Market View

The Big Dilemma

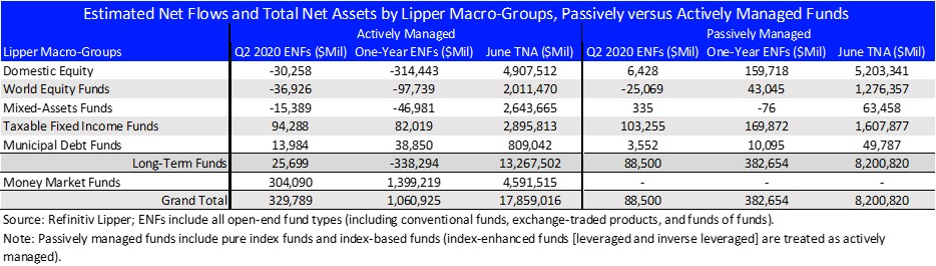

The current Yield to Worst for the Bloomberg Barclays Global Agg Credit Total Return Index, a Global USD Credit Index, is 1.5%. This may seem a low return, however, fund flow data suggests that investors prefer to get a suboptimal low return than experience the uncertainty of the equity market. Even as the MSCI World net return posted a 19% increase in Q2, Lipper data showed USD86bn left Equity Funds while Taxable Fixed Income Funds saw a USD198bn increase. A significant proportion of the latter when to high yield (HY) funds due to the attractive credit spread and yield in April and May.

Multi-asset absolute return portfolio managers now face a difficult decision. At the end of March, Credit was an attractive haven after the COVID sell-off because Global Credit spreads had widened by 120bp and the Yield was a decent 3%. Global HY was even more juicy with spreads widening by 450bp and the yield was 10.5%. The high carry and the potential for capital gains, especially with the US government back-stopping the US credit markets, was irresistible for fixed income veterans, a virtual slam dunk.

However, now with credit spreads, and in particular, yields, approaching pre-COVID levels, the outlook for returns is greatly diminished. The Global Credit Index has returned 7% YTD, and those that focus mostly on that asset class, may well decide that is sufficient for 2020 and rest on their good fortune. For those of us that are still trying to optimize their returns going forward, the return outlook for credit is unappetizing, and we must judiciously look further afield.

The Choices

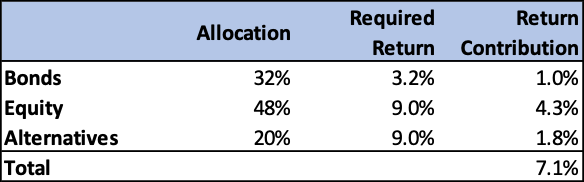

Many of us are in the same boat. Whether we are a retiree or still working, an endowment, a sovereign wealth fund, or an insurance company, we all have future liabilities that need to be paid for through investments. This means we need to get an adequate return on those investments. The required rate of return will depend on your particular situation, but for most the number will be between 5-10% over the cycle. Let’s pick a round number and say we want a 7% return. If our investable universe is Bonds (Credit), Equity and Alternatives, and our Bond portfolio provide a 3.2% YTM (70:30 mix of investment grade and HY), then Equity and Alternatives combined must make 9% in the next 12 months.

Source: Odyssey

Source: Odyssey

For Equity, if earnings are not adjusted higher than current estimates, it would mean that the 2021 MSCI World Index PER would need to be 19.5x (currently 17.8). Apart from extraordinary circumstances such as COVID and the Dotcom boom, the Equity market has only traded as high as 18x – at the peak of the 2017 and 2019 bull rallies. For those that say we now have zero interest rates, so equity multiples can be higher than previously, I would point out that we’ve just had 7 years of zero interest rates in the US from 2009 to 2015. We are not saying you cannot make 9% return from your equity portfolio over the next 12 months, and we hope you do, but we suspect the equity market needs to have a number of positive developments that are not currently apparent for the broad indices to enjoy that type of return.

S&P500 and Current Year PE Ratio

Source: Bloomberg

Can Alternatives bridge the gap? The HFR Hedge Fund Index (HFRHFI) has return 1.6% YTD, which is marginally better than the broad Equity Indices, however, the 6% total return in the last 5 years hardly inspires confidence. The HF Index has even underperformed the Global Credit Index by 24%.

But what about the illiquid strategies? Despite a significant lag in valuation in many cases, unlisted investments do not appear to have gone unscathed. In March AustralianSuper announced they had marked down their unlisted investments by 7.5%. For Q1, Softbank’s Vision Fund with USD76bn invested, lost USD17bn yoy. Carlyle’s Tactical Private Credit Fund’s NAV fell 18% due to COVID and has since recovered approximately half the loss. Commercial real estate has been a mixed bag. Office and industrial exposures have been largely resilient while traditional retail and hotels have suffered and will likely take some time to recover to pre-COVID levels.

Despite some recent losses, there appears a strategic move on the part of large institutional investors to gain further exposure to unlisted investments. Even AustralianSuper is looking to beef its private equity exposure and Calpers has recently stated it believes it needs to raise its exposure to private equity and credit investments if it’s to reach its 7% per annum return target over the next 10 years.

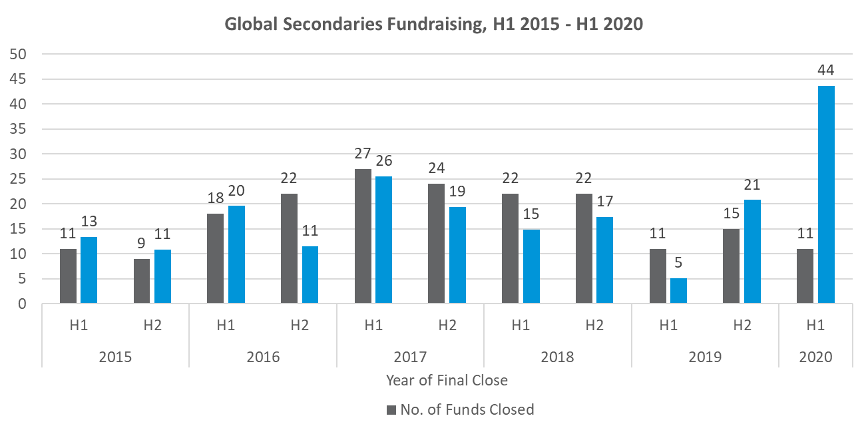

Data tends to support this strategic move by large institutional investors. In H1 2020, private equity experienced USD241bn in fund inflow, USD7bn more than H1 2019[1], despite COVID. While much of the investments were made prior to the COVID lockdown, it indicates the underlying demand. Further, while the number of private secondary transactions declining by 30%, the USD44bn raised in H1 2020 was more than the whole of 2019 (USD26bn)[2], indicating the high demand for secondary transactions.

Source: Prequin

Source: Prequin

Conclusion

The current low yield environment means that for investors that are continually trying to create a portfolio that can provide 5-10% returns going forward, more risk needs to be taken beyond the relative safety of the credit markets. Whether that is through the highly liquid but volatile public equity market, or via unlisted vehicles, or a combination of both, depends on the goals of the individual investor. From our experience, most private investors are underweight alternative assets and further investment in this asset class would likely increase diversification, boost long term returns and lower overall portfolio volatility.

[1] Private Equity International

[2] Prequin

If you like to receive more information on our portfolios solutions, please contact us here: info@odysseycapital-group.com