Nov 15, 2019 | Articles, Global Markets Update

A myriad of positive factors pushed global equities higher, with the MSCI ACWI seeing a total return of 2.76% over the month, before moving higher month-to-date (MTD) in November (+1.35% MTD as at 5th November). This move higher was supported in part by the three US indices, which all achieved all-time highs. European and Asian equities also shook off earlier weakness to close higher due to improving US-China trade sentiment.

However, the improvement in the geopolitical environment helped take a degree of uncertainty off the table, leading corporate credit, particularly investment-grade (IG) debt, to outperform. Markets were risk-on throughout October, extending the gains seen in September amid a combination of a turnaround in trade negotiations, strong economic data, and better-than-expected earnings. Q3 earnings by American and European companies are beating consensus estimates handily.

The Federal Reserve again cut rates but despite the cut, they signalled that it will hold rates for the time being. The US also saw solid economic data and resilient consumption, which taken together with the rate cut, let Morgan Stanley’s model of recession odds in the next 12 months to fall back below 20%.

Volatility in foreign exchange markets remained low, with the UK Pound being the only exception. The currency saw exceptional gains in October, strengthening 5.81% against the dollar as risks of a no-deal Brexit were reduced substantially with Prime Minister Johnson’s withdrawal agreement with the EU. However, the UK parliament failed to vote through the agreement, forcing Johnson to request for an extension to the deadline. Another general election was also called, with the vote tentatively scheduled for 12th December

OUTLOOK

The Federal Reserves’ third-rate cut, along with Q3 earnings beating consensus, has provided support for the case for global equities on a tactical basis. However, risks remain for US equities in the medium-term, with the first being political in nature. Elizabeth Warren is now leading the Democratic candidate and the policies she espouses are set to impact two-thirds of the S&P 500 directly and indirectly. Her policies will, at best, create considerable uncertainty but result in direct damage at worst. Amongst her aims are to ban fracking, break up banks (via the 21st Century Glass-Steagall Act) big tech, increase corporate taxes and target private equity tax avoidance methods. Even if Donald Trump was to be re-elected, there is still bipartisan support around breaking up social media giants and reforming healthcare – including the giant healthcare service organisations.

However, more fundamentally, there are headwinds against US equities’ return on equity (ROE)/operating profit margins (OPM), with the US economic expansion now being the longest ever on record. Should trade tensions not escalate further in 2020, US equities’ defensiveness might be less obvious, enabling a rotation into equities in other parts of the world that have underperformed S&P 500 since the Global Financial Crisis. US share buybacks have arguably peaked in FY18 and Goldman Sachs expects these to slow to $675bn by 2021 from over $900bn in 2018. Separately, there is also the potential for contagion into equities from the problem’s in the $1.1trn leveraged loan market, as well as from any major downgrading of BBB debt into high-yield (HY). S & P 500 – on over 17x forward P/E ratio – is fully valued and especially so if earnings per share (EPS) contracts in FY19 and FY20.

We remain positive on Japan for some of the same arguments as for Europe, although there is a more pronounced structural ROE story linked to improving corporate governance. Asia ex-Japan (AXJ) is trickier as a large part of it depends on the level of USD relative to AXJ currencies. This can go either way but AXJ central banks are easing monetary policy and/or injecting liquidity, while domestic demand stories are resilient. Several countries are also meaningfully cutting corporate taxes (India, Indonesia, and the Philippines) as well as boosting infrastructure spending (Malaysia, Philippines, Singapore, India, and Thailand) – there is a fiscal response to AXJ that is missing from countries in developed markets (DM). We also see China reflating more proactively given the weaker manufacturing PMI data and PPI disinflation. We are not likely to see a huge reflation like 2009/1010 nor 2019, but we could see substantially more stimulus than the very limited amounts YTD.

In contrast, European equities might look relatively better after some progress around Brexit and a recovery in the auto sector from a difficult year. ECB is potentially restarting quantitative easing whilst retaining a very weak monetary policy. Whilst European GDP is weak, it may move sideways in contrast to US GDP, which is set to slow sharply from Q4CY19 through much of 2020. Leading indicators point to European GDP/manufacturing picking up in H1CY20. Less trade uncertainty – admittedly a big if – will also help EU’s very trade-focused economy. Simply put, EU’s economic cycle, as well as equity earnings, lags the US European equities have far greater potential to see riding earnings/ROE’s, with share buybacks accelerating as well – admittedly from a very low level relative to the US. Foreign institutional investors are also underweight European equities, especially UK equities. Whilst ROW/European equities might contract more than US equities in FY19, their outlooks are relatively better in FY20.

However, whilst there is a tactical case to add to equities, we remain cautious for several reasons: 1) Ongoing GDP downgrades will impact earnings while share buyback, which has been the single largest buyer of equities in the last two years, are slowing markedly: 2) A lot is also is riding on Q4 earnings being positive close to double digits as it is off a much lower base in Q4Y18A, but consensus numbers appear optimistic and there is a decent prospect global EPS will contract including US equities: 3) Earnings elsewhere, recent Brexit and trade positives might reverse – we are one tweet from a souring of hopes whilst UK politics is a mess plus markets have already rallied on their positives. Lastly, 4) Investors can sit on cash/remain defensive far longer than is expected.

![]()

![]()

![]()

![]() EQUITIES

EQUITIES

Fig 1: October total return performance of US indices in % returns. Source: Bloomberg

-

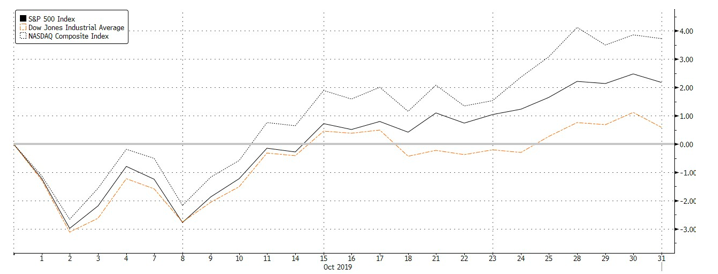

US equities had a rough start earlier in the month amid weak September manufacturing data while trade tensions continued to escalate with the US blacklisting of Chinese companies not helping the situation. However, a positive geopolitical environment helped push benchmark indices to all-time highs later.

-

Tech stocks fared relatively well to help the A & P 500 to a +2.04% MoM gain, Nasdaq outperformed at +3.66% MoM, while the Dow Jones lagged behind at +0.46% MoM, weighed lower by a 10.66% fall in Boeing. (Fig 1).

![]() Fig 2: October total return performance of S & P 500 Growth Vs Value companies. Source: Bloomberg

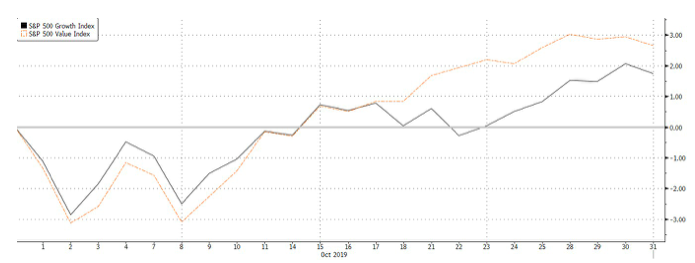

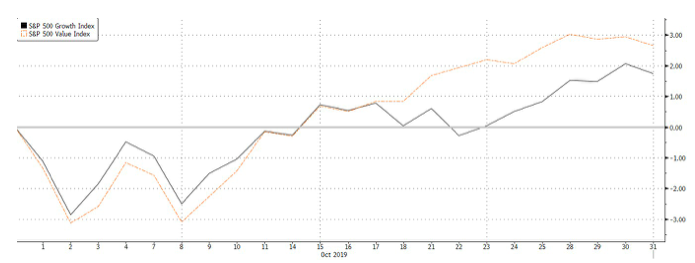

Fig 2: October total return performance of S & P 500 Growth Vs Value companies. Source: Bloomberg

-

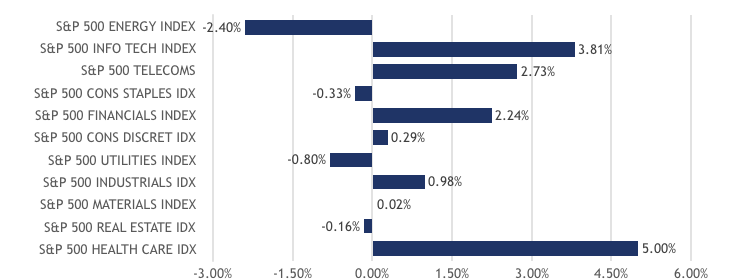

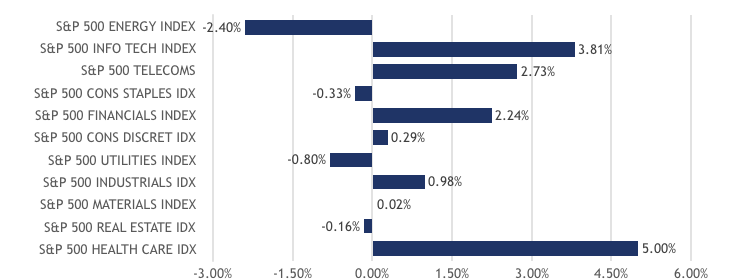

Value continued to outperform this month, although the continued rally into early November mostly saw flows back into growth stocks (Fig 2). Healthcare was the best performing sector, on the back of better than expected earnings results, while IT and Communication Services also outperformed. Energy was the standout laggard as oil prices retreated off last month’s spike.

