Oct 21, 2021 | Articles, Global Markets Update

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Due to the dramatic downturn in the number of pandemic cases, Mr. Yamagiwa, Japan’s Government Minister in charge of COVID-19 commented that beginning in November (when the General Election is over) the government will implement measures to revitalize the COVID-19 inflicted (Japanese) economy by reducing border and travel restrictions, restrictions on restaurant business hours and so on.

Daishiro Yamagiwa, the minister in charge of economic revitalization, said in a Fuji TV program on the 17th, that all requests for restricting restaurant business hours, etc., which were implemented as measures (to protect the community) against the coronavirus, will be lifted if the number of new infections does not increase. He said, “we should be able to live (relatively) unrestricted by November at the earliest.”

The minister also said he would like to urgently prepare the easing of border measures for foreign visitors that require them to stay in home quarantine for 10 days, subject to those visitors providing vaccination certificates.

Original Japanese article below:

https://news.yahoo.co.jp/articles/c5756301d2c2ab867e5939285a2a126651345161

If you would like to receive further details on Odyssey or some of the most attractive private markets investment opportunities Asia has to offer, please get in touch with us.

Oct 21, 2021 | Articles, Global Markets Update

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Market Highlights

The second half of September saw investors taking profits. Slowing global growth, persistent chain supply bottlenecks and inflation, rising US Treasury yields, a mixed reception for the approval of the US USD1tn infrastructure plan, issues in raising the US debt ceiling, and rising oil and gas prices all contributed to the cautious mood.

The S&P 500 fell 5% in September and the NSADAQ fell 7%. While volatility remains, we note some contradictory signals; 1) the equity market frets about persistent inflation but the 5Y UST is at only 1.1%, 2) investors are anticipating a major global growth slow-down but labour conditions are tight and the price of copper has been steady, and 3) prices of some commodities have surged but the price of equity exposures suggest few believe this will be sustained for any length of time, i.e. the SPGSCI (broad commodity index) is 37% above pre-COVID highs whereas the S&P 500 Energy Sector remains 2% below.

Source: Bloomberg

We expect Q3 results to shed some light on the impact of a slowing economy, supply chain issues and inflation. So far, the impact has not been as pronounced as feared and that should put the equity market on a firmer footing. With zero interest rates, rising vaccinations, and the prospect of Merck’s oral COVID treatment being distributed before year end, the probability that the world will steadily move towards normalisation that will continue to support earnings is higher than a reversal or lengthy stalling of the process, in our opinion.

One asset class that continues to surge is commodities. Rising oil prices is one cause, but even tighter supply dynamics have been occurring for much of the year in natural gas. This has exacerbated tight conditions in the fertiliser and coal markets.

Investment Strategy

Asset Allocation

The primary reason why we are long equity is that we expect the global normalization process to continue unabated over the next 3-6 months. We believe this will be positive for equity earnings and sentiment. However, because we are currently experiencing the second lull in economic growth this year and markets remain volatile, we would maintain a healthy cash hoard. In structural bull markets, falls of 5-10% in broad equity indices once or twice per year are not uncommon.

The same factor that is underpinning the equity market – ultra-low interest rates – is also the reason we are having difficulties finding opportunities in fixed income. Credit spreads are close to all-time tight levels, and with the medium-term prospect of rising interest rates, this creates a double headwind for the sector.

Themes

There are many forces currently at work that are widening the wealth gap. This includes the strength in the equity market over the last decade, the growing number of people investing in, or working in, technology related sectors, and the boom in the residential property market that is disproportionately benefitting the wealthy.

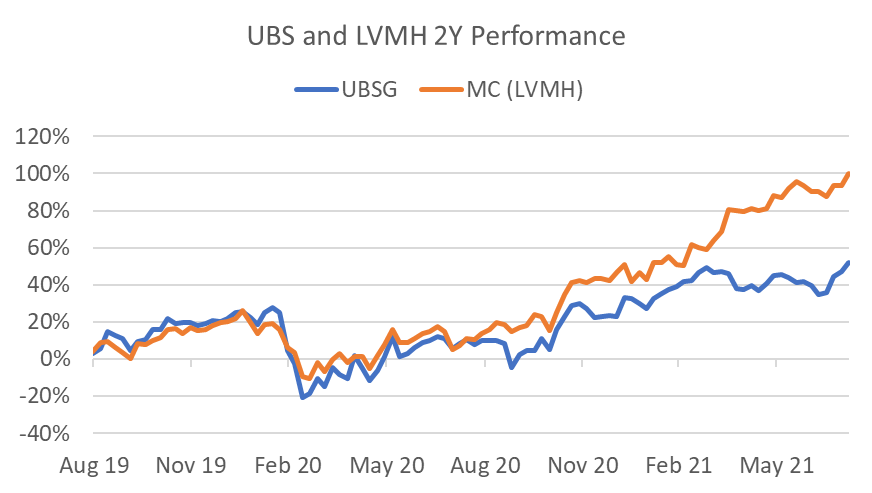

This theme can be expressed effectively through wealth management and boutique high-growth banks, and through luxury product producers. For the former this includes UBS, SVB Financial, First Republic Bank, and Signature Bank. The latter bank also has 20% of its assets in cryto-currency – a burgeoning asset class among the wealthy. Two leading luxury goods providers are LVMH and Estee Lauder.

Source: Bloomberg

This assists in maintaining a high weight in financials that may provide some protection against a rising rates environment. Some energy stocks would also assist. We would suggest a mix of direct commodity exposure and service providers that will likely benefit but not has high a daily correlation.

We suggest some stocks that benefit from a return to a pre-COVID lifestyle. Among these are two boutique sportswear producers, Lululemon and UnderArmour. Involvement in exercise and sports, both personally and spectating is starting to blossom again. People want to work off weight gained since COVID and football games in the US and Europe are again attracting huge crowds and encouraging exercise activities. We believe supply chain issues are transient, while demand is underestimated.

Our exposure to China is growing. At the end of September, it represented 3% of our equity exposure. It currently stands at 10%. We are cautiously optimistic that the market represents value with more than half the exposure from index ETFs. Until the Chinese government provides more tangent evidence of economic support, we remain conservative in our positioning.

Outlook

The equity market is experiencing many headwinds, but we continue to view them as transient rather than structural. Timing when to buy in such a market is difficult and most times the best advice is to just buy a good company at an attractive price and wait for sentiment to improve. We believe we currently have a good mix of investments, including those that benefit from some of the market’s concerns that we expect to partially mitigate those that will likely improve with equity sentiment.

Please note that we are no longer maintaining the Model or Horizon Portfolios. These have been replaced by the Odyssey Optimum Return Fund which is a multi-strategy fund that was launched on 13th September. We use this investable fund to express our investment ideas.

If you like to receive more information on our portfolio solutions, please contact us here: info@odyssey-grp.com.

Sep 14, 2021 | Articles, Global Markets Update

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Waiting for Godot

Long time market stalwarts of the equity market such as Warren Buffet will tell you not to try to time the market. Over the long-term, the statistics completely supports this point of view. However, not everyone is a successful seasoned professional with the same time horizon, and not every investor studies the market and companies every day. The majority of us feel fear and greed. When the market is moving up, we wish we had more exposure, when the market is falling we wish we had less. Most of us have made the mistakes of buying high and selling low. Maintaining discipline to minimise mistakes tends to lead a higher probability of positive outcomes.

