Feb 11, 2020 | Articles, Global Markets Update

Markets were risk on at the start of January on the back of optimism around the successful signing of the US-China phase one deal and the easing of US-Iran tensions. However, that was quickly forgotten and reversed following the coronavirus outbreak, which led to an extended holiday in China and the cancellation of several inbound flights to China by multiple airlines. Fears around the virus eventually impacted the tourism and retail sectors, and weighed on sentiments around global growth, leading to selloffs in the latter part of the month.

Fears around a slowdown in global growth directly impacted oil prices, with the Brent oil price erasing its Dec ’19 gains while it heads lower towards a near term support of $50. Inversely, Gold climbed further to reach highs of $1,611 per ounce before stabilising between $1,580 and $1,550 amid risk-off sentiments

Global equities fell, ultimately dragged lower by Asian equities which bore the brunt of the coronavirus selloff. In fact, the month ended with most major equity indices in the red YTD, with only Nasdaq remaining positive. However, the tapering of concerns around the virus in the first week of Feb saw US equities continue to outperform other regions and eventually went back on track to notch fresh all-time highs.

The risk-off sentiment throughout January also helped support Fixed Income (FI) as demand for sovereign debt, notably US Treasuries (UST), increased. This led to the UST 10Y yield falling to key support of c. 1.50% at the end of the month before rebounding in the first week of Feb. Fund flows into higher quality bond ETFs also dominated this month as markets took risk off amid concerns that the virus will impact corporate earnings.

The risk-off sentiment also led to increased volatility in the FX market and saw the USD strengthen considerably, with the DXY climbing to 98.50 in the year to 6th Feb – its highest in four months. On top of concerns around the coronavirus, GBP also weakened last week amid potential UK-EU trade complications after Johnson and Barnier clashed over rules around post-Brexit trade arrangements.

OUTLOOK

We would simply ascribe a one-third chance it gets much worse with infections climbing until Q2 having a much greater impact on GDP growth in China, Asia ex-Japan and even globally; one-third chance markets are pricing in virus where we are now, i.e. nasty but only having a short-term; one-third chance we see infection rate stabilise and peak in Feb, thus allowing a further risk rally.

There is danger markets get too optimistic too soon. However, China’s unilateral decision to halve trade tariffs is clearly positive, especially if Trump responds graciously. There is no doubt the virus is Xi Jinping’s biggest challenge since taking over in ’12 and he has no one else to blame. He, and the Communist Party of China (CCP), have suffered an enormous blow to their prestige, competence and the China ‘model’.

The only way he, and CCP, can respond is to throw everything they can at containing this virus and to more aggressively reflate the Chinese economy. By jettisoning trade tariffs, Xi is putting the economy ahead of principle. This is positive for the economy and for equities and reduces risk.

Elsewhere, S&P 500 companies’ earnings reports in Q4 are beating consensus forecasts handily whilst recent macroeconomic data in the US is positive, as is a robust ADP report. These are fundamentally important for risk assets. Whilst we should be cautious in the short-term now equities have rebounded strongly with US equities at fresh all-time highs, the medium- to long-term case that there is no alternative (TINA) to equities remains in place.

![]()

![]()

![]()

![]() EQUITIES

EQUITIES

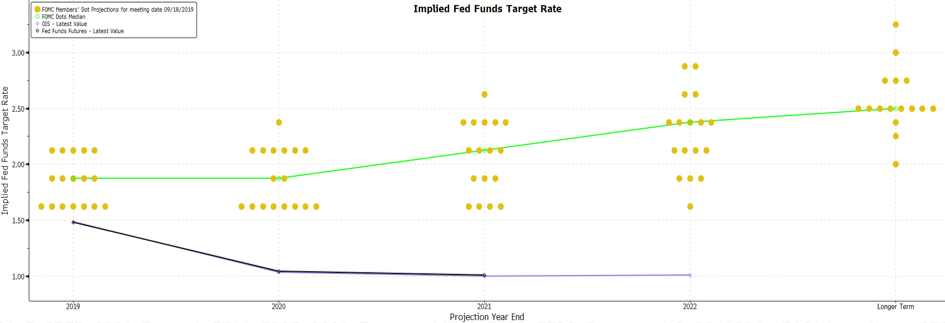

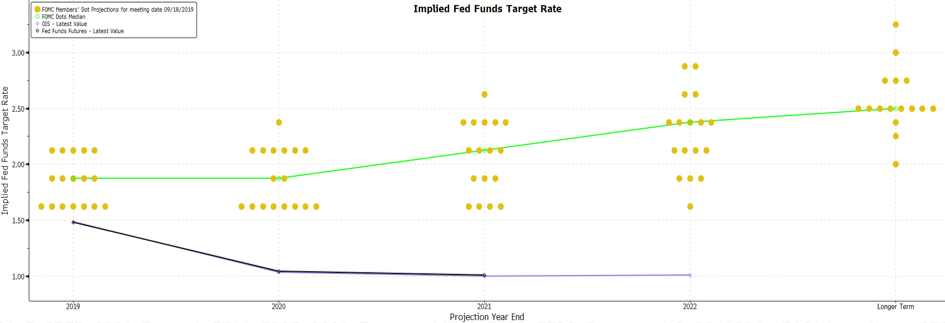

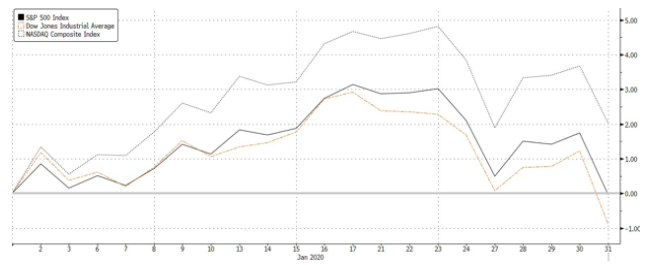

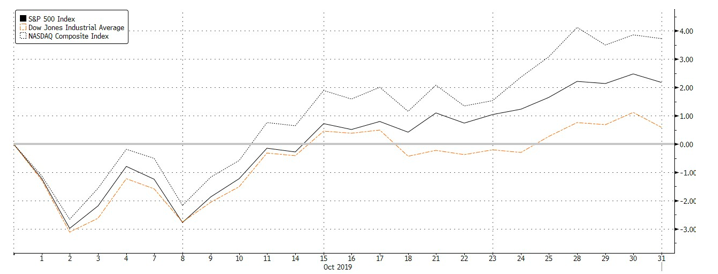

The S&P 500 (-0.16%) lost most of its mid-month gains to close the month mostly flat (Figure 1), while DJIA (-0.99%) performed likewise, weighed lower by a steep decline in Boeing. Nasdaq (+1.99%) managed to hold on to some gains, with tech stocks again outperforming on the back of several earnings beats from the likes of big hitters such as IBM and Facebook.

Figure 1: US major indices’ returns in Jan ’20. Source: Bloomberg

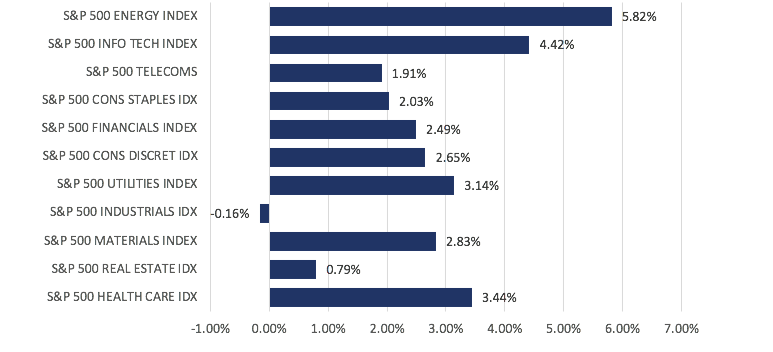

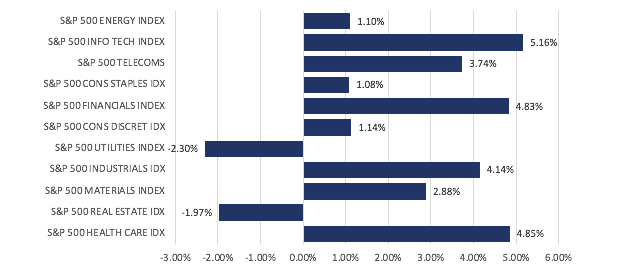

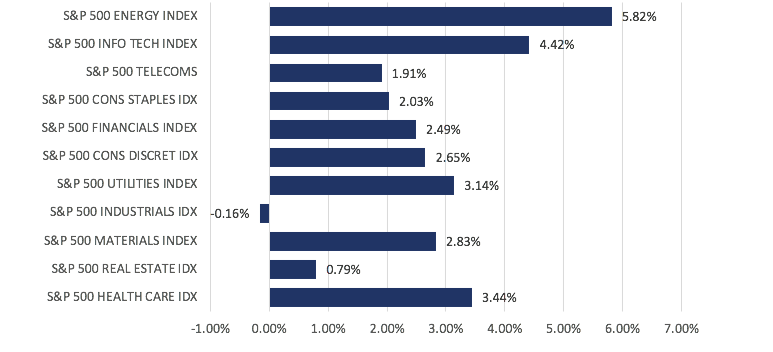

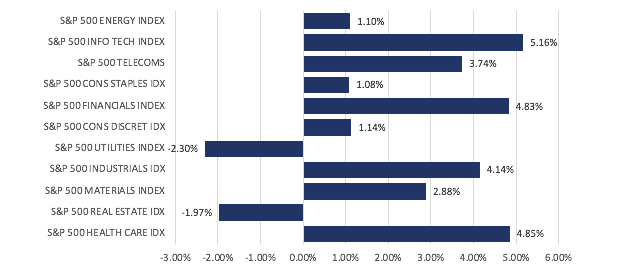

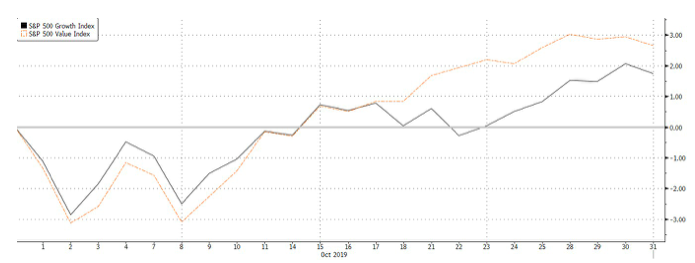

The risk-off appetite from investors saw moves out of Materials, Financials, and Healthcare, while Utilities outperformed alongside IT, which remained surprisingly resilient despite the run-up it had already seen. Energy underperformed significantly, though understandably so as oil prices likewise came sharply off Jan highs (Figure 2).

![]() Figure 2: S&P 500 sector returns in Jan ’20. Source: Bloomberg

Figure 2: S&P 500 sector returns in Jan ’20. Source: Bloomberg

Macroeconomic data was generally supportive in Dec, with ISM Manufacturing PMI rebounding sharply in Jan to 50.9 (vs est. 48.5), while CPI rose 2.3% YoY (vs est. 2.4%) in Dec. Housing starts rose 16.9% MoM (vs est. 1.1%) to a 13Y high as lower mortgage rates, along with higher wages and low unemployment helped buoy demand. Overall, GDP grew at an annualized 2.1% on 4Q19 (vs est. 2.0%), the same as the prior period although consumer spending moderated, and business investment continued to deteriorate. Notably, NFP also fell short of expectations, rising +145k in December (vs. est. +160k) although this came after a strong print in November.

Earnings season is also ongoing, with close to half of all S&P 500 companies having reported as of 31st Jan. Of the 45% that did, 69% reported a positive EPS surprise, while close to two-thirds reported a positive revenue surprise. The current estimated earnings decline in 4Q19 sits at roughly -0.3%, while estimates sit closer to -1.6%.

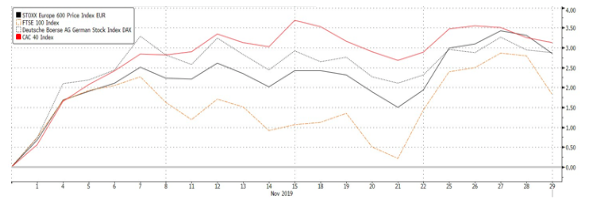

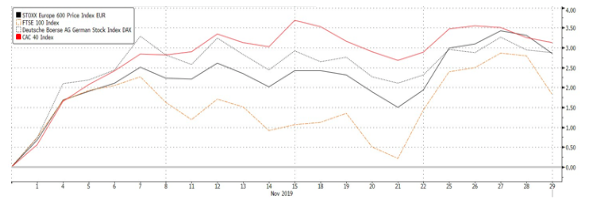

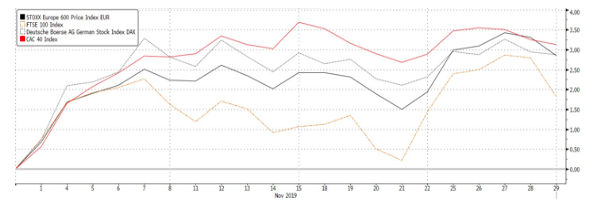

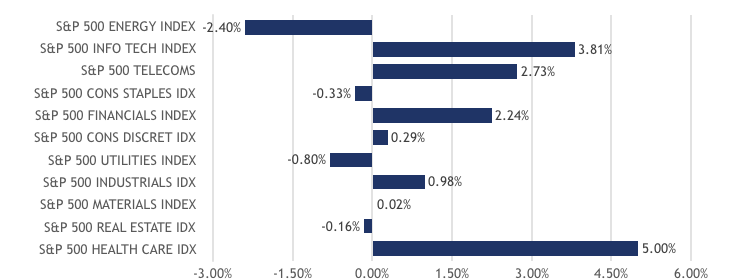

Shares in Europe were likewise down across the board (Figure 3), with shares in the UK leading losses, while the French CAC 40 trailed behind. In terms of data, German manufacturing PMI in Jan rose to 45.2 (vs est. 44.5), while the overall Eurozone figure came in at 47.9 (vs est. 47.8) compared to 46.3 a month earlier. The move, despite it still being a contraction, is its strongest reading since April 2019. Separately, ECB’s chief economist expressed his view that rising labour costs would eventually re-ignite inflation in the region, expressing confidence that the ECB was on track toward its inflation goals.

Figure 3: European major indices return in Jan ’20. Source: Bloomberg

Utilities outperformed significantly, no doubt a result of a risk-off move into defensives, while Basic Resources and Oil & Gas were key laggards. Autos underperformed significantly amidst renewed fears that Trump would impose stricter tariffs on European carmakers (Figure 4).

