Jul 9, 2020 | Articles, Global Markets Update

Market View

Wild Horses

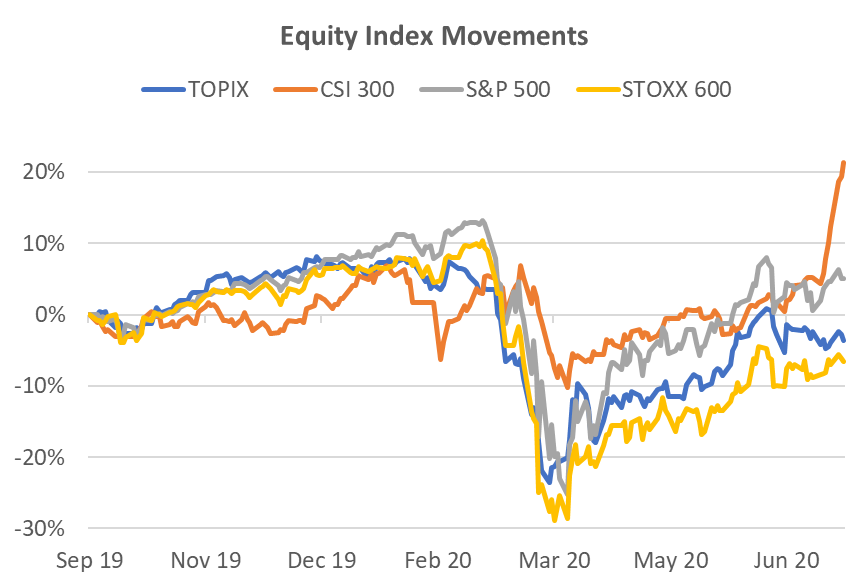

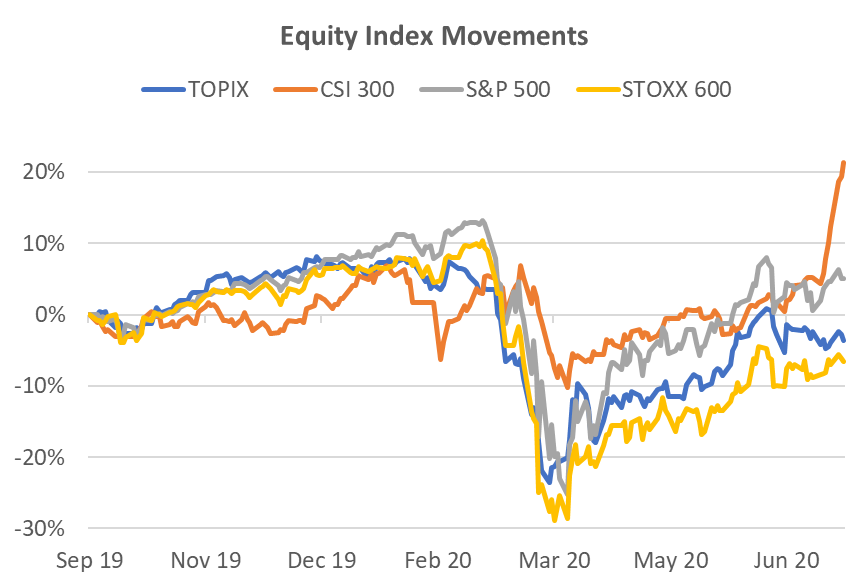

In June, risk markets defied rapidly rising new COVID cases in the US and powered higher. Admittedly, the 1.8% rise in the S&P 500 was primarily driven by a 7% rise in the Information Technology and a 5% rise in Consumer Discretionary sectors. Commodity markets also took an optimistic view, choosing to focus on the loosening of restrictions rather than the continuing rise in new COVID cases that reached over 200,000 per day. This seems to be affirmation of two beliefs; 1) China’s recovery was gaining traction, and 2) the bet that 2nd wave cases would not result in the wholesale global return of mobility restrictions. This led to WTI oil and copper prices to surge 11% and 12% respectively. Equity markets and currencies that had significant commodity exposure rose accordingly. The once popular economic indicator, the Baltic Dry Index, shot up 260%, mainly on the back of increased iron ore shipments to China.

Source: Bloomberg

Indeed, China’s improved industrial production, industrial profits and retail sales numbers for May provided a sense of economic stability. When the positive PMI figures were released at the end of June, indicating an improving trend, China’s equity markets initiated one of its infamous “ears pinned back” rallies. Just one week into July, the CSI 300 has jumped 14% and the MSCI China Index has scrambled to keep up with a 9% surge. While the economic data provided a supportive backdrop, it has been the media drive by the government for people to invest in the equity market that is likely to have had a material impact to the speed of the rise. This is reminiscent of the 2015 boom bust where the CSI 300 doubled in just two months but then gave back 80% of the climb in the subsequent two months. The whole up and down move was largely due to government encouragement and then cessation of the media campaign. Hopefully, experience will temper the market enthusiasm this time.