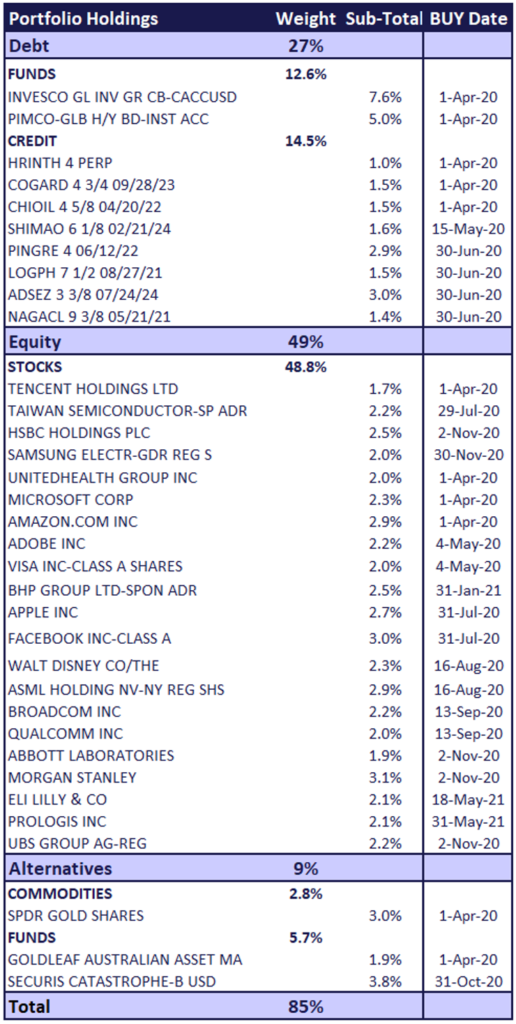

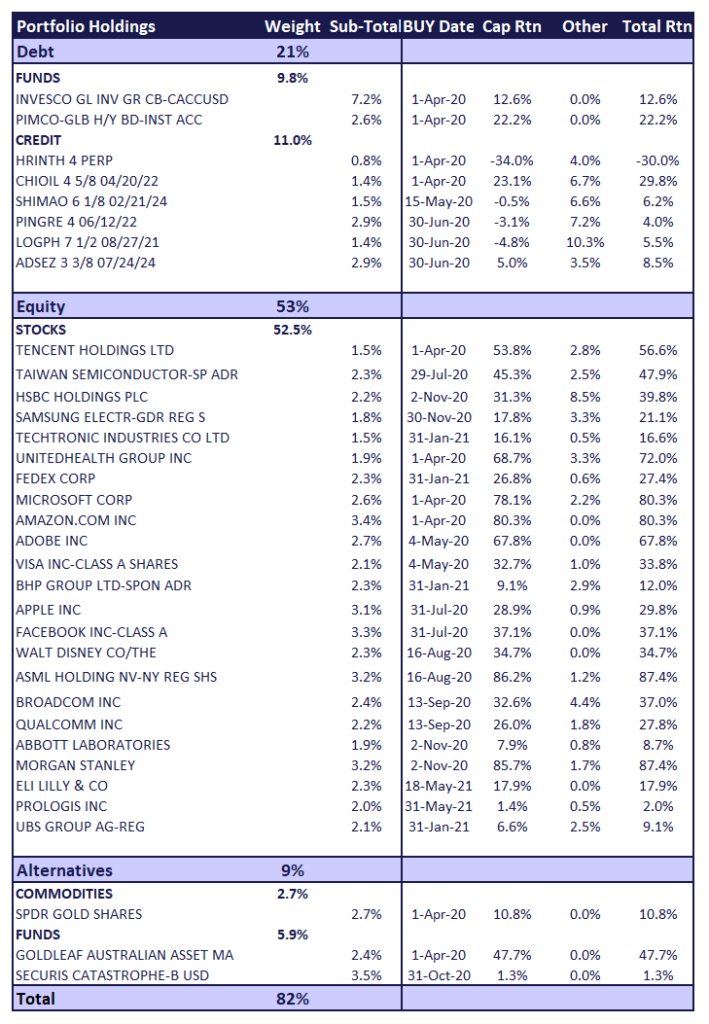

Since the start of April we have been a little cautious of the potential for increased market volatility, but have stayed positive on the economic fundamentals that ultimately drive markets. The performance of the MSCI World since the start of May, the start of the “volatile” season, has been an impressive 8%. During this time our Model Portfolio has maintained the diversification instigated towards the end of 2020 and an equity weight at circa 50-55%. We did perform some stop losses on two China related names and reweighted to the strong US market. In this manner we have tried to stay disciplined – remain invested because of the strength of the underlying economic recovery, committed to stop losses, and reweighted towards the strongest economy. Consequently, the ROI of the equity portfolio is 17% YTD, similar to the MSCI World Index after beating this Index by 20% in 2020. This has been achieved without any outsized positions and with all the stocks being large or mega cap and highly profitable, i.e. no speculative stocks.

The surprising robustness of the US equity market has led to more calls that we are overdue for a sell-off. Perhaps one measure that the market is becoming overheated again is the resurgence of the speculative trade that we saw in Q1 2021. Certainly, some speculative trades have already taken off – Cloud Computing (CLOU), Uranium (URA), and Rare Earth Materials (REMX) – but others such as the main ARK vehicles (ARKQ and ARKG) as well as clean energy (ICLN) have remained subdued so far, but most have bounced off a well-defined support level.

Source: Bloomberg

We acknowledge that on a technical basis, the market may be due for a modest retracement, but we would need to see concrete signs the recovery is stalling to change our cautiously optimistic view. Also, it is noticeable that as the S&P 500 climbed in 2021, the strength of upward earnings revisions has meant the PER valuation for 2021 has not materially changed since the beginning of the year, making the valuation conundrum less acute.

