Jan 13, 2021 | Press Releases

Odyssey Launches 2nd Japanese Hospitality Fund オデッセイジャパンホスピタリティファンドII ローンチ

オデッセイ・ジャパン・ブティック・ホスピタリティ・ファンドIでは、過去18ヶ月にかけて有利で魅力的な投資を行ってまいりました。時の経過とともに、目標である8%の利回りと15%のIRRの投資リターンをもたらすことができるとの確信に至っております。そして、このジャパンファンドIの好調を受けて、オデッセイ・ジャパン・ホスピタリティ・ファンドIIが設立されました。

オデッセイ・ジャパン・ホスピタリティ・ファンドIIで、より付加価値を生み出す潜在性のある日本の旅館不動産投資へ取り組むことになります。ファンドの主要戦略は、日本の旅館を買収し、リニューアル、リポジション、より質の高い運営することで、お客様に魅力的なおもてなし体験を提供すると同時に、投資家へも魅力あるリターンをもたらすことです。

このファンドがメインにターゲットとするのは、ラグジュアリーブティックホテル、旅館、町屋といったアセットタイプです。その3タイプのいずれかへリニューアル可能で、日本有数の観光地にある歴史遺産的建造物が投資対象となります。

Focused Fund capitalising on COVID-19 コロナ禍(COVID-19)においての投資

日本のメジャーなREITやグローバルPE / REファンドとの競争が比較的少なく、取引額が500万~5000万米ドルのミッドレベル価格レンジの買収に的を絞ることで、ファンドと投資家共に、より有利な評価で買収時の利回りを得られます。

このファンドは、ブティックホスピタリティアセットというニッチなマーケットへ焦点を絞り、国内不動産市場の成長を見込んだまたとない投資の機会となります。日本の豊かな文化財とエレガントでクラシックなデザイン様式は美観に優れ、思い出に残るおもてなし体験を提供できるモダンでラグジュアリーなホスピタリティアセットへ再生するための理想的な条件を兼ね備えています。

このファンド戦略に強い関心が寄せられる中、過去6ヶ月間に開拓したパイプラインから第一号案件の取得に期待を寄せています。

Targeted Returns 目標利回り

このファンドは、少なくとも8%の年間利回りと15%以上のIRR、またはその手数料を上回る利益を生み出す買収を対象としています。

Key Dates

Macro Conditions マクロ経済の状況

日本のホスピタリティ資産取得のタイミングとしては、現状、周期的に訪れる日和見状態にありますが、魅力的な利回りと組み合わせることで、ファンドが投資家に大きな増益を提供できる投資機会であると、オデッセイは捉えています。

現在、日本のホスピタリティ不動産市場ファンダメンタルズを見ると、高い需要に対し供給不足という前提に基づき、稼働率と客室料金アップ(ADR)促進を後押ししています。

COVID-19 Contrarian Play コロナ禍(COVID-19)だからこその投資

インターナショナルツーリズムセクターは、コロナ(COVID-19)以前のマクロ経済レベルの堅調な成長により好調に推移しておりましたが、長年の構造的要因によりアフターコロナ(COVID-19後)にも再び元の状況を取り戻すと想定されます。また、日本のホスピタリティセクターは、常に国内の安定したツーリズムマーケットの恩恵を受けており、国内市場はコロナ禍においても各地方の経済回復と利益を牽引し続けています。

ターゲットとするアセットは、インバウンド、国内旅行双方の需要へアピールするものとなります。それぞれのマーケットがその時の状況に応じて、同時にも個別にも使い分けてターゲット設定することが可能です – コロナ禍(COVID-19)でそうであったように、国内の顧客へ方向転換してフォーカスすることでうまくいく例は、既に立ち上げたファンドIのアセットで実証されています。

The Perfect Time to Invest 絶好の投資機会

仮に市場が12~18ヶ月後に回復し、訪日旅行客が再び増加すると想定した場合、一度市場が安定すれば、現在延期されているオリンピックを含む国際的な需要ドライバーが、政府支援を受けて、稼働率とADR強化をもたらすことで資産評価アップへつながることになります。

