May 26, 2021 | Articles, Global Markets Update

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation. This advertisement has not been reviewed by the Monetary Authority of Singapore.

2023 Tourism Recovery Will Be Determined By Inoculation Rate

星野佳路 星野リゾート代表

新型コロナウイルス禍で観光旅行関連の消費はブレーキがかかった状態が続く。いつ、どのように回復するのか。必要な政策は何か。星野リゾート代表、星野佳路氏に聞いた。

――旅行・宿泊の需要をどう見ていますか。

「年4.8兆円あったインバウンドは蒸発したが、旅先を海外から国内に変えた日本人の需要3兆円が補っている。日々の予約は感染者が増えれば落ち、感染者が減れば持ち直す。足元は感染状況が悪化しても昨年ほど予約は落ちない。ワクチン登場が大きい。感染が落ち着けばGoToトラベルも再開するだろう」

「今後はワクチン接種のスピードにかかっている。ワクチン接種が進んだ米国や英国では行動制限解除を見越して旅行予約が回復している。日本でも接種が進めば上向くだろう。需要は2023年にはコロナ前の水準に戻るとみている」

――インバウンドは。

「東京オリンピック・パラリンピックをたとえ無観客でも安全に開催できれば意義は大きい。活躍する選手の姿、開催地の街の様子がテレビ中継で世界に伝わり、次は日本に旅行したいと思う人も増えるだろう」

「どの国も相手国の感染状況やワクチン接種の進捗を見ながら人の往来を元に戻していくプロセスが22年に本格化する。インバウンドは台湾、オーストラリア、中国、アメリカと徐々に戻ってくるのではないか」

――コロナ前に戻りますか。

「オンライン会議の定着で出張は減るかもしれないが、観光は成長軌道に戻る。マレーシア、インドネシア、中国などで増える中間層はコロナ禍が終息すれば海外観光旅行に動き出す」

「国内は変わる兆しがある。日本の観光産業の生産性が低いのは需要が休日に集中していたからだ。需要の波に対応するため雇用も75%が非正規だ。だがコロナ対策でテレワークやワーケーションが普及し、平日需要が増える可能性が出てきた。コロナ後も定着すれば地方の経済・雇用にとってプラスだ」

――必要な政策対応は。

「GoToトラベルの35%の補助率は下げるべきだ。コロナ終息で事業が終わる時に大幅値上げとなり反動減が大きくなる。補助対象はワクチン接種者としてワクチン接種を促進することも提案したい」

「何よりワクチン接種を早く進めて重症者を減らすことが重要。夏に経済が回復するには今後1カ月が勝負どころだ。先行するイスラエルや米欧各国は接種者の行動制限を緩めるインセンティブがある。政策を組み合わせて一気に接種率を上げるべきだ」

――星野リゾートはどう取り組みますか。

「需要が冷えた都市部でホテル運営を投資家から任される案件が増えている。供給過剰の市場で経営を立て直すのはバブル崩壊後に経験を積んでいる」

「ホテル運営企業として世界で認められるため北米には進出したい。日本の付加価値を提供できる温泉旅館をやる。80年代に米国でホテルを買収した日本企業が失敗したのは西洋ホテルをまねたからだと思う」

(聞き手は編集委員 吉田ありさ)

ほしの・よしはる 米コーネル大ホテル経営大学院を修了後、91年に家業の4代目代表に。60歳

Yoshiharu Hoshino, Representative of Hoshino Resorts

Sight seeing travel-related consumption will continue to slow down due to the new coronavirus disease. When and how will you recover? What is the required policy? We asked Mr. Yoshiharu Hoshino, the representative of Hoshino Resorts.

――How do you see the demand for travel and accommodation?

“Inbound, which was 4.8 trillion yen a year, is eliminated but the demand of 3 trillion yen for Japanese who have changed their travel destination from overseas to domestic is supplemented.

