Apr 13, 2018 | Articles, Global Markets Update

HOW WE ARE POSITIONED FOR THE BEGINNING OF Q2 2018

After the wild gyrations and heavy plunges in February, we experienced more downside in March. Since then, there has been a number of disturbing news releases which we expect will see the heightened market volatility to continue in the short term

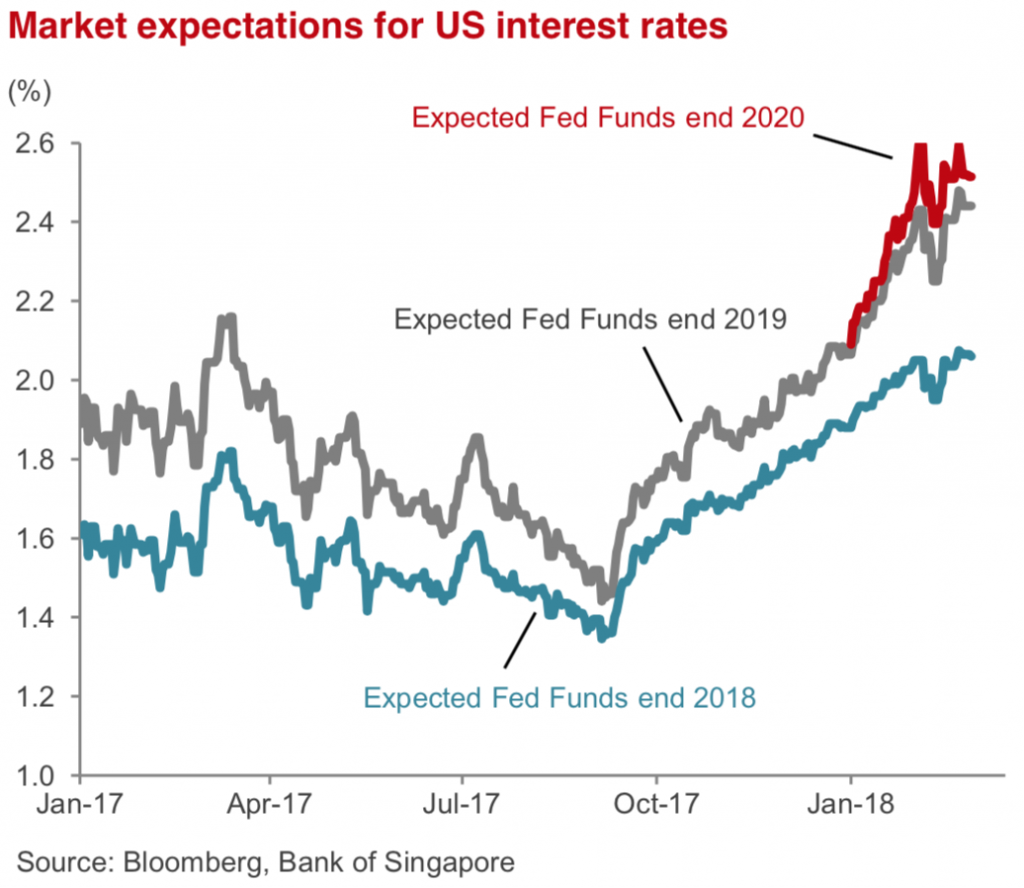

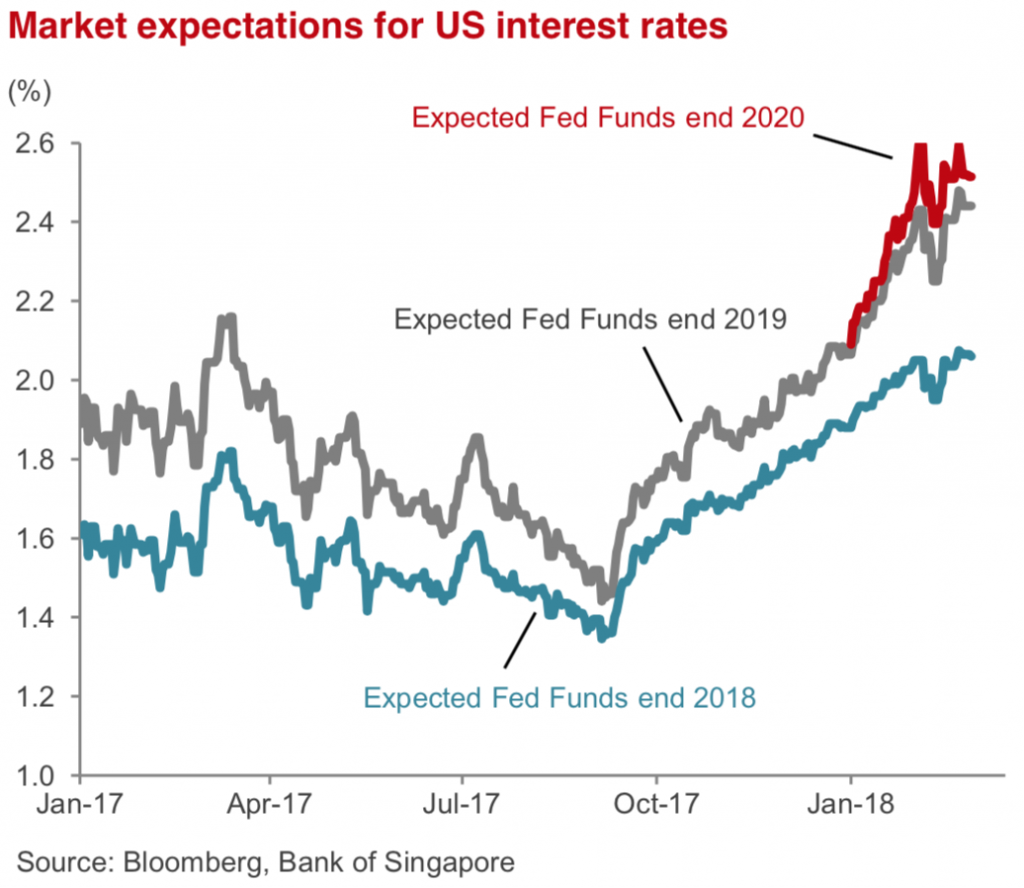

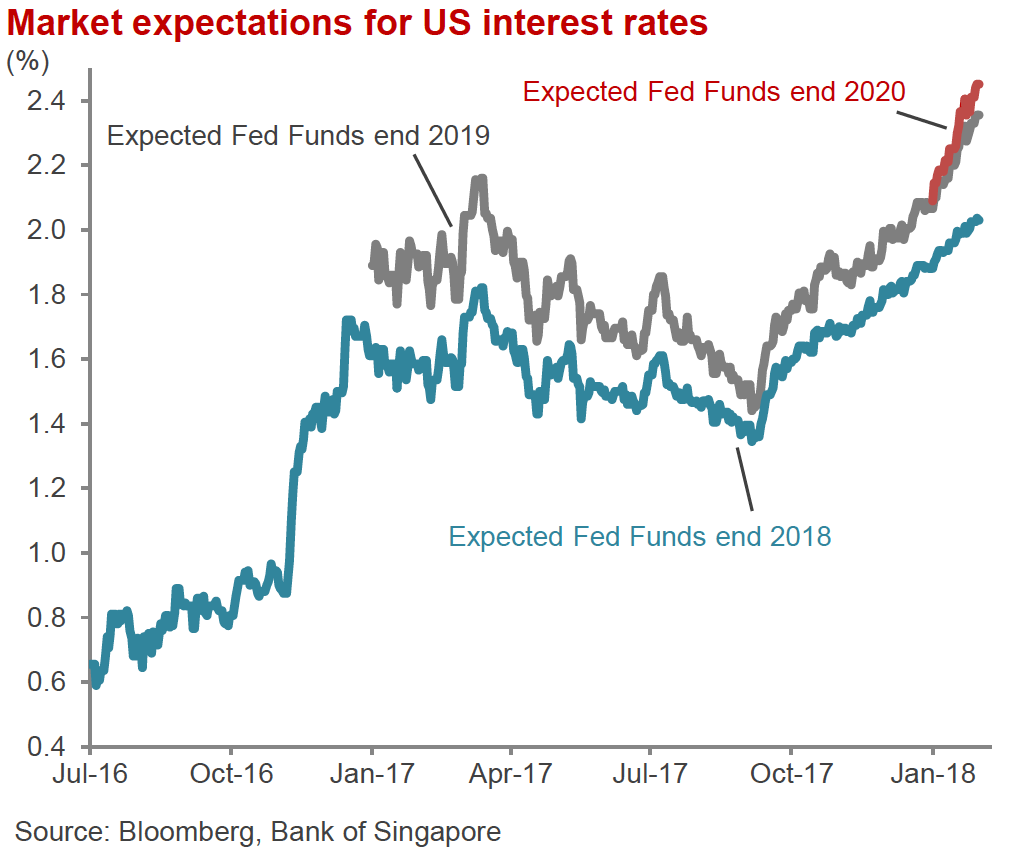

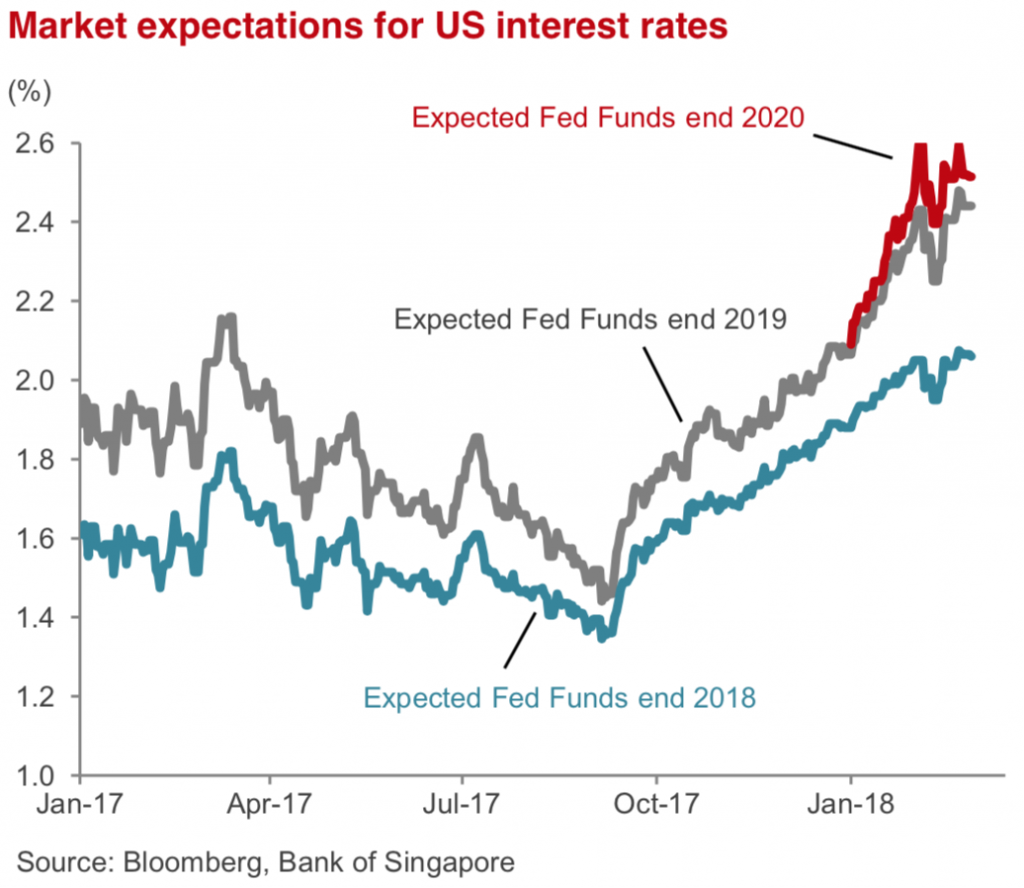

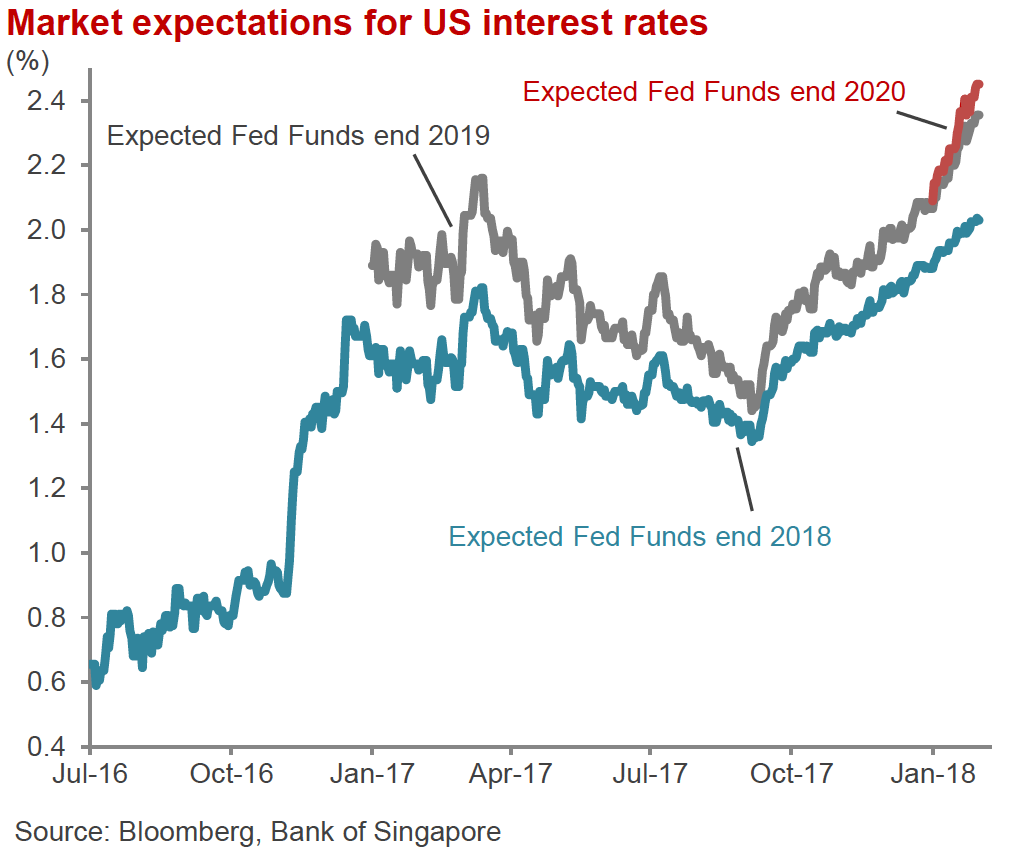

Following on from this recent market volatility, the markets experienced a sudden spike in bond yields, followed by considerable repricing of fixed income securities. This was driven by the market anticipating that the US FED will increase the speed of which it will raise US interest rates for 2018.

Following the stock market sell off, the bond yields stabilised and then actually retraced lower. Uncertainty from the US administration taking an hawkish stance on trade and menacing a real Trade War with China and other trading partners brought about additional market gyrations.

While the current environment should be supportive for stocks, the current news flow is causing real concern to short term investors and the current volatility is shaking some people out of the market. At Odyssey, we do thorough due diligence on any securities we hold in our portfolios, hence we are comfortable in riding out short term volatility. We have also taken advantage of the short term spike in volatility by selling option premium via our Enhanced Income Overlay portfolio solution.

- We still expect the Bond Markets to underperform, especially longer dated Government bonds, as the Central Banks led by the US FED will continue to raise rates and remove their accommodative monetary policies.

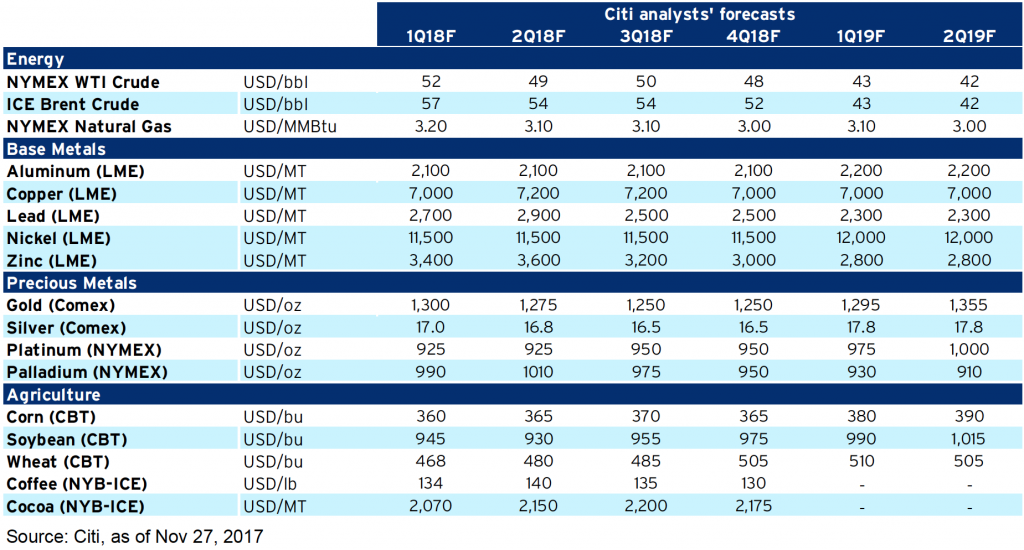

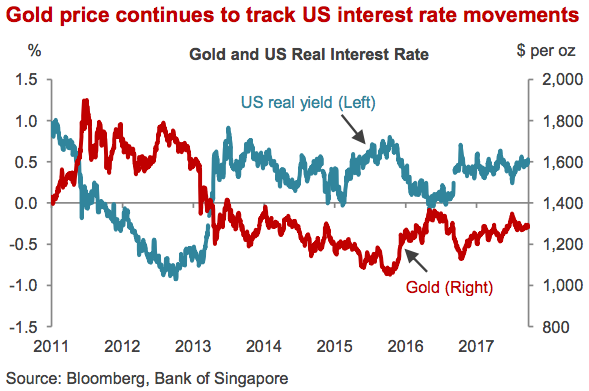

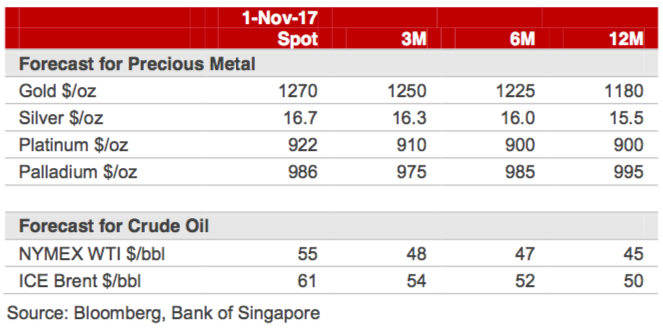

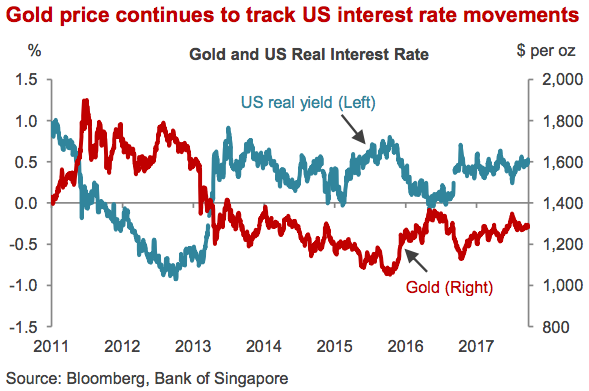

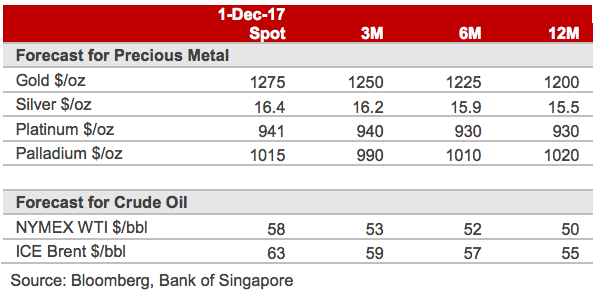

- Commodity markets are expected to remain at a mixed to stabilised levels, with Oil taking a breather after the massive run up in the past few months, we remain long term bullish oil. Gold is still trading in a range.

