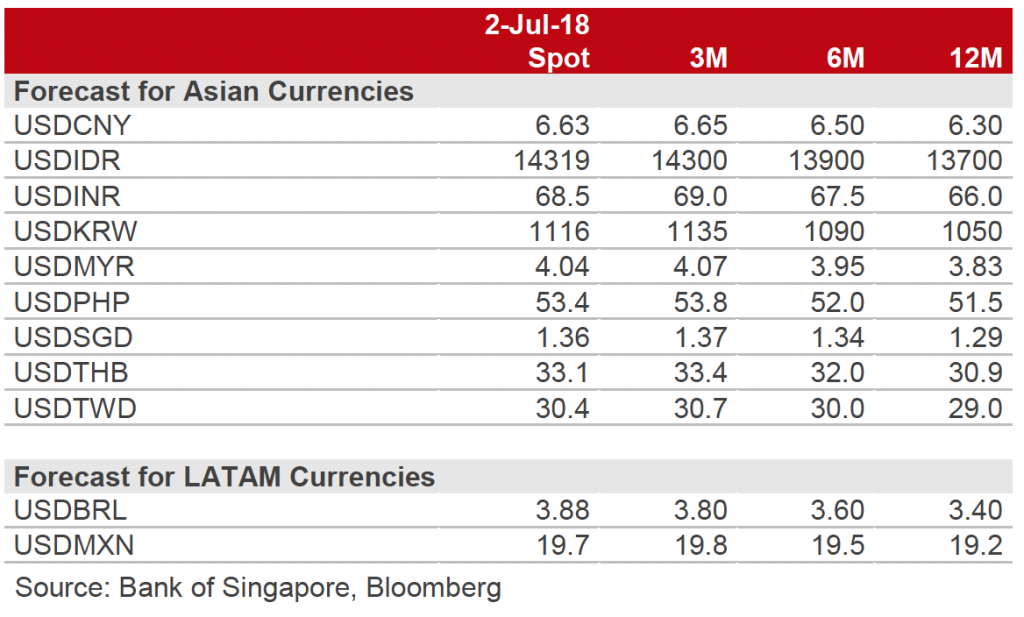

- While the US Dollar has seen a strong comeback over the past quarter, we still believe it is in a long-run secular downtrend.