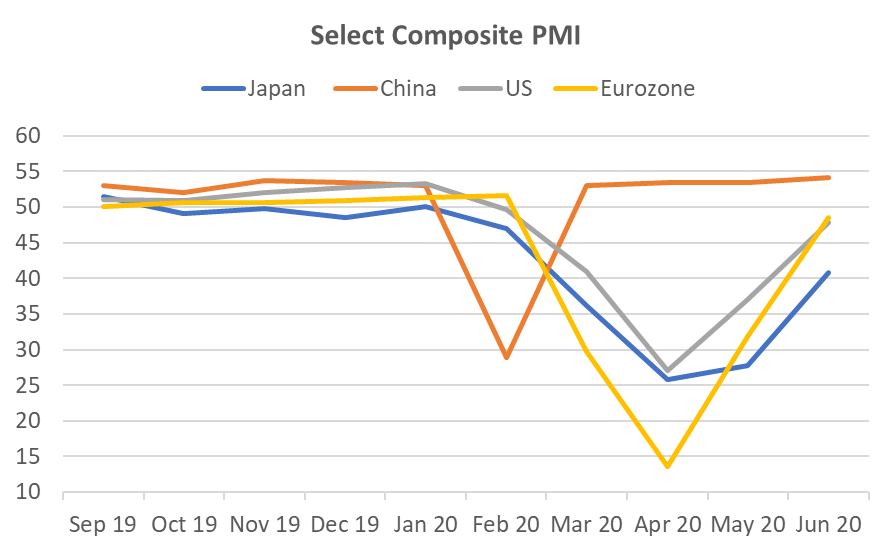

Tail of 4 Markets

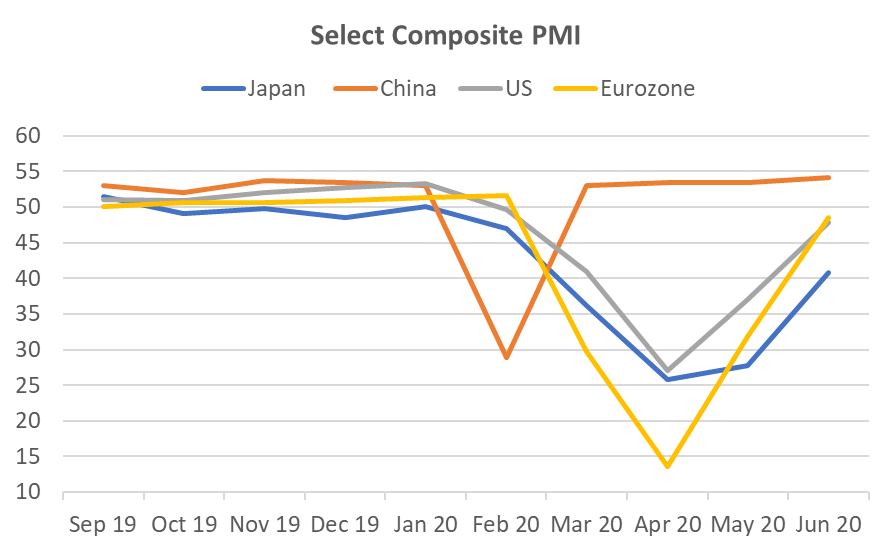

The reliability of China’s economic data has been in question since the 1990’s. If we assume it’s a reasonable representation, based on simple PMI comparisons it could be argued that China’s equity market performance should, indeed, be ahead of other major markets. China only suffered one dramatic month’s dip in PMI before heading back to growth again. Other major regions have suffered 3-4 months of below 50 readings. China’s equity market did not fall dramatically until markets in other regions began to plummet. This occurred when you could argue China’s economy was already stabilising.

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

The other point worth noting is that both the best performing indices, CSI 300 and S&P 500, have less exposure to offshore revenue than either the Topix or the Stoxx 600 that have more than 60% of revenue from offshore. The means any stimulus is likely to be more efficient for the companies in the China and US indices.

Laggards Still Lagging

The market likes what it likes. Currently that does not include banks and industrial stocks, globally. These sectors tend to be more exposed to lockdown restrictions that have been slower than expected to unwind. In a related statistic, in June, US Growth stocks rose 4.1% while Value stocks fell 1% to continue a well-worn path for the last 10 years with the rise and rise of tech stocks. The eventual recovery of the laggards probably heralds the final phase of the equity market dislocation.

This laggard theme also extends in a smaller scale to the credit markets where Asia corporate bonds remain 230bp wide of US corporate bonds. However, Asian bond credit spreads are steadily grinding tighter against their US counterparts, making it an easier choice than exposures to nominally cheap but unloved stocks.

Source: Bloomberg

Source: Bloomberg

If you like to receive more information on our portfolios solutions, please contact us here: info@odysseycapital-group.com

Jun 15, 2020 | Articles, Global Markets Update

Welcome to the May issue of Odyssey’s Lex Capitis, Odyssey Corporate Advisory’s publication that highlights capital and financial markets developments and its potential implications for you and your business.

Odyssey Corporate Advisory is an independent boutique consultant providing business advisory, investment consultancy, and capital markets project management and coordination services catered for your circumstances and preferences.

It would be an understatement to say that the social unrest in 2019, trade war and Covid-19 presents a challenge for businesses. As we approach the mid-2020, businesses that are considering listing in Hong Kong might find it difficult to meet eligibility requirements unless special dispensation is given by the regulators. So what sort of Hong Kong IPOs should investors expect?

Download the full article here.

Lex Capitis is Odyssey Corporate Advisory’s periodical that highlights capital and financial markets developments and its potential implications for you and your business.

Odyssey Corporate Advisory is an independent boutique consultant providing business advisory, investment consultancy, and capital markets project management and coordination services catered for your circumstances and preferences. Corporate Advisory is a division of Odyssey Asset Management Ltd, a Type 1, 4 and 9 SFC licensed Hong Kong company and subsidiary of the Odyssey Group.

Kuan Yu Oh

Managing Director, Co-Head of Corporate Advisory

Mobile: +852 6971-7989

Email: kuanyu.oh@odysseycapital-group.com

Notice

This publication is for informational purposes only and does not address the circumstances of any particular individual or entity. It does not constitute financial advice and should not be used as such. You should seek a duly licensed professional for financial advice. For more information about please see our Disclaimer.

Jun 10, 2020 | Articles, Global Markets Update

Market View – The Old Normal

Our caution last month proved to be unfounded. The power of the unprecedented stimulus, zero interest rates and the prospect of loosening of lockdown restrictions won the battle against extreme lows in economic activity and the prospect of worst economic data to come. As a result, the World MSCI Index is up 14% since mid-April, and up a whopping 43% since the March trough. The Index now sits at only 6% below the pre-COVID peak. Virtually all risk assets moved up in tandem, including credit. Even oil staged a big rally, rising to USD38 per barrel. The confirmation that the market hadn’t lost all sense occurred last Friday when US unemployment fell to 13.3%, a 1.4% decline from the April figure. This was a particularly large positive shock since some commentators were fearing a number closer to 20%. The other shoe has yet to fall, and those that are waiting, may be in for a long wait. Last week the US interest rate curve steepened 15-25bp for 5-10Y.

Despite market movements, the world is not yet back to normal. The trend in new COVID infections globally is actually still rising. However, the regions that concern the financial markets, namely US and Europe, there the trend is falling, even if the fall is stubbornly slow. Significant restrictions still apply in most countries. The daily new cases in the US still number approximately 19,000, a large quantum.

Source: JHU CSSE

Act 4 in a 5 Act Play

We are now in the 4th Act of the expected 5 Act COVID play for equity markets. The Acts can be characterised as:

Act 1: 3rd week of February. Stocks and other risk assets begin to sell off indiscriminately. The culmination of the first Act was the implementation of the lockdown and social distancing that resulted in the market trough on the 23rd of March.

Act 2: Last week of March. The market realized that there were beneficiaries to the austere policies and we witnessed share prices for online businesses start to surge.

Act 3: 1st week of April. Interest swung to quality businesses that were not beneficiaries of the policies but were partly resistant to the situation and would survive largely intact.

Act 4: Mid-May. The 2nd week of May was when Europe began to loosen lockdown restrictions. By mid-May investors started to support stocks that were heavily affected by COVID policies but were likely to survive as long as the end of the policies remained highly visible. This includes the Banks and Industrial sectors.

Act 5: 3rd – 4th week June? Equity markets to recover their previous peak? Currently, the MSCI World Index is 6% below the pre-COVID peak.

While we have yet to see how Act 5 develops, or whether there is a surprise Act 6 or 7, we find it incredible that it may be possible that in just 4 short months that the equity markets could have plummeted as well as recovered during a time when we are witnessing some of the worst economic data the world has seen since the Great Depression. Indeed, the Global Credit Index (USD corporate bonds) is already up 2% YTD.

Room Left in Laggard Play

While much of the low hanging fruit was picked last week in terms of the under-performing Banks and Industrials, we believe there is still value in the laggard play. Value has been beating Growth in recent weeks, and while this may be a temporary blip to the 10-year Growth out-performance, participating in trend reversals can add meaningfully to performance.

