Nov 9, 2018 | Articles, Global Markets Update

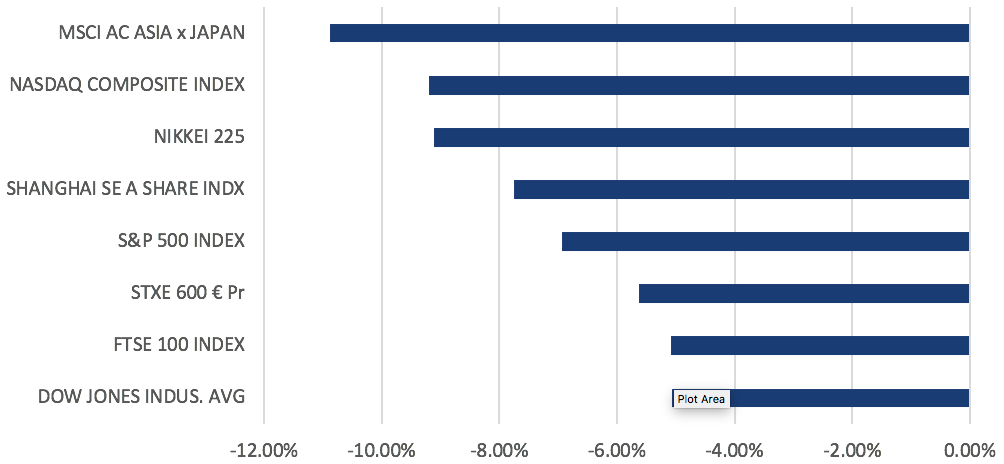

Despite the month-end window dressing, October was a bad month for equities.

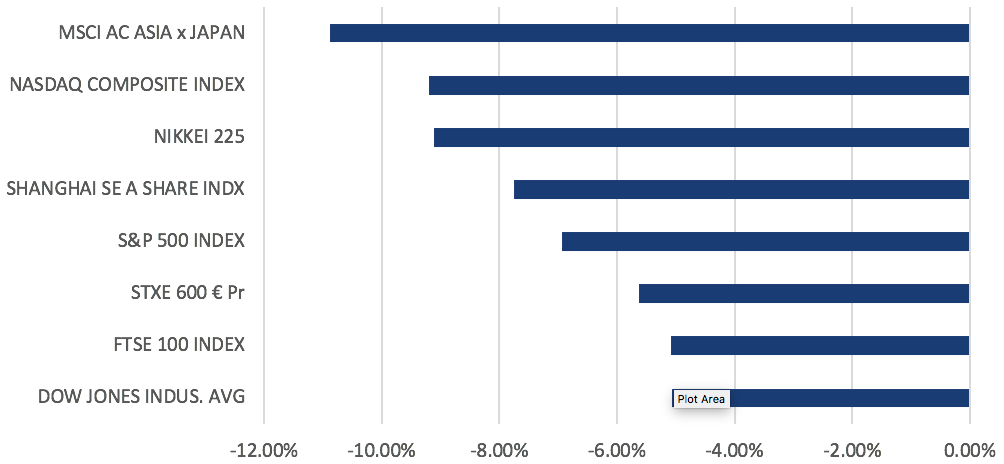

Indices in the major regions all closed significantly lower within the range of -5% to -11%, with MSCI AXJ leading declines (Figure 1). This month was also the worst October since ’08, where indices fell in the ranges of -13% to -25%. Markets were risk-off for most of the month, causing a rotation into defensives like Utilities and Consumer Staples in the S&P 500. A similar trend was seen in Stoxx 600, with the F&B, Utilities and Telecomm Services losing the least over the month.

Figure 1: October returns across major indices

Geopolitics and trade concerns continued to weigh in October, starting with the EU formally rejecting Italy’s budget plans, which led to BTP 10Y yields whipsaw around 3.5% while the spread over Bund yields rose to a high of 327bps during the month. Merkel’s decision to not run for re-election as chairman of the CDU in December also renewed political uncertainty in the region and weighed on the EUR. Trade tensions between US and China seemed to improve toward the month-end (and markets took it as such), despite Trump’s threats to levy all remaining Chinese imports if talks with Xi later this month fail.

Corporate earnings were also the focus of this month, as companies are midway through reporting Q3 earnings. As of last week, 74% of companies in the S&P 500 have reported earnings. 78% of these companies have reported earnings beat, while on aggregate, companies are reporting earnings that are 6.8% above the estimates. We saw weaker earnings from US IT stocks like Amazon, Alphabet and Apple, that resulted in overnight losses of c. 4% – 7% while disappointing earnings outlook from industrial bellwethers like Caterpillar and 3M raised concerns around the global growth outlook.

Our base case is founded on the need for an ability to look across the valley as the short-term may see further downside from:

- A possible deterioration of Sino-US relations, with risk that China retaliates via non-trade means such as CNY devaluation etc;

- Weaker EPS outlook and potential Q3 earnings misses – most likely from companies in Asia ex-Japan;

- Cyclical peak in US GDP growth;

- Rising geopolitical risks – notably in Middle East (ME);

- US tariffs on global auto imports; and

- Italy’s budget deficit;

In the medium-term, solid EPS growth in the low double-digits and positive global GDP growth data still underpin the fundamental case for equities. The negatives in the ‘noise’ should not derail EPS or GDP growth but might reduce, on the margin, a more aggressive Fed rate hike cycle for longer. This suggests that the recent correction in equities is one to be adding into selectively, in a disciplined manner.

We think it is highly likely any evidence of a GDP slowdown in 2019 will be met by increased fiscal spending and greater monetary policy gradualism. Rising rates are a risk, but rates are well below levels that have historically disrupted a positive equity trend. In addition, valuations for non-US equities are reasonable and real estate owned recoveries are underway. Even in the US, equity valuations, excluding IT, SMEs and parts of the consumer discretionary/healthcare sectors, are not overly stretched.

As it is almost impossible to finesse market bottoms, we think the only approach has to be to stay the course with relatively defensive positioning and look to become more risk-on as we cross the valley, by being disciplined in adding into further declines while risk managing portfolios, should a rebound take place. Our assumptions are that we do not see a US/global recession in the next 12-18M; that oil prices – bar any Middle East ‘shocks’ – will not move appreciably higher than the mid 80s; and that concerns over global liquidity tightening are exaggerated.

Equities

- The S&P 500 lost 6.94% in October, while the tech heavy Nasdaq tumbled 9.20% for its biggest monthly fall since Nov ’08, while the Dow Jones fell by 5.07%. The falls sent the U.S. into ‘correction’ territory, despite a decent earnings season for the companies that have reported, and strong macroeconomic data.

