Apr 23, 2019 | Press Releases

[Japanese and International tourists enjoy the Cherry blossoms in Kyoto]

From asia.nikkei.com:

“….In 2018, foreign visitor arrivals jumped 8.7% to 31.19 million from a year earlier. And as Japan sprints toward two major sporting events — the Rugby World Cup from September to November and the Tokyo Summer Olympics next year — the numbers are expected to keep rising. Goals set by Prime Minister Shinzo Abe in 2016 peg foreign tourist arrivals at 40 million in 2020, and 60 million in 2030.

Abe is also working to stimulate domestic tourism, announcing that this year’s annual Golden Week holiday will run from April 27 to May 6. The usual weeklong vacation has been extended to 10 days to celebrate the coronation on May 1 of Crown Prince Naruhito as emperor. Data from JTB, Japan’s leading travel agency, shows the number of residents who are planning to travel domestically during the period is up 1.1% on the year; those with plans to travel abroad are higher by 6.9%.

The surge in foreign visitors to Japan reflects a gradual easing of travel visa requirements since 2013 for countries including Thailand, the Philippines and China; growth in the number of budget airlines in Asia; and a depreciation in the yen, all of which have made Japan one of the most popular destinations in the region….”

See the entire article here.

Odyssey Asset Management Limited

Odyssey Asset Management Ltd, a sister company to the Odyssey Capital Group, is a Hong Kong SFC 1, 4 & 9 licensed company. The Japanese CRE team is headed up by Christopher A. Aiello, and also includes Alex Walker, Daniel Vovil and Sam Luck.

Odyssey Capital Group Ltd is Asia’s leading international Alternative Asset Manager that provides differentiated and bespoke investment solutions across multiple asset classes, including asset management, real estate, private equity and hedge funds. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest in with its clients.

The Odyssey team comprises over 30 experienced executives, asset managers, lawyers, private bankers, trust & tax planning specialists and experienced investors with over 400 years of combined financial and operational experience across the Asia Pacific, Europe and North America.

For more information about the Odyssey Japan Boutique Hospitality Fund, phone or email Daniel Vovil via the contact details listed below.

Daniel Vovil, Co-Founder and President, Odyssey Capital Group

daniel.vovil@odysseycapital-group.com | (852) 9725-5477

Apr 15, 2019 | Articles, Global Markets Update

“Ultimately lower rates are only good to a point because, eventually, the fall in rates is not just about the Fed giving equity investors a “green light” to load up on risk, but also indicates concerns around GDP growth.” `– MORGAN STANLEY

Look through or come off. Financial markets have been surprisingly resilient since the lows at Christmas Eve. Optimism over an early US-China trade deal, the obvious pivot by the Fed to be more ‘dovish’ (FI markets expect a rate cut in ’19 now) relative to its ‘hawkish’ stance last October, and other central banks’ like the ECB and PBoC and China’s more aggressive fiscal reflation, have all helped improve investor sentiment with markets rallying from very oversold conditions at YE18.

Whilst there are undeniably positive drivers, our cautious tactical stance remains as we believe the US-China trade deal will disappoint in leaving considerable post-deal uncertainties with a still material risk that a deal will fail given the wide differences between both parties over post enforcement checks. Underlying corporate earnings are still being downgraded and Q1 results may well disappoint at a time where the S&P 500 has become expensive relative to history whilst other markets are no longer cheap. GDP forecasts continue to be lowered – notably in EU – although China’s GDP outlook has ‘firmed up’.

Political risks are rising in Q2 – notably Brexit agonies, where a ‘no-deal’ is still a distinct possibility, and India, where a likely weak BJP coalition is perhaps the most likely result. Concerns remain around political risks in Turkey, Argentina, South Africa, Brazil, Venezuela, Ukraine and Thailand that could knock-on to EM FX, FI and equities. With strong rallies in equities and JY FI YTD, we believe taking some money off the table makes sense given the potential headwinds and the history of returns in most years since ’09 bar ’17’s exceptional gains. Ultimately, the rally in sovereign bonds YTD, with now around $10tn with negative yields, cannot be reconciled with the rally in riskier assets as the latter implies deflation if not a recession sooner or later.

The main risk to our cautious stance is if investors can use China’s reflation, trade optimism and central banks’ pivot to ‘bridge’ across a weak H1CY19 to an expected recovery in earnings forecast by Q4FY19 and stability in GDP forecasts that would support a further rally in risk assets (and a likely sell-off in USTs). This is not our base case, but we have put in place upside risk management triggers should we be proven wrong.

Recession or not? The inversion of the 3m/10y US yields on 22nd March, the first since ’07, may signal a recession during 2H20 based ib the past albeit this is better in telling us it will happen rather then when (it could be any time from under 12M to well over 3Y). The signal has historically been a reliable predictor of seven of the last nine recessions. There are some very plausible arguments, not least by Mr Dudley (the last New York Fed governor), that this time is different as: quantitative easing by the Fed and other central banks have lowered absolute interest levels to make it technically possible for such an inversion; the Fed is not tightening and financial conditions have eased considerably; there is a breakdown between real interest rates and underlying GDP growth since ’14 as noted by Pictet and; lastly the absence of any obvious ‘bubbles’ in financial assets or the wider economy.

In looking at the components of the US GDP, it is unlikely, given robust consumption underpinned by record low unemployment and accelerating wages (+3.5% YoY in February NFP), we will get a recession in 2020. However, the US economy will slow from Q4CY19 as Federal final spending is set to fall sharply and private sector capital expenditure is expected to ease down, making a ‘shallow’ recession quite feasible. A recession would justify the Fed’s ‘pivot’ and strengthen the FI markets view that the Fed’s next move is to cut rates.

There is a high degree of uncertainty as to what the macro data will bring from deflation and recession to inflation reigniting and GDP numbers surprising to the upside which have binary implications for portfolio construction. Our base case is we avoid a recession this year and next and that exposure to equities remains a better choice than to sovereign bonds. We will need to be nimble and tactically quick to respond to developments which includes a sizable precautionary cash holding to mitigate volatility spikes and to take advantage of them. Strategically we remain convinced we are in a 3.5-year period of low returns and that volatility will rise that argues for portfolio diversification and the use of non-traditional asset classes, as did endowment funds in recent years (Fig 1).