Figure 4: Stoxx 600 sector returns in Jan ’20. Source: Bloomberg

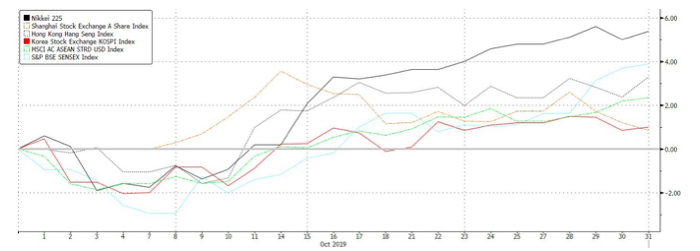

Asian markets bore the brunt of the selloff, with the MSCI Asia ex-Japan Index (-5.16%) logging steep declines, while the SHASHR (-2.41%) and HSI (-6.66%) were still on their Chinese New Year holiday. Nikkei (-1.91%) also closed lower, while MSCI ASEAN (-5.16%) underperformed the broader region.

In Asia, equity markets were undoubtedly alleviated earlier in the month by the news over trade – China understandably one of the top gainers in the region. HSI also rallied, in part off the back of this news, but also as tension on the streets appeared to have tapered off toward the holiday season. Overall, the MSCI Asia ex-Japan gained, while Japan and Sensex lagged the broader region. This was however quickly erased following the outbreak of the coronavirus.

New data also showed China’s GDP grew +6.1% in ‘19, down from +6.6% a year earlier to its slowest pace in 29Y. The results were, however, largely in-line with economists’ expectations and the government’s target of 6% to 6.5%. Industrial output grew 6.9% in ‘19 (vs est. 5.9%) while FAI picked up for the 1st time since June to grow 5.4% in ’19 (vs est. 5.2%), signaling a firmer recovery could be underway.

FIXED INCOME

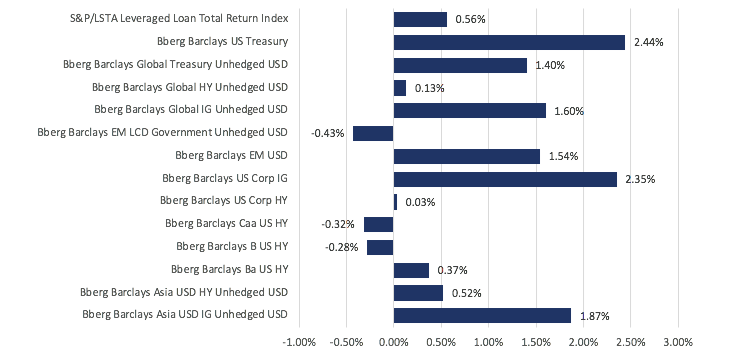

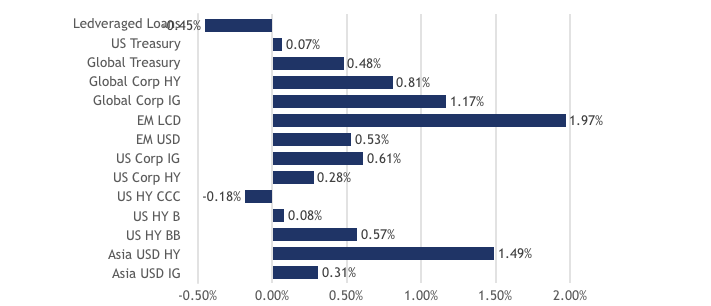

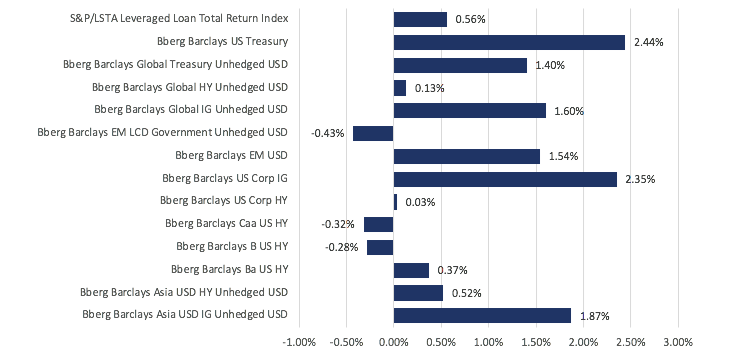

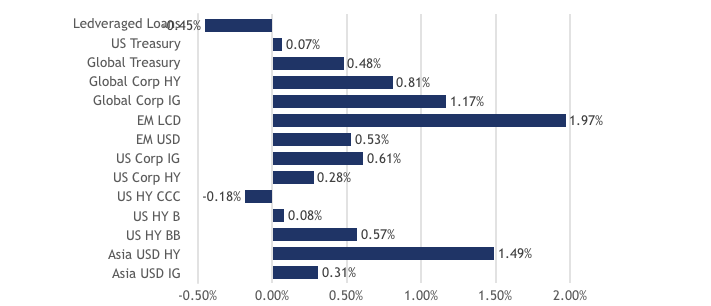

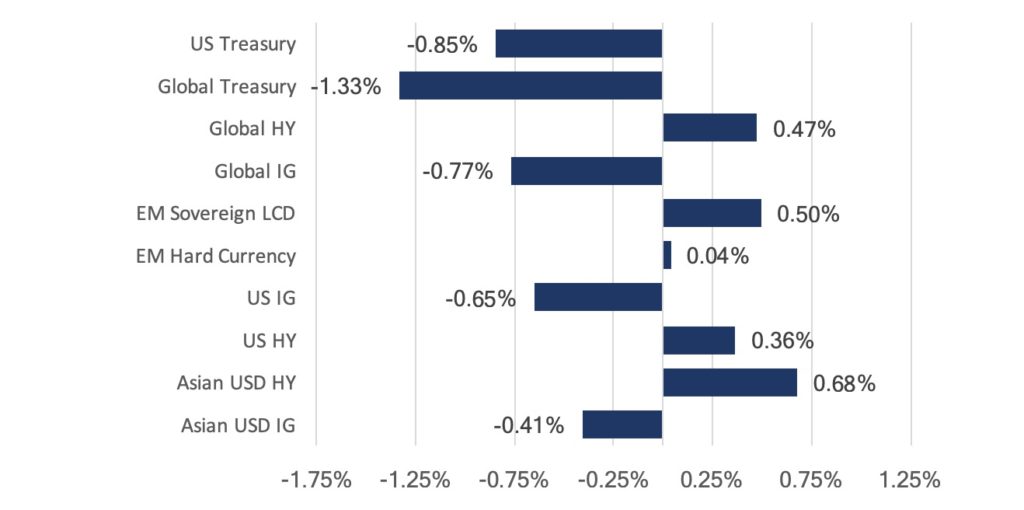

Figure 5: FI sector returns in Jan ’20 Source: Bloomberg

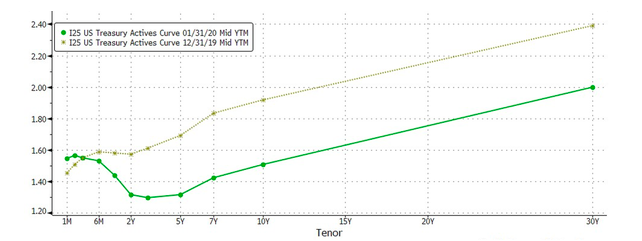

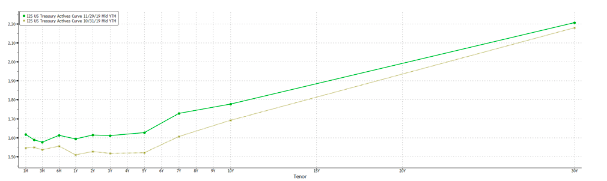

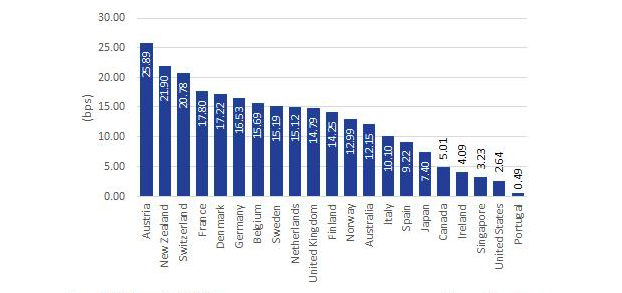

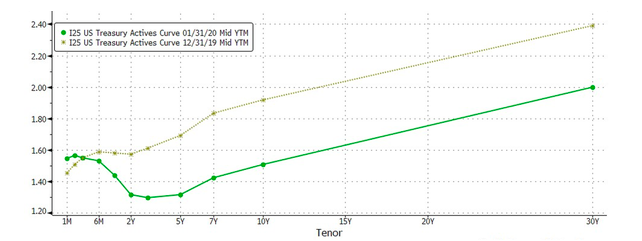

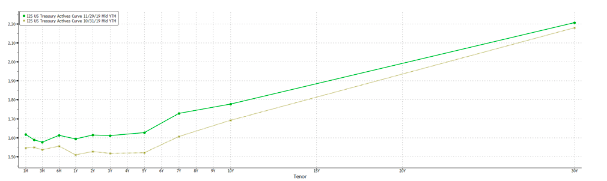

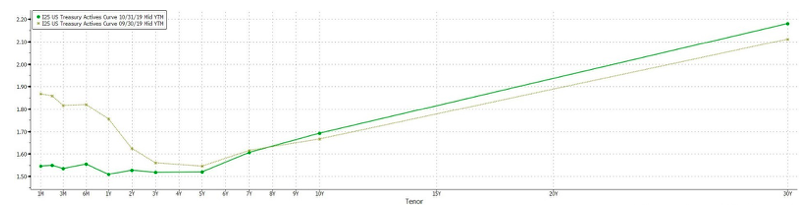

Fixed income markets were risk-off as well as we saw rotation into higher-quality debt. Flows moved back into sovereign debt, with USTs outperforming all other sectors in the asset class (Figure 5). Prices rose and yields fell across the UST curve, with the 10Y yield falling to a support at c. 1.50%. This led to duration spreads flattening (Figure 6), with the 3m/10y inverting momentarily towards the end of Jan, reviving memories of growth fears seen last year.

Figure 6: UST yield curve comparison between Dec’19 and Jan ’20. Source: Bloomberg

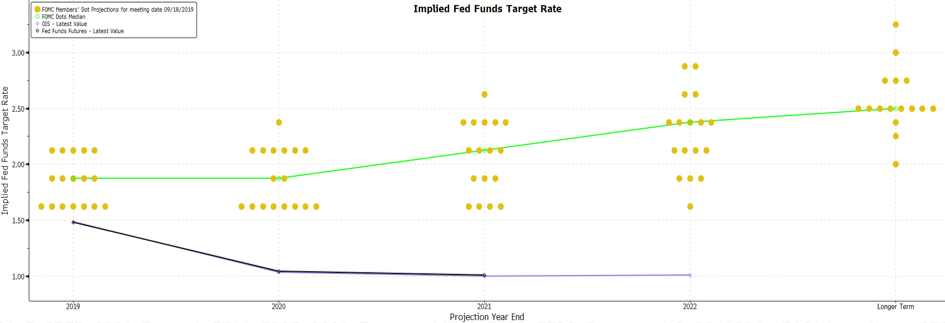

The FOMC also had its first meeting of the year and kept its key interest rate unchanged while indicating that monetary policy will stay on hold. Markets expected this and had little reaction to the news. However, the FOMC raised the IOER and overnight repo rates by 5bps each to 1.6% and 1.5% respectively and said it would continue expanding its balance sheet into 2Q20. It also tweaked its language to say that current monetary policy is appropriate to support inflation “returning” to the 2% target, from saying prices were “near” the goal. Powell clarified in his post-meeting comments that the new language was meant to clarify that the central bank is “not comfortable with inflation running persistently below” the 2% goal.

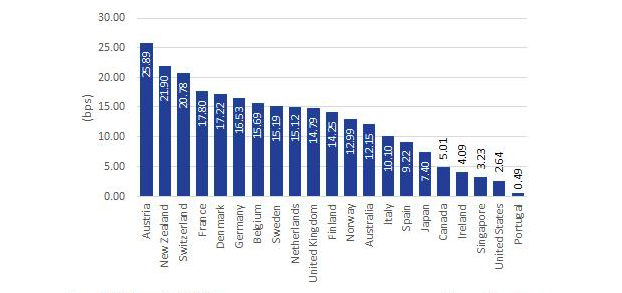

Looking at other parts of the world, JP Morgan estimates that the net supply of euro-area sovereign bonds this year will amount to EUR 188bn, the lowest since ’08. This comes against a backdrop of lower borrowing costs and is lower than the EUR 240bn ECB pledged to buy under its bond-buying program. The expected slowdown in issuance of sovereign debt in the region saw auctions in Spain and Italy during the month draw record demand.

Global credit spreads all widened too, though a fall in sovereign yields helped cushion the impact. US HY spreads widened the most to reverse the narrowing seen in Dec (Figure 7) as concerns around the coronavirus, and its potential impact on the economy and corporate earnings led investors to pull funds out of the sector. UBS noted that the concerns around the virus led to $2.2bn worth of outflows from bond funds since 24th Jan. Global HY issuance was also strong up till the last week of the month. Data from Dealogic showed that global HY bond issuance in Jan amounted to $73.6bn, exceeding any other monthly total over the past 25 years.

Figure 7: Credit spreads widen to reverse Dec’ tightening. Source: Bloomberg

Elsewhere, JP Morgan credit analysts have lowered forecasts for US HY returns, spreads and yields for ‘20 following a strong rally for the debt in Dec. It slashed its return outlook to 6% from 7.5% initially seen in late Nov. YE20 yield forecast was also cut to 6% from 6.25% and spreads to 425 basis points over Treasuries from 440bps. This does not change our preference for riskier debt over IG as valuations in the latter remain rich. However, given the late-cycle environment, we are in, we continue to advise investors to remain cautious when dealing with the riskier end of the credit quality curve.

Concerns around the virus also affected primary issuances in AXJ. Prior to the escalation of the illness, sales of Asia dollar bonds rose to $42.5bn in Jan – a record for issuance levels in any Jan. However, the virus, coupled with the Lunar New Year holidays, saw issuance come to a standstill in the last two weeks of Jan. Despite this, we remain positive on AXJ FI. On top of the reasons highlighted last month – reflation in Asian economies; positive technicals – we remain of the view that central banks in Asia have the willingness, and the ability, to cut rates still. Apart from wanting to support their economies amid the viral outbreak, central banks will undoubtedly move to cut rates to prevent their currencies from strengthening too much as the hunt for yield brings fund flows into the region.