Daily reservations will drop if there is an increase in infection, and will recover if the number of infected people decreases. Even if the infection situation worsens, reservations will not drop as much as last year. Vaccines are coming out. If the situation in Japan recovers, we believe Go To Travel will resume. “

“From now on, it depends on the speed of vaccination. In the United States and the United Kingdom, where vaccination has progressed, travel reservations are recovering in anticipation of lifting restrictions on behavior. In Japan, if vaccination progresses, demand will increase in 2023 and is expected to return to pre-corona levels. “

–What about inbound?

“It would be significant if the Tokyo Olympics and Paralympics could be held safely even without spectators. The appearance of active athletes and the state of the venue city will be broadcast to the world on TV, and more people will want to travel to Japan next time.”

――Would you like to go back to Corona?

“The establishment of online conferences may reduce business trips, but tourism will return to a growth trajectory. The growing middle class in Malaysia, Indonesia, China, etc. will start overseas tourism once the coronavirus situation is over.”

“There are signs that the country will change. The productivity of the Japanese tourism industry is low because demand was concentrated on holidays. 75% of employment is non-regular to respond to the wave of demand. With the spread of industry, there is a possibility that demand will increase on weekdays. If it becomes established after Corona, it will be positive for the local economy and employment. “

–What is the necessary policy response?

“GoTo Travel’s 35% subsidy rate should be lowered. When the business ends at the end of the corona, the price will rise significantly and the reactionary decline will be large. I would also like to propose that the subsidy promote mass vaccination”

“Above all, it is important to accelerate vaccination and reduce the number of seriously ill people. The next month will be the game for the economy to recover in the summer. Leading Israeli countries and the US and European countries have incentives to relax the restrictions on the behavior of vaccinated people. . We should combine policies to raise the inoculation rate at once. “

――How will Hoshino Resorts work?

“Investors are increasingly entrusted with hotel operations in urban areas where demand is low. Rebuilding operations in oversupplied markets has been important after the collapse of the bubble.”

“I want to expand into North America because it is recognized as a hotel management company in the world. I will do a hot spring inn that can provide added value to Japan. The Japanese company that acquired the hotel in the United States in the 1980s failed because it imitated a Western hotel. I think”

(Interviewer is Arisa Yoshida, editorial board member)

Hoshino Yoshiharu became the fourth representative of the family business in 1991 after graduating from Cornell University Hotel Management Graduate School. 60 years old

May 11, 2021 | Articles, Global Markets Update

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Death and Taxes

Investors in the Asian time zone may not have noticed the that on the 4th of May, the Nasdaq fell by -2.8% at its trough before regaining half of its losses by session close. Maximum losses MTD has been as high -3.8%. The main reason for market skittishness has been the funding for Biden’s two proposed stimulus programs, the USD2.3tn American Jobs Plan (infrastructure upgrade) and the USD1.8tn American Families Plan. The funding for these programs will affect two primary drivers of equity returns, corporate profit growth and tax treatment for capital gains.

The payment for these programs includes USD2tn from higher corporate taxes, a proposed hike to 28% from the current 21%, and USD1.5tn from raising the top capital gains tax to 39.6% from 20%. The latter only applies to individuals earning more than USD450,000 or couples earning more than USD500,000 (the 1%’ers). Already, there are reports that Biden may be willing to consider a 25% corporate tax rate, so there will likely be numerous iterations of the actual amounts. In the case of the impact of taxable income, this accounts for approximately 30% of the investment in US stocks, and while the proportion impacted will be far less, the 4th of May price action indicates the market impact could be significant. One of the most beneficial policies that is less controversial is the USD50bn proposal to improve tax collection for which estimates of additional tax collected range from USD700bn to USD1tn.

While the long-term economic impact of these programs will take many years to discern, the debate of these programs during a seasonal period of lower liquidity could lead to bouts of volatility. The obvious sectors that may be adversely affected are those that benefitted most from the Trump tax cuts, technology, communication services and health care. Industrial, energy and materials benefitted the least. Further, the NASDAQ is up 40% from the pre-COVID peak and is up 100% from the COVID trough in March, and profit taking could be a periodic headwind.

