For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Waiting for Godot

Long time market stalwarts of the equity market such as Warren Buffet will tell you not to try to time the market. Over the long-term, the statistics completely supports this point of view. However, not everyone is a successful seasoned professional with the same time horizon, and not every investor studies the market and companies every day. The majority of us feel fear and greed. When the market is moving up, we wish we had more exposure, when the market is falling we wish we had less. Most of us have made the mistakes of buying high and selling low. Maintaining discipline to minimise mistakes tends to lead a higher probability of positive outcomes.

Since the start of April we have been a little cautious of the potential for increased market volatility, but have stayed positive on the economic fundamentals that ultimately drive markets. The performance of the MSCI World since the start of May, the start of the “volatile” season, has been an impressive 8%. During this time our Model Portfolio has maintained the diversification instigated towards the end of 2020 and an equity weight at circa 50-55%. We did perform some stop losses on two China related names and reweighted to the strong US market. In this manner we have tried to stay disciplined – remain invested because of the strength of the underlying economic recovery, committed to stop losses, and reweighted towards the strongest economy. Consequently, the ROI of the equity portfolio is 17% YTD, similar to the MSCI World Index after beating this Index by 20% in 2020. This has been achieved without any outsized positions and with all the stocks being large or mega cap and highly profitable, i.e. no speculative stocks.

The surprising robustness of the US equity market has led to more calls that we are overdue for a sell-off. Perhaps one measure that the market is becoming overheated again is the resurgence of the speculative trade that we saw in Q1 2021. Certainly, some speculative trades have already taken off – Cloud Computing (CLOU), Uranium (URA), and Rare Earth Materials (REMX) – but others such as the main ARK vehicles (ARKQ and ARKG) as well as clean energy (ICLN) have remained subdued so far, but most have bounced off a well-defined support level.

Source: Bloomberg

We acknowledge that on a technical basis, the market may be due for a modest retracement, but we would need to see concrete signs the recovery is stalling to change our cautiously optimistic view. Also, it is noticeable that as the S&P 500 climbed in 2021, the strength of upward earnings revisions has meant the PER valuation for 2021 has not materially changed since the beginning of the year, making the valuation conundrum less acute.

Vaccines Working Where it Counts

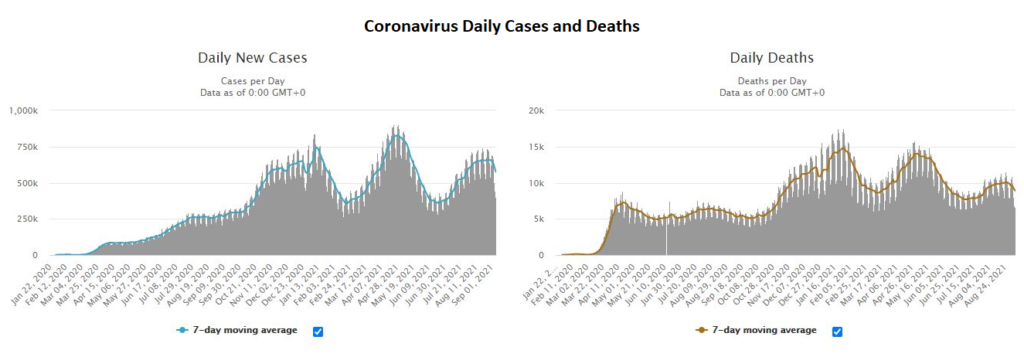

The Delta COVID wave has certainly had an impact on economies, but we are seeing some tentative signs that the infection rate may be peaking on a global basis and importantly, hospitalisations and deaths have not been nearly as high as previous waves. Of course, part of the reason is the vaccination rate that has reached 54% in the US and 60% in the EU for fully vaccinated people. On the basis of people over 18yo the figure is circa 10% higher for both regions.

