Jan 10, 2019 | Articles, Global Markets Update

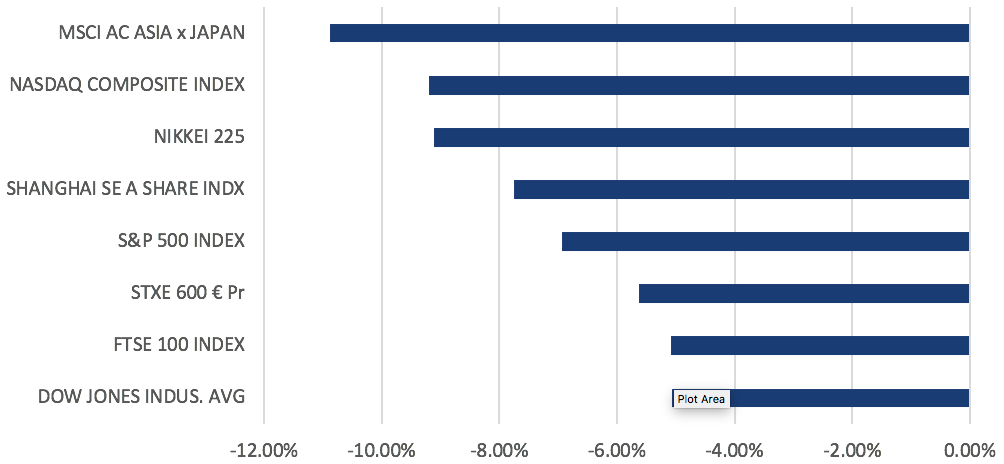

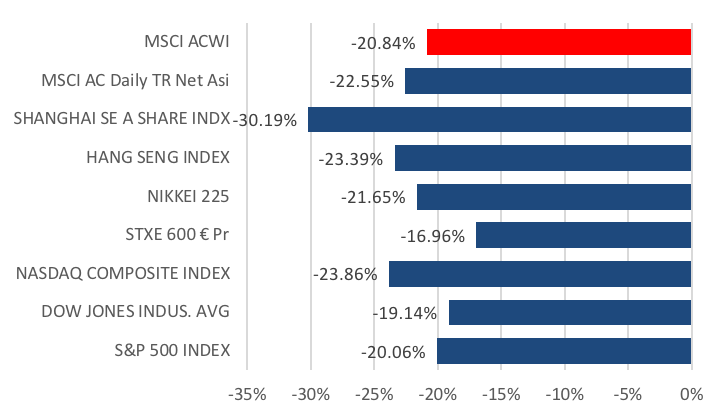

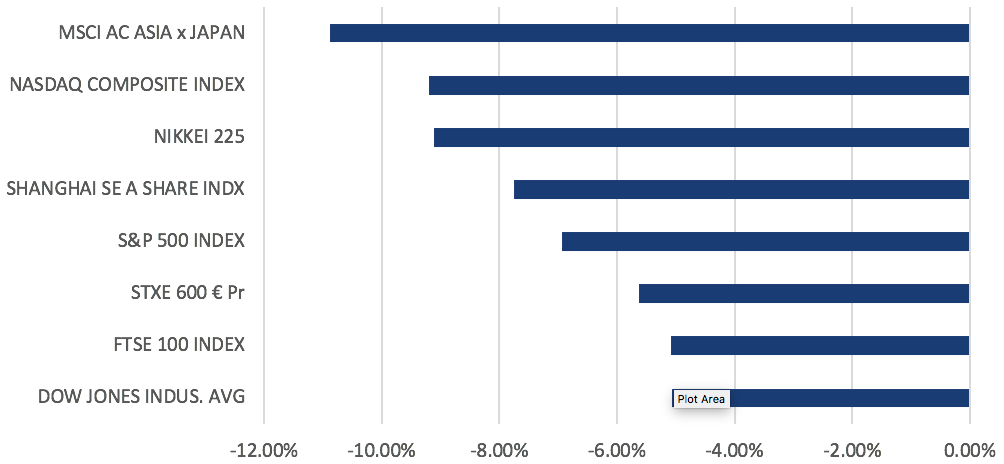

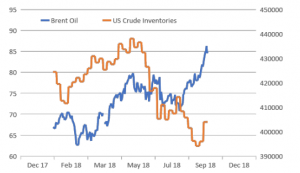

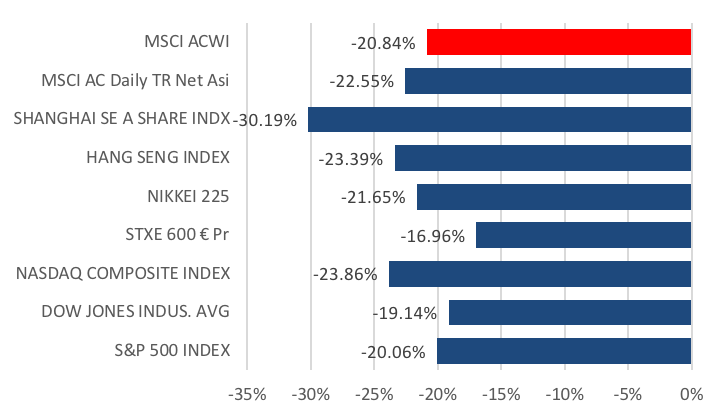

Equities fell momentarily into a technical bear market on Christmas Eve amidst growing concerns that the Fed is raising rates into a slowing global economy, evidenced by weaker manufacturing and other various economic data released over the month. Thin trading through the month worsened the losses. The MSCI ACWI fell to 435.90, 20.84% off its 52W high, before ending the year at 455.66 to register a 11.18% loss for 2018. Most major equity indices also fell into a technical bear market over Christmas (Fig 1). However, the Fed also trimmed its 2019 rate increase projections to two increases from three and lowered the long-term equilibrium Fed rate to 2.75% from 3%.

Fig 1: Global equities fall into bear market over Christmas Source: Bloomberg

Fig 1: Global equities fall into bear market over Christmas Source: Bloomberg

There were several developments in the Sino-US trade situation as well. In the first month after Trump and Xi’s meeting at the G20 conference, we saw China cutting US auto tariffs from to 15% from 40% and making a huge purchase of US soybeans while Trump cited huge progress in trade developments after a phone call with Xi. There were concerns that the arrest of Huawei’s CFO might jeopardize the discussions, but these worries were short-lived.

Brexit developments, however, took a turn for the worse earlier in the month after May delayed a parliamentary vote on the Brexit deal, survived a vote of no confidence and stepped up preparations for a ‘hard’ Brexit. This chain of events led to a volatile month for the GBP, which traded -2.13% to a low of 1.2478 before ending the month almost flat.

We suggested last year might start well, turn tricky and become difficult, but we were surprised by the speed of the changes and, in particular, the severity of the fall in the S&P 500 in December. 1969 was the last time all asset classes struggled and cash outperformed. Our base case for 2019 is it will likely be an uncertain and volatile start but, as we potentially get more clarity over key risks, conditions may become more constructively for risk assets in 19H2.

We are not bearish and do not see a ‘smoking gun’ that will devastate markets. We believe markets are suffering another growth scare often seen since 2010, with 2017 the exception. We doubt a recession is imminent in the USA or globally, nor do we anticipate an earnings contraction either. We believe markets have already discounted a lot of bad news but are ignoring some positives, such as the largest, synchronized fiscal expansion since 2010.

Our base case is predicated on these assumptions: A Sino-US trade deal is desired by both the USA and China; a ‘soft’ Brexit is the probable outcome, albeit it could be delayed; Italy will agree a budget deal with the European Commission (EC) and remain in the EU; China will support its economy sufficiently to defend a 6%+ GDP growth and ensure CNY’s stability; the Fed will raise rates two times in 2019 and then be driven by the data; and that the US GDP will grow at a solid 2.5% in 2019 and global GDP growth will be solid. Should we be wrong and a ‘bear’ market in equities occur, we see a probable Powell ‘put’ limiting the downside.

Tactically, we see the first few months of 2019 as a ‘tricky’ period. Global GDP growth and EPS will slow, and it may take until late April – with Q1 results coming out – to provide jittery investors with a better clue as to the direction for US/global EPS. Likewise, we need to see the spate of GDP downgrades stabilize. Whilst we remain optimistic a trade deal will occur, Trump’s negotiating style may result in fears of a global trade war, including the risk of global auto tariffs, remaining high and this is most investors’ key risk.