We note that Banks remain 27% below the S&P 500’s peak on the 19th February, compared to Consumer Discretionary, Information Technology, and Healthcare, the sectors that have already regained their previous peaks. Because we are mid-cycle in the laggard recovery, we expect there to be some volatility, but as the global economy slowly climbs out of lockdown, we expect the laggard plays to continue to play catch-up. In Industrials, travel related stocks such as airlines and cruise ships, surged last week. This is likely to remain a highly volatile sub-sector but and may represent a highly sensitive play to the loosening of lockdown restrictions.

Figure 2: Performance of S&P 500 Sectors Since pre-COVID Peak Source: Bloomberg

If you like to receive more information on our portfolios solutions, please contact us here: info@odysseycapital-group.com

May 15, 2020 | Articles, Global Markets Update

Lex Capitis Odyssey Corporate Advisory’s periodical that highlights capital and financial markets developments and its potential implications for you and your business.

Odyssey Corporate Advisory is an independent boutique consultant providing business advisory, investment consultancy, project management and coordination services for companies that intend to access the Hong Kong capital markets.

Searching for Diamonds in the Rough

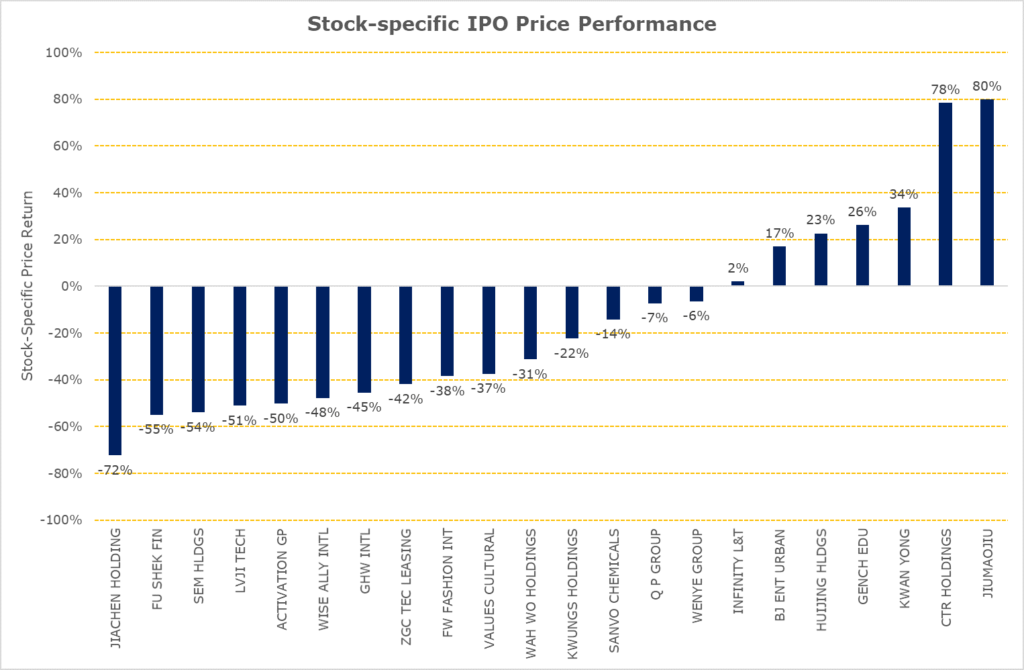

Source: Bloomberg, Odyssey Capital

Summary:

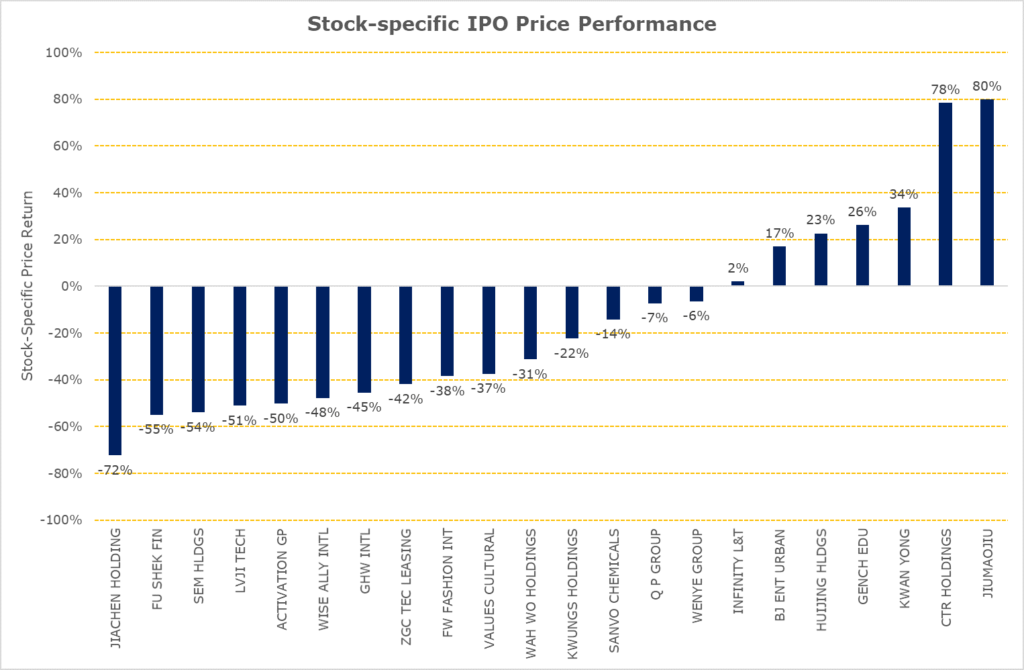

- IPOs of Singapore and Malaysia companies during the two months of 2020 have outperformed the market;

- The price-performance of IPOs with cornerstone investors, on average, performed better than IPOs that did not have cornerstone investors during this period. However, stock-specific factors in each IPO were the key determinant in price performance;

- Size matters, on average, during this period as IPO with a market capitalisation that is greater than HK$1 billion performed, on average, better than IPOs market capitalisation less than HK$500 million. However, stock-specific factors in each IPO drove the disparity in price performance.

IPOs during January and February 2020

During the first two months of 2020, 24 companies listed on the Stock Exchange of Hong Kong. 22 companies were listed on the Main Board and two companies on GEM. There was no one particular industry that dominated, with companies ranging from the construction to television industries. Four IPOs (Wenye Group, Wah Wo Holdings, Jiachen Holdings and China Hongguang Holdings) were undersubscribed in their placing offer and one IPO (HuiJing Holdings) was undersubscribed on the public offer.

| Geography |

Board of listing |

No. of IPOs |

Average returns of IPOs |

Average returns of IPOs adjusted by HSSI returns |

| China |

Main Board |

17 |

-27% |

-19% |

| Hong Kong |

Main Board |

3 |

-38% |

-31% |

| Macau |

Main Board |

1 |

-57% |

-54% |

| Singapore |

Main Board |

2 |

43% |

56% |

| Malaysia |

Main Board |

1 |

-6% |

2% |

|

|

|

|

|

| China |

GEM |

2 |

-37% |

-30% |

Figure 1: Average IPO returns

Source: Bloomberg

Given the current market environment, we examined the stock-specific returns from their IPO date to 29 April 2020 by adjusting each IPO’s price-performance by the price return of the Hang Seng Composite Small Cap Index (“HSSI”). The HSSI is the appropriate market proxy because the IPO market capitalisation of the companies during this period ranged HK$500 million to HK$10,140 million which is within the scope of HSSI’s constituents market capitalisation. Contrary to an earlier media report about the unattractiveness of South-East Asian companies listing in Hong Kong, investors would, on average, have benefitted from investing Malaysian and Singaporean companies that IPO during this period.