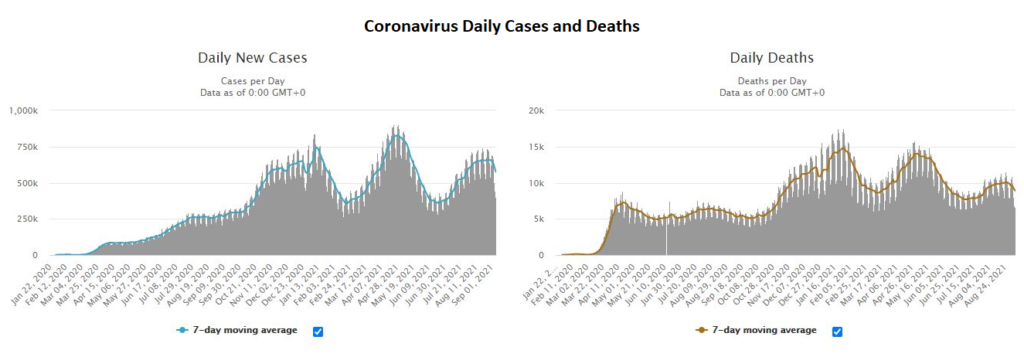

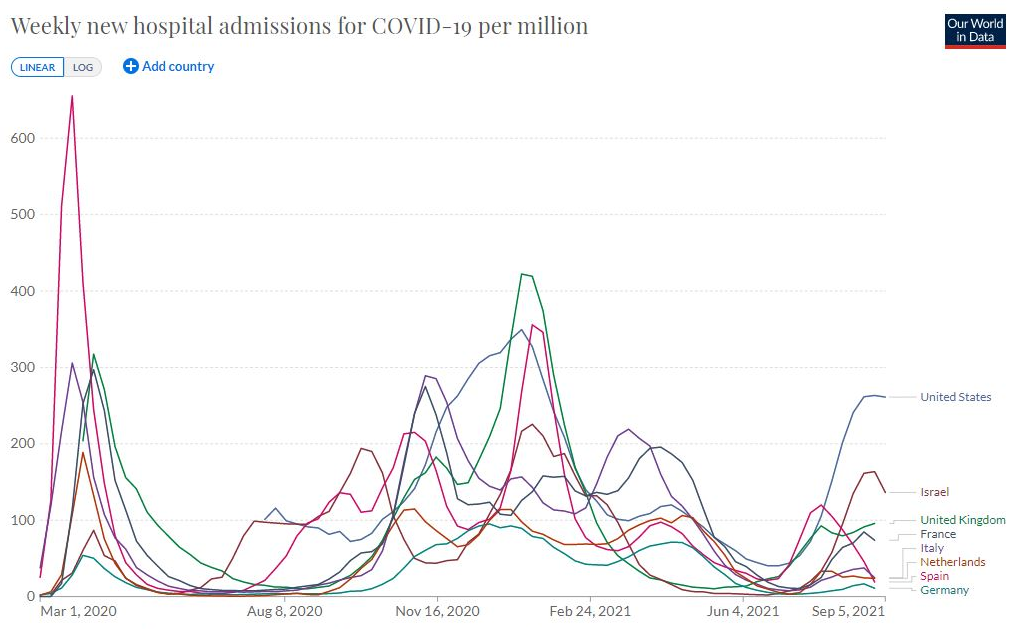

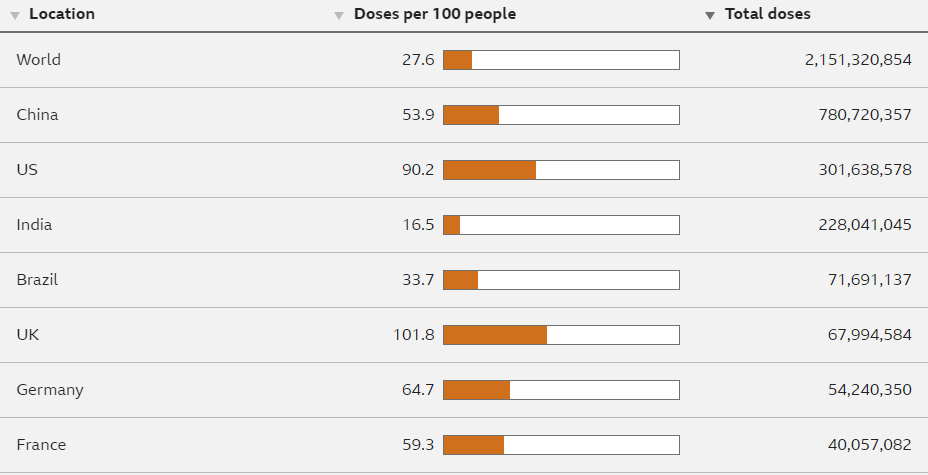

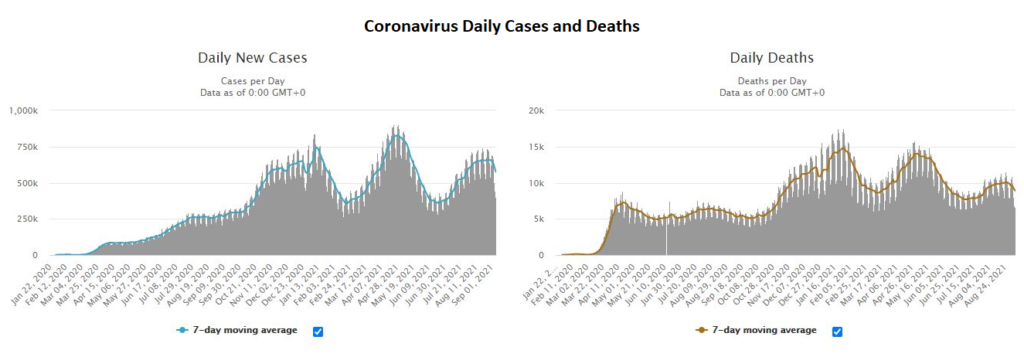

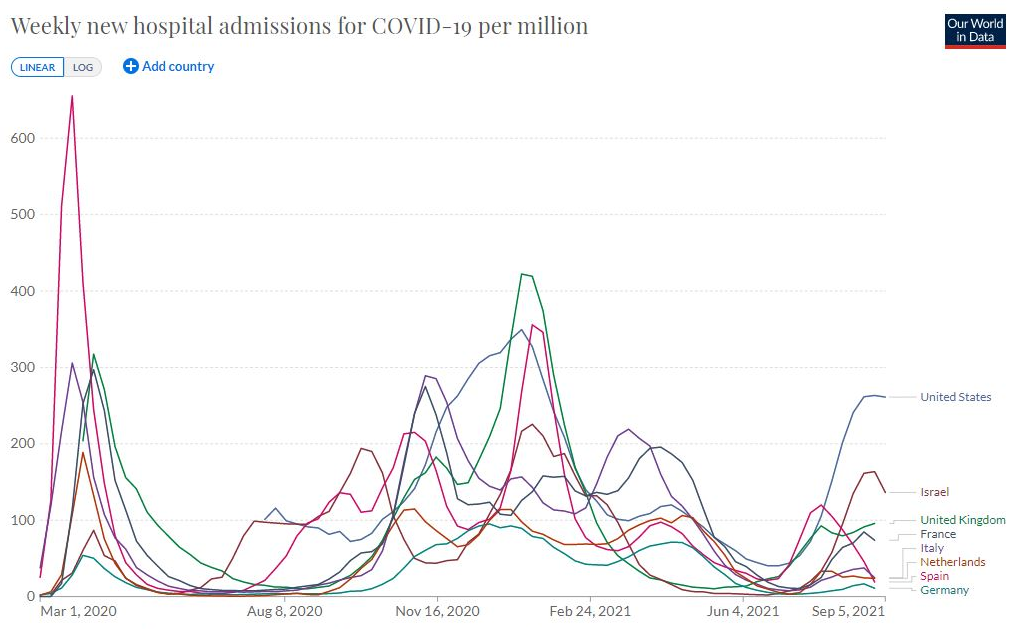

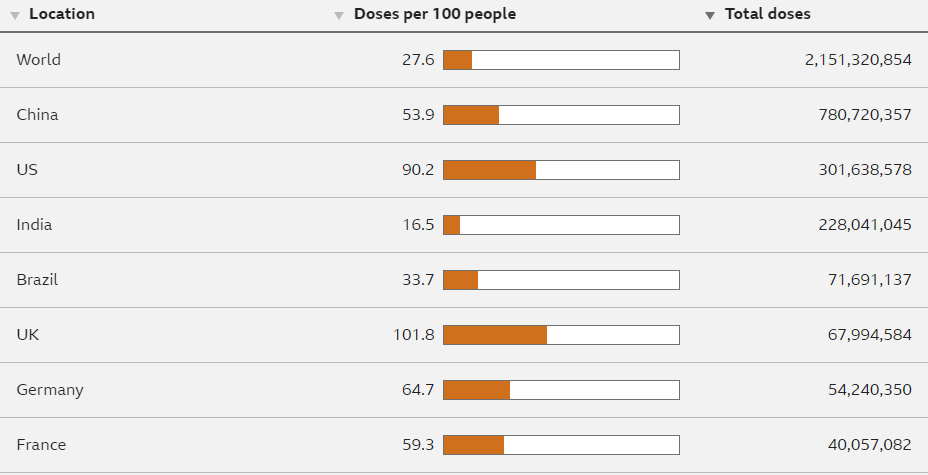

Vaccines Working Where it Counts

The Delta COVID wave has certainly had an impact on economies, but we are seeing some tentative signs that the infection rate may be peaking on a global basis and importantly, hospitalisations and deaths have not been nearly as high as previous waves. Of course, part of the reason is the vaccination rate that has reached 54% in the US and 60% in the EU for fully vaccinated people. On the basis of people over 18yo the figure is circa 10% higher for both regions.

While the global PMI peaked in May, it remains well above 50. There are indeed some supply chain bottlenecks and these could persist for some time, but the inflation rate appears to be stabilizing, albeit at a high rate. Further, if the crowds we are seeing in sporting stadiums in the US and Europe are any indication, nations are starting to enact the “living with COVID” policy. The key here is that despite the high rate of infections, hospitalisations are not spiking towards capacity limits. Should this situation remain, the world can continue to progress to a new “normal” that includes living with COVID. The lockdowns have taken a mental toll and governments are under increasing pressure to pursue normalisation.

Source: Worldometer

Source:Ourworldindata.org

Retail Power Again

We have recently been reminded of the growing power of the retail investor, particularly in situations when a relatively small amount of capital can disrupt a market. One such market is the price of uranium. The price had been languishing ever since the Fukushima nuclear disaster in 2011. However, a Canadian investment fund has almost singlehandedly caused a massive surge in uranium spot prices with a buying spree that has put the nuclear power industry on alert. The spot uranium price for deliveries this month leapt 30.8% over 30 days to $39.75/lb as of September 7. Market analysts credited Sprott Asset Management LP, a uranium trust formed in July to buy up low-cost uranium on the spot market and hold it for the long-term, for the jump in prices. In the first week of September the Fund bought 3mn pounds of uranium to add to the 21mn it had previously purchased.

The uranium price has sent Global X Uranium ETF (URA) up +33% MTD. This is not the first surge for this ETF this year with the price more than doubling to June 30 YTD on uranium price speculation.

Investment Recommendations

The Tencent and Alibaba of SE Asia

SEA Ltd (SE US) is not an undiscovered gem, but it does appear to have plenty of more growth. The company that owns Shopee, the largest e-commerce platform in SE Asia and Taiwan, and Garena, a thriving online games developer and publisher. It also has Seamoney, a burgeoning digital payments and financial services provider in SE Asia. In Q2 revenue grew 159% to USD2.28bn, split fairly equally between games and e-commerce. EBITDA was almost flat at -USD24mn, with the USD741mn of EBITDA made by games being offset by losses in e-commerce and digital payments. However, gross merchandise value grew 88% y-o-y and payment volume grew 150%, indicating the loss-making ventures are scaling well.

The company just raised circa USD6bn, offering 11mn new ADRs at USD318 each and a USD2.5bn convertible bond. This is despite having already raised USD2.6bn of equity in December 2020 and having USD6.3bn in cash as at the end of the year with only USD2.1bn in debt.

The firm appears to have the growth of a much younger Tencent or Alibaba, and without the government oversight. While the SEA market cap is already USD179bn, it remains only 17% of the combined market cap of the two China giants.

