More US Trade tariffs on China, Italy’s debt problem, the Federal Open Market Committee (FOMC) meeting, Liberal Democratic Party (LDP) leadership and Sweden’s election all made September an interesting month for news, but most had a relatively little impact across risk assets over the month.

However, there was significant inter-month volatility in some asset classes and currencies. Italy surprised complacent markets by announcing an irresponsible 2019 budget with increased spending that contradicted the European Union’s (EU) requirement that Italy cuts its debt-to-GDP to 60% from its present 130%. Sweden’s election maintained the form seen elsewhere in EU, with populist parties gaining huge ground but not political power – Italy is the exception. In equities, the S&P 500 ground higher but ‘growth-y’ sectors underperformed relative to defensives, as seen by the fact Nasdaq fell 0.8% against S&P 500’s modest gain of 0.4%. Compared to the last quarter, S&P 500’s gain of c. 7% is the best quarterly gain since 2013. Nikkei was a standout, up 5.5% and 8% from the last month and the last quarter respectively. Robust earnings, Abe’s victory in the LDP leadership battle, and a weaker JPY were the main contributors. A-shares recovered further from its recent two-year low by 3.5%, to head towards testing a 3,000 resistance, but Asia-ex Japan (AXJ) was the standout faller, losing 1.6% on trade concerns, earnings downgrades and FX weakness.

We see the sell-off in Emerging Markets (EM) as an opportunity to switch out of more expensive US equities into AXJ equities and to add to EM local currency debt. We would not rush – trade war escalation could well happen in the short-term – but we fundamentally do not ‘buy’ the EM crisis thesis, do not think US equities have ‘immunity’ to the risks out there that other equity markets have discounted and do not think the world goes into recession. Tactically, in terms of portfolio positioning, we think inaction might be better than action in the short-term given rising geopolitical risks. Poor EM Q3 earnings could well be another catalyst for EM equities to lurch down. In Developed Markets (DM), there is a case to slowly shift exposure in U.S. equities to cheaper European and Japan equities.

Equities

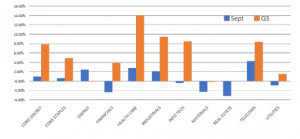

- In the US, we have seen an impressive Q3 as equities benefited from strong Q2 earnings releases, accelerating macroeconomic data and the presumption that U.S. equities offered some ‘immunity’ to trade wars. Sector rotation saw financials, real estate, materials, and utilities all fall while healthcare, telcos, and energy outperformed. Over Q3, the big winner was health care at +14% with energy, materials and real estate all down and financials underperforming along with consumer staples (Fig 1).

Fig 1. Monthly and quarterly performance of SPX sectors Source: Bloomberg

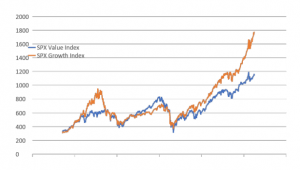

Fig 2. SPX Value vs Growth Source: Bloomberg

- The focus will be on upcoming Q3 results later this month, as late cycle and slowing earnings growth suggests defensive sectors and energy might outperform ‘growth’ and bond ‘proxies’. ‘Value’ stocks are close to record lows against growth (Fig 2) and we are potentially moving into an environment that value tends to do better in.

- In the EU, Stoxx and FTSE 100 are being moved around by politics and links to currencies. Italy may weigh on EU assets and Euro this month. 15th is the key date when details on the budget are revealed, and the fear is its spending plans might be multi-year. The EU financial system is inextricably linked to Italy’s fate given its debt pile is the second largest in size and its feeble GDP growth is not sufficient to reduce the debt let alone add to the debt. Our base case remains a compromise between Italy and EU but this might take time given the coalition’s political strength.

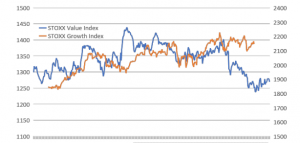

- Morgan Stanley (MS) thinks that European Equities are “unloved, under-owned and undervalued’ and recommends adding to exposures to overweight. Additionally, MS highlighted that value is at record lows to growth (Fig 3) and conditions suit a shift into value. Energy is seen as a late-cycle outperformer too.

Fig 3: STOXX Value vs Growth Source: Bloomberg

- In Asia, we saw the NIKKEI 225 soar almost 8% in Q3 to test multi-decade highs, while China A-shares recovered slightly by 3.5%, back above its support at 2,850 albeit helped by the Chinese government’s moves to reflate the domestic economy to mitigate trade damage from US tariffs, and by PBOC’s trenchant defense of CNY below 6.90.

