Oct 9, 2018 | Articles, Global Markets Update

More US Trade tariffs on China, Italy’s debt problem, the Federal Open Market Committee (FOMC) meeting, Liberal Democratic Party (LDP) leadership and Sweden’s election all made September an interesting month for news, but most had a relatively little impact across risk assets over the month.

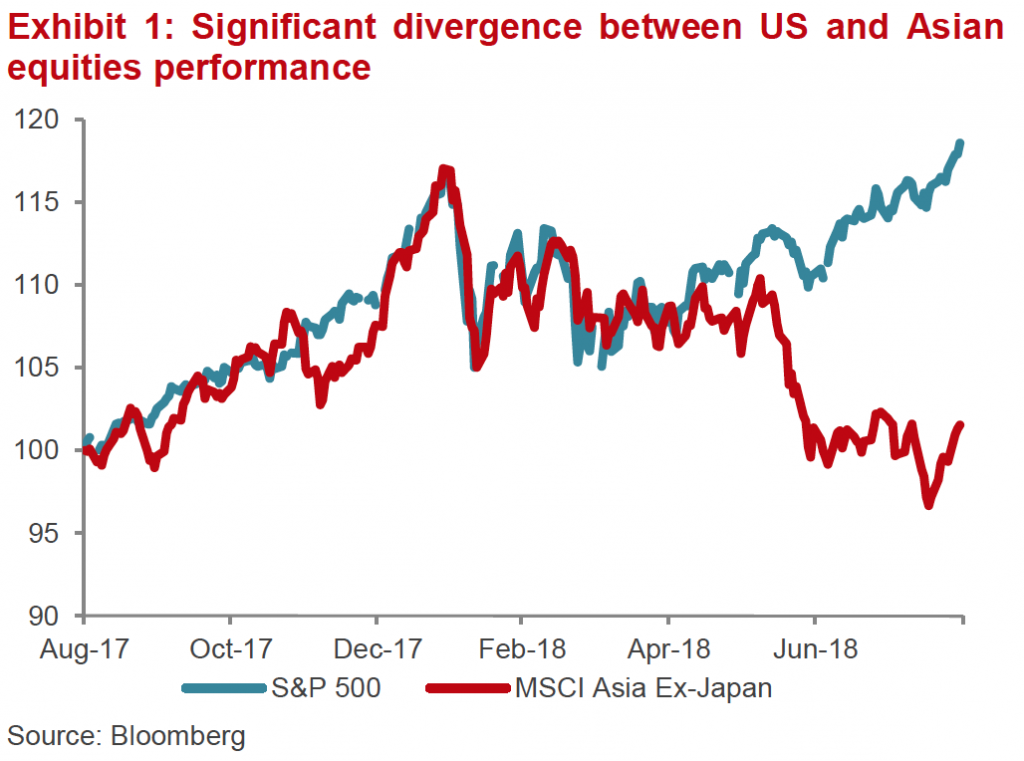

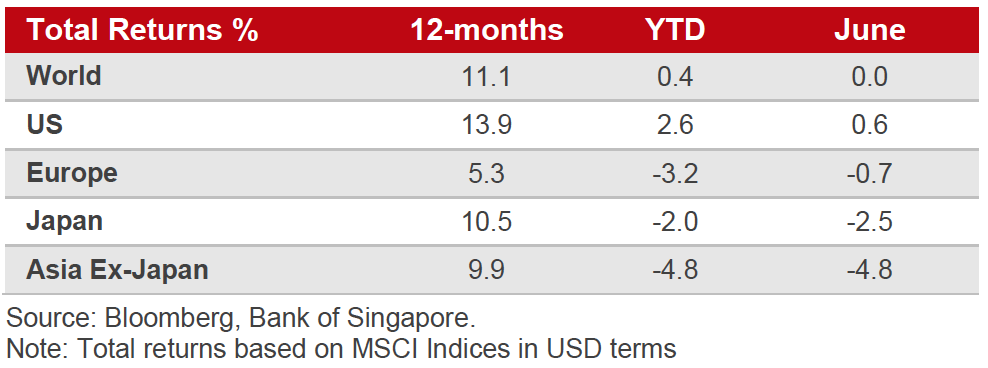

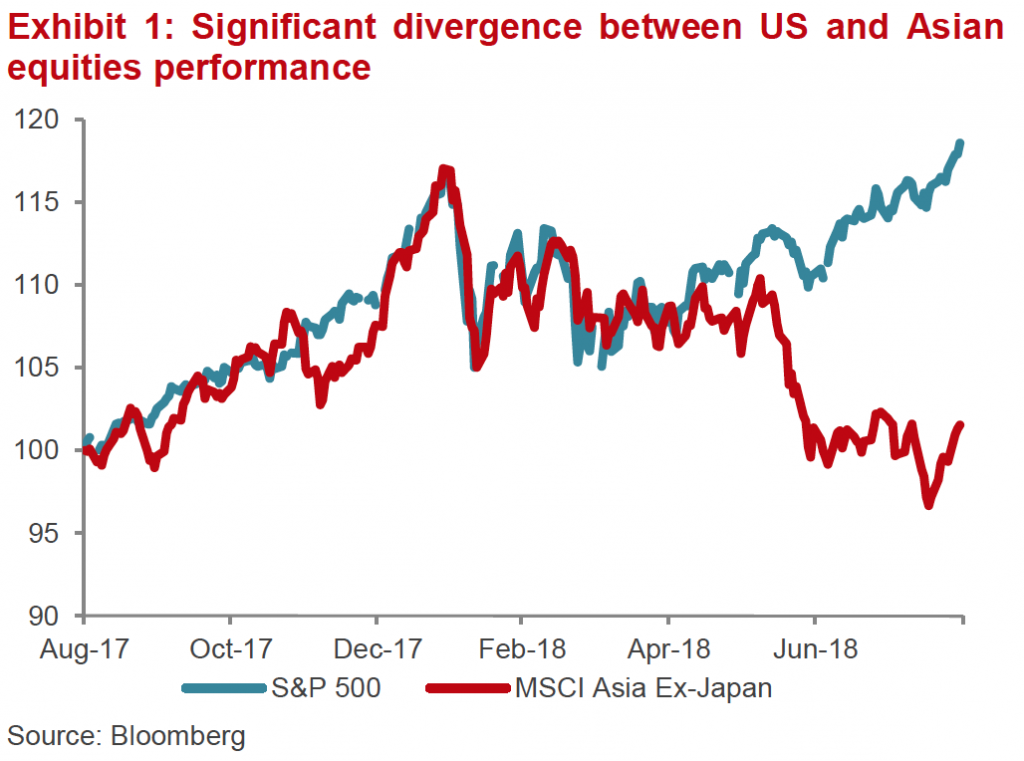

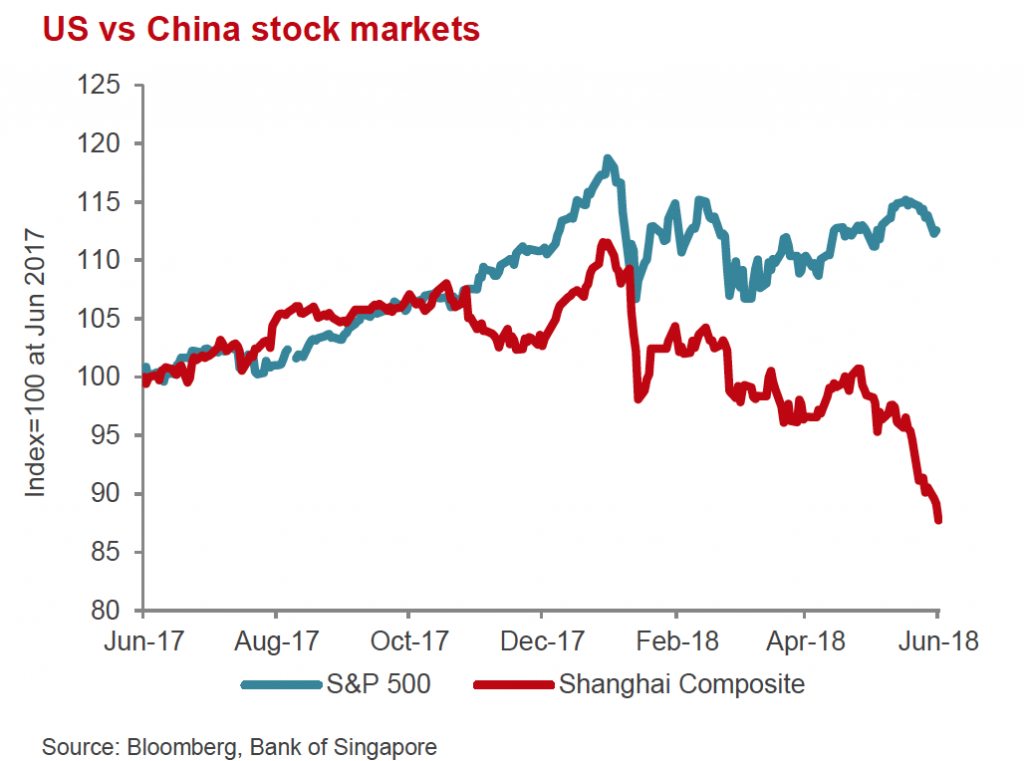

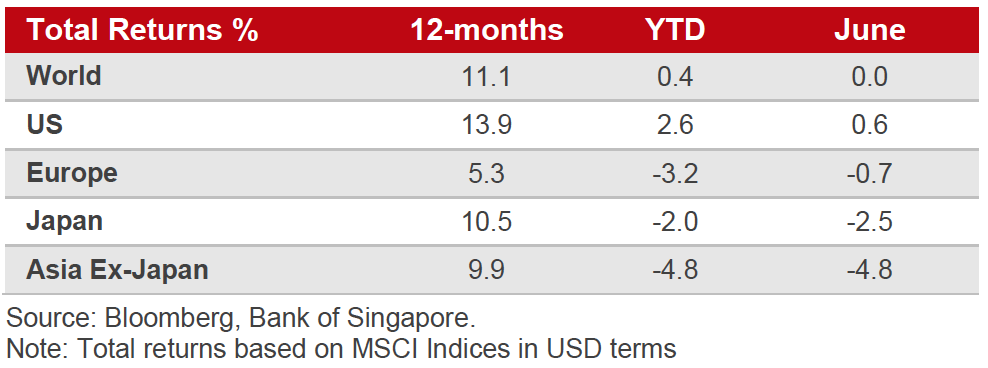

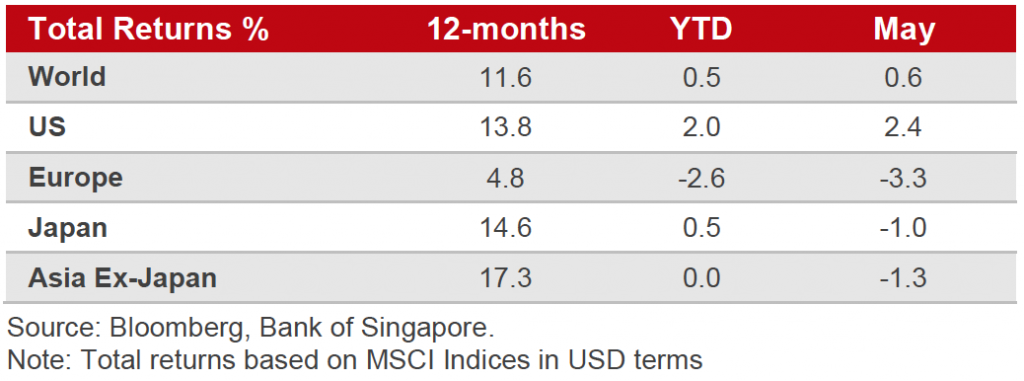

However, there was significant inter-month volatility in some asset classes and currencies. Italy surprised complacent markets by announcing an irresponsible 2019 budget with increased spending that contradicted the European Union’s (EU) requirement that Italy cuts its debt-to-GDP to 60% from its present 130%. Sweden’s election maintained the form seen elsewhere in EU, with populist parties gaining huge ground but not political power – Italy is the exception. In equities, the S&P 500 ground higher but ‘growth-y’ sectors underperformed relative to defensives, as seen by the fact Nasdaq fell 0.8% against S&P 500’s modest gain of 0.4%. Compared to the last quarter, S&P 500’s gain of c. 7% is the best quarterly gain since 2013. Nikkei was a standout, up 5.5% and 8% from the last month and the last quarter respectively. Robust earnings, Abe’s victory in the LDP leadership battle, and a weaker JPY were the main contributors. A-shares recovered further from its recent two-year low by 3.5%, to head towards testing a 3,000 resistance, but Asia-ex Japan (AXJ) was the standout faller, losing 1.6% on trade concerns, earnings downgrades and FX weakness.

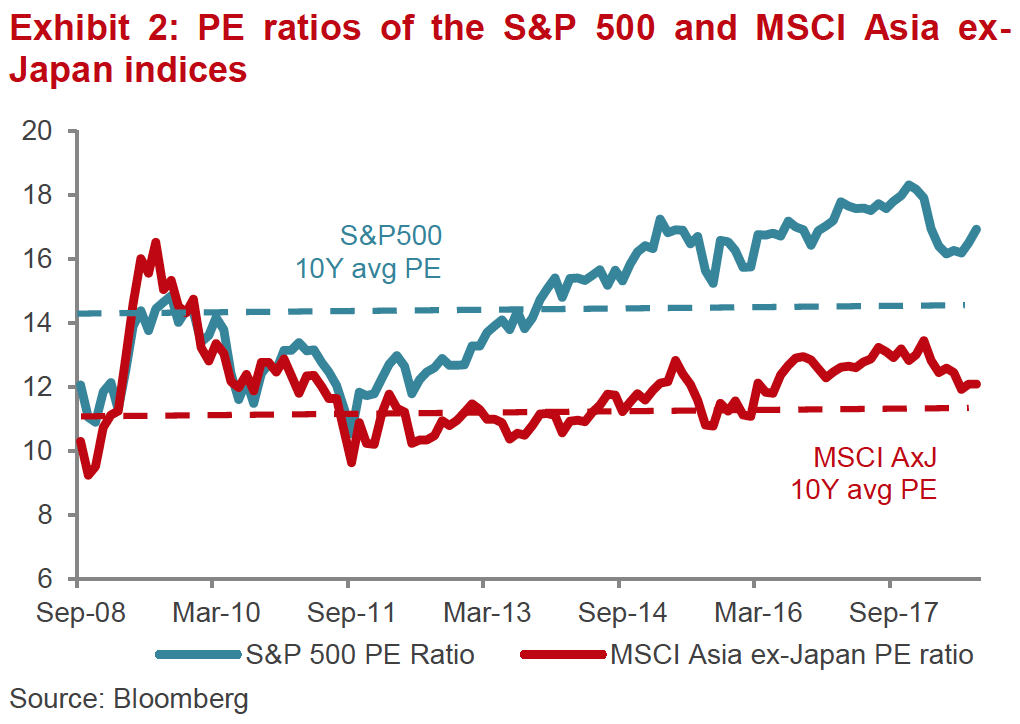

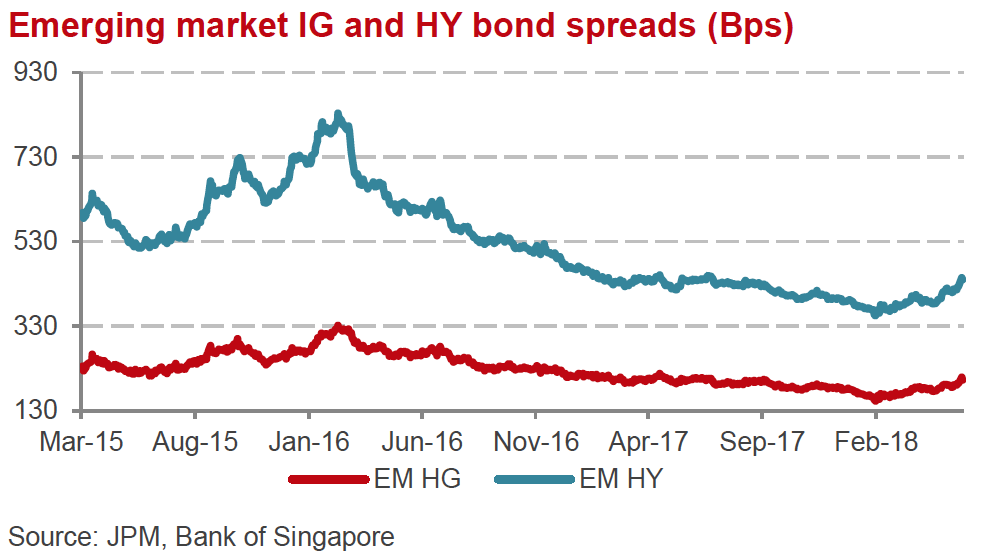

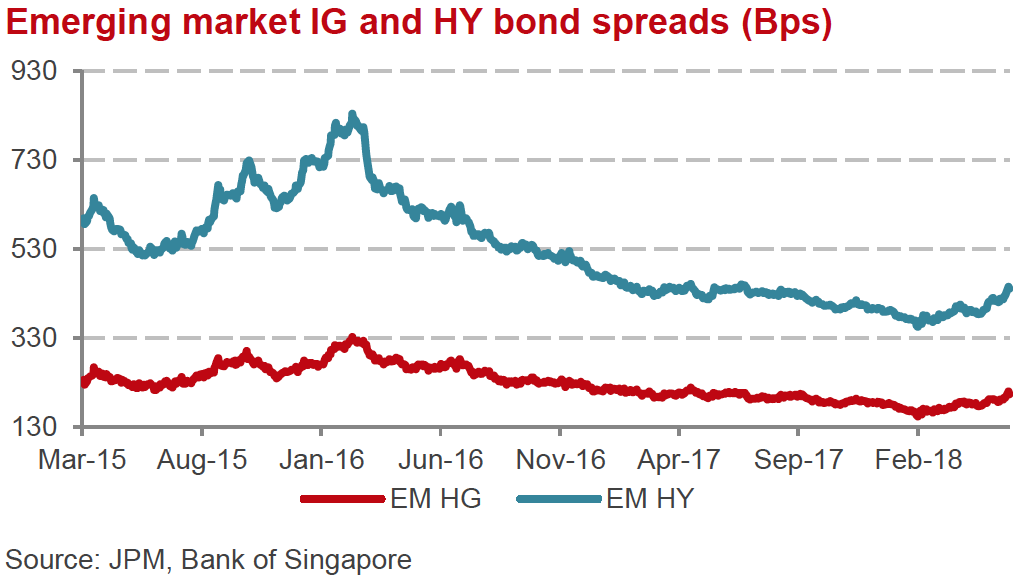

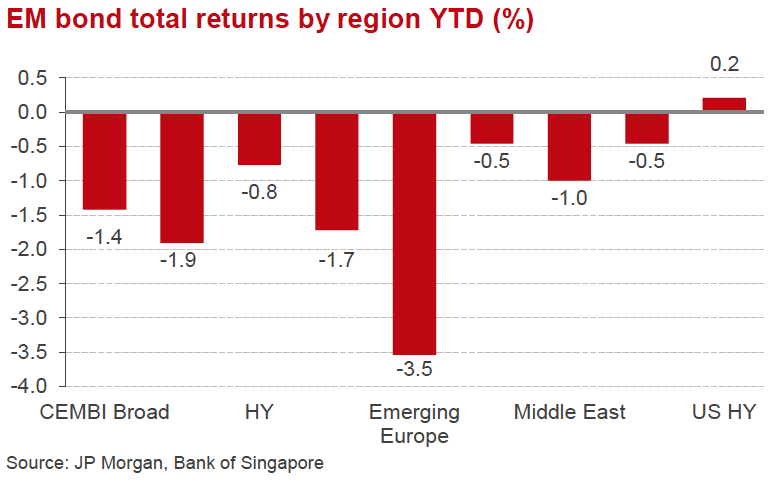

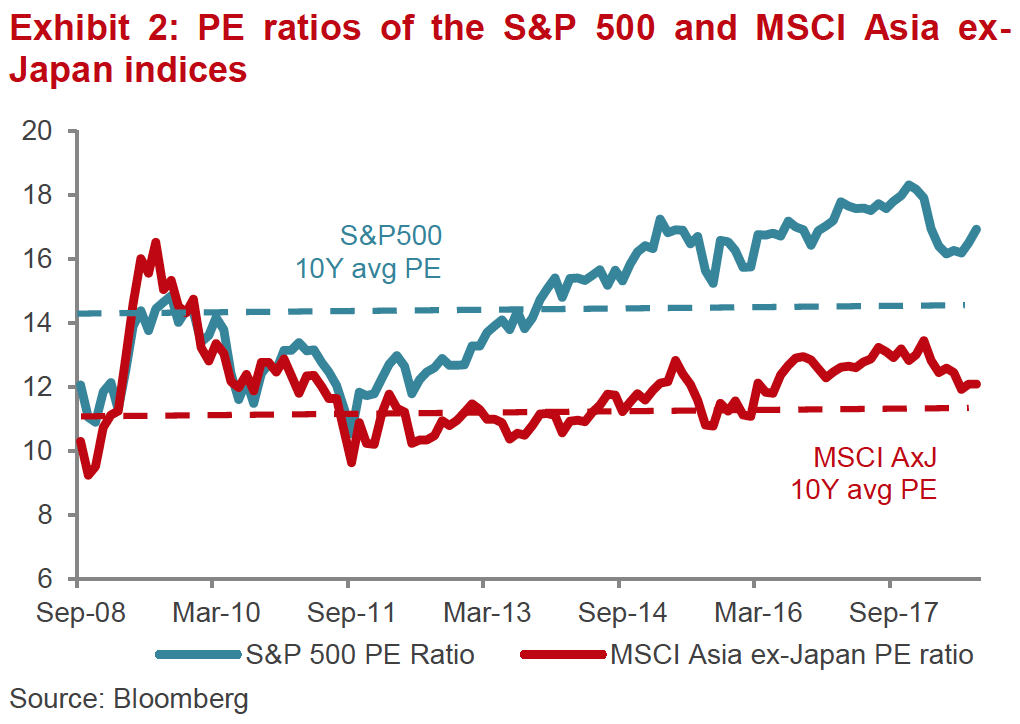

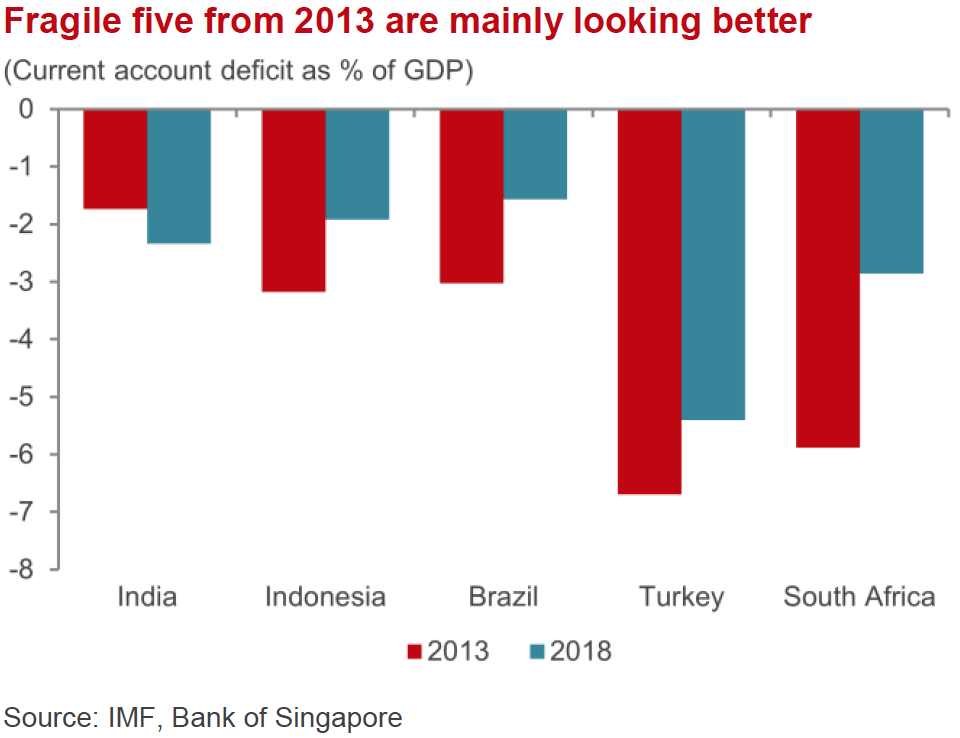

We see the sell-off in Emerging Markets (EM) as an opportunity to switch out of more expensive US equities into AXJ equities and to add to EM local currency debt. We would not rush – trade war escalation could well happen in the short-term – but we fundamentally do not ‘buy’ the EM crisis thesis, do not think US equities have ‘immunity’ to the risks out there that other equity markets have discounted and do not think the world goes into recession. Tactically, in terms of portfolio positioning, we think inaction might be better than action in the short-term given rising geopolitical risks. Poor EM Q3 earnings could well be another catalyst for EM equities to lurch down. In Developed Markets (DM), there is a case to slowly shift exposure in U.S. equities to cheaper European and Japan equities.