Fig 1: Endowment funds – asset allocation in 2007 vs 2018 Source: Bloomberg, Julius Baer

Equities

-

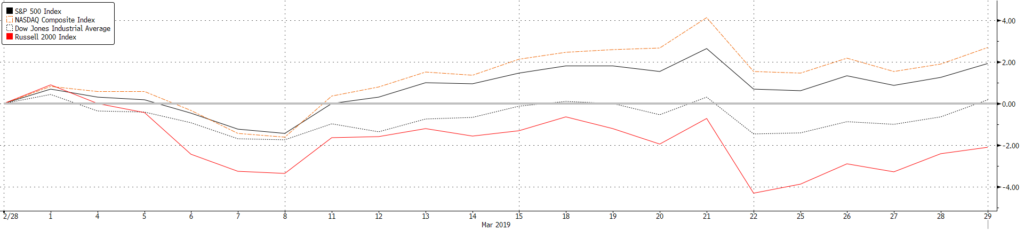

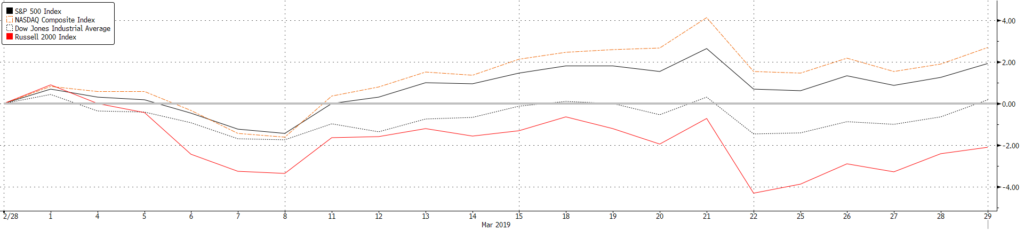

Despite a rough start earlier in the month, US equities were broadly higher as all three major indices managed a higher close in March. NASDAQ (+2.61% MoM) outperformed as Tech shares rallied, while the Dow Jones Industrial Average (+0.05% MoM) under performed after its biggest index component, Boeing, fell by as much as -17.2% from all-time highs after questions were raised over safety issues relating to the company’s 737 MAX planes. Notably, small caps also under performed, with the Russell 2,000 (-2.27% MoM) logging a decline as concerns over economic growth lingered (Fig 2).

Fig 2: March total returns of the S&P 500, DJIA, Nasdaq and Russell 2000 Source: Bloomberg

-

Technicals show the S&P 500 moved through key resistance levels to within 2% of its all-time high. We believe US equities will struggle to move higher as valuations are now expensive relative to history, and earnings are likely to contract in H1FY19 and we are trimming here.

-

Mueller’s report removes the threat of impeachment ahead of the 2020 elections and helps Trump’s re-election chances, especially if the Democrats were to choose a Socialist candidate.

-

We expect macro data to slow in 2019 as fiscal spending slows sharply in H2CY19 while private capital expenditure weakens, creating headwinds to consumption. Weaker growth would support a higher weighting in ‘growth’ sectors as IT over ‘value’. Hence, we expect Nasdaq to outperform.

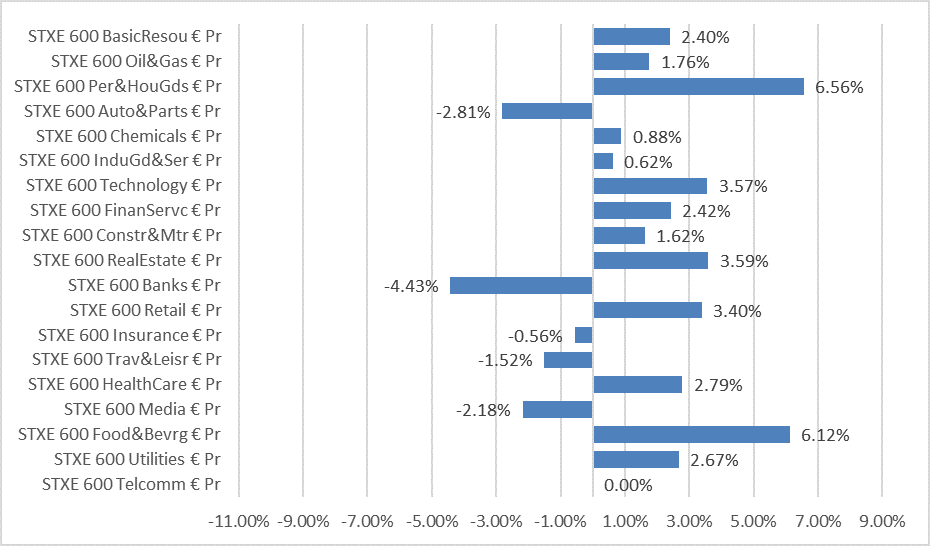

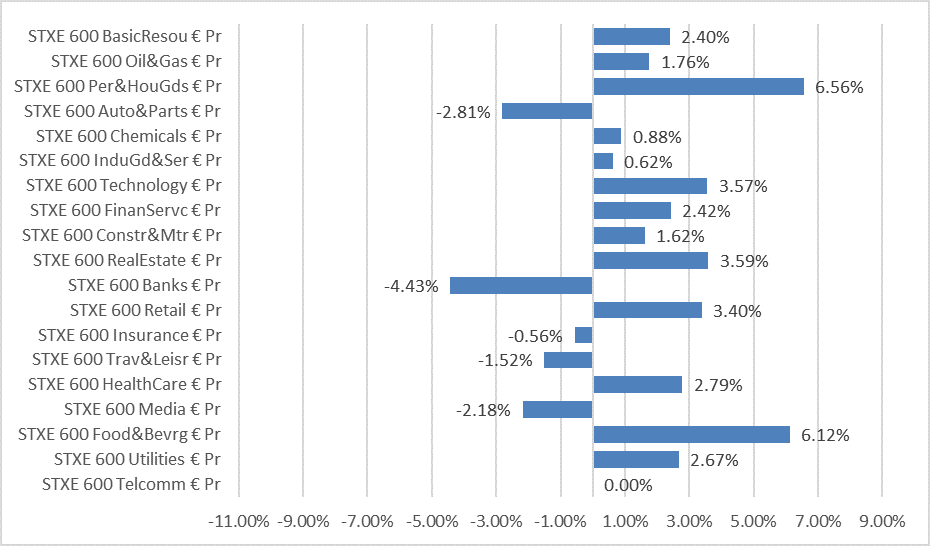

Fig 3: Stoxx 600 MoM sector performance Source: Bloomberg

-

European equities were also higher as Stoxx 600 gained 1.69% in March, led by gains in Personal & Household Goods and Food & Beverages. Bank stocks were the worst performers, after Draghi indicated rates would stay on hold for the rest of the year, a move which sent Bund yields into negative territory for the second time in history (the first being in 2016).

-

Brexit remains the overhang for Stoxx 600 and FTSE 100 and sadly, there is no agreed route and it is still a possibility of a no-deal. The next deadline is 12th April and the hope is an agreement by Parliament based on a ‘softer’ Brexit now that May is reaching out to the Labour party leader.

-

Deteriorating macro data YTD in EU could see the bloc’s economy fall into a shallower, technical recession in 2019 and may imply earnings in 2019 could contract relative to the current consensus of +4%.

-

There are political risks outside of Brexit as well. The EU election during late May might see anti-Euro populist parties gain considerable ground (even more so if the UK was to be involved in the vote) that would likely be a source of volatility in EURO and FI, which will eventually lead into Stoxx 600.