Equities

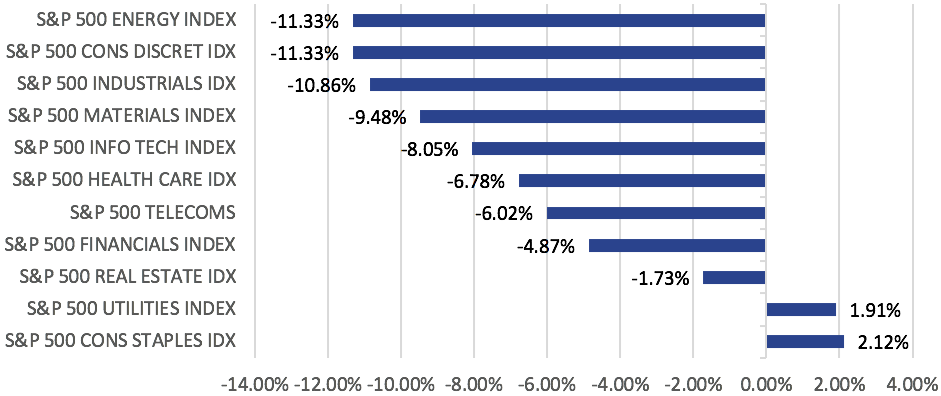

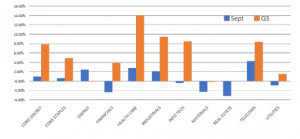

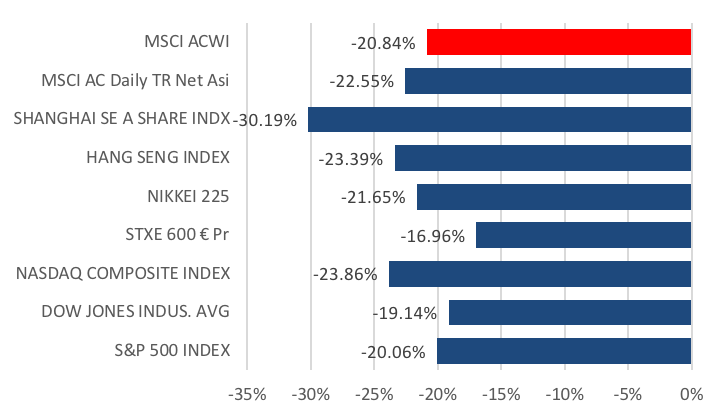

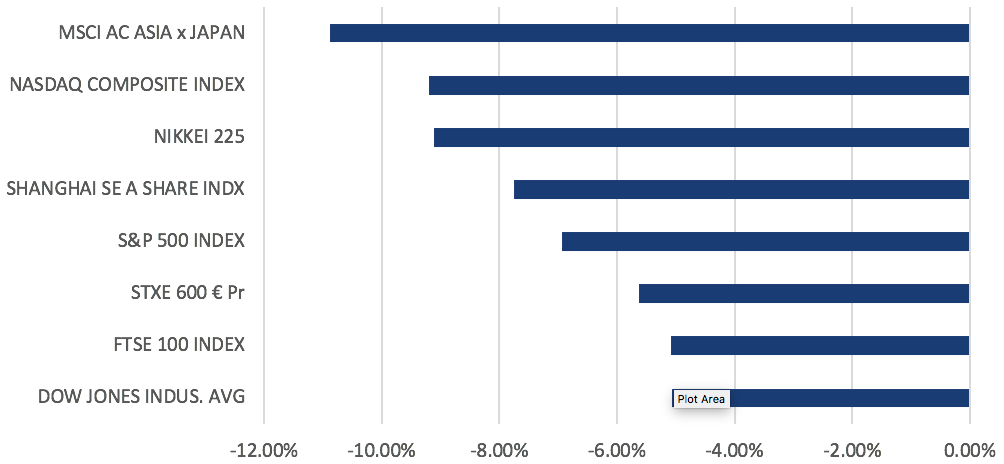

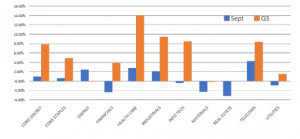

- December was particularly harsh, as all three major indices in the US were down close to -9% over the course of this month. The S&P 500 saw a broad-based decline across all sectors (Fig 2), with Energy (-12.82%) leading losses as global oil prices declined on high inventory levels and weaker economic growth outlooks. Financials (-11.45%) and Industrials (-10.81%) were also particularly hard hit, no doubt a result of dampening expectations for interest rates, and the ongoing trade-related issues with China.

Fig 2: All S&P 500 sectors ended December lower Source: Bloomberg

Fig 2: All S&P 500 sectors ended December lower Source: Bloomberg

- The Stoxx 600 had a relatively better month than Wall Street, falling -5.55% MoM to finish the year -13.24% lower. The index saw a broad-based decline, with Retail (-7.98%), Banks (-7.70%) and Autos (-7.21%) leading losses. It was also a down month for the FTSE 100, which fell -3.61% MoM.

- China A-shares fell 3.65% in Dec to end the year 24.60% lower, while the HSI likewise declined 3.78% to finish FY18 14.60% lower. Despite some positive developments around the 90-day US-China truce, an early rally by Asian equities quickly subsided as negative sentiment continued to weigh on investors, as evidenced by the -2.93% MoM decline in the MSCI Asia ex-Japan Index. Data releases did not provide much needed respite either – in China, industrial profits fell for the first time since 2015, as November trade data surprised on the downside as exports struggled despite tax rebates and a weak currency, while a slowdown in imports highlighted slowing global trade and a weakness in domestic growth.

- China’s Central Economic Working Conference was also held this month, with the outcome being a renewed focus in stabilizing economic growth through policy stimulus. There was also quite a bit of focus on PBOC’s newly announced Targeted Medium-Term Lending Facility, aimed to provide low-cost liquidity to smaller companies.

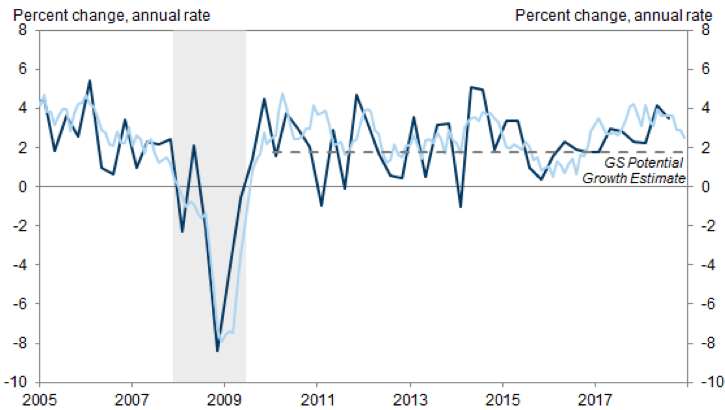

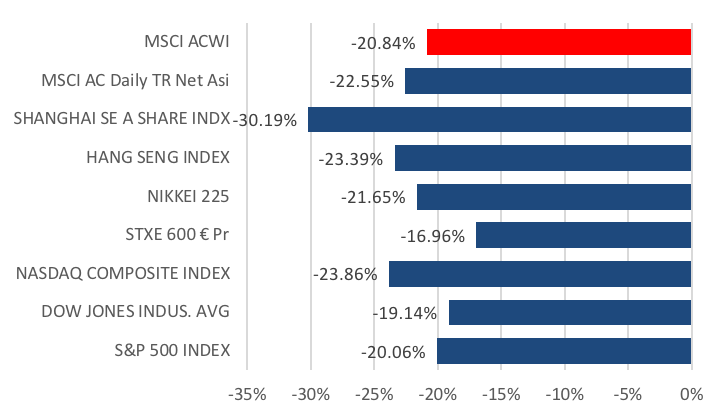

- The fundamental question for 2019 is whether the deteriorating growth environment will negatively impact US growth. The short answer is yes, but not materially. In a recent report, Goldman Sachs (GS) notes that slower global growth could affect US growth through 1) the reduction of demand for US exports 2) a reduction of US business investment spending and 3) tightening of US financial conditions. While we might see this play out over the course of 1Q19 (and GS predicts that this could trim 0.4% off US growth), the economy should be strong enough to cope with this negative drag (Fig 3)

Fig 3: US Growth Remains Solid Source: GS Global Investment Research

- Tail risks continue to be an escalation in the Sino-US trade dispute, and a sudden spike in inflation which could force the Fed to raise rates far more aggressively than the market currently expects. UBS predicts that this could result in a flat or inverted yield curve somewhere in the middle of the year, followed by sell-offs in the equity market, which could set the stage for an early recession in 2020.

- Brexit remains the biggest geopolitical risk in the Eurozone, because the outcome remains largely uncertain. While the impact may be more contained within UK/EU, odds are for a weaker and potentially volatile GBP as the process drags on, dampening Capex prospects and continuing the overhang on GDP growth. The next key date to watch is the week of 14thJanuary, where May’s delayed ‘meaningful vote’ is scheduled to take place.