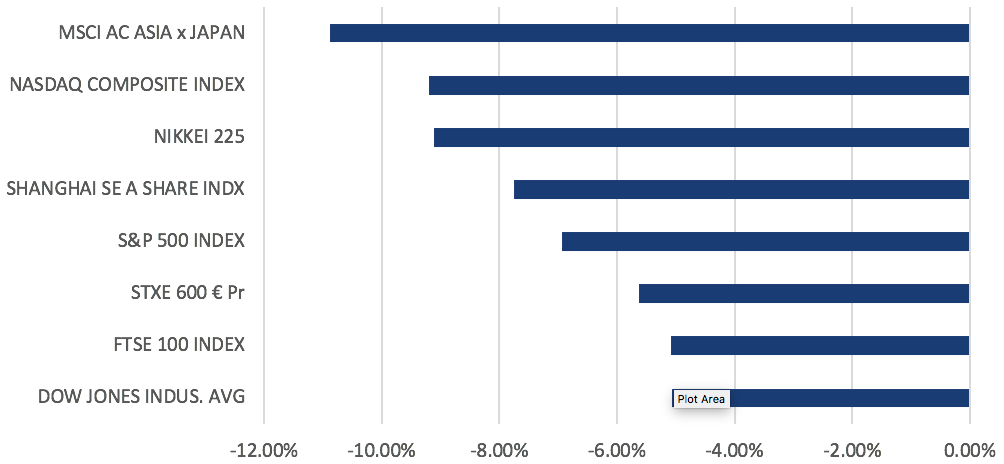

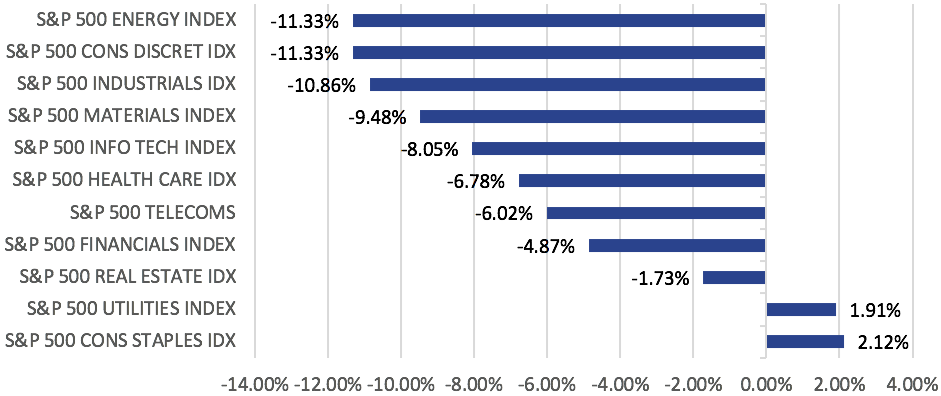

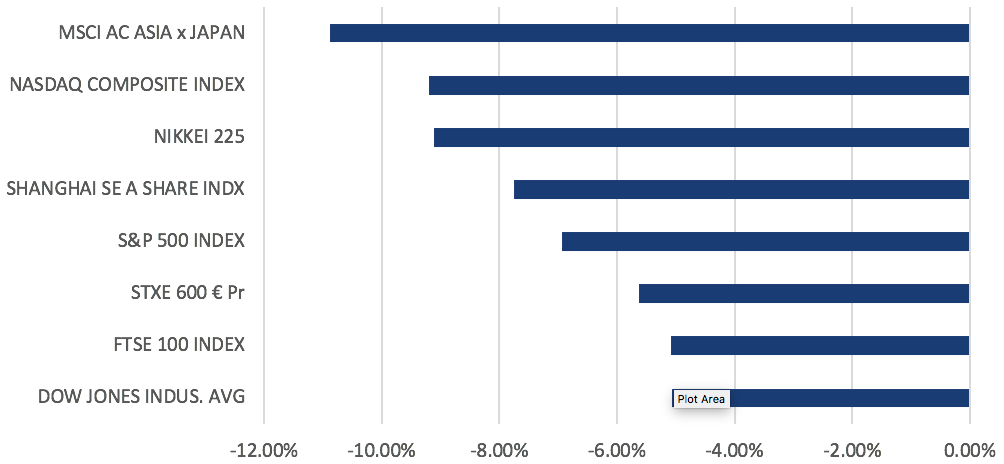

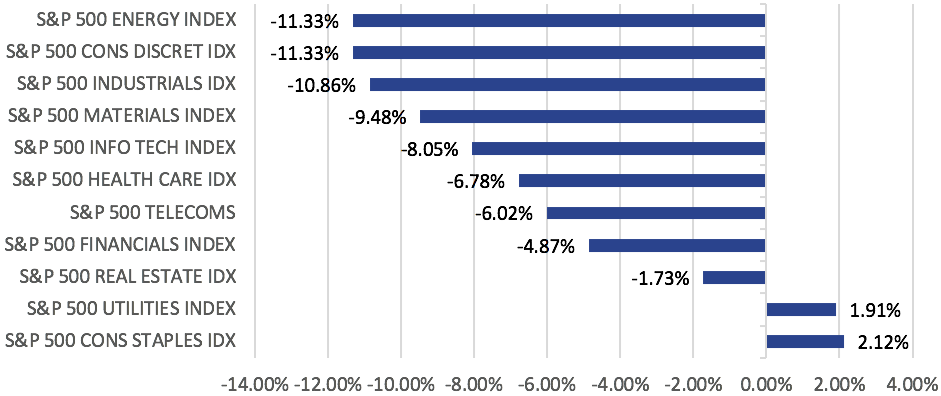

Figure 2: S&P 500 Sector Performance in October

- The month saw further evidence of sector rotation, with defensives in the S&P 500, namely Utilities (+1.91%) and Consumer Staples (+2.12%) holding up while Consumer Discretionary (-11.33%), Energy (-11.33%) and Industrials (-11.33%) led declines (Figure 2).

- With U.S. equity markets starting to look choppy, we continue to emphasize last month’s call that late cycle and slowing earnings growth suggest defensive sectors may outperform – there is increasing evidence that this sector rotation is happening, along with value outperforming growth by over 3% this month.

- Additionally, the outcome of the U.S. mid-term elections has the Democrats take control of the HoR, while the GOP retains control of the Senate. This result is neutral to slightly positive for U.S. equities.

- In-line with the global equity rout, STOXX 600 fell -5.63% for the month and saw broad-based losses across all sectors except for Telecommunications (+0.01%), which barely ended the month flat. The FTSE 100 was also lower on the month, losing -5.09%.

- The EU summit earlier in the month also brought the spotlight back on to Brexit, and the conflict between Rome and Brussels over Italy’s proposed fiscal budget deficit. On both scenarios, our base case remains that a compromise will be reached by the respective deadlines. On Brexit, the outcome will also depend on whether May is able to get the votes in Parliament.

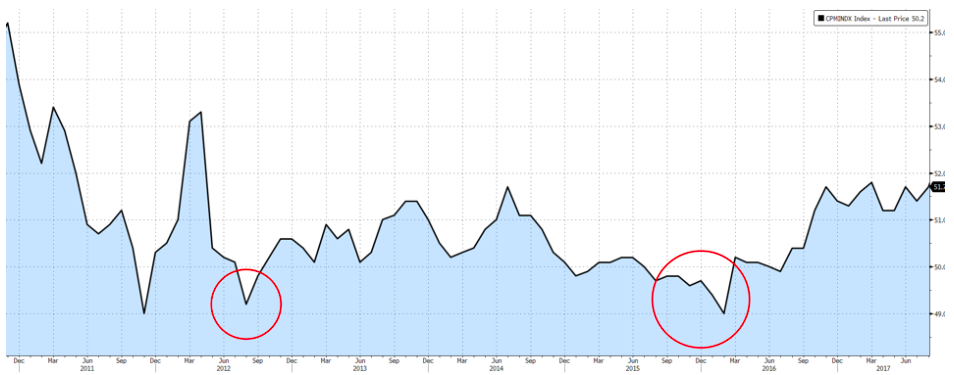

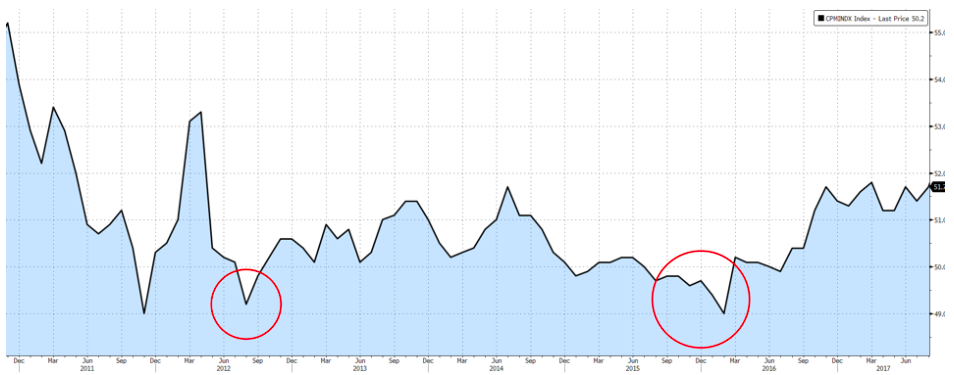

Figure 3: China’s Official PMI

- China A-shares extended losses to an intra-month low of -12%, after which a slew of new government policies and renewed optimism on the trade scenario with the U.S. helped lift sentiment on the index to close -7.75% lower for the month. While PMI weakness continued in October, it still remains far from levels that would warrant cause for concern, which would be somewhere closer to the lows witnessed between ’12 to ’16 (Figure 3). Interestingly, these were addressed through similar waves of stimulus policies which we see today – commitments to boost growth, stabilize employment, finance, external trade, foreign investments and supporting private enterprises. .

- Overall, our view is that the situation for Chinese markets is far from the pessimism that it has experienced, and while growth expectations have inadvertently dampened, the willingness to be flexible in amending interventionist policies and drastic measures to protect the economy are encouraging.

- While there is value support for EM equities more broadly, there is also merit in being patient as the US still has an option to extend tariffs on all Chinese imports, and will likely raise them to 25% by the end of the year which will worsen Sino-US relations. There is also a genuine risk that China will allow the CNY to weaken past 7, which EM Asia would struggle with.

Fixed-Income

Figure 4: UST 10Y yield reaches fresh 7Y highs and testing 3.2%

- Positive economic data in September supported US growth in Q3, pushing UST 10Y yield to a fresh 7Y high (Figure 4) of 3.233% early in the month. However, risk-off sentiments from the equity selloff late in the month led to increased demand for safe haven assets, causing the UST 10Y yield to fall back down, ending the month just 8.23bps higher at 3.144%.

- Corporate debt also underperformed sovereigns over the month, with High Yield (HY) debt losing the most. Global HY spreads increased 43.59bps, while US HY spreads increased 55bps, with the asset class losing 1.6% MoM. US bond funds saw net outflows of more than $13bn, relative to $3.8bn in EM debt funds.

- US economic data released over the month is unlikely to change the Fed’s decision to raise rates in December. JP Morgan expects UST yields to rise steadily into late ’19 as they think the Fed will probably hike rates every quarter through to the end of next year. In addition, the US Treasury is expecting to issue $425bn worth of USTs in 18Q4, bringing the total borrowing this year to $1.34tn, more than double of that in ’17. This increased supply, along with the Fed reducing its balance sheet, could put further pressure on UST yields to rise.

- The risks to longer duration FI remain high, be it technical supply issues, an inflation ‘shock’ (PCE data saw PCE inflation continue to rise while private sector wages rose at a 5% YoY pace) or even China dumping its USTs. We continue to think allocations to longer duration, high quality FI makes little strategical sense bar a short-term tactical trade, and remain in favour of shorter duration, lower credit quality FI despite the higher risk and more probable refinancing issues, especially for weaker Chinese property companies.

Currencies

- USD was stronger in October, with the DXY gaining 2.10% on the back of strong economic data and having its ‘safe haven’ features tested when trade tensions were on the rise. Aside from USD strength, DXY was also supported by weakness in GBP and EUR (accounting for 70% of the index) from Brexit and Italian concerns. The two key events this month that will likely move the USD are 1) the US mid-term elections, and 2) Trump and Xi’s meeting at the end of the month.

- There is increasing downside risk for the EUR after testing 1.13, a key support level, twice in October. We see a renewed layer of political uncertainty with Merkel’s decision not to seek re-election as leader of CDU in ’21, while Italy’s proposed budget deficit continues to weigh on EUR sentiment. Should the EUR break its support of 1.13, we may see 1.10 as the next possible support. If 1.13 holds, we can expect to see a new range between 1.13 to a familiar resistance of 1.18.

- It was also a troubling month for Asia ex-Japan currencies, with CNY leading other currencies lower. Higher oil prices and rising rates were not supportive either, particularly for the INR and IDR. China released a stream of mixed data with improvements in consumer spending but unsurprisingly soft industrial data. 7.0 remains a strong support for USDCNY.

Commodities

- Brent ended c. 16% lower from a recent high of $86.29 on a mix of slowing industrial data from trade wars and OPEC boosting its production to its highest levels since 2016 causing Brent to break below its 200DMA ($73.98) on the 1st of Nov. Oil has remained above its 200DMA since September 2017. The higher output has since replaced the tight supply sentiment.

- Gold is finally coming off from its floor of 1200 as the risk-off in equity markets led to some looking to the precious metal as a safe haven asset, and the technical show that 1215 is now a resistance-turned-support.