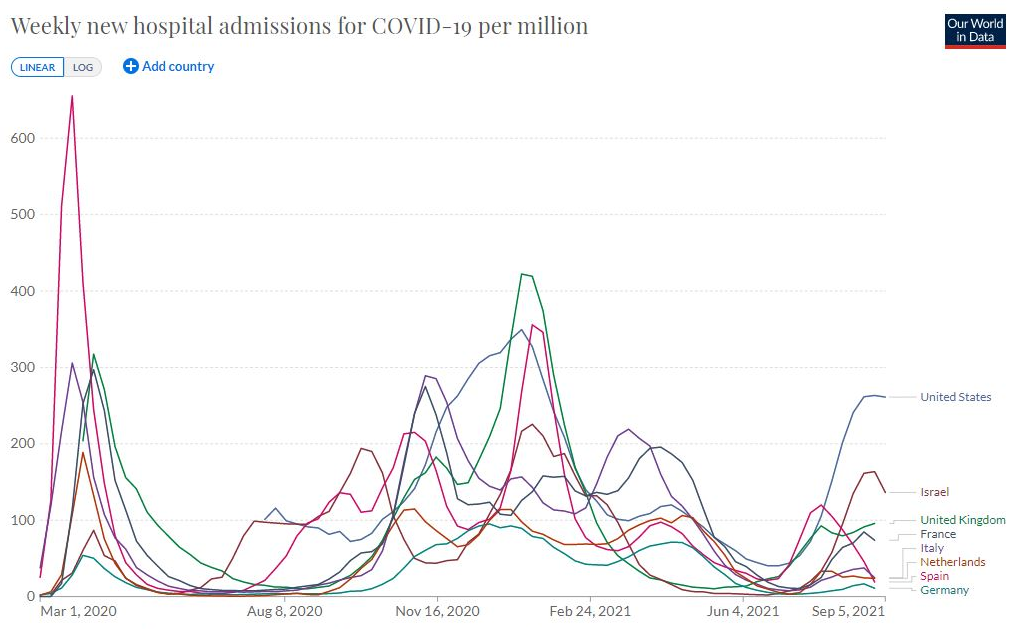

While the global PMI peaked in May, it remains well above 50. There are indeed some supply chain bottlenecks and these could persist for some time, but the inflation rate appears to be stabilizing, albeit at a high rate. Further, if the crowds we are seeing in sporting stadiums in the US and Europe are any indication, nations are starting to enact the “living with COVID” policy. The key here is that despite the high rate of infections, hospitalisations are not spiking towards capacity limits. Should this situation remain, the world can continue to progress to a new “normal” that includes living with COVID. The lockdowns have taken a mental toll and governments are under increasing pressure to pursue normalisation.

Source: Worldometer

Source:Ourworldindata.org

Retail Power Again

We have recently been reminded of the growing power of the retail investor, particularly in situations when a relatively small amount of capital can disrupt a market. One such market is the price of uranium. The price had been languishing ever since the Fukushima nuclear disaster in 2011. However, a Canadian investment fund has almost singlehandedly caused a massive surge in uranium spot prices with a buying spree that has put the nuclear power industry on alert. The spot uranium price for deliveries this month leapt 30.8% over 30 days to $39.75/lb as of September 7. Market analysts credited Sprott Asset Management LP, a uranium trust formed in July to buy up low-cost uranium on the spot market and hold it for the long-term, for the jump in prices. In the first week of September the Fund bought 3mn pounds of uranium to add to the 21mn it had previously purchased.

The uranium price has sent Global X Uranium ETF (URA) up +33% MTD. This is not the first surge for this ETF this year with the price more than doubling to June 30 YTD on uranium price speculation.

Investment Recommendations

The Tencent and Alibaba of SE Asia

SEA Ltd (SE US) is not an undiscovered gem, but it does appear to have plenty of more growth. The company that owns Shopee, the largest e-commerce platform in SE Asia and Taiwan, and Garena, a thriving online games developer and publisher. It also has Seamoney, a burgeoning digital payments and financial services provider in SE Asia. In Q2 revenue grew 159% to USD2.28bn, split fairly equally between games and e-commerce. EBITDA was almost flat at -USD24mn, with the USD741mn of EBITDA made by games being offset by losses in e-commerce and digital payments. However, gross merchandise value grew 88% y-o-y and payment volume grew 150%, indicating the loss-making ventures are scaling well.

The company just raised circa USD6bn, offering 11mn new ADRs at USD318 each and a USD2.5bn convertible bond. This is despite having already raised USD2.6bn of equity in December 2020 and having USD6.3bn in cash as at the end of the year with only USD2.1bn in debt.

The firm appears to have the growth of a much younger Tencent or Alibaba, and without the government oversight. While the SEA market cap is already USD179bn, it remains only 17% of the combined market cap of the two China giants.

Source: Bloomberg

Odyssey Model Portfolio Performance

Please note that from next month the Odyssey Model Portfolio and the Horizon Portfolio performances will be replaced by the Odyssey Optimum Return Index which is a discretionary portfolio managed by Odyssey. The Model Portfolio was the precursor strategy to the Optimum Return Index.

If you like to receive more information on our portfolio solutions, please contact us here: info@odyssey-grp.com.