Dec 17, 2020 | Articles, Global Markets Update

December Market View

Christmas Cheer

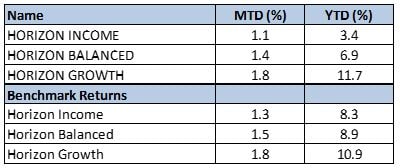

Last month was the best November on record for many major Equity Indices. The MSCI World Index was up 12.2%, even higher than the S&P 500 index, with Europe leading the charge. The MSCI Europe Index jumped 13.8%. Credit and commodities, particularly oil, joined in the festive atmosphere as risk assets rose on the back of positive vaccine news as well as the dissipation of US election concern.

The anticipated massive roll-out of COVID vaccines expected in H1 2021 has resulted in cyclical stocks being in the ascendency during the month, despite mixed reports on new COVID cases. The MSCI European Bank Index surged 31% and the European Energy Index rise was even higher at 33%. Industrials gained 14% and even InfoTech climbed 15%. The US story was similar. The momentum has so far continued into December.

Source: Bloomberg

2021 – A Year of Normalisation

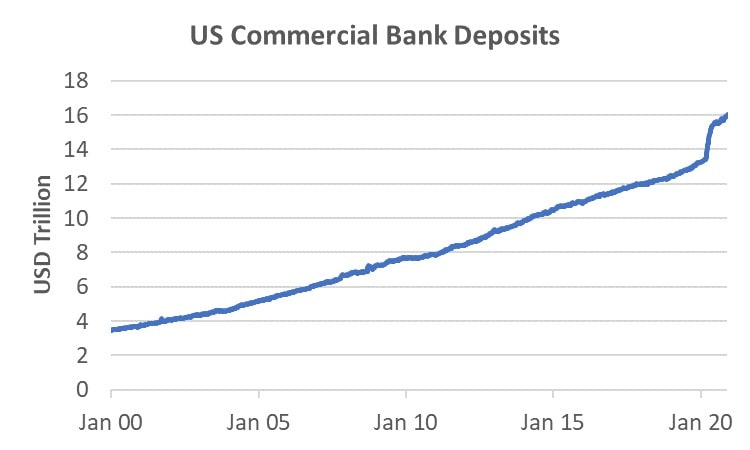

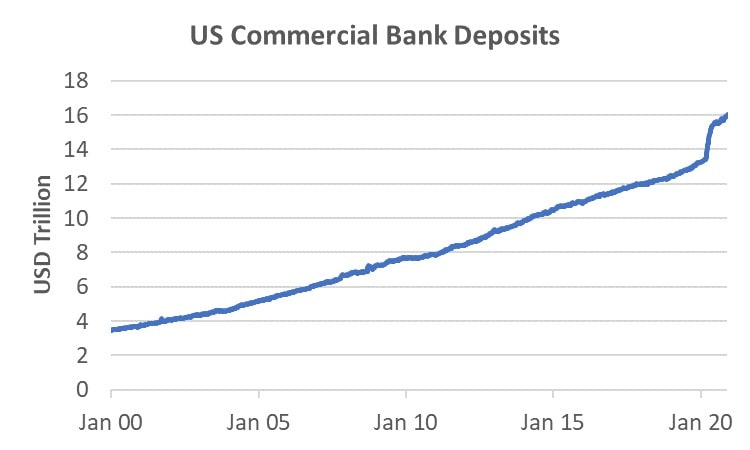

Some say the world will never be quite the same after COVID. Certainly, the gains in technology adoption, particularly those that facilitate a stay-at-home lifestyle, is not likely to regress. However, current growth rates are not likely sustainable and as people return to a semblance of pre-COVID lifestyles, cyclical stocks are likely to be greater beneficiaries. As an example of the potential pent-up demand for pre-COVID goods and services, US commercial bank deposits has now grown by USD2.5tn since the end of February 2020. Despite the higher unemployment rate, there is clearly a large swathe of money that could be used on consumption as lockdown restrictions ease. Europe has experienced a similar phenomenon where household bank deposits grew by EUR401bn from Feb – Oct, almost twice the level of the corresponding period in 2019.

Source: FRED

Can Equity Markets Go Higher?

The MSCI World TR Index has gained a staggering 67% since the nadir on March 23. It is now 10% above the pre-COVID peak and up 14% YTD. With nominal GDP in major economies not expected to regain 2019 levels until at least H2 2021, it is valid to question whether the market has run ahead of itself. After-all, even with a then unprecedented stimulus, the Index took a full six years to regain its pre-GFC peak. For COVID it took less than six months. However, the cause of each crisis was vastly different. The GFC was an issue of acute overleverage at the consumer level. Following the GFC it took almost 5 years for US households to recover their net worth. While there is only data to April 2020, it appears there was only a momentary disruption to household net worth due to COVID before a full recovery. With the subsequent rise in equity markets, in addition to house prices rising 2.6% from March to September 2020, we can assume US household net worth is currently higher than pre-COVID.

Source: FRED

While equity gains in the last 6 months are unlikely to be repeated in 2021, there does not appear to be any structural impediments to equity markets going higher as long as economies do start to normalize in a manner that is not materially different from expectations. We would not be surprised of a few bumps in the equity markets over the transition period in the next 1-3 months, but we remain constructive over the medium to long term due to the low interest rate and heavy fiscal stimulus environment.

Financials, Mid-Small caps, Europe and Asia are Popular Bets

There are several popular themes for 2021 and they are generally recovery focused. In short, those that suffered the most during COVID are expected to benefit the most in the recovery. This includes cyclical stocks, mid-caps or small-caps, due to leverage to the local economy, Europe, where corporates have been decimated by the lockdowns, and Asia, where the earnings growth appears to be highest.

Source: UBS, JPMorgan, Morgan Stanley

What to do with FAANMG?