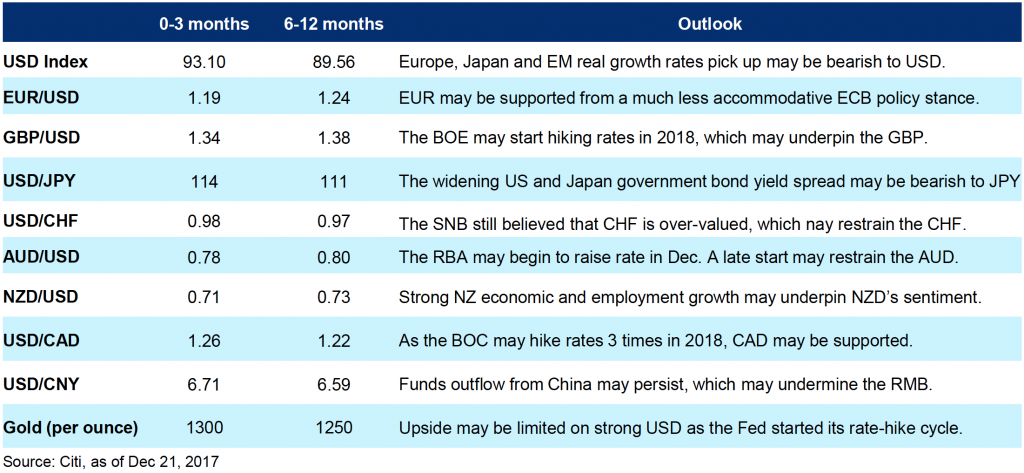

- The US Dollar is still in a downtrend for the long run, as expected rate hikes have been discounted, and the markets are now focusing on other developed economies to start their rates rises.

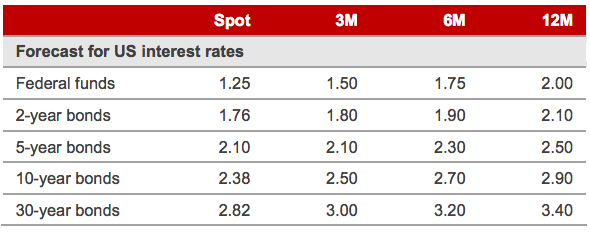

- The consensus for the FED to hike up to 3 times this year, but we see a real risk of 4 potential hikes, as the US growth and inflation are picking up.

- We are overweight European stocks, specifically because valuations are cheaper and it is our view that the EURO will keep appreciating versus the US Dollar.

- While Brexit and the Italian political impasse are likely to be negative factors, we think Europe from here will outperform the US market over the medium term.

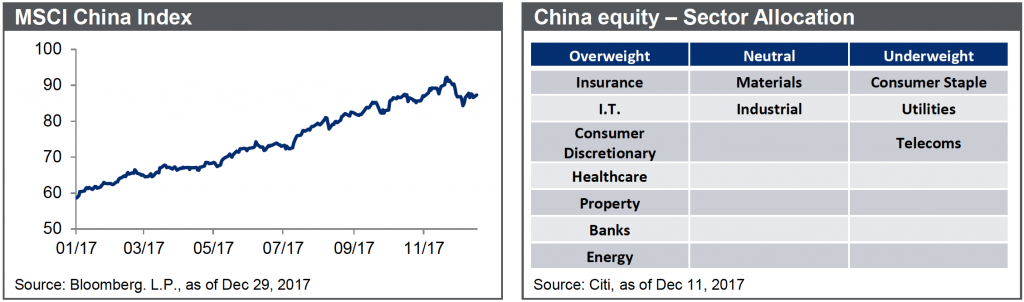

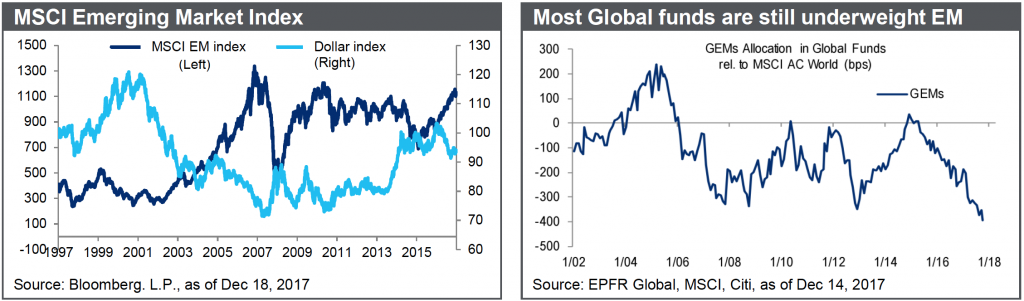

- We are in constructive on Emerging markets and China, as we see the economies growing at fast pace and in turn delivering stronger EPS growth. This said, we are becoming concerned with the US led Trade War, as well as likely contagion from the Russian Crisis.

Equities – Cautious

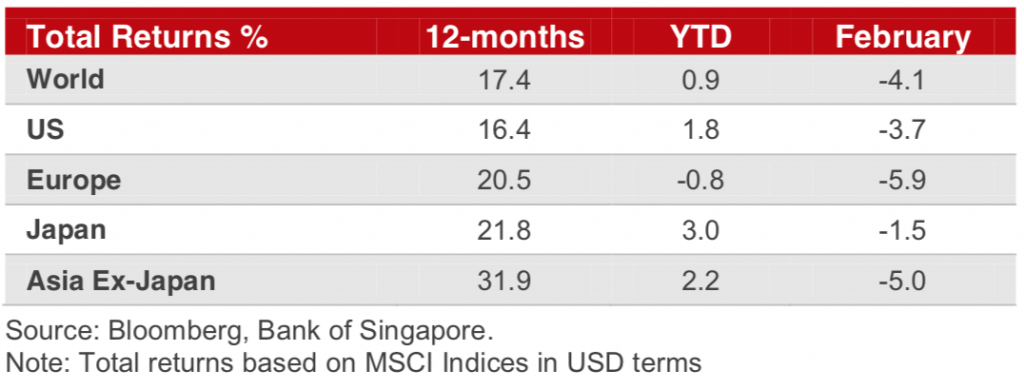

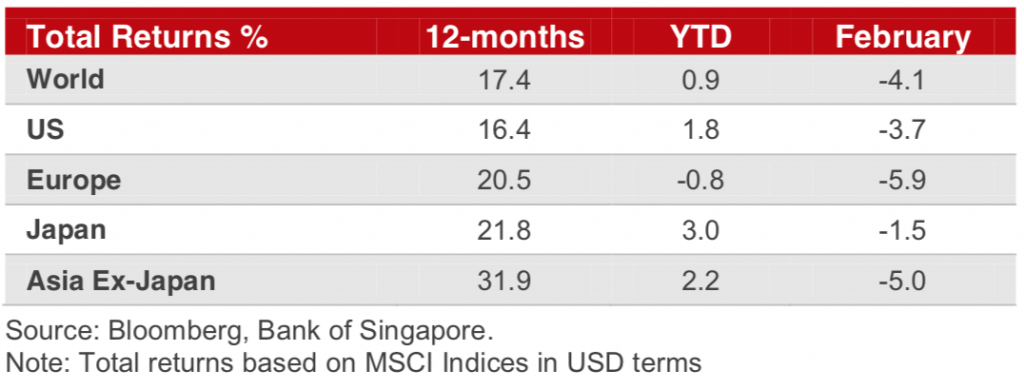

- Equities across the world had massive gyrations in the month of February, with more losses, combined with more volatility for the month of March.

- Our forecast for Year End Word stock markets is still a positive return, albeit in the single digits.

Bonds – Bearish

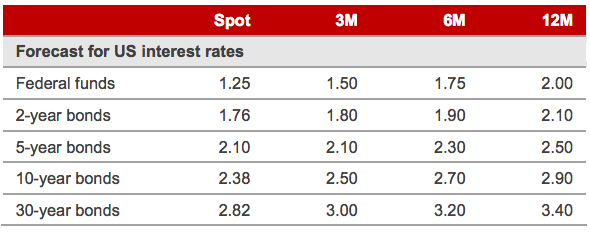

- A rising interest rate means most bond markets are vulnerable. Treasury Yields had moved up a massive 50 bps around the end of Q4 17 and Q1 18, hovering around the important 3% level. We believe the US 10yr will reach 3.25% by year end and we expect the yield curve to steepen as long dated bonds will sell off, while short dated will stay stable.

- If investors need to be positioned in fixed income, we prefer either inflation protected bonds (e.g. TIPS) or high quality corporate bonds with short durations trading at or near face value.

Commodities – Constructive

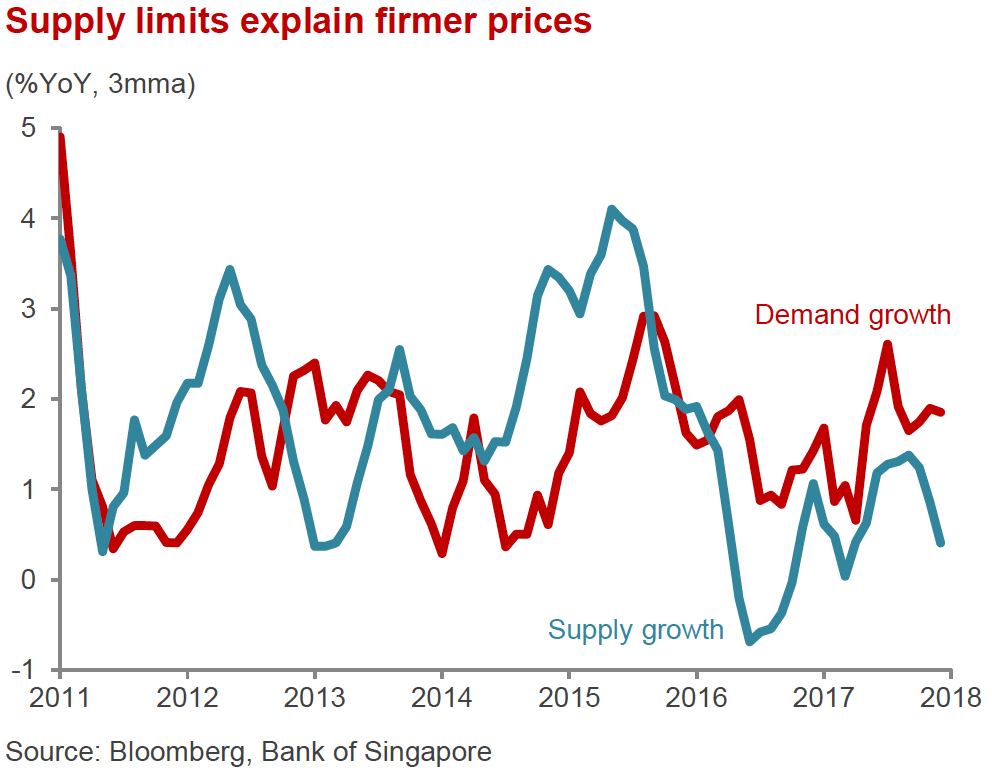

- Oil prices have rallied in the past 6 months on the back of limited supplies.

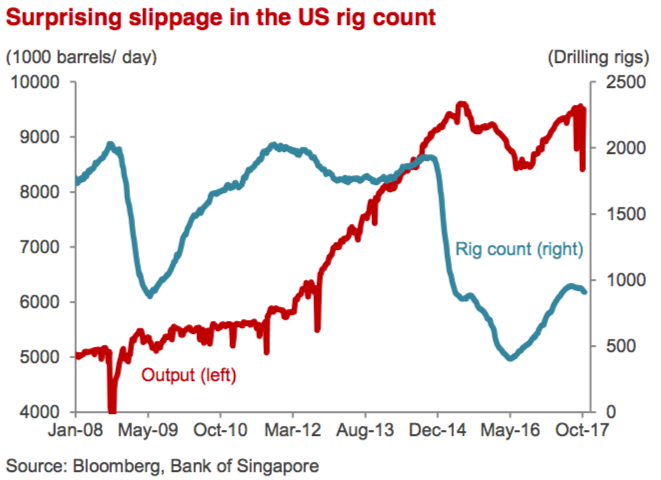

- Oil demand continues to grow at a steady pace, while the US rig counts has been increasing but at a lower speed than expected, while OPEC has been very successful at keeping the current level of production unchanged. While we think short term, we could see a correction in the price of Oil, we remain bullish for the long term. We are also watching the developments in Saudi Arabia closely.

- Gold has also recovered the recent losses taking the lead from a very heavy sell off in the US Dollar at the end of 2017 and the beginning of 2018.

- We see Gold remaining in a range of 1250/1350.

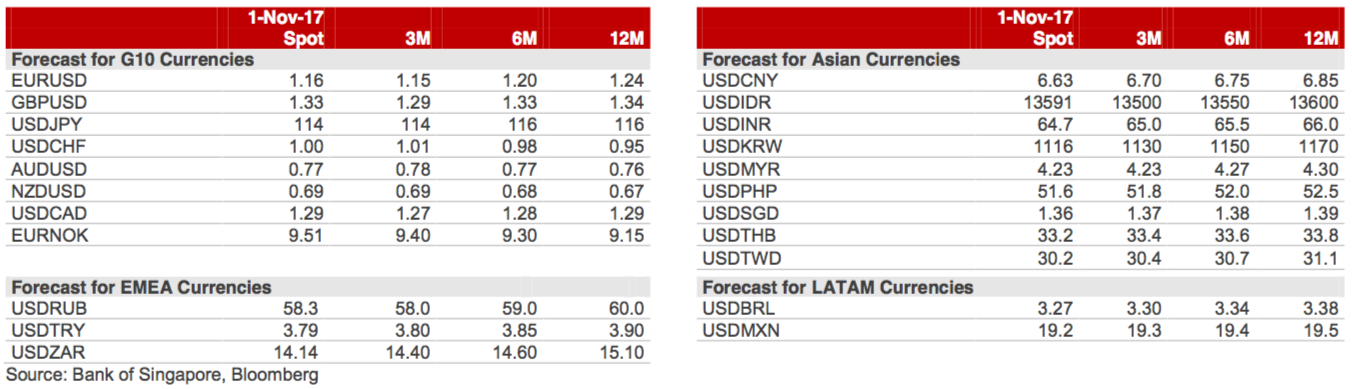

Currencies – Consensus bearish on USD

- While the passage of the Tax Cut and the rising bond yields should be positive for the US Dollar, the greenback is likely to be vulnerable in case of a real Trade War.

- Our view is the anticipated rate hikes by the Fed for 2018 are priced in, the market is focused on other Central Banks to follow and change their accommodative stance.

- While we believe that the Dollar can strengthen in the short term, we expect the downtrend to carry on in the medium term.

Alternatives – Bullish

- We are positive on selective property markets, with a preference for commercial over residential. Our favoured countries for exposure include Australia, Japan, UK, South East Asia, USA, and Vietnam. Please ask for more information on some of the projects we are currently working on.

- We also have a positive outlook on Private Equity as we see better growth opportunities, whilst lower valuations are seen across the industry compared to most stock markets.

BULLISH SECTORS

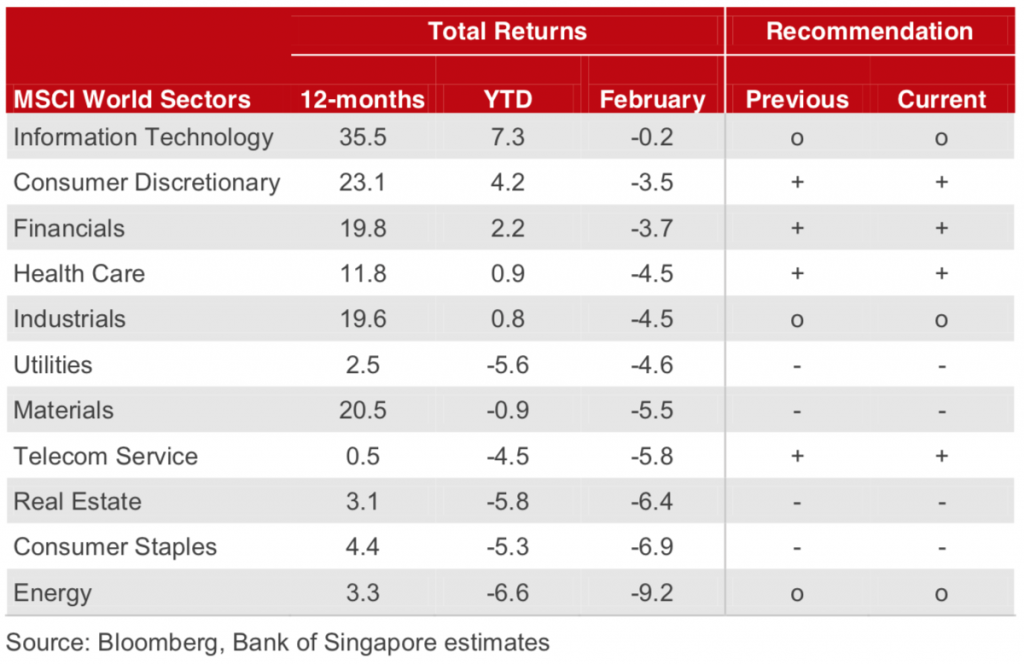

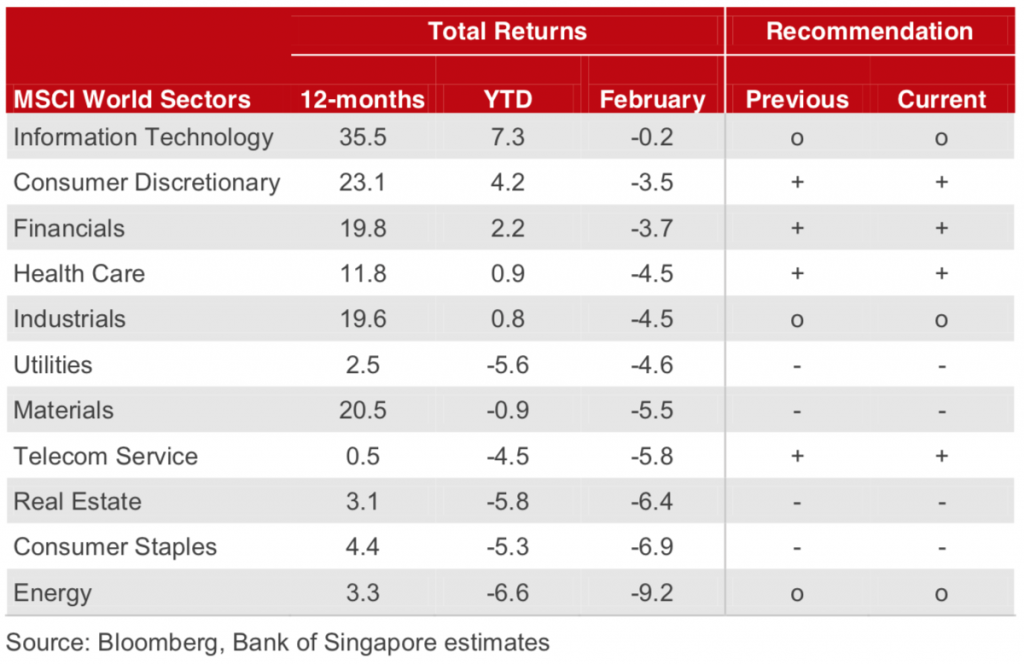

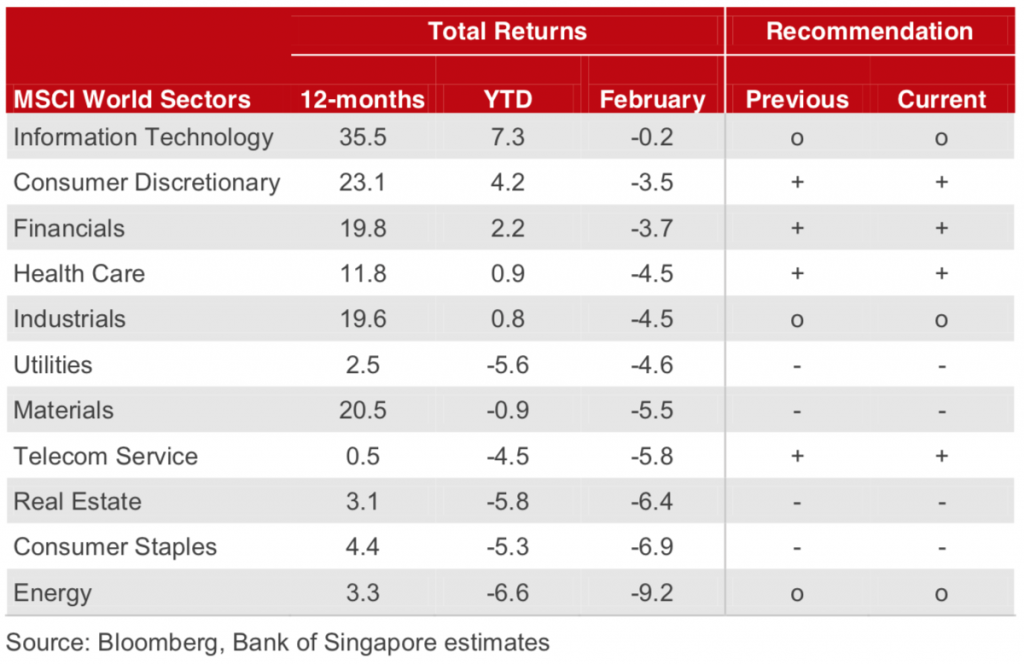

- Utilities, Real Estate and Energy were the best performer sectors in March, as investors became more defensive and risk adverse, while defensive sectors like Financials, Consumer Discretionary and Technology were the underperformers.

