For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Death and Taxes

Investors in the Asian time zone may not have noticed the that on the 4th of May, the Nasdaq fell by -2.8% at its trough before regaining half of its losses by session close. Maximum losses MTD has been as high -3.8%. The main reason for market skittishness has been the funding for Biden’s two proposed stimulus programs, the USD2.3tn American Jobs Plan (infrastructure upgrade) and the USD1.8tn American Families Plan. The funding for these programs will affect two primary drivers of equity returns, corporate profit growth and tax treatment for capital gains.

The payment for these programs includes USD2tn from higher corporate taxes, a proposed hike to 28% from the current 21%, and USD1.5tn from raising the top capital gains tax to 39.6% from 20%. The latter only applies to individuals earning more than USD450,000 or couples earning more than USD500,000 (the 1%’ers). Already, there are reports that Biden may be willing to consider a 25% corporate tax rate, so there will likely be numerous iterations of the actual amounts. In the case of the impact of taxable income, this accounts for approximately 30% of the investment in US stocks, and while the proportion impacted will be far less, the 4th of May price action indicates the market impact could be significant. One of the most beneficial policies that is less controversial is the USD50bn proposal to improve tax collection for which estimates of additional tax collected range from USD700bn to USD1tn.

While the long-term economic impact of these programs will take many years to discern, the debate of these programs during a seasonal period of lower liquidity could lead to bouts of volatility. The obvious sectors that may be adversely affected are those that benefitted most from the Trump tax cuts, technology, communication services and health care. Industrial, energy and materials benefitted the least. Further, the NASDAQ is up 40% from the pre-COVID peak and is up 100% from the COVID trough in March, and profit taking could be a periodic headwind.

Rising Prices

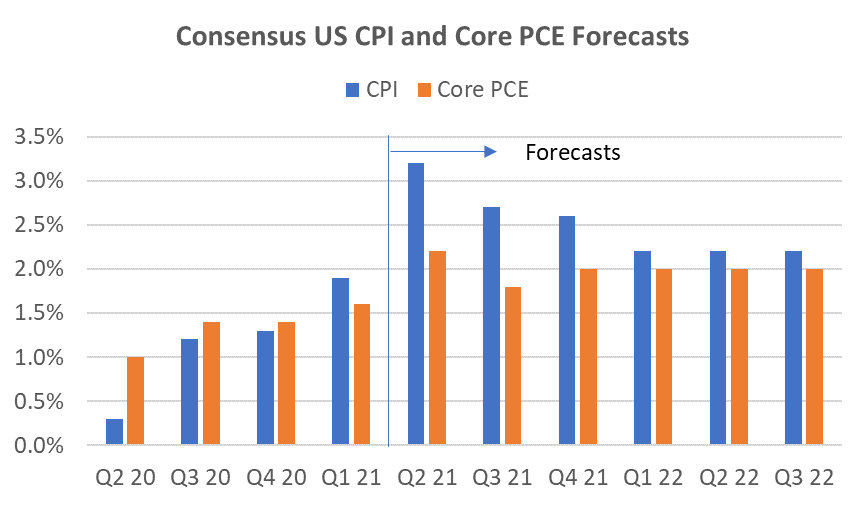

The SPGS Commodity Index rose +8.2% in April and is up +23% YTD. Together with a slew of reports from companies such as Coca-Cola, Whirlpool, Proctor & Gamble, and even Berkshire Hathaway, that prices are rising sharply and being accepted, investors should be prepared higher headline US inflation numbers in the next two quarters. This is expected. Inflation rises during an economic recovery. The unknowns are how high inflation may rise, and importantly, how much is considered transient. So far, the Fed appears unperturbed and the 10Y UST yield appears to have lost momentum since its March peak. Consensus forecasts for Q2 2021 US CPI is now at 3.2% and has been rising steadily since mid-2020. We should not be overly surprised of a monthly number close to 4%. This quarter is expected to be the peak, with CPI gradually declining for the remaining 2021 quarters. A CPI number significantly higher than 4% or a CPI that does not begin to decline after this quarter may cause concerns.