FX

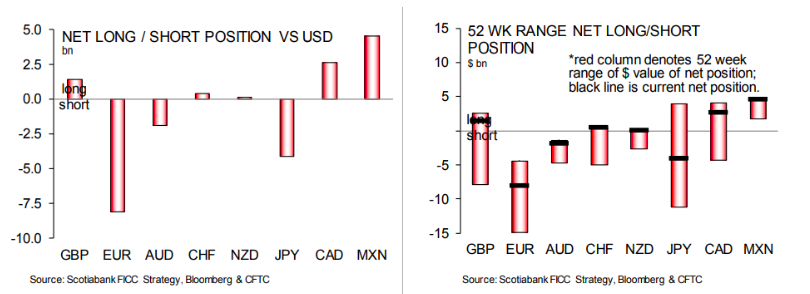

Concerns around the coronavirus saw USDCNH break above 7 again momentarily and caused a spike in volatility in the rest of the world. As for the rest of Asia, investors began to assume the worst; tourist and export-based economies such as Australia (AUD -3.74%), Thailand (THB -3.69%), S. Korea (KRW -2.86%) and Singapore (SGD -2.86%) were affected the most YTD (6th February).

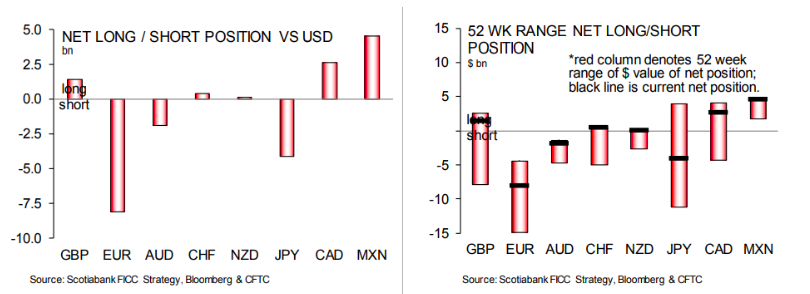

The relative outperformers YTD in Asian FX were IDR (+1.67%), INR (+0.26%), PHP (-0.24%) and VND (-0.20%) as investors favoured higher-yielding FX and as oil prices fell. In the G7 space, JPY experienced a healthy bout of volatility as traders rode the 107 to 110 range as shown by positions as uncertainty rocked markets (Figure 8).

The remainder of the G7 currencies also weakened as the ultimate haven, the dollar, supported by the resilient consumer, once again led the charge. The DXY climbed from 96.40 to 98.50 YTD (6th February). GBP and EUR also led losses (aside from AUD) as traders unwound longs (GBP) and remained bearish (EUR).

In the coming months, aside from an overall slowdown/weakness in FX, we continue to see further weakness in the AUD, THB, KRW, and SGD as the economic damage from the coronavirus seeps its way into trade-related data and of course, tourism.

However, the damage is reparable. Countries affected by the coronavirus have reacted much quicker to contain, mitigate and attempt to treat the virus. Although we understand the asymptomatic attribute may drive fear, we do not believe this fear will last forever. China, much different than it was in ‘03, is much more capable in stabilizing and stimulating its economy using state-owned entities. Like we have seen for the second time on 31st Dec, the RRR rate was cut once again and as we write this, China has ordered state-owned funds, lenders as well as brokerages to pump liquidity to virally affected parts of its economy.

Figure 8: Long/Short Positions against US.

COMMODITIES

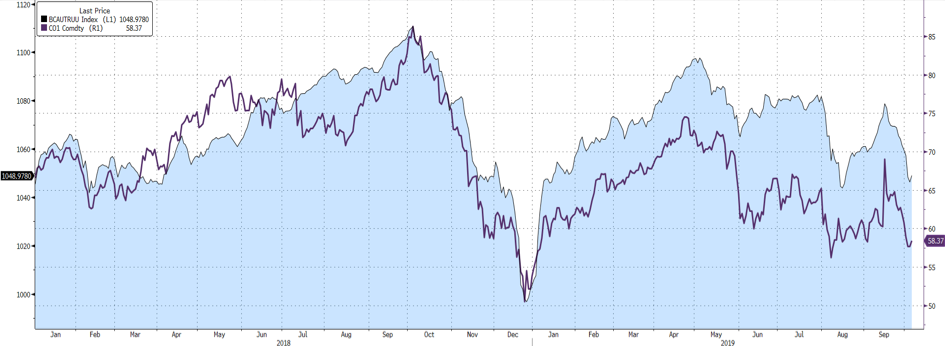

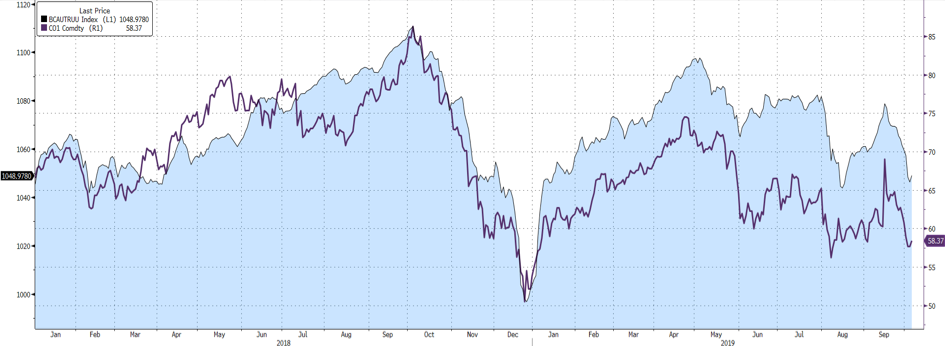

The Brent oil price experienced a tumultuous start to the year as it fell from its high of $71/bbl (from Iran-US tensions from the death of Iranian General Soleimani and the signing of Phase One of the trade deal) before ultimately falling amid fears of a global slowdown from the coronavirus. This prompted a rapid unwinding of long positions that caused Brent to reverse all its gains from Dec ‘19 (Figure 9).

Inversely, Gold climbed further to reach highs of $1,611 per ounce before stabilising between $1,580 and $1,550.

We believe that the virus will continue to take center stage for commodities and metals as the demand for energy falls, particularly due to the slowdown of auto-manufacturing economies in Asia. This will, in turn, lead to a build-up in inventories as we believe demand growth will slow for the better part of ‘20.

We see further room for Brent to fall before finding support at the $50 region due to three reasons – a recent OPEC+ emergency meeting was called for (OPEC+ officials recommended 600kbpd of additional cuts in output, but Saudi Arabia and Russia are at odds around this decision); positioning still places investors net-long and therefore more room for a sell-off; the coronavirus’ pressure on China might hamper its growth in the short-term and affect near-term demand (some Chinese commodity companies are reportedly claiming force majeure on some of their contracts).

Although concerns of the coronavirus infection rate will continue to weigh down on oil, we believe OPEC+ policy revisions and a slowdown in fears (as markets tend to do) will place a floor on the oil price within the coming month.

Figure 9: Chart showing WTI Oil vs Net Positions.

Jan 15, 2020 | Articles, Global Markets Update

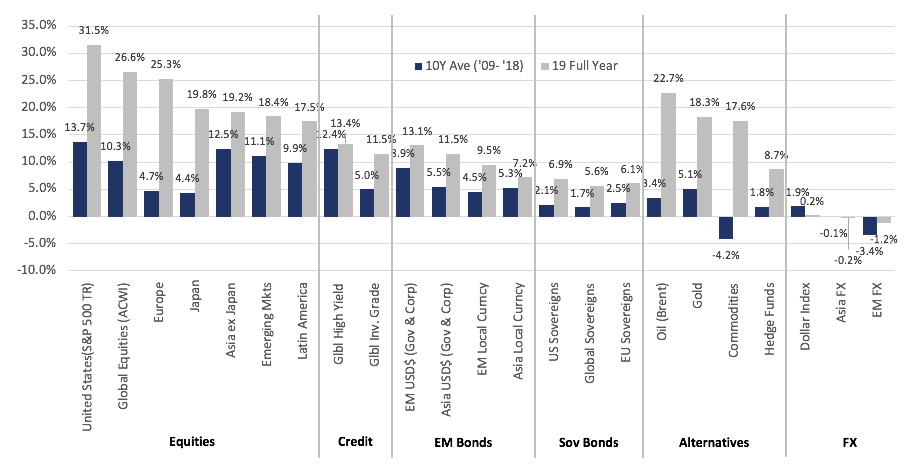

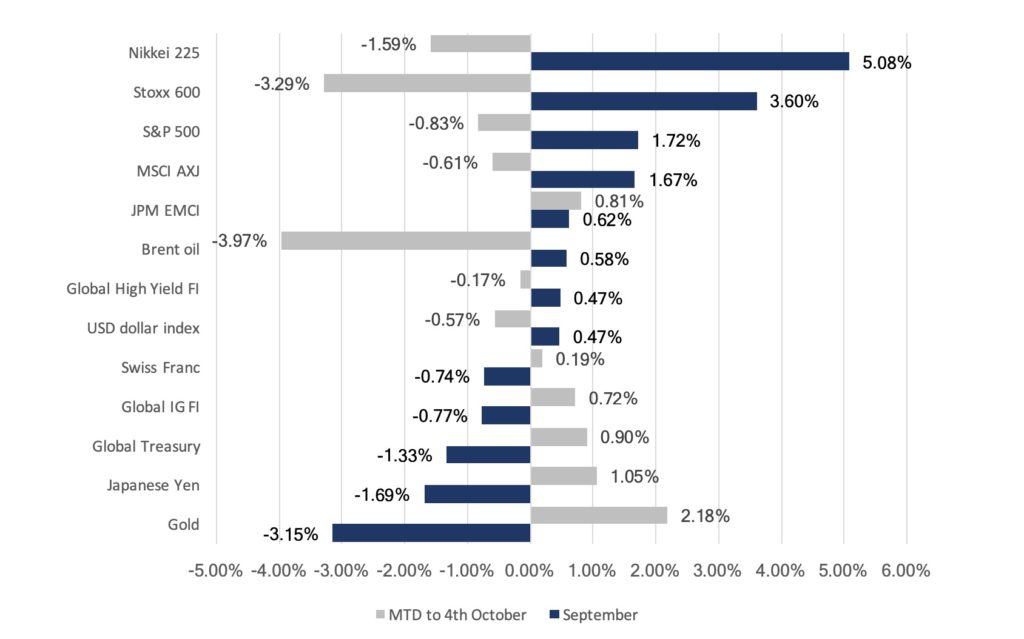

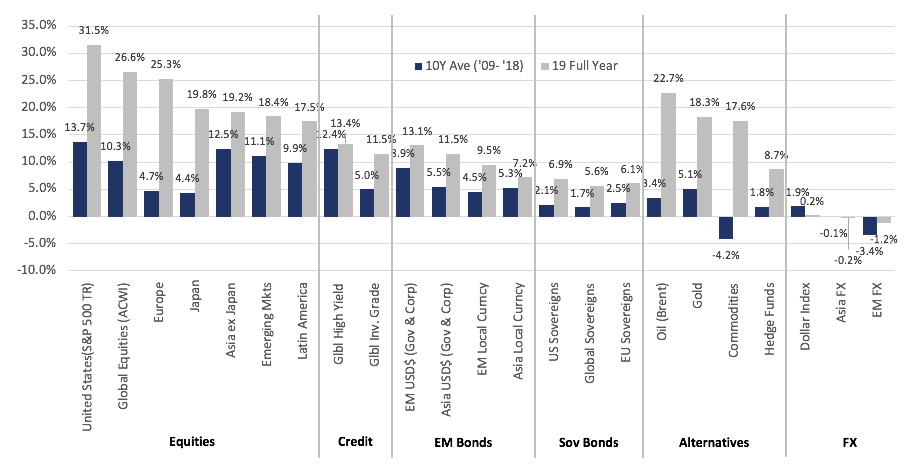

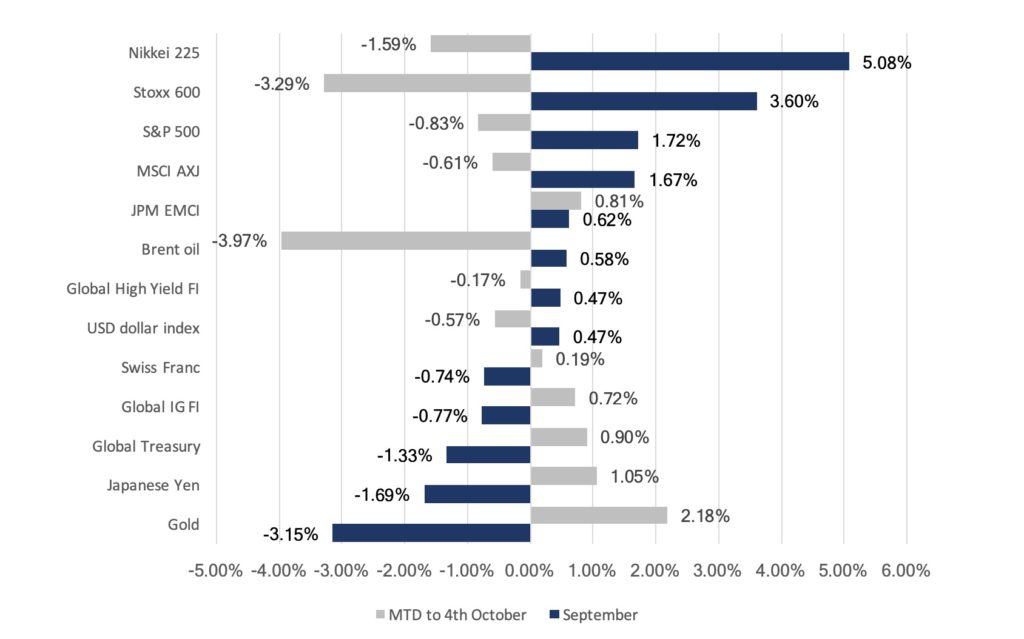

All asset classes had an extraordinary year in ’19 with most far surpassing their 10-year averages (Figure 1). Geopolitical uncertainty saw various asset classes move sideways for almost the first half of the year, but markets picked up once we saw clarity.