Rising Prices

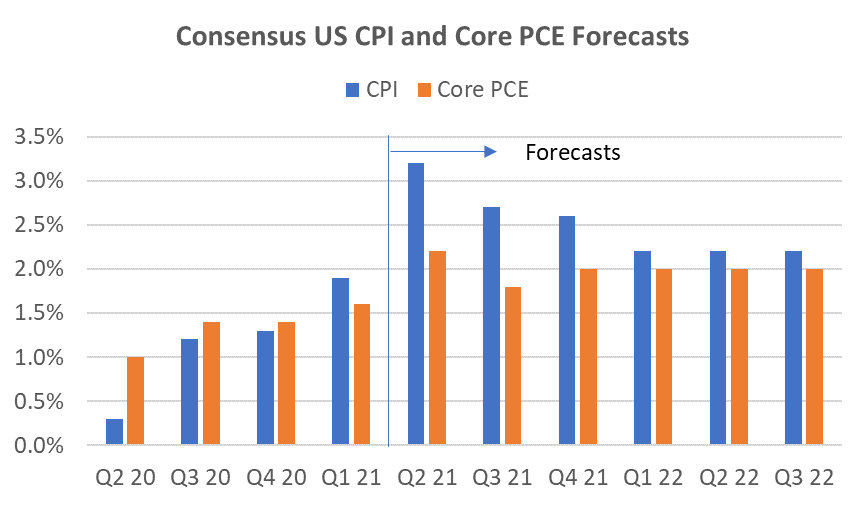

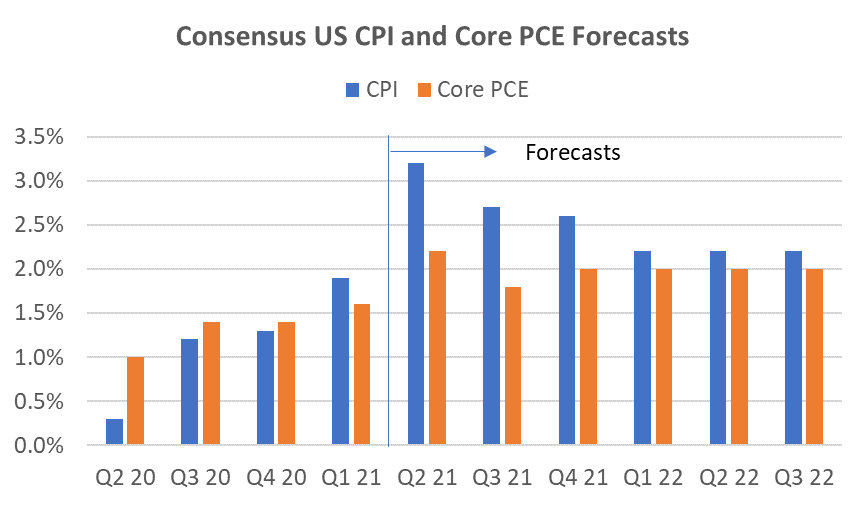

The SPGS Commodity Index rose +8.2% in April and is up +23% YTD. Together with a slew of reports from companies such as Coca-Cola, Whirlpool, Proctor & Gamble, and even Berkshire Hathaway, that prices are rising sharply and being accepted, investors should be prepared higher headline US inflation numbers in the next two quarters. This is expected. Inflation rises during an economic recovery. The unknowns are how high inflation may rise, and importantly, how much is considered transient. So far, the Fed appears unperturbed and the 10Y UST yield appears to have lost momentum since its March peak. Consensus forecasts for Q2 2021 US CPI is now at 3.2% and has been rising steadily since mid-2020. We should not be overly surprised of a monthly number close to 4%. This quarter is expected to be the peak, with CPI gradually declining for the remaining 2021 quarters. A CPI number significantly higher than 4% or a CPI that does not begin to decline after this quarter may cause concerns.

Source: Bloomberg

Earnings Growth Still Very Strong

The key driver of equity returns, EPS growth, remains very robust. For the US, 87% of S&P500 companies beat EPS estimates by 24% and top line growth surprised by 4%. Discretionary and Financials led the pack. For the Stoxx600, 72% beat EPS by 18% and revenue growth surprised by 7%. Strong EPS outperformance is generally positive for the markets, however, the impact has been subdued in the latest quarter (see chart below). The reasons for this are likely to be many but the crux can be alluded to a sell on the fact mentality. Technicals, valuations, strong YTD performance potential tax increases likely all played a role. Nevertheless, strong earnings indicate this remains more a buy on dips market than a sell on dips.

