Oct 15, 2019 | Articles, Global Markets Update

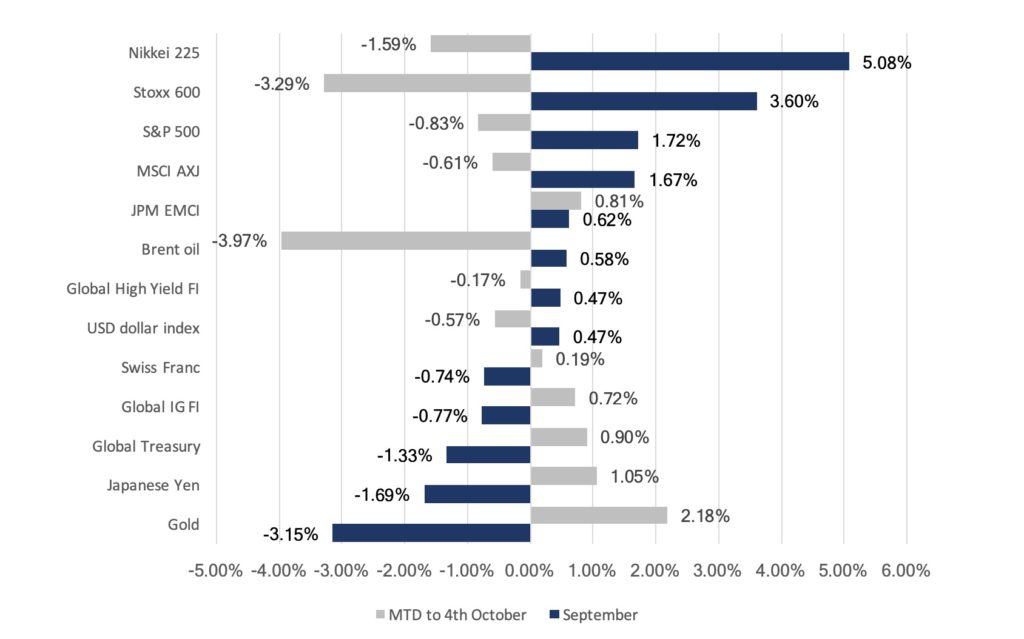

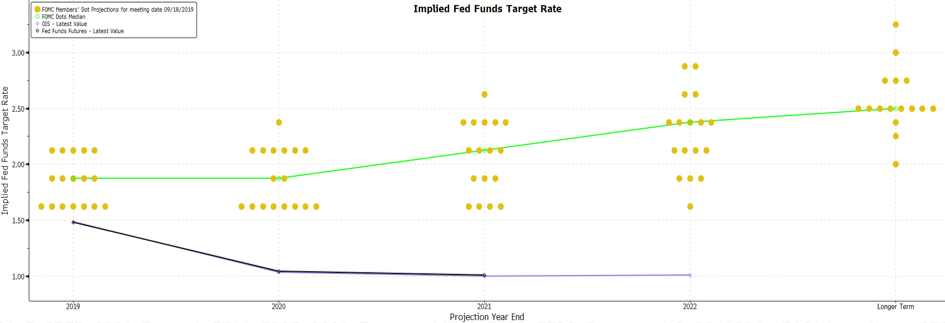

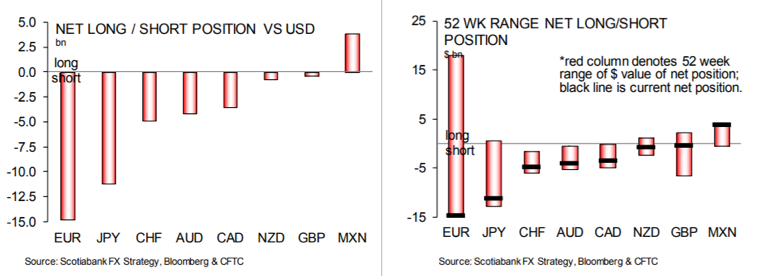

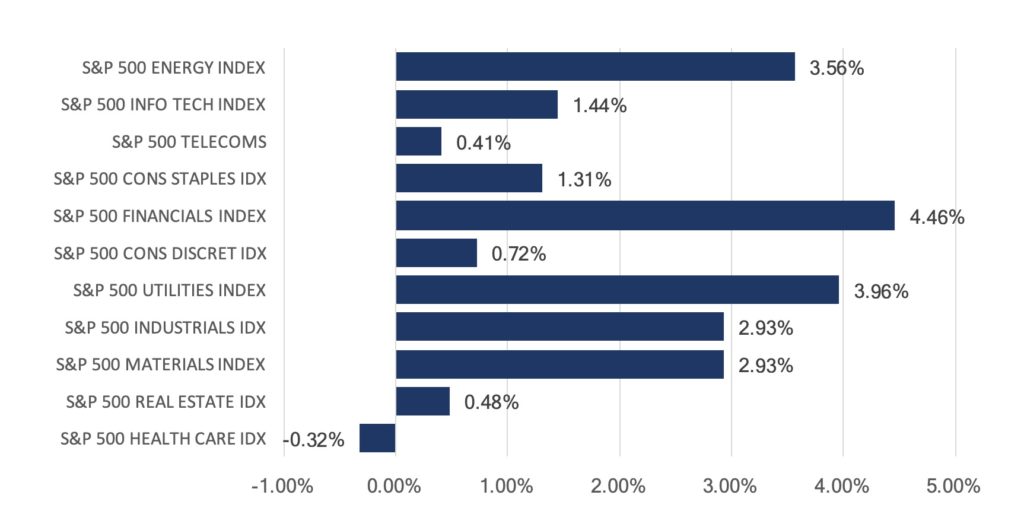

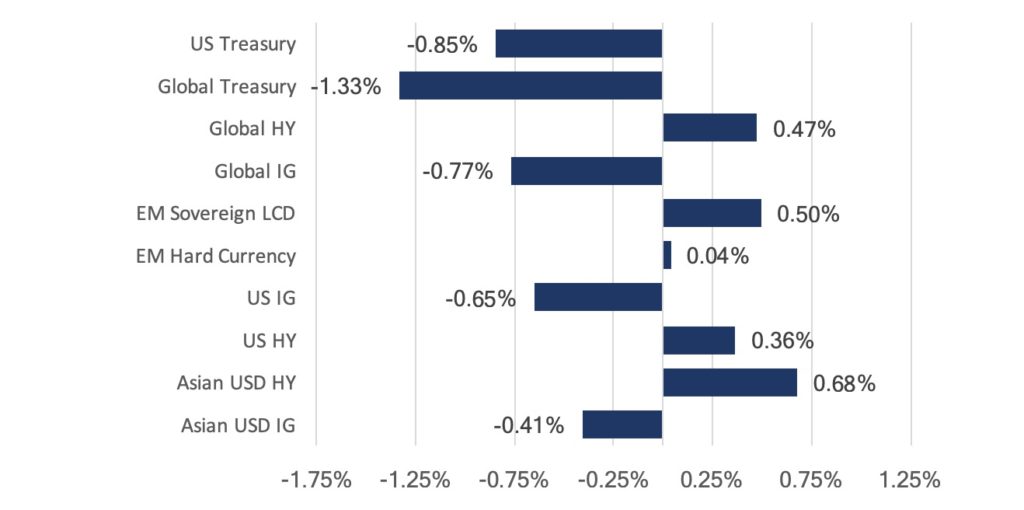

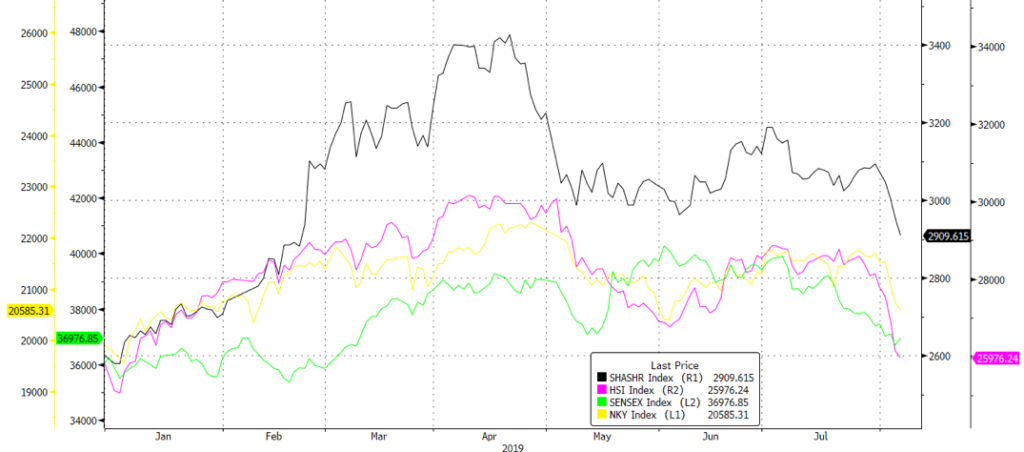

Markets saw a risk-on rotation in September (Figure 1) amid positive trade developments earlier in the month. China suspended tariffs on 16 types of US products, while the USA delayed tariff hikes from 1st October to 15th October in order to avoid China’s 70th anniversary. On top of the 16 products, China also talked about removing tariffs on bigger ticket items like soybeans and pork and have reportedly started making big purchases of those items. This led the S&P 500 back near an all-time high, while sovereign debt and high-quality corporate debt ended the month lower, with US Treasury (UST) 2Y and 10Y yields paring most of the losses seen in August.

Fig 1: Risk-on rotation sees outflows from haven assets. Source: Bloomberg

However, there remain challenges in negotiations. Reports that the White House was considering limiting capital flows from US to China surfaced at the end of the month. The reports hit markets negatively though those were quickly denied by US officials. In addition, Chinese officials mentioned over the weekend that they are now less willing to agree to the kind of broad trade deal that Trump is seeking and are narrowing the number of topics to be discussed.

European equities also recovered across the month, supported by the ECB’s commitments to further erase monetary policy, with Stoxx recovering losses in August to trade at levels last seen in July. However, the WTO’s decision to allow US to impose tariffs on Europe given Europe’s illegal aircraft subsidies to Airbus saw Stoxx fall in the first week of October. Asian equities, on the other hand, were a mixed bag, though the MSCI Asia ex-Japan index managed to close higher.

However, global growth concerns resurfaced in the first week of October as data for September, particularly for the US, came in weaker than expected, causing a rotation back into safer assets, paring gains/losses seen last month (Figure 1).

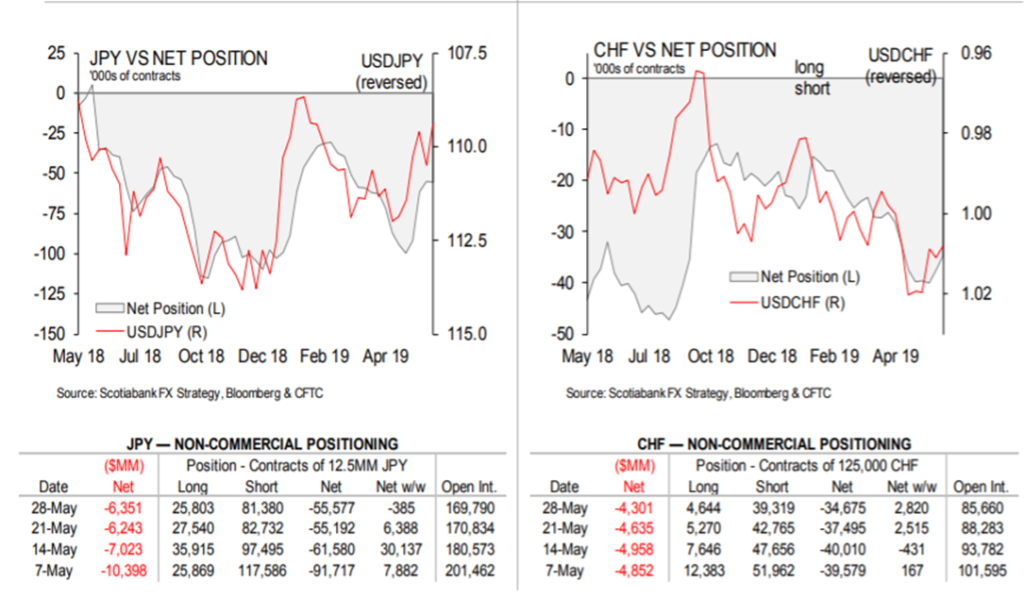

FX remained relatively quiet across the month, with volatility remaining low. GBP saw one of the largest moves within the G10 group, apart from the move out of safe-haven currencies like JPY and CHF. The pound continues to be driven by Brexit headlines, gaining strength in September amid a series of developments that reduced the probability of a no-deal. However, the currency pared gains during the last week of the month after Boris Johnson called for early elections and Corbyn indicated he will call a vote of no-confidence after a Brexit deadline extension was secured.

Separately, the USD strengthened over the month, with DXY gaining 0.47%, underpinning the reality that USD remains the least ‘bad’ developed markets (DM) currency with the EU facing recession amid a divided European Central Bank (ECB), and the Bank of Japan (BOJ) hinting it will ease on the 31st October. The Swiss National Bank (SNB) has also been leaning toward a dovish tilt and that will ease the CHF. Likewise, emerging markets (EM) central banks were seen to be cutting rates – this includes India – whilst the People’s Bank of China (PBOC) effectively lowered rates 10bps via a new rate-setting benchmark and injecting liquidity to the system. This seems to suggest that we might see the dollar remain stronger for longer and that might potentially weigh on EM Asian currencies and thus equities likewise.

Oil prices saw increased volatility this month, driven by a drone attack on Saudi Arabia’s production plants. The Brent oil price spiked to $70 after the attack but quickly retraced to end the month lower. Saudi Arabis has since brought production levels back to levels seen before the attack. Prices were also pressured lower by concerns of a slowdown in global growth, accompanied by EIA and EIA data that showed increases in US crude inventory.

Outlook

Liu He and Lighthizer are reportedly set to meet (10th October). This comes just a week before the US is scheduled to increase tariffs on $250bn worth of Chinese goods to 30% from 25%. While both sides have exchanged small gestures of goodwill over the past few weeks, our view is that it does not circumvent the longer-term strategic confrontation between the two powers, and a wide gap on substantial issues – such as IP transfer rights and Xii’s “Made in China 2020” policy – that neither side is likely to back down on. Moreover, we have seen unprecedented bipartisan support in the US, and polls show that 80% of the US public see the need to address the issue. With that said, there is still room for a small deal to be cut in the near-term, and we do not think it would be wise betting against it. In addition, Trump’s latest ‘impeachment’ debacle and the allegations he pressured Ukraine’s leader to investigate Biden and sons are potentially damaging. The allegations could affect his re-election efforts and, as some might hope, his current role as President. We shall see – it would not be ‘out of character’ for Trump to turn even more erratic and throw a curveball in the way of trade negotiations as a distraction from domestic issues, whether or not that might be in favour of a deal.

However, moving away from geopolitics to the US economy, we think US macro data remains quite resilient but a weaker Conference Board consumer survey following the earlier disappointment in the University of Michigan’s consumer sentiment survey are early signs that there might be some weakness in this consumer-led economy. As we have noted before, the strong consumption dichotomy to weak corporate manufacturing and capital expenditure data will not be resolved one way or another, and the risk is that consumption weakens, adding to fears of a recession as quite possible and that equities will enter a bear market – they note the massive rotation of late-term momentum/growth sectors to value/cyclical’s preceded the last two recessions too. MS has called US markets reliably well in the last few years and often, rightly, been cautious about it too.

Brexit remains an overhang on Europe, and the immediate outlook seems dependent on whether Boris Johnson will be able to secure a deal with the European Commission (EC) at the European Union (EU) Summit on the 17th and 18th of October. Whilst Parliament has sensibly voted to not have a no-deal Brexit, Johnson is still committed to taking the UK out by the end of the month. We were delighted by the UK Supreme Court’s unanimous decision that Johnson’s prorogation move was unlawful (thus, in effect, saying he lied to the Queen). Boris was put into power by 93,000 votes (or 0.2% of the voting public) of which 75% were white males over 65 years old! Whilst 52% voted to leave, this accounted for 37% of those that could have voted and of that 52 %, not one was asked what type of Brexit was favoured. Democracy is failing the UK and it is now similar to a banana republic in the degree of volatility in policy action – with potentially damaging consequences – and instability in the country from what used to be a stable democracy with tramlines in terms of policy outlook. Whilst the Court’s decision is welcome – and GBP gained a big hit – the harsh reality remains the UK is in a mess over Brexit and the outlook is unclear. What ought to happen is either a fresh election (at this point it seems Labour’s policies and Corbyn make it unelectable plus, as a party more in favour to remain its route to victory is in marginal seats that voted to leave in ’16) or a 2nd referendum and we struggle to see where the upside for GBP is, whereas we see reasons for it to retest recent lows since the Brexit vote in ’16. A no-deal Brexit would be painful, and stupid, but over time this can be corrected whereas Labour’s policies are disastrous if implemented given the leadership is Marxist Cabal.

There is – in our view – a structural risk around oil that is potentially far earlier than peak oil which some see as soon as ’25. The Economist rightly notes that there is a (major) risk that the climate change impact could ‘force’ far more hostile regulatory action by governments that would impact oil companies hard. One consultancy sees such action happening within the next 2-3 years. This throws open the question about whether to hold oil stocks at all given these risks. We have some sympathy with this argument and realise that climate change is something we need to get on top of.

On the other hand, gold is ‘swinging’ around but has not followed falling UST yields higher lately and is trading in the $1,480-1,520/Oz range after bottoming out at about $1,463/Oz (prior 6y high) spike lower MTD. We remain an owner of gold in portfolios at a 3-5% weighting as a portfolio diversifier, an alternative ‘safe haven’ asset to sovereign FI and as a play on negative-yielding global FI (now at about $17tn or 30% of all FI). It is worth noting that central banks are a far larger, consistent buyer of gold for reserves than in the past – China added 5% to its already considerable reserves in the last 12M – in order to diversify from an over-reliance on USD as trade becomes less certain.

