Last week saw the heaviest sell-off in the S&P 500 (the worst since Dec ’18), with US indices seeing sharp pullbacks into early August just shortly after making fresh all-time highs in the last week of July. A re-escalation of Sino-US trade tensions, as well as a pullback in rate cut expectations (with market expectations of a rate cut cycle against Powell’s comment that this month’s move was more of an ‘insurance’ cut), were key factors contributing to the decline in risk-on assets. Likewise, weaker-than-expected data releases globally added to concerns over the state of the global economy, bringing oil down below its key US$60/bbl support despite the worsening relations between the US and Iran. Economically, the US continued to display relative resilience compared to most other major developed markets, understandably outperforming as the S&P 500, Dow Jones and Nasdaq gained 1.31%, 0.99% and 2.11% in July. This was in comparison to the Stoxx 600 (+0.23% MoM) which was buoyed by better-than-expected (albeit heavily downgraded) earnings releases, and Japanese equities in the Nikkei 225 (+1.15% MoM) which saw a pretty decent month. The MSCI Asia ex-Japan (-2.17% MoM), however, underperformed significantly as Chinese equities tumbled on weak data and the trade spat, with A-shares falling -1.55%, and amid the ongoing protests in Hong Kong which undoubtedly weighed on the HSI (-2.68% MoM). The YTD rally in Indian equities also came to an end, with the Sensex (-4.86% MoM) coming off all-time highs to be the underperformer for the month.

What was mostly a calm month for currencies (with the exception of Boris Johnson’s election and steep moves in GBP) soon turned into a storm after Trump surprised markets with his additional imposition of tariffs on Chinese goods. The DXY surged to a YTD high of 98.900 on Powell’s comments before retreating back to 97.220, while in early August, retaliatory moves by the PBoC saw onshore CNY quickly fall below the key psychological Rmb7.0 level. Prior to that, the Euro was mostly led lower by a weaker Sterling on renewed hard Brexit concerns and Boris’ loss in the by-election which nipped away at whatever was left of the majority vote that he had.

Outlook

The sudden shift in sentiment brings back memories of the plunge in Q4CY18, and in particular, the heavy selling during December towards Christmas Eve. Markets have discounted much of the good news – from better-than-expected (albeit post-downgraded) earnings, the ‘dovish’ pivot by the Fed and global central banks, the trade ‘truce’ as well as a moderation of geopolitical risks in the short-term – to the point that Morgan Stanley thinks 22 other central banks will join the Fed in cutting rates by YE19. H2CY19 will potentially be much rougher as geopolitical risks are rising with 1) a ‘no deal’ Brexit 2) dysfunctionality in Spain 3) Italian opposition to EU’s fiscal rules and a possible election giving Salvini control 3) greater Russian adventurism 4) a brutal crackdown on HK’s protesters 5) rising tensions around the South China Sea, Taiwan, 6) worsening tensions between Korea and Japan and 7) rising tensions in the Middle East alongside 8) the instability of Trump.

We have deliberately held an underweight equity positioning and high cash levels for much of this year, more so since April and that worked in May but was impacted by both Powell’s end-May ‘pivot’, and renewed hopes of a trade ‘truce’. We stuck with our defensive positioning as we feared that the optimism in markets (not least as Forward P/E’s on the S&P 500 pushed through 17.5x) was not justified, although the Fed U-turn in November despite robust macroeconomic data (in particular, consumption) caught us out. I see the potential for this correction to run c. 10-15% more, with the S&P 500 re-testing 200DMAs at 2,770 as other, more trade-vulnerable markets to suffer more. EM/AXJ markets are more at risk, not just to trade-related damages, but also to a stronger USD. I struggle to find enthusiasm for US Treasuries, having missed the rally and as the yield on 10Y US Treasuries, below 1.8%, are giving you a negative real interest rate & prefer cash. Our trades into gold found vindication (clearly Bitcoin would have been better!), but we doubt that prices can run much further through key resistances at $1,450-60/Oz.

We remain cautious around risk assets and prefer holding cash in USD. Any major correction offers a trading opportunity to rebuild riskier assets – notably quality equity franchises as Visa or Diageo. In the near term, we could see volatility spike up across most asset classes. Helmets on. The elixirs that could soothe markets might also bring about some damage to capital markets; the Fed moving into a rate cutting cycle; Trump, fearing his trade policies might cost him the election, could ease off on tariffs on China; Powell’s complete U-turn in monetary policy despite US macro data remaining solid, can only be explained by a pandering to please capital markets. On this note, any fall of 10%+ (as we saw in December last year) will likely move a Powell-led Fed to exercise the ‘put’ option that markets expect. This probably sets the lower range of any selloff in the S&P 500 to around 2,630 – 2,770 (Fig 1), which is not unlikely given our expectation of both earnings & GDP downgrades, as well as potential damage caused by trade tensions and geopolitical worries.