Equities were easily the best performing asset class with US indices leading the charge to close the year at new all-time highs. Gains in the asset class were driven largely by expansion in multiples – more so in the US than in any other region – making equities more expensive in absolute terms. Fixed income also saw robust gains across the board as investors hunt for yield. This year saw negative-yielding debt reach $17tn at its peak, pushing investors either further down the duration curve or towards lower quality credit, thus allowing global high yield (HY) to outperform the other FI sectors.

Gold had its best year since ‘13 and rose to a new 6Y-high as investors, especially in Q4CY19, embraced its merits as a safe haven asset and portfolio diversifier. ‘19 was a year of record low FX volatility with DXY up just 22bps as USD sold off against rest of world (ROW) FX in Q4 having been up c. 2.5% at the end of Q3CY19. Oil also rose strongly for its best year since ‘14 – again much of the gains seen in Q4CY19 after OPEC cut production further and then SAUDI ARABIA additionally cut more.

Fig 1: Global multi-asset total returns. Source: LGT, Bloomberg

OUTLOOK

We are risk-on as we start the new year. While we are still bullish on equities, we see relatively less value in US equities having seen its performance last year. The expansion in multiples of that magnitude in the US will eventually need to be supported by earnings growth. However, we think that the probability of that happening is low given the US is late-cycle with regards to expansion and faces a slower economy this year on a YoY basis relative to others which might be stable, or even better (EMs especially). A number of people see US equities underperform equities in ROW in ‘20 given potentially relatively weaker earnings per share (EPS) growth of c. 5% in FY20 relative to the 10%+ for ROW.

In addition, US equities also face potential political/regulatory headwinds – some of which have bipartisan support – and higher barriers to monetary/fiscal policy action bar a material slowdown. This compares with economies in other parts of the world that has more capacity for further monetary easing or fiscal reflation (which we already saw in Japan and might potentially see in Europe).

However, we see relatively less value in FI and are underweight the asset class. We do not see anything in the near-term that will cause a blow-up in the space but acknowledge that there are greater risks here compared to equities – there is the possibility of ‘fallen angels’ in BBBs; defaults in leveraged loans. Moody’s also argued that US HY FI is overvalued with unattractive risk-reward compensation given how spreads have tightened considerably in’19.

Within the FX markets, there are strategists arguing for USD relative weakness – notably against emerging markets (EM) currencies/JPY. Whilst we can see risks for USD in ’20 – important as a driver of portfolio flows to ROW equities and EM equities more so – equally, we’d want to see a clear trend of USD weakness develop before being too bearish. We struggle to be too negative on it as opposed to other developed markets (DM) FX. Gold has merit as a ‘safe haven’ diversifier in a way overvalued sovereign FI is no longer. Oil has upside if one agrees on US shale oil production. Goldman Sachs (GS) forecasts that growth in shale inventory will slow sharply given firm demand from EMs, OPEC’s disciplined production and IMO regulatory action. In addition, oil remains a warrant against the Middle East geopolitical flare-ups, not unlike what we saw happen between the US and Iran last week.

A US airstrike killed Qasem Soleimani, a top Iranian commander, thus explicitly raising the temperature and shifts the scenario from being a proxy war to a direct confrontation. Much now depends on Iran’s threatened retaliation which the US has stated will result in a 2nd round of US attacks on Iranian targets. This, thus, has scope to escalate – the key question is to what degree. We don’t think it is in Iran’s interest to escalate this to a full-on military conflict (as much as it is not in the US’s interest), but it cannot sit back and do nothing. This creates uncertainty and will likely drive oil prices.

We have warned previously that Trump might behave more erratically around impeachment pressures and this deliberate attack follows the same playbook Clinton used. That impeachment process now appears it will be dragged out as opposed to hopes (for markets at least) that there will be a quick Senate trial. This is not good news for certainty and for further risk of erratic behaviour – to the degree the US-China trade deal is not yet signed – to hurt risk-on assets.

As ever we continue to strongly argue that we are in a low return, high volatility set of market conditions – a strategic view that was borne out in ’18 but clearly failed last year – that requires us to be diversified as much as possible and seek uncorrelated alternative income strategies. On the evidence, the USD might ease-off, it may be appropriate to run with less USD-hedged allocations too. Capital market assumptions forecasts for the next five years suggest higher quality FI could deliver zero returns (with capital losses offset by coupons) while equities offer 5-6% with the S&P 500 closer to 3% (EM FI and equities offer highest returns but obviously at higher volatilities). These implied returns are not compelling and make capital preservation even more important when returns are low. After equities had a banner yearning ’19, we need to be quick to react to any major correction.

![]()

![]()

![]()

![]() EQUITIES

EQUITIES

Global equities were broadly higher following Trump’s sign off on a ‘Phase One’ trade deal with China, notably so in the US where markets dismissed impeachment news as all three major indices pushed deeper into the all-time high territory. The S&P 500 gained +2.86% in December, taking ‘19’s total return to an impressive +31.48%. Likewise, the Dow and Nasdaq gained +1.74% and +3.54% respectively this month, with the latter outperforming the year with a +36.74% total return as tech stocks led the advance (Figure 2).

Fig 2: US equity indices total returns. Source: Bloomberg

The S&P 500 saw a broad-based gain this month, with all sectors seeing a positive close. Gains were led by Energy and IT stocks, though interestingly the two were the worst and best-performing sectors this year at +48.04% and +7.64% respectively (Figure 3).

![]() Fig 3: S&P 500 sector returns in Dec. Source: Bloomberg

Fig 3: S&P 500 sector returns in Dec. Source: Bloomberg

Markets in the US were also supported by generally positive data prints, with Q3 GDP matching expectations at 2.1%, while core PCE gained 2.1% QoQ for the same quarter. University of Michigan’s consumer sentiment index also had a slight beat, coming in at 99.3 (vs est. 99.2). November’s Non-farm payroll print came in surprisingly strong at +266k (vs est. +183k), even if one were to subtract the 48k GM workers that returned from strike. Unemployment fell to a 50Y low of 3.5%, while wage growth stood at +3.1% (vs est. 3%). The only weak spot came in US retail sales, which gained only +0.2% MoM (vs est. +0.5%), although October’s reading was revised up to +0.4% from the previously reported +0.3%.

Over in Europe, the ECB left rates unchanged as expected, re-affirming commitments to its bond-buying program and low rates until the region can get closer to its inflation goal. Overall, conditions were generally helpful, allowing the Stoxx 600 index to gain 2.06% for the month, taking the full-year gain to +25.26%. Unlike last month, shares in the FTSE 100 outperformed at +2.67% this time around, while DAX lagged behind with a meager +0.10%, after Germany’s manufacturing PMI fell unexpectedly to 43.4 in December (vs est. 44.6) (Figure 4).

Fig 4: European regional indices Dec total returns. Source: Bloomberg

In Asia, equity markets were undoubtedly alleviated by the news over trade, with China understandably one of the top gainers in the region, gaining 6.20%. The HSI also rallied +7.00%, in part off the back of this news, but also as tension on the streets appeared to have tapered off toward the holiday season. Overall, the MSCI Asia ex-Japan (AXJ) gained 6.42%, while Japan and the Sensex lagged the broader region at +1.56% and +1.16% MoM respectively.

There were some encouraging numbers out of China that showed stabilization and a pickup in growth momentum. We also saw China unveil more pro-growth measures, with financial institutions now required to price floating-rate loans on the back of the revamped LPR as of 1st Jan, which will lower costs for c. CNY 152tn worth of outstanding loans in the market. The revised securities law also simplifies the process for corporate bond issuance and raised the penalty for issuance fraud to CNY 20m from CNY 600k, which will take effect on the 1st March.

FIXED INCOME

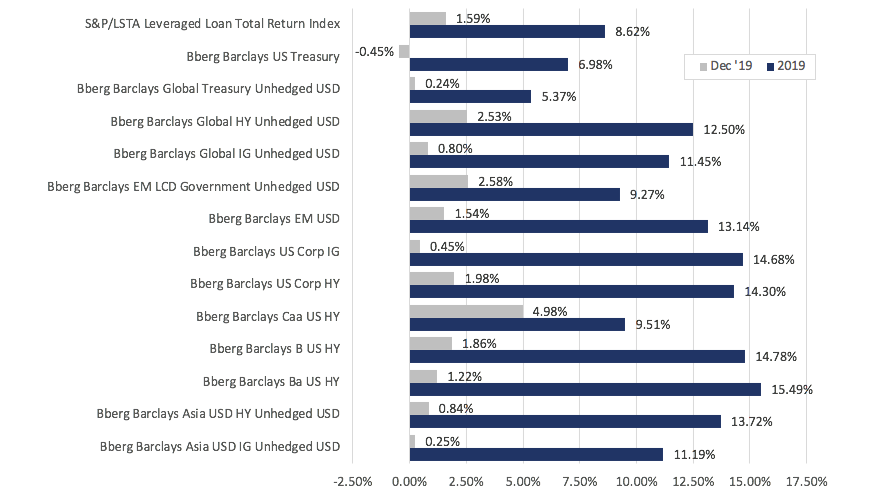

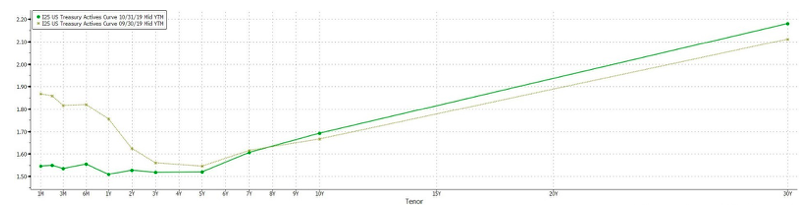

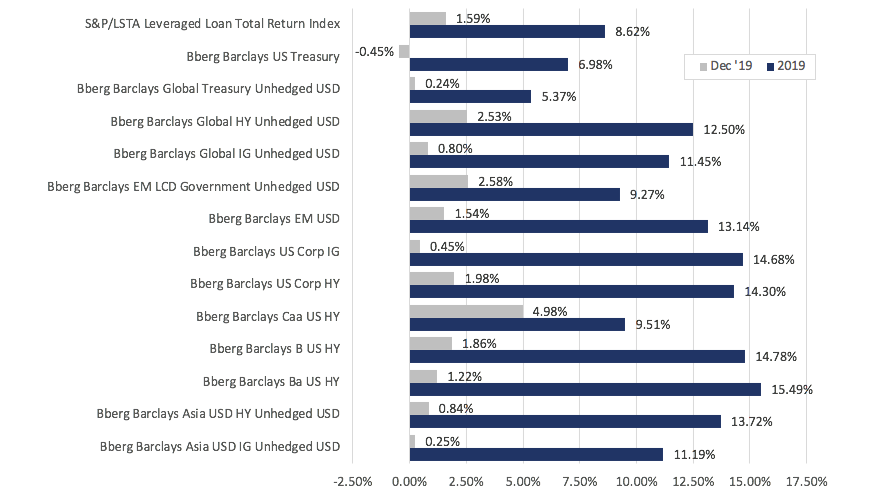

Fig 5: FI sector returns in Dec and in 2019. Source: Bloomberg

The fixed income market was positive in Dec (Figure 5), leading various sectors to see multi-year high YoY returns. Global investment grade (IG) and HY saw their best YoY performance since ’09 and ’16 respectively, while US Treasuries (UST), the only sector to fall in Dec, saw its best YoY returns since ’11.

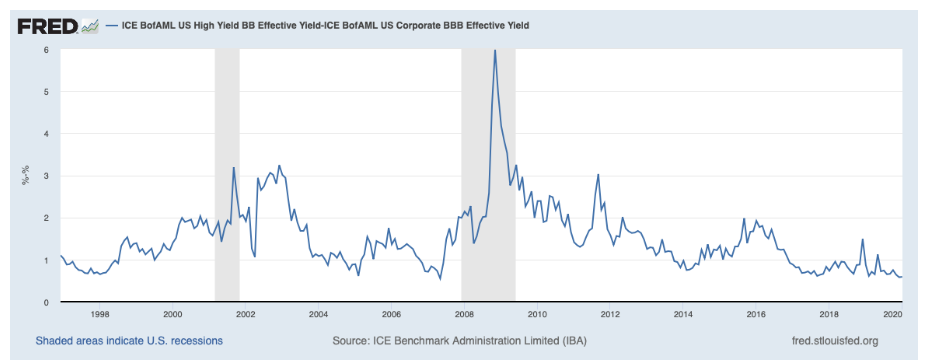

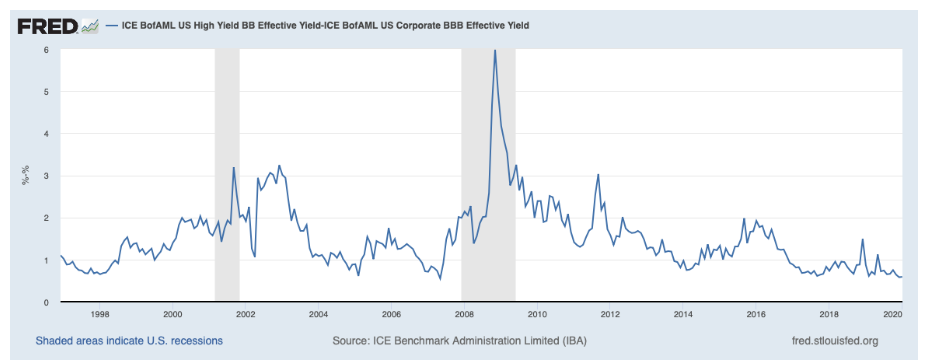

Global IG spreads narrowed in the last few days of ’19, ending the year at 94bps – 59bps tighter YoY while global HY spreads narrowed 127bps to 419bps. Credit spreads ended the year near/at ’19 lows (Figure 6) as central banks around the world adopted, in one way or another, monetary easing policies. Apparent progress in US-China trade negotiations and more geopolitical certainty also contributed to the risk-on sentiment, thus supporting HY debt.

Moving forward, the tight spreads are attracting primary issuance of c. $120bn in Jan after pausing for much of Dec. HY could also see a busy month as companies look to refinance debt, with c. $9.5bn worth of HY bonds scheduled to mature or be called this month.