市場安定までの12~18ヶ月の遅れは、さらなるデューデリジェンスの実施や買収の完了、必要な強化と対策、また、出入国制限解除後の渡航再開を見据えたリポジションのためには、理想的なタイムフレームとも言えます。アセットリポジショニングと資本効率向上に不可欠な施設の休業による影響は限定的にとどめられ、オペレーション削減から生じる混乱も最小限に抑えられます。

その結果、今後12ヶ月間で、大幅値引き物件の(最大で50%ディスカウントも散見される)オフマーケット取引を実行することができ、インターナショナルマーケットの回復に先んじて、強力な国内市場を狙ったリポジショニングとリノベーションがより高い収益を確保し、優れたリターンを提供することになります。

これらのファクターがコロナ(COVID-19)によりまたとない投資機会をもたらし、当社の投資戦略は、多くのファンド機関からも追随されています。

ご不明な点がございましたら、馬場ゆきまで日本語にてお問い合わせください。yuki.baba@odysseycapital-group.com

Click here to download the full article.

Why Choose Odyssey? オデッセイが選ばれる理由

オデッセイ・グループ・リミテッドは、アジアのミッドマーケットをリードするオルタナティブ アセット マネジメント企業です。オルタナティブ・クレジット、不動産、プライベート・エクイティ、ヘッジファンド等資産クラス別マルチアセットを取り扱い、差別化を図り、ご要望に応じた投資ソリューションを提供します。クライアントと共同で潜在的に付加価値を生み出せる資産への投資機会の発掘に注力します。

オデッセイチームには、37名以上の経験豊富なアセットマネージャー、弁護士、プライベートバンカー、信託・税務プランの専門家、ベテラン投資家といった各分野の優秀なメンバーで構成されています。アジア太平洋地域、ヨーロッパ、北米においてそれぞれ平均22年に及ぶファイナンス、執行、運用の実績をもちます。

オデッセイチームのこの経験こそが、リージョナルの幅広い業界専門知識、グローバルマクロ経済や地政学的トレンドの洞察と強力なグローバルネットワーク関係構築を可能にします。

目標とする成果達成のために総力をあげて取り組むことで、オデッセイ・グループと提携するクライアントには幅広く深い専門知識をお役立ていただけます。

当社の革新的なアプローチは、慎重かつ長期的な視点で魅力的な投資収益を生み出します。

投資パートナーとの高水準で長期的な利益の一致を追求するために、ビジネスパートナーとして高い能力をもつプロフェッショナルがオデッセイには揃っています。お客様のニーズに応える「信うr頼のパートナー」となることが私たちの信条です。

弊社へのお問合せ・アジアで最も魅力あるオルタナティブ投資機会について更にお知りになりたければ、馬場ゆきまで日本語にてお問い合わせください。yuki.baba@odysseycapital-group.com

このプレスリリースコンテンツはご自由にシェアいただけます。

オデッセイ・日本ファンドチーム

ジェームス・ウィーラー

ジェームス・ウィーラー

機関投資家営業 マネージングディレクター

マニュライフ、その他独立系アセットマネジメント会社においてアジア、中東、ヨーロッパにおける15数年の機関投資家営業の経験を持ち、グローバルな機関投資家の投資業務に携わってきた。様々な投資商品における豊富な経験と知見を持つ。

ダニエル・ボービル

ダニエル・ボービル

オデッセイ社長/�投資総責任者

マッコーリー銀行、スタンダード・チャーター銀行の投資銀行部門アジア地区のディレクターを経て、オデッセイグループを設立し、グループの投資、営業部門を総括。不動産プライベートエクイティにおいては20数年の経験を持っている。

垣田 宜廣

垣田 宜廣

ポートフォリオ責任者 マネージングディレクター

ヒルトン日本・ミクロネシア地区マーケティングディレクターを経てゴールドマンサックスリアルティジャパンにおいてホテルポートフォリオ アセットマネージメントの責任者。

その後東証一部上場不動産ホテル開発責任者、不動産投資ファンドCIOなどホスピタリティアセットマネジメントの枢要職務を歴任。

サム・ラック

サム・ラック

ディレクター / オペレーション責任者

ファンド、また不動産業務のオペレーション業務を担当

馬場 ゆき

馬場 ゆき

シニア・アドバイザー

旅館オーナーで、旅館投資、再生、オペレーションを専門とするシニアアドバイザー

Jan 8, 2021 | Articles, Global Markets Update

January Market View

Equity Market Recovery – Historical Context

The very optimistic November market sentiment carried over to December. Again, all risk assets recorded robust gains, albeit at a lower rate than the previous month. The big question now is whether the strong momentum shown in the last two months can carry over into the New Year.