Source: JP Morgan

Is there a potential for a lull in growth in the US as we have seen in other regions, most notably in China? This is certainly a risk, and higher inflation may exacerbate the impact to corporate profits that will have flow-on affects for markets. However, progress on approving stimulus programs may mitigate the impact of any short-term lull in growth that the most recent jobs claims data might indicate.

Investment Recommendations

Back to the Pack But for How Long?

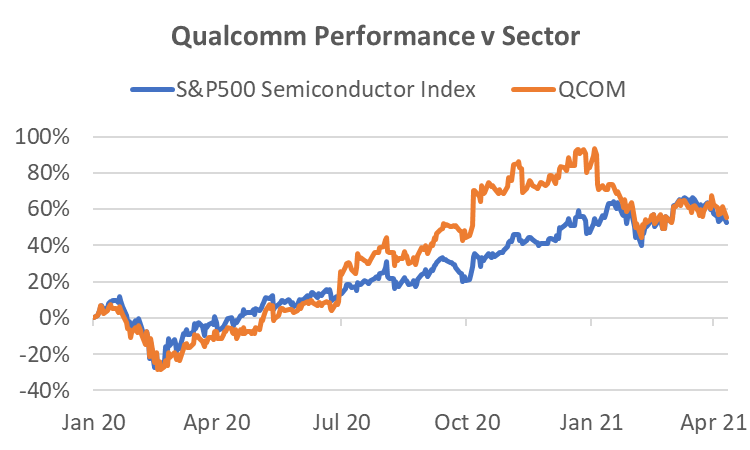

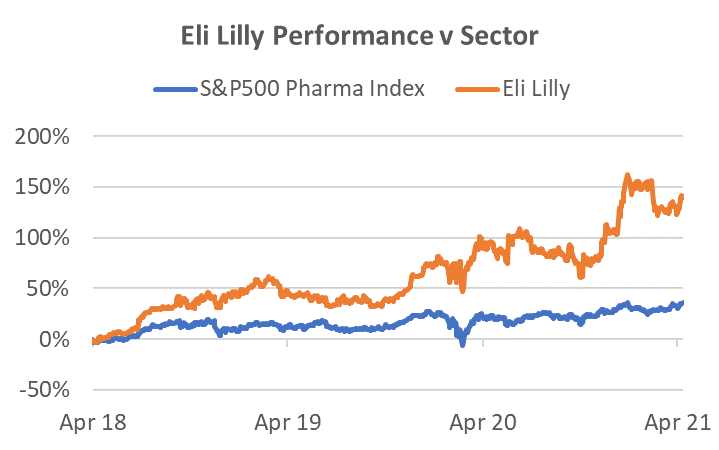

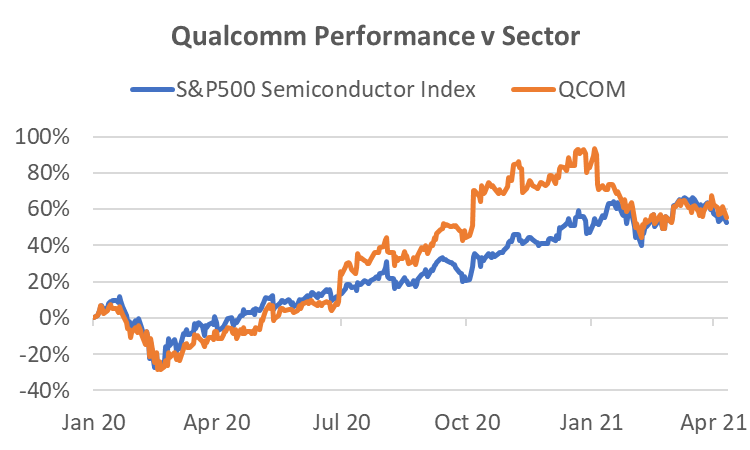

This month we highlight two stocks that were market darlings last year but have faced a few headwinds recently. These two stocks are Qualcomm (QCOM) and Eli Lilly (LLY). In 2020 these stocks were considered best in class exposures for 5G and Pharmaceuticals respectively and returned 73% and 28% for the year. This year QCOM is down -10% YTD and in March 2021, LLY fell -9%.