- Technology stocks are still a crowded sector and bore the brunt of the sharp selloff, with intensifying government scrutiny in the US and Europe and growing trade tensions. Nevertheless, Technology is still the best performing sector YTD. We remain buyers of selected Tech names on dips, but very cautious.

- We are still positive on Financials after the heavy sell off in March., and we see a renewed push up in interest rates in the US and in the rest of the world, that will benefit the banks. We expect an eventual easing of capital restrictions, which could make it easier to increase dividends and buybacks.

- We remain positive on Consumer Discretionary especially in Europe and in Asia, that will benefit from the strong growth of the economy and from sustained improvements in labour markets and consumer confidence.

- We like Energy stocks as a defensive play and a possible hedge in case of more geopolitical turmoil.

HOW WE MANAGE RISK – PORTFOLIO PROTECTION, HEDGING & TAKING PROFITS

As opposed to just going to cash, we prefer alternative strategies such as hedging via options and option writing strategies to smooth out portfolio volatility.

We also actively monitor profits using trailing stop losses with the view of protecting and locking in gains.

PORTFOLIO MANAGEMENT SERVICES

Please let us know if you would like to hear more about our Discretionary Portfolios and how we consistently generate an additional 0.5% to 1.5% per month using our Options Overlay.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at.

Mar 10, 2018 | Articles, Global Markets Update

HOW WE ARE POSITIONED FOR THE END OF Q1 2018

After the wild gyrations and heavy plunges in the markets in February, we remain considerably cautious and expect the new volatile environment to stay.

The markets took a fright from the sudden spike up in bond yields and a considerable repricing of the pace of interest rates rises.

While we see significant headwinds in the new more hawkish interest rates paradigm, we think the momentum of bond yields rises will probably slowdown from here.

This environment should be still supportive for stocks as they will benefit from the US tax cuts, unless we get a real Trade War from the Trump Administration.

- We expect the Bond Markets to underperform, especially longer dated Government bonds, as the Central Banks led by the Fed will continue to raise rates and remove their accommodative monetary policies.

- Commodity markets are expected to remain at a mixed to stabilised level, with Oil taking a breather after the massive run up in the past few months, but we are still long term bullish, whilst Gold will remain range bound.

- The US Dollar is still on a long-term downtrend, as expected rate hikes have been discounted and the markets are now focusing on other countries to raise interest rates.

- The general consensus for the Fed to hike up to 3 times this year, but we see a real risk of 4 hikes, as growth and inflation are picking up.

- We still recommend to be overweight European and Japanese stocks, as valuations are cheaper and we believe the Euro and the Yen will keep appreciating versus the US Dollar.

- Whilst Brexit and the Italian elections might be causes of short term uncertainty, we are very impressed with Europe’s economic indicators.

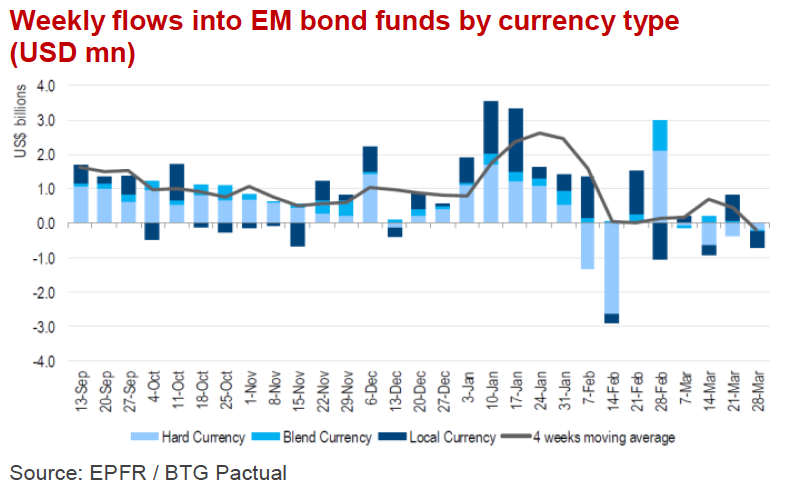

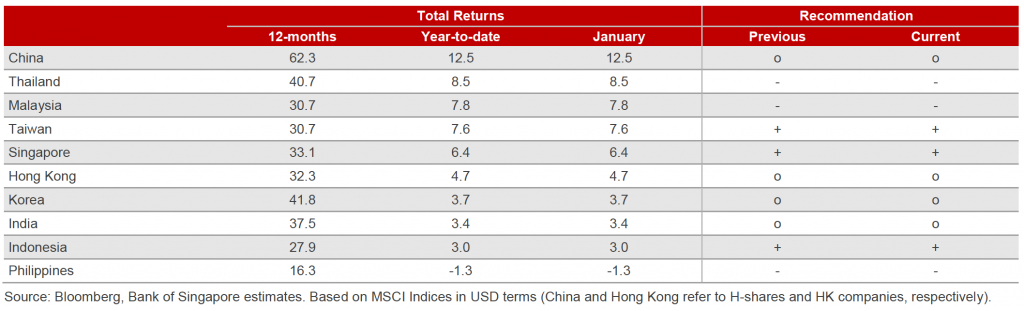

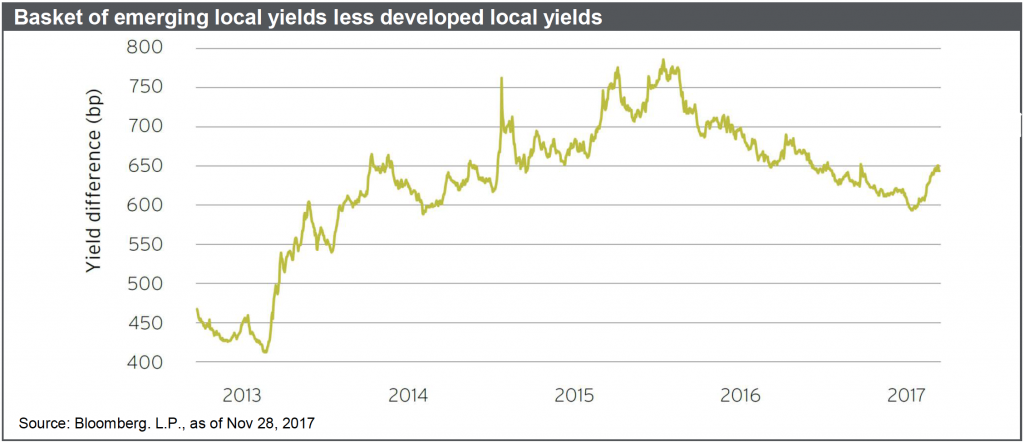

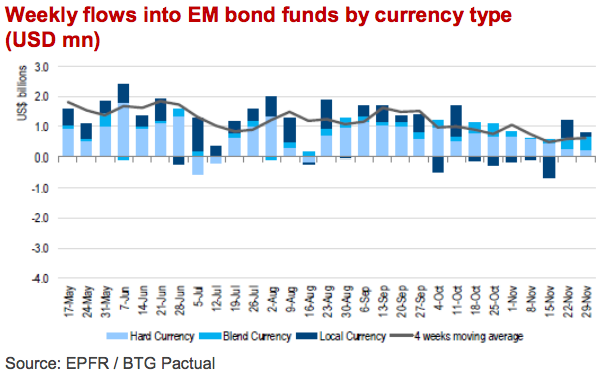

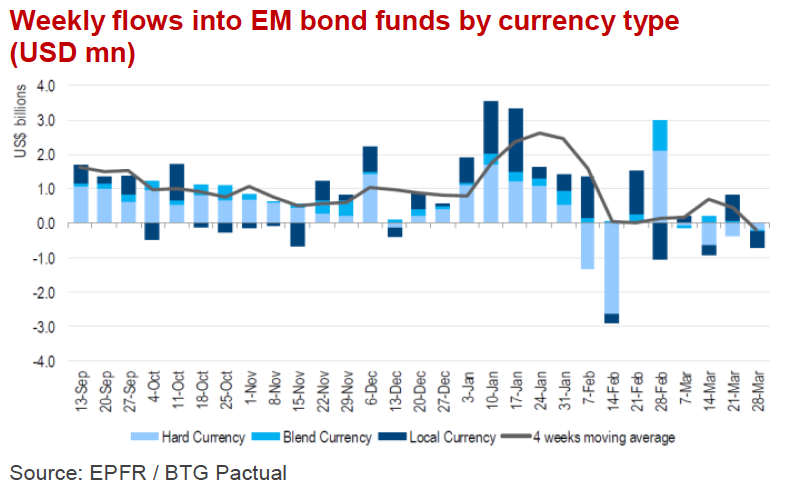

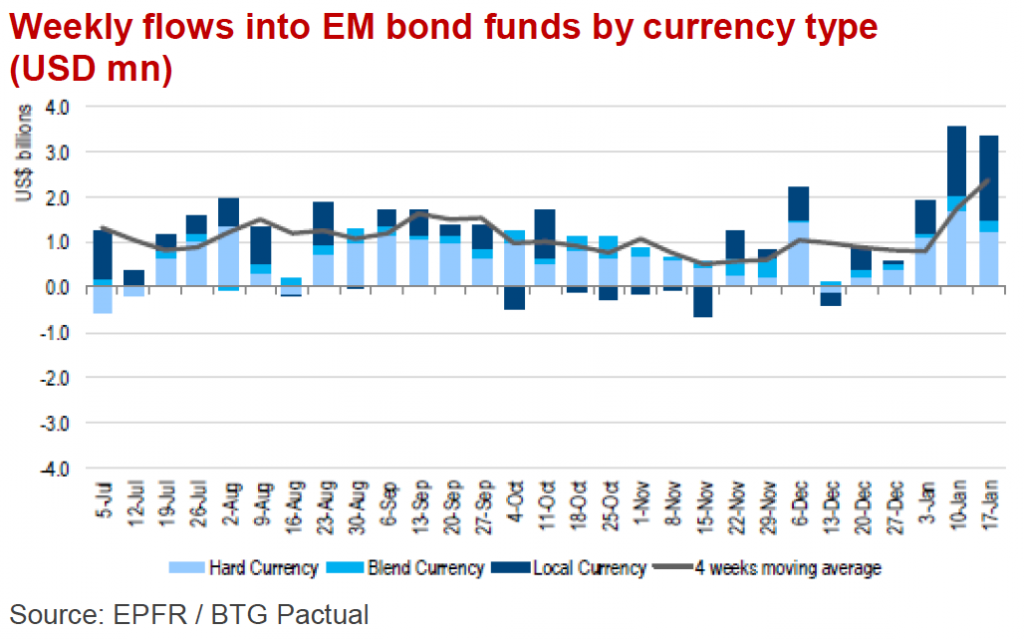

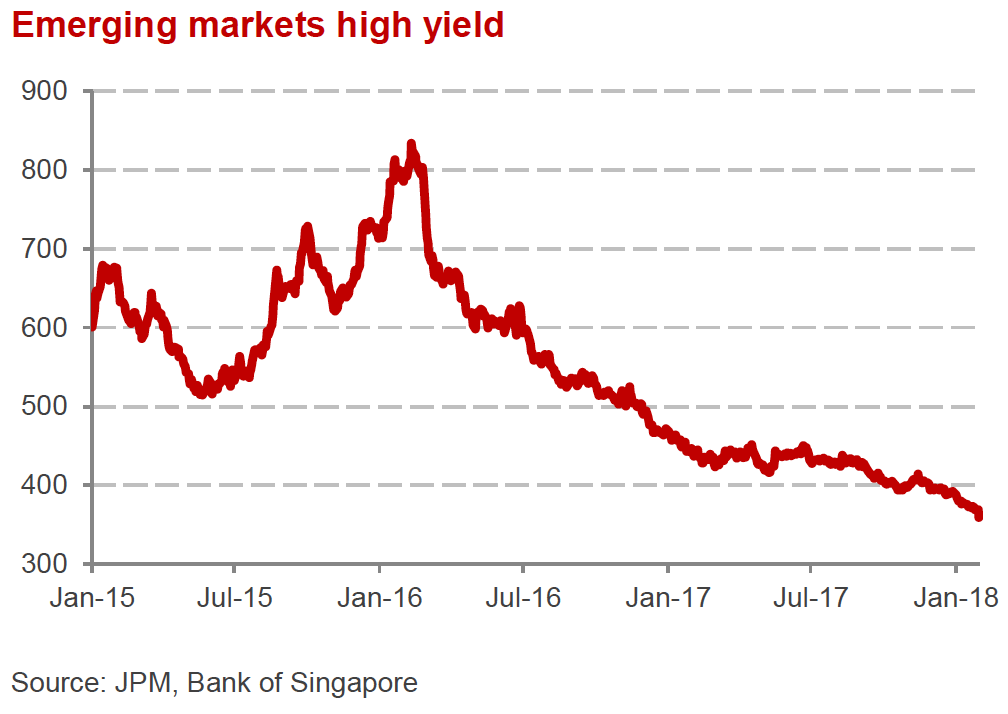

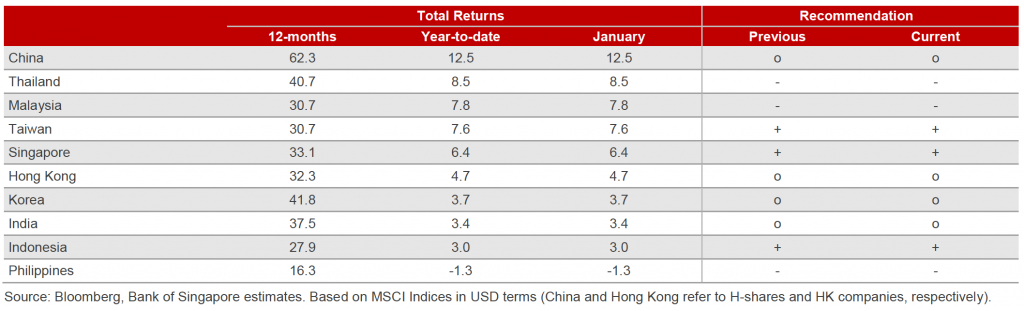

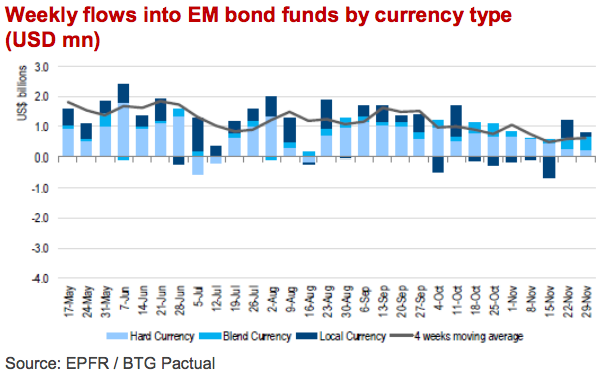

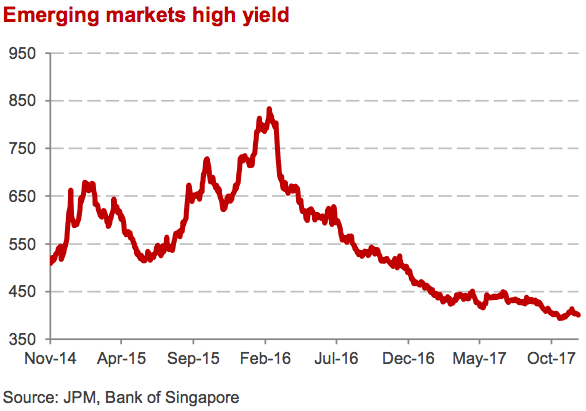

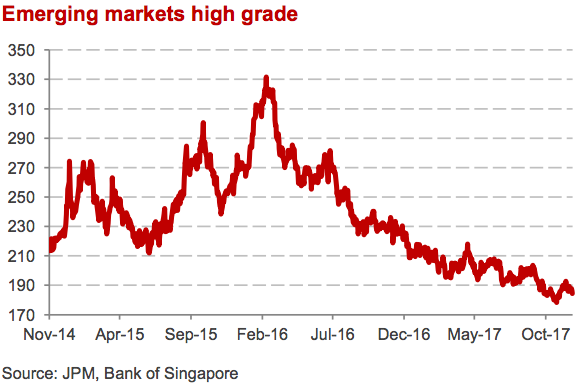

- We are still constructive on Emerging markets and China as we see the economies growing at a fast pace and set to deliver strong EPS growth.

