Market Update: December 2019

Markets traded mostly higher in November on the back of improving trade headlines and despite Trump’s signing of the Hong Kong Human Rights and Democracy Act and potential sanctions against Chinese officials for abuse against the Uighur Muslims. We saw indices in the US push all-time highs, while the Stoxx 600 also came within 1% of their all-time highs during the month. While Asian equities saw more of a mixed performance amid the protests in Hong Kong and weakness in Chinese economic data, global equities were buoyed by positives – particularly in the US and Europe. This aligns well with our view (and Morgan Stanley’s), which is an expected recovery in the global economy from 1Q19, led by Emerging Markets (EM) given the easing of trade tensions and scope for easier monetary policies in the region, while Goldman Sachs expects the US economy to also pick up as the effects of lower interest rates start to kick in.

Corporate credit – in particular, High yield (HY) debt – was a key beneficiary of this month’s risk-on appetite, with investors chasing yields and rotating out of sovereign debt, driving yields, more broadly, in the Investment Grade (IG) universe higher as well. We also saw some steepening in the US Treasury (UST) curve, after the Fed held rates steady and indicated that it will continue to do so unless something dire happened which would impact the US economy. We also saw safe-haven currencies weaken, with the exception of the dollar which gained in the back of stronger data, as did the EUR while GBP continued to ebb and flow with the latest news reports on the UK elections. Currencies in Latin America underperformed and suffered amid the ongoing protests in Chile, as well as the resumption of steel tariffs on Brazil and Argentina by the US later in the month.

OUTLOOK

Hong Kong equities are almost flat YTD relative to the double-digit gains in global equities, including Asia ex-Japan where Chinese equities have led the way up. The difficult question is whether this underperformance since protests began and the economic recession as a consequence, has discounted much of the plausible risks. There are, arguably, three scenarios being a) a Chinese crackdown that would ultimately end Hong Kong’s separate system and unique appeal overnight, which would see Hong Kong equities fall sharply and struggle to recover; b) a compromise in which case Hong Kong equities would soar; c) a continued stalemate, marked by episodic spikes in violence, that the city slowly gets used to, and ultimately the protests lose ground to the realities of jobs and studies while the people move on. This might take time like the leftist riots in 1967 which lasted from May until December with huge casualty numbers after violence flared in July with bombs going off. Hong Kong has a long history of existential challenges be it the WW2 Japanese occupation and then the handover in 1997; serious riots in 1956 between pro-Chinese Communist Party and pro-Kuomintang factions that required troops to control it; 1966 riots over a hike in Star Ferry prices, 1967 riots between leftists and the British – again troops were needed; a police riot against anti-corruption reforms in 1977 and 1981; a march in 2002 against a proposed national security law; 2014 protests over Chinese proposed democracy reforms that lasted 79 days and finally 2015 riots in Mong Kok.

Interestingly an inquiry commissioned by then-governor David Trench suggested that the events had also exposed a gap between the colonial government and the people – a gap that would be “a continual danger and anxiety for any form of administration.” It highlighted the problems faced by Hong Kong’s youth, saying: “The evidence before us points to the probability that young people are less likely to put up with conditions which their parents accepted without comment.” It said solutions depended on the continuing prosperity and success of Hong Kong “since its future well-being is in the hands of the young people of today” and that it was in the youth “that Hong Kong must make its major and most significant investment.” The riots in 1956, 1966, 1967, 2014 and the current protests today had deep roots in terms of poverty, lack of opportunities for the younger people and inadequate housing. In terms of the 1967 severe riots and the 2014 and 2019 protests, the sovereign power was a clear target. The British government responded with measures to address social grievances and address the housing shortage, yet it never offered democracy or accountability. This might be one way out of the current impasse and, so far, these protests are not of the length, or violence, of 1956. Hong Kong recovered from its pasts tests and should the Hong Kong/Chinese government heed some of those earlier lessons, there is a path forward.