Source: Bloomberg

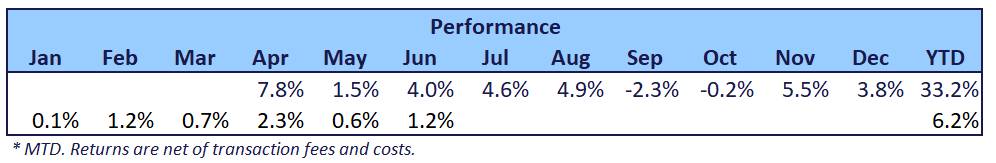

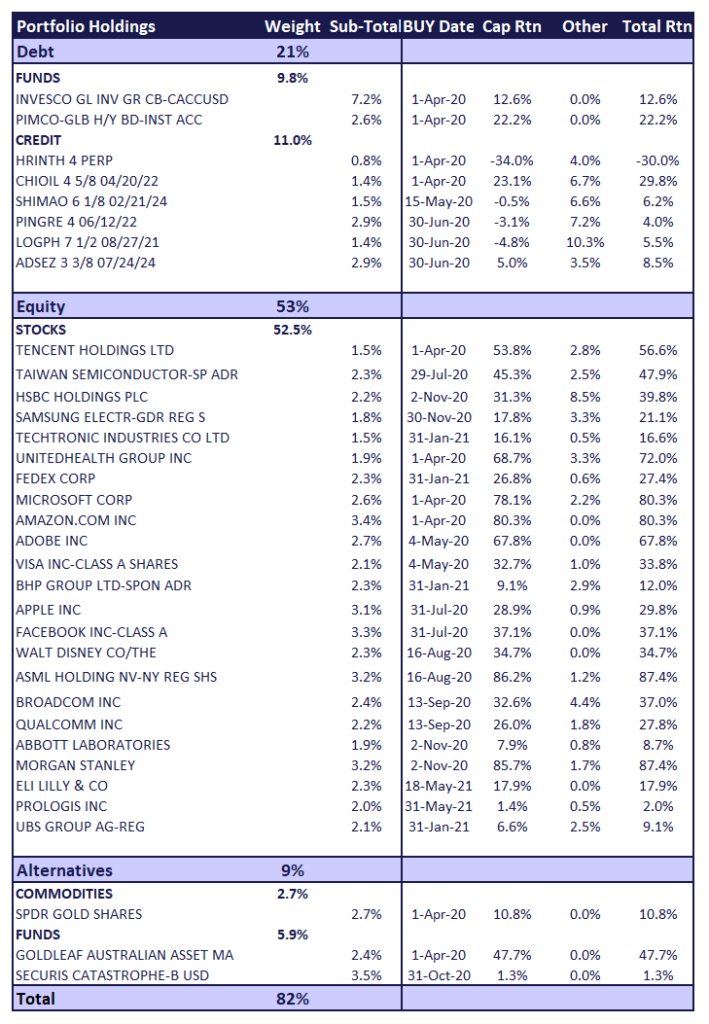

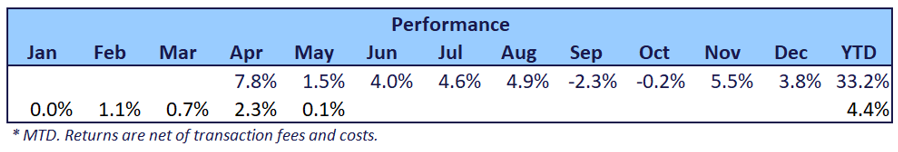

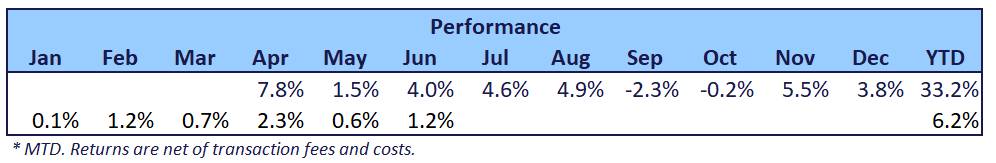

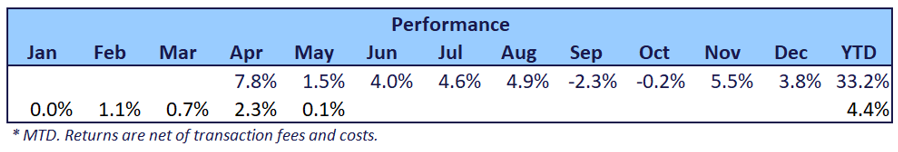

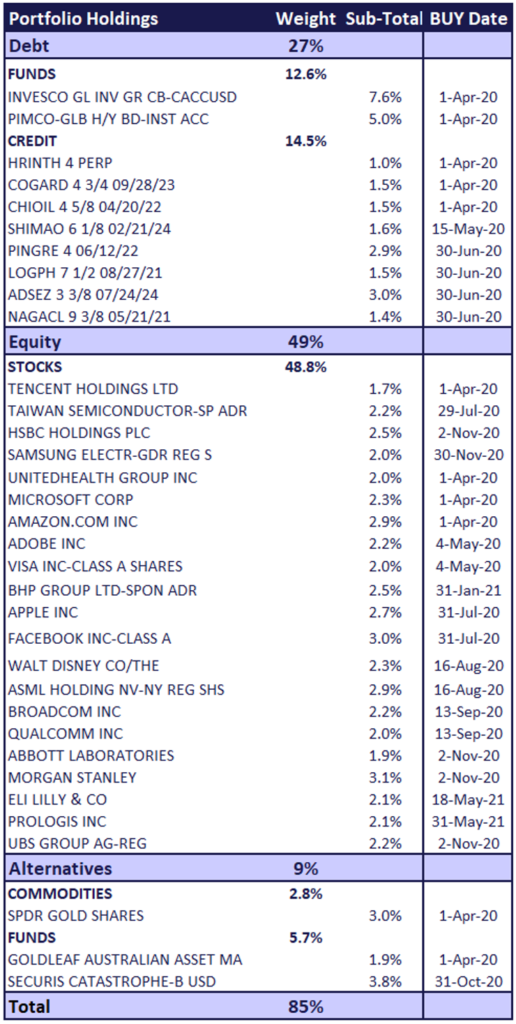

Odyssey Model Portfolio Performance

Please note that from next month the Odyssey Model Portfolio and the Horizon Portfolio performances will be replaced by the Odyssey Optimum Return Index which is a discretionary portfolio managed by Odyssey. The Model Portfolio was the precursor strategy to the Optimum Return Index.

If you like to receive more information on our portfolio solutions, please contact us here: info@odyssey-grp.com.

Aug 11, 2021 | Articles, Global Markets Update

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation. This advertisement has not been reviewed by the Monetary Authority of Singapore.

A Tale of Two Assets

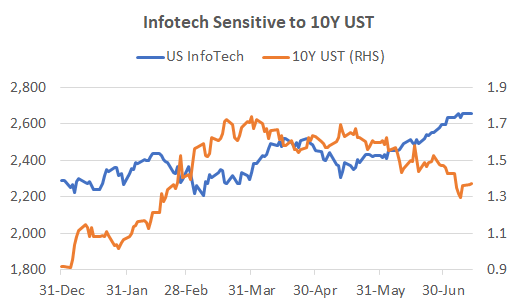

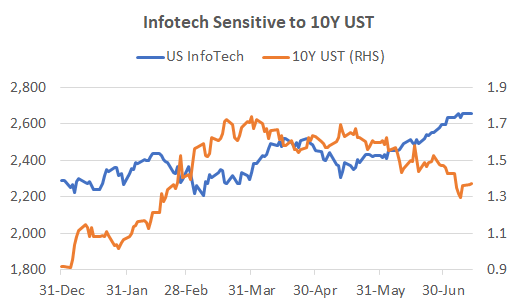

A major driver of the US equity market in recent months has been continuing decline in the yield of the 10Y UST. This has caught many by surprise, including us. Apparently, there are two forces at play. The first is the positioning of large players in the market that are concerned that if the Fed raises rates earlier rather than later, this will lead to a marked slow-down in economic growth. This positioning by some large players has forced traders who were short the bonds to unwind their trades, causing further downward pressure on yields. The second is the Fed’s own buying of treasury assets, providing an active buyer, exacerbating the downward pressure on yields.

Underwhelming economic data for June and July has fueled the slowdown fears. However, the risk for equity markets is that these two forces diminish or reverse in the next few months. There is an expectation for the Fed to start tapering in the Sep-Nov period and we have previously remarked that bond traders are usually positioned on the “long” side of the trade and a backup in yields can be quite sudden and dramatic as traders are forced to unwind positions. We are not rates experts but the risk reward appears to favour higher 10Y yields by the end of the year. The equity market appears to agree, with the US Bank sector up +6% since August 4, although this is not a particularly strong signal.

What does this mean for equity and credit markets? The credit market is easier. Long duration assets will likely again be hurt as they were in Q1 2021. The equity market is more difficult to fathom. On the positive side, a robust economy should drive top line growth and recovery plays but at the expense of rising costs, i.e. it will depend on the rate of real GDP growth. Should real economic growth exceed expectations, it could be enough to counter any rise in 10Y yields. Therefore, we remain neutral on the equity markets and would continue to avoid or minimize medium and long duration credit assets.

In equity we would maintain our core diversified portfolio and opportunistically add recovery plays as sentiment and economic data stabilizes. We would remain overweight the US, but diversify with some European and Asian stocks. The recent US July non-farm payrolls surprised to the upside with 943,000 and 261,000 people joined the workforce, edging up the participation rate. Further, the USD1tn infrastructure package has passed the senate and is likely to enacted. These should support future economic data. Another positive is the Q2 earnings season which has been strong for all three regions, but where Europe indices have reacted more favorably than the US, probably due to the higher proportion of “Value” stocks as well as higher recovery potential.

Source: JP Morgan

Asia Revisited

Last month we were a hesitant in recommending adding allocation to China equities, citing the difficulty in finding a compelling rationale. However, we did suggest China’s Healthcare and Materials sectors as verdant sectors to find longer-term investments in the volatile China markets. In the last month, MSCI China has fallen -5% and the Healthcare sector has recorded a similar fall, but the Materials sector has risen by +6%, an +11% outperformance.

While there’s no marked change to valuations or earnings outlook, there are some signs of price action stabilization. Bell-weathers Tencent and Alibaba seemed to have found some support at recent levels despite further rumblings about technology regulations. We have also seen sharp upward movements from a variety of stocks in traditional industries – from autos, glass makers, property developers and utilities. Even the much-maligned Zoomlion Heavy has had a +27% pop this month. This suggests there are active value hunters in this market. While we continue to struggle to find a rationale to significantly increase allocation and still prefer a structured method to play this market, those with some stomach for volatility may want to consider a toe-hold into quality names where the price has been beaten down.

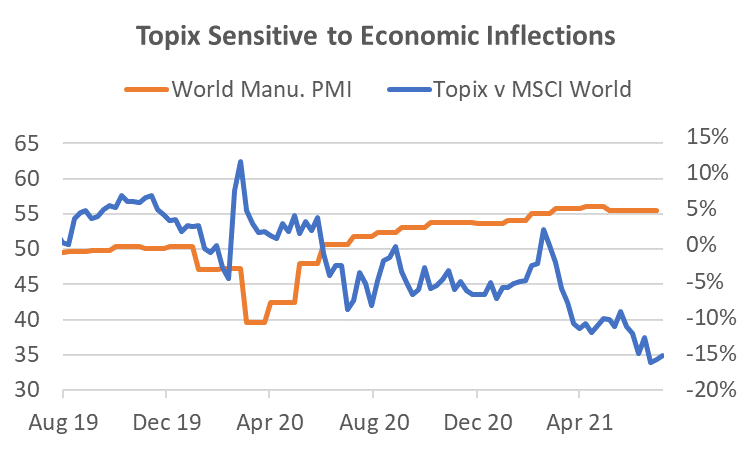

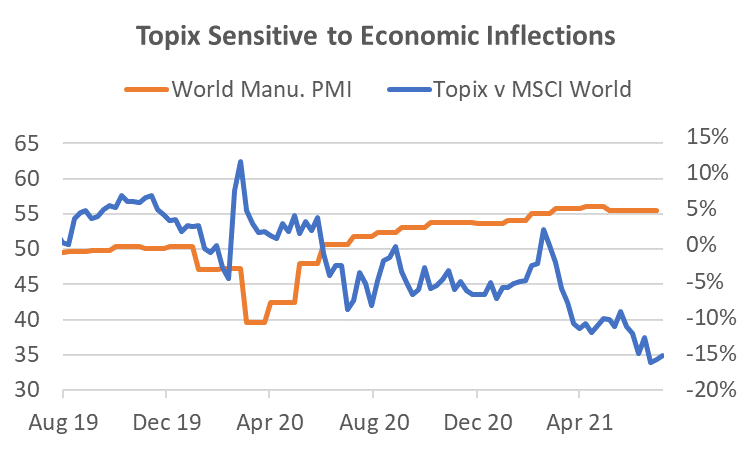

There are few equity markets as sensitive to the global economy as Japan. Although exports to GDP is similar to China at circa 18%, the largest stocks in the Topix are largely export oriented, whereas for China the largest stocks are domestically focused. In times of strong global economic growth, Japan can outperform global equity indices. Since mid-March, near the peak of the economic data, the Topix has underperformed MSCI World by -18%. Should the global economy gain steam in H2 2021, as is expected by many economists, Japan’s indices may well rebound. In addition, Japan’s valuations are cheaper in relation to China in absolute terms as well as relative to its own 10Y median valuation.