Time to Listing

| Longest application days |

345 |

| Average application days |

198 |

| Shortest application days |

119 |

Figure 2: Timing from application to allotment of Shares

Source: Odyssey Capital

There was no change in the time required for the listing process, the average time from submission of the IPO application until the allotment of shares took more than six months, i.e. it required at least one renewal of the IPO application. The IPO that took the longest was almost a year whilst the shortest took just under four months. There was no discernible difference in the time required between main board applications and GEM board applications.

Size Matters?

| Stock Code |

Name |

IPO Market Capitalisation (HKD Millions) |

IPO returns adjusted by HSSI returns |

| 09968.HK |

HUIJING HLDGS |

10,140 |

23% |

| 09922.HK |

JIUMAOJIU |

9,131 |

80% |

| 01745.HK |

LVJI TECH |

2,990 |

-51% |

| 01525.HK |

GENCH EDU |

2,511 |

26% |

| 03718.HK |

BJ ENT URBAN |

2,484 |

17% |

| 09919.HK |

ACTIVATION GP |

1,616 |

-50% |

| Average Stock-specific IPO Price Performance (Market Capitalisation greater than HK$1,000 million) |

7% |

Figure 3: Large IPOs

Source: Bloomberg

| Stock Code |

Name |

IPO Market Capitalisation (HKD Millions) |

IPO returns adjusted by HSSI returns |

| 02528.HK |

FW FASHION INT |

800 |

-38% |

| 01802.HK |

WENYE GROUP |

630 |

-6% |

| 01412.HK |

Q P GROUP |

628 |

-7% |

| 01442.HK |

INFINITY L&T |

620 |

2% |

| 00301.HK |

SANVO CHEMICALS |

556 |

-14% |

| 01937.HK |

JIACHEN HOLDING |

530 |

-72% |

| 09998.HK |

KWAN YONG |

520 |

34% |

| 01740.HK |

VALUES CULTURAL |

519 |

-37% |

| 01925.HK |

KWUNGS HOLDINGS |

518 |

-22% |

| 09933.HK |

GHW INTL |

510 |

-45% |

| 01601.HK |

ZGC TEC LEASING |

507 |

-42% |

| 01416.HK |

CTR HOLDINGS |

504 |

78% |

| 02263.HK |

FU SHEK FIN |

500 |

-55% |

| 09929.HK |

SEM HLDGS |

500 |

-54% |

| 09918.HK |

WISE ALLY INTL |

500 |

-48% |

| 09938.HK |

WAH WO HOLDINGS |

500 |

-31% |

| 08500.HK |

ICONCULTURE |

250 |

-48% |

| 08646.HK |

CHINA HONGGUANG |

231 |

-13% |

| Average Stock-specific IPO Price Performance (Market Capitalisation less than HK$1,000 million) |

-23% |

Figure 4: Small IPOs

Source: Bloomberg

Although on average, IPOs with a market capitalisation greater than HK$1,000 million performed better than IPOs with a market capitalisation less than HK$1,000 million, there was a wide disparity in price-performance between IPOs. Compared to LVJI Technology Holdings and Activation Group Holdings, 12 small IPOs had smaller negative returns. CTR Holdings and Kwan Yong Holdings had better returns compared to Huijing Holdings which was the largest IPO for the period.

Odyssey Corporate Advisory is a boutique corporate advisor providing independent and impartial investment and capital markets consulting services catered for your circumstances and preferences. Corporate Advisory is a division of Odyssey Asset Management Ltd, a Type 1, 4 and 9 SFC licensed company and subsidiary of the Odyssey Group. If you have any enquiries, please contact:

Kuan Yu Oh

Managing Director, Co-Head of Corporate Advisory

Mobile: +852 6971-7989

Email: kuanyu.oh@odysseycapital-group.com

Notice

This publication is for informational purposes only and does not address the circumstances of any particular individual or entity. It does not constitute financial advice and should not be used as such. You should seek a duly licensed professional for financial advice. For more information about please see our Disclaimer.

May 13, 2020 | Articles, Global Markets Update

Market View

The equity markets have been buoyant for the last 6 weeks. Global virus cases have peaked and many countries have started a tentative process of loosening lockdown restrictions. To assist the recovery, G20 countries have announced a stimulus program that is equivalent to 9.3% of combined GDP, notably supported by close to zero interest rates. This level of stimulus is unprecedented.

On the other hand, we have almost total cessation of activity in very large swathes of the global economy, particularly in the service industries that constitute 65%-75% of GDP for Europe and the US. This sector employs a similar level of the workforce. US unemployment has already reached 14.7% with a 2% lower participation rate. Unemployment rates in the US and Europe are expected to peak in Q2 with significant recovery by year end. Whether the current valuations of the equity market are justified depends on the speed at which lockdown measures are removed and how rapidly the global economy normalizes.

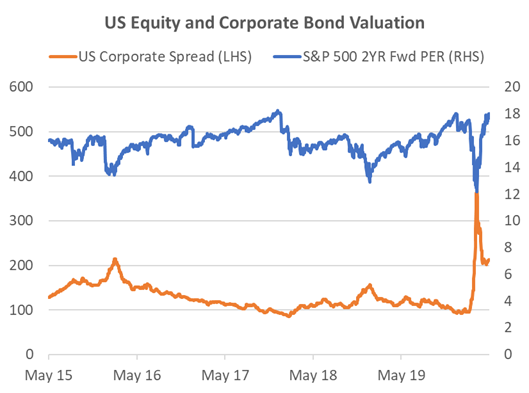

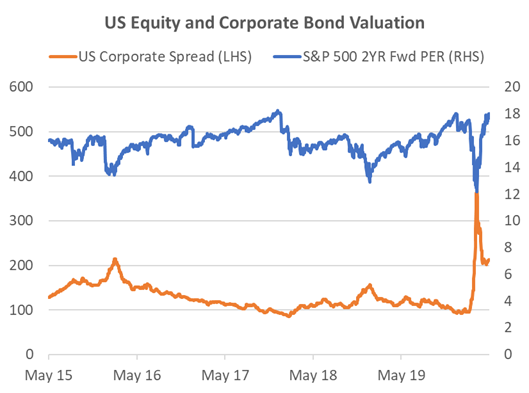

In the last three recessions, it has taken an average of approximately 4 years for earnings per share and the unemployment rate to reach the previous peak. This is clearly not what the market is expecting with the huge stimulus in place. The 2021 estimated PER for the S&P 500 is close to 18x, approximating the highest level for the last 5 years and a level that hasn’t been breached since the Dotcom boom, twenty years ago.

Muddying the situation is that famous brands that are weathering the lockdown well are at all-time high two year forward PERs. We all know of the usual suspects that have benefited from the lockdowns such as Netflix and other online businesses, as well as pharmaceutical companies share that have skyrocketed due to their work on a vaccine. However, some of the largest consumer discretionary companies that have been negatively affected by the virus, but are expected to bounce back strongly, are also at highly elevated valuations. This is in contrast to those businesses seen as the most vulnerable to the virus where valuations have plummeted. Unlike previous deep recessions, the high-quality businesses you want to own for the long term never really became cheap. As Warren Buffet recently lamented “we don’t see anything attractive to do”.