Many equity investors still have material holdings in these stocks. Despite their preference for other stocks, sell-side strategists and analysts are hardly infallible and often look at the shorter term. Valuations for some of these stocks are well-within their historical range (Facebook and Amazon) and with low interest rates, it is difficult to argue they are expensive. I would not necessarily be a seller of any of these stocks for long term investors as long as the rest of the equity portfolio is well-diversified and position sizes are not excessive. However, admittedly, the upside for other sectors appears potentially higher.

The Case for Using Fund Managers

It’s been a great ride for a decade or more with FAANMG. The same goes for Tencent and Alibaba. However, the downside of an easy ride is that many investors may not be used to the difficult slog of seeking new investment ideas, monitoring a wide range of stocks, and being tactical and dynamic with asset allocation. Some investors may be happy to ride through poorer relative performance periods, content with a longer-term view. For those that want to work their money a little harder every year, allocating a portion of their equity investment to active fund managers whose job is to be concerned with relative performance may be an alternative. Another benefit is that mutual fund managers won’t hold significant amounts of cash so that if you are positive on the equity market in 2021, you will not be tempted to sell stocks during periods of volatility because some stocks have fallen precariously, and miss re-investing should it bounce back up quickly, i.e. the investment is more strategic and because it is diversified it will likely fall less than single stocks.

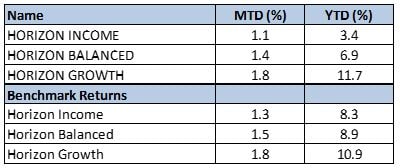

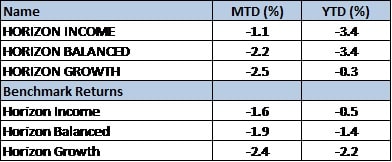

Performances

If you like to receive more information on our portfolios solutions, please contact us here: info@odysseycapital-group.com

Nov 16, 2020 | Articles, Global Markets Update

November Market View

In God we Trust

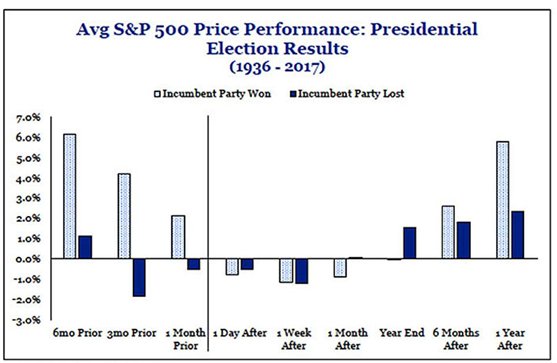

It appeared there was 2 main factors driving the market on US election day. The first was simply the relief that the event was finally taking place after a nervous S&P 500 had fallen 8% in the prior 3 weeks. The second was a little more perplexing. As the polls see-sawed from favouring one candidate to the other, the market kept going up. The one constant was that it was a close race, i.e. neither party was going to control both houses. This can be interpreted as neither candidate being particularly appealing to the market, and the likely difficulty in carrying out ideological policy was regarded as a positive.

The market is expecting that the highest priority of the government post-election is to get the stimulus bill passed. Jerome Powell has recently reiterated that the country requires “direct fiscal support”. Assuming the departing President actually departs, and the bill is passed, the remaining gorilla in the room is COVID.

Hallelujah

Pfizer and BionTech announced on November 10 that in phase 3 trials their vaccine was more than 90% effective in preventing COVID-19 in participants without evidence of prior infection. Submission for emergency FDA approval is planned soon after the safety milestone is achieved, which is expected in the third week of November. The partnership projects producing up to 50 million vaccine doses in 2020 and up to 1.3 bn doses in 2021.

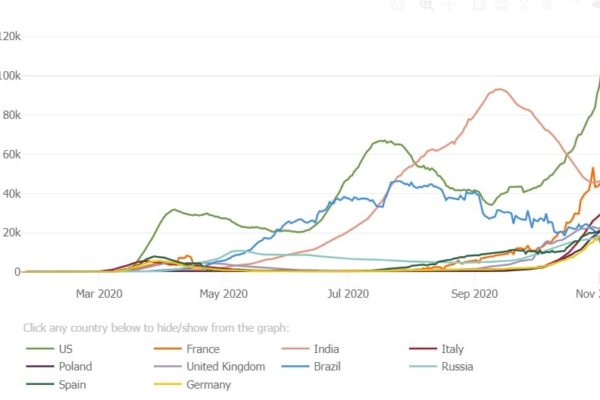

At a time when the second wave continues to spread rapidly across the US and Europe, this is indeed welcomed news. Other Western firms also in phase 3 trials that have yet to report are Moderna, Johnson & Johnson, and AstraZeneca & University of Oxford. All these firms have received funding from the US government to develop and distribute a COVID vaccine.

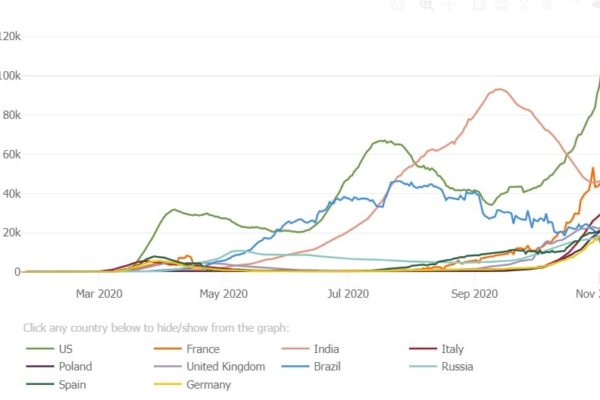

Chart 2: New COVID cases in the US and Select Countries

Source: Johns Hopkins University

Return of the Prodigal Son

The two most shunned sectors in the last 7 months have been the US Banks and Energy. While the oil price is a complicated issue, the banks have historically been a favoured sector to benefit from recessionary conditions. However, due to unique aspects of the COVID induced recession and the resultant low and flat interest rate yield curve, the Banks have had little succour from investors … until now.

