Jun 15, 2020 | Articles, Global Markets Update

Welcome to the May issue of Odyssey’s Lex Capitis, Odyssey Corporate Advisory’s publication that highlights capital and financial markets developments and its potential implications for you and your business.

Odyssey Corporate Advisory is an independent boutique consultant providing business advisory, investment consultancy, and capital markets project management and coordination services catered for your circumstances and preferences.

It would be an understatement to say that the social unrest in 2019, trade war and Covid-19 presents a challenge for businesses. As we approach the mid-2020, businesses that are considering listing in Hong Kong might find it difficult to meet eligibility requirements unless special dispensation is given by the regulators. So what sort of Hong Kong IPOs should investors expect?

Download the full article here.

Lex Capitis is Odyssey Corporate Advisory’s periodical that highlights capital and financial markets developments and its potential implications for you and your business.

Odyssey Corporate Advisory is an independent boutique consultant providing business advisory, investment consultancy, and capital markets project management and coordination services catered for your circumstances and preferences. Corporate Advisory is a division of Odyssey Asset Management Ltd, a Type 1, 4 and 9 SFC licensed Hong Kong company and subsidiary of the Odyssey Group.

Kuan Yu Oh

Managing Director, Co-Head of Corporate Advisory

Mobile: +852 6971-7989

Email: kuanyu.oh@odysseycapital-group.com

Notice

This publication is for informational purposes only and does not address the circumstances of any particular individual or entity. It does not constitute financial advice and should not be used as such. You should seek a duly licensed professional for financial advice. For more information about please see our Disclaimer.

Jun 10, 2020 | Articles, Global Markets Update

Market View – The Old Normal

Our caution last month proved to be unfounded. The power of the unprecedented stimulus, zero interest rates and the prospect of loosening of lockdown restrictions won the battle against extreme lows in economic activity and the prospect of worst economic data to come. As a result, the World MSCI Index is up 14% since mid-April, and up a whopping 43% since the March trough. The Index now sits at only 6% below the pre-COVID peak. Virtually all risk assets moved up in tandem, including credit. Even oil staged a big rally, rising to USD38 per barrel. The confirmation that the market hadn’t lost all sense occurred last Friday when US unemployment fell to 13.3%, a 1.4% decline from the April figure. This was a particularly large positive shock since some commentators were fearing a number closer to 20%. The other shoe has yet to fall, and those that are waiting, may be in for a long wait. Last week the US interest rate curve steepened 15-25bp for 5-10Y.

Despite market movements, the world is not yet back to normal. The trend in new COVID infections globally is actually still rising. However, the regions that concern the financial markets, namely US and Europe, there the trend is falling, even if the fall is stubbornly slow. Significant restrictions still apply in most countries. The daily new cases in the US still number approximately 19,000, a large quantum.

Source: JHU CSSE

Act 4 in a 5 Act Play

We are now in the 4th Act of the expected 5 Act COVID play for equity markets. The Acts can be characterised as:

Act 1: 3rd week of February. Stocks and other risk assets begin to sell off indiscriminately. The culmination of the first Act was the implementation of the lockdown and social distancing that resulted in the market trough on the 23rd of March.

Act 2: Last week of March. The market realized that there were beneficiaries to the austere policies and we witnessed share prices for online businesses start to surge.

Act 3: 1st week of April. Interest swung to quality businesses that were not beneficiaries of the policies but were partly resistant to the situation and would survive largely intact.

Act 4: Mid-May. The 2nd week of May was when Europe began to loosen lockdown restrictions. By mid-May investors started to support stocks that were heavily affected by COVID policies but were likely to survive as long as the end of the policies remained highly visible. This includes the Banks and Industrial sectors.

Act 5: 3rd – 4th week June? Equity markets to recover their previous peak? Currently, the MSCI World Index is 6% below the pre-COVID peak.

While we have yet to see how Act 5 develops, or whether there is a surprise Act 6 or 7, we find it incredible that it may be possible that in just 4 short months that the equity markets could have plummeted as well as recovered during a time when we are witnessing some of the worst economic data the world has seen since the Great Depression. Indeed, the Global Credit Index (USD corporate bonds) is already up 2% YTD.