Source: Bloomberg

Investment Recommendations

Europe

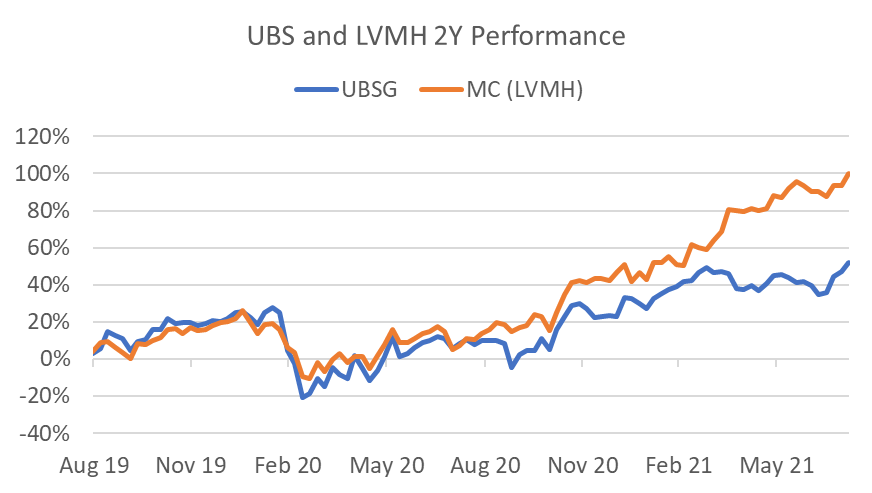

Two industries where European companies have an edge over other regions are wealth management, and luxury goods. Within these sectors, the undeniable leaders are UBS and LVMH. Because of the resilience of their businesses, their management acumen, and higher organic growth, they trade at a deserved premium.

In a world where the rich keep getting richer, UBS is well positioned. It is already the largest Private Bank in the world and the Bank’s focus on UHNW and Asia has seen it continue to outperform expectations. Together with strong abilities in FX and Equities, Q2 2021 Profit before Tax was 28% above consensus. The stock trades at a PER of only 8x 2021 and 0.9x tangible book value.

LVMH’s is the largest luxury goods company in the world and its pricing power is such that it has a policy of never discounting prices on its top brands such as Louis Vuitton. Last year was the first year the company reported negative revenue and EBITDA growth since 2009. Despite the fall in 2020, free cash flow was still EURD8.4bn, the highest on record. In 2021, the company has bounced back with Q2 organic sales growth of 14% above 2019 (not the depressed 2020) and H1 EBIT beat consensus by 15%. The consistently strong cash flow allows the company to cherry pick strong brands as they did with the Tiffany acquisition that was completed in January 2021.

Source: Bloomberg, Odyssey

Japan

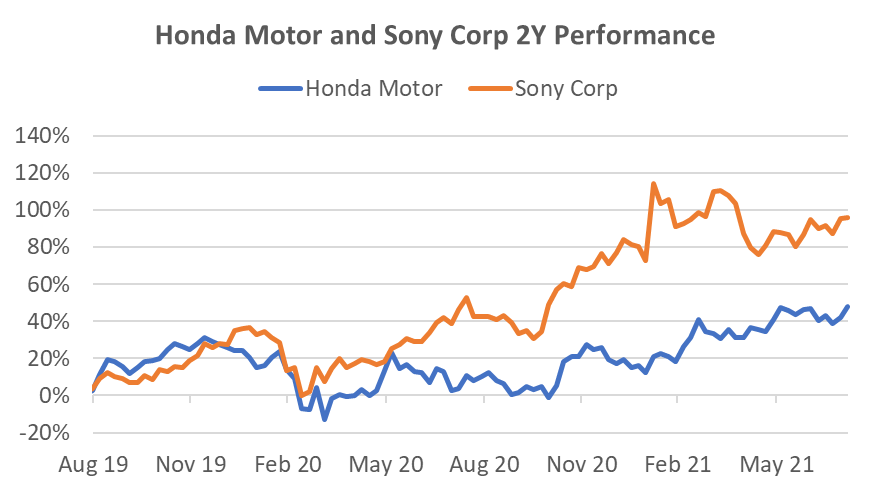

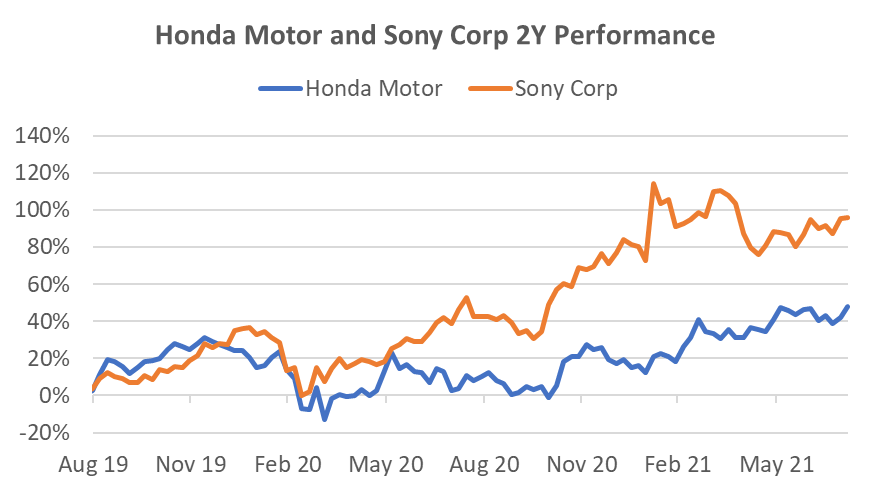

Japanese products remain in high demand for many sectors – gaming, robotics, consumer electronics, and autos to name just a few. Today, I want to touch on two sectors, autos and consumer electronics. Both have performed well but should also thrive with higher global economic growth.

In autos we like Honda Motor. We like the growth of its motorcycle business in Thailand, Vietnam and India but also because its motor car business has been gaining market share. Q1 operating profit released on 3 August was 2.5x consensus and the company raised full year guidance by 18%. This is expected to be achievable through a combination of strong sales and cost control (including lowering incentives in Norther America). The company has also announced a JPY70bn share buy-back scheme totaling circa 1% of approximately outstanding shares. Forward PER is just 8.7x with a 3.6% dividend.

Sony Corp provides exposure to several long-term themes we like such as gaming, entertainment content, semiconductors and electric vehicles. The entertainment giant reported a 15% increase in sales and a 26% rise in OP in Q1 through performances in Games and Network Services, Music, Pictures and Electronics Products and Solutions. In July, Sony announced it had sold 10 million Playstation 5 (PS5) modules. That’s the fastest to 10 million for any of the PS modules and 43% faster than the fastest selling Xbox from Microsoft. Historically, Sony tried to establish its own eco-system and platforms, but the firm has realized in recent years that it is primarily a provider of content and that to maximise profits, that content needs to be efficiently distributed across multiple platforms. For example, it now has distribution agreements with Netflix and Disney+ and has started converted some of its most popular game titles to other platforms.

Source: Bloomberg, Odyssey

Odyssey Model Portfolio Performance

If you like to receive more information on our portfolio solutions, please contact us here: info@odyssey-grp.com.

Jul 13, 2021 | Articles, Global Markets Update

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Short Term Drivers

The 13th of June marked the start of the Q2 reporting season and the announcement of June US CPI. Fedex’s Q4 reported in late June (May YE) and may augur what to expect – strong revenue recovery but with higher-than-expected cost pressures coming through. This may assist sectors where input costs are less relevant such as Tech. Speaking of Tech, anyone else surprised at the outperformance in recent weeks? The culprit lies in the 10Y UST where the yield has been falling until the last few days. The falling yield occurred in the face of higher-than-expected US CPI readings so the movement was a little baffling. We can only assume that the bond market saw rising inflation as a transitory phenomenon, but we felt the bond market was becoming complacent. Indeed, in the days prior to the June CPI announcement yields on the 5Y and 10Y UST began to back up as the market started to realise that inflation may be higher and stickier than they thought. The 5.4% y-o-y CPI print was higher than the 4.9% consensus and in total the 10Y yield had risen 10bp in 3 days. While this may not be a large move in the scheme of things, I suspect, at least in the short term that we may not be able to rely on UST yields to support the Tech sector and it may even provide a headwind depending on whether the backup in yields has legs.

Source: Bloomberg

The Banks have exactly the opposite problem as Tech. Falling interest rates has been the cause of some weakness in Bank shares. They can also be vulnerable to cost pressures, and revenue growth may be more laboured compared to Tech. The only thing these two sectors have in common is that they are both towards the top of historical valuations so they both need to perform to maintain their elevated levels. Early indications from JP Morgan and Goldman Sachs results suggest the market the market has high expectations as share prices were soft following strong top and bottom-line beats for both banks. Investors are becoming more critical as cost pressures rise and easy trading gains have diminished.

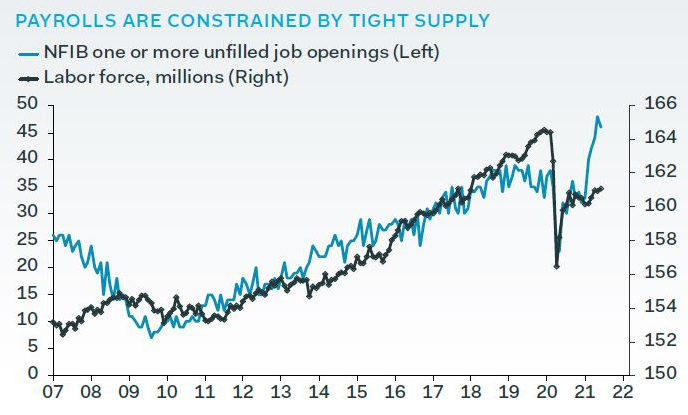

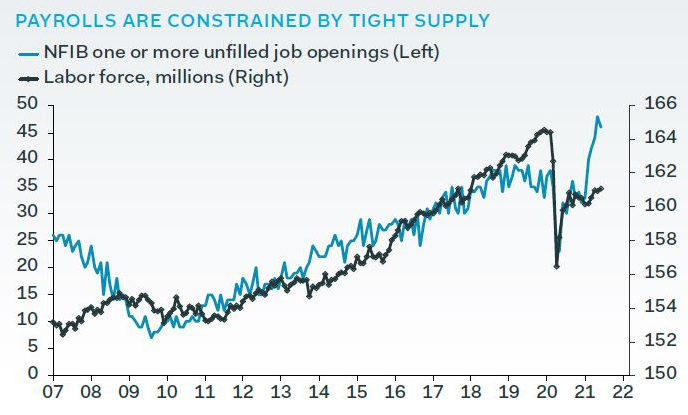

While we are in the transitory inflation camp, the strength and duration of this bout of inflation may be higher and longer than the market expects. The consensus view has been that chain supply shortages will ameliorate as global businesses recover with less interruptions, and labour shortages will also dissipate once the COVID benefits cease in Q3 2021. This assumes there has been no structural change in either of these facets, but these assumptions may not be entirely correct, given the severe interruption to both global businesses and the labour market.