Despite all the negatives out there, equities (especially in the US) have stayed remarkably resilient YTD, and the with S&P 500 and MSCI ACWI just off all-time highs, it partly reflects the fact there is no alternative with over $15tn of negative-yielding FI and a large chunk of the rest offering negative real rates. It is worth noting that if you take the UST 10Y yield at about 1.6% relative to the S&P 500’s yield and compound that at 3% growth p.a. on just income over 10Y, the S&P 500 is yielding more than double that of UST’s, and one could argue that the S&P 500 is a safer bet than UST’s too!

Separately, the recent failure of WeWork to access public markets given the degree of skepticism around its business model is another illustration that private equity (PE) is substantially overpaying for private vs public markets, and the returns are thus questionable. AQR forecasts PE returns over the next decade to be under 3% – roughly similar to their forecast for S&P 500 – but the former is far more illiquid and much of the gains are removed via exorbitant fees charged by the PE fund managers (Financial Times estimate 60% of PE ‘alpha’ went to the fund manager in funds followed in last decade). This is made worse, in practice, as unless you are invested in one of the top PE funds (which are mostly inaccessible), your return profile is far worse relative to returns from public equities easily accessible via low cost, passive ETFs – in the last 20Y, top PE funds have returned about 16% p.a. relative to a median fund at about 11%, and poorer funds under 8%.

Thus, our portfolio positioning remains defensive, and we prefer to hold higher amounts of cash so that we can add tactically when we see bouts of weakness in equity markets. We would prefer to have a higher weightage of equities as we see it as the ‘least bad’ asset class, particularly against relatively ‘expensive’ USTs, nor the high-yield (HY) or Senior Loan space where risks remain high. Overall, we remain overweight on Alternatives as our belief is that we are entering a period of higher volatility and lower returns and on this basis, we would prefer to derive returns from an asset class that can generate less or even uncorrelated returns to traditional markets, with the benefit of additional diversification.

![]()

![]()

![]()

![]() Equities

Equities

Fig 2: YTD total return performance of US indices in % returns. Source: Bloomberg

-

It was quite a volatile month for equity markets in the US, having climbed the wall of worry to come a few points shy of all-time highs before coming off, then falling even more steeply in early October. A combination of mixed macroeconomic results and the overhang of trade tariffs weighed on markets. Tech stocks continued to see weakness as the Nasdaq underperformed at +0.46% MoM, against the S&P 500 and Dow which were up +1.72% MoM and +1.95% MoM respectively.

![]() Fig 3: Total Return performance of S&P 500 Growth vs Value companies. Source: Bloomberg

Fig 3: Total Return performance of S&P 500 Growth vs Value companies. Source: Bloomberg

-

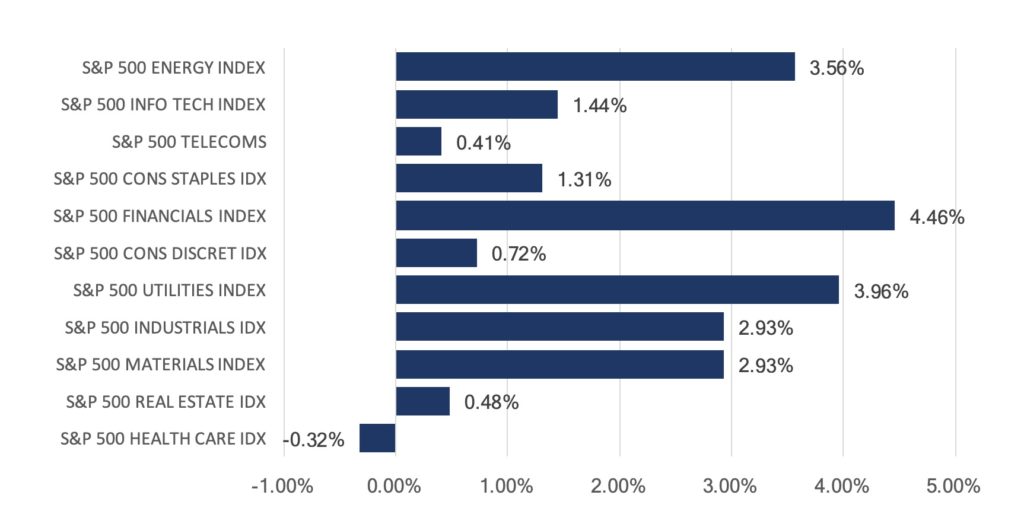

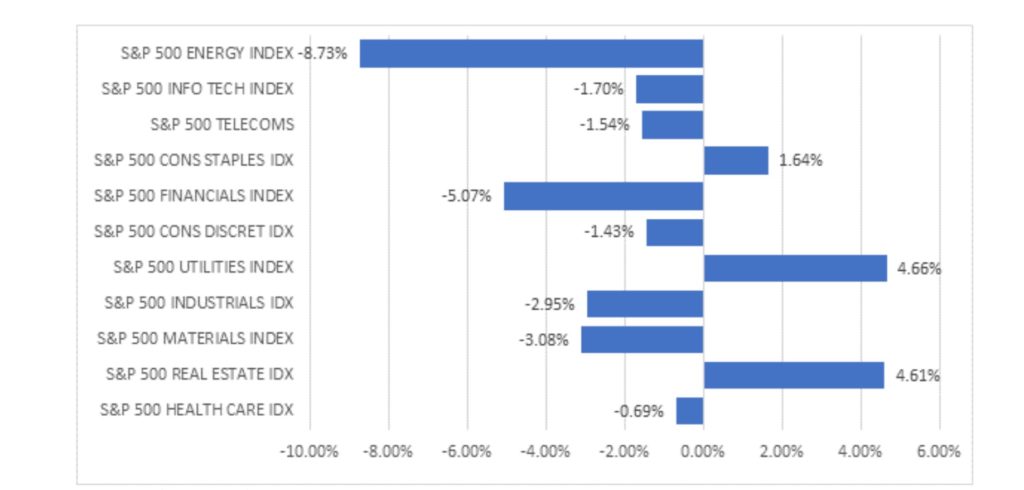

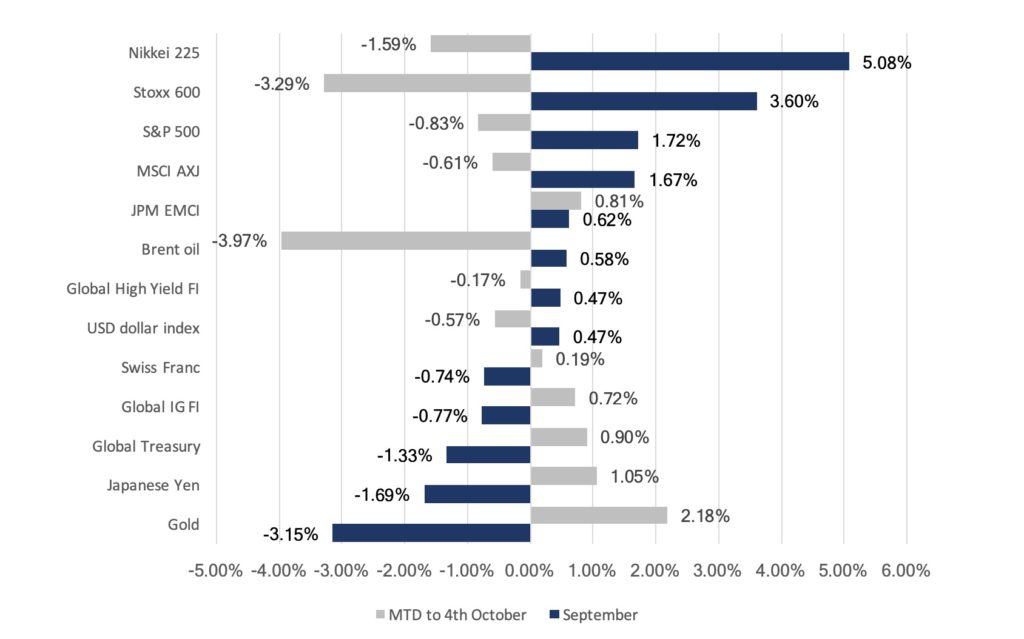

Within the S&P 500, the month saw quite a marked rotation out of Growth into Value (Figure 3), but also as investors shifted out of YTD winners into names that have underperformed thus far. Financials (+4.46% MoM) and Utilities (+3.96% MoM) outperformed, alongside Energy (+3.56% MoM) which rebounded on the back of higher oil prices following the drone strike on Saudi Aramco’s production facility. Healthcare (-0.32%) was the laggard sector (Figure 4).

Fig 4: Performance of S&P 500 sectors in September. Source: Bloomberg

Fig 4: Performance of S&P 500 sectors in September. Source: Bloomberg

-

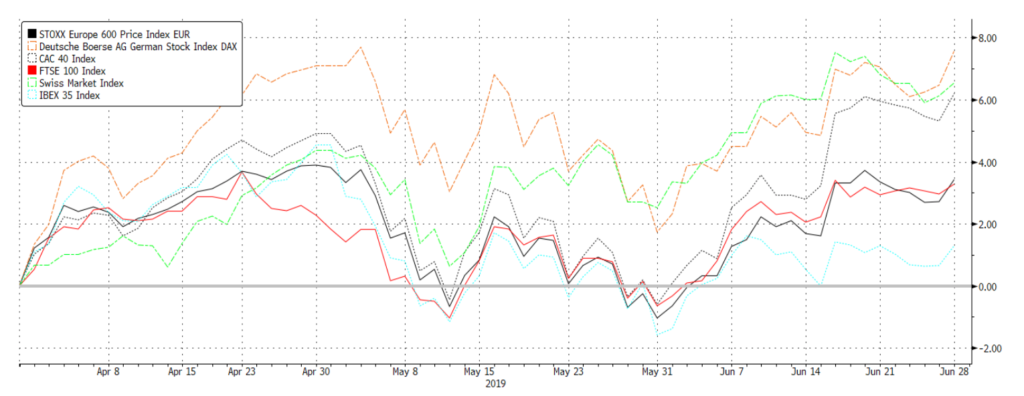

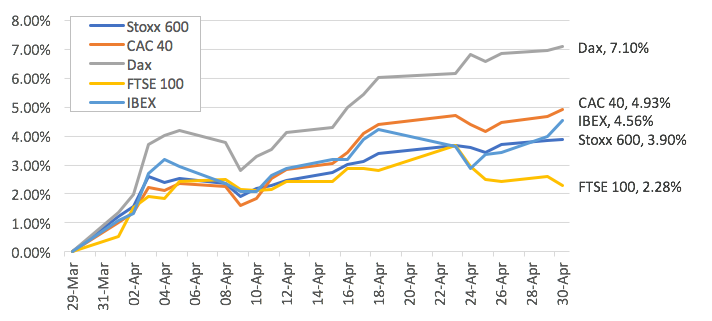

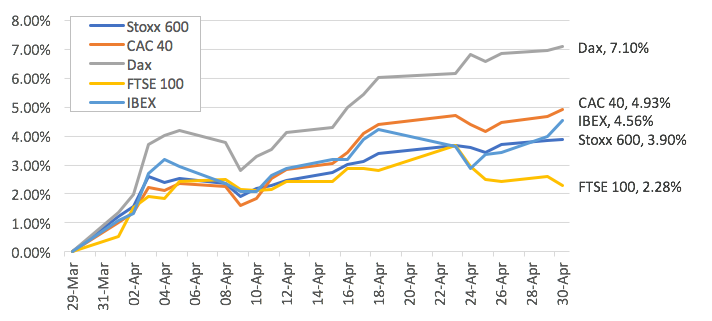

European stocks saw continued momentum from late August, with the Stoxx 600 gaining +3.60% MoM last month. Markets were buoyed by commitments from the ECB to further ease monetary policy, but also as talk that Germany and France might move to roll out some degree of fiscal easing as well. The German DAX led gains at +4.09% MoM, while the FTSE 100 underperformed at +2.79% MoM as Brexit uncertainty continued to weigh on shares in the index.

Fig 5: YTD total return performance of major European indices. Source: Bloomberg

Fig 5: YTD total return performance of major European indices. Source: Bloomberg

-

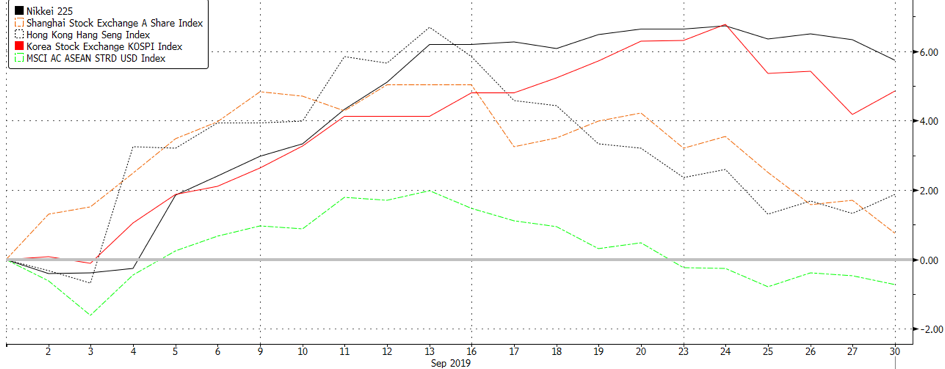

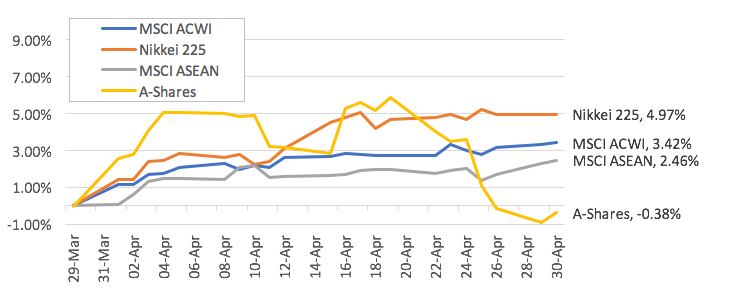

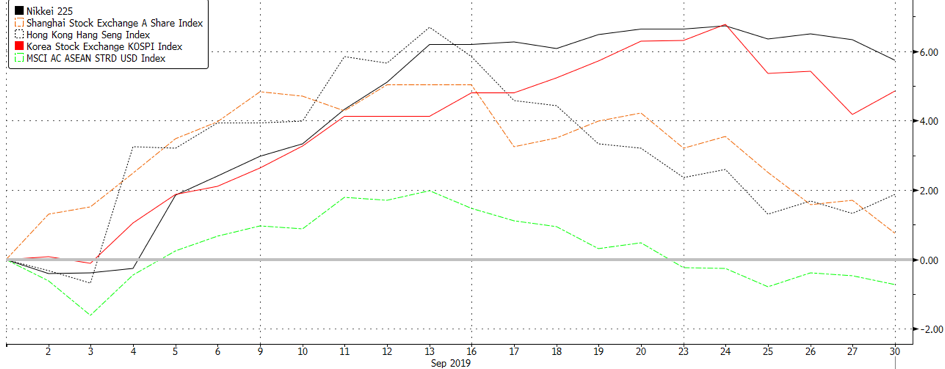

In comparison, markets in Asia saw mixed performance through the month, with the Nikkei outperforming at +5.08% MoM, alongside the Kospi which also rebounded this month at +4.84% MoM on the back of a recovery in chipmakers.

-

The HSI (+1.43% MoM) was weighed lower by domestic-oriented stocks amidst the ongoing protests in the streets, while Chinese equities also had a weak showing as markets moved on mixed macro data and the ongoing trade negotiations with the US.

-

ASEAN indices underperformed the broader region, with the MSCI ASEAN index falling -0.91% MoM, on the back of USD resilience as currencies in the region floundered. On top, the overarching concerns over global growth were also a negative contributor given the region’s high dependence on this.

Fig 6: Total return performance of Asian indices in September. Source: Bloomberg

Fig 6: Total return performance of Asian indices in September. Source: Bloomberg

Fixed Income

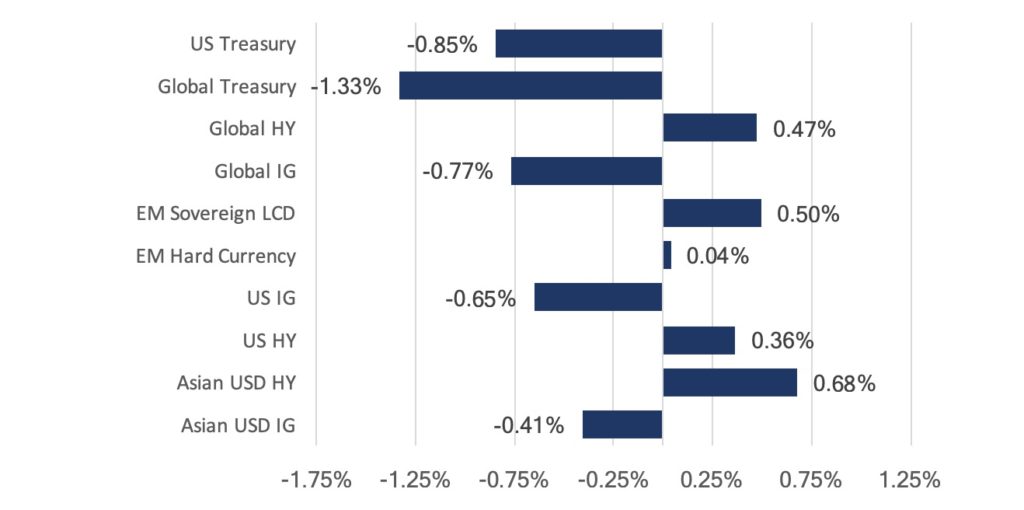

Fig 7: FI Sector index returns in September. Source: Bloomberg

-

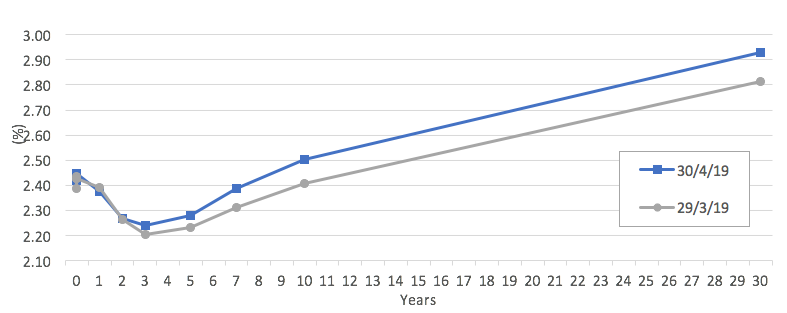

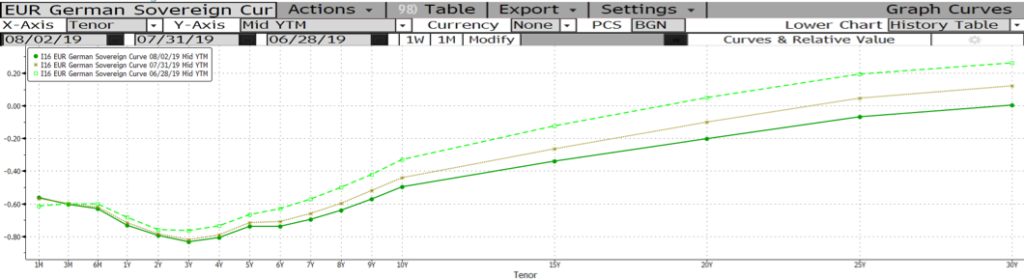

The risk-on trade last month saw a rotation out of higher quality fixed income. Sovereign debt was the worst hit (Figure 7), with the Bloomberg Barclays Global Treasury index losing 1.33%. The UST curve shifted higher over the month (Figure 8), with yields rising as much as % following strong August economic data. The German sovereign debt curve shifted higher too, with the 30Y yield going into positive region at one point before ending the month below zero.