Room Left in Laggard Play

While much of the low hanging fruit was picked last week in terms of the under-performing Banks and Industrials, we believe there is still value in the laggard play. Value has been beating Growth in recent weeks, and while this may be a temporary blip to the 10-year Growth out-performance, participating in trend reversals can add meaningfully to performance.

We note that Banks remain 27% below the S&P 500’s peak on the 19th February, compared to Consumer Discretionary, Information Technology, and Healthcare, the sectors that have already regained their previous peaks. Because we are mid-cycle in the laggard recovery, we expect there to be some volatility, but as the global economy slowly climbs out of lockdown, we expect the laggard plays to continue to play catch-up. In Industrials, travel related stocks such as airlines and cruise ships, surged last week. This is likely to remain a highly volatile sub-sector but and may represent a highly sensitive play to the loosening of lockdown restrictions.

Figure 2: Performance of S&P 500 Sectors Since pre-COVID Peak Source: Bloomberg

If you like to receive more information on our portfolios solutions, please contact us here: info@odysseycapital-group.com

Jun 5, 2020 | Articles, Press Releases

Odyssey Group Ltd is pleased to announce the partnership with the Australian Stock Exchange listed, K2 Asset Management (ASX Code: KAM).

Odyssey is constantly seeking ways to drive value for its clients and has been researching solutions to further develop its asset management offering to meet the demand of the firms ever evolving client needs. Odyssey has selected K2 from a large number of possible partners. K2 will assist Odyssey on a number of business lines, including co-managing Odyssey’s in-house Horizon Discretionary Portfolios, bespoke portfolio services and Odyssey’s Satellite trade service, Navigator. Odyssey’s clients in turn will benefit from K2’s experienced team and resources, as well as K2’s consistent alpha that they have generated over the past 21 years.

The following is a summary of K2’s pedigree:

- K2 has a 21 year track record of delivering consistent alpha through multiple economic cycles.

- K2 is an ASX listed Boutique Fund manager which is 68% owned by staff and related parties (ASX Code: KAM)

- K2 operates 5 equity products, including: 2 Australian funds and 3 international funds, along with several other client mandates.

- In September 1999, K2 became one of Australia’s first Long/Short Funds.

- K2 Australian Small Cap Fund (ASX Code: KSM) is the only small cap active listed ETP in the market.

- K2 has 14 staff including 6 dedicated investment professionals.

- K2’s current funds under management is AU$120M.

- K2 has 20 years of investing in Absolute Return fund strategies with a proven track record of persistent alpha generation.

- K2’s focus is on capital preservation with a focus on alpha generation via their proprietary stock selection process.

- Being an absolute manager, K2 have the ability to move to 100% cash at any time.

For further details please visit K2’s website here.

Campbell Neal, Chairman and CEO of K2 commented:

“K2 are pleased to partner with Odyssey as our Asia Pacific partner and to further extend our reach into the Asian region. We look forward to assisting the Odyssey team in managing their client’s investment portfolios and funds”.

Alex Walker, Co-Founder & CEO of the Odyssey Group Ltd added:

“Odyssey is excited about its partnership with such a seasoned and professional firm that is K2. We look forward to our clients benefiting from K2’s 21 years of out performance and strategic insight into the global markets.”

Odyssey’s partnership with K2 highlights sustained interest by Asia Pacific based clients in accessing institutional-quality investment portfolio solutions, that are independent and unconflicted.

The original K2 press release can be accessed here.

Please see the press release as featured in the Australian Financial Review online or download a copy here.

If you would like to learn more, please contact your Odyssey Wealth Manager or contact Jeff Hiew.

May 15, 2020 | Careers

Odyssey Group is Asian’ leading independent Alternative Asset Manager. We are currently expanding its External Asset Management (EAM) Platform and are actively inviting experienced Private Bankers and Wealth Managers to join this market leading platform.