We have entered the statistically weaker May-Oct period for equity markets. So far, sentiment has been buoyant due to prospect of lockdown restrictions loosening. The market is like a prisoner getting excited at the prospect of getting out of jail. However, once we are out, reality will set in and the hard slog of getting back into a normal life begins. There will be times when we wonder why we were so excited, and for many, finding a job in the real world will be very difficult for some time.

The US market bounce from the bottom has been rapid. From its March 23 trough, the S&P 500 has taken just 26 days to regain 60% of its previous peak after the 34% fall. Following the 2008 GFC, it took 373 days to reach this level of recovery. Perhaps, this is a tough comparison since the market fell 57%. The closest in terms of peak to trough fall and the speed of the fall was the 1987 Crash when the market fell 33% in the space of days, but then it took 469 days to recover 60%. The fastest recovery before the current situation is the 1990-91 recession. Here, the peak to trough was only 20%, but the 60% recovery was reached in 111 days. The market appears to be expecting that the huge stimulus package, zero interest rates, and the fact that this recession was caused by government actions specific to the Coronavirus and therefore, can be undone by the reversal of those policies, to be the game changers.

Figure 1: Market Crash Comparison Source: Bloomberg, Odyssey Capital

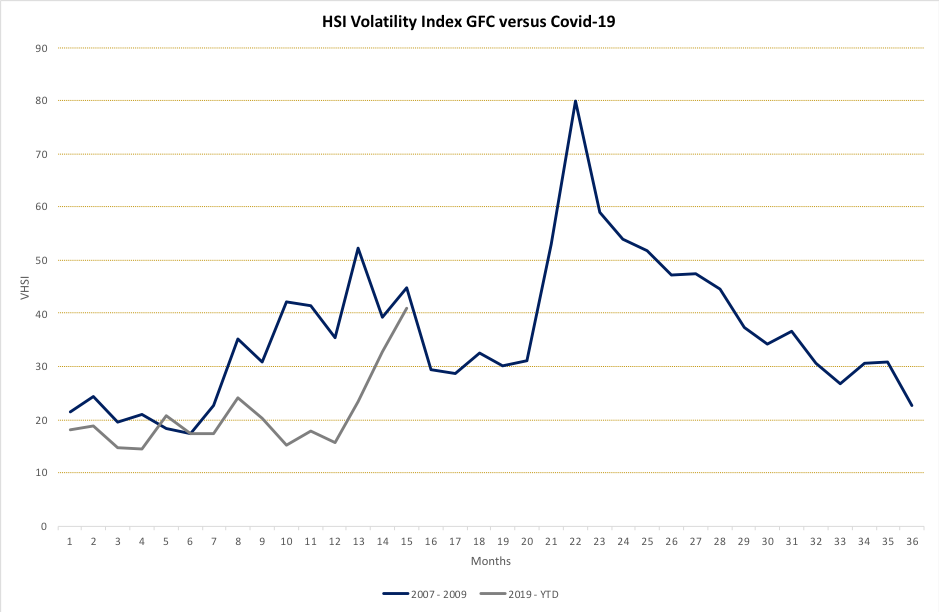

Where is the Value?

The speed of the equity bounce was a surprise. What should not have been a surprise was the transient nature of the huge spike in equity volatility, the level of which rivalled the GFC. That was an excellent time to be short equity volatility in structured products where you were overly compensated for risk. Now that the volatility opportunity has faded, what are the current opportunities?

On a relative basis, valuations for Asian and European equity indices are close to their nadir relative to the US. While European equities show the same symptoms as the US market where resilient quality businesses are priced very expensively, the same characteristic does not appear as prevalent in Asia. For the latter there are still quite a few quality businesses we’d like to own for the long term on historically modest valuations.

By asset class we still prefer fixed income. While the US investment grade indices are already back to where they were at the beginning of the year, BBB spreads remain close to 100bp wider. US high yield (HY) is still trading at a wide credit spread of 720bp, implying a 5yr default rate of approximately 50%. Since the majority of US HY bonds are issued by listed companies, what does it say about the equity value of those companies? What many equity investors may forget is that there is contractual obligation for a company to repay that bond and the interest, and if they do not pay, bondholders can force a liquidation of the company. In such a case, equity holders rank last to receive money, if there is any left. Often, there is not. This payment ranking system is the reason why in a crisis situation corporate credit generally outperforms equity by a wide margin. However, in the last couple of weeks, equity has roared ahead while bond spreads have remained stagnant. This suggests there is a disparity between the corporate risks that bondholders perceive, particularly for high yield, and those that equity holders perceive.

Figure 2: US Equity and Corporate Bond Valuation Source: Bloomberg, Odyssey Capital

In alternatives we also note that some managers are creating new funds to take advantage of the current dislocation in markets, particularly in the private credit space. These provide significant interest. However, we remain a little cautious of ongoing vehicles that have yet to mark down their investments to account for the current business environment. Private investment valuations often show little correlation to the public markets. The only time that changes is when the real economy is affected significantly. Then the correlation is very high, even though it is revealed on a lagged basis.

If you like to receive more information on our portfolios solutions, please contact us here: info@odysseycapital-group.com

Apr 15, 2020 | Articles, Global Markets Update

Welcome to the inaugural issue of Odyssey’s Capital Pulse, Odyssey Corporate Advisory’s quarterly publication that focuses on major capital and financial markets events that occurred during the quarter and its potential implications for you and your business.

Odyssey Corporate Advisory is an independent boutique consultant providing business advisory, investment consultancy, project management and coordination services for companies that intends to access the Hong Kong capital markets.

It has been a busy quarter for the Hong Kong capital markets despite most major economies in the world implementing national border closures and movement restrictions due to COVID-19.

In this inaugural issue we have highlighted interesting regulatory developments from a primary market perspective and our financial market expectations from a secondary market perspective.

Download a copy of CAPITAL PULSE here.

SEARCHING FOR THE LIGHT AT THE END OF THE TUNNEL

For six months ended 31 March 2020, there were 212 applications for listing on the Hong Kong Stock Exchange compared to 255 applications in 2019 and 243 in 2018 based on their first posting date. However, since January 2020, application for listing activity has slowed markedly with only 57 new applications for the first quarter, which is almost a 50% decline in new applications compared to the same quarter in 2018 and 2019. There were 33 approval-in-principle outstanding with 28 approval-in-principle granted during the quarter. 69 applications lapsed but 38 applicants renewed their listing applications representing a 55% renewal rate. Four applications were withdrawn and 139 applications remain in the pipeline.

During the quarter, 40 new companies listed on the stock exchange and two companies were transferred from the Hong Kong GEM Board to the main board under the grandfathering arrangements. This compares to 38 companies in 2019 and 36 companies in 2018 for the same quarter. However, funds raised were significantly lower averaging HK$349 million per IPO which was approximately 40% lower than 2019 and 50% lower than 2018.