Fig 8: UST yield curve in September relative to August. Source: Bloomberg

-

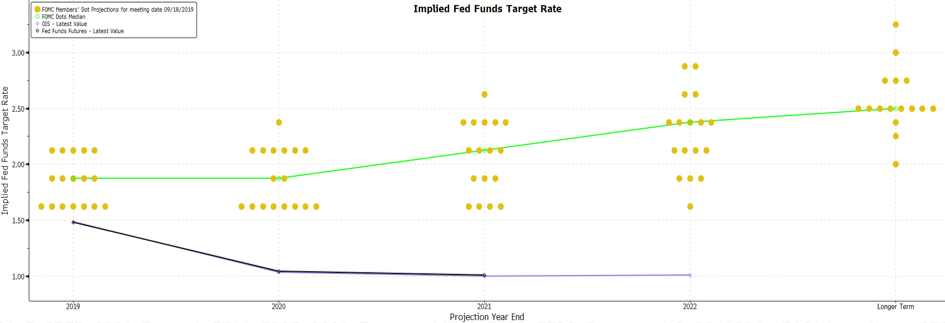

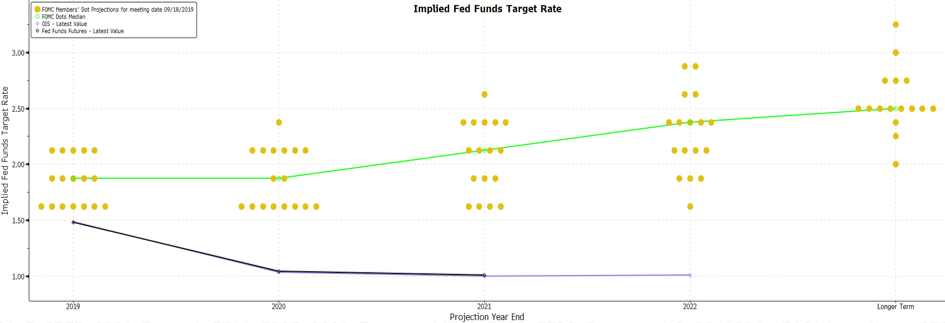

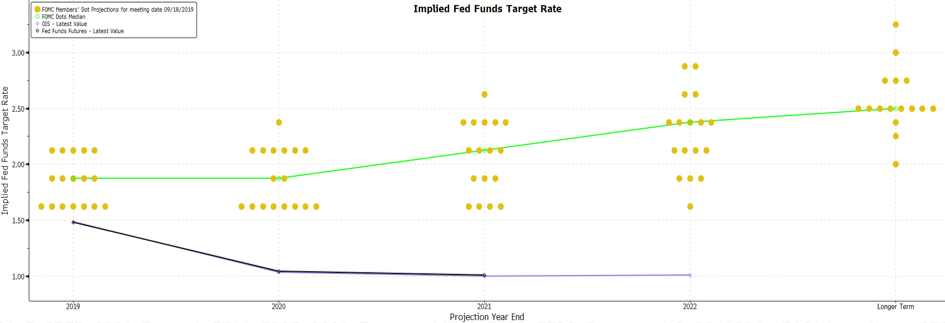

The FOMC meeting outcome lent some support later in there month too – members were divided on the forecasted path of interest rates, based on the dot plot (Figure 9), but the median forecast still showed rates to remain at the same level at YE19 and YE20, as compared to the market’s expectation of 2 more cuts by then.

Fig 9: FOMC dot plot in September. Source: Bloomberg

Fig 9: FOMC dot plot in September. Source: Bloomberg

-

However, the disappointing September economic data released last week reignited concerns of slower global growth, causing investors to rotate back into sovereign debt, reversing the gain sovereign yields saw last month.

-

Central banks also remained dovish – in addition to the Fed and ECB, more central banks around the world are expressing dovishness. We had BOE and Norges Bank indicate the possibility of cutting rates at their next meetings, while central banks in Asia like BOJ, BI, BOT, BSP and RBI cutting rates/showing dovish signals. Barring any positive surprises, we expect sovereign yields to remain suppressed in the near future.

-

EMs were also more resilient relative to their DM counterparts. There was a substantial amount of inflows into EM last month, though that could be partly caused by the stronger economic data released earlier in the year, which led markets to think that the economy is stabilizing and that the Fed will stop their rate cuts. We think firms in EMs are in better shape than their DM counterparts, making the current yield differential quite attractive (Figure 10).

Fig 10: EM/DM yield differential. Source: Bloomberg

Fig 10: EM/DM yield differential. Source: Bloomberg

-

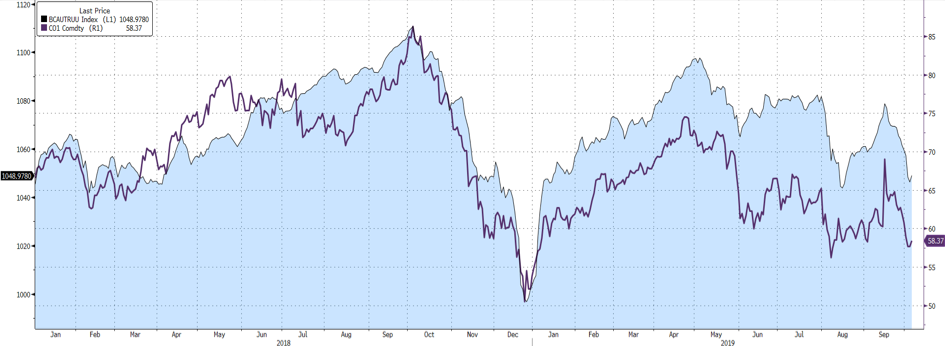

Corporate credit managed to mostly close the month higher too (Figure 7). High yield debt outperformed the investment-grade sector as it followed equities higher amid the risk on environment, but CCCs were weaker, falling 0.15% after being weighed down by energy bonds (Figure 11).

-

HY saw increased issuance as companies sought to refinance existing debt. US HY companies issued more than $30bn worth of debt last month – the most in c. 2Y. BB debt saw the greatest issuance in the month, making up 42% of total HY issuance, putting pressure on BB yields as it rose 7bps while B and CCC yields fell 24bps and 8bps respectively.

-

IG debt also saw increased issuance over September, with $158.3bn worth of debt issued. This record issuance was also met with strong demand as the corporate IG index spread tightened 5bps. According to Bloomberg, dealer estimates for October call for about $85bn in new issuance.

Fig 11: Correlation between US CCC debt (LHS) and oil prices (RHS) – 1st Jan ’18 to 4th Oct ’19. Source: Bloomberg

Fig 11: Correlation between US CCC debt (LHS) and oil prices (RHS) – 1st Jan ’18 to 4th Oct ’19. Source: Bloomberg

FX

-

September saw another month of quiet trading as volatility remained low. Volatility continues to be driven by two key events: Brexit and trade uncertainty.

-

USD remained resilient over September but fell in the first week of October on weaker data, with ISM manufacturing falling far below expectations. Although it is well known that ISM manufacturing is but a small part of the overall economic picture – we believe that the disappointing report contributes to the budding fear of an economic slowdown and places much more emphasis on upcoming data.

-

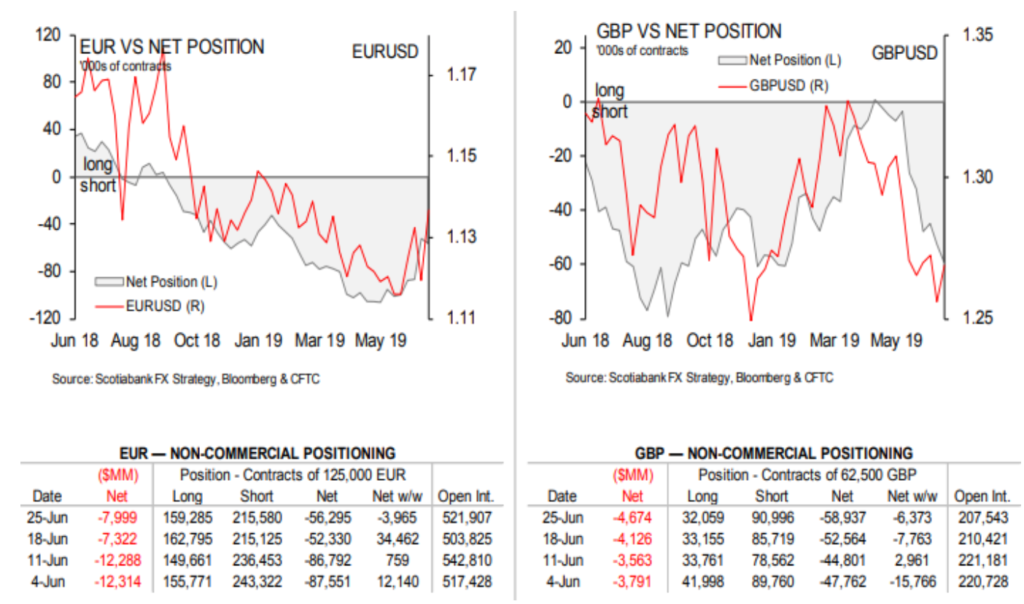

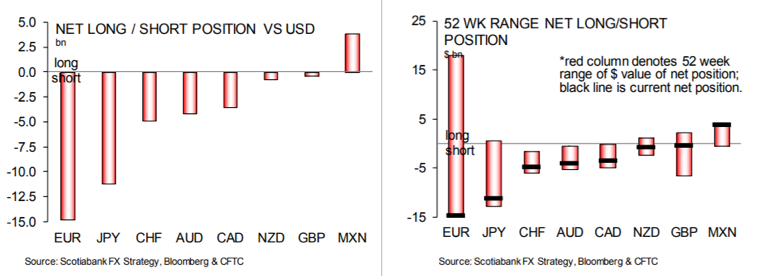

GBP gained 1.09% in September despite Brexit uncertainty as markets seem to have priced in a scenario of an extension following the likely breakdown of Boris Johnson’s new proposal to the EU this week. This caused August’s short squeeze to carry forward. September also saw a small build-up of longs from asset managers and funds, as reflected in recent COT reports (Figure 12).

Fig 12: GBP net long/short positions. Source: Scotiabank

Fig 12: GBP net long/short positions. Source: Scotiabank

-

We continue to see further GBP weakness in the short term, before Brexit’s next key development on 31st October and believe that it will test its floor of 1.20, given Johnson’s inability to deliver a deal acceptable by the EU as we think the complexity of Northern Ireland’s border will not be solved by then. Also, with Johnson’s current proposal of a hard border unlikely to be accepted, the uncertainty caused within this short timeframe spells ill for the pound.

-

We must also consider Johnson as the ultimate factor for the pound’s instability. His hard stance toward the UK’s departure on 31st October is likely to generate several headlines (not news). This has also, reportedly, prompted the UK government to initiate preparatory measures in the event of a no-deal, further instilling fear and allowing 1.20 to look very achievable.

-

In the coming months, we do not, however, believe that 1.20 will fail as a support and see GBP rising to 1.25 and potentially beyond (in November and December). Despite the ambiguity of the Benn Act, an act that that requires the PM to seek an extension to the Brexit deadline if a deal is not reached by then, we expect Johnson to abide by that law, thus avoiding a no-deal Brexit in the near-term.

COMMODITIES

-

The drone attack on Saudi Arabia’s refineries led to a high degree of volatility across September. This caused oil prices to spike, with the Brent oil price hitting $70, before sharply retracing to common support level at $58.35.

-

We anticipated the return to its common support on the basis that a single drone strike would be unlikely to warrant such a large reaction in the price. Also, with the theme of a global economic slowdown – which has remained as a roof over the commodity’s price – we saw it as very likely for the spike to simply remain as a spike.

-

Over the next two months, we see the potential for 50 to remain as Oil’s support. This is due to two main reasons, firstly, that much of the news of a global slowdown has already been priced into oil – leaving it with only so much more room for the price to fall and secondly, a substantial amount of the risk premium from tensions in the Middle East (which has escalated substantially, recently) has yet to be priced in. $50 has been a strong psychological and technical support since mid ’17 (Figure 13).

Fig 13: Brent oil sees a strong support at $50. Source: Bloomberg

- While we see fundamental support for Gold in the longer term, we believe it may have seen its limit in the near-term having reached recent highs. We established last month – based on momentum – that Gold’s upwards channel had a key support of 1500. The key signal to its recent turnaround was when Gold failed to break above its recent high of 1550 (Figure 14). One cannot ignore the technical factors simply since momentum remains both its biggest strength and weakness since its stellar climb from 1275.

Fig 14: Gold might see weakness in the near-term. Source: Bloomberg

Sep 16, 2019 | Articles, Global Markets Update

August was, as expected, a tricky month for risk assets as geopolitical issues continued to sway markets, forcing investors into safe-haven assets amid escalating trade tensions, the Brexit debacle, and a string of weak macroeconomic data releases. Equity markets were red across the board, led lower by Emerging Markets (through the MSCI Em Index) which sold off by more than 5% MoM on global growth concerns as investors de-risked and made a flight to safety. The FTSE 100 also declined by as much, as risks of a ‘no deal’ Brexit grew, while the HSI suffered the most, falling close to 7.4% MoM amidst the ongoing protests. Conversely, US Treasuries rallied with 10Y bond yields falling steeply from 2.014% to close the month just as 1.496% – just under a key 1.5% support albeit recovering above that level in the first few days of September. Gold also climbed as safe-haven assets rallied, but oil swung around US$60/bbl with one downside risk remaining the fast expansion in US shale output seen to rise by another 4.5mm/bpd by YE23.

Markets were not helped either by the surprise contraction in the US’ ISM Manufacturing index, which fell unexpectedly to 49.1, the lowest level since Jan ’16. Whilst consumer data remained relatively solid (in particular, robust household consumption), August did see a steep decline in consumer sentiment with the index falling to its lowest since Oct ’16. On a global scale, we saw contractions in the manufacturing sectors across Europe and Asia, and more markedly so the former, which also saw weak sentiment after Germany’s ZEW index fell to it lowest since December ’11.

On the trade front, we saw a sharp decline of retaliatory moves on both sides, with the most recent round of tariffs imposed by the US notably hitting a significant number of consumer goods. China has been reportedly preparing for their own ‘no deal’ scenario on trade, despite earlier concessions to buy 12mn tons of soybeans from the US this year, and this was not helped by the fact that the US also approved a major arms sale to Taiwan, which some see as a ‘red line’ that may have been crossed.

The Fed’s FOMC meeting minutes also came in less ‘dovish’ than markets had hoped, with broad consensus that July’s 25bps cut was more of an ‘insurance’ one, although views are clearly mixed. Powell indicated at his Jackson Hole speech that the Fed would ‘act appropriately’ to extend the US’ economic expansion, which many took as a sign that the Fed would indeed pander to markets should the need arise. He did, however, allude to a flatter Philips curve, implying that inflation was likely to remain low even if labour markets were to improve. This implied that ‘interest rates will run, on average, significantly closer to their effective lower bound.’

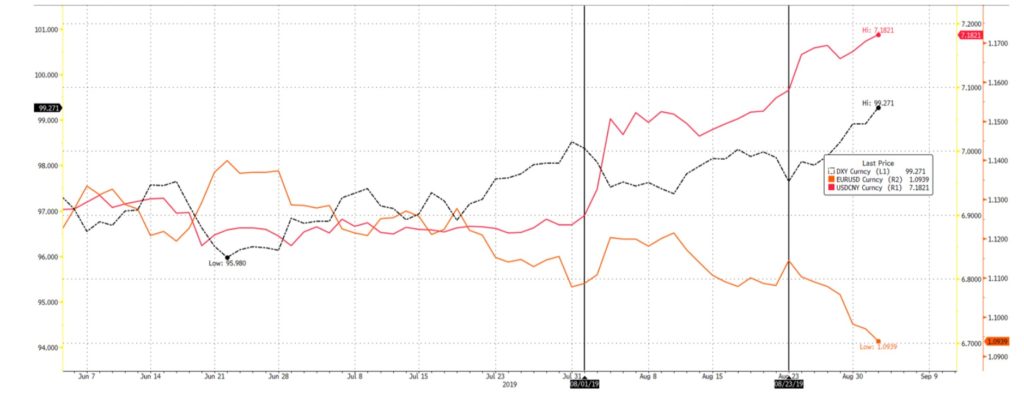

It was a likewise rocky month for currencies, with the decline in USDCNY this month, the worst since ’94, while rising ‘no deal’ Brexit risks weighed on the Pound. A string of weaker macro data releases – notably manufacturing data ‘ was not particularly helpful either. The big question is whether consumer spending stays on course, helping to prop up the economy and thus implying a rebound in global manufacturing. More worryingly is the case where this does not happen, consumption fails, in turn sharply increasing recession fears.