ROLE SUMMARY

You will be responsible for bringing in new accounts and developing AUM. Cross-selling a wide range of private banking and wealth management products and solutions to clients will be part of your core responsibilities.

Private Client Advisers at Odyssey develop deep client relationships in order to thoroughly understand the client’s situation and utilise that knowledge to develop tailored wealth management strategies. The Advisers are able to add value to individual and corporate clients by building and drawing upon a network of internal resources, often global, to achieve desired results. Successful Advisers are able to develop and adapt a disciplined sales process to convert a pipeline of prospects into target market clients. In addition, they are able to deliver quality client relationships (solutions and services) in an intensely competitive fragmented market, taking advantage of the Odyssey platform while protecting the client/firm by complying with relevant policies, procedures, and country legal/regulatory requirements.

Markets covered: Greater China – Hong Kong, China, Taiwan.

The ideal candidate is an existing private banker and has at least 60%-70% of his/her key clients domiciled in the countries covered. Other candidates and client coverage may be considered.

ROLE REQUIREMENTS

New Client and Business Development

- Grow client net revenue annually in core product areas: investment management, capital markets, real estate, and banking & lending.

- Create sales and marketing strategies designed to generate revenue growth and to acquire new target clients within different sectors.

- Prospecting – generate leads and develop prospects, network to identify referrals to new clients/prospects.

- Profile, qualify, and convert prospects into clients.

- Identify and execute on new business opportunities with existing clients.

- Orchestrate appropriate specialist resources to develop tailored, long-term solutions for clients/prospects.

- Present and communicate to clients/prospects complex financial concepts and investment strategies in a way that is easily understood.

Relationship Management

- Serve as the client’s advocate and trusted advisor (primary contact) for strategic advice on financial matters.

- Create, organise, and implement a wealth management strategy designed to deepen relationships with existing clients.

- Manage client expectations regarding service and deliverables.

- Ensure financial strategies are kept current and appropriately aligned with client objectives.

- Understand and communicate the risk involved with financial and investment strategies.

- Ensure all client inquiries and problems are handled effectively and resolved.

- Help team members to acquire experience and establish credibility with clients.

Compliance Oversight and Controls

- Comply with all regulatory policies and control procedures regarding client transactions and suitability.

- Oversee and ensure clients are on-boarded appropriately including all required documentation is complete and accurate.

Experience

- 3 to 5 years minimum industry experience.

- Established client base with existing AUM.

Qualifications

- SFC licensed.

- CWM or other designation a plus.

Languages

- English, Mandarin (preferred), Cantonese (preferred).

Roles Details

- Primary Location: Hong Kong

- Schedule: Full-time

- Education Level: Bachelor’s Degree or higher

YOUR BENEFITS

- Flexible

- Better Economics

- Tailored Fees

- Equity Participation

- Full Support

- Investment Advisory Desk

- Deal Flow

- Tactical Ideas

- Unrestricted View

- Large Range of Providers

- Independent

- Scale

- Fun Culture

YOUR CLIENT BENEFITS

- Competitive Pricing

- Broader Access

- Research

- Buy Ideas

- Discretionary Portfolios

- Investment Advisory

- VIP Client Events

PRODUCTS

- Discretionary Portfolio Service

- Bespoke Portfolio Mandates

- IPO Allocations & New Bond Issues

- Real Estate Opportunities

- Co-Investment Opportunities

- Differentiated Investment Funds

- Mortgages

- Insurance Solutions

- Institutional Solutions

PLATFORM FEATURES

- Open Architecture, Access & Pricing

- Full Product Suite including Credit Facilities

- 24 hours Trading Platform

- Online Access

- Investment Advisory Desk

- Research Desk

- Multi Valuation “Balance Sheet” Solution

- Full front, Middle and Back Office Support

If you would like to apply for the role, or have questions, contact us here.

WHO ARE ODYSSEY

Odyssey Capital Group Ltd is Asia’s leading independent Alternative Asset Manager that provides differentiated and bespoke investment solutions across multiple asset classes. We aim to only employ the highest quality people as partners in our business, while pursuing the highest standards, and aligning our interests with those of our investment partners. It is our mantra to be the “trusted partner” for our clients’ needs.

