Sep 23, 2020 | Articles, Global Markets Update

Market View

A Bump, or Something More?

August was the 5th strong consecutive month for Equity and risk assets. From the bottom of the equity market in March, the MSCI World Index was up 53% at the end of August. The Index had not seen a drawdown of 5% or more since June. In that case the market nervousness was due to Jerome Powell providing investors a reality check on his expectation for the recovery of the economy.

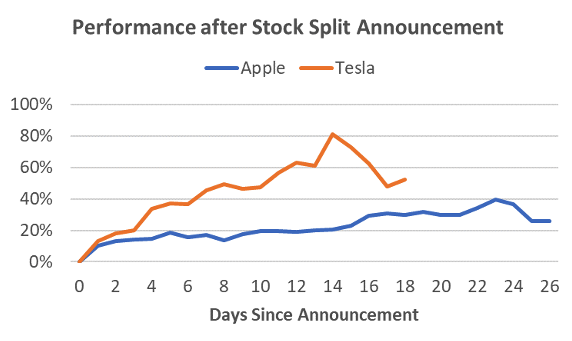

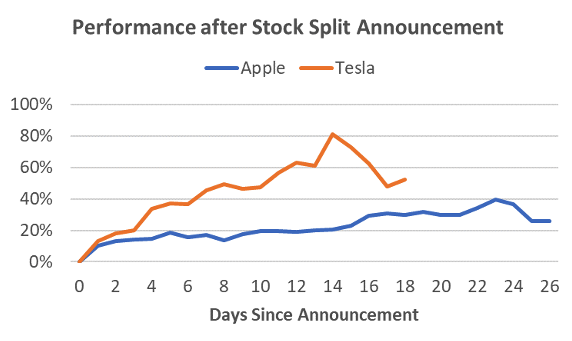

The most recent sell-off that started on September 3, appeared to be due to technical reasons. The previous 4 weeks saw a significant run on speculative names and this seemed to have been sparked by the Tesla and Apple stock splits that both had effective dates at the end of August. Between the stock split announcements and the effective date, the Tesla share price surged an incredible 80% and Apple jumped almost 40%. While this was also on the back of strong Q2 results, it appeared this was also driven up by a speculative element. Other speculative investments such as the Cloud X Computing ETF (CLOU US) also jumped 20% in the 3 weeks prior to the end sell-off. After such a strong run, when the stock splits became effective, it was merely a matter of time before investors decided to take profits. The level of the share price falls was in concert with the strength of the rally.

Chart: Apple and Tesla share price Source: Bloomberg, Odyssey

The large question now is whether the mini sell-off portends a change in the direction of the equity market. We remain constructive on risk assets in the medium term (3-6 months) due to the unprecedented stimulus and zero interest rate policies by central banks. However, we also think it is likely that 1) the absolute returns from equity may slow down from its break-neck speed and 2) stock picking may become more difficult than just buying FAAMNG or technology stocks.

On a fundamental level, economies are improving, but many are at a slower pace than many had hoped. Recent economic data from China, Europe and the US still point to a recovery, but that pace of recovery is decelerating, rather than accelerating. The much hoped-for game changer is an effective and safe COVID 19 vaccine. With the Fall flu season starting in October, there is a real risk that a third wave may occur. There appears a sense of urgency to have a vaccine available to the US population before the Dec-Mar peak flu months. While we are hopeful a vaccine eventuates in time, the current timeline for a vaccine approval has been compressed from 3-4 years to nine months. This may prove too ambitious. Of the three US government backed candidates currently in phase 3 trials, two have already started testing more than 20,000 subjects with a goal as high as 30,000. Even if the trials are successful, there remains one last hurdle – that is the perception that the vaccine will not be safe. US surveys have revealed a high reluctance to take a COVID vaccine due to safety concerns. The number has been as high as 60% of respondents expressing some doubt as to whether they would take the vaccine.

Prudent Diversification

A concentrated portfolio of high-tech stocks, or FAANG, would have worked tremendously over the last 5 months. However, the recent sell-off has shown that this is an over-crowded trade and investors are balking at the pace of the share price climb, if not valuations. We are of the view that many of the FAANG are core equity holdings and we would not be sellers of a judicious level of these stocks that is in keeping with an investor’s risk profile. Further, COVID has likely reaccelerated the adoption of technology that is not likely to dissipate meaningfully, even with the presence of a successful vaccine. Nevertheless, the outperformance of Growth versus Value remains close to extremes and a more diversified strategy going forward appears to be a prudent strategy. By diversification we mean by asset class as well as within the equity portfolio.

Source: Bloomberg, Odyssey

Last month we had already discussed the use of more alternative assets, in addition to equities, and we suggest investors to continue to assess non-listed investments that would provide a good fit to their risk and return goals.

Conclusion

A very long time-line of the US equity market is virtually a straight line. However, sometimes it does not feel very straight on a week to week basis. If your risk tolerance is weekly, monthly or quarterly rather than multi-year, this may be a prudent time to consider whether your portfolio is sufficiently diversified. This does not necessarily mean a lower potential return. It simply means you are remaining open to other ways of generating returns that perhaps have a better risk return profile than your current portfolio.