- Nikkei’s surge may continue into Q4 on further positive earnings revisions, better macro data, and certainty of policy under Abe-Kuroda. China is facing the risk that the US, under Trump, is starting a new cold war of which trade is but one form of confrontation and containment. For Chinese equities, China’s moves to dial-back its aggressive de-leveraging, start to unfreeze the halted WMP sector and stabilize the CNY are all positive steps, but in the short term, Q3 results might be quite disappointing, especially in the consumer related space.

- It seems that in AXJ regions, central banks and governments are taking sensible steps in the face of a severe sell-off in FI and FX by raising interest rates, seeking to slow imports and allowing FX to weaken. In particular India, Indonesia and Philippines are raising rates and letting their currencies crash. This suggests these economies and markets will recover far faster once the pressure lifts, as it surely will, offering good value opportunities for patient investors.

Fixed-Income

- US Treasury yields broke through a multi-year high (Fig 4), with the 10y yield jumping 11bps to 3.18% after a raft of better-than-expected macro numbers came out last week. The 2Y10Y yield curve has also steepened a little too. Shorts on 10y UST are now at record highs.

Fig 4: UST 10Y yield hits 7Y high. Source: Bloomberg

- Whilst there were large outflows from DM government bonds last month (the most since February), EM Fixed-Income saw large inflows for the first time in several months and yields tightened quite sharply. This, despite lurid warnings of the degree corporate debt, has risen in EM since GFC, was obvious the buying was from larger institutions and sovereign wealth funds.

- The debate in where US Treasury yields may go from here is polarised between the bulls and the bears, with both sides having plausible arguments. The argument for higher inflation and a stronger USD assumes the US labor market is tightening to a point where wage inflation must accelerate fast, but that inflation expectations will remain anchored at what are historically unprecedented lows for far longer, is dangerously complacent. Bears think the opposite, and that there is sufficient slack in the labor force, the tick up in inflation is temporary, and the Fed is in danger of over-tightening, which might catalyze the next recession as soon as 2020. No one knows whether US labor markets are tighter than understood or has more slack than realized but we will find out sooner than later.

Currencies

- USD DXY fell below a key level at 95 as Draghi’s apparently ‘hawkish’ comments pushed Euro back above its 200DMA just above 1.18 and positive Brexit ‘noise’ helped GBP through 1.32 but this soon evaporated with Italy’s budget quickly unshackling Euro that promptly tested its key YTD support at 1.1515 whilst GBP tumbled back below 1.30 in part from the baleful specter of Boris stalking May in the Conservative party’s corridors of power.

- USD upside to continue for longer appears to be the direction recent FX forecast revisions are going, even if many still see a weaker USD against the EURO and JPY in the medium term. On the face of the evidence, the stronger-than-expected US economy and related Fed rate hikes against weaker data in EU and EM/AXJ and higher UST real yield differential is USD supportive, and there is still a lot of stale USD bears out there to take a contrarian stance against the Dollar.

Commodities

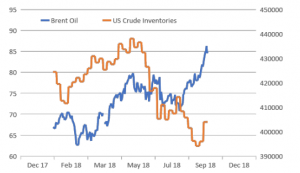

- The Brent Oil price soared 7% last month to $83/brl, and last week moved to YTD highs of over $86/brl despite a huge jump in US crude oil inventories (Fig 5) and a suggestion that Saudi Arabia and Russia might produce more to mitigate the likely supply reduction from Iran after US sanctions start 4th November.

Fig 5: Brent oil price is rising despite a recent jump in US inventories Source: Bloomberg, EIA

- Gold has traded flat in last month around $1,200/Oz after bouncing from support at $1,150/Oz – a level that saw a surge in physical gold buying by Asians, attracted by a lower cost, and a significant slowdown of speculative investors’ selling. Gold remains a by-product of USD moves, which many appear to prefer as the ‘safer’ haven asset.

- Oil prices will be driven by geopolitical risks – should Iran blockade the strategic Hormuz straits through which 40% of global seaborne oil is transported, we would see prices jump to $100/bpd in the short term. The medium-term too looks to be constructive for oil prices given estimates that demand will rise by 1.5mn/bpd over the next few years yet oil supplies might falter, in part after 60% cuts to oil E&P CapEx between H2CY14-’17. Reforms in the shipping industry to use less polluting fuel mixes will add to demand too. Several houses predict Brent oil at $100/brl by 2020.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at.