- Earlier in September, we posited that China’s policymakers faced an increasingly difficult balance between policy decisions, and that every subsequent move would result in elevated costs and risks. Daiwa highlights that we saw this unfold numerous times over the past few months, as the PBOC took to defending the CNY at the 7.00 mark. While a fall below this level would have negative implications (i.e. capital flight), the result has been 1) denying a downward adjustment which would have been supportive of export competitiveness and 2) Offsetting a good deal of stimulus effects from both fiscal and monetary measures, as we have observed from the continued weakness in data toward the year-end.

- We expect more guidance by the PBOC in early March, particularly around growth targets which are slated for announcement during the National People’s Congress meeting. It is widely expected that the government will maintain an expansionary fiscal policy and much like 2018, the consensus is for another four 50bps cuts to the Reserve Requirement Ratio this year. The positioning of the Chinese government has clearly turned toward an easing stance with more measures expected to come in 2019.

Fixed-Income

- Sovereign debt rallied sharply in December as weak economic data raised concerns of a global growth slowdown and increased demand for safe haven assets. The UST yield curve shifted lower through the month, with the 2Y UST yield falling 29.87bps, the most since June 2016, while the 10Y UST yield fell 30.37bps, its largest decline since January 2010. The 2Y-10Y spread remained largely unchanged at 19.64bps at the end of December. The Bunds yield also fell 7.1bps over the month and continued falling in the first week of January to reach its lowest level since April 2017. However, sovereign yields saw a pick up on 5thJanuary after a strong NFP number and Powell’s reassurance that the Fed will not rush to raise interest rates helped ease concerns.

Fig 4: Bond spreads reach highest levels since ’16 Source: Bloomberg

- Credit also saw positive returns across the sectors, with spreads reaching its highest levels since 2016 (Fig 4). US IG bonds gained the most in December, with the Bloomberg Barclays Global US Corporate Total Return index up 1.47%, despite IG bond funds seeing six straight weeks of outflows (Fig 5). Investors withdrew $17.8bn from IG bond funds in December. This helped pare its losses in 2018 to -2.51%.

Fig 5: US IG bonds see six straight weeks of outflows Source: Bloomberg, Lipper

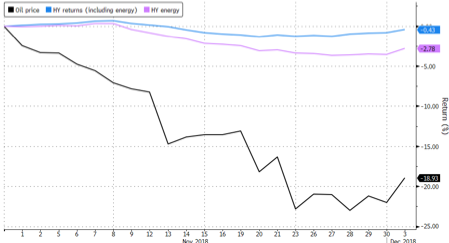

- HY debt underperformed in December as it tracked equities and oil prices lower. US HY performed the worst in December, with the Bloomberg Barclays US Corporate HY Total Return index falling 2.14% while spreads widened to 526bps, just shy of the 30M peak set on 27th December’s performance caused the US HY sector to end the year -2.08%, resulting in its worst year since 2015. HY bond funds also saw seven straight weeks of outflow, with $8.2bn withdrawn in December.

- However, issuance dried up in December. US IG bonds went through the last three weeks of December without any issuance and ended 2018 with $1.08tn in issuance, falling 11% from ‘17’s $1.21tn amidst a combination of higher borrowing costs and overseas cash repatriation. There was also no issuance of US HY debt in December, the first time in over 10 years.

- US HY now appears to be of value, given the levels it is currently trading at – 7.95% yield with a 5.26% spread. Sell-side forecasters are expecting US HY to bounce back in 2019 (Fig 6). Key drivers of US HY bonds – default rates, earnings, GDP growth, corporate cash flow – also look to be generally supportive. However, despite its cheaper valuations, US HY presents higher risk given the near-term uncertainty, higher volatility and tighter financial conditions. BofAML raised its US HY default rate estimate for 2019 to 5.5% from 4.25% and suggests a risk neutral spread of 5%, relative to 5.3% currently. It is necessary, even more so now, to be selective of better-quality names in this space. Given the amount of uncertainty in markets now, we continue to recommend sticking with short duration debt.

|

US HY ’19 Expected

Returns (%)

|

Leveraged loans ’19

Expected Returns (%)

|

| JP Morgan |

3.25 |

6 |

| BofAML |

2.4 |

4 – 5 |

| Citibank |

2.7 |

3.3 |

| Morgan Stanley |

0.5 |

1.3 |

| Wells Fargo |

6 – 7 |

3 – 4 |

| UBS |

5.6 |

4.3 |

| Barclays |

3.5 – 4.5 |

4.5 – 5.5 |

Fig 6: Sell-side expectations for US HY and Leveraged Loans Source: Bloomberg

- European credit will likely be a difficult space to trade in this year as investor sentiment wanes. This year, the region faces risks in the form of Brexit uncertainty and a slowdown in global and European growth. In addition, with the ECB stopping net asset purchases and only reinvesting its maturing holdings, it removes a safety net of sorts, worsening liquidity in the space.

FX – REVIEW

- December’s biggest move in currencies was the USDJPY, which fell 3.42% in December, and continued its decline in early January to a low of 104.87 before recovering back to the 108 region. The decline came as disappointing US data sparked fears over a US slowdown, spurring a risk-off move to the ‘safe haven’ JPY.

- The JPM EM FX Index was mostly unchanged at 62.221, falling 0.5% for the month. Within the index, there was notable resilience in the USDTHB, which instead moved -1.02% from 32.885THB to 32.548THB, strengthening even further against the Dollar in early Jan to 31.965THB.

- This month also saw the DXY break its 50DMA support at 96.6 to fall -1.13% in December, finding a new support from its 100DMA at the 96.0 level. The EUR gained 1.33% against the dollar for the month, but also mostly from general Dollar weakness over slowing growth in the US.

- The base case this year is a complicated one, but we are more inclined to think the Dollar will likely end the year in a weaker position. While appearing to be overvalued on a fundamental basis, there are still too many reasons why uncertainties will keep its ‘safe haven’ status supported especially over the first half of the year.

- Moves in the GBP will still largely be dependent on news surrounding Brexit. As discussed earlier, a no-deal scenario could potentially send the sterling significantly lower from where it is now, and that situation might present a short-term opportunity for a tactical trade. Our base case is more likely a soft deal (rather than a no-deal situation), which should support the sterling as well as the euro.

- We are cautiously optimistic that EM Asia currencies could rise against the dollar over the next few months, if not more so in the second half of 2019. As we have witnessed over the course of 2018, this will also largely depend on how the CNY moves, as a no-deal trade scenario between the US and China could potentially send the Chinese currency below 7 and that would have a contagion effect onto the rest of Asia.

COMMODITIES

- The growth scare in December led Brent oil prices to extend its November losses, leading to an 8.36% loss over the month. Oil prices were volatile, initially supported by OPEC’s pledge to cut output after the meeting in Vienna before concerns around global growth and rising supply from Russia and US eventually weighed on prices.

- Gold gained significantly over December, rising 5.08% through the month past a key level at $1,250/oz, as markets saw a flight to safety amidst the uncertainties in the month.

- We are bullish on oil prices are see it averaging $70/brl with further upside from here. Our base case is for a Sino-US trade deal, hence reducing concerns of slowing global growth and offering greater clarity into oil demand. OPEC+’s agreement to lower output will officially begin this month and should provide support to oil prices.

- We see technicals supporting Gold from here on and expect it to trade in the range of $1,250 – $1,320/oz.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at.

Dec 12, 2018 | Articles, Global Markets Update

Global equity markets recovered slightly from the October sell-off, with the MSCI All Country World Index ending November +1.30%. However, while investors stuck with equities, global trade and geopolitical events led them to remain defensive. This month saw a continued rotation into defensive sectors like Health Care and Real Estate on the S&P 500, and the Telecommunications, Utilities and F&B sectors on Stoxx 600. The US mid-term election results at the start of the month saw the Democrats take the House while the Republicans retained control of the Senate. This was in line with expectations and helped provide an early boost to the US equity markets.

“Too late to buy equities, too early to buy fixed income (FI)” was a perceptive quote out last week. We think 2019 will be another tricky year after this year given the large number of uncertainties out there and a lack of predictable outcomes. In our view, no one (including the Fed), really knows what might happen to inflation next year with widely polarised views on how many Fed hikes there will be as there are a wide range of inflation expectations.