- Sanctions on Iran kicked in on the 5th of November, but the waivers issued to 8 countries are likely to offset some if not most of the supply-side impacts on the global oil market. The waivers also reduce the probability of Iran blocking the Straits of Hormuz, which has taken away some of the geopolitical risk premium that we have seen in oil prices over the past few months.

- At present, we still remain bullish on oil (and energy, more generally), on the basis that demand still remains strong, against a backdrop of weak capex over the past few years which will eventually result in a structural shortage on the supply side.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at.

Oct 31, 2018 | Press Releases

Odyssey Capital Group Ltd is pleased to announce that the Odyssey Japan Private Equity Real Estate division has been selected by Shinhan Investment Corp (a division of Shinhan Financial Group) to be their Japan Hospitality Advisor and Fund Manager for an institutional mandate.

The joint venture will allow Shinhan’s clients to benefit from Odyssey’s Japan Hospitality investment strategy, which includes seeking investments in boutique hotels, Ryokan’s (Traditional Japanese Inns) and Machiya’s (Traditional Japanese Townhouses) in the Kansai region and other areas of Japan. The investment model is to acquire, re-position and operate. By deploying a value-add strategy, Odyssey aims to increase the value of the assets acquired both at the asset level and the operational level. Odyssey’s goal is to increase the value of the underlying assets through a combination of property enhancements and improving the operational efficiencies of the underlying assets.

On the back of its strong and stable corporate governance and financial structure, Shinhan Investment Corp is fast emerging as a leader in Korea’s securities industry and provides securities trading, wealth management, and investment banking services, mergers and acquisitions, investment trusts, and corporate financing services. Shinhan Investment serves clients worldwide and is a subsidiary of Shinhan Financial Group, the second largest Bank in South Korea. Shinhan is, historically, the first bank in Korea, established in 1897 and now boasting more than 10,000 employees with more than US$260 billion in total assets.

Coinciding with the partnership between Odyssey and Shinhan is the initial acquisition of an attractive boutique hotel in Kyoto, Hotel Owan (https://resistay.jp/en/room/owan-amaterrace/) with the closing completed on the Friday 26th of October.

Kyoto is the historical capital of Japan and, as a result, many of Japan’s greatest entertainers, artists, chefs, designers and architects have resided and honed their craft in and around the city.

Odyssey’s boutique hotel asset embodies Japanese traditional culture and combines traditional, historical, Kyoto-based design and art motifs with modern and funky, boutique construction. Hotel Owan has 19 rooms which spread across 4 floors and comprise 8 wholly unique styles to cater to all types of affluent taste, whether they be for a room that includes tatami floor space, or one fitted with spacious, family-sized, double bunk beds or sleek and minimalist rooms for couples. With traditional Kyoto crafts, such as Nishijin fabric, and delicately featured interiors, you can feel an authentic beautiful Kyoto experience during your stay.

The appeal for local and foreign guests is well established as Hotel Owan has operated at an occupancy rate above 80% since it’s opening in 2017 and frequently experiences periods of 100% occupancy with consistent, ubiquitous, rave reviews on its quality of construction and design, it’s feel and styling and its central location and service.

Odyssey’s Japan Real Estate investment team, led by Christopher A. Aiello, was able to acquire the asset at a below market price and felt that current market demand will allow for increasing Average Daily Room Rates (ADR’s) by 20% to 25% over the next 12 months. Odyssey also plans to add concierge service upgrades and also employ a focused and upgraded digital marketing and direct bookings strategy.

The Managing Director of Odyssey Japan CRE, Christopher Aiello said, “We are excited to have completed the acquisition of this wonderful boutique hotel today. We have been able to secure this asset over other bidders due to the long term vision we have for the Japanese Boutique Hospitality industry, the strength of the Odyssey team and our seasoned relationships in Japan. We were able to secure a very attractive debt package for this acquisition from Mitsublishi UFG, one of the leading banks in Japan with an LTV ratio of 65%, non-recourse debt, and with an annual cost of 1.6% pa.”

Odyssey has long-term working relationships with the top leading individuals and firms in the Japanese commercial real estate and hospitality market and these partnerships include our panel banks, trust institutions, local asset managers, legal counsel, tax specialists and accountancy professionals.

The Odyssey CRE team commenced operations in early 2017 in Japan, and its well established and deep local presence, networks and insights allowed for the identification of the best and most appropriate real estate opportunities for the Odyssey Japan Hospitality strategy. Since this time, the Manager has reviewed more than 50 assets and has built up a robust pipeline.

The Odyssey Japan Real Estate investment team looks forward to providing our valued clients with more unique and exciting opportunities in what, we believe, will be one of the most successful Japanese hospitality investment projects to date. Please contact Odyssey, should you be interested in investing in Japanese real estate.

Odyssey Asset Management Limited

Odyssey Asset Management Ltd, a sister company to the Odyssey Capital Group, is a Hong Kong SFC 1, 4 & 9 licensed company. The Japanese CRE team is headed up by Christopher A. Aiello, and also includes Alex Walker, Daniel Vovil and Sam Luck.

Odyssey Capital Group Ltd is Asia’s leading independent Alternative Asset Manager that provides differentiated and bespoke investment solutions across multiple asset classes, including asset management, real estate, private equity and hedge funds. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest in with its clients.

The Odyssey team comprises over 30 experienced executives, asset managers, lawyers, private bankers, trust & tax planning specialists and experienced investors with over 400 years of combined financial and operational experience across the Asia Pacific, Europe and North America.

If you would like to learn more about Owan Hotel or if you would like to learn about our upcoming property purchases, please get in touch with us at: japan@odysseycapital-group.com

For more information about the Odyssey Japan Boutique Hospitality Fund, phone or email Daniel Vovil via the contact details listed below.

Daniel Vovil, Co-Founder and President, Odyssey Capital Group

daniel.vovil@odysseycapital-group.com | (852) 9725-5477

Sep 25, 2018 | Press Releases

Dear Clients & Friends,

We are very pleased to announce that, as part of our Japanese Boutique Hotel strategy, we have made our first acquisition, a uniquely charmingRyokan (traditional Japanese inn) called “Kagetsu” in Echigo Yuzawa, Niigata Prefecture – see the website here: https://www.shousenkaku-kagetsu.com

(Kagetsu Ryokan Room with outside Bath)

(Kagetsu Ryokan Room with outside Bath)

(Kagetsu Ryokan In-house Onsen)

(Kagetsu Ryokan In-house Onsen)

Kagetsu is surrounded by three exceptional ski resorts and bordered by Takizawa Park and a quaint river that flows from the nearby Fudotaki Falls. Kagetsu has been owned and operated by the same family for more than 30 years.

During the winter season, our guests have access to 3 different ski resorts where they are able to enjoy the renowned Japanese slopes or beautiful hot-springs.

(Fudotaki Falls in Echigo Yuzawa)

(Fudotaki Falls in Echigo Yuzawa)

(Local Echigo Yuzawa Hot Springs)

(Local Echigo Yuzawa Hot Springs)

But it’s also the Spring, Summer and Fall that attract tourists from all over, as these seasons are filled with hiking and mountain biking, golfing, fishing, delicious farm to table local cuisine, sake tasting at famous sake breweries. The area is well known for young couples to make pledges and prayers at the famous Fudotaki Falls.

(Yuzawa River)

(Yuzawa River)

(Yuzawa Chuo Park)

(Yuzawa Chuo Park)

After completing thorough due diligence, the key parameters for the purchase of Kagetsu included: the abundant tourist experiences that guests can enjoy during all four seasons in the surrounding area and community, securing a below market acquisition price which will contribute to the a targeted IRR of 20.3%, an attractive cash-on-cash yield of 12% based on the application of our value-enhancement strategies along with favourable debt financing at 1.8% p.a., all combine as key factors behind the acquisition of this unique property as the first of many for Odyssey’s Japan Boutique Accommodation strategy.

(Kagetsu Ryokan Entrance)

(Kagetsu Ryokan Entrance)

(Kagetsu Ryokan Deluxe Room)

(Kagetsu Ryokan Deluxe Room)

Clients of Odyssey are eligible for a 20% discount on room stays so please contact your Private Client Adviser if you are planning to be in Japan and would like to experience the charm of Kagetsu.

If you would like to learn more about Kagetsu or if you would like to learn about our upcoming property purchases, please get in touch with us at: japan@odysseycapital-group.com

(Kagetsu Ryokan Banquet Hall)

(Kagetsu Ryokan Banquet Hall)

For more information about the Odyssey Japan Boutique Hospitality Fund, phone or email Daniel Vovil via the contact details listed below.

Daniel Vovil, Co-Founder and President, Odyssey Capital Group

daniel.vovil@odysseycapital-group.com | (852) 9725-5477

Feb 26, 2018 | Articles, Press Releases

Positive Returns – Even in Bear Markets!

Odyssey is always looking for ways to generate additional returns for our clients. As part of this goal, some 5 years ago we developed the Enhanced Income Overlay, which allows us to generate additional passive income from 0.25% to 1.5% per month for our clients, irrespective of market conditions, while taking on minimal risk. Since then, our clients have enjoyed consistent returns with additional income being generated from the Enhanced Income Overlay.

To help further support the Enhanced Income Overlay solution, Odyssey bolstered the Asset Management team by hiring seasoned market veteran, Max Martirani who has 15 year track record of delivering positive performance, even during the global financial crisis. Max’s CV is impressive, he has worked for some of the most well known banks and hedge funds. It is his experience that has allowed us further develop the Enhanced Income Overlay to generate positive performance for our clients’ portfolios in both bull and bear markets.

The overlay can be added to:

- An existing investment portfolio.

- A new portfolio.

- As a standalone trading vehicle.

The Enhanced Income Overlay aims to generate between 0.5% and 1.5% in income per month, this is generated by selling listed option contracts. This return is in excess of any gains and income generated or received from the underlying portfolio’s assets. We employ rigorous risk management tools and are focused on placing only defined risk option strategies to ensure that we conservatively manage the portfolios risk exposure at all times.

