For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Market Highlights

After a difficult September, October epitomised a V-shaped recovery in equity markets with the MSCI World TR Index surging 5.7%.

Performances were led by the US with the S&P 500 up 6.9%. US Growth stocks surged 9.1% while Value grew at only half this rate at 4.6%. MSCI Europe climbed 4.5% while Asia Pacific only managed a flat result.

The main driver has been the strength of the US Q3 earnings season. With approximately 52% of S&P 500 companies reported, 78% reported EPS beats of 11% with 71% also surprising on the upside in revenue. Similar numbers are being recorded by Europe, while Japan’s season has been less positive. While US index performances have been stellar, it is worth noting that a large portion of the rise has been due to just a handful of stocks. For instance, Microsoft and Tesla, at a combined weight of just 7.5% was responsible for 26% (1.8% out of 6.9%) of the S&P 500 performance. The stocks were up 18% and 44% respectively. The duo also accounted for 19% of the MSCI World TR Index performance. It is a month where active equity managers would be hard pressed to keep up with US indices unless they also had large positions in MSFT and TSLA. Nvidia, which is the 8th largest allocation in the S&P 500 at 1.9% has also been on a tear that has continued into November.

Commodities finished the month on a subdued note after some metals spiked mid-month on fears of a severe supply squeeze. Nevertheless, the SPGS Commodity Index was still up 5.5% with WTI Oil up 11%. The Global Credit Index was flat for the month.

Speculation Déjà vu

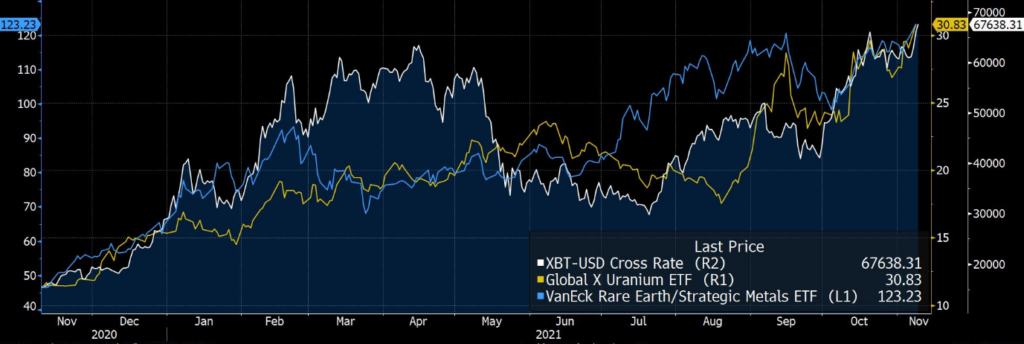

The rapid movement of Tesla and Nvidia brings us to another feature of the markets that has become increasingly prevalent, that of speculation. Last October we saw the start of a speculative bubble that extended until Q1/Q2 2021 when crypto-currencies, alternative energy stocks, “ARK” stocks, and other speculative exposures came back to earth. However, many speculators and day-traders must have fared well since they are at it again, ramping up assets where the speculative demand far-outstrips the physical real-world demand. This time it is again being led by crypto-currencies, but uranium exposures have also surged with the Global X Uranium ETF (URA) up 76% since mid-August, as well as rare-earth metal stocks. This is the result of a world flush with liquidity, consumer savings enormously bolstered by COVID, and large cap stocks already up 20+% YTD. The additional liquidity leaks into speculative assets, and due to being less liquid, prices are driven up quickly.

The market cap of Tesla is once again greater than the combined market cap of the 10 largest car companies in the world despite expecting to have circa 1% market share this year. It will be interesting to see how the EV market changes over the next 3 years as Toyota, BMW, Audi, Mercedes, Honda, Ford and GM accelerate their production of EVs.

Even in China we have seen results of excess liquidity and pent-up savings with the speculative Chi-Next Index up +18% YTD compared to the large-cap broad CSI300 Index down -3%.

Investment Strategy

V-Shaped market movements are difficult to navigate but we remain positive for the markets for the remainder of the year. The liquidity driving speculative investments is likely to remain supportive of most risk assets.

While we are generally cautious following a strong month, the reason for the equity market strength – a strong earnings season – compels a pro-equity stance. Earlier in the year, a strong Q2 reporting season, together with a benign rates environment were the factors that have propelled the equity market since May. This was largely despite the Delta variant and slowing economic growth concerns.

Certainly, supply chain integrity has been an issue, but global COVID infection rates have been declining, and importantly they have been declining in areas that have caused supply chain bottlenecks. Temporary shortage of fossil fuels is likely to remain for some time but already many commodity prices are moderating after spiking in mid-October.

We maintain our focus on the US equity with Europe being the next preferred market. While Japan could perform with a recovering global economy, China appears focused on dampening some of the excesses of the past and may continue to represent a difficult investment environment.

While we continue to support quality in our portfolio, the announcement by Pfizer of an anti-viral drug that appears to have high efficacy against COVID-19, suggest it may be prudent to have some cyclical stocks as well as exposures that have underperformed due to lock-down restrictions such as travel-related stocks. Since many of these stocks can be more volatile than blue-chips, you may consider ETFs such as AWAY US that has technology-based stocks in the global travel and tourism industry, as well as JETS US which, as the name suggests, is an ETF of global airline-related stocks.

Outlook

Our positive outlook on the markets to year-end means that we would increase our investments in market leaders such as GOOGL, Microsoft and Apple. For those with the risk appetite, we would also add some additional risk to the above-mentioned ETFs as well as small cap exposure, either through single stocks, or via a Russell 2000 tracker ETF such as IWM US. This said, we note that the S&P500 is at the highest PER valuation for the year in regard to next 2022 earnings at 21x, and speculative assets are frothy to say the least. We suggest investors remain prudent in their allocations and be watchful for changes in market sentiment.

We have recently launched the Odyssey Optimum Return Fund. This is an investable global multi-strategy fund that is designed for clients that would like to invest in the global equity and credit in a risk-controlled manner. The goal is to provide attractive returns in bull markets and to preserve capital in bear markets. The latest factsheet can be found here.

If you like to receive more information on our portfolio solutions, please contact us here: info@odyssey-grp.com.