History would suggest, should common sense prevail by the Hong Kong and Chinese governments, as well as protesters’ use of violence, Hong Kong will survive this latest test and continue to prosper given its separate system and its unique set of skills, position, and importance. We have heard arguments Hong Kong is no longer important to China, that it is only 2-3% of China’s GDP and that the Chinese government would be happy to see a colonial-era creation become a backwater. This is inaccurate. Hong Kong raised the bulk of Chinese corporates’ offshore capital – a role even more important given the US’s veiled threats to close its capital markets to Chinese companies (as it did to Russian companies). China will retain its capital controls for many more years, making Hong Kong’s role as the key offshore intermediary critical, thus making no sense for China to allow Hong Kong to wither on the vine, barring extraordinary circumstance, suggesting the medium- to long-term view on Hong Kong equities ought to be positive even if, in the short-term, it looks obscure and horrifying on occasions. Other than the British imposing self-harm via Brexit, most people do not deliberately damage their country, which suggests support for protesters will decline should the Hong Kong and Chinese governments do things to address the underlying socio-economic problems and allow some greater democratic accountability of the, so far, dire Hong Kong governments under Chinese rule. A huge affordable housing program, limits on mainland migration to Hong Kong, assistance for the young in creating jobs and improved infrastructure are all well within the remit of the Hong Kong government given its huge reserves, and if this is not a sufficient crisis to justify spending, what is? If history repeats, in terms of solutions to this crisis, then Hong Kong equities are buys and become more so if short-term events result in further selloffs.

Our base case remains common sense will prevail, that the Chinese government will avoid cracking down on Hong Kong and that measures will be taken to address underlying grievances. Undoubtedly, radicals in the protesters will never accept what will be offered as it will be deemed too little but the key is to win back the 2mn+ people that marched in position to Chinese government’s misrule in Hong Kong as history shows Hong Kong people to be pragmatic and that their protests do lead to change.

EQUITIES

Fig 1: US indices returns. Source: Bloomberg

-

Markets in the US continued to push all-time highs in November as talks of a ‘Phase One’ trade deal – despite the concern around Trump’s signing of HK’s Human Rights and Democracy Act – added support to settlement, on top of the news that a United States-Mexico-Canada Agreement deal was nearing. The S&P 500 gained +3.40% MoM, underperforming the Dow Jones (+3.72% MoM) and Nasdaq (+4.50% MoM) (Fig 1).

-

Data, in general, continued to remain relatively positive – the University of Michigan’s Consumer Sentiment Index rose to 96.8 (vs est 95.7) in November, on top of a slight improvement in small business optimism. October’s consumer price index rose +1.8Y YoY, while the producer price index picked up a +0.4% MoM after September’s disappointing -0.4% figure.

-

3Q19 earnings season in the US has also neared a conclusion, with companies reporting a decline in earnings (-2.2%) for a third consecutive quarter. 75% of companies in the index beat EPS estimates, with Utilities reporting the highest earnings growth across all sectors at +10% QoQ. Notably, 85 companies guided for lower EPS estimates in the period ahead.

-

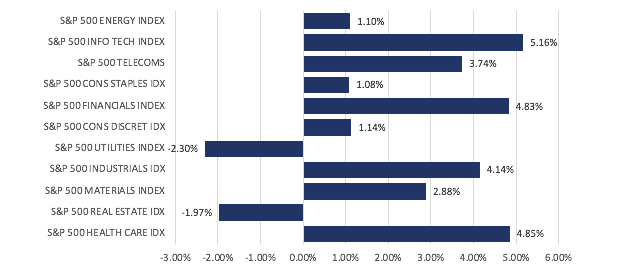

Ironically, despite stronger earnings Utilities, along with Real Estate, were the only detractors this month, while all other sectors were positive as Info Tech, Financials and Health Care outperformed (Fig 2).