Outlook

Trade continues to deteriorate, but it is starting to look like Trump may need to strike a deal before it starts to compromise his re-election efforts. This suggests that we could see some headway in negotiations sometime in H2CY19. However, data out of China suggests that reflation might be coming through and underpinning the economy, which also makes them an unlikely party that might cede a compromise. It is thus a question of where the Yuan goes, as trade might get worse before it gets better. MS thinks that the >5% fall in CNY is a key move which may help offset US tariffs. They estimate that if all US tariffs are implemented by YE19, it will hit China’s GDP by -80bps which can be offset by a 10% decline in CNY which should boost GDP by c. 30bps. On top, much of the damage would be to US importers, retailers and consumers, and if the US moves to impose 25% on all Chinese imports, we could see a US recession as early as 3Q20 which would be a key period for the US elections.

A reluctant Fed has found itself in a difficult position with the FI markets expecting a rate cut versus what their intentions might instead be. As the Fed dislikes ‘surprising’ markets, Powell will either need to forewarn markets that the Fed is more ‘hawkish’, or give in. Should the Fed choose not to cut rates this month, the risk is that longer duration US Treasuries and IG bonds could selloff hard, as might equities.

In Hong Kong, Carrie Lam has finally caved in by offering to withdraw the controversial Extradition Bill. The question then is whether this is enough to dampen down the violence of the protests, with the danger being that it will not, as the focus grows increasingly more on universal suffrage. This raises the risk that a thus far patient Chinese government will crack down harshly ahead of Oct 1st – a symbolically important date which marks the 70th anniversary of CCP taking power in 1949. In our view, it might be too early to bet on sold down HK equities.

We remain underweight Equities but prefer to stay in high-quality US names with defensive characteristics. Within the US, we still prefer growth stocks (in particular, Tech), although we would avoid social media names that appear to face increasing regulatory risks (i.e. Facebook, Google). We prefer holding cash in USD and have an overweight in Alternatives. We also prefer to keep our underweight in Fixed Income, whilst acknowledging that we have missed rally in US Treasuries so far this year. We prefer to remain cautious in this area as our view is that yields do not reward the current risk undertaken. Likewise, we have shifted HY holdings to a minimum, as a severe risk-off event could derail this space and our view is that a selloff here if it does happen, could be particularly painful.

![]()

![]()

![]()

![]() Equities

Equities

-

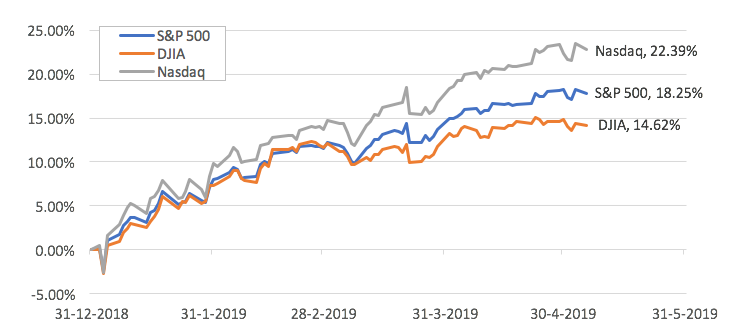

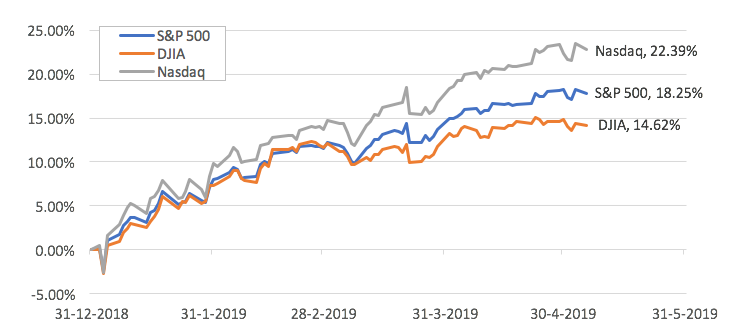

Equity markets in the US saw a steep decline earlier in the month, recovering briefly only to be rocked by a combination of weak manufacturing data and the continued escalation of Sino-US trade tensions. The S&P 500 traded mostly rangebound between 2,940 and 2,830, closing -1.81% lower for the month. The Dow was down -1.72% MoM, while tech stocks suffered, and the Nasdaq fell -2.60% MoM (Fig 1).

Fig 1: YTD performances of US indices. Source: Bloomberg

-

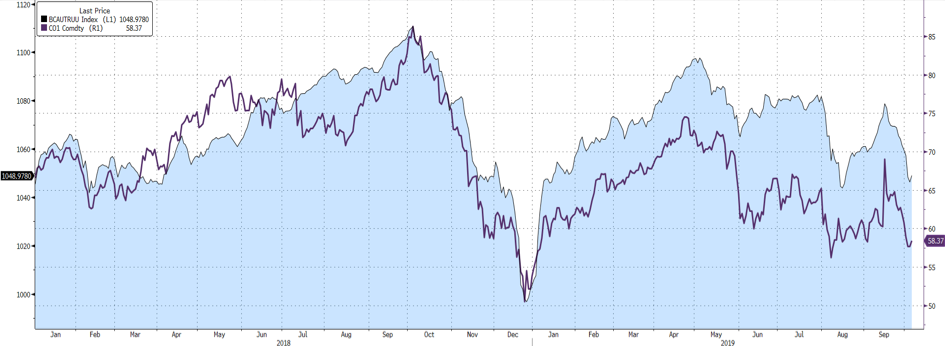

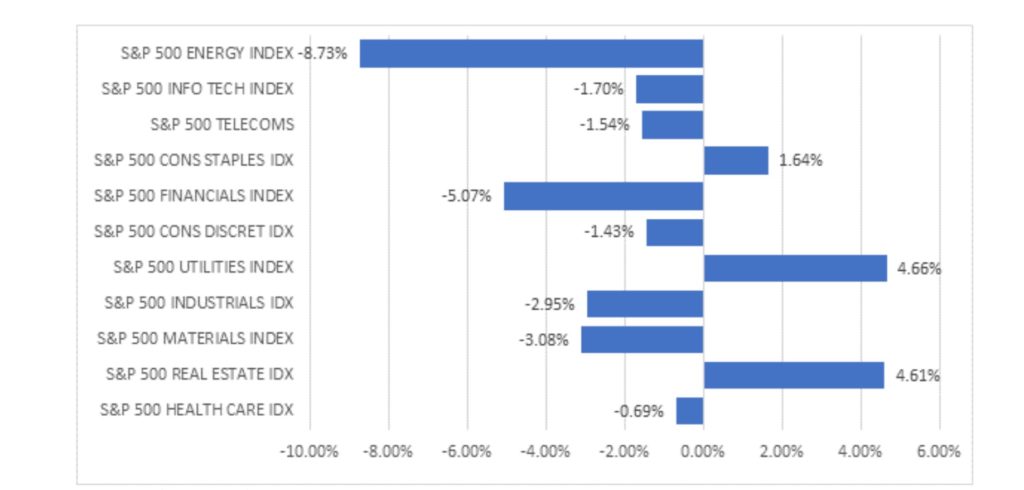

Within![]() the S%P 500. Energy shares underperformed on the back of weak oil prices, which fell as a result of lower demand expectations after macro data pointed to a slowing global economy. Similarly, financials also fell significantly as expectations of a rate cut cycle grew. Thus, we saw a rotation into defensives like Utilities, Real Estate, and Consumer Staples which outperformed (Fig 2).

the S%P 500. Energy shares underperformed on the back of weak oil prices, which fell as a result of lower demand expectations after macro data pointed to a slowing global economy. Similarly, financials also fell significantly as expectations of a rate cut cycle grew. Thus, we saw a rotation into defensives like Utilities, Real Estate, and Consumer Staples which outperformed (Fig 2).

![]() Fig 2: Performace of S&P 500 sectors in August. Source: Bloomberg

Fig 2: Performace of S&P 500 sectors in August. Source: Bloomberg

-

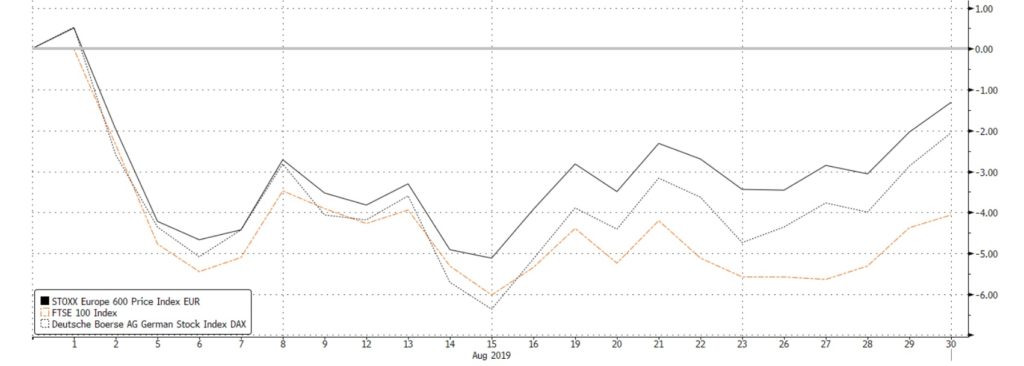

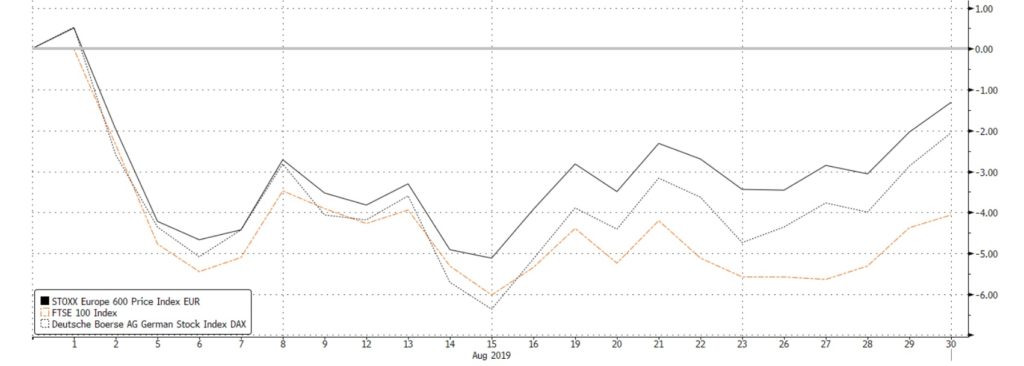

European stocks also declined, albeit somewhat buoyed by an intended rollout of significant easing measures by the ECB. The Stoxx 600 index was down -1.63% MoM, weight lower by Germany’s DAX index (-2.05% MoM), but more so by the FTSE 100 which declined by 5% MoM (Fig 3). Sector performance in the region was similar to that of their US counterparts, with defensives like Utilities (+3.33% MoM) and Real Estate (+2.76%) outperforming.

Fig 3: Performance of the SXXP, FTSE 100 and DAX in August. Source: Bloomberg

Fig 3: Performance of the SXXP, FTSE 100 and DAX in August. Source: Bloomberg

-

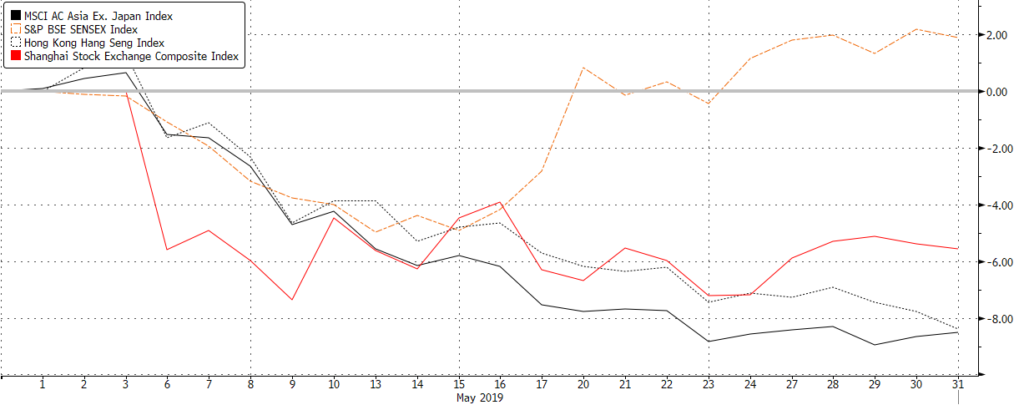

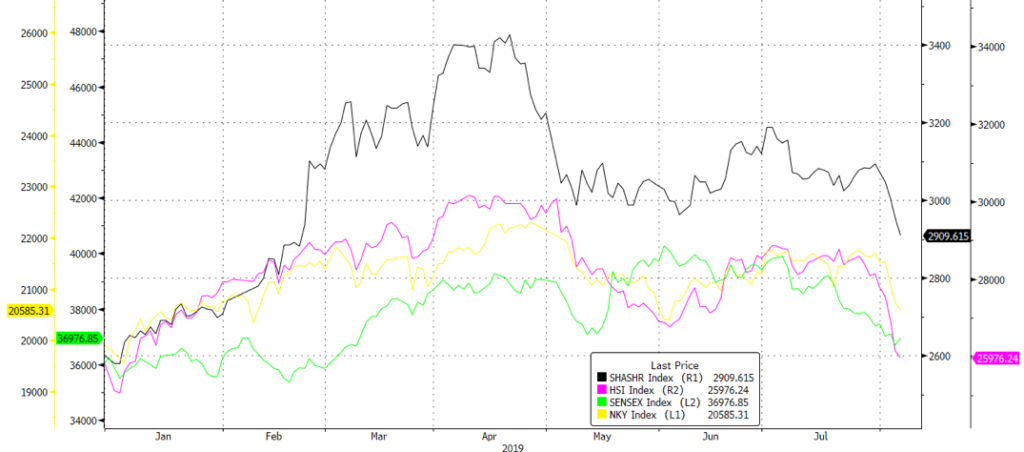

Stocks in Asia were hard hit by several factors, with EM (MSCI ASEAN fell -4.53% MoM) names seeing a steeper decline, especially those which were more vulnerable to a slowdown in global growth/trade. A-shares (-1.56% MoM) stayed relatively resilient, notably outperforming its large index peers despite the ongoing dispute with the US and weaker manufacturing data. The HSI (-7.39% MoM) was understandably the key underperformer in the region, given the unrest on the streets and mounting concerns that China might be growing weary of staying their hand and choose to intervene more sternly (Fig 4).

Fig 4: Performance of Asian indices in August. Source: Bloomberg

Fig 4: Performance of Asian indices in August. Source: Bloomberg

Fixed Income

-

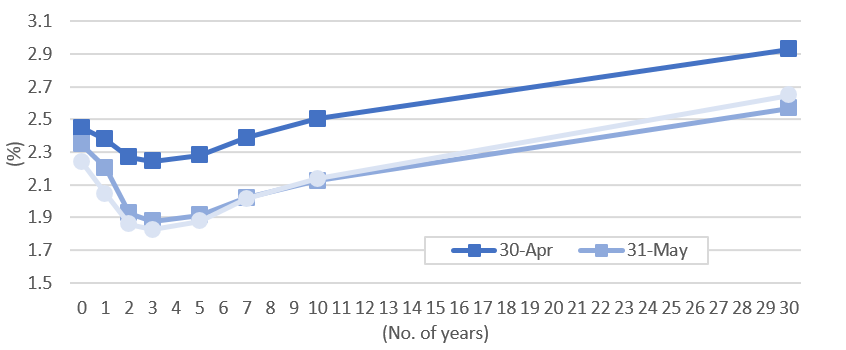

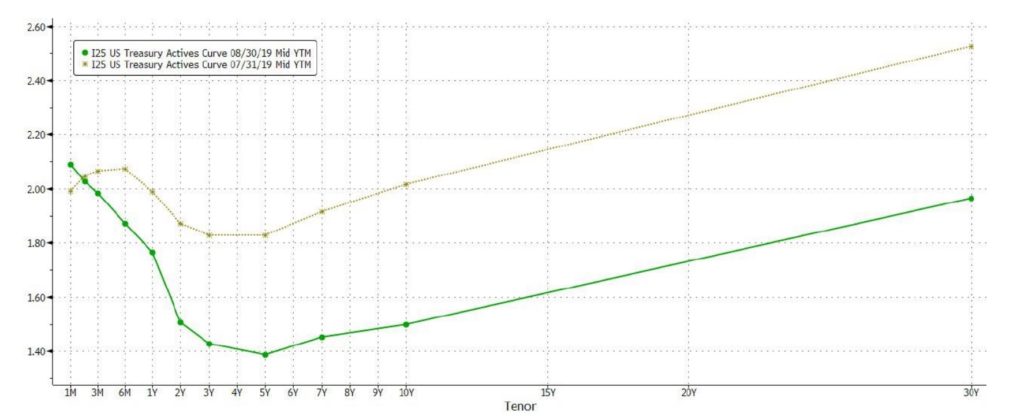

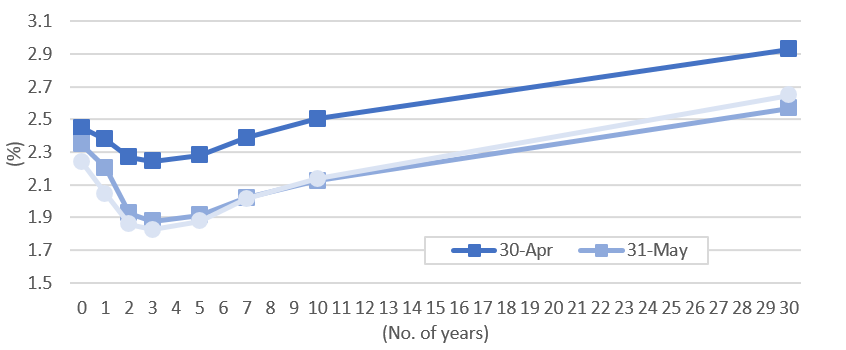

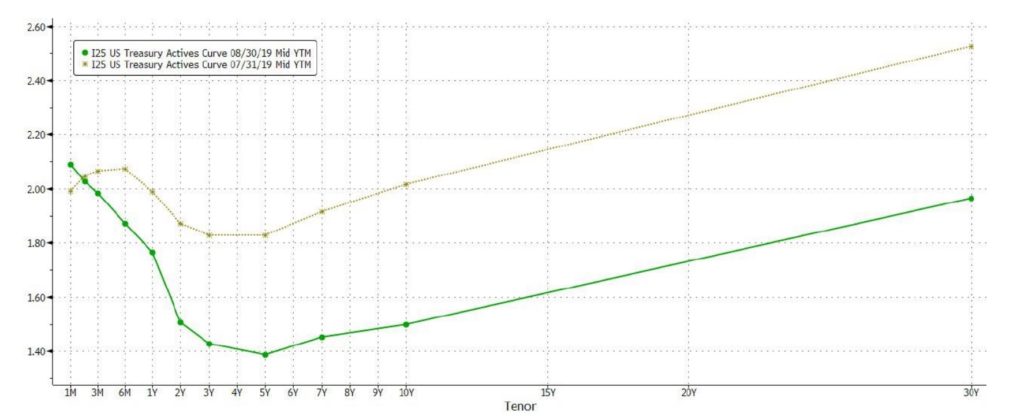

US Treasury yields plummeted amid the flight to safety as trade tensions and concerns over global growth weighed in, with the entire yield curve making a parallel shift downwards. 2Y yields fell by 37bps to close at 1.504%, while the 10Y yields saw an even steeper decline from 2.014% to close the month at 1.496% (Fig 5).