“Unprecedented” is a word often used about the COVID crisis and certainly most of us have never experienced a similar situation. While it is also an unprecedented situation for the financial markets, broad equity index performances have certainly experienced a similar backdrop. In the last 50 years we have seen a similar rate of recovery from market lows three times – from September 1974, July 1982, and of course from February 2009 during the GFC. It is interesting to note that in these three periods, and indeed for the recovery of all seven previous drawdowns in the last 50 years of greater than 20%, that there appears a significant resistance level after the MSCI World Index approaches 40-50% recovery. Ominously, we are about there now in this recovery.

Source: Bloomberg, Odyssey

As market veterans realise, every situation is slightly different, and this time may end up reacting very different than history. However, markets also do tend to repeat themselves in a broad sense. At the end of the day, none of us have a crystal ball, so we advise investors not to get caught up with the hype and stay disciplined with their risk allocations and investment decisions.

The short-term question is what the January performance will look like and whether that is a harbinger for 2021 performance. While there is plenty of statistical evidence for “Sell in May and Go Away” until November, the evidence for January is less clear cut. In the last 50 years, the proportion of times both January and the full year return was positive is just 54%. You don’t need to run the stats on that to realize the two are not correlated. The proportion of times that January is positive is 64%, again hardly something to get excited about. Compare that to the 78% of years where the month of December is positive.

Why is the Equity Market so Much Higher than pre-COVID?

The simple answer is valuation multiple expansion. Optimists may say that valuation multiples should be high at the bottom of the economic cycle and low at the top. This phenomenon can be seen in many cyclical industries. However, for the market as a whole, there is little empirical evidence for this. The only time we have seen forward PER estimates this high was during the Dotcom boom and that was a speculative rally. Under this scenario, stock prices rise if the gain in EPS is higher than the fall in the EPS multiple. How does the maths stack up when looking at the S&P500 and consensus EPS forecasts? The S&P500 is trading on a next year (2022) forward PE multiple of 19.5x. This is 32% higher than the 13.3x multiple in 2010-2015 period in the years when the market was climbing out of the GFC when we also had zero interest rates. The market is expecting earnings growth to slow in 2022. If we assume this as peak cycle, we would expect the forward PE ratio to fall at least back towards the average of 13.3x, if not below. This means 2022 EPS expectations need to be 42% higher than 2020 level and 22% higher than the very strong 2019 level in order for the market to merely stay flat. This appears a tough ask.

However, should the market believe a higher market multiple is justifiable for longer, then the reliance on EPS growth is lower. This situation may play out should the recovery appear strong in 2021, providing the expectation strong growth will remain for 2022. Periods of high valuations can persist, as they did in the late 1990s, and while they have historically always reverted to mean, the timing is difficult to predict.

Source: Bloomberg

Diminishing Choices

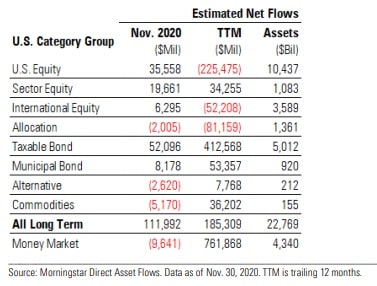

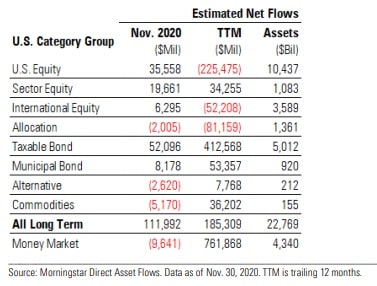

Since the trough of the equity market in March 2020, the MSCI World Total Return Index has surged by a staggering 70%. However, despite positive inflows in November after the US elections, US equity has experienced fund outflows in a trend that has persisted since 2015. In the liquid space the main beneficiary has been credit and in the illiquid space, while transactions have slowed significantly, the growing popularity of private equity, credit and real estate appears undiminished.