Fig 2: S&P 500 sector returns. Source: Bloomberg

-

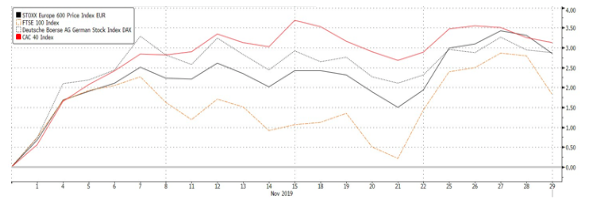

Despite the European Commission cutting their eurozone growth and inflation outlook earlier in the month, European equities were up +2.69% MoM, helped higher by the German DAX (+2.87% MoM) and French CAC40 (+3.06% MoM). The FTSE 100 (+1.35% MoM) amid political concerns ahead of the snap general elections which will be held on Dec 12th (Fig 3).

Fig 3: Returns of major European indices. Source: Bloomberg

Fig 3: Returns of major European indices. Source: Bloomberg

-

Nevertheless, data in the region was also generally positive, suggesting a bottoming in economic weakness. This was particularly so in Germany where the ZEW survey (though still negative), rose unexpectedly to -2.1 (vs est. -13.0) from October’s reading of -22.8, while the Ifo business survey improved for its third consecutive month.

-

Defensives in Europe underperformed this month, with Utilities and Telecommunications being the only sectors in the red, while Technology, Basic Resources, and Industrial Goods & Services outperforming.

Fig 4: Stoxx 600 sector returns. Source: Bloomberg

-

Based on the chart below, it was clear that returns in Asia were mixed despite the rally in both US and European equities. Nikkei and Sensex outperformed at +1.60% and +1.66% MoM respectively, while A-shares (-1.93% MoM), the HSI (-2.08% MoM) and MSCI ASEAN (-1.79% MoM) lagged severely (Fig 5).

Fig 5: Returns of major Asian indices. Source: Bloomberg

-

Exports in China fell for a third consecutive month (albeit beating estimates at -0.9% YoY vs est -3.9% YoY), while Oct industrial production weakened to +4.7% YoY (vs est. +5.4% YoY). Capital spending slowed, while retail sales growth slowed to +7.2% MoM (vs est +7.8% MoM). Industrial profits also fell 9.9% in Oct amid slowing domestic demand and trade tensions. The silver lining came in Caixin’s manufacturing PMI, which rose to 51.8 in Nov (vs est. 51.5), with output and new orders seeing some pickup.

-

To some extent, this was mitigated by the People’s Bank of China which made unexpected moves to add liquidity to the banking system by offering loans to banks and trimming its benchmark 1Y/5Y LPR by 5bps, and cuts to its short-term repo rate (for the first time in 4Y).

-

Overall, weakness in China was understandable given the poor data readings, and this, in turn, weighed on equities in the ASEAN region. Likewise, this applied to Hong Kong, although share prices in the HSI also came under heavy pressure from the ongoing protests and concerns around a decline in economic activity.

FIXED INCOME

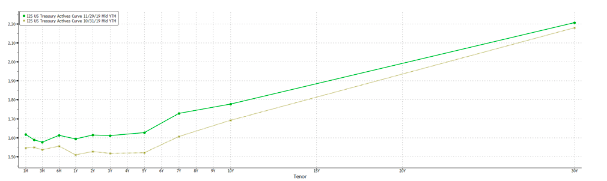

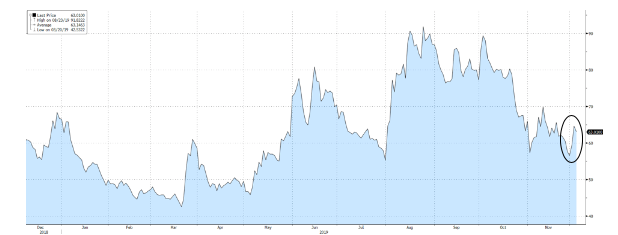

Fig 6: UST curve. Source: Bloomberg

Risk-on markets in November saw sovereign yields extending their rise throughout the month. The UST yield curve flattened slightly, and yields rose across the curve with the belly of the curve seeing the largest MoM shifts (Fig 6), resulting in a 30bps MoM fall in USTs. Reports at the start of this month showing the Fed, in its review of its monetary policy tools, considering allowing inflation to temporarily run above its 2% also helped the curve steepen, but effects from multiple trade-related headlines took over and introduced volatility in USTs, causing the MOVE index, which tracks US interest rate volatility, to shoot up (Fig 7).