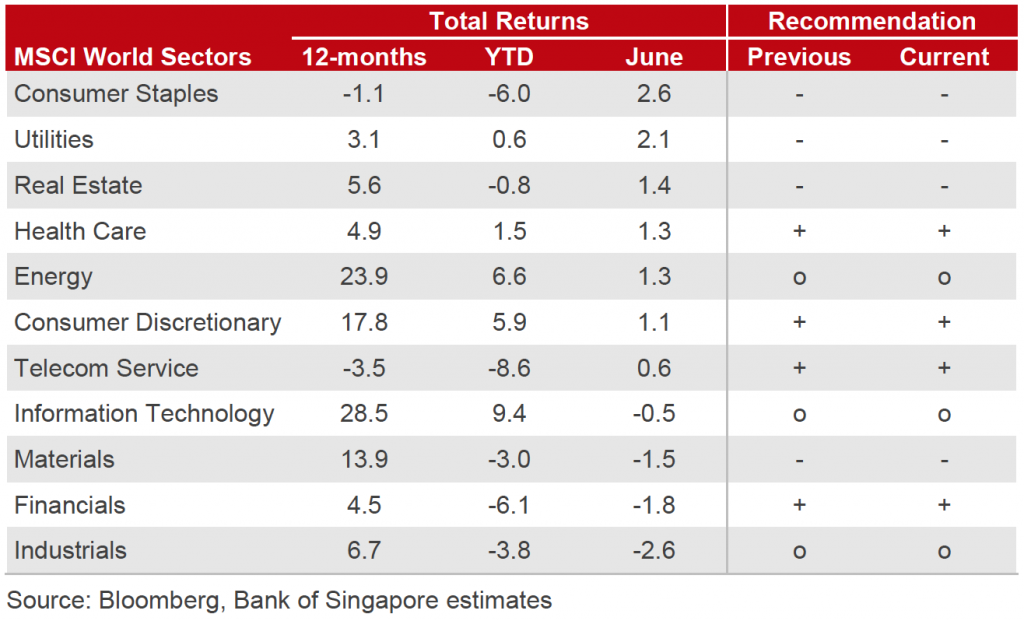

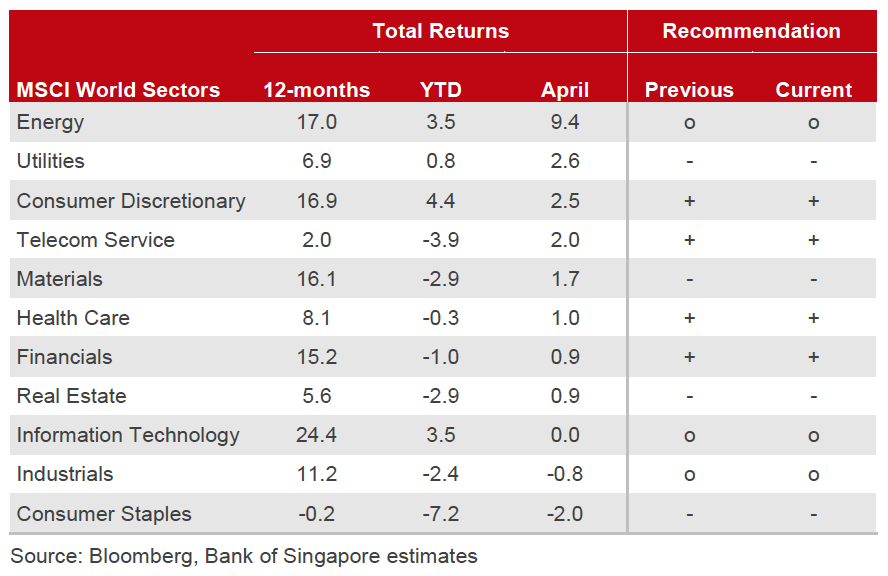

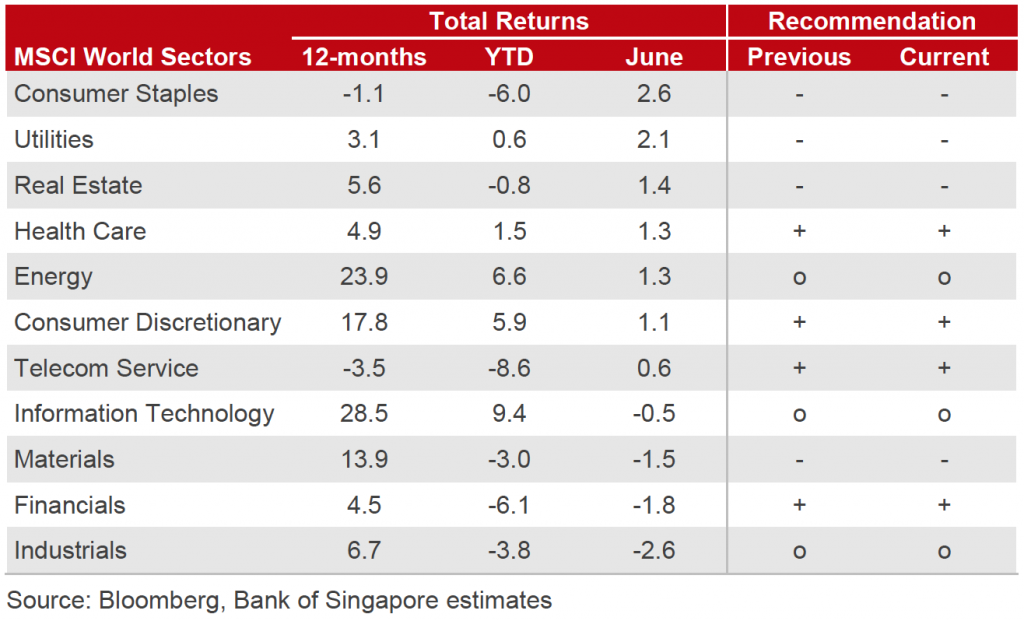

Equities

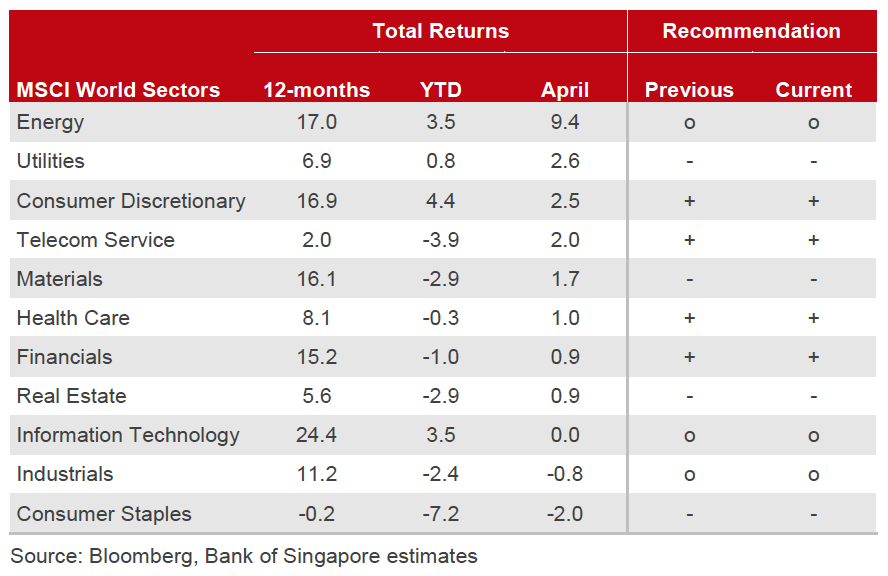

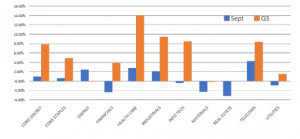

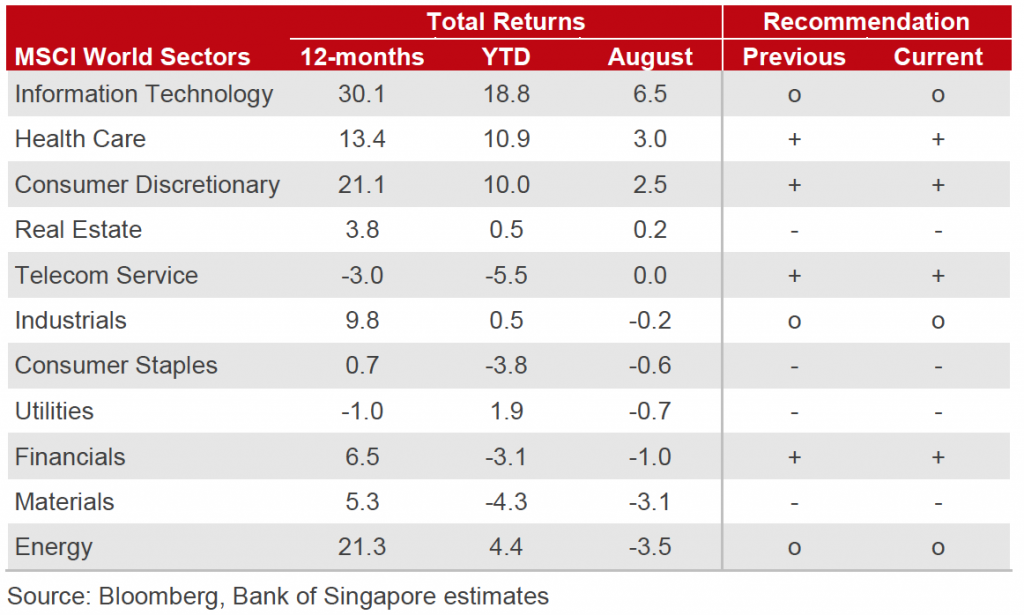

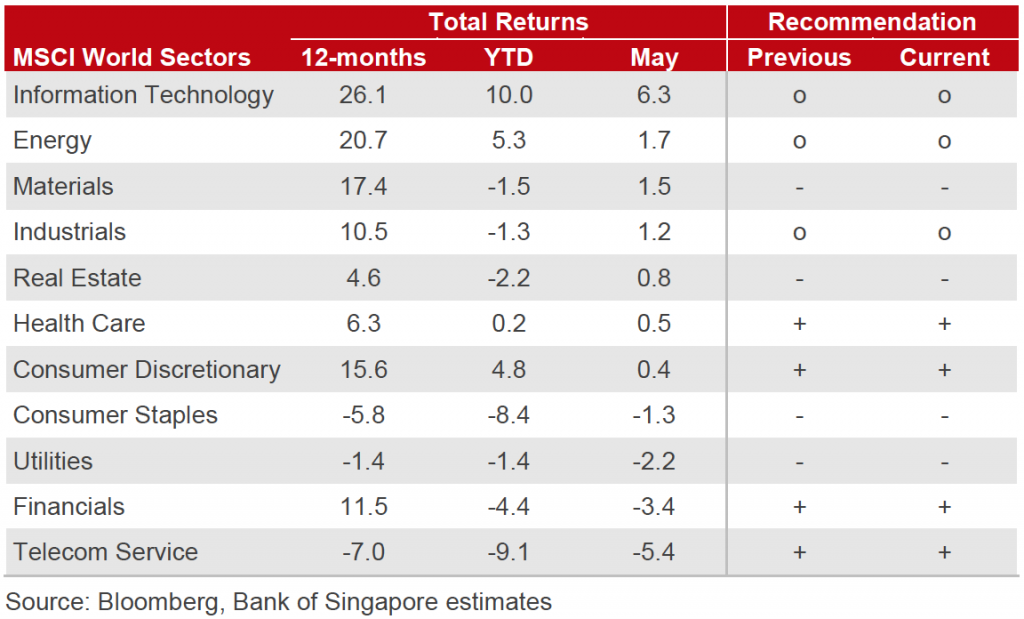

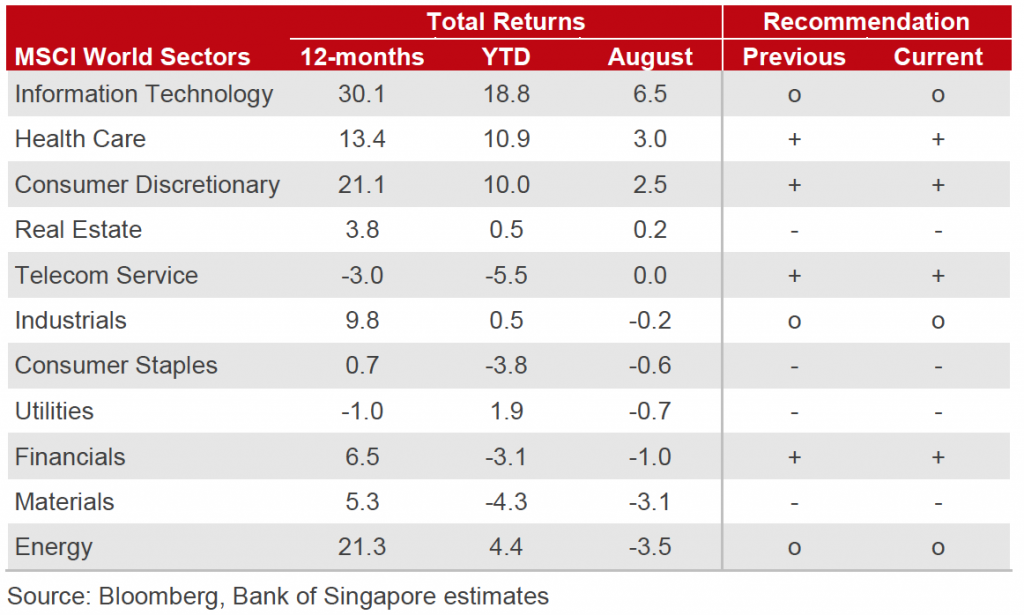

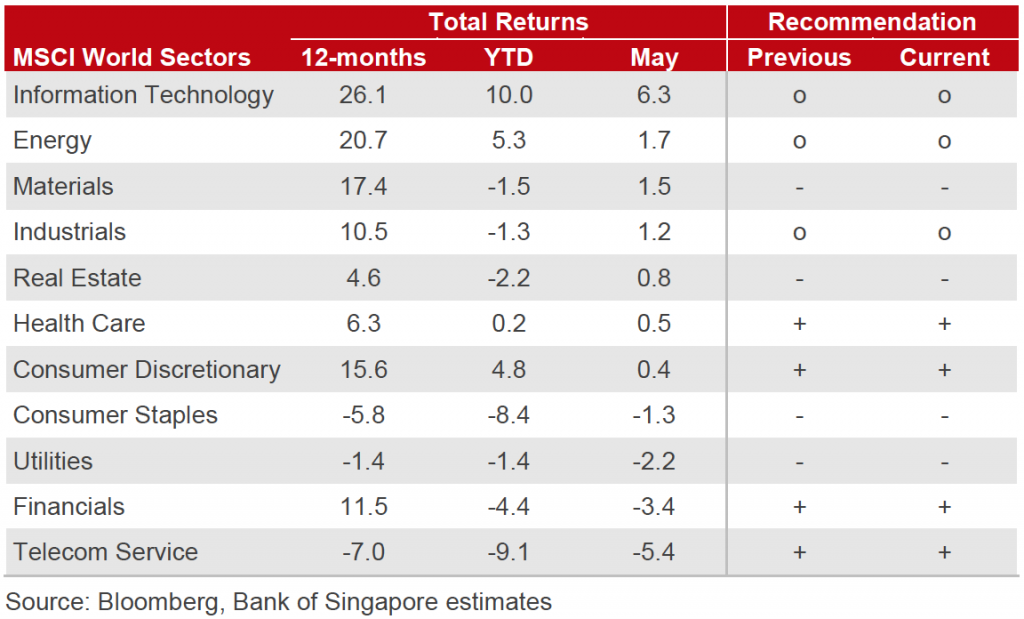

- In the US, we have seen an impressive Q3 as equities benefited from strong Q2 earnings releases, accelerating macroeconomic data and the presumption that U.S. equities offered some ‘immunity’ to trade wars. Sector rotation saw financials, real estate, materials, and utilities all fall while healthcare, telcos, and energy outperformed. Over Q3, the big winner was health care at +14% with energy, materials and real estate all down and financials underperforming along with consumer staples (Fig 1).

Fig 1. Monthly and quarterly performance of SPX sectors Source: Bloomberg

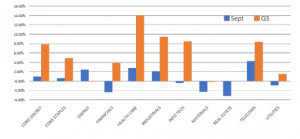

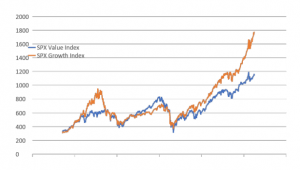

Fig 2. SPX Value vs Growth Source: Bloomberg

- The focus will be on upcoming Q3 results later this month, as late cycle and slowing earnings growth suggests defensive sectors and energy might outperform ‘growth’ and bond ‘proxies’. ‘Value’ stocks are close to record lows against growth (Fig 2) and we are potentially moving into an environment that value tends to do better in.

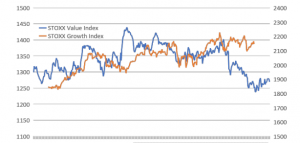

- In the EU, Stoxx and FTSE 100 are being moved around by politics and links to currencies. Italy may weigh on EU assets and Euro this month. 15th is the key date when details on the budget are revealed, and the fear is its spending plans might be multi-year. The EU financial system is inextricably linked to Italy’s fate given its debt pile is the second largest in size and its feeble GDP growth is not sufficient to reduce the debt let alone add to the debt. Our base case remains a compromise between Italy and EU but this might take time given the coalition’s political strength.

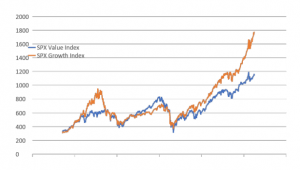

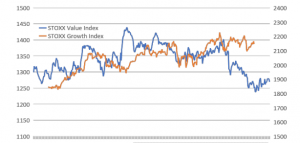

- Morgan Stanley (MS) thinks that European Equities are “unloved, under-owned and undervalued’ and recommends adding to exposures to overweight. Additionally, MS highlighted that value is at record lows to growth (Fig 3) and conditions suit a shift into value. Energy is seen as a late-cycle outperformer too.

Fig 3: STOXX Value vs Growth Source: Bloomberg

- In Asia, we saw the NIKKEI 225 soar almost 8% in Q3 to test multi-decade highs, while China A-shares recovered slightly by 3.5%, back above its support at 2,850 albeit helped by the Chinese government’s moves to reflate the domestic economy to mitigate trade damage from US tariffs, and by PBOC’s trenchant defense of CNY below 6.90.

- Nikkei’s surge may continue into Q4 on further positive earnings revisions, better macro data, and certainty of policy under Abe-Kuroda. China is facing the risk that the US, under Trump, is starting a new cold war of which trade is but one form of confrontation and containment. For Chinese equities, China’s moves to dial-back its aggressive de-leveraging, start to unfreeze the halted WMP sector and stabilize the CNY are all positive steps, but in the short term, Q3 results might be quite disappointing, especially in the consumer related space.

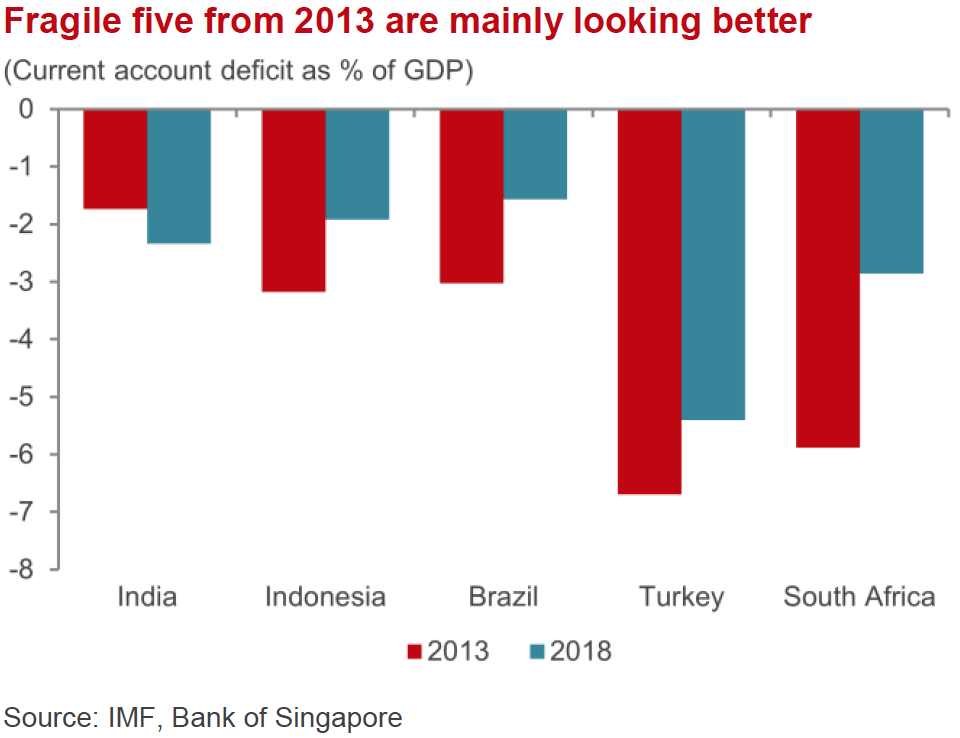

- It seems that in AXJ regions, central banks and governments are taking sensible steps in the face of a severe sell-off in FI and FX by raising interest rates, seeking to slow imports and allowing FX to weaken. In particular India, Indonesia and Philippines are raising rates and letting their currencies crash. This suggests these economies and markets will recover far faster once the pressure lifts, as it surely will, offering good value opportunities for patient investors.

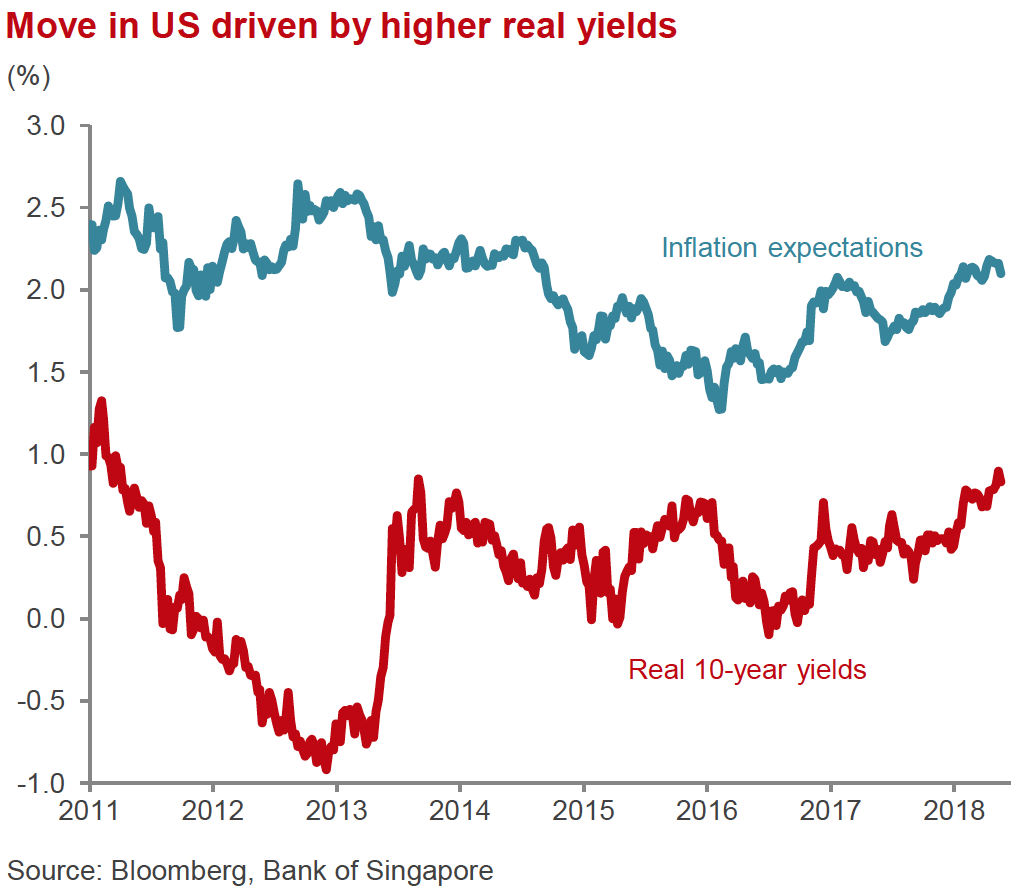

Fixed-Income

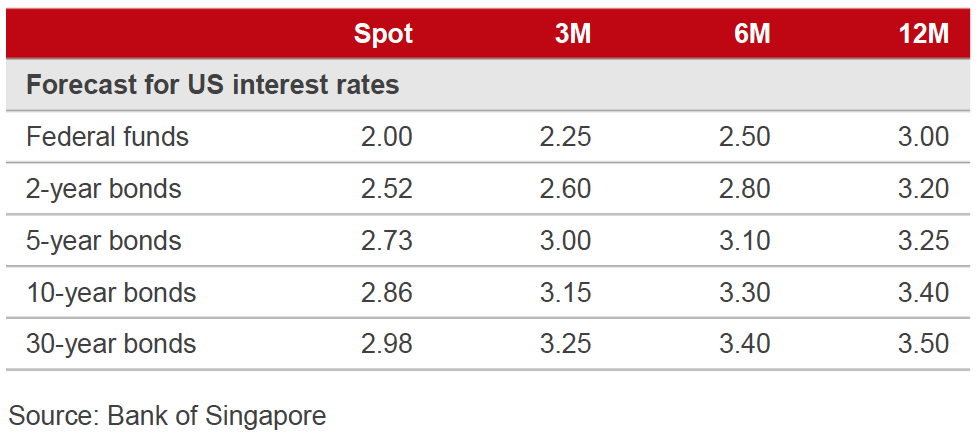

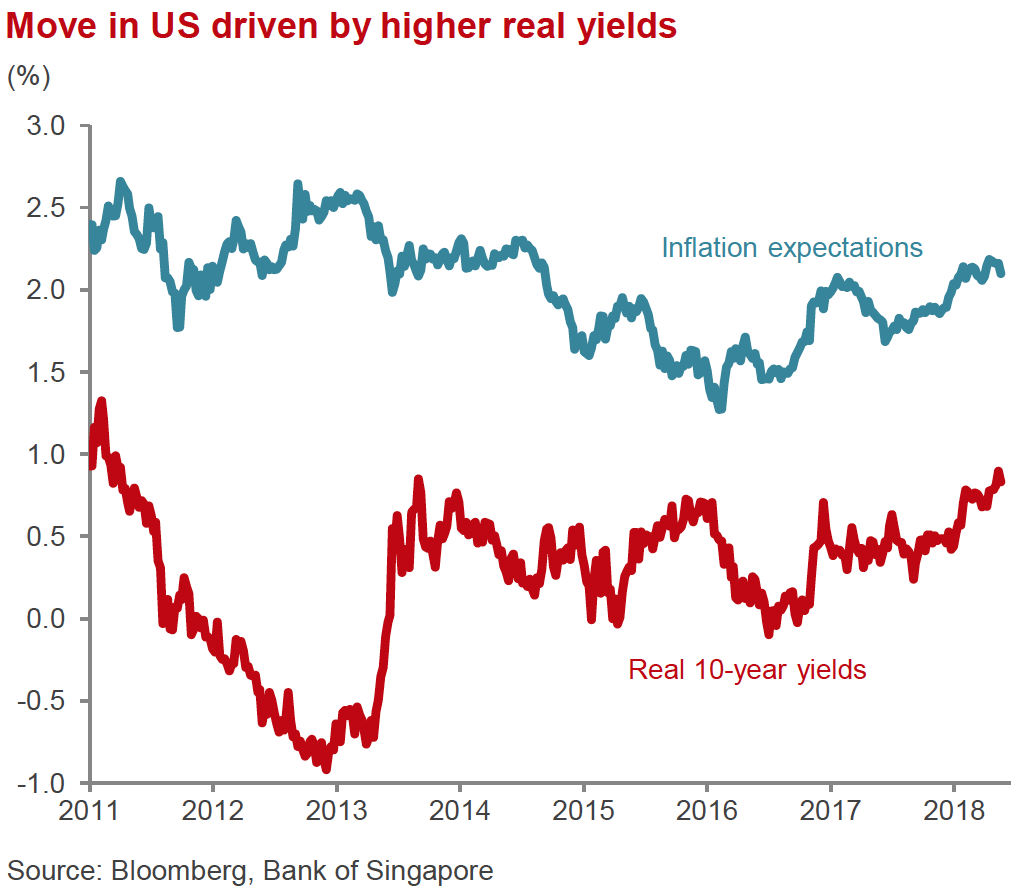

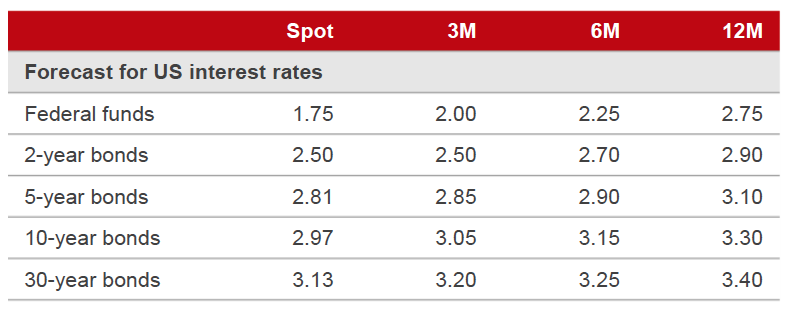

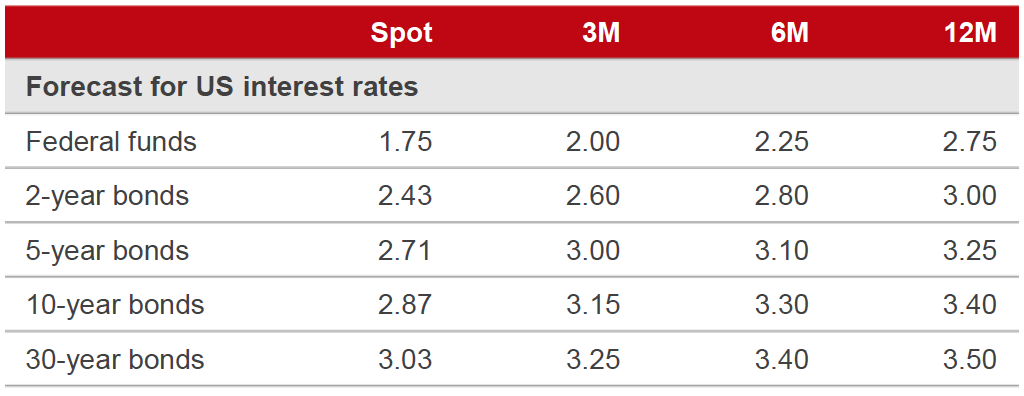

- US Treasury yields broke through a multi-year high (Fig 4), with the 10y yield jumping 11bps to 3.18% after a raft of better-than-expected macro numbers came out last week. The 2Y10Y yield curve has also steepened a little too. Shorts on 10y UST are now at record highs.