Fig 5: 1M Comparison of US treasury Yield Curve. Source: Bloomberg

Fig 5: 1M Comparison of US treasury Yield Curve. Source: Bloomberg

-

US Investment Grade bonds outperformed, with the aggregate index gaining 3.14%, followed by Asian USD IG bonds which gained 2.41% for the month. Understandably, EM Local Currency Debt declined by -2.00%, while globally, prices of HY bonds fell by -1.56%. CCC bonds in the US also suffered, losing -1.88%.

-

August saw a number of major banks lowering bond yield forecasts, with the HSBC slashing US10YT estimates to 1.5% at YE19 from an earlier 2.1%, and 10Y Bund yields to -0.8% from an earlier -0.2%. Similar moves were made by JP Morgan and Goldman Sachs, the latter trimming its YE19 forecast for US10YT yields to 1.75% from an earlier 2.80%.

-

September is seasonally one of the busiest months for fixed income, with primary issuance in the IG segment set to be as high as $125b according to a preliminary survey of dealers. Although IG spreads have widened significantly since early August, demand looks to remain strong after we saw a month of record flows into IG bond funds.

FX

-

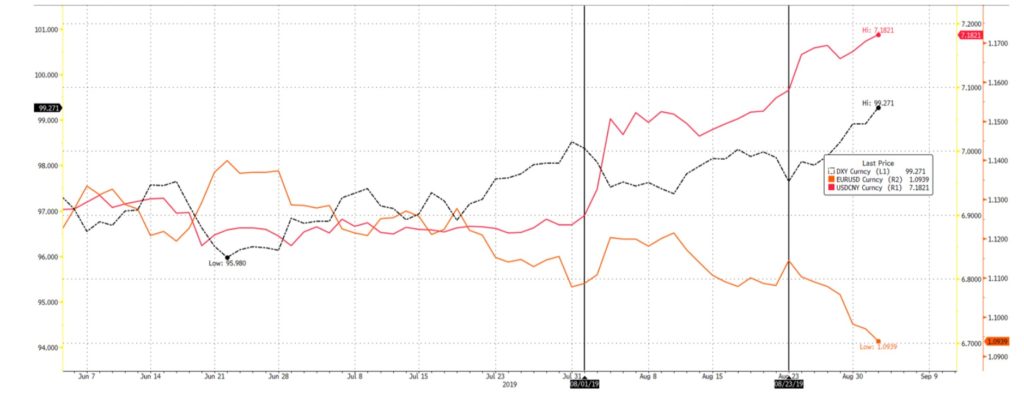

The FX market continues to be driven by geopolitical events (Fig 6). August saw retaliatory actions taken by both the US and China, signaling yet another escalation between the two nations. Brexit ‘clarity’ continues to drive the Sterling as market participants unwound short positions as parliament lowered chances of a hard Brexit. The EUR rose in tandem with the Sterling, aided by the possibility of ‘QE 2.0’ which was sparked from the steady stream of deteriorating industrial and manufacturing data. These factors caused both the EUR and the Sterling to dip below key support levels of 1.20 for the Sterling and EUR’s 1.10.

Fig 6: Tariffs are still the main source of activity for FX. New tariffs highlighted by black vertical lines. Source: Bloomberg

Fig 6: Tariffs are still the main source of activity for FX. New tariffs highlighted by black vertical lines. Source: Bloomberg

-

CNY weakened 4.34% from 6.88 t0 7.18, the EUR fell 1.31% from 1.1070 to 1.0940 after it managed to touch 1.12 and GBP fell 1.50% from 1.2150 to 1.1970 and managed to trade to a monthly high of 1.23 on short squeezes. It is worth noting that 1.20 is a 2.5-year support for the Sterling. This caused the DXY to extend its yearly highs from July to touch 99.130 on the 2nd of September. This G7 volatility is to remain at ‘elevated’ levels relative to the first half of 2019.

-

Positioning wise, GBP is now highly net short with over -100k net contracts, the largest it experienced since 2018, and JPY is now net-long since the beginning of August. We currently see room for GBP to rise further, simply on the fact that 1.20 remains a strong support and provides an opportunity for a short squeeze. With net shorts at a yearly high, the unlikelihood of a no-deal exit increasing along with the help of the EUR (aided by temporary CNY strength), we believe that GBP may reach 1.25. Should tensions continue to ease, we see GBP, AUD, as well as major export-based FX pairs (THB, KRW, and TWD) to continue to gain (Fig 7).

Fig 7: The CNY remains the primary driver of AXJ currencies. Source: Bloomberg

Fig 7: The CNY remains the primary driver of AXJ currencies. Source: Bloomberg

Commodities

-

Brent fell below a key psychological/technical support of $60/bbl as Trump added new tariffs on Aug 1st, adding to fears of a slowdown in global growth. The announcement of tariffs caused the Brent price to dip from $64.10 to $56 and Gold saw a rise from $1413 to $1550 (Sep 4th). China’s retaliatory response on Aug 23rd added even more downside pressure. Brent ended the month slightly lower at $59 and maintained a short-term trading range between $61.30 and $58, after recovering from $56. Gold still maintains a strong upwards momentum as its previous resistance has now become a support (Fig 8).

Fig 8: Gold’s momentum is supported by tariffs. Its previous resistance is now a support. Source: Bloomberg

Fig 8: Gold’s momentum is supported by tariffs. Its previous resistance is now a support. Source: Bloomberg

-

The trading range is caused by a few factors; global refinery outages fell to seasonal nine-year lows as they front-loaded 2019 maintenance cycles in preparation for IMO 2020 rules; OPEC’s output rose for the first time since its commitment to dent supply, due to Russia’s 1.2% gain in output (this comes before their re-commitment on the 4th Sept); Hurricane Dorian, the first Cat 5 major hurricane of 2019, which if foreseen to impact the Gulf of Mexico.

-

For September, we see Brent’s $58 to hold as a support and for the 200DMA at $64 to be tested. With freshly added tariffs and further interactions to be had with President Xi and Trump, we believe that this familiar phase of non-aggression should allow other short-term factors to push the price of oil higher in the interim. This includes the return to commitments cut from Russia to cause a further slowdown in OPEC supply, and for Hurricane Dorian to reach the Gulf of Mexico and thus dent production.

Fig 9: Retaliatory tariffs have pushed oil lower, whilst OPEC supply kept prices buoyant. Source: Bloomberg

Fig 9: Retaliatory tariffs have pushed oil lower, whilst OPEC supply kept prices buoyant. Source: Bloomberg

Aug 22, 2019 | Articles, Global Markets Update

Last week saw the heaviest sell-off in the S&P 500 (the worst since Dec ’18), with US indices seeing sharp pullbacks into early August just shortly after making fresh all-time highs in the last week of July. A re-escalation of Sino-US trade tensions, as well as a pullback in rate cut expectations (with market expectations of a rate cut cycle against Powell’s comment that this month’s move was more of an ‘insurance’ cut), were key factors contributing to the decline in risk-on assets. Likewise, weaker-than-expected data releases globally added to concerns over the state of the global economy, bringing oil down below its key US$60/bbl support despite the worsening relations between the US and Iran. Economically, the US continued to display relative resilience compared to most other major developed markets, understandably outperforming as the S&P 500, Dow Jones and Nasdaq gained 1.31%, 0.99% and 2.11% in July. This was in comparison to the Stoxx 600 (+0.23% MoM) which was buoyed by better-than-expected (albeit heavily downgraded) earnings releases, and Japanese equities in the Nikkei 225 (+1.15% MoM) which saw a pretty decent month. The MSCI Asia ex-Japan (-2.17% MoM), however, underperformed significantly as Chinese equities tumbled on weak data and the trade spat, with A-shares falling -1.55%, and amid the ongoing protests in Hong Kong which undoubtedly weighed on the HSI (-2.68% MoM). The YTD rally in Indian equities also came to an end, with the Sensex (-4.86% MoM) coming off all-time highs to be the underperformer for the month.

What was mostly a calm month for currencies (with the exception of Boris Johnson’s election and steep moves in GBP) soon turned into a storm after Trump surprised markets with his additional imposition of tariffs on Chinese goods. The DXY surged to a YTD high of 98.900 on Powell’s comments before retreating back to 97.220, while in early August, retaliatory moves by the PBoC saw onshore CNY quickly fall below the key psychological Rmb7.0 level. Prior to that, the Euro was mostly led lower by a weaker Sterling on renewed hard Brexit concerns and Boris’ loss in the by-election which nipped away at whatever was left of the majority vote that he had.

Outlook

The sudden shift in sentiment brings back memories of the plunge in Q4CY18, and in particular, the heavy selling during December towards Christmas Eve. Markets have discounted much of the good news – from better-than-expected (albeit post-downgraded) earnings, the ‘dovish’ pivot by the Fed and global central banks, the trade ‘truce’ as well as a moderation of geopolitical risks in the short-term – to the point that Morgan Stanley thinks 22 other central banks will join the Fed in cutting rates by YE19. H2CY19 will potentially be much rougher as geopolitical risks are rising with 1) a ‘no deal’ Brexit 2) dysfunctionality in Spain 3) Italian opposition to EU’s fiscal rules and a possible election giving Salvini control 3) greater Russian adventurism 4) a brutal crackdown on HK’s protesters 5) rising tensions around the South China Sea, Taiwan, 6) worsening tensions between Korea and Japan and 7) rising tensions in the Middle East alongside 8) the instability of Trump.

We have deliberately held an underweight equity positioning and high cash levels for much of this year, more so since April and that worked in May but was impacted by both Powell’s end-May ‘pivot’, and renewed hopes of a trade ‘truce’. We stuck with our defensive positioning as we feared that the optimism in markets (not least as Forward P/E’s on the S&P 500 pushed through 17.5x) was not justified, although the Fed U-turn in November despite robust macroeconomic data (in particular, consumption) caught us out. I see the potential for this correction to run c. 10-15% more, with the S&P 500 re-testing 200DMAs at 2,770 as other, more trade-vulnerable markets to suffer more. EM/AXJ markets are more at risk, not just to trade-related damages, but also to a stronger USD. I struggle to find enthusiasm for US Treasuries, having missed the rally and as the yield on 10Y US Treasuries, below 1.8%, are giving you a negative real interest rate & prefer cash. Our trades into gold found vindication (clearly Bitcoin would have been better!), but we doubt that prices can run much further through key resistances at $1,450-60/Oz.

We remain cautious around risk assets and prefer holding cash in USD. Any major correction offers a trading opportunity to rebuild riskier assets – notably quality equity franchises as Visa or Diageo. In the near term, we could see volatility spike up across most asset classes. Helmets on. The elixirs that could soothe markets might also bring about some damage to capital markets; the Fed moving into a rate cutting cycle; Trump, fearing his trade policies might cost him the election, could ease off on tariffs on China; Powell’s complete U-turn in monetary policy despite US macro data remaining solid, can only be explained by a pandering to please capital markets. On this note, any fall of 10%+ (as we saw in December last year) will likely move a Powell-led Fed to exercise the ‘put’ option that markets expect. This probably sets the lower range of any selloff in the S&P 500 to around 2,630 – 2,770 (Fig 1), which is not unlikely given our expectation of both earnings & GDP downgrades, as well as potential damage caused by trade tensions and geopolitical worries.

![]()

![]()

![]()

![]()

Fig 1: SPX projected to test a mid-term support of 2,630 Source: Bloomberg

The US, The Global Economy and Powell’s ‘Put’

US GDP data is always distorted between Q1 and Q2. It is clear the huge jump in 2Q19’s consumption numbers after a weak Q1 was in part carried over from the previous quarter (the US government shut down may have had an impact) but nonetheless, it was robust and reflects solid consumer sentiment surveys. Q2 was also impacted by destocking in inventories that had boosted Q1. By stripping these out, the likely underlying GDP growth in Q2 was c. 3% relative to Q1’s 2%. Government spending, buoyed by the Trump fiscal boost of $1.5trn, accelerated but this will slow down in Q3 and fall off a cliff by Q4CY19 as the new fiscal year kicks-in. Business fixed asset investments and net trade were negatives. All in all, this was a solid quarter underpinned by consumption, which accounts for 70% of the US’ GDP. The strength in consumption is at odds with the caution corporates are providing, via a negative-to-positive forward guidance ratio of 3:1 for H2FY19 earnings, and their reduction in capital expenditure. With unemployment at 50Y lows, accelerating wages (private sector wages, including perks, are rising at over 4% p.a.), low mortgage costs and confidence around job security; there is a decent argument that the consumer, assuming Trump leaves trade tariffs as they are (the next $300bn of US tariffs on Chinese imports would mostly hit consumer related items), will remain resilient in H2CY19 (the latest Conference Board survey was very strong). If so, then the ‘gap’ between consumer optimism and corporate caution (if not FI markets’ pessimism) might close in favour of the consumer, implying upside to US domestic demand, GDP growth and earnings growth in the S&P 500. Of course, the risks for corporates include a strong labour market (which will drive up employment costs more quickly and so impacting margins), along with trade-related damage and a higher USD.

For us, what is quite clear is that the Q2 GDP data, recent NFP, consumer sentiment surveys, and durables, along with US equity indices close to all-time highs, do not provide the reasons for the Fed to cut rates – indeed Professor Shiller rightly suggested the current conditions in the economy and capital markets support the argument more for a rate hike than the Powell ‘put’ of a rate cut we experienced. Clearly, the Fed is pandering to capital markets and the critic-in-chief, Trump. Resilient consumption and, as a result, better S&P 500 earnings, may support the index’s rally to break firmly through 3,000 (GS’s revised price target is 3,100), but it might limit the Fed to a one-off rate cut, boost inflation and underpin US GDP growth and USD. We continue to see more downside risks from rising geopolitical scenarios (‘no deal’ BREXIT, Iran confrontation, worsening Japan-Korea trade spat, South China Seas tensions, US’s possible sale of F-16s to Taiwan in Q4 which is a redline for China, political risks in Italy and Spain and risks around Turkey and South Africa). In addition, IMF recently cut global GDP growth forecasts in both CY19 and CY20, with the bulk of these downgrades coming from the BRICS.

Frankly, it is very difficult, we find, to have a strong conviction on the outlook and that means capital markets could be prone to violent, large moves and spikes in volatility as we have just seen. But with Nasdaq still up c. 15% YTD and double-digit gains in the MSCI ACWI, the odds suggest going more defensive in portfolios by reducing riskier assets like equities (with US stocks on expensive valuations), and high-yield FI (forecasted default rates are moving up), but we will be monitoring US consumption positives as well as the degree of monetary easing we get by the Fed alongside the other 22 central banks globally (MS thinks that they will cut rates by YE19). Our basic thesis is risk assets have discounted a lot of the positives yet are ignoring the negatives at a time when the rally in sovereign debt implies a dichotomy on outcomes – one, or other, of these two asset classes, will sell-off hard.

Re-escalation of Sino-US trade tensions

Last year, China’s move to allow the CNY to depreciate from 6.23 to 6.98 had ‘neutralised’ the initial 10% of US tariffs, a move which in part incentivised Trump to impose even hasher tariffs. Indeed, Trump made it clear that the latest 10% on the remaining $300bn of PRC imports (due by 1/9), could be increased to 25% or higher. Whilst China could likewise impose higher tariffs on US imports, it is running out of room and will thus need to find other ways to retaliate. It appears China is taking a tougher line since the earlier breakdown in talks earlier this May, and not compromising on core structural economic objectives. One line of thought here is that despite the trade war and with domestic reflationary policies perking up the Chinese economy, China is emboldened in its negotiating position. Another is that they can live with the ‘pain’ and wait for Trump to be replaced after Nov 20thby a more rational administration. Certainly, the narrative around this Sino-US trade war posits a decreasing likelihood that an accord will be reached before the next US election, with some suggesting that Trump sees a deal as potentially giving Democrats an opportunity to attack him. There are no signs yet, electorally, that the trade war is hurting Trump’s appeal. Having said that, 68% of the latest round of tariffed goods are consumer items, and should Trump increase tariffs significantly further from here, he risks alienating the voters and creating a recession – MS thinks if this extra $300bn of imports were to suffer a 25% tariff, the US economy would go into recession within 6-9M, coinciding with a key voting period in Q2 and Q3 when most make their mind up.

‘Weaponising’ the CNY has long been talked about by bears of the currency, but this has not happened, and most studies still see CNY as at fair value. However, the Chinese lack an obvious trade-related retaliatory measure, so they could, if angered, choose to devalue the CNY by another 5-6% (Fig 2). Fundamentally, China is moving towards both a trade and current account deficit – US surplus is the large exception – so it is not wrong to assume that the CNY might fall further. Bears argue that the currency should depreciate to 7.50-7.60, even 8.00, as this would ease pressure on PBoC from sticking to tighter monetary policy. The principal reason against a major devaluation is that the government rightly fears capital flight that, if extreme, could destabilise its financial system by creating a liquidity run. With capital controls and a stable currency, China can retain sufficient domestic liquidity to ensure that a solvency crisis does not deteriorate into a more damaging liquidity crisis. A major amount of capital fleeing China could force the PBoC to jack up rates precipitating a recession. Financial system defaults – given high corporate debt-to-GDP – alongside capital flight, would only increase the risks. We think it is unlikely that the PBoC and the Chinese government would take this risk, but where the line-in-the-sand is we do not know – it might be here at 7.00 or at 7.20. If we take 6.80 as an average point, then a 5% depreciation from there implies that 7.10-7.20 is feasible. Another factor against a rapid fall in CNY is that China prides itself in the relative stability of the currency, and the benefits that this carries for its vast trading complex. Lastly, if forecasts prove right and China moves into a trade & current account deficit, a weaker CNY would most definitely be negative. If this were to be the case, we would not be surprised if China accelerates its selling of US Treasuries given their YTD rally and the recent moves in CNY.

