ODYSSEY HORIZON PORTFOLIOS – HOW DID WE DO IN 2017?

Our successful calls in 2017:

- Overweight equities, especially Hong Kong and Japan. On a sector basis, we were long financials and cyclicals.

- We were oil bulls from mid-year with Shell and Chevron our top picks.

- We were US dollar bears, mainly versus the Euro, especially after the French Elections.

Our less successful calls in 2017:

- Taking profit too early in technology companies, indeed not being overweight enough the sector prior to the big run up.

- Expecting Europe to outperform the US, given valuations and strong upturn in growth in the Eurozone.

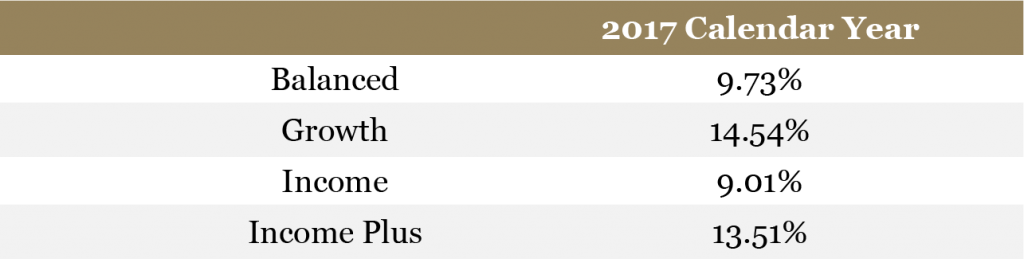

Horizon Portfolios

Click here if you would like to receive further information on our Horizon portfolios.

New Zealand Equity Portfolios

Click here if you would like to receive further information on our New Zealand Equity portfolios.

Enhanced Income – Options Overlay

Click here if you would like to receive further information about our options overlays.

2017: THE YEAR IN REVIEW

2017 was an interesting year, proving to delivering some unexpected returns, in summary:

- Global equities returned over 20% in 2017, to post their best year since the global financial crisis in 2008/9.

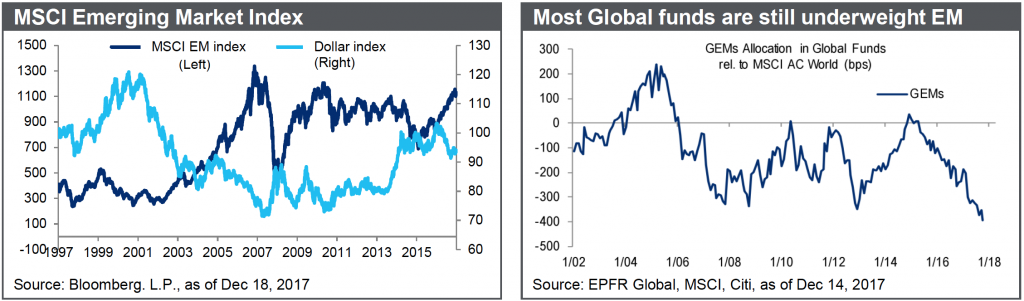

- Emerging Markets outperformed advancing 38%, compared to developed markets which finished up 20%.

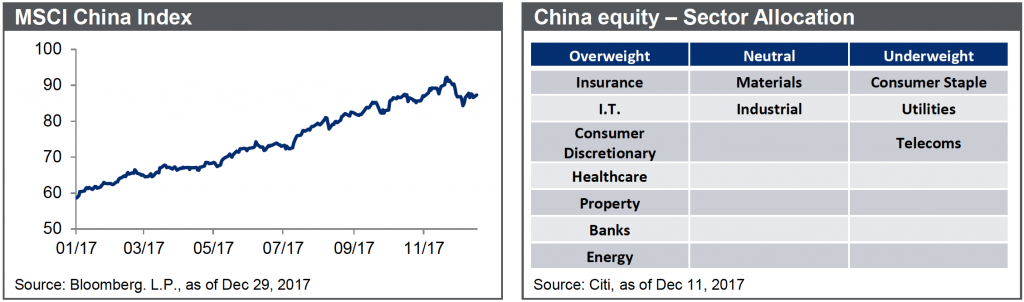

- China led the way rising 54%, whilst the worst performing major market was Russia, up only 6%.