The positive takeaway from this for equity markets is that it appears investors are underweight equity, and its most liquid rival for fund flow, bonds, is providing a historically low yield. The Bloomberg Barclays Global Credit Index is currently yielding 1.4%. It is doubtful many investors, private or institutional, would be satisfied with that return, even for a relatively “safe” asset class.

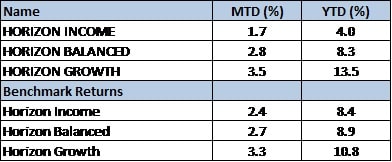

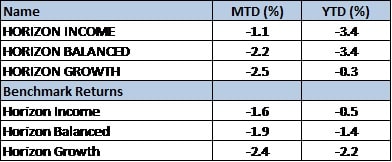

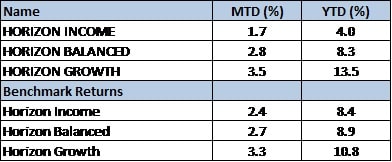

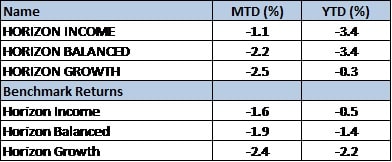

Performances

December Returns

If you like to receive more information on our portfolios solutions, please contact us here: info@odysseycapital-group.com

Dec 17, 2020 | Articles, Global Markets Update

December Market View

Christmas Cheer

Last month was the best November on record for many major Equity Indices. The MSCI World Index was up 12.2%, even higher than the S&P 500 index, with Europe leading the charge. The MSCI Europe Index jumped 13.8%. Credit and commodities, particularly oil, joined in the festive atmosphere as risk assets rose on the back of positive vaccine news as well as the dissipation of US election concern.

The anticipated massive roll-out of COVID vaccines expected in H1 2021 has resulted in cyclical stocks being in the ascendency during the month, despite mixed reports on new COVID cases. The MSCI European Bank Index surged 31% and the European Energy Index rise was even higher at 33%. Industrials gained 14% and even InfoTech climbed 15%. The US story was similar. The momentum has so far continued into December.

