SEPTEMBER 2018

September started badly for equities outside the US, especially for EM equities outside AXJ, and the IT sector within US equities. Trade fears over whether the US will impose 25% tariffs on a further $200bn of imports from China last week and roll-out tariffs on global auto exports to the US, along with contagion from South Africa, hit EM equities, FX and fixed income (FI). Both JP Morgan EMCI and the JP Morgan local currency debt indices hit all-time lows. The current market turmoil is at odds with broadly supportive fundamentals in GDP. Several houses revised up US growth this year, and for the next three years, whilst latest Japanese and Chinese data are solid. Although EU economic data has eased off to 16-month lows, it is still at a robust level in absolute terms.

On the trade war front, Trump’s belligerent tweets might be a reaction to his growing difficulties domestically as his past behaviour catches up with him. His close aides, Cohen and Manafort, were convicted which could open him up to a risk of impeachment proceedings should the Democrats win the House in November. Trump has indicated he will proceed swiftly to impose further tariffs on China, to which the latter has indicated it will retaliate appropriately. He also suggested tariffs on auto imports will be rolled out despite EU’s zero tariff offer. It is difficult to ascertain a meaningful strategy with the current U.S. Administration.

MARKETS OVERVIEW

Equities – A Mixed Bag

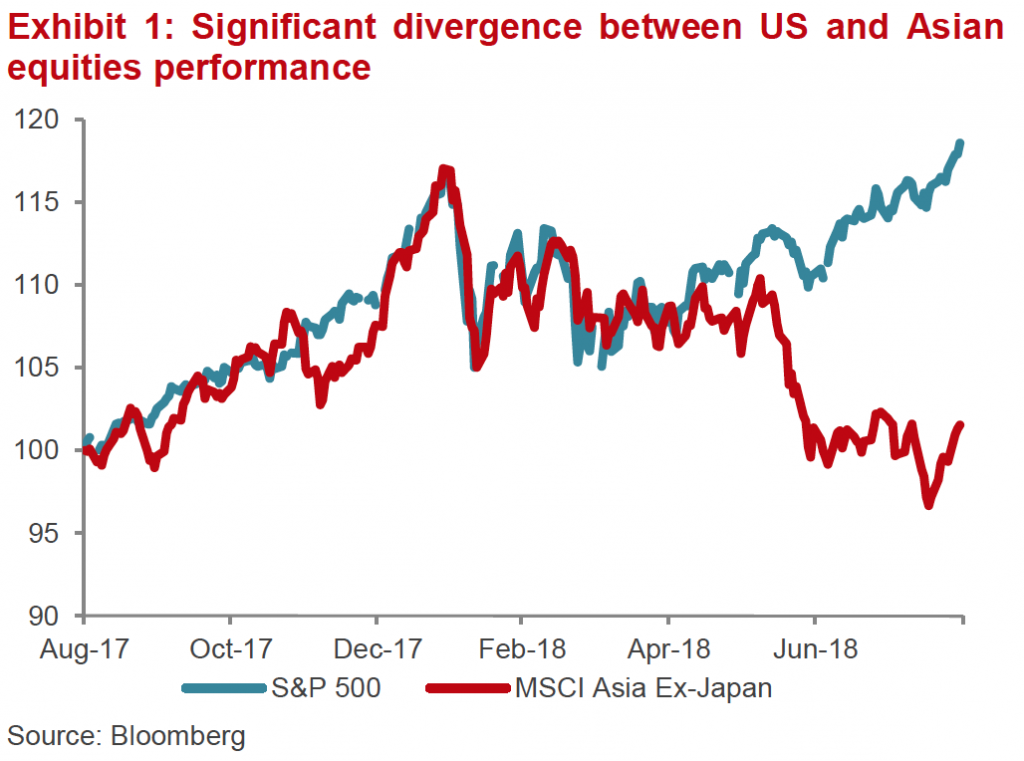

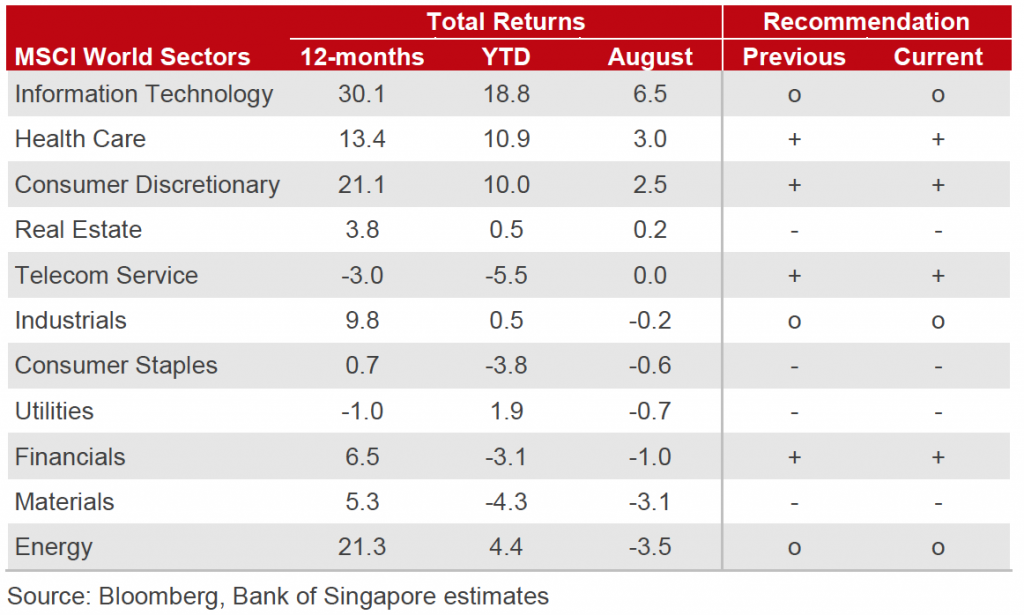

- August saw a mixed performance, as US indices were led higher by Nasdaq’s c.6% gain. The S&P 500 was up over 3% while the trade-impacted DJIA lagged, gaining just 2%. Nikkei was up close to 1.5% but STOXX 600 and FTSE-100 fell by 2.4% and 4% respectively. Emerging market (EM)/AXJ equities fell, led by A-shares which was off over 5%, but most rallied from lows at the start of the month – a recovery in sentiment over Turkey and Argentina was short-lived as Trump again upset markets in the last week, with further trade threats despite negotiating a deal with Mexico.

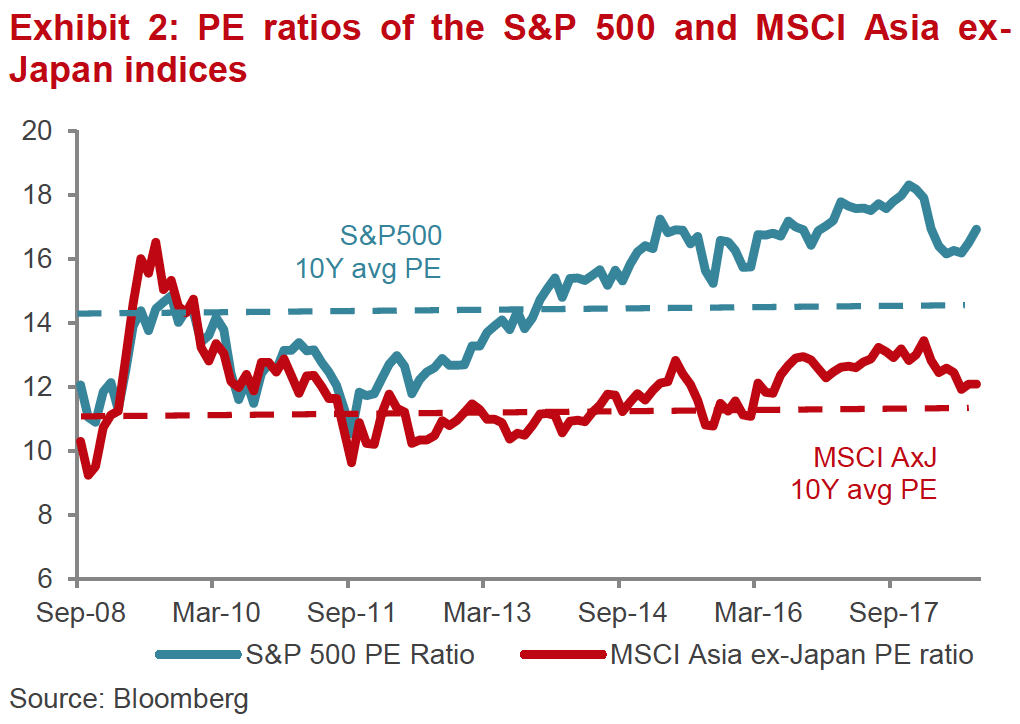

- 2Q18 results in the U.S. were excellent and have led to further upwards revisions for EPS growth for FY18. These are now at +23% vs. +11% at year-end 2017, putting S&P 500 on c.18x forward price/earnings ratio (PER). However, if one strips out the IT sector and Amazon, then it trades on closer to 14x with the large US banks PERs at a reasonable 11x. This makes non-IT/Amazon US equities quite reasonable relative to the past and against other equity regions.