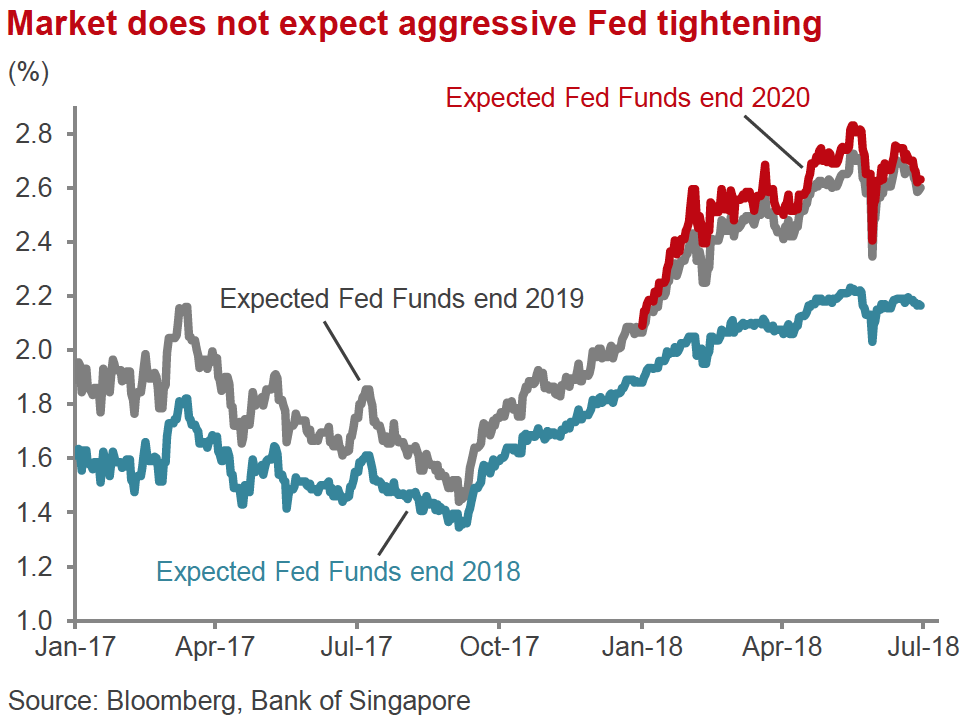

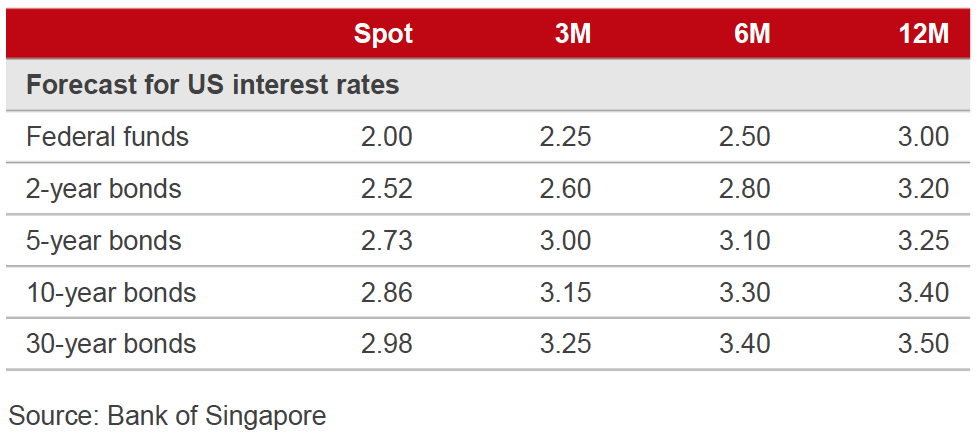

- In line with what markets have already priced in, we still expect two more hikes from the Fed, for a total of four rate hikes this year. The unlikely exception to this scenario would be a severe deterioration of trade tensions, which could see the Fed slow down its pace of rate hikes.

MARKETS OVERVIEW

Equities – Cautious

- Globally, equity markets closed mostly flat-to-negative, with small gains in the US opposed to losses in most of the other markets. Notably, the S&P 500 saw significant sector disparity in 1H18 as consumer discretionary(+10.81%) led gains, helped by Amazon (+45.35%), Netflix (+103.91%) and Nike (+27.39%). The IT sector followed closely with a c.10% gain, whereas financials (-5.00%) and defensive sectors, as consumer staples and telecommunication services (both off c. 10%), hugely underperformed. Q2 saw the ‘FAANGs’ once again providing key leadership.

- We remain neutral and opportunistic buyers on best names, as the sector still remains the most expensive with a forward P/E of 19.3x.