Short Market View

August capped off the 5th strong consecutive month for Equity and risk assets. From the bottom of the equity market in March, the MSCI World Index was up 53% at the end of August. The Index had not seen a drawdown of 5% or more since June. In that context it was not surprising that in early September the Tech sector and some speculative stocks saw profit taking after a strong rally during August. Tesla surged 80% in just 14 trading days after it’s Q2 results and stock split announcement. We remain positive on FAAMNG as core holdings in an equity portfolio, but valuations of growth stocks in general appear stretched and a more diversified approach going forward appears prudent.

If you like to receive more information on our portfolios solutions, please contact us here: info@odysseycapital-group.com

Sep 14, 2020 | Careers

As part of the Odyssey Group’s continued expansion, we are looking to recruit a dynamic Client Support Manager to support the Distribution team. The ideal candidate’s primary duties and responsibilities are as follow:

Key Responsibilities

- Help maintain the current prospect/client database. Our clients are institutional, family office and HNW individuals.

- Research and improve on the quality of the data and information. Must be proficient in Microsoft and web-based applications such as outlook, excel, LinkedIn, google search, CRM tools etc.

- Seek new client leads to add to the database. Must be able to research and use initiative to find out information.

- Help follow up leads by way of telephone, email and attending events. Must be comfortable to be able to communicate directly with clients and professionals.

- Qualify and book meetings for the distribution team. Must be highly organized and responsive.

- The role requires some technical understanding of real estate, wealth management and also sales. This is a role with potential to grow their career into sales manager and distribution business development management.

- Provide valuable assistance to the team in implementing and executing marketing campaign and product roadshows to engage new and existing customers for further cross-selling and building loyalty.

Qualifications

- 2-5 years of experience in a similar sales role, preferably within the financial services industry

- Knowledge of client journey management, database marketing and client segmentation

- Strong interpersonal and communication skills, good team player and ability to influence

- Independent, professional, pro-active and strong marketing sense

- Ability to work multi-task with creative problem-solving skills

- Proficient in using technology-based application such as LinkedIn, Zoom and other Social Media platforms to communicate with prospects.

- University degree or above preferred

- Excellent verbal and written in English with ability to communicate in Cantonese and Mandarin highly desirable

If interested, please email: info@odysseycapital-group.com

About us

The Odyssey Group Ltd is Asia’s leading international Alternative Asset Manager that provides differentiated and bespoke investment solutions across multiple asset classes, including asset management, real estate, private equity and hedge funds. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest with its clients.

Odyssey’s subsidiary, Odyssey Asset Management Limited (OAML), is a Hong Kong based company that is currently licensed by the Hong Kong Securities and Futures Commission to carry out regulated activities in Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management).