- In U.S. equities, we also see that sector rotation continues with evidence that the expensive IT sector is struggling as investors become more discriminating with Facebook, Twitter, Netflix and Google facing headwinds whilst the newly minted $1tn market cap duo, Apple and Amazon, climb higher. Since June, utilities, telcos and real estate have outperformed growth sectors on a relative basis.

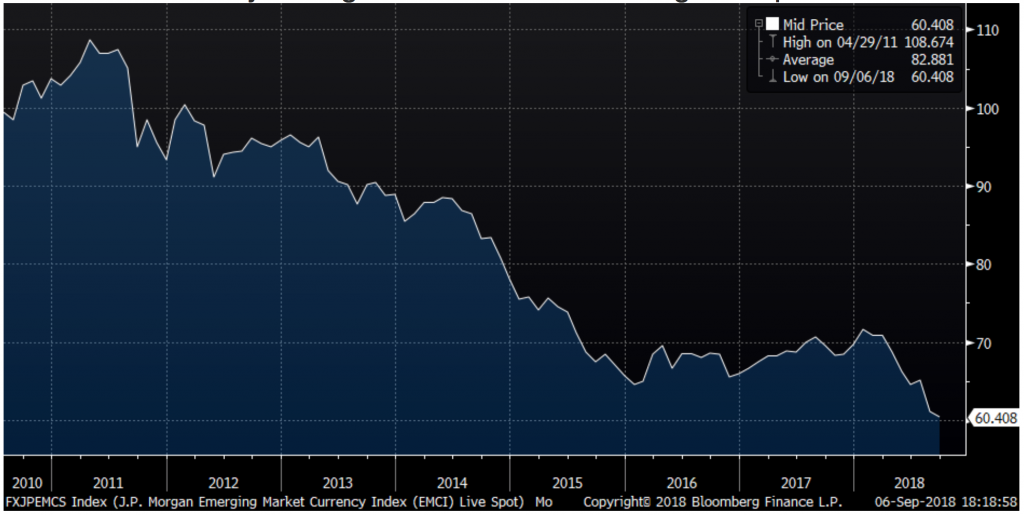

- EM continued to have a torrid time as Argentina blew up, forcing the government to sharply raise rates to 60% to defend the currency, and volatility in Turkish assets was extreme. Concern this week has also spread to South Africa. At the time of writing, the MSCI EM index is flirting with a bear market, and the JPM EMCI is at an all-time low. In contrast to developed markets (DM) equities where earnings have beaten forecasts YTD, EM/AXJ earnings have disappointed – notably in the giant IT/social media stocks like Tencent and from KOSPI – leading to earnings downgrades.

- Further trade escalation will hurt APAC and EM hard. Japan will also suffer given its strategically important car industry. Whilst some of the damage has been discounted in the declines in equity and currency markets YTD, we doubt this is fully the case and could see further downside in the short term.

- We are in the camp where the global economic outlook is fundamentally sound and expect trade disputes to de-escalate before major economic damage is done. We doubt the Fed will tighten aggressively, limiting USD strength, nor do we sympathise with the view that forecasts much tighter financial conditions which would lead to a severe APAC and EM equity correction. We also do not see Argentina, Turkey and South Africa as ‘canaries in the mine’ for the wider EM asset class, and certainly not for APAC, but rather as idiosyncratic events at a time where sentiment has become less forgiving.

Source: Bank of Singapore

Source: Bank of Singapore

- As a result, we see any further material sell-off in APAC as an opportunity to add assets. With the top five AXJ IT/social media stocks underperforming ‘FAANGs’ by 50% YTD, we think value is emerging in AXJ equities relative to US IT and would look to move AXJ from underweight to overweight. We highlight the possibility that Trump might want to agree a deal with China ahead of the mid-terms and around the Sino-US summit between him and Xi Jinping in November before the G20 meeting.