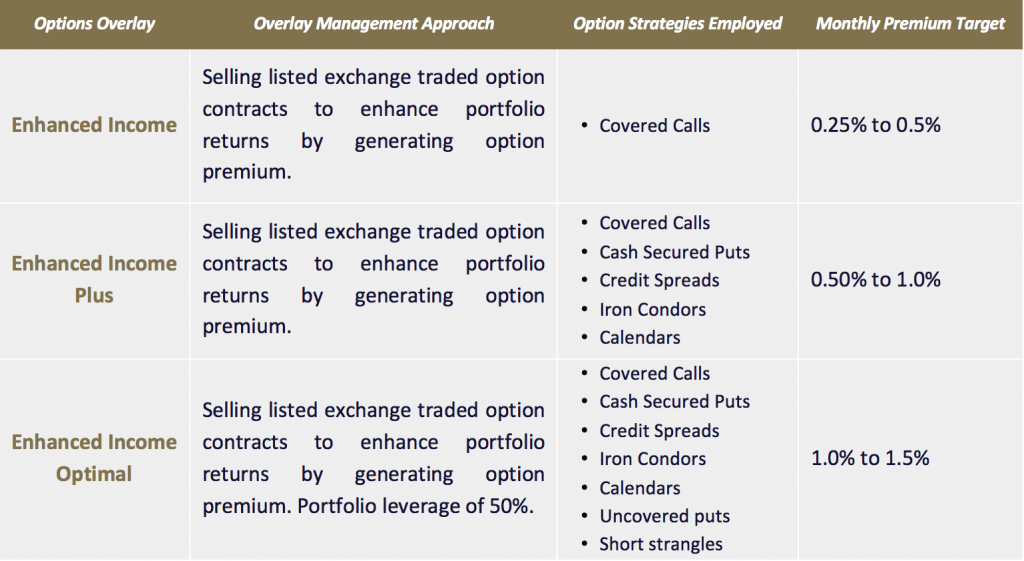

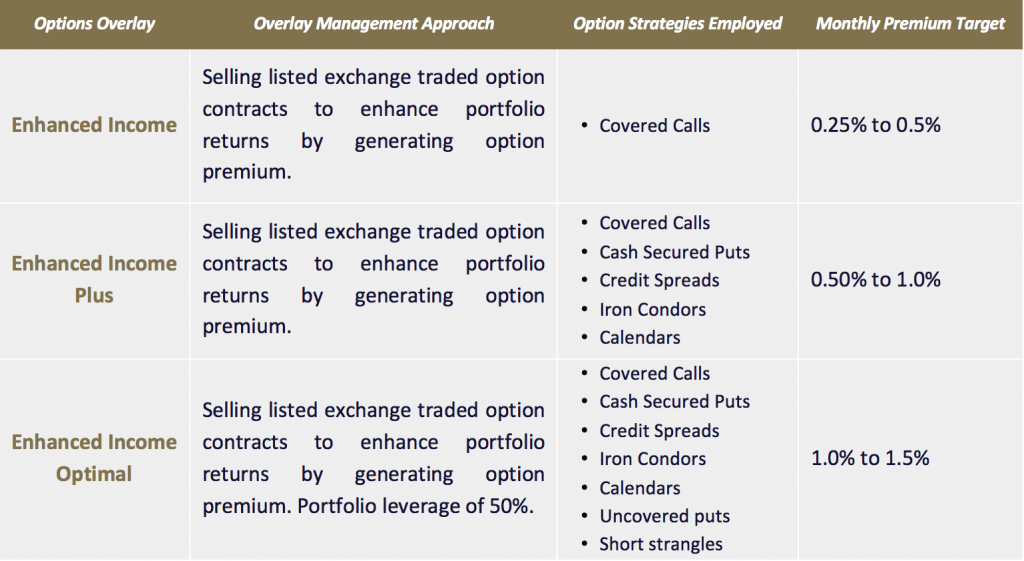

Available Overlay Choices

The following is a summary of the different overlay’s that we offer:

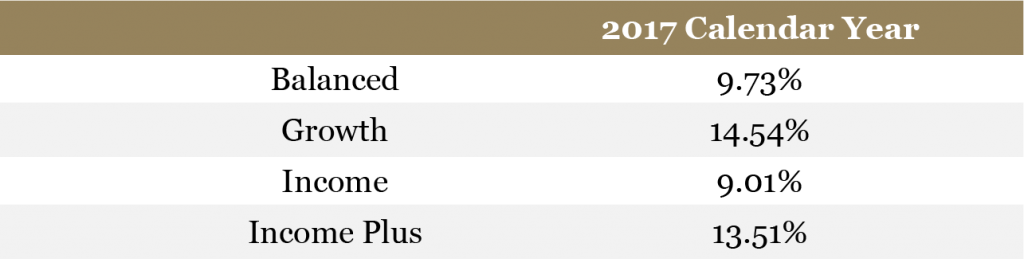

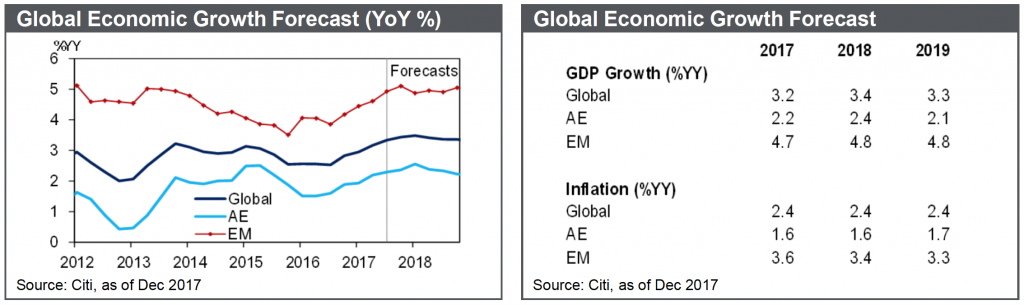

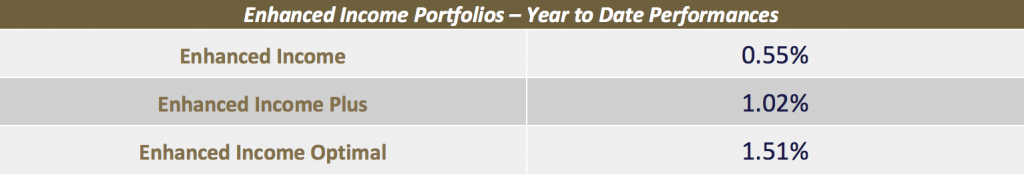

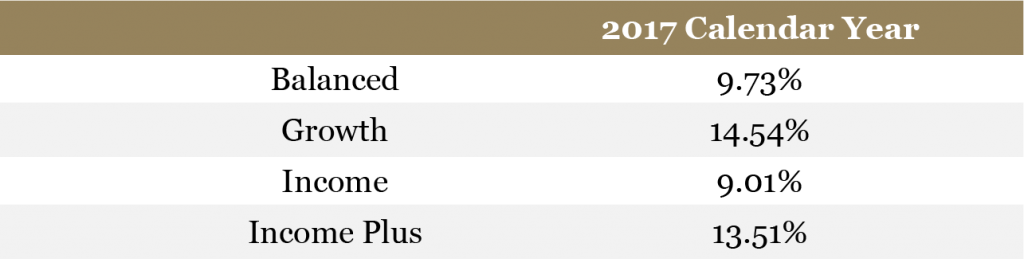

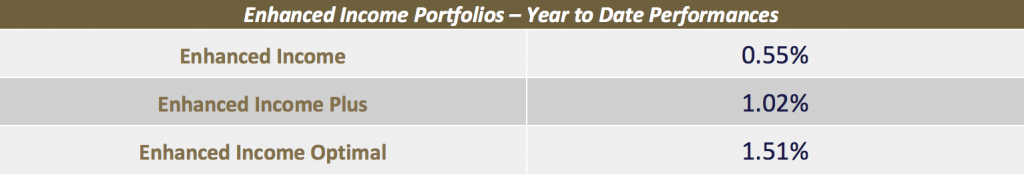

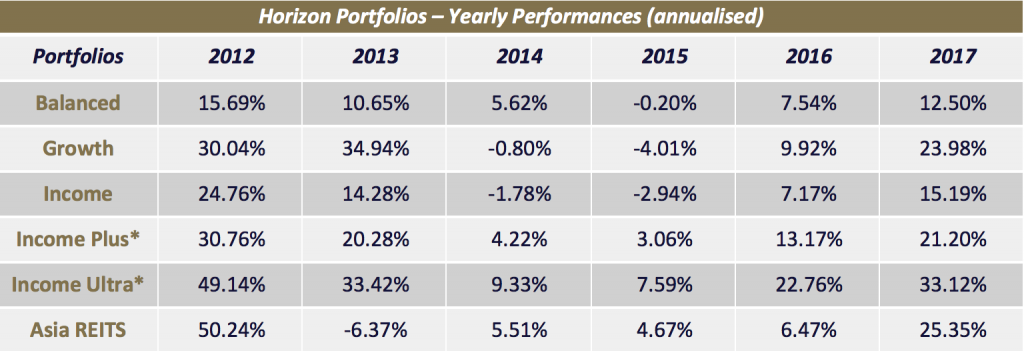

Past Performance

The following is the performance for our Enhanced Income Overlay and our inhouse Horizon Discretionary Portfolios:

*These portfolios employ the Enhanced Income Plus options overlay.

*These portfolios employ the Enhanced Income Plus options overlay.

Our portfolios have a consistent track record and have even been back tested and stress tested and have shown to produce satisfactory returns.

The option overlay will increase the portfolios returns during a bull market, but the option overlay provides real alpha to the portfolios returns as these will be enhanced during sideways and bear markets as the income generated from the option overlay provides additional yield for the portfolio.

Portfolio Manager

Max Martirani is the Managing Director of Odyssey Asset Management, with responsibility for overseeing the groups hedge fund strategies and managing the segregated portfolios.

Mr. Martirani has over 20 years of experience finance industry and working with large institutions such as Citigroup, HVB, Mizuho Corporate Bank, Banca Commerciale Italiana and Barclays.

Prior to joining Odyssey Asset Management, Mr. Martirani has been a Senior Portfolio Manager at Symmetry Investments where he manages a macro portfolio investing in global liquid assets focused on Asia and developed markets since 2014. He was a Senior Portfolio Manager at Graham Capital in London from 2012 to 2014, managing a macro portfolio investing in FX and equity derivatives.