Web: www.odysseycapital-group.com

Aug 7, 2020 | Articles, Global Markets Update

Market View

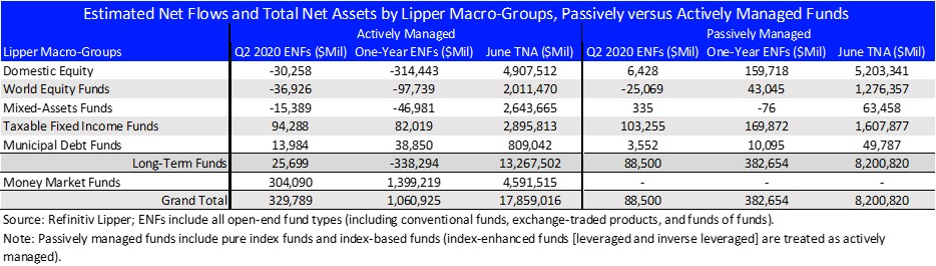

The Big Dilemma

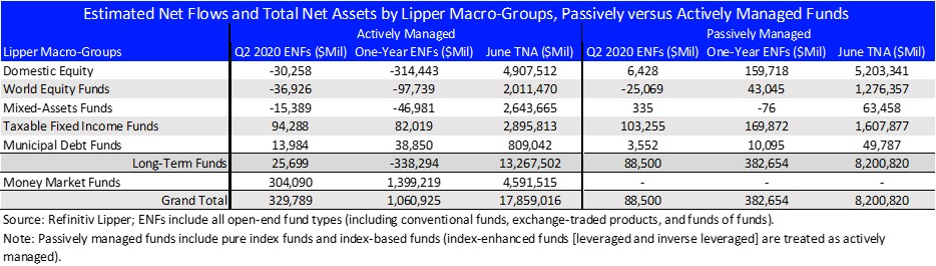

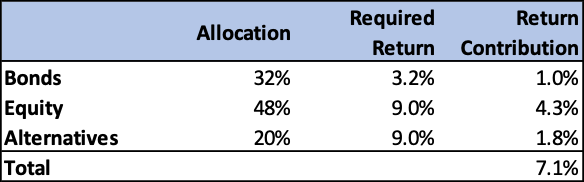

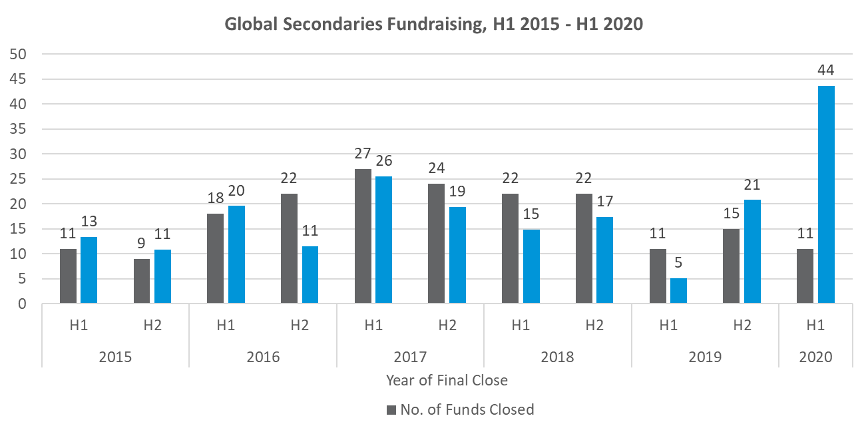

The current Yield to Worst for the Bloomberg Barclays Global Agg Credit Total Return Index, a Global USD Credit Index, is 1.5%. This may seem a low return, however, fund flow data suggests that investors prefer to get a suboptimal low return than experience the uncertainty of the equity market. Even as the MSCI World net return posted a 19% increase in Q2, Lipper data showed USD86bn left Equity Funds while Taxable Fixed Income Funds saw a USD198bn increase. A significant proportion of the latter when to high yield (HY) funds due to the attractive credit spread and yield in April and May.

Multi-asset absolute return portfolio managers now face a difficult decision. At the end of March, Credit was an attractive haven after the COVID sell-off because Global Credit spreads had widened by 120bp and the Yield was a decent 3%. Global HY was even more juicy with spreads widening by 450bp and the yield was 10.5%. The high carry and the potential for capital gains, especially with the US government back-stopping the US credit markets, was irresistible for fixed income veterans, a virtual slam dunk.

However, now with credit spreads, and in particular, yields, approaching pre-COVID levels, the outlook for returns is greatly diminished. The Global Credit Index has returned 7% YTD, and those that focus mostly on that asset class, may well decide that is sufficient for 2020 and rest on their good fortune. For those of us that are still trying to optimize their returns going forward, the return outlook for credit is unappetizing, and we must judiciously look further afield.

The Choices

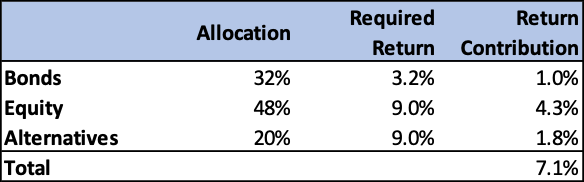

Many of us are in the same boat. Whether we are a retiree or still working, an endowment, a sovereign wealth fund, or an insurance company, we all have future liabilities that need to be paid for through investments. This means we need to get an adequate return on those investments. The required rate of return will depend on your particular situation, but for most the number will be between 5-10% over the cycle. Let’s pick a round number and say we want a 7% return. If our investable universe is Bonds (Credit), Equity and Alternatives, and our Bond portfolio provide a 3.2% YTM (70:30 mix of investment grade and HY), then Equity and Alternatives combined must make 9% in the next 12 months.

Source: Odyssey

Source: Odyssey

For Equity, if earnings are not adjusted higher than current estimates, it would mean that the 2021 MSCI World Index PER would need to be 19.5x (currently 17.8). Apart from extraordinary circumstances such as COVID and the Dotcom boom, the Equity market has only traded as high as 18x – at the peak of the 2017 and 2019 bull rallies. For those that say we now have zero interest rates, so equity multiples can be higher than previously, I would point out that we’ve just had 7 years of zero interest rates in the US from 2009 to 2015. We are not saying you cannot make 9% return from your equity portfolio over the next 12 months, and we hope you do, but we suspect the equity market needs to have a number of positive developments that are not currently apparent for the broad indices to enjoy that type of return.

S&P500 and Current Year PE Ratio

Source: Bloomberg

Can Alternatives bridge the gap? The HFR Hedge Fund Index (HFRHFI) has return 1.6% YTD, which is marginally better than the broad Equity Indices, however, the 6% total return in the last 5 years hardly inspires confidence. The HF Index has even underperformed the Global Credit Index by 24%.

But what about the illiquid strategies? Despite a significant lag in valuation in many cases, unlisted investments do not appear to have gone unscathed. In March AustralianSuper announced they had marked down their unlisted investments by 7.5%. For Q1, Softbank’s Vision Fund with USD76bn invested, lost USD17bn yoy. Carlyle’s Tactical Private Credit Fund’s NAV fell 18% due to COVID and has since recovered approximately half the loss. Commercial real estate has been a mixed bag. Office and industrial exposures have been largely resilient while traditional retail and hotels have suffered and will likely take some time to recover to pre-COVID levels.

Despite some recent losses, there appears a strategic move on the part of large institutional investors to gain further exposure to unlisted investments. Even AustralianSuper is looking to beef its private equity exposure and Calpers has recently stated it believes it needs to raise its exposure to private equity and credit investments if it’s to reach its 7% per annum return target over the next 10 years.