Source: Bloomberg

Prior to the Pfizer & BionTech success, the US Banks sector were down 34% YTD. On the announcement the sector gained 13%. Other downtrodden sectors such as those in the travel industry companies surged, with Cruise Ships rising 27-28% and the Global JETS (airlines) ETF jumped 18%.

At the same time, stocks that had benefitted most from COVID, such as many in the Tech sector fell heavily as investors sold momentum and bought value. Given the 66% difference in performance between the InfoTech and Bank sectors YTD prior to the announcement, this was understandable. The Banks sector still needs to rise 75% to catch up to the InfoTech YTD performance, and we expect this performance gap has more room to narrow. Indeed, the more diversified portfolio we have been calling for over the last two months seems even more applicable.

Short Market Comment

October was a month of two halves, with equity markets surging up in the first half, only to give up those gains up and more as the election and surging COVID cases cast a pall over the markets. The MSCI World Index fell -2.5%. US Tech stocks continued to their losses after a difficult September, while US banks started to outperform, in a trend that has accelerated into November. WTI Oil also fell 11% while credit markets and Gold were relatively resilient.

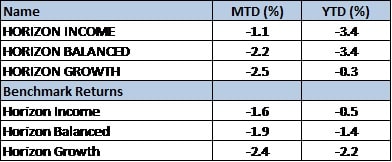

Horizon Portfolio Performance

If you like to receive more information on our portfolios solutions, please contact us here: info@odysseycapital-group.com

Oct 6, 2020 | Articles, Global Markets Update

COVID 4 : Governments 2

September was a difficult month for equity markets as MSCI ACWI (developed and EM) dropped -3.4%. Tech stocks were particularly hard hit as the NASDAQ fell -12% from peak to trough before recovery a little to be down -5.2% for the month. Further, against the trend was the 2.1% rise in the USD Index and Gold fell -4.2%. Commodities also gave up ground with WTI oil falling -5.6% the London Metals Index fell -1.6%. One of the few places to hide was investment-grade credit which was flat for the month.

At the end of the month, just as Tech stocks appeared to be finding their feet, President Trump succumbed to the Virus, creating yet another cause for uncertainty. Along with the second COVID wave in Europe, cases in the US mid-west rising, major global economies starting to lose recovery steam, and the difficulty in passing the stimulus package in the US Congress, equity markets could remain unsettled in the short term.

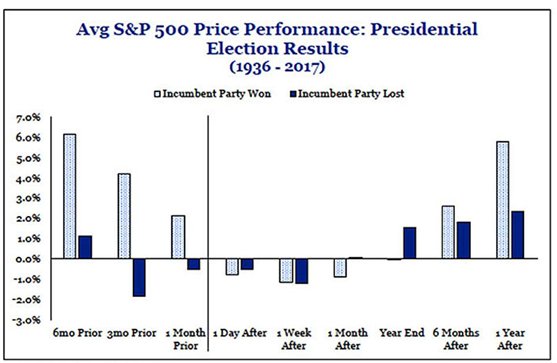

Despite the likelihood that the health of the president and the upcoming US elections may hold many investors’ attention, we remain relatively sanguine for the medium term. A Biden victory appears already partially baked into prices and is generally perceived less favourably for markets than a Trump victory, but it may be pertinent that during Obama’s 8 year reign the S&P 500 Index surged 160%, an annualized return of 12.7% p.a. Not even “Reaganomics” could outperform those numbers. Yes, there is the threat of a tax-cut roll-back, but that is not a given and could be politically unpalatable in the medium term as the nation struggles to recover from the Virus. Apart from some stated policy differences concerning a few sectors, both candidates are keen to support rapid economic recovery and that could be the overriding factor for markets. In fact, the sector differences have already begun to play out some months back in Defence and Health Care with some sub-sectors at 10-year low valuations relative to the Index.

Source: Strategas Research Partners

Second Half Comeback?

Composite PMI numbers for the large economies still appears relatively resilient. But the improvement in numbers coincided with lower new COVID cases and loosening restrictions in many parts of the world. Recently, lockdown rules have been tightened in some countries such as France, Spain and the UK. More are planned if conditions to do improve with New York also planning stricter rules as cases start to climb again. Large scale vaccine treatment is expected to be ready by mid-2021, but that’s 8 months away. With the coming change of seasons, the risk of a growing infection rate and further tightening of lockdown rules cannot be discarded.

Source: Bloomberg, Odyssey

To offset these economic impediments and the potential for social unrest, governments may need to do more. This means further boosts to fiscal stimulus. The US is deliberating over a massive stimulus package. Despite the urgency, the consensus view is that it will not pass Congress before the US election. That means the market must be supported on the belief that the package will pass both houses expeditiously after the election. Any news that suggests the package may be further delayed is unlikely to meet with a positive market response. On the other hand, if taken at face value: the President’s health continues to improve, the elections proceed without abnormal scandal, and the stimulus package can be passed since the elected government should have a mandate, we can realistically look constructively at the equity market. Real-life and the markets usually do not behave so smoothly, but if we can eventually reach the same results, the market result should also be similar.

As for other regions, Europe also has significant firepower. Of the EUR1.35tn package approved, there remained EUR850bn unused as of 10 September. In China, local governments must sell CNY3.75tn worth of so-called special bonds by the end of October, with CNY2.27tn issued by the end of July. That’s already more than in the whole of 2019, and the government is hoping this will jump-start private spending and investment.

Ultimately, the use of a fiscal stimulus is not a solution. It’s a stop-gap measure to attempt to contain the damage to the economy until the impact of the virus is mitigated in some fashion, either through social policy (where the efficacy has been mixed) or through a medical solution.

Conclusion

On a 3-6 month view, we are mildly constructive on the equity market. In the short term, the market is understandably fragile and any adverse news could add to existing headwinds. However, the major governments are not without firepower, and while there are delays to enactment and efficacy of stimulus measures, on balance, global economies should receive enough support to be maintained until a more permanent solution is found. In a sense, the criticism of these stimulus measures is familiar with what China has faced regularly over the last 20 years – that the dependence on liquidity-driven growth and repair of the economy during difficult periods would result in an economic implosion. During that time China’s economy has grown 12 times, from a USD1.2tn economy to a USD14.4tn economy.

