Market Update: March 2020

February was a tumultuous month for markets, which saw an elevated level of volatility across asset classes that extended even further into early March. Just as the coronavirus appeared to have come under some extent of control in China and other regions, Italy, South Korea and Iran quickly turned into hotbeds of infections and now increasingly, it looks like the rest of Europe and the U.S. will not be spared. Concern over how this would affect growth across these regions prompted a flight to safety, pushing the S&P 500 down -8.41% MoM, and sending the benchmark 10Y US Treasury Yield below 1% for the first time ever, and yields in Europe deeper into negative territory.

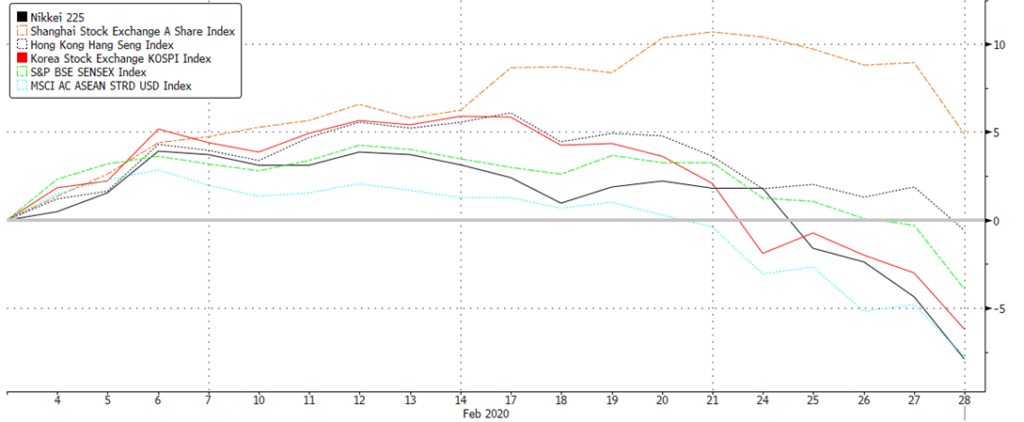

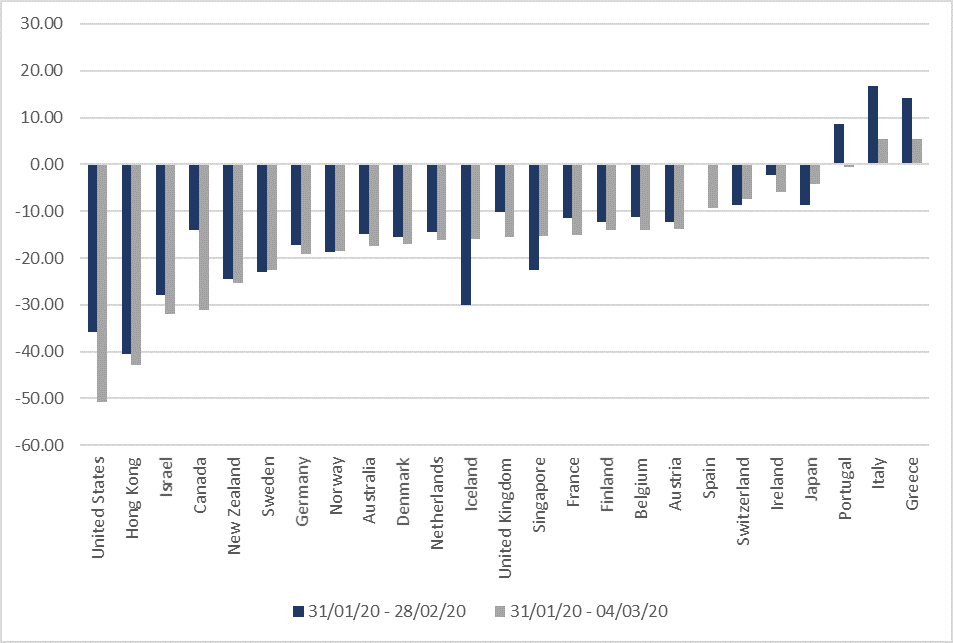

While equity markets were down across the board (the MSCI All-country World Index fell -8.21% MoM), the U.S. and Europe (the Stoxx 600 was down -8.54% MoM) saw a much steeper decline compared to their Asian counterparts like China A-shares (-3.22% MoM), the HSI (-0.69% MoM) and the broader MSCI Asia ex-Japan Index (-2.91%). The MSCI ASEAN Index (-9.29% MoM) underperformed, however, not least as markets grew concerned that this highly trade-dependent region would be significantly affected by a slowdown in global growth.