Odyssey’s sister business, Odyssey Asset Management Ltd is a SFC Type 1, 4 & 9 licensed company, who offers the most entrepreneurial and full service External Asset Manager (EAM) platform in Asia. The EAM platform allows experienced Private Bankers and Wealth Management exclusive access to an independent and comprehensive platform that allows them to offer a range of market leading solutions in order to address all of their client’s needs.

WHAT DO WE DO

Our EAM platform allows experienced Private Bankers with established client bases to transform from being employees to being business owners, in turn securing their financial future. Odyssey takes care of the day to day administrative tasks to allow you to focus on servicing your clients and addressing all their investment, wealth, tax and planning needs. At Odyssey clients come first, hence we are constantly seeking ways we can create value for you and your clients. You can find more details on our website here: http://www.odysseycapital-group.com/external-asset-management-platform/

May 15, 2020 | Articles, Global Markets Update

Lex Capitis Odyssey Corporate Advisory’s periodical that highlights capital and financial markets developments and its potential implications for you and your business.

Odyssey Corporate Advisory is an independent boutique consultant providing business advisory, investment consultancy, project management and coordination services for companies that intend to access the Hong Kong capital markets.

Searching for Diamonds in the Rough

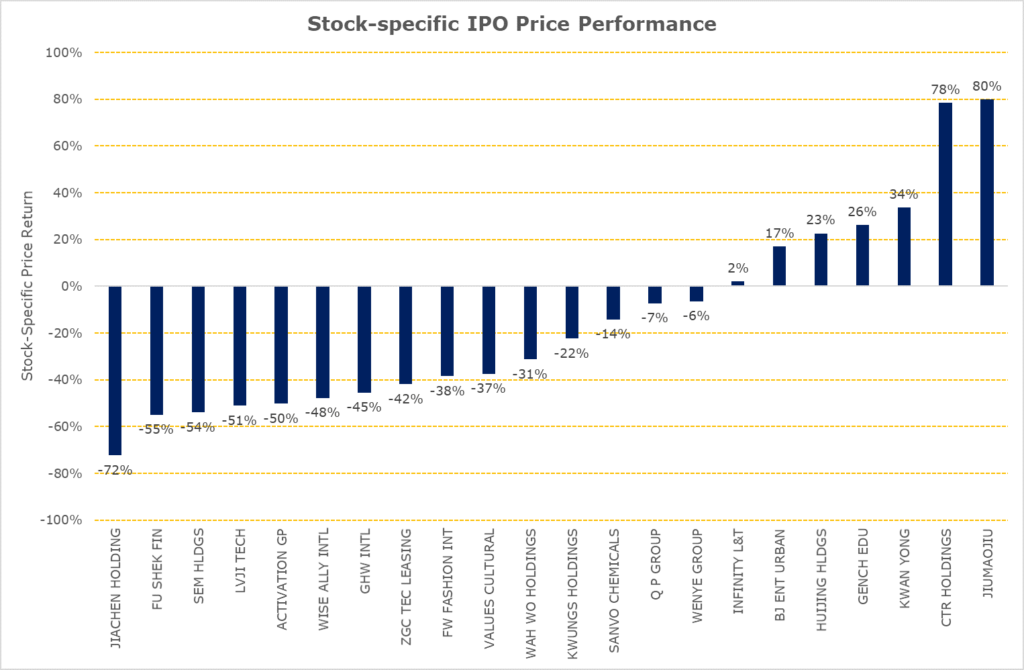

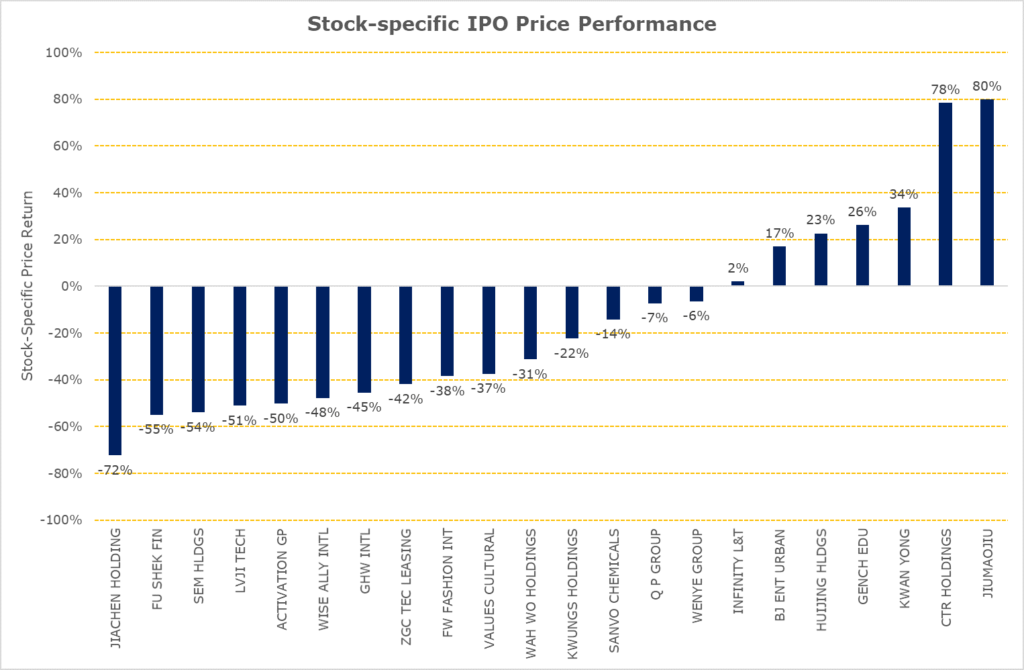

Source: Bloomberg, Odyssey Capital

Summary:

- IPOs of Singapore and Malaysia companies during the two months of 2020 have outperformed the market;

- The price-performance of IPOs with cornerstone investors, on average, performed better than IPOs that did not have cornerstone investors during this period. However, stock-specific factors in each IPO were the key determinant in price performance;