Source: Bloomberg

2021 – A Year of Normalisation

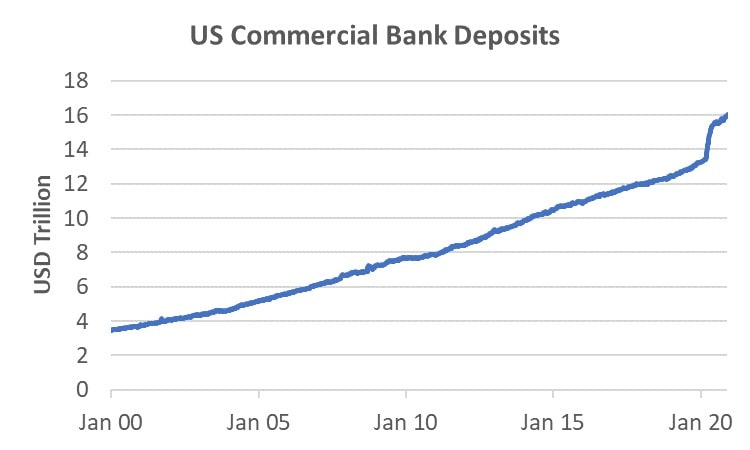

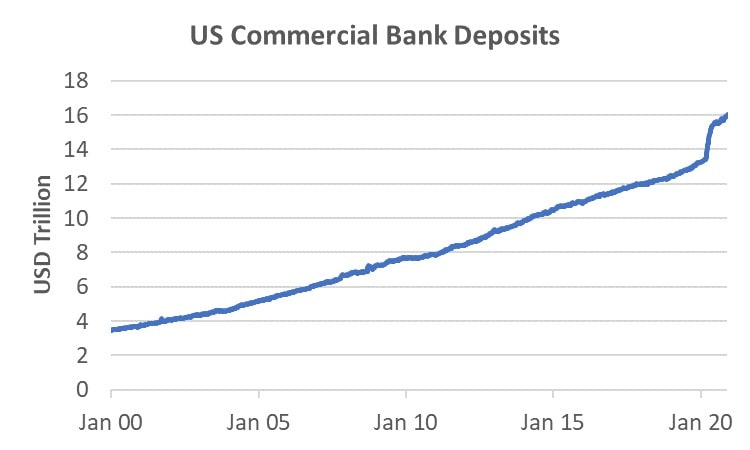

Some say the world will never be quite the same after COVID. Certainly, the gains in technology adoption, particularly those that facilitate a stay-at-home lifestyle, is not likely to regress. However, current growth rates are not likely sustainable and as people return to a semblance of pre-COVID lifestyles, cyclical stocks are likely to be greater beneficiaries. As an example of the potential pent-up demand for pre-COVID goods and services, US commercial bank deposits has now grown by USD2.5tn since the end of February 2020. Despite the higher unemployment rate, there is clearly a large swathe of money that could be used on consumption as lockdown restrictions ease. Europe has experienced a similar phenomenon where household bank deposits grew by EUR401bn from Feb – Oct, almost twice the level of the corresponding period in 2019.

Source: FRED

Can Equity Markets Go Higher?

The MSCI World TR Index has gained a staggering 67% since the nadir on March 23. It is now 10% above the pre-COVID peak and up 14% YTD. With nominal GDP in major economies not expected to regain 2019 levels until at least H2 2021, it is valid to question whether the market has run ahead of itself. After-all, even with a then unprecedented stimulus, the Index took a full six years to regain its pre-GFC peak. For COVID it took less than six months. However, the cause of each crisis was vastly different. The GFC was an issue of acute overleverage at the consumer level. Following the GFC it took almost 5 years for US households to recover their net worth. While there is only data to April 2020, it appears there was only a momentary disruption to household net worth due to COVID before a full recovery. With the subsequent rise in equity markets, in addition to house prices rising 2.6% from March to September 2020, we can assume US household net worth is currently higher than pre-COVID.

Source: FRED

While equity gains in the last 6 months are unlikely to be repeated in 2021, there does not appear to be any structural impediments to equity markets going higher as long as economies do start to normalize in a manner that is not materially different from expectations. We would not be surprised of a few bumps in the equity markets over the transition period in the next 1-3 months, but we remain constructive over the medium to long term due to the low interest rate and heavy fiscal stimulus environment.

Financials, Mid-Small caps, Europe and Asia are Popular Bets

There are several popular themes for 2021 and they are generally recovery focused. In short, those that suffered the most during COVID are expected to benefit the most in the recovery. This includes cyclical stocks, mid-caps or small-caps, due to leverage to the local economy, Europe, where corporates have been decimated by the lockdowns, and Asia, where the earnings growth appears to be highest.

Source: UBS, JPMorgan, Morgan Stanley

What to do with FAANMG?

Many equity investors still have material holdings in these stocks. Despite their preference for other stocks, sell-side strategists and analysts are hardly infallible and often look at the shorter term. Valuations for some of these stocks are well-within their historical range (Facebook and Amazon) and with low interest rates, it is difficult to argue they are expensive. I would not necessarily be a seller of any of these stocks for long term investors as long as the rest of the equity portfolio is well-diversified and position sizes are not excessive. However, admittedly, the upside for other sectors appears potentially higher.