Understandably, oil prices also fell on similar concerns, with the price of Brent Crude off -13.14% MoM to US$58.16/bbl, sending Energy shares in the S&P 500 down -15.27%, and Oil & Gas names in the Stoxx 600 down -13.27% over the month.

On the U.S. political front, we saw Joe Biden take the DNC by storm, surprising markets with a strong comeback to take ten of the fifteen contests on Super Tuesday to prompt Bloomberg, Warren and Buttigieg to drop out of the race in quick succession to leave the contest between him and Bernie Sanders.

OUTLOOK

We are not supportive of a recession thesis in the U.S. nor globally, and do not think that we will be seeing a global pandemic. Our base case is that ‘this too shall pass’, but perhaps later than we had initially expected with the next four to six weeks being a tricky period as developed markets weigh the potential damage against reflation measures. Our sense is that the actual damage from the virus is far, far less than the fear of it but sooner than later fear will turn into realism. In our view, this pattern of behaviour might continue well into April.

Morgan Stanley’s strategists have opined a similar base case to mine, in that the virus will continue to spread into 1H20 before tapering off. In this case, global growth will likely see half a percentage point shaved off to c. 2.5%, but we will avoid a recession altogether. Their/our bull case scenario would see the spread taper off by late March, while the bear case sees it spreading well into 2H20 and thus result in global growth dropping to as low as -2.1% and a likely recession even if the Fed cuts by as much as 125bps. As such, anything less than the most drastic, worst-case scenario would suggest that the selloff will come to pass, and not indicative of the end of the cycle.

Having adopted a relatively conservative stance up to this point, we committed a portion of our cash pile last Friday when U.S. markets came off. We seek to cautiously use further dips to add to equities, and possibly high yield fixed Income if we see markets dip further. We see no reason to rush back into markets but will keep a close eye on technical indicators as opportunities to deploy capital might present themselves(Thursday’s fall took the S&P 500 a percentage point below Its 200DMA, with the Dow now 4.5% below, although Nasdaq remains above this level).

We expect further volatility as markets attempt to price in the short-term impact of the virus, effects of reflation in the medium to long-term, as well as political risks in the U.S. Over the next four the six weeks, however, it is more than likely that the virus will be the key driver. With the U.S. arguably being too complacent around the situation, they will undoubtedly go into high gear and exaggerate risks through far more draconian measures that will hurt sentiment – therefore we remain cautious in adding to U.S. equities.

We remain far more optimistic around China and the broader Asia ex-Japan region (bar South Korea), as they have adjusted to the situation and are now coming out the other side as infection rates slow, and markedly so in the case of China. Reflation in Asia ex-Japan seems to be more aggressive too – Singapore and Malaysia, for example, are boosting fiscal spending by a combined c. $9bn which is larger than the $8bn plus US Congress had earlier sought to pass.

Figure 1: A-shares outperformance towards end Feb Source: Bloomberg

We believe that the Fed has made a big error in cutting rates by 50bps, and this is a view that appears to be shares by quite a few others. There is no evidence that the US economy is or will be too badly damaged by the virus, especially after recent data releases which have been fairly supportive (ISM Manufacturing showed signs of recovery, while consumer data remained solid). A move like this comes across as more of trying to please the markets rather than being responsible, and to do it before Super Tuesday results were out beggars belief. The Fed has now used up a decent chunk of its ammunition, helped UST yields plunge to all-time lows, dumped the US Dollar and arguably created more worry than confidence as many might wonder why the Fed might make such moves. Fixed Income markets are now expecting 100bps of cuts in ’20 from just 25bps at the end of February.

This has sharply lowered the real interest rate differential USD had, and both the EUR & JPY reacted sharply to the Fed’s daft move, reigniting the latter’s ‘safe haven’ attributes which appeared to have been lost in last month’s selloff. With the virus spreading quickly into other developed markets, Japan’s poor handling of its spread is less of a negative. Indeed China and Singapore (Vietnam, too, has been quick to be strict on its approach) might be the exceptions, with other countries potentially far less able to handle an outbreak.