Fig 4: UST 10Y yield hits 7Y high. Source: Bloomberg

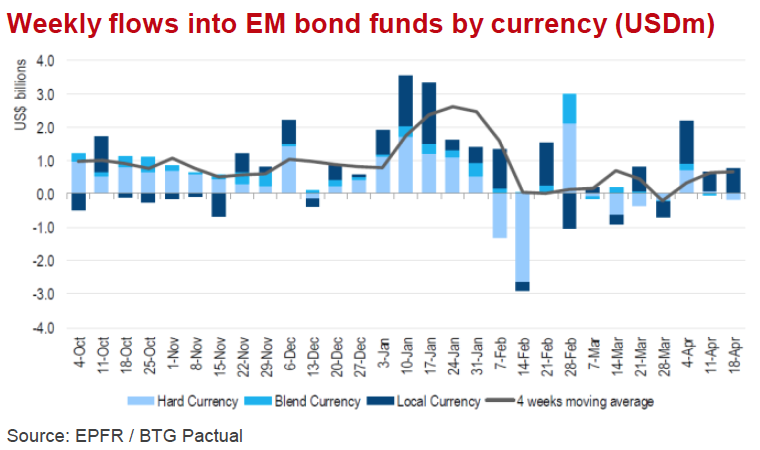

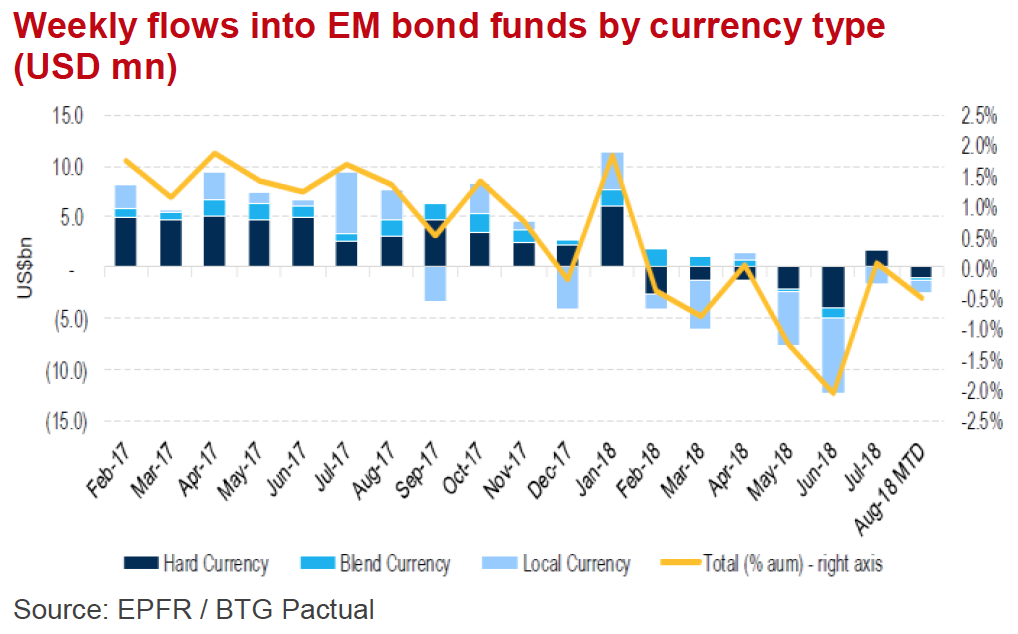

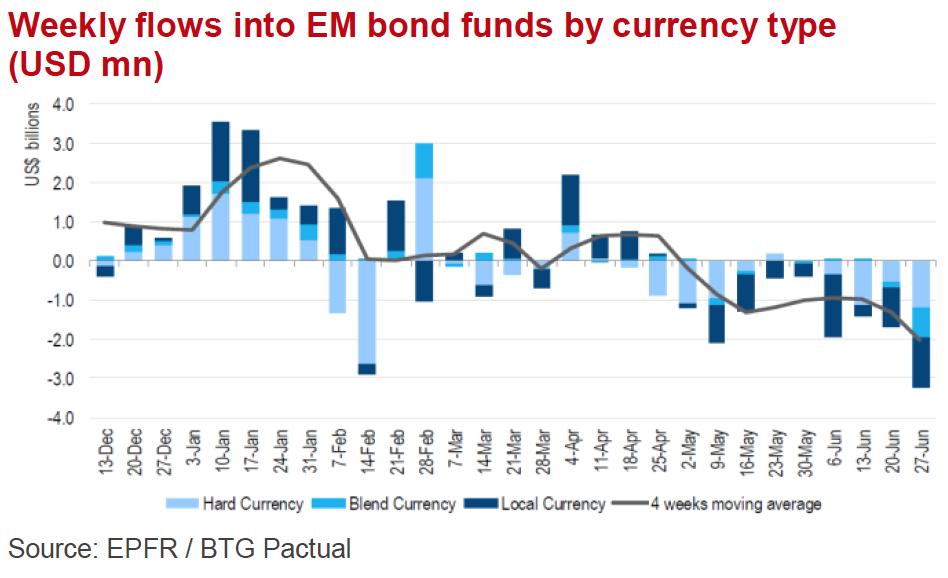

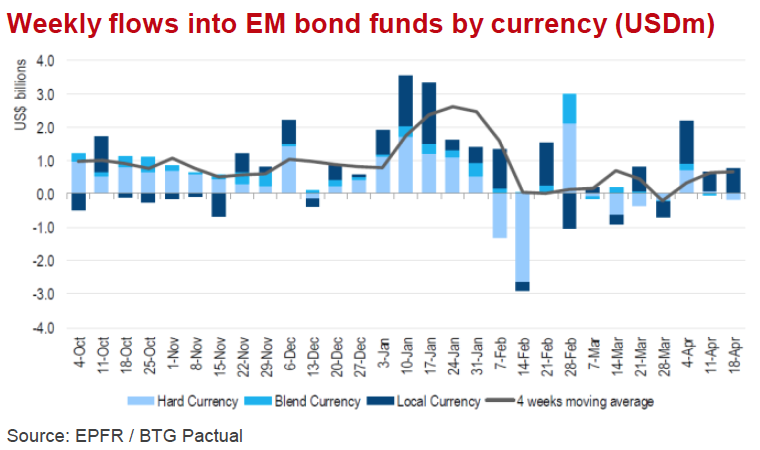

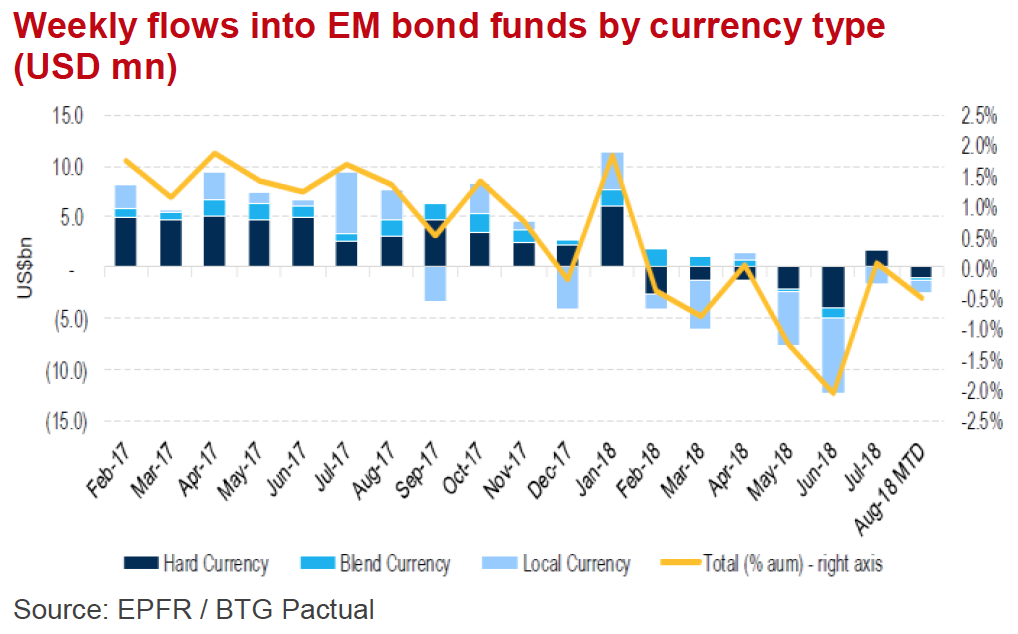

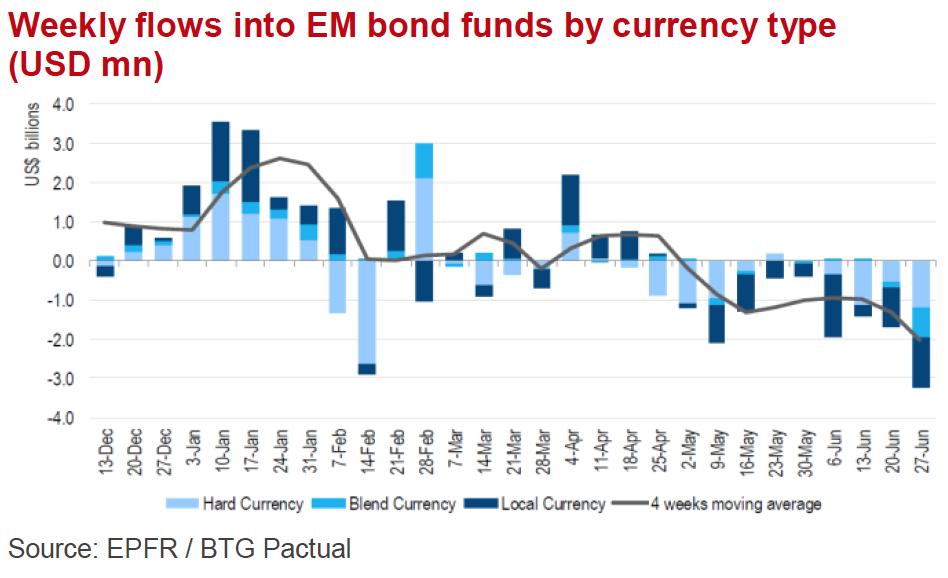

- Whilst there were large outflows from DM government bonds last month (the most since February), EM Fixed-Income saw large inflows for the first time in several months and yields tightened quite sharply. This, despite lurid warnings of the degree corporate debt, has risen in EM since GFC, was obvious the buying was from larger institutions and sovereign wealth funds.

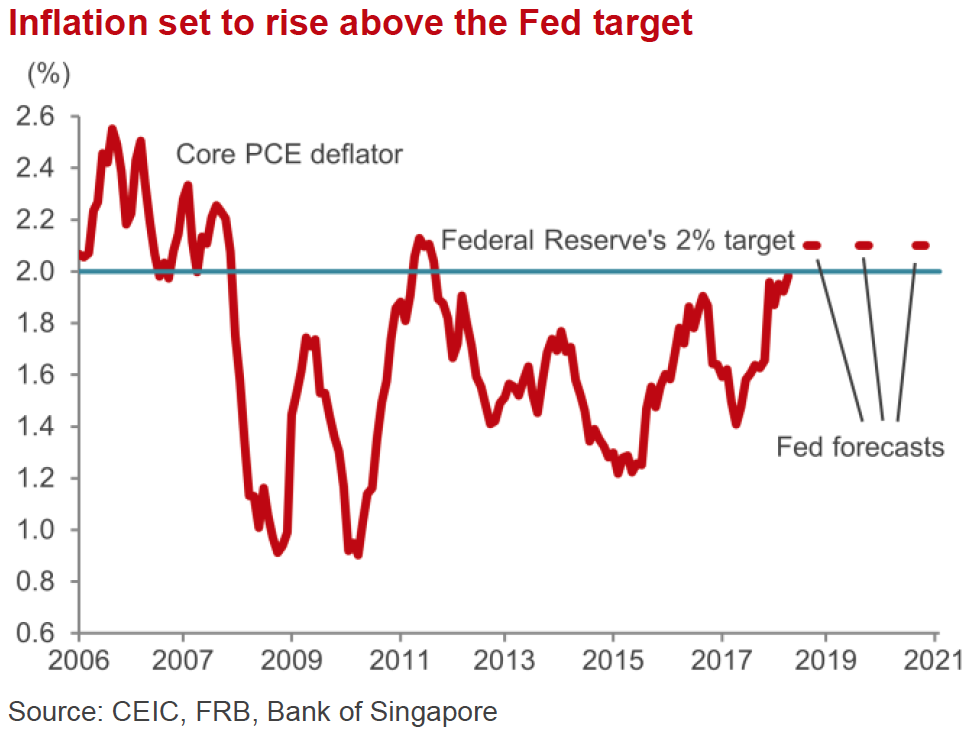

- The debate in where US Treasury yields may go from here is polarised between the bulls and the bears, with both sides having plausible arguments. The argument for higher inflation and a stronger USD assumes the US labor market is tightening to a point where wage inflation must accelerate fast, but that inflation expectations will remain anchored at what are historically unprecedented lows for far longer, is dangerously complacent. Bears think the opposite, and that there is sufficient slack in the labor force, the tick up in inflation is temporary, and the Fed is in danger of over-tightening, which might catalyze the next recession as soon as 2020. No one knows whether US labor markets are tighter than understood or has more slack than realized but we will find out sooner than later.

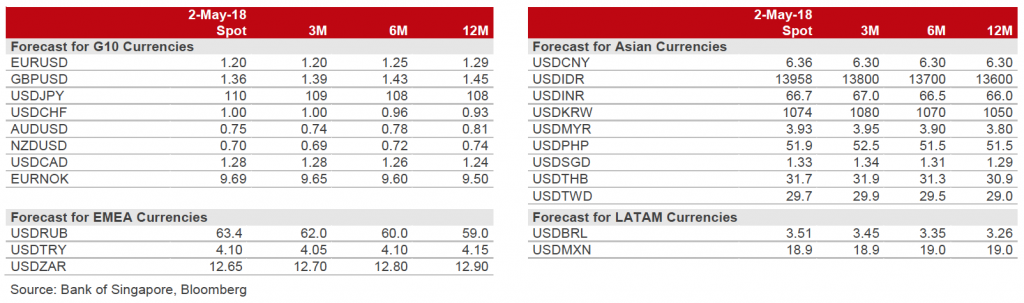

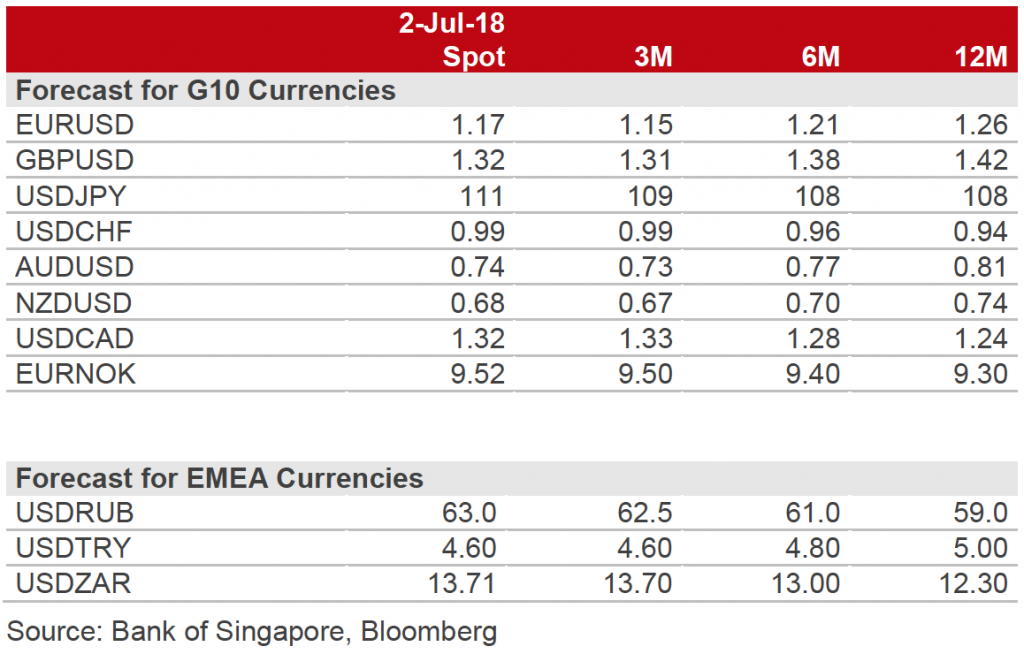

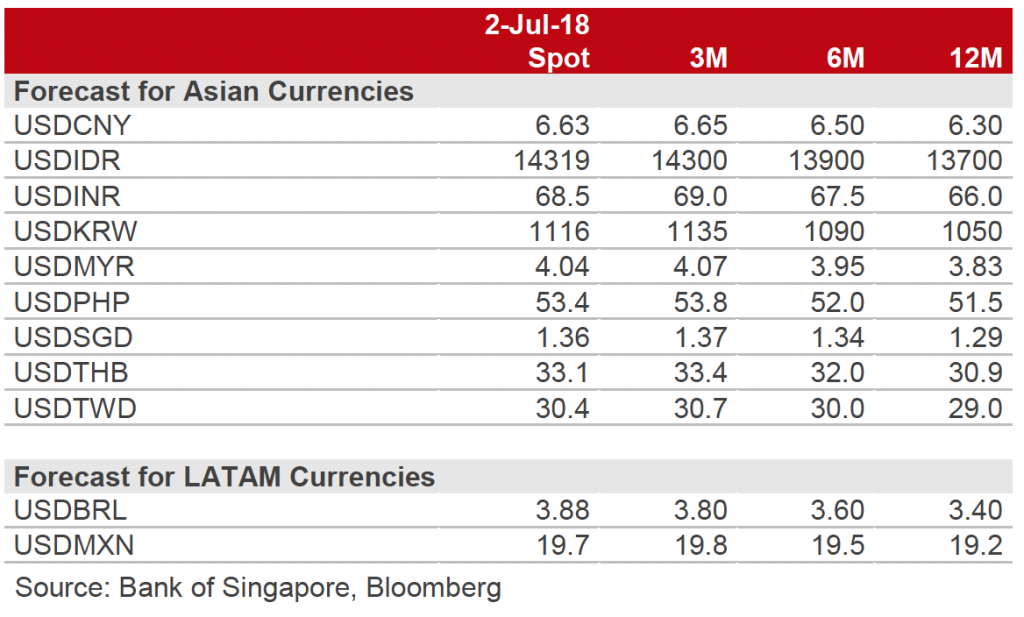

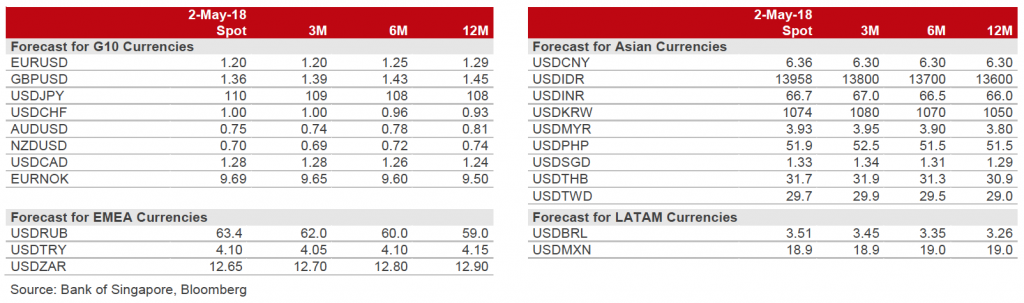

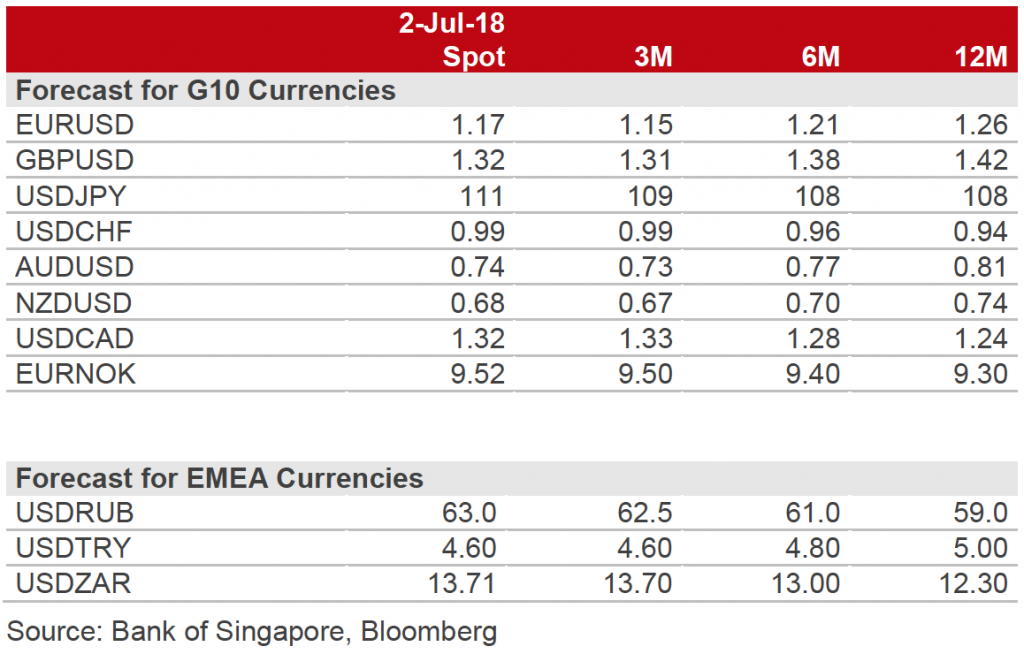

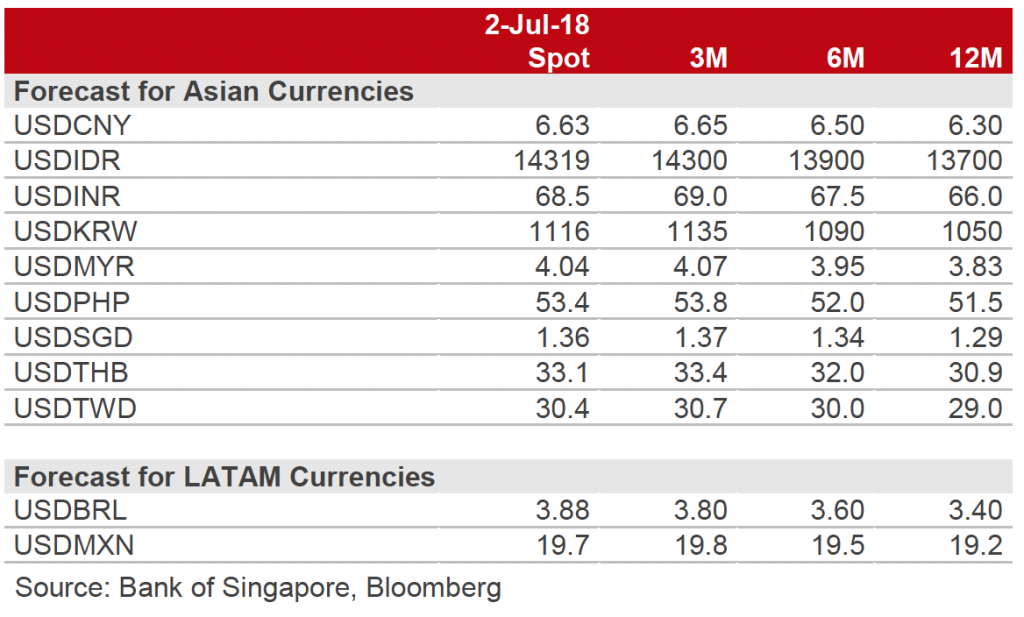

Currencies

- USD DXY fell below a key level at 95 as Draghi’s apparently ‘hawkish’ comments pushed Euro back above its 200DMA just above 1.18 and positive Brexit ‘noise’ helped GBP through 1.32 but this soon evaporated with Italy’s budget quickly unshackling Euro that promptly tested its key YTD support at 1.1515 whilst GBP tumbled back below 1.30 in part from the baleful specter of Boris stalking May in the Conservative party’s corridors of power.

- USD upside to continue for longer appears to be the direction recent FX forecast revisions are going, even if many still see a weaker USD against the EURO and JPY in the medium term. On the face of the evidence, the stronger-than-expected US economy and related Fed rate hikes against weaker data in EU and EM/AXJ and higher UST real yield differential is USD supportive, and there is still a lot of stale USD bears out there to take a contrarian stance against the Dollar.

Commodities

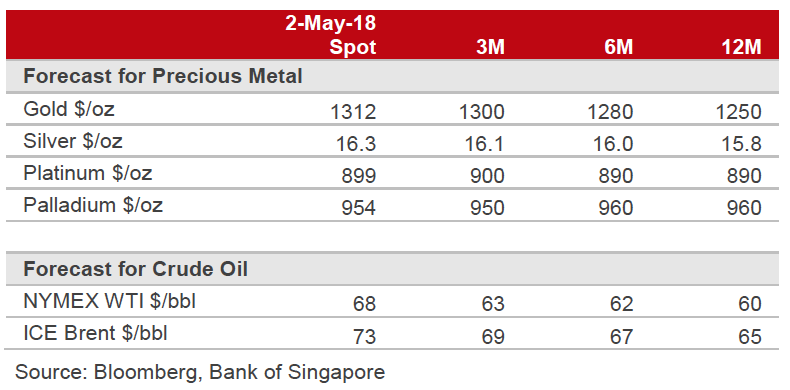

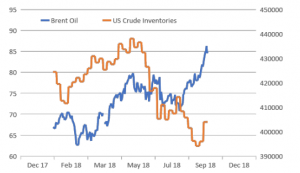

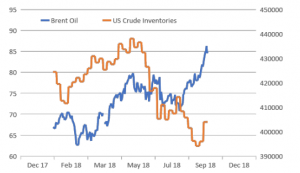

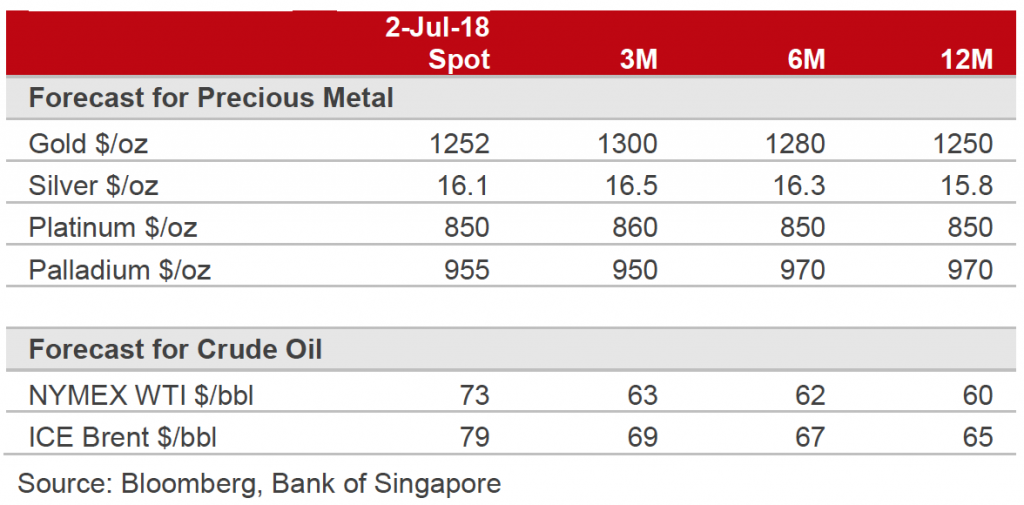

- The Brent Oil price soared 7% last month to $83/brl, and last week moved to YTD highs of over $86/brl despite a huge jump in US crude oil inventories (Fig 5) and a suggestion that Saudi Arabia and Russia might produce more to mitigate the likely supply reduction from Iran after US sanctions start 4th November.