MARKETS OVERVIEW

Equities – Constructive

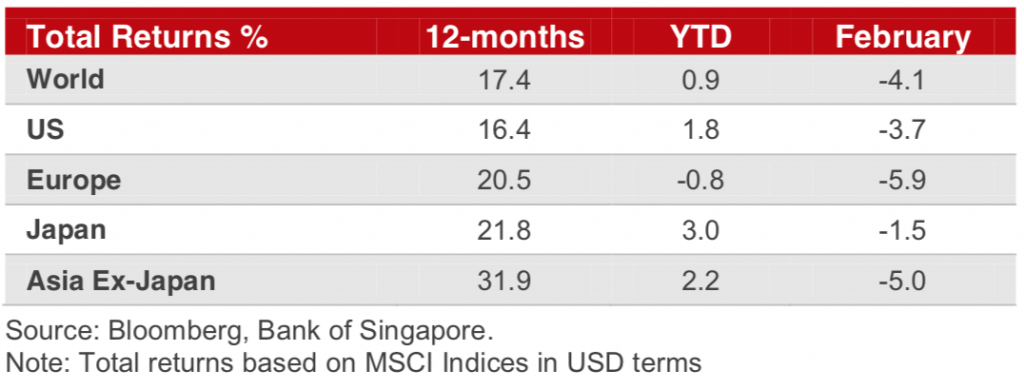

- Equities across the world had massive gyrations in the month of February, with huge losses in the first 10 days of the month, only partially recovered.

- Our forecast for Year End Word stock markets is still a positive return, albeit in the single digit.

Bonds – Bearish

- A rising interest rate means most bond markets are vulnerable. Treasury Yields have moved up a massive 50 bps in the last 3 months hovering around the important 3% level. We believe that the US 10yr will reach 3.25% by the end of the year and we expect the yield curve to keep steepening as long dated bonds will sell off, while short dated should stay stable.

- If investors need to be positioned in fixed income, we prefer either inflation protected bonds (e.g. TIPS) or high quality corporate bonds with short durations trading at or near face value.

Commodities – Constructive

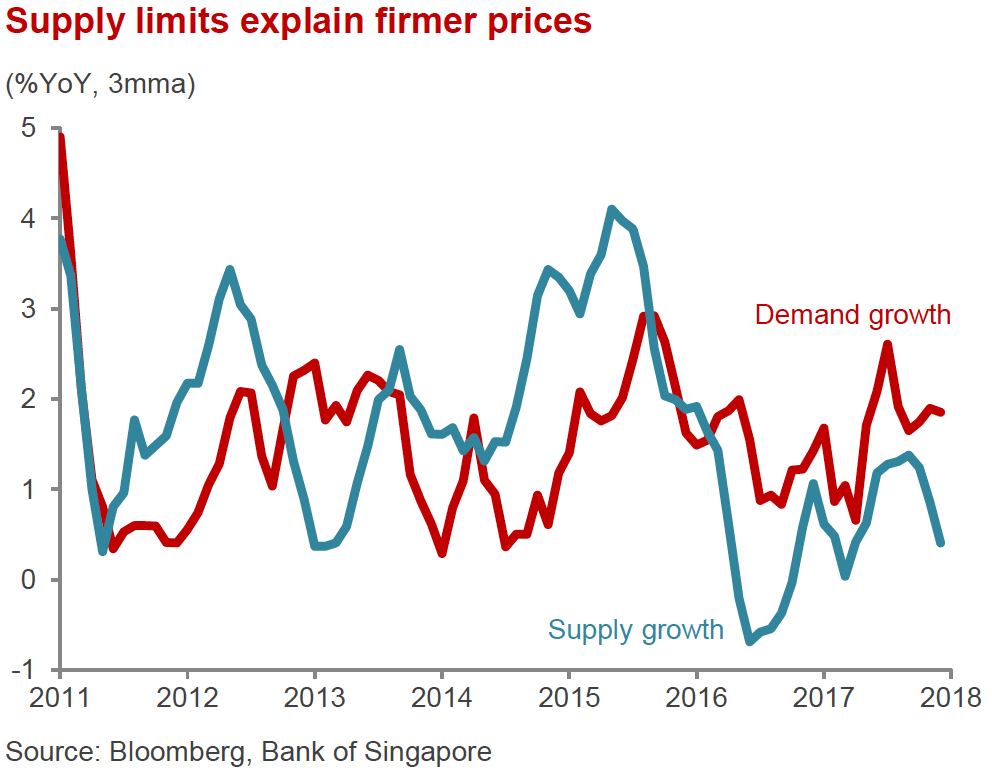

- Oil prices have rallied in the past 6 months with limit on supplies having supported prices.

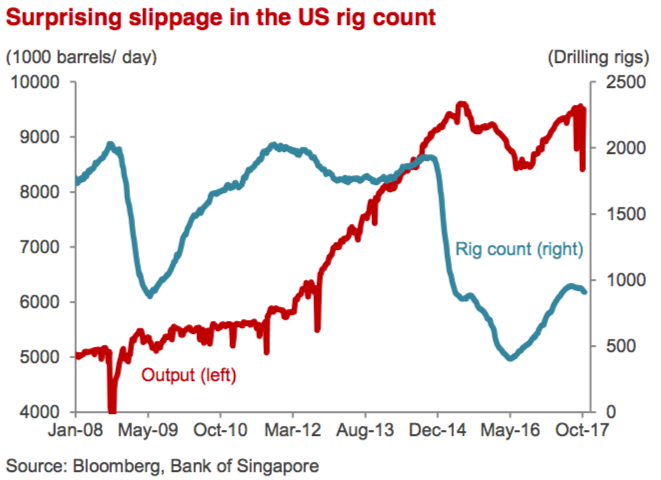

- Oil demand continues to grow at a steady pace, notwithstanding the fact that the US rig counts has been increasing but at a lower pace than expected, whilst OPEC has been very successful in maintaining the current production unchanged. While we think that in the short term we could see a correction in the Oil price, we remain bullish for the long term, being also wary of developments in Saudi Arabia.

- Gold has also recovered the recent losses taking the lead from a very heavy sell off in the US Dollar at the end of 2017 and the beginning of 2018.

- We think Gold is still in a range of 1250/1350.

Currencies – Consensus bearish on USD

- While the passage of the Tax Cut plan and rising bond yields should be positive for the US Dollar, the greenback could be vulnerable in the case of a real Trade War.

- As rate hikes by the Fed are mostly discounted, the market is focused on other Central Banks to follow and change their accommodative stances.

- While we believe that the Dollar can strengthen in the short term, we expect the downtrend to carry on in the medium term.

Alternatives – Bullish

- We are generally positive on the property markets, with a preference for commercial over residential. Our favoured countries for exposure include Australia, UK, South East Asia, USA, and Vietnam. Please ask for more information on some of the projects we are currently working on.

- We also have a positive outlook on Private Equity as we see better growth opportunities, whilst lower valuations are seen across the industry compared to most stock markets.

BULLISH SECTORS

- Technology, Consumer Discretionary and Financials were the best performer sectors in February, while defensive sectors like Energy, Consumer Staples and Real Estate were the underperformers.

- Technology stocks are still a crowded sector and initially bore the brunt of the sharp sell off, but recovered very quickly to be the best performing sector. We remain buyers of selected Tech names on dips.

- We are still positive on Financials as the sector outperformed most sectors in the February sell off. Valuations are still not expensive, and we see a renewed push up in interest rates in the US and in the rest of the world, which will benefit the banks. We expect an eventual easing of capital restrictions, which could make it easier to increase dividends and buybacks.

- We remain positive on Consumer Discretionary stocks especially in Europe and in Asia, which will benefit from the strong growth in the economy and from sustained improvements in labour markets and consumer confidence.

HOW WE MANAGE RISK – PORTFOLIO PROTECTION, HEDGING & TAKING PROFITS

As opposed to just going to cash, we prefer alternative strategies such as hedging via options and option writing strategies to smooth out portfolio volatility.

We also actively monitor profits using trailing stop losses with the view of protecting and locking in gains.

PORTFOLIO MANAGEMENT SERVICES

Please let us know if you would like to hear more about our Discretionary Portfolios and how we consistently generate an additional 0.5% to 1.5% per month using our portfolio Enhanced Income Overlay.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at.

Feb 9, 2018 | Articles, Global Markets Update

HOW WE ARE POSITIONED FOR Q1 2018

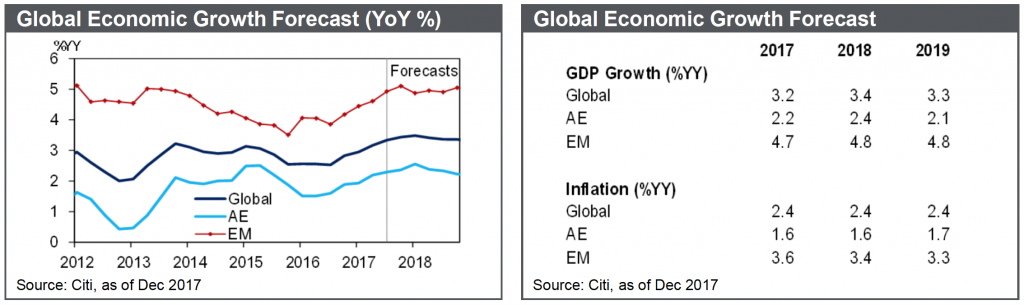

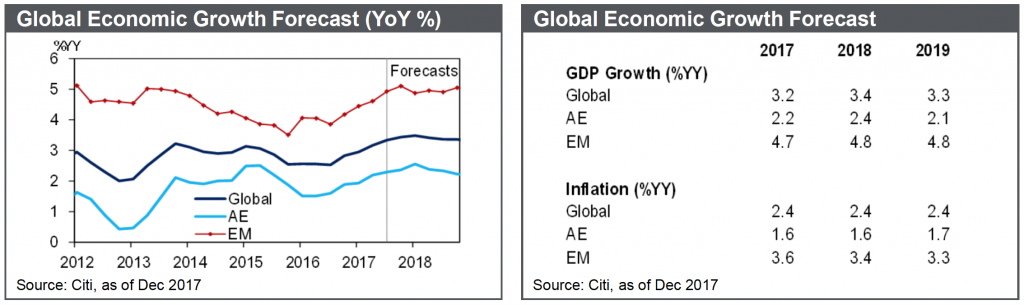

We anticipate that markets will be trading well into the beginning of the year, after the very strong finish of 2017. We expect 2018 to be another year of synchronised growth in the world with Developed Markets growing at around 2.3% and Emerging Markets to grow at a level close to 4.8% on average.

This environment should be still supportive for stocks at least for the Q1 and Q2 as we will benefit from the US tax cuts, and until the rates normalization will kick in.

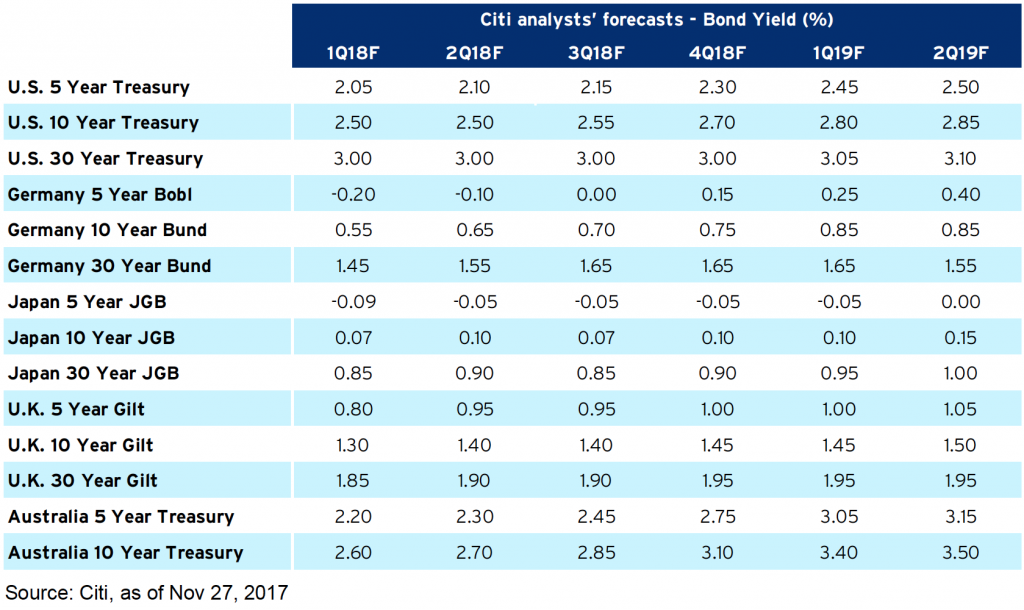

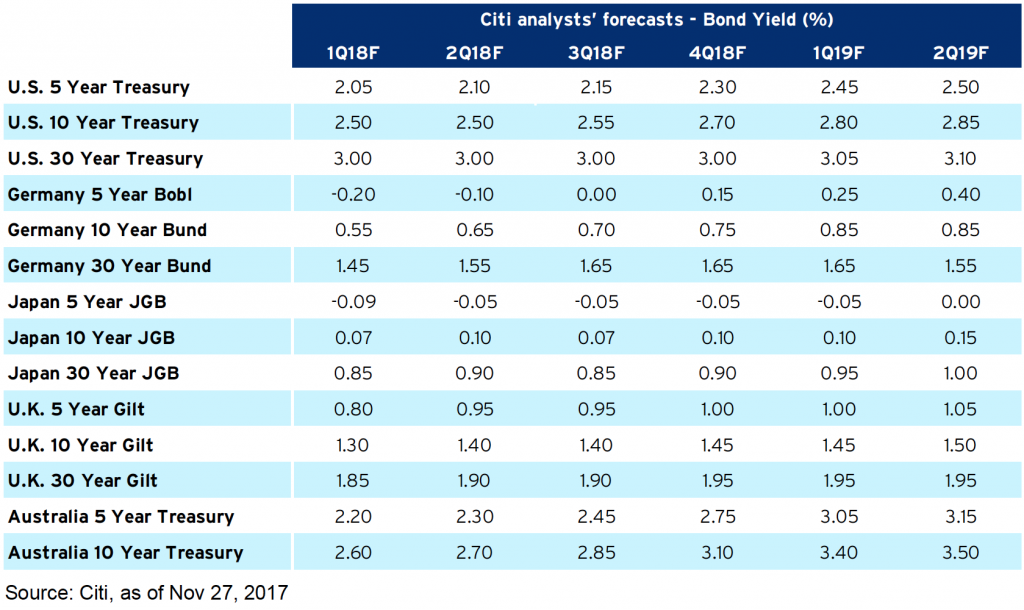

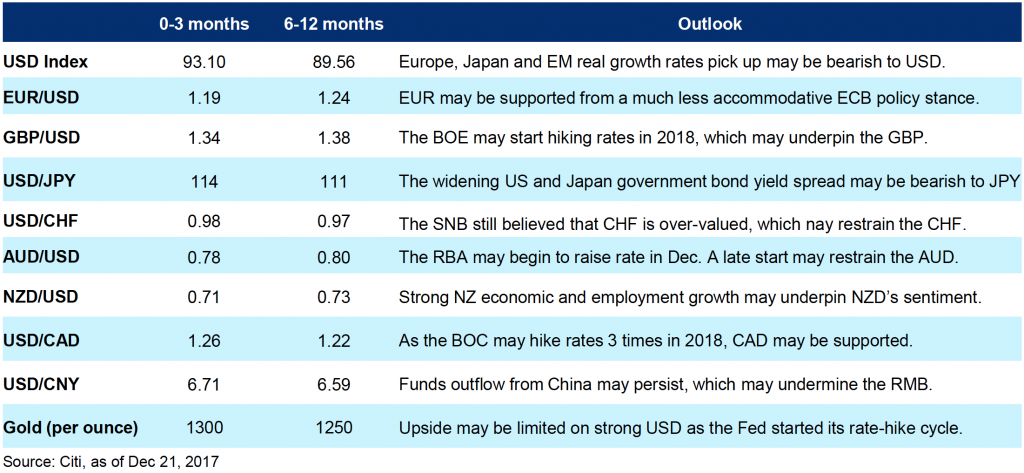

- We expect the Bond Markets to underperform, especially longer dated Government bonds, as the Central Banks led by the Fed will continue to raise rates and remove their accommodative monetary policies.

- Commodity markets are expected to remain at a mixed to stabilised level, with Oil taking a breather after the massive run up in the past few months, but still long term bullish, while Gold still trading in a range.

- The US Dollar is still in a downtrend for the long run, as expected rate hikes have been discounted, and the markets are now focusing on other countries to raise interest rates.

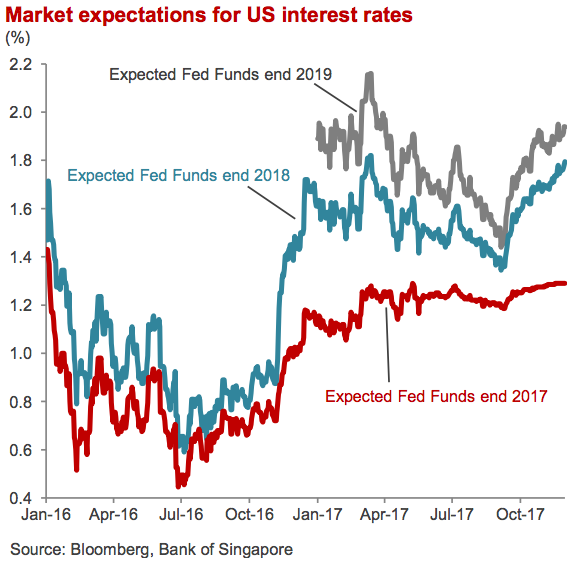

- The general consensus id for the Fed to hike 3 times this year, but we see a real risk of potentially 4 hikes during 2018, as growth and inflation are picking up.

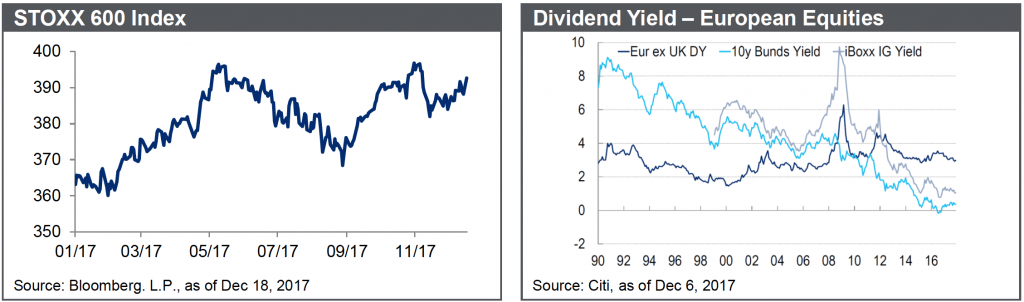

- We like to be overweight European and Japanese stocks, as valuations are cheaper and we believe the Euro and the Yen will keep appreciating versus the Us Dollar.

- While Brexit and the Italian elections might be a cause for short term uncertainty, we are very impressed with Europe’s economic indicators.

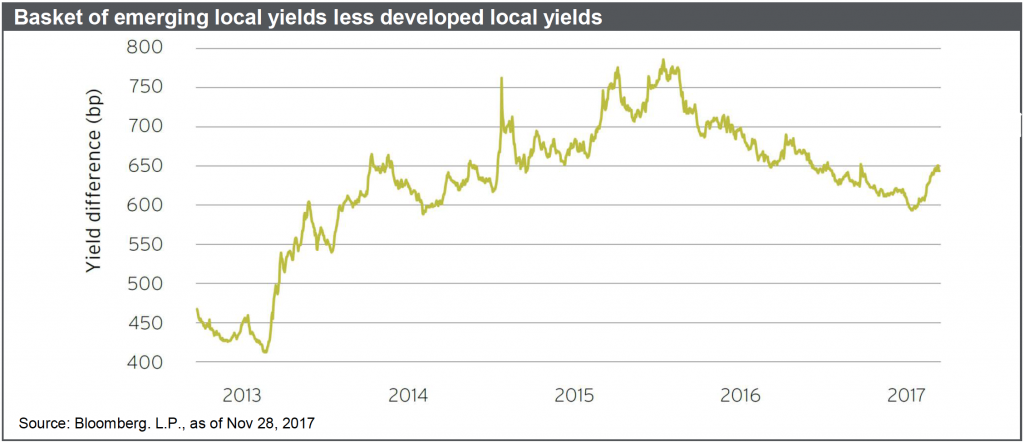

- We are still constructive on Emerging markets and China as we see the economies growing at fast pace and deliver strong EPS growth.