- At the sector level, it was a case of Tech versus the rest. The global IT sector outperformed by almost 15%, with Materials in second place outperforming by only 4%.Energy was clear laggard, although the sector recovered somewhat in H2 2017, alongside a 46% rebound in the oil price.

- More broadly, cyclical sectors beat defensives by 7%, but value continued to lag behind growth in both developed and emerging markets.

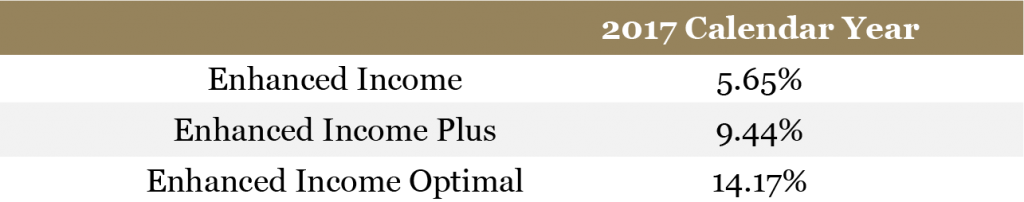

Asset Performance in 2017

- Earnings growth rebounded last year, marginally beating consensus expectations. MSCI ACWI is now expected to have delivered 15% EPS growth in 2017, up from an expected growth of 13% last January.Emerging Markets saw the biggest upward revision , and are currently expected to see earnings growth by 23%. In contrast, Europe ex-UK disappointed with expectations falling from 11% to 9%. Consensus for 2018 global EPS growth is currently 10%, with EM expected to lead again with 13% growth.

- Bonds underperformed equities especially Government bonds that were capped by more hawkish central banks.World IG returned almost 5%, while World HY performed better at almost 7%.

- Gold and Oil performed well in the commodity space up 13.7% and 12.5% respectively, whilst in the FX space the US$ Dollar was the big loser down almost 10%, with the Euro one of the main beneficiaries.

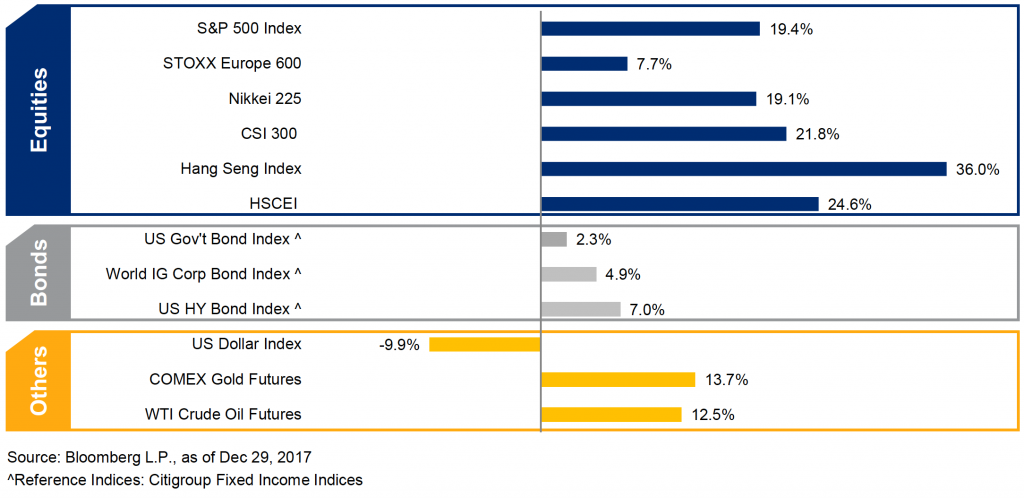

FORECASTS FOR 2018

We expect the global financial markets to make further gains this year driven by a number of key factors, summarised below:

- The Trump tax policies will support US companies at least in the short term while the economy receives this alternative form of stimulus.

