A Bump, or Something More?

August was the 5th strong consecutive month for Equity and risk assets. From the bottom of the equity market in March, the MSCI World Index was up 53% at the end of August. The Index had not seen a drawdown of 5% or more since June. In that case the market nervousness was due to Jerome Powell providing investors a reality check on his expectation for the recovery of the economy.

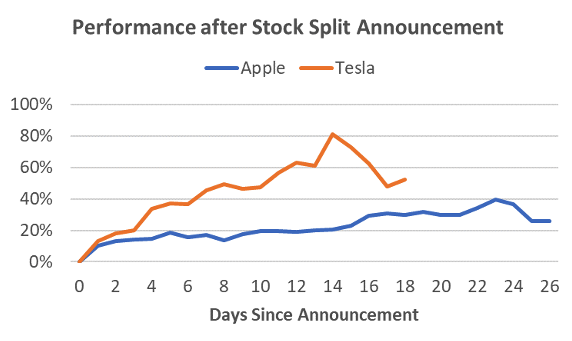

The most recent sell-off that started on September 3, appeared to be due to technical reasons. The previous 4 weeks saw a significant run on speculative names and this seemed to have been sparked by the Tesla and Apple stock splits that both had effective dates at the end of August. Between the stock split announcements and the effective date, the Tesla share price surged an incredible 80% and Apple jumped almost 40%. While this was also on the back of strong Q2 results, it appeared this was also driven up by a speculative element. Other speculative investments such as the Cloud X Computing ETF (CLOU US) also jumped 20% in the 3 weeks prior to the end sell-off. After such a strong run, when the stock splits became effective, it was merely a matter of time before investors decided to take profits. The level of the share price falls was in concert with the strength of the rally.

Chart: Apple and Tesla share price Source: Bloomberg, Odyssey

The large question now is whether the mini sell-off portends a change in the direction of the equity market. We remain constructive on risk assets in the medium term (3-6 months) due to the unprecedented stimulus and zero interest rate policies by central banks. However, we also think it is likely that 1) the absolute returns from equity may slow down from its break-neck speed and 2) stock picking may become more difficult than just buying FAAMNG or technology stocks.

On a fundamental level, economies are improving, but many are at a slower pace than many had hoped. Recent economic data from China, Europe and the US still point to a recovery, but that pace of recovery is decelerating, rather than accelerating. The much hoped-for game changer is an effective and safe COVID 19 vaccine. With the Fall flu season starting in October, there is a real risk that a third wave may occur. There appears a sense of urgency to have a vaccine available to the US population before the Dec-Mar peak flu months. While we are hopeful a vaccine eventuates in time, the current timeline for a vaccine approval has been compressed from 3-4 years to nine months. This may prove too ambitious. Of the three US government backed candidates currently in phase 3 trials, two have already started testing more than 20,000 subjects with a goal as high as 30,000. Even if the trials are successful, there remains one last hurdle – that is the perception that the vaccine will not be safe. US surveys have revealed a high reluctance to take a COVID vaccine due to safety concerns. The number has been as high as 60% of respondents expressing some doubt as to whether they would take the vaccine.

Prudent Diversification

A concentrated portfolio of high-tech stocks, or FAANG, would have worked tremendously over the last 5 months. However, the recent sell-off has shown that this is an over-crowded trade and investors are balking at the pace of the share price climb, if not valuations. We are of the view that many of the FAANG are core equity holdings and we would not be sellers of a judicious level of these stocks that is in keeping with an investor’s risk profile. Further, COVID has likely reaccelerated the adoption of technology that is not likely to dissipate meaningfully, even with the presence of a successful vaccine. Nevertheless, the outperformance of Growth versus Value remains close to extremes and a more diversified strategy going forward appears to be a prudent strategy. By diversification we mean by asset class as well as within the equity portfolio.

Source: Bloomberg, Odyssey

Last month we had already discussed the use of more alternative assets, in addition to equities, and we suggest investors to continue to assess non-listed investments that would provide a good fit to their risk and return goals.

Conclusion

A very long time-line of the US equity market is virtually a straight line. However, sometimes it does not feel very straight on a week to week basis. If your risk tolerance is weekly, monthly or quarterly rather than multi-year, this may be a prudent time to consider whether your portfolio is sufficiently diversified. This does not necessarily mean a lower potential return. It simply means you are remaining open to other ways of generating returns that perhaps have a better risk return profile than your current portfolio.

Short Market View

August capped off the 5th strong consecutive month for Equity and risk assets. From the bottom of the equity market in March, the MSCI World Index was up 53% at the end of August. The Index had not seen a drawdown of 5% or more since June. In that context it was not surprising that in early September the Tech sector and some speculative stocks saw profit taking after a strong rally during August. Tesla surged 80% in just 14 trading days after it’s Q2 results and stock split announcement. We remain positive on FAAMNG as core holdings in an equity portfolio, but valuations of growth stocks in general appear stretched and a more diversified approach going forward appears prudent.

If you like to receive more information on our portfolios solutions, please contact us here: info@odysseycapital-group.com