Mr. Martirani holds a Business Administration (Hons) degree from the European Business School, London.

Odyssey Overview

Odyssey Capital Group Ltd is an international alternative asset manager that provides differentiated and bespoke investment solutions across multiple asset classes, including asset management, real estate, private equity and hedge funds. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest with its clients.

Our entrepreneurial culture allows us to generate attractive investment returns by following a prudent and long term approach. We aim to only employ the highest quality people as partners in our business, while pursuing the highest standards, and aligning out interests with those of our investment partners.

The Odyssey team have over 400 years of combined financial and operational experience across Asia Pacific, Europe and North America. This allows the Odyssey team to provide a broad regional industry expertise, insight into global macro and geopolitical trends, and a powerful network of global relationships. When clients partner with the Odyssey Group of companies, they benefit from the breadth and depth of expertise with the entire firm working in unison to achieve a targeted outcome.

Summary

In summary, our proprietary Enhanced Income Overlays provide our clients an additional source of passive income for investment portfolios. We are the only firm in Asia that offers this service and are proud to continue to provide our clients this unique service for their portfolios.

If you would like to generate additional, consistent and passive income for your investment portfolio, please contact us to find out more.

Jan 10, 2018 | Articles, Global Markets Update

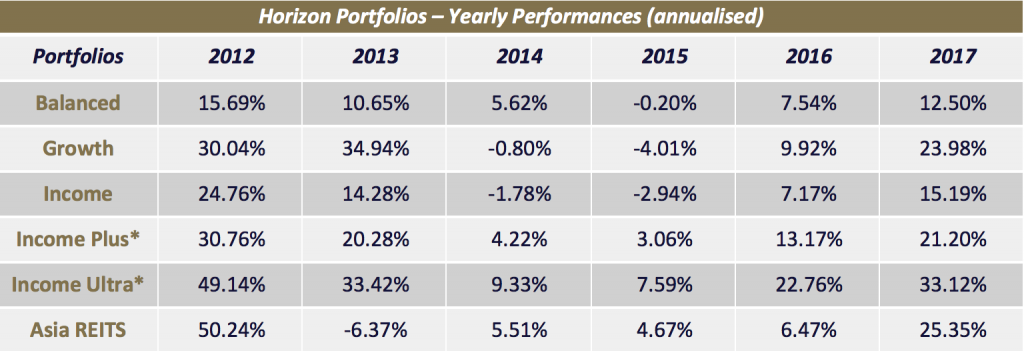

ODYSSEY HORIZON PORTFOLIOS – HOW DID WE DO IN 2017?

2017 was a successful year for our inhouse Horizon portfolios, with each portfolio outperforming its respective benchmark. In addition, a majority of our trades out performed their targeted price levels.

Our proprietary Enhanced Income Options Overlay contributed an additional 5.65% to 14.17% return for those client portfolios that took advantage of this solution. This return is in excess of any capital appreciation and income from the underlying portfolio securities.

Our successful calls in 2017:

- Overweight equities, especially Hong Kong and Japan. On a sector basis, we were long financials and cyclicals.

- We were oil bulls from mid-year with Shell and Chevron our top picks.

- We were US dollar bears, mainly versus the Euro, especially after the French Elections.

Our less successful calls in 2017:

- Taking profit too early in technology companies, indeed not being overweight enough the sector prior to the big run up.

- Expecting Europe to outperform the US, given valuations and strong upturn in growth in the Eurozone.

Horizon Portfolios

Click here if you would like to receive further information on our Horizon portfolios.

New Zealand Equity Portfolios

Click here if you would like to receive further information on our New Zealand Equity portfolios.

Enhanced Income – Options Overlay

Click here if you would like to receive further information about our options overlays.

2017: THE YEAR IN REVIEW

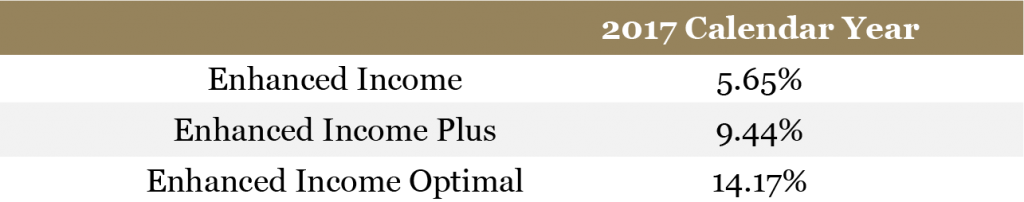

2017 was an interesting year, proving to delivering some unexpected returns, in summary:

- Global equities returned over 20% in 2017, to post their best year since the global financial crisis in 2008/9.

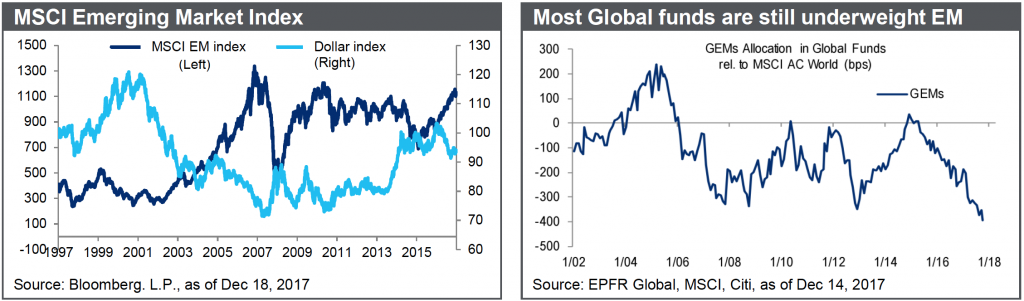

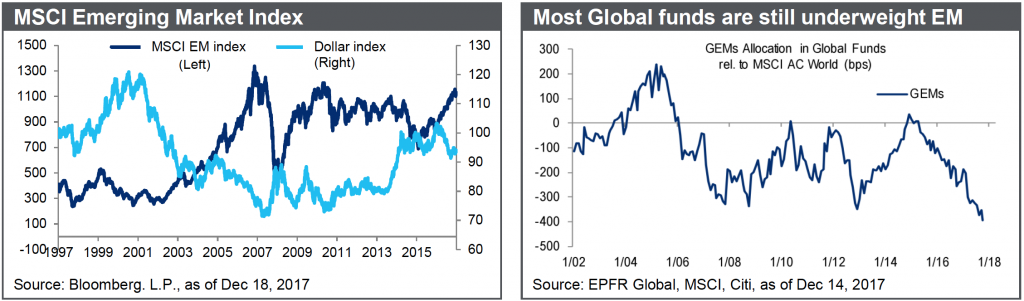

- Emerging Markets outperformed advancing 38%, compared to developed markets which finished up 20%.

- China led the way rising 54%, whilst the worst performing major market was Russia, up only 6%.

- At the sector level, it was a case of Tech versus the rest. The global IT sector outperformed by almost 15%, with Materials in second place outperforming by only 4%.Energy was clear laggard, although the sector recovered somewhat in H2 2017, alongside a 46% rebound in the oil price.

- More broadly, cyclical sectors beat defensives by 7%, but value continued to lag behind growth in both developed and emerging markets.

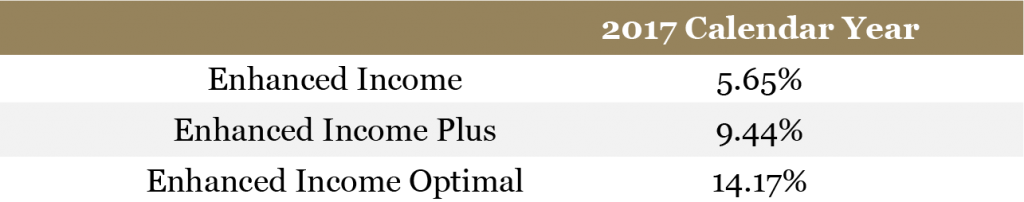

Asset Performance in 2017

- Earnings growth rebounded last year, marginally beating consensus expectations. MSCI ACWI is now expected to have delivered 15% EPS growth in 2017, up from an expected growth of 13% last January.Emerging Markets saw the biggest upward revision , and are currently expected to see earnings growth by 23%. In contrast, Europe ex-UK disappointed with expectations falling from 11% to 9%. Consensus for 2018 global EPS growth is currently 10%, with EM expected to lead again with 13% growth.

- Bonds underperformed equities especially Government bonds that were capped by more hawkish central banks.World IG returned almost 5%, while World HY performed better at almost 7%.

- Gold and Oil performed well in the commodity space up 13.7% and 12.5% respectively, whilst in the FX space the US$ Dollar was the big loser down almost 10%, with the Euro one of the main beneficiaries.