Fig 6: Corporate credit spreads in 2019. Source: Bloomberg

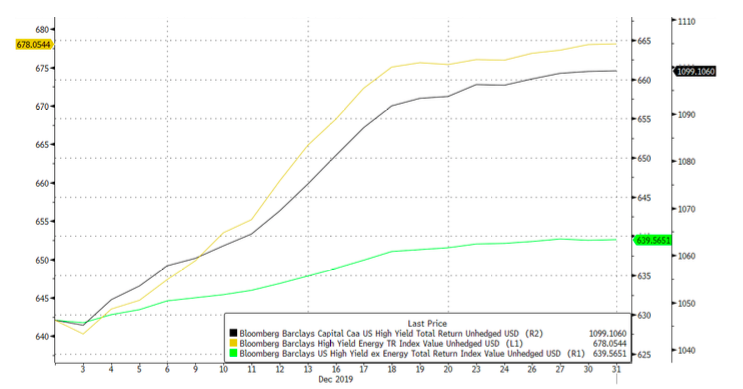

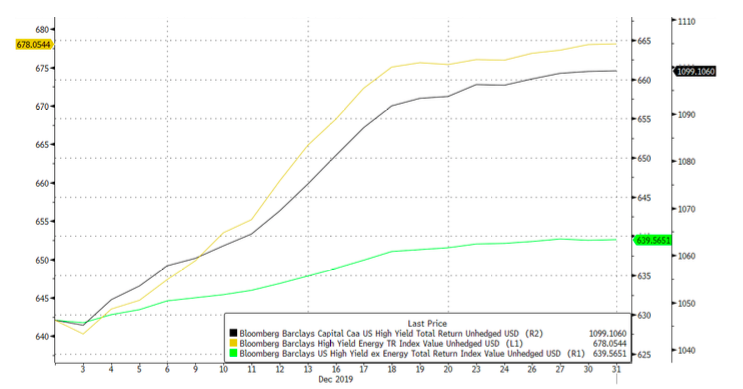

Within HY, CCC debt ended the month as the best performing sector within FI. With spreads rising above 10% for the first time since ’16 after being sold off earlier in the year, coupled with improving market risk sentiment, yield-hungry investors jumped at the chance after hiding out in the BB space for much of ’19. Energy led gains in the sector with oil prices rising for most of the month (Figure 7).

Fig 7: Returns of HY Energy debts vs CCC and HY ex-energy. Source: Bloomberg

This hunt for yield also saw spreads between IG and HY narrow. In particular, ICE BofAML data showed BB/BBB spreads to be at its lowest since pre-GFC (Figure 8), suggesting how overvalued the BB space has become. This trend is likely the reason why Wall Street analysts are forecasting gains of only 1% – 7.5% for US HY in ’20.

However, not all analysts share this view – Blackrock raised its rating for global HY to overweight, arguing that the sector will be supported by stable monetary policy worldwide, and the potential for an inflection in growth.

Blackrock also simultaneously downgraded global IG citing rich valuations, especially with negative rates in Europe and Japan.

Fig 8: BBB/BB spreads. Source: Bloomberg

Blackrock also upgraded EM local currency debt (LCD) to a “high conviction overweight” noting the attractive coupons and the potential for currency appreciation as USD sees a potentially trying year in ’20. EM LCD saw a strong Dec as USD weakened.

Within EM, we continue to see value in AXJ FI, particularly in the HY space. Apart from a potential reflation in the Asian economies, the sector is likely also supported by technicals. Many HY issuers advanced their refinancing to ’19 and hence these volumes are unlikely to be sustained in ’20, providing support for prices. While China saw another record year of onshore corporate defaults, we see little reason for concern. A number of defaults are a result of idiosyncratic reasons and are not representative of the entire market. Besides, the amount of onshore defaults (c. CNY 130bn in the last few weeks of ’19) is small relative to the entire market.

Finally, we see an additional source of risk in European companies. Moody’s expect companies in Europe to face more rating cuts and higher odds of default this year. It expects defaults to almost triple as more HY companies struggle with weak demand. Moody’s also forecasts the rate of missed payments in the region to catch up with the USA.

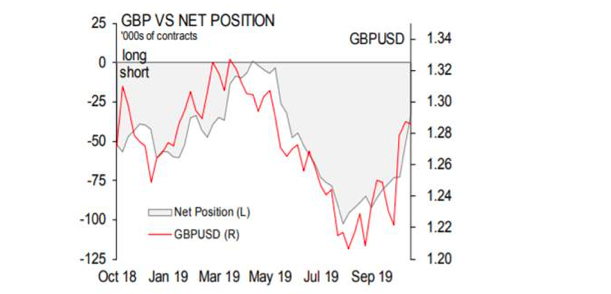

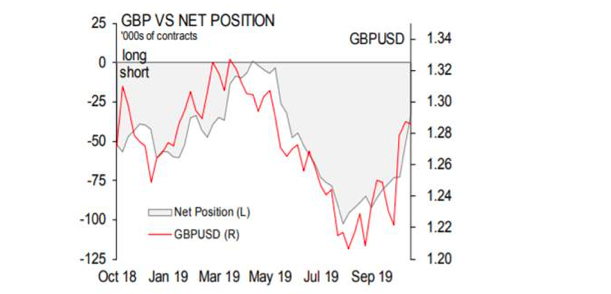

FX

USD was by far one of the worst-performing currencies in Dec, weakening against all of its G10 peers and most of the EM currencies. DXY fell 1.92% over the month, falling below 97 for the first time since July ’19 while the JPM EMCI gained 2.66%, its best month since Jan ’19. FX movements continue to be driven by geopolitical events like Brexit and US-China trade over the month. The dollar recovered slightly on the back of positive economic data but failed to sustain the momentum. The weakening sentiment for the USD was reflected in the extended fall in aggregate long USD positioning while GBP positioning turned marginally net positive for the first time in ’19 (Figure 9).

Fig 9: USD and GBP positioning as at 24 Dec ’19. Source: Bloomberg

The Dec weakness for DXY led the index to end ‘19 just 22bps higher while CAD ended the year as the best performer within the G10 group. Asian currencies saw a good year too, with most currencies stronger against the dollar, led by THB. However, tensions and protests in larger European and LatAm EM markets, particularly in Turkey and Chile, weighed on the JPM EMCI, which ended the year -1.36%. Volatility in FX markets also spiked up in the first week of ’20 following US’s assassination of Qasem Soleimani with haven currencies strengthening.

Looking forward, we continue to remain a USD bull until proven otherwise. Despite recent events, USD has proven to be very resilient since the global financial crisis and remains to us the least bad major DM currency fundamentally. However, we are more cautious on USD this year than in the previous five years as US GDP might slow relative to its peers while the S&P 500 looks relatively unattractive. Swaps around fully hedged FI is also not supportive of FIIs buying hedged USTs despite the relative real yield differential positives. If FIIs anticipate a weaker USD, this will boost hedging demand or reduce unhedged buying. Lastly, fiscal reflation looks improbable in the USA this year but more likely to happen in Europe, Japan and ROW – fiscal spending helps strengthen currencies where this happens. In addition, a key catalyst for EUR gains would be signs that Germany is closer to abandoning its overly prudent ‘zero budget’ policy that’s become institutionalized.

Fig 10: FX returns in 2019. Source: Bloomberg

COMMODITIES

The Brent oil price extended its uptrend in Dec after an initial tumble in the first week of the month, resulting in its best year since ’14. Much of the gain here was on the back of an OPEC production cut, with Saudi Arabia committing larger than required cuts. Gold also had its best year since ‘13 and rose to a new 6Y-high at $1,550/Oz as investors, especially in Q4CY19, embraced its merits as a safe haven asset and portfolio diversifier.

Brent oil rallied in the first few days of January following the assassination of Soleimani, but it was surprising that it failed to break above its resistance at $70 until today (08 Jan 2020). This suggests that either markets doubt a severe Iranian response or that oil fundamentals are looking ‘softer’. Oil is still technically in the range of $55-75/brl with low $80s an even bigger resistance. Bears continue to point to an expected surplus of production and building inventories as reasons to be wary of upside from here. However, the fact is Iran probably has the military capability and proximity to close Hormuz Straits through which 40%+ of the world’s sea-bourne oil exports travel.

Dec 12, 2019 | Articles, Global Markets Update

Markets traded mostly higher in November on the back of improving trade headlines and despite Trump’s signing of the Hong Kong Human Rights and Democracy Act and potential sanctions against Chinese officials for abuse against the Uighur Muslims. We saw indices in the US push all-time highs, while the Stoxx 600 also came within 1% of their all-time highs during the month. While Asian equities saw more of a mixed performance amid the protests in Hong Kong and weakness in Chinese economic data, global equities were buoyed by positives – particularly in the US and Europe. This aligns well with our view (and Morgan Stanley’s), which is an expected recovery in the global economy from 1Q19, led by Emerging Markets (EM) given the easing of trade tensions and scope for easier monetary policies in the region, while Goldman Sachs expects the US economy to also pick up as the effects of lower interest rates start to kick in.

Corporate credit – in particular, High yield (HY) debt – was a key beneficiary of this month’s risk-on appetite, with investors chasing yields and rotating out of sovereign debt, driving yields, more broadly, in the Investment Grade (IG) universe higher as well. We also saw some steepening in the US Treasury (UST) curve, after the Fed held rates steady and indicated that it will continue to do so unless something dire happened which would impact the US economy. We also saw safe-haven currencies weaken, with the exception of the dollar which gained in the back of stronger data, as did the EUR while GBP continued to ebb and flow with the latest news reports on the UK elections. Currencies in Latin America underperformed and suffered amid the ongoing protests in Chile, as well as the resumption of steel tariffs on Brazil and Argentina by the US later in the month.

OUTLOOK

Hong Kong equities are almost flat YTD relative to the double-digit gains in global equities, including Asia ex-Japan where Chinese equities have led the way up. The difficult question is whether this underperformance since protests began and the economic recession as a consequence, has discounted much of the plausible risks. There are, arguably, three scenarios being a) a Chinese crackdown that would ultimately end Hong Kong’s separate system and unique appeal overnight, which would see Hong Kong equities fall sharply and struggle to recover; b) a compromise in which case Hong Kong equities would soar; c) a continued stalemate, marked by episodic spikes in violence, that the city slowly gets used to, and ultimately the protests lose ground to the realities of jobs and studies while the people move on. This might take time like the leftist riots in 1967 which lasted from May until December with huge casualty numbers after violence flared in July with bombs going off. Hong Kong has a long history of existential challenges be it the WW2 Japanese occupation and then the handover in 1997; serious riots in 1956 between pro-Chinese Communist Party and pro-Kuomintang factions that required troops to control it; 1966 riots over a hike in Star Ferry prices, 1967 riots between leftists and the British – again troops were needed; a police riot against anti-corruption reforms in 1977 and 1981; a march in 2002 against a proposed national security law; 2014 protests over Chinese proposed democracy reforms that lasted 79 days and finally 2015 riots in Mong Kok.

Interestingly an inquiry commissioned by then-governor David Trench suggested that the events had also exposed a gap between the colonial government and the people – a gap that would be “a continual danger and anxiety for any form of administration.” It highlighted the problems faced by Hong Kong’s youth, saying: “The evidence before us points to the probability that young people are less likely to put up with conditions which their parents accepted without comment.” It said solutions depended on the continuing prosperity and success of Hong Kong “since its future well-being is in the hands of the young people of today” and that it was in the youth “that Hong Kong must make its major and most significant investment.” The riots in 1956, 1966, 1967, 2014 and the current protests today had deep roots in terms of poverty, lack of opportunities for the younger people and inadequate housing. In terms of the 1967 severe riots and the 2014 and 2019 protests, the sovereign power was a clear target. The British government responded with measures to address social grievances and address the housing shortage, yet it never offered democracy or accountability. This might be one way out of the current impasse and, so far, these protests are not of the length, or violence, of 1956. Hong Kong recovered from its pasts tests and should the Hong Kong/Chinese government heed some of those earlier lessons, there is a path forward.

History would suggest, should common sense prevail by the Hong Kong and Chinese governments, as well as protesters’ use of violence, Hong Kong will survive this latest test and continue to prosper given its separate system and its unique set of skills, position, and importance. We have heard arguments Hong Kong is no longer important to China, that it is only 2-3% of China’s GDP and that the Chinese government would be happy to see a colonial-era creation become a backwater. This is inaccurate. Hong Kong raised the bulk of Chinese corporates’ offshore capital – a role even more important given the US’s veiled threats to close its capital markets to Chinese companies (as it did to Russian companies). China will retain its capital controls for many more years, making Hong Kong’s role as the key offshore intermediary critical, thus making no sense for China to allow Hong Kong to wither on the vine, barring extraordinary circumstance, suggesting the medium- to long-term view on Hong Kong equities ought to be positive even if, in the short-term, it looks obscure and horrifying on occasions. Other than the British imposing self-harm via Brexit, most people do not deliberately damage their country, which suggests support for protesters will decline should the Hong Kong and Chinese governments do things to address the underlying socio-economic problems and allow some greater democratic accountability of the, so far, dire Hong Kong governments under Chinese rule. A huge affordable housing program, limits on mainland migration to Hong Kong, assistance for the young in creating jobs and improved infrastructure are all well within the remit of the Hong Kong government given its huge reserves, and if this is not a sufficient crisis to justify spending, what is? If history repeats, in terms of solutions to this crisis, then Hong Kong equities are buys and become more so if short-term events result in further selloffs.

Our base case remains common sense will prevail, that the Chinese government will avoid cracking down on Hong Kong and that measures will be taken to address underlying grievances. Undoubtedly, radicals in the protesters will never accept what will be offered as it will be deemed too little but the key is to win back the 2mn+ people that marched in position to Chinese government’s misrule in Hong Kong as history shows Hong Kong people to be pragmatic and that their protests do lead to change.

![]()

![]()

![]()

![]() EQUITIES

EQUITIES

Fig 1: US indices returns. Source: Bloomberg

-

Markets in the US continued to push all-time highs in November as talks of a ‘Phase One’ trade deal – despite the concern around Trump’s signing of HK’s Human Rights and Democracy Act – added support to settlement, on top of the news that a United States-Mexico-Canada Agreement deal was nearing. The S&P 500 gained +3.40% MoM, underperforming the Dow Jones (+3.72% MoM) and Nasdaq (+4.50% MoM) (Fig 1).

-

Data, in general, continued to remain relatively positive – the University of Michigan’s Consumer Sentiment Index rose to 96.8 (vs est 95.7) in November, on top of a slight improvement in small business optimism. October’s consumer price index rose +1.8Y YoY, while the producer price index picked up a +0.4% MoM after September’s disappointing -0.4% figure.