Markets were also focused on the meeting between Trump and Xi at the G20 summit. The meeting ended with a 90-day truce and set up a framework for future trade talks. We see this truce as a win for both parties in the short-term, given the avoidance of a trade escalation. However, in the longer term, this truce is simply a ‘pause’ in a very complicated dispute and does very little in reducing the substantial differences between China and the US. We remain cautious on whether any of the existing structural issues can be resolved by the end of the 90-day truce. One reason for this is the hostility present within the US administration against China.

Global trade, extending beyond the more well-publicized Sino-US squabble still remains largely uncertain. Sizeable geo-political concerns also remain, with unclear outcomes from Brexit; the Italian budget; Russia’s encroachment on Ukraine; and the powder keg that is the Middle East with its important links to oil prices. In FI, there are opposing views over developments in credit quality and on the favoured spot for duration whilst FX, unlike last year end’s strong consensus behind further USD weakness, appears to have little in the way of conviction.

Depending on the outcomes of these important, but uncertain, outcomes, there could be the need for speedy and material portfolio construction changes. As we’ve seen this year, 2019 could well be another year where making capital gains in equities might prove to be difficult, whilst owning FI might fail to preserve capital. The significant de-rating of equities, despite solid earnings growth bar Asia ex-Japan, provides us with reason to remain more weighted here than in FI, which we still see as a dangerous asset class outside short duration holdings where the risk is not rewarded by the yields. Given the difficulties going forward for traditional asset classes with weaker returns than normal and likely higher volatility, we continue to recommend diversifying into non-traditional asset classes as alternatives and private assets, and the use of significant tactical cash holdings from time to time.

Equities

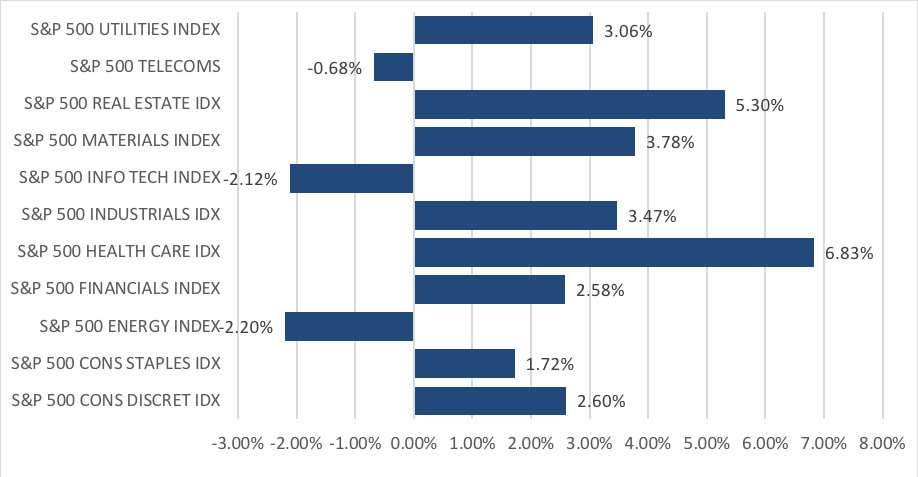

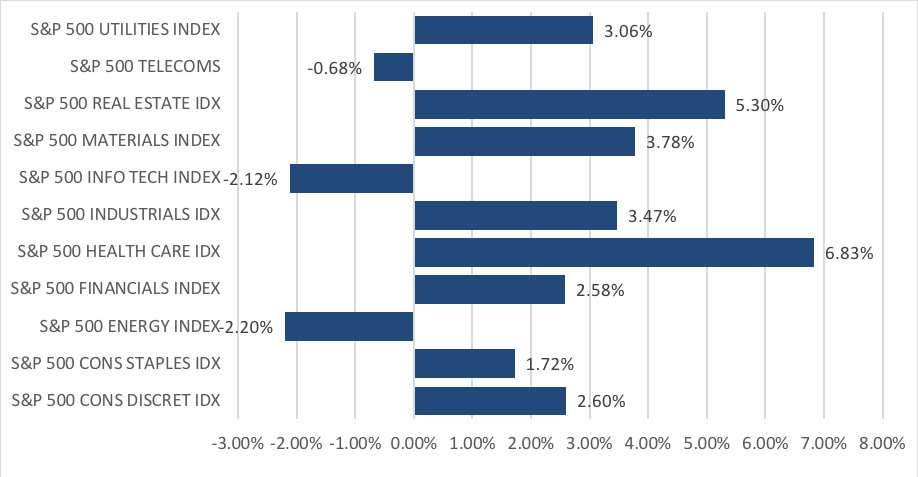

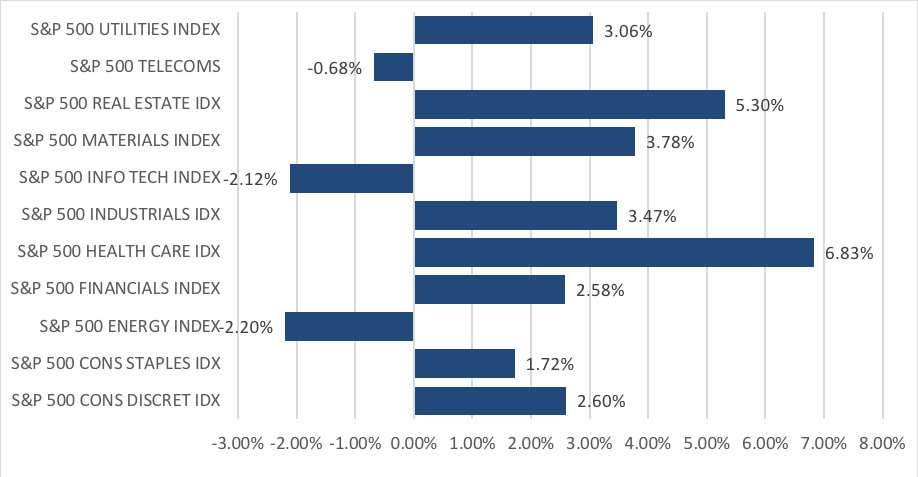

Fig 1: S&P 500 Sector Performance in November Source: Bloomberg

Fig 1: S&P 500 Sector Performance in November Source: Bloomberg

- The S&P 500 gained 1.79%, with Healthcare (+6.83%) and Real Estate (+5.30%) as the biggest gainers in the index which saw gains across most sectors, with the exception of Energy (-2.20%), Info Tech (-2.12%) and Telecommunications (-0.68%). Likewise, the Dow Jones gained 1.68%, while the tech-heavy Nasdaq also managed to gain 0.34% to end the month on a higher close. [Fig 1]

Figure 2: S&P 500 Sector Performance in October

Figure 2: S&P 500 Sector Performance in October

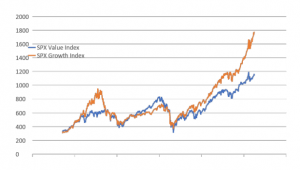

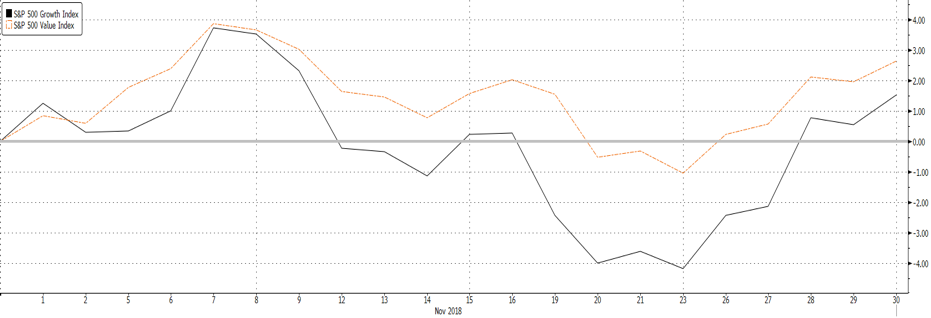

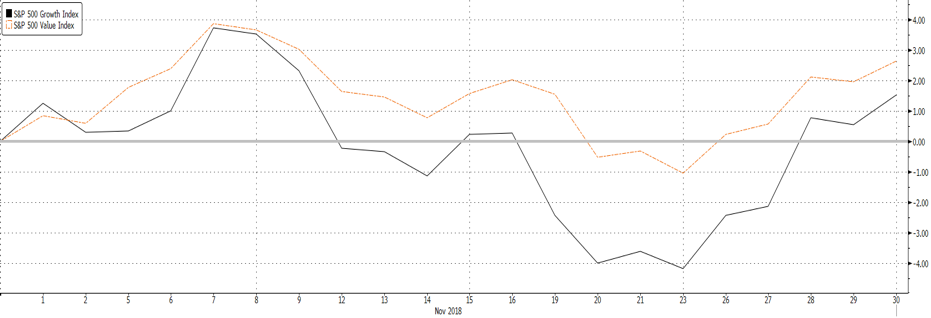

- As we highlighted last month, the divergence between growth and value extended through November, with the SVX Index (Value) closing +2.63% higher and the SGX Index (Growth) trailing behind at +1.53%. [Fig 2]

- Fundamentally, composite lead indicators in the US continue to reflect a strong economy, with nothing to suggest below-trend growth over the next few quarters. The ISM Manufacturing survey came in well above expectations, as production and new orders rebounded from a month ago while export activity held steady and respondents remained confident around business strength.

