May 11, 2021 | Articles, Global Markets Update

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Death and Taxes

Investors in the Asian time zone may not have noticed the that on the 4th of May, the Nasdaq fell by -2.8% at its trough before regaining half of its losses by session close. Maximum losses MTD has been as high -3.8%. The main reason for market skittishness has been the funding for Biden’s two proposed stimulus programs, the USD2.3tn American Jobs Plan (infrastructure upgrade) and the USD1.8tn American Families Plan. The funding for these programs will affect two primary drivers of equity returns, corporate profit growth and tax treatment for capital gains.

The payment for these programs includes USD2tn from higher corporate taxes, a proposed hike to 28% from the current 21%, and USD1.5tn from raising the top capital gains tax to 39.6% from 20%. The latter only applies to individuals earning more than USD450,000 or couples earning more than USD500,000 (the 1%’ers). Already, there are reports that Biden may be willing to consider a 25% corporate tax rate, so there will likely be numerous iterations of the actual amounts. In the case of the impact of taxable income, this accounts for approximately 30% of the investment in US stocks, and while the proportion impacted will be far less, the 4th of May price action indicates the market impact could be significant. One of the most beneficial policies that is less controversial is the USD50bn proposal to improve tax collection for which estimates of additional tax collected range from USD700bn to USD1tn.

While the long-term economic impact of these programs will take many years to discern, the debate of these programs during a seasonal period of lower liquidity could lead to bouts of volatility. The obvious sectors that may be adversely affected are those that benefitted most from the Trump tax cuts, technology, communication services and health care. Industrial, energy and materials benefitted the least. Further, the NASDAQ is up 40% from the pre-COVID peak and is up 100% from the COVID trough in March, and profit taking could be a periodic headwind.

Rising Prices

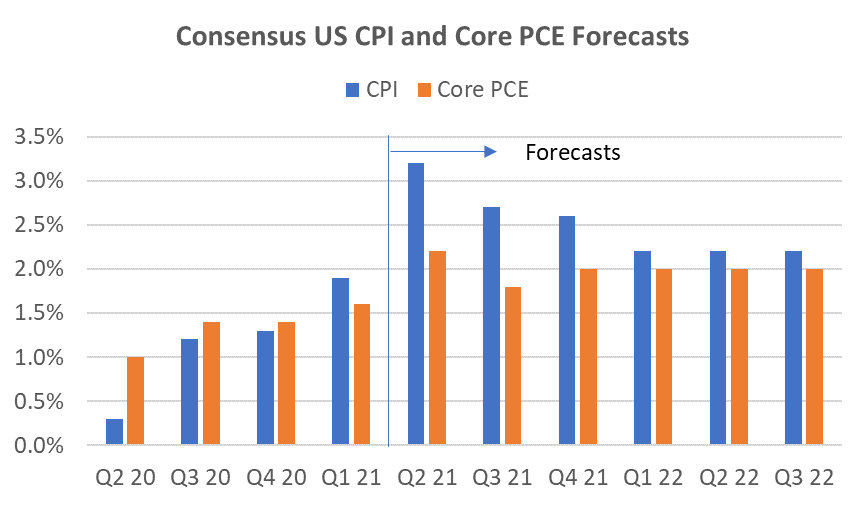

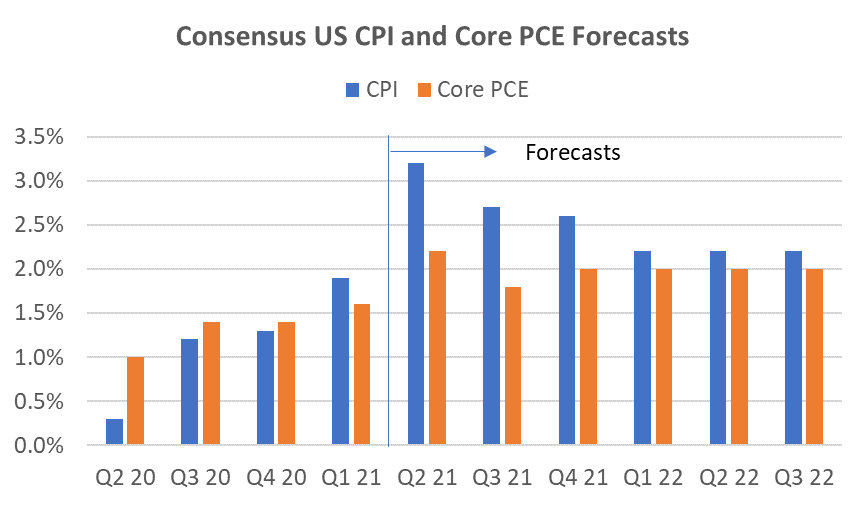

The SPGS Commodity Index rose +8.2% in April and is up +23% YTD. Together with a slew of reports from companies such as Coca-Cola, Whirlpool, Proctor & Gamble, and even Berkshire Hathaway, that prices are rising sharply and being accepted, investors should be prepared higher headline US inflation numbers in the next two quarters. This is expected. Inflation rises during an economic recovery. The unknowns are how high inflation may rise, and importantly, how much is considered transient. So far, the Fed appears unperturbed and the 10Y UST yield appears to have lost momentum since its March peak. Consensus forecasts for Q2 2021 US CPI is now at 3.2% and has been rising steadily since mid-2020. We should not be overly surprised of a monthly number close to 4%. This quarter is expected to be the peak, with CPI gradually declining for the remaining 2021 quarters. A CPI number significantly higher than 4% or a CPI that does not begin to decline after this quarter may cause concerns.