The Case for Using Fund Managers

It’s been a great ride for a decade or more with FAANMG. The same goes for Tencent and Alibaba. However, the downside of an easy ride is that many investors may not be used to the difficult slog of seeking new investment ideas, monitoring a wide range of stocks, and being tactical and dynamic with asset allocation. Some investors may be happy to ride through poorer relative performance periods, content with a longer-term view. For those that want to work their money a little harder every year, allocating a portion of their equity investment to active fund managers whose job is to be concerned with relative performance may be an alternative. Another benefit is that mutual fund managers won’t hold significant amounts of cash so that if you are positive on the equity market in 2021, you will not be tempted to sell stocks during periods of volatility because some stocks have fallen precariously, and miss re-investing should it bounce back up quickly, i.e. the investment is more strategic and because it is diversified it will likely fall less than single stocks.

Performances

If you like to receive more information on our portfolios solutions, please contact us here: info@odysseycapital-group.com

Nov 16, 2020 | Articles, Global Markets Update

November Market View

In God we Trust

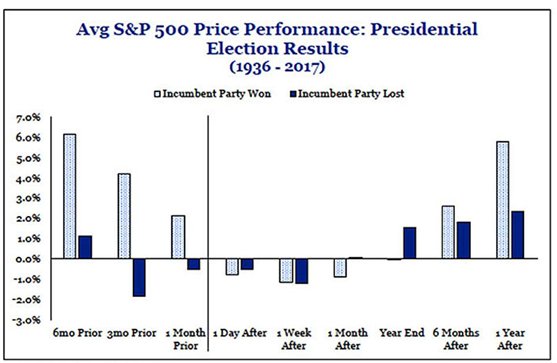

It appeared there was 2 main factors driving the market on US election day. The first was simply the relief that the event was finally taking place after a nervous S&P 500 had fallen 8% in the prior 3 weeks. The second was a little more perplexing. As the polls see-sawed from favouring one candidate to the other, the market kept going up. The one constant was that it was a close race, i.e. neither party was going to control both houses. This can be interpreted as neither candidate being particularly appealing to the market, and the likely difficulty in carrying out ideological policy was regarded as a positive.

The market is expecting that the highest priority of the government post-election is to get the stimulus bill passed. Jerome Powell has recently reiterated that the country requires “direct fiscal support”. Assuming the departing President actually departs, and the bill is passed, the remaining gorilla in the room is COVID.

Hallelujah

Pfizer and BionTech announced on November 10 that in phase 3 trials their vaccine was more than 90% effective in preventing COVID-19 in participants without evidence of prior infection. Submission for emergency FDA approval is planned soon after the safety milestone is achieved, which is expected in the third week of November. The partnership projects producing up to 50 million vaccine doses in 2020 and up to 1.3 bn doses in 2021.

At a time when the second wave continues to spread rapidly across the US and Europe, this is indeed welcomed news. Other Western firms also in phase 3 trials that have yet to report are Moderna, Johnson & Johnson, and AstraZeneca & University of Oxford. All these firms have received funding from the US government to develop and distribute a COVID vaccine.