MARKETS OVERVIEW

Equities – Constructive

- Equities across the world have started the year with a bang carrying on the strong momentum from December 2017, with record inflows in equity and equity funds.

- Our forecast for Year End Word stock markets is high single digits, so that means that we are by no means expecting the strong momentum seen in January to carry on at the same pace over the year.

Bonds – Bearish

- A rising interest rate means most bond markets are vulnerable. After most of last year when bond prices have been stable, we have seen yields starting to break higher toward the end of last year and then this year. We believe US 10yr will reach 3.25% by year end and we expect the yield curve to keep steepening as long dated bonds will sell off, while short dated will stay stable.

- If investors need to be positioned in fixed income, we prefer either inflation protected bonds (e.g. TIPS) or high quality corporate bonds with short durations trading at or near face value.

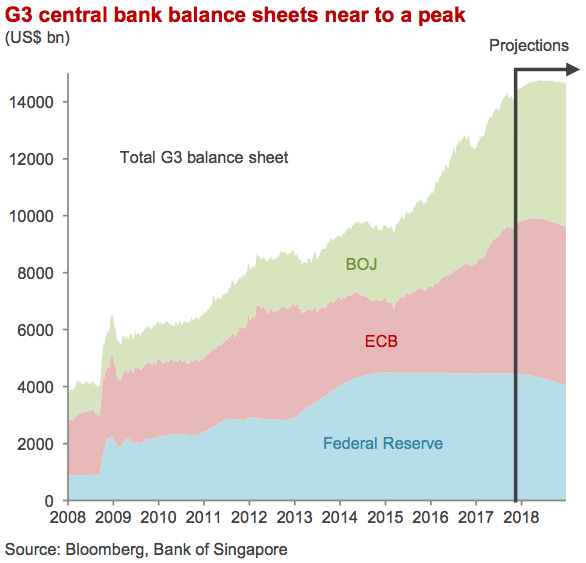

Commodities – Constructive

- Oil prices have rallied in the past 6 months with limit on supplies have been supporting prices.

- Oil demand continues to grow at a steady pace, while the US rig counts has been increasing but at a lower speed than expected, while the OPEC has been very successful to maintain the current production unchanged. While we think short term, we could see a correction in the Oil price we remain bullish for the long term, being also wary of developments in Saudi Arabia.

- Gold has also recovered the recent losses taking the lead from a very heavy sell off in the US Dollar at the end of 2017 and the beginning of 2018.

- We think Gold is still in range 1250/1350.

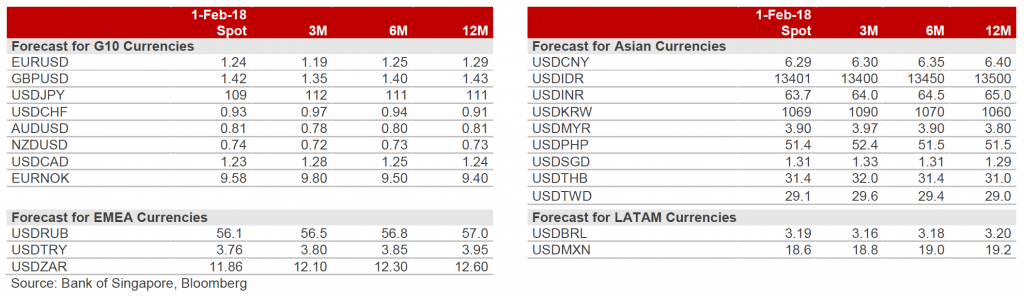

Currencies – Consensus bearish on USD

- While the passage of the Tax Cut and the rising bond yields should have been positive for the US Dollar, the greenback sold off heavily at the end of 2017 and in January 2018.

- As rate hikes by the Fed are mostly expected, the market is focused on other Central Banks to follow and change their accommodative.

- While we believe that the Dollar can strengthened in the short term, we expect the downtrend to carry on in the medium term.

Alternatives – Bullish

- We are generally positive on the property markets, with a preference for commercial over residential. Our favoured countries for exposure include Australia, UK, South East Asia, USA, and Vietnam. Please ask for more information on some of the projects we are currently working on.

- We also have a positive outlook on Private Equity as we see better growth opportunities, whilst lower valuations are seen across the industry compared to most stock markets.

BULLISH SECTORS

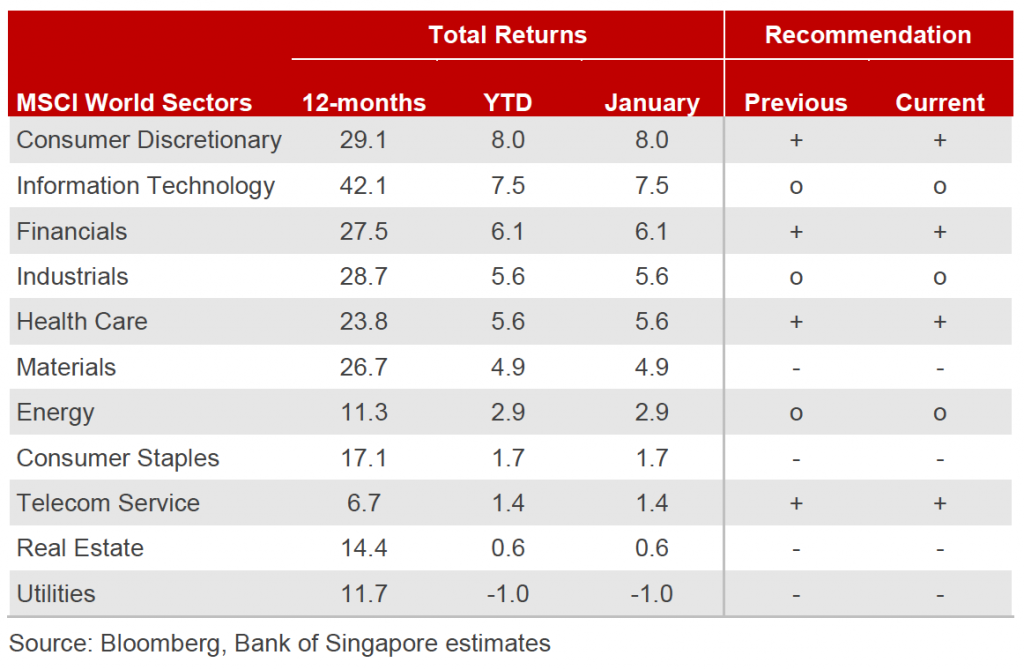

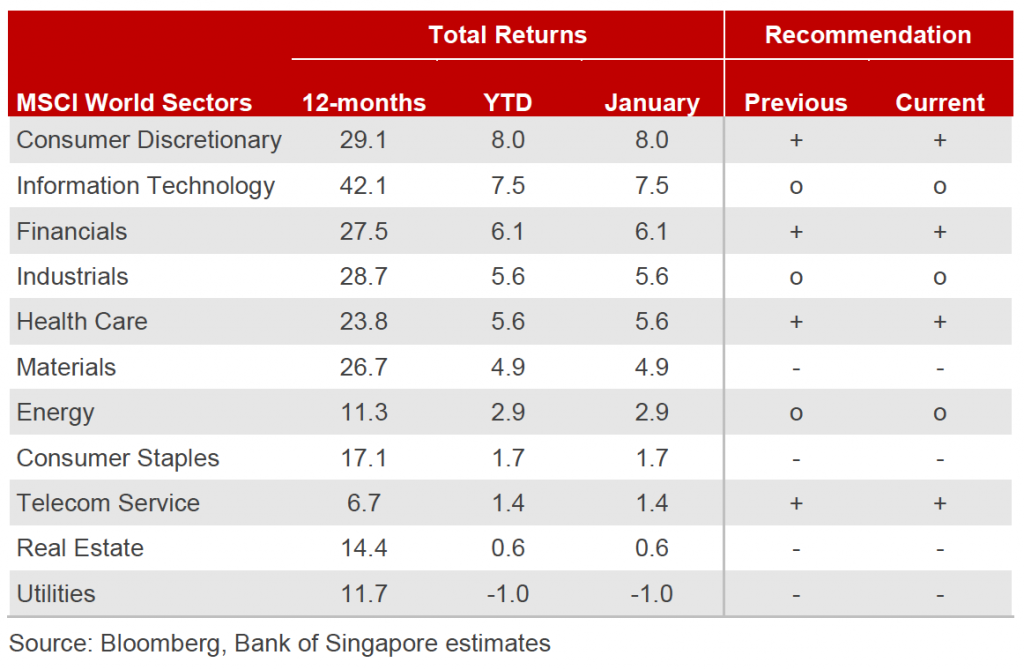

- Technology, Cyclicals and Financials were the best performer sector in 2017, while Utilities and Real Estate underperformed.

- Technology stocks have had the best performance in the last 12 months. Given that it is the most expensive sector, we are willing to take some profit on the sector and looking to re-engage in case of a 5%/10% correction.

- We think buy dips on energy and Oil stocks, given the strong fundamentals and outlook on Oil price. They still provide some of the most compelling dividend in the markets.

- We are still positive on the Financial sector after a rally last year; valuations are still not expensive, and we see a renewed push up in interest rates in the US and in the rest of the world.

- We generally like Cyclicals especially in Europe and in Asia, that will benefit from the strong growth of the economy.

HOW WE MANAGE RISK – PORTFOLIO PROTECTION, HEDGING & TAKING PROFITS

As opposed to just going to cash, we prefer alternative strategies such as hedging via options and option writing strategies to smooth out portfolio volatility.

We also actively monitor profits using trailing stop losses with the view of protecting and locking in gains.

PORTFOLIO MANAGEMENT SERVICES

Please let us know if you would like to hear more about our Discretionary Portfolios and how we consistently generate an additional 0.5% to 1.5% per month using our portfolio Enhanced Income Overlay.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at.

Jan 10, 2018 | Articles, Global Markets Update

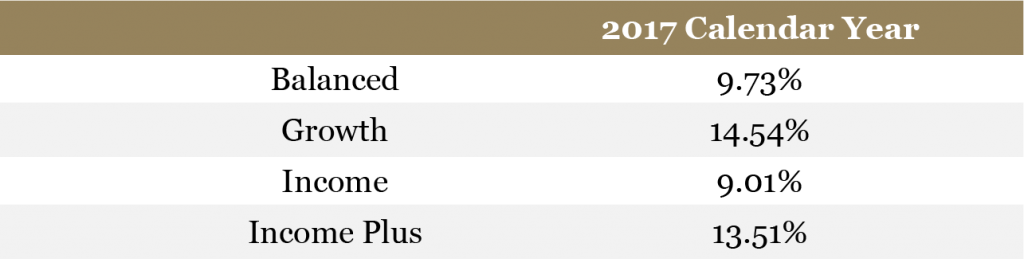

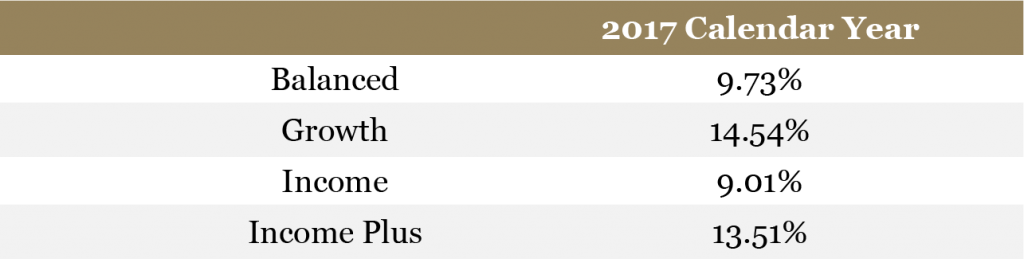

ODYSSEY HORIZON PORTFOLIOS – HOW DID WE DO IN 2017?

2017 was a successful year for our inhouse Horizon portfolios, with each portfolio outperforming its respective benchmark. In addition, a majority of our trades out performed their targeted price levels.

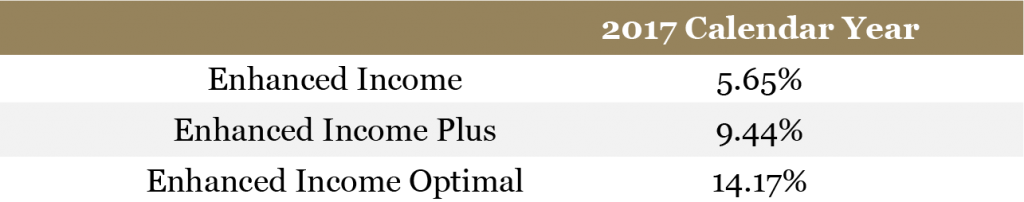

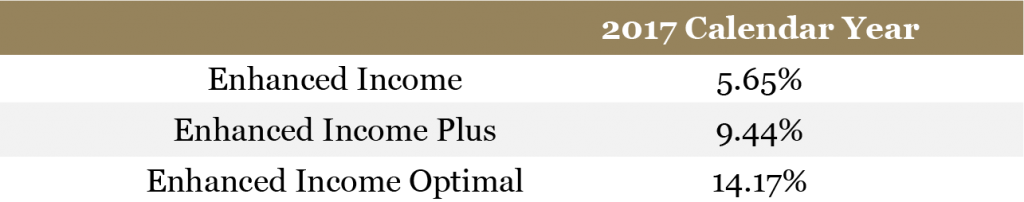

Our proprietary Enhanced Income Options Overlay contributed an additional 5.65% to 14.17% return for those client portfolios that took advantage of this solution. This return is in excess of any capital appreciation and income from the underlying portfolio securities.

Our successful calls in 2017:

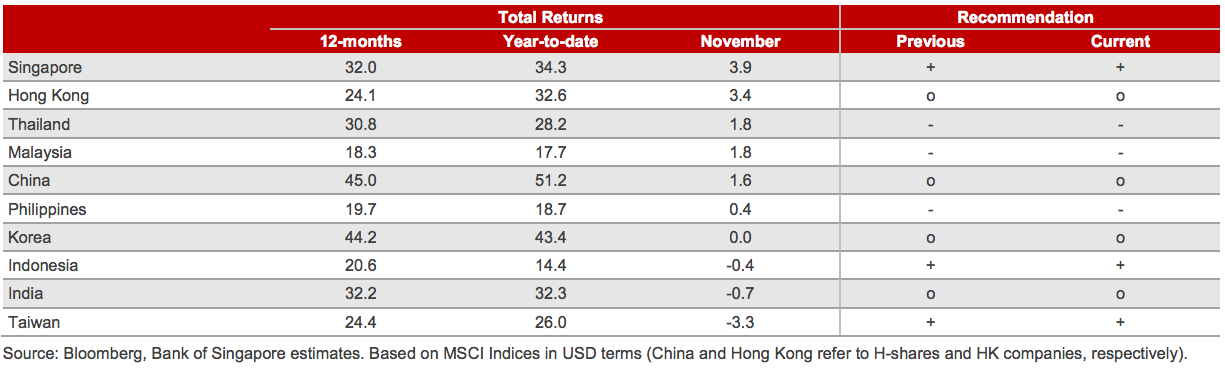

- Overweight equities, especially Hong Kong and Japan. On a sector basis, we were long financials and cyclicals.

- We were oil bulls from mid-year with Shell and Chevron our top picks.

- We were US dollar bears, mainly versus the Euro, especially after the French Elections.

Our less successful calls in 2017:

- Taking profit too early in technology companies, indeed not being overweight enough the sector prior to the big run up.

- Expecting Europe to outperform the US, given valuations and strong upturn in growth in the Eurozone.

Horizon Portfolios

Click here if you would like to receive further information on our Horizon portfolios.

New Zealand Equity Portfolios

Click here if you would like to receive further information on our New Zealand Equity portfolios.

Enhanced Income – Options Overlay

Click here if you would like to receive further information about our options overlays.

2017: THE YEAR IN REVIEW

2017 was an interesting year, proving to delivering some unexpected returns, in summary:

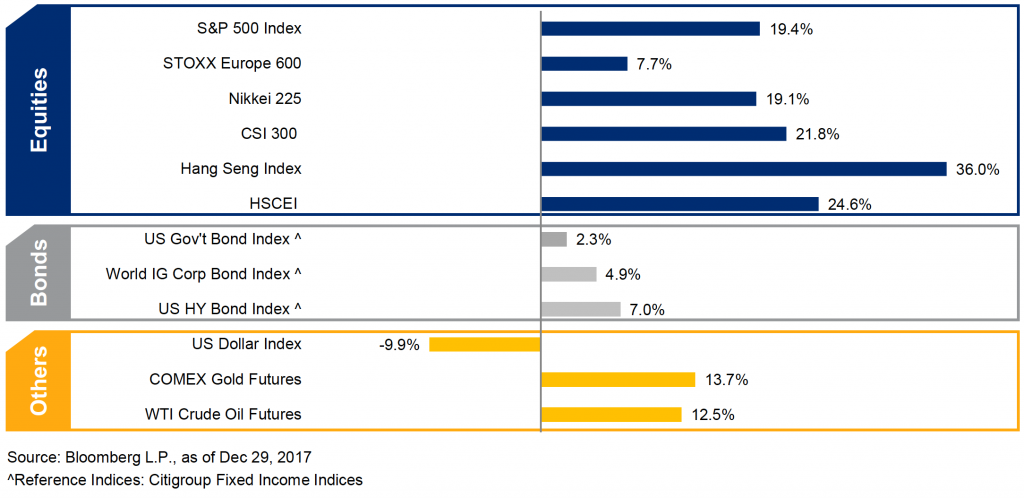

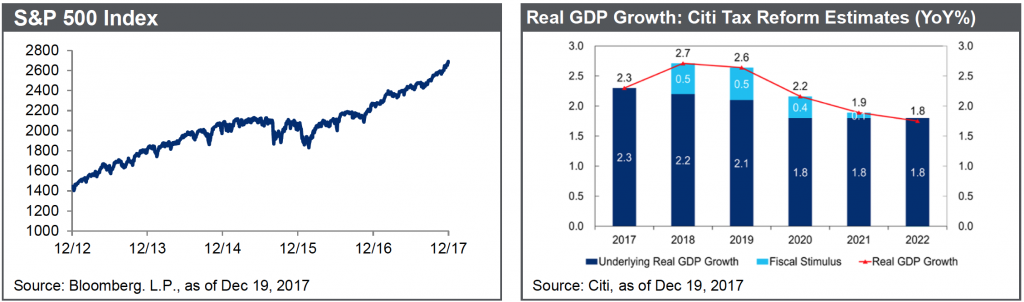

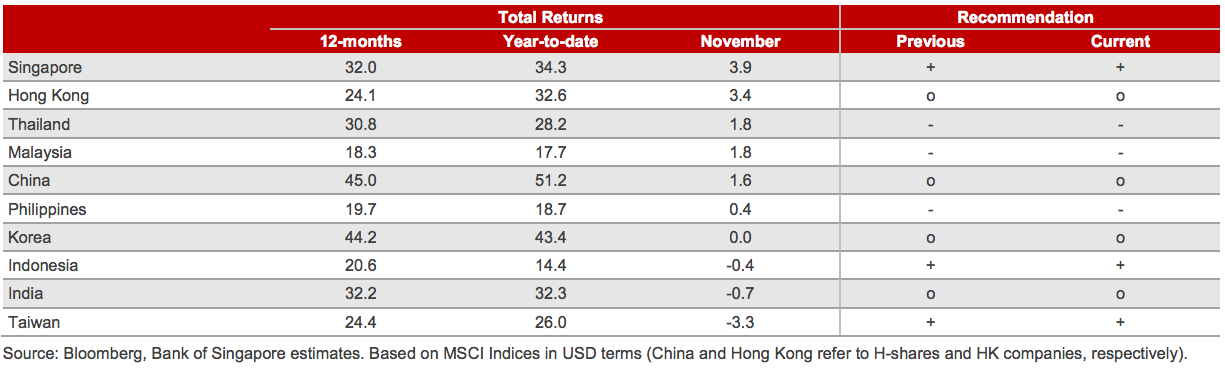

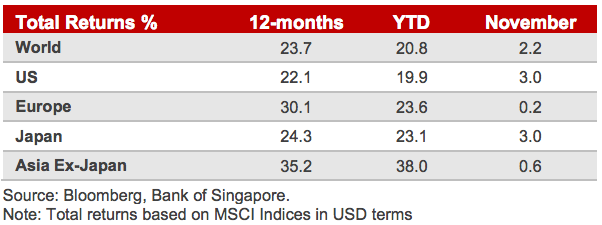

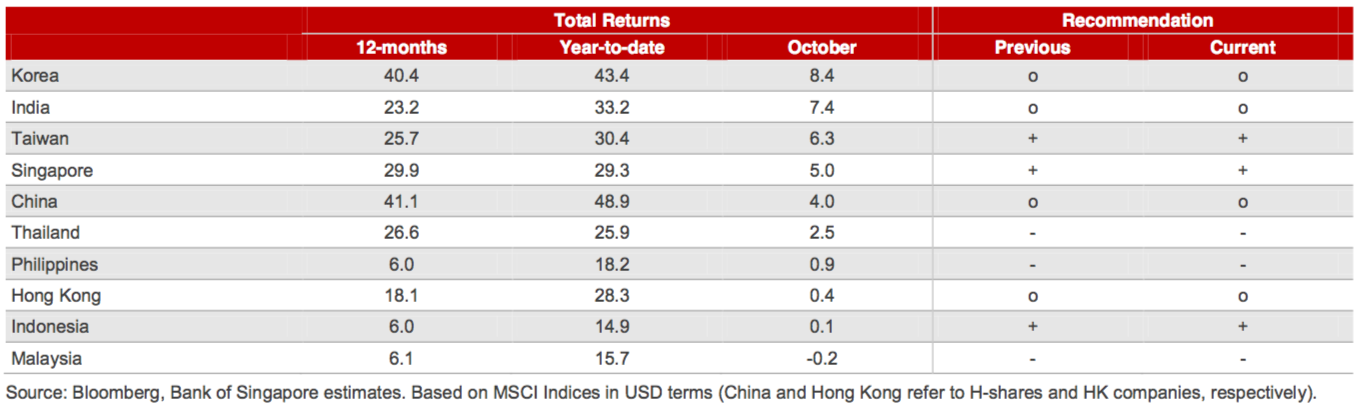

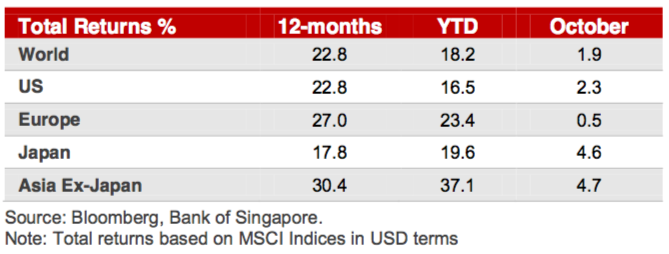

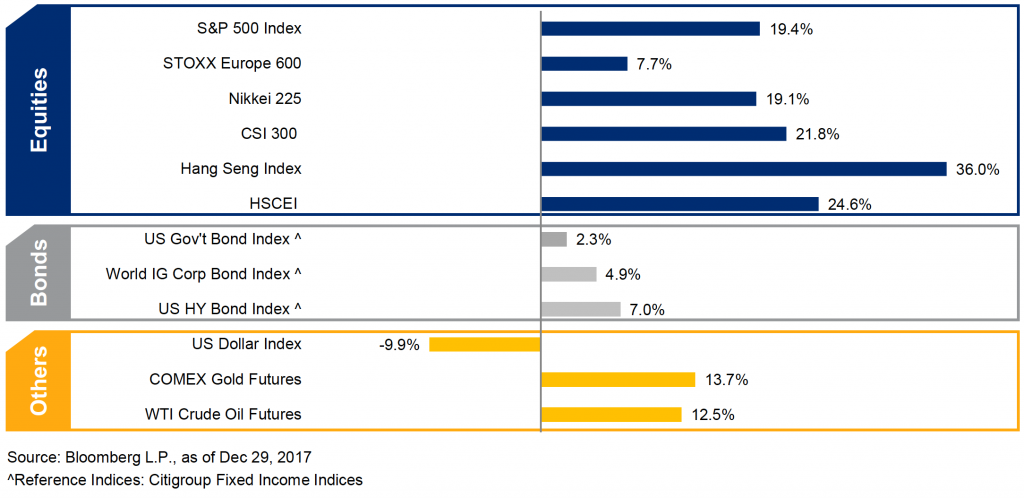

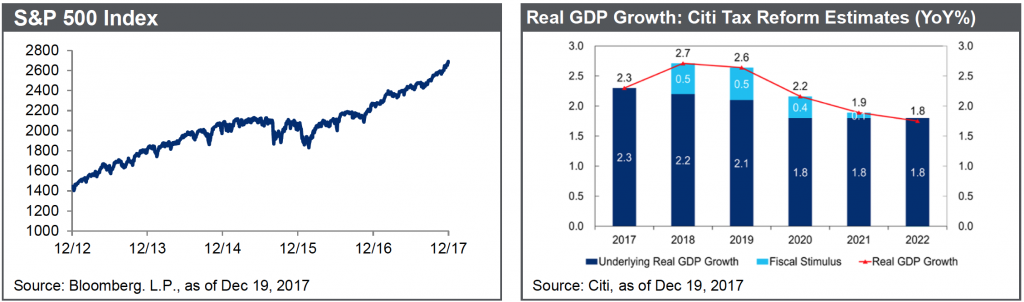

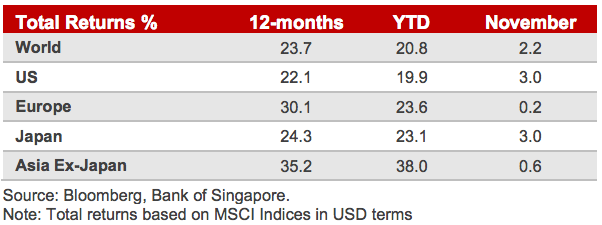

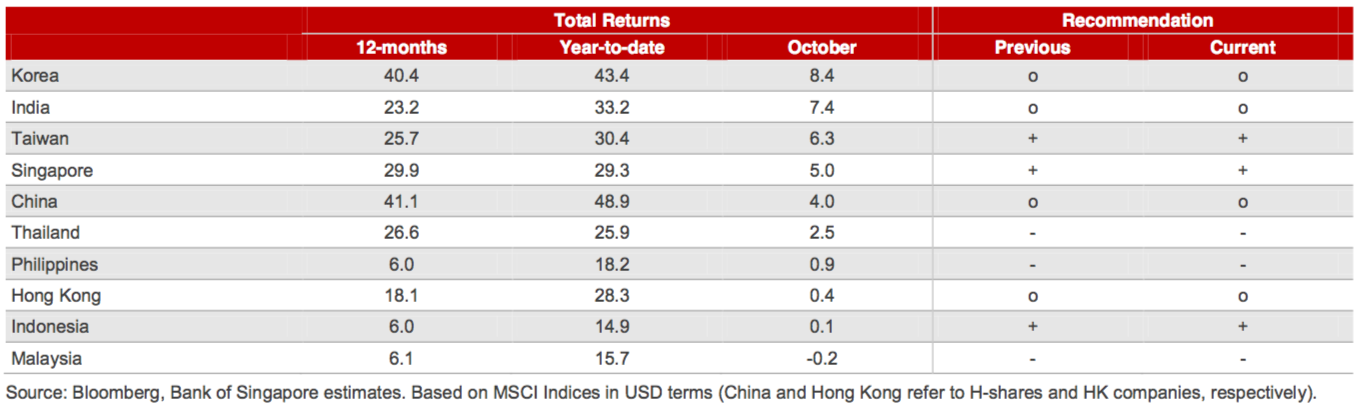

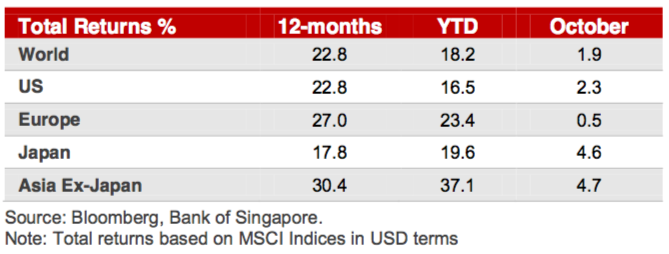

- Global equities returned over 20% in 2017, to post their best year since the global financial crisis in 2008/9.

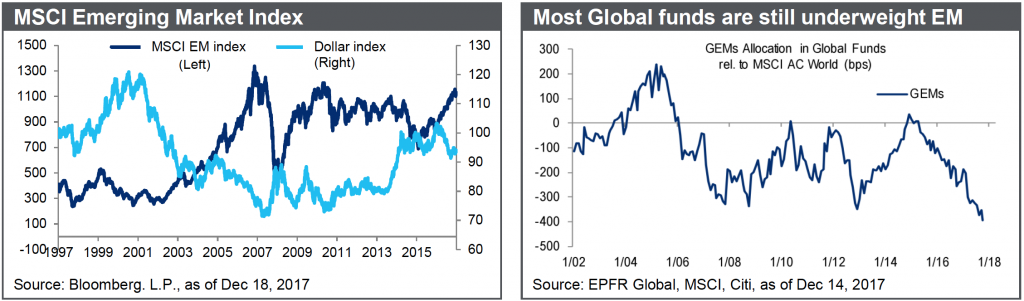

- Emerging Markets outperformed advancing 38%, compared to developed markets which finished up 20%.

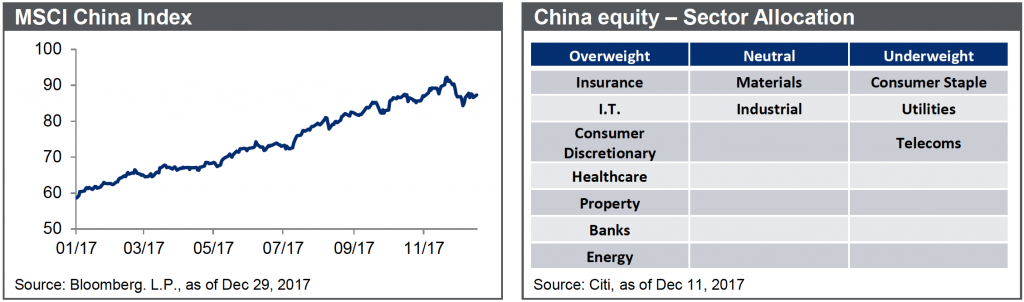

- China led the way rising 54%, whilst the worst performing major market was Russia, up only 6%.

- At the sector level, it was a case of Tech versus the rest. The global IT sector outperformed by almost 15%, with Materials in second place outperforming by only 4%.Energy was clear laggard, although the sector recovered somewhat in H2 2017, alongside a 46% rebound in the oil price.

- More broadly, cyclical sectors beat defensives by 7%, but value continued to lag behind growth in both developed and emerging markets.

Asset Performance in 2017

- Earnings growth rebounded last year, marginally beating consensus expectations. MSCI ACWI is now expected to have delivered 15% EPS growth in 2017, up from an expected growth of 13% last January.Emerging Markets saw the biggest upward revision , and are currently expected to see earnings growth by 23%. In contrast, Europe ex-UK disappointed with expectations falling from 11% to 9%. Consensus for 2018 global EPS growth is currently 10%, with EM expected to lead again with 13% growth.

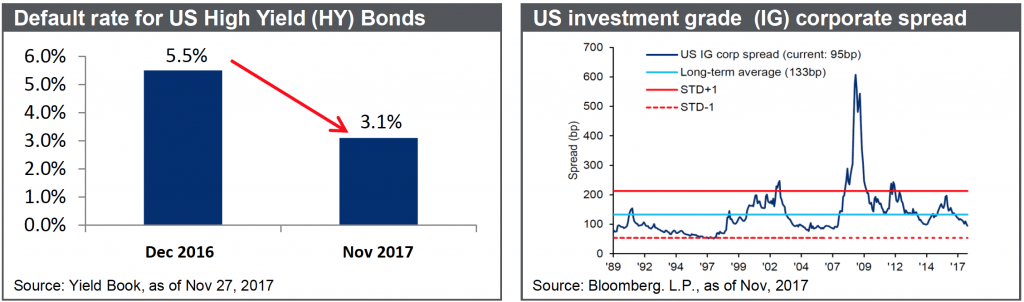

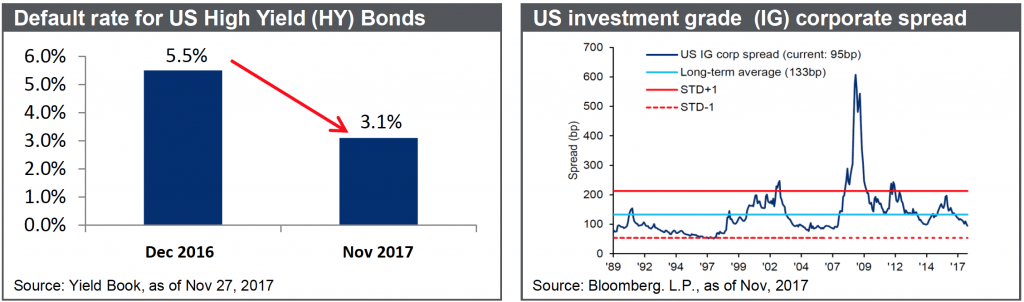

- Bonds underperformed equities especially Government bonds that were capped by more hawkish central banks.World IG returned almost 5%, while World HY performed better at almost 7%.

- Gold and Oil performed well in the commodity space up 13.7% and 12.5% respectively, whilst in the FX space the US$ Dollar was the big loser down almost 10%, with the Euro one of the main beneficiaries.

FORECASTS FOR 2018

We expect the global financial markets to make further gains this year driven by a number of key factors, summarised below:

- The Trump tax policies will support US companies at least in the short term while the economy receives this alternative form of stimulus.

- Consensus real GDP growth of 2.5% in Developed Markets and almost 5% growth in Emerging Markets.

- This year would be another year of synchronized global growth.

- As the major economies will keep growing in 2018, Central Banks will continue the process of removing accommodative monetary policies, but more slowly than anticipated by the market.

- While we are bullish US stocks, we think European, Japanese and Emerging Markets will outperform in 2018

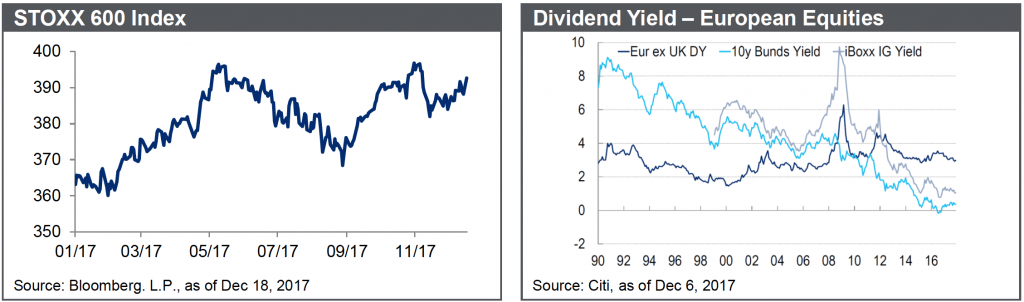

- We are overweight European equities, given the robust recovery in the Eurozone economies, and a dividend yield that is at 3 times that of corporate bond yields.

- European equity valuations are at long term PER averages of 16x PER – much more attractive than US equities at 18.5x PER for 11-13% EPS growth 2018.

- For China, EPS growth is expected to exceed 15%.

- The market has been worried about RMB depreciation, capital outflows and an economic hard landing but these fears proved to be overblown.

- Hong Kong equities may still be supported by increasing Southbound inflows from China with EPS growth also to be expected around 15%.

- Consensus forecasts in Emerging Markets, especially Emerging Asia, are in the 12-15% range.

- Moreover, most Global investors are still underweight EM and thus could increase their holdings.

STOCKS WE LIKE – OUR TOP 10 FOR 2018

Click here if you would like to receive further information on our 2018 top stock picks.

MARKETS OVERVIEW

Equities – New highs as global expansion continues

- Equities remain our preferred asset class, even after the strong run-up in 2017, we still expect positive returns in 2018 supported by the continuing expansion and earnings strength, although we see more muted returns than in 2017

- Within Developed Markets, we prefer Europe and Japan, where valuations are supportive and whose economies are relatively more levered to the global cycle and the rebound in global investment spending is greater than in the US. Globally, we prefer Emerging Markets equities relative to Developed Markets.

- The US tax reform could lead to an additional 1.5% of GDP growth over the next 4 years, albeit at the expense of an increased deficit and the rising debt burden.

- According to Citi a 21% tax rate could add $8 to 2018 EPS, and the consensus 2018 year end target for the S&P500 year has been raised to 2,800.

- Sectorwise we still favour Financials, Consumer Discretionary, Telecoms, Industrials and Health care, with the Technology sector as the usual wild card.

Bonds – Bearish

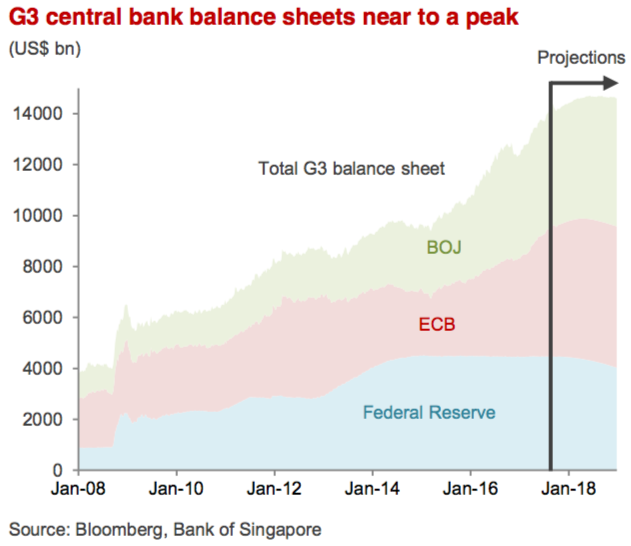

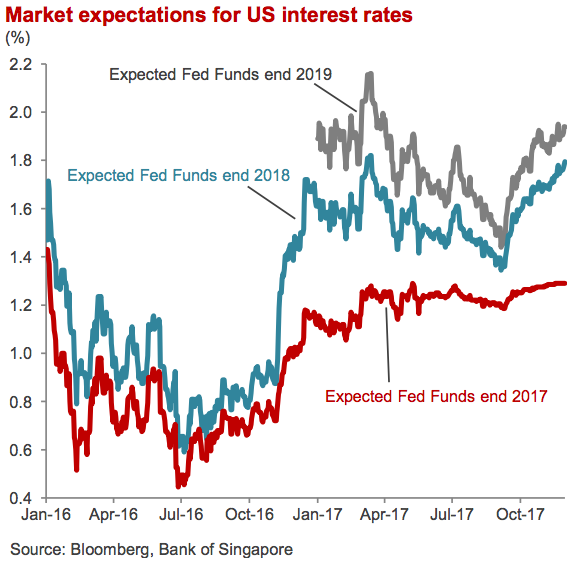

- We are bearish on Government Bonds, given the very low yields, and the fact that Central banks across the World will keep raising rates and normalising monetary policy.