Source: Bloomberg

Earnings Growth Still Very Strong

The key driver of equity returns, EPS growth, remains very robust. For the US, 87% of S&P500 companies beat EPS estimates by 24% and top line growth surprised by 4%. Discretionary and Financials led the pack. For the Stoxx600, 72% beat EPS by 18% and revenue growth surprised by 7%. Strong EPS outperformance is generally positive for the markets, however, the impact has been subdued in the latest quarter (see chart below). The reasons for this are likely to be many but the crux can be alluded to a sell on the fact mentality. Technicals, valuations, strong YTD performance potential tax increases likely all played a role. Nevertheless, strong earnings indicate this remains more a buy on dips market than a sell on dips.

Source: JP Morgan

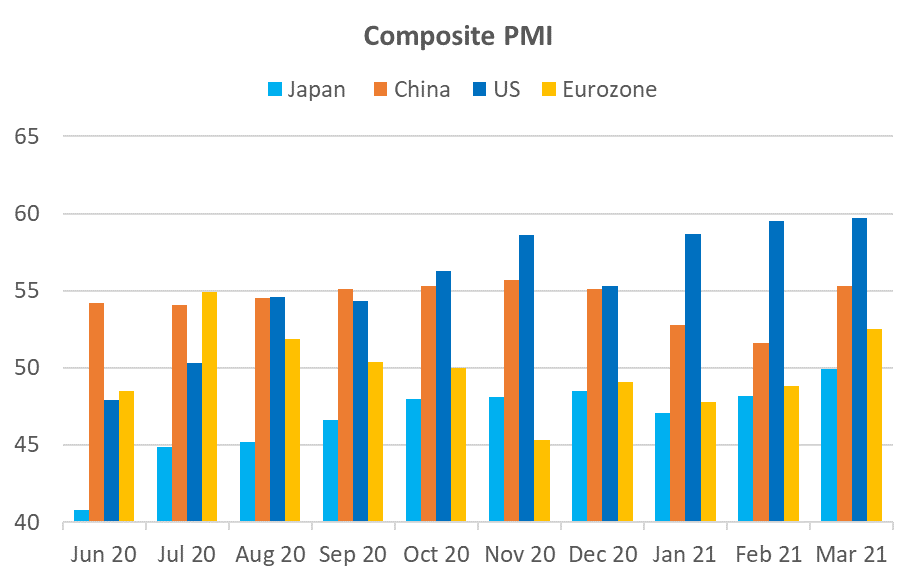

Is there a potential for a lull in growth in the US as we have seen in other regions, most notably in China? This is certainly a risk, and higher inflation may exacerbate the impact to corporate profits that will have flow-on affects for markets. However, progress on approving stimulus programs may mitigate the impact of any short-term lull in growth that the most recent jobs claims data might indicate.

Investment Recommendations

Back to the Pack But for How Long?

