Market Update: December 2020

December Market View

Christmas Cheer

Last month was the best November on record for many major Equity Indices. The MSCI World Index was up 12.2%, even higher than the S&P 500 index, with Europe leading the charge. The MSCI Europe Index jumped 13.8%. Credit and commodities, particularly oil, joined in the festive atmosphere as risk assets rose on the back of positive vaccine news as well as the dissipation of US election concern.

The anticipated massive roll-out of COVID vaccines expected in H1 2021 has resulted in cyclical stocks being in the ascendency during the month, despite mixed reports on new COVID cases. The MSCI European Bank Index surged 31% and the European Energy Index rise was even higher at 33%. Industrials gained 14% and even InfoTech climbed 15%. The US story was similar. The momentum has so far continued into December.

Source: Bloomberg

2021 – A Year of Normalisation

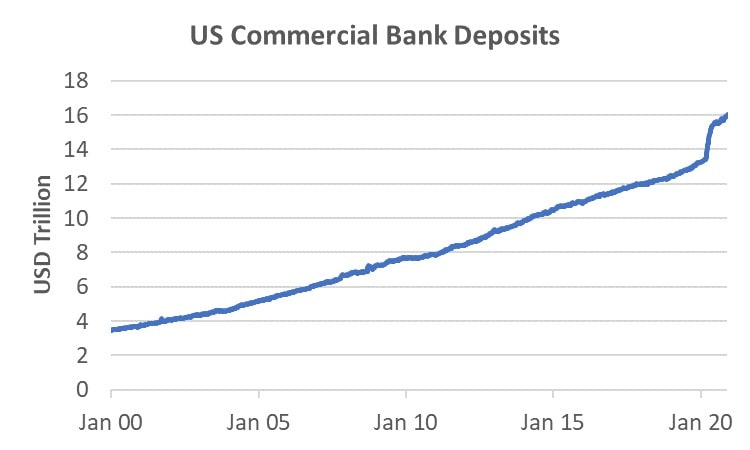

Some say the world will never be quite the same after COVID. Certainly, the gains in technology adoption, particularly those that facilitate a stay-at-home lifestyle, is not likely to regress. However, current growth rates are not likely sustainable and as people return to a semblance of pre-COVID lifestyles, cyclical stocks are likely to be greater beneficiaries. As an example of the potential pent-up demand for pre-COVID goods and services, US commercial bank deposits has now grown by USD2.5tn since the end of February 2020. Despite the higher unemployment rate, there is clearly a large swathe of money that could be used on consumption as lockdown restrictions ease. Europe has experienced a similar phenomenon where household bank deposits grew by EUR401bn from Feb – Oct, almost twice the level of the corresponding period in 2019.

Source: FRED

Can Equity Markets Go Higher?

The MSCI World TR Index has gained a staggering 67% since the nadir on March 23. It is now 10% above the pre-COVID peak and up 14% YTD. With nominal GDP in major economies not expected to regain 2019 levels until at least H2 2021, it is valid to question whether the market has run ahead of itself. After-all, even with a then unprecedented stimulus, the Index took a full six years to regain its pre-GFC peak. For COVID it took less than six months. However, the cause of each crisis was vastly different. The GFC was an issue of acute overleverage at the consumer level. Following the GFC it took almost 5 years for US households to recover their net worth. While there is only data to April 2020, it appears there was only a momentary disruption to household net worth due to COVID before a full recovery. With the subsequent rise in equity markets, in addition to house prices rising 2.6% from March to September 2020, we can assume US household net worth is currently higher than pre-COVID.

Source: FRED

While equity gains in the last 6 months are unlikely to be repeated in 2021, there does not appear to be any structural impediments to equity markets going higher as long as economies do start to normalize in a manner that is not materially different from expectations. We would not be surprised of a few bumps in the equity markets over the transition period in the next 1-3 months, but we remain constructive over the medium to long term due to the low interest rate and heavy fiscal stimulus environment.

Financials, Mid-Small caps, Europe and Asia are Popular Bets

There are several popular themes for 2021 and they are generally recovery focused. In short, those that suffered the most during COVID are expected to benefit the most in the recovery. This includes cyclical stocks, mid-caps or small-caps, due to leverage to the local economy, Europe, where corporates have been decimated by the lockdowns, and Asia, where the earnings growth appears to be highest.

Source: UBS, JPMorgan, Morgan Stanley

What to do with FAANMG?

Many equity investors still have material holdings in these stocks. Despite their preference for other stocks, sell-side strategists and analysts are hardly infallible and often look at the shorter term. Valuations for some of these stocks are well-within their historical range (Facebook and Amazon) and with low interest rates, it is difficult to argue they are expensive. I would not necessarily be a seller of any of these stocks for long term investors as long as the rest of the equity portfolio is well-diversified and position sizes are not excessive. However, admittedly, the upside for other sectors appears potentially higher.

The Case for Using Fund Managers

It’s been a great ride for a decade or more with FAANMG. The same goes for Tencent and Alibaba. However, the downside of an easy ride is that many investors may not be used to the difficult slog of seeking new investment ideas, monitoring a wide range of stocks, and being tactical and dynamic with asset allocation. Some investors may be happy to ride through poorer relative performance periods, content with a longer-term view. For those that want to work their money a little harder every year, allocating a portion of their equity investment to active fund managers whose job is to be concerned with relative performance may be an alternative. Another benefit is that mutual fund managers won’t hold significant amounts of cash so that if you are positive on the equity market in 2021, you will not be tempted to sell stocks during periods of volatility because some stocks have fallen precariously, and miss re-investing should it bounce back up quickly, i.e. the investment is more strategic and because it is diversified it will likely fall less than single stocks.

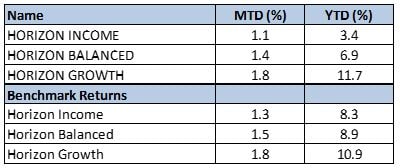

Performances

If you like to receive more information on our portfolios solutions, please contact us here: info@odysseycapital-group.com