Given that measures to contain Covid-19 only started during the quarter, it appears that the slowdown in fund raising activity was well underway since mid-late 2019 given the time required for the raising equity capital, if not for Alibaba’s secondary listing on and Budweiser APAC IPO. Unfortunately, the slowdown is expected to continue given lower market valuations even though it has been reported in the media of an expected mega-IPO by the end of this year. Unlike traders where day-to-day market fluctuations matters, equity capital raising require significantly amount more time making current market conditions less relevant for companies planning such an undertaking.

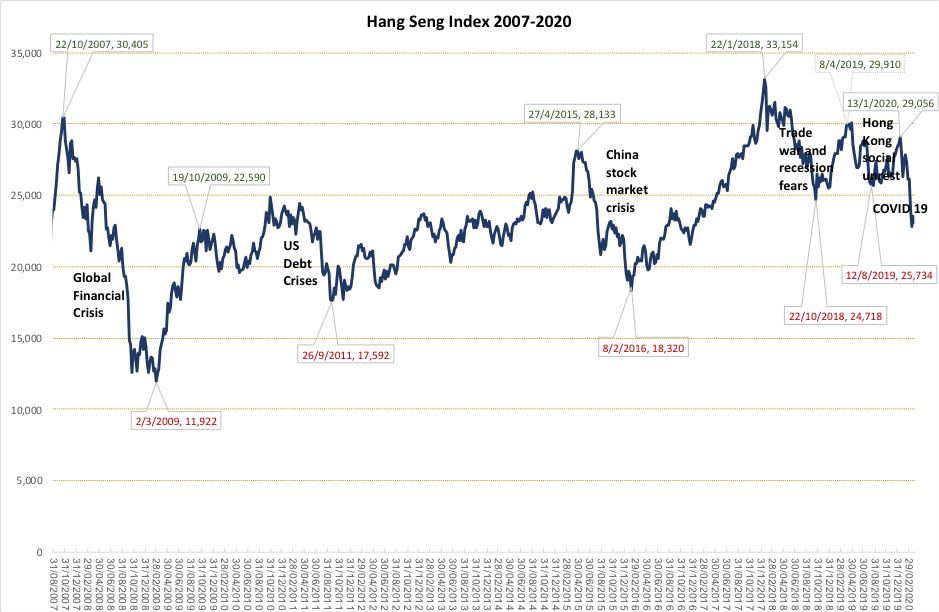

THE MORE THINGS CHANGE, THE MORE THEY STAY THE SAME

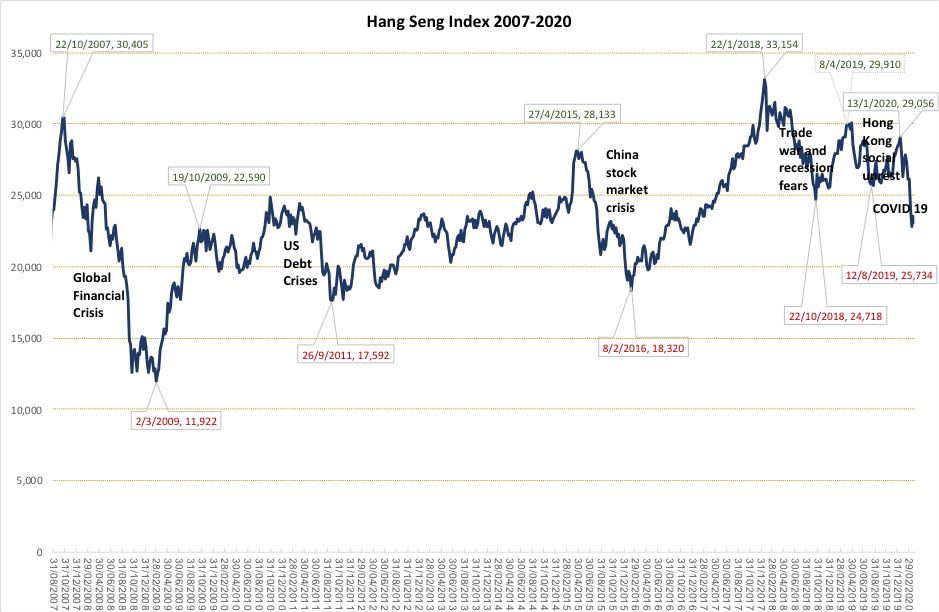

Every market crisis may have a different root cause, but the market reaction to each crisis may not be so dissimilar. Even in the post GFC a low interest rate environment, we still witness the classic decade long cycle between major financial crisis. Although we have experienced average weekly swings in the Hang Seng Index (“HSI”) of over 800 points per week since the beginning of the year, it would come as no surprise that there will be more volatile markets in the foreseeable future.

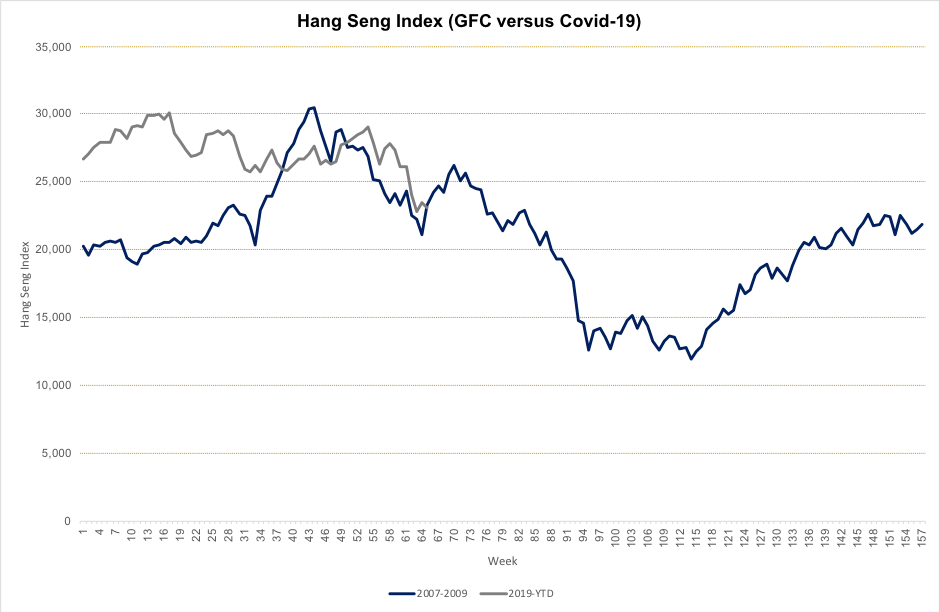

Figure 1: Hang Seng Index (Weekly)

Apart from the GFC when the HSI fell almost 20,000 points over 16 months, the last significant correction was in 2015-2016 during the China stock market crisis when the HSI fell 10,000 points over 9 months. However the long-term picture indicates that we are now experiencing the somewhat overdue major correction in this decade long market cycle.

