Outlook

Despite heightened worries about the impact of the virus on the US, we believe data is consistent with our base case (60% probability) in which new virus cases peak by mid-April in Europe and the US; the most severe restrictions are lifted from May; and a coordinated monetary and fiscal response allows for a V-shaped recovery to take hold from the third quarter of this year with rapid acceleration in the fourth quarter. UBS “expects to see evidence by mid-month that the US is starting to bend the curve. In Europe, we see more compelling evidence that governments in Italy, Germany, France, and Spain are bending the curve now”.

Market developments over the coming weeks will hinge on four key factors: First, whether we see further evidence that containment measures are slowing infection rates. Second, whether announced government stimulus measures are actually succeeding in preventing job losses and bankruptcies. If governments can do this, then we could expect a relatively swift recovery in demand when economies reopen ie to ‘preserve capacity’. Thirdly central banks’ measures to prevent a liquidity crisis work in the next 2-3 months and thus stop a solvency crisis developing that might result in a severer recession or even a depression (and a far worse public healthcare crisis than this virus). Lastly evidence of a slowdown in infections and lower morbidity rates, as the use of better therapeutics make treatment more effective, should reduce fear and pessimism.

We believe markets are past the peak in panic seen in mid-March but very poor macro data, and the rising death toll, may mean we are not yet at maximum pessimism and that a retest of the 23rd March lows at 2,237 on SPX and 10year US Treasury yield at 31bps are quite possible and this fits with previous corrections needing markets to form a ‘double-bottom’. We would look to deploy cash and reposition defensive assets, as some of our Alternatives, into riskier assets into such declines.

With equities and lower quality bonds offering the most attractive valuations since 2016, higher risk investors can put excess cash to work via an averaging-in strategy. In addition, investors can buy gold as increasingly the only genuine ‘safe haven’ asset. We see opportunities in Asian equities that are relatively cheap and whose earnings impact from the virus is likely to be relatively limited, as well as quality stocks globally, that can protect dividend payments, that should be resilient.

We think credit is closer to pricing in our downside scenario than equities, and US investment grade, US high yield, and US dollar-denominated emerging market sovereign bonds all offer attractive opportunities after selling-off to levels last seen in the GFC. To put this into perspective US HY spreads over USTs blew-out by over 1,000bps, similar to the fall in GFC, which implies a 50% default rate over the next five years whereas SPX, using our estimates for ‘normalised’ earnings in FY21, is trading at just under 15x vs. the long-term 16.6x average and on over 2x PBV that is decent value but hardly a bargain. The explosive rally in equity markets late March means they are closer to pricing in our base case scenario and the need to be more selective. Equities main attraction is they look cheap relative to high quality bonds and offer better income too.

When to Downgrade the Lockdown?

A real concern is that unless economic activity is restored relatively quickly, companies with much reduced, or no, revenues will face a solvency issue and this risk is made worse by a record high debt to equity level that could lead to a Depression via a horrific credit crisis – surely a danger most governments would seek to avoid? We might not be able to contain the virus, but we can avoid triggering a solvency/credit crisis that may have other enormous public health consequences.

Perspective: Fullerton’s “letter”

We will like to end this off with a speech from former Capital Group Chairman Jim Fullerton. He delivered this speech in Nov 1974 amid a prolonged bear market and provides us with a historical perspective, and some optimism, in a market environment like what we are in today.

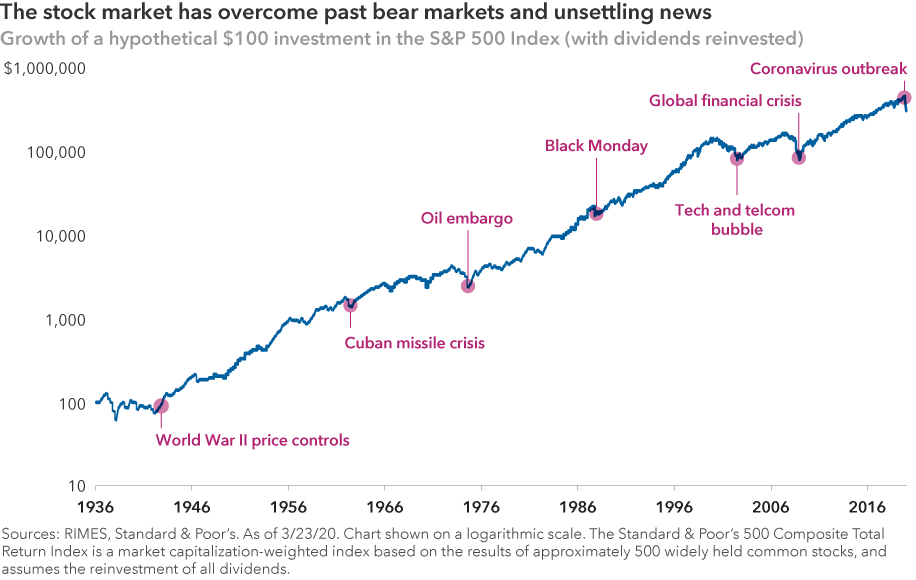

Figure 1: Stock markets’ resilience Source: Capital Group

The speech is as follows:

“Courage! We have been here before”: One significant reason why there is such an extreme degree of bearishness, pessimism, bewildering confusion, and sheer terror in the minds of brokers and investors alike right now, is that most people today have nothing in their own experience that they can relate to, which is similar to this market decline. My message to you, therefore, is: Courage! We have been here before. Bear markets have lasted this long before. Well-managed mutual funds have gone down this much before. And shareholders in those funds and we the industry survived and prospered.

I don’t know if we have seen the absolute bottom of this prolonged bear market, (although I think we’ve seen the lows for a lot of individual stocks). Each economic, market and financial crisis is different from previous ones. But in their very difference, there is commonality. Namely, each crisis is characterized by its own new set of nonrecurring factors, its own set of apparently insoluble problems and its own set of apparently logical reasons for well-founded pessimism about the future.

Today there are thoughtful, experienced, respected economists, bankers, investors and businessmen who can give you well-reasoned, logical, documented arguments why this bear market is different; why this time the economic problems are different; why this time things are going to get worse — and hence, why this is not a good time to invest in common stocks, even though they may appear low. Today people are saying: “There are so many bewildering uncertainties, and so many enormous problems still facing us — both long and short term — that there is no hope for more than an occasional rally until some of these uncertainties are cleared up. This is a whole new ballgame.”

A whole new ballgame: In 1942 everybody knew it was a whole new ballgame. And it was. Uncertainties? We were all in a war that we were losing. The Germans had overrun France. The British had been thrown out of Dunkirk. The Pacific Fleet had been disastrously crippled at Pearl Harbor. We had surrendered Bataan, and the British had surrendered Singapore. In April 1942, inflation was rampant.

Today almost every financial journal or investment letter carries a list of reasons why investors are standing on the sidelines. They usually include (1) continued inflation; (2) illiquidity in the banking system; (3) shortage of energy; (4) possibility of further outbreak of hostilities in the Middle East; and (5) high interest rates. These are serious problems.

But on Saturday, April 11, 1942, The Wall Street Journal stated: “Brokers are certain that among the factors that are depressing potential investors are, (1) widening defeats of the United Nations; (2) a new German drive on Libya; (3) doubts concerning Russia’s ability to hold when the Germans get ready for a full-dress attack; (4) the ocean transport situation with the United Nations, which has become more critical; and (5) Washington is again considering either more drastic rationing with price fixing or still higher taxes as a means of filling the ‘inflationary gap’ between increased public buying power and the diminishing supply of consumer goods.” (Virtually all of these concerns were realized and got worse.)

On the same day, discussing the slow price erosion of many groups of stocks, a leading stock market commentator said: “The market remains in the dark as to just what it has to discount. And as yet, signs are still lacking that the market has reached permanently solid ground for a sustained reversal.” Yet on April 28, 1942, in that gloomy environment, in the midst of a war we were losing, faced with excess profits taxes and wage and price controls, shortages of gasoline and rubber and other crucial materials, and with the virtual certainty in the minds of everyone that once the war was over we’d face a post-war depression in that environment, the market turned around.

A return to reality: What turned the market around in April of 1942? Simply a return to reality. Simply a slow but growing recognition that despite all the bad news, despite all the gloomy outlook, the United States was going to survive, that strongly financed, well-managed U.S. corporations were going to survive also. The reality was that those companies were far more valuable than the prices of their stocks indicated. So, on Wednesday, April 29, 1942, for no apparent visible reason, investors again began to recognize reality.

The Dow Jones Industrial Average is not reality. Reality is not price-to-earnings ratios and technical market studies. Symbols on the tape are not the real world. In the real world, companies create wealth. Stock certificates don’t. Stock certificates are simply proxies for reality.

Now I’d like to close with this: “Some people say they want to wait for a clearer view of the future. But when the future is again clear, the present bargains will have vanished. In fact, does anyone think that today’s prices will prevail once full confidence has been restored?” That comment was made 42 years ago by Dean Witter in May of 1932 — only a few weeks before the end of the worst bear market in history. Have courage! We have been here before — and we’ve survived and prospered.

If you like to receive more information on our portfolios solutions, please contact us here: info@odysseycapital-group.com