Fixed Income – EM FI Hit Hard

- In response to the question regarding the government’s approach to its upcoming budget, Italy’s PM said, “If it is a choice between the people or the rating agencies, we will support the people”, which some fear will be much higher than EU’s 3% deficit limit. Italian BTPs promptly sold off with the 10Y yield rising above 3% at one point. Safe haven Bunds’ yield fell towards 30bps and the spread between BTP 10Y yield to Bunds yield again hit 2.9% – like the sell-off after the election.

- Elsewhere in DM, FI yields were less exciting. UST yields fell on risk-off sentiment and a “dovish” interpretation of Powell’s Jackson Hole speech but then rose on continued evidence of the strength of the US economy – not least on a very powerful August ISM manufacturing print. The 10Y yield tested key support at 2.80% before slowly recovering to 2.90% despite EM volatility while the yield gap remained stable.

- UK Gilts rallied on weaker macro data with hopes that BOE was just ‘two and done’. BOJ was forced to actively intervene in JGBs ahead of its MPC meeting where some hoped it might lift ‘YCC’ target to 20bps, but this died down after its relatively dovish statement.

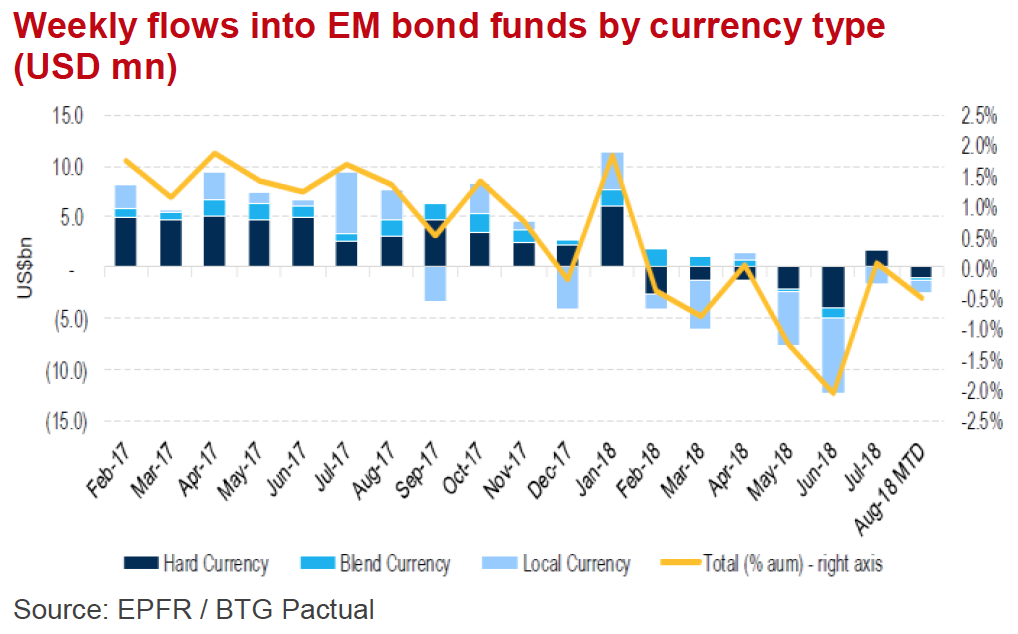

- EM FI was hit hard in the last few days on renewed volatility in EM, and especially in markets that are large components of EM FI weighting as Turkey, S. Africa and Argentina. This knocked-on through to Indonesian FI and AXJ high-yield more generally. The JPM EM FI index fell to an all-time low linked to the EM FX weakness.