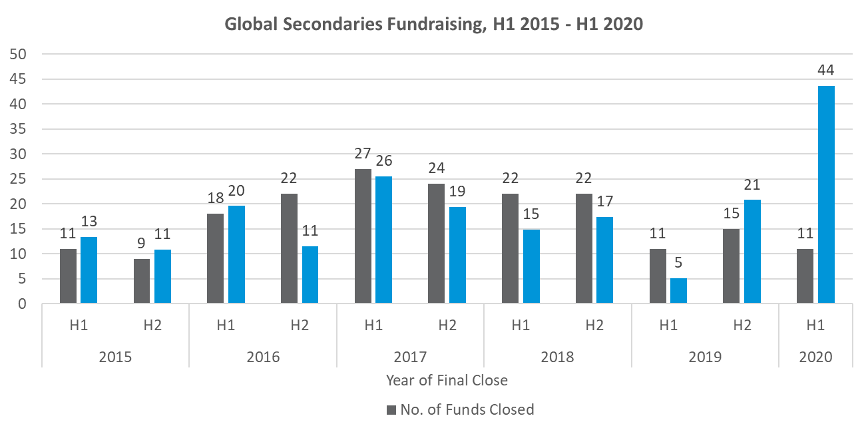

Data tends to support this strategic move by large institutional investors. In H1 2020, private equity experienced USD241bn in fund inflow, USD7bn more than H1 2019[1], despite COVID. While much of the investments were made prior to the COVID lockdown, it indicates the underlying demand. Further, while the number of private secondary transactions declining by 30%, the USD44bn raised in H1 2020 was more than the whole of 2019 (USD26bn)[2], indicating the high demand for secondary transactions.

Source: Prequin

Source: Prequin

Conclusion

The current low yield environment means that for investors that are continually trying to create a portfolio that can provide 5-10% returns going forward, more risk needs to be taken beyond the relative safety of the credit markets. Whether that is through the highly liquid but volatile public equity market, or via unlisted vehicles, or a combination of both, depends on the goals of the individual investor. From our experience, most private investors are underweight alternative assets and further investment in this asset class would likely increase diversification, boost long term returns and lower overall portfolio volatility.

[1] Private Equity International

[2] Prequin

If you like to receive more information on our portfolios solutions, please contact us here: info@odysseycapital-group.com

Jul 21, 2020 | Articles, Global Markets Update

Welcome to the June issue of Capital Pulse, Odyssey Corporate Advisory’s quarterly publication that focuses on major capital and financial markets events that occurred during the quarter and its potential implications for you and your business.

Odyssey Corporate Advisory is an independent boutique consultant providing business advisory, investment consultancy, project management and coordination services for companies that intends to access the Hong Kong capital markets.

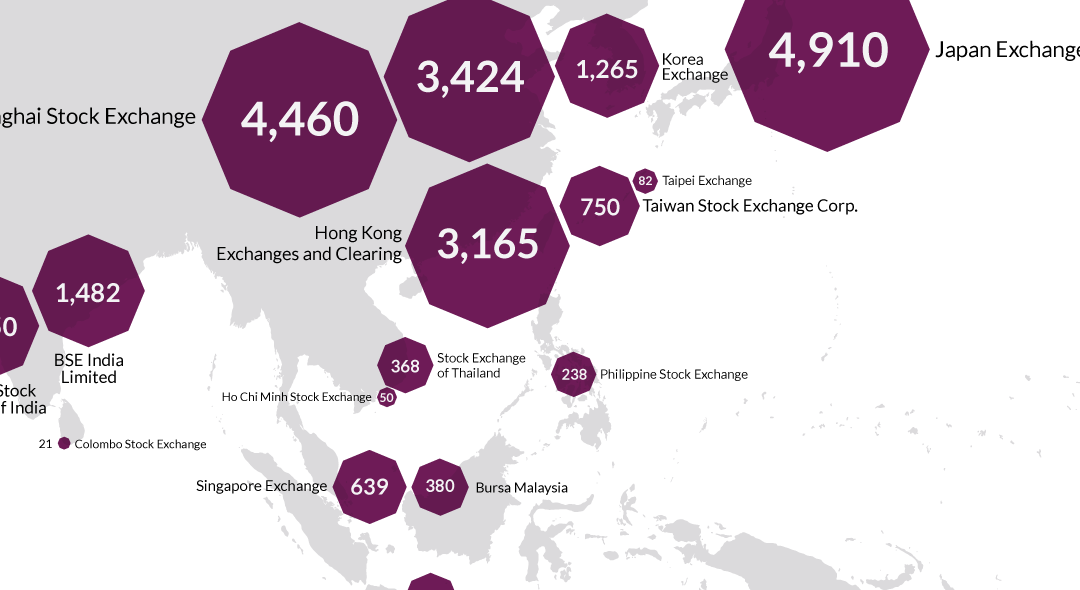

Secondary listings are likely to remain the flavour of the month, if not the year. So, what are secondary listings and is this a money-making opportunity for investors? Are there any shareholder rights implications for investors owning secondary listed companies in Hong Kong compared to primary or dual-primary listed companies?