Source: Pantheon Macroeconomics

What About Asia?

It has been profitable to be long the US equity market with the S&P500 up +16% YTD, however, MSCI Europe is not far behind with a 14% rise. Asia ex-Japan has been the black sheep, up just +4%, and only +3% including Japan in USD terms. While Europe’s economy has faced difficulties in its recovery, investor’s switch to Value sectors in 2021 such as Financials and Industrials that comprise 30% of the Index has been of great assistance. These sectors only comprise 19% for the S&P500. Given that the consensus is for a strong global recovery in H2 2021, supported by climbing vaccination rates, Europe may continue to perform.

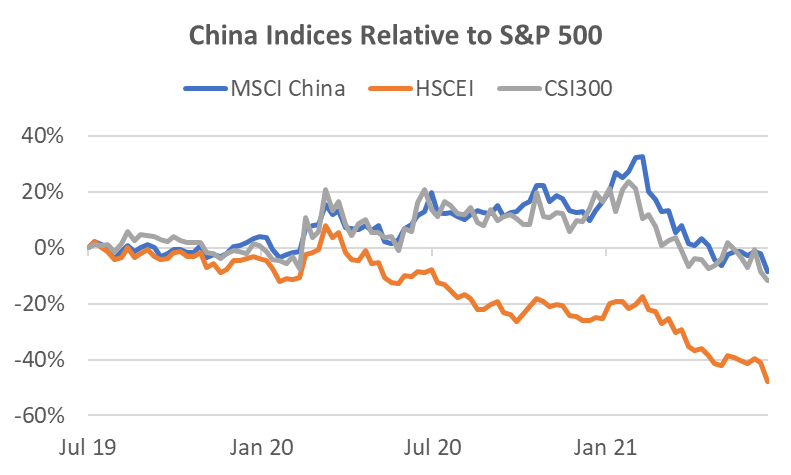

That leaves the question of Asia. While China was the first economy to recover from COVID and Japan was a major beneficiary of the early optimism for recovery in world trade, both have since languished.

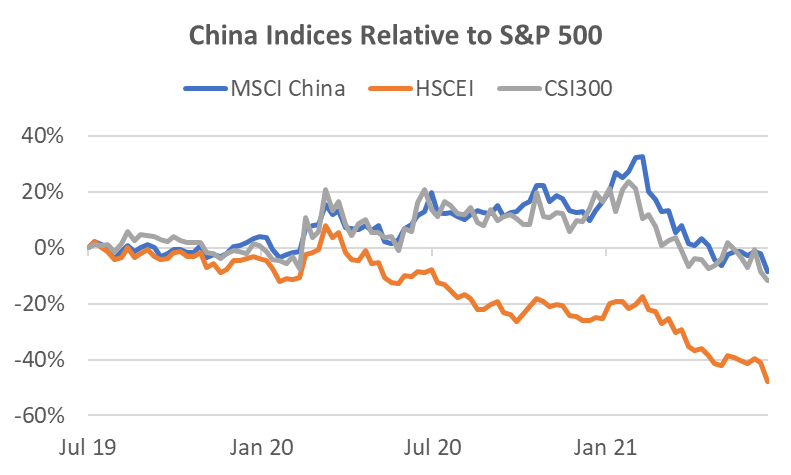

A primary reason for the performance of Asia ex-Japan has been China. No matter which index you look at, the performance has been poor – from the +2% performance of the CSI300 to the -6% of the HSCEI that is heavily influenced by offshore investors. Even MSCI China is down -3%. At least the MSCI China Index is 17% above the pre-COVID high and the CSI300 is 22% above, but the HSCEI is -11% below that level.

.

Source: Bloomberg

There are several reasons for the performance. On the macro side, China is constrained in stimulating its economy due to the already high credit to GDP figure that has more than doubled to 290% since 2008. The figure had largely stabilised at 260% between 2016-2019, but shot up again in response to government stimulation since COVID. With the moderation in fiscal stimulus in 2021, growth has also moderated. However, on July 7th, the China government announced it will lower the reserve ratio (RRR) held by banks from the current 12.5% to stimulate further lending. Recent data must be causing the government some concern. This will be the first decline in the RRR since March 2020 and will continue the decline of the RRR since its peak in 2011 of 21.5%. Response from the market since the announcement so far has been muted, but historically China investors have been sensitive to inflections in liquidity. Should there be more concrete signs of a loosening bias, it may result in a rebound in cyclical sectors as well as large cap stocks that have declined significantly.

A major cause of the malaise in China indices has been the double whammy on the two largest sectors in the indices – financials and information technology. For the HSCEI these two sectors account for a massive 63% of the Index. The China banks have been lampooned by investors for having to perform national service in supporting the economic recovery and thus bringing into question the quality of their balance sheets. This also has knock-on effects on their margins and profitability. The second factor, and possibly the more egregious in the eyes of investors is the government clamp-down on what it terms as undesirable practices in the technology sector. In recent memory, technology companies have been the shining light for China equity, but now government regulation has added tremendous uncertainty in this sector. From online shopping to ride hail to online education, it is difficult to discern a concrete policy. Little wonder prices of online technology shares continue to be under pressure.

The good news is that the current policy push will not last forever and the impact on most companies is likely to be minor. Tencent has had many penalties and warnings over the years that has done little to stop its growth momentum. Alibaba’s recent USD2.8bn fine for abusing market dominance hardly makes a dent in its USD73bn hoard of cash. Most importantly, the battle for global technology competitiveness is a major priority for the China government so it has no intention of suppressing innovation, but the booming industry has far outstripped the government’s ability to adequately monitor and regulate, hence we are seeing a rushed piecemeal approach. The bad news is that the lack of policy structure means it is difficult to forecast how long the policy push will last and whether we’ve seen the worst of the news. To add salt to the wound, the Tech sector has been used as a political tool in the battle for economic domination between the US and China, causing greater uncertainty, particularly among the China firms listed in the US.

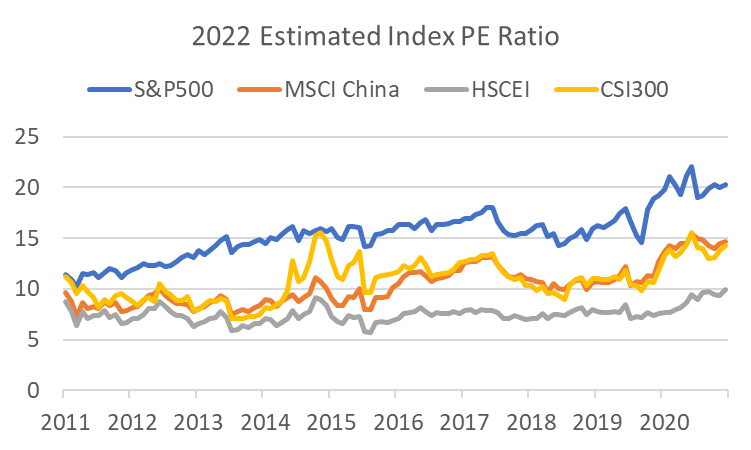

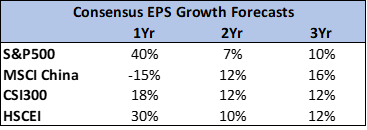

Is China Cheap?

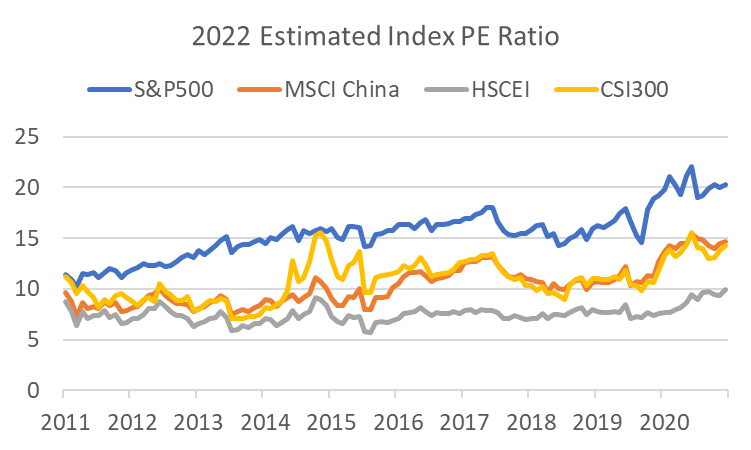

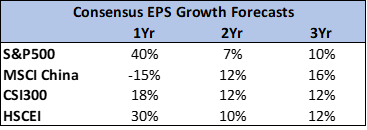

The case is ambiguous. In absolute terms the indices are not cheap, being close to their highest PE ratio level in the last 10 years. Relative to the US you could make the case the China Indices are not far off the largest gap to the US, particularly in the case of the HSCEI. While the situation certainly bears watching, it does not appear yet a compelling story; 1) China indices tend to overshoot on both sides, and 2) earnings growth relative to the US is not currently compelling.