-

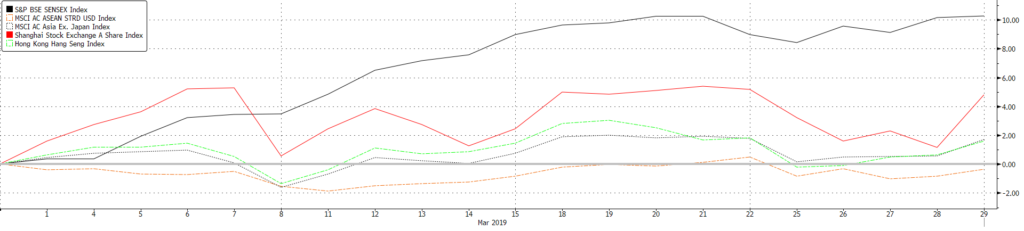

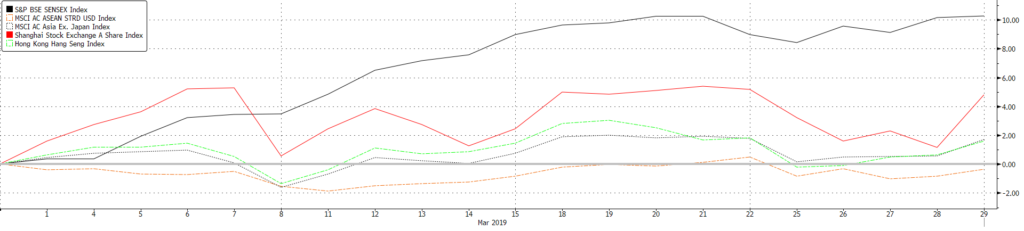

Shares in Asia also trended higher across the board, with China A-shares (+5.10% MoM) once again outperforming the region. This time, however, India’s Sensex (+7.82% MoM) surged ahead as INR also gained, taking the index to a +10.17% monthly gain on a USD-adjusted basis. For the quarter, A-shares are still significantly higher at +27.03% compared to the Sensex at +7.79% which still under performs the broader MSCI Asia ex-Japan Index which is up 11.21% in USD terms.

Fig 4: USD-adjusted Total Returns across indices in Asia Source: Bloomberg

-

-

Nikkei, on the other hand, fell 0.84% with the Yen mostly unchanged from the start of the month. Japanese equities continue to under perform in Asia, climbing +5.95% this quarter against most other indices which have logged double digit gains. Last weekend, Abe’s coalition also won approval to run a record ¥101.46tn fiscal budget in 2019, with close to ¥2tn set aside for stimulus measure aimed at cushioning the Oct 1 increase in consumption tax

-

AxJ equities are being led higher by Chinese equities and especially A-shares as local retail investors are buying again along with foreign investors, ahead of an increased weighting in MSCI EM next month. We remain overweight Chinese equities and would use any weakness to add to A-shares as we see it hitting 3,600 during 2019 as reflation of the Chinese economy comes about.

Fixed Income

-

The UST yield curve shifted lower over the month, especially in the belly of the curve with the 2Y and 10Y yields inclusive. This caused the 3m/10y spread to invert and led to the steepening of the 5y/30y spread. The Fed’s decision to hold rates in its March FOMC meeting while signalling that it won’t raise rates in ’19 caused the 10Y yield to break its 2.6% support to trade below 2.4% for the first time since December ’17. The 2Y yield also fell below the Fed funds floor of 2.25% after the meeting. However, trade optimism and strong manufacturing PMI data from US and China at the end of the month helped push yields higher. March’s developments saw USTs register their best Q1 result in 3Y as the 10Y yield fell 28bps.

-

European sovereign bond yields fell too as demand increased amid a slowdown in the European economy. The Bunds yield fell and traded below 0% for the first time since ’16. This saw the total sum of negative yielding debt represented in the Bloomberg Barclays Global Aggregate Bond Index to rise to $10.07tn – the highest level since September ’17.

-

Corporate credits saw positive returns across most sectors (Fig 6), but under performed sovereigns as the market turned more risk averse and went up the quality curve. US IG was the best performing sector in the credit space after Asian dollar bonds, returning 2.50% last month. This was mostly supported by falling rates while spreads ended the month mostly unchanged. Strong demand for primary issuances in the IG space also helped lower the borrowing costs for highly rated companies. March saw a 28.57% increase in primary issuances as companies issued $131.28bn worth of debt. IG funds also saw the largest fund inflows in March relative to other sectors. IG funds attracted $13.17bn worth of funds in the month.

Fig 5: Fixed Income sector returns in March ’19 and 19Q1 Source: Bloomberg

-

The key question is whether the Fed’s ‘pivot’, not least in what markets perceived as a ‘dovish’ March FOMC meeting, will prove to be the inflection point in this hiking cycle or, as we believe, a pause. Our view is that the markets have mistaken Powell’s comments to be purely about pausing when, in fact, he explicitly noted that the Fed was data-dependent. We see US macro data as being sufficiently strong to allow the Fed to hike one more time – probably in December 2019, whereas we do see EU data weakness being supportive of the ECB’s recent caution and for lower yields.

-

Whilst we have long failed to find value in higher quality FI (sovereign and IG), even our preferred weightings in US HY FI and Asian HY FI have seen sufficient spread compression YTD to no longer offer much price upside although we would remain invested to ‘clip’ still decent coupons but warn we could see short-term volatility.

-

Tactically, we remain overweight in short-duration paper – be it high quality or HY – as the yield is similar to longer duration paper without the same level of interest rate or default risks.

FX

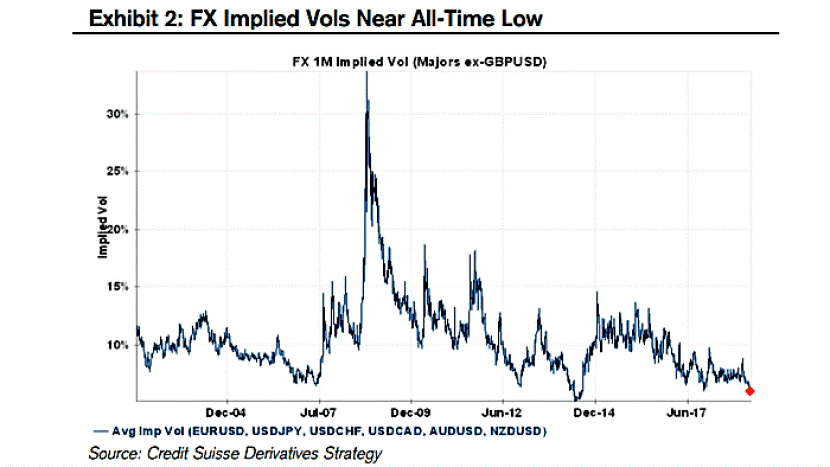

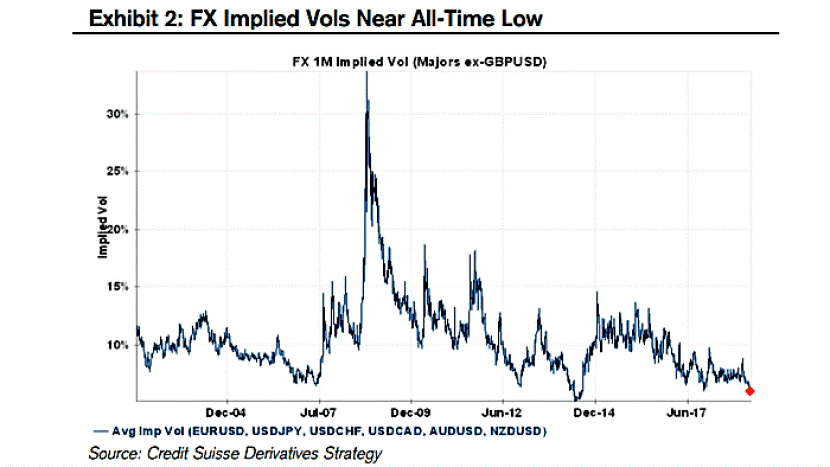

Fig 6: FX implied volatility near all-time low Source: Credit Suisse Derivatives Strategy

-

Volatility in the G7 pairs, bar GBP, has dipped since the start of 2019 as FX markets remain in uncertainty due to key events such as Sino-US trade development and Brexit (Fig 6). EMFX volatility picked up in March, mainly due to BRL, TRY and ZAR experiencing large movements. (Fig 7).