Fig 1: SPX projected to test a mid-term support of 2,630 Source: Bloomberg

The US, The Global Economy and Powell’s ‘Put’

US GDP data is always distorted between Q1 and Q2. It is clear the huge jump in 2Q19’s consumption numbers after a weak Q1 was in part carried over from the previous quarter (the US government shut down may have had an impact) but nonetheless, it was robust and reflects solid consumer sentiment surveys. Q2 was also impacted by destocking in inventories that had boosted Q1. By stripping these out, the likely underlying GDP growth in Q2 was c. 3% relative to Q1’s 2%. Government spending, buoyed by the Trump fiscal boost of $1.5trn, accelerated but this will slow down in Q3 and fall off a cliff by Q4CY19 as the new fiscal year kicks-in. Business fixed asset investments and net trade were negatives. All in all, this was a solid quarter underpinned by consumption, which accounts for 70% of the US’ GDP. The strength in consumption is at odds with the caution corporates are providing, via a negative-to-positive forward guidance ratio of 3:1 for H2FY19 earnings, and their reduction in capital expenditure. With unemployment at 50Y lows, accelerating wages (private sector wages, including perks, are rising at over 4% p.a.), low mortgage costs and confidence around job security; there is a decent argument that the consumer, assuming Trump leaves trade tariffs as they are (the next $300bn of US tariffs on Chinese imports would mostly hit consumer related items), will remain resilient in H2CY19 (the latest Conference Board survey was very strong). If so, then the ‘gap’ between consumer optimism and corporate caution (if not FI markets’ pessimism) might close in favour of the consumer, implying upside to US domestic demand, GDP growth and earnings growth in the S&P 500. Of course, the risks for corporates include a strong labour market (which will drive up employment costs more quickly and so impacting margins), along with trade-related damage and a higher USD.

For us, what is quite clear is that the Q2 GDP data, recent NFP, consumer sentiment surveys, and durables, along with US equity indices close to all-time highs, do not provide the reasons for the Fed to cut rates – indeed Professor Shiller rightly suggested the current conditions in the economy and capital markets support the argument more for a rate hike than the Powell ‘put’ of a rate cut we experienced. Clearly, the Fed is pandering to capital markets and the critic-in-chief, Trump. Resilient consumption and, as a result, better S&P 500 earnings, may support the index’s rally to break firmly through 3,000 (GS’s revised price target is 3,100), but it might limit the Fed to a one-off rate cut, boost inflation and underpin US GDP growth and USD. We continue to see more downside risks from rising geopolitical scenarios (‘no deal’ BREXIT, Iran confrontation, worsening Japan-Korea trade spat, South China Seas tensions, US’s possible sale of F-16s to Taiwan in Q4 which is a redline for China, political risks in Italy and Spain and risks around Turkey and South Africa). In addition, IMF recently cut global GDP growth forecasts in both CY19 and CY20, with the bulk of these downgrades coming from the BRICS.

Frankly, it is very difficult, we find, to have a strong conviction on the outlook and that means capital markets could be prone to violent, large moves and spikes in volatility as we have just seen. But with Nasdaq still up c. 15% YTD and double-digit gains in the MSCI ACWI, the odds suggest going more defensive in portfolios by reducing riskier assets like equities (with US stocks on expensive valuations), and high-yield FI (forecasted default rates are moving up), but we will be monitoring US consumption positives as well as the degree of monetary easing we get by the Fed alongside the other 22 central banks globally (MS thinks that they will cut rates by YE19). Our basic thesis is risk assets have discounted a lot of the positives yet are ignoring the negatives at a time when the rally in sovereign debt implies a dichotomy on outcomes – one, or other, of these two asset classes, will sell-off hard.