Source: Bloomberg

Source: Bloomberg

Without clear earnings momentum or a valuation argument it is difficult to have a more positive recommendation on China allocation. The only real positive we can point to is the announced fall in the RRR but whether that heralds a real change in sentiment may depend on any further stimulus measures. However, there are sectors that have positive sentiment that we’ll touch on in the following section, and some China bell-weathers do appear to be trading around (and some slightly through) technical support levels. Whether the latter will bounce back is difficult to discern but perhaps a mix of stocks with positive sentiment and mega caps around their support levels may be logical strategy. That said, China stocks are more volatile than those in the US and should be treated as such.

Investment Recommendations

China Sectors with Positive Sentiment

Source: Bloomberg

When investing in China stocks, we look for two primary attributes; 1) a structural tailwind, and 2) positive or at least neutral sentiment. As a proxy to a structural tailwind long-term returns provides an indication, in this case over the last 5 years. The YTD returns provide a proxy for current sentiment. These two filters indicate Healthcare and Materials are potential sectors of interest.

Healthcare

Healthcare is not a sector for value investors. The three largest stocks in this sector have consensus forward PE ratios of 186x for Wuxi Biologics (H), 66x for Shenzhen Mindray (A), and 50x for Jiangsu Hengrui Med (A). Rounding out the top 10 is a stock we’ve previously held in the Model portfolio, CSPC Pharmaceutical, which we bought at a modest 17x valuation, however, all stocks in this sector can be very volatile and can exhibit significant price drawdowns before recovering and exceeding previous highs. Valuations can fluctuate wildly along with the high growth expectations, but because of the structural tailwind the sector has performed well over time.

It’s not coincidental that Wuxi and Mindray are on high valuations. The outsourcing of drug design and manufacturing that benefits Wuxi has resulted in revenue growing by 4.6x in the last 5 years and EBITDA by 6x. Revenue in 2020 grew by 41% and backlog grew by 122% to USD11.3bn. Nevertheless, this robust growth rate appears priced into the shares and perhaps buying on a significant dip may be the way to play this stock. One potential source of risk yet to play a factor is the high US exposure. Should the US-Sino relationship deteriorate to a level that may potentially involve the Wuxi business, this may provide an entry point. North America and China comprise the largest customer base and both account for at 44% of revenue each, not to mention also having three manufacturing facilities in the US.

Mindray is also in an area that has a structural tailwind – global medical equipment manufacture and distribution, specifically equipment involved with life information and support, diagnosis, and imaging. It is the largest medical device company in China and one of the top 50 globally. The company is expecting 20+% growth for the top and bottom-line in 2021 despite already delivering close to 30% growth in both in 2020. Management explained that only 5 out of 25 core products benefitted from COVID-related demand in 2020 while 20 the remaining products were dragged by the pandemic and are recovering. In 2021, 53% of the revenue came from China with only 8% from the US. While valuations remain high relative to other sectors, within the medical device sub-sector the valuation does not appear misplaced. Even in the US medical device companies often trade at double the market multiple due to the favourable industry growth dynamics. Further, medical devices would be less vulnerable to government regulation than drugs.

Source: Bloomberg

What about the CSPC Pharmaceutical Group (H)? This is closer to being a traditional pharmaceutical company. Top and bottom-line growth has not dipped since 2011 when the firm suffered for being more a generic vitamin and antibiotics company. It has since transformed via acquisitions into a more sophisticated and innovative drug company in cardiovascular diseases and oncology with a strong pipeline of products. Interestingly, the stock has fallen 15% since its recent high 4 weeks ago due to pressure by the Chinese government to ensure new oncology drugs are innovative. The increasing scrutiny hit all drug related stocks and CSPC was by no means the worst affected. At 18x 2021 earnings, it would be one of the cheaper pharmaceutical stocks in the sector with a respectable future growth profile. For Q1 2021 revenue grew 10% and net profit grew 27% y-o-y.

Materials

This sector has a mix of exposures, both domestic and global. The moderation in China’s economy has meant that companies that have exposure to the economy and with products that are priced locally such as cement have not fared well. Whether the recent cut in the RRR will help to stimulate the cement price or volume is yet to be seen, but given the recent 30-50% declines in the share price of large cement producers, it certainly bears watching. However, companies that have internationally priced products such as copper and aluminium as well as those with structural demand in providing materials for electric vehicle (EV) batteries have performed well.

Given the consensus positive view on the global economy for H2 2021 as well as the recent indication that China appears to be trying to re-stimulate its economy, copper exposures are of interest. Zijin Mining Group (H) is the largest component of the Materials Index at 10% and is particularly interesting because while the largest profit contributor in 2020 was copper (and growing), the second largest profit generator was gold which may also provide an inflation play. While Zijin provides an interesting diversification play, it is not the cheapest copper play or the most sensitive to the copper price. JP Morgan calculates that Zijin’s earnings increase about 6% for every 5% move in the copper price. For investors wanting greater sensitivity, JPM advocates MMG (1208.HK) that has 83% exposure to copper and where 2021 earnings will move about 18% for every 5% copper price move and is on 7x 2021 EV/EBITDA relative to Zijin’s 15x, although both stocks are rated “Overweight”. MMG’s market cap is one tenth the size of Zijin’s USD40bn.

Source: Bloomberg

Tencent and Alibaba

Tencent has fallen -27% from its January peak and Alibaba (9988.HK) has fallen -33% from its October 2020 peak. Prospective consensus PE at 22x is the lowest BABA has traded since the stock listed in 2014. While the sentiment is slightly better for Tencent, it is also trading close to the bottom of its valuation range of 28-40x prospective PER at 31x. While valuations appear interesting of themselves, there are also structured methods to play this exposure.

One method is via a fixed coupon note (FCN) containing Tencent and 9988. This instrument will pay the investor a high coupon for the period with the risk that if at the end of the period the price of either share is below the strike, say 15% below the current price, the investor will receive shares at the end of that period in the worst performing share at the strike price. Essentially the investor is willing to accept the coupon in exchange for the potential that the note will be swapped into the shares of the worst performing stock of the two stocks at the strike price. If the price of both shares is above the strike price at the end of the period, the investor simply collects the coupon and the capital is returned, i.e. the investor does not receive any shares. Pricing is subject to change but currently, you can receive a note as per below.

Source: Vontobel, Odyssey

The presence of a KO Barrier means that if at any time after the first month the share price of both stocks is above the original price, the note can be called by the bank and you will receive whatever coupon has accrued prior to the call. Having the call increases the coupon, but it can be removed for a lower coupon.

Of course, there are many iterations – whether you just want exposure to 1 stock, a different strike price or a different tenor. If you are interested in such a pay-off profile, please enquire with your advisor. Investors should be aware that you can lose capital investing in an FCN and should be fully aware of the risks before proceeding.

Odyssey Model Portfolio Performance

Please note there was a technical issue in May that produced an inaccurate return for that month in the previous monthly update.

If you like to receive more information on our portfolio solutions, please contact us here: info@odyssey-grp.com.

Jun 10, 2021 | Articles, Global Markets Update

For Accredited Investors Only as defined in the Monetary Authority of Singapore Securities and Futures Act (Cap. 289) and its subsidiary legislation. For Professional Investors Only as defined in the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) and its subsidiary legislation. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Playing the Long Game

Since the beginning of the year, we have been mildly cautious in our commentary. The equity market appeared to be getting ahead of itself with rapid economic recovery widely anticipated. While the economy has been largely robust, the real economy is a little like the equity market, there are mini-cycles within the larger cycles. With strong economic data in Q1 2021, particularly in the US, it was not a surprise to see some cooling for April and May data. This may persist for a few months before the economy again gathers steam. There is likely to be too much easy money floating around for spending to simply stagnate for a protracted period.

Apart from the various stimulus programs around the world, we have also mentioned previously about the USD2+tn of additional savings in the US since the start of the COVID. However, these pale in comparison to the wealth created by the stock market. The MSCI World Index has gained 23% since the pre-COVID peak. That’s USD10.7tn of wealth creation, equating to 13% of world GDP. This wealth would have far greater impact if it was evenly spread, nevertheless, it should still greatly boost consumer spending power. The gains of the relatively wealthy may also pressure the redistribution of wealth as we are seeing with President Biden’s capital gains tax proposals that would ultimately benefit more broad-based spending.

The other factor is economic re-opening. With governments in Singapore, Hong Kong, and Australia clamping down on travel and social distancing restrictions in recent weeks, it may be easy to lose sight that the largest centres of COVID infections have witnessed dramatic falls in infection rates. US new cases are now below 10,000 per day. Just five months ago they were peaking at over 300,000 per day. That’s a 97% drop in numbers. Already, more than half of adult Americans are fully vaccinated and 62% have had at least one shot. In India, the infection rate remains high and the efficacy of detection remains debatable, however, reported new cases are now less than a quarter of where they were at the beginning of May. Some variant of COVID is likely to be around for years, but as the world steadily becomes vaccinated, it is likely to be a case where we learn to live with virus rather than the current stop-start to full reopening.