Last month we suggested clients maintain a diversified portfolio, within their equity portfolio as well including asset classes that have low correlation to equity. Given the current economic, political and market headwinds, we reiterate this advice.

Short Market Comment

September was a difficult month for equity markets as MSCI ACWI (developed and EM) dropped -3.4%. Tech stocks were particularly hard hit as the NASDAQ fell -12% from peak to trough before recovery a little to be down -5.2% for the month. Further, against the trend was the 2.1% rise in the USD Index and Gold fell -4.2%. Commodities also gave up ground with WTI oil falling -5.6% the London Metals Index fell -1.6%. One of the few places to hide was investment-grade credit which was flat for the month.

If you like to receive more information on our portfolios solutions, please contact us here: info@odysseycapital-group.com

Sep 23, 2020 | Articles, Global Markets Update

Market View

A Bump, or Something More?

August was the 5th strong consecutive month for Equity and risk assets. From the bottom of the equity market in March, the MSCI World Index was up 53% at the end of August. The Index had not seen a drawdown of 5% or more since June. In that case the market nervousness was due to Jerome Powell providing investors a reality check on his expectation for the recovery of the economy.

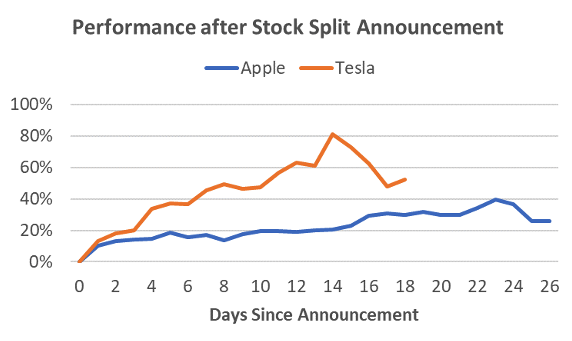

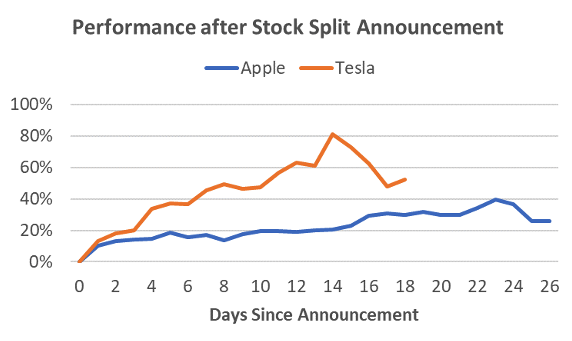

The most recent sell-off that started on September 3, appeared to be due to technical reasons. The previous 4 weeks saw a significant run on speculative names and this seemed to have been sparked by the Tesla and Apple stock splits that both had effective dates at the end of August. Between the stock split announcements and the effective date, the Tesla share price surged an incredible 80% and Apple jumped almost 40%. While this was also on the back of strong Q2 results, it appeared this was also driven up by a speculative element. Other speculative investments such as the Cloud X Computing ETF (CLOU US) also jumped 20% in the 3 weeks prior to the end sell-off. After such a strong run, when the stock splits became effective, it was merely a matter of time before investors decided to take profits. The level of the share price falls was in concert with the strength of the rally.

Chart: Apple and Tesla share price Source: Bloomberg, Odyssey

The large question now is whether the mini sell-off portends a change in the direction of the equity market. We remain constructive on risk assets in the medium term (3-6 months) due to the unprecedented stimulus and zero interest rate policies by central banks. However, we also think it is likely that 1) the absolute returns from equity may slow down from its break-neck speed and 2) stock picking may become more difficult than just buying FAAMNG or technology stocks.

On a fundamental level, economies are improving, but many are at a slower pace than many had hoped. Recent economic data from China, Europe and the US still point to a recovery, but that pace of recovery is decelerating, rather than accelerating. The much hoped-for game changer is an effective and safe COVID 19 vaccine. With the Fall flu season starting in October, there is a real risk that a third wave may occur. There appears a sense of urgency to have a vaccine available to the US population before the Dec-Mar peak flu months. While we are hopeful a vaccine eventuates in time, the current timeline for a vaccine approval has been compressed from 3-4 years to nine months. This may prove too ambitious. Of the three US government backed candidates currently in phase 3 trials, two have already started testing more than 20,000 subjects with a goal as high as 30,000. Even if the trials are successful, there remains one last hurdle – that is the perception that the vaccine will not be safe. US surveys have revealed a high reluctance to take a COVID vaccine due to safety concerns. The number has been as high as 60% of respondents expressing some doubt as to whether they would take the vaccine.

Prudent Diversification

A concentrated portfolio of high-tech stocks, or FAANG, would have worked tremendously over the last 5 months. However, the recent sell-off has shown that this is an over-crowded trade and investors are balking at the pace of the share price climb, if not valuations. We are of the view that many of the FAANG are core equity holdings and we would not be sellers of a judicious level of these stocks that is in keeping with an investor’s risk profile. Further, COVID has likely reaccelerated the adoption of technology that is not likely to dissipate meaningfully, even with the presence of a successful vaccine. Nevertheless, the outperformance of Growth versus Value remains close to extremes and a more diversified strategy going forward appears to be a prudent strategy. By diversification we mean by asset class as well as within the equity portfolio.

Source: Bloomberg, Odyssey

Last month we had already discussed the use of more alternative assets, in addition to equities, and we suggest investors to continue to assess non-listed investments that would provide a good fit to their risk and return goals.

Conclusion

A very long time-line of the US equity market is virtually a straight line. However, sometimes it does not feel very straight on a week to week basis. If your risk tolerance is weekly, monthly or quarterly rather than multi-year, this may be a prudent time to consider whether your portfolio is sufficiently diversified. This does not necessarily mean a lower potential return. It simply means you are remaining open to other ways of generating returns that perhaps have a better risk return profile than your current portfolio.