Source: Bloomberg

Earnings Growth Still Very Strong

The key driver of equity returns, EPS growth, remains very robust. For the US, 87% of S&P500 companies beat EPS estimates by 24% and top line growth surprised by 4%. Discretionary and Financials led the pack. For the Stoxx600, 72% beat EPS by 18% and revenue growth surprised by 7%. Strong EPS outperformance is generally positive for the markets, however, the impact has been subdued in the latest quarter (see chart below). The reasons for this are likely to be many but the crux can be alluded to a sell on the fact mentality. Technicals, valuations, strong YTD performance potential tax increases likely all played a role. Nevertheless, strong earnings indicate this remains more a buy on dips market than a sell on dips.

Source: JP Morgan

Is there a potential for a lull in growth in the US as we have seen in other regions, most notably in China? This is certainly a risk, and higher inflation may exacerbate the impact to corporate profits that will have flow-on affects for markets. However, progress on approving stimulus programs may mitigate the impact of any short-term lull in growth that the most recent jobs claims data might indicate.

Investment Recommendations

Back to the Pack But for How Long?

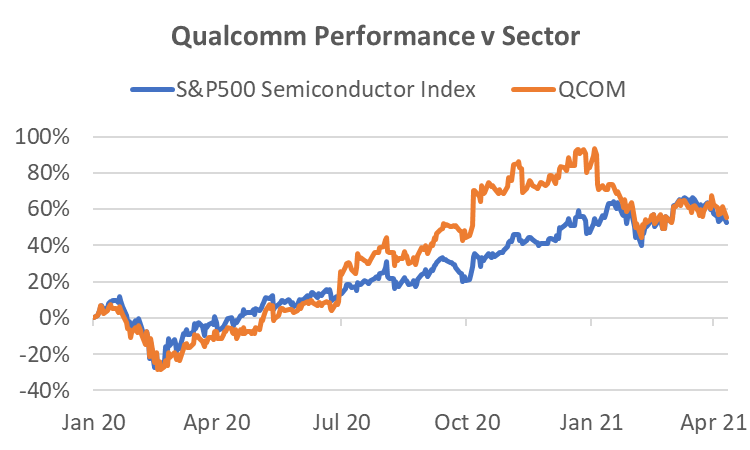

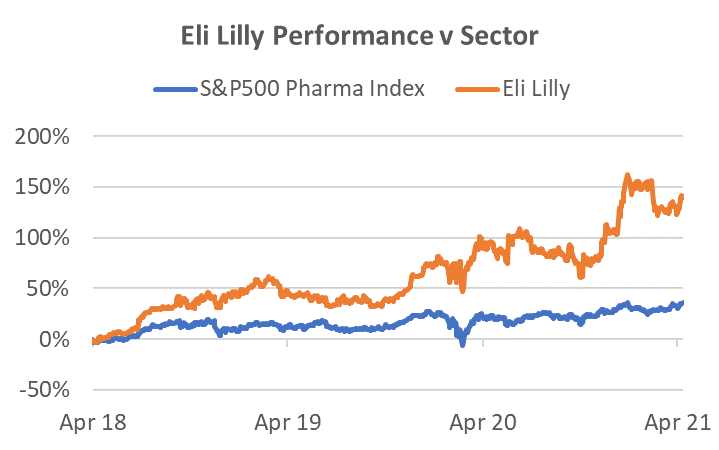

This month we highlight two stocks that were market darlings last year but have faced a few headwinds recently. These two stocks are Qualcomm (QCOM) and Eli Lilly (LLY). In 2020 these stocks were considered best in class exposures for 5G and Pharmaceuticals respectively and returned 73% and 28% for the year. This year QCOM is down -10% YTD and in March 2021, LLY fell -9%.

QCOM has suffered from 3 main concerns; 1) component shortages, 2) weaker sell-through 3) Apple Inc. deciding to take the wireless modem business in-house. The latter accounts for around 20% of QCOM’s revenues. However, the latest quarterly result showed that 1) & 2) have been well managed through optimizing product mix, solid execution, and increasing opportunities in China from loss of market share by Huawei. Further, despite the gradual loss of the Apple business, consensus revenue growth for the firm is 49% over the next two years and EPS growth is expected to surge by 155%. The 5G story has not changed and the pullback brings the stock to more attractive valuations.