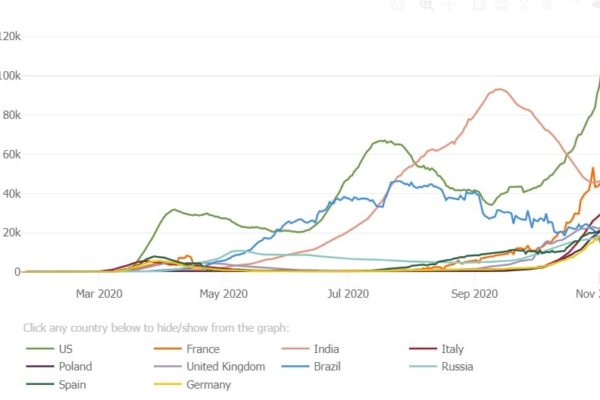

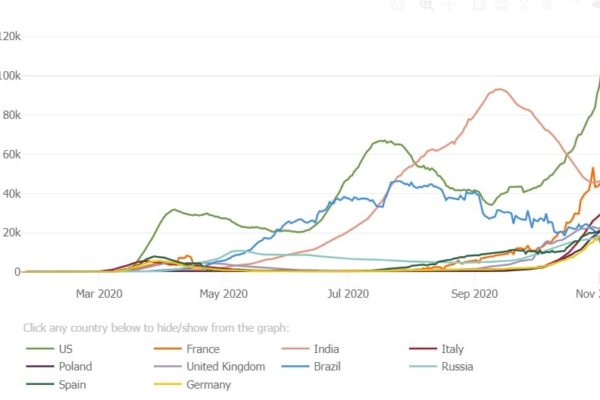

Chart 2: New COVID cases in the US and Select Countries

Source: Johns Hopkins University

Return of the Prodigal Son

The two most shunned sectors in the last 7 months have been the US Banks and Energy. While the oil price is a complicated issue, the banks have historically been a favoured sector to benefit from recessionary conditions. However, due to unique aspects of the COVID induced recession and the resultant low and flat interest rate yield curve, the Banks have had little succour from investors … until now.

Source: Bloomberg

Prior to the Pfizer & BionTech success, the US Banks sector were down 34% YTD. On the announcement the sector gained 13%. Other downtrodden sectors such as those in the travel industry companies surged, with Cruise Ships rising 27-28% and the Global JETS (airlines) ETF jumped 18%.

At the same time, stocks that had benefitted most from COVID, such as many in the Tech sector fell heavily as investors sold momentum and bought value. Given the 66% difference in performance between the InfoTech and Bank sectors YTD prior to the announcement, this was understandable. The Banks sector still needs to rise 75% to catch up to the InfoTech YTD performance, and we expect this performance gap has more room to narrow. Indeed, the more diversified portfolio we have been calling for over the last two months seems even more applicable.

Short Market Comment

October was a month of two halves, with equity markets surging up in the first half, only to give up those gains up and more as the election and surging COVID cases cast a pall over the markets. The MSCI World Index fell -2.5%. US Tech stocks continued to their losses after a difficult September, while US banks started to outperform, in a trend that has accelerated into November. WTI Oil also fell 11% while credit markets and Gold were relatively resilient.

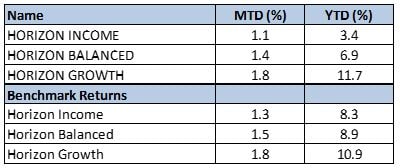

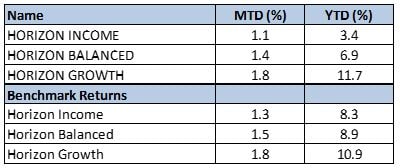

Horizon Portfolio Performance

If you like to receive more information on our portfolios solutions, please contact us here: info@odysseycapital-group.com

Oct 6, 2020 | Articles, Global Markets Update

COVID 4 : Governments 2

September was a difficult month for equity markets as MSCI ACWI (developed and EM) dropped -3.4%. Tech stocks were particularly hard hit as the NASDAQ fell -12% from peak to trough before recovery a little to be down -5.2% for the month. Further, against the trend was the 2.1% rise in the USD Index and Gold fell -4.2%. Commodities also gave up ground with WTI oil falling -5.6% the London Metals Index fell -1.6%. One of the few places to hide was investment-grade credit which was flat for the month.

At the end of the month, just as Tech stocks appeared to be finding their feet, President Trump succumbed to the Virus, creating yet another cause for uncertainty. Along with the second COVID wave in Europe, cases in the US mid-west rising, major global economies starting to lose recovery steam, and the difficulty in passing the stimulus package in the US Congress, equity markets could remain unsettled in the short term.