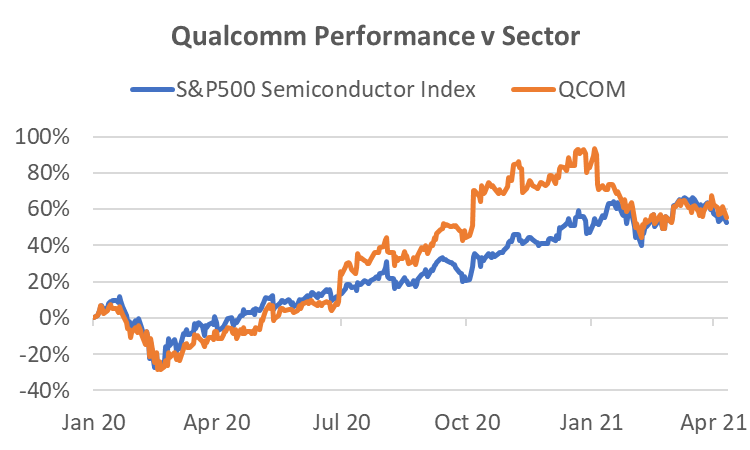

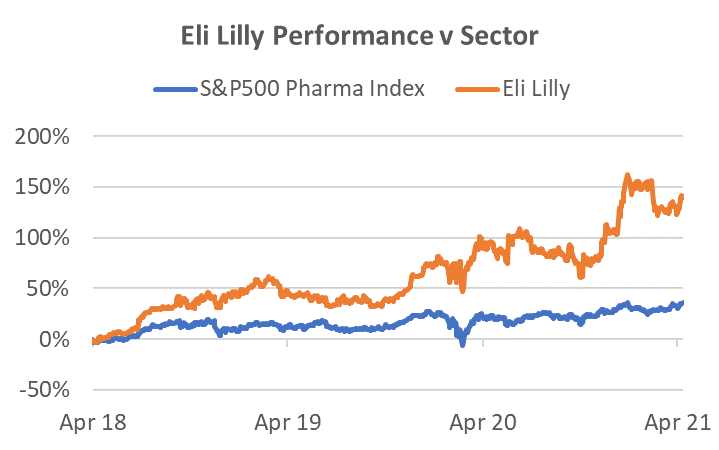

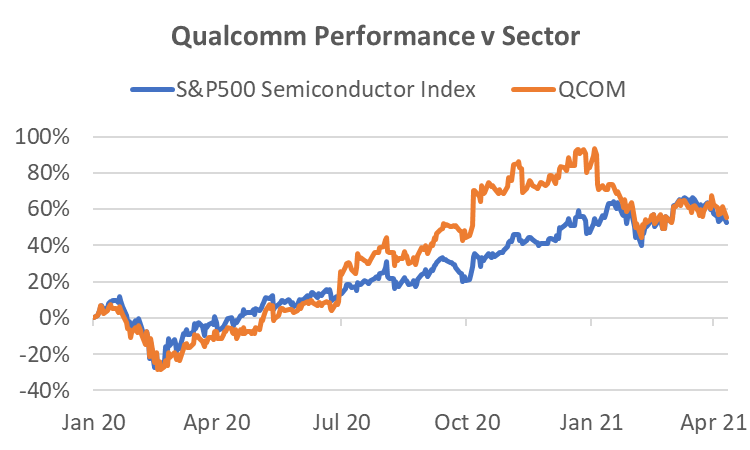

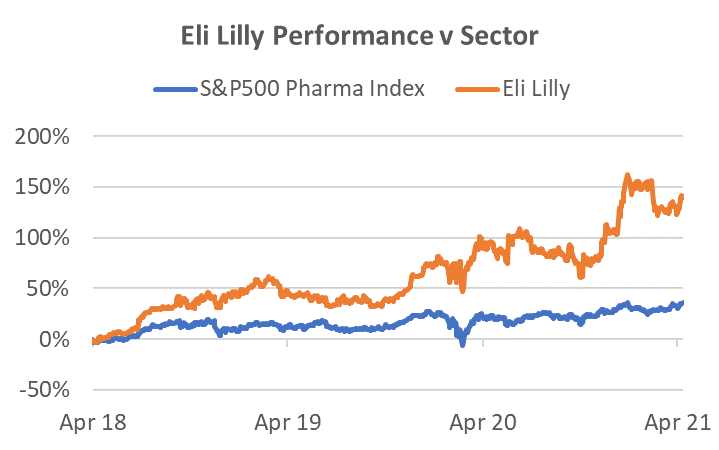

This month we highlight two stocks that were market darlings last year but have faced a few headwinds recently. These two stocks are Qualcomm (QCOM) and Eli Lilly (LLY). In 2020 these stocks were considered best in class exposures for 5G and Pharmaceuticals respectively and returned 73% and 28% for the year. This year QCOM is down -10% YTD and in March 2021, LLY fell -9%.

QCOM has suffered from 3 main concerns; 1) component shortages, 2) weaker sell-through 3) Apple Inc. deciding to take the wireless modem business in-house. The latter accounts for around 20% of QCOM’s revenues. However, the latest quarterly result showed that 1) & 2) have been well managed through optimizing product mix, solid execution, and increasing opportunities in China from loss of market share by Huawei. Further, despite the gradual loss of the Apple business, consensus revenue growth for the firm is 49% over the next two years and EPS growth is expected to surge by 155%. The 5G story has not changed and the pullback brings the stock to more attractive valuations.

Source: Bloomberg, Odyssey

LLY has had the strongest pipeline among the large pharmaceuticals for several years. One of the most exciting developments has been LLY’s drug for the treatment of Alzheimer’s, Donanemab. In the US, 4.5mn people suffer from early-stage Alzheimer’s so the potential of the drug is huge. In January, an initial Phase 2 trials showed promising results which catapulted the market cap of the stock by USD19bn. However, in March a more extensive Phase 2 trial showed mixed results – the drug cleared substantial amounts of amyloid plaques in the brains of treated patients. But outcomes in secondary trial goals — measures of cognition, memory, and activities of daily living — were more mixed and further study recommended. The result caused the January gains to be wiped out as concerns grew about the efficacy of the drug. These are only Phase 2 trials and a more comprehensive test (results expected in June) is being conducted in preparation for Phase 3 trials later this year. While the results have been mixed relative to the high expectations developed in January, the drug appears at least as effective as its main rival, Aducanumab, produced by Biogen. Hence, the potential remains for this drug to become a blockbuster and highly profitable.

Regardless of Donanemab’s future success, LLY recorded 16% revenue growth in Q1 2021, backed by a strong portfolio in neuroscience, diabetes, oncology and immunology. While the Pharmaceuticals sub-Index has trailed the S&P500 at +6% YTD, should we see a continuance of recent uncertainty over the next quarter, the defensive nature of the industry could lead to outperformance. We continue to see LLY leading the pack as it has over the lasts 5 years with a price gain of 139%, almost 4x the sector return.