Fig 7: EM FX volatility vs. G7 FX volalitlity Source: Bloomberg

-

The Fed’s dot plot implies that interest rates will remain on hold for the remainder of this year and only improve by +25bps in 2020 and inflation unexpected eased in February. This clarity for the USD has finally come through as markets are no longer pulled by “certainty” (positive market data in Jan/Feb) and “uncertainty” (a “patient” Fed in Jan/Feb). Powell noted that interest rates will remain on hold for “some time”.

-

The Turkish Lira experienced another bout of volatility since Aug 2018. The jump happened overnight and TRY fell 7.50% to 5.84, past a significant key support at 5.50. The Turkish government has reported its suspicion of large foreign banks shorting the Lira. Overnight rates increased to 1300% to prevent shorting. Emergency interest rate measurements taken by the Turkish government failed to suppress TRY weakness.

-

DXY is edging up again towards a key resistance at 97.50 and USD yields bottomed out and it remains, on a relative basis, the best DM economy and that is constructive for the USD. We remain, thus, USD bulls until it is clearer its structural risks (rising fiscal deficit and potential overvaluation) become obstacles.

-

The outlook for GBP, BRL, TRY ZAR and the Argentine peso depends on political developments. An agreed cross-party ‘soft’ Brexit deal would boost GBP towards 1.40 but a no-deal departure on 12th April could sink it back to 1.20. EUR, to a greater extent, will be linked to GBP, but the EU-wide elections could also be a downside risk as it was in ’14.

Commodities

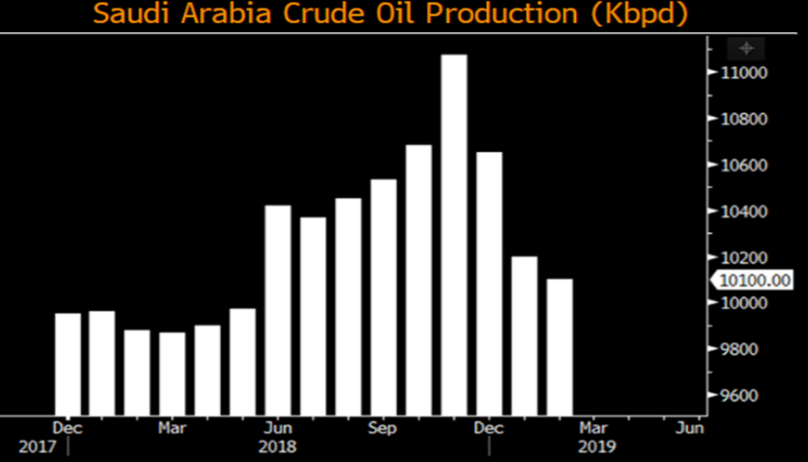

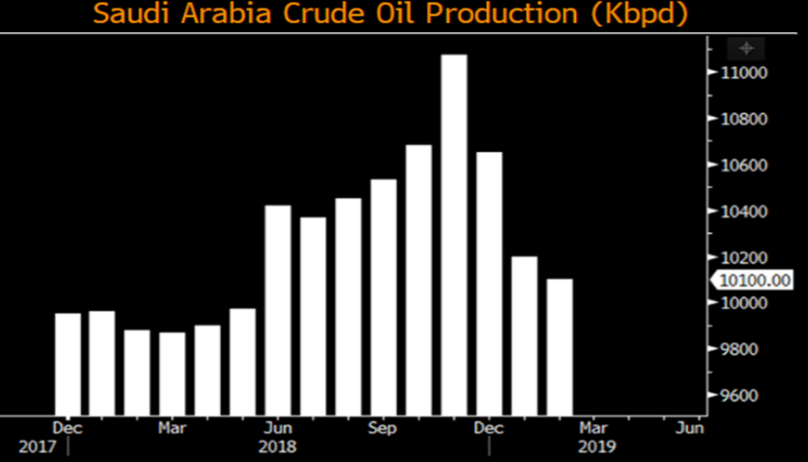

Fig 8: Saudi leads OPEC+ cuts to production Source: Bloomberg

-

Brent crude saw a strong quarter, rising 27.12% YTD and 3.57% in March as OPEC+ cuts to oil production continued. The cartel cut a further 295K/bpd in March, and is believed to continue its commitments to cutting supply and re-balancing the market.

-

Volatile production from countries like Egypt added to supply this month, but we believe that the remainder of OPEC+ countries will eventually catch up and limit their supplies, and this effect should outweigh any of the headwinds.

-

Gold closed mostly flat this month, unable to move past its US$1,352/Oz high in February. This was understandable given the increased risk-on sentiment reflected by the climb in equity markets. This movement in March formed the right shoulder of a Head and Shoulders pattern which started in January.

-

The oil price is being pulled around by OPEC’s (notably Saudi Arabia) supply discipline and regulatory developments on bunker oil relative to rapidly increasing US shale oil production and a slowing global economy impacting demand. In the shorter term, we see the Brent oil price capped around $70/brl but the longer term could see oil prices test $90/brl by 2021 as the effects of the huge 50% fall in capital expenditure since H2CY14 impacts production. Given this, we are trimming our energy exposure.

-

Industrial metals are benefiting from optimism around China’s ability to reflate the economy and from a series of supply disruption that have boosted copper and iron ore at a time the mining giants have proven to be disciplined in capacity expansion, and that could lead to prices moving higher from here in 2019.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at.

Apr 12, 2019 | Articles, Australian Budget Update

The 2019 Australian Federal Budget was handed down by Treasurer Josh Frydenberg on Tuesday, 2nd April announcing the Federal Budget will be back in the black for the first time in twelve years, with a budget surplus of A$7.1 billion dollars forecast for 2019/2020.

Budget Headlines

-

The 2019 Budget shows that tax will be a key topic of discussion in the upcoming election.

-

Forecast surplus of A$7.1 billion in 2019-20 and A$45 billion over the next 4 years.

-

Government introduced an ‘Enhanced’ personal income tax cuts for low and middle-income earners in 2019 tax returns. A$158 billion of personal income tax cuts are promised over a decade.

-

A boost to the instant asset write-off threshold for small to medium enterprises to A$30,000 announced on Budget night.