- Size matters, on average, during this period as IPO with a market capitalisation that is greater than HK$1 billion performed, on average, better than IPOs market capitalisation less than HK$500 million. However, stock-specific factors in each IPO drove the disparity in price performance.

IPOs during January and February 2020

During the first two months of 2020, 24 companies listed on the Stock Exchange of Hong Kong. 22 companies were listed on the Main Board and two companies on GEM. There was no one particular industry that dominated, with companies ranging from the construction to television industries. Four IPOs (Wenye Group, Wah Wo Holdings, Jiachen Holdings and China Hongguang Holdings) were undersubscribed in their placing offer and one IPO (HuiJing Holdings) was undersubscribed on the public offer.

| Geography |

Board of listing |

No. of IPOs |

Average returns of IPOs |

Average returns of IPOs adjusted by HSSI returns |

| China |

Main Board |

17 |

-27% |

-19% |

| Hong Kong |

Main Board |

3 |

-38% |

-31% |

| Macau |

Main Board |

1 |

-57% |

-54% |

| Singapore |

Main Board |

2 |

43% |

56% |

| Malaysia |

Main Board |

1 |

-6% |

2% |

|

|

|

|

|

| China |

GEM |

2 |

-37% |

-30% |

Figure 1: Average IPO returns

Source: Bloomberg

Given the current market environment, we examined the stock-specific returns from their IPO date to 29 April 2020 by adjusting each IPO’s price-performance by the price return of the Hang Seng Composite Small Cap Index (“HSSI”). The HSSI is the appropriate market proxy because the IPO market capitalisation of the companies during this period ranged HK$500 million to HK$10,140 million which is within the scope of HSSI’s constituents market capitalisation. Contrary to an earlier media report about the unattractiveness of South-East Asian companies listing in Hong Kong, investors would, on average, have benefitted from investing Malaysian and Singaporean companies that IPO during this period.