Source: Bloomberg, Odyssey

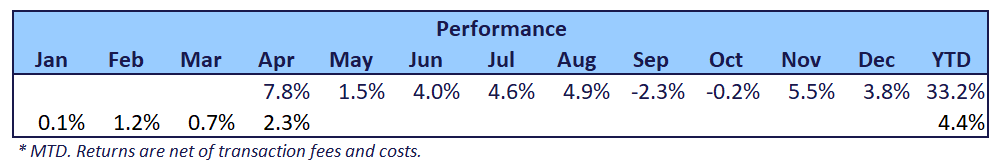

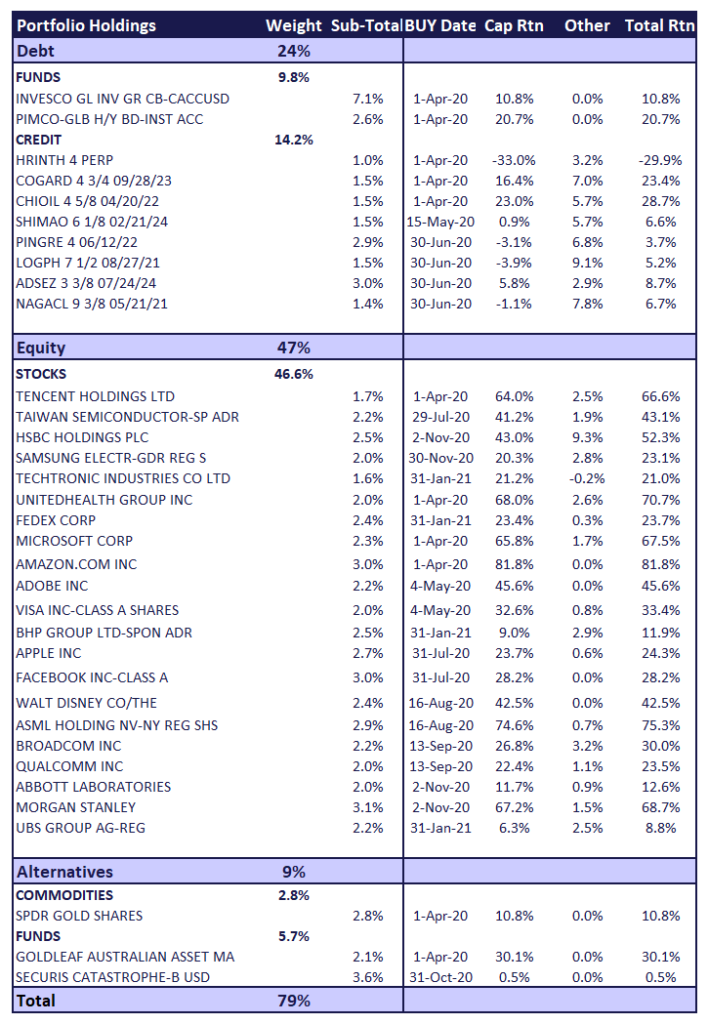

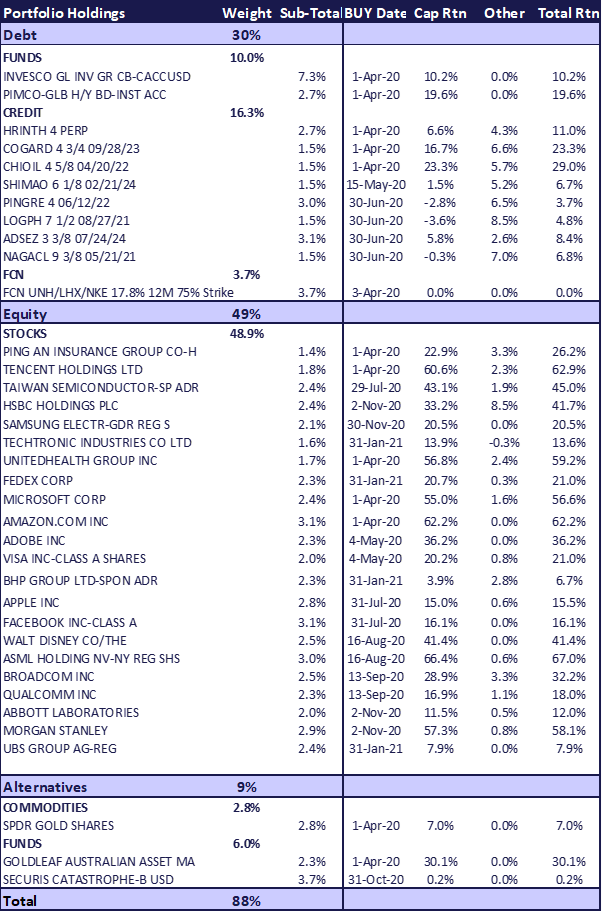

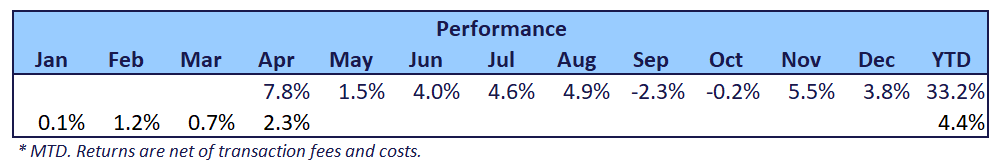

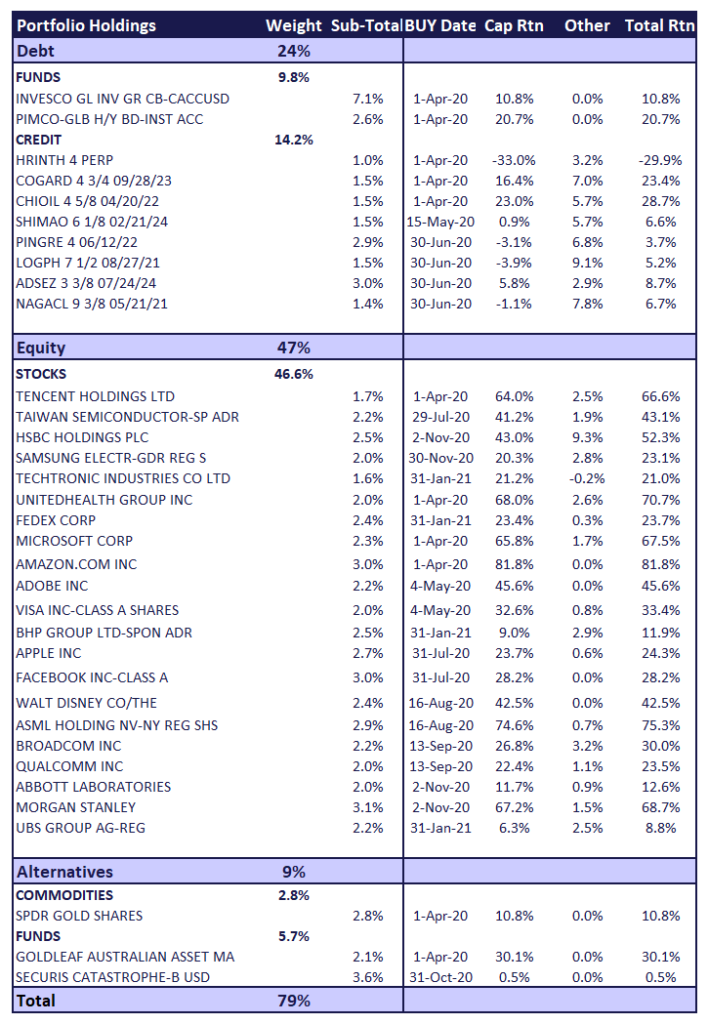

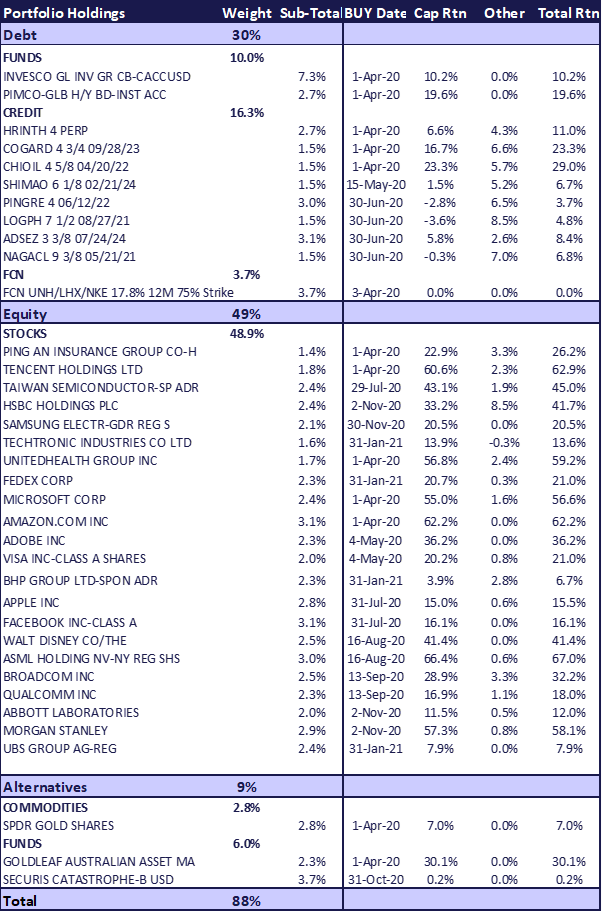

Odyssey Model Portfolio Performance

If you like to receive more information on our portfolio solutions, please contact us here: info@odyssey-grp.com.

May 5, 2021 | Careers

Role: Managing Director/Director – Distribution

Company: Odyssey Asset Management (SG) Pte. Ltd.

Location: Singapore

Reporting to: Head of Distribution, James Wheeler (based in Hong Kong)

Role Summary

There is currently an opportunity to join the Odyssey Group, one of Asia’s leading private markets asset managers, whose strategic investor is the ASX listed, Auctus Investment Group (AVC:AU).

The MD of Distribution will lead the Distribution team for the Odyssey Group’s Singapore office and drive the group forward in its South East Asia expansion.

The seasoned candidate will have a proven track record of raising AUM for private market opportunities and have an existing database of investors in the region.

Reporting to the Head of Distribution, the candidate will be responsible for developing and maintaining relationships with HNW, UHNW, Family Offices, B2B and institutional clients throughout the South East Asia region, with a primary focus on raising Aum for Odyssey’s inhouse and Co-GP products, funds and deals.

For further information on the Odyssey Group, refer to the company presentation here.

Responsibilities

- Responsible for business development and execution of sales strategies

- Drive sales of Odyssey managed products and external partners

- Manage and maintain relations with existing client portfolios