-

October also saw the bulk of S & P 500 companies, with 393 of the 500 companies having reported an aggregate positive earnings surprise of +4.69%, while the headline number for sales was significantly lower, with around 60% of companies reporting an aggregate positive surprise of +0.55%. Healthcare, Financial and IT companies led with the most upside surprises.

Fig 3: Performance of the S&P 500 sectors in October. Source: Bloomberg

Fig 3: Performance of the S&P 500 sectors in October. Source: Bloomberg

-

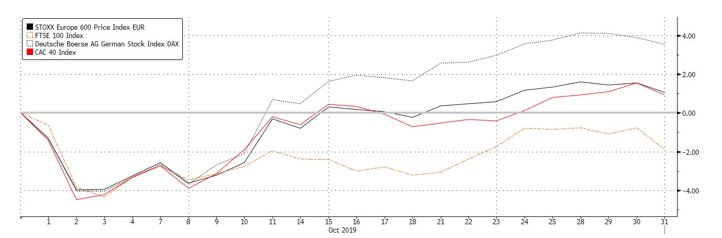

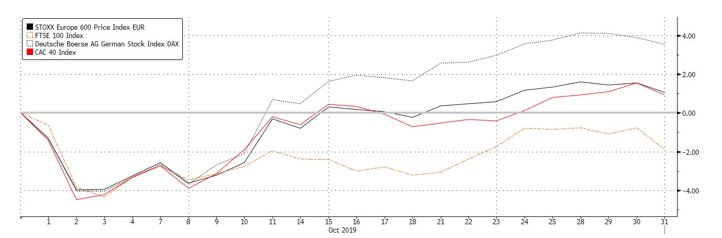

In Europe, Germany’s DAX (3.53% MoM) led gains in the region, extending the rally in Stoxx 600 (+0.92% MoM) by yet another month as the pickup US-China trade deal was supportive. In contrast, the FTSE 100 (-2.16%MoM) underperformed significantly as Brexit continued to be a key issue weighing on equities in the UK, and also as the GBP gained significantly over the course of this month.

Fig 4: October total return performance of European indices in % returns. Source: Bloomberg

Fig 4: October total return performance of European indices in % returns. Source: Bloomberg

-

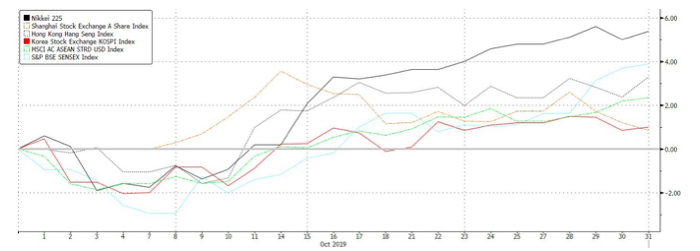

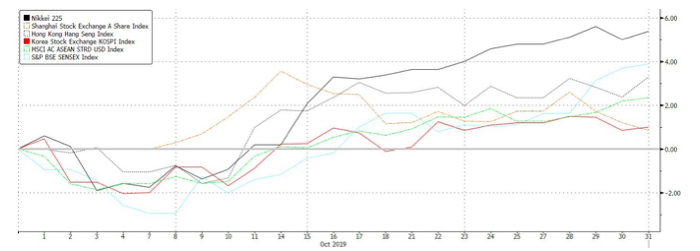

Markets in Asia were mostly helped higher by trade optimism too, although Japan’s Nikkei 225 (+5.38% MoM_ outperformed the broader region after a weak set of inflation numbers raised hopes of easing measure, and also as political tensions between Korea and Japan appeared to have simmered. Likewise, the Hang Seng Index (+3.12% MoM) also gained on the back of a recovery in mainland companies despite continued weakness in more domestic-oriented stocks. MSCI ASEAN (+2.20% MoM) was also helped higher by trade optimism, with currencies in the region also seeing a likewise recovery.

Fig 5: Total return performance of Asian indices in October. Source: Bloomberg

Fig 5: Total return performance of Asian indices in October. Source: Bloomberg

FIXED INCOME

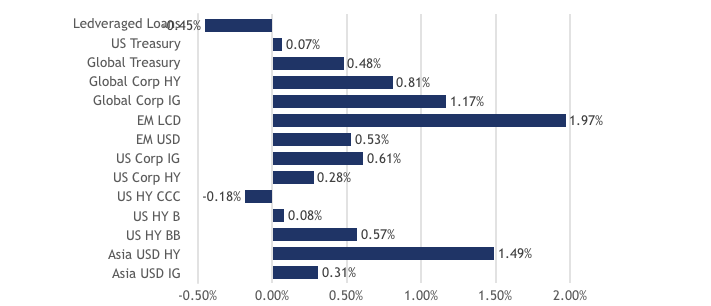

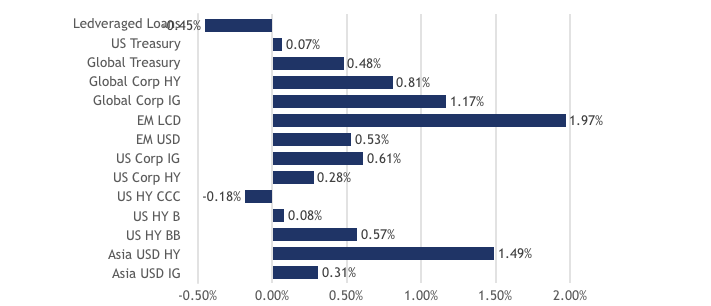

Fig 6: FI Sector index returns in October. Source: Bloomberg

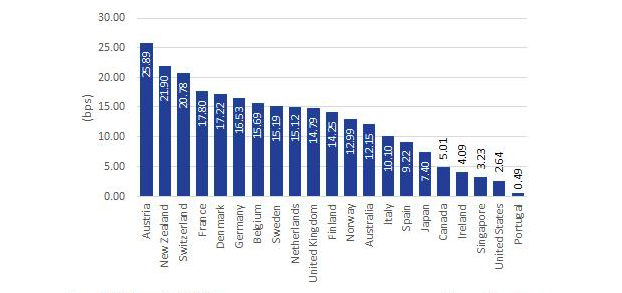

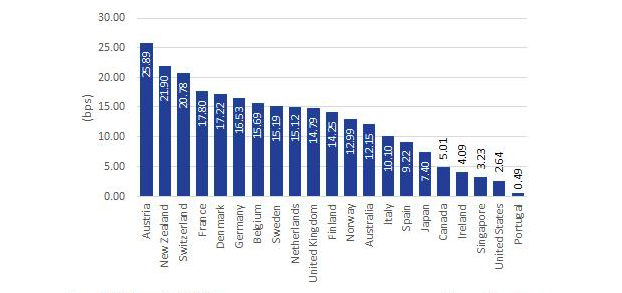

Fig 7: DM Sovereign 10-year yields. Source: Bloomberg

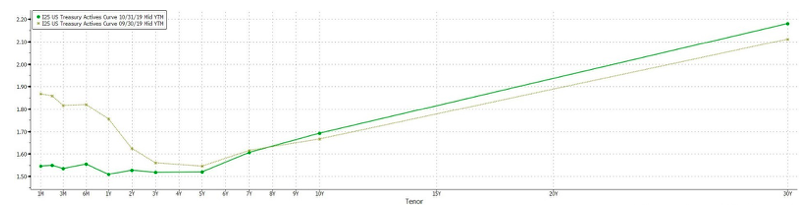

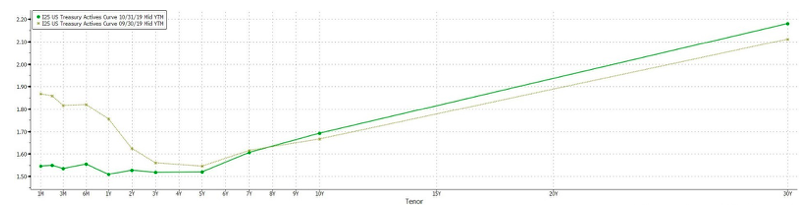

Fig 8: US Treasury curve – September vs October. Source: Bloomberg

Fig 8: US Treasury curve – September vs October. Source: Bloomberg

-

The UST curve also steepened over the month, with yields of maturities longer than 7Y increasing (Fig 8). Key duration spreads like the 3m/10y and 2y/10y spreads both increased to 16.7bps from -14.3bps to 4.3bps. The 10Y UST moved through a 1.80% resistance while the 30Y yield rose 50bps off lows below 2%.

-

The recent October economic data from the US mostly surprised on the upside, supporting the Fed’s decision to hold rates constant and presents a risk for longer-dated sovereign debt in the US as longer-term inflation expectations rise. Fed futures now predict under 20% probability of a rate cut in December.

-

However, there might still be opportunities in the emerging market, particularly Asia, space. Despite the scale back of geopolitical risks, Asian economies are still relatively weaker while the Asian central banks still have space to ease monetary policy.

Fig 9: Divergence of CCC yields relative to BB and B. Source: St Louis Fed, ICE

Fig 9: Divergence of CCC yields relative to BB and B. Source: St Louis Fed, ICE

-

Within the corporate credit space, IG debt mostly outperformed HY in developed markets as investors remained cautious amid rising default risks. However, these concerns are largely concentrated in the more leveraged CCC space, with yields diverging from higher-rated HY credit (Fig 9).