-

3Q19 earnings season in the US has also neared a conclusion, with companies reporting a decline in earnings (-2.2%) for a third consecutive quarter. 75% of companies in the index beat EPS estimates, with Utilities reporting the highest earnings growth across all sectors at +10% QoQ. Notably, 85 companies guided for lower EPS estimates in the period ahead.

-

Ironically, despite stronger earnings Utilities, along with Real Estate, were the only detractors this month, while all other sectors were positive as Info Tech, Financials and Health Care outperformed (Fig 2).

![]() Fig 2: S&P 500 sector returns. Source: Bloomberg

Fig 2: S&P 500 sector returns. Source: Bloomberg

-

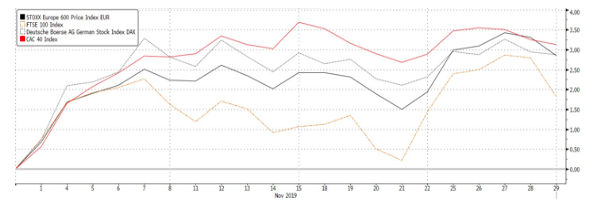

Despite the European Commission cutting their eurozone growth and inflation outlook earlier in the month, European equities were up +2.69% MoM, helped higher by the German DAX (+2.87% MoM) and French CAC40 (+3.06% MoM). The FTSE 100 (+1.35% MoM) amid political concerns ahead of the snap general elections which will be held on Dec 12th (Fig 3).

Fig 3: Returns of major European indices. Source: Bloomberg

Fig 3: Returns of major European indices. Source: Bloomberg

-

Nevertheless, data in the region was also generally positive, suggesting a bottoming in economic weakness. This was particularly so in Germany where the ZEW survey (though still negative), rose unexpectedly to -2.1 (vs est. -13.0) from October’s reading of -22.8, while the Ifo business survey improved for its third consecutive month.

-

Defensives in Europe underperformed this month, with Utilities and Telecommunications being the only sectors in the red, while Technology, Basic Resources, and Industrial Goods & Services outperforming.

Fig 4: Stoxx 600 sector returns. Source: Bloomberg

-

Based on the chart below, it was clear that returns in Asia were mixed despite the rally in both US and European equities. Nikkei and Sensex outperformed at +1.60% and +1.66% MoM respectively, while A-shares (-1.93% MoM), the HSI (-2.08% MoM) and MSCI ASEAN (-1.79% MoM) lagged severely (Fig 5).

Fig 5: Returns of major Asian indices. Source: Bloomberg

-

Exports in China fell for a third consecutive month (albeit beating estimates at -0.9% YoY vs est -3.9% YoY), while Oct industrial production weakened to +4.7% YoY (vs est. +5.4% YoY). Capital spending slowed, while retail sales growth slowed to +7.2% MoM (vs est +7.8% MoM). Industrial profits also fell 9.9% in Oct amid slowing domestic demand and trade tensions. The silver lining came in Caixin’s manufacturing PMI, which rose to 51.8 in Nov (vs est. 51.5), with output and new orders seeing some pickup.

-

To some extent, this was mitigated by the People’s Bank of China which made unexpected moves to add liquidity to the banking system by offering loans to banks and trimming its benchmark 1Y/5Y LPR by 5bps, and cuts to its short-term repo rate (for the first time in 4Y).

-

Overall, weakness in China was understandable given the poor data readings, and this, in turn, weighed on equities in the ASEAN region. Likewise, this applied to Hong Kong, although share prices in the HSI also came under heavy pressure from the ongoing protests and concerns around a decline in economic activity.

FIXED INCOME

Fig 6: UST curve. Source: Bloomberg

Risk-on markets in November saw sovereign yields extending their rise throughout the month. The UST yield curve flattened slightly, and yields rose across the curve with the belly of the curve seeing the largest MoM shifts (Fig 6), resulting in a 30bps MoM fall in USTs. Reports at the start of this month showing the Fed, in its review of its monetary policy tools, considering allowing inflation to temporarily run above its 2% also helped the curve steepen, but effects from multiple trade-related headlines took over and introduced volatility in USTs, causing the MOVE index, which tracks US interest rate volatility, to shoot up (Fig 7).

Fig 7: MOVE Index shooting up in the first week of December. Source: Bloomberg

-

Corporate credit outperformed sovereign debt again this month as the hunt for yield continued to lead inflows into HY debt. US and Asia were slightly more resilient, with both IG and HY managing to register positive returns, while IG in other parts of the world fell.

-

Data over the month also seem to point towards a global growth recovery, supporting the case for HY. However, we continue to watch default risks very closely. The number of bonds in the ICE HY index trading with spreads of more than 10% – a commonly used definition for distressed debt – has risen during the month to the highest since ’16 as investors move out of lower-quality CCC debt.

-

Protests in Chile and Columbia saw the countries’ debt weigh on the EM USD-denominated debt index. However, the index managed to eke out a gain as modest gains in Russian and Turkish debt managed to offset losses seen in the Latin American countries. However, USD strength weighed on EM local currency debt, causing it to be the worst-performing sector after global treasuries.

-

We remain of the view that opportunities in the EM space, particularly in Asia, are still present. Asian central banks still have space to ease monetary policy, with several of them also expressing preparedness to do so.

FX

-

Overall, the dollar performed moderately well as recent data began to lead investors away from fears of a drastic slowdown. The 10Y and 30Y yields have found some support at 170bps and 221bps respectively, supported by shorts continuing to unwind. 10Y contracts have sold off to be at their lowest net-short position since November ’18.

-

Despite overall USD exposure remaining lower in markets since June ’19, November has seen a pickup in dollar longs, likely due to the continued sell-off in treasury bonds.

-

The EUR advanced earlier this month on short coverings as ZEW and exports reported better than expected, however YoY industrial production reported -4.30% vs. an expected -2.90%. We continue to see positioning to remain flat until we near clarification on ECB policies. Resistance still remains strong along 1.11.

-

AUD positioning was very reactive towards interest rate decisions. The decision to hold rate movements until ‘20 saw a large unwinding in shorts, resulting in a stronger AUD. Positive trade development also supported AUD further. We will likely see a build-up in shorts again on further tariff developments. AUD still remains on a downtrend with key resistances seen along 0.687.

-

In our previous monthly, we noted that there would be an obvious increase in volatility between 1.25 and 1.35 as elections drew nearer and labeled a Corbyn victory as unlikely, simply due to the self-destructive nature of Labour policies. Johnson now leads 43% to Labour’s 32%, which implies more distance between the UK and a No-Deal. GBP remains net short with more being added in November. We expect more volatility with 1.30 to remain very supportive and are still Sterling bears in the long run.

COMMODITIES

-

Oil and gold mainly reacted towards trade developments. Oil’s positioning has picked up since October and is now at its highest since June this year. Likewise, for Gold, positioning remains extremely net long and has in fact, risen, despite the recent sell-off during pulsated fears as Hong Kong grew larger as a wedge between China and the US.

-

Gold has fallen through technical levels and saw a prolonged period of trading between 1,550 and 1,480. We continue to believe it remains a diversifier in portfolios simply due to the prolonged acquisition from Central Banks and the ever-reliable haven attributes that it possesses in times of trade uncertainty.

- Over the month, several FOMC members also came out saying that they think US monetary policy is at a good place and reinforced last month’s meeting decision to hold rates and to continue holding rates, leading markets to price in a 0% probability of a rate cut this month.

Nov 15, 2019 | Articles, Global Markets Update

A myriad of positive factors pushed global equities higher, with the MSCI ACWI seeing a total return of 2.76% over the month, before moving higher month-to-date (MTD) in November (+1.35% MTD as at 5th November). This move higher was supported in part by the three US indices, which all achieved all-time highs. European and Asian equities also shook off earlier weakness to close higher due to improving US-China trade sentiment.

However, the improvement in the geopolitical environment helped take a degree of uncertainty off the table, leading corporate credit, particularly investment-grade (IG) debt, to outperform. Markets were risk-on throughout October, extending the gains seen in September amid a combination of a turnaround in trade negotiations, strong economic data, and better-than-expected earnings. Q3 earnings by American and European companies are beating consensus estimates handily.

The Federal Reserve again cut rates but despite the cut, they signalled that it will hold rates for the time being. The US also saw solid economic data and resilient consumption, which taken together with the rate cut, let Morgan Stanley’s model of recession odds in the next 12 months to fall back below 20%.

Volatility in foreign exchange markets remained low, with the UK Pound being the only exception. The currency saw exceptional gains in October, strengthening 5.81% against the dollar as risks of a no-deal Brexit were reduced substantially with Prime Minister Johnson’s withdrawal agreement with the EU. However, the UK parliament failed to vote through the agreement, forcing Johnson to request for an extension to the deadline. Another general election was also called, with the vote tentatively scheduled for 12th December

OUTLOOK

The Federal Reserves’ third-rate cut, along with Q3 earnings beating consensus, has provided support for the case for global equities on a tactical basis. However, risks remain for US equities in the medium-term, with the first being political in nature. Elizabeth Warren is now leading the Democratic candidate and the policies she espouses are set to impact two-thirds of the S&P 500 directly and indirectly. Her policies will, at best, create considerable uncertainty but result in direct damage at worst. Amongst her aims are to ban fracking, break up banks (via the 21st Century Glass-Steagall Act) big tech, increase corporate taxes and target private equity tax avoidance methods. Even if Donald Trump was to be re-elected, there is still bipartisan support around breaking up social media giants and reforming healthcare – including the giant healthcare service organisations.

However, more fundamentally, there are headwinds against US equities’ return on equity (ROE)/operating profit margins (OPM), with the US economic expansion now being the longest ever on record. Should trade tensions not escalate further in 2020, US equities’ defensiveness might be less obvious, enabling a rotation into equities in other parts of the world that have underperformed S&P 500 since the Global Financial Crisis. US share buybacks have arguably peaked in FY18 and Goldman Sachs expects these to slow to $675bn by 2021 from over $900bn in 2018. Separately, there is also the potential for contagion into equities from the problem’s in the $1.1trn leveraged loan market, as well as from any major downgrading of BBB debt into high-yield (HY). S & P 500 – on over 17x forward P/E ratio – is fully valued and especially so if earnings per share (EPS) contracts in FY19 and FY20.

We remain positive on Japan for some of the same arguments as for Europe, although there is a more pronounced structural ROE story linked to improving corporate governance. Asia ex-Japan (AXJ) is trickier as a large part of it depends on the level of USD relative to AXJ currencies. This can go either way but AXJ central banks are easing monetary policy and/or injecting liquidity, while domestic demand stories are resilient. Several countries are also meaningfully cutting corporate taxes (India, Indonesia, and the Philippines) as well as boosting infrastructure spending (Malaysia, Philippines, Singapore, India, and Thailand) – there is a fiscal response to AXJ that is missing from countries in developed markets (DM). We also see China reflating more proactively given the weaker manufacturing PMI data and PPI disinflation. We are not likely to see a huge reflation like 2009/1010 nor 2019, but we could see substantially more stimulus than the very limited amounts YTD.

In contrast, European equities might look relatively better after some progress around Brexit and a recovery in the auto sector from a difficult year. ECB is potentially restarting quantitative easing whilst retaining a very weak monetary policy. Whilst European GDP is weak, it may move sideways in contrast to US GDP, which is set to slow sharply from Q4CY19 through much of 2020. Leading indicators point to European GDP/manufacturing picking up in H1CY20. Less trade uncertainty – admittedly a big if – will also help EU’s very trade-focused economy. Simply put, EU’s economic cycle, as well as equity earnings, lags the US European equities have far greater potential to see riding earnings/ROE’s, with share buybacks accelerating as well – admittedly from a very low level relative to the US. Foreign institutional investors are also underweight European equities, especially UK equities. Whilst ROW/European equities might contract more than US equities in FY19, their outlooks are relatively better in FY20.

However, whilst there is a tactical case to add to equities, we remain cautious for several reasons: 1) Ongoing GDP downgrades will impact earnings while share buyback, which has been the single largest buyer of equities in the last two years, are slowing markedly: 2) A lot is also is riding on Q4 earnings being positive close to double digits as it is off a much lower base in Q4Y18A, but consensus numbers appear optimistic and there is a decent prospect global EPS will contract including US equities: 3) Earnings elsewhere, recent Brexit and trade positives might reverse – we are one tweet from a souring of hopes whilst UK politics is a mess plus markets have already rallied on their positives. Lastly, 4) Investors can sit on cash/remain defensive far longer than is expected.

![]()

![]()

![]()

![]() EQUITIES

EQUITIES

Fig 1: October total return performance of US indices in % returns. Source: Bloomberg

-

US equities had a rough start earlier in the month amid weak September manufacturing data while trade tensions continued to escalate with the US blacklisting of Chinese companies not helping the situation. However, a positive geopolitical environment helped push benchmark indices to all-time highs later.

-

Tech stocks fared relatively well to help the A & P 500 to a +2.04% MoM gain, Nasdaq outperformed at +3.66% MoM, while the Dow Jones lagged behind at +0.46% MoM, weighed lower by a 10.66% fall in Boeing. (Fig 1).

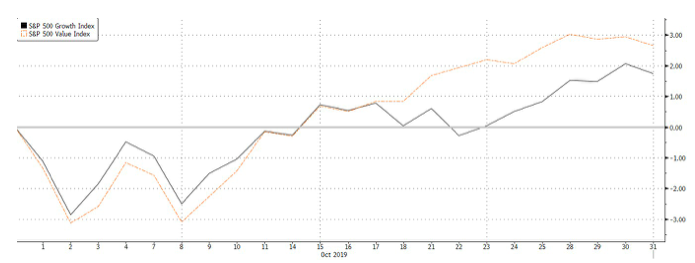

![]() Fig 2: October total return performance of S & P 500 Growth Vs Value companies. Source: Bloomberg

Fig 2: October total return performance of S & P 500 Growth Vs Value companies. Source: Bloomberg

-

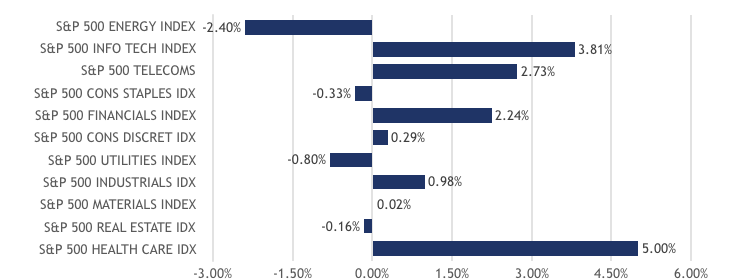

Value continued to outperform this month, although the continued rally into early November mostly saw flows back into growth stocks (Fig 2). Healthcare was the best performing sector, on the back of better than expected earnings results, while IT and Communication Services also outperformed. Energy was the standout laggard as oil prices retreated off last month’s spike.