Time to Listing

| Longest application days |

345 |

| Average application days |

198 |

| Shortest application days |

119 |

Figure 2: Timing from application to allotment of Shares

Source: Odyssey Capital

There was no change in the time required for the listing process, the average time from submission of the IPO application until the allotment of shares took more than six months, i.e. it required at least one renewal of the IPO application. The IPO that took the longest was almost a year whilst the shortest took just under four months. There was no discernible difference in the time required between main board applications and GEM board applications.

Size Matters?

| Stock Code |

Name |

IPO Market Capitalisation (HKD Millions) |

IPO returns adjusted by HSSI returns |

| 09968.HK |

HUIJING HLDGS |

10,140 |

23% |

| 09922.HK |

JIUMAOJIU |

9,131 |

80% |

| 01745.HK |

LVJI TECH |

2,990 |

-51% |

| 01525.HK |

GENCH EDU |

2,511 |

26% |

| 03718.HK |

BJ ENT URBAN |

2,484 |

17% |

| 09919.HK |

ACTIVATION GP |

1,616 |

-50% |

| Average Stock-specific IPO Price Performance (Market Capitalisation greater than HK$1,000 million) |

7% |

Figure 3: Large IPOs

Source: Bloomberg

| Stock Code |

Name |

IPO Market Capitalisation (HKD Millions) |

IPO returns adjusted by HSSI returns |

| 02528.HK |

FW FASHION INT |

800 |

-38% |

| 01802.HK |

WENYE GROUP |

630 |

-6% |

| 01412.HK |

Q P GROUP |

628 |

-7% |

| 01442.HK |

INFINITY L&T |

620 |

2% |

| 00301.HK |

SANVO CHEMICALS |

556 |

-14% |

| 01937.HK |

JIACHEN HOLDING |

530 |

-72% |

| 09998.HK |

KWAN YONG |

520 |

34% |

| 01740.HK |

VALUES CULTURAL |

519 |

-37% |

| 01925.HK |

KWUNGS HOLDINGS |

518 |

-22% |

| 09933.HK |

GHW INTL |

510 |

-45% |

| 01601.HK |

ZGC TEC LEASING |

507 |

-42% |

| 01416.HK |

CTR HOLDINGS |

504 |

78% |

| 02263.HK |

FU SHEK FIN |

500 |

-55% |

| 09929.HK |

SEM HLDGS |

500 |

-54% |

| 09918.HK |

WISE ALLY INTL |

500 |

-48% |

| 09938.HK |

WAH WO HOLDINGS |

500 |

-31% |

| 08500.HK |

ICONCULTURE |

250 |

-48% |

| 08646.HK |

CHINA HONGGUANG |

231 |

-13% |

| Average Stock-specific IPO Price Performance (Market Capitalisation less than HK$1,000 million) |

-23% |

Figure 4: Small IPOs

Source: Bloomberg

Although on average, IPOs with a market capitalisation greater than HK$1,000 million performed better than IPOs with a market capitalisation less than HK$1,000 million, there was a wide disparity in price-performance between IPOs. Compared to LVJI Technology Holdings and Activation Group Holdings, 12 small IPOs had smaller negative returns. CTR Holdings and Kwan Yong Holdings had better returns compared to Huijing Holdings which was the largest IPO for the period.

Odyssey Corporate Advisory is a boutique corporate advisor providing independent and impartial investment and capital markets consulting services catered for your circumstances and preferences. Corporate Advisory is a division of Odyssey Asset Management Ltd, a Type 1, 4 and 9 SFC licensed company and subsidiary of the Odyssey Group. If you have any enquiries, please contact:

Kuan Yu Oh

Managing Director, Co-Head of Corporate Advisory

Mobile: +852 6971-7989

Email: kuanyu.oh@odysseycapital-group.com

Notice

This publication is for informational purposes only and does not address the circumstances of any particular individual or entity. It does not constitute financial advice and should not be used as such. You should seek a duly licensed professional for financial advice. For more information about please see our Disclaimer.