Fig 5: Brent oil price is rising despite a recent jump in US inventories Source: Bloomberg, EIA

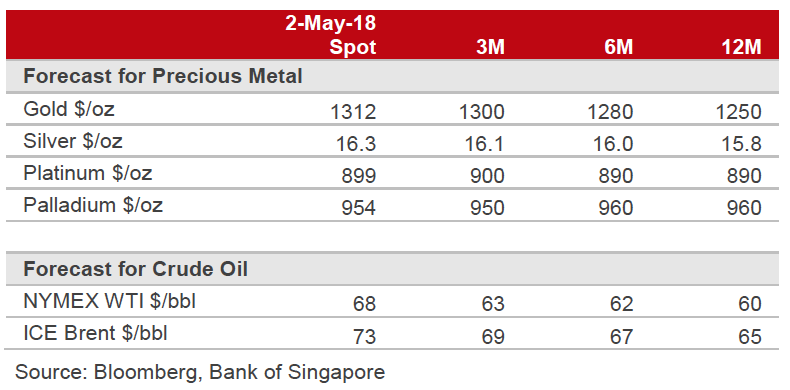

- Gold has traded flat in last month around $1,200/Oz after bouncing from support at $1,150/Oz – a level that saw a surge in physical gold buying by Asians, attracted by a lower cost, and a significant slowdown of speculative investors’ selling. Gold remains a by-product of USD moves, which many appear to prefer as the ‘safer’ haven asset.

- Oil prices will be driven by geopolitical risks – should Iran blockade the strategic Hormuz straits through which 40% of global seaborne oil is transported, we would see prices jump to $100/bpd in the short term. The medium-term too looks to be constructive for oil prices given estimates that demand will rise by 1.5mn/bpd over the next few years yet oil supplies might falter, in part after 60% cuts to oil E&P CapEx between H2CY14-’17. Reforms in the shipping industry to use less polluting fuel mixes will add to demand too. Several houses predict Brent oil at $100/brl by 2020.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at.

Sep 12, 2018 | Articles, Global Markets Update

SEPTEMBER 2018

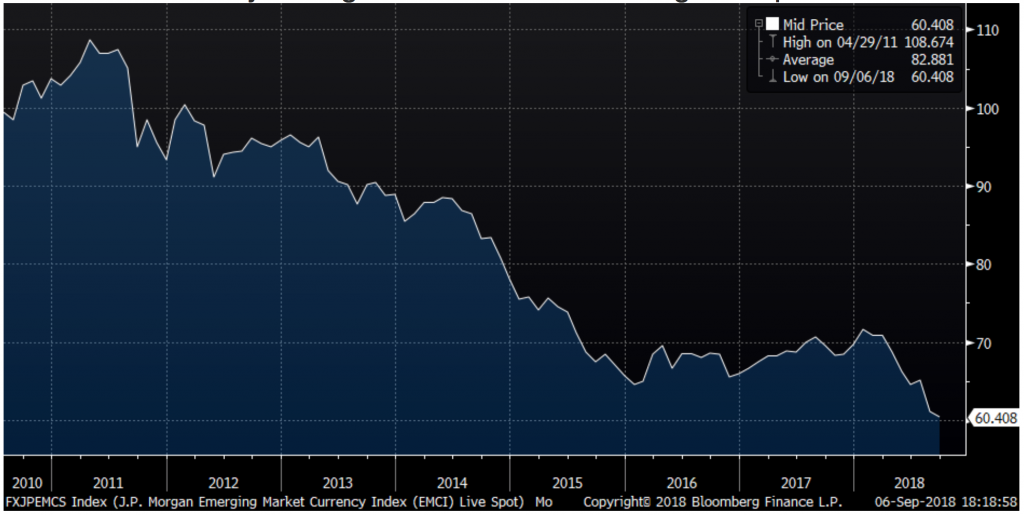

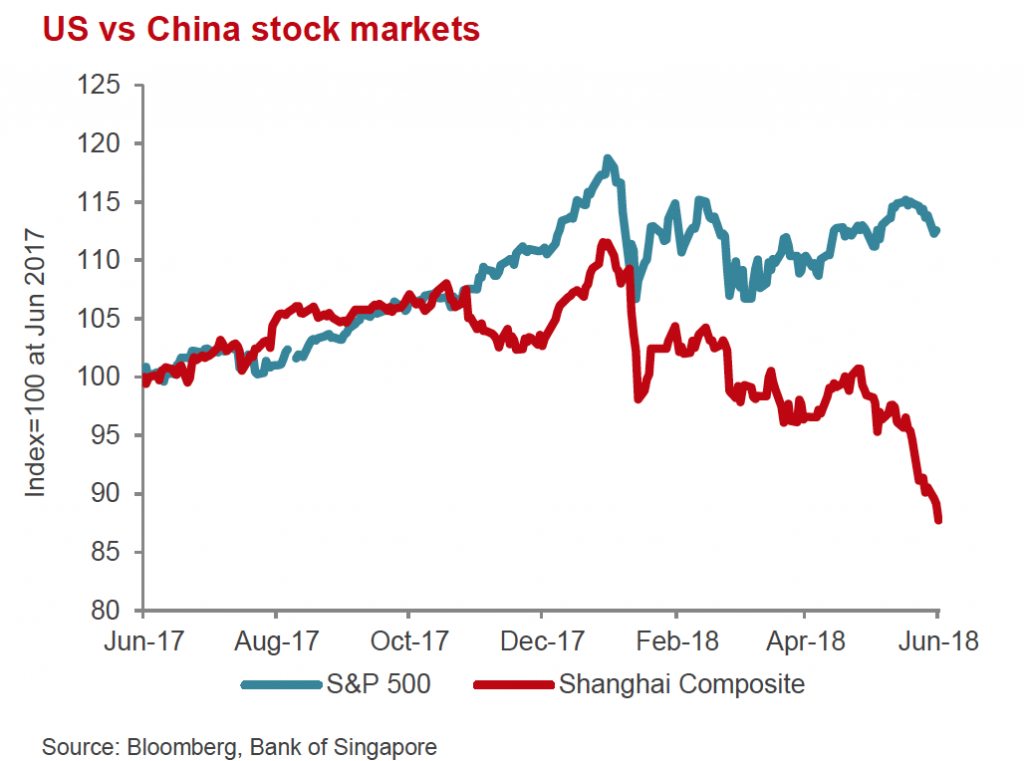

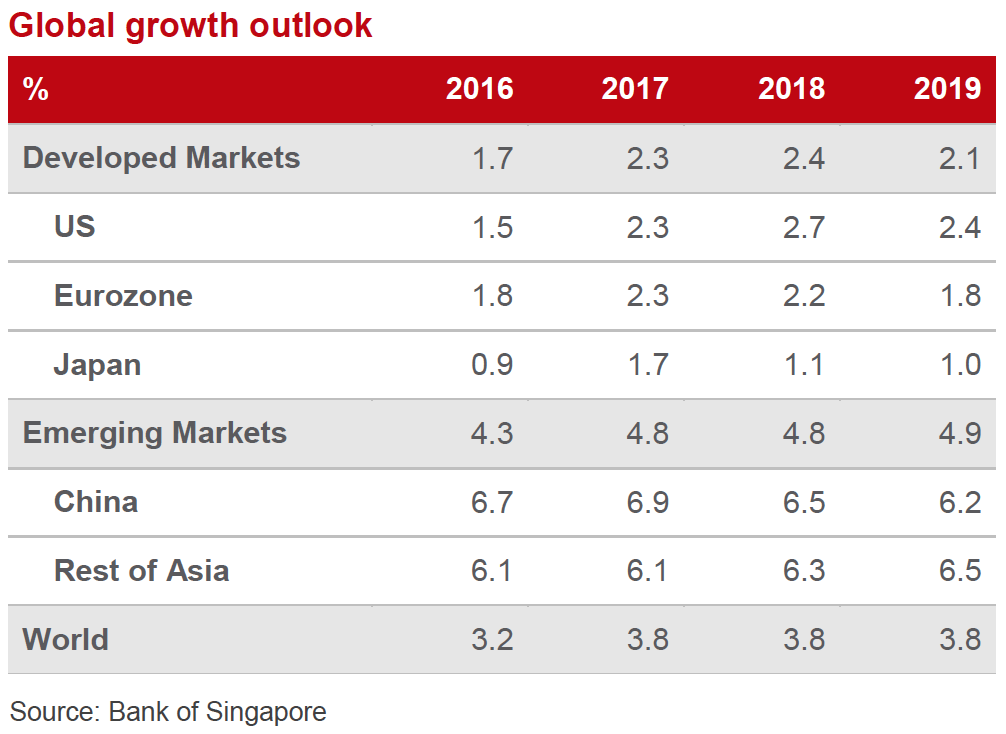

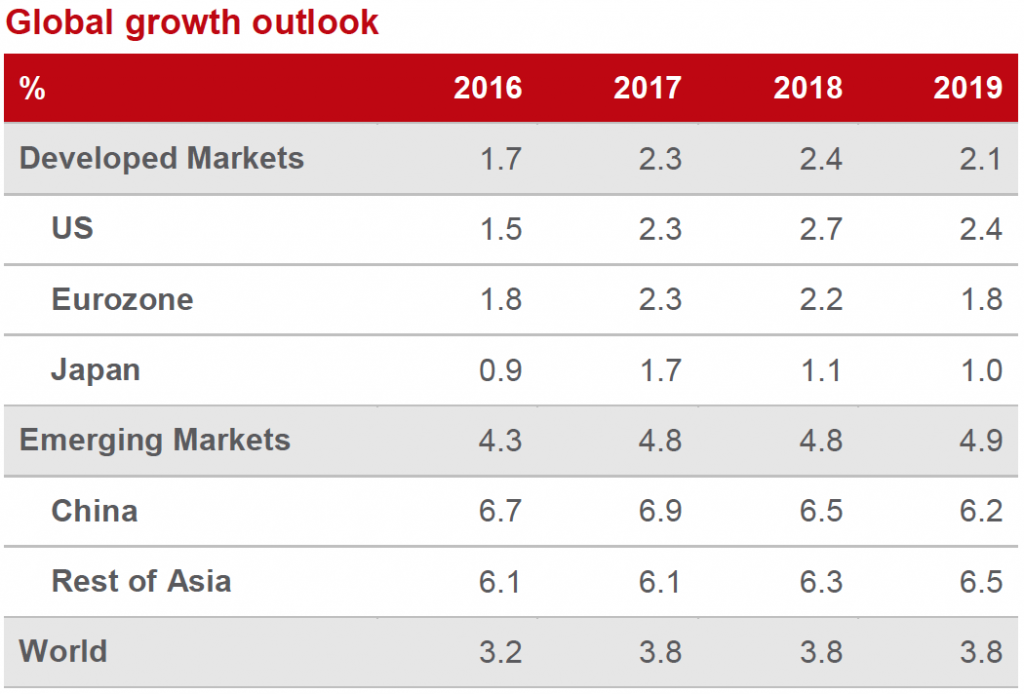

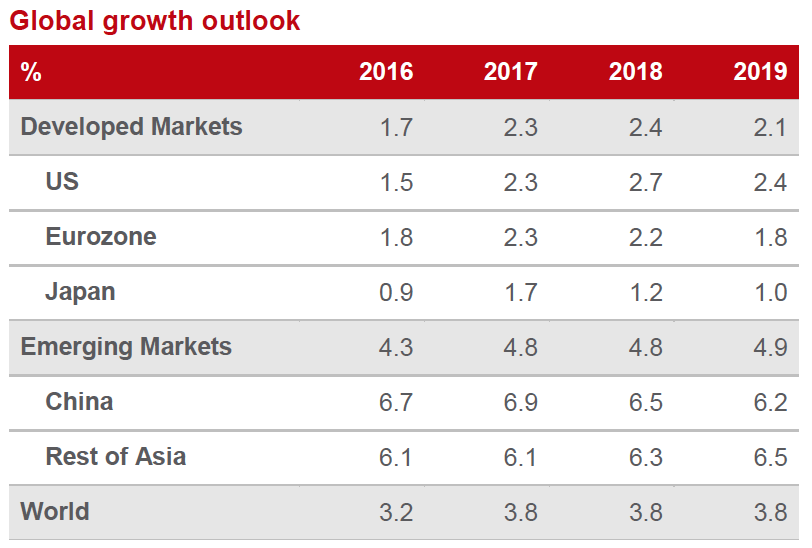

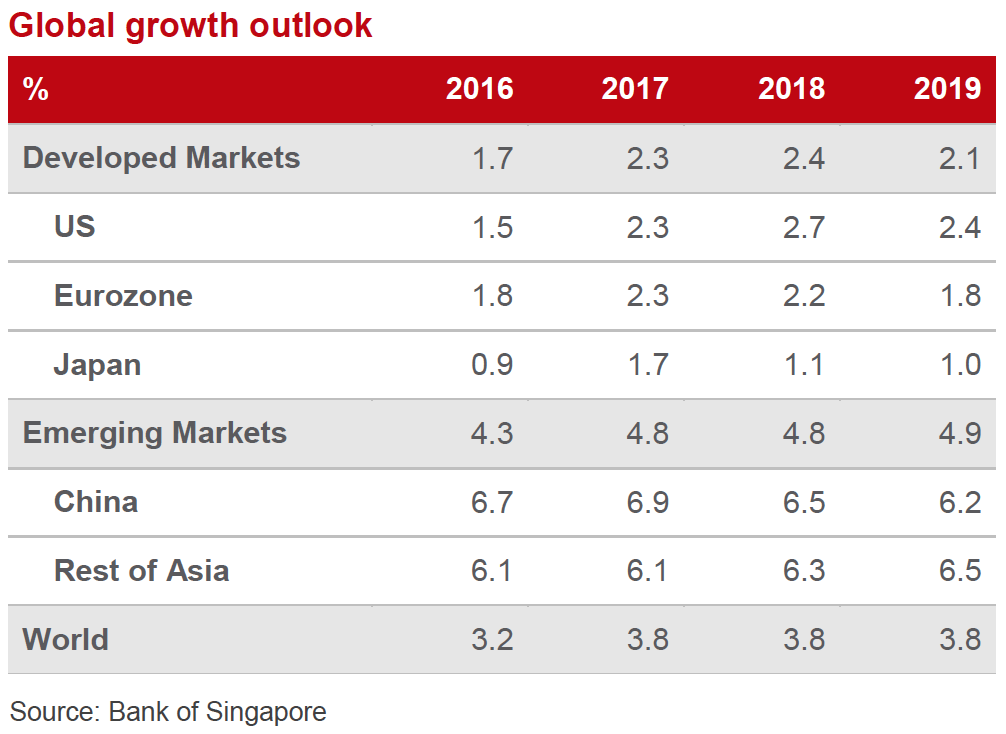

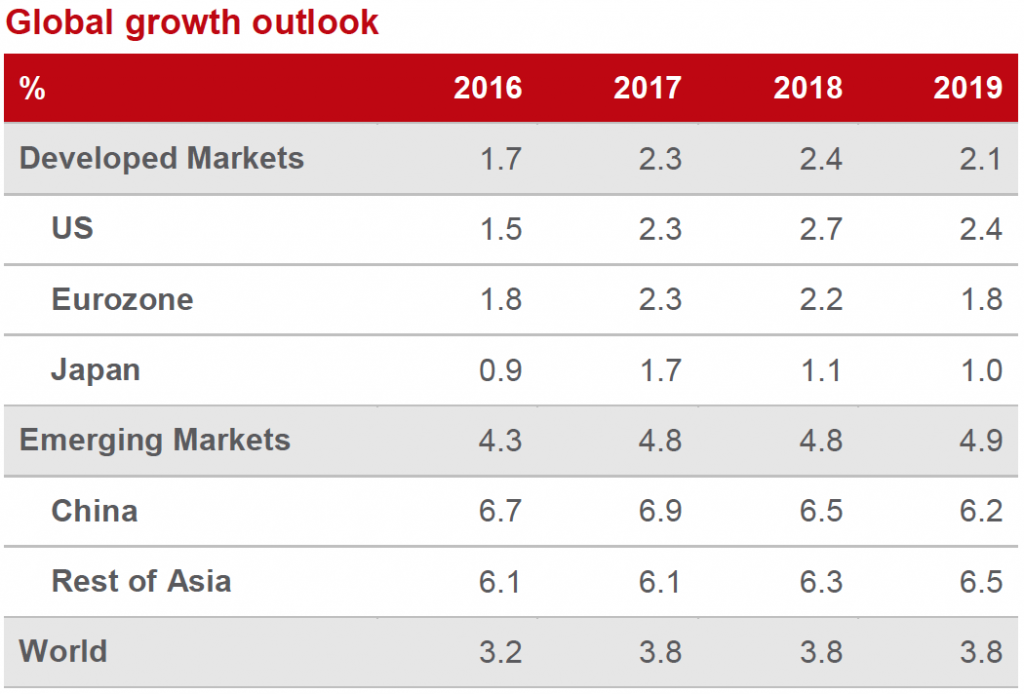

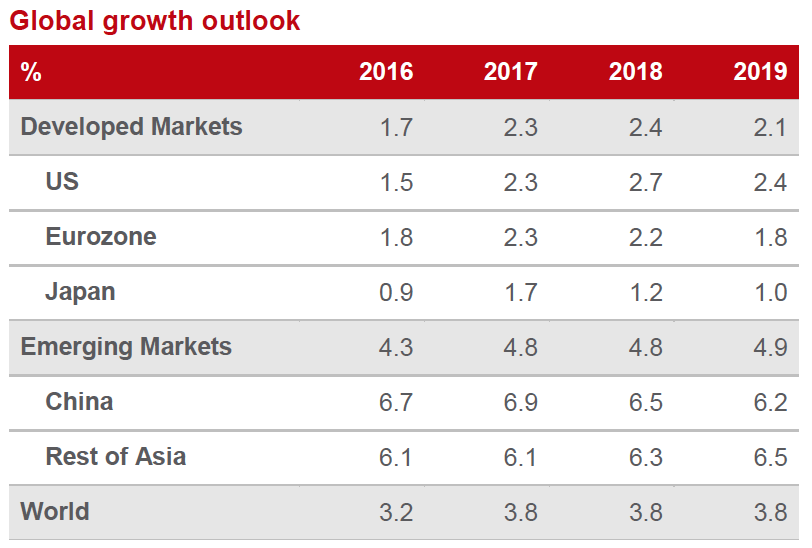

September started badly for equities outside the US, especially for EM equities outside AXJ, and the IT sector within US equities. Trade fears over whether the US will impose 25% tariffs on a further $200bn of imports from China last week and roll-out tariffs on global auto exports to the US, along with contagion from South Africa, hit EM equities, FX and fixed income (FI). Both JP Morgan EMCI and the JP Morgan local currency debt indices hit all-time lows. The current market turmoil is at odds with broadly supportive fundamentals in GDP. Several houses revised up US growth this year, and for the next three years, whilst latest Japanese and Chinese data are solid. Although EU economic data has eased off to 16-month lows, it is still at a robust level in absolute terms.

On the trade war front, Trump’s belligerent tweets might be a reaction to his growing difficulties domestically as his past behaviour catches up with him. His close aides, Cohen and Manafort, were convicted which could open him up to a risk of impeachment proceedings should the Democrats win the House in November. Trump has indicated he will proceed swiftly to impose further tariffs on China, to which the latter has indicated it will retaliate appropriately. He also suggested tariffs on auto imports will be rolled out despite EU’s zero tariff offer. It is difficult to ascertain a meaningful strategy with the current U.S. Administration.

MARKETS OVERVIEW

Equities – A Mixed Bag

- August saw a mixed performance, as US indices were led higher by Nasdaq’s c.6% gain. The S&P 500 was up over 3% while the trade-impacted DJIA lagged, gaining just 2%. Nikkei was up close to 1.5% but STOXX 600 and FTSE-100 fell by 2.4% and 4% respectively. Emerging market (EM)/AXJ equities fell, led by A-shares which was off over 5%, but most rallied from lows at the start of the month – a recovery in sentiment over Turkey and Argentina was short-lived as Trump again upset markets in the last week, with further trade threats despite negotiating a deal with Mexico.

- 2Q18 results in the U.S. were excellent and have led to further upwards revisions for EPS growth for FY18. These are now at +23% vs. +11% at year-end 2017, putting S&P 500 on c.18x forward price/earnings ratio (PER). However, if one strips out the IT sector and Amazon, then it trades on closer to 14x with the large US banks PERs at a reasonable 11x. This makes non-IT/Amazon US equities quite reasonable relative to the past and against other equity regions.

- In U.S. equities, we also see that sector rotation continues with evidence that the expensive IT sector is struggling as investors become more discriminating with Facebook, Twitter, Netflix and Google facing headwinds whilst the newly minted $1tn market cap duo, Apple and Amazon, climb higher. Since June, utilities, telcos and real estate have outperformed growth sectors on a relative basis.

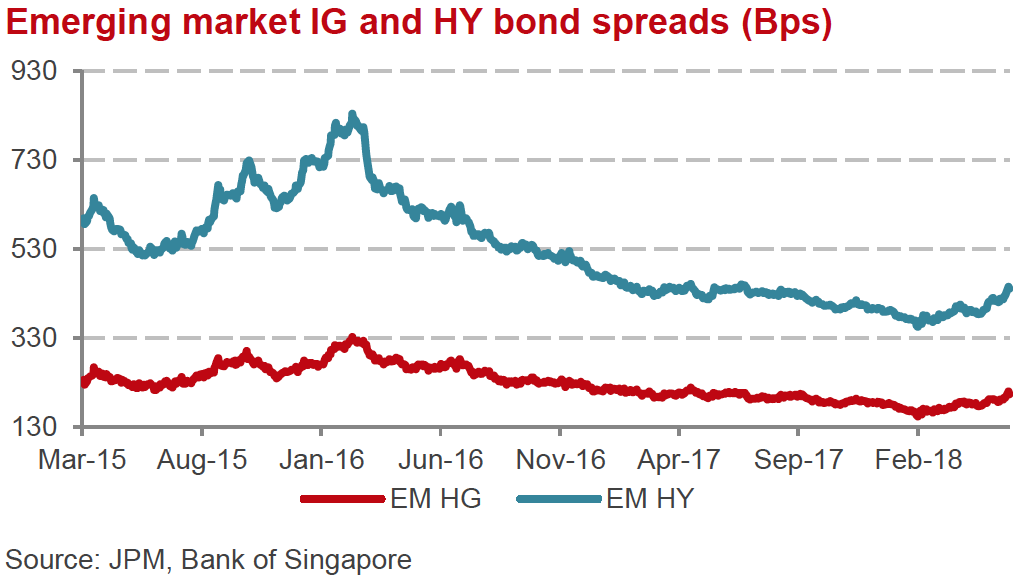

- EM continued to have a torrid time as Argentina blew up, forcing the government to sharply raise rates to 60% to defend the currency, and volatility in Turkish assets was extreme. Concern this week has also spread to South Africa. At the time of writing, the MSCI EM index is flirting with a bear market, and the JPM EMCI is at an all-time low. In contrast to developed markets (DM) equities where earnings have beaten forecasts YTD, EM/AXJ earnings have disappointed – notably in the giant IT/social media stocks like Tencent and from KOSPI – leading to earnings downgrades.

- Further trade escalation will hurt APAC and EM hard. Japan will also suffer given its strategically important car industry. Whilst some of the damage has been discounted in the declines in equity and currency markets YTD, we doubt this is fully the case and could see further downside in the short term.

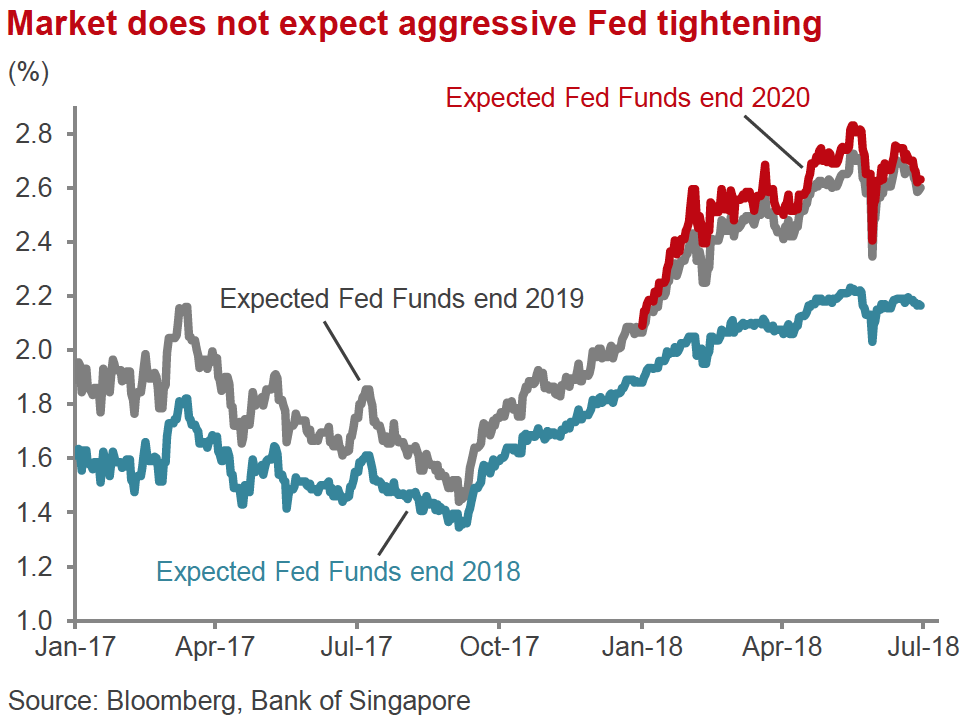

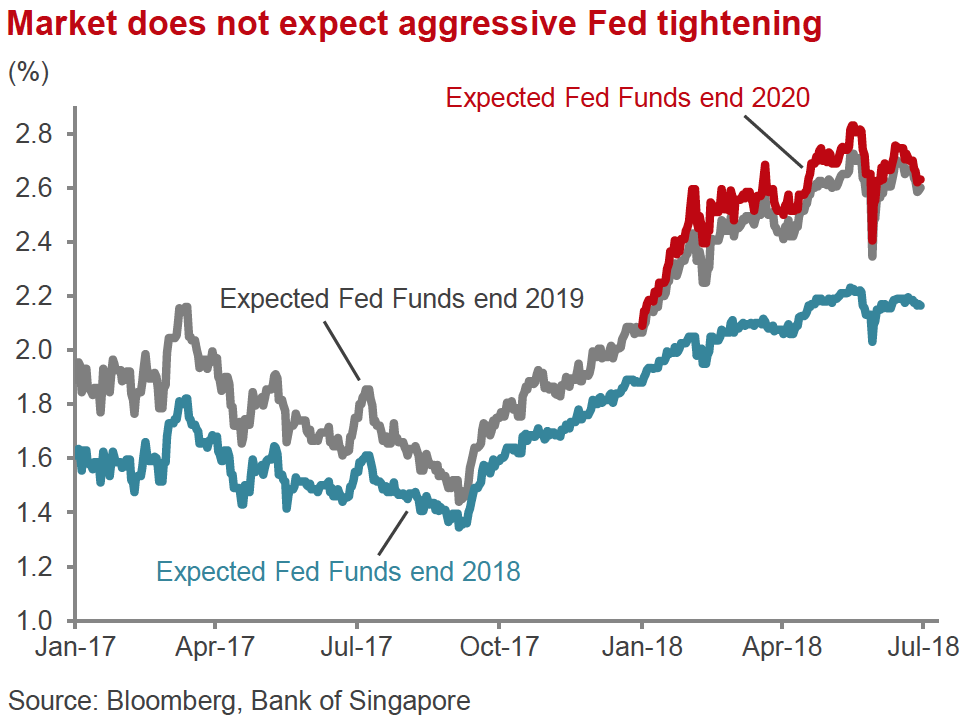

- We are in the camp where the global economic outlook is fundamentally sound and expect trade disputes to de-escalate before major economic damage is done. We doubt the Fed will tighten aggressively, limiting USD strength, nor do we sympathise with the view that forecasts much tighter financial conditions which would lead to a severe APAC and EM equity correction. We also do not see Argentina, Turkey and South Africa as ‘canaries in the mine’ for the wider EM asset class, and certainly not for APAC, but rather as idiosyncratic events at a time where sentiment has become less forgiving.