- Consensus real GDP growth of 2.5% in Developed Markets and almost 5% growth in Emerging Markets.

- This year would be another year of synchronized global growth.

- As the major economies will keep growing in 2018, Central Banks will continue the process of removing accommodative monetary policies, but more slowly than anticipated by the market.

- While we are bullish US stocks, we think European, Japanese and Emerging Markets will outperform in 2018

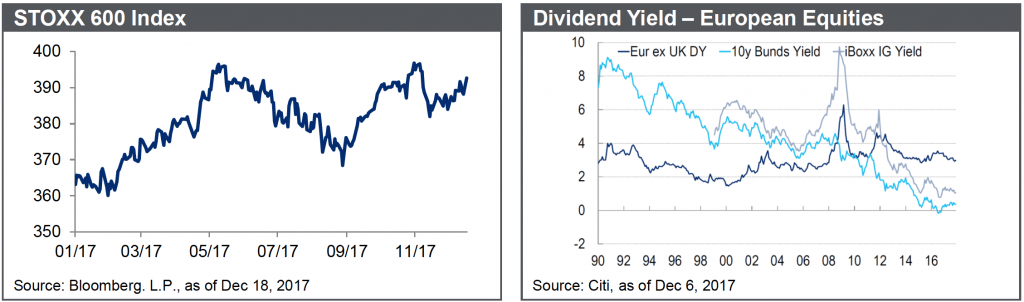

- We are overweight European equities, given the robust recovery in the Eurozone economies, and a dividend yield that is at 3 times that of corporate bond yields.

- European equity valuations are at long term PER averages of 16x PER – much more attractive than US equities at 18.5x PER for 11-13% EPS growth 2018.

- For China, EPS growth is expected to exceed 15%.

- The market has been worried about RMB depreciation, capital outflows and an economic hard landing but these fears proved to be overblown.

- Hong Kong equities may still be supported by increasing Southbound inflows from China with EPS growth also to be expected around 15%.

- Consensus forecasts in Emerging Markets, especially Emerging Asia, are in the 12-15% range.

- Moreover, most Global investors are still underweight EM and thus could increase their holdings.

STOCKS WE LIKE – OUR TOP 10 FOR 2018

Click here if you would like to receive further information on our 2018 top stock picks.

MARKETS OVERVIEW

Equities – New highs as global expansion continues

- Equities remain our preferred asset class, even after the strong run-up in 2017, we still expect positive returns in 2018 supported by the continuing expansion and earnings strength, although we see more muted returns than in 2017

- Within Developed Markets, we prefer Europe and Japan, where valuations are supportive and whose economies are relatively more levered to the global cycle and the rebound in global investment spending is greater than in the US. Globally, we prefer Emerging Markets equities relative to Developed Markets.

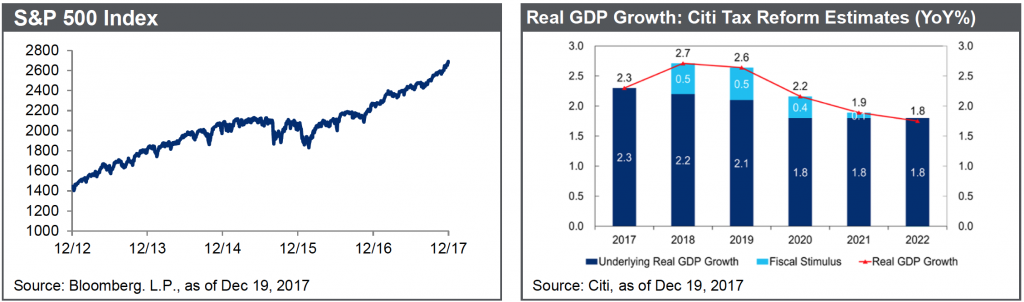

- The US tax reform could lead to an additional 1.5% of GDP growth over the next 4 years, albeit at the expense of an increased deficit and the rising debt burden.