- GS sees single-digit absolute returns on the S&P 500 for FY19, with the view that US Equities are likely to provide a lower risk-adjusted return compared to its long-term average. In terms of allocation within the US, we are inclined to agree with the GS view to increase exposure to defensive assets within US, as with sectors such as Communication Services and Utilities, and continue to be much more selective when it comes to growth stocks, particularly within IT.

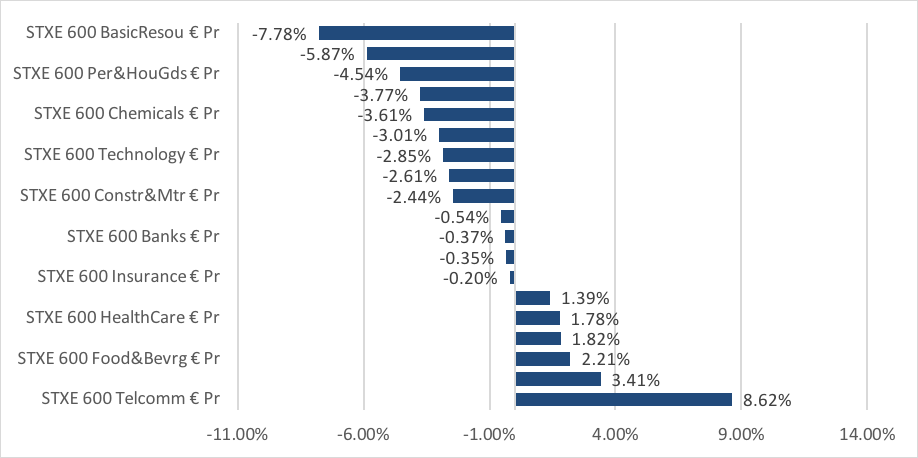

Fig 3: S&P 500 Sector Performance in November Source: Bloomberg

Fig 3: S&P 500 Sector Performance in November Source: Bloomberg

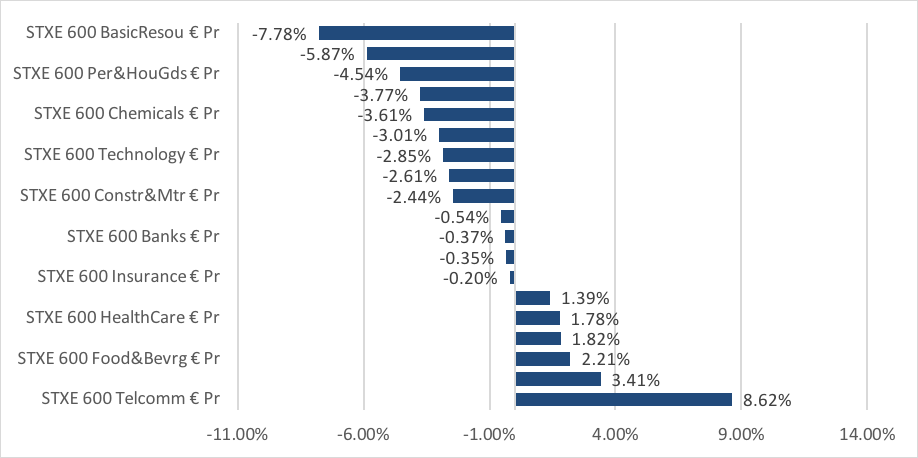

- The Stoxx 600 fell 1.14% in November, but we saw a marked difference in performance across sectors as Telecommunications (+8.62%) and Utilities (+3.41%) outperformed, while Basic Resources (-7.78%) and Oil & Gas (-5.87%) saw steep declines. Given our expectation of elevated political risks next year, we choose to remain underweight Europe in our portfolio allocations. In our view, the risk-reward still remains somewhat lacking in these markets, and until valuations decline lower or we are able to gain some clarity on these issues, we would avoid being too heavily allocated into this region. [Fig 3]

- Asian markets were largely focused around the outcome of the Trump-Xi meeting on the 30th, where the announcement of the 90-day ceasefire sent most Asian markets higher early into December, with the exception of China A-shares which closed -0.57% lower on the month.

- In our view, the agreement between Trump and Xi was more symbolic rather than substantial, and that the Chinese came to the table from a position of weaker bargaining power to provide Xi some relief to focus on the domestic economy.

- The next date to look out for is December 20th, which is scheduled to be the Central Economic Working Conference, where the Politburo’s policymakers are likely to discuss growth and inflation targets for CY19, and any adjustment to policies which they will choose to undertake.

- Ultimately, the question now will be whether China can bring enough to the table to satisfy the U.S.’ concerns around industrial policy & IPR. Our economist foresees a long-drawn negotiation that lies ahead, and what we can expect from that is further market volatility as risks continue to rise around tariffs or threats around them.

- More broadly for Asia ex-Japan, we could very well be looking at the start of a bottoming process which has had seen some uplift from the recent ceasefire in the Sino-US trade conflict. At valuations that float around 11.5x FY19 P/E for MSCI Asia ex-Japan (AxJ), valuations remain at unjustified trough-like levels, which is a prime reason why we have moved from c. 50% to 5% cash in out Asia ex-Japan portfolio, and re-allocated back into what we view as a market with attractive risk-to-reward.

Fixed-Income

- UST yields traded higher earlier in the month after the mid-term elections and on technical factors, with the 2Y yield rising to a high of 2.97% and the 10Y at a high of 3.24%, just above a key resistance level of 3.2% [Fig 4]. However, markets perceived Powell’s speech late in the month to be dovish, causing the UST 10Y yield to fall significantly and end the month at 2.99%, while the 2Y yield finished just 20bps lower at 2.79%. The yield curve continued to flatten into early December.

Fig 4: Flattening yield curve Source: Bloomberg

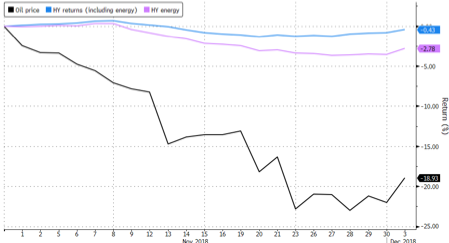

- HY debt continued to lose the most amid concerns of slowing growth globally and in the US. The HY energy sector fell 3.58%, its worst since losing 8.41% in February ‘16 while CCCs led the decline in the general HY sector (Figs 5 & 6).

Fig 5: HY energy sector’s worst month since ’16 Source: Bloomberg

Fig 5: HY energy sector’s worst month since ’16 Source: Bloomberg

Fig 6: CCC debt leads decline Source: Bloomberg

Fig 6: CCC debt leads decline Source: Bloomberg

- The Fed will likely raise rates by another 25bps to 2.25%-2.50% when they meet later this month. Fed fund futures are pricing in a 78.4% probability of that at time of writing. The futures are also pricing in a 75.3% probability that rates will remain at 2.25%-2.50% after January ‘19’s meeting but is more uncertain about a rate increase in March ’19.

- Given the current environment, we recommend staying defensive by allocating to government bonds. We also prefer to remain at the front-end of the curve, given that the current yield spreads do not provide a sufficient yield pick-up to justify the duration risk in longer duration bonds.

- We remain positive on HY debt, albeit less so than in previous months. HY bonds have fallen recently and this pullback came earlier than expected. Yet, there is no sign of a collapse in earnings or an approaching recession. This supports the case that HY debt still remains an attractive asset class, though there is a need to be more selective on the companies we allocate to.

FX

- The USD had a volatile month with mid-term elections, tariff developments, dovish Fedspeak and what markets took to be mixed data releases. December opened with a 90-day ceasefire between Trump and Xi, amidst slowing momentum from October’s stream of strong data.Going into ’19, we expect more sensitivity from the greenback around data releases, given the Fed will also be largely data-dependent.

- The EUR saw a monthly high of 1.145 against the dollar, and a low of 1.12 before ending the month at 1.13, just 3bps from where it started. The EUR remains weighed down by political uncertainty, not least Brexit’s key vote on December 16, and a yet unresolved budget from Italy. It remains to be seen how these headwinds will weigh on the EUR, but we remain more concerned around the GBP which is currently sitting near a critical support at 1.27.