HEDGING LISTING POSITIONS

We provided an introductory discussion on secondary listing in the June edition of Lex Capitis. In this month’s Capital Pulse, we delve deeper into this category of listed companies and the renewed interest in this space.

The possible legislation of the Holding Foreign Companies Accountable Act (“HFAA”) and the timely creation of Chapter 19C in the Stock Exchange of Hong Kong (“Exchange”) listing rules (“Listing Rules” ) late last year has revitalised secondary listings in Hong Kong.

The recent listings of Alibaba, Netease and JD.com have raised HK$163.04 billion, and further similar secondary listings are expected. With the exception of these recent secondary listings, such listings have traditionally been far and few.

Typically, companies secondary list in Hong Kong because their business has a major exposure to Asia, but their home stock exchange is not based in Asia. Alternatively, Asian companies obtain a secondary listing in Hong Kong because most of its business are concentrated in Hong Kong and/or China.

However, from an investor point of view, secondary listings do not offer much to investors, unless there is an arbitrage opportunity in the IPO with its already listed shares in an overseas exchange, because investors can purchase those company’s shares in their home stock exchange. The only exception to this case is mainland Chinese investors that rely on the stock-connect arrangements with overseas stock exchanges to purchase international shares.

Since 1999, Hong Kong only had 13 companies that chose to obtain a secondary listing status in Hong Kong because these companies believed their business would benefit tangibly or intangibly from a secondary listing status. However, seven of these companies has delisted predominantly due to low trading volumes of its secondary listed shares. The history of secondary listed companies in Hong Kong since 1999 is presented in Table 1 below.

Given the current geopolitical environment, the HKEX might benefit from the return of large Chinese companies listed in the USA via a secondary listing and, thus, Hong Kong retaining its status as a premier exchange to raise capital in 2020. However, with the unrelenting ravaging impact of Covid-19 on the real economy, one would wonder whether there are any more rabbits left in the hat? Perhaps recent announcement by the CEO of the HKEX not to renew his contract could be telling.

Table 1: Secondary Listings in Hong Kong

|

Stock Code

|

Company Name |

Country |

Nature of Business |

Primary Exchg. |

Listing Date |

Market Cap with IPO price (HKD Billion) |

Delisting date |

Delisting reason |

|

09618

|

JD.com, Inc. |

China |

Information Technology – e-commerce, retail |

New York |

18/6/2020 |

596.5 |

|

|

|

09999

|

NetEase, Inc. |

China |

Information Technology – games and online services |

New York |

11/6/2020 |

421.8 |

|

|

| 09988 |

Alibaba Group Holding Ltd. – SW |

China |

Information Technology – e-commerce, retail, e-payment |

New York |

26/11/2019 |

3764 |

|

|

| 06288 |

Fast Retailing Co., Ltd. – DR |

Japan |

Consumer Goods – Apparel |

Tokyo |

5/3/2014 |

282 |

|

|

| 06813 |

CapitaMalls Asia Ltd |

Singapore |

Properties & Construction – Shopping Malls |

Singapore |

18/10/2011 |

30.265 |

22/7/2014 |

Restructuring into Parent

|

|

06388

|

Tapestry, Inc. – RS ( Formerly Coach Inc.) |

USA |

Consumer Goods – Apparel |

New York |

1/12/2011 |

141.54 |

2/3/2018 |

Low trading volume |

|

00805

|

Glencore plc |

Switzerland |

Materials – Commodities |

London |

25/5/2011 |

3.716 |

31/1/2018 |

Low portion of shares on the HK Register |

|

00847

|

KAZ Minerals PLC |

Kazakhstan |

Materials – Mining |

London |

29/6/2011 |

88.64 |

1/8/2018 |

Low portion of shares on the HK Register |

| 01021 |

Midas Holdings Ltd |

China |

Materials – Alloy Manufacturing |

Singapore |

6/10/2010 |

6.43 |

1/8/2018 |

Insolvent: liquidated

|

| 01878 |

SouthGobi Resources Ltd |

Mongolia |

Energy – Coal Mining |

Toronto |

29/1/2010 |

20.36 |

|

|

| 06488 |

SBI Holdings, Inc |

Japan |

Financials – Securities, AM |

Tokyo / Osaka |

14/4/2011 |

17.405 |

25/6/2014 |

Low trading volume

|

|

06210

|

Vale S.A. |

Brazil |

Materials – Mining |

Brazil / New York |

8/12/2010 |

1337 |

28/7/2016 |

Low trading volume |

| 00945 |

Manulife Financial Corporation |

Canada |

Financials – Insurance |

Toronto |

27/9/1999 |

46.464 |

|

|

|

|

|

|

|

|

|

|

|

Source: HKEX, Bloomberg

WHY DID THOU REJECT OR RETURN?