- According to Citi a 21% tax rate could add $8 to 2018 EPS, and the consensus 2018 year end target for the S&P500 year has been raised to 2,800.

- Sectorwise we still favour Financials, Consumer Discretionary, Telecoms, Industrials and Health care, with the Technology sector as the usual wild card.

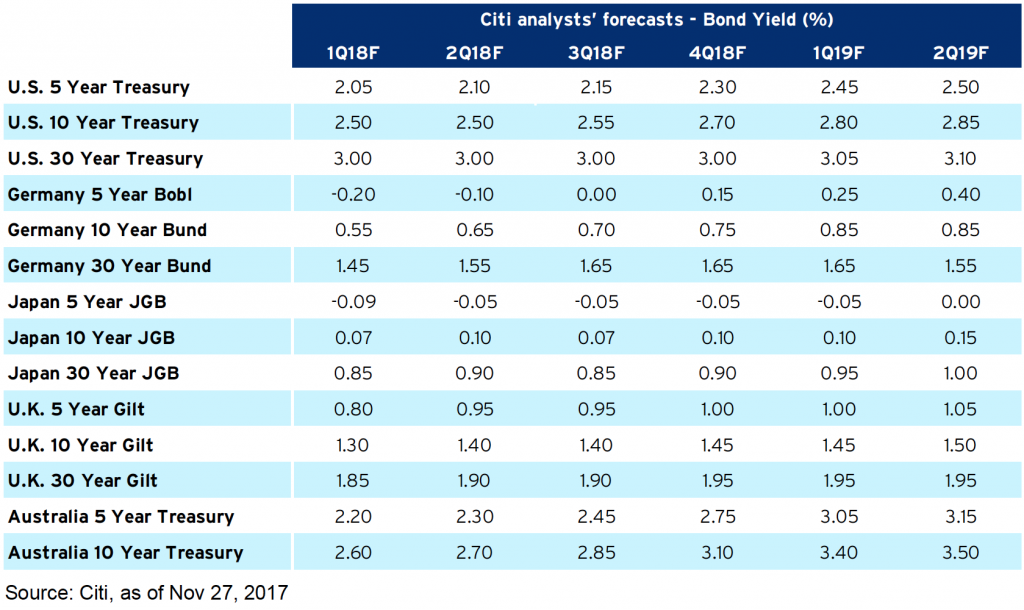

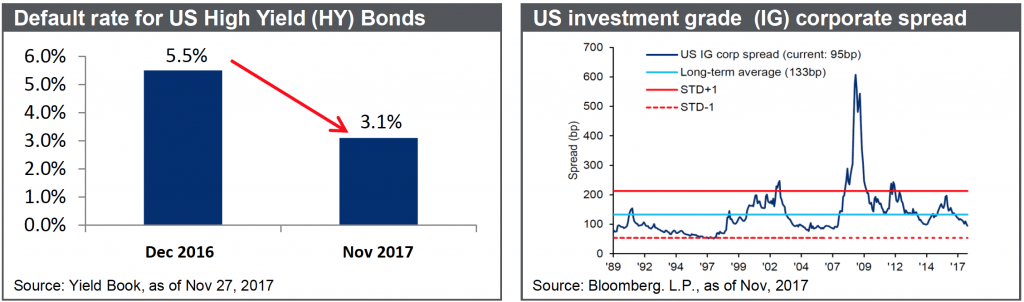

Bonds – Bearish

- We are bearish on Government Bonds, given the very low yields, and the fact that Central banks across the World will keep raising rates and normalising monetary policy.

- More broadly, the risk of greater fiscal expansion in the US, discussions about the Fed adopting a higher inflation target and the risk with respect to reduced global QE all suggest that yields will rise.