Source: Bank of Singapore

Source: Bank of Singapore

- As a result, we see any further material sell-off in APAC as an opportunity to add assets. With the top five AXJ IT/social media stocks underperforming ‘FAANGs’ by 50% YTD, we think value is emerging in AXJ equities relative to US IT and would look to move AXJ from underweight to overweight. We highlight the possibility that Trump might want to agree a deal with China ahead of the mid-terms and around the Sino-US summit between him and Xi Jinping in November before the G20 meeting.

Fixed Income – EM FI Hit Hard

- In response to the question regarding the government’s approach to its upcoming budget, Italy’s PM said, “If it is a choice between the people or the rating agencies, we will support the people”, which some fear will be much higher than EU’s 3% deficit limit. Italian BTPs promptly sold off with the 10Y yield rising above 3% at one point. Safe haven Bunds’ yield fell towards 30bps and the spread between BTP 10Y yield to Bunds yield again hit 2.9% – like the sell-off after the election.

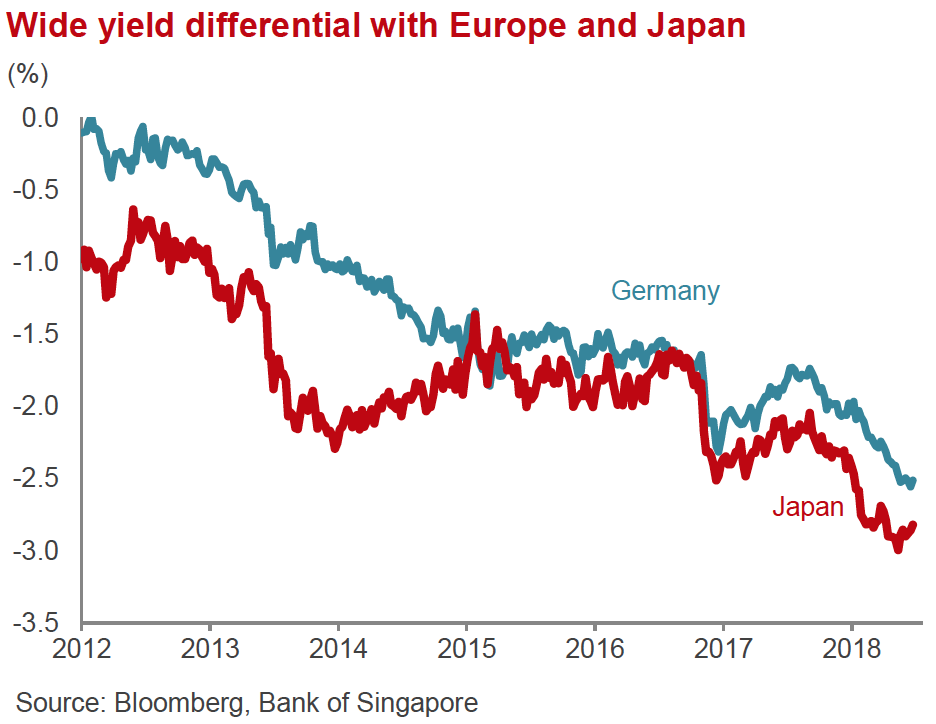

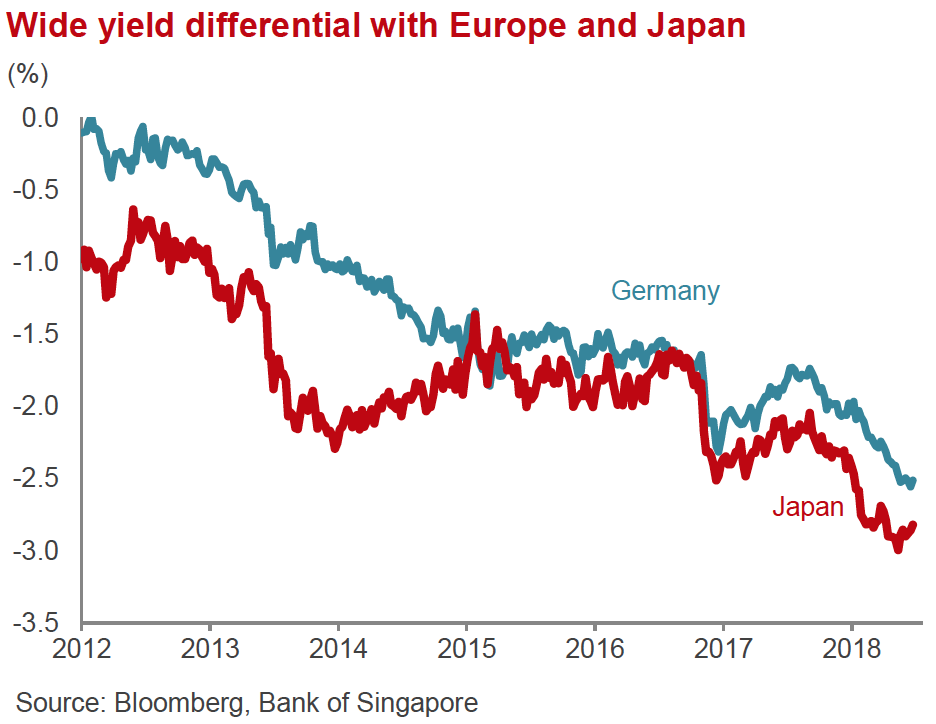

- Elsewhere in DM, FI yields were less exciting. UST yields fell on risk-off sentiment and a “dovish” interpretation of Powell’s Jackson Hole speech but then rose on continued evidence of the strength of the US economy – not least on a very powerful August ISM manufacturing print. The 10Y yield tested key support at 2.80% before slowly recovering to 2.90% despite EM volatility while the yield gap remained stable.

- UK Gilts rallied on weaker macro data with hopes that BOE was just ‘two and done’. BOJ was forced to actively intervene in JGBs ahead of its MPC meeting where some hoped it might lift ‘YCC’ target to 20bps, but this died down after its relatively dovish statement.

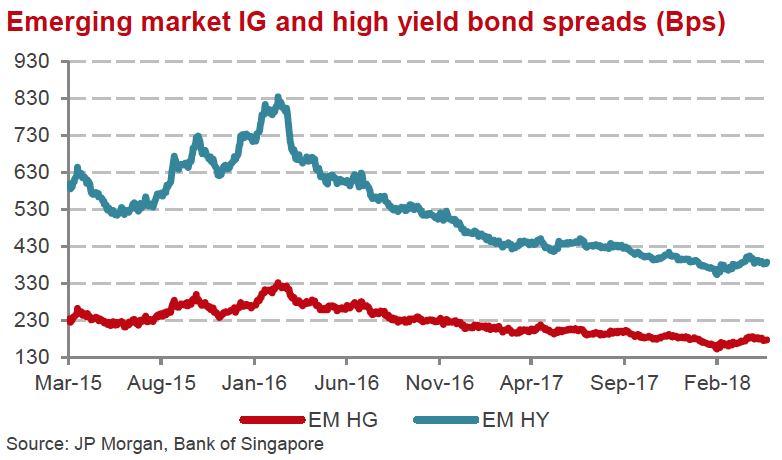

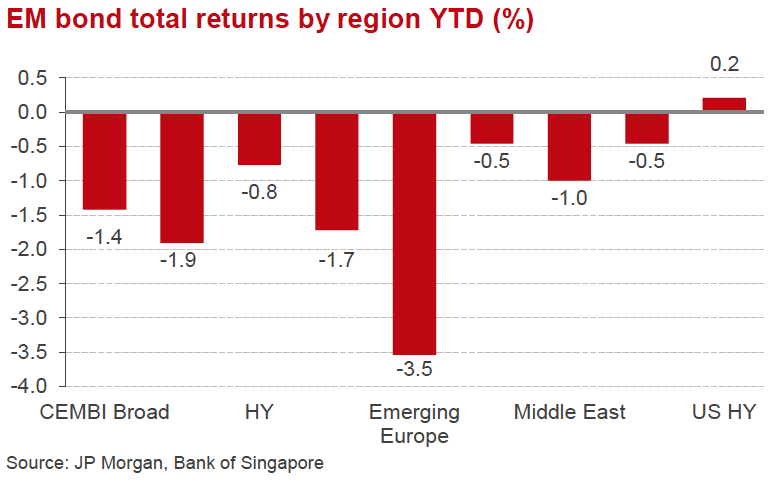

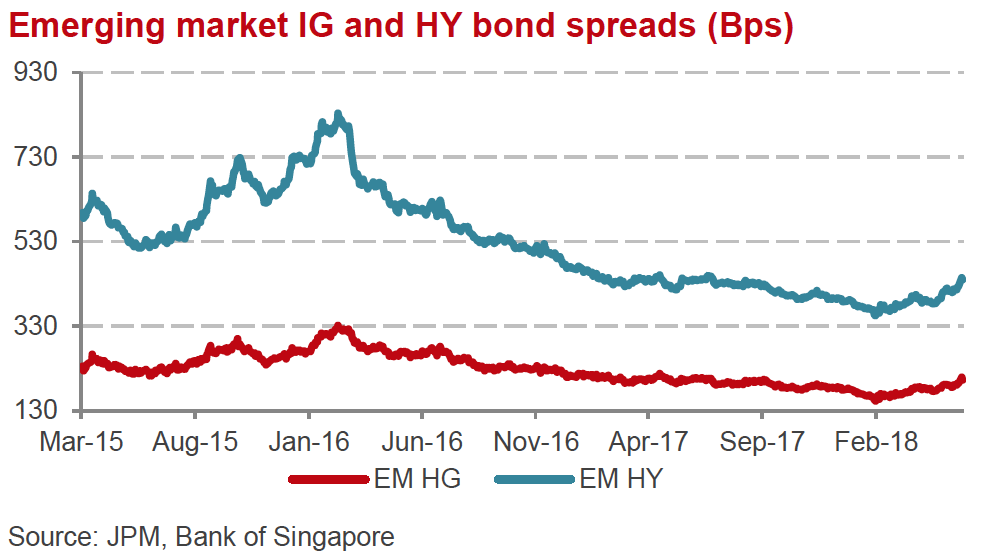

- EM FI was hit hard in the last few days on renewed volatility in EM, and especially in markets that are large components of EM FI weighting as Turkey, S. Africa and Argentina. This knocked-on through to Indonesian FI and AXJ high-yield more generally. The JPM EM FI index fell to an all-time low linked to the EM FX weakness.

Source: Bank of Singapore

Source: Bank of Singapore

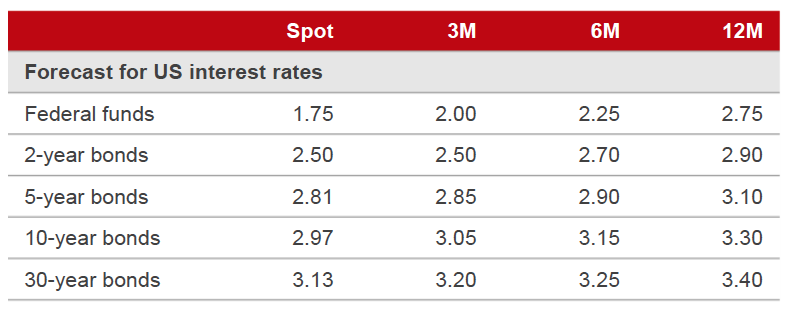

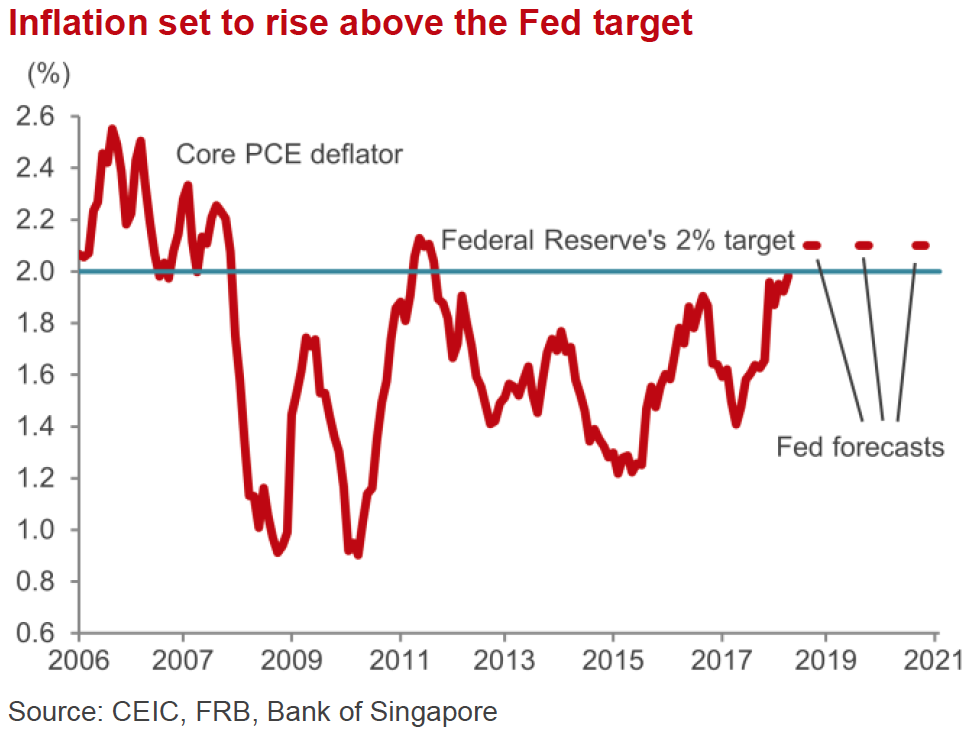

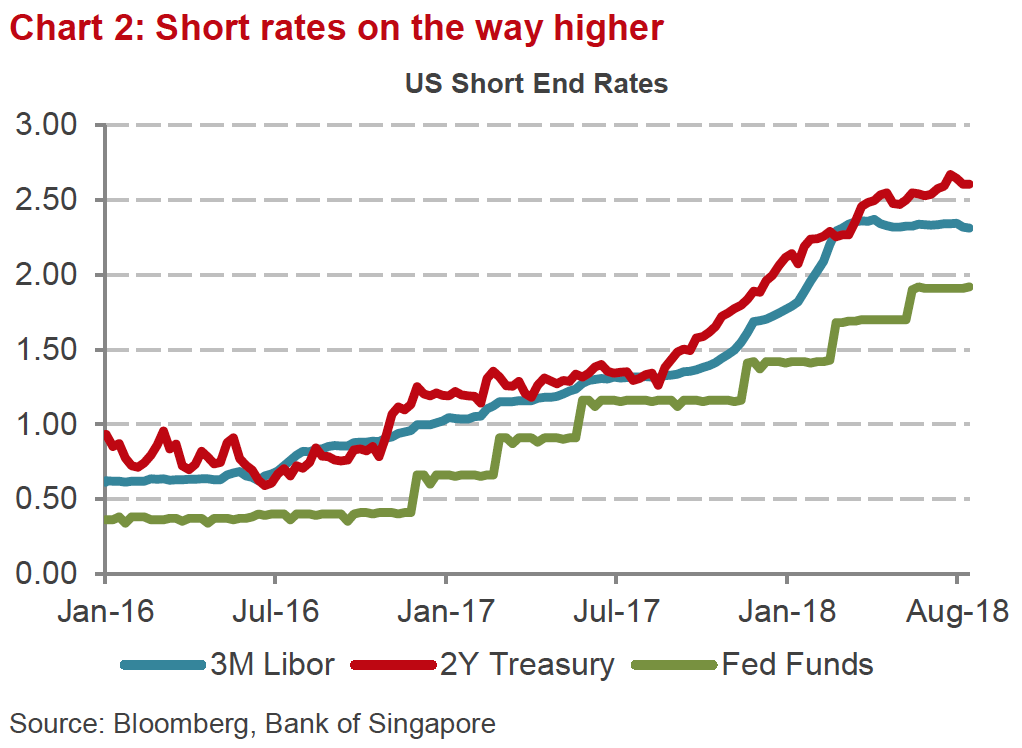

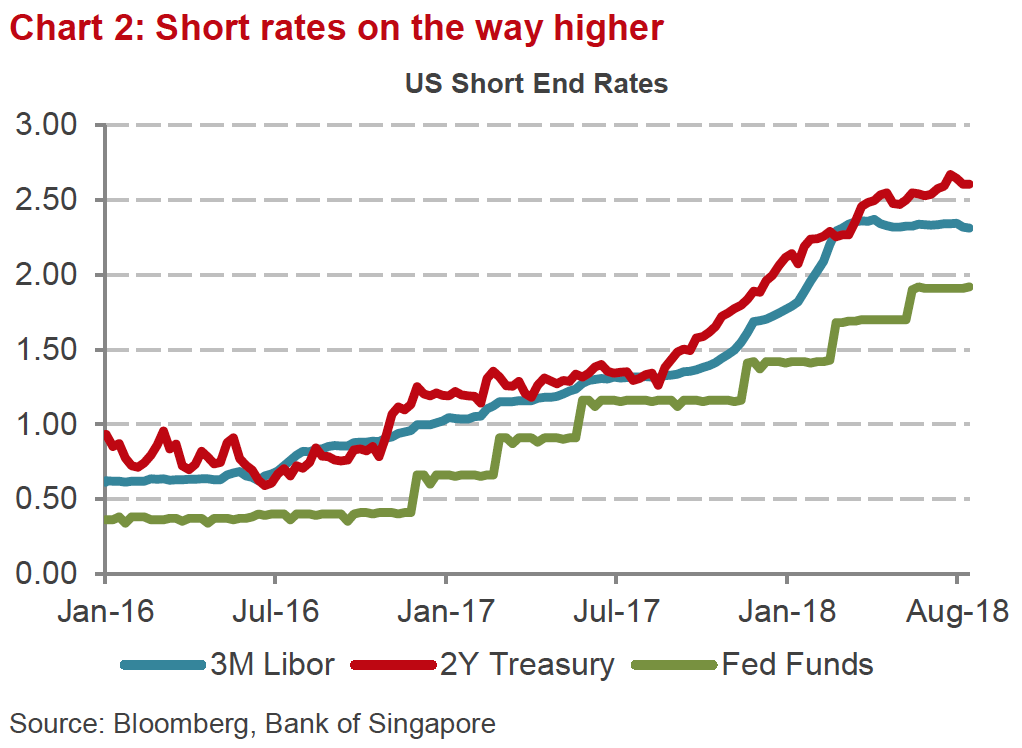

- The key as to whether there will be substantial damage in FI is both the degree to which rates rise and, more importantly, the pace of the rises, and whether this is a consequence of stronger growth or higher inflation. These matter particularly to EM FI, which can handle gradual rate hikes in the context of stronger growth but will be at risk if fast hikes are more related to higher inflation.

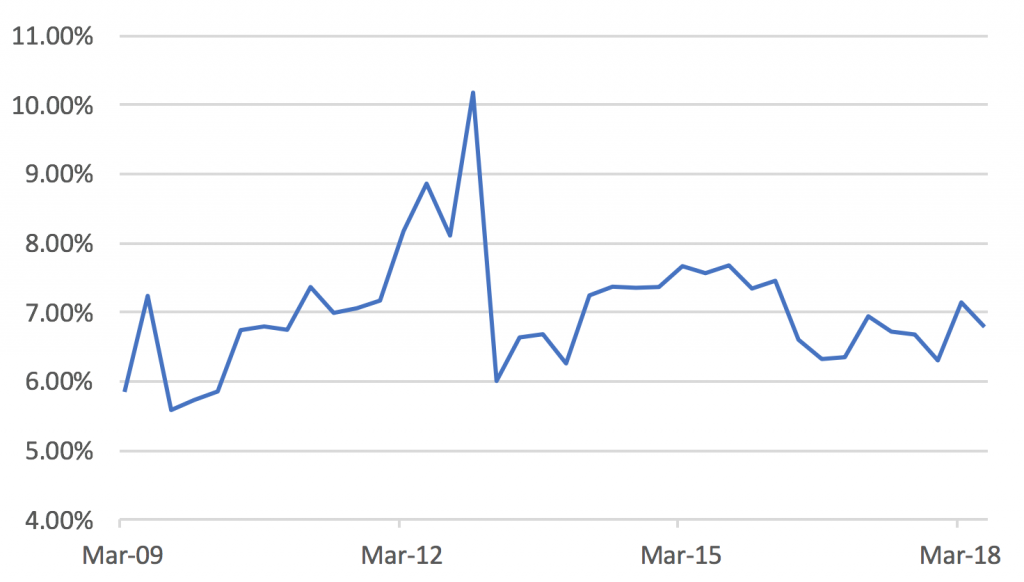

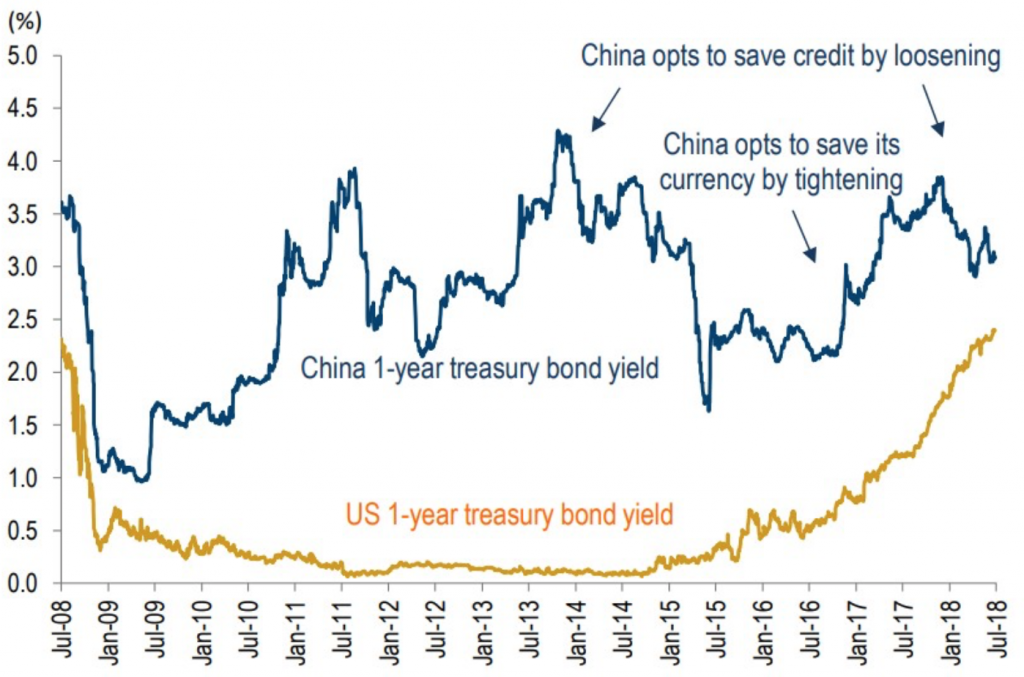

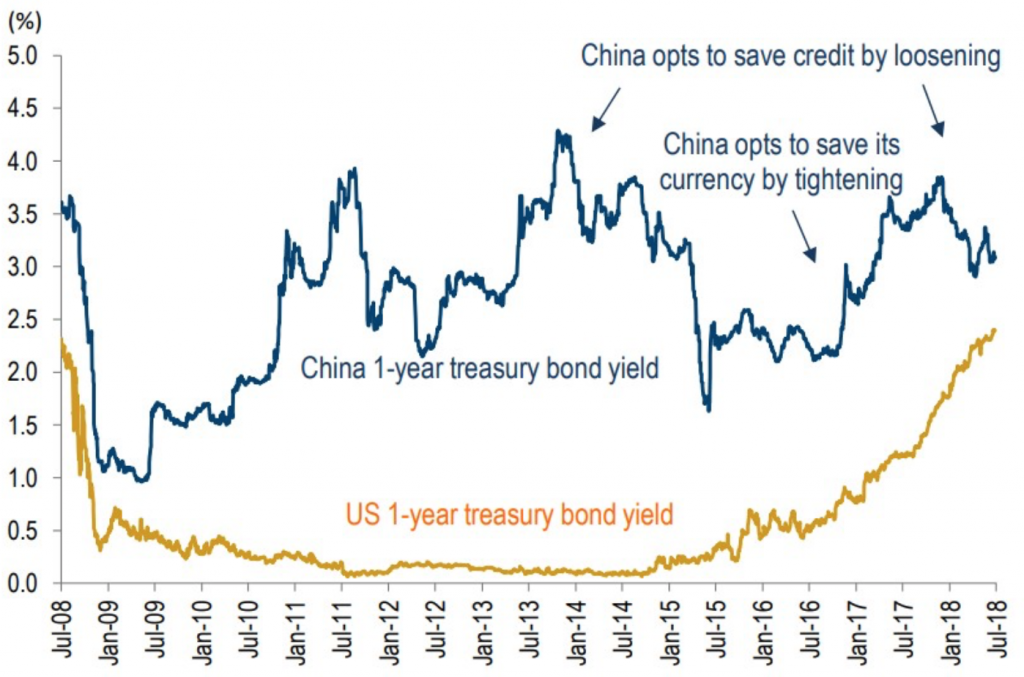

- With EM/AXJ business cycle positioning different from that of the US, the divergent monetary policies are creating volatility and making the ‘carry trade’ less attractive as yield differentials narrow. This is evident between CNY Chinese Government Bond (CGB) yields and USTs (Fig 1). This is creating pressure on EM FI with substantial outflows back to DM FI of a magnitude last seen in the 2013 ‘taper tantrum’. Some of the larger EM FI funds like Goldman Sachs and Templeton have been hit hard too. For now, it is hard to see where the marginal buyer of EM FI might come from.

CGB 10Y-UST 10Y spread | Source: Bloomberg

CGB 10Y-UST 10Y spread | Source: Bloomberg

Commodities – Constructive

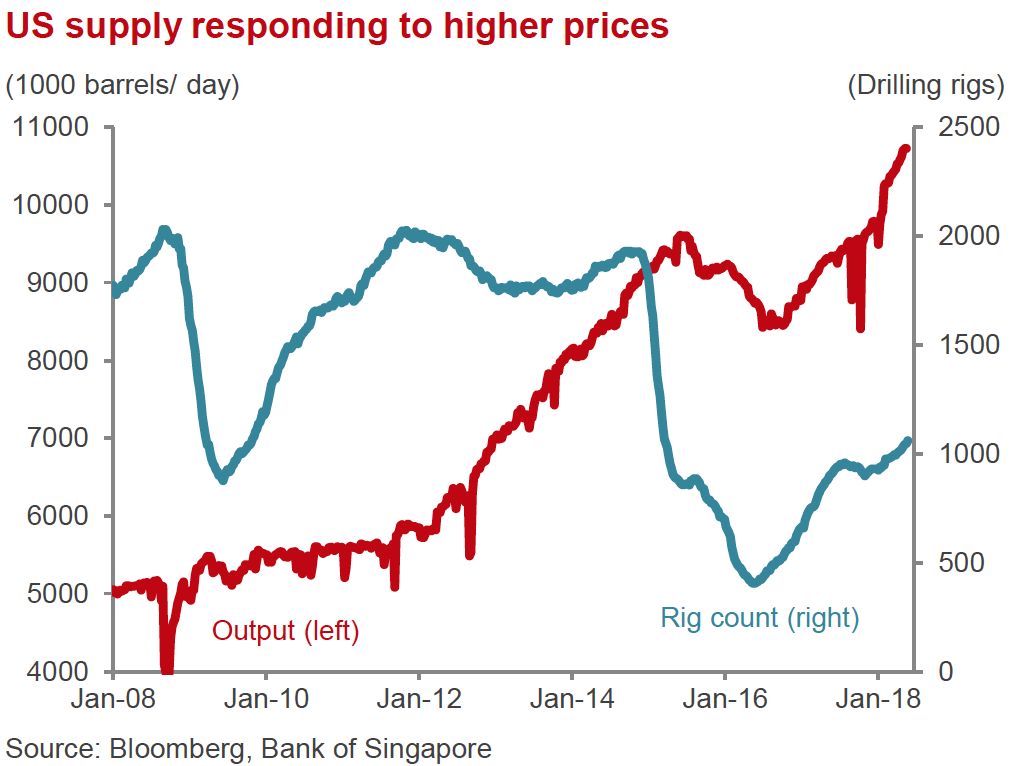

- The Brent oil price rose c. 5% in August after testing, but not breaking through, strong technical support at $70/brl. The drivers of the rise were growing fears of supply being reduced by 1mn/bpd or more once US levies sanctions on Iranian exports in early November; the threat Iran has made it would block the Straits of Hormuz through which 35% of the global traded crude oil is shipped; and stronger US demand that saw inventories drop more than forecast.