The Exchange published its annual listing decision on applications that it rejected and returned in the past year. The primary cause for rejection is as follows:

Table 2: Reasons for rejection of IPO application

|

Cause for Rejection

|

No. Applications |

|

Commercial Rationale

|

16 |

|

Valuation

|

4

|

| Suitability of Director / Person with substantial influence |

1

|

| Profit Requirement |

1

|

Source: HKEX-GL126-2020

The Exchange continues its practice to vet the commercial rationale for listing as the main factor in determining suitability. The question on valuation of the business usually rides on the back of the commercial rationale concerns. Based on the drafting of the rejection listing decision, it appears the failure to meet the profit requirement stems from a lack of understanding of the Listing Rules. These rejection highlights the importance of careful homework, planning and independent advice on the part of these companies that would have saved them a lot of money and heartache.

The Exchange highlighted two returned applications last year and provided more guidance on the inclusion of financial information rule on the application process which may suggest a substantial number of applications were returned as it fell afoul of this rule. For simplicity, we provided a tabular version of the guidance.

Table 3: Financial Performance disclosure requirements

|

Application Date

|

Company Year End |

Must listing by (MB) |

Must listing by (GEM) |

Financial performance disclosures in the Application Proof (Main Board) |

Financial performance disclosures in the Application Proof (GEM) |

Financial performance disclosures in the Prospectus (Main Board) |

Financial performance disclosures in the Prospectus (GEM) |

Other Conditions |

|

Between 1 January 2020 and 29 February 2020

|

31-Dec-19 |

No later than 31 March 2020 |

No later than 29 February 2020 |

2017, 2018, 9M2019 |

2018, 9M2019 |

2017, 2018, 2019 |

2018, 2019 |

HKEX-GL56-13, HKEX-GL25-11 |

|

Between 1 March 2020 and 30 June 2020

|

31-Dec-19 |

|

|

2017, 2018, 2019 |

2018, 2019 |

2017, 2018, 2019 |

2018, 2019 |

HKEX-GL56-13

|

| Between 1 July 2020 and 31 August 2020 |

31-Dec-19 |

|

|

2017, 2018, 2019, 3M2020 |

2018, 2019, 3M2020 |

2017, 2018, 2019, 3M2020 |

2018, 2019, 3M2020 |

HKEX-GL56-13

|

| Between 1 September 2020 and 31 December 2020 |

31-Dec-19 |

|

|

2017, 2018, 2019, 6M2020 / 9M2020* |

2017, 2018, 2019, 6M2020 / 9M2021* |

2017, 2018, 2019, 6M2020 / 9M2020* |

2017, 2018, 2019, 6M2020 / 9M2021* |

HKEX-GL56-13

|

* Depending on availability

Source: HKEX-GL127-2020, HKEX-GL56-13, HKEX-GL25-11

Although this appears to be a simple guidance to follow, there were media reports of a large biotechnology company that, was listed earlier this year, had its initial application for IPO returned because it did not adhere the guidance above.

Odyssey Corporate Advisory is a boutique corporate advisor providing independent and impartial investment and capital markets consultancy services catered for your circumstances and preferences. Corporate Advisory is a division of Odyssey Asset Management Ltd, a Type 1, 4 and 9 SFC licensed company and subsidiary of the Odyssey Group. If you have any enquiries, please contact:

Kuan Yu Oh

Managing Director, Co-Head of Corporate Advisory

Mobile: +852 6971-7989

Email: kuanyu.oh@odysseycapital-group.com

Notice

This publication is for informational purposes only and does not address the circumstances of any particular individual or entity. It does not constitute financial advice and should not be used as such. You should seek a duly licensed professional for investment advice. For more information about please see our Disclaimer.

Jul 9, 2020 | Articles, Global Markets Update

Market View

Wild Horses

In June, risk markets defied rapidly rising new COVID cases in the US and powered higher. Admittedly, the 1.8% rise in the S&P 500 was primarily driven by a 7% rise in the Information Technology and a 5% rise in Consumer Discretionary sectors. Commodity markets also took an optimistic view, choosing to focus on the loosening of restrictions rather than the continuing rise in new COVID cases that reached over 200,000 per day. This seems to be affirmation of two beliefs; 1) China’s recovery was gaining traction, and 2) the bet that 2nd wave cases would not result in the wholesale global return of mobility restrictions. This led to WTI oil and copper prices to surge 11% and 12% respectively. Equity markets and currencies that had significant commodity exposure rose accordingly. The once popular economic indicator, the Baltic Dry Index, shot up 260%, mainly on the back of increased iron ore shipments to China.

Source: Bloomberg

Indeed, China’s improved industrial production, industrial profits and retail sales numbers for May provided a sense of economic stability. When the positive PMI figures were released at the end of June, indicating an improving trend, China’s equity markets initiated one of its infamous “ears pinned back” rallies. Just one week into July, the CSI 300 has jumped 14% and the MSCI China Index has scrambled to keep up with a 9% surge. While the economic data provided a supportive backdrop, it has been the media drive by the government for people to invest in the equity market that is likely to have had a material impact to the speed of the rise. This is reminiscent of the 2015 boom bust where the CSI 300 doubled in just two months but then gave back 80% of the climb in the subsequent two months. The whole up and down move was largely due to government encouragement and then cessation of the media campaign. Hopefully, experience will temper the market enthusiasm this time.