- CNY continued to decline throughout November, but found some artificial support from the 6.97 to 6.95 region before recovering to 6.83 just after the Trump-Xi meeting. Although CNY led most AXJ currencies lower, INR emerged victorious against its peers, ending November higher by +5.90%, supported by cheap oil prices to alleviate its twin deficits.

- Uncertainty around China’s growth given the challenges it will face might cause further doubt on the strength of the CNY. There also remains much uncertainty around EM FX as the spotlight is now on the fragile partnership that is beginning to foster between US and China.

Commodities

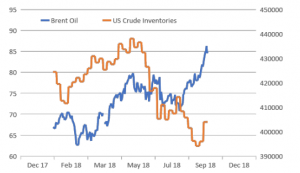

- As we draw closer to December’s Vienna meeting, investors have been notably wary with the release of inventory data and news around Russia, Saudi Arabia and potential changes on the supply-side. Despite the sanctions against Iran (albeit with waivers issued to eight nations), November saw Brent plunge from 72.70 (on Nov 1st, Brent fell below its 200DMA for the first time since Aug ’17) to eventually form a short-term support at 59.

- December 2nd’s positive news gave a 5% boost to oil; a trade war ceasefire brought a short lived risk-on appetite to markets; Alberta’s oilfields cut their production by 350,000bbls/day, and the OPEC President hinted a likely production cut during the month.

- Looking ahead, directionality on oil prices could be largely driven by the outcome of the Vienna meeting on 6th Dec.

- In terms of support for Brent crude, we look to three factors in determining our stance 1) Demand is still growing, albeit at a far more muted pace than we had originally expected 2) Supply can and will be cut if necessary, and the OPEC alliance with Russia will be able to do this & 3) The market clearly underprices a risk premium that, in our view, is clearly more evident in the Middle East

- For the factors listed above, we continue to remain bullish on oil prices, with the view that over the next few months, Brent Crude should normalise closer to or above US$70/bbl as opposed to c. US$61 where it sits now.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at.

Nov 9, 2018 | Articles, Global Markets Update

Despite the month-end window dressing, October was a bad month for equities.

Indices in the major regions all closed significantly lower within the range of -5% to -11%, with MSCI AXJ leading declines (Figure 1). This month was also the worst October since ’08, where indices fell in the ranges of -13% to -25%. Markets were risk-off for most of the month, causing a rotation into defensives like Utilities and Consumer Staples in the S&P 500. A similar trend was seen in Stoxx 600, with the F&B, Utilities and Telecomm Services losing the least over the month.

Figure 1: October returns across major indices

Geopolitics and trade concerns continued to weigh in October, starting with the EU formally rejecting Italy’s budget plans, which led to BTP 10Y yields whipsaw around 3.5% while the spread over Bund yields rose to a high of 327bps during the month. Merkel’s decision to not run for re-election as chairman of the CDU in December also renewed political uncertainty in the region and weighed on the EUR. Trade tensions between US and China seemed to improve toward the month-end (and markets took it as such), despite Trump’s threats to levy all remaining Chinese imports if talks with Xi later this month fail.

Corporate earnings were also the focus of this month, as companies are midway through reporting Q3 earnings. As of last week, 74% of companies in the S&P 500 have reported earnings. 78% of these companies have reported earnings beat, while on aggregate, companies are reporting earnings that are 6.8% above the estimates. We saw weaker earnings from US IT stocks like Amazon, Alphabet and Apple, that resulted in overnight losses of c. 4% – 7% while disappointing earnings outlook from industrial bellwethers like Caterpillar and 3M raised concerns around the global growth outlook.

Our base case is founded on the need for an ability to look across the valley as the short-term may see further downside from:

- A possible deterioration of Sino-US relations, with risk that China retaliates via non-trade means such as CNY devaluation etc;

- Weaker EPS outlook and potential Q3 earnings misses – most likely from companies in Asia ex-Japan;

- Cyclical peak in US GDP growth;

- Rising geopolitical risks – notably in Middle East (ME);

- US tariffs on global auto imports; and

- Italy’s budget deficit;

In the medium-term, solid EPS growth in the low double-digits and positive global GDP growth data still underpin the fundamental case for equities. The negatives in the ‘noise’ should not derail EPS or GDP growth but might reduce, on the margin, a more aggressive Fed rate hike cycle for longer. This suggests that the recent correction in equities is one to be adding into selectively, in a disciplined manner.

We think it is highly likely any evidence of a GDP slowdown in 2019 will be met by increased fiscal spending and greater monetary policy gradualism. Rising rates are a risk, but rates are well below levels that have historically disrupted a positive equity trend. In addition, valuations for non-US equities are reasonable and real estate owned recoveries are underway. Even in the US, equity valuations, excluding IT, SMEs and parts of the consumer discretionary/healthcare sectors, are not overly stretched.

As it is almost impossible to finesse market bottoms, we think the only approach has to be to stay the course with relatively defensive positioning and look to become more risk-on as we cross the valley, by being disciplined in adding into further declines while risk managing portfolios, should a rebound take place. Our assumptions are that we do not see a US/global recession in the next 12-18M; that oil prices – bar any Middle East ‘shocks’ – will not move appreciably higher than the mid 80s; and that concerns over global liquidity tightening are exaggerated.

Equities

- The S&P 500 lost 6.94% in October, while the tech heavy Nasdaq tumbled 9.20% for its biggest monthly fall since Nov ’08, while the Dow Jones fell by 5.07%. The falls sent the U.S. into ‘correction’ territory, despite a decent earnings season for the companies that have reported, and strong macroeconomic data.

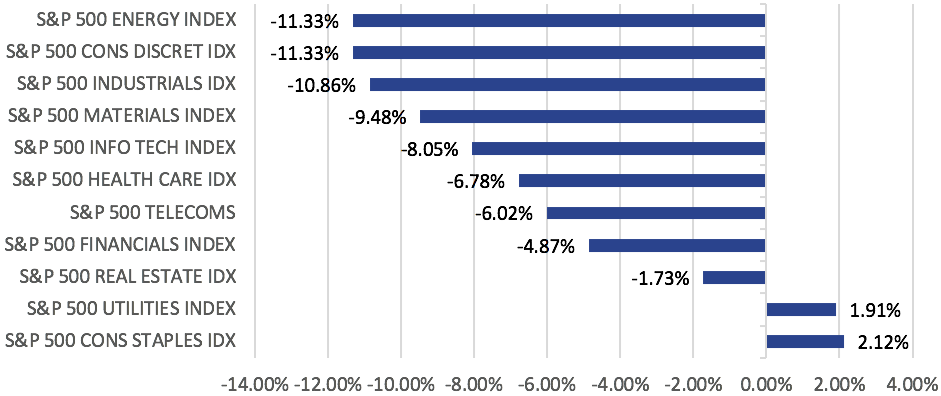

Figure 2: S&P 500 Sector Performance in October

- The month saw further evidence of sector rotation, with defensives in the S&P 500, namely Utilities (+1.91%) and Consumer Staples (+2.12%) holding up while Consumer Discretionary (-11.33%), Energy (-11.33%) and Industrials (-11.33%) led declines (Figure 2).

- With U.S. equity markets starting to look choppy, we continue to emphasize last month’s call that late cycle and slowing earnings growth suggest defensive sectors may outperform – there is increasing evidence that this sector rotation is happening, along with value outperforming growth by over 3% this month.

- Additionally, the outcome of the U.S. mid-term elections has the Democrats take control of the HoR, while the GOP retains control of the Senate. This result is neutral to slightly positive for U.S. equities.

- In-line with the global equity rout, STOXX 600 fell -5.63% for the month and saw broad-based losses across all sectors except for Telecommunications (+0.01%), which barely ended the month flat. The FTSE 100 was also lower on the month, losing -5.09%.

- The EU summit earlier in the month also brought the spotlight back on to Brexit, and the conflict between Rome and Brussels over Italy’s proposed fiscal budget deficit. On both scenarios, our base case remains that a compromise will be reached by the respective deadlines. On Brexit, the outcome will also depend on whether May is able to get the votes in Parliament.