Short Market View

August capped off the 5th strong consecutive month for Equity and risk assets. From the bottom of the equity market in March, the MSCI World Index was up 53% at the end of August. The Index had not seen a drawdown of 5% or more since June. In that context it was not surprising that in early September the Tech sector and some speculative stocks saw profit taking after a strong rally during August. Tesla surged 80% in just 14 trading days after it’s Q2 results and stock split announcement. We remain positive on FAAMNG as core holdings in an equity portfolio, but valuations of growth stocks in general appear stretched and a more diversified approach going forward appears prudent.

If you like to receive more information on our portfolios solutions, please contact us here: info@odysseycapital-group.com

Aug 7, 2020 | Articles, Global Markets Update

Market View

The Big Dilemma

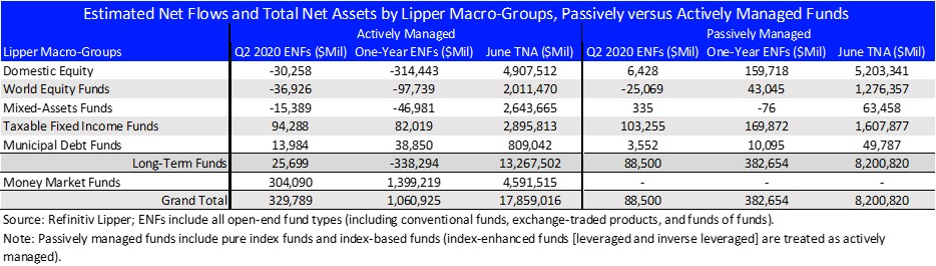

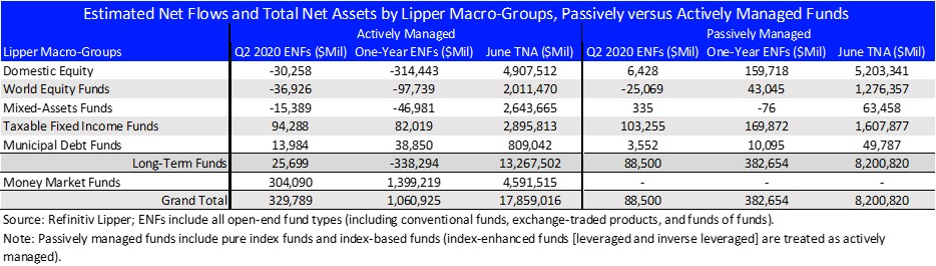

The current Yield to Worst for the Bloomberg Barclays Global Agg Credit Total Return Index, a Global USD Credit Index, is 1.5%. This may seem a low return, however, fund flow data suggests that investors prefer to get a suboptimal low return than experience the uncertainty of the equity market. Even as the MSCI World net return posted a 19% increase in Q2, Lipper data showed USD86bn left Equity Funds while Taxable Fixed Income Funds saw a USD198bn increase. A significant proportion of the latter when to high yield (HY) funds due to the attractive credit spread and yield in April and May.

Multi-asset absolute return portfolio managers now face a difficult decision. At the end of March, Credit was an attractive haven after the COVID sell-off because Global Credit spreads had widened by 120bp and the Yield was a decent 3%. Global HY was even more juicy with spreads widening by 450bp and the yield was 10.5%. The high carry and the potential for capital gains, especially with the US government back-stopping the US credit markets, was irresistible for fixed income veterans, a virtual slam dunk.

However, now with credit spreads, and in particular, yields, approaching pre-COVID levels, the outlook for returns is greatly diminished. The Global Credit Index has returned 7% YTD, and those that focus mostly on that asset class, may well decide that is sufficient for 2020 and rest on their good fortune. For those of us that are still trying to optimize their returns going forward, the return outlook for credit is unappetizing, and we must judiciously look further afield.

The Choices

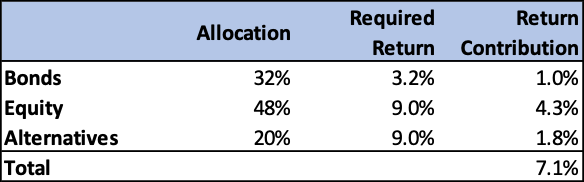

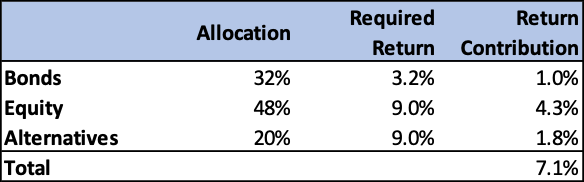

Many of us are in the same boat. Whether we are a retiree or still working, an endowment, a sovereign wealth fund, or an insurance company, we all have future liabilities that need to be paid for through investments. This means we need to get an adequate return on those investments. The required rate of return will depend on your particular situation, but for most the number will be between 5-10% over the cycle. Let’s pick a round number and say we want a 7% return. If our investable universe is Bonds (Credit), Equity and Alternatives, and our Bond portfolio provide a 3.2% YTM (70:30 mix of investment grade and HY), then Equity and Alternatives combined must make 9% in the next 12 months.

Source: Odyssey

Source: Odyssey

For Equity, if earnings are not adjusted higher than current estimates, it would mean that the 2021 MSCI World Index PER would need to be 19.5x (currently 17.8). Apart from extraordinary circumstances such as COVID and the Dotcom boom, the Equity market has only traded as high as 18x – at the peak of the 2017 and 2019 bull rallies. For those that say we now have zero interest rates, so equity multiples can be higher than previously, I would point out that we’ve just had 7 years of zero interest rates in the US from 2009 to 2015. We are not saying you cannot make 9% return from your equity portfolio over the next 12 months, and we hope you do, but we suspect the equity market needs to have a number of positive developments that are not currently apparent for the broad indices to enjoy that type of return.