Source: Bank of Singapore

Source: Bank of Singapore

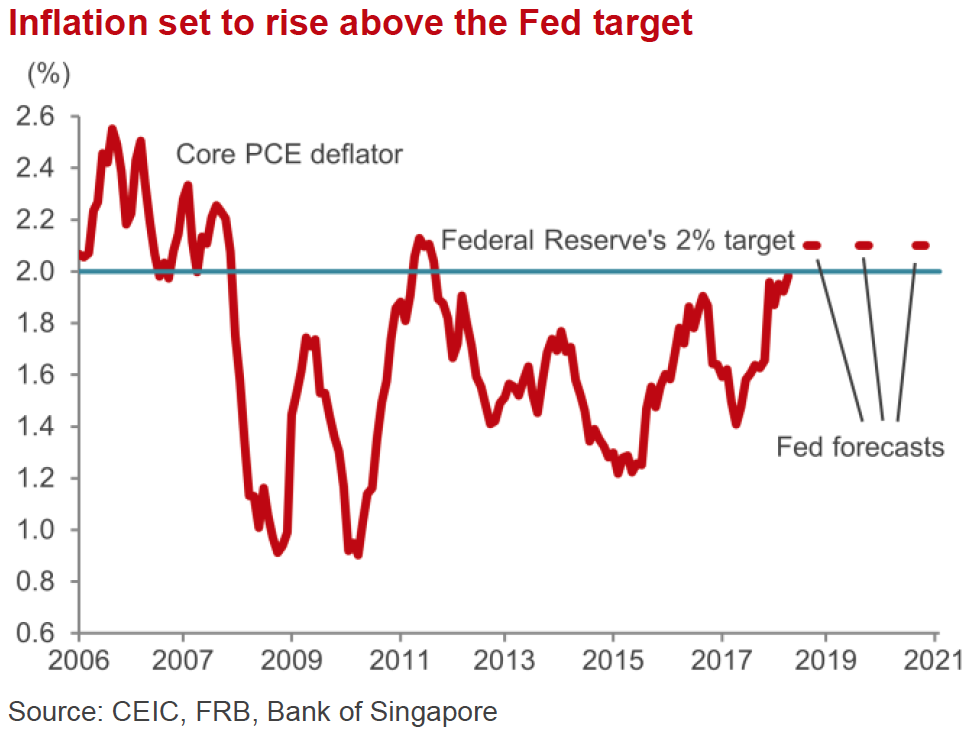

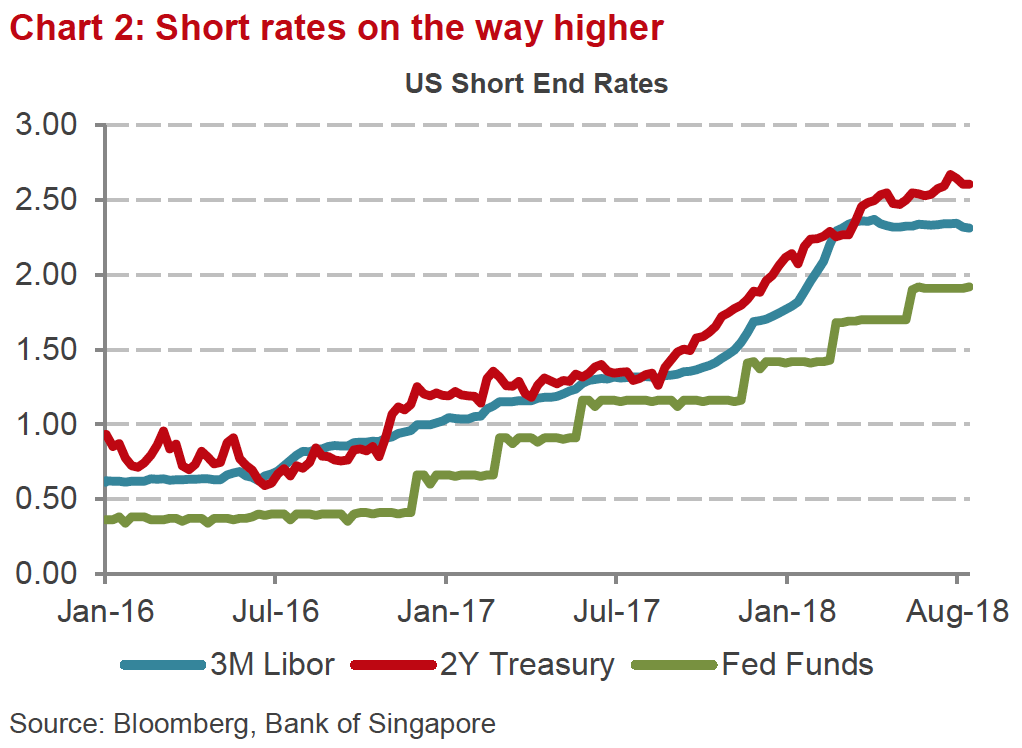

- The key as to whether there will be substantial damage in FI is both the degree to which rates rise and, more importantly, the pace of the rises, and whether this is a consequence of stronger growth or higher inflation. These matter particularly to EM FI, which can handle gradual rate hikes in the context of stronger growth but will be at risk if fast hikes are more related to higher inflation.