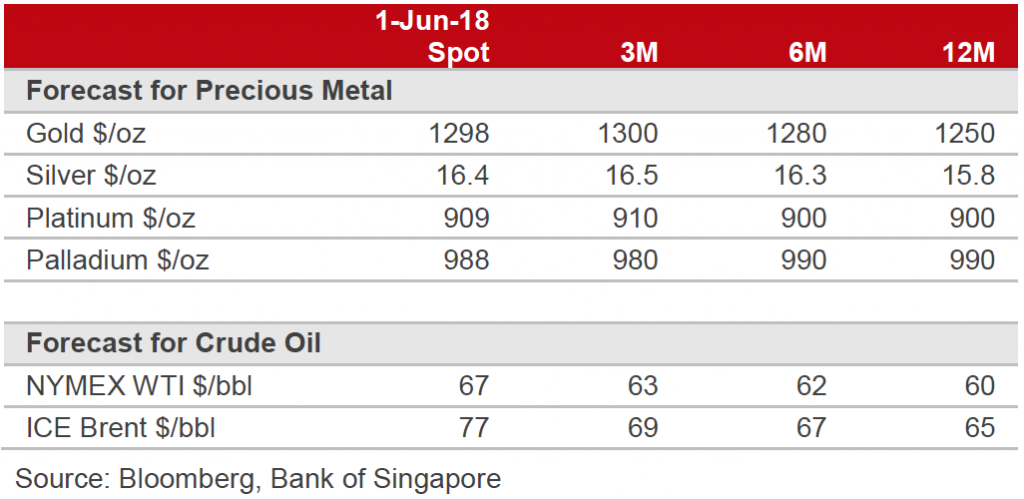

- Gold continues to trade inversely to USD. The dollar surged earlier in the month and Gold fell sharply through $1,200/Oz to a low around $1,160/Oz before recovering to just at $1,200 as USD weakened. As interest rates rise, so the opportunity cost of owning gold increases and likely higher UST yields will support USD too. There was some indication heavy speculative selling of gold eased-off after it fell below $1,180/Oz. Gold fell almost 2% for the month.

- We see gold’s direction, for now, being yoked to the USD but the precious metal does seem to be in a price area of historical support. We remain constructive on the outlook for oil prices in the short-term and longer-term. In the short-term, geopolitical concerns around the supply-side reduction in oil exports after sanctions on Iran, and the latter’s possible retaliation, may worsen in the run up to their imposition in early November. In the longer term, we believe there are consequences from the huge capex cut in oil exploration and production spending between H2 2014-H1 2017 which could result in a shortage from 2020 onwards. In addition, new rules on anti-pollution for shipping will add 2-3mn/bpd demand for lower sulphur oil that is currently in tight supply given the existing refinery capacities and capabilities.

Currencies – EM FX suffers

- So USD traded in relatively tight ranges against other DM currencies. Earlier in the month, the DXY rose to a point where some forecasters became more bullish it might break out towards 100 but sentiment changed, notably after Powell’s Jackson Hole speech, and DXY briefly broke below 95 before recovering again.

- The main mover against USD amongst DM currencies was GBP. It broke below its 1.30 support, on Brexit fears there might be no deal, to test support at 1.27 before optimism a deal might happen saw it rally to test, but not break above, 1.30.

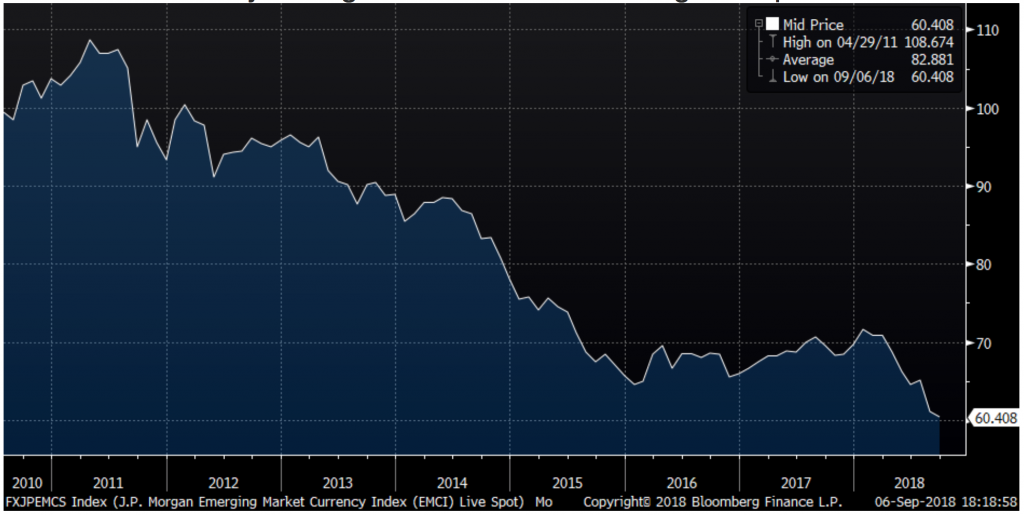

- The main action was USD vs. EM FX with some huge falls – notably the Argentine peso – but this does not show up in the DXY. The JPM EMCI fell to an all-time low (Fig 2), with big falls across many including IDR, INR, BRL, ZAR, etc. INR was impacted after its latest trade and current account deficit rose to a 5 year high on increased oil and gold imports.

JPM EMCI at ATL | Source: Bloomberg

JPM EMCI at ATL | Source: Bloomberg

- PBoC upped the rhetoric to defend CNY and acted once it rose through 6.90. This helped stabilize the currency, which strengthened from a low of 6.96 to a high of 6.80 intra-month. PBoC made it clear that a weaker CNY was undesirable and that it wanted to limit speculative capital flight. Likely too is a desire by the Chinese government to avoid further upsetting ongoing trade discussions with USA after Trump explicitly highlighted the weak CNY as a problem.

- It is likely the link between trade escalation and a stronger USD will continue given this reduces the US trade deficit, all things being equal; makes US assets relatively more attractive; and enhances its ‘safe haven’ attributes relative to JPY as a trade war would be damaging to Japan’s economy – notably if US imposes auto tariffs. Unsurprisingly, this would also be bad for the trading countries’ currencies – especially EM/AXJ.

HOW WE MANAGE RISK – PORTFOLIO PROTECTION, HEDGING & TAKING PROFITS

As opposed to just going to cash, we prefer alternative strategies such as hedging via options and option writing strategies to smooth out portfolio volatility.

We also actively monitor profits using trailing stop losses with the view of protecting and locking in gains.

PORTFOLIO MANAGEMENT SERVICES

Please let us know if you would like to hear more about our Discretionary Portfolios and how we consistently generate an additional 0.5% to 1% per month using our Options Overlay.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at.

Aug 11, 2018 | Articles, Global Markets Update

MACRO – REVIEW

Equities mostly had a slightly better month in July with strong Q2FY18 results helping S&P 500 (SPX) up 3.5%, while NASDAQ rose just over 2% but for US IT, some of the recent moves have been stark: at one point, FACEBOOK led the FAANGs down 9.6% in three days. STOXX 600 rose over 3% helped by a weaker EURO and Asia ex-Japan (AXJ) underperformed developed markets (DM), rising just 34bps. However, A-shares finally rose after closing lower for several months as its key 2,700 support held while foreign institutional investors (FIIs) bought AXJ equities over the last two weeks after two months of heavy selling lately. The rally in global equities stuttered after the US indicated it might increase tariffs to 25%, from 10%, on an extra $200bn worth of imports from China, thereby knocking hopes of potential de-escalation of trade tensions. This was in contrast to the more positive tone which was set when the US agreed to postpone tariffs on EU auto imports.

There were mild moves in fixed income (FI) with the bell-weather UST 10y yield gaining 10bps to test its 3% key resistance, but with little change to the yield. German Bunds’ yield rose sharply by close to 15bps to 44bps. That helped support EUR against USD, despite a ‘dovish’ European Central Bank (ECB) meeting. After the heavy prior months declines in investment grade (IG) and high yield (HY) credit, there was some recovery last month which also helped emerging market (EM) HY bonds. Fears over CNY weakness, which fell by close to 3% against USD, persisted as the People’s Bank of China (PBoC) declined to intervene. JPY eased off by -1% as its ‘safe haven’ position suffered erosion in favour of USD after the Bank of Japan (BOJ) remained ‘dovish’ in last week’s meeting. DXY again moved through key resistance at 95, although it displayed greater strength versus EM FX than DM FX. Oil fell sharply by over 6% from close to $80/brl to test key support at $71/brl on supply-side concerns, including the possible release from US’s strategic reserve. Gold moved inversely to USD gains to fall over 2% through support of $1,220/Oz.

MACRO – OUTLOOK

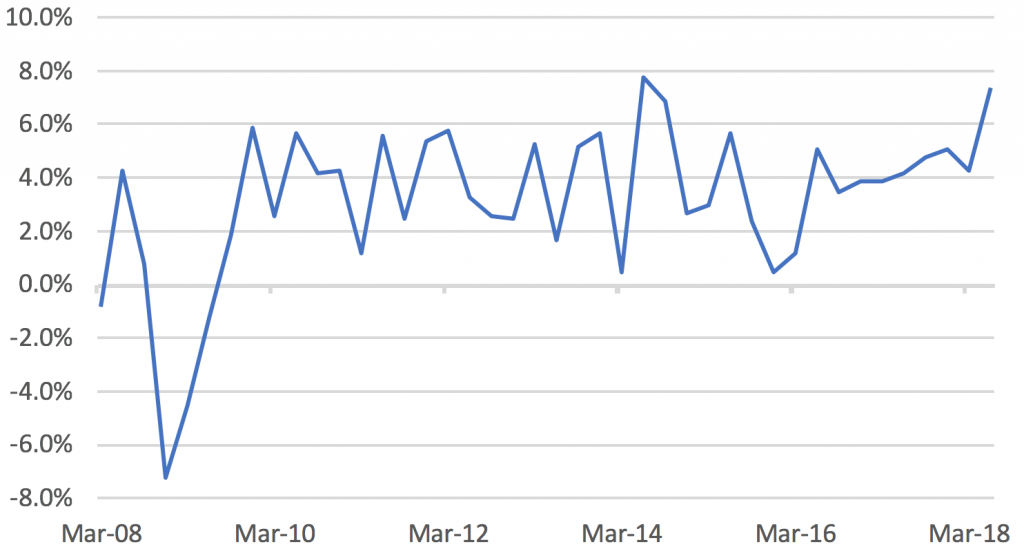

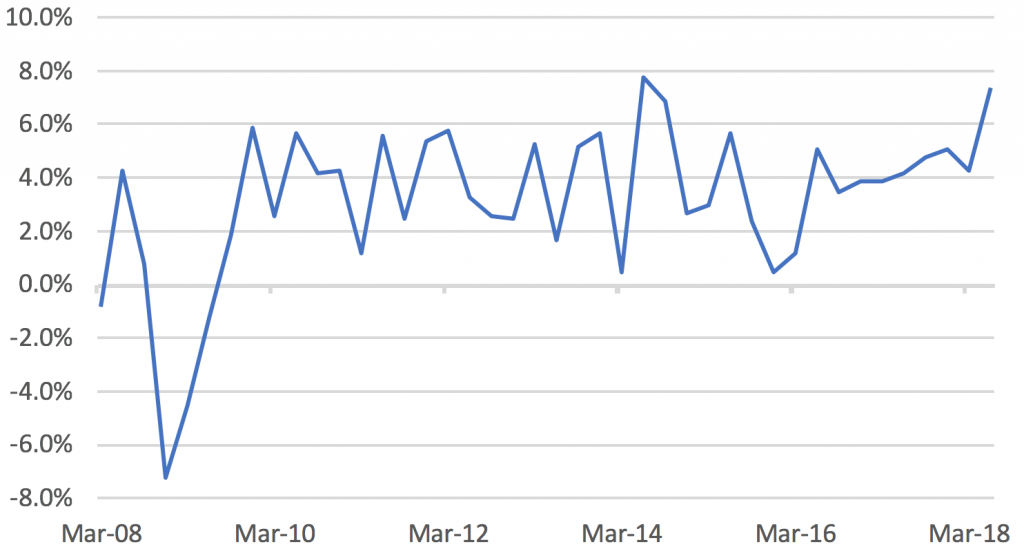

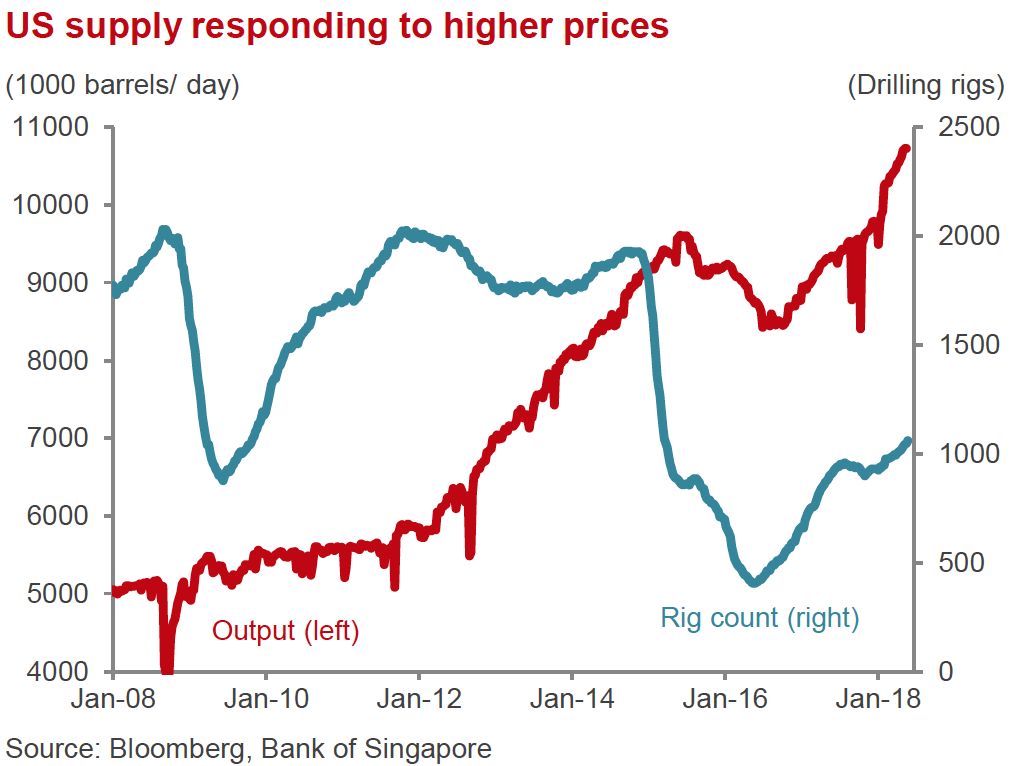

Fig 1. US GDP annualised QoQ growth | Source: Bureau of Economic Analysis

There is reason to be more positive following the US Q2 GDP result. Nominal GDP grew 7.4% (Fig 1) – almost China- like – as the real number of 4.1% was adjusted by a 3.3% deflator. Final sales were +5.3% while GDP was dragged down by inventory destocking, with only moderate evidence of trade war ‘front running’ seen in net exports. The fact that US savings rate has been materially raised is encouraging for consumer spending and services, which accounts for 88% of GDP. The resilient private sector fixed asset investment (FAI) is also constructive and the fact that part of it is from Energy Exploration & Production (E&P) pick-up is hardly a surprise given higher oil prices. Indeed, with major oil companies having slashed FAI by over 50% from H2CY14-CY16, a change of direction suggests this will be supportive for private sector FAI, job creation and higher wages going forward.

We have expected that US fiscal spending will kick-in with effect from H2CY18 onwards into much of CY19. It is interesting to note the pick-up in fiscal spending by the public sector outside the Federal government whilst Congress has voted to boost defence spending recently. There is a strong link between rising property prices and higher tax revenues at a state and local government level and this was an area that got savaged in the post-GFC period along with huge job cuts.

All in all, the detail is more encouraging, showing that the US economy is in a ‘sweet spot’ cyclically and this might persist until at least H2CY19. The higher savings rate (Fig 2) supports continued robust consumption along with rising wages, limited unemployment, rising house prices and reduced income tax rates. Private sector FAI may well be underpinned by a strong recovery in energy FAI linked to higher oil prices (we think prices will go higher in the next few years) along with tax cuts. Lastly, the bulk of the fiscal boost – estimated at 80bps directly onto GDP – comes into effect from H2CY18 through much of CY19. This all suggests that the second longest economic expansion on record could easily last through ’19.

Fig 2. US Personal savings rate | Source: Bureau of Economic Analysis

Nominal GDP growth of 7.4% is a ‘heady’ number in anyone’s language, and it surely implies of a build-up in inflationary pressures. It supports the Fed’s plan for two further rate increases in CY18 and more in CY19. It is hard to see how it can be argued the Fed is ahead of the curve, and instead supports the thesis that the Fed is behind the curve. A higher savings rate supporting consumption strength; recovering private sector FAI; likely higher oil prices; and a tight labour market, all suggest that the 2.5% long-term Fed rate assumption that the FI markets are using – and thus the yield curve inversion – might prove to be spectacularly wrong. The strength of the economy helps Trump pursue his aggressive trade policies and may help the Republican party (GOP) in the November mid-term elections.

There is an assumption the US GDP strength is a one-off from the tax cuts and will evaporate next year, along with sharply lower SPX earnings per share (EPS) growth. This helps moderate UST yields and USD strength, as well as caution on SPX’s outlook from Q4FY18 onwards. On the other hand, there is a more positive narrative, that the US economy is structurally, as well as cyclically, stronger than the consensus might realise. Higher savings rate, combined with low unemployment, accelerating wage growth (PCE private sector wages grew +4.7% YTD from +1.7% last year) and rising house prices implies a structurally better supported level of consumption and hence, a higher rate of GDP growth (as consumption is c. 70% of GDP).

Private sector FAI has been subdued for much of the decade post-GFC and only started to pick-up in late ‘16/H1CY17. However, this pick-up comes from a low point where FAI was running below the replacement rate for several years and so there’s scope for a catch-up. Secondly, US companies, to some extent, used cheaper labour as a substitute for capital/FAI given high unemployment and weak labour costs post-GFC, but this is now inflecting more in favour of spending on capital as labour costs are rising (Fig 3). In addition, a recovery in energy FAI is an extremely important subset of overall corporate FAI given that it has been as much as one-third of overall corporate FAI. Financials, another key subset, are again increasing FAI too after large cuts post-GFC.

Fig 3. Unit labour costs as % of gross value added | Source: Bureau of Economic Analysis

A severe trade war, oil rocketing through $100/brl on some Middle Eastern (ME) ‘shock’ and the Fed tightening much too quickly, are all policy risks for sure, but there is a plausible case US economic strength is being underestimated for the reasons noted above. On top, the psychology of most economists and strategists is deeply rooted in extrapolating the relatively feeble post-GFC recovery out in future years. However, the US household has rebuilt its balance sheet to now the highest it has ever been in wealth, debt is under control and wages/job security are good. In other words, we may now be in a more conventional economic cycle as opposed to an abnormal one. We suspect many cannot grasp this paradigm shift. Add to this a substantial cyclical fiscal boost and US GDP might well surprise to the upside in the next few years. This obviously is supportive for a higher EPS growth, a stronger USD and a larger need for the Fed to tighten beyond its current ‘dots plot’. It might also help Trump win a second term!

Whilst we think trade tensions may remain heightened for several months, we believe China has re-considered its confrontational approach to the US and that might enable an agreement between the two over time. US’s agreement to postpone the proposed tariff on autos was another positive. Equity valuations outside the USA are looking more attractive – notably in AXJ that is trading close to lows seen outside a major crisis at around 1.2x PBV – and global GDP growth and EPS growth are both holding up so far. Admittedly, the latest move by the US to potentially increase tariffs from 10% to 25% on an extra $200bn worth of imports from China, and China’s plan to impose retaliatory tariffs on an extra $60bn worth of US imports, will not help short term volatility, but the first signs of FX intervention by PBoC to support CNY are a positive step.

We are cautious Tech on valuation grounds and concerns over the risks associated with ‘momentum-style’ retail inflows into passive ETFs, which have indiscriminately supported rising valuations – the 20%+ falls in both Facebook and Twitter illustrate these risks are not theoretical. IT accounted for 55% of the SPX’s gain YTD, near the post Tech-bubble highs and is growing at an unsustainable pace. Five companies, Apple, Alphabet, Microsoft, Amazon and Facebook, now account for over $3.5tn of market capitalisation. As Morgan Stanley notes: “The fact that Tech is so large and represents such a significant proportion of the ‘winners’ YTD makes contagion from a positioning unwind more likely now than ever.” We have warned previously that once the FAANGs stop rising, this is not simply a risk for IT (and NASDAQ) but for the wider market (IT is 26% of SPX’s weighting) and consequently, for the passive ETFs that offer no price discovery nor risk management.

US EQUITIES – REVIEW

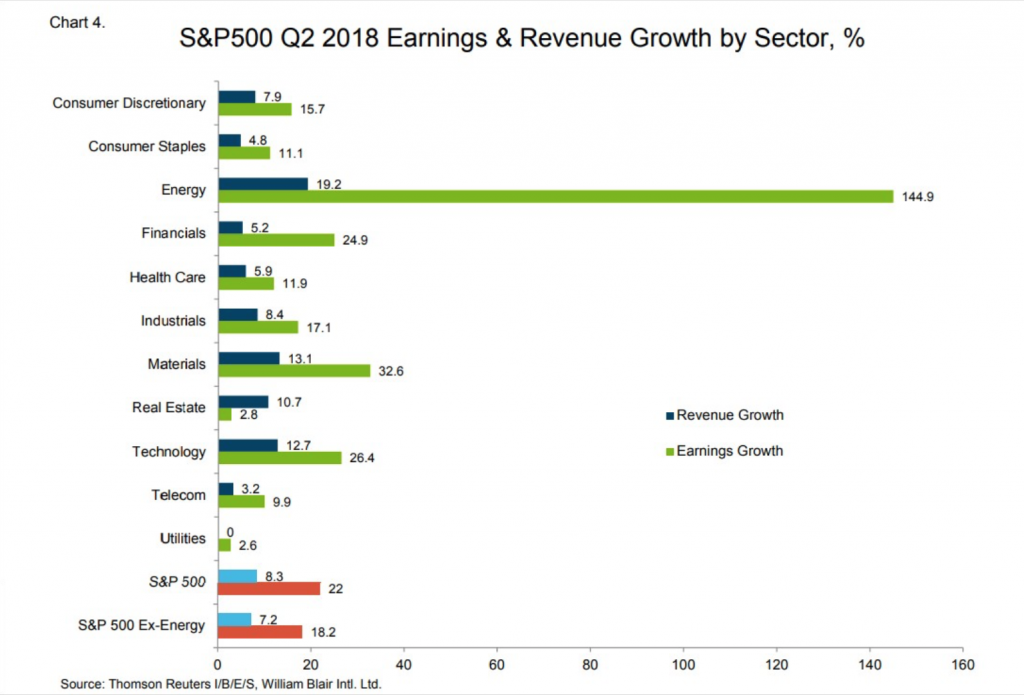

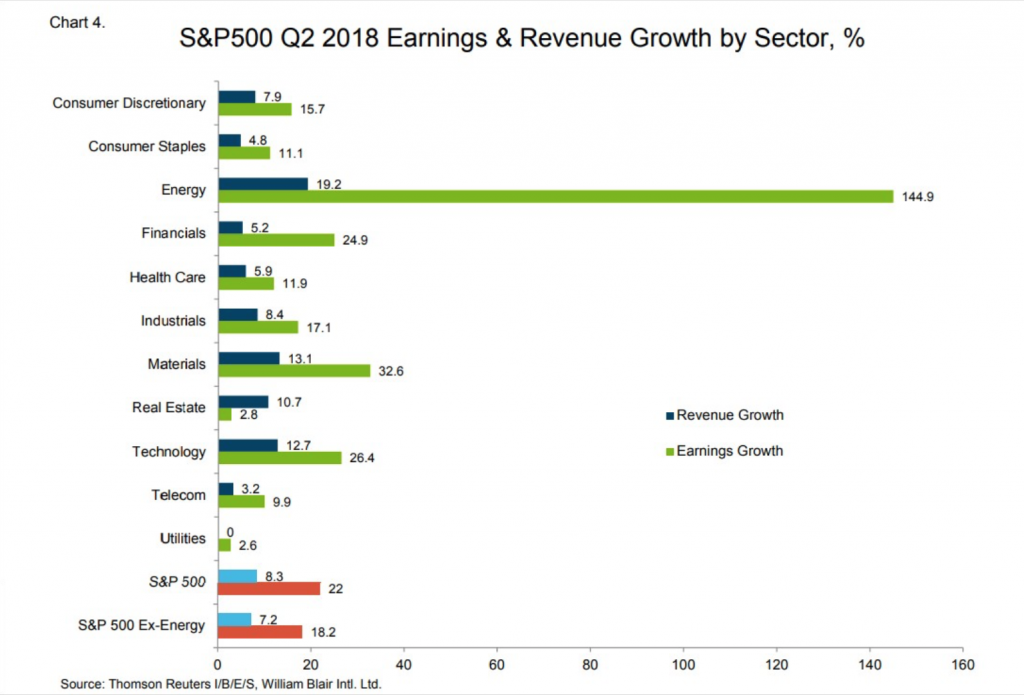

Fig 4. SPX 2Q18 earnings and revenue growth by sector

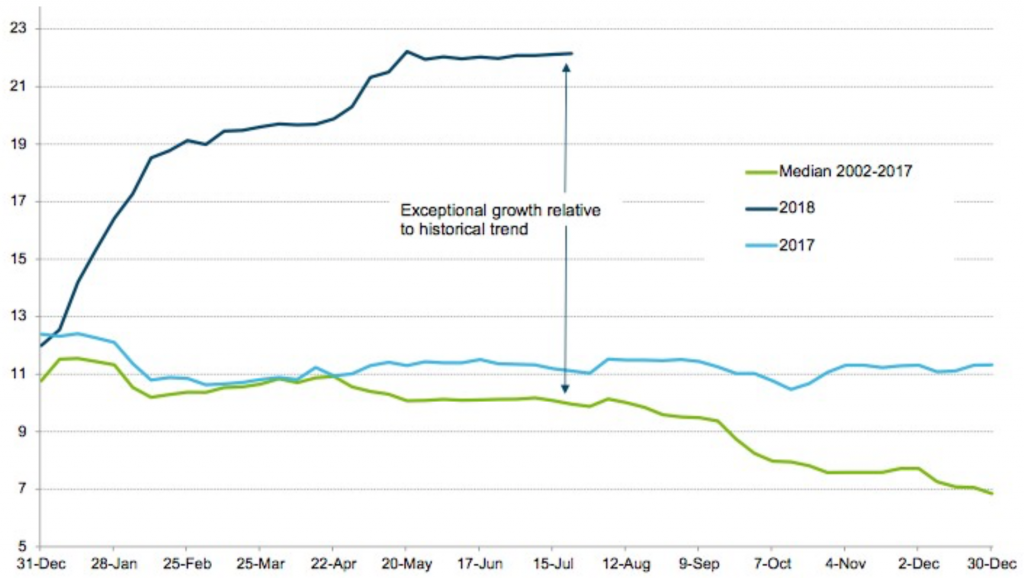

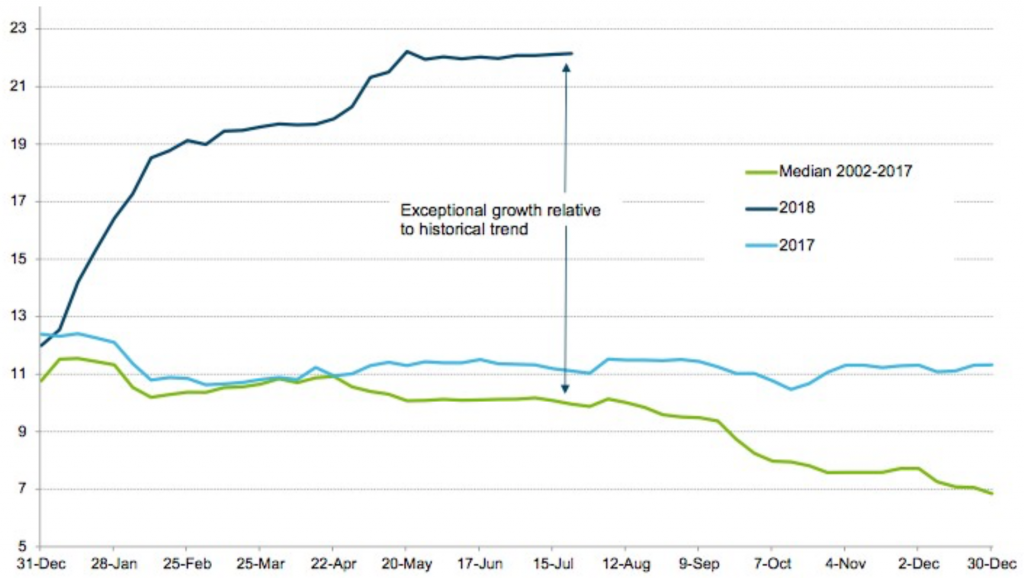

- 81% of the companies in SPX have reported Q2 results, beating estimates by over 80% in both the topline and EPS (Fig 4). The likely 27% YoY growth makes this the best quarter since the recovery year in 2010 and the best outside a recovery year since 200 Analysts started the year with FY18 forecasts at +11% and these have now been revised to +23% (Fig 5), with +10% built-in for FY19.