S&P500 and Current Year PE Ratio

Source: Bloomberg

Can Alternatives bridge the gap? The HFR Hedge Fund Index (HFRHFI) has return 1.6% YTD, which is marginally better than the broad Equity Indices, however, the 6% total return in the last 5 years hardly inspires confidence. The HF Index has even underperformed the Global Credit Index by 24%.

But what about the illiquid strategies? Despite a significant lag in valuation in many cases, unlisted investments do not appear to have gone unscathed. In March AustralianSuper announced they had marked down their unlisted investments by 7.5%. For Q1, Softbank’s Vision Fund with USD76bn invested, lost USD17bn yoy. Carlyle’s Tactical Private Credit Fund’s NAV fell 18% due to COVID and has since recovered approximately half the loss. Commercial real estate has been a mixed bag. Office and industrial exposures have been largely resilient while traditional retail and hotels have suffered and will likely take some time to recover to pre-COVID levels.

Despite some recent losses, there appears a strategic move on the part of large institutional investors to gain further exposure to unlisted investments. Even AustralianSuper is looking to beef its private equity exposure and Calpers has recently stated it believes it needs to raise its exposure to private equity and credit investments if it’s to reach its 7% per annum return target over the next 10 years.

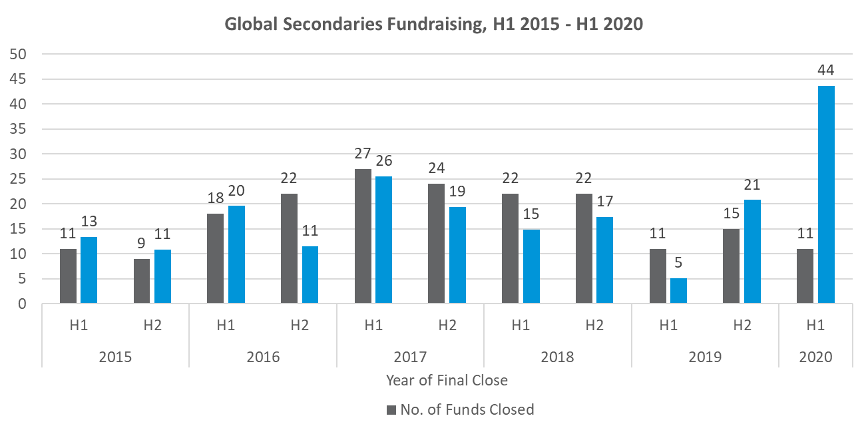

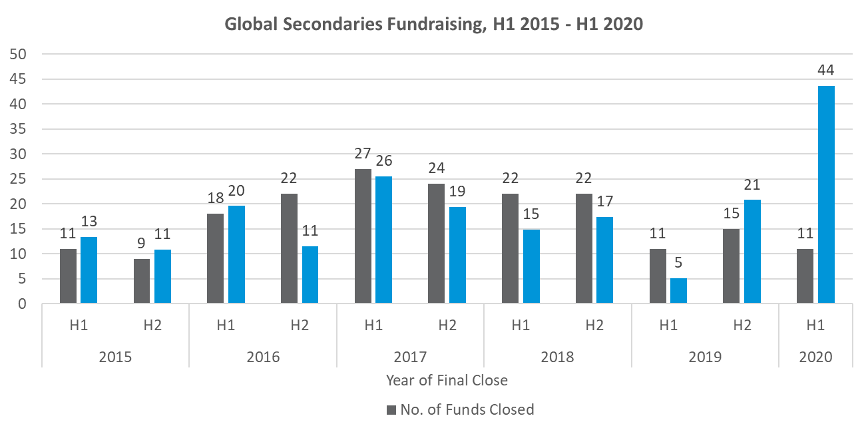

Data tends to support this strategic move by large institutional investors. In H1 2020, private equity experienced USD241bn in fund inflow, USD7bn more than H1 2019[1], despite COVID. While much of the investments were made prior to the COVID lockdown, it indicates the underlying demand. Further, while the number of private secondary transactions declining by 30%, the USD44bn raised in H1 2020 was more than the whole of 2019 (USD26bn)[2], indicating the high demand for secondary transactions.

Source: Prequin

Source: Prequin

Conclusion

The current low yield environment means that for investors that are continually trying to create a portfolio that can provide 5-10% returns going forward, more risk needs to be taken beyond the relative safety of the credit markets. Whether that is through the highly liquid but volatile public equity market, or via unlisted vehicles, or a combination of both, depends on the goals of the individual investor. From our experience, most private investors are underweight alternative assets and further investment in this asset class would likely increase diversification, boost long term returns and lower overall portfolio volatility.

[1] Private Equity International

[2] Prequin

If you like to receive more information on our portfolios solutions, please contact us here: info@odysseycapital-group.com