Re-escalation of Sino-US trade tensions

Last year, China’s move to allow the CNY to depreciate from 6.23 to 6.98 had ‘neutralised’ the initial 10% of US tariffs, a move which in part incentivised Trump to impose even hasher tariffs. Indeed, Trump made it clear that the latest 10% on the remaining $300bn of PRC imports (due by 1/9), could be increased to 25% or higher. Whilst China could likewise impose higher tariffs on US imports, it is running out of room and will thus need to find other ways to retaliate. It appears China is taking a tougher line since the earlier breakdown in talks earlier this May, and not compromising on core structural economic objectives. One line of thought here is that despite the trade war and with domestic reflationary policies perking up the Chinese economy, China is emboldened in its negotiating position. Another is that they can live with the ‘pain’ and wait for Trump to be replaced after Nov 20thby a more rational administration. Certainly, the narrative around this Sino-US trade war posits a decreasing likelihood that an accord will be reached before the next US election, with some suggesting that Trump sees a deal as potentially giving Democrats an opportunity to attack him. There are no signs yet, electorally, that the trade war is hurting Trump’s appeal. Having said that, 68% of the latest round of tariffed goods are consumer items, and should Trump increase tariffs significantly further from here, he risks alienating the voters and creating a recession – MS thinks if this extra $300bn of imports were to suffer a 25% tariff, the US economy would go into recession within 6-9M, coinciding with a key voting period in Q2 and Q3 when most make their mind up.

‘Weaponising’ the CNY has long been talked about by bears of the currency, but this has not happened, and most studies still see CNY as at fair value. However, the Chinese lack an obvious trade-related retaliatory measure, so they could, if angered, choose to devalue the CNY by another 5-6% (Fig 2). Fundamentally, China is moving towards both a trade and current account deficit – US surplus is the large exception – so it is not wrong to assume that the CNY might fall further. Bears argue that the currency should depreciate to 7.50-7.60, even 8.00, as this would ease pressure on PBoC from sticking to tighter monetary policy. The principal reason against a major devaluation is that the government rightly fears capital flight that, if extreme, could destabilise its financial system by creating a liquidity run. With capital controls and a stable currency, China can retain sufficient domestic liquidity to ensure that a solvency crisis does not deteriorate into a more damaging liquidity crisis. A major amount of capital fleeing China could force the PBoC to jack up rates precipitating a recession. Financial system defaults – given high corporate debt-to-GDP – alongside capital flight, would only increase the risks. We think it is unlikely that the PBoC and the Chinese government would take this risk, but where the line-in-the-sand is we do not know – it might be here at 7.00 or at 7.20. If we take 6.80 as an average point, then a 5% depreciation from there implies that 7.10-7.20 is feasible. Another factor against a rapid fall in CNY is that China prides itself in the relative stability of the currency, and the benefits that this carries for its vast trading complex. Lastly, if forecasts prove right and China moves into a trade & current account deficit, a weaker CNY would most definitely be negative. If this were to be the case, we would not be surprised if China accelerates its selling of US Treasuries given their YTD rally and the recent moves in CNY.

As the two sides’ trade confrontation spirals further into a toxic standoff, it will damage not just their own but the global economy as well; in doing so adding to more GDP downgrades, notably in the trade sensitive EU where feeble domestic demand and an underpowered ECB cannot offset trade weakness, as well as APAC. It also raises the stakes in that the Sino-US trade dispute is part of a wider strategic confrontation between the two that is just starting. The risks lie in a higher non-trade conflict (as with issues around the South China Seas or the US’ intent to sell F-16s to Taiwan), take on a greater life and further reduce hopes of a trade compromise.

Fig 2: CNH’s room to weaken to 7.35 Source: Bloomberg

Equities

-

The S&P 500 has once again failed to confirm a breakout above 3,000, and it could be that the rally ahead of the Fed’s expected rate cut was the ‘rumour’ helped by a better-than-expected Q2 EPS reading, albeit one that is tracking a negative two-to-three percent YoY earnings contraction for a second quarter in a row. Nonetheless, the correction thus far across US indices has been steep (Fig 3), while other markets are breaking 200DMAs as – in APAC – the STI, KOSPI, and the HSI with others heading there.

Fig 3: YTD performance of US indices Source: Bloomberg

-

Q1FY19 earnings for S&P 500 ‘beat’ the conservative consensus by around 3%, falling just -30bps YoY whilst 76% of the 77% S&P 500 companies that have reported Q2FY19 earnings have also ‘beaten’ conservative consensus estimates. Factset thinks that the companies which have reported so far – along with estimates for those to report – will see Q2FY19 earnings fall by -1.0% YoY relative to the -4-5% consensus estimate during the pre-results season. Year-to-date, S&P 500 EPS has been cut by -6.5% from YE18 estimates.

-

The same is true for Stoxx, where Q2 results are seeing a net ‘beat’ over significantly downgraded forecasts after Q1 results were out but will still likely be down -4% YoY on an absolute basis. There is ‘polarisation’ between where S&P 500 H2 earnings will go with consensus (and Goldman Sachs) expecting +3% (GS also forecasts +5% FY20E), which implies a double-digit recovery in H2 and especially in Q4FY19 where comparatives to the FY18 base look easier.