- Increase existing institutional business by increasing share of client business

- Work on a team level to identify new opportunities within the target market

- Develop and maintain internal relationships with other divisions

Requirements

- Degree holder in related discipline

- Minimum 8-10 years B2B/family sales experience preferred

- Must be able to be MAS licensed

- Established network of proven clients

- Self-motivated individual, with a commitment to excellence

- Excellent communication skills and ability to deal with clients

- Fluent written and spoken English, other languages preferred

- Ability to interact effectively with individuals at all levels in the organisation

- Ability to focus and prioritise the key initiatives across a broad range of opportunities and relationships

Package

- Base salary based on candidates experience

- Commission on AUM raised

- Other incentives depending on the candidate’s experience and achievements

Availability

The role is available now, we anticipate filling the role in the next 3 months.

Contact

Please contact us for further information and a preliminary confidential call.

Email: careers@odyssey-grp.com

About Us

The Odyssey Group Ltd is one of Asia’s leading Private Market Asset Managers who provides differentiated and bespoke investment solutions across multiple asset classes, including private real estate, alternative credit and private equity. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest with its clients.

Odyssey’s subsidiary, Odyssey Asset Management (SG) Pte. Ltd., is a Singapore-based Fund Management company that is currently licensed by the Monetary Authority of Singapore.

Apr 9, 2021 | Articles, Global Markets Update

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation. This advertisement has not been reviewed by the Monetary Authority of Singapore.