- After another move at the mid-December meeting we see the Fed pushing through 3 more hikes in 2018. Monetary tightening will come from balance sheets adjustments as well as interest rates increases. The Fed is already shrinking its balance sheet, and ECB purchases are set to finish by the end of 2018. With Japan already proceeding at a slower pace, overall G3 balance sheets are set to peak in 3Q 2018.

- Nevertheless, risks to developed market investment grade bonds are not severe, and we think will produce a positive return, although yet again underperforming equities.

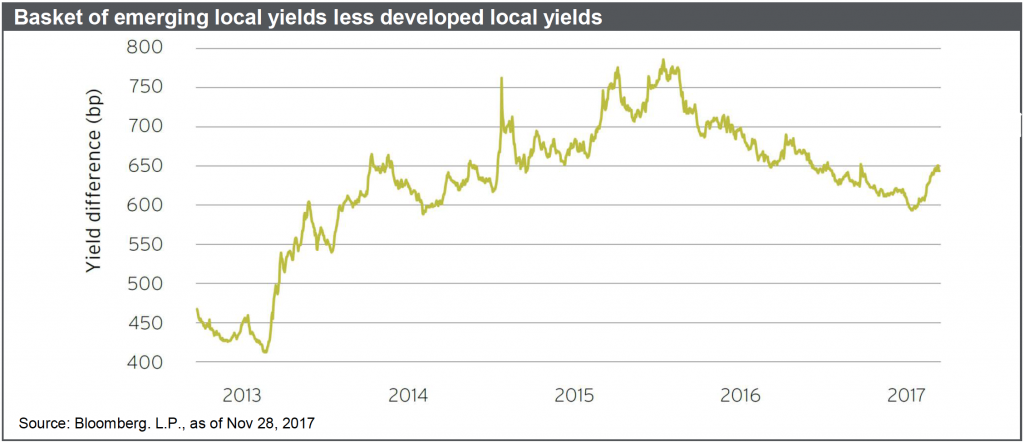

- High Yield and especially Emerging Markets bonds would be our favourite place to invest in the Fixed Income space.

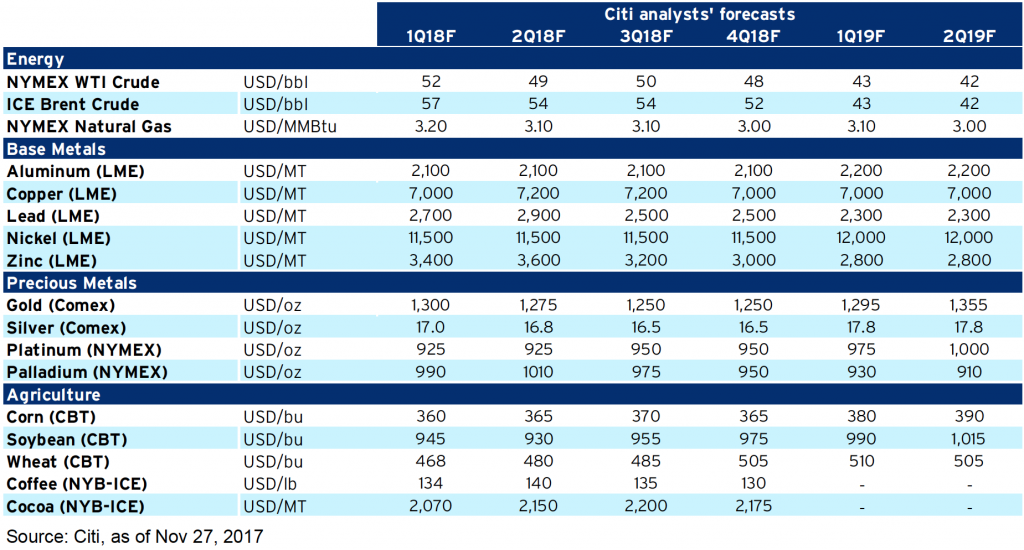

Commodities – Expected Range Markets

- We remain bullish on Oil as the OPEC agreement to restrict supply is holding together better than we expected, even though the recent up move has exceeded our expectations.