QCOM has suffered from 3 main concerns; 1) component shortages, 2) weaker sell-through 3) Apple Inc. deciding to take the wireless modem business in-house. The latter accounts for around 20% of QCOM’s revenues. However, the latest quarterly result showed that 1) & 2) have been well managed through optimizing product mix, solid execution, and increasing opportunities in China from loss of market share by Huawei. Further, despite the gradual loss of the Apple business, consensus revenue growth for the firm is 49% over the next two years and EPS growth is expected to surge by 155%. The 5G story has not changed and the pullback brings the stock to more attractive valuations.

Source: Bloomberg, Odyssey

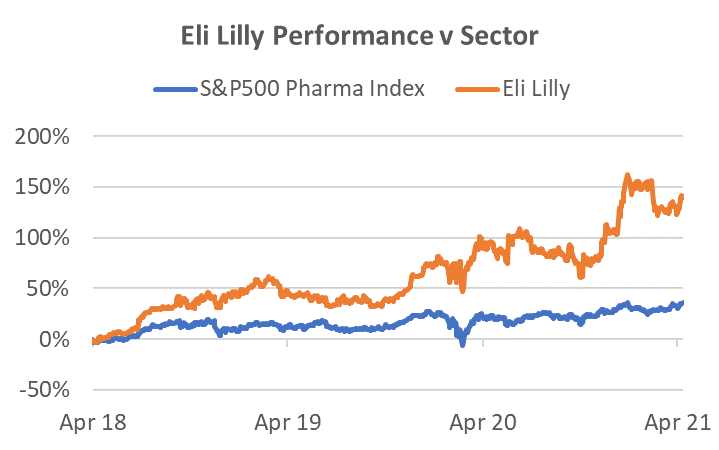

LLY has had the strongest pipeline among the large pharmaceuticals for several years. One of the most exciting developments has been LLY’s drug for the treatment of Alzheimer’s, Donanemab. In the US, 4.5mn people suffer from early-stage Alzheimer’s so the potential of the drug is huge. In January, an initial Phase 2 trials showed promising results which catapulted the market cap of the stock by USD19bn. However, in March a more extensive Phase 2 trial showed mixed results – the drug cleared substantial amounts of amyloid plaques in the brains of treated patients. But outcomes in secondary trial goals — measures of cognition, memory, and activities of daily living — were more mixed and further study recommended. The result caused the January gains to be wiped out as concerns grew about the efficacy of the drug. These are only Phase 2 trials and a more comprehensive test (results expected in June) is being conducted in preparation for Phase 3 trials later this year. While the results have been mixed relative to the high expectations developed in January, the drug appears at least as effective as its main rival, Aducanumab, produced by Biogen. Hence, the potential remains for this drug to become a blockbuster and highly profitable.

Regardless of Donanemab’s future success, LLY recorded 16% revenue growth in Q1 2021, backed by a strong portfolio in neuroscience, diabetes, oncology and immunology. While the Pharmaceuticals sub-Index has trailed the S&P500 at +6% YTD, should we see a continuance of recent uncertainty over the next quarter, the defensive nature of the industry could lead to outperformance. We continue to see LLY leading the pack as it has over the lasts 5 years with a price gain of 139%, almost 4x the sector return.