April 2021 Insight

All Roads Lead to New York

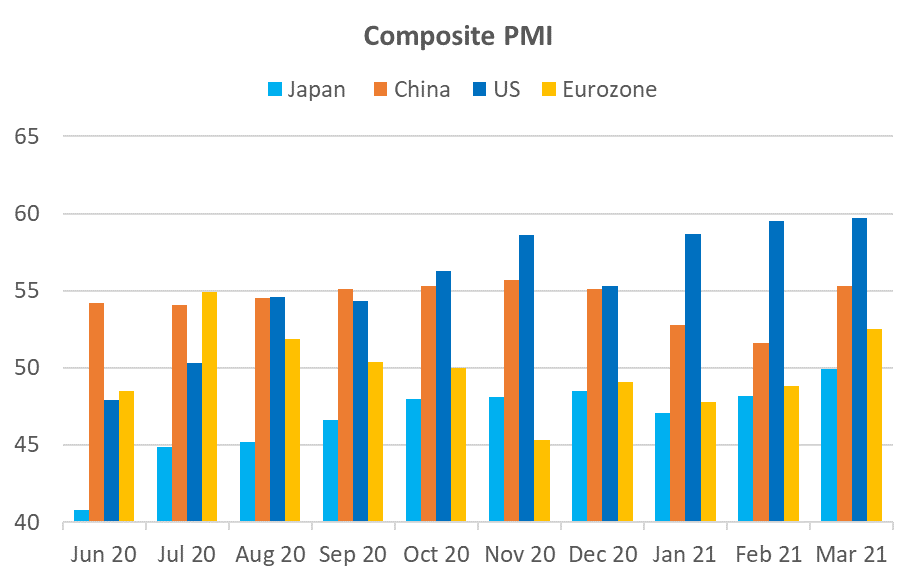

The first quarter produced solid returns for risk investors overall but proved to be tricky for tech stock investors, small-cap speculators, and long-duration bondholders. A major reason was the rise in long-end yields which questioned the valuation of growth stocks under the glare of potential inflation. The flip side of this argument is that the caution around inflation has been inspired by the rapid recovery in economic growth, particularly in the US. Unlike other regions where the economy faltered in January and February, US PMI has been consistently strong in Q1, underscored by Non-farm payrolls surging to 916,000 in March, 250,000 ahead of consensus. Gains were led by leisure, hospitality, and construction – sectors that had been hit the hardest during COVID.

A potential game-changer is President Biden following up a USD1.9tn relief bill with a massive USD2tn plan to reinvigorate US infrastructure. No doubt the plan will go through several iterations before approval, but despite Republican aversion to taxes, conceptually it should gain bipartisan support. Even spread out over 8 years, this would be a long-term fillip for the economy. As Jamie Dimon wrote in his 2021 letter to JPMorgan shareholders “the economy will likely boom”. Given the strength in the US economy, the potential for further stimulus, and the superior speed of the vaccine rollout (as of April 7, 64mn Americans had been vaccinated), it remains our most favoured investment destination.

Source: Bloomberg

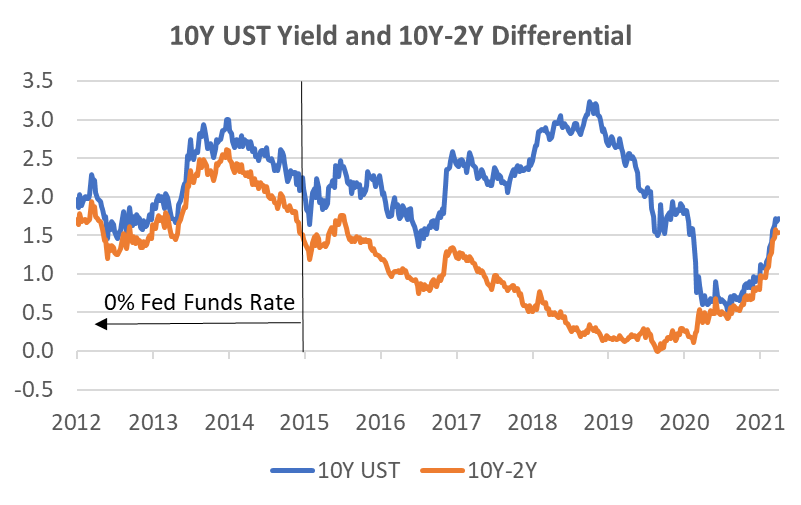

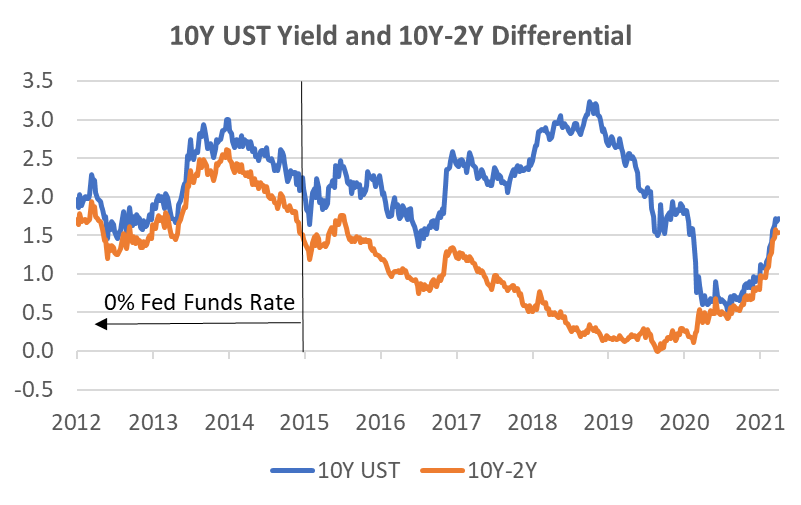

Possible Speed Humps

There are two short-term caveats to our optimistic view on the US. The first is that the long end of the rate curve is likely to continue to rise as the economy strengthens. While the momentum appears to have subsided for now, the absolute level of the UST10Y, as well as the UST10Y-2Y yield differential, remains well below levels in the last decade during “normal” economic conditions, even when the target rate was anchored to zero. Any rapid rise in long-end rates would likely again represent a headwind for growth stocks.