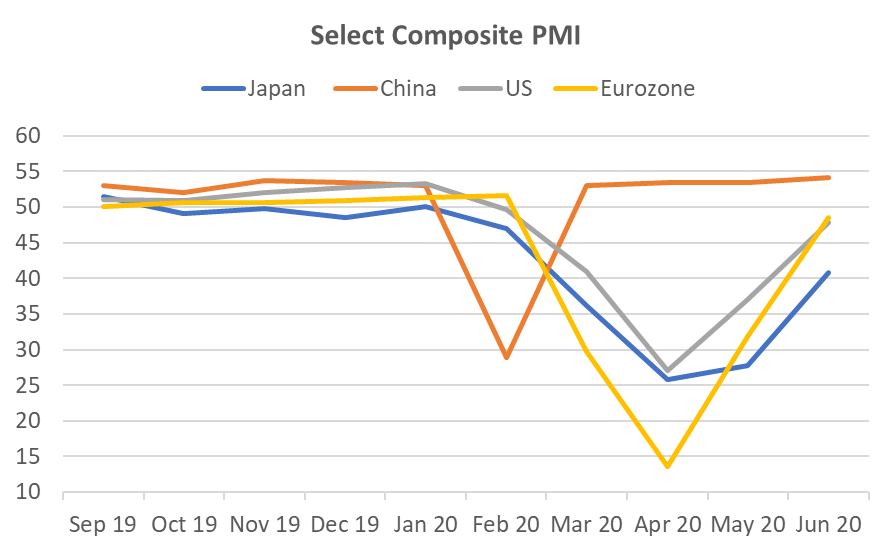

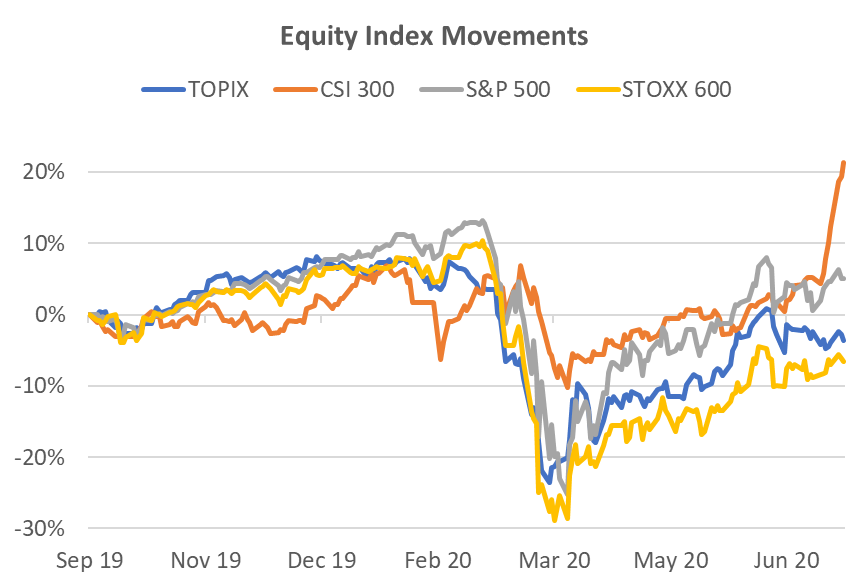

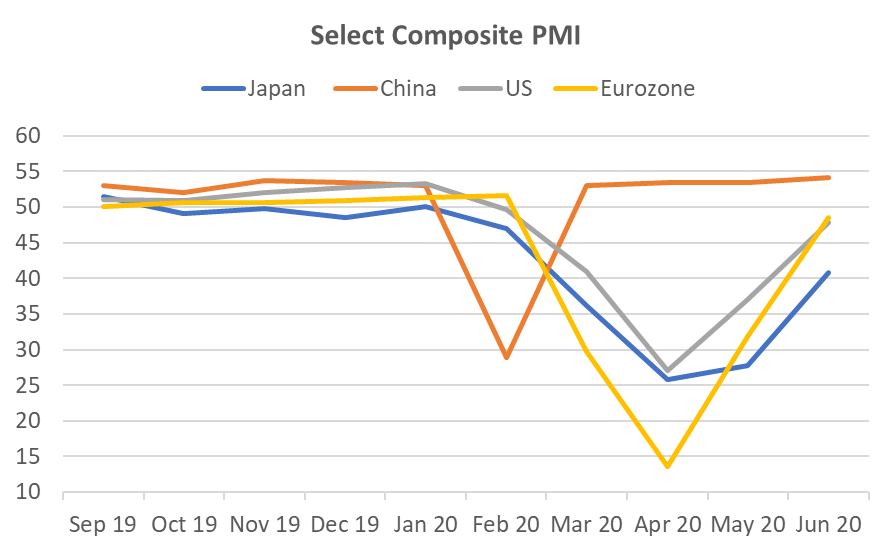

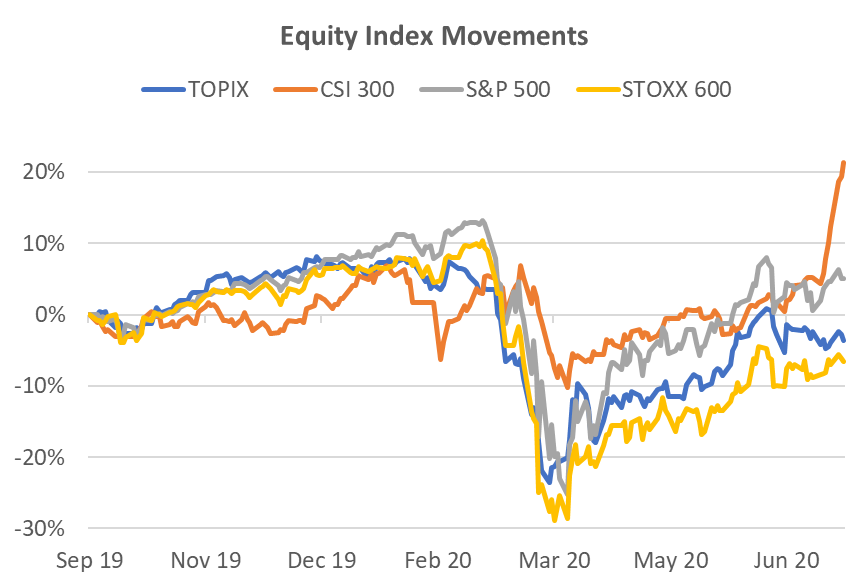

Tail of 4 Markets

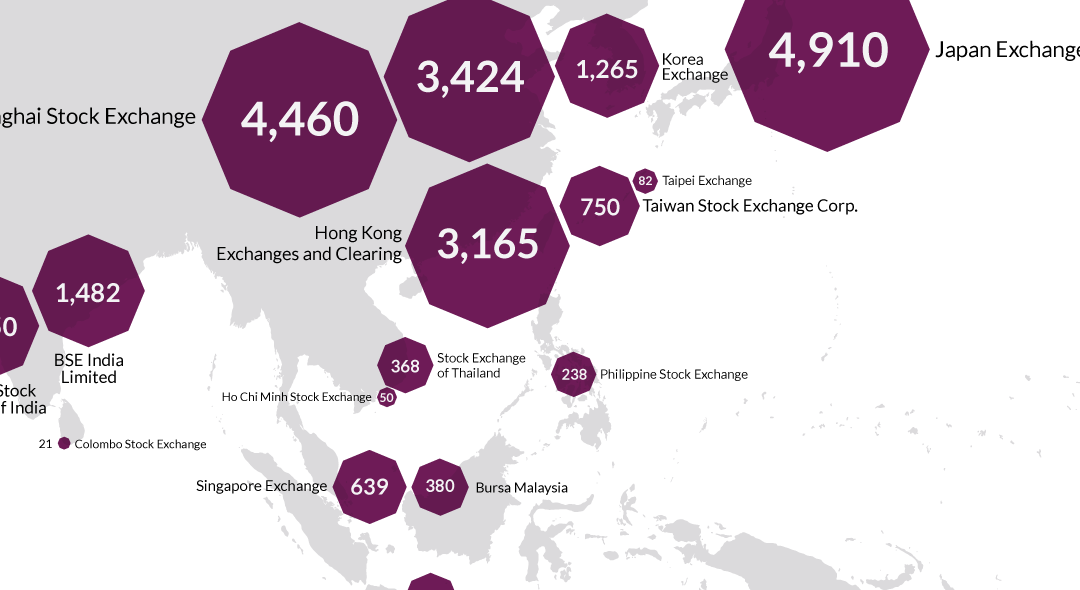

The reliability of China’s economic data has been in question since the 1990’s. If we assume it’s a reasonable representation, based on simple PMI comparisons it could be argued that China’s equity market performance should, indeed, be ahead of other major markets. China only suffered one dramatic month’s dip in PMI before heading back to growth again. Other major regions have suffered 3-4 months of below 50 readings. China’s equity market did not fall dramatically until markets in other regions began to plummet. This occurred when you could argue China’s economy was already stabilising.

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

The other point worth noting is that both the best performing indices, CSI 300 and S&P 500, have less exposure to offshore revenue than either the Topix or the Stoxx 600 that have more than 60% of revenue from offshore. The means any stimulus is likely to be more efficient for the companies in the China and US indices.

Laggards Still Lagging

The market likes what it likes. Currently that does not include banks and industrial stocks, globally. These sectors tend to be more exposed to lockdown restrictions that have been slower than expected to unwind. In a related statistic, in June, US Growth stocks rose 4.1% while Value stocks fell 1% to continue a well-worn path for the last 10 years with the rise and rise of tech stocks. The eventual recovery of the laggards probably heralds the final phase of the equity market dislocation.

This laggard theme also extends in a smaller scale to the credit markets where Asia corporate bonds remain 230bp wide of US corporate bonds. However, Asian bond credit spreads are steadily grinding tighter against their US counterparts, making it an easier choice than exposures to nominally cheap but unloved stocks.

Source: Bloomberg

Source: Bloomberg

If you like to receive more information on our portfolios solutions, please contact us here: info@odysseycapital-group.com

Source: Bloomberg

Source: Bloomberg Source: Bloomberg

Source: Bloomberg Source: Bloomberg

Source: Bloomberg