-

October also saw the bulk of S & P 500 companies, with 393 of the 500 companies having reported an aggregate positive earnings surprise of +4.69%, while the headline number for sales was significantly lower, with around 60% of companies reporting an aggregate positive surprise of +0.55%. Healthcare, Financial and IT companies led with the most upside surprises.

Fig 3: Performance of the S&P 500 sectors in October. Source: Bloomberg

Fig 3: Performance of the S&P 500 sectors in October. Source: Bloomberg

-

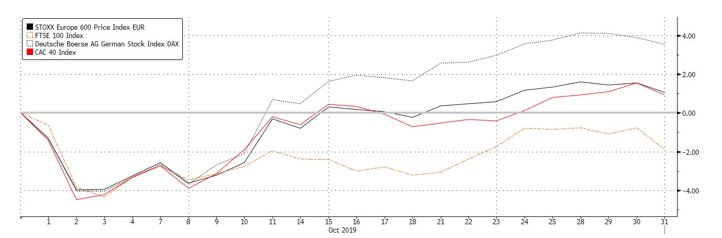

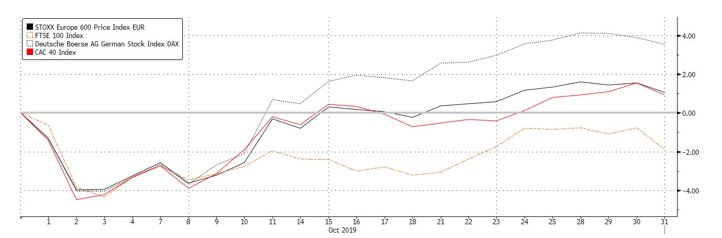

In Europe, Germany’s DAX (3.53% MoM) led gains in the region, extending the rally in Stoxx 600 (+0.92% MoM) by yet another month as the pickup US-China trade deal was supportive. In contrast, the FTSE 100 (-2.16%MoM) underperformed significantly as Brexit continued to be a key issue weighing on equities in the UK, and also as the GBP gained significantly over the course of this month.

Fig 4: October total return performance of European indices in % returns. Source: Bloomberg

Fig 4: October total return performance of European indices in % returns. Source: Bloomberg

-

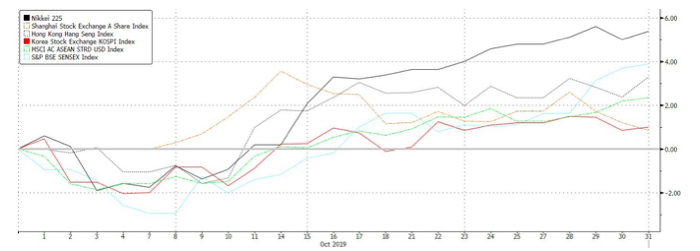

Markets in Asia were mostly helped higher by trade optimism too, although Japan’s Nikkei 225 (+5.38% MoM_ outperformed the broader region after a weak set of inflation numbers raised hopes of easing measure, and also as political tensions between Korea and Japan appeared to have simmered. Likewise, the Hang Seng Index (+3.12% MoM) also gained on the back of a recovery in mainland companies despite continued weakness in more domestic-oriented stocks. MSCI ASEAN (+2.20% MoM) was also helped higher by trade optimism, with currencies in the region also seeing a likewise recovery.

Fig 5: Total return performance of Asian indices in October. Source: Bloomberg

Fig 5: Total return performance of Asian indices in October. Source: Bloomberg

FIXED INCOME

Fig 6: FI Sector index returns in October. Source: Bloomberg

Fig 7: DM Sovereign 10-year yields. Source: Bloomberg

Fig 8: US Treasury curve – September vs October. Source: Bloomberg

Fig 8: US Treasury curve – September vs October. Source: Bloomberg

-

The UST curve also steepened over the month, with yields of maturities longer than 7Y increasing (Fig 8). Key duration spreads like the 3m/10y and 2y/10y spreads both increased to 16.7bps from -14.3bps to 4.3bps. The 10Y UST moved through a 1.80% resistance while the 30Y yield rose 50bps off lows below 2%.

-

The recent October economic data from the US mostly surprised on the upside, supporting the Fed’s decision to hold rates constant and presents a risk for longer-dated sovereign debt in the US as longer-term inflation expectations rise. Fed futures now predict under 20% probability of a rate cut in December.

-

However, there might still be opportunities in the emerging market, particularly Asia, space. Despite the scale back of geopolitical risks, Asian economies are still relatively weaker while the Asian central banks still have space to ease monetary policy.

Fig 9: Divergence of CCC yields relative to BB and B. Source: St Louis Fed, ICE

Fig 9: Divergence of CCC yields relative to BB and B. Source: St Louis Fed, ICE

-

Within the corporate credit space, IG debt mostly outperformed HY in developed markets as investors remained cautious amid rising default risks. However, these concerns are largely concentrated in the more leveraged CCC space, with yields diverging from higher-rated HY credit (Fig 9).

-

Another notable observation is the narrowing of BBB-BB spreads to ’07 lows (Fig 10), as investors chase yields in the BB space. This also likely suggests the perceived risks present in the BBB space. CreditSights see just under $70bn of BBB US debt vulnerable to a downgrade into HY over the next 12M. This typically translates to forced sales of these fallen angels due to constraints set by the various portfolio mandates.

Fig 10: Narrowing of BBB-BB spread to ’07 lows. Source: St Louis Fed, ICE

Fig 10: Narrowing of BBB-BB spread to ’07 lows. Source: St Louis Fed, ICE

-

However, we note that HY outperforms IG in Asia. There seems to be an opportunity in Asian USD HY if geopolitical risks ease further and stabilise markets. This yield spread between the sector and US HY is currently attractive (Fig 11) and has space to narrow further should market conditions prove favorable.

Fig 11: Yield differential between Asian USD HY and US HY. Source: Alpinum IM

FX

-

Forward volatility in FX remains at all-time lows. However, October saw some interesting moves with GBP surging on the reality that a no-deal has been pushed to a far corner of the deal table, causing the majority of shorts to reverse, releasing a lot of pressure off Sterling and is now considered to be at a neutral position.

-

Sterling’s shorts began to drastically reverse by $1.60bn on the 20th of October, bringing shorts to an all-time low since Mat (Fig 12). We believe that Sterling’s current price and position are neutral, which implies the next bout of volatility to ramp up this coming December. A Conservative victory is unlikely, but still possible, which may cause the current Withdrawl Bill, a deal far worse than its predecessor and can be considered an ideological “Hard Brexit” to pass.

Fig 12: Reversal of GBP shorts. Source: Scotiabank FICC Strategy, Bloomberg and CFTC

Fig 12: Reversal of GBP shorts. Source: Scotiabank FICC Strategy, Bloomberg and CFTC

-

The repercussions of such a deal will prevail for years and spill into all trade negotiations with the EU. The UK’s FAI, FDI, and GDP growth will be severely impacted, and it is also worth noting that the Brexit Damage Assessment has yet to be released. This gives rise to our belief that GBP will once again trade sideways in its current range of 1.25 and 1.35 until we near the elections.

-

A positive outcome of the elections is a hung parliament, as this implies that none of the extremist, nationalistic or radical parties are passed and may lead us to a second referendum and amendments to the Withdrawl Agreement (a ‘soft’ Brexit). This will be the most constructive path for the Sterling and could finally see the Sterling in a temporary net-long position.

-

The worst-case scenario would be a Labour victory – their policies are severely more damaging and could have a harsher impact on FDI which will eventually lead to large portfolio selling. We could see the GBP dip to 1.20.

-

In the longer term, we remain Sterling Gears as, under most scenarios, Brexit remains a likely possibility and therefore harmful to the UK”s economy, to FDI and to FAI. Structurally, the UK suffers poor productivity and higher inflation than its developed market peers and has borrowed too much today that will reduce forward growth. Multiple UK governments have addressed these structural weaknesses by enabling GBP to depreciate and thus it is likely that this will continue.

-

CNH (+2.26% MoM) and JPY (-1.00% MoM) also saw some movement as China’s stimulus policies began to take effect and reversed some of the damage from trade disputes. The Caixin Manufacturing PMI diverged further from the official PMI and rose for a 4th straight month in October to reach a 2Y high, while improved risk sentiments over the month weighed on the JPY.

COMMODITIES

-

Oil prices moved slightly higher over the month as the reduction in trade tensions helped improve sentiment around the global economy, and thus, oil demand. This helped relieve downward pressure on oil prices, ut the potential ascent to $70 remains very fragile and relies heavily on the positive development of trade and for the Middle Eastern tensions to escalate. We expect oil prices to trade flat between a range of $55, a new medium-support level as well as $65, its 2000DMA.

Fig 13: Gold positioning. Source: Scotiabank FICC Strategy, Bloomberg and CFTC

-

Gold’s positioning has significantly thinned since its stellar rise from $1,275/oz (Fig 13). Gold remained very technical for the month of September up until the recent, positive developments on Brexit and trade developments that edge investors to be risk-on. Gold strengthened, briefly to $1520/oz, as October ended with the Fed’s decision to cut rates, just before positive trade development and US jobs data weighed on risk-on sentiment. $1,480/oz, previous key support, is now once again in effect.

Oct 15, 2019 | Articles, Global Markets Update

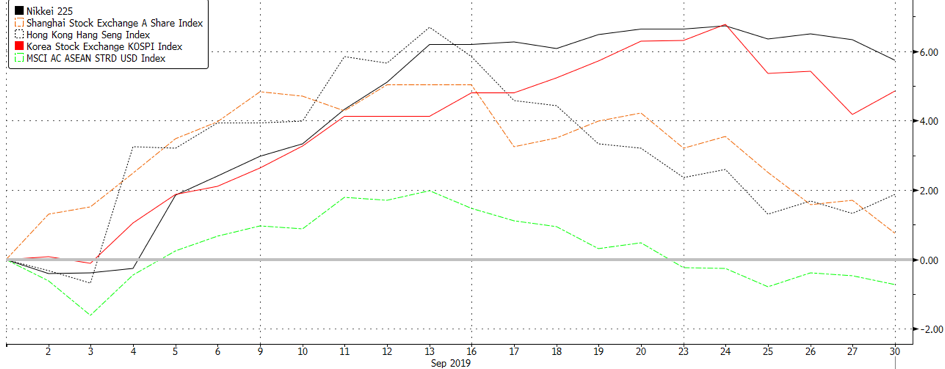

Markets saw a risk-on rotation in September (Figure 1) amid positive trade developments earlier in the month. China suspended tariffs on 16 types of US products, while the USA delayed tariff hikes from 1st October to 15th October in order to avoid China’s 70th anniversary. On top of the 16 products, China also talked about removing tariffs on bigger ticket items like soybeans and pork and have reportedly started making big purchases of those items. This led the S&P 500 back near an all-time high, while sovereign debt and high-quality corporate debt ended the month lower, with US Treasury (UST) 2Y and 10Y yields paring most of the losses seen in August.

Fig 1: Risk-on rotation sees outflows from haven assets. Source: Bloomberg

However, there remain challenges in negotiations. Reports that the White House was considering limiting capital flows from US to China surfaced at the end of the month. The reports hit markets negatively though those were quickly denied by US officials. In addition, Chinese officials mentioned over the weekend that they are now less willing to agree to the kind of broad trade deal that Trump is seeking and are narrowing the number of topics to be discussed.

European equities also recovered across the month, supported by the ECB’s commitments to further erase monetary policy, with Stoxx recovering losses in August to trade at levels last seen in July. However, the WTO’s decision to allow US to impose tariffs on Europe given Europe’s illegal aircraft subsidies to Airbus saw Stoxx fall in the first week of October. Asian equities, on the other hand, were a mixed bag, though the MSCI Asia ex-Japan index managed to close higher.

However, global growth concerns resurfaced in the first week of October as data for September, particularly for the US, came in weaker than expected, causing a rotation back into safer assets, paring gains/losses seen last month (Figure 1).

FX remained relatively quiet across the month, with volatility remaining low. GBP saw one of the largest moves within the G10 group, apart from the move out of safe-haven currencies like JPY and CHF. The pound continues to be driven by Brexit headlines, gaining strength in September amid a series of developments that reduced the probability of a no-deal. However, the currency pared gains during the last week of the month after Boris Johnson called for early elections and Corbyn indicated he will call a vote of no-confidence after a Brexit deadline extension was secured.

Separately, the USD strengthened over the month, with DXY gaining 0.47%, underpinning the reality that USD remains the least ‘bad’ developed markets (DM) currency with the EU facing recession amid a divided European Central Bank (ECB), and the Bank of Japan (BOJ) hinting it will ease on the 31st October. The Swiss National Bank (SNB) has also been leaning toward a dovish tilt and that will ease the CHF. Likewise, emerging markets (EM) central banks were seen to be cutting rates – this includes India – whilst the People’s Bank of China (PBOC) effectively lowered rates 10bps via a new rate-setting benchmark and injecting liquidity to the system. This seems to suggest that we might see the dollar remain stronger for longer and that might potentially weigh on EM Asian currencies and thus equities likewise.

Oil prices saw increased volatility this month, driven by a drone attack on Saudi Arabia’s production plants. The Brent oil price spiked to $70 after the attack but quickly retraced to end the month lower. Saudi Arabis has since brought production levels back to levels seen before the attack. Prices were also pressured lower by concerns of a slowdown in global growth, accompanied by EIA and EIA data that showed increases in US crude inventory.

Outlook

Liu He and Lighthizer are reportedly set to meet (10th October). This comes just a week before the US is scheduled to increase tariffs on $250bn worth of Chinese goods to 30% from 25%. While both sides have exchanged small gestures of goodwill over the past few weeks, our view is that it does not circumvent the longer-term strategic confrontation between the two powers, and a wide gap on substantial issues – such as IP transfer rights and Xii’s “Made in China 2020” policy – that neither side is likely to back down on. Moreover, we have seen unprecedented bipartisan support in the US, and polls show that 80% of the US public see the need to address the issue. With that said, there is still room for a small deal to be cut in the near-term, and we do not think it would be wise betting against it. In addition, Trump’s latest ‘impeachment’ debacle and the allegations he pressured Ukraine’s leader to investigate Biden and sons are potentially damaging. The allegations could affect his re-election efforts and, as some might hope, his current role as President. We shall see – it would not be ‘out of character’ for Trump to turn even more erratic and throw a curveball in the way of trade negotiations as a distraction from domestic issues, whether or not that might be in favour of a deal.