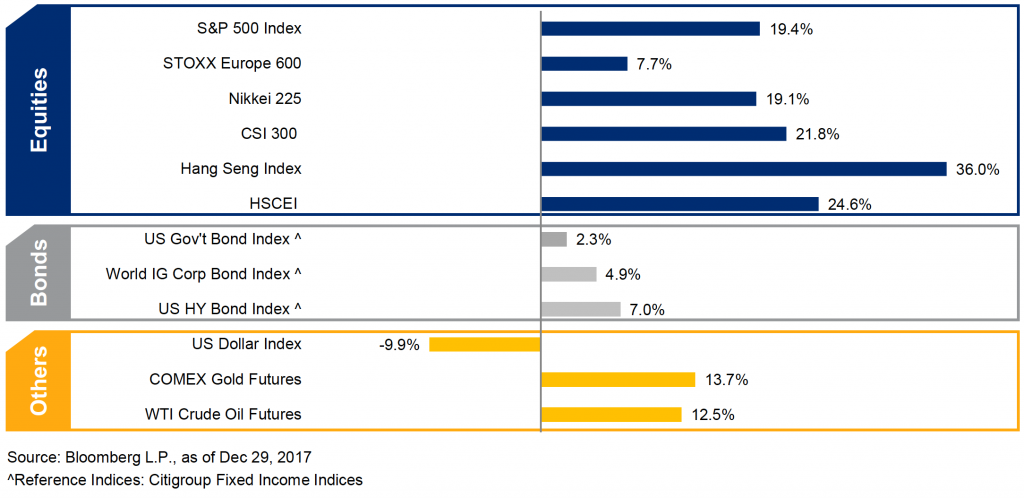

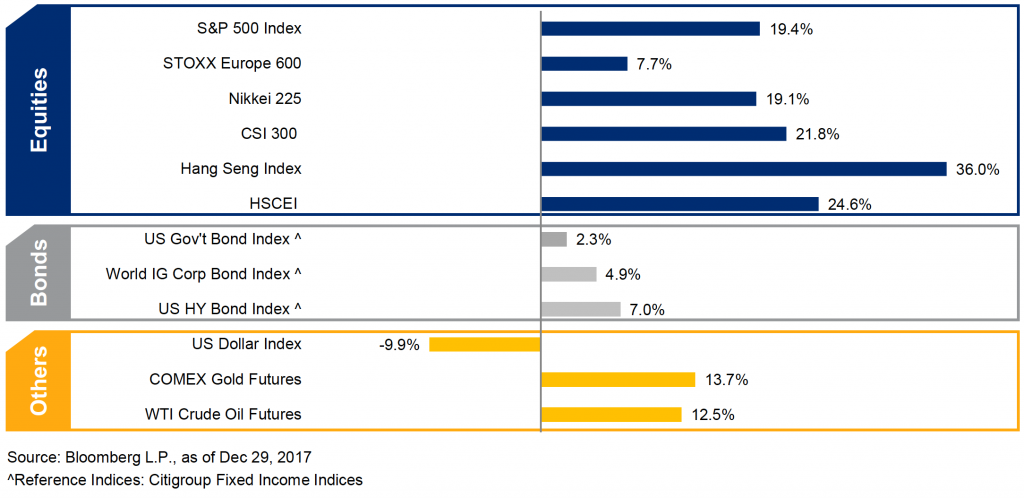

FORECASTS FOR 2018

We expect the global financial markets to make further gains this year driven by a number of key factors, summarised below:

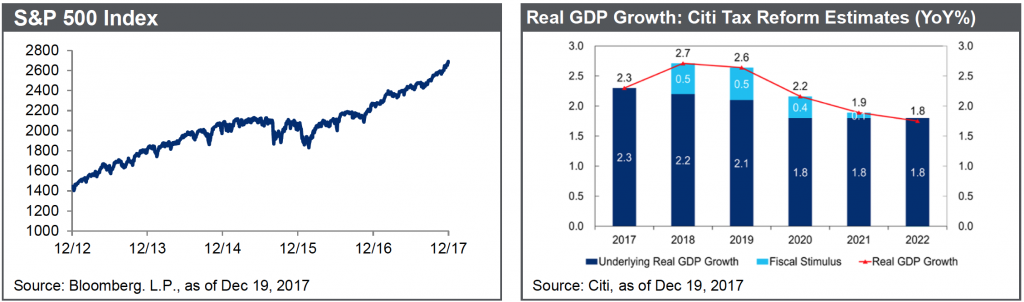

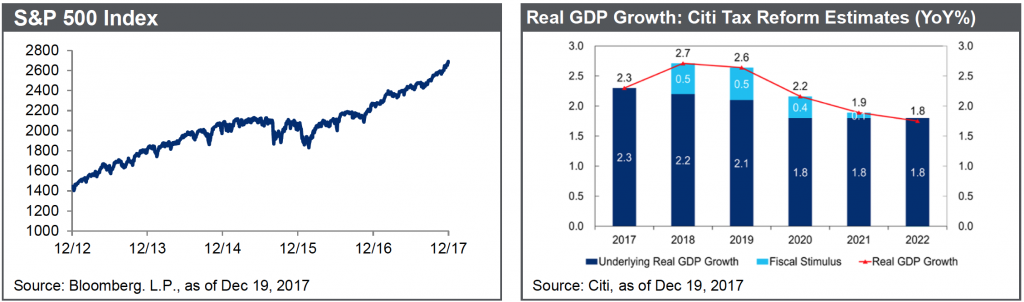

- The Trump tax policies will support US companies at least in the short term while the economy receives this alternative form of stimulus.

- Consensus real GDP growth of 2.5% in Developed Markets and almost 5% growth in Emerging Markets.

- This year would be another year of synchronized global growth.

- As the major economies will keep growing in 2018, Central Banks will continue the process of removing accommodative monetary policies, but more slowly than anticipated by the market.

- While we are bullish US stocks, we think European, Japanese and Emerging Markets will outperform in 2018

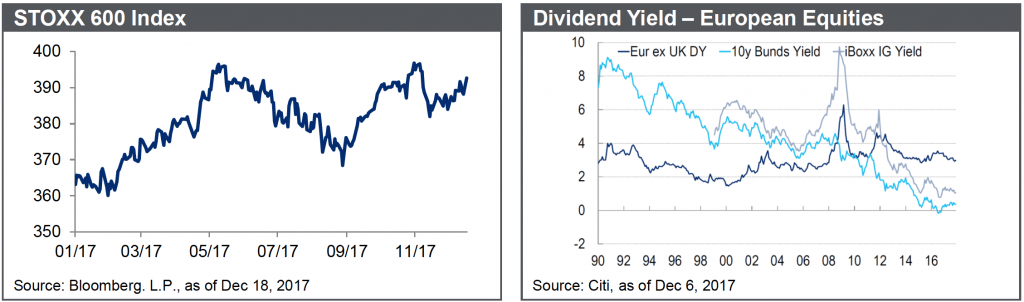

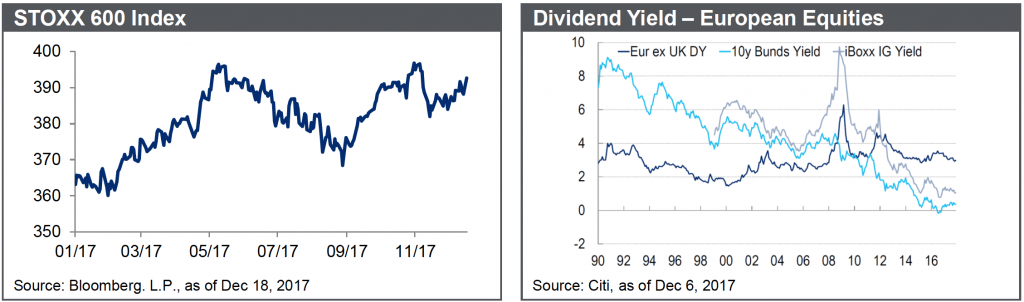

- We are overweight European equities, given the robust recovery in the Eurozone economies, and a dividend yield that is at 3 times that of corporate bond yields.

- European equity valuations are at long term PER averages of 16x PER – much more attractive than US equities at 18.5x PER for 11-13% EPS growth 2018.

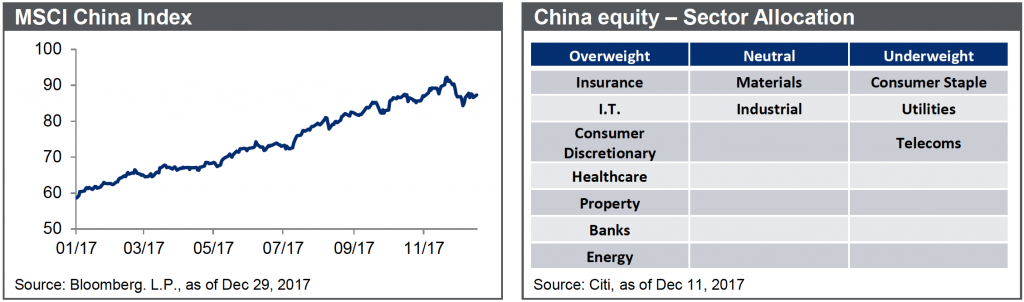

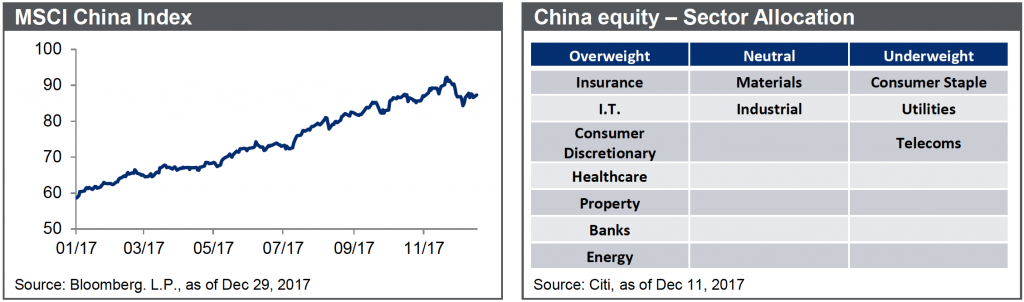

- For China, EPS growth is expected to exceed 15%.

- The market has been worried about RMB depreciation, capital outflows and an economic hard landing but these fears proved to be overblown.

- Hong Kong equities may still be supported by increasing Southbound inflows from China with EPS growth also to be expected around 15%.

- Consensus forecasts in Emerging Markets, especially Emerging Asia, are in the 12-15% range.

- Moreover, most Global investors are still underweight EM and thus could increase their holdings.

STOCKS WE LIKE – OUR TOP 10 FOR 2018

Click here if you would like to receive further information on our 2018 top stock picks.

MARKETS OVERVIEW

Equities – New highs as global expansion continues

- Equities remain our preferred asset class, even after the strong run-up in 2017, we still expect positive returns in 2018 supported by the continuing expansion and earnings strength, although we see more muted returns than in 2017

- Within Developed Markets, we prefer Europe and Japan, where valuations are supportive and whose economies are relatively more levered to the global cycle and the rebound in global investment spending is greater than in the US. Globally, we prefer Emerging Markets equities relative to Developed Markets.

- The US tax reform could lead to an additional 1.5% of GDP growth over the next 4 years, albeit at the expense of an increased deficit and the rising debt burden.

- According to Citi a 21% tax rate could add $8 to 2018 EPS, and the consensus 2018 year end target for the S&P500 year has been raised to 2,800.