- With EM/AXJ business cycle positioning different from that of the US, the divergent monetary policies are creating volatility and making the ‘carry trade’ less attractive as yield differentials narrow. This is evident between CNY Chinese Government Bond (CGB) yields and USTs (Fig 1). This is creating pressure on EM FI with substantial outflows back to DM FI of a magnitude last seen in the 2013 ‘taper tantrum’. Some of the larger EM FI funds like Goldman Sachs and Templeton have been hit hard too. For now, it is hard to see where the marginal buyer of EM FI might come from.

CGB 10Y-UST 10Y spread | Source: Bloomberg

CGB 10Y-UST 10Y spread | Source: Bloomberg

Commodities – Constructive

- The Brent oil price rose c. 5% in August after testing, but not breaking through, strong technical support at $70/brl. The drivers of the rise were growing fears of supply being reduced by 1mn/bpd or more once US levies sanctions on Iranian exports in early November; the threat Iran has made it would block the Straits of Hormuz through which 35% of the global traded crude oil is shipped; and stronger US demand that saw inventories drop more than forecast.

- Gold continues to trade inversely to USD. The dollar surged earlier in the month and Gold fell sharply through $1,200/Oz to a low around $1,160/Oz before recovering to just at $1,200 as USD weakened. As interest rates rise, so the opportunity cost of owning gold increases and likely higher UST yields will support USD too. There was some indication heavy speculative selling of gold eased-off after it fell below $1,180/Oz. Gold fell almost 2% for the month.

- We see gold’s direction, for now, being yoked to the USD but the precious metal does seem to be in a price area of historical support. We remain constructive on the outlook for oil prices in the short-term and longer-term. In the short-term, geopolitical concerns around the supply-side reduction in oil exports after sanctions on Iran, and the latter’s possible retaliation, may worsen in the run up to their imposition in early November. In the longer term, we believe there are consequences from the huge capex cut in oil exploration and production spending between H2 2014-H1 2017 which could result in a shortage from 2020 onwards. In addition, new rules on anti-pollution for shipping will add 2-3mn/bpd demand for lower sulphur oil that is currently in tight supply given the existing refinery capacities and capabilities.

Currencies – EM FX suffers

- So USD traded in relatively tight ranges against other DM currencies. Earlier in the month, the DXY rose to a point where some forecasters became more bullish it might break out towards 100 but sentiment changed, notably after Powell’s Jackson Hole speech, and DXY briefly broke below 95 before recovering again.

- The main mover against USD amongst DM currencies was GBP. It broke below its 1.30 support, on Brexit fears there might be no deal, to test support at 1.27 before optimism a deal might happen saw it rally to test, but not break above, 1.30.

- The main action was USD vs. EM FX with some huge falls – notably the Argentine peso – but this does not show up in the DXY. The JPM EMCI fell to an all-time low (Fig 2), with big falls across many including IDR, INR, BRL, ZAR, etc. INR was impacted after its latest trade and current account deficit rose to a 5 year high on increased oil and gold imports.

JPM EMCI at ATL | Source: Bloomberg

JPM EMCI at ATL | Source: Bloomberg

- PBoC upped the rhetoric to defend CNY and acted once it rose through 6.90. This helped stabilize the currency, which strengthened from a low of 6.96 to a high of 6.80 intra-month. PBoC made it clear that a weaker CNY was undesirable and that it wanted to limit speculative capital flight. Likely too is a desire by the Chinese government to avoid further upsetting ongoing trade discussions with USA after Trump explicitly highlighted the weak CNY as a problem.

- It is likely the link between trade escalation and a stronger USD will continue given this reduces the US trade deficit, all things being equal; makes US assets relatively more attractive; and enhances its ‘safe haven’ attributes relative to JPY as a trade war would be damaging to Japan’s economy – notably if US imposes auto tariffs. Unsurprisingly, this would also be bad for the trading countries’ currencies – especially EM/AXJ.

HOW WE MANAGE RISK – PORTFOLIO PROTECTION, HEDGING & TAKING PROFITS

As opposed to just going to cash, we prefer alternative strategies such as hedging via options and option writing strategies to smooth out portfolio volatility.

We also actively monitor profits using trailing stop losses with the view of protecting and locking in gains.

PORTFOLIO MANAGEMENT SERVICES

Please let us know if you would like to hear more about our Discretionary Portfolios and how we consistently generate an additional 0.5% to 1% per month using our Options Overlay.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at.