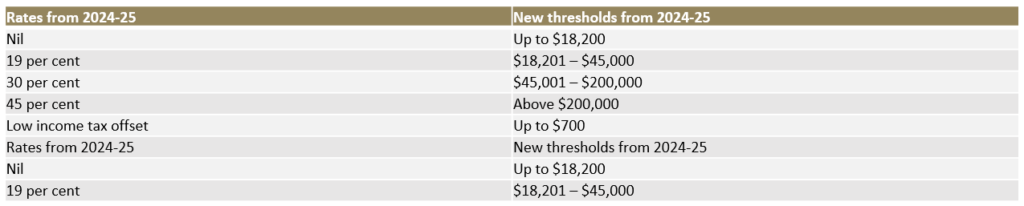

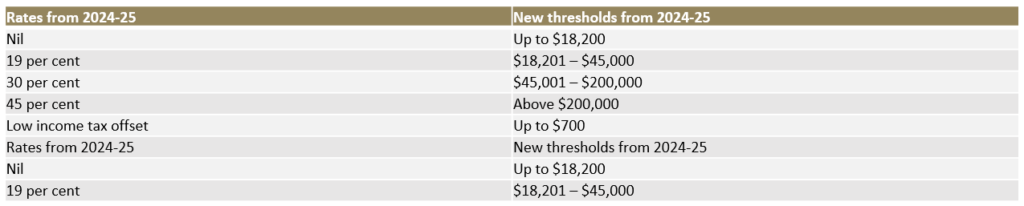

Below is an infographic from PwC highlighting the key announcements from the Federal Budget.

Fig 1: Key announcements from federal budget Source: Budget.gov.au

What does the budget mean for Australian Expats?

Personal Income Tax Cuts – Australian residents

The Government is reducing tax for low and middle income earners of up to A$1,080 for single earners or up to A$2,160 for dual income families for the 2018/2019 to 2021/22 income years. Taxpayers will be able to access the offset after they lodge their end of year tax returns from 1 July 2019.

From 2022/2023, the Government will increase the top threshold of the 19 per cent tax bracket from A$41,000 to A$45,000 and the low income tax offset from A$645 to A$700.

From 1 July 2024, the Government is also increasing tax thresholds further and reducing the 32.5 per cent tax rate to 30 per cent.

By 2024, under the proposed changes there will only be three tax brackets: 19 per cent, 30 per cent and 45 per cent.

It’s important to note these new tax rates only applies to Australian residents and no changes has been made to the Non-resident tax rate. For current Non-resident tax rates please click here

Summary of changes to rates and thresholds – Australian residents

Superannuation changes

From 1 July 2020 the Government will amend the superannuation contribution rules to allow people aged 65 and 66 to make voluntary contributions to superannuation without meeting the work tests.

People age under 67 at any time during a financial year will be able to trigger the non-concessional bring-forward rule (e.g. allowing individual to contribute three years of non-concessional contributions up to A$300,000 in single year). Previously this rule only applied to people age under 65.

Under the proposed changes, the age for spouse contributions has increased from 69 to 74, which allows individuals to make contributions on behalf of their spouse for a longer period. In addition, where the receiving spouse is age 65 or 66 they no longer need to meet a work test.

Whilst the superannuation changes may not apply to all Australian expats, it is however important to plan for your super in advance before returning to Australia to take advantage of the contribution limits available and ensuring a successful transition to retirement in Australia.

Funding ATO Tax Avoidance Taskforce

The Government will provide A$1.0 billion over four years from 2019/20, to the Australian Taxation Office (ATO) to extend and expand the operation of the Tax Avoidance Taskforce focused on large corporates, multinationals and high wealth individuals.

The measure is estimated to increase tax collections by $4.6 billion resulting in a net gain to the budget of $3.6 billion over the forward estimates period.

The Tax Avoidance Taskforce undertakes compliance activities targeting multinationals, large public and private groups, trusts and high wealth individuals. This funding is expected to result in further increases in ATO examination activity.

Effective from 1 January 2020, the list of Exchange of Information countries will be expanded to add the following countries:

- Curacao

- Lebanon

- Nauru

- Pakistan

- Panama

- Peru

- Qatar

- UAE

As a result, distributions from Managed Investment Trusts (MITs) to these countries that are currently subject to the 30% withholding tax rate may qualify for the lower 15% withholding tax.

Summary

The 2019 Federal Budget from the Coalition delivered a strong focus on building a stronger economy and securing a better future for all Australians. This comes through lower income taxes, incentives for small to medium business and increased infrastructure spend.

It’s important to note these proposed changes have not yet been legislated until the current Coalition government gets re-elected. It’s also important to be aware of the opposition’s response to these changes and their respective policies. These policies will become clearer as the federal election gets closer.

Whether you are an Australian resident or expat living overseas, it’s important to understand how the budget may impact your personal circumstances.

For a copy of 2019/2020 Budget, click here

CONTACT

For a confidential discussion on the Australian budget and planning matters, please contact Jeff Hiew

Mar 27, 2019 | Press Releases

[Tourists in the overcrowded tourist destination Sensoji, Tokyo]

From Scmp.com:

“A boom in the tourism sector has seen significant growth in both the macroeconomy and Japan’s hospitality sector,” said Christopher Aiello, manager of Hong Kong-based Odyssey Capital Group’s Odyssey Japan Boutique Hospitality Fund. “And since Prime Minister Shinzo Abe’s appointment in 2012, tourist arrivals have risen fourfold. The demand for accommodation has never been higher.”

Odyssey Capital is renovating traditional town and guest houses, and is repurposing them as luxury boutique hotels.

See the entire article here.

Odyssey Asset Management Limited

Odyssey Asset Management Ltd, a sister company to the Odyssey Capital Group, is a Hong Kong SFC 1, 4 & 9 licensed company. The Japanese CRE team is headed up by Christopher A. Aiello, and also includes Alex Walker, Daniel Vovil and Sam Luck.

Odyssey Capital Group Ltd is Asia’s leading international Alternative Asset Manager that provides differentiated and bespoke investment solutions across multiple asset classes, including asset management, real estate, private equity and hedge funds. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest in with its clients.

The Odyssey team comprises over 30 experienced executives, asset managers, lawyers, private bankers, trust & tax planning specialists and experienced investors with over 400 years of combined financial and operational experience across the Asia Pacific, Europe and North America.

For more information about the Odyssey Japan Boutique Hospitality Fund, phone or email Daniel Vovil via the contact details listed below.