Jul 21, 2020 | Articles, Global Markets Update

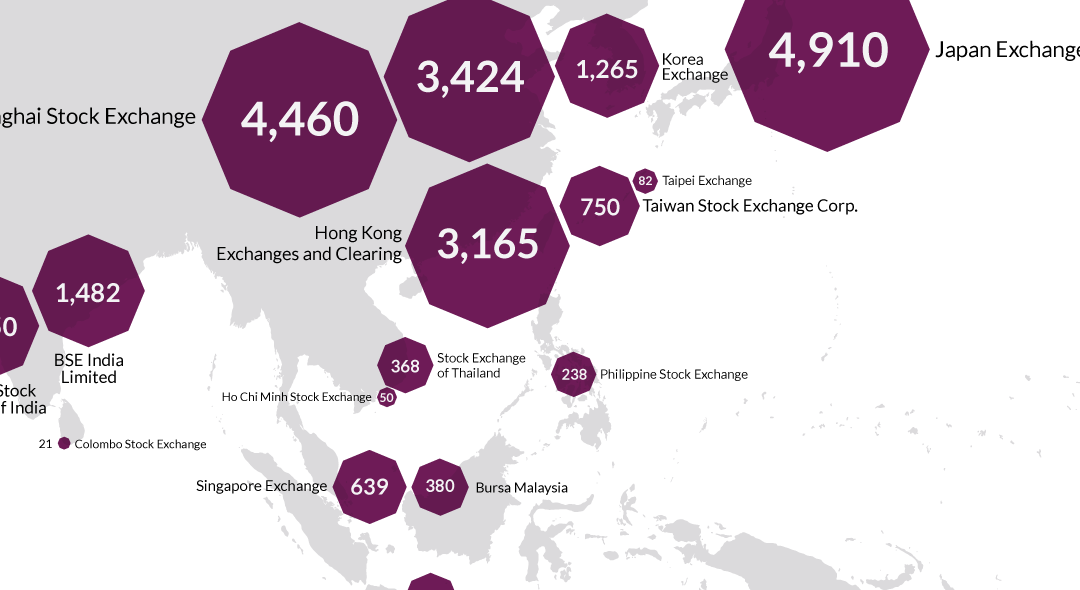

Welcome to the June issue of Capital Pulse, Odyssey Corporate Advisory’s quarterly publication that focuses on major capital and financial markets events that occurred during the quarter and its potential implications for you and your business.

Odyssey Corporate Advisory is an independent boutique consultant providing business advisory, investment consultancy, project management and coordination services for companies that intends to access the Hong Kong capital markets.

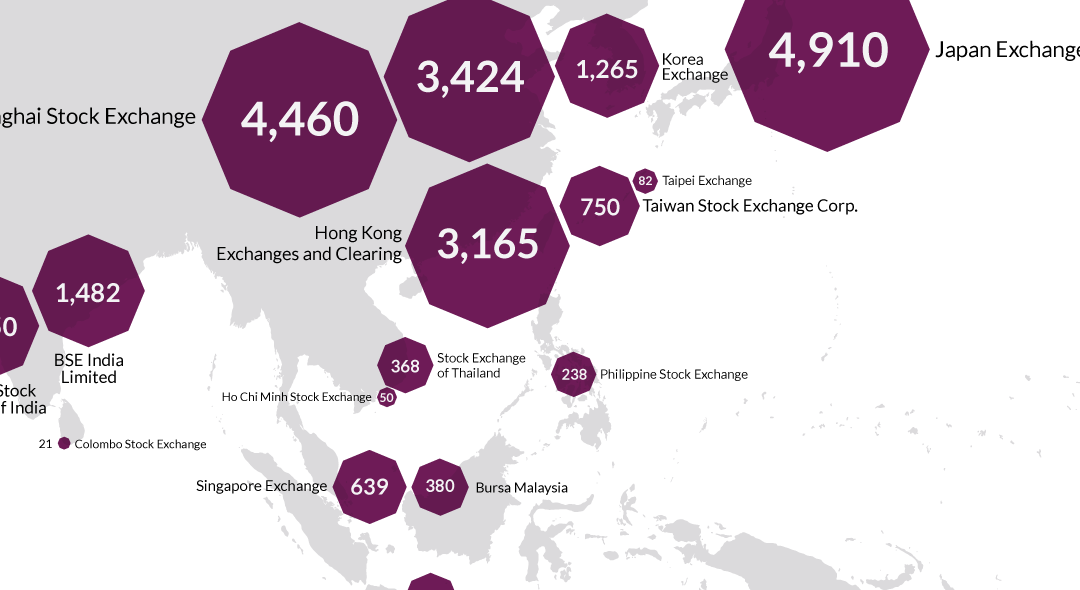

Secondary listings are likely to remain the flavour of the month, if not the year. So, what are secondary listings and is this a money-making opportunity for investors? Are there any shareholder rights implications for investors owning secondary listed companies in Hong Kong compared to primary or dual-primary listed companies?

HEDGING LISTING POSITIONS

We provided an introductory discussion on secondary listing in the June edition of Lex Capitis. In this month’s Capital Pulse, we delve deeper into this category of listed companies and the renewed interest in this space.

The possible legislation of the Holding Foreign Companies Accountable Act (“HFAA”) and the timely creation of Chapter 19C in the Stock Exchange of Hong Kong (“Exchange”) listing rules (“Listing Rules” ) late last year has revitalised secondary listings in Hong Kong.

The recent listings of Alibaba, Netease and JD.com have raised HK$163.04 billion, and further similar secondary listings are expected. With the exception of these recent secondary listings, such listings have traditionally been far and few.

Typically, companies secondary list in Hong Kong because their business has a major exposure to Asia, but their home stock exchange is not based in Asia. Alternatively, Asian companies obtain a secondary listing in Hong Kong because most of its business are concentrated in Hong Kong and/or China.

However, from an investor point of view, secondary listings do not offer much to investors, unless there is an arbitrage opportunity in the IPO with its already listed shares in an overseas exchange, because investors can purchase those company’s shares in their home stock exchange. The only exception to this case is mainland Chinese investors that rely on the stock-connect arrangements with overseas stock exchanges to purchase international shares.

Since 1999, Hong Kong only had 13 companies that chose to obtain a secondary listing status in Hong Kong because these companies believed their business would benefit tangibly or intangibly from a secondary listing status. However, seven of these companies has delisted predominantly due to low trading volumes of its secondary listed shares. The history of secondary listed companies in Hong Kong since 1999 is presented in Table 1 below.

Given the current geopolitical environment, the HKEX might benefit from the return of large Chinese companies listed in the USA via a secondary listing and, thus, Hong Kong retaining its status as a premier exchange to raise capital in 2020. However, with the unrelenting ravaging impact of Covid-19 on the real economy, one would wonder whether there are any more rabbits left in the hat? Perhaps recent announcement by the CEO of the HKEX not to renew his contract could be telling.