Source: Bloomberg, Odyssey

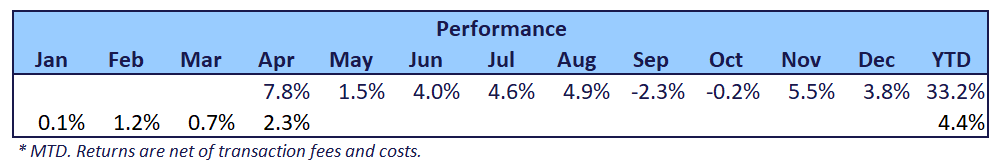

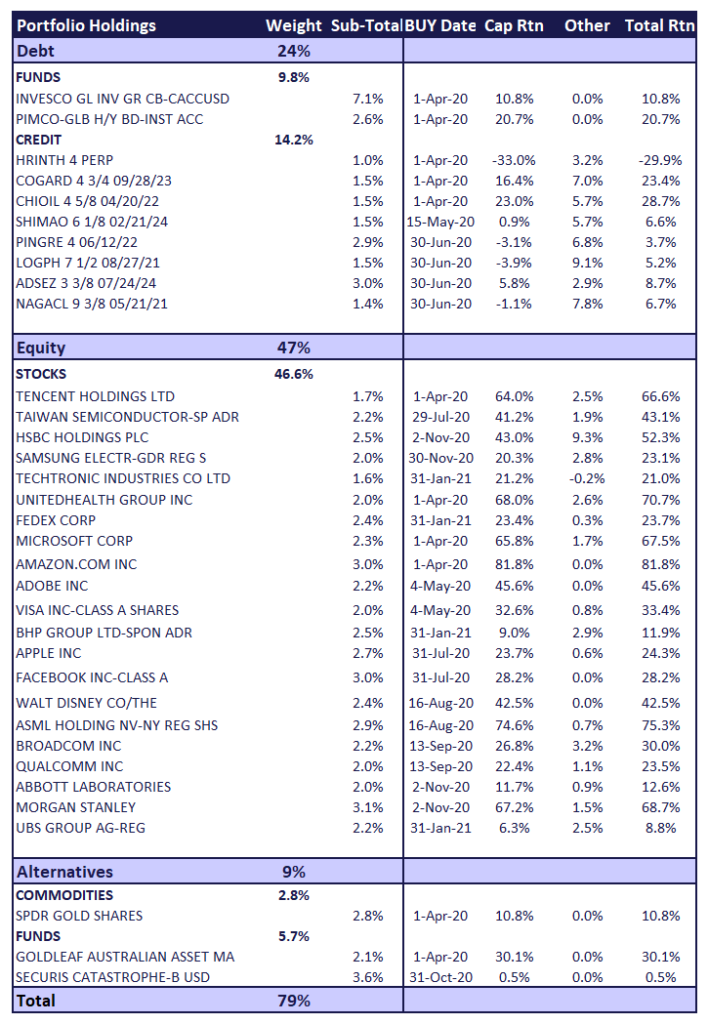

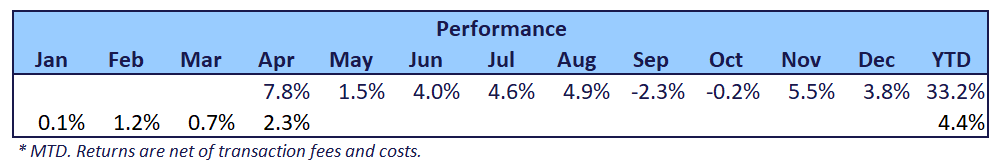

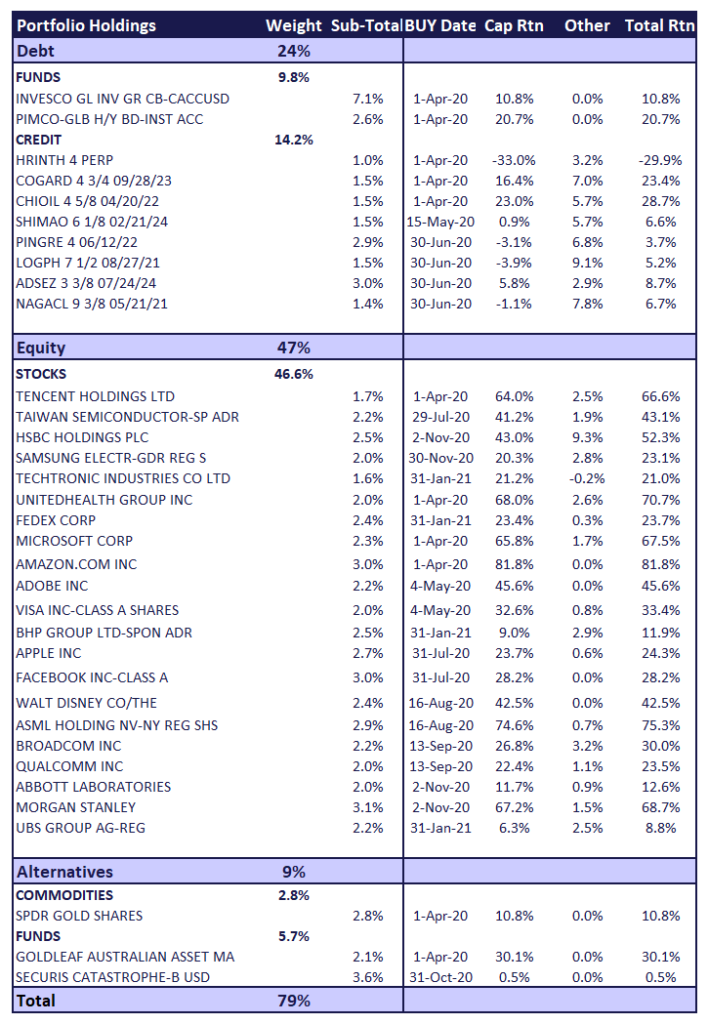

Odyssey Model Portfolio Performance

If you like to receive more information on our portfolio solutions, please contact us here: info@odyssey-grp.com.

May 5, 2021 | Careers

Role: Managing Director/Director – Distribution

Company: Odyssey Asset Management (SG) Pte. Ltd.

Location: Singapore

Reporting to: Head of Distribution, James Wheeler (based in Hong Kong)

Role Summary

There is currently an opportunity to join the Odyssey Group, one of Asia’s leading private markets asset managers, whose strategic investor is the ASX listed, Auctus Investment Group (AVC:AU).

The MD of Distribution will lead the Distribution team for the Odyssey Group’s Singapore office and drive the group forward in its South East Asia expansion.

The seasoned candidate will have a proven track record of raising AUM for private market opportunities and have an existing database of investors in the region.

Reporting to the Head of Distribution, the candidate will be responsible for developing and maintaining relationships with HNW, UHNW, Family Offices, B2B and institutional clients throughout the South East Asia region, with a primary focus on raising Aum for Odyssey’s inhouse and Co-GP products, funds and deals.

For further information on the Odyssey Group, refer to the company presentation here.

Responsibilities

- Responsible for business development and execution of sales strategies

- Drive sales of Odyssey managed products and external partners

- Manage and maintain relations with existing client portfolios