-

Another notable observation is the narrowing of BBB-BB spreads to ’07 lows (Fig 10), as investors chase yields in the BB space. This also likely suggests the perceived risks present in the BBB space. CreditSights see just under $70bn of BBB US debt vulnerable to a downgrade into HY over the next 12M. This typically translates to forced sales of these fallen angels due to constraints set by the various portfolio mandates.

Fig 10: Narrowing of BBB-BB spread to ’07 lows. Source: St Louis Fed, ICE

Fig 10: Narrowing of BBB-BB spread to ’07 lows. Source: St Louis Fed, ICE

-

However, we note that HY outperforms IG in Asia. There seems to be an opportunity in Asian USD HY if geopolitical risks ease further and stabilise markets. This yield spread between the sector and US HY is currently attractive (Fig 11) and has space to narrow further should market conditions prove favorable.

Fig 11: Yield differential between Asian USD HY and US HY. Source: Alpinum IM

FX

-

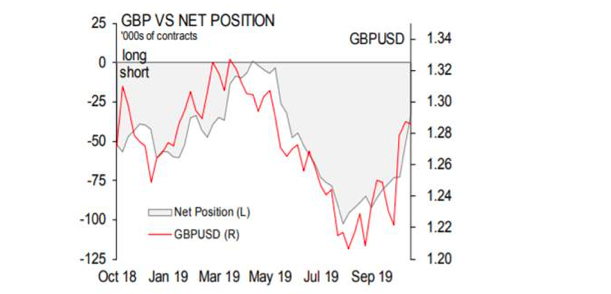

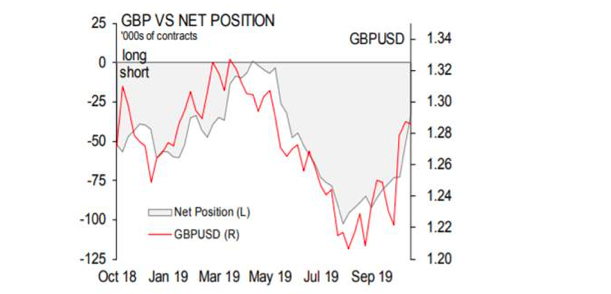

Forward volatility in FX remains at all-time lows. However, October saw some interesting moves with GBP surging on the reality that a no-deal has been pushed to a far corner of the deal table, causing the majority of shorts to reverse, releasing a lot of pressure off Sterling and is now considered to be at a neutral position.

-

Sterling’s shorts began to drastically reverse by $1.60bn on the 20th of October, bringing shorts to an all-time low since Mat (Fig 12). We believe that Sterling’s current price and position are neutral, which implies the next bout of volatility to ramp up this coming December. A Conservative victory is unlikely, but still possible, which may cause the current Withdrawl Bill, a deal far worse than its predecessor and can be considered an ideological “Hard Brexit” to pass.

Fig 12: Reversal of GBP shorts. Source: Scotiabank FICC Strategy, Bloomberg and CFTC

Fig 12: Reversal of GBP shorts. Source: Scotiabank FICC Strategy, Bloomberg and CFTC

-

The repercussions of such a deal will prevail for years and spill into all trade negotiations with the EU. The UK’s FAI, FDI, and GDP growth will be severely impacted, and it is also worth noting that the Brexit Damage Assessment has yet to be released. This gives rise to our belief that GBP will once again trade sideways in its current range of 1.25 and 1.35 until we near the elections.

-

A positive outcome of the elections is a hung parliament, as this implies that none of the extremist, nationalistic or radical parties are passed and may lead us to a second referendum and amendments to the Withdrawl Agreement (a ‘soft’ Brexit). This will be the most constructive path for the Sterling and could finally see the Sterling in a temporary net-long position.

-

The worst-case scenario would be a Labour victory – their policies are severely more damaging and could have a harsher impact on FDI which will eventually lead to large portfolio selling. We could see the GBP dip to 1.20.

-

In the longer term, we remain Sterling Gears as, under most scenarios, Brexit remains a likely possibility and therefore harmful to the UK”s economy, to FDI and to FAI. Structurally, the UK suffers poor productivity and higher inflation than its developed market peers and has borrowed too much today that will reduce forward growth. Multiple UK governments have addressed these structural weaknesses by enabling GBP to depreciate and thus it is likely that this will continue.

-

CNH (+2.26% MoM) and JPY (-1.00% MoM) also saw some movement as China’s stimulus policies began to take effect and reversed some of the damage from trade disputes. The Caixin Manufacturing PMI diverged further from the official PMI and rose for a 4th straight month in October to reach a 2Y high, while improved risk sentiments over the month weighed on the JPY.

COMMODITIES

-

Oil prices moved slightly higher over the month as the reduction in trade tensions helped improve sentiment around the global economy, and thus, oil demand. This helped relieve downward pressure on oil prices, ut the potential ascent to $70 remains very fragile and relies heavily on the positive development of trade and for the Middle Eastern tensions to escalate. We expect oil prices to trade flat between a range of $55, a new medium-support level as well as $65, its 2000DMA.

Fig 13: Gold positioning. Source: Scotiabank FICC Strategy, Bloomberg and CFTC

-

Gold’s positioning has significantly thinned since its stellar rise from $1,275/oz (Fig 13). Gold remained very technical for the month of September up until the recent, positive developments on Brexit and trade developments that edge investors to be risk-on. Gold strengthened, briefly to $1520/oz, as October ended with the Fed’s decision to cut rates, just before positive trade development and US jobs data weighed on risk-on sentiment. $1,480/oz, previous key support, is now once again in effect.

Oct 15, 2019 | Articles, Global Markets Update

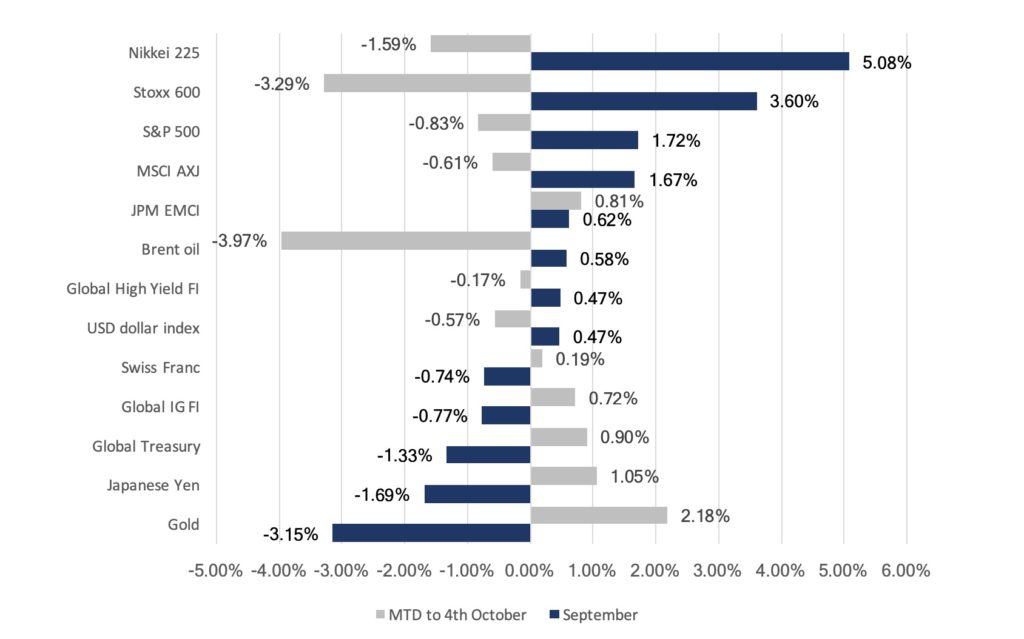

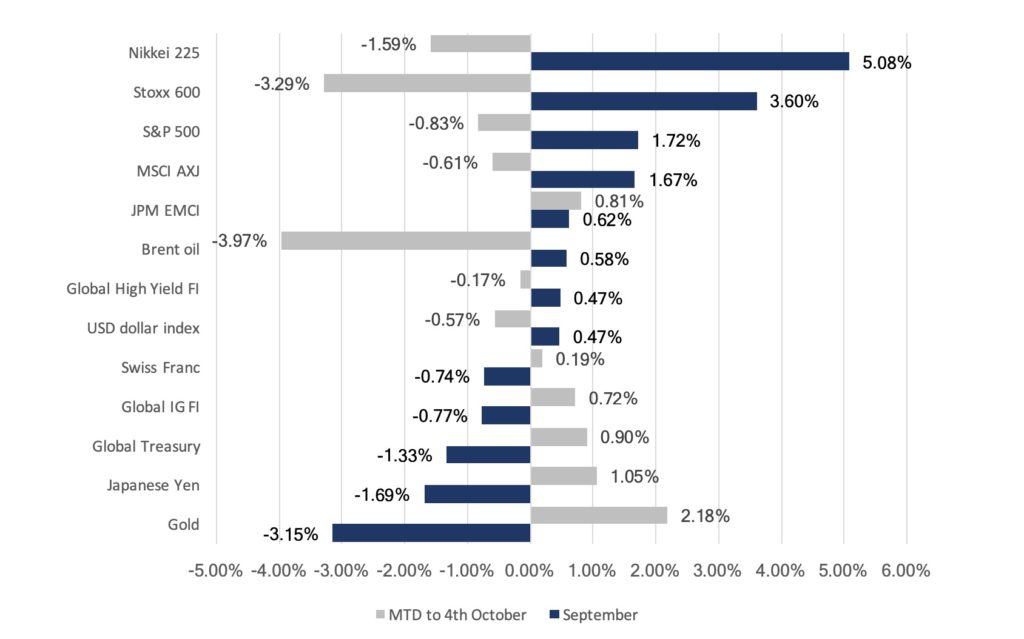

Markets saw a risk-on rotation in September (Figure 1) amid positive trade developments earlier in the month. China suspended tariffs on 16 types of US products, while the USA delayed tariff hikes from 1st October to 15th October in order to avoid China’s 70th anniversary. On top of the 16 products, China also talked about removing tariffs on bigger ticket items like soybeans and pork and have reportedly started making big purchases of those items. This led the S&P 500 back near an all-time high, while sovereign debt and high-quality corporate debt ended the month lower, with US Treasury (UST) 2Y and 10Y yields paring most of the losses seen in August.