- Sectorwise we still favour Financials, Consumer Discretionary, Telecoms, Industrials and Health care, with the Technology sector as the usual wild card.

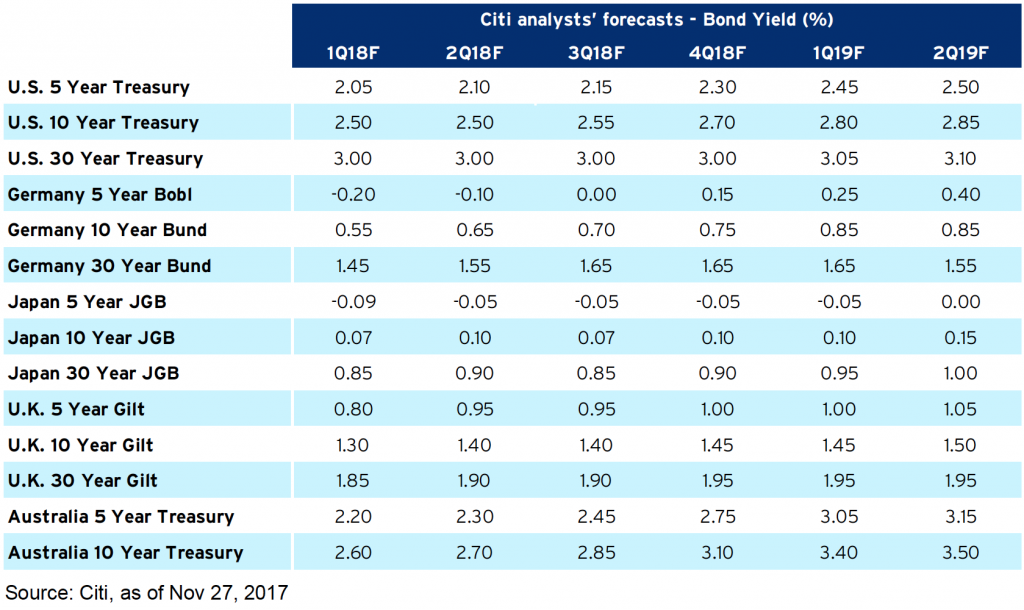

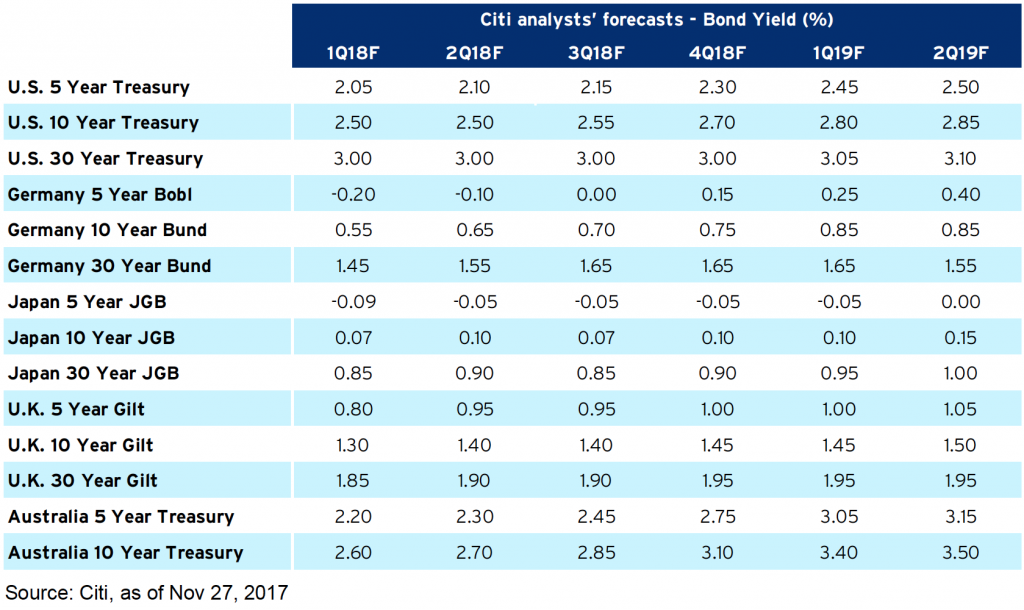

Bonds – Bearish

- We are bearish on Government Bonds, given the very low yields, and the fact that Central banks across the World will keep raising rates and normalising monetary policy.

- More broadly, the risk of greater fiscal expansion in the US, discussions about the Fed adopting a higher inflation target and the risk with respect to reduced global QE all suggest that yields will rise.

- After another move at the mid-December meeting we see the Fed pushing through 3 more hikes in 2018. Monetary tightening will come from balance sheets adjustments as well as interest rates increases. The Fed is already shrinking its balance sheet, and ECB purchases are set to finish by the end of 2018. With Japan already proceeding at a slower pace, overall G3 balance sheets are set to peak in 3Q 2018.

- Nevertheless, risks to developed market investment grade bonds are not severe, and we think will produce a positive return, although yet again underperforming equities.

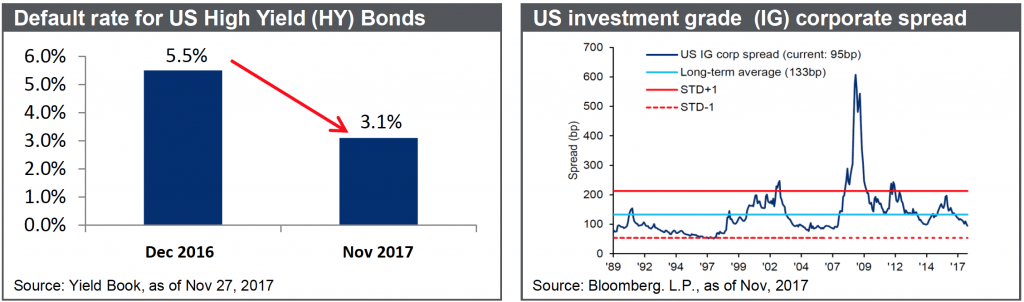

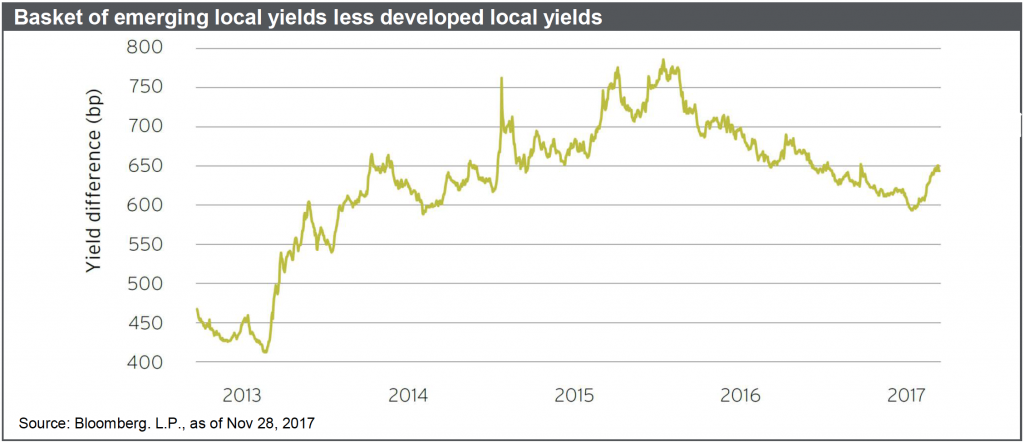

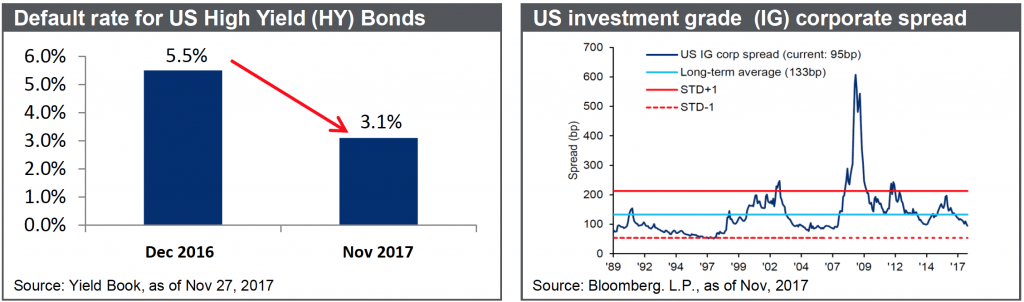

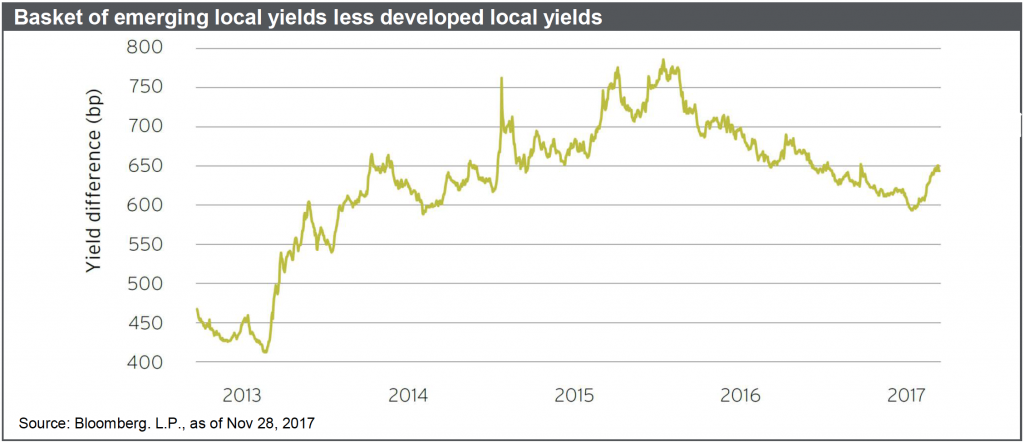

- High Yield and especially Emerging Markets bonds would be our favourite place to invest in the Fixed Income space.