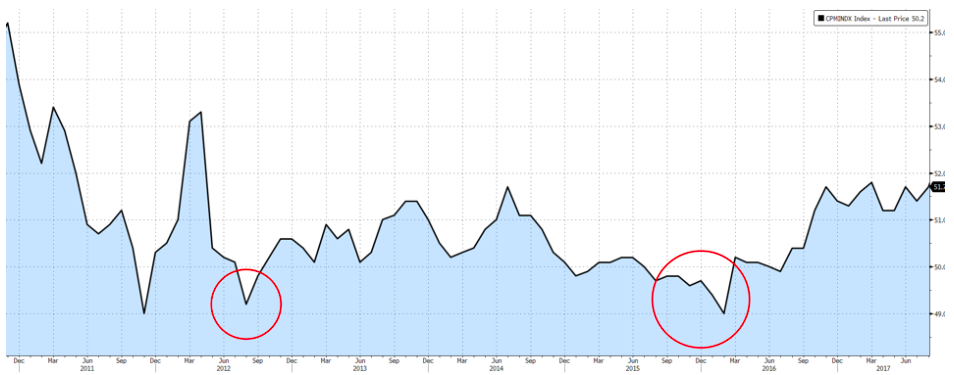

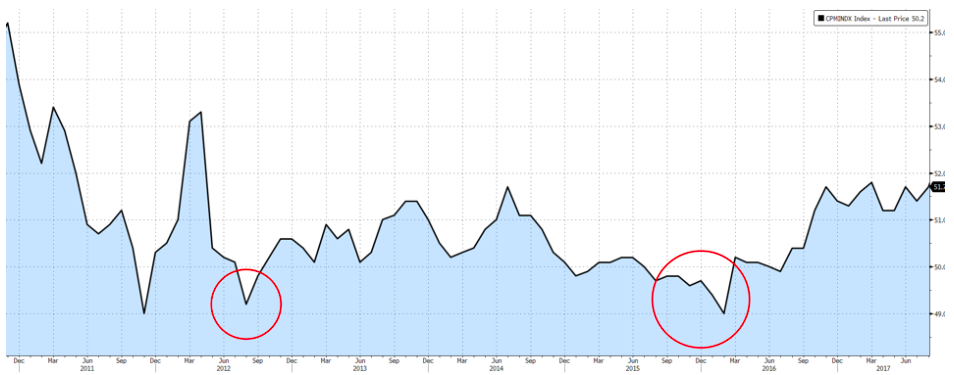

Figure 3: China’s Official PMI

- China A-shares extended losses to an intra-month low of -12%, after which a slew of new government policies and renewed optimism on the trade scenario with the U.S. helped lift sentiment on the index to close -7.75% lower for the month. While PMI weakness continued in October, it still remains far from levels that would warrant cause for concern, which would be somewhere closer to the lows witnessed between ’12 to ’16 (Figure 3). Interestingly, these were addressed through similar waves of stimulus policies which we see today – commitments to boost growth, stabilize employment, finance, external trade, foreign investments and supporting private enterprises. .

- Overall, our view is that the situation for Chinese markets is far from the pessimism that it has experienced, and while growth expectations have inadvertently dampened, the willingness to be flexible in amending interventionist policies and drastic measures to protect the economy are encouraging.

- While there is value support for EM equities more broadly, there is also merit in being patient as the US still has an option to extend tariffs on all Chinese imports, and will likely raise them to 25% by the end of the year which will worsen Sino-US relations. There is also a genuine risk that China will allow the CNY to weaken past 7, which EM Asia would struggle with.

Fixed-Income

Figure 4: UST 10Y yield reaches fresh 7Y highs and testing 3.2%

- Positive economic data in September supported US growth in Q3, pushing UST 10Y yield to a fresh 7Y high (Figure 4) of 3.233% early in the month. However, risk-off sentiments from the equity selloff late in the month led to increased demand for safe haven assets, causing the UST 10Y yield to fall back down, ending the month just 8.23bps higher at 3.144%.

- Corporate debt also underperformed sovereigns over the month, with High Yield (HY) debt losing the most. Global HY spreads increased 43.59bps, while US HY spreads increased 55bps, with the asset class losing 1.6% MoM. US bond funds saw net outflows of more than $13bn, relative to $3.8bn in EM debt funds.

- US economic data released over the month is unlikely to change the Fed’s decision to raise rates in December. JP Morgan expects UST yields to rise steadily into late ’19 as they think the Fed will probably hike rates every quarter through to the end of next year. In addition, the US Treasury is expecting to issue $425bn worth of USTs in 18Q4, bringing the total borrowing this year to $1.34tn, more than double of that in ’17. This increased supply, along with the Fed reducing its balance sheet, could put further pressure on UST yields to rise.

- The risks to longer duration FI remain high, be it technical supply issues, an inflation ‘shock’ (PCE data saw PCE inflation continue to rise while private sector wages rose at a 5% YoY pace) or even China dumping its USTs. We continue to think allocations to longer duration, high quality FI makes little strategical sense bar a short-term tactical trade, and remain in favour of shorter duration, lower credit quality FI despite the higher risk and more probable refinancing issues, especially for weaker Chinese property companies.

Currencies

- USD was stronger in October, with the DXY gaining 2.10% on the back of strong economic data and having its ‘safe haven’ features tested when trade tensions were on the rise. Aside from USD strength, DXY was also supported by weakness in GBP and EUR (accounting for 70% of the index) from Brexit and Italian concerns. The two key events this month that will likely move the USD are 1) the US mid-term elections, and 2) Trump and Xi’s meeting at the end of the month.

- There is increasing downside risk for the EUR after testing 1.13, a key support level, twice in October. We see a renewed layer of political uncertainty with Merkel’s decision not to seek re-election as leader of CDU in ’21, while Italy’s proposed budget deficit continues to weigh on EUR sentiment. Should the EUR break its support of 1.13, we may see 1.10 as the next possible support. If 1.13 holds, we can expect to see a new range between 1.13 to a familiar resistance of 1.18.

- It was also a troubling month for Asia ex-Japan currencies, with CNY leading other currencies lower. Higher oil prices and rising rates were not supportive either, particularly for the INR and IDR. China released a stream of mixed data with improvements in consumer spending but unsurprisingly soft industrial data. 7.0 remains a strong support for USDCNY.

Commodities

- Brent ended c. 16% lower from a recent high of $86.29 on a mix of slowing industrial data from trade wars and OPEC boosting its production to its highest levels since 2016 causing Brent to break below its 200DMA ($73.98) on the 1st of Nov. Oil has remained above its 200DMA since September 2017. The higher output has since replaced the tight supply sentiment.

- Gold is finally coming off from its floor of 1200 as the risk-off in equity markets led to some looking to the precious metal as a safe haven asset, and the technical show that 1215 is now a resistance-turned-support.

- Sanctions on Iran kicked in on the 5th of November, but the waivers issued to 8 countries are likely to offset some if not most of the supply-side impacts on the global oil market. The waivers also reduce the probability of Iran blocking the Straits of Hormuz, which has taken away some of the geopolitical risk premium that we have seen in oil prices over the past few months.

- At present, we still remain bullish on oil (and energy, more generally), on the basis that demand still remains strong, against a backdrop of weak capex over the past few years which will eventually result in a structural shortage on the supply side.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at.

Oct 9, 2018 | Articles, Global Markets Update

More US Trade tariffs on China, Italy’s debt problem, the Federal Open Market Committee (FOMC) meeting, Liberal Democratic Party (LDP) leadership and Sweden’s election all made September an interesting month for news, but most had a relatively little impact across risk assets over the month.

However, there was significant inter-month volatility in some asset classes and currencies. Italy surprised complacent markets by announcing an irresponsible 2019 budget with increased spending that contradicted the European Union’s (EU) requirement that Italy cuts its debt-to-GDP to 60% from its present 130%. Sweden’s election maintained the form seen elsewhere in EU, with populist parties gaining huge ground but not political power – Italy is the exception. In equities, the S&P 500 ground higher but ‘growth-y’ sectors underperformed relative to defensives, as seen by the fact Nasdaq fell 0.8% against S&P 500’s modest gain of 0.4%. Compared to the last quarter, S&P 500’s gain of c. 7% is the best quarterly gain since 2013. Nikkei was a standout, up 5.5% and 8% from the last month and the last quarter respectively. Robust earnings, Abe’s victory in the LDP leadership battle, and a weaker JPY were the main contributors. A-shares recovered further from its recent two-year low by 3.5%, to head towards testing a 3,000 resistance, but Asia-ex Japan (AXJ) was the standout faller, losing 1.6% on trade concerns, earnings downgrades and FX weakness.

We see the sell-off in Emerging Markets (EM) as an opportunity to switch out of more expensive US equities into AXJ equities and to add to EM local currency debt. We would not rush – trade war escalation could well happen in the short-term – but we fundamentally do not ‘buy’ the EM crisis thesis, do not think US equities have ‘immunity’ to the risks out there that other equity markets have discounted and do not think the world goes into recession. Tactically, in terms of portfolio positioning, we think inaction might be better than action in the short-term given rising geopolitical risks. Poor EM Q3 earnings could well be another catalyst for EM equities to lurch down. In Developed Markets (DM), there is a case to slowly shift exposure in U.S. equities to cheaper European and Japan equities.