Fig 1: Risk-on rotation sees outflows from haven assets. Source: Bloomberg

However, there remain challenges in negotiations. Reports that the White House was considering limiting capital flows from US to China surfaced at the end of the month. The reports hit markets negatively though those were quickly denied by US officials. In addition, Chinese officials mentioned over the weekend that they are now less willing to agree to the kind of broad trade deal that Trump is seeking and are narrowing the number of topics to be discussed.

European equities also recovered across the month, supported by the ECB’s commitments to further erase monetary policy, with Stoxx recovering losses in August to trade at levels last seen in July. However, the WTO’s decision to allow US to impose tariffs on Europe given Europe’s illegal aircraft subsidies to Airbus saw Stoxx fall in the first week of October. Asian equities, on the other hand, were a mixed bag, though the MSCI Asia ex-Japan index managed to close higher.

However, global growth concerns resurfaced in the first week of October as data for September, particularly for the US, came in weaker than expected, causing a rotation back into safer assets, paring gains/losses seen last month (Figure 1).

FX remained relatively quiet across the month, with volatility remaining low. GBP saw one of the largest moves within the G10 group, apart from the move out of safe-haven currencies like JPY and CHF. The pound continues to be driven by Brexit headlines, gaining strength in September amid a series of developments that reduced the probability of a no-deal. However, the currency pared gains during the last week of the month after Boris Johnson called for early elections and Corbyn indicated he will call a vote of no-confidence after a Brexit deadline extension was secured.

Separately, the USD strengthened over the month, with DXY gaining 0.47%, underpinning the reality that USD remains the least ‘bad’ developed markets (DM) currency with the EU facing recession amid a divided European Central Bank (ECB), and the Bank of Japan (BOJ) hinting it will ease on the 31st October. The Swiss National Bank (SNB) has also been leaning toward a dovish tilt and that will ease the CHF. Likewise, emerging markets (EM) central banks were seen to be cutting rates – this includes India – whilst the People’s Bank of China (PBOC) effectively lowered rates 10bps via a new rate-setting benchmark and injecting liquidity to the system. This seems to suggest that we might see the dollar remain stronger for longer and that might potentially weigh on EM Asian currencies and thus equities likewise.

Oil prices saw increased volatility this month, driven by a drone attack on Saudi Arabia’s production plants. The Brent oil price spiked to $70 after the attack but quickly retraced to end the month lower. Saudi Arabis has since brought production levels back to levels seen before the attack. Prices were also pressured lower by concerns of a slowdown in global growth, accompanied by EIA and EIA data that showed increases in US crude inventory.

Outlook

Liu He and Lighthizer are reportedly set to meet (10th October). This comes just a week before the US is scheduled to increase tariffs on $250bn worth of Chinese goods to 30% from 25%. While both sides have exchanged small gestures of goodwill over the past few weeks, our view is that it does not circumvent the longer-term strategic confrontation between the two powers, and a wide gap on substantial issues – such as IP transfer rights and Xii’s “Made in China 2020” policy – that neither side is likely to back down on. Moreover, we have seen unprecedented bipartisan support in the US, and polls show that 80% of the US public see the need to address the issue. With that said, there is still room for a small deal to be cut in the near-term, and we do not think it would be wise betting against it. In addition, Trump’s latest ‘impeachment’ debacle and the allegations he pressured Ukraine’s leader to investigate Biden and sons are potentially damaging. The allegations could affect his re-election efforts and, as some might hope, his current role as President. We shall see – it would not be ‘out of character’ for Trump to turn even more erratic and throw a curveball in the way of trade negotiations as a distraction from domestic issues, whether or not that might be in favour of a deal.

However, moving away from geopolitics to the US economy, we think US macro data remains quite resilient but a weaker Conference Board consumer survey following the earlier disappointment in the University of Michigan’s consumer sentiment survey are early signs that there might be some weakness in this consumer-led economy. As we have noted before, the strong consumption dichotomy to weak corporate manufacturing and capital expenditure data will not be resolved one way or another, and the risk is that consumption weakens, adding to fears of a recession as quite possible and that equities will enter a bear market – they note the massive rotation of late-term momentum/growth sectors to value/cyclical’s preceded the last two recessions too. MS has called US markets reliably well in the last few years and often, rightly, been cautious about it too.

Brexit remains an overhang on Europe, and the immediate outlook seems dependent on whether Boris Johnson will be able to secure a deal with the European Commission (EC) at the European Union (EU) Summit on the 17th and 18th of October. Whilst Parliament has sensibly voted to not have a no-deal Brexit, Johnson is still committed to taking the UK out by the end of the month. We were delighted by the UK Supreme Court’s unanimous decision that Johnson’s prorogation move was unlawful (thus, in effect, saying he lied to the Queen). Boris was put into power by 93,000 votes (or 0.2% of the voting public) of which 75% were white males over 65 years old! Whilst 52% voted to leave, this accounted for 37% of those that could have voted and of that 52 %, not one was asked what type of Brexit was favoured. Democracy is failing the UK and it is now similar to a banana republic in the degree of volatility in policy action – with potentially damaging consequences – and instability in the country from what used to be a stable democracy with tramlines in terms of policy outlook. Whilst the Court’s decision is welcome – and GBP gained a big hit – the harsh reality remains the UK is in a mess over Brexit and the outlook is unclear. What ought to happen is either a fresh election (at this point it seems Labour’s policies and Corbyn make it unelectable plus, as a party more in favour to remain its route to victory is in marginal seats that voted to leave in ’16) or a 2nd referendum and we struggle to see where the upside for GBP is, whereas we see reasons for it to retest recent lows since the Brexit vote in ’16. A no-deal Brexit would be painful, and stupid, but over time this can be corrected whereas Labour’s policies are disastrous if implemented given the leadership is Marxist Cabal.

There is – in our view – a structural risk around oil that is potentially far earlier than peak oil which some see as soon as ’25. The Economist rightly notes that there is a (major) risk that the climate change impact could ‘force’ far more hostile regulatory action by governments that would impact oil companies hard. One consultancy sees such action happening within the next 2-3 years. This throws open the question about whether to hold oil stocks at all given these risks. We have some sympathy with this argument and realise that climate change is something we need to get on top of.

On the other hand, gold is ‘swinging’ around but has not followed falling UST yields higher lately and is trading in the $1,480-1,520/Oz range after bottoming out at about $1,463/Oz (prior 6y high) spike lower MTD. We remain an owner of gold in portfolios at a 3-5% weighting as a portfolio diversifier, an alternative ‘safe haven’ asset to sovereign FI and as a play on negative-yielding global FI (now at about $17tn or 30% of all FI). It is worth noting that central banks are a far larger, consistent buyer of gold for reserves than in the past – China added 5% to its already considerable reserves in the last 12M – in order to diversify from an over-reliance on USD as trade becomes less certain.

Despite all the negatives out there, equities (especially in the US) have stayed remarkably resilient YTD, and the with S&P 500 and MSCI ACWI just off all-time highs, it partly reflects the fact there is no alternative with over $15tn of negative-yielding FI and a large chunk of the rest offering negative real rates. It is worth noting that if you take the UST 10Y yield at about 1.6% relative to the S&P 500’s yield and compound that at 3% growth p.a. on just income over 10Y, the S&P 500 is yielding more than double that of UST’s, and one could argue that the S&P 500 is a safer bet than UST’s too!

Separately, the recent failure of WeWork to access public markets given the degree of skepticism around its business model is another illustration that private equity (PE) is substantially overpaying for private vs public markets, and the returns are thus questionable. AQR forecasts PE returns over the next decade to be under 3% – roughly similar to their forecast for S&P 500 – but the former is far more illiquid and much of the gains are removed via exorbitant fees charged by the PE fund managers (Financial Times estimate 60% of PE ‘alpha’ went to the fund manager in funds followed in last decade). This is made worse, in practice, as unless you are invested in one of the top PE funds (which are mostly inaccessible), your return profile is far worse relative to returns from public equities easily accessible via low cost, passive ETFs – in the last 20Y, top PE funds have returned about 16% p.a. relative to a median fund at about 11%, and poorer funds under 8%.

Thus, our portfolio positioning remains defensive, and we prefer to hold higher amounts of cash so that we can add tactically when we see bouts of weakness in equity markets. We would prefer to have a higher weightage of equities as we see it as the ‘least bad’ asset class, particularly against relatively ‘expensive’ USTs, nor the high-yield (HY) or Senior Loan space where risks remain high. Overall, we remain overweight on Alternatives as our belief is that we are entering a period of higher volatility and lower returns and on this basis, we would prefer to derive returns from an asset class that can generate less or even uncorrelated returns to traditional markets, with the benefit of additional diversification.