Source: BBC News

If It’s Not Broken…

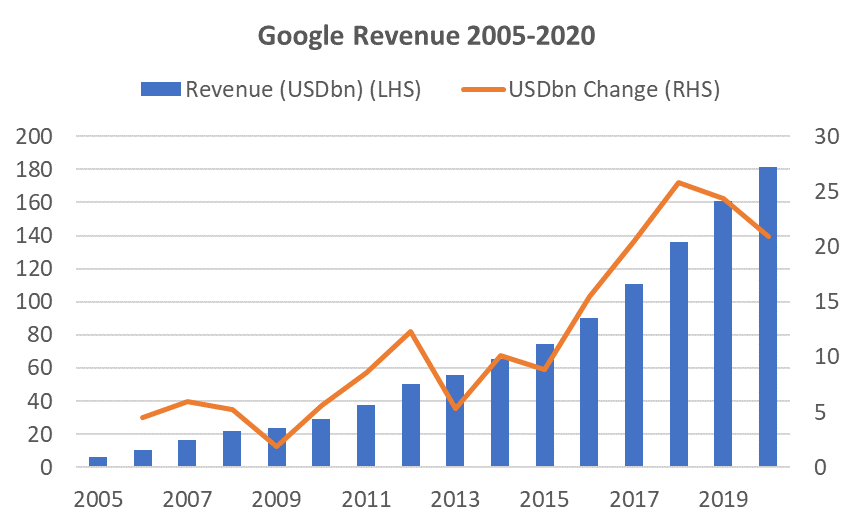

In recent years Growth stocks have clearly outperformed Value stocks. Indeed, from April 2020 to the end of 2020 (post-COVID sell-off), the MSCI World Growth Total Return Index outperformed MSCI Value by 22%. However, YTD to the end of May, Value is up 17% and has outperformed Growth by 10%. With the prospect of continued economic re-opening and the potential for regulatory headwinds for certain mega tech stocks we expect a diversified portfolio may continue to outperform a growth portfolio over the Northern summer. For example, recent discussions between the G7 on a 15% Global corporate tax rate could provide a headwind for mega tech stocks such as Google, Apple, and Facebook to name just a few until the issue is finally resolved. Considering the complexity of the issue, this may drag on for some time. In the meantime, these companies have a structural and operating tailwind so price performance will likely hinge on which contains the greater surprise factor.

The clear outperformance of Growth over Value is a relatively recent phenomenon. Even during the Dotcom boom, Growth did not really stand out in terms of performance until 1999, the final year of the bubble. During the 2003-2007 bull market, the MSCI World Value Total Return Index outperformed the Growth Index by 9%. In fact, after both the 2001/2002 recession and the 2008 GFC, Value clearly outperformed Growth in the year following the market trough. The difference during COVID was the government-imposed restrictions on travel and social distancing which favoured products and services that enabled online access. It appears as though equity investor views are now also “normalising”.

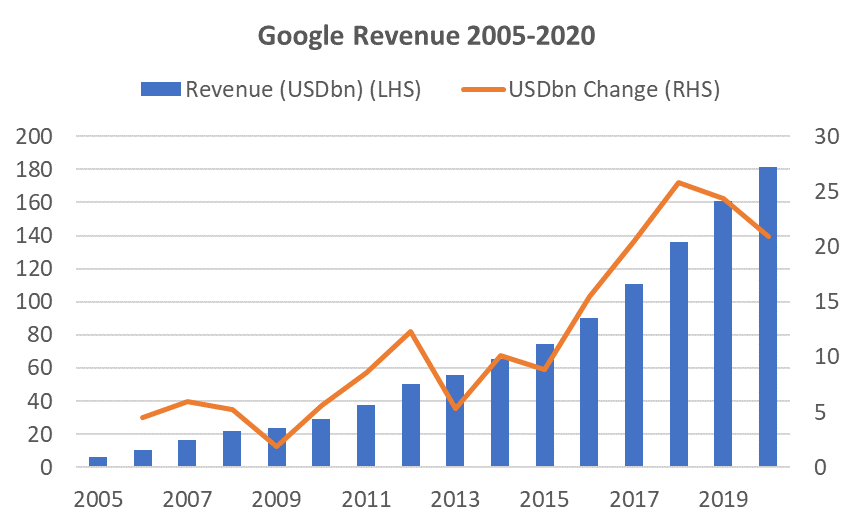

The clear outperformance of Growth over Value started to occur at the beginning of 2017. One could argue about the reason behind the performance. Was it the flattening of the US yield curve as the short end rose that occurred at almost the same as the start of the outperformance of Growth? Market theory and strategists may suggest this was the cause and they are probably at least partly correct, but I prefer a more mundane business reason such as demand for tech products beginning to accelerate. Tech companies have been the big driver of Growth Indices. Google used to provide search query statistics and we could have used that as a proxy for the growth of online products and services but they stopped providing that information in 2013. However, we can still use Google’s/Alphabet’s revenues as a guide. By 2017, Google was already reporting USD110bn in annual revenue, hence percentage growth may not provide an accurate gauge of industry growth, but when we look at absolute growth we can see there is indeed a jump from 2015 to 2018. There is a tripling in revenue growth in absolute terms. Facebook’s revenues show a similar acceleration in absolute dollars over this period. This indicates a large step-up in the amount of money being spent for online services.

Source: Statista.com

In 2020, certain tech companies like Zoom specifically benefitted from COVID and had massive growth rates from a low level, however, it was not yet obvious that this would be followed by a structural surge in spending on tech companies. This required the mega-caps to show an acceleration in growth. Google’s revenue growth both percentage change and absolute terms had been falling since 2018, but in Q1 2021, revenue growth was a huge 34%, or USD14bn in just one quarter. This is the largest percentage change for a quarter on a y-o-y basis since Q4 2012 and the largest gain in dollar terms for the company ever. It indicates that spending on technology services (in this case advertising) was coming back and notably far stronger than it was previously. This is supported by robust results from Facebook, Snap, and others that largely depended on advertising.

The percentage growth rates appear unsustainable for the mega-caps, and indeed, consensus forecasts for subsequent quarters are more subdued, but as to the question as to whether there has been another acceleration in revenue spent on the sector to justify a large increase in tech share prices, the answer is “yes”. Whether the quantum of the share price increases is justified is a more difficult question, and because it appears more difficult, the market may take some time to digest this conundrum which, together with the regulatory uncertainty, could see tech stocks, and hence Growth Indices, range-bound in the interim.

Investment Recommendations

Progress on Laggards

In recent months we have been tilting recommendations towards laggard stocks, those that are currently out of favour. Because of this, sometimes investors need to be patient. Other times, the wait may be a short one as we have seen with Eli Lilly (LLY), a name we suggested last month. If you recall, mixed results on their drug for Alzheimer’s saw the stock drop significantly. Nevertheless, we mentioned that the drug, based on data to date, appeared to be as effective, if not superior, to Biogen’s Aduhelm. Well, Aduhelm, somewhat unexpectedly, received FDA approval on June 4 and the stock rocketed as much as 50% before settling 40% higher. LLY, having a 5x larger market cap, settled 9% higher on the news. Overall, it’s been a 12% pop since our recommendation which is a nice little win on a mega-cap in an uninspired market. Among other “event-driven” trades we also highlighted the Cruise-liners two months ago. Royal Caribbean is expected to resume US cruises on June 26th. This stock and Norwegian Cruise Lines, which are expected to start US cruises in July, are up a little from our recommendation but have yet to break out of the trading range that a sentiment change would likely precipitate.

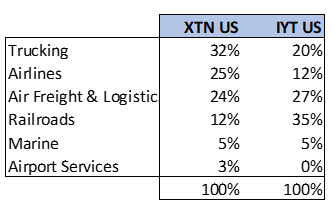

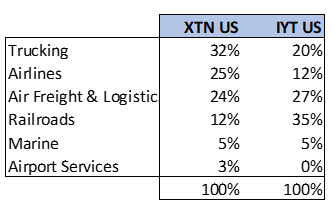

US Transport – a Mix of Tailwind and Recovery Potential

This sector is intriguing. There is a mixed bag of firms that i) benefitted from COVID such as UPS, logistics company Expeditors International, and road transporter JB Hunt, ii) some that were mildly negatively impacted such as FedEx and rail transport, and iii) others where operations were decimated such as the airlines. The latter is one of the few subsectors where share prices remain significantly below pre-COVID levels. Even the major US hotel chains are trading above pre-COVID levels despite 60-65% occupancy rates. Meanwhile, airline bookings for the week of June 4-10 are 83% as high as those taken over the same period in 2019. American Airlines recently mentioned that their load factor in May was 84% and that they were seeing yields at or above 90%. We don’t want to make too much of a continuing difficult time for airlines but obviously, the trends are currently improving.

There are two liquid ETFs that cover the US transport sector, IYT, and XTN. Both have their unique features, particularly XTN which is equal-weighted with 41 positions whereas IYT is concentrated with only 20 positions. Curiously, despite their differences, their performances have been similar for the last 5 years.

Transport ETF Subsector Exposure

Chart: Performance of Transport ETFs and JETS US (predominantly US airlines ETF)

Source: Bloomberg

Logical to Like Logistics

There are also 2 stocks we like in the Transport sector. One is FedEx (FDX) that we have highlighted in February’s Insight after the stock price slipped despite a robust operating performance. The company is expected to announce Q4 earnings on June 24 (May YE). The other is a stock called XPO Logistics (XPO) which is benefitting from the secular tailwinds from growth in e-commerce. It has a diversified business with approximately 60% in transportation and 40% in logistics. The geographic split between the US and European exposure is similarly 60:40. Revenue has grown from just USD7.6bn in 2015 when the company was still loss-making to a consensus USD19.3bn in revenue and USD676mn in estimated profit for 2021. Since 2015 YE the share price has risen by 440%. In December 2020 the company also announced that it intends to spin-off the logistics business in H2 2021 that may result in a positive re-rating of the combined business.

When speaking of logistics, it’s difficult not to mention, Prologis (PLD), a REIT that focuses on logistics facilities and is the largest industrial real estate company in the world. A combination of robust growth prospects, high occupancy (95%), and strong pricing is likely to produce compelling NAV and cash flow growth over the medium and long term. PLD estimates that e-commerce consumes 3x more space than brick and mortar retailers because transport costs account for 50% of supply chain spend, which places pressure on the need for warehouses near population centres. While there is a risk that the stock is already well-discovered and well-held, the fundamentals provide a strong case for ownership. A smaller logistics REIT that has a domestic US focus is Duke Realty (DRE). It is only one-fifth the market cap of PLD. Both provide an expected dividend yield of circa 2% for 2021. Back in March we noted the strong recovery of REITs as an asset class and postulated there still may be further upside.

Odyssey Model Portfolio Performance

Note: Due to a technical issue, we are not able to provide returns for the securities in the Model portfolio for this month.

If you like to receive more information on our portfolio solutions, please contact us here: info@odyssey-grp.com.