The collapse in yields – whilst probably good for mortgage refinancing and property demand – now suggests a deeply negative real rate. That suggests that FI markets think an imminent and severe recession may well be on its way soon, as compared to equity markets that are still not materially off all-time highs. This extreme dichotomy cannot last and my base case is that FI markets are exaggerating the risks, instead driving up bond prices to make the asset class effectively uninvestable bar short-term tactical trades.

This further underlines the relative attraction of cash vis-à-vis Fixed Deposits (3M LIBOR is now at 1% from 1.7% a month earlier), and also why we prefer to diversify into alternative income and alternatives more generally. We would consider looking at senior loans, on the basis that rates cannot get much lower (can they?) and have capped lower limits. Once things stabilize, the low base of US Treasury yields will further add to demand for positive yielding FI assets, not least High Yield bonds (The US HYG ETF is yielding 5.08%, thus providing a yield pick-up of over 4.2%). Having said that, there remains a concern around default risks jumping higher if the virus was to harm FCF generation, and not just the energy/oil-related CCC bonds either.

Figure 2: Chart showing DXY performance since 1994 Source: Bloomberg

In currencies, we wonder if this could be the inflection point for the US dollar. USD has plunged 3% WTD on the Fed’s move, with JPY storming back from the 110 level to test a key support at 105. EUR was also up sharply from its recent low of 1.0800. Both the ECB and BOJ may well ease next week/end March respectively, but probably along the lines of a 10bps cut compared to the Fed which some see cutting by a 100bps by the end of the year. Both Japan and the EU are likely to undertake far more expansive fiscal spending than the US might, given the high chance of partisan gridlock In the latter. If Germany was to abandon its idiotic zero deficit fiscal stance, this would boost EUR sharply. In our view, the DXY may have peaked at its 20Y high at c. 100.

EQUITIES

Markets in the US continued into all-time high territory throughout the most of February, though the tail end of the month into early March saw heavy selling amid Covid-19 concerns with the US starting to see its first few cases of the highly infectious virus. Last week was the S&P 500’s worst weekly decline since Oct ’08, with bank stocks taking a particularly hard beating (the widely-followed KBW bank index fell by as much as 20.7% from its Jan high) across a broader market selloff, and rising expectations of further rate cuts. Both the S&P 500 and Dow fell into a technical recession.

Figure 3: Performance of major US indices in Feb ’20 Source: Bloomberg

All sectors in the S&P 500 closed lower in the month of Feb, although defensive sectors like Telecommunications, Real Estate and Health Care were noticeably more resilient. Energy shares saw the steepest decline at -15.27%, extending January’s loss and weighed lower by a significant decline in oil prices which sold off on concern over a potential fall in global growth which would result in less demand.

Figure 4: S&P 500 sector returns in Feb ’20 Source: Bloomberg

Nevertheless, economic data showed some relative strength in the US economy, with University of Michigan’s US consumer sentiment survey coming in at 100.9 (vs est. 99.5), while retail sales rose 0.3% MoM in Jan to meet economists’ expectations. Headline PPI also beat estimates handily to rise 2.1% YoY in Jan (vs est. 1.6%). Home data was positive over the month, with new home sales up 7.9% in Jan to its strongest since mid ’07 on the back of cheaper borrowing costs, while home prices in 20 cities were up 2.85% YoY in Dec. Consumer confidence also edged higher in Feb to its best level in over half a year.

European markets were not spared from the bloodbath, not least with ECB chief economist’s warning that the coronavirus would be a ‘pretty serious short-term hit’ to Europe’s economy. The moves across indices were fairly similar, with all three major indices seeing a similar 8-9% move down alongside the Stoxx 600.

Figure 5: Performance of major European indices in Feb ’20 Source: Bloomberg

Within the Stoxx 600, all sectors saw losses although Oil & Gas and Travel & Leisure names took an understandably worse beating considering the outbreak compared to other sectors, although Basic Resources, Insurance, Media and F&B were not too far off. Notably, however, Utilities – often seen as a bond proxy and now more so given the rapid decline in bond yields – outperformed with only a -2.96% decline relative to the double-digit loss seen across sectors.