Source: Bloomberg, Odyssey

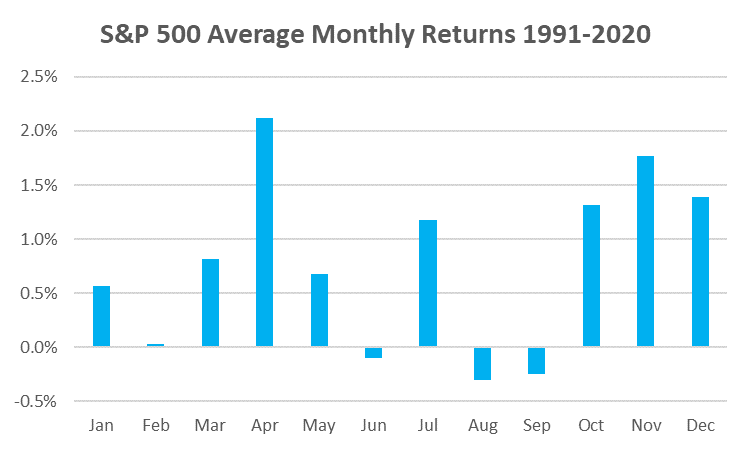

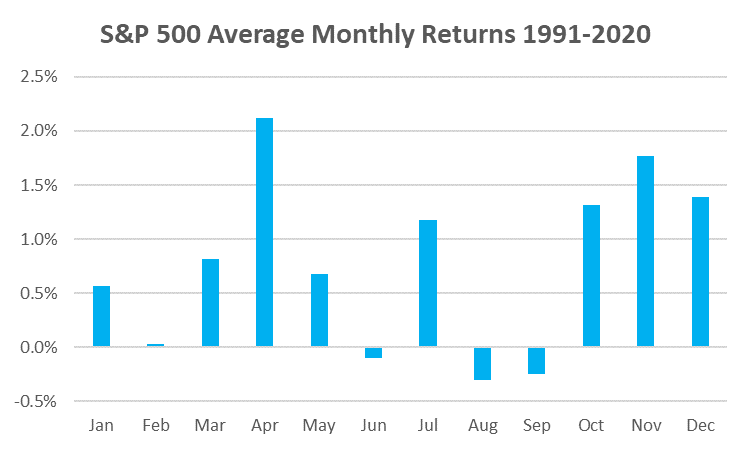

The second potential short-term headwind is one we face every year. The statistical “Sell in May …” is real, although with statistics we are talking about an average number. In the last 30 years, the May-Sep period returned +1.3% on average and was positive 70% of the time. In comparison, the Oct-Apr period returned +8.4% and was positive 83% of the time. There were actually 5 months with worse average returns than May which returned +0.7%. April, November, and December were the best-performing months. The other noteworthy feature is that the standard deviation for monthly averages was uniformly high at circa 4%. Since the level of dispersion is twice the highest average monthly return, making generalisations can be quite risky.

While these types of statistics should not be relied upon, it does show that, as long as the fundamentals are positive, the May-Sep period can be a profitable one. It’s just that the risk-reward is generally not as good as during the Oct-Apr period.

Source: Bloomberg, Odyssey

Some Respite for Income Investors?

After a strong 2020 when investment grade (IG) credits benefitted from both falling rate yields as well as recovery in spreads from April onwards, 2021 has been a different story. The Bloomberg Barclays Global Credit Index has returned -3.5% YTD. With a lower duration and a 2.75% higher yield, the Global HY Index has fared better with a 1.1% return. The main driver of credit returns this year has been long-end rates. With credit spreads remaining close to all-time tight levels, future returns are likely to continue to be at the mercy of long-end rate movements.

One liquid yield play that has performed well despite rate movements has been REITs. While REIT prices have traditionally shown a negative correlation to the direction of yield movements, recent upward grinding moves of the sector have been due to the recovery in the price to book ratio (PBR) that fell 37% in Feb-Mar 2020. Now that the PBR has recovered close to its 5Y peak at 2.4x, but the estimated dividend yield has fallen to just 3.1% compared to its usual 3.5-4.5% range, the upside may now be more limited. We say “may” because the market cap of many recovery stocks is now higher than where they were pre-COVID, even adjusting for a “normal” operating environment.

