For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Dear Clients,

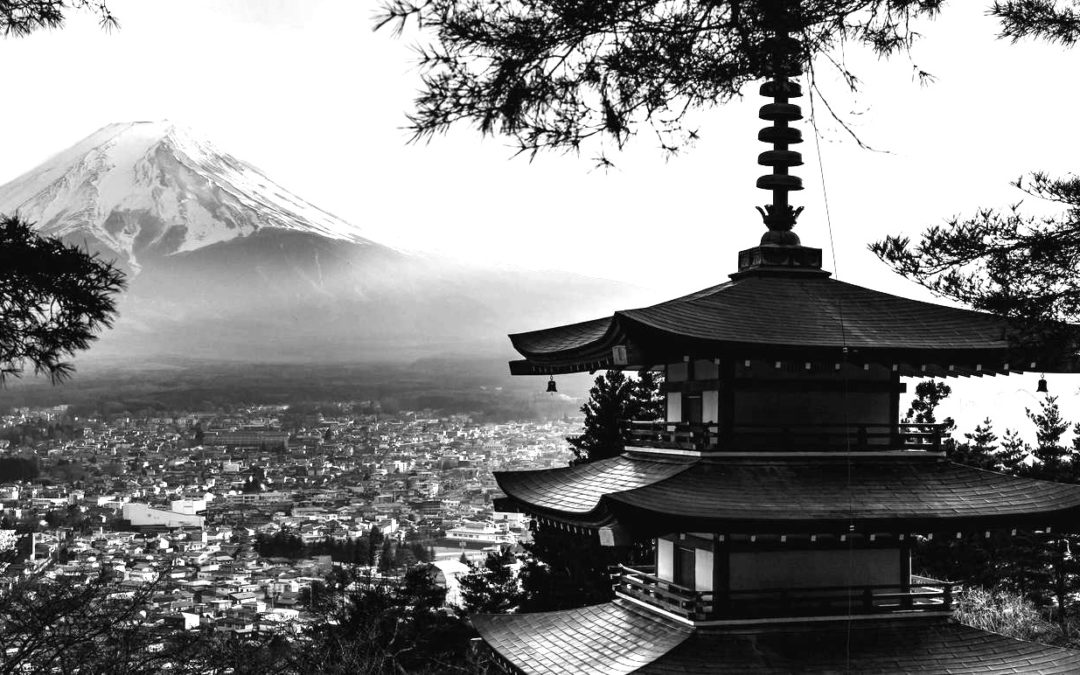

Our Japanese Real Estate team are delighted to bring to you Part Two of our Thought Leadership series looking at a key investment asset within our portfolios; Japanese boutique hotels or “Ryokan’s” as they are known in Japan. Part Two takes a deep dive and analyses the emerging trends, dynamics and unique features of Ryokans and what makes them such a compelling asset. Our Thought Leadership series on Ryokan’s includes the following topics:

Part One: What are Ryokan’s, how do they operate and what are the key features?

Part Three: Investment thesis and case study of Ryokans

We hope you find Part Two interesting and a fascinating continuation into understanding the world of Ryokan’s. We have linked Part One again here for those who may have missed this, and we looked forward to sharing Part Three next week.

If you like to receive more information, please contact:

James Wheeler

Managing Director – Head of Distribution

james.wheeler@odyssey-grp.com

www.odyssey-grp.com