- Value outperformed Growth last month, in one of the best moves since 200 NASDAQ underperformed both SPX and DJIA for the first time in months, reminiscent of its sell-off in 2016. Facebook lost over 20%, and Twitter 27%, in two days. Sector moves last month also indicated some shift into defensives.

- July’s robust non-farm payroll (NFP), if adjusted for strong increases to the two prior months, and the 30bps rise in hourly wages to 7% YoY pace put the seal on a robust set of data. Q2 nominal GDP growth was a phenomenal 7.4% and real GDP growth of 4.1% was after a 3.3% deflator as final sales rose 5.3%.

- The Federal Open Market Committee (FOMC) continued to guide for robust growth after the Beige book also found growth to be broadly improving. Fed Futures are estimating a 90% probability of another 25bps hike in September and over a 60% chance of a fourth rise in Decemb

- Trump and his team are getting increasingly agitated about Robert Mueller’s investigation into Russian influence in the election campaign, which is mostly ignored as a threat by marke However, the risk is rising that something of substance, linking the Trump campaign, is uncovered.

Fig 5. Weekly progression of analysts’ annual growth estimates for SPX EPS (%) | Source: William Blair

US EQUITIES – OUTLOOK

- US equities historically have derated by 10-15% as EPS growth slo On current forecasts this inflection point could be as early as Q3FY18/Q4FY18. This, along with concerns around the IT sector’s leadership, suggests caution ahead around US equities and FAANGs as we go into autumn. A key debate is revolving around whether the FY19 EPS provide evidence of slower, ‘late-cycle’ earning or, whether we are more ‘mid- cycle’ with a more robust outlook for EPS growth and strength of the USD.

- Despite the strength in Q2 GDP growth, it is likely growth might continue at a robust level, as only a small part of the Federal fiscal spending increase was spent, with around a third coming into H2CY18 and the bulk coming into CY19. Hefty inventory destocking seen last quarter should also reverse with consumption and the private sector investment will likely remain robust in H2CY18.

- The strength of the economic data and breadth of the growth will support FOMC in raising rates twice more this year, but the important debate is whether FOMC’s guidance for the long-term Fed equilibrium interest rate (R-STAR or R*) is correct at 3%. If inflation returns, the consensus R* will be proven too lo

- Even the Fed Chair, Powell, whilst criticising trade protectionism, provided ‘cover’ for short term measures against China if this was to enable lower overall tariffs in the medium to long ter Trump has minimal domestic opposition to his trade policies making risk markets volatile around his latest ‘tweets’, but the key is whether trade protectionism gets worse in the short term and for how long this lasts – past history suggests 18 months as an average. That said, some think Trump might announce a deal just before the US mid-term elections in early November.

EU EQUITIES – REVIEW

- A weaker Euro and GBP helped both STOXX and FTSE 100 gain last mon STOXX results so far are disappointing with more profit ‘misses’ than ‘beats’ despite topline beats.

- EU macroeconomic data mostly missed forecasts last month and activity in consumption, investment, exports and manufacturing hit 1-2y lo This has disappointed earlier hopes that the ‘soft’ patch in H1CY18 would stabilise and see recovery, with several sell-side houses downgrading GDP for CY18 and CY19. However, the decline, overall, is modest and comes off a higher absolute level.

- Despite some mixed messages, the ECB meeting was relatively ‘dovish’, with several strategists interpreting it to mean no rate rises until 2020 at the earli UK‘s Bank of England (BOE) raised rates by 25bps but this, too, was characterised as a ‘dovish’ move with BOE likely to be on hold until after BREXIT.

- Political risks rumble on as May just survived to the summer break, by offering just enough to the ‘leavers’ and ‘remainers’ to get through some close votes on B Likewise, the disparate coalition in Italy staggers along, despite the huge ideological differences, but could easily come back again to haunt EUR risk assets.

EU EQUITIES – OUTLOOK

- Weaker-than-expected STOXX EPS is a rite of the summer in most years since GFC (vs SPX reliably beating estimates) and will not help an unloved region if we get further EPS downgrades from consensus of +9%. STOXX is seen to be the equity region most vulnerable to trade protectionism – more so than Japan, EM and AXJ!

- FTSE 100 EPS growth is forecast to be +7% FY18, in contrast with a much stronger EPS growth last ye This forecast could be at risk due to weaker economic growth as BREXIT risks start to bite and may raise questions over the degree of cover for dividends and thus for income funds that are major investors in UK equities.

- The fractious battles within May’s Conservative party will, at some point, force her to decide on a strategy, be it ‘soft’ (as most people expect) or ‘hard’, which could trigger her government’s fall and result in fresh election Many now fear the UK government is so ill-prepared to negotiate with EU that a ‘hard’ exit, or no deal, is a growing risk for the economy, FTSE 100 and GBP.

APAC AND EM EQUITIES – REVIEW

- The latest TANKAN was quite upbeat with some indicators at their best since the ‘90s, including some positive labour market dat This contrasted with ‘hard’ data disappointments such as lower-than-expected inflation. BOJ’s recent meeting was more ‘dovish’ that some hoped with no change to its ‘yield curve control’ (YCC). Q2CY18 EPS are still mostly yet to be released, but guidance so far is encouraging.

- AXJ has continued to see EPS downgrades, notably in the IT/social media sector that led the MSCI AXJ rally last year (Tencent has lost more market cap YTD than Facebook). Estimates are now at +10% FY18 from +15%. Weaker AXJ FX has also reduced AXJ EPS in USD-adjusted terms.

- Central banks in the region are under greater pressure to tighten against USD strength while facing further pressure from a weak Indonesia, Philippines and India have all raised rates in the last few weeks to help stem FX weakness. Others are proving less ‘dovish’, although there are mixed messages from PBoC as to whether it is easing or tightening around the deleveraging issue.

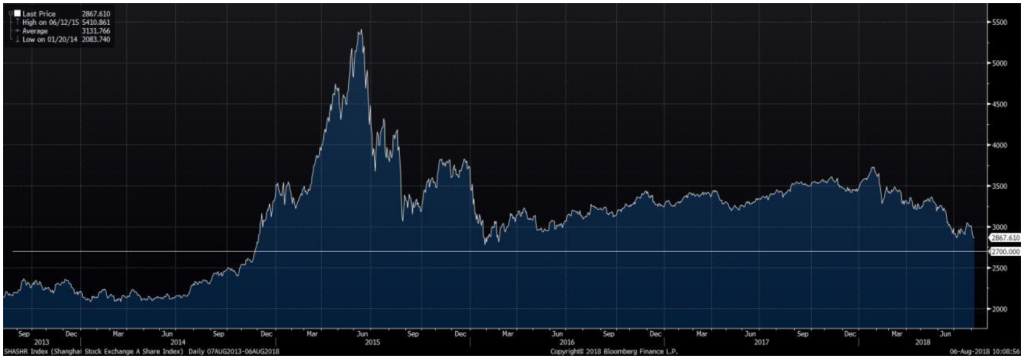

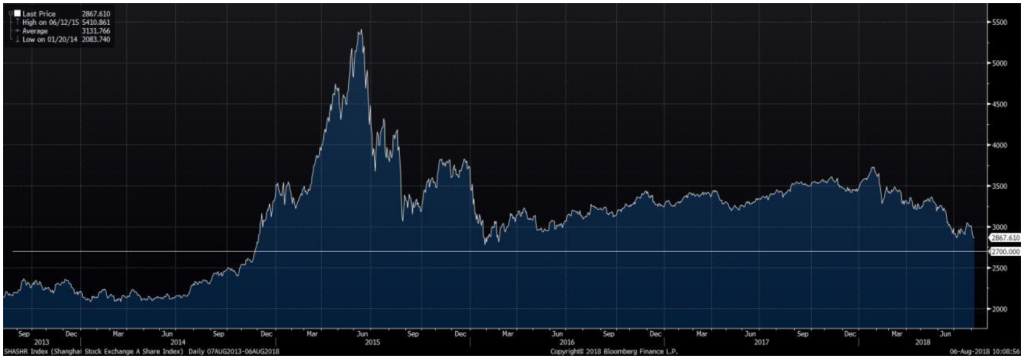

- A-shares’ 20% ‘dive’ ended at a 2y-low, but the index rebounded back above key supports at 2,700 towards testing 3,000 again (Fig 6) on hopes that policy action might be taken to support the domestic economy and to limit CNY weakne Underlying macro data, although easing-off a bit, remain supportive as does profit guidance with a number of positive profit warnings.

- ASEAN equities rallied after hitting valuations that previously marked lows outside major crises with financials in the vanguard. Evidence the region’s central banks were being proactive also helped lower FX fears.

- Q2 data out shows whilst the government and FIIs sold down Indian equities heavily, this was bought by local mutual fund.

Fig 6. A-shares see support at 2,700 and moves towards testing 3,000 | Source: Bloomberg

APAC AND EM EQUITIES – OUTLOOK

- BOJ might alter its equity ETF buying pattern that hitherto has helped Nikkei 225 to be more focused on the TOPIX composition which could have some stock specific and ETF implication A continued ‘dovish’ BOJ will reduce risks of a stronger JPY – that is TOPIX positive but not so much for financials.

- AXJ and Chinese equities will take their lead from developments around trade and The latest round of USA tariff escalation, and Chinese retaliation, have dampened hopes that a more conciliatory China outlook was developing as it appears USA is determined to punish first and listen second. UBS estimates a full trade war would see AXJ EPS fall to be flat in FY18 and negative in FY19.

- On a more optimistic note, China at last appears to have taken steps to intervene against CNY weakness for the first time. That is a critical step as a breach of 00 against USD would be a dangerous move as it would indicate the use of a deliberate devaluation of CNY as a weapon against US trade protectionism and in doing so, widen the trade battle into a currency war.

- The Chinese government and PBoC, after recently hinting at an easier monetary policy and other actions to support the domestic economy, confused investors last week by repeating an earlier message of its commitment to deleveraging and further property market restraints that will limit the upside for Chinese equities, including property shares, in the short term.

- Whilst the rally in large cap Indian equities have taken valuations for the NIFTY 50 to levels that require a solid EPS recovery to come through to justify any further gains, the mid-to-smaller (SMEs) caps have seen a 30-40% sello This massive selloff offers better value and justifies a switch from larger caps, but this may require patience to see the rewards, given the damage to local investors in the SME space.

FIXED INCOME – REVIEW

- The various DM central bank meetings re-emphasised the differences in monetary policy, with FOMC highlighting a relatively robust outlook for the US economy, albeit without overheating, while both ECB and BOJ guided more ‘dovishly’ than was expected, as did the BOE.

- Bunds yield jumped 14bps+ as political risks eased-off over Italy and Germany’s coalition government as the CSU and CDU ‘kissed and made up’.

- Credit rallied modestly across the board, after the prior months’ sell-off, led by EM and global HY as investors again found sufficient value in yields, given the lack of yield elsewhere in FI, to re-ent

- More ‘hawkish’ EM central banks guidance and action saw a recovery in interest in EM local currency debt(LCD).

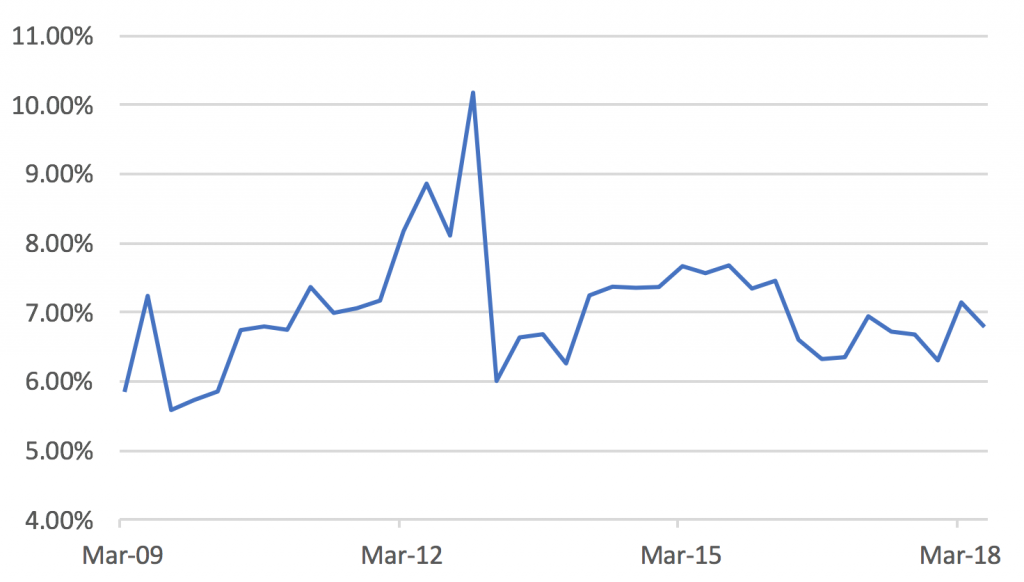

- Inflows continued in floating rate debt like senior bank loans, and other less liquid forms of floating rate like trade finance and private debt, given their short duration, and hence attractiveness, if rates were to rise (Fig 7).

Fig 7. Short-duration bank loans vs YTM | Source: BofAML, JPM, S&P

FIXED INCOME – OUTLOOK

- The debate around the right level of R* in the US is essentially a debate about wage inflation; longevity of this economic expansion; and the degree of slack in the labour forc The ‘doves’ think there is more ‘slack’ in the labour force than the ‘hawks’, although no one really knows the answer –the official unemployment rate is at 3.9% whilst jobless claims at 200,000 are at 50y-lows, but the wider unemployment rate is at 7.5%, and the participation rate is low.

- Our belief is that wage inflation is present and accelerating, and that an R* at 75-3% will prove to be too low. However, until that consensus is shaken, it provides an anchor for UST 10y yield at 3% and implies the yield curve will ‘invert’ possibly after Fed’s expected rate hike in September.

- Our view, for now, is that an inverted yield curve is not a sign of a recession, be it that longer term yields are mispriced after its massive quantitative easing (QE), or that the US Treasury has been issuing a lot of shorter duration pap However, the facts are that an inverted yield curve has reliably predicted a recession with an average delay of 21 months and policy errors, such as a severe trade war, could cause the next recession by late 2020.

- US Treasury issuance is set to jump massively in H2CY18 to help fund increased fiscal spending, yet the Fed is committed to reducing its balance sheet slowly but su The combination might put pressure on UST yields to rise beyond simply underlying Fed rate hikes. The Fed estimated its QE helped lower UST 10y yield by 60-80bps thus quantitative tightening (QT) might have the opposite effect on yields when issuance is set to sharply rise over the next few years.

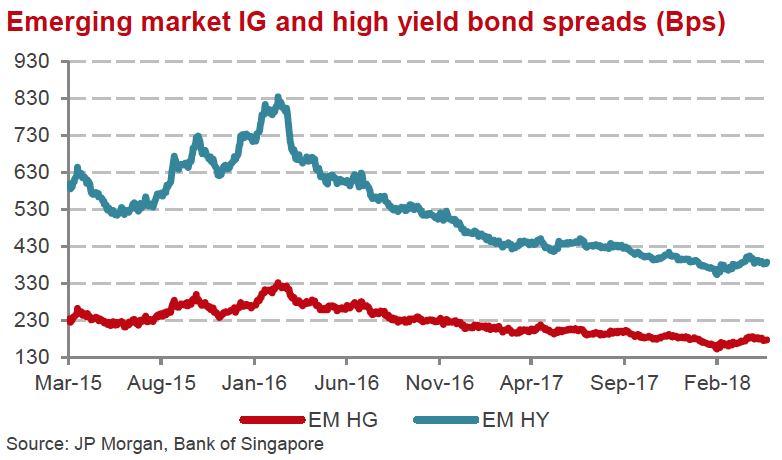

- The sharp fall in EM HY recently has only partially reversed and we still see value in selected segments like better quality Chinese property developers and Indian steel companies. We would increase exposure from very low levels to be more neutral, but will only do so graduall Fundamentally, the credit metrics of EM borrowers are mispriced relative to greater risks in indebted DM countries.

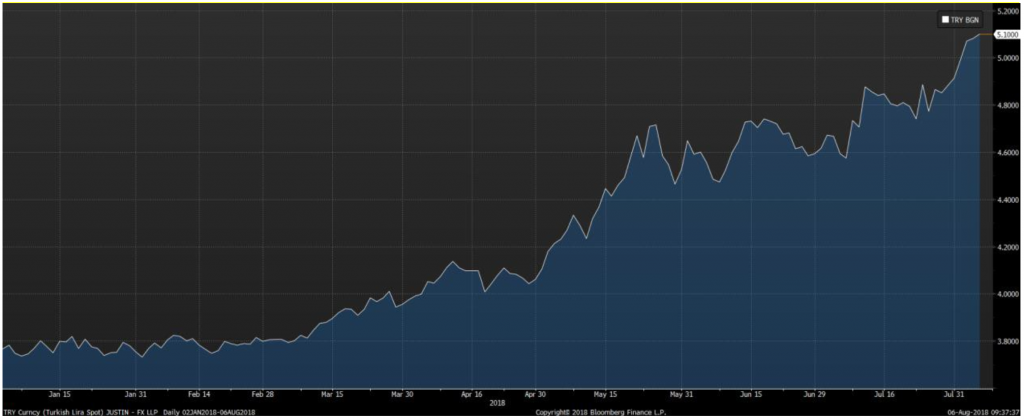

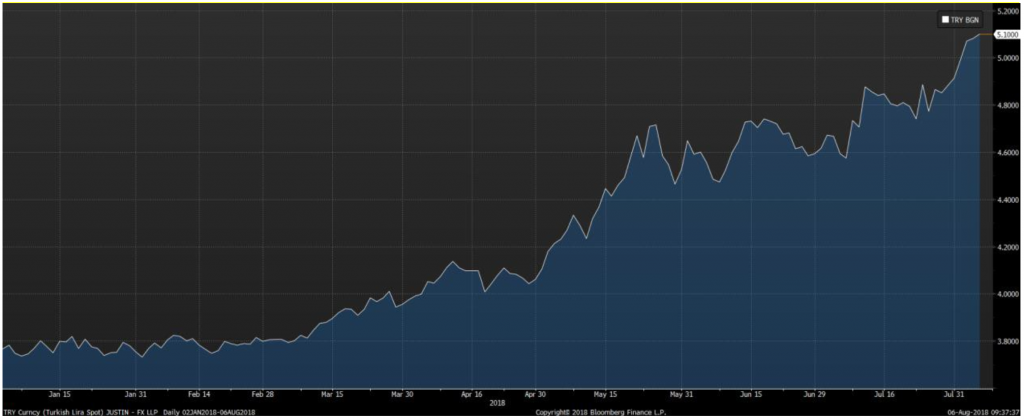

- Admittedly, an idea for very aggressive investors would be to pick up a 19% yield in the 2027 Turkish sovereign lira bond, with the Turkish lira (TRY) having devalued hugely YTD (Fig 8). The USD 2027 Turkish sovereign yields 7.5%. It is always darkest just before dawn, but markets are likely to pressure Erdogan into accepting more orthodox economic policies or suffer a FX crisis.

Fig 8. Extent of TRY weakness against USD YTD | Source: Bloomberg

FX – REVIEW

- For the second month in a row, the action continued to be in USD versus EM FX. Those countries with prudent economic decision making (e.g. Indonesia, India and Philippines) were rewarded with stable or strengthening currenci Others, such as Turkey, continued to worry more cautious investors and saw further large falls.

- Much of the focus was also on the free-falling CNY, and the pressure this puts on other AXJ, EM and other commodity currencies as the AU After rapidly falling over 5%, CNY stabilised to a degree last week, closing at 6.84. Real yield differential to USD has also helped CNY weakness (Fig 9).

- DXY, with weightings of 56% in EUR, 16% In GBP and 11% in JPY was relatively stable below key resistance at 95 until a weaker narrative around all three currencies saw USD gain late last week. A weaker JPY broke through a key support at 130 after the BOJ meeting failed to alter YCC guidance; GBP was testing 1.30 support on a perception the BOE rate rise might be the last for some time; and worse-than-expected EU macro data impacted EUR.

- The Indian rupee (INR) tested its all-time low close to 70 against USD before rallying after RBI hiked 25bps last week and guided for higher inflation. Other than FIIs selling down equities and INR FI, the current account deficit has also started to deteriorate quite substantially from a higher oil bill, a sharp increase in gold imports and a general rise in other impo FX markets are punishing countries running current account deficits.

Fig 9. Narrowing China-US real yield gap | Source: CEIC, Daiwa

FX – OUTLOOK

- For now, real yield differentials are treading water in DM FX and unless US macro data firmly pushes the UST 10y yield through 3%, it is hard to see the catalyst for major moves. Consensus forecasts still cling to a stronger EUR, and a stronger JPY, against USD by YE18, linked to where some see fundamental value at 30 and 100 respectively.

- The main story in DM FX is around GBP, with several houses lowering GBP forecasts around heightened BREXIT risks (HSBC now forecasts 1.27 YE18) including UK failing to agree on any deal in time for the March ‘19 deadline. A tail risk would be if May’s government was to fall and a Corbyn-led Labour coalition was to succeed. This could see GBP test its all-time low at 1.04 set 35y

- CNY’s neglect by PBoC is a concern to us as our base case is that China wants a stable CNY and is more frightened of capital flight than ensuring greater export competiti In the past, China has indicated it would not wish to see a CNY move of more than 5-6%, which would imply more active intervention now. Should CNY stabilise, this will help AXJ and EM FX too.

- YTD, the Philippine peso (PHP) and INR, along with the Indonesian rupiah (IDR), have fallen the most versus USD but all three have seen their currencies stabilise or gain in last week or so. However, the Thai baht (THB), which had been relatively strong versus USD YTD, is now weakening as its central bank (BOT) remains on hold and ‘dovish’ (Fig 10).

- A puzzle is the resilience of SGD to USD strength and weakness in both MYR and CNY as both are large components of the SGD-trade weighted bask Should the MAS remain on hold in the October monetary policy review, the SGD could weaken sharply from here to test 1.40 if it breaks above 1.3760 key support.

- The US has highlighted it might take action against trade partners that run surpluses of over $20b This might explain the recent ‘hawkish’ comments from South Korea’s Central Bank Governor. Another country potentially at risk is Vietnam as it also fulfils the US criteria around unfair trade. However, VND has mostly tracked USD and the recovery of its FX reserves was from a pitifully low level close to requiring IMF support.

Fig 10. Percentage returns of IDR, PHP, INR and THB against USD (Inversed Y-axis) | Source: Bloomberg

COMMODITIES – REVIEW

- Brent oil fell hard over the last month from over $80/brl to test key support at $71/brl (Fig 11) after the rise in US crude oil inventories, Trump’s threat to release part of US’s strategic reserve of over 600mn/brl and Saudi Arabia’s production numbers which beat estim Oil markets ignored threats from Iran in its ‘tweet’ war with Trump – it could close down the straits of Hormuz through which 40% of globally traded oil is shipped – and an EIA report that forecast higher demand.

- Gold moved inversely to USD gains, notably against the USD/EM FX moves, as speculative investors dumped oil-backed ETFs in siz The precious metal is now testing support levels in the low $1,200/Oz area.

Fig 11. Brent prices testing support at $71/brl | Source: Bloomberg

COMMODITIES – OUTLOOK

- We remain cyclically positive on the outlook for the demand for oil in the next 3- Changes in regulations around shipping pollution controls could add as much as 2-3mn/bpd by 2020; and the huge 50% cut in oil E&P spending between H2CY14 through much of 2017 will leave capacity constrained by as early as 2020 too with a real risk of a supply-side ‘crunch’. Underlying global demand is rising faster than earlier forecast at closer to 1.5mn/bpd. Sell-side forecasts are noting these positives and are raising forecasts for the next few years with some expecting $100/brl by 2020.

- We remain constructive on the integrated oil majors as not only might oil prices go considerably higher, but these companies have radically reduced costs of upstream production by as much as 40-50% and thus are generating substantial free cash flows that easily cover capex and dividends yet valuations do not reflect the upside from these positive fundamental development

- There is strong support for Gold at $1,180/Oz (Fig 12) and we remain of the view gold offers defensive portfolio diversification attractions in a period FI might prove costly as a defensive asset clas However, timing is all and until USD gains start to peter out, Gold might continue to fall, but clearly much of the speculative interest has been whittled away.

Fig 12. Gold heading towards strong support at $1,180/oz | Source: Bloomberg

HOW WE MANAGE RISK – PORTFOLIO PROTECTION, HEDGING & TAKING PROFITS

As opposed to just going to cash, we prefer alternative strategies such as hedging via options and option writing strategies to smooth out portfolio volatility.

We also actively monitor profits using trailing stop losses with the view of protecting and locking in gains.

PORTFOLIO MANAGEMENT SERVICES

Please let us know if you would like to hear more about our Discretionary Portfolios and how we consistently generate an additional 0.5% to 1% per month using our Options Overlay.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at.

Jul 13, 2018 | Articles, Global Markets Update

HOW WE ARE POSITIONED FOR 3Q18

It was a choppy and volatile month as US President Trump announced a 25% levy on $50 billion of imports from China, who likewise responded with similar measures. Stakes were raised toward month-end as the US threatened additional import tariffs of close too $200 billion.

Non-US equities were the hardest hit, notably Asia ex-Japan, which saw its benchmark index off 5.2% from last month. China’s A-shares were particularly hit hard, down c. 8% for the month, and 20% off its January peak. It was a rough month in general for AxJ/EM equities despite a strong finish on a quarter-end window dressing. It was also a poor month for Europe as the Stoxx 600, and in particular Italy’s MIB, also fell after the Italian election result that took Euro lower to test a key support at 1.15. On the other hand, US equities saw large inflows as they are seen to be relative winners from developments in trade while ‘growth’ equities have outperformed – within US equities – by 20%.