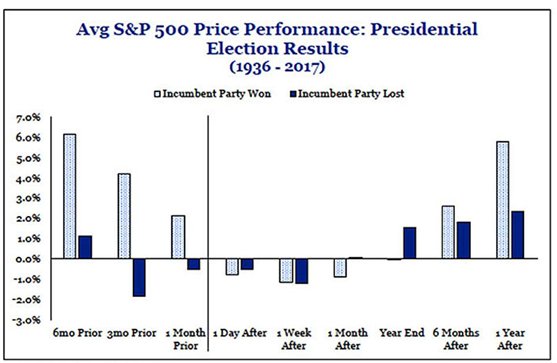

Despite the likelihood that the health of the president and the upcoming US elections may hold many investors’ attention, we remain relatively sanguine for the medium term. A Biden victory appears already partially baked into prices and is generally perceived less favourably for markets than a Trump victory, but it may be pertinent that during Obama’s 8 year reign the S&P 500 Index surged 160%, an annualized return of 12.7% p.a. Not even “Reaganomics” could outperform those numbers. Yes, there is the threat of a tax-cut roll-back, but that is not a given and could be politically unpalatable in the medium term as the nation struggles to recover from the Virus. Apart from some stated policy differences concerning a few sectors, both candidates are keen to support rapid economic recovery and that could be the overriding factor for markets. In fact, the sector differences have already begun to play out some months back in Defence and Health Care with some sub-sectors at 10-year low valuations relative to the Index.

Source: Strategas Research Partners

Second Half Comeback?

Composite PMI numbers for the large economies still appears relatively resilient. But the improvement in numbers coincided with lower new COVID cases and loosening restrictions in many parts of the world. Recently, lockdown rules have been tightened in some countries such as France, Spain and the UK. More are planned if conditions to do improve with New York also planning stricter rules as cases start to climb again. Large scale vaccine treatment is expected to be ready by mid-2021, but that’s 8 months away. With the coming change of seasons, the risk of a growing infection rate and further tightening of lockdown rules cannot be discarded.

Source: Bloomberg, Odyssey

To offset these economic impediments and the potential for social unrest, governments may need to do more. This means further boosts to fiscal stimulus. The US is deliberating over a massive stimulus package. Despite the urgency, the consensus view is that it will not pass Congress before the US election. That means the market must be supported on the belief that the package will pass both houses expeditiously after the election. Any news that suggests the package may be further delayed is unlikely to meet with a positive market response. On the other hand, if taken at face value: the President’s health continues to improve, the elections proceed without abnormal scandal, and the stimulus package can be passed since the elected government should have a mandate, we can realistically look constructively at the equity market. Real-life and the markets usually do not behave so smoothly, but if we can eventually reach the same results, the market result should also be similar.

As for other regions, Europe also has significant firepower. Of the EUR1.35tn package approved, there remained EUR850bn unused as of 10 September. In China, local governments must sell CNY3.75tn worth of so-called special bonds by the end of October, with CNY2.27tn issued by the end of July. That’s already more than in the whole of 2019, and the government is hoping this will jump-start private spending and investment.

Ultimately, the use of a fiscal stimulus is not a solution. It’s a stop-gap measure to attempt to contain the damage to the economy until the impact of the virus is mitigated in some fashion, either through social policy (where the efficacy has been mixed) or through a medical solution.

Conclusion

On a 3-6 month view, we are mildly constructive on the equity market. In the short term, the market is understandably fragile and any adverse news could add to existing headwinds. However, the major governments are not without firepower, and while there are delays to enactment and efficacy of stimulus measures, on balance, global economies should receive enough support to be maintained until a more permanent solution is found. In a sense, the criticism of these stimulus measures is familiar with what China has faced regularly over the last 20 years – that the dependence on liquidity-driven growth and repair of the economy during difficult periods would result in an economic implosion. During that time China’s economy has grown 12 times, from a USD1.2tn economy to a USD14.4tn economy.

Last month we suggested clients maintain a diversified portfolio, within their equity portfolio as well including asset classes that have low correlation to equity. Given the current economic, political and market headwinds, we reiterate this advice.

Short Market Comment

September was a difficult month for equity markets as MSCI ACWI (developed and EM) dropped -3.4%. Tech stocks were particularly hard hit as the NASDAQ fell -12% from peak to trough before recovery a little to be down -5.2% for the month. Further, against the trend was the 2.1% rise in the USD Index and Gold fell -4.2%. Commodities also gave up ground with WTI oil falling -5.6% the London Metals Index fell -1.6%. One of the few places to hide was investment-grade credit which was flat for the month.

If you like to receive more information on our portfolios solutions, please contact us here: info@odysseycapital-group.com

ジェームス・ウィーラー

ジェームス・ウィーラー ダニエル・ボービル

ダニエル・ボービル 垣田 宜廣

垣田 宜廣 サム・ラック

サム・ラック 馬場 ゆき

馬場 ゆき