![]()

![]()

![]()

![]() Equities

Equities

Fig 2: YTD total return performance of US indices in % returns. Source: Bloomberg

-

It was quite a volatile month for equity markets in the US, having climbed the wall of worry to come a few points shy of all-time highs before coming off, then falling even more steeply in early October. A combination of mixed macroeconomic results and the overhang of trade tariffs weighed on markets. Tech stocks continued to see weakness as the Nasdaq underperformed at +0.46% MoM, against the S&P 500 and Dow which were up +1.72% MoM and +1.95% MoM respectively.

![]() Fig 3: Total Return performance of S&P 500 Growth vs Value companies. Source: Bloomberg

Fig 3: Total Return performance of S&P 500 Growth vs Value companies. Source: Bloomberg

-

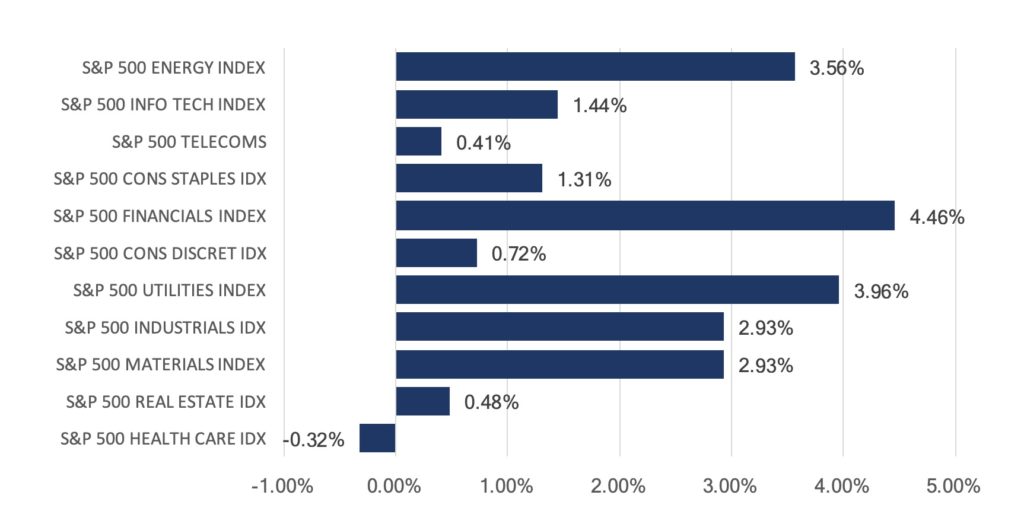

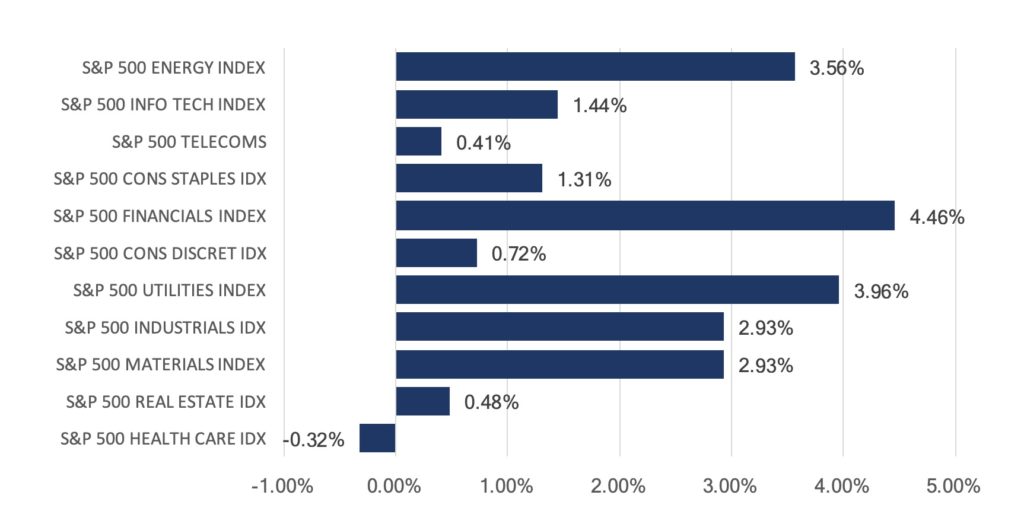

Within the S&P 500, the month saw quite a marked rotation out of Growth into Value (Figure 3), but also as investors shifted out of YTD winners into names that have underperformed thus far. Financials (+4.46% MoM) and Utilities (+3.96% MoM) outperformed, alongside Energy (+3.56% MoM) which rebounded on the back of higher oil prices following the drone strike on Saudi Aramco’s production facility. Healthcare (-0.32%) was the laggard sector (Figure 4).

Fig 4: Performance of S&P 500 sectors in September. Source: Bloomberg

Fig 4: Performance of S&P 500 sectors in September. Source: Bloomberg

-

European stocks saw continued momentum from late August, with the Stoxx 600 gaining +3.60% MoM last month. Markets were buoyed by commitments from the ECB to further ease monetary policy, but also as talk that Germany and France might move to roll out some degree of fiscal easing as well. The German DAX led gains at +4.09% MoM, while the FTSE 100 underperformed at +2.79% MoM as Brexit uncertainty continued to weigh on shares in the index.

Fig 5: YTD total return performance of major European indices. Source: Bloomberg

Fig 5: YTD total return performance of major European indices. Source: Bloomberg

-

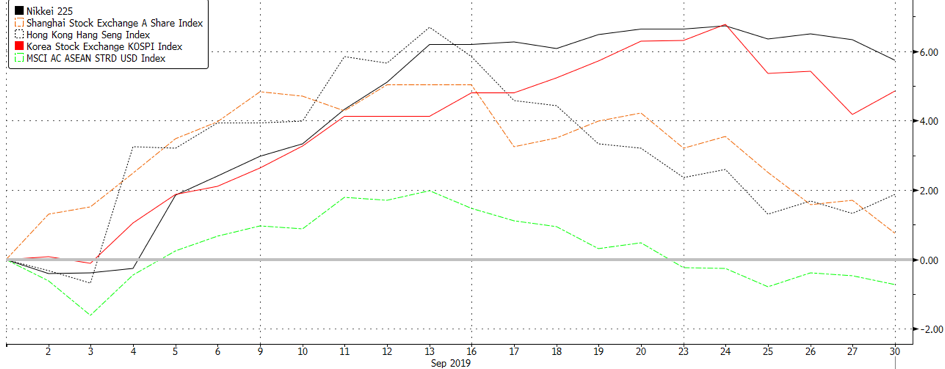

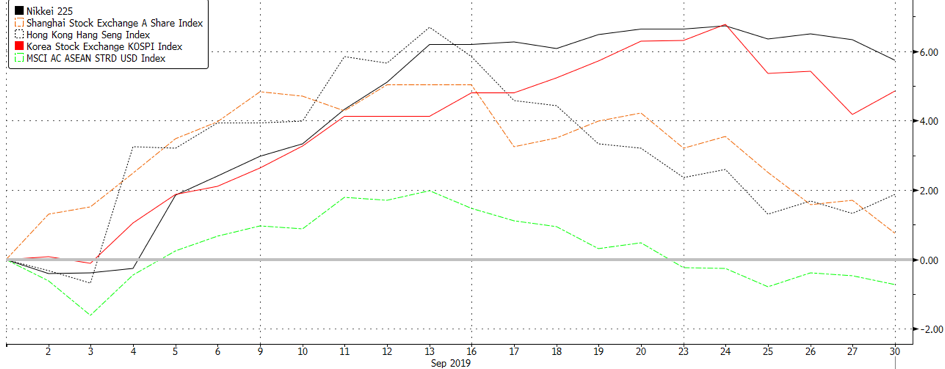

In comparison, markets in Asia saw mixed performance through the month, with the Nikkei outperforming at +5.08% MoM, alongside the Kospi which also rebounded this month at +4.84% MoM on the back of a recovery in chipmakers.

-

The HSI (+1.43% MoM) was weighed lower by domestic-oriented stocks amidst the ongoing protests in the streets, while Chinese equities also had a weak showing as markets moved on mixed macro data and the ongoing trade negotiations with the US.

-

ASEAN indices underperformed the broader region, with the MSCI ASEAN index falling -0.91% MoM, on the back of USD resilience as currencies in the region floundered. On top, the overarching concerns over global growth were also a negative contributor given the region’s high dependence on this.