-

This is opposed to others like Morgan Stanley, who see a contraction in overall FY19 earnings, and think that earnings consensus for H2FY19 is way too high, and that might result in the S&P 500 correcting 10%+ as investors become more pessimistic. To the extent that the US consumer looks to be in rude health, the key to growth/contraction in FY19 earnings might lie in whether toplines hold up (helped by stronger consumption spending), and the degree to which corporate operating profit margins are squeezed. One lead indicator for future earnings are today’s sales growth and here the ‘weak-ish’ Q2FY19, in contrast to better than expected earnings ‘beats’, is a downside indicator into H2.

-

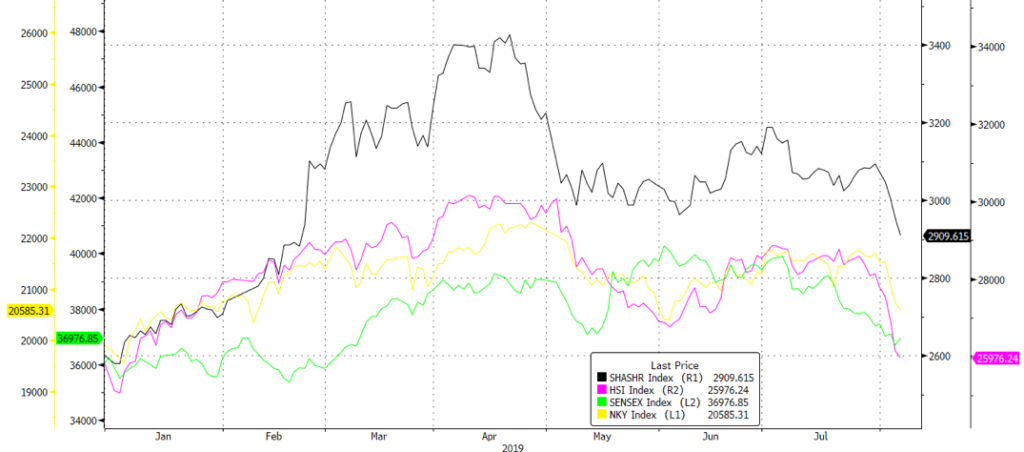

In APAC, our overweight positioning in Chinese equities (Fig 4)is starting to look a lot less clever as trade and a depreciating CNY hits the defensive domestic counters like Tencent and Alibaba, as well as preferred names in Real Estate and Financials. Our sense is thus a need to reduce exposures in this region. Meanwhile, domestic troubles are making Indian equities less attractive, while ASEAN is exposed to trade damage and USD strength.

Fig 4: YTD performance of Asian indices Source: Bloomberg

Fig 4: YTD performance of Asian indices Source: Bloomberg

Fixed Income

-

US Treasury (UST) rates were mostly flat in July. While the 2Y yield ended at 1.87%, 11.72bps higher MoM, the 10Y yield was mostly flat at 2.01%. However, yields tanked, and the UST yield curve flattened in the first two days of August after Trump announced the tariffs on additional Chinese imports (Fig 5). Weaker manufacturing data after also weighed on yields. Despite this, we remain convinced that the current economic conditions in the US do not warrant a monetary policy easing cycle.

Fig 5: Flattening of UST yield curve Source: Bloomberg

Fig 5: Flattening of UST yield curve Source: Bloomberg

-

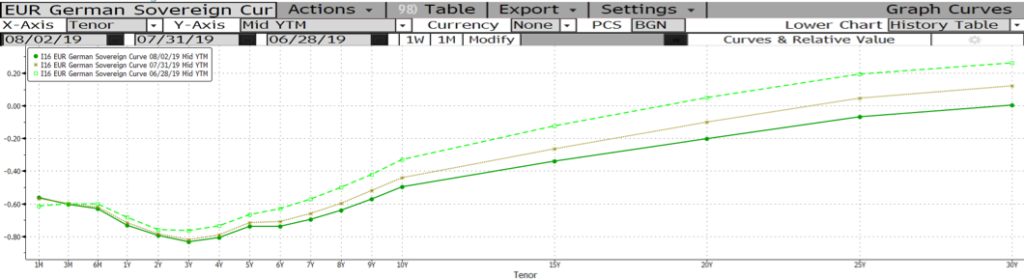

German bunds yield trended lower throughout July, extending declines from June, as European economic data remained weak. The fall in German yields accelerated in the first two days of August as well, ending the week with the entire German yield curve in negative territory (Fig 6).