Equities

- In the US, we have seen an impressive Q3 as equities benefited from strong Q2 earnings releases, accelerating macroeconomic data and the presumption that U.S. equities offered some ‘immunity’ to trade wars. Sector rotation saw financials, real estate, materials, and utilities all fall while healthcare, telcos, and energy outperformed. Over Q3, the big winner was health care at +14% with energy, materials and real estate all down and financials underperforming along with consumer staples (Fig 1).

Fig 1. Monthly and quarterly performance of SPX sectors Source: Bloomberg

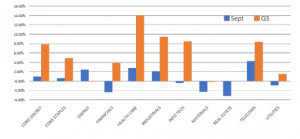

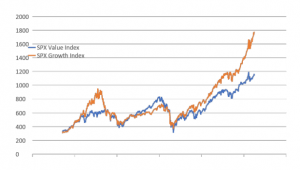

Fig 2. SPX Value vs Growth Source: Bloomberg

- The focus will be on upcoming Q3 results later this month, as late cycle and slowing earnings growth suggests defensive sectors and energy might outperform ‘growth’ and bond ‘proxies’. ‘Value’ stocks are close to record lows against growth (Fig 2) and we are potentially moving into an environment that value tends to do better in.

- In the EU, Stoxx and FTSE 100 are being moved around by politics and links to currencies. Italy may weigh on EU assets and Euro this month. 15th is the key date when details on the budget are revealed, and the fear is its spending plans might be multi-year. The EU financial system is inextricably linked to Italy’s fate given its debt pile is the second largest in size and its feeble GDP growth is not sufficient to reduce the debt let alone add to the debt. Our base case remains a compromise between Italy and EU but this might take time given the coalition’s political strength.

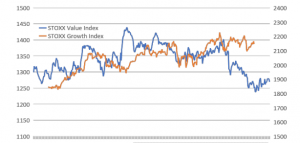

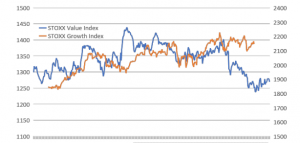

- Morgan Stanley (MS) thinks that European Equities are “unloved, under-owned and undervalued’ and recommends adding to exposures to overweight. Additionally, MS highlighted that value is at record lows to growth (Fig 3) and conditions suit a shift into value. Energy is seen as a late-cycle outperformer too.

Fig 3: STOXX Value vs Growth Source: Bloomberg

- In Asia, we saw the NIKKEI 225 soar almost 8% in Q3 to test multi-decade highs, while China A-shares recovered slightly by 3.5%, back above its support at 2,850 albeit helped by the Chinese government’s moves to reflate the domestic economy to mitigate trade damage from US tariffs, and by PBOC’s trenchant defense of CNY below 6.90.

- Nikkei’s surge may continue into Q4 on further positive earnings revisions, better macro data, and certainty of policy under Abe-Kuroda. China is facing the risk that the US, under Trump, is starting a new cold war of which trade is but one form of confrontation and containment. For Chinese equities, China’s moves to dial-back its aggressive de-leveraging, start to unfreeze the halted WMP sector and stabilize the CNY are all positive steps, but in the short term, Q3 results might be quite disappointing, especially in the consumer related space.

- It seems that in AXJ regions, central banks and governments are taking sensible steps in the face of a severe sell-off in FI and FX by raising interest rates, seeking to slow imports and allowing FX to weaken. In particular India, Indonesia and Philippines are raising rates and letting their currencies crash. This suggests these economies and markets will recover far faster once the pressure lifts, as it surely will, offering good value opportunities for patient investors.

Fixed-Income

- US Treasury yields broke through a multi-year high (Fig 4), with the 10y yield jumping 11bps to 3.18% after a raft of better-than-expected macro numbers came out last week. The 2Y10Y yield curve has also steepened a little too. Shorts on 10y UST are now at record highs.

Fig 4: UST 10Y yield hits 7Y high. Source: Bloomberg

- Whilst there were large outflows from DM government bonds last month (the most since February), EM Fixed-Income saw large inflows for the first time in several months and yields tightened quite sharply. This, despite lurid warnings of the degree corporate debt, has risen in EM since GFC, was obvious the buying was from larger institutions and sovereign wealth funds.

- The debate in where US Treasury yields may go from here is polarised between the bulls and the bears, with both sides having plausible arguments. The argument for higher inflation and a stronger USD assumes the US labor market is tightening to a point where wage inflation must accelerate fast, but that inflation expectations will remain anchored at what are historically unprecedented lows for far longer, is dangerously complacent. Bears think the opposite, and that there is sufficient slack in the labor force, the tick up in inflation is temporary, and the Fed is in danger of over-tightening, which might catalyze the next recession as soon as 2020. No one knows whether US labor markets are tighter than understood or has more slack than realized but we will find out sooner than later.

Currencies

- USD DXY fell below a key level at 95 as Draghi’s apparently ‘hawkish’ comments pushed Euro back above its 200DMA just above 1.18 and positive Brexit ‘noise’ helped GBP through 1.32 but this soon evaporated with Italy’s budget quickly unshackling Euro that promptly tested its key YTD support at 1.1515 whilst GBP tumbled back below 1.30 in part from the baleful specter of Boris stalking May in the Conservative party’s corridors of power.

- USD upside to continue for longer appears to be the direction recent FX forecast revisions are going, even if many still see a weaker USD against the EURO and JPY in the medium term. On the face of the evidence, the stronger-than-expected US economy and related Fed rate hikes against weaker data in EU and EM/AXJ and higher UST real yield differential is USD supportive, and there is still a lot of stale USD bears out there to take a contrarian stance against the Dollar.

Commodities

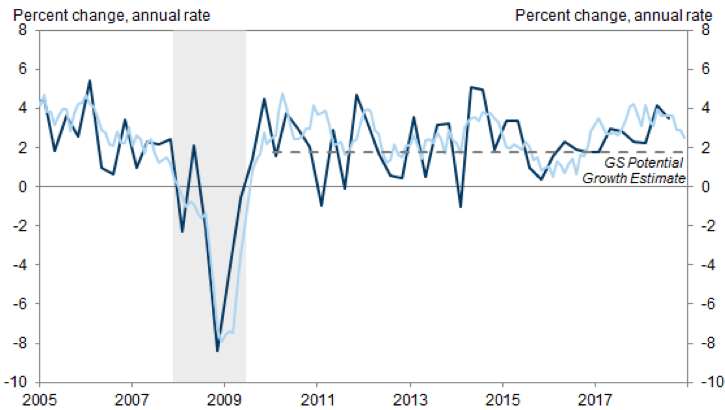

- The Brent Oil price soared 7% last month to $83/brl, and last week moved to YTD highs of over $86/brl despite a huge jump in US crude oil inventories (Fig 5) and a suggestion that Saudi Arabia and Russia might produce more to mitigate the likely supply reduction from Iran after US sanctions start 4th November.

Fig 5: Brent oil price is rising despite a recent jump in US inventories Source: Bloomberg, EIA

- Gold has traded flat in last month around $1,200/Oz after bouncing from support at $1,150/Oz – a level that saw a surge in physical gold buying by Asians, attracted by a lower cost, and a significant slowdown of speculative investors’ selling. Gold remains a by-product of USD moves, which many appear to prefer as the ‘safer’ haven asset.

- Oil prices will be driven by geopolitical risks – should Iran blockade the strategic Hormuz straits through which 40% of global seaborne oil is transported, we would see prices jump to $100/bpd in the short term. The medium-term too looks to be constructive for oil prices given estimates that demand will rise by 1.5mn/bpd over the next few years yet oil supplies might falter, in part after 60% cuts to oil E&P CapEx between H2CY14-’17. Reforms in the shipping industry to use less polluting fuel mixes will add to demand too. Several houses predict Brent oil at $100/brl by 2020.

CONTACT

We would be more than happy to have an informal chat about these and the other services we offer as well as the current opportunities we are looking at.

Fig 1: Global equities fall into bear market over Christmas Source: Bloomberg

Fig 1: Global equities fall into bear market over Christmas Source: Bloomberg Fig 2: All S&P 500 sectors ended December lower Source: Bloomberg

Fig 2: All S&P 500 sectors ended December lower Source: Bloomberg

Figure 2: S&P 500 Sector Performance in October

Figure 2: S&P 500 Sector Performance in October Fig 3: S&P 500 Sector Performance in November Source: Bloomberg

Fig 3: S&P 500 Sector Performance in November Source: Bloomberg