Figure 6: Stoxx 600 sector returns in Feb ’20 Source: Bloomberg

Most markets in Asia were also down, though much of the fallout had already happened over the course of January, and losses were relatively muted compared to indices in the US and Europe. The NIKKEI and MSCI ASEAN were the biggest losers in the region, falling -8.05% and -7.96% respectively. Perhaps in-line with the situation looking more contained in China and given the heavy selling which we saw earlier last month, China A-shares outperformed at +4.87% to be the only big index in this region to close positive this month.

Figure 7: Performance of major Asian indices in Feb’20 Source: Bloomberg

On the macroeconomic front, China also unveiled a string of easing measures including interest rates loans, injecting liquidity via reverse repos, and targeted tax cuts to small firms and the private sector. The PBoC is also slated to offer CNY 500b of lending and discounts to funding to commercial lenders for loans to small companies and the agricultural sector. The moves come amid China’s latest factory PMI for Feb, which fell to an all-time low of 35.7 (vs est. 45). Overall, we saw an increasing number of countries introduce a slew of easing measures, most notably so in Southeast Asia.

FIXED INCOME

There was a clear shift to quality in Feb as fears around COVID-19 plagued markets. 10Y sovereign yields in developed markets mostly fell through Feb and into first few days of March (Fig 8).

Figure 8: DM 10Y sovereign yields Source: Bloomberg

10Y UST yields led the decline, falling 36bps through Feb and a further 15bps in the first two trading days in March – a large part of it was caused by fears of a deeper Covid-19 outbreak. New cases and fatalities in the US, and in other countries outside China, led the FOMC to announce an emergency rate cut of 50bps on 3rd March. This led to the 10Y yield falling to a record low of 0.9043% intraday before easing higher to close 1.00% that same day (Fig 9). The 3M UST yield also fell to 0.70% at the close of 4th March – significantly below the Fed’s new policy rate range of 1% – 1.25%, while the 30Y yield fell to a record low of 1.61%. As of 3rd March, markets are pricing in an 84% probability of at least one more rate cut by YE20, and a 42% probability of at least two rate cuts.

Figure 9: 10Y UST falls to record low intraday Source: Bloomberg

Over in Europe, sovereign yields were also pressured lower, especially in Italy after the number of reported Covid-19 cases in the country spiked up. After warning of the virus’ short-term impact on Europe’s economy, ECB Chief Economist Philip Lane said the new normal for ECB rates ranged somewhere between zero and 3% while Bank of Spain’s governor Pablo Hernandez de Cos said the bank should adopt an inflation target of 2%. Markets are also pricing in one cut by ECB in July. ECB president Lagarde downplayed the likelihood of ECB providing an immediate response to the outbreak earlier in Feb, but the Fed’s recent move might likely pressure the ECB into cutting, potentially sending rates further into negative territory.

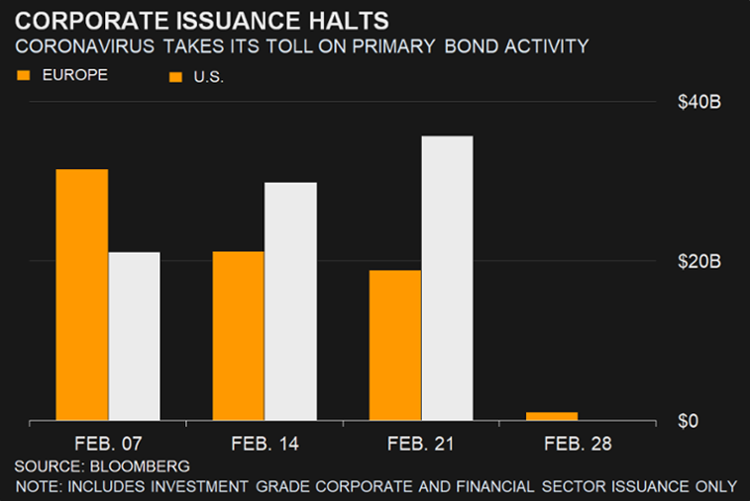

The flight to safety was prevalent in the credit space too. The amount of inflows into IG was significant, thus capping the spread widening and leading the sector to outperform HY credit. Global and US IG index spreads were narrowing to their lowest in early ’18 before widening again towards the end of Feb when Covid-19 induced fears resurfaced (Fig 10). The spread widening was more significant in the HY, with global HY index spreads widening to levels last seen in ’16. This led to the spread between IG and HY widening too, with the BBB/BB spread moving form a record low 38bps to 150bps. Ultimately, the higher coupons in HY will offset the spread widening in the lower quality segment of the market but bottom up credit selection is important – we recommend avoiding certain sectors like Energy and Gaming, which might see significant impact in the near-term from the virus outbreak.