As the two sides’ trade confrontation spirals further into a toxic standoff, it will damage not just their own but the global economy as well; in doing so adding to more GDP downgrades, notably in the trade sensitive EU where feeble domestic demand and an underpowered ECB cannot offset trade weakness, as well as APAC. It also raises the stakes in that the Sino-US trade dispute is part of a wider strategic confrontation between the two that is just starting. The risks lie in a higher non-trade conflict (as with issues around the South China Seas or the US’ intent to sell F-16s to Taiwan), take on a greater life and further reduce hopes of a trade compromise.

Fig 2: CNH’s room to weaken to 7.35 Source: Bloomberg

Equities

-

The S&P 500 has once again failed to confirm a breakout above 3,000, and it could be that the rally ahead of the Fed’s expected rate cut was the ‘rumour’ helped by a better-than-expected Q2 EPS reading, albeit one that is tracking a negative two-to-three percent YoY earnings contraction for a second quarter in a row. Nonetheless, the correction thus far across US indices has been steep (Fig 3), while other markets are breaking 200DMAs as – in APAC – the STI, KOSPI, and the HSI with others heading there. ![]()

![]() Fig 3: YTD performance of US indices Source: Bloomberg

Fig 3: YTD performance of US indices Source: Bloomberg

-

Q1FY19 earnings for S&P 500 ‘beat’ the conservative consensus by around 3%, falling just -30bps YoY whilst 76% of the 77% S&P 500 companies that have reported Q2FY19 earnings have also ‘beaten’ conservative consensus estimates. Factset thinks that the companies which have reported so far – along with estimates for those to report – will see Q2FY19 earnings fall by -1.0% YoY relative to the -4-5% consensus estimate during the pre-results season. Year-to-date, S&P 500 EPS has been cut by -6.5% from YE18 estimates.

-

The same is true for Stoxx, where Q2 results are seeing a net ‘beat’ over significantly downgraded forecasts after Q1 results were out but will still likely be down -4% YoY on an absolute basis. There is ‘polarisation’ between where S&P 500 H2 earnings will go with consensus (and Goldman Sachs) expecting +3% (GS also forecasts +5% FY20E), which implies a double-digit recovery in H2 and especially in Q4FY19 where comparatives to the FY18 base look easier.

-

This is opposed to others like Morgan Stanley, who see a contraction in overall FY19 earnings, and think that earnings consensus for H2FY19 is way too high, and that might result in the S&P 500 correcting 10%+ as investors become more pessimistic. To the extent that the US consumer looks to be in rude health, the key to growth/contraction in FY19 earnings might lie in whether toplines hold up (helped by stronger consumption spending), and the degree to which corporate operating profit margins are squeezed. One lead indicator for future earnings are today’s sales growth and here the ‘weak-ish’ Q2FY19, in contrast to better than expected earnings ‘beats’, is a downside indicator into H2.

-

In APAC, our overweight positioning in Chinese equities (Fig 4)is starting to look a lot less clever as trade and a depreciating CNY hits the defensive domestic counters like Tencent and Alibaba, as well as preferred names in Real Estate and Financials. Our sense is thus a need to reduce exposures in this region. Meanwhile, domestic troubles are making Indian equities less attractive, while ASEAN is exposed to trade damage and USD strength.

Fig 4: YTD performance of Asian indices Source: Bloomberg

Fig 4: YTD performance of Asian indices Source: Bloomberg

Fixed Income

-

US Treasury (UST) rates were mostly flat in July. While the 2Y yield ended at 1.87%, 11.72bps higher MoM, the 10Y yield was mostly flat at 2.01%. However, yields tanked, and the UST yield curve flattened in the first two days of August after Trump announced the tariffs on additional Chinese imports (Fig 5). Weaker manufacturing data after also weighed on yields. Despite this, we remain convinced that the current economic conditions in the US do not warrant a monetary policy easing cycle.

Fig 5: Flattening of UST yield curve Source: Bloomberg

Fig 5: Flattening of UST yield curve Source: Bloomberg

-

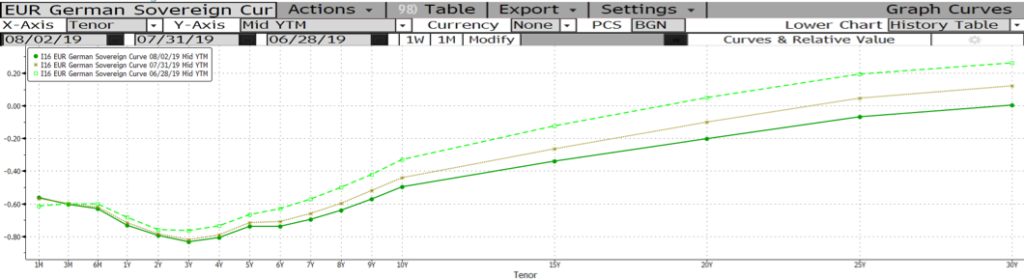

German bunds yield trended lower throughout July, extending declines from June, as European economic data remained weak. The fall in German yields accelerated in the first two days of August as well, ending the week with the entire German yield curve in negative territory (Fig 6).

Fig 6: Germany sovereign yield curve falls below zero Source: Bloomberg

Fig 6: Germany sovereign yield curve falls below zero Source: Bloomberg

-

EM debt was the best performer last month. EM hard currency debt, represented by the Bloomberg Barclays EM USD Aggregate index, returned 1.00% while EM sovereign local currency debt (LCD), represented by the Bloomberg Barclays EM Local Currency Government index, returned 0.98%. We continue to favour EM debt, particularly hard currency debt, relative to other FI sectors given the market’s hunt for yield in the current low-interest rate environment. We are more cautious around LCD, especially given the strong dollar.

-

Within corporate credits, high yield (HY) debt generally outperformed investment grade (IG) debt (Fig 7). Both IG and HY index spreads are trading at the lower levels seen in ‘18, with the IG index yield trading at 2Y lows. With IG yields back at that level, we don’t think it justifies the inherent risks and thus prefer HY debt.

Fig 7: HY vs IG returns Source: Bloomberg

Fig 7: HY vs IG returns Source: Bloomberg

FX

-

The DXY reached a YTD high of 98.90 last week but has since continued to fall since Trump’s renewed tariff threats. Previous resistance levels, bar the 103 peak in end 2016, can be seen at 100 (Fig 8). This is likely the next level of resistance if markets continue to back the dollar on the Fed’s less-than-expected dovishness. We have seen the DXY break through a key resistance of 98.50 over the last week, with support from its 200DMA at 96.93.

Fig 8: DXY resistance at 100 Source: Bloomberg

Fig 8: DXY resistance at 100 Source: Bloomberg

Fig 9: EURUSD breaks below key support of 1.11 Source: Bloomberg

Fig 9: EURUSD breaks below key support of 1.11 Source: Bloomberg

-

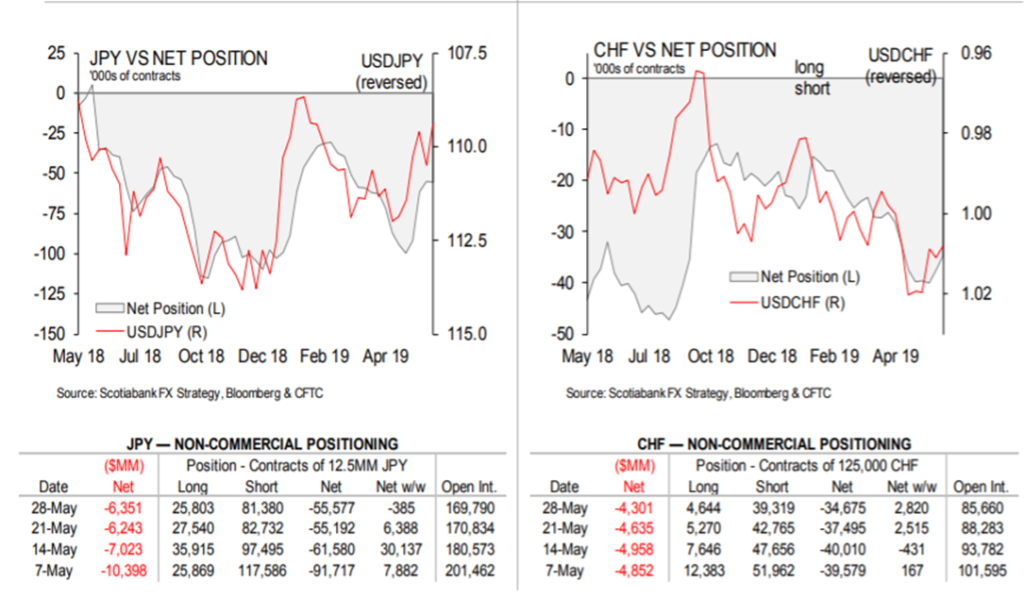

In our previous monthly, we noted that the flight to ‘safe haven’ currencies could be steep, should trade tensions escalate once again. They did, and we saw JPY gaining to 105.60. We expect haven currencies (JPY, CHF) to see continuedstrength, and for the Sterling to be exposed to the downside in lieu of Brexit uncertainty.

-

Citi’s broad NEER values show the Yuan dipping below 98 with speculation that China will further adjust its real effective rate lower to offset the impact of new tariffs. This will likely put downward pressure on Asian currencies as they adjust to accommodate this pressure. We see an opportunity in shorting the Thai baht, as a weaker yuan might release some of the latter’s strength which we saw in July.

Commodities

-

Last month, we noted a trading range between US$60-68/bbl, based off numerous factors including Trump’s pressure on Iranian production as well as a slowdown in overall demand from trade wars. In July, Brent saw a rise to US$67/bbl, helped higher by the continued momentum of production declines from June as well as an inventory decline for Cushing crude. Hurricane Barry also helped push oil prices higher by shutting down c. 1m bpd of production in the Gulf of Mexico. However, this rise was soon offset in a gradual build of inventory once again as exports slowed from a dip in demand due to trade wars. Short bouts of dollar strength from Powell’s less-dovish comments also helped push oil lower.

-

We adjust our trading range for oil to US$60-$65/bbl, with a bias to the downside, and see the $60 level as a support that may break by the end of Q3. We follow the 200DMA resistance level of $65 and note that the support at $60 has been tested 4 times since June. With the added tariffs from the US, as well as a retaliatory stance from China, we foresee that tensions are more likely than not to rise and this should further dampen the overall mood for risk, and therefore the outlook for global growth.

(Fig 10)

Fig 10: Brent crude on a downward trend Source: Bloomberg

Fig 10: Brent crude on a downward trend Source: Bloomberg

Fig 11: Gold’s upward channel Source: Bloomberg

Fig 11: Gold’s upward channel Source: Bloomberg

-

The increasingly uncertain backdrop has and will likely continue to benefit the precious metal, with the potential for prices to rise above US$1,500/Oz. From a technical perspective, we view Gold’s momentum to be too strong for a “sell-off” reversal, similar to what we saw in equity markets.

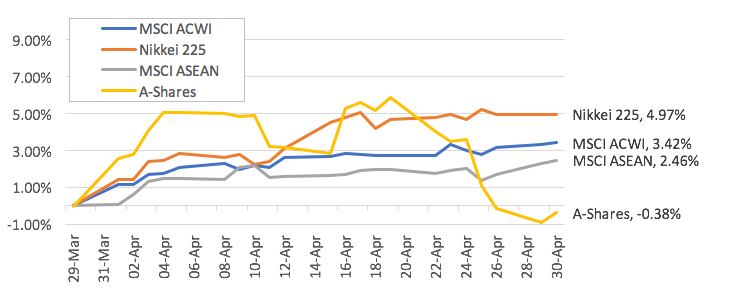

Jul 9, 2019 | Articles, Global Markets Update

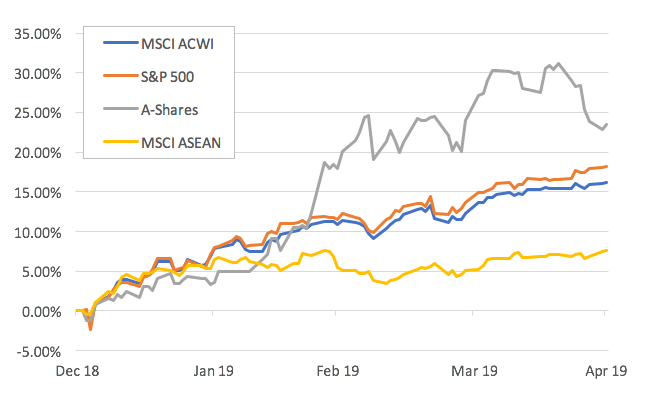

June was a robust month for risk assets with equities rallying on a more ‘dovish’ Fed that shifted from talking about more accommodation to Powell effectively telling markets the Fed will cut rates July – the question now being 25bps or 50bps, and whether it is ‘one and done’ or if there will be several cuts. US markets once again are at all-time highs and for the third time in under a year. US was the best performing region, with the S&P 500, DJIA and Nasdaq gaining 6.89%, 7.19% and 7.42% respectively over the month. This is relative to Stoxx’s 4.28% and Nikkei’s 3.28%. Asia ex-Japan (AXJ) also saw a strong month with MSCI AXJ recovering from May to gain 6.06%. The US-China trade truce, from G20 Summit, added cream to the outcome. Fixed income (FI) rallied strongly on the 100bps shift in Fed funds rate expectations but the underlying narrative here, of a much weaker GDP outlook, is hard to reconcile with the rally in equities and tight high yield (HY) FI spreads. Moody’s highlighted it raised its default rate forecast for the first time in some years that has negative implications for HY FI in 6-9 months. Asian FI spreads remained ‘tight’ too, with Asian USD HY index spread ending the month at 4.55%, and the Asian USD investment grade (IG) index spread ending the month at 1.35%.

We remain cautious towards risk assets with much of the good news – a Fed rate cut and a US-China trade truce – now being discounted by markets. We also believe the next few months may well be tougher conditions for equities and HY FI. US growth – not least nominal GDP growth – is set to slow sharply in H2CY19 although we doubt a recession will unfold (the chances of recession are much higher in both the European Union and UK in our opinion). We also see reasons for more downside risks in equities as earnings forecasts look too optimistic relative to the likely outcome. The topline and margins will likely face a squeeze, and this makes the current forecasts of S&P 500 earnings per share (EPS) growing +10% in the remaining six months of the year improbable. We share a similar conservative view as Morgan Stanley (MS) which forecasts S&P 500 could fall 10% this quarter as investors start to discount weaker fundamentals.

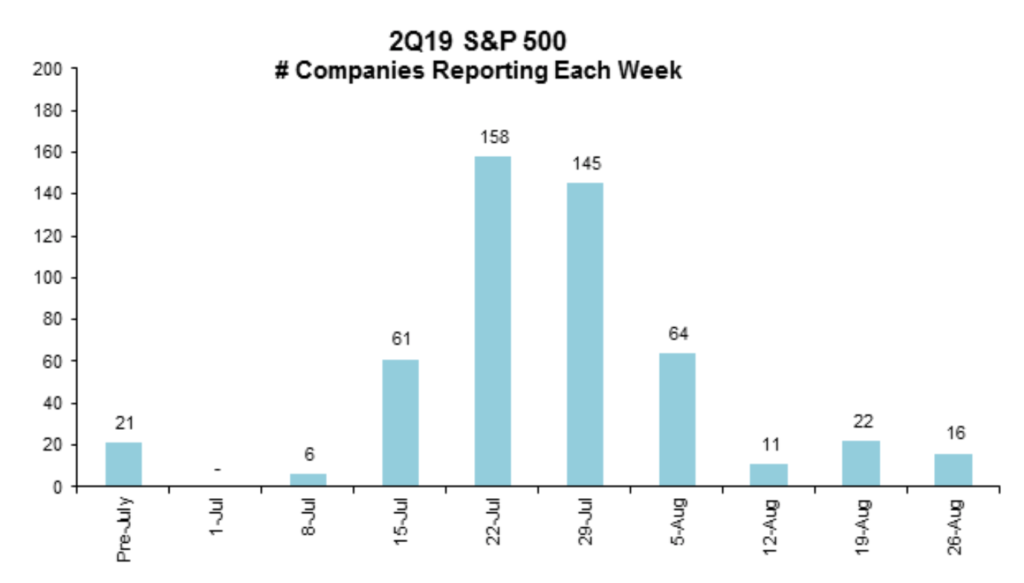

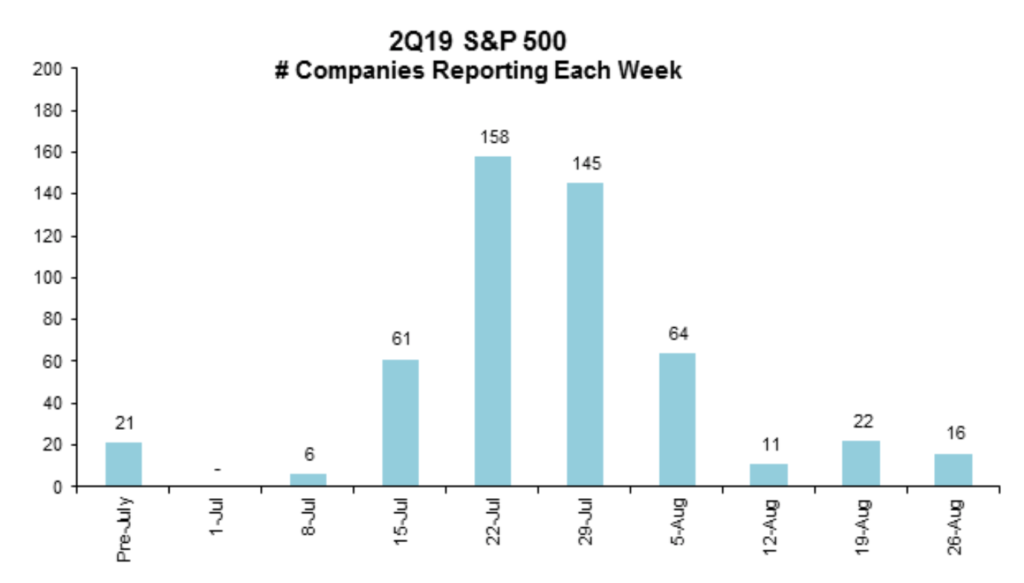

There is a debate as to whether the Fed will cut several times by YE19 as FI markets hope, or just do one ‘insurance’ cut – should the Fed start a new rate cut cycle, this will imply underlying macro conditions are weaker than equities are discounting. Our base case remains that the US economy is resilient, and the Fed will cut once, later this month, then pause but with S&P 500 expensive ahead of what may be two years of earnings contractions. Q2 results loom as the key driver for equities starting off in the week of 15th July, with about 50% of the S&P 500 reporting by week of 22nd July (Figure 1). The bar is a conservative one, given a dismal reading of MS’ Negative-to-positive guidance ratio of 3.48x. There is, obviously, a disconnect between the reason why both equities and FI rallied strongly last month. We see downside risks for both asset classes but, should FI be right and a recession is imminent then equities and HY FI would suffer sharp reversals.