Investment Recommendations

Laggard Recovery Plays

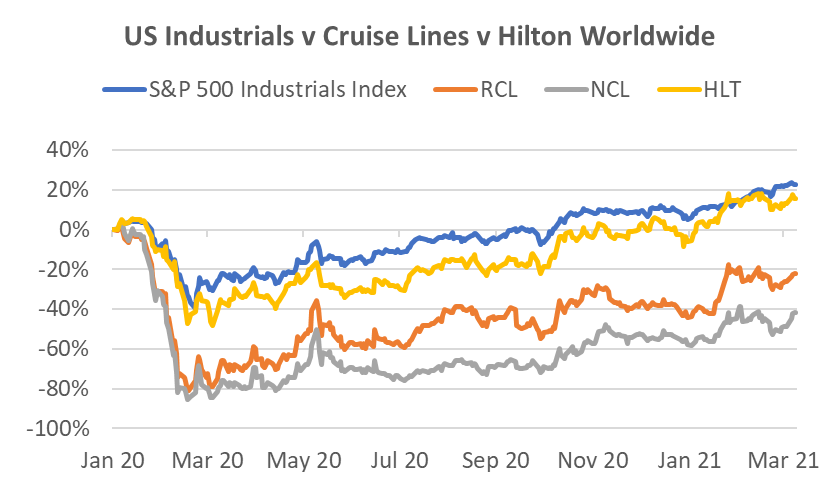

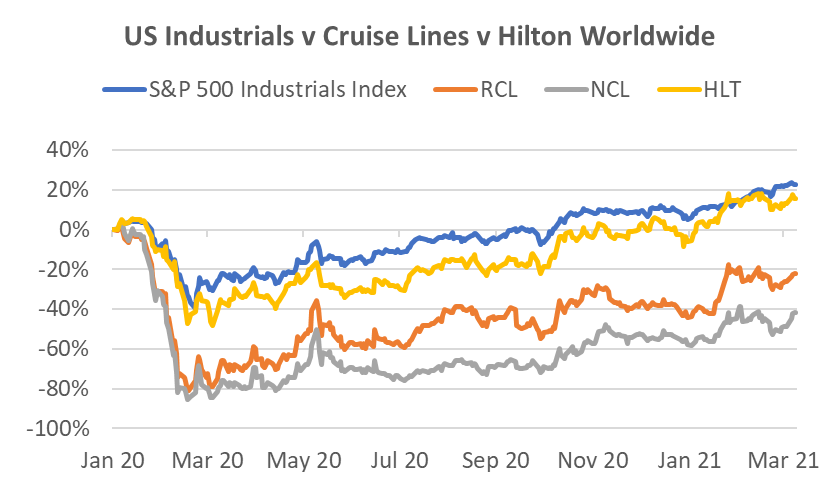

The Industrials sector is an obvious recovery play. While the Industrials sector is full of cyclical stocks, in many cases the market has already valued a full recovery despite current difficult trading conditions. Indeed, the US Industrials Index is now 18% higher than the pre-COVID peak and performance only lags the S&P 500 Index by 3%.

One industrial sector that has lagged, but has recently received highly positive news, are cruise lines. On April 7 the US CDC has stated US cruises could resume by mid-summer. Norwegian Cruise Lines (NCL) has already stated it plans to start cruises from US ports on July 4 with fully vaccinated guests. Bookings for H2 2021 have been accelerating in recent weeks and prices have been more resilient than expected. While H2 2021 bookings are still shy of 2019, 2022 bookings are well ahead of 2019 due to very strong pent-up demand. With better guidance in respect to re-openings, the share prices of listed hotel chains such as Hilton and Marriott are already back to, or above, the pre-COVID peaks whereas NCL and Royal Caribbean Lines (RCL) remain circa 40% and 20% respectively below their peaks. For NCL, we like their smaller, more modern fleet that appears at an advantage in the post-COVID environment, and RCL is the premium brand in the sector, a factor we rarely ignore in an early upswing cycle. These stocks can be more volatile than the mega-cap we usually recommend and should be sized accordingly.

Source: Bloomberg, Odyssey

Social Media is All About the Camera

We’ve been encouraged by our recent positive calls on Facebook and Google. Another we have liked since their blockbuster Q4 result is Snap Inc (SNAP). The stock then fell 30% due to rising rates but has since begun to climb back up. It’s not a cheap stock on traditional measures but management’s recent rare claim that they believe revenues can potentially grow by 50% for several years means short-term valuations do not capture the embedded value in the business. For instance, Snap’s ARPU is currently less than 10% of Facebook’s. That’s a lot of upside for a company that is widely acknowledged as one of the most innovative among social media platforms, thereby maintaining its “lit” status among the young. Many of Facebook’s features appear after Snap first introduces it on their platform and this is likely to continue. Indeed, Snap is now designing products it says are more difficult to replicate and many of these revolve around the phone camera. In addition, they are doubling down on what they believe is the next evolution in computing, augmented reality (AR). Revenue growth of 62% in Q4 2020 demonstrates its leverage to the recovery in ad spending, but it also underscores the structural growth story of harnessing social media among a younger audience.

Odyssey Model Portfolio Performance

Horizon Performance

If you like to receive more information on our portfolio solutions, please contact us here: info@odyssey-grp.com.

Apr 8, 2021 | Articles

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Dear Clients,

Our Japanese Real Estate team are delighted to bring you the third and final instalment of our Thought Leadership series looking at a key investment asset within our portfolios; Japanese boutique hotels or “Ryokan’s” as they are known in Japan. Part Three presents our investment case and takes you through a variety of case studies that have informed our view and decision making when investing into Ryokan’s. We hope that this final instalment brings together the theory we discussed in Part One and Part Two and helps you understand why we find Ryokan’s such a compelling asset.

Our Thought Leadership Series on Ryokan’s includes the following topics:

Part One: What are Ryokan’s, how do they operate and what are the key features?

Part Two: Sector Analysis – what are the emerging trends, dynamics and unique selling points of Ryokans?

Part Three: Investment Thesis & Case Study of Ryokans

If you like to receive more information, please contact:

James Wheeler

Managing Director – Head of Distribution

james.wheeler@odyssey-grp.com

www.odyssey-grp.com

Apr 1, 2021 | Articles

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Dear Clients,

Our Japanese Real Estate team are delighted to bring to you Part Two of our Thought Leadership series looking at a key investment asset within our portfolios; Japanese boutique hotels or “Ryokan’s” as they are known in Japan. Part Two takes a deep dive and analyses the emerging trends, dynamics and unique features of Ryokans and what makes them such a compelling asset. Our Thought Leadership series on Ryokan’s includes the following topics:

Part One: What are Ryokan’s, how do they operate and what are the key features?

Part Two: Sector Analysis – what are the emerging trends, dynamics and unique selling points of Ryokans?

Part Three: Investment thesis and case study of Ryokans

We hope you find Part Two interesting and a fascinating continuation into understanding the world of Ryokan’s. We have linked Part One again here for those who may have missed this, and we looked forward to sharing Part Three next week.

If you like to receive more information, please contact:

James Wheeler

Managing Director – Head of Distribution

james.wheeler@odyssey-grp.com

www.odyssey-grp.com