The 2019 Australian Federal Budget was handed down by Treasurer Josh Frydenberg on Tuesday, 2nd April announcing the Federal Budget will be back in the black for the first time in twelve years, with a budget surplus of A$7.1 billion dollars forecast for 2019/2020.

Budget Headlines

-

The 2019 Budget shows that tax will be a key topic of discussion in the upcoming election.

-

Forecast surplus of A$7.1 billion in 2019-20 and A$45 billion over the next 4 years.

-

Government introduced an ‘Enhanced’ personal income tax cuts for low and middle-income earners in 2019 tax returns. A$158 billion of personal income tax cuts are promised over a decade.

-

A boost to the instant asset write-off threshold for small to medium enterprises to A$30,000 announced on Budget night.

Below is an infographic from PwC highlighting the key announcements from the Federal Budget.

Fig 1: Key announcements from federal budget Source: Budget.gov.au

What does the budget mean for Australian Expats?

Personal Income Tax Cuts – Australian residents

The Government is reducing tax for low and middle income earners of up to A$1,080 for single earners or up to A$2,160 for dual income families for the 2018/2019 to 2021/22 income years. Taxpayers will be able to access the offset after they lodge their end of year tax returns from 1 July 2019.

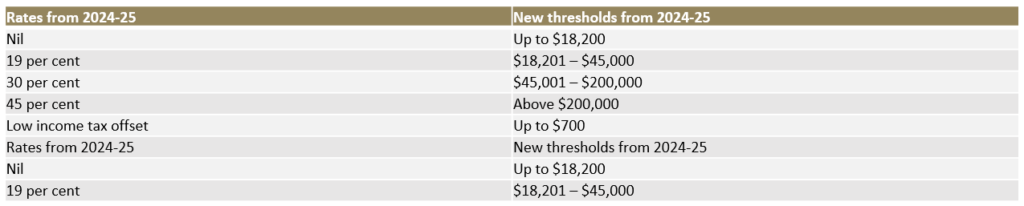

From 2022/2023, the Government will increase the top threshold of the 19 per cent tax bracket from A$41,000 to A$45,000 and the low income tax offset from A$645 to A$700.

From 1 July 2024, the Government is also increasing tax thresholds further and reducing the 32.5 per cent tax rate to 30 per cent.

By 2024, under the proposed changes there will only be three tax brackets: 19 per cent, 30 per cent and 45 per cent.

It’s important to note these new tax rates only applies to Australian residents and no changes has been made to the Non-resident tax rate. For current Non-resident tax rates please click here

Summary of changes to rates and thresholds – Australian residents

Superannuation changes

From 1 July 2020 the Government will amend the superannuation contribution rules to allow people aged 65 and 66 to make voluntary contributions to superannuation without meeting the work tests.

People age under 67 at any time during a financial year will be able to trigger the non-concessional bring-forward rule (e.g. allowing individual to contribute three years of non-concessional contributions up to A$300,000 in single year). Previously this rule only applied to people age under 65.

Under the proposed changes, the age for spouse contributions has increased from 69 to 74, which allows individuals to make contributions on behalf of their spouse for a longer period. In addition, where the receiving spouse is age 65 or 66 they no longer need to meet a work test.

Whilst the superannuation changes may not apply to all Australian expats, it is however important to plan for your super in advance before returning to Australia to take advantage of the contribution limits available and ensuring a successful transition to retirement in Australia.

Funding ATO Tax Avoidance Taskforce

The Government will provide A$1.0 billion over four years from 2019/20, to the Australian Taxation Office (ATO) to extend and expand the operation of the Tax Avoidance Taskforce focused on large corporates, multinationals and high wealth individuals.

The measure is estimated to increase tax collections by $4.6 billion resulting in a net gain to the budget of $3.6 billion over the forward estimates period.

The Tax Avoidance Taskforce undertakes compliance activities targeting multinationals, large public and private groups, trusts and high wealth individuals. This funding is expected to result in further increases in ATO examination activity.

Effective from 1 January 2020, the list of Exchange of Information countries will be expanded to add the following countries:

- Curacao

- Lebanon

- Nauru

- Pakistan

- Panama

- Peru

- Qatar

- UAE

As a result, distributions from Managed Investment Trusts (MITs) to these countries that are currently subject to the 30% withholding tax rate may qualify for the lower 15% withholding tax.

Summary

The 2019 Federal Budget from the Coalition delivered a strong focus on building a stronger economy and securing a better future for all Australians. This comes through lower income taxes, incentives for small to medium business and increased infrastructure spend.

It’s important to note these proposed changes have not yet been legislated until the current Coalition government gets re-elected. It’s also important to be aware of the opposition’s response to these changes and their respective policies. These policies will become clearer as the federal election gets closer.

Whether you are an Australian resident or expat living overseas, it’s important to understand how the budget may impact your personal circumstances.

For a copy of 2019/2020 Budget, click here

CONTACT

For a confidential discussion on the Australian budget and planning matters, please contact Jeff Hiew