Fig 7: MOVE Index shooting up in the first week of December. Source: Bloomberg

-

Corporate credit outperformed sovereign debt again this month as the hunt for yield continued to lead inflows into HY debt. US and Asia were slightly more resilient, with both IG and HY managing to register positive returns, while IG in other parts of the world fell.

-

Data over the month also seem to point towards a global growth recovery, supporting the case for HY. However, we continue to watch default risks very closely. The number of bonds in the ICE HY index trading with spreads of more than 10% – a commonly used definition for distressed debt – has risen during the month to the highest since ’16 as investors move out of lower-quality CCC debt.

-

Protests in Chile and Columbia saw the countries’ debt weigh on the EM USD-denominated debt index. However, the index managed to eke out a gain as modest gains in Russian and Turkish debt managed to offset losses seen in the Latin American countries. However, USD strength weighed on EM local currency debt, causing it to be the worst-performing sector after global treasuries.

-

We remain of the view that opportunities in the EM space, particularly in Asia, are still present. Asian central banks still have space to ease monetary policy, with several of them also expressing preparedness to do so.

FX

-

Overall, the dollar performed moderately well as recent data began to lead investors away from fears of a drastic slowdown. The 10Y and 30Y yields have found some support at 170bps and 221bps respectively, supported by shorts continuing to unwind. 10Y contracts have sold off to be at their lowest net-short position since November ’18.

-

Despite overall USD exposure remaining lower in markets since June ’19, November has seen a pickup in dollar longs, likely due to the continued sell-off in treasury bonds.

-

The EUR advanced earlier this month on short coverings as ZEW and exports reported better than expected, however YoY industrial production reported -4.30% vs. an expected -2.90%. We continue to see positioning to remain flat until we near clarification on ECB policies. Resistance still remains strong along 1.11.

-

AUD positioning was very reactive towards interest rate decisions. The decision to hold rate movements until ‘20 saw a large unwinding in shorts, resulting in a stronger AUD. Positive trade development also supported AUD further. We will likely see a build-up in shorts again on further tariff developments. AUD still remains on a downtrend with key resistances seen along 0.687.

-

In our previous monthly, we noted that there would be an obvious increase in volatility between 1.25 and 1.35 as elections drew nearer and labeled a Corbyn victory as unlikely, simply due to the self-destructive nature of Labour policies. Johnson now leads 43% to Labour’s 32%, which implies more distance between the UK and a No-Deal. GBP remains net short with more being added in November. We expect more volatility with 1.30 to remain very supportive and are still Sterling bears in the long run.

COMMODITIES

-

Oil and gold mainly reacted towards trade developments. Oil’s positioning has picked up since October and is now at its highest since June this year. Likewise, for Gold, positioning remains extremely net long and has in fact, risen, despite the recent sell-off during pulsated fears as Hong Kong grew larger as a wedge between China and the US.

-

Gold has fallen through technical levels and saw a prolonged period of trading between 1,550 and 1,480. We continue to believe it remains a diversifier in portfolios simply due to the prolonged acquisition from Central Banks and the ever-reliable haven attributes that it possesses in times of trade uncertainty.

- Over the month, several FOMC members also came out saying that they think US monetary policy is at a good place and reinforced last month’s meeting decision to hold rates and to continue holding rates, leading markets to price in a 0% probability of a rate cut this month.