Figure 10: Global IG and HY spreads widden amid Covid-19 fears Source: Bloomberg

Issuance during the last week of Feb, especially in IG, also came to a standstill as companies held off in the face of the virus induced sell off (Fig 11). Technical indicators might be supportive of the asset class in general in the near-term as uncertainty around the severity of the Covid-19 outbreak. There is even an argument to buy credit now that spreads have widened significantly enough for there to be some insurance. In the longer term, rates are likely going to stay lower for longer with inflation unlikely to come back anytime soon.

Figure 11: IG issuance comes to a standstill Source: Bloomberg

FX

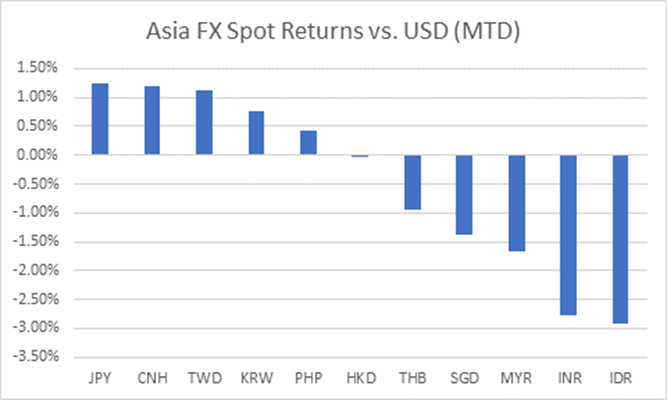

This month saw FX volatility spike at its quickest pace since the Sino-US flareups – Asian currencies bore the full brunt of the damage earlier in the month as trade-related data in the APAC region fell at a record pace amidst concerns of an elongated disruption in the supply chain.

As the infection rate climbed in South Korea, Iran, Italy and Japan, risk-off sentiments continued to dampen markets causing once-favoured carry trades such as the IDR and INR to unwind. Investors then sought the JPY as a haven while the CNY remained resilient from its aggressive reflation (Fig 1).

Adding to our previous point, the Federal Reserve unexpectedly lowered interest rates by 50bps in the beginning of March, causing mixed reactions to the drastic move. This caused the dollar to reverse its gains, relieve the KRW’s pressure and further boosted JPY as it continued to pare its losses from 112.23 to 106.85.

We foresee weakness in the USD, and further weakness in the INR and IDR as we believe these countries remain at the highest risk due to its lack of infrastructure spending as well as population density.

We remain positive on CNH as we continue believe there is further room for the PBoC to reflate its economy and that markets have already priced in a much lower 1Q GDP reading. We also remain bullish on JPY and SGD as they stand to benefit the most from the Fed’s recent rate cut.

Figure 12: Asian currencies fell hard in Feb Source: Bloomberg

COMMODITIES

The Brent oil price continued its selling momentum from January as global growth continued to reel from the coronavirus. Oil fell a total of -15.60% and remained above its key support of $50. It ended the month at $52/barrel. Gold continued to gain from its haven attributes and touched a 7-year high of $1,689/oz.

Our view remains unchanged – a slowdown in global growth will continue to be the main headwind for Oil and as a catalyst for Gold. Automobile sales around the world has slowed down with China’s automobile purchases almost coming to a halt as a recent report from the PCA is showing car sales falling by over 80%.

We continue to believe that $50 is a strong support for Oil based on two factors; global reflation led by China and a supply cut from OPEC+ members in the near-distant future. Of the two factors mentioned, in the short term, we argue that Saudi Arabia’s proposal of a further 1.5-million-barrel cut remains unlikely. Our belief is that OPEC+’s rate of participation remains hard to quantify as investors are expecting a certain amount of reluctancy from Russia and Iran.

We continue to see limited upside for Gold for the same reason that Oil will see further upside; global reflation and markets being accustomed to the coronavirus’s rate of infection. We believe that the inflection point is located at $1,600/oz, a key support level for Gold. As the initial shock of the coronavirus is now over, we see Gold trading on fear and uncertainty rather than panic, seen by Gold since it rose from $1,480.