- More broadly, the risk of greater fiscal expansion in the US, discussions about the Fed adopting a higher inflation target and the risk with respect to reduced global QE all suggest that yields will rise.

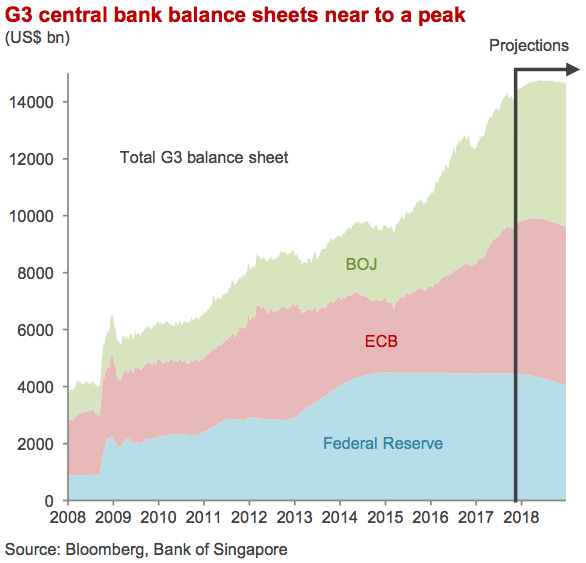

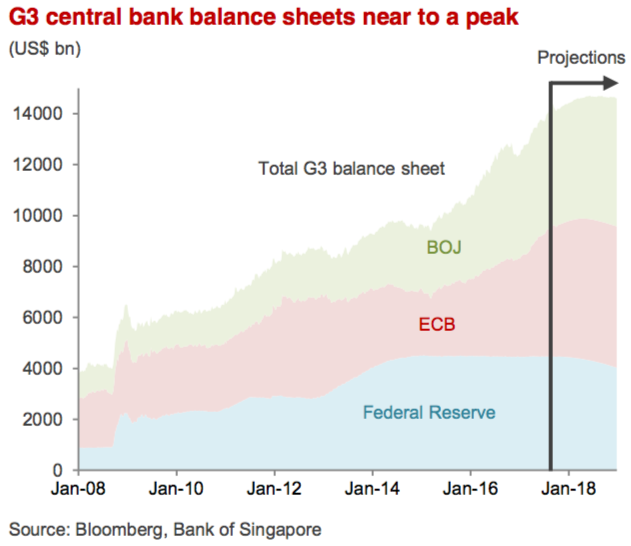

- After another move at the mid-December meeting we see the Fed pushing through 3 more hikes in 2018. Monetary tightening will come from balance sheets adjustments as well as interest rates increases. The Fed is already shrinking its balance sheet, and ECB purchases are set to finish by the end of 2018. With Japan already proceeding at a slower pace, overall G3 balance sheets are set to peak in 3Q 2018.

- Nevertheless, risks to developed market investment grade bonds are not severe, and we think will produce a positive return, although yet again underperforming equities.

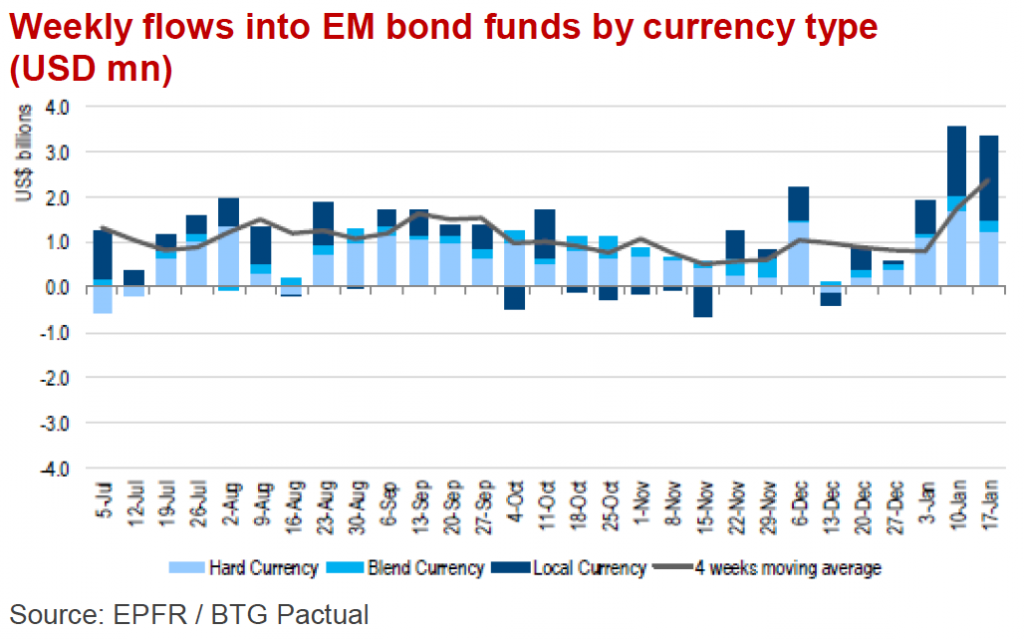

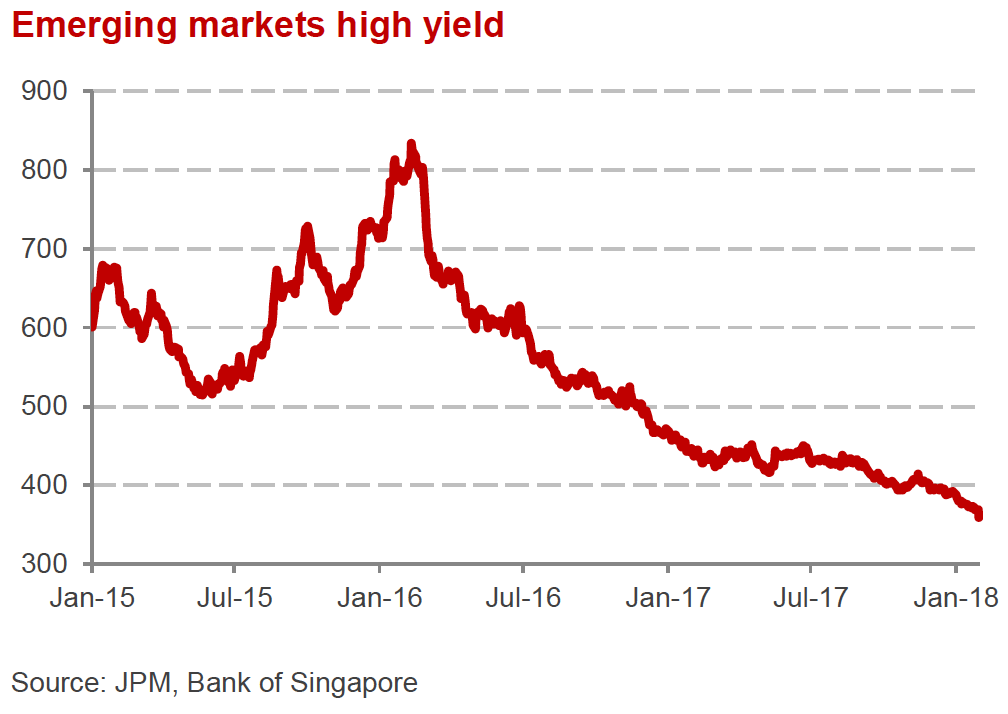

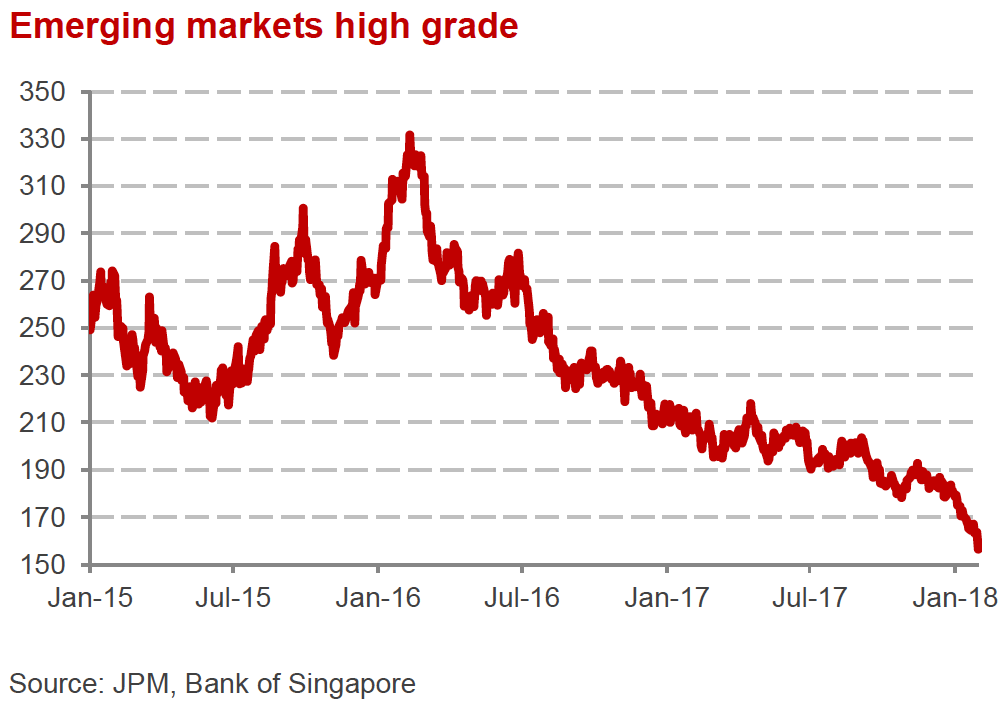

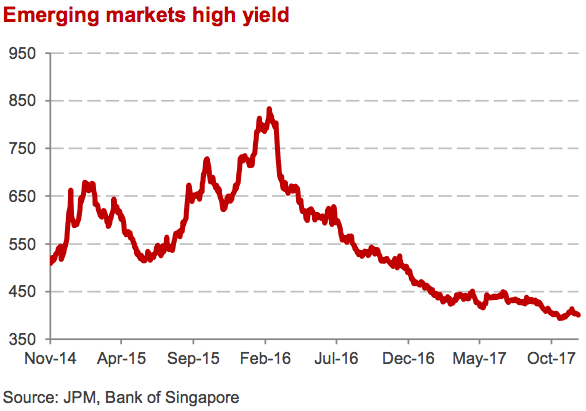

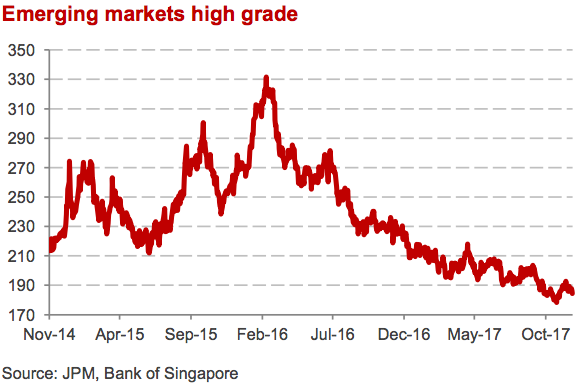

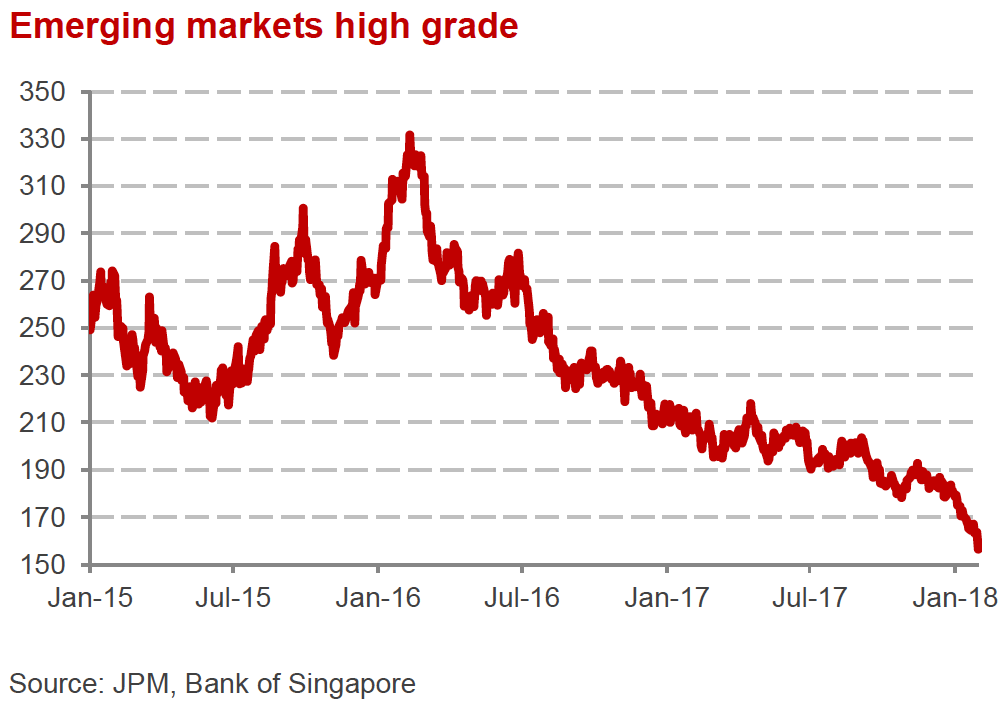

- High Yield and especially Emerging Markets bonds would be our favourite place to invest in the Fixed Income space.

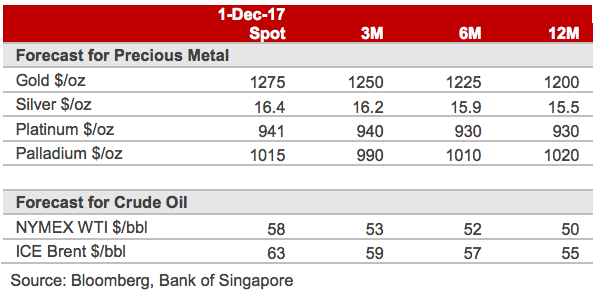

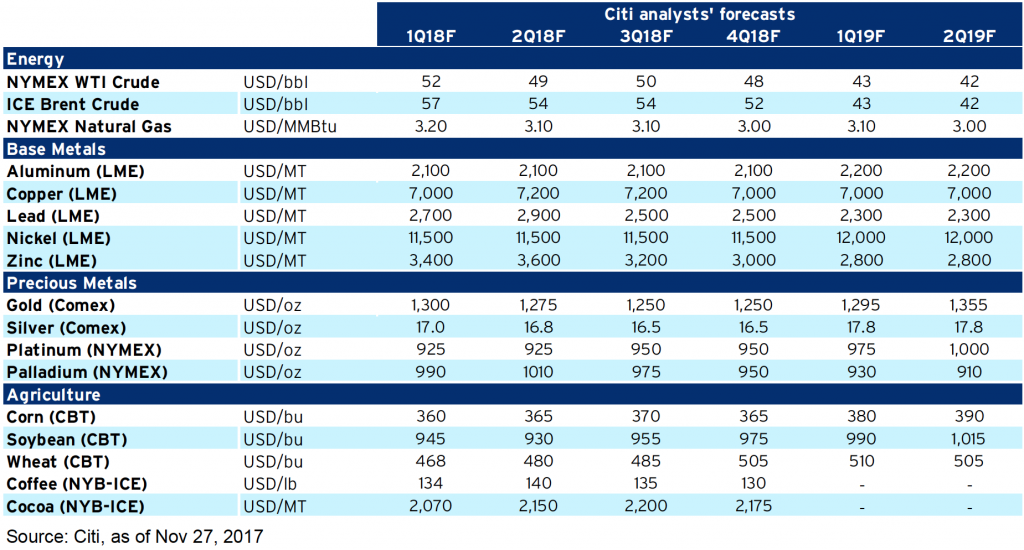

Commodities – Expected Range Markets

- We remain bullish on Oil as the OPEC agreement to restrict supply is holding together better than we expected, even though the recent up move has exceeded our expectations.

- While oil demand has been growing at a steady pace, US production has recovered from the effects of the hurricane, and so the US rig count is improving again, as drilling is responding to the recent strength in prices.

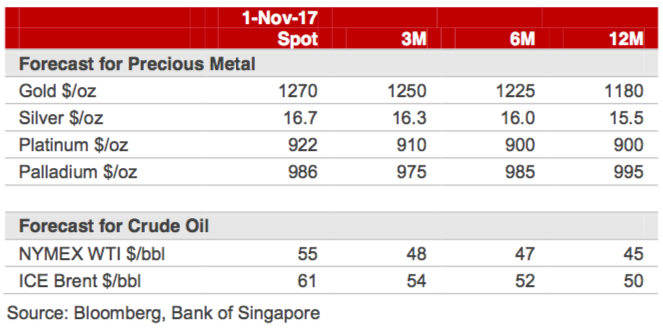

- We are neutral on Gold as we see the market poised to hover between 1,200 and 1,300. While a strong stock market will reduce the need for a safe heaven, the weak US dollar will give gold some king of support, meaning that we will not see a pronounced sell off.