However, moving away from geopolitics to the US economy, we think US macro data remains quite resilient but a weaker Conference Board consumer survey following the earlier disappointment in the University of Michigan’s consumer sentiment survey are early signs that there might be some weakness in this consumer-led economy. As we have noted before, the strong consumption dichotomy to weak corporate manufacturing and capital expenditure data will not be resolved one way or another, and the risk is that consumption weakens, adding to fears of a recession as quite possible and that equities will enter a bear market – they note the massive rotation of late-term momentum/growth sectors to value/cyclical’s preceded the last two recessions too. MS has called US markets reliably well in the last few years and often, rightly, been cautious about it too.

Brexit remains an overhang on Europe, and the immediate outlook seems dependent on whether Boris Johnson will be able to secure a deal with the European Commission (EC) at the European Union (EU) Summit on the 17th and 18th of October. Whilst Parliament has sensibly voted to not have a no-deal Brexit, Johnson is still committed to taking the UK out by the end of the month. We were delighted by the UK Supreme Court’s unanimous decision that Johnson’s prorogation move was unlawful (thus, in effect, saying he lied to the Queen). Boris was put into power by 93,000 votes (or 0.2% of the voting public) of which 75% were white males over 65 years old! Whilst 52% voted to leave, this accounted for 37% of those that could have voted and of that 52 %, not one was asked what type of Brexit was favoured. Democracy is failing the UK and it is now similar to a banana republic in the degree of volatility in policy action – with potentially damaging consequences – and instability in the country from what used to be a stable democracy with tramlines in terms of policy outlook. Whilst the Court’s decision is welcome – and GBP gained a big hit – the harsh reality remains the UK is in a mess over Brexit and the outlook is unclear. What ought to happen is either a fresh election (at this point it seems Labour’s policies and Corbyn make it unelectable plus, as a party more in favour to remain its route to victory is in marginal seats that voted to leave in ’16) or a 2nd referendum and we struggle to see where the upside for GBP is, whereas we see reasons for it to retest recent lows since the Brexit vote in ’16. A no-deal Brexit would be painful, and stupid, but over time this can be corrected whereas Labour’s policies are disastrous if implemented given the leadership is Marxist Cabal.

There is – in our view – a structural risk around oil that is potentially far earlier than peak oil which some see as soon as ’25. The Economist rightly notes that there is a (major) risk that the climate change impact could ‘force’ far more hostile regulatory action by governments that would impact oil companies hard. One consultancy sees such action happening within the next 2-3 years. This throws open the question about whether to hold oil stocks at all given these risks. We have some sympathy with this argument and realise that climate change is something we need to get on top of.

On the other hand, gold is ‘swinging’ around but has not followed falling UST yields higher lately and is trading in the $1,480-1,520/Oz range after bottoming out at about $1,463/Oz (prior 6y high) spike lower MTD. We remain an owner of gold in portfolios at a 3-5% weighting as a portfolio diversifier, an alternative ‘safe haven’ asset to sovereign FI and as a play on negative-yielding global FI (now at about $17tn or 30% of all FI). It is worth noting that central banks are a far larger, consistent buyer of gold for reserves than in the past – China added 5% to its already considerable reserves in the last 12M – in order to diversify from an over-reliance on USD as trade becomes less certain.

Despite all the negatives out there, equities (especially in the US) have stayed remarkably resilient YTD, and the with S&P 500 and MSCI ACWI just off all-time highs, it partly reflects the fact there is no alternative with over $15tn of negative-yielding FI and a large chunk of the rest offering negative real rates. It is worth noting that if you take the UST 10Y yield at about 1.6% relative to the S&P 500’s yield and compound that at 3% growth p.a. on just income over 10Y, the S&P 500 is yielding more than double that of UST’s, and one could argue that the S&P 500 is a safer bet than UST’s too!

Separately, the recent failure of WeWork to access public markets given the degree of skepticism around its business model is another illustration that private equity (PE) is substantially overpaying for private vs public markets, and the returns are thus questionable. AQR forecasts PE returns over the next decade to be under 3% – roughly similar to their forecast for S&P 500 – but the former is far more illiquid and much of the gains are removed via exorbitant fees charged by the PE fund managers (Financial Times estimate 60% of PE ‘alpha’ went to the fund manager in funds followed in last decade). This is made worse, in practice, as unless you are invested in one of the top PE funds (which are mostly inaccessible), your return profile is far worse relative to returns from public equities easily accessible via low cost, passive ETFs – in the last 20Y, top PE funds have returned about 16% p.a. relative to a median fund at about 11%, and poorer funds under 8%.

Thus, our portfolio positioning remains defensive, and we prefer to hold higher amounts of cash so that we can add tactically when we see bouts of weakness in equity markets. We would prefer to have a higher weightage of equities as we see it as the ‘least bad’ asset class, particularly against relatively ‘expensive’ USTs, nor the high-yield (HY) or Senior Loan space where risks remain high. Overall, we remain overweight on Alternatives as our belief is that we are entering a period of higher volatility and lower returns and on this basis, we would prefer to derive returns from an asset class that can generate less or even uncorrelated returns to traditional markets, with the benefit of additional diversification.

![]()

![]()

![]()

![]() Equities

Equities

Fig 2: YTD total return performance of US indices in % returns. Source: Bloomberg

-

It was quite a volatile month for equity markets in the US, having climbed the wall of worry to come a few points shy of all-time highs before coming off, then falling even more steeply in early October. A combination of mixed macroeconomic results and the overhang of trade tariffs weighed on markets. Tech stocks continued to see weakness as the Nasdaq underperformed at +0.46% MoM, against the S&P 500 and Dow which were up +1.72% MoM and +1.95% MoM respectively.

![]() Fig 3: Total Return performance of S&P 500 Growth vs Value companies. Source: Bloomberg

Fig 3: Total Return performance of S&P 500 Growth vs Value companies. Source: Bloomberg

-

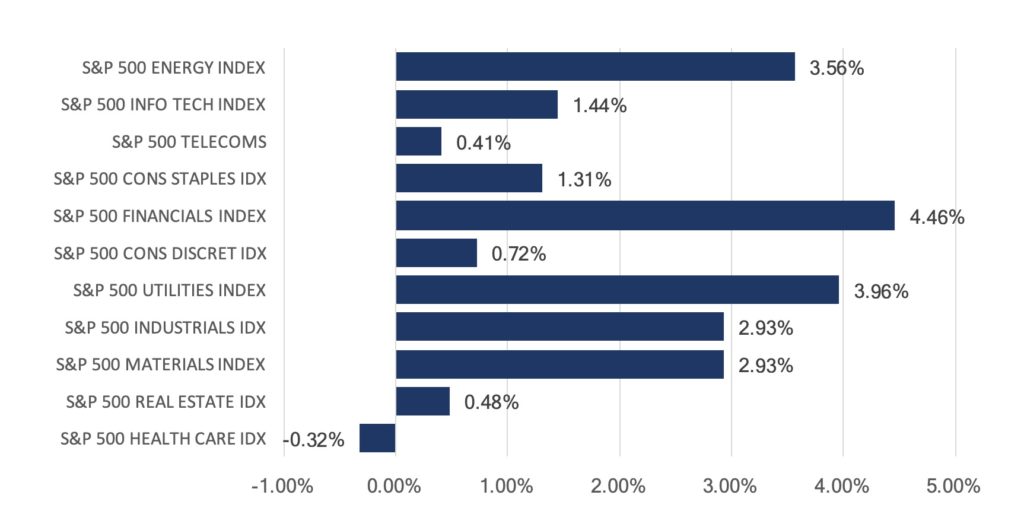

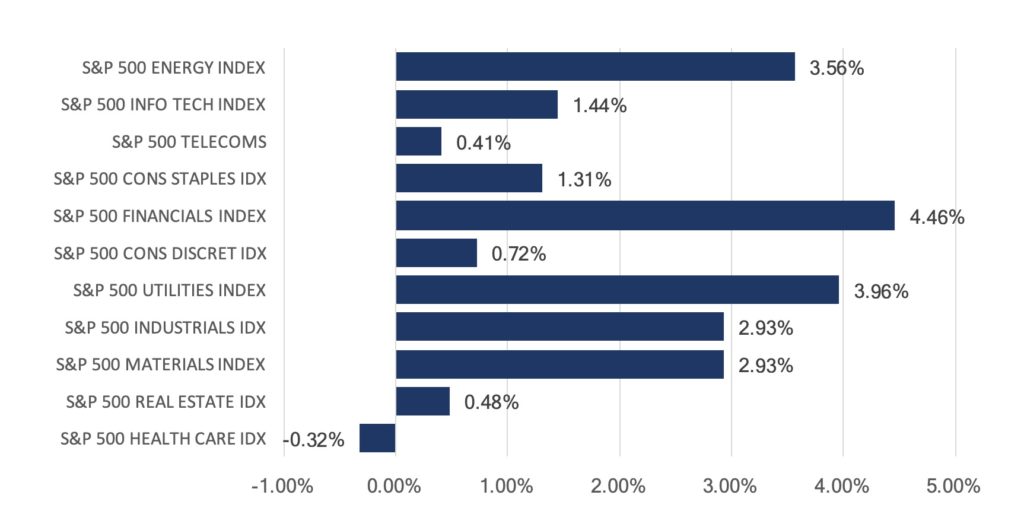

Within the S&P 500, the month saw quite a marked rotation out of Growth into Value (Figure 3), but also as investors shifted out of YTD winners into names that have underperformed thus far. Financials (+4.46% MoM) and Utilities (+3.96% MoM) outperformed, alongside Energy (+3.56% MoM) which rebounded on the back of higher oil prices following the drone strike on Saudi Aramco’s production facility. Healthcare (-0.32%) was the laggard sector (Figure 4).

Fig 4: Performance of S&P 500 sectors in September. Source: Bloomberg

Fig 4: Performance of S&P 500 sectors in September. Source: Bloomberg

-

European stocks saw continued momentum from late August, with the Stoxx 600 gaining +3.60% MoM last month. Markets were buoyed by commitments from the ECB to further ease monetary policy, but also as talk that Germany and France might move to roll out some degree of fiscal easing as well. The German DAX led gains at +4.09% MoM, while the FTSE 100 underperformed at +2.79% MoM as Brexit uncertainty continued to weigh on shares in the index.

Fig 5: YTD total return performance of major European indices. Source: Bloomberg

Fig 5: YTD total return performance of major European indices. Source: Bloomberg

-

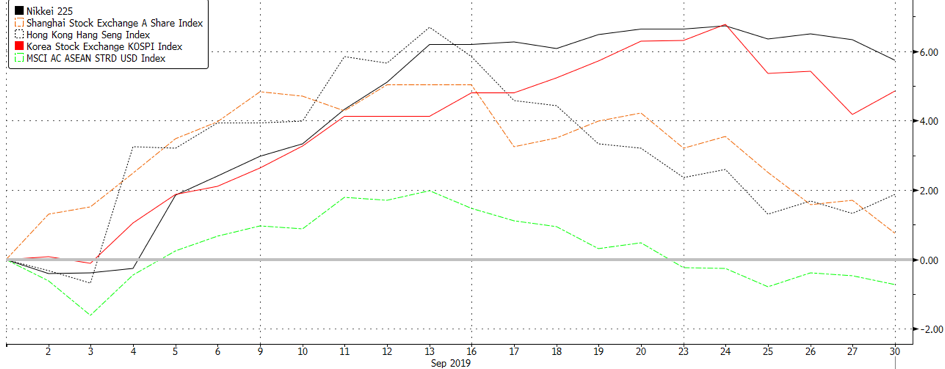

In comparison, markets in Asia saw mixed performance through the month, with the Nikkei outperforming at +5.08% MoM, alongside the Kospi which also rebounded this month at +4.84% MoM on the back of a recovery in chipmakers.

-

The HSI (+1.43% MoM) was weighed lower by domestic-oriented stocks amidst the ongoing protests in the streets, while Chinese equities also had a weak showing as markets moved on mixed macro data and the ongoing trade negotiations with the US.

-

ASEAN indices underperformed the broader region, with the MSCI ASEAN index falling -0.91% MoM, on the back of USD resilience as currencies in the region floundered. On top, the overarching concerns over global growth were also a negative contributor given the region’s high dependence on this.

Fig 6: Total return performance of Asian indices in September. Source: Bloomberg

Fig 6: Total return performance of Asian indices in September. Source: Bloomberg

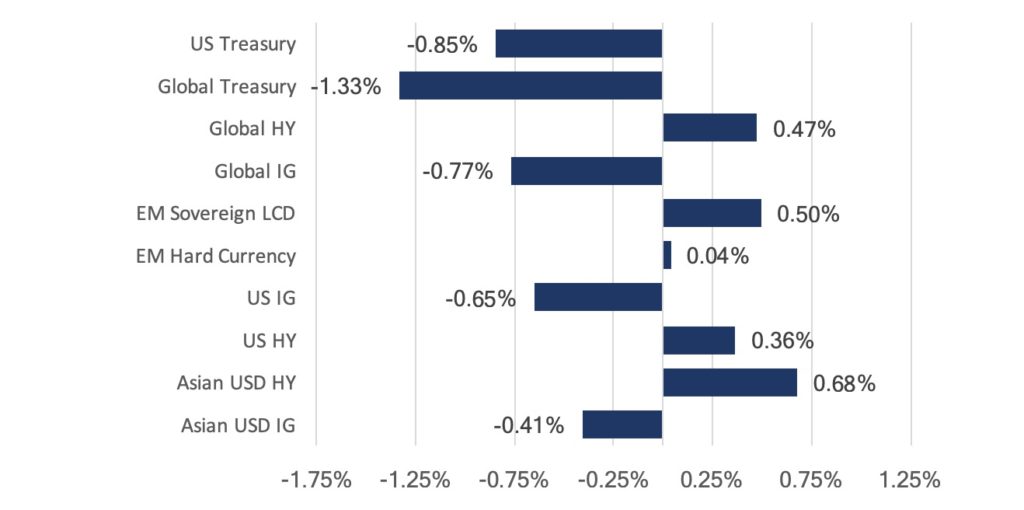

Fixed Income

Fig 7: FI Sector index returns in September. Source: Bloomberg

-