![]()

![]()

![]()

![]()

Figure 1: No. of S&P 500 companies reporting each week Source: Morgan Stanley

On US and China’s trade truce during the G20 Summit, MS notes: “Developments over the weekend do not do enough to remove the uncertainty created by trade tensions, and they remain an overhang on corporate confidence. Risks remain skewed to the downside – if trade tensions escalate, (i.e., the US imposes 25% tariffs on the remaining US$300 billion of imports from China and they remain in effect for 4-6 months), we could wind up in a global recession in about three quarters.”

The recent history is that trade truces do not hold for long and underlying fundamental differences re-emerge. China will not accept US enforcement and monitoring, removal of industrial subsidies and constraints on its Made in China 2025 objective while US wants China to undertake structural changes. We do expect a deal later – by late Q4 or Q1CY20 – given US election realities and for economic factors in both countries but it is quite possible it gets worse again before it gets better.

Equities

- US equities continued to climb the wall of worry this month but saw a late rally after last weekend’s Trump-Xi meeting which bore a largely positive outcome. The three major indices had a similar performance, gaining 7% to see the S&P 500 have its best June since ’55 and the best 1H since ’97.

![]()

![]()

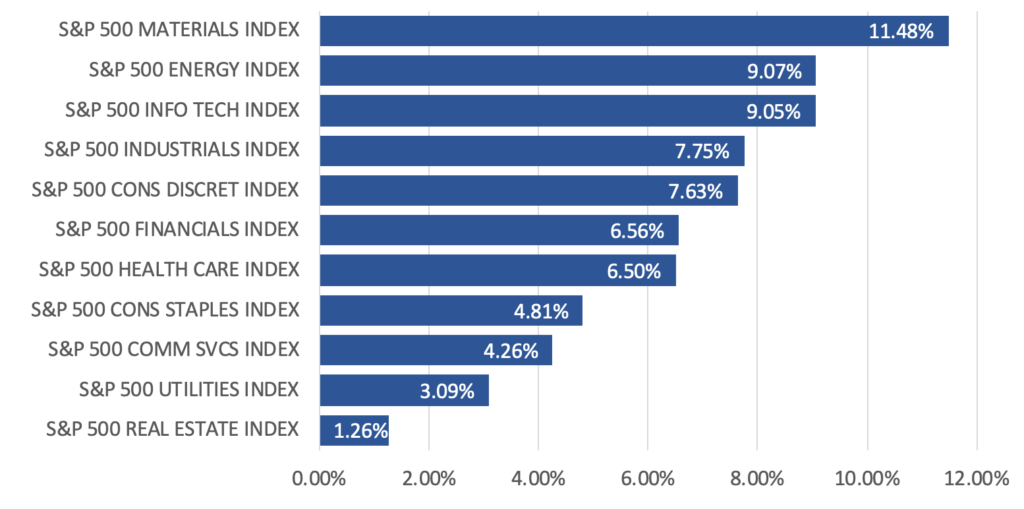

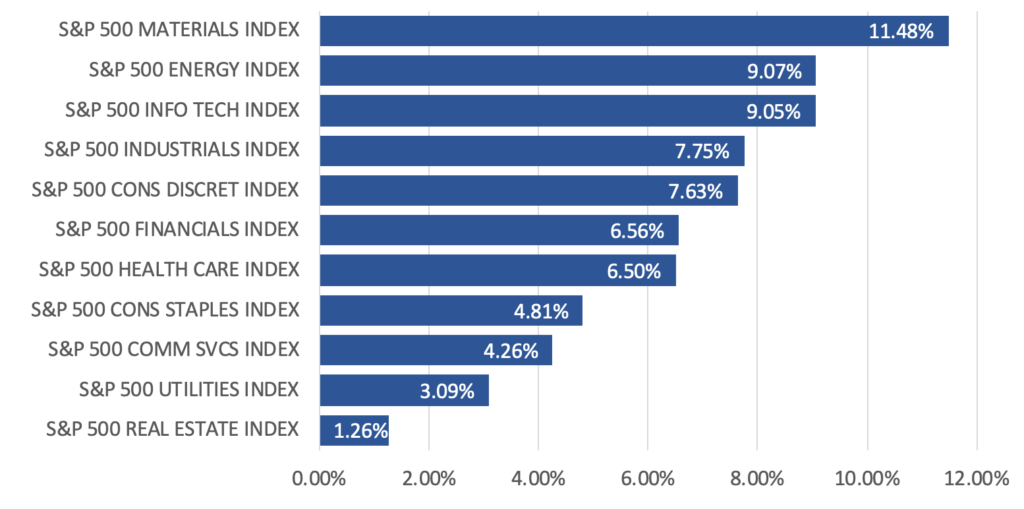

Figure 2: S&P 500 sector performance Source: Bloomberg

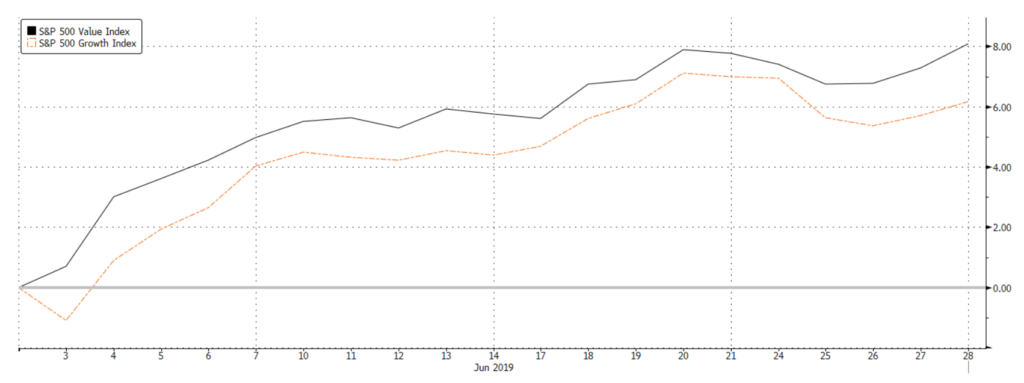

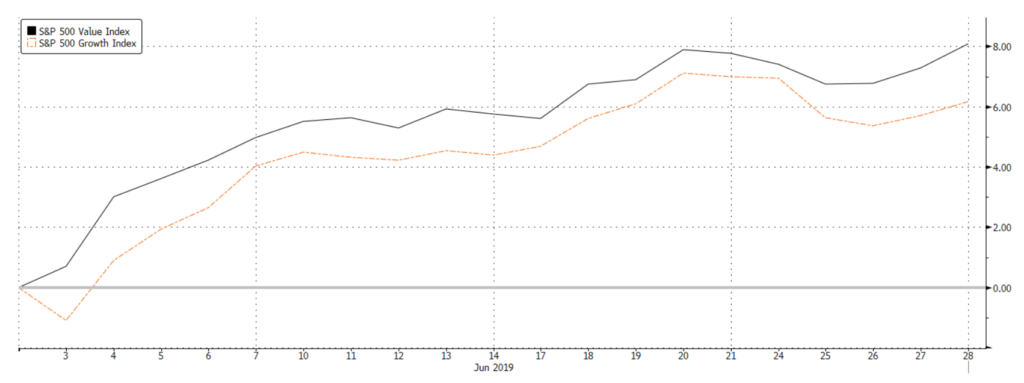

- In the S&P 500, Materials (+11.48% MoM) led gains, alongside Energy (+9.07% MoM) and Info Tech (+9.05% MoM) shares which also outperformed. Risk-on sentiment saw a rotation out of defensives like Real Estate (+1.26% MoM), Utilities (+3.09% MoM), Communication Services (+4.26% MoM) and Consumer Staples (+4.81% MoM) (Figure 2). Value stocks also outperformed growth significantly this month (Figure 3).

Figure 3: Value vs. Growth Source: Bloomberg

- June did see a string of weak data releases from the US, which was arguably supportive of equity markets as the case for rate cuts grew even stronger. Although June’s Fed meeting saw rates unchanged, this sentiment was echoed by Powell who took on a much more dovish stance, signalling possible rate cuts and indicating that the Fed would ‘act as appropriate to sustain the expansion’, without any mention of the earlier-emphasized ‘patient’ approach.

- To the extent that US equities have rallied to fresh all-time highs, we think that much of the recent good news (trade ‘truce’ back in play, a ‘dovish’ Fed likely to cut rates, decent Q1 results) has already been priced-in. It is hard to see catalysts that would help sustain a rally in US equities from here. In fact, a higher probability of further GDP downgrades will inadvertently exacerbate EPS estimates to the extent that this may impact markets quite significantly. As such, keeping a close eye on Q2 results will be key, and if we see a quarter of earnings contraction alongside GDP downgrades, that will be very negative for US markets.

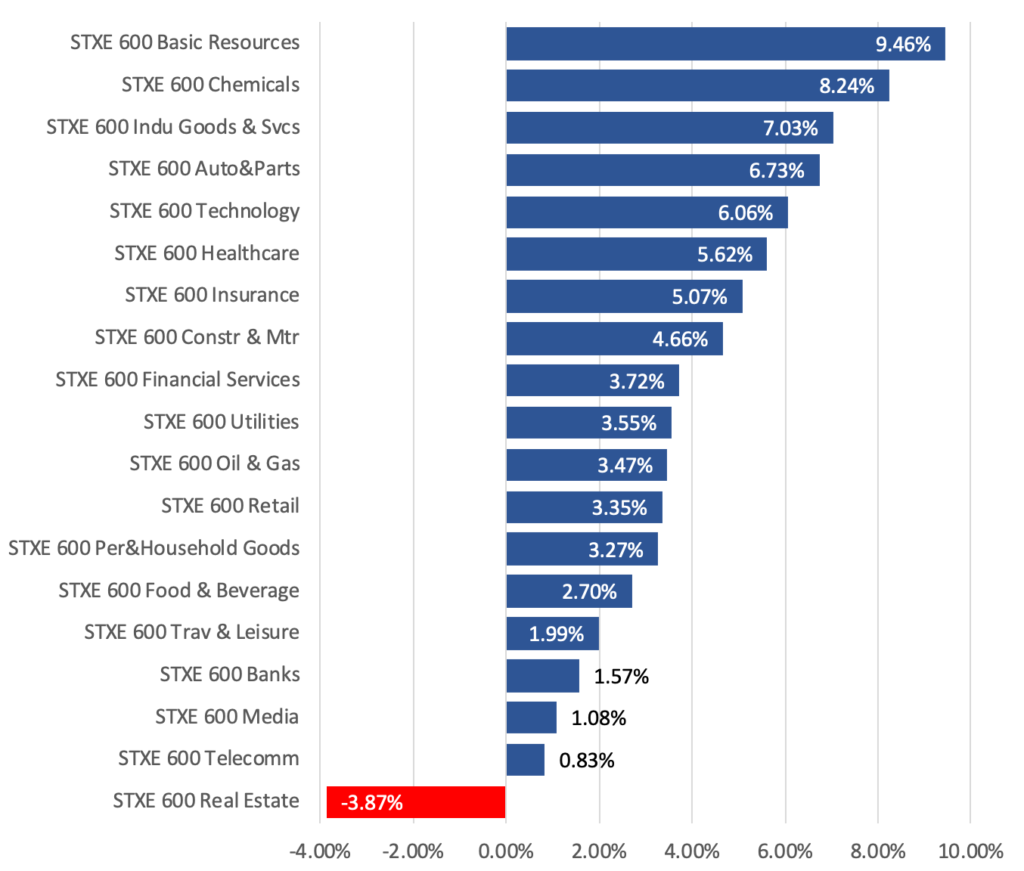

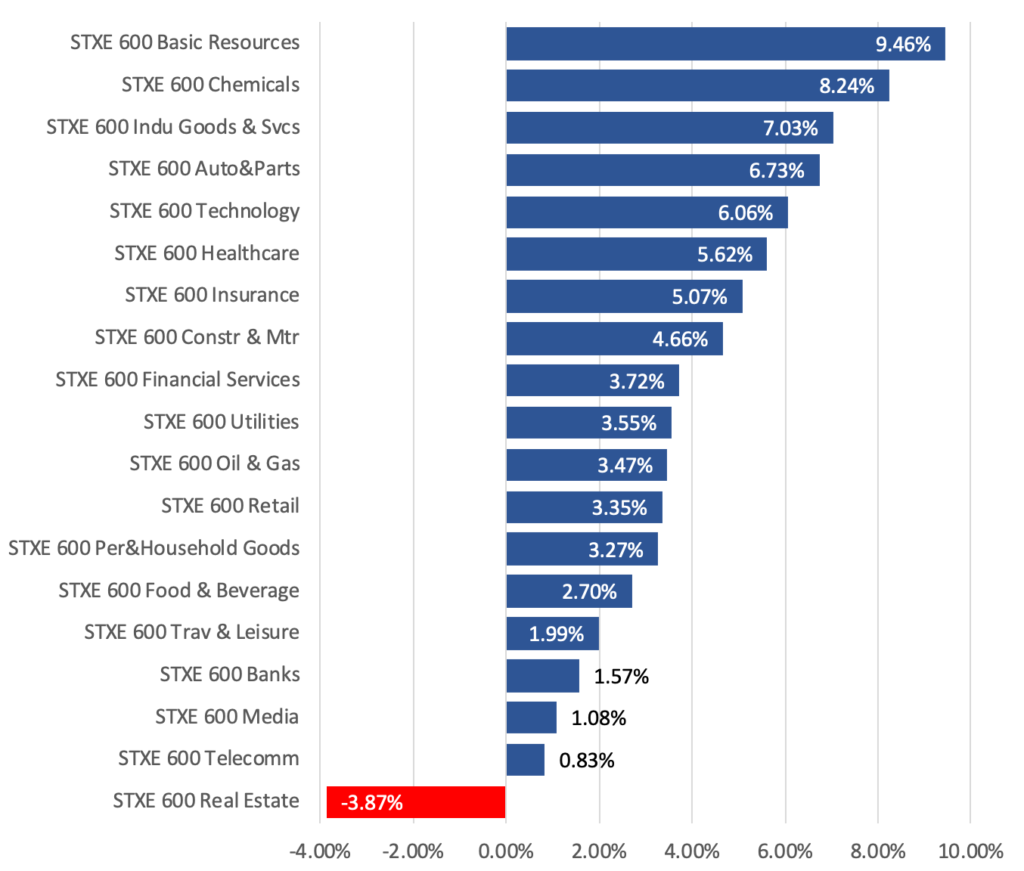

- The Stoxx 600 (+4.28% MoM) gained likewise, seeing broad-based gains across all sectors with the exception of Real Estate (-3.87% MoM). Basic Resources (+9.46% MoM) and Chemicals (+8.24% MoM) outperformed significantly, while Banks (+1.57% MoM) and defensives lagged (Figure 4).

Figure 4: Stoxx 600 Sector Performance Source: Bloomberg

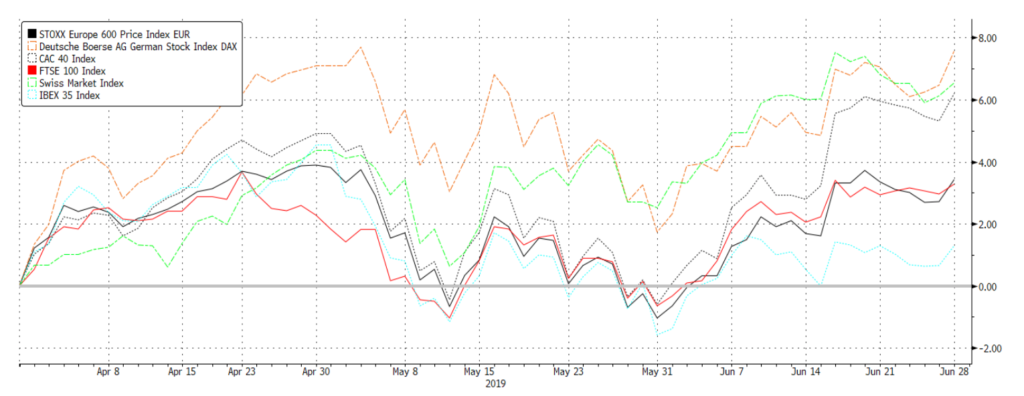

- This quarter, the index managed a slight 1.52% QoQ gain though performance varied significantly. The German DAX (+7.57% QoQ), Swiss Market Index (+4.44% QoQ) and France’s CAC 40 (+3.52% QoQ) lead the broader market, while Spain’s IBEX (-0.45% QoQ) underperformed significantly (Figure 5).

Figure 5: Regional indices performance Source: Bloomberg

- Economic data in this region has been weak so far this year, and has not shown any signs of significant improvement in the near-term. This will like weigh on the economic growth in Europe, which will in turn affect the corporate profit cycle in the region. In addition, the region is facing further headwinds in the form of potential trade tariffs from the US. US’s auto tariff threat still hangs in the background, along with the US Trade Representative’s recent proposal to impose tariffs on $4bn worth of European goods, increasing risks of further growth downgrades as supply chains are disrupted.