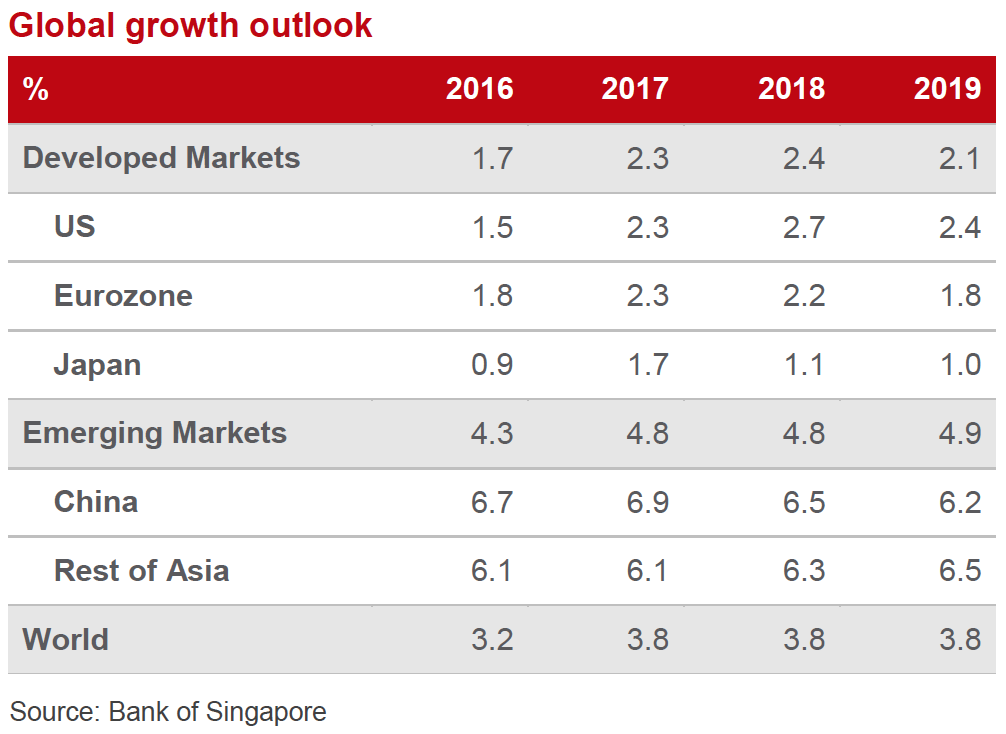

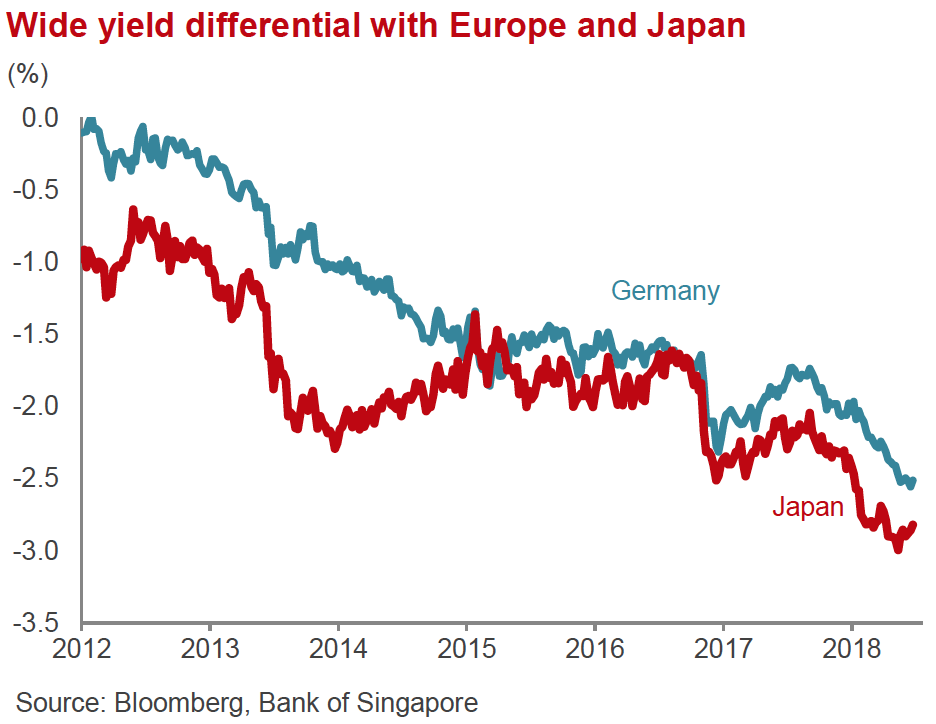

- Our broader forecast for equities still remains positive, albeit on single-digit returns for the year. We would like to remain invested in US markets as we see a likely outperformance given the current Goldilock scenario, and its relatively ‘safer’ status. We remain neutral on European and Japanese shares, though the Stoxx 600 will likely take direction from trade movements, and the Nikkei will be likewise equally vulnerable should the US impose tariffs on auto imports.

- Asia ex-Japan equities suffered hefty foreign institutional investors (FII) outflows last month and YTD, underperforming equities across other regions. Apart from A-shares, KOSPI fell 6.25%, although TAIEX remained resilient to come off only 35bps. Whilst trade concerns clearly were the key driver of the selling, other drivers include widespread earnings downgrades, weaker FX, specific political risks in Malaysia and India, and some technical factors. At an industry level, there were concerns over the semiconductor sector and the Apple supply chain while financials generally suffered.