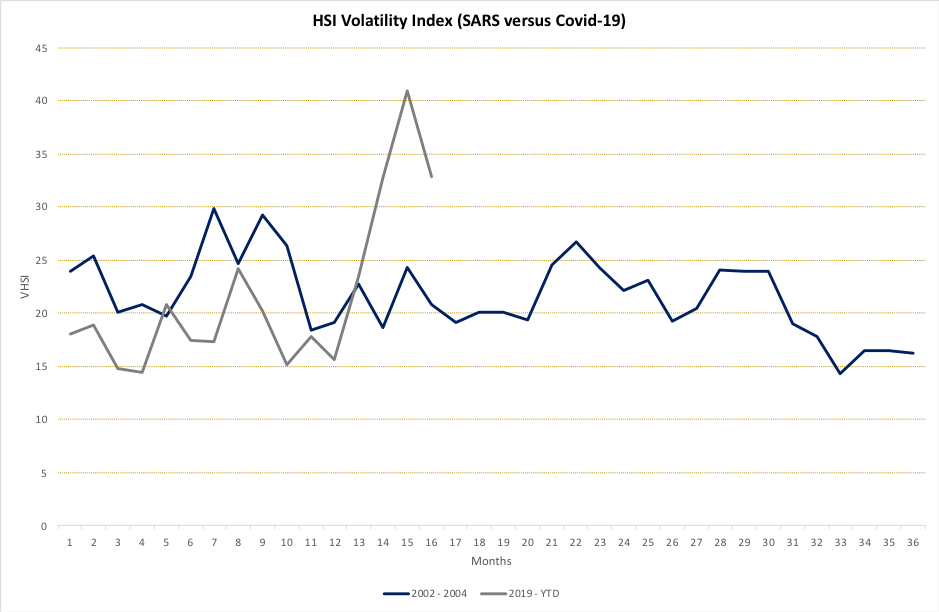

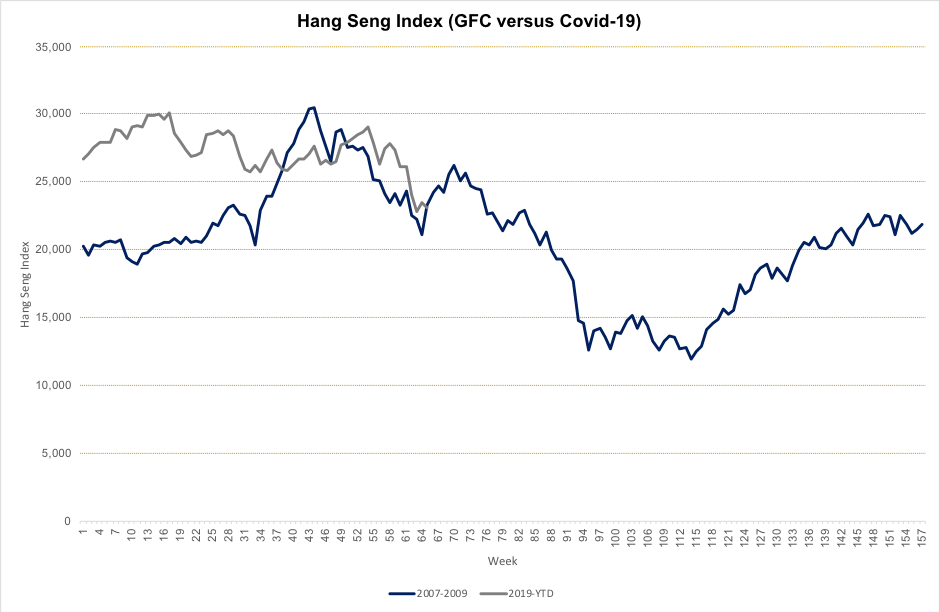

Figure 2: Covid-19 versus SARS market experience

Figure 3: Covid-19 versus GFC market experience

Whilst not suggesting that history is expected to repeat itself, there are a couple of points that history could serve as a guide. Apart from much greater volatility, the market tends to require a longer period to digest the magnitude and economic consequences of each crisis. There is one major difference between SARS and Covid-19, namely SARS predominately affected the Greater China region whereas Covid-19 has global footprint, and the associated economic problems are expected to be more pronounced and perhaps prolonged. Therefore it appears the GFC market experience might be a better proxy than SARs.

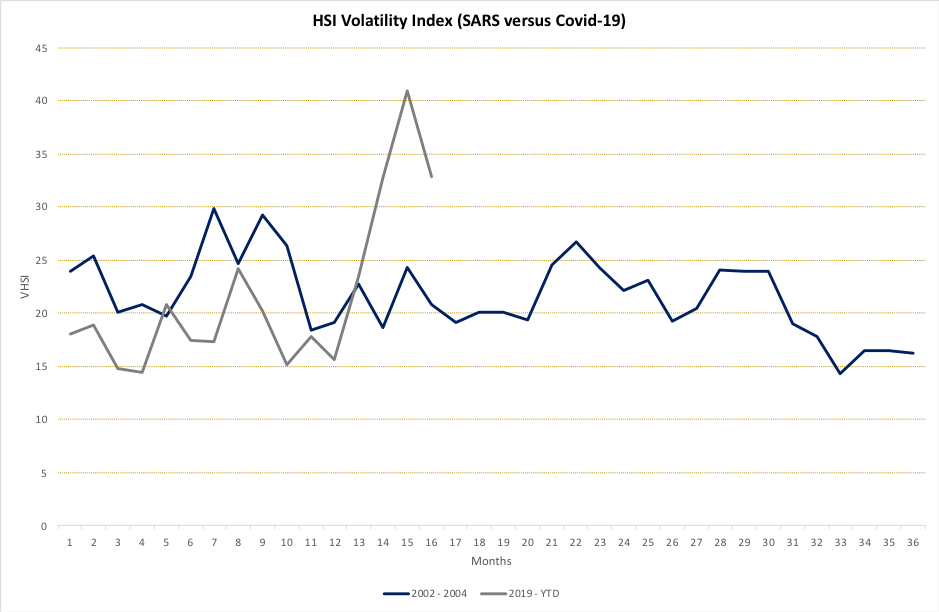

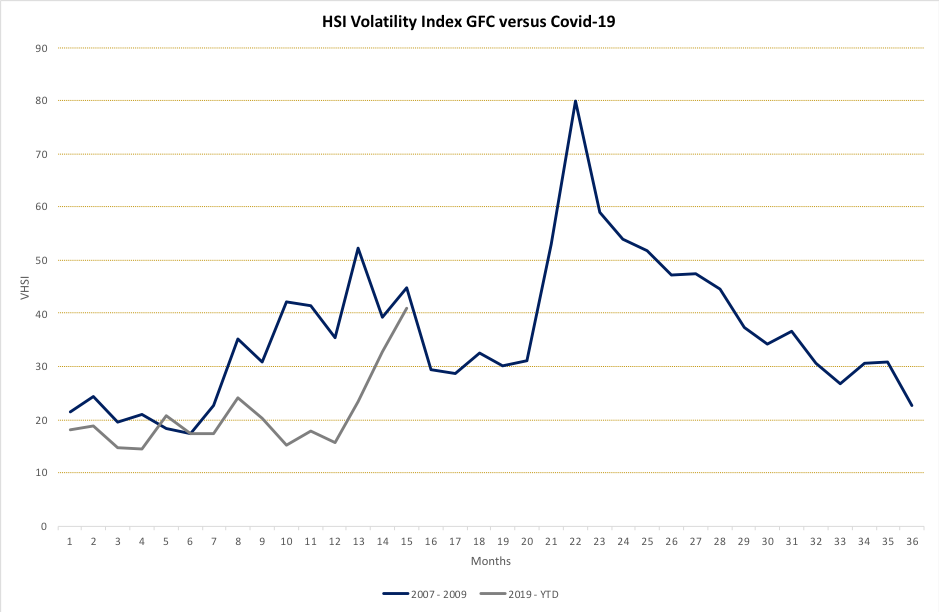

Volatility, volatility and more volatility

Figure 4: Covid-19 versus SARS volatility experience

Figure 5: Covid-19 versus GFC volatility experience

The behaviour of the HSI Volatility Index further demonstrates the parallels between the current market environment and the GFC rather than SARS where less volatility in the equity markets. If the GFC experience is any guide, we are nowhere close to the end of the tunnel. Investors should be wary of V-shape, W-shape or U-shape economic predictions given the extreme uncertainty.