Fig 6: Total return performance of Asian indices in September. Source: Bloomberg

Fig 6: Total return performance of Asian indices in September. Source: Bloomberg

Fixed Income

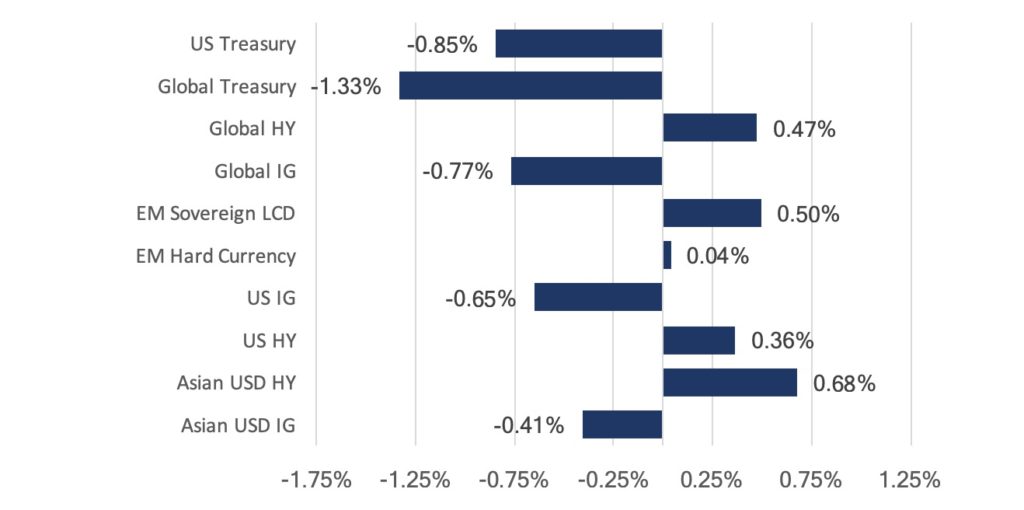

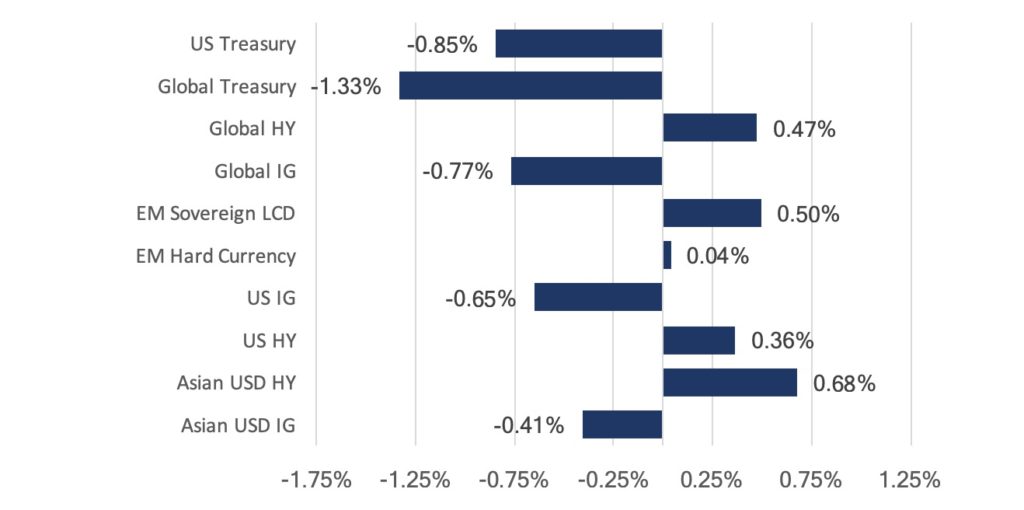

Fig 7: FI Sector index returns in September. Source: Bloomberg

-

The risk-on trade last month saw a rotation out of higher quality fixed income. Sovereign debt was the worst hit (Figure 7), with the Bloomberg Barclays Global Treasury index losing 1.33%. The UST curve shifted higher over the month (Figure 8), with yields rising as much as % following strong August economic data. The German sovereign debt curve shifted higher too, with the 30Y yield going into positive region at one point before ending the month below zero.

Fig 8: UST yield curve in September relative to August. Source: Bloomberg

-

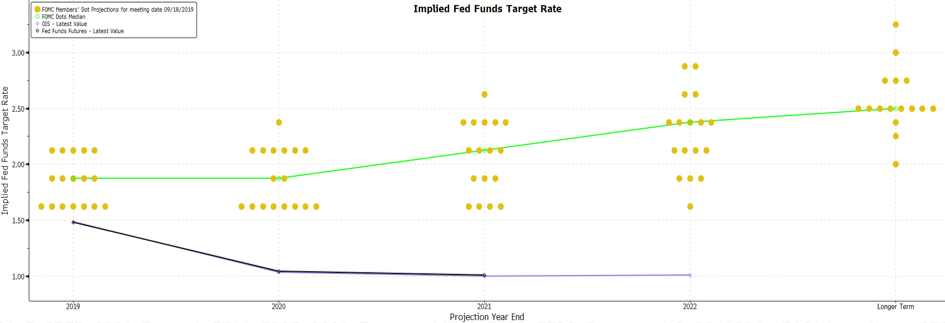

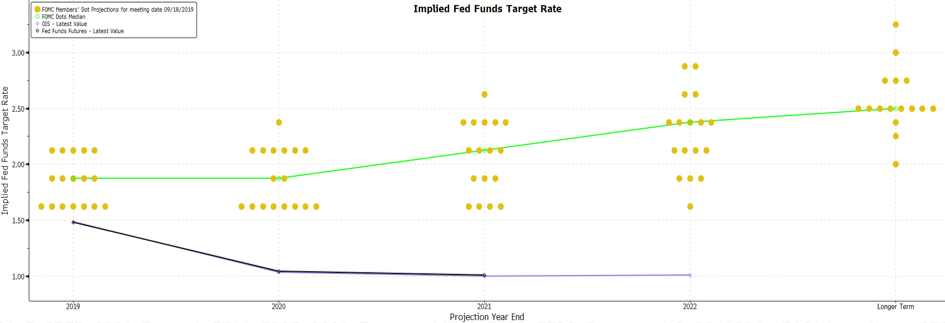

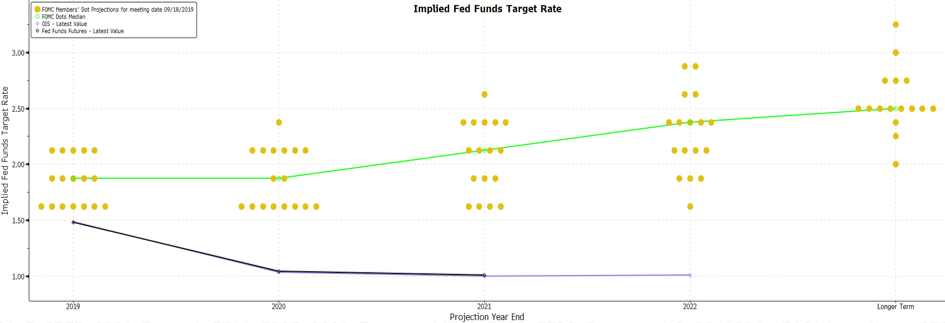

The FOMC meeting outcome lent some support later in there month too – members were divided on the forecasted path of interest rates, based on the dot plot (Figure 9), but the median forecast still showed rates to remain at the same level at YE19 and YE20, as compared to the market’s expectation of 2 more cuts by then.

Fig 9: FOMC dot plot in September. Source: Bloomberg

Fig 9: FOMC dot plot in September. Source: Bloomberg

-

However, the disappointing September economic data released last week reignited concerns of slower global growth, causing investors to rotate back into sovereign debt, reversing the gain sovereign yields saw last month.

-

Central banks also remained dovish – in addition to the Fed and ECB, more central banks around the world are expressing dovishness. We had BOE and Norges Bank indicate the possibility of cutting rates at their next meetings, while central banks in Asia like BOJ, BI, BOT, BSP and RBI cutting rates/showing dovish signals. Barring any positive surprises, we expect sovereign yields to remain suppressed in the near future.

-

EMs were also more resilient relative to their DM counterparts. There was a substantial amount of inflows into EM last month, though that could be partly caused by the stronger economic data released earlier in the year, which led markets to think that the economy is stabilizing and that the Fed will stop their rate cuts. We think firms in EMs are in better shape than their DM counterparts, making the current yield differential quite attractive (Figure 10).

Fig 10: EM/DM yield differential. Source: Bloomberg

Fig 10: EM/DM yield differential. Source: Bloomberg

-

Corporate credit managed to mostly close the month higher too (Figure 7). High yield debt outperformed the investment-grade sector as it followed equities higher amid the risk on environment, but CCCs were weaker, falling 0.15% after being weighed down by energy bonds (Figure 11).

-

HY saw increased issuance as companies sought to refinance existing debt. US HY companies issued more than $30bn worth of debt last month – the most in c. 2Y. BB debt saw the greatest issuance in the month, making up 42% of total HY issuance, putting pressure on BB yields as it rose 7bps while B and CCC yields fell 24bps and 8bps respectively.

-

IG debt also saw increased issuance over September, with $158.3bn worth of debt issued. This record issuance was also met with strong demand as the corporate IG index spread tightened 5bps. According to Bloomberg, dealer estimates for October call for about $85bn in new issuance.