Source: Bloomberg, Odyssey

LLY has had the strongest pipeline among the large pharmaceuticals for several years. One of the most exciting developments has been LLY’s drug for the treatment of Alzheimer’s, Donanemab. In the US, 4.5mn people suffer from early-stage Alzheimer’s so the potential of the drug is huge. In January, an initial Phase 2 trials showed promising results which catapulted the market cap of the stock by USD19bn. However, in March a more extensive Phase 2 trial showed mixed results – the drug cleared substantial amounts of amyloid plaques in the brains of treated patients. But outcomes in secondary trial goals — measures of cognition, memory, and activities of daily living — were more mixed and further study recommended. The result caused the January gains to be wiped out as concerns grew about the efficacy of the drug. These are only Phase 2 trials and a more comprehensive test (results expected in June) is being conducted in preparation for Phase 3 trials later this year. While the results have been mixed relative to the high expectations developed in January, the drug appears at least as effective as its main rival, Aducanumab, produced by Biogen. Hence, the potential remains for this drug to become a blockbuster and highly profitable.

Regardless of Donanemab’s future success, LLY recorded 16% revenue growth in Q1 2021, backed by a strong portfolio in neuroscience, diabetes, oncology and immunology. While the Pharmaceuticals sub-Index has trailed the S&P500 at +6% YTD, should we see a continuance of recent uncertainty over the next quarter, the defensive nature of the industry could lead to outperformance. We continue to see LLY leading the pack as it has over the lasts 5 years with a price gain of 139%, almost 4x the sector return.

Source: Bloomberg, Odyssey

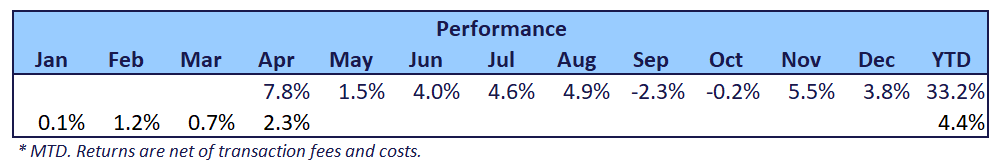

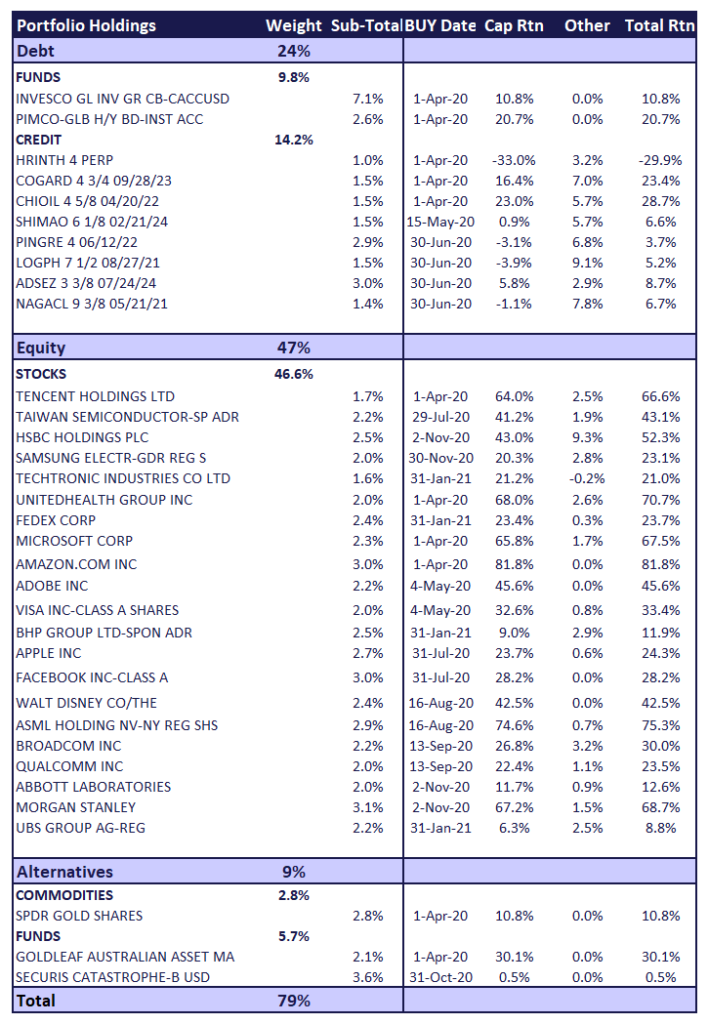

Odyssey Model Portfolio Performance

If you like to receive more information on our portfolio solutions, please contact us here: info@odyssey-grp.com.