The key takeaway is companies need to manage their capital positions carefully during the next few quarters as cost of equity will remain expensive and there may be little appetite for capital issuance in general. Those companies who would like deploy excess cash to take advantage investment opportunities in current market conditions should be aware that something that looks cheap can become (a lot) cheaper. Such investors need to stay vigilant in filtering out the noise in the market in their investment decisions.

NOTABLE REGULATORY INITIATIVES DURING THE QUARTER

Consultation on Corporate Weighted Voting Rights

The stock exchange published its consultation paper on corporate weighted voting rights on 31st January 2020. This is a follow-up to the weighted voting rights rules implemented on 24 April 2018 that applies to individual shareholders and the stock exchange’s decision to defer this consultation on 25 July 2018. Put simply the rationale for the corporate weighted voting rights are namely:

- Companies that are considered innovative by regulators have an ownership and business operating environment which is crucial for the success of the business that necessitates super-voting shares or weighted voting rights;

- It will affect the valuation of such company by stock analysts; and

- The competition allows it, if the stock exchange does not follow suit, it will lose business.

However, what about minority shareholder protection under the listing rules? The proposed protection measures include limiting the life of corporate weighted voting rights to ten years and the corporate weighted voting rights beneficiary must actively drive the business of the listing applicant. Also, size matters as the market capitalisation of the beneficiary entity of the weighted voting rights must be at least HK$200 billion (approximately US$25 billion) and the market capitalisation of the listing applicant must not account for more than 30% of the market capitalisation of such entity.

The consultation paper tries to present a balance view for allowing corporate weighted voting rights and similar points were previously presented in the 2018 consultation paper. Whilst a full response to the current consultation paper is outside the scope of this Quarterly update, it is interesting to observe the corporate governance measures for corporate weighted voting rights are similar to those implemented for individual weighted voting rights even though minority shareholder protection under corporate weighted voting rights maybe more complex. Further as the stock exchange plays catch-up with its competitors, it seems that this is a missed opportunity to cater the listing rules for other industries that may have similar operating environment but are not currently considered “innovative”. Nevertheless, the creation of such rules are beneficial for innovative companies choosing to list in Hong Kong and may benefit investors by extending the range of investee companies. One small point to note, if you would like to provide feedback on this consultation paper, the deadline is 1st May 2020. Perhaps an extension of the deadline might be helpful given the current environment.

Guidance and training on Environmental, Social and Governance

The term Environmental Social Governance (“ESG”) was made popular from a 2005 in a joint study by financial institutions and supported by the Swiss government on the back of an invitation of the then UN General Secretary Kofi Annan to develop guidelines and recommendations on integrating environmental, social and corporate governance issues in the financial services. It draws up qualitative factors that investors should consider to judge the sustainability of a business such as:

| ESG |

Typical Qualitative Factors |

| Environmental |

Resource exploitation

Pollution

Climate change |

| Social |

Workplace exploitation

Diversity policies and practices

Community engagement |

| Governance |

Business ethics

Corruption

Remuneration policy and practices |

Table 1: ESG Factors

In summary, the emphasis is on the listed company to explain its ESG policy and approach to the investing public rather than to focus on specific areas. It leaves a free-hand to the company to explain the material ESG risks of the business in the ESG report following a policy of “comply or explain”, i.e. if an ESG risk is not relevant or material to the company then it can explain why such disclosure is unnecessary. This is a positive step towards establishing a minimum standard of reporting to investors, especially since ESG funds a more recent trend in asset management products and incorporation into investment processes in the Asia Pacific region as opposed to the US and European counterparts. The Global Reporting Initiative or GRI standards is a reference for a deeper discussion of ESG issues.

OTHER HOUSEKEEPING MATTERS

Guidance provided to companies due to Covid-19

The regulators issued a Joint guidance on results announcement in light of the travel restrictions relating to Covid-19 on 4th February 2020 and 16th March 2020, and an FAQ on this topic on 28th February 2020. Listed companies are requested to consult with the Exchange on their ability to meeting their financial results announcement obligations in light of the Covid-19 and are required to publish material financial information to maintain their trading status. Listed companies may defer the publication of its annual reports due on 31st March 2020 and 30th April 2020 initially for up to 60 days from the date of the 16th March 2020 joint guidance statement if the company has published, on or before 31st March 2020 financial information specified therein.

Streamlining of Guidance Letters and FAQs relating to listing matters

The listing department has updated their guidance to the market pertaining to issues relating to controlling shareholders, mineral applicant companies and distributorship business. Thus far, there has been three new guidance letters, 20 updates to guidance material to the market and 54 withdrawal of the same as part of this streamlining initiative.

The update to controlling shareholder guidance letter is a minor housekeeping item to incorporate the principle that the ownership continuity and control requirement applies to the single largest shareholder when an applicant does not have a controlling shareholder, which was previously published in FAQ Series 1 No.16 that has been withdrawn.

Similarly, the update to the minerals companies guidance letter draws principles from eight guidance materials that have been withdrawn pertaining to disclosures in the prospectus and competent persons report such as conditions for exclusion of assets in such report but supplemented by alternative disclosure in the prospectus.

There have been further clarifications provided in the updated guidance letter to applicants that are distributorship businesses on issues of which parties are considered distributors and sub-distributors, and risk disclosure requirements on cannibalisation and control over sub-distributors on the business model.

Odyssey Corporate Advisory is a boutique corporate advisor providing independent and impartial investment and capital markets consultancy services catered for your circumstances and preferences. Corporate Advisory is a division of Odyssey Asset Management Ltd, a Type 1, 4 and 9 SFC licensed company and subsidiary of the Odyssey Group. If you have any enquiries, please contact:

Kuan Yu Oh

Managing Director, Co-Head of Corporate Advisory

Mobile: +852 6971-7989

Email: kuanyu.oh@odysseycapital-group.com

Notice

This publication is for informational purposes only and does not address the circumstances of any particular individual or entity. It does not constitute financial advice and should not be used as such. You should seek a duly licensed professional for investment advice. For more information about please see our Disclaimer.

Source: Bloomberg

Source: Bloomberg Source: Bloomberg

Source: Bloomberg Source: Bloomberg

Source: Bloomberg