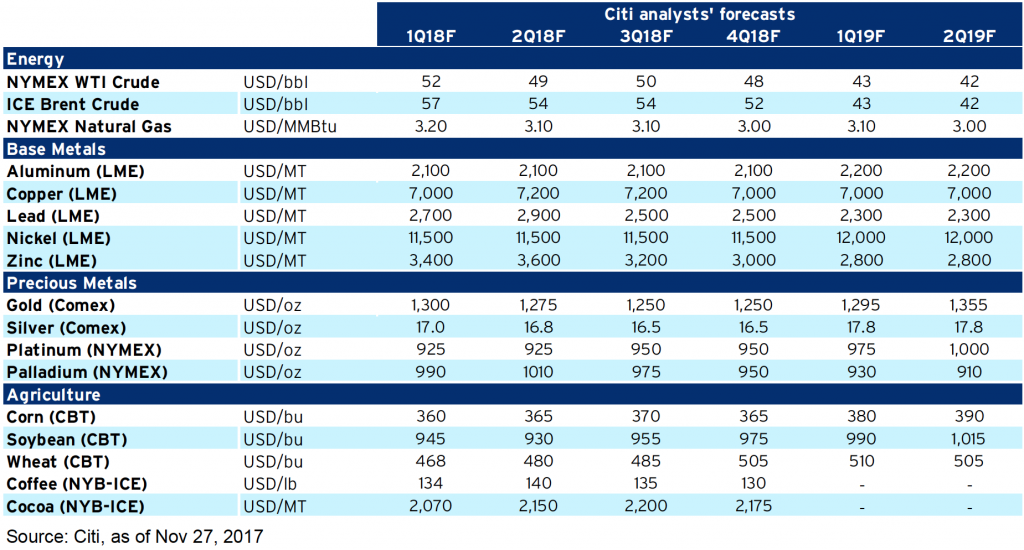

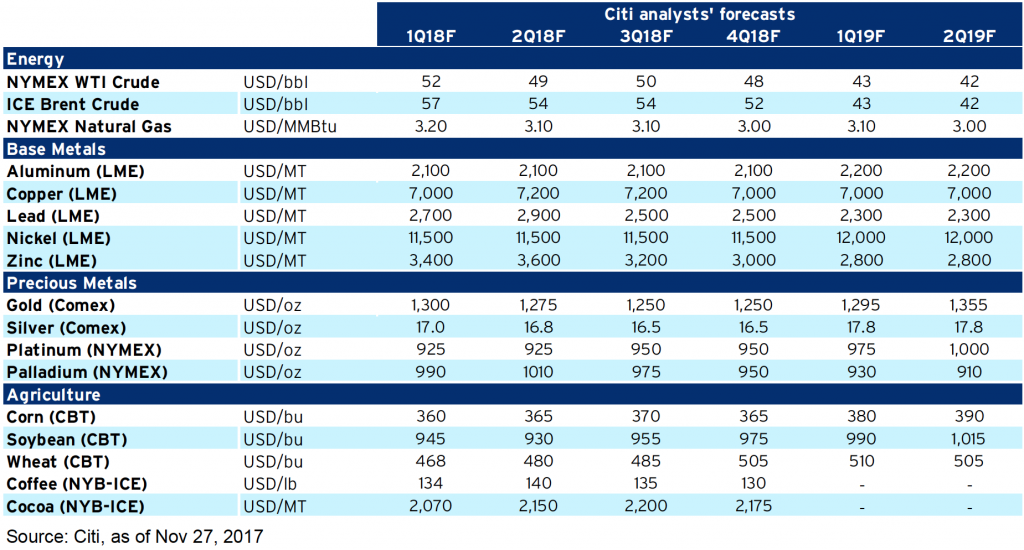

Commodities – Expected Range Markets

- We remain bullish on Oil as the OPEC agreement to restrict supply is holding together better than we expected, even though the recent up move has exceeded our expectations.

- While oil demand has been growing at a steady pace, US production has recovered from the effects of the hurricane, and so the US rig count is improving again, as drilling is responding to the recent strength in prices.

- We are neutral on Gold as we see the market poised to hover between 1,200 and 1,300. While a strong stock market will reduce the need for a safe heaven, the weak US dollar will give gold some king of support, meaning that we will not see a pronounced sell off.

Currencies – Consensus bearish on USD we remain neutral to slightly bearish

- After the hard sell off of the Dollar in 2017, consensus is for a continuation of the same trend in 2018. While the Fed will continue hiking rates, as will many other Central Banks, and unless the Fed becomes much more hawkish, the Dollar will find it hard to stage a real comeback.

- We still favor the Euro, as well as the Australian Dollar, New Zealand Dollar, with the British pound as the potential wild card.

- We would expect higher yielding Emerging Markets currencies also to perform well in this environment.

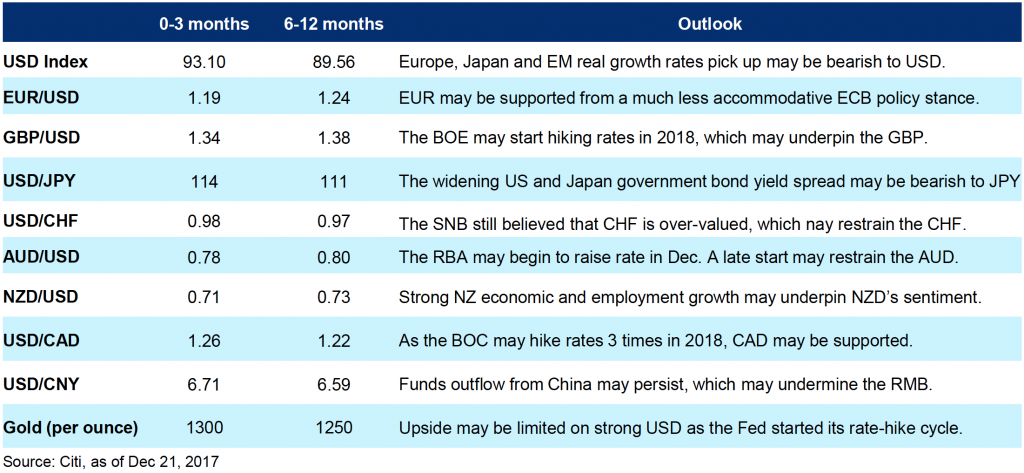

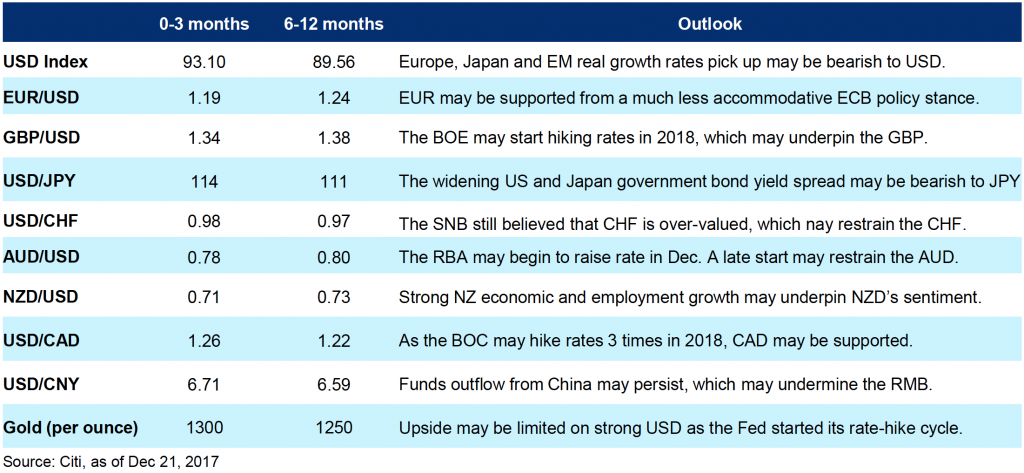

Foreign Exchange Forecasts

RISKS FOR 2018

While we are optimistic about 2018, there are of course risks to our constructive base case scenario:

- Geopolitical events: North Korea risks albeit abating, Saudi Arabia and Iran tensions, the Spain-Catalonia crisis, elections in Italy and implication for the euro, a sudden drop in Chinese economy, and a negative end of the NAFTA talks with implications for trade relations around the world.

- Potential central bank’s policy mistakes (J Powell takes over at the Fed in February, and Draghi will step down next year).

- The return of inflation, that would compromise the current Goldilocks scenario.

HOW WE MANAGE RISK – PORTFOLIO PROTECTION, HEDGING & TAKING PROFITS

As opposed to just going to cash, we prefer alternative strategies such as hedging via options and option writing strategies to smooth out portfolio volatility. We also actively monitor profits using trailing stop losses with the view of protecting and locking in gains.

PORTFOLIO MANAGEMENT SERVICES

Please let us know if you would like to hear more about our Discretionary Portfolios or how we can create tailored portfolio based on your investing needs.

PORTFOLIO OPTIONS OVERLAY SERVICE

If you are interested in receiving an additional 0.5% to 1.5% per month in income on your portfolio, please enquire about our Portfolio Options Overlay service.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at. Please contact us at contact@odysseycapital-group.com or on +852 2111-0668.

Click here if you would like to receive further information on information on other investment opportunities that we are investing into for 2018.

(Kagetsu Ryokan Room with outside Bath)

(Kagetsu Ryokan Room with outside Bath) (Kagetsu Ryokan In-house Onsen)

(Kagetsu Ryokan In-house Onsen) (Fudotaki Falls in Echigo Yuzawa)

(Fudotaki Falls in Echigo Yuzawa)  (Local Echigo Yuzawa Hot Springs)

(Local Echigo Yuzawa Hot Springs) (Yuzawa River)

(Yuzawa River)  (Yuzawa Chuo Park)

(Yuzawa Chuo Park) (Kagetsu Ryokan Entrance)

(Kagetsu Ryokan Entrance) (Kagetsu Ryokan Deluxe Room)

(Kagetsu Ryokan Deluxe Room) (Kagetsu Ryokan Banquet Hall)

(Kagetsu Ryokan Banquet Hall)

*These portfolios employ the Enhanced Income Plus options overlay.

*These portfolios employ the Enhanced Income Plus options overlay.