Fig 6: Germany sovereign yield curve falls below zero Source: Bloomberg

Fig 6: Germany sovereign yield curve falls below zero Source: Bloomberg

-

EM debt was the best performer last month. EM hard currency debt, represented by the Bloomberg Barclays EM USD Aggregate index, returned 1.00% while EM sovereign local currency debt (LCD), represented by the Bloomberg Barclays EM Local Currency Government index, returned 0.98%. We continue to favour EM debt, particularly hard currency debt, relative to other FI sectors given the market’s hunt for yield in the current low-interest rate environment. We are more cautious around LCD, especially given the strong dollar.

-

Within corporate credits, high yield (HY) debt generally outperformed investment grade (IG) debt (Fig 7). Both IG and HY index spreads are trading at the lower levels seen in ‘18, with the IG index yield trading at 2Y lows. With IG yields back at that level, we don’t think it justifies the inherent risks and thus prefer HY debt.

Fig 7: HY vs IG returns Source: Bloomberg

Fig 7: HY vs IG returns Source: Bloomberg

FX

-

The DXY reached a YTD high of 98.90 last week but has since continued to fall since Trump’s renewed tariff threats. Previous resistance levels, bar the 103 peak in end 2016, can be seen at 100 (Fig 8). This is likely the next level of resistance if markets continue to back the dollar on the Fed’s less-than-expected dovishness. We have seen the DXY break through a key resistance of 98.50 over the last week, with support from its 200DMA at 96.93.

Fig 8: DXY resistance at 100 Source: Bloomberg

Fig 8: DXY resistance at 100 Source: Bloomberg

-

We’ve also broken new ground on the EUR with the 1.11 handle broken (Fig 9), though a fall past 1.10 and lower is not unlikely. Volatility still remains low – but not as low as mid-July.

Fig 9: EURUSD breaks below key support of 1.11 Source: Bloomberg

Fig 9: EURUSD breaks below key support of 1.11 Source: Bloomberg

-

In our previous monthly, we noted that the flight to ‘safe haven’ currencies could be steep, should trade tensions escalate once again. They did, and we saw JPY gaining to 105.60. We expect haven currencies (JPY, CHF) to see continuedstrength, and for the Sterling to be exposed to the downside in lieu of Brexit uncertainty.

-

Citi’s broad NEER values show the Yuan dipping below 98 with speculation that China will further adjust its real effective rate lower to offset the impact of new tariffs. This will likely put downward pressure on Asian currencies as they adjust to accommodate this pressure. We see an opportunity in shorting the Thai baht, as a weaker yuan might release some of the latter’s strength which we saw in July.

Commodities

-

Last month, we noted a trading range between US$60-68/bbl, based off numerous factors including Trump’s pressure on Iranian production as well as a slowdown in overall demand from trade wars. In July, Brent saw a rise to US$67/bbl, helped higher by the continued momentum of production declines from June as well as an inventory decline for Cushing crude. Hurricane Barry also helped push oil prices higher by shutting down c. 1m bpd of production in the Gulf of Mexico. However, this rise was soon offset in a gradual build of inventory once again as exports slowed from a dip in demand due to trade wars. Short bouts of dollar strength from Powell’s less-dovish comments also helped push oil lower.

-

We adjust our trading range for oil to US$60-$65/bbl, with a bias to the downside, and see the $60 level as a support that may break by the end of Q3. We follow the 200DMA resistance level of $65 and note that the support at $60 has been tested 4 times since June. With the added tariffs from the US, as well as a retaliatory stance from China, we foresee that tensions are more likely than not to rise and this should further dampen the overall mood for risk, and therefore the outlook for global growth.

(Fig 10)

Fig 10: Brent crude on a downward trend Source: Bloomberg

Fig 10: Brent crude on a downward trend Source: Bloomberg

-

Gold maintained an upwards channel since slowing down from its momentum in June (Fig 11),not least helped by the fact that China has also been purchasing a record $15.7bn worth of gold since Jan ’19.

Fig 11: Gold’s upward channel Source: Bloomberg

Fig 11: Gold’s upward channel Source: Bloomberg

-

The increasingly uncertain backdrop has and will likely continue to benefit the precious metal, with the potential for prices to rise above US$1,500/Oz. From a technical perspective, we view Gold’s momentum to be too strong for a “sell-off” reversal, similar to what we saw in equity markets.