- While oil demand has been growing at a steady pace, US production has recovered from the effects of the hurricane, and so the US rig count is improving again, as drilling is responding to the recent strength in prices.

- We are neutral on Gold as we see the market poised to hover between 1,200 and 1,300. While a strong stock market will reduce the need for a safe heaven, the weak US dollar will give gold some king of support, meaning that we will not see a pronounced sell off.

Currencies – Consensus bearish on USD we remain neutral to slightly bearish

- After the hard sell off of the Dollar in 2017, consensus is for a continuation of the same trend in 2018. While the Fed will continue hiking rates, as will many other Central Banks, and unless the Fed becomes much more hawkish, the Dollar will find it hard to stage a real comeback.

- We still favor the Euro, as well as the Australian Dollar, New Zealand Dollar, with the British pound as the potential wild card.

- We would expect higher yielding Emerging Markets currencies also to perform well in this environment.

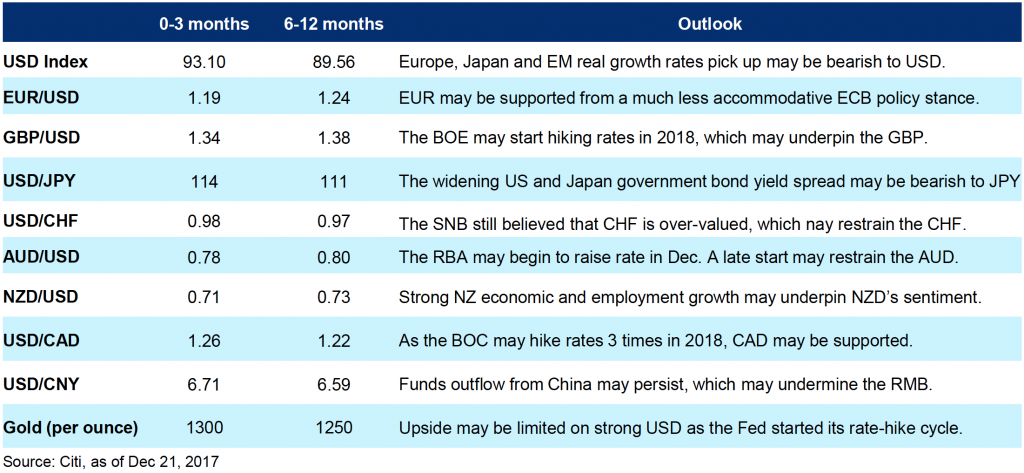

Foreign Exchange Forecasts

RISKS FOR 2018

While we are optimistic about 2018, there are of course risks to our constructive base case scenario:

- Geopolitical events: North Korea risks albeit abating, Saudi Arabia and Iran tensions, the Spain-Catalonia crisis, elections in Italy and implication for the euro, a sudden drop in Chinese economy, and a negative end of the NAFTA talks with implications for trade relations around the world.

- Potential central bank’s policy mistakes (J Powell takes over at the Fed in February, and Draghi will step down next year).

- The return of inflation, that would compromise the current Goldilocks scenario.

HOW WE MANAGE RISK – PORTFOLIO PROTECTION, HEDGING & TAKING PROFITS

As opposed to just going to cash, we prefer alternative strategies such as hedging via options and option writing strategies to smooth out portfolio volatility. We also actively monitor profits using trailing stop losses with the view of protecting and locking in gains.

PORTFOLIO MANAGEMENT SERVICES

Please let us know if you would like to hear more about our Discretionary Portfolios or how we can create tailored portfolio based on your investing needs.

PORTFOLIO OPTIONS OVERLAY SERVICE

If you are interested in receiving an additional 0.5% to 1.5% per month in income on your portfolio, please enquire about our Portfolio Options Overlay service.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at. Please contact us at contact@odysseycapital-group.com or on +852 2111-0668.

Click here if you would like to receive further information on information on other investment opportunities that we are investing into for 2018.