Daniel Vovil, Co-Founder and President, Odyssey Capital Group

daniel.vovil@odysseycapital-group.com | (852) 9725-5477

Mar 18, 2019 | Articles, Global Markets Update

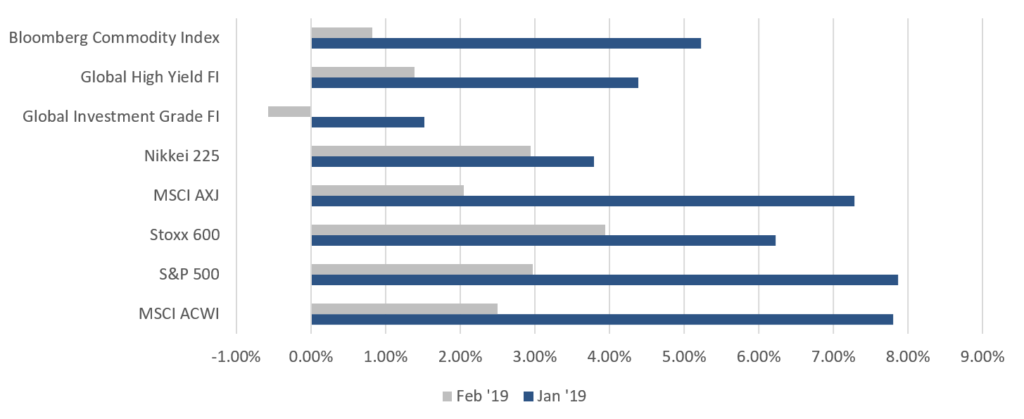

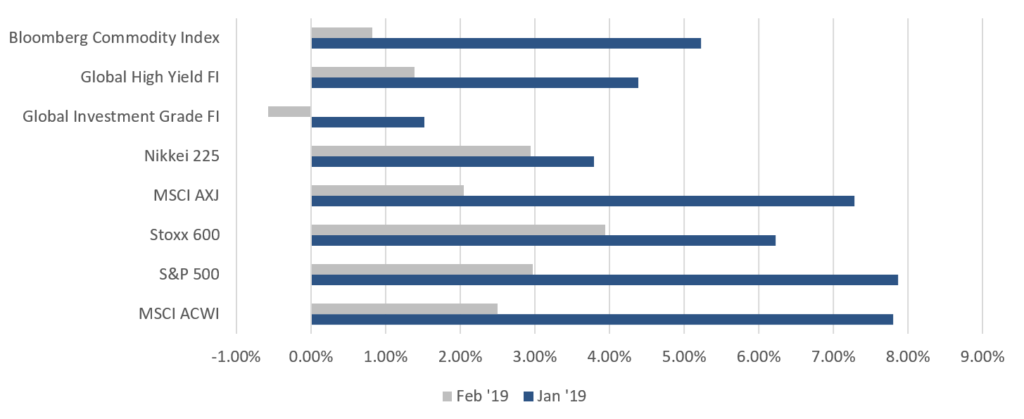

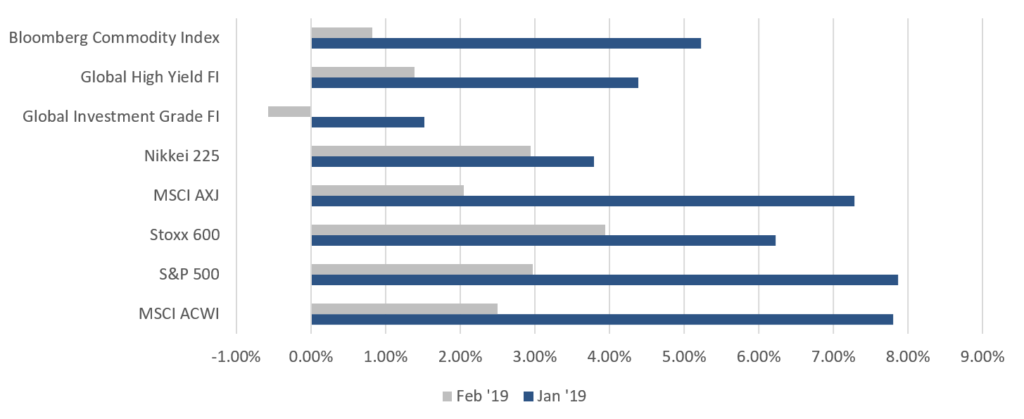

The rally for equities continues after the best January in over 30 years, defying the gloomy consensus seen at the end of 2018 as the S&P 500 (+ 3.0%), NASDAQ (+3.4%) and Dow (+3.7%) gained MoM alongside other major markets which were also up by 2-3%. The exceptions were UK’s FTSE 100 (+1.5%) on a stronger GBP, and a storming move up of 13.8% in China A-shares, including a one-day jump of 5.6% which happened just last week. The week was also the best gain for the index in over four years, as domestic investors’ ‘mojo’ started to reappear (see more below) following last year’s bear market. Stoxx surged 3.9% – in part from very oversold levels – but also helped by a weaker EUR and reduced trade war fears. The S&P 500 beat lowered earnings consensus forecasts for 4Q18 by over 3% to record 13% earnings growth YoY, but elsewhere results were more mixed – Some markets in Asia ex-Japan such as Singapore and Malaysia, instead suffered meaningful earnings contractions. Nikkei’s 3% rise was supported by record share buybacks in corporates’ guidance post-results.

Fig 1: Risk asset performance in Dec ’18 vs Jan ’19 Source: Bloomberg

We are increasingly positive on Chinese shares, whether offshore or A-shares. We like the attractive valuations, proactive policy action, fiscal expansion, PBoC’s easing and improving earnings forecasts in contrast to other large equity markets which are mostly experiencing weaker earnings forecasts, slowing GDP and more limited fiscal expansion. Our base case remains a Sino-US trade deal will occur – most probably in Q2 – and this should underpin CNY below 7.00 if not push it to strengthen further to 6.50 by YE19.

Fig 2: Normalized 10Y chart of SHASHR against the HSI Source: Bloomberg

We are becoming more cautious overall after equity markets and other higher risk assets (such as lower quality HY FI), have rallied strongly from Xmas eve lows. This has taken S&P 500 valuations back into expensive territory, and most other equity regions to fair value from inexpensive – bar PRC equities that remain attractive. Likewise, the rally in credit, with spreads tightening across the board but more so for HY (CCC’s especially) and EM FI, has moved most areas of FI back to fair value whilst sovereign DM FI continue to offer unappealing risk-reward ratios. We see the huge increase in supply of US treasury issuances driving yields higher, with 10Y UST yields testing 3% during 2019. We think that the upside from a likely Sino-US trade deal is mostly priced-in, whereas the risks from an equally likely US imposition of tariffs on global auto imports – at some point in Q2 – is being ignored. We believe that the adage “it is better to travel than arrive”, will apply to the Sino-US trade deal as there is a high chance it will be a partial deal, leaving scope for plenty of future uncertainties as we are only at the cusp of a wider strategic confrontation between the two superpowers.

On a fundamental basis, traditional drivers of risk assets (growth in earnings and GDP) continue to be downgraded (the exception being upgrades to PRC earnings forecasts), and we doubt these will stabilise until 2H19 with 1Q19 set to be quite disappointing. Other positives are also increasingly discounted by markets, namely reduced fears over a Brexit ‘no deal’ outcome, pension reforms in Brazil and a more ‘dovish’ Fed. Admittedly, not all is gloomy as positioning remains light on several indicators, including above average cash levels according to BAML’s PMS survey of the largest global allocators.

We are also seeing offsetting policy action by some governments, notably PRC, increasing fiscal spending, and some central banks turning more ‘dovish’, including the Fed and PBOC, with ECB widely expected to turn more ‘dovish’ too. As a consequence, we have been raising cash and cash equivalents across portfolios and will continue to do so should markets rally further.