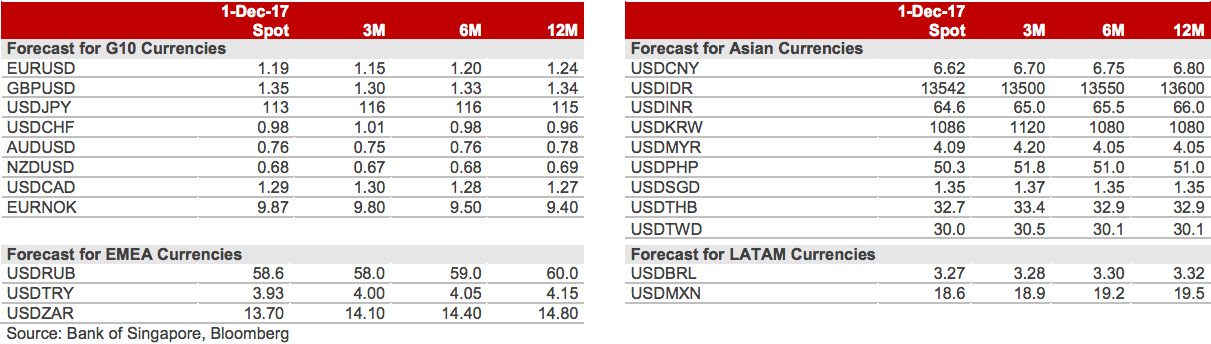

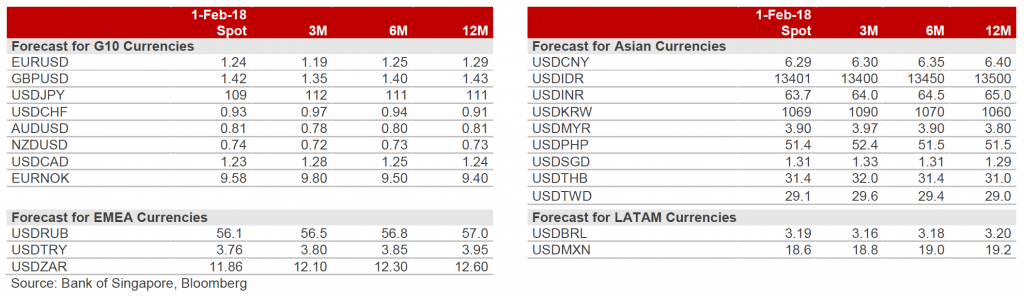

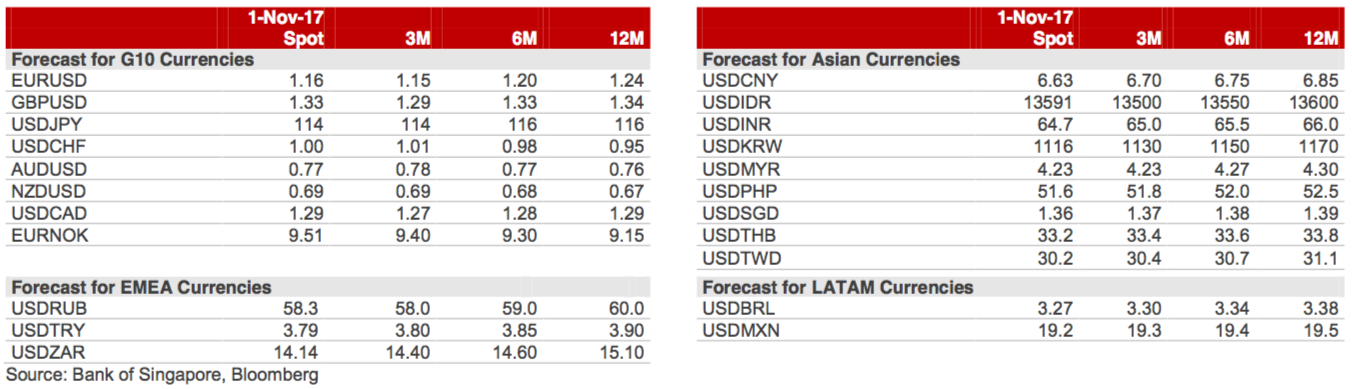

Currencies – Consensus bearish on USD we remain neutral to slightly bearish

- After the hard sell off of the Dollar in 2017, consensus is for a continuation of the same trend in 2018. While the Fed will continue hiking rates, as will many other Central Banks, and unless the Fed becomes much more hawkish, the Dollar will find it hard to stage a real comeback.

- We still favor the Euro, as well as the Australian Dollar, New Zealand Dollar, with the British pound as the potential wild card.

- We would expect higher yielding Emerging Markets currencies also to perform well in this environment.

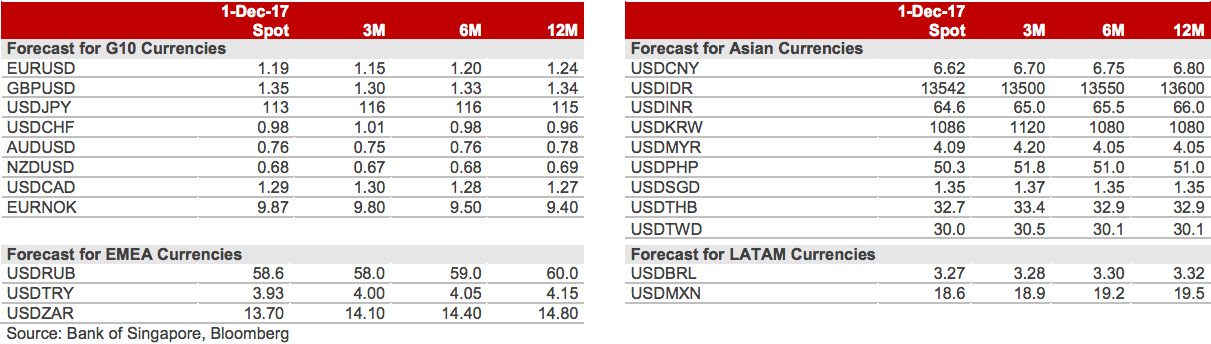

Foreign Exchange Forecasts

RISKS FOR 2018

While we are optimistic about 2018, there are of course risks to our constructive base case scenario:

- Geopolitical events: North Korea risks albeit abating, Saudi Arabia and Iran tensions, the Spain-Catalonia crisis, elections in Italy and implication for the euro, a sudden drop in Chinese economy, and a negative end of the NAFTA talks with implications for trade relations around the world.

- Potential central bank’s policy mistakes (J Powell takes over at the Fed in February, and Draghi will step down next year).

- The return of inflation, that would compromise the current Goldilocks scenario.

HOW WE MANAGE RISK – PORTFOLIO PROTECTION, HEDGING & TAKING PROFITS

As opposed to just going to cash, we prefer alternative strategies such as hedging via options and option writing strategies to smooth out portfolio volatility. We also actively monitor profits using trailing stop losses with the view of protecting and locking in gains.

PORTFOLIO MANAGEMENT SERVICES

Please let us know if you would like to hear more about our Discretionary Portfolios or how we can create tailored portfolio based on your investing needs.

PORTFOLIO OPTIONS OVERLAY SERVICE

If you are interested in receiving an additional 0.5% to 1.5% per month in income on your portfolio, please enquire about our Portfolio Options Overlay service.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at. Please contact us at contact@odysseycapital-group.com or on +852 2111-0668.

Click here if you would like to receive further information on information on other investment opportunities that we are investing into for 2018.

Dec 8, 2017 | Articles, Global Markets Update

HOW WE ARE POSITIONED FOR THE END OF Q4 17

We anticipate that markets will be trading, reasonably supported into year-end. US stock indexes have reached new highs after an impressive run-up, and then have sold off the last days of November. They overcame uncertainties surrounding the Tax Cut and headlines about Trump. In addition, the HK and Asian markets have been trading higher; meanwhile, European and UK stocks have overall been slightly underperforming. This is mainly contributed to a stronger Euro and uncertainty regarding Brexit and the Political risk following the fiasco in the German coalition.

- Bond prices globally have traded weaker as the market has been preparing for interest rate rises and the end of Quantitative Easing.

- Commodity markets are expected to remain at a mixed to stabilised level, with Oil trading well above the 50 level and reaching 60. Gold’s massive bull run has been partially reversed with prices dipping below the 1300 support level, helped by the strengthening of the US Dollar and diminishing fears about North Korea.

- The US Dollar is likely still to be weak in the medium term, as expected rate hikes have been discounted, and the markets are now focusing on other countries to raise interest rates.

- Overall, we remain medium-term relatively constructive on stocks; however, we are wary at the current levels. We see some uncertainty surrounding future Central Bank moves and political risk. For this reason, we advise buying high dividend stocks and to generally carry and rotate from overvalued sectors to more undervalued.

- Market complacency is still at its extreme, but we do not think it is sustainable. Therefore, we suggest buying protection via hedging strategies to protect against market volatility while it trades at multi-year lows. Strategies prefer purchasing puts, selling call spreads, buying bear ETFs or allocating more to cash for this month are advised.

- We could see some volatility over the next Fed meeting on 13th December and possibly some uncertainties over the debt ceiling more headlines on Trump.

- However, we believe that the rate outlook seems pretty much discounted, and that we can expect to see the start of offloading the Fed Balance Sheets. This would be more crucial for the market.

- Another hike is forecasted for December, with the market giving an 80% chance of a hike as the Fed seems comfortable with the current pace of economic growth. However, the weakening of the USD this year has loosened financial conditions by increasing the levels of exports.

- While we are wary of Brexit and the stronger Euro, we believe that the existence of cheap valuations and a generally underweight position in European assets make certain European equities attractive.

- A stronger Euro, while a small drag on some European exporters, will be overall beneficial as it will contribute to a positive outlook for Europe.

- We are constructive on Emerging Markets, as markets look solid and seem immune to the US interest rate hikes.

- We are still interested in South East Asian economies, as reforms have helped boost investments and growth. India, Indonesia, Vietnam and Philippines are our recommended markets to analyse.

MARKETS OVERVIEW

Equities – Expecting Sideways Moves

- Equities across the board have made new highs on the year. However, we are still concerned about a possible pullback due to valuation multiples looking stretched and the potential of stubborn political impasse from the US and uncertainties about the Central banks tapering. We think that a potentially positive tax cut could be seen as an excuse to take profit by some investors and we would prefer to fade a further rally rather than chase the move higher. For the long-term, we are selectively choosing overweight equities, against bonds: these offer the best return prospects against other asset classes over a 12-month horizon.

- We discussed last month that it would be viable to take profits on overvalued sectors like Technology and rotate into more undervalued sectors like Healthcare and Energy, and we will still believe this is the better investment option.

Bonds – Bearish

- A rising interest rate means most bond markets are vulnerable. After the big climb last year, the US bond yields have stalled in a range, and then have come off. European yields have been trending higher in the last few months as the ECB has announced that the end of QE could be approaching. Most sovereign bonds are still looking expensive and vulnerable to any hawkish changes from the Central Bank policies, especially in Europe, UK and Japan.

- If investors need to be positioned in fixed income, we prefer either inflation protected bonds (e.g. TIPS) or high quality corporate bonds with short durations trading at or near face value.

- Our previous view was to use bonds as an alternative for cash balances which were earning next to nothing. However, in this environment the risk of capital loss on bonds outweigh the potential rewards for trying to get a better than zero percent coupon.

Commodities – Expected Sideways Markets

- Oil prices have rallied in the past couple of months driven by limits on supplies, ultimately supporting the price rise.

- Oil demand continues to grow at a steady pace, while the US rig count has been trending lower, therefore, we believe a range of 50/60 seems reasonable with short-term risk to the upside. From a medium-term perspective, we remain bullish.

- Gold has come off after the big rally of the past few months, as geopolitical risks have faded and the US Dollar has strengthened from the lows. At the current level of 1275, we are neutral to bullish on Gold for the short term, but we are less positive for the long term.

Currencies – Consensus bearish on USD

- While the passage of the Tax Cut could be positive for the US Dollar, the main driver for the dollar’s strength will come from a US interest rate rise, and if the Fed is more hawkish than expected, we could see a renewed interest in buying USD. We are bullish on the Euro as investors are still too underweight. Economic data has been solid, pushing the ECB to talk about increasing rates earlier than expected, as Draghi mentioned in the last meeting. We remain bearish on the Sterling and the Yen, and neutral on Canadian Dollar, Australian Dollar and New Zealand Dollar.

Alternatives – Bullish

- We are generally positive on the property markets, with a preference for commercial over residential. Our favoured countries for exposure include Australia, UK, South East Asia, USA, and Vietnam. Please ask for more information on some of the projects we are currently working on.

- We also have a positive outlook on Private Equity as we see better growth opportunities, whilst lower valuations are seen across the industry compared to most stock markets.

BULLISH SECTORS

- Telecom, Consumers and Real Estate outperformed. The Technology and Material sectors was the biggest underperformers, with Financial and Health Care also performing well.

- Technology stocks have had the best performance Year to Date. Given that it is the most expensive sector, we still have the view that it is the right time to reduce some long positions and take some profits as the Tax Cut package will not benefit too much the sector.

- The Healthcare sector continues to benefit from improving pipeline productivity and an increasing number of new drugs approved by FDA.

- We think buy dips in the Energy sector after the strong performance of the past few months.

- We are still positive on Financials after a rally this year; valuations are still not expensive, and we see a renewed push up in interest rates in the US and in the rest of the world.

- Improving business and consumer confidence should continue to support credit demand.

- Stronger economic growth will reduce non-performing loans.

- Capital ratios have improved, and a steeper yield curve should be positive.

HOW WE MANAGE RISK – PORTFOLIO PROTECTION, HEDGING & TAKING PROFITS

As opposed to just going to cash, we prefer alternative strategies such as hedging via options and option writing strategies to smooth out portfolio volatility. We also actively monitor profits using trailing stop losses with the view of protecting and locking in gains.

PORTFOLIO MANAGEMENT SERVICES

Please let us know if you would like to hear more about our Discretionary Portfolios or how we can create tailored portfolio based on your investing needs.

PORTFOLIO OPTIONS OVERLAY SERVICE

If you are interested in receiving an additional 0.5% to 1.5% per month in income on your portfolio, please enquire about our Portfolio Options Overlay service.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at. Please contact us at contact@odysseycapital-group.com or on +852 2111-0668.

Nov 8, 2017 | Articles, Global Markets Update

HOW WE ARE POSITIONED FOR Q4 17

We anticipate that markets will be trading, well supported into year-end. US stock indexes have reached new highs after an impressive run-up. They overcame uncertainties surrounding the US politics and headlines about North Korea. In addition, the HK and Asian markets have been trading higher; meanwhile, European and UK stocks have overall been slightly underperforming. This is mainly contributed to a stronger Euro and uncertainty regarding Brexit and the Political risk in Spain.

- Bond prices globally have still traded weakly as the market has been preparing for interest rate rises and the end of Quantitative Easing.

- Commodity markets are expected to remain at a mixed to stabilised level, with Oil trading well above the 50 level and reaching 55. Gold’s massive bull run has been partially reversed with prices dipping below the 1300 support level, helped by the strengthening of the US Dollar and diminishing fears about North Korea.

- The US Dollar is likely still to be weak in the medium term, as expected rate hikes have been discounted, and the markets are now focusing on other countries to raise interest rates.

- Overall, we remain medium-term relatively constructive on stocks; however, we are wary at the current levels and we would buy into a correction. We see some uncertainty surrounding future Central Bank moves and geopolitical risk. For this reason, we advise buying high dividend stocks and to generally carry and rotate from overvalued sectors to more undervalued.

- Market complacency is still at its extreme, but we do not think it is sustainable. Therefore, we suggest buying protection via hedging strategies to protect against market volatility while it trades at multi-year lows. Strategies prefer purchasing puts, selling call spreads, buying bear ETFs or allocating more to cash for this month are advised.

- It is interesting to note that since the last Fed Meeting in October, the USD has strengthened and the US yields have spiked.

- However, we believe that the rate outlook seems pretty much discounted, and that we can expect to see the start of offloading the Fed Balance Sheets. This would be more crucial for the market.

- Another hike is forecasted for December, with the market giving an 80% chance of a hike as the Fed seems comfortable with the current pace of economic growth. However, the weakening of the USD this year has loosened financial conditions by increasing the levels of exports.

- While we are wary of Brexit and the stronger Euro, we believe that the existence of cheap valuations and a generally underweight position in European assets make certain European equities attractive.

- A stronger Euro, while a small drag on some European exporters, will be overall beneficial as it will contribute to a positive outlook for Europe.

- We are constructive on Emerging Markets, as markets look solid and seem immune to the US interest rate hikes.

- We are still interested in South East Asian economies, as reforms have helped boost investments and growth. India, Indonesia, Vietnam and Philippines are our recommended markets to analyse.

MARKETS OVERVIEW Equities – Expecting Sideways Moves

MARKETS OVERVIEW Equities – Expecting Sideways Moves

- Equities across the board have made new highs on the year. However, we are still concerned about a possible pullback due to valuation multiples looking stretched and the potential of stubborn political impasse from the US. In addition, there some further geopolitical worries about North Korea and uncertainties about the Central banks tapering. For the long-term, we are selectively choosing overweight equities, against bonds: these offer the best return prospects against other asset classes over a 12-month horizon.

- We discussed last month that it would be viable to take profits on overvalued sectors like Technology and rotate into more undervalued sectors like Healthcare and Energy, and we will still believe this is the better investment option.

Bonds – Bearish

Bonds – Bearish

- A rising interest rate means most bond markets are vulnerable. After the big climb last year, the US bond yields have stalled in a range, and then have come off. European yields have been trending higher in the last few months as the ECB has announced that the end of QE could be approaching. Most sovereign bonds are still looking expensive and vulnerable to any hawkish changes from the Central Bank policies, especially in Europe, UK and Japan.

- If investors need to be positioned in fixed income, we prefer either inflation protected bonds (e.g. TIPS) or high quality corporate bonds with short durations trading at or near face value.

- Our previous view was to use bonds as an alternative for cash balances which were earning next to nothing. However, in this environment the risk of capital loss on bonds outweigh the potential rewards for trying to get a better than zero percent coupon.

Commodities – Expected Sideways Markets

- Oil prices have rallied in the past month with limit on supplies have been supporting prices.

- Oil demand continues to grow at a steady pace, while the US rig count has been trending lower, therefore, we believe a range of 50/60 seems reasonable with short-term risk to the upside. From a medium-term perspective, we remain bullish.

- Gold has come off after the big rally of the past few months, as geopolitical risks have faded and the US Dollar has strengthened from the lows. At the current level of 1275, we are neutral to bullish on Gold for the short term, but we are less positive for the long term.

Currencies – Consensus bearish on USD

Currencies – Consensus bearish on USD

- Until there is more clarity on Trump’s policies, the US dollar will continue to loweragainst most currencies. While interest rate hikes will benefit the USD, the Administration’s fiscal policies could put a ceiling on the value of the greenback. The main driver of the US dollar’s strength will come from a US interest rate rise, and if the Fed is more hawkish than expected, we could see a renewed interest in buying USD. We are bullish on the Euro as investors are still too underweight. Economic data has been solid, pushing the ECB to talk about increasing rates earlier than expected, as Draghi mentioned in the last meeting. We remain bearish on the Sterling and the Yen, and neutral on Canadian Dollar, Australian Dollar and New Zealand Dollar.

Alternatives – Bullish

Alternatives – Bullish

- We are generally positive on the property markets, with a preference for commercial over residential. Our favoured countries for exposure include Australia, UK, South East Asia, USA, and Vietnam. Please ask for more information on some of the projects we are currently working on.

- We also have a positive outlook on Private Equity as we see better growth opportunities, whilst lower valuations are seen across the industry compared to most stock markets.

BULLISH SECTORS

- Technology, Materials and Industrials outperformed. The Telecom and Health Care sectors was the biggest loser, with Financial and Industrial also performing well.

- Technology stocks have had the best performance Year to Date. Given that it is the most expensive sector, we still have the view that it is the right time to reduce some long positions and take some profits particularly because we believe exposure to China could be negative.

- The Healthcare sector continues to benefit from improving pipeline productivity and an increasing number of new drugs approved by FDA.

- We think it is time to take some profit on the Energy sector after the strong performance in September and October.

- Lastly, we are still positive on Financials although a 4% rally in September and 1.5% in October: valuations are still not expensive, and we see a renewed push up in interest rates in the US and in the rest of the world.

- Improving business and consumer confidence should continue to support credit demand.

- Stronger economic growth will reduce non-performing loans.

- Capital ratios have improved, and a steeper yield curve should be positive.

HOW WE MANAGE RISK – PORTFOLIO PROTECTION, HEDGING & TAKING PROFITS

As opposed to just going to cash, we prefer alternative strategies such as hedging via options and option writing strategies to smooth out portfolio volatility. We also actively monitor profits using trailing stop losses with the view of protecting and locking in gains.

PORTFOLIO MANAGEMENT SERVICES

Please let us know if you would like to hear more about our Discretionary Portfolios and how we consistently generate an additional 0.5% to 1.5% per month using our Options Overlay.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at. Please contact us at contact@odysseycapital-group.com or on +852 2111-0668.

MARKETS OVERVIEW Equities – Expecting Sideways Moves

MARKETS OVERVIEW Equities – Expecting Sideways Moves Bonds – Bearish

Bonds – Bearish

Currencies – Consensus bearish on USD

Currencies – Consensus bearish on USD Alternatives – Bullish

Alternatives – Bullish