- Increase existing institutional business by increasing share of client business

- Work on a team level to identify new opportunities within the target market

- Develop and maintain internal relationships with other divisions

Requirements

- Degree holder in related discipline

- Minimum 8-10 years B2B/family sales experience preferred

- Must be able to be MAS licensed

- Established network of proven clients

- Self-motivated individual, with a commitment to excellence

- Excellent communication skills and ability to deal with clients

- Fluent written and spoken English, other languages preferred

- Ability to interact effectively with individuals at all levels in the organisation

- Ability to focus and prioritise the key initiatives across a broad range of opportunities and relationships

Package

- Base salary based on candidates experience

- Commission on AUM raised

- Other incentives depending on the candidate’s experience and achievements

Availability

The role is available now, we anticipate filling the role in the next 3 months.

Contact

Please contact us for further information and a preliminary confidential call.

Email: careers@odyssey-grp.com

About Us

The Odyssey Group Ltd is one of Asia’s leading Private Market Asset Managers who provides differentiated and bespoke investment solutions across multiple asset classes, including private real estate, alternative credit and private equity. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest with its clients.

Odyssey’s subsidiary, Odyssey Asset Management (SG) Pte. Ltd., is a Singapore-based Fund Management company that is currently licensed by the Monetary Authority of Singapore.