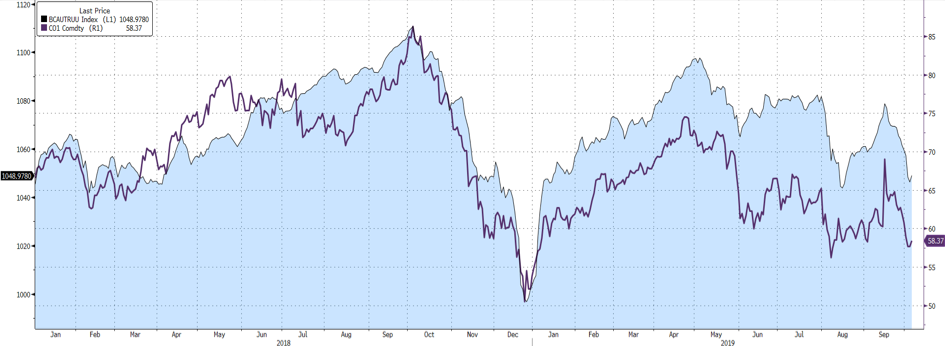

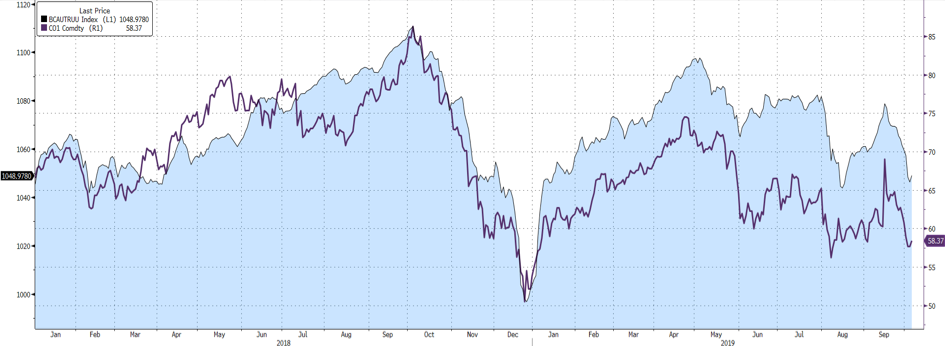

Fig 11: Correlation between US CCC debt (LHS) and oil prices (RHS) – 1st Jan ’18 to 4th Oct ’19. Source: Bloomberg

Fig 11: Correlation between US CCC debt (LHS) and oil prices (RHS) – 1st Jan ’18 to 4th Oct ’19. Source: Bloomberg

FX

-

September saw another month of quiet trading as volatility remained low. Volatility continues to be driven by two key events: Brexit and trade uncertainty.

-

USD remained resilient over September but fell in the first week of October on weaker data, with ISM manufacturing falling far below expectations. Although it is well known that ISM manufacturing is but a small part of the overall economic picture – we believe that the disappointing report contributes to the budding fear of an economic slowdown and places much more emphasis on upcoming data.

-

GBP gained 1.09% in September despite Brexit uncertainty as markets seem to have priced in a scenario of an extension following the likely breakdown of Boris Johnson’s new proposal to the EU this week. This caused August’s short squeeze to carry forward. September also saw a small build-up of longs from asset managers and funds, as reflected in recent COT reports (Figure 12).

Fig 12: GBP net long/short positions. Source: Scotiabank

Fig 12: GBP net long/short positions. Source: Scotiabank

-

We continue to see further GBP weakness in the short term, before Brexit’s next key development on 31st October and believe that it will test its floor of 1.20, given Johnson’s inability to deliver a deal acceptable by the EU as we think the complexity of Northern Ireland’s border will not be solved by then. Also, with Johnson’s current proposal of a hard border unlikely to be accepted, the uncertainty caused within this short timeframe spells ill for the pound.

-

We must also consider Johnson as the ultimate factor for the pound’s instability. His hard stance toward the UK’s departure on 31st October is likely to generate several headlines (not news). This has also, reportedly, prompted the UK government to initiate preparatory measures in the event of a no-deal, further instilling fear and allowing 1.20 to look very achievable.

-

In the coming months, we do not, however, believe that 1.20 will fail as a support and see GBP rising to 1.25 and potentially beyond (in November and December). Despite the ambiguity of the Benn Act, an act that that requires the PM to seek an extension to the Brexit deadline if a deal is not reached by then, we expect Johnson to abide by that law, thus avoiding a no-deal Brexit in the near-term.

COMMODITIES

-

The drone attack on Saudi Arabia’s refineries led to a high degree of volatility across September. This caused oil prices to spike, with the Brent oil price hitting $70, before sharply retracing to common support level at $58.35.

-

We anticipated the return to its common support on the basis that a single drone strike would be unlikely to warrant such a large reaction in the price. Also, with the theme of a global economic slowdown – which has remained as a roof over the commodity’s price – we saw it as very likely for the spike to simply remain as a spike.

-

Over the next two months, we see the potential for 50 to remain as Oil’s support. This is due to two main reasons, firstly, that much of the news of a global slowdown has already been priced into oil – leaving it with only so much more room for the price to fall and secondly, a substantial amount of the risk premium from tensions in the Middle East (which has escalated substantially, recently) has yet to be priced in. $50 has been a strong psychological and technical support since mid ’17 (Figure 13).

Fig 13: Brent oil sees a strong support at $50. Source: Bloomberg

- While we see fundamental support for Gold in the longer term, we believe it may have seen its limit in the near-term having reached recent highs. We established last month – based on momentum – that Gold’s upwards channel had a key support of 1500. The key signal to its recent turnaround was when Gold failed to break above its recent high of 1550 (Figure 14). One cannot ignore the technical factors simply since momentum remains both its biggest strength and weakness since its stellar climb from 1275.

Fig 14: Gold might see weakness in the near-term. Source: Bloomberg

Sep 30, 2019 | Careers

With the rapid expansion of Odyssey Asset Management division within the Odyssey Group, an opportunity has come up for a Client Development Executive role in the Distribution team. The role will be an integral member of the Distribution team working closely with the Directors and key stakeholders of the business. The role will largely be supporting the Distribution team in daily administration and client-related tasks such as lead generation and execution. The role will also be collaborating with other business divisions within the Odyssey group to coordinate and carry out strategic activities as set out in the marketing plan.

Ideally, you will be based in either Hong Kong or Singapore.

Key Responsibilities

- Help keep the current prospect/client spreadsheet and database updated. Our clients are institutional, family office and HNW.

- Research and improve on the quality of the data and information. Must be proficient in Microsoft and web-based application such as outlook, excel, LinkedIn, google search, CRM tools, etc.

- Seek new client leads to add to the database. Must be able to research and use initiative to find out information.

- Help follow up leads by way of telephone, email and attending events. Must be comfortable to be able to communicate directly with clients and professionals.

- Book meetings and manage the team’s calendar. Must be highly organized and responsive.

- The role requires some technical understanding of real estate, finance and also sales. This is a role with the potential to grow their career into sales manager and distribution business development management.

- Assisting the Directors in implementing and executing marketing program/campaign to engage and reactivate existing customers for further cross-selling and building loyalty.

Qualifications

- At least 6 years of experience in a similar sales support role, preferably within the financial services industry.

- Knowledge of customer journey management, database marketing, and customer segmentation.

- Strong interpersonal and communication skills, good team player and ability to influence.

- Independent, professional, pro-active and strong marketing sense.

- Ability to work multi-task with creative problem-solving skills.

- University degree or above preferred.

- Excellent verbal and written in English with the ability to communicate in Cantonese and Mandarin highly desirable.

If you would like to apply for the role, or have questions, contact us here.

About us

The Odyssey Group Ltd is Asia’s leading international Alternative Asset Manager providing differentiated and bespoke investment solutions across multiple asset classes, including alternative credit, real estate, private equity, and hedge funds. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest with its clients.

The Odyssey team comprises over 40 experienced asset managers, lawyers, private bankers, trust & tax planning specialists and experienced investors, each with an average of 25 years of financial, execution and operational experience across the Asia Pacific, Europe, and North America. This experience allows the Odyssey team broad regional industry expertise, insight into global macro and geopolitical trends, and a powerful network of global relationships. When clients partner with the Odyssey Group of companies, they benefit from the breadth and depth of expertise with the entire firm working in unison to achieve a targeted outcome. Our innovative approach allows us to generate attractive investment returns within the context of a prudent and long term horizon.

Odyssey employs the highest quality people as partners in our business while pursuing the highest standards long-term and aligning our interests with our investment partners. It is our mantra to be the ‘trusted partner’ for our clients’ needs.

Sep 30, 2019 | Careers

With the rapid expansion of Odyssey Asset Management division within the Odyssey Group, an opportunity has come up for a Customer Relationship Manager to join the team. The role will be an integral member working closely with the Directors and key stakeholders of the business. The role will largely be supporting the team in the daily administration and client-related tasks such as lead generation and execution as well as performing project-related tasks and also managing the calendars of key members in the team. The role will also be collaborating with other business divisions within the Odyssey group to coordinate and carry out strategic activities as set out in the marketing plan.

Ideally, you will be based in either Hong Kong or Singapore but this role also has the possibility of being remote for the right person.

Key Responsibilities

- Help keep the current prospect/client spreadsheet and database updated. Our clients are institutional, family office and HNW.

- Research and improve on the quality of the data and information. Must be proficient in Microsoft and web-based application such as outlook, excel, LinkedIn, google search, CRM tools, etc.

- Seek new client leads to add to the database. Must be able to research and use initiative to find out information.

- Help follow up leads by way of telephone, email and attending events. Must be comfortable to be able to communicate directly with clients and professionals.

- Book meetings and manage the team’s calendar. Must be highly organized and responsive.

- The role requires some technical understanding of real estate, finance and also sales. This is a role with the potential to grow their career into sales manager and distribution business development management.

- Assisting the Directors in implementing and executing marketing program/campaign to engage and reactivate existing customers for further cross-selling and building loyalty.

Qualifications

- At least 6 years of experience in an administration or assistant role, preferably within the financial services industry.

- Knowledge of calendar management, Microsoft Office and Outlook.

- Strong interpersonal and communication skills, good team player and ability to influence.

- Independent, professional, pro-active and strong marketing sense.

- Ability to work multi-task with creative problem-solving skills.