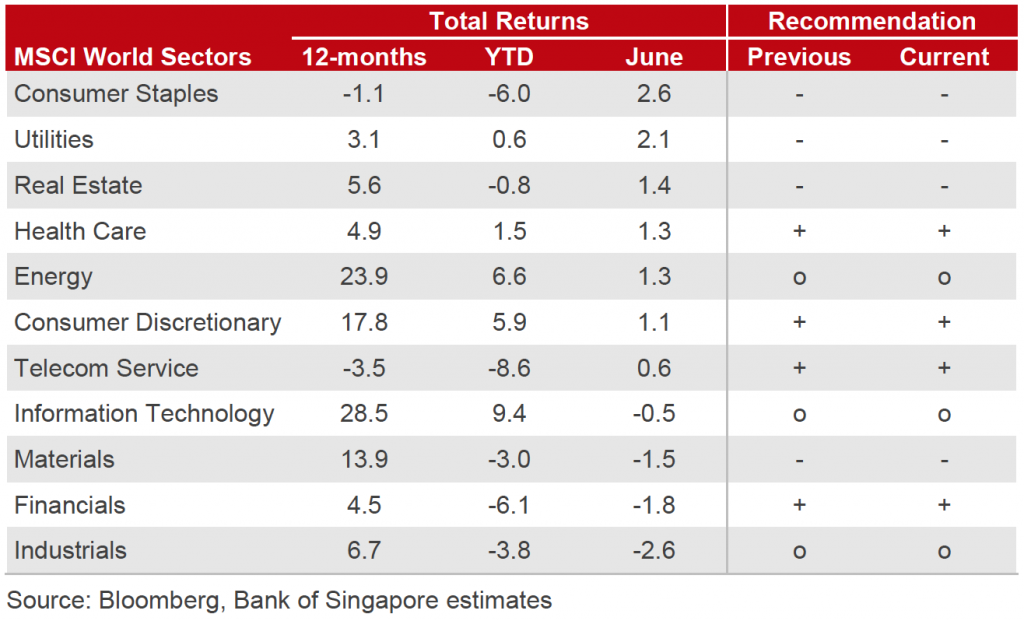

Equities – Preferred Sectors

- We remain neutral and opportunistic buyers in Technology, on a best-name basis as the sector is still the most expensive with a forward P/E of 19.3x.

- While Financials have underperformed over the last few months, we view concerns over the flattening curve as overblown. A renewed drive in US interest rates and the rest of the world will benefit the banks. We expect an eventual easing of capital restrictions, which could make it easier to increase dividends and buybacks. We prefer Asian banks, followed by US banks, over European at this stage.

- We also remain positive on Consumer Discretionary, especially in Europe and Asia. The sector will benefit from continued strength in global economic growth, as well as sustained improvements in labour markets and consumer confidence.

- We like Energy stocks as a defensive play, and a good hedge against the geopolitical turmoil over the long run. However, we are slightly concerned that the market could be toppish in the short term.

Bonds – Mostly Bearish

- A rising interest rate environment leaves most bond markets vulnerable. Treasury Yields, following global uncertainty, have retraced almost 30 basis points from the highs earlier in the year, but we expect to see a move higher to reach 3.25.

- For investors that need to be positioned in fixed-income, we prefer either inflation-protected bonds (e.g. TIPS), or high quality corporate bonds with short durations trading at or near face value.

- Whilst EM FI remains vulnerable to trade developments and EM FX weakness, the yield is starting to look attractive again, particularly on a medium-to-longer term view. Credit metrics are fundamentally superior to developed markets, and there is a growing domestic investor base. In most countries, we are also starting to see reduced borrowings and that includes China.

Commodities – Constructive

- Oil rallied by over 2% last month, after the Trump administration suggested sanctions on countries that did not reduce their imports of Iranian crude to zero by November. US Energy Information Administration (EIA) also saw the sharpest drop in US crude inventories since 2016 and OPEC’s decision, on 22nd June, to increase production by 1mn/bpd was seen as conservative. The price was volatile in the month but remained above key support, for Brent, at $74.25/brl (Fig 6) but failed to breakout above resistance at $80/brl.

- Demand continues to grow, as US rig counts have been increasing at a lower-than-expected pace, and markets have discounted the announcement of an OPEC production increase. While a short-term correction in Oil prices may occur, we remain bullish in the longer-run with the view that developments in Saudi Arabia and Iran may see upside surprises.

- Gold remains in the $1,250 – 1,360/Oz range, and at the lower-end, looks more interesting as a safe haven asset in portfolios. This comes especially at a time where we remain cautious of longer duration, high quality DM bonds. Should the US Dollar gain/stall, Gold looks to be an increasingly attractive option, especially after its selloff from recent highs due to a bounce in the greenback.

Currencies – Consensus Bearish On USD

- So far, it seems trade war concerns have only really impacted Emerging Market currencies against the US Dollar, as the flight to quality in recent weeks have been positive for the greenback. Movement in Developed Market currencies were mostly sideways – bar JPY – as the DXY remains below key resistance at 95 despite testing the level twice last month.

- As rate hikes by the Fed are mostly expected, the market is focused on other Central Banks to follow and change their accommodative stance.

- While we concede that the Dollar may see further strength in the shorter-term, we expect its downtrend to carry on in the medium term.

Alternatives – Bullish

- We remain generally positive on property markets, with a preference for commercial over residential. Our favoured countries for exposure include Australia, UK, Southeast Asia (particularly Vietnam) and in the US. Please ask for more information on some of the projects we are currently working on.

- We also have a positive outlook on Private Equity, as we see better growth opportunities as opposed to lower valuations that have been pencilled in for listed equity markets.

HOW WE MANAGE RISK – PORTFOLIO PROTECTION, HEDGING & TAKING PROFITS

As opposed to just going to cash, we prefer alternative strategies such as hedging via options and option writing strategies to smooth out portfolio volatility.

We also actively monitor profits using trailing stop losses with the view of protecting and locking in gains.

PORTFOLIO MANAGEMENT SERVICES

Please let us know if you would like to hear more about our Discretionary Portfolios and how we consistently generate an additional 0.5% to 1.5% per month using our Options Overlay.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at.