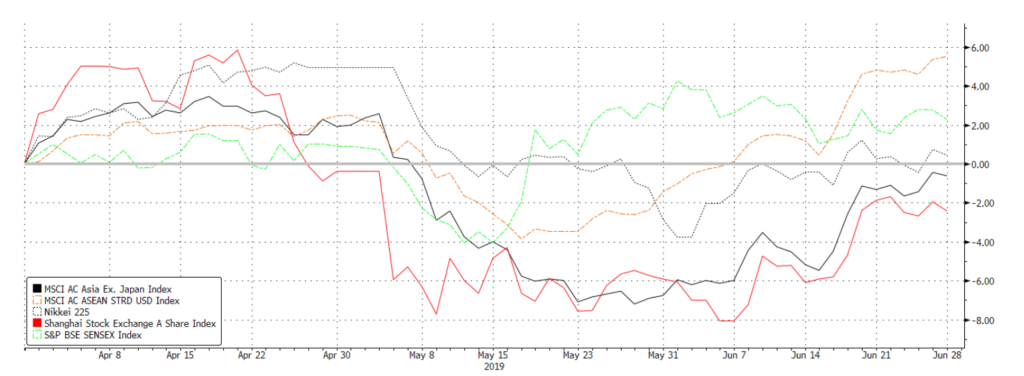

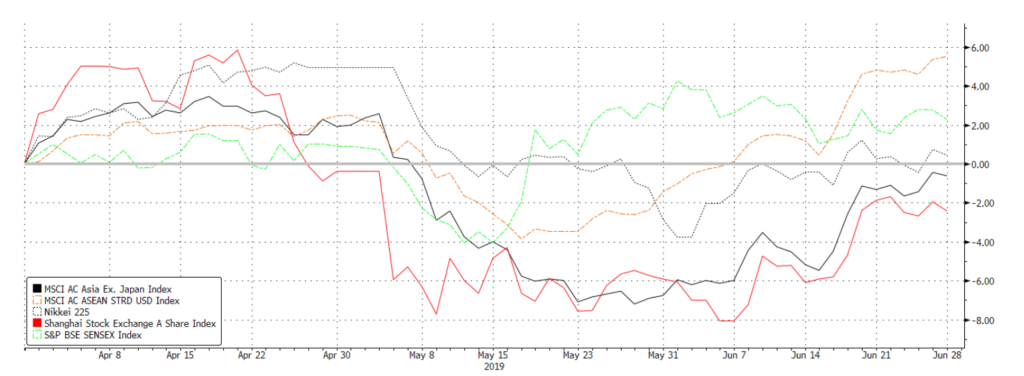

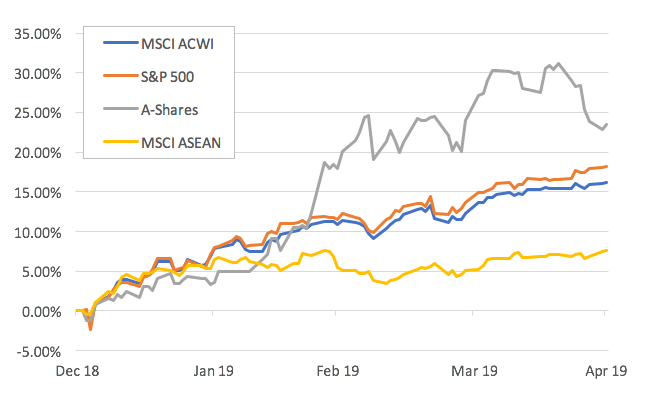

- Asian equities were broadly higher this month, not least helped by the positive rhetoric leading up to and the eventual ‘truce’ that between Trump and Xi during their meeting. This quarter, the MSCI ASEAN (+3.93% QoQ) outperformed, alongside the Sensex (+1.87% QoQ) which came off slightly from its all-time highs logged earlier in the month. China A-shares (-3.62% QoQ) also gave up some its gains from the Q1 rally, though recovering significantly from April and May’s steep decline (Figure 6).

Figure 6: Asian indices performance Source: Bloomberg

- The US-China deal has been undoubtedly positive for Asian equities, fuelling in particular a recovery in Chinese markets over the past week or so. Understandably, this is likely to carry on if trade tensions between the US and China simmer and of course, if the former does not start putting pressure on the rest of APAC to re-negotiate terms. In the longer-term, however, we would caution once more that the substantive, structural issues still remain and there is a reasonable chance that relations between China and the US could deteriorate again, just as it fell apart during the last round of negotiations which many (including us) had thought would have resulted in a far more substantial agreement by this time of the year.

Fixed Income

- Rates were in focus last month as central banks globally expressed dovishness. In addition to dovish statements from the Fed and ECB, BOJ held rates but pledged to continue its bond purchases while widening the purchase range for 1Y to 3Y JGBs to between JPY 250bn and JPY 500bn for July; central banks in Asia mostly held rates constant (except India, which cut its rates by 25bps) but expressed dovishness in response to the Fed’s decision.

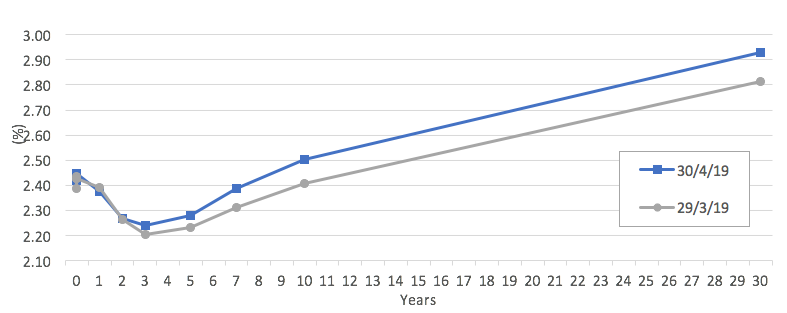

- The UST yield curve shifted lower throughout the month on expectations of a July rate cut, coupled with moderately weak economic data. Shorter duration yields, which are typically more sensitive to policy changes, saw greater falls, causing the curve to steepen. the 10Y UST yield broke below a significant support of 2% intraday for the first time since November ’16. The 10Y yield found support at that level and has been fluctuating around the 2% mark for the rest of the month.

Figure 7: Spread compression pushed overall yields lower Source: Bloomberg

- Credits moved higher in June too, with all sectors ending the month higher. Yields across all sectors fell, mostly from spread tightening (Figure 7). Investors were less cautious in June, as HY debt broadly outperformed IG, with the safer BB debt outperforming the riskier CCC bonds. The Bloomberg Barclays US HY index yield fell below 6% for the first time since April ’18 and saw the biggest MoM fall since January.

- However, the best performing sector in June was EM local currency sovereign debt as investors looked for yield in today’s yield-scarce environment. While the index spread tightened only a mere 4.26bps, a weaker USD in June and the dovish sentiment from central banks in the EM regions helped boost returns in this sector.

- We expect the Fed to cut rates by 25bps later this month as a form of an insurance cut, then pause. Markets are pricing in a 100% probability of a cut this month and it is highly unlikely the Fed will not go ahead, barring some extraordinarily positive June macro data. Whilst there are polarizing views over whether this is the start of a new Fed rate-cut cycle, we do not feel the macro data is sufficiently weak to lead the Fed towards that direction despite some warning of imminent recession as early as H2CY19.

- Lagarde’s nomination could potentially be supportive for European sovereign debt, given how she is seen to be more accommodative and will likely continue the monetary stimulus that Draghi has started. This could place more downward pressure on Bund yields.

FX

- A weak month for the dollar and volatility remains low. Key events, such as the lack of negativity during G20, a trickle of negative and inflated data led markets to experience bouts of volatility but with an emphasis on the lack of directionality.

- The Fed’s comments after June’s FOMC meeting led markets to price in a Fed cut in July. This leads us to shift our base case to a data driven dollar with traders and investors wondering if July will be a ‘one and done’ cut. The DXY fell below its 200DMA of 96.715, a major support level since ‘18, since peaking at a resistance level of 98.30 before recovering to 98.80. We see this recovery as a short bout of strength caused by the lack of negativity from the G20 meeting.

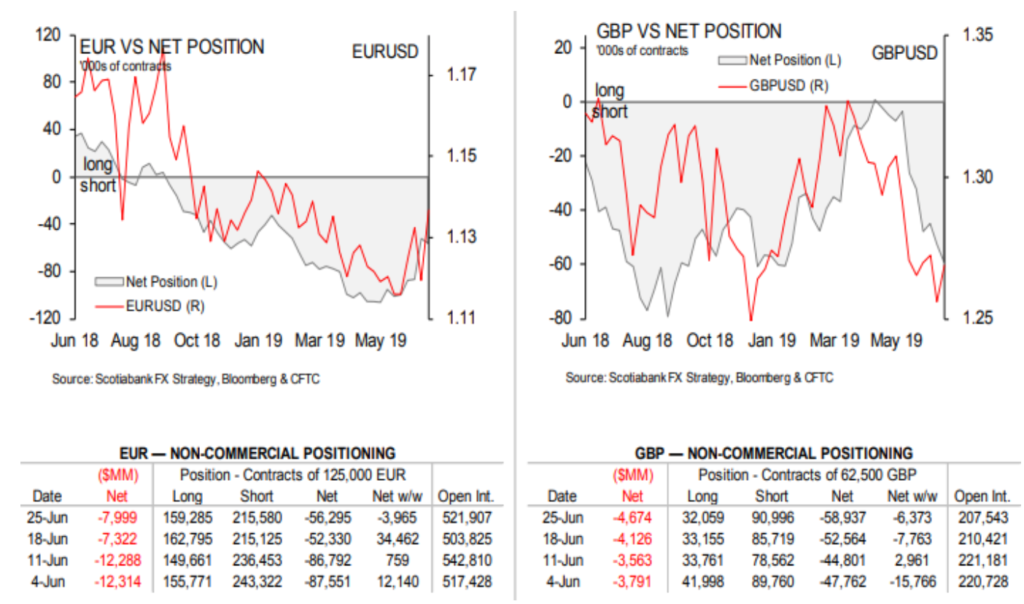

Figure 8: EUR and GBP non-commercial positioning Source: Scotiabank, Bloomberg, CFTC

- CFTC reports showed shorts decreasing rapidly in the EUR (Figure 8). The currency finished stronger in June against the USD, with traders adopting a positive view towards the ECB, relative to the Fed. ECB’s election of Lagarde also came as a healthy surprise to the market.

- Haven currencies also saw a dramatic reversal in shorts, with JPY being net long at the end of June among both retail and institutional traders. JPY gained significantly throughout June. We attribute the bulk of JPY’s strength to dollar weakness and haven attributes. However, the significant data that Japan reported, such as its Tankan survey as well as overall industrial production painted a much more negative outlook for future data. CHF also followed suit, drastically decreasing in shorts.

- Our views for Q3 will be based off yield directionality, CFTC sentiments, as well as economic data. These factors might point to a weaker dollar, but we think the USD will be supported by relative weakness in its major counterparts like EUR and GBP.

- Markets might move JPY higher if there are any potential trade tensions in the near-term, given its status as a haven currency, given that the net longs we have seen in CFTC reports. However, we remain sceptical of the fundamentals behind that shift as a worsening trade war will adversely affect Japan’s economy, notwithstanding the risks of auto tariffs still hanging in the background.

Commodities

- Oil picked up from May’s drop of US$73.60/bbl to US$62.30/bbl, boosted by two significant events: (1) Heightened tension between the US and Iran, and (2) OPEC+’s extension of its 1.2mbpd production cut to March ’20. Till mid-June, Brent ranged from US$65.00/bbl and found support at US$60.80/bbl as the International Energy Agency released its monthly report for June. Key takeaways from the report are (1) Global demand will slow by 0.1mbpd from May’s report; (2) ‘20 estimates non-OPEC production to be up 2.26mbpd; (3) OPEC crude production down 0.23mbpd, due to Iran production. CFTC reports showed WoW positions becoming net positive from the week of 18th June and onwards (Figure 9).

Figure 9: WTI non-commercial positioning Source: Scotiabank, Bloomberg, CFTC

Figure 9: WTI non-commercial positioning Source: Scotiabank, Bloomberg, CFTC

- We currently see a trading range for oil between US$60.80/bbl – US$68.00/bbl. We base this view on both negative and positive factors cancelling themselves out. OPEC+’s production cuts and Trump’s pressure to drive Iranian production to zero (and potential for tensions to escalate), are stopping oil from breaking below a short-term support of US$60.80/bbl. On the other hand, a slowdown in global demand for oil, as noted by the IEA (due to trade wars) and record production in US shale have been massive headwinds for oil. This stopped oil from advancing past US$67.75/bbl during June.

- Gold surged 9% from US$1306/Oz to a 5-year high of US$1439/Oz before retracing slightly and ending the month US$1409/Oz. The surge reflects perceived dollar weakness from the upcoming Fed cuts in July. On technicals, gold broke above a 5-year long resistance at US$1350/Oz, before continuing higher to US$1439/Oz. It is worth mentioning that as June came to an end, Gold failed to break above US$1439/Oz twice, confirming a resistance level.

- In our view, the outlook for gold will largely depend on dollar directionality. But in the shorter-term, we see buying opportunities should Gold retreat to $1380/Oz, in particular as investors start taking profit on the rally

Jun 13, 2019 | Articles, Global Markets Update

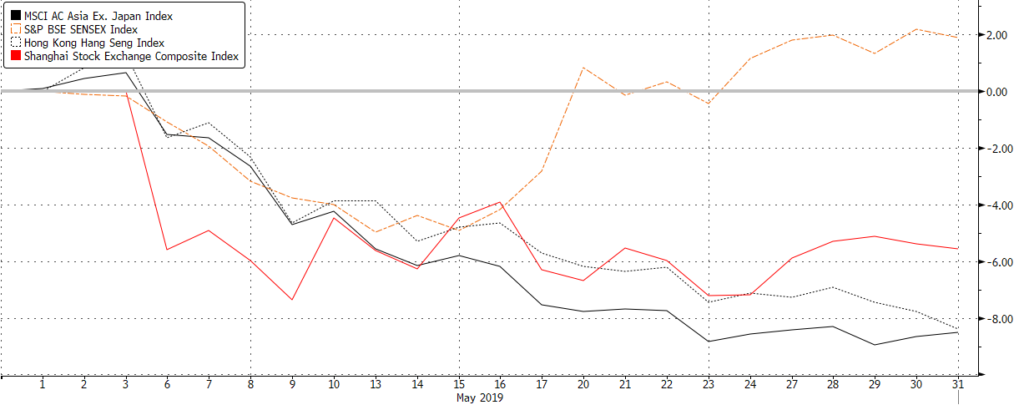

Equities were hit hard last month after sentiment soured after a rapid about-turn on a US-China trade deal that was expected to be signed. The US blamed it on a U-turn by the Chinese leadership that worried the deal, as it stood, might be seen as ‘humiliating’. Unsurprisingly, Asia Pacific (APAC) markets were hard hit with Hong Kong off almost 10%, MSCI Asia ex-Japan (AXJ) -9% and Nikkei 225 -7.5%. The exception was India after the BJP’s surprising landslide victory, which saw Sensex rise 1.75% for the month on the hope this will enable further reform progress. India was not alone in producing a positive election result as Australia, Europe, Indonesia, Philippines, South Africa and Thailand all exceeded expectations and helped equities and currencies. US markets were not spared with trade impacted Nasdaq off -7.9%, notably the semiconductor space, and S&P 500 off -6.6%. A further negative for US technology/social media are concerns around antitrust actions by the regulators that included Facebook, Google, Amazon and Apple.

Risk-off assets rallied with the US Treasury (UST) 10Y yield dropping quickly through the support at 2.30% towards a stronger support at 2.00% and the lowest since September ’17, whilst 10Y German bunds, in part around worries over Italy’s fiscal rectitude, rallied such that the yield fell into unchartered territory below the previous low at -20bps. US high yield (HY) fixed income (FI) belatedly saw spreads widen out by 70bps, led by weakness in CCCs that fell -2.2%. However, AXJ HY FI was resilient, gaining 8bps over May, helped by positive election results and a belief the key sub-sector, China’s real estate developers’ HY FI, would be defensive should a trade war continue as it is a sector that will gain from domestic reflation.

Gold, after being puzzlingly quiet, rallied, along with JPY, later in May with the former breaking through key resistances at $1,300 and $1,320. Apart from the ‘safe haven’ JPY rally, the USD gained 2.5% against CNY that fell from 6.74 to end at 6.90 but tested key support at 6.96 during the month on worsening trade news. Continued Brexit chaos helped sink GBP by over 3% towards YTD lows at 1.26. Oil was the worst performing asset class of all, with Brent oil plunging over 11% to break strong support at $70/brl then $68/brl to head to testing the next support at $60/brl, off a combination of rising US crude inventories, with US producing a record 12.5mn/bpd last month, forecasts of weaker global demand and concern that Russia might seek to increase its production amount at the next OPEC meeting this month.

Equities

-

All three major US indices fell significantly in May, breaking their respective 200DMA support lines although there was some respite in a Fed ‘put’, after FOMC comments were released in early June which saw equity markets make a broader rebound with Powell’s comments helping to alleviate some selling pressure. Energy (-11.70% MoM) stocks were the biggest losers this month, led lower as oil prices fell on the back of concerns over the impact of US tariffs on global growth.

Figure 1: Relative performance of US indices Source: Bloomberg

-

IT (-8.91% MoM) shares also saw a big fall, alongside the Nasdaq (-7.93% MoM) as growth stocks came off and investors fled into safe haven assets. Notably, a big contributor to weakness came from Semiconductor stocks, as the Philadelphia Semiconductor Index (-16.70% MoM) came off sharply from all-time highs after weaker guidance from Q1 earnings reports raised fears that an anticipated 2H19 recovery in the industry could be delayed. This weakness extended over the past week, following antitrust concerns over the reach of Facebook and Amazon which fell -7.50% and -6.11% overnight last week as the news broke (Figure 1)

-

On the geopolitical front, headlines continued to be dominated by trade, first with the ramping up of tariffs on China, then subsequently an announcement on tariffs for all Mexican exports effective June 10th. Thankfully both US and Mexico reached a deal, with Trump removing the tariff threat ‘indefinitely’. He also delayed implementation of tariffs on numerous Chinese exports to 15th June from 1st June to allow exporters to bring their goods into US before the tariff rates are increased.