- University degree or above preferred.

- Excellent verbal and written in English with the ability to communicate in Cantonese and Mandarin highly desirable.

If you would like to apply for the role, or have questions, contact us here.

About us

The Odyssey Group Ltd is Asia’s leading international Alternative Asset Manager providing differentiated and bespoke investment solutions across multiple asset classes, including alternative credit, real estate, private equity, and hedge funds. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest with its clients.

The Odyssey team comprises over 40 experienced asset managers, lawyers, private bankers, trust & tax planning specialists and experienced investors, each with an average of 25 years of financial, execution and operational experience across the Asia Pacific, Europe, and North America. This experience allows the Odyssey team broad regional industry expertise, insight into global macro and geopolitical trends, and a powerful network of global relationships. When clients partner with the Odyssey Group of companies, they benefit from the breadth and depth of expertise with the entire firm working in unison to achieve a targeted outcome. Our innovative approach allows us to generate attractive investment returns within the context of a prudent and long term horizon.

Odyssey employs the highest quality people as partners in our business while pursuing the highest standards long-term and aligning our interests with our investment partners. It is our mantra to be the ‘trusted partner’ for our clients’ needs.

Sep 27, 2019 | Careers

As part of the Odyssey Group’s continued expansion, we are hiring a new Chief Compliance Officer (CCO) for the firm. The CCO will oversee the group’s compliance and risk operations and policies. The following is a summary of the role and responsibilities.

Responsibilities:

- Ensure that the firm complies with its own internal policies and procedures, and with all applicable legal and regulatory requirements (for example, the SFC’s Fund Manager Code of Conduct).

- Provide support and guidance to and have regular communication with the senior management to ensure that risks are adequately managed.

- Maintain sufficiently detailed compliance procedures and ensure the procedures are being enforced to give senior management reasonable assurance that the firm complies with all applicable requirements at all times.

- Liaise with and act as the principal point of contact for any applicable regulatory authorities, including regulatory returns and/or inspections.

- Act as the focal point for the oversight of all activities relating to the prevention and detection of money laundering and terrorist financing (AML/CTF).

- Develop, oversee, and continuously review AML/CTF systems to ensure they remain up-to-date and meet current statutory and regulatory requirements.

- Advise on regulatory updates from the respective regulator, manage internal compulsory compliance training, when applicable, for all licensed and support staff on SFC updates and procedures.

- Implementation of SFC updates and procedures.

- Maintain the internal Compliance Policy & Procedures Manual.

- Maintain all internal client forms to ensure they are in-line with the current regulations.

- Maintain the Compliance calendar (i.e., reporting to the regulators, annual returns for SFC, MAS, etc.)

- Manage reporting/notifications to the regulators.

- Circulate to relevant staff notices and circulars issued by the regulators and provide guidance to staff on these notices and circulars.

- Manage and maintain CPT training records of a licensed representative. (inclusive of identifying suitable courses to attend).

- Advice and provide control and procedures regarding ‘Personal Data Access Requests’ made by Clients.

- Regular report requirements and meetings with senior management.

- Attend Board meetings when required for strategic planning (advising on compliance).

- Attend Corporate Governance meetings when required.

- Advise and guide Advisers & Staff on Compliance matters to support the business.

- Handle all complaints maintain the complaints register, monitor & identify trends, root-causes, and/or identify areas of concerns. Satisfy senior management that staff can recognise a complaint and appropriately record them.

- Review of financial promotion, publications, invitations; including preparation.

- Managing compliance inspections by the regulator.

Money Laundering & Terrorist Financing:

- Guidance & advice on relevant legislation and obligations of access to Dow Jones – Factiva (Global Search Engine) DataBase Client Searches (e.g., PEP’s).

- Enhanced customer due diligence.

- AML STR reporting advice to the Financial Intelligence Unit “FIU.”

- AML training to be provided to ALL staff once per year and new recruits at their induction to OAML.

- Customer File Review/New Business Checks:

- All new business and transactions checked for Suitability – ‘Most Suitable Advice’ in accordance with regulatory requirements.

- Handle all complaints received so that complaints are investigated promptly, and findings reported back to the client with recommendations for a final Response.

- Maintain the Complaints Register, monitor & identify trends, root causes, and/or identify areas of concern across one or more individuals.

- Satisfy senior management that staff can recognise a complaint and appropriately record them.

- Identify lessons learned, both internally and externally.

- Training to be provided to ALL staff.

Licensing:

- Process all licensing application for, potentially responsible officers and representatives’ licenses; liaise with the regulatory, statutory, and other relevant bodies to ensure that licenses are issued in accordance with the regulator’s timeframe.

General Operations:

- Must possess the technical competence and experience necessary for the performance of their functions, including:

- Develop a deep understanding of the Firm and its operations and structure.

- Identify conflicts of interest and how they are reviewed and resolved.

- Develop a detailed knowledge of the firm’s clients and products.

- Have a deep understanding of the firm’s compliance and technology platforms.

- Have detailed knowledge of the firm’s policies and procedures and how they are applied and monitored.

- Understand the markets in which the firm operates.

- Insist that the client comes first and ensure the firm has a culture of doing the right thing by asking “should I” rather than “can I” do this.

- Have an appreciation for what they do not know and recognise when they are relying on the expertise of others.

Requirements and Qualifications:

- 5-8 years of experience in a similar CCO, with licensed entities within the financial services industry, independent asset management, or wealth management preferred.

- Experience with the following regulators or regulations: SFC (required), MAS (preferred), ASIC (preferred), CIB (required), HK Company & Trust license (preferred), Cayman AML (preferred) and CRS/FACTA (required).

- Strong management experience from Asset Management house/Investment bank/Brokerage firms.

- Extensive knowledge of liquid and ill-liquid investment products and strategies.

- Industry experience in the Asian private wealth industry required.

- Knowledge of global securities markets, with an emphasis on Asia.

- Strong interpersonal and communication skills, good team player, and ability to influence.

- Independent, professional, pro-active, and strong compliance experience and proven track record.

- Ability to work multi-task with creative problem-solving skills.

- Strong business acumen, a strong sense of commitment, mature, self-reliant, and able to work under pressure.

- Entrepreneurial drive and executive presence; trustworthy and discreet with the highest integrity, both personally and professionally.

- Exceptional written and verbal communication skills and presentation abilities.

- Proficiency in written and spoken English, Putonghua (preferred) and Cantonese (preferred).

- Degree or above in Law, compliance, or related disciplines.

- Proficiency in Microsoft Office applications and other IT skills is preferred.

- Ability to travel up to 25%.

Key Competencies:

- Commercial compliance mindset.

- Proactive and solutions orientated.

- Team player.

- Multi-disciplined.

- Investment Product expertise.

Benefits:

- Package commensurate with experience.

- Employee Share Option Plan.

- Flexible working arrangements.

- Generous paid time off.

Role Location:

Availability:

- The candidate needs to be in a position to start working at the firm in the next 1 to 2 months.

Contact:

If you would like to apply for the role, or have questions, contact us here.

About Us:

The Odyssey Group Ltd is Asia’s leading international Alternative Asset Manager providing differentiated and bespoke investment solutions across multiple asset classes, including alternative credit, real estate, private equity, and hedge funds. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest with its clients.

The Odyssey team comprises over 40 experienced asset managers, lawyers, private bankers, trust & tax planning specialists and experienced investors, each with an average of 25 years of financial, execution and operational experience across the Asia Pacific, Europe, and North America.

This experience allows the Odyssey team broad regional industry expertise, insight into global macro and geopolitical trends, and a powerful network of global relationships.

When clients partner with the Odyssey Group of companies, they benefit from the breadth and depth of expertise with the entire firm working in unison to achieve a targeted outcome. Our innovative approach allows us to generate attractive investment returns within the context of a prudent and long term horizon.

Odyssey employs the highest quality people as partners in our business while pursuing the highest standards long-term and aligning our interests with our investment partners. It is our mantra to be the ‘trusted partner’ for our clients’ needs.

EQUITIES

Fig 2: October total return performance of S & P 500 Growth Vs Value companies. Source: Bloomberg

Fig 3: Performance of the S&P 500 sectors in October. Source: Bloomberg

Fig 3: Performance of the S&P 500 sectors in October. Source: Bloomberg Fig 4: October total return performance of European indices in % returns. Source: Bloomberg

Fig 4: October total return performance of European indices in % returns. Source: Bloomberg Fig 5: Total return performance of Asian indices in October. Source: Bloomberg

Fig 5: Total return performance of Asian indices in October. Source: Bloomberg

Fig 8: US Treasury curve – September vs October. Source: Bloomberg

Fig 8: US Treasury curve – September vs October. Source: Bloomberg Fig 9: Divergence of CCC yields relative to BB and B. Source: St Louis Fed, ICE

Fig 9: Divergence of CCC yields relative to BB and B. Source: St Louis Fed, ICE Fig 10: Narrowing of BBB-BB spread to ’07 lows. Source: St Louis Fed, ICE

Fig 10: Narrowing of BBB-BB spread to ’07 lows. Source: St Louis Fed, ICE

Fig 12: Reversal of GBP shorts. Source: Scotiabank FICC Strategy, Bloomberg and CFTC

Fig 12: Reversal of GBP shorts. Source: Scotiabank FICC Strategy, Bloomberg and CFTC

Fig 12: GBP net long/short positions. Source: Scotiabank

Fig 12: GBP net long/short positions. Source: Scotiabank