Equities

- Trump declared a national emergency over the ‘wall’ in a bid to allay his support base that House Democrats are challenging. Last week we also witnessed the Trump-Kim summit which ended abruptly on an impasse, resulting in both parties going home empty handed without a deal.

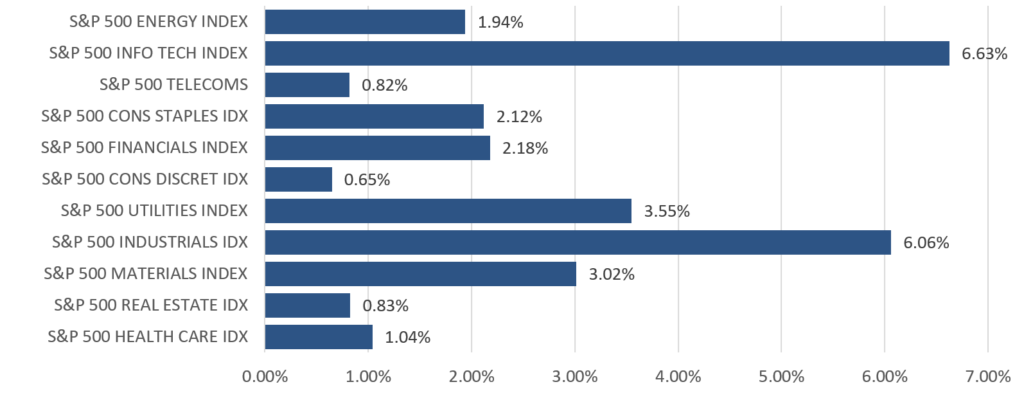

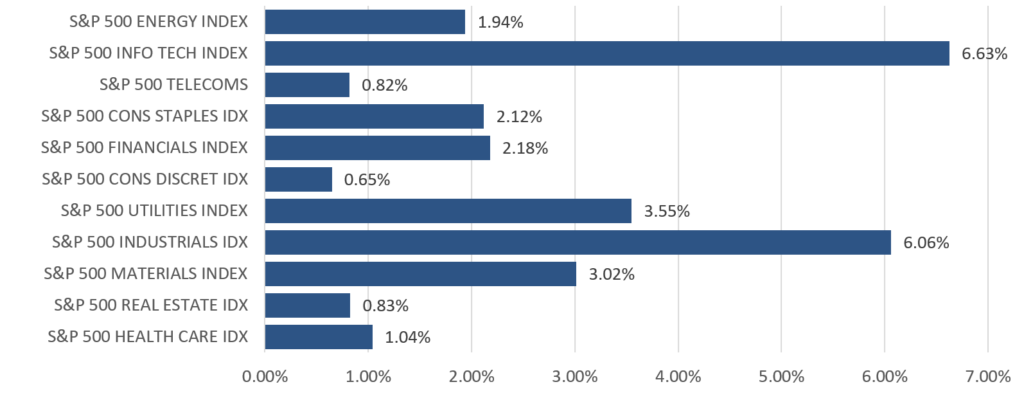

- US equities continued up from Jan’s recovery, with all three benchmark indices ending the month firmly positive as IT (+6.63%) and Industrials (+6.06%) led gains in the S&P 500 (+2.97%), while the Dow and Nasdaq were up 3.67% and 3.44% respectively. Markets were also somewhat sated after Powell reiterated the FOMC’s patient approach and sensitivity to capital markets, but also that the Fed would hold a much larger balance sheet than it did pre-crisis.

Fig 3: MoM moves across S&P 500 sectors Source: Bloomberg

- S&P 500 has reported earnings for 4Q18 – 72% of companies have beat estimates to an aggregate earnings surprise of 3.59%, while the aggregate growth rate of earnings came in at +13.07%, in-line with the estimate of +12.10% at the end of FY18. Unsurprisingly, elevated oil prices helped the Energy sector to the highest earnings growth of all, at +93.5%.

- For 1Q19, the aggregate analyst prediction is a -3.2% decline in earnings. MS has warned that FY19 could see a possible earnings contraction after a string of forecast downgrades, trimming their own estimates for FY19 EPS growth to just 1% from an earlier 4.3%. The house maintains their S&P 500 price target of 2,750 at YE19. Consensus FY19 EPS (Earnings Per Share) growth is estimated at +5%, but there remains a risk of an overall contraction although analysts see a recovery from weaker H1 earnings by Q4 coming from an easier base of comparison.

- European equities saw broad-based gains, with the Stoxx 600 climbing 3.94% in the month. Materials (+7.26%), Chemicals (+6.07%) and Insurance (+6.19%) led gains across sectors, while defensives like Utilities (+0.27%) and Telecommunications (-0.01%) were visibly weaker. Real Estate (-1.76%) was the only sector to see a decline.

- Stoxx is being torn by upside from relatively cheap valuations against the S&P 500, and its far worse economic performance that could result in an earnings contraction. EU SMEs are more vulnerable to a weaker economy, but could rally in the short-term if ECB becomes more supportive. EU will be especially impacted if US imposes auto tariffs that would hit the large EU auto OEMs hard. Our base case is Trump will impose tariffs, if more to appease his support base, but would lift them quickly to avoid damaging the US economy – a bit akin to NAFTA.

- Shares in Asia trended higher on optimism around trade, as rhetoric (mostly from the US) and sentiment on a near-term trade deal grew increasingly positive particularly toward month-end. The MSCI Asia ex-Japan’s +2.05% MoM gain was completely overshadowed by the run up in China A-shares (+13.91% MoM), which have surged over 20% from early Jan lows into a technical bull market.

Fig 4: SHASHR outperformance against other indices in Asia Source: Bloomberg

- The Nikkei also managed to climb 2.94% last month, but on the back of a weaker JPY which saw the index only up +0.62% MoM in USD-adjusted terms. GDP growth in 4Q18 came in at 1.4%, with IMF forecasts pointing to a further slowing of economic momentum in ’19. Corporate profitability has, however, stayed near record levels, and risks around deflation have decreased significantly.

- Over the course of this month, the delay of trade tariffs were confirmed, alongside subsequent reports which pointed toward substantial progress in the ongoing negotiations with March 27th now being suggested as the tentative date for Trump and Xi to sign off on a deal. However, the US’ point negotiator Lighthizer did temper market expectations later in the month, commenting that ‘much still needs to be done’ before an agreement could be reached.

- We see a lot of good news discounted by gains in Asia ex-Japan and EM equities YTD, with valuations of MSCI Asia ex-Japan back at historical levels and earnings forecasts still coming down. Given this, there is a stronger case to turn more defensive and move tactically into cash. An exception – see above – might be A-shares, as opposed to a number of H/HK shares looking more vulnerable now.

Fixed-Income

- US Treasury yields traded within a tight range for most of February before better-than-expected 4Q18 GDP numbers led UST 2Y yields to end 5.65bps higher at 2.51%, and UST 10Y yields to end 8.67bps higher at 2.72%. The yield curve saw a parallel shift downwards across the 2Y to 10Y period, with the 2Y10Y spread increasing by only 3bps over the month. Technically, UST 10Y yields found support at 2.63%, having failed to break below the level despite testing it four times.