The trade conflict will be priced-in at some point but, unfortunately, this may remain a moving target ahead of the US mid-term elections and, in the short term, may get worse. There remains a fundamental gap between US – that views existing trade as ‘fundamentally unfair’ – and the rest of the world, hence its tariff impositions. This explains why, should there be any resultant retaliatory action by China, EU and Canada, would further US tariffs be triggered. EU and China want to negotiate first before the US imposes tariffs thus the two sides are unable to compromise.

- Fixed-income (FI) markets were mixed as a continued selloff in credit was led by investment-grade (IG) credit, and further weakness in emerging market (EM) FI more generally – not least in local currency debt (LCD).

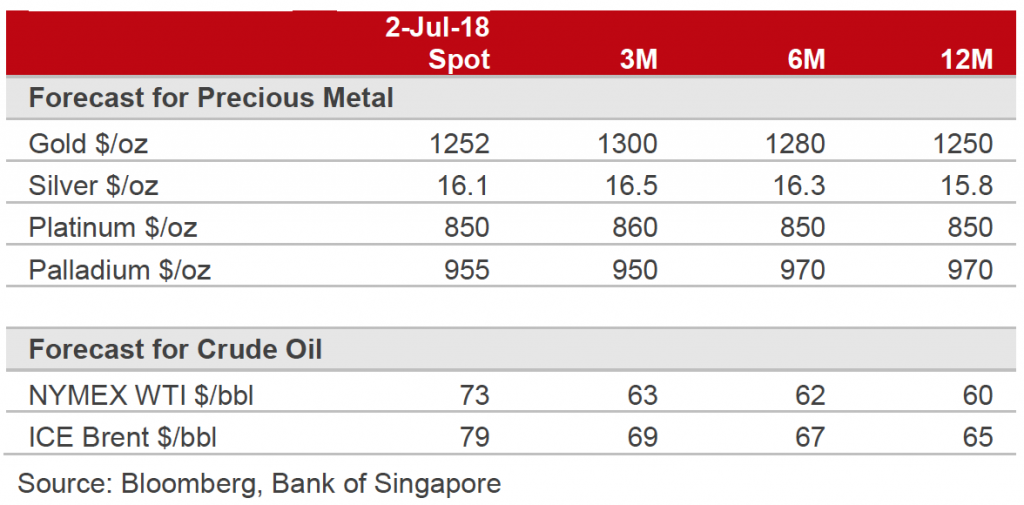

- Commodities remained well-supported, with Oil still seeing favourable supply-demand dynamics, amidst potential disruptions in the Middle East. Gold remains range-bound in the $1,240 – $1,360 region.

- While the US Dollar has seen a strong comeback over the past quarter, we still believe it is in a long-run secular downtrend.

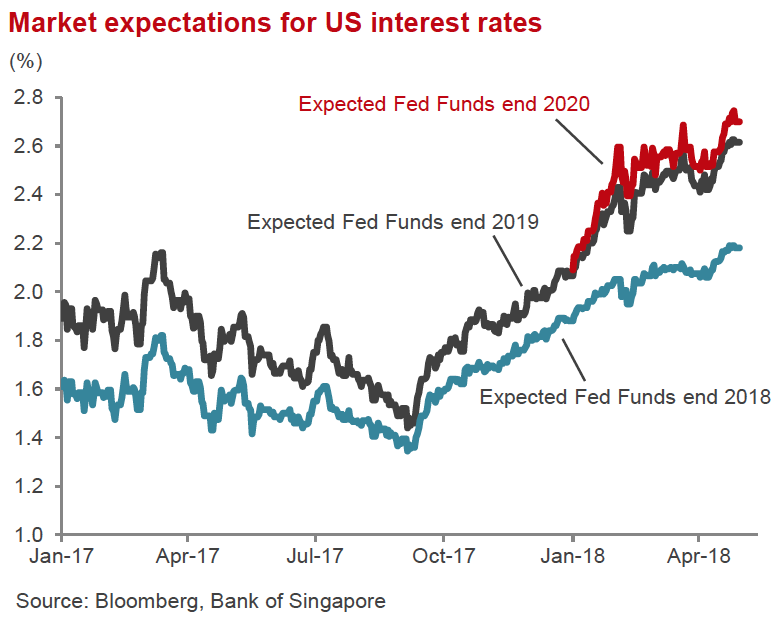

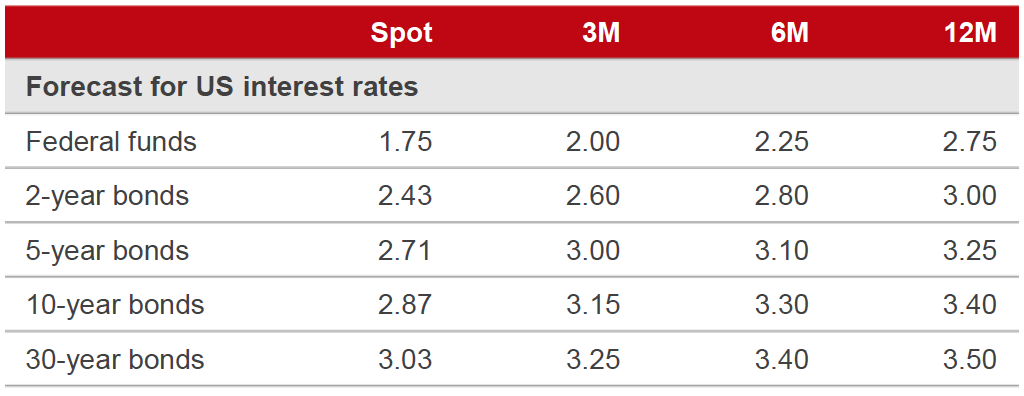

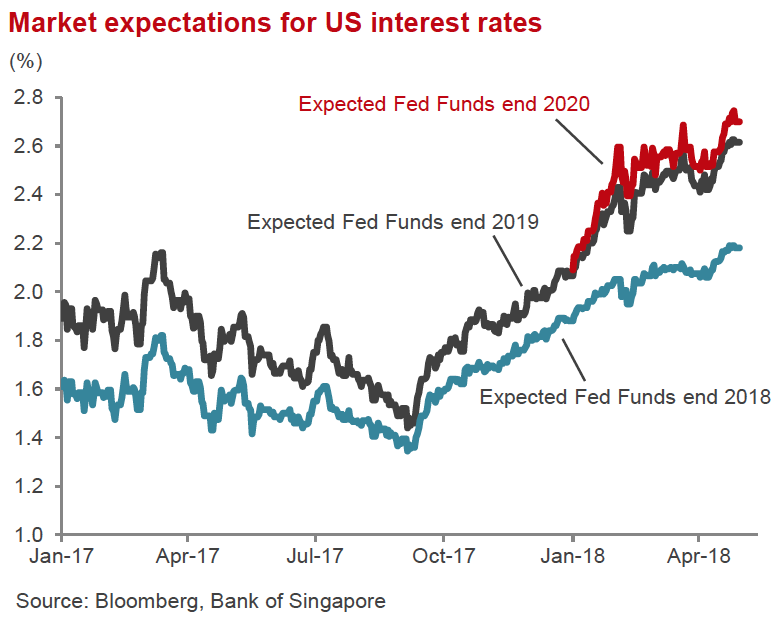

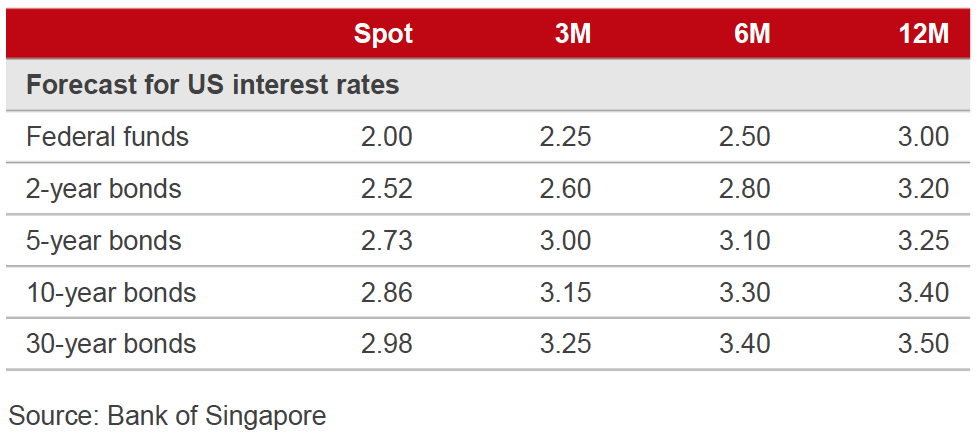

- In line with what markets have already priced in, we still expect two more hikes from the Fed, for a total of four rate hikes this year. The unlikely exception to this scenario would be a severe deterioration of trade tensions, which could see the Fed slow down its pace of rate hikes.

MARKETS OVERVIEW

Equities – Cautious

- Globally, equity markets closed mostly flat-to-negative, with small gains in the US opposed to losses in most of the other markets. Notably, the S&P 500 saw significant sector disparity in 1H18 as consumer discretionary(+10.81%) led gains, helped by Amazon (+45.35%), Netflix (+103.91%) and Nike (+27.39%). The IT sector followed closely with a c.10% gain, whereas financials (-5.00%) and defensive sectors, as consumer staples and telecommunication services (both off c. 10%), hugely underperformed. Q2 saw the ‘FAANGs’ once again providing key leadership.

- We remain neutral and opportunistic buyers on best names, as the sector still remains the most expensive with a forward P/E of 19.3x.

- Our broader forecast for equities still remains positive, albeit on single-digit returns for the year. We would like to remain invested in US markets as we see a likely outperformance given the current Goldilock scenario, and its relatively ‘safer’ status. We remain neutral on European and Japanese shares, though the Stoxx 600 will likely take direction from trade movements, and the Nikkei will be likewise equally vulnerable should the US impose tariffs on auto imports.

- Asia ex-Japan equities suffered hefty foreign institutional investors (FII) outflows last month and YTD, underperforming equities across other regions. Apart from A-shares, KOSPI fell 6.25%, although TAIEX remained resilient to come off only 35bps. Whilst trade concerns clearly were the key driver of the selling, other drivers include widespread earnings downgrades, weaker FX, specific political risks in Malaysia and India, and some technical factors. At an industry level, there were concerns over the semiconductor sector and the Apple supply chain while financials generally suffered.

Equities – Preferred Sectors

- We remain neutral and opportunistic buyers in Technology, on a best-name basis as the sector is still the most expensive with a forward P/E of 19.3x.

- While Financials have underperformed over the last few months, we view concerns over the flattening curve as overblown. A renewed drive in US interest rates and the rest of the world will benefit the banks. We expect an eventual easing of capital restrictions, which could make it easier to increase dividends and buybacks. We prefer Asian banks, followed by US banks, over European at this stage.

- We also remain positive on Consumer Discretionary, especially in Europe and Asia. The sector will benefit from continued strength in global economic growth, as well as sustained improvements in labour markets and consumer confidence.

- We like Energy stocks as a defensive play, and a good hedge against the geopolitical turmoil over the long run. However, we are slightly concerned that the market could be toppish in the short term.

Bonds – Mostly Bearish

- A rising interest rate environment leaves most bond markets vulnerable. Treasury Yields, following global uncertainty, have retraced almost 30 basis points from the highs earlier in the year, but we expect to see a move higher to reach 3.25.

- For investors that need to be positioned in fixed-income, we prefer either inflation-protected bonds (e.g. TIPS), or high quality corporate bonds with short durations trading at or near face value.

- Whilst EM FI remains vulnerable to trade developments and EM FX weakness, the yield is starting to look attractive again, particularly on a medium-to-longer term view. Credit metrics are fundamentally superior to developed markets, and there is a growing domestic investor base. In most countries, we are also starting to see reduced borrowings and that includes China.

Commodities – Constructive

- Oil rallied by over 2% last month, after the Trump administration suggested sanctions on countries that did not reduce their imports of Iranian crude to zero by November. US Energy Information Administration (EIA) also saw the sharpest drop in US crude inventories since 2016 and OPEC’s decision, on 22nd June, to increase production by 1mn/bpd was seen as conservative. The price was volatile in the month but remained above key support, for Brent, at $74.25/brl (Fig 6) but failed to breakout above resistance at $80/brl.

- Demand continues to grow, as US rig counts have been increasing at a lower-than-expected pace, and markets have discounted the announcement of an OPEC production increase. While a short-term correction in Oil prices may occur, we remain bullish in the longer-run with the view that developments in Saudi Arabia and Iran may see upside surprises.

- Gold remains in the $1,250 – 1,360/Oz range, and at the lower-end, looks more interesting as a safe haven asset in portfolios. This comes especially at a time where we remain cautious of longer duration, high quality DM bonds. Should the US Dollar gain/stall, Gold looks to be an increasingly attractive option, especially after its selloff from recent highs due to a bounce in the greenback.

Currencies – Consensus Bearish On USD

- So far, it seems trade war concerns have only really impacted Emerging Market currencies against the US Dollar, as the flight to quality in recent weeks have been positive for the greenback. Movement in Developed Market currencies were mostly sideways – bar JPY – as the DXY remains below key resistance at 95 despite testing the level twice last month.

- As rate hikes by the Fed are mostly expected, the market is focused on other Central Banks to follow and change their accommodative stance.

- While we concede that the Dollar may see further strength in the shorter-term, we expect its downtrend to carry on in the medium term.

Alternatives – Bullish

- We remain generally positive on property markets, with a preference for commercial over residential. Our favoured countries for exposure include Australia, UK, Southeast Asia (particularly Vietnam) and in the US. Please ask for more information on some of the projects we are currently working on.

- We also have a positive outlook on Private Equity, as we see better growth opportunities as opposed to lower valuations that have been pencilled in for listed equity markets.

HOW WE MANAGE RISK – PORTFOLIO PROTECTION, HEDGING & TAKING PROFITS

As opposed to just going to cash, we prefer alternative strategies such as hedging via options and option writing strategies to smooth out portfolio volatility.

We also actively monitor profits using trailing stop losses with the view of protecting and locking in gains.

PORTFOLIO MANAGEMENT SERVICES

Please let us know if you would like to hear more about our Discretionary Portfolios and how we consistently generate an additional 0.5% to 1.5% per month using our Options Overlay.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at.

Jun 14, 2018 | Articles, Global Markets Update

HOW WE ARE POSITIONED FOR THE END OF Q2 2018

Global equities had a choppy and volatile month as initial strong gains gave way to profit taking in May.

US equities, fuelled by a positive 1Q earnings season, outperformed the rest of the world; while European equities, dragged down by higher political risk in Italy, considerably underperformed.

While the current environment demonstrates strong earnings and solid economic growth and should be supportive for the broader global equity markets. We anticipate that the recent rise in volatility will likely stay elevated for the time being while the current as Trade War Risk and Inflation risk returns, along with the US 10-year Yield hovering around the 3% mark.

Source: Bank of Singapore – Monthly Investment Guide, June 2018

Source: Bank of Singapore – Monthly Investment Guide, June 2018

- We continue to expect the Bond Markets to underperform, as the Central Banks, led by the Fed, will continue to raise rates and remove their accommodative monetary policies.

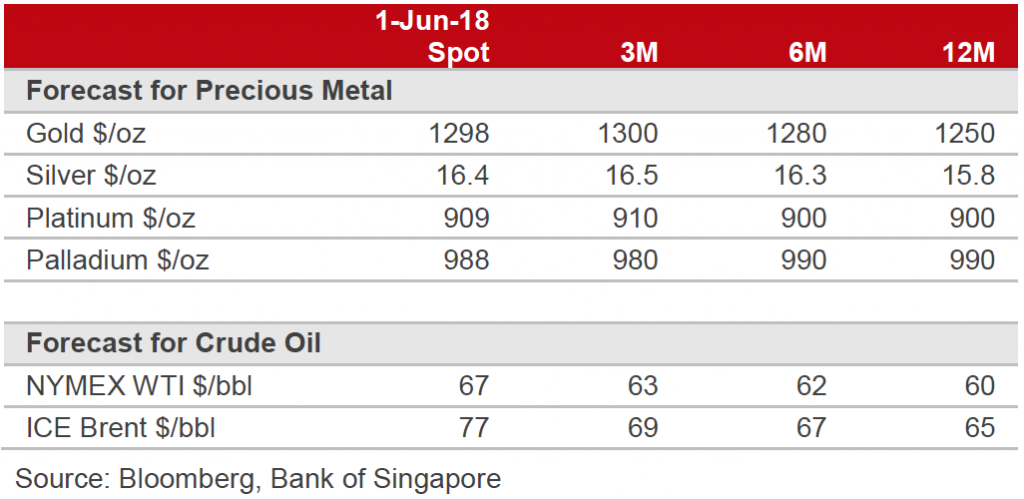

- Commodity markets are mostly bullish , with Oil still trading close at 3 years high, while Gold is currently trading in a range.

- The US Dollar has made a strong come back in the past couple of months, but we still believe it is in a downtrend in the long run.

- The general consensus was initially for the Fed to hike up to 3 times this year, however, now we see a real risk of 4 potential hikes, as wage growth and inflation are picking up – essentially a 0.25% hike every quarter.

Source: Bank of Singapore – Monthly Investment Guide, June 2018

Source: Bank of Singapore – Monthly Investment Guide, June 2018

MARKETS OVERVIEW

Equities – Cautiously Constructive

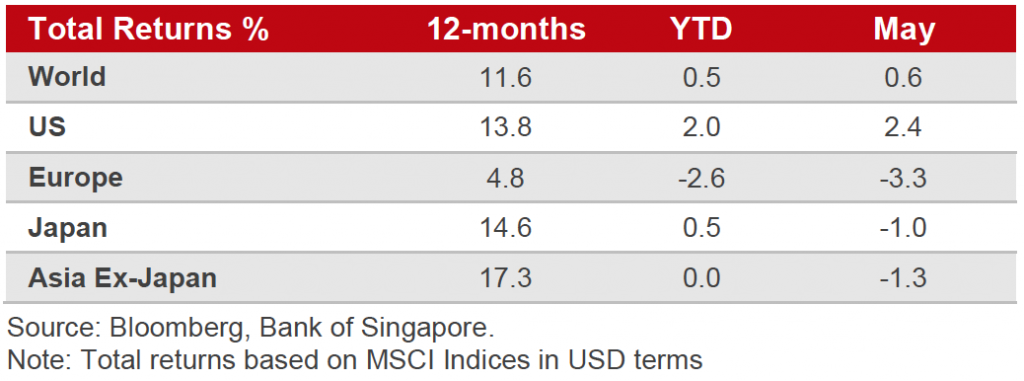

- Overall, equities across the world had a flat May, with gains only in the US, as opposed to losses in most of the other markets.

- Our forecast for Year End Word stock markets is still a positive return, albeit in the single digits.

- We would like to move to neutral on European stocks after the very weak May performance, as we see few risks arising from the new Government in Italy. Even though valuations are cheaper we believe the Euro will appreciate, versus the Us Dollar, in the long run.

- Japan had a negative month in May and we remain neutral there too.

- Asia ex-Japan underperformed in May as the market grew concerned about the Malaysian elections. Malaysia, Singapore and Korea were the worst performers, while China and Hong Kong were the top performers. Emerging Markets as an Asset Class has been struggling with notable examples like Argentina and Turkey.

Bonds – Bearish

- A rising interest rate environment means most bond markets are vulnerable. Treasury Yields had moved up a massive 50 bps around the end of Q4 17 and Q1 18, hovering now around the critical 3% level. We believe US 10yr will reach 3.25% by year-end.

- While yields came off a considerable 30bps in May during the selloff of Italian bonds, we still see the US moving higher as the Fed will probably deliver a rate hike in Mid-June.

- If investors need to be positioned in fixed income, we prefer either inflation protected bonds (e.g. TIPS) or high quality corporate bonds with short durations – trading at or near face value.

Commodities – Constructive

- Oil prices have rallied in the past 6 months as limits on supplies have been supporting prices.

- Oil demand continues to grow at a steady pace, while the US rig counts have been increasing, albeit at a lower speed than expected. So far, Opec has been very successful maintaining the current production rate. While we think short-term we could see a correction in the Oil price, we remain bullish for the long-term, as we are also wary of developments in Saudi Arabia and Iran.

- Gold has sold-off from the recent highs after a bounce in the US Dollar and with the stock market stabilising.

- We think Gold is still in the range of 1250/1350.

Currencies – Consensus is bearish on the US Dollar

- While the recent Emerging Markets uncertainty and the flight to quality in recent weeks have been positive for the US Dollar, the greenback could be vulnerable in the event of a real Trade War.

- As rate hikes by the Fed are mostly expected, the market is focused on other Central Banks to follow and change their accommodative stance.

- While we believe that the US Dollar can be strengthened in the short term, we expect the downtrend to carry on in the medium term.

Alternatives – Bullish

- We are generally positive on the property markets, with a preference for commercial over residential. Our favoured countries for exposure include Japan, Australia and Vietnam. Please ask if you require more information on some of the projects we are currently working on.

- We also have a positive outlook on Private Equity as we see better growth opportunities, whilst lower valuations are being seen across the industry compared to most other stock markets.

BULLISH SECTORS

- The Technology sector was the best performer in May, while the Telecom, Financial and Utilities sectors were the worst performers.

- Technology stocks outperformed and were supported by strong earnings and sales momentum. We remain neutral and opportunistic buyers of attractive companies in this sector, but are being very selective given the sectoo is currbelty the most expensive with a forward P/E of 19.3x.

- We are still positive on the Financial sector after its underperformance in May, as we think the concern over banks suffering a flat yield curve is overblown. We think a renewed increase in interest rates in the US and in the rest of the world will benefit the banks. We expect an eventual easing of capital restrictions, which could make it easier to increase dividends and buybacks. We prefer US banks over European ones, at this stage.

- We remain positive on Consumer Discretionary sector especially in Europe and in Asia as it will benefit from the strong economic growth and from sustained improvements in labour markets and consumer confidence.

- We like Energy stocks as a defensive play and a possible hedge in case of more geopolitical turmoil in the long run but we are aware that the market could be toppish in the short-term.

HOW WE MANAGE RISK – PORTFOLIO PROTECTION, HEDGING & TAKING PROFITS

As opposed to just going to cash, we prefer alternative strategies such as hedging via options and option writing strategies to smooth out portfolio volatility.

We also actively monitor profits using trailing stop losses with the view of protecting and locking in gains.

PORTFOLIO MANAGEMENT SERVICES

Please let us know if you would like to hear more about our Discretionary Portfolios and how we consistently generate an additional 0.5% to 1.5% per month using our Options Overlay.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at.

May 15, 2018 | Articles, Global Markets Update

HOW WE ARE POSITIONED FOR THE REST OF Q2 2018

After the sell off in February and March, the global stock market had a positive run up in April.

While the European and Japanese markets completed a strong bounce, the US and the rest of Asia underperformed.

While the current environment of strong earnings and solid economic growth should be supportive for stocks, we see the new volatility here to stay as geopolitical risk is back and so is inflation risk, with US 10 year Yield hovering around the 3% level.

Source: Bank of Singapore – Monthly Investment Guide, April 2018

Source: Bank of Singapore – Monthly Investment Guide, April 2018

- It is our view that global Bond markets to underperform, as the Central Banks led by the Fed will continue to raise rates and remove their accommodative monetary policies.

- Commodity markets are in a bull market, with Oil trading at 3 years high, while Gold is on the upper band of the recent trading range.

- The US Dollar is still in a downtrend for the long run, while a more aggressive Fed in the short run could help the greenbuck bounce from here.

- The general consensus was initially for the Fed to hike up to 3 times during 2018, but now we see a real risk of 4 potential hikes, as growth and inflation are picking up, with a quarterly rate rise of 0.25% each quarter.

MARKETS OVERVIEW

Equities – Cautiously Constructive

- Equities across the world had a positive April after losses in February and March, we remain positive, but we believe prudence is warranted.

- Our forecast for Year End Word stock markets is still a positive return, albeit in single digits.

- We still like to be overweight European stocks, as valuations are more attractive and we believe the Euro will keep appreciating versus the Us Dollar.

- While Brexit and the Italian political impasse might be negative factors, we think Europe from here will outperform the US market.

- Japan had a better month in April as selling pressure from foreign investors eased.

- Asia ex-Japan underperformed in April as the market grew concerned about the region’s growth.

- Taiwan and Indonesia were the worst, while Singapore and India were the top performers.

- Emerging Markets have been struggling with notable examples like Russia and Turkey.

Bonds – Bearish

- A rising interest rate environment means most global bond markets are vulnerable and may come udner pressure. Treasury Yields moved up a massive 50 bps towards the end of Q417. Q118 is now hovering now around the important 3% level. It is our view that the US 10yr will reach 3.25% by year end .

- If investors need to be positioned in fixed income, we prefer either inflation protected bonds (e.g. TIPS) or high quality corporate bonds with short duration trading at or near face value.

Commodities constructive

- Oil prices have rallied for the past 6 months as limits on supplies have been supportive of prices.

- Oil demand continues to grow at a steady pace, while the US rig counts has been increasing but at a lower speed than expected. Opec has been very successful in keeping production unchanged. While we think short term we could see a correction in the Oil price, we remain bullish for the long term, being also conscious of developments in Saudi Arabia and Iran.

- Gold has sold off from the recent highs after a bounce in the US Dollar and with the stock market stabilising.

- We think Gold is still in a price range 1250/1350.

Currencies – Consensus bearish on USD

- While the passage of the Tax Cut and the rising bond yields should be positive for the US Dollar, the greenback could be vulnerable in case of a real Trade War.

- As rate hikes by the Fed are mostly expected, the market is focused on other Central Banks to follow and change their accommodative stance.

- While we believe that the Dollar can strenghted in the short term, we expect the downtrend to carry on in the medium term.

Alternatives – Bullish

- We are generally positive on the property markets, with a preference for commercial over residential. Our favoured countries for exposure include Australia, UK, South East Asia, Japan, USA, and Vietnam. Please ask for more information on some of the projects we are currently working on.

- We also have a positive outlook on Private Equity as we see better growth opportunities, whilst lower valuations are seen across the industry compared to most stock markets.

BULLISH SECTORS

- Energy was the best performer sector in April, as oil price surged to 3 years high, while sectors like Industrials , Consumer Staples and Technology were the underperformers.

- Technology stocks suffered as the market grew concerned about a slower than expected smartphones replacement cycle, with semiconductors performing the worse in an otherwise crowded sector. We remain neutral and opportunistic buyers on best names.

- We are still positive on Financials after the underperformance in April, as we think the worry about banks suffering a flat yield curve is overblown. We think a renewed push up in interest rates in the US and in the rest of the world, that will benefit the banks. We expect an eventual easing of capital restrictions, which could make it easier to increase dividends and buybacks.

- We remain positive on Consumer Discretionary especially in Europe and in Asia, that will benefit from the strong growth of the economy and from sustained improvements in labour markets and consumer confidence.

- We like Energy stocks as a defensive play and a possible hedge in case of more geopolitical turmoil for the long run, but we are aware that the market could be toppish in the short term.

HOW WE MANAGE RISK – PORTFOLIO PROTECTION, HEDGING & TAKING PROFITS

As opposed to just going to cash, we prefer alternative strategies such as hedging via options and option writing strategies to smooth out portfolio volatility.

We also actively monitor profits using trailing stop losses with the view of protecting and locking in gains.

PORTFOLIO MANAGEMENT SERVICES

Please let us know if you would like to hear more about our Discretionary Portfolios and how we consistently generate an additional 0.5% to 1.5% per month using our Options Overlay.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at.

Source: Bank of Singapore

Source: Bank of Singapore

Source: Bank of Singapore

Source: Bank of Singapore CGB 10Y-UST 10Y spread | Source: Bloomberg

CGB 10Y-UST 10Y spread | Source: Bloomberg JPM EMCI at ATL | Source: Bloomberg

JPM EMCI at ATL | Source: Bloomberg

Source: Bank of Singapore – Monthly Investment Guide, June 2018

Source: Bank of Singapore – Monthly Investment Guide, June 2018

Source: Bank of Singapore – Monthly Investment Guide, June 2018

Source: Bank of Singapore – Monthly Investment Guide, June 2018

Source: Bank of Singapore – Monthly Investment Guide, April 2018

Source: Bank of Singapore – Monthly Investment Guide, April 2018