Table 1: Secondary Listings in Hong Kong

|

Stock Code

|

Company Name |

Country |

Nature of Business |

Primary Exchg. |

Listing Date |

Market Cap with IPO price (HKD Billion) |

Delisting date |

Delisting reason |

|

09618

|

JD.com, Inc. |

China |

Information Technology – e-commerce, retail |

New York |

18/6/2020 |

596.5 |

|

|

|

09999

|

NetEase, Inc. |

China |

Information Technology – games and online services |

New York |

11/6/2020 |

421.8 |

|

|

| 09988 |

Alibaba Group Holding Ltd. – SW |

China |

Information Technology – e-commerce, retail, e-payment |

New York |

26/11/2019 |

3764 |

|

|

| 06288 |

Fast Retailing Co., Ltd. – DR |

Japan |

Consumer Goods – Apparel |

Tokyo |

5/3/2014 |

282 |

|

|

| 06813 |

CapitaMalls Asia Ltd |

Singapore |

Properties & Construction – Shopping Malls |

Singapore |

18/10/2011 |

30.265 |

22/7/2014 |

Restructuring into Parent

|

|

06388

|

Tapestry, Inc. – RS ( Formerly Coach Inc.) |

USA |

Consumer Goods – Apparel |

New York |

1/12/2011 |

141.54 |

2/3/2018 |

Low trading volume |

|

00805

|

Glencore plc |

Switzerland |

Materials – Commodities |

London |

25/5/2011 |

3.716 |

31/1/2018 |

Low portion of shares on the HK Register |

|

00847

|

KAZ Minerals PLC |

Kazakhstan |

Materials – Mining |

London |

29/6/2011 |

88.64 |

1/8/2018 |

Low portion of shares on the HK Register |

| 01021 |

Midas Holdings Ltd |

China |

Materials – Alloy Manufacturing |

Singapore |

6/10/2010 |

6.43 |

1/8/2018 |

Insolvent: liquidated

|

| 01878 |

SouthGobi Resources Ltd |

Mongolia |

Energy – Coal Mining |

Toronto |

29/1/2010 |

20.36 |

|

|

| 06488 |

SBI Holdings, Inc |

Japan |

Financials – Securities, AM |

Tokyo / Osaka |

14/4/2011 |

17.405 |

25/6/2014 |

Low trading volume

|

|

06210

|

Vale S.A. |

Brazil |

Materials – Mining |

Brazil / New York |

8/12/2010 |

1337 |

28/7/2016 |

Low trading volume |

| 00945 |

Manulife Financial Corporation |

Canada |

Financials – Insurance |

Toronto |

27/9/1999 |

46.464 |

|

|

|

|

|

|

|

|

|

|

|

Source: HKEX, Bloomberg

WHY DID THOU REJECT OR RETURN?

The Exchange published its annual listing decision on applications that it rejected and returned in the past year. The primary cause for rejection is as follows:

Table 2: Reasons for rejection of IPO application

|

Cause for Rejection

|

No. Applications |

|

Commercial Rationale

|

16 |

|

Valuation

|

4

|

| Suitability of Director / Person with substantial influence |

1

|

| Profit Requirement |

1

|

Source: HKEX-GL126-2020

The Exchange continues its practice to vet the commercial rationale for listing as the main factor in determining suitability. The question on valuation of the business usually rides on the back of the commercial rationale concerns. Based on the drafting of the rejection listing decision, it appears the failure to meet the profit requirement stems from a lack of understanding of the Listing Rules. These rejection highlights the importance of careful homework, planning and independent advice on the part of these companies that would have saved them a lot of money and heartache.

The Exchange highlighted two returned applications last year and provided more guidance on the inclusion of financial information rule on the application process which may suggest a substantial number of applications were returned as it fell afoul of this rule. For simplicity, we provided a tabular version of the guidance.

Table 3: Financial Performance disclosure requirements

|

Application Date

|

Company Year End |

Must listing by (MB) |

Must listing by (GEM) |

Financial performance disclosures in the Application Proof (Main Board) |

Financial performance disclosures in the Application Proof (GEM) |

Financial performance disclosures in the Prospectus (Main Board) |

Financial performance disclosures in the Prospectus (GEM) |

Other Conditions |

|

Between 1 January 2020 and 29 February 2020

|

31-Dec-19 |

No later than 31 March 2020 |

No later than 29 February 2020 |

2017, 2018, 9M2019 |

2018, 9M2019 |

2017, 2018, 2019 |

2018, 2019 |

HKEX-GL56-13, HKEX-GL25-11 |

|

Between 1 March 2020 and 30 June 2020

|

31-Dec-19 |

|

|

2017, 2018, 2019 |

2018, 2019 |

2017, 2018, 2019 |

2018, 2019 |

HKEX-GL56-13

|

| Between 1 July 2020 and 31 August 2020 |

31-Dec-19 |

|

|

2017, 2018, 2019, 3M2020 |

2018, 2019, 3M2020 |

2017, 2018, 2019, 3M2020 |

2018, 2019, 3M2020 |

HKEX-GL56-13

|

| Between 1 September 2020 and 31 December 2020 |

31-Dec-19 |

|

|

2017, 2018, 2019, 6M2020 / 9M2020* |

2017, 2018, 2019, 6M2020 / 9M2021* |

2017, 2018, 2019, 6M2020 / 9M2020* |

2017, 2018, 2019, 6M2020 / 9M2021* |

HKEX-GL56-13

|

* Depending on availability

Source: HKEX-GL127-2020, HKEX-GL56-13, HKEX-GL25-11

Although this appears to be a simple guidance to follow, there were media reports of a large biotechnology company that, was listed earlier this year, had its initial application for IPO returned because it did not adhere the guidance above.

Odyssey Corporate Advisory is a boutique corporate advisor providing independent and impartial investment and capital markets consultancy services catered for your circumstances and preferences. Corporate Advisory is a division of Odyssey Asset Management Ltd, a Type 1, 4 and 9 SFC licensed company and subsidiary of the Odyssey Group. If you have any enquiries, please contact:

Kuan Yu Oh

Managing Director, Co-Head of Corporate Advisory

Mobile: +852 6971-7989

Email: kuanyu.oh@odysseycapital-group.com

Notice

This publication is for informational purposes only and does not address the circumstances of any particular individual or entity. It does not constitute financial advice and should not be used as such. You should seek a duly licensed professional for investment advice. For more information about please see our Disclaimer.