- European sovereign bonds were mixed. Bund yields saw weakness throughout the month following multiple weak economic data releases, hitting a low of 0.08% before ending the month at 0.18%. Strong demand for new Italian and French debt issuances followed a series of strong European sovereign bond sales this year.

- PIMCO and CS both expect UST yields to rise in order to absorb the massive extra issuance needed to fund the fiscal deficit, with both expecting UST 10Y yields to reach 3% in 2H19. Foreign buying is impacted by a high cost of hedging USD, effectively eliminating most of the nominal yield pick-up available.

- The Fed may have erred by switching from being too ‘hawkish’ in Oct last year to being too ‘dovish’ following the Q4 swoon in capital markets. With the US economy seemingly still in rude good health and markets having recovered, there lies a growing possibility that the Fed might surprise complacent FI markets by reasserting its 2 rate hikes in the ‘dot plot’ guidance, even if technical factors instead support an end to balance sheet reduction.

- There is polarisation around whether to move up the credit curve to avoid a coming credit crisis. To some extent, this is linked to recession risks over the next 12-18 months. Those who doubt this would prefer the risk-reward in HY and EM FI. What is worth noting, is that PIMCO thinks the rating agencies are far too optimistic with their ratings, plus we know the majority of issuances are covenant-lite, and that reduces recovery rates.

FX

- FX volatility has fallen significantly, with the DXY barely moving and most other currencies stuck in their respective trading ranges. GBP, AUD and JPY were the exceptions.

- USD – January’s dip was compensated by gains in a risk-on environment as political tensions eased up. Overall, there are mixed sentiments for the dollar as investors juggled between Powell’s dovishness and positive US economic data.

- JPY weakened sharply against the USD last month to test, and weaken through, key support at 111.50, as the BOJ reiterated its accommodative monetary policy stance, macro data disappointed and concerns grew about global auto tariffs which Japan would be significantly impacted by.

- The EUR touched a monthly low of 1.123 on fears of auto tariffs. ECB and others, as IMF, have revised growth projections lower to 1.7% for 2019. The EUR has shifted its trading range from 1.13-1.18 in to 1.125-1.15, weighed down by potential snap elections in Italy as well as Spain. Brexit also weighed on the EUR.

Fig 5: GBP moves on Brexit Source: Bloomberg

- So far this year, Brexit has seen the GBP trade in a wide range of 1.27 to 1.33. It started the month at 1.310, traded to a low of 1.277, but ended the month at 1.326, on increased hopes a ‘no-deal’ option will be rejected by Parliament. It recovered above its 200DMA at 1.30 after falling below this level earlier in the month. Markets are currently pricing in a potential second referendum, which will add strength to GBP. 1.33 remains a key resistance level.

COMMODITIES

- Brent crude gained 6.69% through the month, breaking through its key resistance at US$64/bbl on continued commitment to production cuts from OPEC+. Prices were also supported by reports that the group could move toward a more formal agreement, which could see the cartel control 66% of the global supply of oil and over 90% of spare capacity.

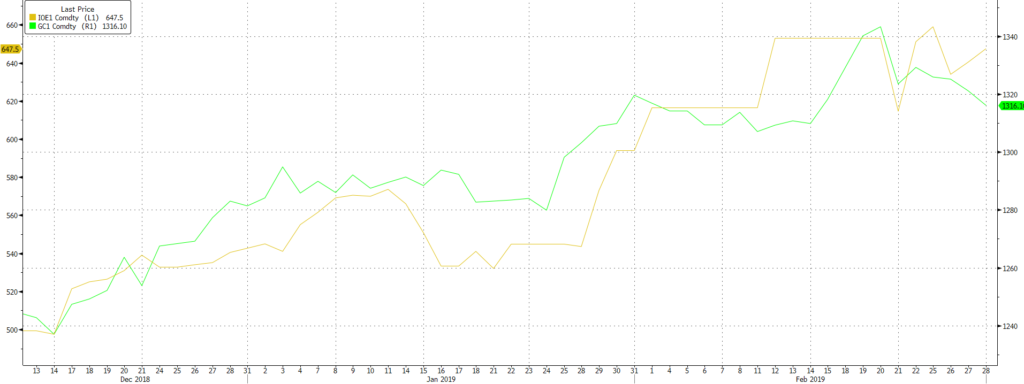

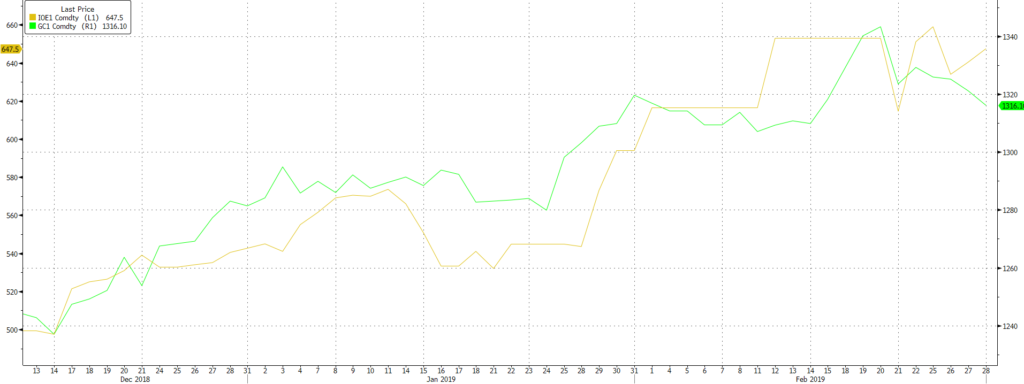

Fig 6: Gold (green line) tapers off, while Iron Ore (yellow) hits all-time high Source: Bloomberg

- Gold broke out earlier this month to test a high of US$1,346.71 /Oz, but failed to test the key resistance level just above $1,360/Oz. It then fell sharply thereafter on a combination of profit-taking and rising UST yields, alongside a stronger dollar which weighed on the precious metal. It broke through support levels at $1,320 in late-Feb, and $1,300 in early March to where it is currently testing the next key support at $1,280.

- Iron ore hit its all-time-high after the Vale mine disaster abruptly tightened global supply, whilst PRC’s implicit ban on Australian coal imports created movements in thermal and coking coal and again, highlighted the dangers of being a major supplier to PRC as the ban was linked to Australia’s decision to exclude Huawei as a supplier to 5G telephone systems on national security grounds.

- We remain constructive on oil as we believe there are supply-side restrictions that will underpin prices above $60/brl for Brent. The super OPEC+ cartel will have much greater pricing control than OPEC did, and thus will more easily be able to counter rising supply from US shale oil production to retain their status as a price leader. US shale oil producers will remain a force – just this week, both Exxon and Chevon said that they would triple oil production by ’23 at their respective Permian basin fields. It is material as Exxon expects to produce over 1m bpd by then, with Chevron not too far behind.

- Another support for oil prices is the continued capex discipline of the large, integrated oil companies, as spending remains 40% below the peak in 2014, with estimates that it will rise just 5% this year. If this continues, there is a genuine risk of a supply crunch by as early as next year that could see oil prices jump to over US$90/bbl.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at.